France is the global leader in fashion, with Paris Fashion Week a key destination for both haute couture and ready-to-wear.

The market is distinguished by the prevalence of country-of-origin luxury brands, which are widely available through both online and offline channels.

France is a popular destination for international brands and one of the most visited countries in the world for fashion and leisure travel. It is home to most iconic luxury retail brands, such as Dior, Chanel, Saint Laurent, Hermès and Louis Vuitton, as well as numerous designers.

The information provided below will offer you a comprehensive guide to successfully accessing the French market.

1. Key data

Overview

P 1.Market overview

P 2.Trends

P 3.Regulations

P 4.Distribution channels

P 5.Awards and innovative programmes

P 6.Federations and organisations

P 7.Events

P 8.Magazines and newsletters

• Despite the global economic and geopolitical context, the global luxury goods market had a record year in 2023, with an estimated value of €1.5 trillion. This represents an increase of 8 to 10% compared with the previous year, partly due to price increases by luxury brands.

• 80% of this growth was driven by personal luxury goods (fashion, jewellery, leather goods, etc.), the automotive sector and the hotel industry

• France remains the global leader in the luxury goods market, with four companies in the top 10 of Deloitte's 2023 luxury goods companies by sales: LVMH (1st), Kering (2nd), L'Oréal (6th), and Hermès (8th).

Chanel, which ranked at the fifth position and under the UK base, remains one of the driving forces behind the French luxury industry 1

• In France, the luxury and fashion industry generated a turnover of €42 billion in 2022, more than automotive and aerospace industry combined.

• France's luxury goods market is projected to generate a revenue of €17.61bn in 2024 and is expected to experience an annual growth rate of 3.29% (CAGR 2024-2028).

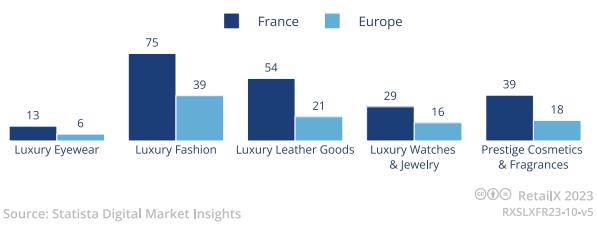

• The largest segment within the luxury goods market is luxury fashion, with a market volume of €6.32bn in 2024, followed by luxury leather goods and prestige cosmetics and fragrances.

• With a few exceptions and despite a slowdown in the market, in 2023, major luxury groups' such as LVMH made record profits and sales as market returns to “normal”.

• French luxury shoppers spend more than the average European luxury shopper.

• In terms of per capita revenues, the luxury good market in France is estimated to generate €271.99 per person in 2024.2

• 43% of French luxury shoppers shop-in-store, generating 80% of revenues 3

• Online sales are predicted to contribute 17.8% of the total revenue in the luxury goods market by 2024.

• 41% of French online buyers use their mobile phone to complete a purchase.4

• 67% of French luxury shoppers are interested in buying more sustainable products.

1 Global Powers of Luxury Goods 2023 | Deloitte Global

2 Luxury Goods - France | Statista Market Forecast

3 RetailX France Luxury Ecommerce Report 2023

4 Ibid.

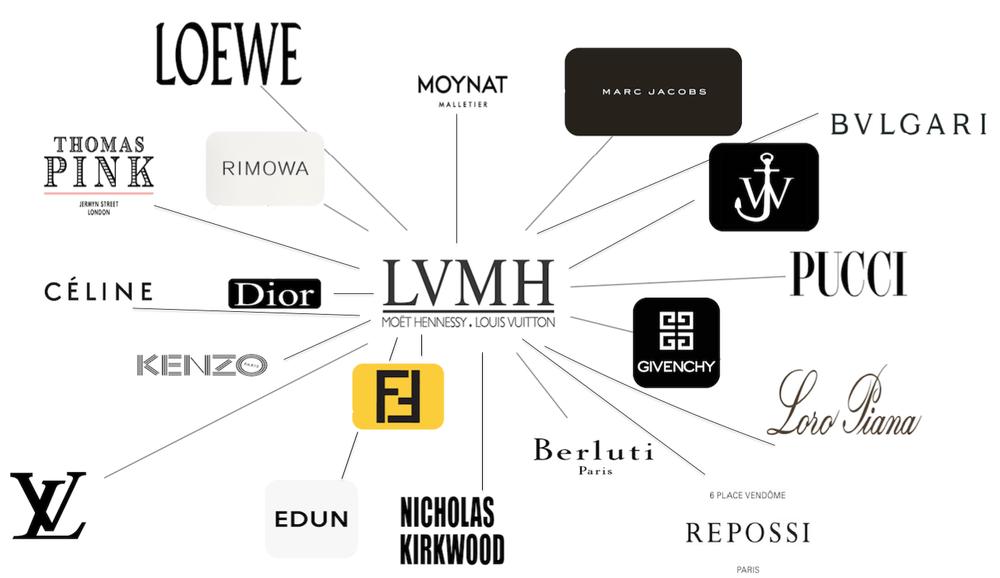

The LVMH Group, also known as Moët Hennessy Louis Vuitton, is the world leader in luxury goods. The group gathers 75 prestigious brands - including Moët & Chandon, TAG Heuer and Bulgari, with €86.2 billion revenue in 2023 and a retail network of over 6,000 stores worldwide. Fashion remains the core focus for Bernard Arnault's group, with a portfolio that includes Dior, Louis Vuitton, Céline and Kenzo. Louis Vuitton is currently the second most valuable clothing brand in the world and the most influential luxury fashion brand in France since 2018.

Number 2 in the global luxury goods industry, with 47,000 employees worldwide, the Kering Group comprises six iconic fashion and leather goods houses (Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen and Brioni), five jewellery brands (Boucheron, Pomellato, Dodo, Qeelin, Ginori 1735), as well as the Kering Eyewear and Kering Beauté entities. In 2023, Kering's global revenue amounted to about €19.5 billion.

Chanel, a century-old French fashion house creates, manufactures and distributes high-end luxury products in fashion, fragrance and beauty, and watches & fine jewellery. Also known for its No.5 perfumes and quilted leather handbags, Chanel is a major player in the promotion of culture, art,creativity and craftsmanship. The company is one of the most valuable luxury brands worldwide, alongside other luxury fashion giants such as Louis Vuitton, Hermès, and Gucci. Its global revenue reached €18.2 billion in 2023.

Hermès is a French luxury design house established in 1837. It specialises in leather goods, lifestyle accessories, home furnishings, perfumery, jewellery, watches and ready-to-wear. Hermès is an independent family-owned company. Axel Dumas, a sixth-generation family member, has been the CEO since 2013. They are well known for their “carré de soie” (square silk scarf) and Birkin bag.

In a turbulent economic and geopolitical context, luxury brands are facing a challenging environment, with strategies for differentiation becoming increasingly polarised between those focusing on elevation and those offering more accessible luxury. While hyper-luxury customers now account for around 40% of major brands' sales, there is also a need to appeal to consumers with more limited purchasing power, particularly among Gen Z, who are aspirational targets. 5 The millennial and Gen Z generations currently represent the largest consumer spending power within the luxury goods market, with Gen Alpha fast approaching this position. Unlike their elders, possession is not their only purchase driver and are often looking for a story, an experience and an ethical commitment from brands By 2025, 70% of the luxury goods market will be accounted for by Generation Z.6

In the context of the global pandemic, luxury brands have demonstrated resilience, with performance levels returning to those seen prior to the onset of the crisis. However, the luxury sector is undergoing a significant transformation, with an increasing focus on eco-friendlier business models. For instance, brands like Hermès, one of the leading purveyors of luxury goods in the world, has been committed to using high-quality raw materials from renewable natural sources in the manufacture of its long-lasting products. This shift towards sustainability has been driven by external factors. Luxury goods consumers are becoming increasingly aware of the environmental issues associated with the apparel manufacturing industry and expect solutions from luxury brands that go beyond the production of a luxury product. Moreover, there is a growing regulatory pressure within the French/EU market.

5 Polarisation, mutations géographiques, tarifs... Quelles tendances pour le marché du luxe en 2024 ? (journalduluxe.fr)

6 Luxe, Mode & Beauté 23 mai- Trends & Networking (hubinstitute.com)

New models for optimising usage have therefore been developed by companies such as reparation to ensure the durability of products, second-hand to increase the number of uses, recycling or upcycling to give a second life to existing parts, and rental to limit consumption and maximise usage. In April 2021, French luxury group LVMH launched Nona Source, the first online resale platform of deadstock materials, collected from the group's houses, which enables designers to purchase remnants from the ateliers of Dior, Givenchy, Louis Vuitton and others at a significantly reduced cost.

The market for second-hand luxury goods continues to experience significant growth, mainly driven by the decline in purchasing power and the increase in the level of trust in C2C resale platforms. An increasing number of affluent consumers view resale as a sustainable shopping option, while brands are leveraging resale as a means of enhancing their sustainability credentials. According to Bain & Co., second hand luxury sales increased by 65% from 2017 to 2021, outpacing new luxury sales by more than five times over the same period. Monogram Paris, Vestiaire Collective and Collector Square have established themselves as key players in this market

4. France is spearheading the sustainable fashion agenda

France is actively advocating for more stringent sustainable fashion legislation, more than any other EU country. Along with additional clauses from older French laws and broader EU proposals in the pipeline, several new pieces of legislation have been introduced in France. These include enhanced supply chain traceability, more transparent product labelling to combat greenwashing, and updates to the extended producer responsibility (EPR) scheme, with the aim of reducing pre- and post-consumer waste.

In addition to the French government’s efforts, numerous actors, associations, and initiatives in France, such as Federation de la Mode Circulaire, Paris Good Fashion, and Fashion Green Hub, are dedicated to driving tangible changes in the fashion industry towards a more responsible approach. With the support of LE DEFI and in partnership with PwC and in cooperation with the Member Houses, the Fédération de la Haute Couture et de la Mode (FHCM) launched two eco-design tools7 for Member Houses and the brands listed in the Official Calendar of Paris Fashion Week® (PFW®) and the Haute Couture weeks as part of its policy in favour of sustainable development:

▪ Ecodesign and support tool for events: it is the first eco-design tool capable of offering a globalised environmental and social approach applied to the organisation of events with the objective of measuring the environmental, social and economic impact of the PFW® and can be applied to the entire value chain

7 Microsoft Word - FHCM CP US.docx

of fashion shows and presentations, in their physical and digital dimensions. It allows each participating House to complete the calculations of their environmental, social and economic impact before organising an event (fashion show/presentation/showroom) and assist them in making the most appropriate choice of service providers, with the aim of reducing environmental impact and optimising social impact.

▪ Ecodesign and support tool for collections and the industrial value chain: this tool helps companies to eco-design their collections by measuring the environmental and social impact of their entire industrial value chain.

Luxury brands are continuing to invest in digital channels to reach new customers and offer exclusive online experiences, while maintaining the exclusivity and time-honoured craftsmanship that are the hallmarks of luxury products. Luxury brands are embracing cutting-edge digital technologies such as AI, machine learning and the Internet of Things, enabling them to offer their customers a unique, innovative and personalised experience, but also revolutionising sustainability, supply chains and product authenticity.8 For example, to sell luxury to Gen Z, Tiffany & Co and Cartier collaborated with Snapchat allowing users to try on their products virtually through AR technology.9

Moreover, the majority of major luxury brands are investigating the potential of virtual reality and the metaverse. A number of high-end fashion brands are at the forefront of this trend, including Louis Vuitton, Fendi, and Dolce & Gabbana. Some of these brands (e.g. Gucci and Balenciaga) have even started accepting cryptocurrencies as a form of payment, while NFTs and online gaming are set to become increasingly important in the luxury industry. This shift allows brands to connect with younger consumers in a more playful and futuristic way. Digital transformation also plays a crucial role in accelerating the green transition (e.g water and energy consumption measurment, data analysis for production and collection management).

To ensure the authenticity of luxury products and combat counterfeiting, many brands are adopting blockchain technology, such as Louis Vuitton, which have implemented blockchain solutions to track their products from creation to sale. It also helps to promote more responsible and sustainable sourcing, as well as providing proof of authenticity for secondhand buyers.

8 Global Powers of Luxury Goods 2023 | Deloitte Global

9 Cartier and Tiffany are getting into AR to sell luxury to Gen Z | MIT Technology Review

The advent of social networks and new platforms has led to a shift in consumer behaviour, with networks becoming an integral part of the shopping experience.10 In order to remain competitive, brands must adapt their strategies to align with these new digital ecosystems Tik Tok, for instance, is a popular social media mainly used by younger generations11 and a valuable platform for luxury brands to connect and engage with these consumers Renowned luxury brands such as Dior and Chanel are successfully using algorithms to enhance their marketing strategies, for example by working with influencers, who are a powerful tool for engaging customers by enabling a wide range of promotional activities. For instance, Codec.ai is an award-winning AI powered cultural consultancy that helps brands identify, understand and levelup their audience intelligence

Personalisation, customer loyalty and the in-store retail experience remain the key elements that differentiate luxury from traditional retail.12 Physical shops accounts for the largest share of luxury market value. 90% of French people say they prefer physical shops. However, consumers expect brand experience that goes beyond the simple purchase of a product. Other sales channels and business models are also taking off. According to McKinsey forecasts, almost 20% of luxury goods sales will be made online by 2025.13

Extended Producer Responsibility Companies managing textile clothing products are subject to the principle of Extended Producer Responsibility (EPR).

10 Luxe, Mode et Beauté, quelles innovations pour fluidifier le parcours d’achat ? | HUB Institute - Digital Think Tank

11 Retail Economics and TikTok: The Power of Social Commerce: Building Brands in the TikTok Era (Full) by tiktokforbusinesseu - Issuu

12 Le marché mondial du luxe - Faits et chiffres | Statista

13 Journal du Luxe Intelligence #4 : bilan 2023 et perspectives 2024 pour le Luxe.

Companies subject to EPR must either:

• Collectively establish approved eco-organisations (with other companies subject to EPR in the same sector). Companies subject to EPR contribute financially to them in return. The sector has a dedicated eco-organisation called Refashion (formerly Eco-TLC), which fulfils the obligations of manufacturers in terms of waste management for their products. Manufacturers pay a fee to Refashion. In return, Refashion must meet the collection and recovery targets for used textiles set out in the guidelines. They are also responsible for developing the textile waste management chain (collection, sorting and recovery). Find more information on their website: Website in english.

• Or establish an individual collection and treatment system approved by the authorities.

Note: the regulations applicable to individual systems are complex. It is generally simpler and more advantageous to contribute to an eco-organisation.

For more information regarding the EPR scheme, follow this link: Filières à Responsabilité Élargie du Producteur (REP) | Entreprendre.Service-Public.fr

Composition labelling is mandatory on clothing, written in French, indicating the percentages of textile fibres used in the garment.

Only the indication of the composition is mandatory at the community level (see the above-mentioned regulation). The indication of the geographical origin relating to the manufacture of the product ("Made in", in particular) is optional but relatively common in this field, considering the requirements of certain importing countries, as well as consumers' appetite for this information.

Care labelling is optional but strongly recommended to avoid the professional's liability in case of incidents. It provides care instructions and may include symbols.

The standard EN ISO 3758:2023 sets the 5 symbols used to specify washing, bleaching, drying, ironing, and dry cleaning conditions, for example. The use of these symbols is not royalty-free: in France, it entails a fee collected by COFREET. For more information on the European legislation on Textile Label:

• Textile Label - Your Europe (europa.eu)

• Regulation (EU) No 1007/2011 of the European Parliament and of the Council of 27 September 2011

The AGEC, or “Anti-Waste Circular Economy Law”, requires all fashion brands in French territory to provide environmental labels on their products (or online product page) to clearly show where and how they were made. Additionally, brands must share the contents of each garment, such as recycled materials, unsafe chemicals, or synthetics prone to shedding plastic microfibers. For more detailed information, click here.

The Haute Couture label is a legally controlled designation in France since 1945. Haute couture is a French tradition that represents luxury, excellence and expertise. In contrast to ready-to-wear garments, haute couture items are bespoke, typically for high-profile clients. Only a few fashion houses are able to obtain this designation each year. The responsibility for obtaining this label lies with the Commission de Contrôle et de Classement de Couture et de Création, which operates under the aegis of the French Ministry of Industry. 14 The different criteria can be found on the following link: Tout savoir sur l'appellation haute couture - Fashion Skills (fashion-skills.com).

France, despite being a neighboring market, has its specificities and in order to develop your brand successfully, it is essential to take into accounts several elements that can make the difference, such as: the language, the customer service, the shipping cost/return cost, number of SKUs, production capacity, social networks reach, etc. We recommend studying the market, discussing with potential partners, learning from others’ experiences and making the relevant adjustments. To do this the best way possible, it is essential to work with partners for various aspects, such as: labelling, logistics, translation, brand representation, PR & comm, etc.

There are several showrooms and agencies in France which can help you access the market through various services. You will find a comprehensive list on the following map: showrooms and agencies in France as well as a short selection in the table below with a luxury focus. Before reaching out, it is important to select the ones that match the most with your needs and requirements, depending on various criteria:

• international reach or local representation only,

• distribution format or tailorized support,

• PR and communication services

• etc.

Five0Five Showroom is a multi-branded showroom and agency representing a curated selection of international, contemporary and luxury brands for both men and women.

Partelio is a multi-company retail group with over 10 years' experience and 302 sites under management.

Services include: multi-brand showroom & consultancy, point of sale management, training, cleaning, maintenance, interim, point of sale search, field sales, and 360 retail.

Boon Paris is an open art gallery and showroom that showcases international artists, designers, and fashion brands in a 700-square-metre space in central Paris.

Services include: international PR & communication with permanent press office showroom and sales management services.

Talent to Trend is a Parisian fashion agency created in 2015, with multi-brand showrooms in Paris and Tokyo.

Services include: brand development, consulting, showroom organisation (events), commercial agent and communication support.

Created in 2013, Ag-ency is a luxury multi-brand showroom present at every Paris Fashion Weeks.

Services include: consultancy, business development, showroom, PR/Communication, ongoing customer support.

IMONI Showroom Paris is a fashion & lifestyle, sales, press and design agency with a physical showroom in Paris and a digital showroom.

Services include: PR/ communication, exhibition service and trade show/ digital showroom

France, and Paris in particular, is home to a considerable number of concept stores. A concept store is a themed retail store that relies on product exclusivity, innovation, and creative staging to attract customers. In contrast to traditional retail stores, concept stores aim to create an environment that goes beyond the mere sale of products. The following map will provide you a comprehensive list of concept stores in Paris, including those in the Fashion Retail sector: Concept Stores Map

Galerie Lafayette is France's best known department store and a major French marketplace. The shopping destination offers a comprehensive range of luxury fashion and accessories for men, women and children.

La Samaritaine offers an unparalleled selection of brands, encompassing luxury fashion, fine jewellery and watches, accessories, and exclusive designer items.

Le Bon Marché Rive Gauche is the oldest Parisian department store and the only one of the Rive Gauche. It features a selection of cutting-edge and exclusive brands.

Since its inauguration in 1865, Printemps has been one of the leading department store in Paris, renowned for its fashion, luxury, and beauty offerings. The store boasts an astonishing total area of 45,000 sqm dedicated to shopping, dining, and tailor-made services.

BHV MARAIS is a department store located in the historical and trendy Le Marais district. It is a distinctive shopping destination, offering a vast selection of over 2,000 fashion and design brands, along with a diverse range of activities.

The LVMH Prize for Young Fashion Designers was launched in 2013. This competition is open to fashion designers from all over the world aged between 18 and 40 who have created at least two womenswear, menswear or genderless ready-to-wear collections.

The LVMH Prize includes three awards:

• The LVMH Prize for Young Fashion Designers

• The Karl Lagerfeld Prize

• The Savoir-Faire Prize

The newly created Savoir-Faire Prize focuses on exceptional craftsmanship, technical expertise and innovation, as well as sustainability in a young brand.

Association Nationale pour le Développement des Arts de la Mode (ANDAM) Fashion Award was established in 1989 by Nathalie Dufour as a joint venture between the French Ministry of Culture and the Defi Mode fashion organisation. It is widely regarded as a benchmark for fashion professionals and a pathway to Paris Fashion Week for promising new designers.

The Hyères International Festival of Fashion, Photography and Accessories was established in 1986 and has since become a highly regarded institution. The springboard has enabled designers such as Anthony Vaccarello, Julien Dossena and Marine Serre to gain greater visibility.

Founded in the 1950’s, the International Woolmark Prize is the world’s most prestigious award for rising fashion stars, investing in creativity and nurturing talent to positively shape the fashion industry. It connects an astonishing list of industry legends, both past and present including Karl Lagerfeld, Yves Saint Laurent and Edward Crutchley.

E-Fashion Awards is a competition to reveal, support and encourage young fashion designers committed to an eco-responsible approach.

The Textile Fashion Care Awards by COFREET (TFCA) reward European companies committed to an eco-responsible approach that combines textile care and innovation.

▪ Launched by the FHCM, "Welcome to Paris" is a programme of events outside the official calendar of the Paris Fashion Week. It is dedicated to international initiatives wishing to promote creative brands in Paris during fashion weeks. Each organisation can represent a city, a country or a group of cities or countries. It enables a collective of brands (professional organisation, foundation, association, etc.), representative of the fashion industry in its country, to present three to eight designers and benefit from visibility on the FHCM digital platform.

▪ Since January 2020, the Fédération de la Haute Couture et de la Mode (FHCM) has been operating with the support of LE DEFI and L'Oréal Paris - SPHERE - Paris Fashion Week® showroom. SPHERE is part of the Federation's policy of supporting young designers and brings together a range of brands invited to the official calendar or prize-winners, selected for their creativity and development potential.

Fédération de la Haute Couture et de La Mode (FHCM) is the most important fashion organisation in France. It brings together French and international fashion houses selected for their creativity and unique, innovative know-how. The FHCM is both a professional organisation serving its members and an event organisation coordinating Paris Fashion Week® and Haute Couture Week.

Founded in 1954, the Comité Colbert is an association and lobby whose aim is to promote French luxury throughout the world. The members of the association include today 93 luxury brands, such as Chloé, Christian Dior Couture and Balmain, 18 cultural institutions and 6 European members.

The Fédération Française du Prêt à Porter Féminin is the partner of French fashion entrepreneurs. It supports brands in their responsible development in France and abroad. The Federation works alongside entrepreneurs to guide them towards new markets, work on their growth strategy and anticipate the new challenges they face.

Comité de Développement et de Promotion de l’Habillement (DEFI) is a committee recognised as being in the public interest, bringing together the 3,500 French players in the fashion and clothing industry - from luxury giants to fashion unions and federations, as well as independent designers. Its main goal is to promote French fashion by supporting emerging young designers and giving them global exposure

The Union Française des Industries Mode & Habillement (UFIMH) is the representative body for the entire fashion and clothing sector: brands, fashion manufacturers, professional and image clothing manufacturers, fashion and accessories designers.

Paris Good Fashion : initiated by the City of Paris, Paris Good Fashion brings together players in the sector - brands, designers, experts, citizens - who are committed to taking concrete actions to transform the industry towards fashion that respects the environment and human rights. Its aim is to make Paris the capital of sustainable fashion by 2030.

Fédération de la Mode Circulaire : represents over 250 companies and retailers engaged in circular fashion. To enhance the positive socioenvironmental impact of circular fashion over the long term, the Federation champions transparent, responsible, and fair fashion, injecting dynamism into the fight to halt global climate change caused by the fashion and luxury industries.

The Fédération de la Maille, de la Lingerie & du Balnéaire supports companies to succeed globally. It offers information and training tools to enable members to develop or advance strategies and react to economic fluctuations, while maintaining a focus on future trends.

The Institut Fracais du Textile et de l’Habillement (IFTH) is the benchmark French Technology Centre for industrial companies and brands in the textile and fashion sectors. With 145 employees, including 110 engineers and technicians, IFTH has human and technological resources that are unique in France for testing, innovating, certifying and training.

Refashion is a private, non-profit company approved by the French Ministries of Ecology and Economy. It is the Producer Responsibility Organisation (PRO) for Clothing, Household Linen and Footwear Extended Producer Responsibility (EPR) in France. It is responsible for preventing waste and managing the end-of-life of products placed on the French market.

Paris Fashion Week (PFW) reflects Paris's role as the world capital of fashion due to its economic and cultural importance. It takes place four times a year, with two editions of womenswear (spring/summer in September and autumn/winter in March) and two editions of menswear (autumn/winter in January and spring/summer in June). It is structured by its official calendar, around which events of various kinds are organised.

The composition of the Official Calendar is based on the Members of the Chambre Syndicale de la Mode Masculine and the Chambre Syndicale de la Mode Féminine, who are entitled to participate, as well as on the guest Houses.

Haute Couture Week is held twice a year, in January and July. The Official Calendar is the foundation upon which events are organised, reflecting the unique position of Paris as the only place where Haute Couture creation and the associated know-how are expressed.

During Haute Couture Week, the Chambre Syndicale de la Haute Couture also organises the Haute Joaillerie (fine jewellery) calendar, during which the associated Haute Joaillerie Houses present their collections.

More than 20 years after its creation, WHO'S NEXT Paris has become the leading international fashion trade show for womenswear in Europe. It operates different shows including:

▪ The Salon International de la Lingerie

▪ Premiere Classe

▪ Matter and Shape

▪ Bijorhca

▪ Interfilière Paris

Four times a year during Paris Fashion Week, the Tranoï Paris fashion trade show takes place in prestigious venues and establishes a relationship between creativity and business. It is the most attended event by international buyers and the leading fashion event for women’s designers during Paris Fashion Week.

Le Journal du luxe is a luxury news website with articles on fashion, beauty, watches, jewellery, lifestyle and business.

Numéro is a French monthly magazine that covers fashion, art, cinema, music and lifestyle.

Vogue France is the French edition of Vogue magazine, formerly called Vogue Paris from its inception until 2021. Featuring collaborations with the industry's top designers, photographers and talents, Vogue France provides a platform for both established and emerging professionals to showcase their work.

Luxe Digital is a website that covers luxury fashion, travel, culture, and business with reviews, guides, and stories.

MODEM: modemonline.com and the Modem editions are the go-to resources for professionals in the fashion and design industries, offering a comprehensive range of tools and information to support their work.

Harper's BAZAAR France: for nearly 156 years, Harper's Bazaar has been a leading publication in the fashion and luxury sector, combining creativity and daring with a focus on quality and innovation.

FashionNetwork France is the information website for fashion, luxury and beauty professionals. With more than 850,000 subscribers to its daily newsletters and 300 articles published every day, it is the world's leading source of information for fashion professionals.

WeAr is the only leading global B2B magazine for fashion & footwear published in 8 language versions It is a leading international trade magazine for the fashion industry which fuses art with fashion and couture.

RUNWAY Magazine covers the latest trends and events in fashion, culture and art from around the world.

Any questions?

Please get in touch with the DBT team based in France: CommercialEnquiries.Paris@fcdo.gov.uk

Bibliography

Global Powers of Luxury Goods 2023 | Deloitte Global

RetailX France Luxury Ecommerce Report 2023

Polarisation, mutations géographiques, tarifs... Quelles tendances pour le marché du luxe en 2024 ? (journalduluxe.fr)

Luxe : le ralentissement se confirme, le segment premium résiste - Le Revenu

L'avenir du secteur du luxe : les perspectives pour 2024 - EIML (eiml-paris.fr)

Retail and Luxury Marketbeat in France in 2023 | France | Cushman & Wakefield (cushmanwakefield.com)

Luxury Goods - France | Statista Market Forecast

France Luxury Report 2023 - InternetRetailing

Luxe, Mode et Beauté, quelles innovations pour fluidifier le parcours d’achat ? | HUB Institute - Digital Think Tank

Cartier and Tiffany are getting into AR to sell luxury to Gen Z | MIT Technology Review

Other useful links :

Doing business online (e-commerce): rules to follow | Entreprendre.Service-Public.fr

Balances, promotion or reduction, liquidation | Entreprendre.Service-Public.fr

Producer Responsibility Organisations | Filières à Responsabilité Élargie du Producteur (ademe.fr)

Refashion.fr - Refashion for a 100% circular textile industry

Inside The Luxury Fashion Industry’s Big Sustainability Push | British Vogue