France is the global leader in fashion, with Paris Fashion Week a key destination for both haute couture and ready-to-wear.

The market is distinguished by the prevalence of country-of-origin brands, which are widely available through both online and offline channels.

The French retail market is mature and offers high potential for turnover, profitability, and brand recognition. The population is upwardly mobile, and the country attracts large numbers of tourists.

The information provided below will offer you a comprehensive guide to successfully accessing the French market.

P 1.Market overview

P 2.Trends

P 3.Regulations

P 4.Distribution channels

P 5.Federations and organisations

P 6.Events

After a promising 2022, the French fashion retail market experienced a period of stagnation in 2023. The fashion sector (comprising clothing, footwear, accessories and household linen) generated a turnover of €39.85 billion in 2023, down 0.2% on 2022 1 The clothing market alone reached €26.7 billion.

Source: INSEE, IFM Panel

▪ Despite the impact of inflation, the final figures released by the Institut Français de la Mode (IFM)2 indicated a 1.3% decline in value in 2023 compared to the previous year.

▪ The number of units purchased in 2023 totalled 2.6 billion, down 3% on 2022 and down 13% on 2019.

▪ Sales generated in 2023 remained 5.6% lower on average than pre-crisis levels in 2019.

▪ Clothing prices increased by 4% on average in 2023, compared to +6% in 2022.

Men's clothing is the only category to grow in 2023 (+0.6%). However, the Institut Français de la Mode notes that there is still a transfer of fashion purchases to textile chains, since according to the Union Sport & Cycle, textiles in sports chains are up by 1%.3

Footwear was more affected than clothing due to the rise of sports retailers Sporting goods accounted for a quarter of the Fashion market: €9.96bn Sportswear sales (up 2.4% on 2022 and +39% on 2017) and €2.9 bn Sneakers sales (up 8.4% vs 2022).

Since the outbreak of the pandemic, the ready-to-wear sector in France has been in crisis. Brands well known to French consumers such as Camaïeu, Kookaï, André, San Marina, Kaporal, Don't Call Me Jennyfer, Du Pareil au Même and Sergent Major have suffered from a combination of factors that have had a significant impact on the industry, including the pandemic, inflation, rising costs of energy, raw materials, rents and wages, and competition from second-hand goods and fast fashion.4 For instance, Camaïeu, the womenswear retailer and one of France's leading names in fashion distribution, whose liquidation in October 2022 came as a shock, was recently bought back by Celio.5

2 Les derniers résultats de la consommation d'articles d'habillement et textile en 2023 | Institut Français de la Mode (ifmparis.fr)

3 Les 9 chiffres-clés du marché de la mode en 2023 (lsa-conso.fr)

4 Après Camaïeu, Kookaï, André… Naf Naf placée en redressement judiciaire (20minutes.fr)

5 La marque Camaïeu rachetée par Celio pour 1,8 million d'euros (lefigaro.fr)

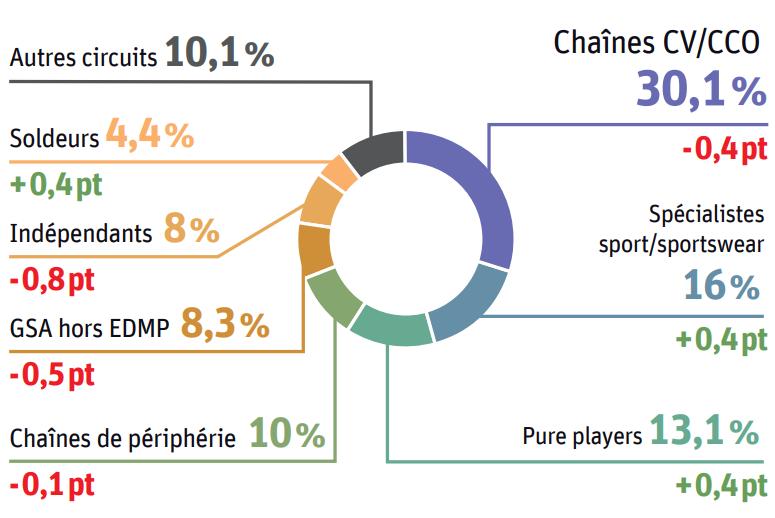

City centre and shopping centre chains (e.g. Zara, Primark, Okaidi, Etam) represent the primary shopping destination, followed by sports retailers and pure players.

centre & shopping centre chains

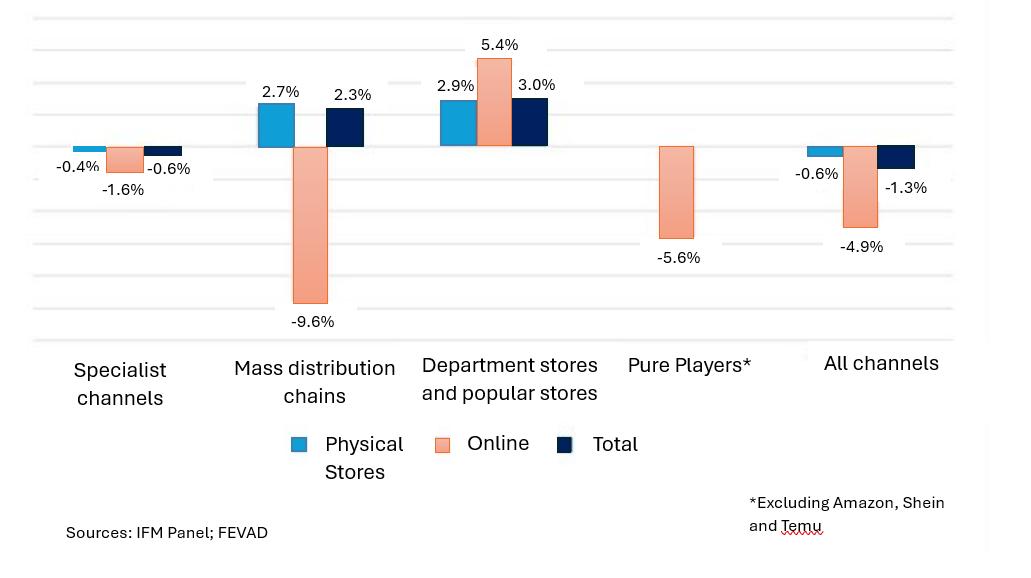

Figure 3 - Market share in value of the various distribution channels in France in %, and change vs 2022 in pt 6

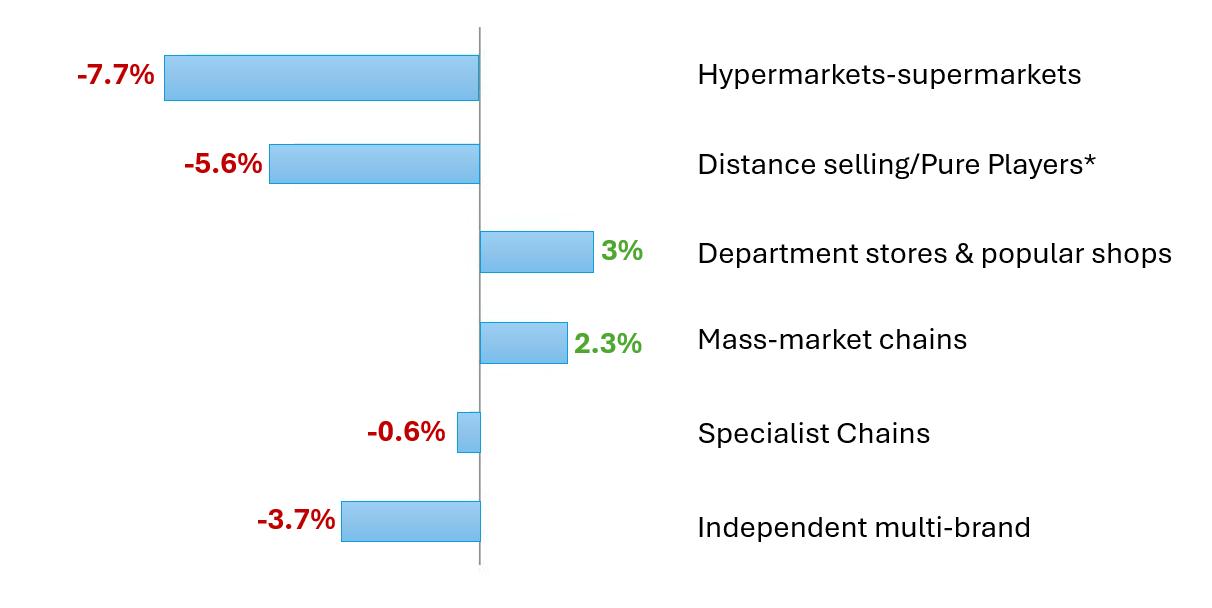

In its latest quarterly barometer, Kantar reveals that in 2023 the fashion market has seen a shift in power towards sports retailers and discounters (e.g. Action, Noz) In the first half of the year, Action became the volume leader for footwear products (socks, tights, etc.) and number five for underwear.7 Sales outlets had a market share of over 8.5% in transactions According to the Institut Français de la Mode, this success is being felt by large food retailers, with hypermarkets and supermarkets recording the biggest declines in recent years.

6 source: Katar, LSA Data

7 Action, Shein, Vinted... Les enseignes de mode face à une nouvelle concurrence (lsa-conso.fr)

8 Source : Institut Français de la Mode

Hypermarkets and supermarkets represent the channel where fashion sales fell the most in 2023 (-7.7% compared to 2022) and have lost almost a quarter of their clothing sales since 2019 (-23.6%). The mid-range fashion sector has experienced a significant increase in price points, with many consumers perceiving the value proposition to be below expectations.

In 2023, online sales (including Amazon, Temu and Shein) accounted for 21.4% of the total fashion retail market.

▪ The three pure players Amazon, Temu and Shein generated sales of €1.3 billion, equivalent to 4% of clothing consumption.9

▪ The market share of French players: 46% (+4.1%)

▪ The market share of international players: 54% (+0,9%)

The end of the year continues to be a peak period for online sales, driven by the continued momentum of Black Friday and the demand for end-of-year gifts.10

However, while sales in physical shops fell slightly (-0.6%), the FEVAD reports a 4.9% decline in online sales (excluding Amazon, Temu and Shein) in 2023. Nevertheless, this represents a 10.9% increase compared to 2019. Following a sharp increase during the COVID-19 crisis, online sales have stabilised and reached 17% in 2023, compared with 18% in 2022 (15% in 2019). On average, e-commerce has grown from 7% to 10% of sales across all specialist channels (including mass distribution channels) between 2019 and 2023

9 Les 9 chiffres-clés du marché de la mode en 2023 (lsa-conso.fr)

10 Mode : la fin d’année 2023 a profité aux pure players [Baromètre Kantar/LSA] (lsa-conso.fr)

The indirect effects of inflation have had a significant influence on consumer behaviour, with fashion purchases frequently employed as a means of coping with the considerable price increases witnessed in the food and energy sectors.

In 2023, 90% of French people say they prefer physical shops (vs. 88% in 2022). Large cities such as Paris have a highly diversified offer, including luxury boutiques and major brand shops.12 In less urban areas, clothing shops tend to focus on local needs, with a predominance of multi-brand shops or national chains.

France is actively advocating for more stringent sustainable fashion legislation, more than any other EU country. Along with additional clauses from older French laws and broader EU proposals in the pipeline, several new pieces of legislation have been introduced in France. These include enhanced supply chain traceability, more transparent product labelling to combat greenwashing, and updates to the extended producer responsibility (EPR) scheme, with the aim of reducing pre- and post-consumer waste. In addition to the French government’s efforts, numerous actors, associations, and initiatives in France, such as Federation de la Mode Circulaire, Paris Good Fashion, and Fashion Green Hub, are dedicated to driving tangible changes in the fashion industry towards a more responsible approach.

11 Source : Kantar Worldpanel Fashion 2023

12 Le marché des magasins d'habillement en France en 2024 (modelesdebusinessplan.com)

According to FEVAD, 45% of French online shoppers have bought at least one second-hand product in the last 12 months.13 French consumers are interested in the potential to sell items they no longer require, including clothing and other personal items. This shift in consumer behaviour has led to a decline in enthusiasm for new products and a rise in popularity of second-hand items. Platforms Leboncoin and Vinted are the dominant players in the second-hand fashion sector. However, aware of the competition from these giants, many players in the sector are adapting and trying to cope with this new trend. For example, KIABI launched its own dedicated platform, Seconde Main by KIABI, connecting buyers and sellers of second-hand clothing. According to the Institut Français de la Mode, 38% of the players consulted have already developed a second-hand offer, while 24% intend to develop it over the course of the year. Second-hand fashion is very popular among younger generations. The under-35s are the most inclined to this type of purchase (60%), while the over-65s are still timid (25% have bought in the last in the last 12 months).

The impact of influencers and social media platforms, such as Instagram, Tiktok and Pinterest, on fashion trends and consumer buying decisions is on the rise. The advent of social networks and new platforms has led to a shift in consumer behaviour, with networks becoming an integral part of the shopping experience.14 In order to remain competitive, brands must adapt their strategies to align with these new digital ecosystems. Tik Tok, for instance, is a popular social media mainly used by younger generations15 and a valuable platform for brands to connect and engage with these consumers.

13 Edition 2024 des « Chiffres-clés du e-commerce » : La Fevad publie son rapport annuel sur l’état du marché - Fevad, la Fédération du e-commerce et de la vente à distance

14 Luxe, Mode et Beauté, quelles innovations pour fluidifier le parcours d’achat ? | HUB Institute - Digital Think Tank

15 Retail Economics and TikTok: The Power of Social Commerce: Building Brands in the TikTok Era (Full) by tiktokforbusinesseu - Issuu

The popularity of children's fashion has grown in recent years, with companies launching a range of stylish garments in line with current fashion trends for children. 16 The children's wear market is dynamic and growing, with products tailored to the specific needs and preferences of young consumers and their parents. Factors such as increasing disposable income, media coverage, customised products, innovation, affordable prices and a growing awareness of children's clothing brands among parents are influencing the growth of the global children's clothing market. 17 The French children's clothing market is characterised by a multitude of distribution channels, each responding to specific consumer needs and expectations. 18 Brands such as Kiabi, Okaidi, Orchestra, Cyrillus and Jacadi offer a wide range of clothing and accessories at a variety of prices, appealing to a diverse customer base. Additionally, gender-neutral clothing is a prominent trend in the children's wear market. Manufacturers are focusing on launching gender-neutral apparel and boosting their product sales.

Companies managing textile clothing products are subject to the principle of Extended Producer Responsibility (EPR). Companies subject to EPR must either:

• Collectively establish approved eco-organisations (with other companies subject to EPR in the same sector). Companies subject to EPR contribute financially to them in return. The sector has a dedicated eco-organisation called Refashion (formerly Eco-TLC), which fulfils the obligations of manufacturers in terms of waste management for their products. Manufacturers pay a fee to Refashion. In return, Refashion must meet the collection and recovery targets for used textiles set out in the guidelines. They are also responsible for developing the textile waste management chain (collection, sorting and recovery). Find more information on their website: Website in English

• Or establish an individual collection and treatment system approved by the authorities.

Note: the regulations applicable to individual systems are complex. It is generally simpler and more advantageous to contribute to an eco-organisation.

In addition to these obligations, companies subject to EPR must:

• Obtain a unique identifier (IDU) and display it in specific documents.

• Submit an annual declaration, particularly regarding the quantity of products placed on the market.

16 Kids Apparel Market Size, Share Growth & Trends [2032] (fortunebusinessinsights.com)

17 Ibid. 18

• Display certain environmental characteristics of the products on the packaging.

• Depending on the situation and the sector, comply with other obligations (such as affixing sorting signage, etc.).

For more information regarding the EPR scheme, follow this link: Filières à Responsabilité Élargie du Producteur (REP) | Entreprendre.Service-Public.fr

➔ Online sales platforms

Online sales platforms may not be subject to EPR for the products they sell if a third party (such as the product manufacturer) has already fulfilled its obligations for the same products. This compliance may have been achieved by the third party making a financial contribution to an approved eco-organisation or by setting up an individual scheme for these products and obtaining a unique identifier (IDU).

For an online sales platform to benefit from this exemption, it must record the corresponding justifications in a register made available, upon request, to the ministry responsible for the environment.

Composition labelling is mandatory on clothing, written in French, indicating the percentages of textile fibres used in the garment.

Only the indication of the composition is mandatory at the community level (see the above-mentioned regulation). The indication of the geographical origin relating to the manufacture of the product ("Made in", in particular) is optional but relatively common in this field, considering the requirements of certain importing countries, as well as consumers' appetite for this information.

Care labelling is optional but strongly recommended to avoid the professional's liability in case of incidents. It provides care instructions and may include symbols.

The standard EN ISO 3758:2023 sets the 5 symbols used to specify washing, bleaching, drying, ironing, and dry cleaning conditions, for example. The use of these symbols is not royalty-free: in France, it entails a fee collected by COFREET.

For more information on the European legislation on Textile Label:

• Textile Label - Your Europe (europa.eu)

• Regulation (EU) No 1007/2011 of the European Parliament and of the Council of 27 September 2011

The AGEC, or “Anti-Waste Circular Economy Law”, requires all fashion brands that sell more than 10,000 units of garments, footwear, and home textiles in French territory to provide a verified environmental label on their products (or online product page) to clearly show where and how they were made. This labelling includes information on reparability, recyclability, sustainability, re-use possibilities, recycled material content, use of renewable resources, traceability, and the presence of plastic microfibres. More detailed information: here.

‘Ecobalyse’ is a new calculation method launched by the French government which will determine the future environmental labelling to which fashion companies selling in France will require to adhere by autumn 2024. This calculation method will give each garment a score, by considering the environmental impact of the product throughout its life cycle, as well as the sustainability of the garment itself. This new tool is currently open to consultation, before the publication of a decree scheduled for May, and effective implementation in the autumn. Learn more: here

France has taken a pioneering step to counteract the detrimental effects of fast fashion by proposing a levy of 5 euros on each fast fashion item sold. The French National Assembly approved this tax proposal in April 2024, making a significant move against the environmental and social impact of fast fashion companies like SHEIN and Temu The objective of the legislation is to make fast fashion brands less attractive to consumers in France by increasing the price of products, thereby encouraging consumers to choose more sustainable alternatives or to limit their apparel consumption. Nevertheless, the proposal still needs the French Senate’s approval before being adopted.

In France, there are two periods of "soldes" (sales) each year: one in winter and the other in summer. The regulations are set out in an amended decree, which limits the period to four weeks and defines the start and end dates. All products offered during the “soldes” period must have been available for purchase for a minimum of one month prior to the commencement of the “soldes”. It is mandatory to display the reference price alongside the sales price, as well as the discount applied. It is possible to create pre-sales operations at any point throughout the year, however the term "soldes" cannot be used. For more information : Quelle est la réglementation des soldes ? | economie.gouv.fr

France, despite being a neighboring market, has its specificities and in order to develop your brand successfully, it is essential to take into accounts several elements that can make the difference, such as: the language, the customer service, the shipping cost/return cost, number of SKUs, production capacity, social networks reach, etc. We recommend studying the market, discussing with potential partners, learning from others’ experiences and making the relevant adjustments. To do this the best way possible, it is essential to work with partner for various aspects, such as: labelling, logistics, translation, brand representation, PR & comm, etc.

There are several showrooms and agencies in France which can help you access the market through various services. You will find a comprehensive list on the following map: showrooms and agencies in France. Before reaching out, it is important to select the ones that match the most with your needs and requirements, depending on various criteria:

• international reach or local representation only,

• distribution format or tailorized support,

• PR and communication services

• etc.

France, and Paris in particular, is home to a considerable number of concept stores. A concept store is a themed retail store that relies on product exclusivity, innovation, and creative staging to attract customers. In contrast to traditional retail stores, concept stores aim to create an environment that goes beyond the mere sale of products. The following map will provide you a comprehensive list of concept stores in Paris, including those in the Fashion Retail sector : Concept Stores Map.

Galerie Lafayette is France's best known department store and a major French marketplace. The shopping destination offers a comprehensive range of luxury fashion and accessories for men, women and children.

Le Bon Marché Rive Gauche is the oldest Parisian department store and the only one of the Rive Gauche. It features a selection of cutting-edge and exclusive brands.

Since its inauguration in 1865, Printemps has been one of the leading department store in Paris, renowned for its fashion, luxury, and beauty offerings. The store boasts an astonishing total area of 45,000 sqm dedicated to shopping, dining, and tailor-made services.

BHV MARAIS is a department store located in the historical and trendy Le Marais district. It is a distinctive shopping destination, offering a vast selection of over 2,000 fashion and design brands, along with a diverse range of activities.

The French ready-to-wear retail sector is characterised by a diverse range of groups, which collectively own the majority of the country's renowned ready-to-wear brands. The most notable ones are outlined below:

• Groupe Beaumanoir: Sarenza, Caroll, Morgan, Vib’s, Bonobo, Bréal, CacheCache.

• Fast Retailing France : Comptoir des Cotonniers, Princesse tam tam

• Groupe SMCP: Sandro, Maje, Claudie Pierlot, Fursac

• Mulliez Family: Kiabi, Groupe Decathlon, Fashion Cube (Pimkie, Brice, Jules, Rouge Gorge Lingerie), Tape à l’œil

• Groupe Shiever: Intersport, Intersport Outlet, Blackstore, Go Sport

• Groupe Celio: Celio, Camaïeu

• Etam Group: Etam, Maison 123, Undiz, Livy, Ysé

• Promod

• Groupe Antonelle-UJA : Antonelle, Un Jour Ailleurs, Kookaï

4.

Sarenza is an e-commerce company that specializes in selling shoes and accessories.

Spartoo is an online sales site specialised in the sale of shoes, ready-to-wear, leather goods, and small decorative objects

Zalando is a German online retailer that offers over 1,500 brands of shoes, clothes and accessories for every style and occasion.

La Redoute is a French top online retailer that specializes in fashion, home decor, and lifestyle products.

Veepee is a French retailer company that sells products through online flash sales.

Brandalley is a UK based online fashion retailer that launches multiple flash sales each day which typically last for a week at a time.

ShowroomPrivé is a French private sales website that gives its members access to the stocks of major brands at reduced prices.

The Fédération Française du Prêt à Porter Féminin is the partner of French fashion entrepreneurs. It supports brands in their responsible development in France and abroad. The Federation works alongside entrepreneurs to guide them towards new markets, work on their growth strategy and anticipate the new challenges they face.

The Union Française des Industries Mode & Habillement (UFIMH) is the representative body for the entire fashion and clothing sector: brands, fashion manufacturers, professional and image clothing manufacturers, fashion and accessories designers.

Founded in 1929, the Fédération Française de la Chaussure (FFC) brings together around 200 brands. In all, 120 companies - manufacturers and designers of footwear products - spread across the country.

Founded in 1948, Alliance France Cuir (formerly known as the Conseil National du Cuir) is a unique trade organisation dedicated to the leather industry.

Union du Grand Commerce de Centre-Ville (UCV), a member of Alliance du Commerce, is the trade federation that brings together department stores, popular shops and town centre retailers.

Fédération Nationale de l'Habillement (FNH) is the only employers' union representing independent retailers in the clothing and textiles sector.

The Conseil National des Centres Commerciaux (CNCC) is the only professional organisation that brings together all the players in the shopping centre industry.

The Fédération de la Maille, de la Lingerie & du Balnéaire supports companies to succeed globally. It offers information and training tools to enable members to develop or advance strategies and react to economic fluctuations, while maintaining a focus on future trends.

The Institut Fracais du Textile et de l’Habillement (IFTH) is the benchmark French Technology Centre for industrial companies and brands in the textile and fashion sectors. With 145 employees, including 110 engineers and technicians, IFTH has human and technological resources that are unique in France for testing, innovating, certifying and training.

FEVAD is the Federation of e-commerce and distance selling, it is a professional organisation that brings together e-commerce and online sales companies.

More than 20 years after its creation, WHO'S NEXT Paris has become the leading international fashion trade show for womenswear in Europe. It operates different shows including:

▪ The Salon International de la Lingerie

▪ Premiere Classe

▪ Matter and Shape

▪ Bijorhca

▪ Interfilière Paris

Playtime Paris

Since 2007, Playtime Paris has been at the forefront of the children's fashion and lifestyle sector, showcasing the best collections of international designers and avant-garde brands twice a year. It is a global reference for the entire children's market, offering a unique combination of fashion, lifestyle, and parenthood brands, as well as distinctive spaces such as New Now, Singular, and an area dedicated to illustrators.

The ‘French Days’ is one of the most eagerly awaited promotional periods in France Similar to the Black Fridays, this event is held twice a year, in spring and autumn, since 2018. It generally lasts for five days but some offers are only available for a few hours, or while stocks last. Many brands and distribution channels take part of it such as La Redoute and Showroomprivé, who are one of the six French founders of French Days. Please be advised that the event is not solely focused on French products.

Some French retailers, such as Sport 2000 and Intersport, organise supplier days (journées d'achat) where suppliers can showcase their products to buyers. Intersport, for example, holds 'des journées d'achat' twice a year.

Any questions?

Please get in touch with the DBT team based in France: CommercialEnquiries.Paris@fcdo.gov.uk

Edition 2024 des « Chiffres-clés du e-commerce » : La Fevad publie son rapport annuel sur l’état du marchéFevad, la Fédération du e-commerce et de la vente à distance

Tous les chiffres sur l’habillement (lsa-conso.fr)

Les 9 chiffres-clés du marché de la mode en 2023 (lsa-conso.fr)

Mode : la fin d’année 2023 a profité aux pure players [Baromètre Kantar/LSA] (lsa-conso.fr)

Luxe, Mode et Beauté, quelles innovations pour fluidifier le parcours d’achat ? | HUB Institute - Digital Think Tank

Retail Economics and TikTok: The Power of Social Commerce: Building Brands in the TikTok Era (Full) by tiktokforbusinesseu - Issuu

Kids Apparel Market Size, Share Growth & Trends [2032] (fortunebusinessinsights.com)

Marché de l'habillement pour enfants : tendances et perspectives en 2024 (fashionunited.fr)