POLAND'S ASCENT TOWARDS SILICON VALLEY STATUSSEPARATING HYPE FROM REALITY

For daily news visit us at wbj.pl Since 1994 Poland’s leading business magazine in English WARSAW BUSINESS JOURNAL AUGUST - SEPTEMBER 2023 ~ No. 4 (79) Visit us online

DECLINE Exclusive Interview: Soren Rodian Olsen talks about Nrep's Logicenters and 7R Merger BÉRANGER DUMONT General Manager at BPI Real Estate on sustainability, innovation, and customer satisfaction

WARSAW'S OFFICE MARKET SHINES AMIDST GLOBAL

8 In Review News

14 Opinion

War never changes. Neither Does Restoration by Sergiusz Prokurat

16 Exclusive

Interview: United States

Ambassador Mark Brzezinski by Ewa Boneicka

18

Cover Story

Interview: Béranger Dumont, General Manager at BPI Real Estate Poland by Morten Lindholm

27 Lokale Immobilia

News

The office rental market revolution By Anna Rzhevkina

Interview: Soren Rodian Olsen by Morten Lindholm

No room for micro-apartments? by Sean Reynaud

CEEQA's Ukraine Live Connect project Interview by Morten Lindholm

42 Investing in Poland

News

Is Poland the next Silicon Valley or tech hub? by Sean Reynaud

48 Features

Food of the future by Sean Reynaud

Luxury market by Sean Reynaud

57 Tech News

Interview: Nico Schoenerberger by Beata Socha

62 Life + Style

2 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL AUG/SEPT

18 52 44 48 36 ALL IMAGES SHUTTERSTOCK EXCEPT TOP COURTESY OF CAPITAL PARK

Season's best 64 Events

PERSONAL INSIGHTS FROM 2023 ABOUT BUSINESS IN POLAND

Poland's Ongoing Attraction for Global Business

Poland remains a magnet for foreign enterprises and investors. In the first half of 2023, I assisted over ten international companies in establishing operations in Poland, guiding them through their business setup, marketing strategies, talent acquisition, and proper online positioning. Their reasons for choosing Poland include a rich talent pool, competitive costs, and untapped consumer potential. Noteworthy nations represented among these companies are Lithuania, Finland, China, Dubai, Brazil, Georgia, Israel, Denmark, Germany, Norway, and the USA.

The Profound Evolution of AI

This year marks a pivotal moment in the widespread acceptance of artificial intelligence(AI). While AI has existed for some time, the emergence of applications like ChatGPT has showcased its transformative potential and disrupted established norms. While not unique to Poland, this development bodes well for countries fostering young, driven entrepreneurs. Poland is wellpositioned in this regard. Top local companies like Zabka, Allegro, and CD Projekt are already driving significant developments in this area. However, we have only scratched the surface of AI's potential.

Ukraine's Impact on Poland's Landscape

The complex influence of Ukraine cannot be disregarded as a factor shaping Poland's past, present, and future—both positively and negatively. We have seen a stabilization in the influx of refugees, along with the repatriation of many to Ukraine or their resettlement abroad. Since the onset of the war, Poland has successfully integrated over half a million individuals into its workforce while providing educational support for children and families. Conversations about Ukraine's reconstruction pervade governmental, corporate, and association discussions, positioning Poland as a vital leader in aiding Ukrainian investments and recovery. While the timeline remains uncertain, the shadow of the ongoing conflict underscores the need for vigilance in navigating its impact on various aspects of life.

Navigating Election Year Dynamics in Poland

Poland is preparing for the parliamentary election scheduled on October 15th. While Warsaw Business Journal maintains a nonpartisan stance as a business-focused medium, completely avoiding the political landscape is challenging. The media landscape is becoming polarized, with distinct factions aligning their narratives on the state of Poland's economy and citizens' quality of life. Noticeable discrepancies are emerging. Data from the first half of 2023 indicates that Polish GDP has slipped into a recession. Yet another news segment focuses on the projected 1% growth for the year. The contrast underlines what the forthcoming months of contrasting perspectives will be.

Several indicators paint an optimistic outlook as we zoom out to gain a broader perspective amidst the noise. July saw Warsaw's airport breaking passenger records, a testament to thriving connectivity. In stark contrast, local hotels report dwindling occupancy rates. The real estate sector contributes to the complexity, with apartment sales declining in the first half of the year. However, primary markets are now witnessing rising prices due to inflation and demand outpacing supply.

Amid this dynamic flux, Warsaw Business Journal remains committed to delivering nuanced insights; you can sign up for our daily news coverage on Polandam.pl. Our focus remains steadfast on providing valuable businesscentric perspectives, as we have done for nearly 30 years, particularly during this pivotal election year in Poland.

In this issue, we have gathered a selection of insights, investigations, and interviews with movers and shakers in Poland.

Enjoy the read!

4 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL PORTRAIT BY PIOTR NAREWSKI

MORTEN LINDHOLM

PUBLISHER'S NOTE

Béranger Dumont

Béranger Dumont has been General Manager of BPI Real Estate Poland since 2020 and sits on the Belgian Chamber of Commerce Board. With a background as an Ernst & Young auditor, he holds an MBA in finance and real estate from Solvay Brussels School and Louvain School of Management.

Interview on page 18

GUESTS

Ambassador Mark Brzezinski

Ambassador Brzezinski, former U.S. Ambassador to Sweden, led transformative U.S.-European trade initiatives and secured major Swedish investments, including Volvo's $1 billion South Carolina factory. He orchestrated the historic U.S. Presidential visit to Stockholm, uniting Nordic leaders on energy and innovation. As the inaugural Executive Director of the White House's Arctic Executive Steering Committee, he tackled Arctic strategy. Previously, he excelled in law and finance, championing sustainability. Council on Foreign Relations and Trilateral Commission member. Academic achievements from Dartmouth, UVA, and Oxford.

Interview on page 16

Soren Rodian Olsen

Soren Rodian Olsen has 21 years of senior management and real estate experience in Poland. He heads Nrep’s logistics branch in Poland, Logicenters, and set up Nrep’s offices in Warsaw in 2021. Prior to joining Nrep, Soren was a Partner and Head of Capital Markets at Cushman & Wakefield. In previous roles he was Head of Aberdeen Asset Management in Poland and between 2002 and 2008 he worked for Bank BPH (Bank Austria Creditanstalt) and mBank (Commerzbank) as Head of Asset Management, Real Estate, Supply Chain and Business Continuity. He holds an MBA from the University of Westminster, is a member of RICS and is the Chair of ULI Poland.

Interview on page 34

Morten Lindholm

Editor-in-Chief/Publisher mlindholm@valkea.com

Kevin Demaria Art Director kdemaria@valkea.com

Jessica Sirotin Editor

Contributors

Nikodem Chinowski Sergiusz Prokurat

Sean Reynaud

Anna Rzhevkina Beata Socha

Sales Izabela Kaysiewicz ikaysiewicz@valkea.com

Agnieszka Mańkowska amankowska@valkea.com

Katarzyna Pomierna kpomierna@valkea.com

Print & Distribution

Krzysztof Wiliński dystrybucja@valkea.com

Event Director, Valkea Events

Magda Gajewska mgajewska@valkea.com

Contact:

phone: +48 22 257 75 00

fax: +48 22 257 75 99 e-mail: wbj@wbj.pl WBJ.pl

For enquiries,subscriptions-related please email us at wbj@wbj.pl

WarsawBusinessJournal @wbjpl

All photographs used in this issue are courtesy of partners and companies unless specified otherwise.

Copyright © 2023 by Valkea Media SA

Published by ul. Jerzego Ficowskiego

6 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

not be

manner whatsoever

express written

All rights reserved. This publication or any portion thereof may

reproduced or used in any

without the

permission of the publisher.

S.A.01-747

CEO NIP:

To subscribe

15 Valkea Media

Warszawa Tomasz Opiela,

525-21-77-350 www.valkea.com

through RUCH SA: www.prenumerata.ruch.com.pl, prenumerata@ruch.com.pl, 801 800 803 ON THE COVER

IN REVIEW

DEMAND FOR AC RISES WITH TEMPERATURES

Before the onset of Poland's scorching summer heatwaves, interest in renting apartments equipped with air conditioning surged by 91% in May, compared to the same period a year ago. There was also a 38% increase in the demand for purchasing air-conditioned apartments, according to Otodom. There are, however, twice as many apartments for rent with AC rather than apartments for sale. (biznes.interia.pl)

8 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK

AGRICULTURE Poland second in blueberry production in the EU

Poland is the second-largest producer of blueberries in the European Union after Spain and the sixth in the world, the Polish Economic Institute reported. From 2013 to 2022, Poland delivered almost 100,000 tons of blueberries to foreign markets.

In 2022 alone, exports from Poland reached €107.3 million, which, according to Eurostat, accounted for 16.5% of the total value of EU exports. The largest recipients include Germany, Great Britain, the Netherlands, Sweden, and Latvia.

ENERGY Poland to create insurance instrument for companies investing in Ukraine

Polish companies waiting for over a year will soon have access to a new insurance instrument for investments in Ukraine. Minister Jadwiga Emilewicz announced that the insurance, backed by the Polish government, will be available to Polish firms and foreign companies, including Ukrainian entrepreneurs.

State export credit insurer KUKE will provide this unique instrument and aims to support bilateral economic cooperation. In addition, the Polish government is preparing a new investment fund, financed through PFR (Polish Development Fund) bonds, to further assist Polish investments in Ukraine.

ENVIRONMENT Poland lost €16 bln in 40 years due to climate change

Over the last 40 years, Poland lost €16 billion, or about PLN 70 billion, due to climate change, a report by the EY consulting showed. In 2021 alone, the total value of damages paid due to natural disasters amounted to PLN 994 million, mostly to cover damage caused by torrential rains, flooding, storms, hail, and hurricanes.

The report also notes that in the worst-case scenario, Poland’s GDP may decrease by up to 10% due to destructive weather phenomena by 2050. In an optimistic scenario, in which the goals set out in the Paris Agreement would be achieved, the relative decline in GDP is expected to amount to 3%.

RETAIL Food retail market will grow at 6% a year in 2023-2028

The grocery retail market in Poland is expected to grow at an average annual rate of 6% from 2023 to 2028, driven by factors such as inflation, increased demand from Ukrainian immigrants, and changing consumer behaviors. In 2022, the market saw a record double-digit growth, reaching a value of approximately PLN 368 billion.

Discount stores are the leading channel in the grocery retail market, accounting for over one-third of sales. These stores have been expanding their offerings, including fresh and convenience products, premium private label brands, and selected non-food items. Additionally, online sales are projected to grow at a higher rate, contributing to the market's overall growth.

HEALTH Private healthcare market expected to grow 7% annually in 2023-2027

The private healthcare market in Poland is projected to grow at a 7% annual rate from 2023 to 2028, with health insurance and medical subscriptions rising by 9% and 8%, respectively, according to PMR research. In 2022, the market’s value exceeded PLN 70 billion with double-digit growth, driven by increased demand for medical services amid the pandemic.

MILITARY Poland signs deal with Sweden for Saab 340 aircraft

On July 25th, the Armament Inspectorate signed a contract to supply Swedish Saab 340 AEW early warning aircraft. The two Saab 340 AEW aircraft will provide the Polish Armed Forces with early detection and warning capabilities for airborne threats. Polish Minister of National Defense, Mariusz Błaszczak, stated that this acquisition would enhance the eastern flank of NATO and make Poland’s airspace safer.

10 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL News

IN REVIEW THIS PAGE UNSPLASH, OPPOSITE PAGE SHUTTERSTOCK

POLITICS Let the Games Begin: Only 2 Months Left Until the Next Election

Politicians are closing ranks. Their time is coming to try and persuade Polish voters about the positive impact only they can bring in the upcoming autumn parliamentary elections.

PROGRAMS OR PR?

The elections will also determine the parameters within which the forthcoming local elections will unfold, taking place four months after the parliamentary battles in autumn. The ruling party holds a significant advantage in this arena. While campaign funding for PiS is constrained by regulations, these restrictions do not apply to the government. The government utilizes the Family 500+ Program to set up information points that morph into campaign events, employs state television for propagandistic purposes, and exerts influence over major state-owned enterprises to shape advertising and content, all in an effort to steer voters towards the desired choice.

WHAT’S TO BE DISCUSSED?

The current political struggle revolves economic and social issues. Firstly, restoring the splendor of the Family 500+ Program.

The current social assistance of PLN 500 monthly, has eroded in value to about PLN 350 due to recent high inflation. Ahead of the elections in July 2023, the value of monthly social support paid by the Family 500+ Program was indexed from PLN 500 to PLN 800 (implementation to take place only from 2024).

Secondly, significant political discussions are ongoing about domestic living conditions. In mid-2023, a discussion about housing needs swept through the Polish media and reached the dangerous conclusion that housing is a fundamental right rather than a commodity. The result was the introduction of the First Apartment program, popularly known as the "safe loan" program, in July. This initiative offers a secure 2% loan, with the government subsidizing the disparity between the prevailing market interest rate and the fixed 2% rate for those under 45 years old and without prior property ownership. Moreover, the program circumvents the jurisdiction of both the Monetary Policy Council

(MPC) and the decisions made by the National Bank of Poland (NBP), both of which determine interest rates, alongside the credit holidays initiated during the summer of 2022.

For several months now, all opposition parties have been grappling with the challenge of devising strategies against a rival whose political strategies depend upon the progressive increase of state influence in the economy and social assistance to citizens. The opposition has responded with criticism of existing social programs while also advocating their extension with such inducements as a safer 0% credit option, and a rent subsidy of PLN 600, among others. From the point of view of the average voter, this strategy may seem rather contrived. But free social benefits guarantee votes, even if they cause debt and inflation.

IS IT ALL RIGGED?

Yet the numerous scandals and instances of misconduct involving individuals connected to the current authorities are not forgotten. Neither are the disruptions during the Covid pandemic and the noticeable inflation. In order to mobilise people to vote for PiS, the ruling party's marketers have conceived the notion of conducting a referendum with four questions to coincide with the elections. These questions are clearly designed to exploit voters’ emotions, evoking the fear that often accompanies issues such as the privatization of enterprises or immigration.

The election date, October 15, coincides with the global observance of Pope John Paul II Day, which is likely to intensify the activity within churches. Voters at church services are likely to receive information candidates and take these conclusions into the nearby polling station, conveniently situated next door. At the moment, everything indicates that the majority of those outraged by scandals, affected by inflation, and tired of the poor situation in the country will say, come Sunday, that things are not so bad after all.

WBJ.PL 11 Elections BY SERGIUSZ PROKURAT IN REVIEW

More flops, fewer ventures

Due west 16.4%

y/y increase in Polish exports to Germany in 2022, reaching €96.4 billion.

(GUS)

21.3%

more companies went bankrupt in Q2 2023 than in the same quarter of 2022 (97).

-5.5%

fewer companies were founded in the same period (88,549).

(GUS)

Job market stabilizes

-0.8%

y/y drop in new recruitment processes launched in July, but a 2% increase m/m.

(Grant Thornton)

Sky high

1.94 million

the number of passengers traveling via Warsaw Chopin Airport in July – a new record. Since the beginning of 2023, the airport has handled over 10 million passengers.

13.8%

y/y increase in average monthly salary in Q2 (to PLN 7,005.76), but a decrease of 1.7% q/q.

(GUS)

53% of employers struggling to hire skilled industrial workers (Grafton Recruitment)

Growth forecast improves 0.7%

expected GDP growth in 2023, 2.2% in 2024

(Polish Economic Institute)

PMI still low 43.5 points

Poland’s PMI in July, a drop from 45.1 points the previous month.

(S&P Global)

12 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL News in Numbers

IN REVIEW

Anyone interested in conducting business in the US has heard of companies based in the state of Delaware. This state's prominent position as investors' preferred choice for incorporation is entirely justified. Thanks to its business-friendly regulations and case law, Delaware, despite being the second smallest US state, is home to some 1.5 million companies from around the world. This roster includes 68% of Fortune 500 companies, among them Amazon, Facebook, Uber, Tesla, UPS and Nike, among others.

A Delaware-based company can do business in other states too by obtaining a foreign qualification while still retaining the right to the application of Delaware law. Other advantages of incorporating in Delaware include:

- absence of sales, capital gains, inheritance and VAT taxes;

- privacy protection for individuals holding positions in the company.

An additional advantage is the so-called "Delaware loophole" which is used by businesses operating outside the State of Delaware to minimize their tax liabilities. The State of Delaware does not impose any tax on profits flowing from "intangible assets," i.e., such as trademarks or intellectual property rights. It is estimated that the "Delaware loophole" costs other states about $1.5 trillion in taxes they could collect from companies. However, the use of the "Delaware loophole" is not a circumvention of the law and its compatibility with the US tax system seems undeniable.

Instead of a tax on profits, Delaware imposes a franchise tax ranging from $170 to $180,000, depending on the

INCORPORATING IN DELAWARE AND ALTERNATIVES FOR FOREIGN INVESTORS

by Jarosław Kurpiejewski, Attorney-at-law, Senior Associate at Ilasz & Associates

company's assets. The state also charges a small registration fee on the annual return and an agency fee. More than 40% of the State of Delaware's total revenue comes from small franchise fees. There is no minimum capital required to open a business.

Other entrepreneur-friendly states include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. Where Delaware imposes a franchise tax, those states have no income tax and thus often no tax on dividends. However, the lack of income tax is offset by exceptions, other taxes or lack of exemptions offered by other states. For example, Washington State imposes a 7% income tax on capital gains, targeting a specific segment of high-earning individuals with incomes exceeding $250,000. This tax pertains to gains realized on investments, including interest, dividends, or profits from the sale of stocks. Capital gains arise from the sale of capital assets, excluding real estate.

The state of Delaware is the undisputed leader among entrepreneurs. However, although it boasts many apparent benefits, the decision of where to establish a company should be guided by a comprehensive analysis of factors such as the nature of the business, and both local as well as federal tax implications. This is especially crucial for foreign investors who aren't obligated by tax considerations tied to their residence in a specific US state.

For more information, visit: www.ilaszlawfirm.com

WBJ.PL 13

BUSINESS SPOTLIGHT

OPINION

WAR NEVER CHANGES. NEITHER DOES RESTORATION

BY SERGIUSZ PROKURAT

even before the outbreak of the war, Ukrainians constituted the largest group of economic migrants in Poland. When the Russian aggression began, almost 8.5 million Ukrainian citizens came to Poland. Now it is estimated that from 1.5 million to 2.3 million of them permanently reside in Poland, including about 950,000 classified as war refugees. Nearly 500,000 are of working age, and most are women and children.

UKRAINIANS IN POLAND

Since January 2023, upon arrival in Poland, Ukrainians can easily obtain a Polish PESEL number. Having this number makes it easier to obtain a residence permit if the refugee finds a job. An estimated 50-55% of refugees from Ukraine are now employed in Poland. According to data from the latest edition of the “Barometer of the Polish Labor Market”, individuals from Ukraine are already employed in almost every second Polish company, typically in lowerlevel positions. This year, taxes and contributions collected from their salaries are projected to contribute approximately PLN 5.5 billion to the budget.

At the same time, on the expenditures side, Ukrainians receive various benefits: PLN 500 per month from the Family 500+ program, Family Care Capital (RKO), PLN 300 for school starter kits, family allowances (totalling PLN 2 billion) and education-related expenses (totalling PLN 2.9 billion), all amounting to a total of PLN 4.9 billion. They are satisfied and reportedly believe that their standard of living has improved significantly. This is hardly surprising, because the

minimum wage in Poland is PLN 3,600 gross, and in Ukraine it is UAH 6,500, approximately PLN 846.

Ukrainians value the security and peace found in Poland, which is understandable, considering many of them fled the conflicts in 2022 and 2014. They also clearly appreciate the Polish willingness to help and their kindness in high regard, sentiments that persist even a year after the outbreak of the war. Furthermore, they enjoy the availability of employment and a well-developed infrastructure. However, the question arises: Do they plan to return to their home country when the war is over?

This is a fundamental problem that is reluctantly raised during any discussion on the reconstruction of Ukraine. The acceptance and assimilation of Ukrainians is in the interest of every country that receives immigrants, especially since it was mainly women who left during the war. Yet, I believe that 3/4 of those who left will not return to Ukraine after the war.

Simply type the word “divorce” into Google (‘розлучення’) and it becomes evident that its usage has been on the rise in various locations worldwide since 2022, including Poland, the Czech Republic, France, Germany and beyond. In addition, many demobilised soldiers are expected to leave Ukraine after the war to reunite with their families abroad. For the moment, due to the ongoing conflict, Ukraine has imposed restrictions on men from leaving the country.

From a demographic perspective, Ukraine has already experienced substantial losses, even if it

14 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK

Russia’s aggression against Ukraine caused numerous losses both among the population and the economy. The country is facing a long and costly period of reconstruction, during which it will certainly need support. Ukrainians who are in Poland can help.

regains all the lost territories and Russia suffers defeat. Ultimately, the conflict between Russia and Ukraine has no winners, only losers.

THE FUTURE OF UKRAINE

Ambitious plans to rebuild Ukraine are already under consideration by politicians. But discussions about reconstruction projects have taken precedence over those concerning human capital, a resource that cannot be so easily replenished. Tenders are set to be announced for the reconstruction, as the money will come from EU and US funds. The World Bank’s estimation places reconstruction costs at that $411 billion. This amount, of course, increases with each Russian attack.

For comparison, Ukraine’s GDP in 2019, before the outbreak of the COVID-19 pandemic, had reached as much as $153.9 billion. This means that the cumulative value of the country’s goods and services is decidedly lower than the funds needed to rebuild the country following the extensive devastation caused by the Russian invasion. The impact of this devastation is substantial; in 2022 alone, the economy shrank by 30%, leading to an unemployment rate of 35%. More than three-quarters of companies have stopped or reduced production. Suffice it to say that three million people live in homes destroyed or damaged by the Russian invasion. The scale of the devastation caused by the Russian invasion of Ukraine is truly overwhelming. The Russians destroyed or seriously damaged over 150,000 housing estates in Ukraine, thousands of educational facilities, over eight hundred healthcare facilities and hundreds of bridges. This catastrophe is a dire consequence of Russia’s 19th-century ambitions.

The reconstruction of Ukraine will undoubtedly take place once the conflict ends. But even as the war continues, discus-

YAHIDNE, UKRAINE - JULY 8: Volunteers from the organization "Repair Together" are clearing the rubble of a war-damaged local House of Culture, cleaning and stacking bricks for reuse.

sions regarding the implementation of projects in Ukraine are underway. The funds required for this process will primarily come from Western countries such as the United States, Germany, Italy and France. Their vested interest transcends any simple consideration of profit and loss. Recently, the G7 countries established a donor platform to coordinate ongoing and long-term support to Ukraine and its post-war recovery.

Ukraine can get loans from the World Bank (£240 million), and is poised to receive potential EU funding of up to €50 billion over four years in the form of both grants and loans. Additionally, US assistance to Ukraine totalling $1.3 billion will be provided for the modernisation of Ukraine’s energy system and critical infrastructure.

The recovery plan is divided into three main pillars. The first pillar involves the rapid reconstruction of essential facilities and infrastructure for daily living. The second pillar addresses the urgent reconstruction of hospitals, schools and construction of temporary residential buildings. The third pillar consists of a long-term transformation plan for the country.

IS REBUILDING IS POSSIBLE?

The “Reconstruction of Ukraine” program has been initiated in Poland, spearheaded by the Polish Investment and Trade Agency (PAIH)., and three thousand Polish companies have already applied. The competition for contracts related to Ukraine’s reconstruction will certainly be fierce, and extend beyond the borders of Poland alone. Of course, the influence and power of various countries will play a pivotal role in the outcome.

For Polish companies interested in securing contracts in Ukrainian, several strategies should be considered. Perhaps employ Ukrainians, and look for partners among Ukrainian companies? This will facilitate communication and understanding of these difficult conditions of the very wild East.

Even before the war, Ukraine faced issues such as nepotism, corruption, and a range of macroeconomic challenges, coupled with geopolitical risks. After the war, if it will be necessary to clear the ports of mines, temporarily restricting water transport for business activities. The reconstruction of roads to facilitate land transport will be necessary and urgent. Nevertheless, the war continues, and Ukraine’s population is dwindling every day.

WBJ.PL 15

Insights on Poland: An Interview with the United States Ambassador

United States Ambassador Mark Brzezinski shares insights into Poland’s role on the global stage and its strong partnerships with international businesses.

WBJ: In Poland, parliamentary elections are coming soon and the rivalry between PiS and the democratic opposition is very tense. What do you think?

Mark Brzezinski: Poland’s political leadership is a matter for the people of Poland and their representatives to decide through their constitutional processes. Opinion polls show constant shifts, so I doubt anyone could predict the outcome. It would be inappropriate for me even to try.

My embassy colleagues and I are in communication with all parties across the political spectrum. We expect to have good relations with whichever government the Polish people choose in the elections. Because that is our job as representatives of the United States, but more importantly, we share common interests and values with Poland’s political leaders, both in the government and the opposition. I expect continuity on key issues such as support for Ukraine.

How does the economic situation of Poland affect the activities of foreign ambassadors in our country?

Over the last year and several months, the United States and Poland have strengthened our economic cooperation. I am proud that bilateral trade between the United States and Poland has increased exponentially over the last 30 years, and in 2021 trade was the highest in our history. American companies love working in Poland and want to expand our mutual prosperity. The most significant example is Poland's selection of Westinghouse to construct the first nuclear power plant here in Poland. That is more than just a business agreement. That is the start of a hundred-year strategic collaboration to address Poland's energy security and environmental commitment. Economic security and energy security are national security.

The Polish economy continues to attract American investment. I am constantly hearing from American CEOs saying, "We're coming to Poland because Poland is open for business. We understand it is next to a war zone, but Poland is open for business and a good place to invest. It is a good place to manufacture our products. It's a good place for engineering, tech innovation, and building regional hubs." I have programs at the American Embassy to which I invite specific CEOs. The CEO of Google, Sundar Pichai, the CEO of YouTube, Susan Wojcicki, the CEO of Boston Consulting Group, Hans-Paul Burkner, and the CEO of McDonald's, Chris Kempczinski, have all taken part.

In these meetings, they have shared that they are opening new McDonald's across Poland; YouTube has announced thousands of Polish white-collar tech jobs in Poland; Google has purchased the Warsaw hub, a major building complex here, for $1 billion last year. These are important signals that the Polish economy will continue to advance and thrive.

Our bilateral relationship is nurtured and cared for by the American business community investing in Poland and our shared future. This year, we have

16 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

PORTRAIT COURTESY OF THE US EMBASSY

seen expansion and growth, allowing for more opportunities for both countries.

When you finish the position of Ambassador to Poland, will you continue to work as a diplomat or work at a university?

Although I have been blessed to have been selected twice to represent my country abroad, I am a lawyer, not a career diplomat. I spent a decade as a partner in a law firm; later, I was Managing Director at a capital management company; most recently, I founded my own company – but I have put that on hold while I serve as Ambassador.

As U.S. Ambassador to Poland how do you see your role in promoting equality between men and women in all spheres of life?

I am absolutely committed to gender equality. Let me tell you why. The Brzezinski house has been filled with strong women throughout my life.

Let me say a bit about my mother. She was an artist, and her work was every bit as important as my father’s. My parents practiced true gender equality. When the kids came home from school, and my mom was working with her chainsaw on a huge sculpture, we did not interrupt her until she finished because her work was just as important as my dad’s. And I so respect now, as an adult – how my dad supported her.

I am also proud of my sister, Mika Brzezinski. She has stood up to political intimidation and established herself as a top journalist in the United States.

Professionally as well as personally, I have worked with many strong women.

You know, I served as U.S. Ambassador to Sweden. One of the things that I loved about Sweden when I was Ambassador was that well over half of the ministers in the Swedish government were women at that time. Magdalena Andersson was Minister of Finance; she’s Prime Minister now. Ann Linde, Foreign Minister now, was in the Ministry of Justice. These are the people leading Sweden into NATO now – whom I worked with and respected when I was Ambassador there.

If you want to talk about the U.S. government, look at some of the powerful women that have come to Poland while I have been Ambassador: Kamala Harris, the Vice President; Nancy Pelosi, when she was Speaker of the House; Janet Yellen, the Secretary of the Treasury; General Jacqueline Van Ovost, Combatant Commander of the Transportation Command; Samantha Power, the head of the United States Agency for International Develop-

ment (USAID). And that is only a few among many. There is still a lot of work to be done on gender equality, but as the father of a teenage girl, it is incredibly important to me. I am firmly committed to gender equality, and my team at the embassy has originated and been engaged in many programs to advance women in business, science, and other fields.

What are your thoughts about World Refugee Day and the position of Ukrainians in Poland today? On June 20, we celebrated World Refugee Day to recognize the enormous contributions of refugees to the societies where they find new homes. This day was an appropriate moment to reflect on the incredible support Poland has provided not only to Ukraine but also to Ukrainians who found refuge in Poland after they were forced to flee their homeland.

Poland continues to rise to the occasion, particularly as it seeks to welcome Ukrainian women into the workforce, offering workplace flexibilities, training opportunities, and other tools to help refugees access jobs.

In many ways, American companies such as GE, Intel, Amazon, and others are leading the way, employing thousands of women from Ukraine, and launching programs to provide both Ukrainians and Poles with the opportunity to be trained or retrained to address the needs of the industries of the future. From digital technologies to advanced manufacturing, developing these important skills now is a key investment in the long-term success and prosperity of the entire region. The U.S. Embassy is also expanding the Academy of Women Entrepreneurs program in Poland to have a group just for Ukrainian women here in addition to the two for Polish women.

While these programs make it easier for Ukrainian women to find a job in Poland, they are also about investing in the future. Companies are smartly investing in their workforces – Poles and Ukrainians – so they can better collaborate today and be prepared to take on the challenges of tomorrow. But the knowledge gained will also prepare participants for the reconstruction of Ukraine's economy when it is safe for them to return home. This war will end, and when it does, Poles and Ukrainian will be at the forefront of the rebuilding process.

What an incredible opportunity for Ukraine, Poland, and the world to rebuild in a way that improves lives, strengthens security, and ensures we are all more prosperous, resilient, and united.

WBJ.PL 17 INTERVIEW BY EWA BONIECKA

American companies love working in Poland and want to expand our mutual prosperity

BPI Real Estate Poland is on a mission to redefine the landscape of modern living in Poland. Béranger Dumont, General Manager at BPI Real Estate Poland speaks with WBJ about the company’s commitment to sustainability, innovation, and customer satisfaction.

Sustainability and Dynamic Growth: An interview with Béranger Dumont

, General Manager

at BPI Real Estate Poland

WBJ: You've been in the Polish market for nearly 15 years. Can you share some insights into the key changes you have observed in the real estate market during this period?

Since our debut on the Polish real estate market in 2009 with our first project – the multi-phase project Cztery Oceany in Gdańsk's Przymorze district, we have witnessed dynamic growth in the residential sector. Growing demand for housing in urban centers and on the outskirts has been driven by urbanization, demographic shifts, and improving economic conditions for Polish citizens.

Over the past decade, it's been hard not to notice changes in architectural trends and the

18 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL COVER INTERVIEW

PRESS MATERIAL

Chmielna DUO, Warsaw

application of new construction technologies, which are evident in more recent projects (such as Wola Libre and WolaRe in Warsaw, where we pioneered innovative ground remediation work preceding the construction of new buildings). The Polish real estate sector has matured significantly, and customers now increasingly emphasize energy efficiency, sustainable materials, and smart solutions in their homes. Quality of execution and real estate-related services have become increasingly important to clients, motivating us to elevate project standards and customer service.

Infrastructure development, including investments in new roads, communication networks, and the expansion of public transport, has increased the value of real estate in various regions of Poland. This, in turn, has prompted us to expand our operations to other Polish cities. We are already developing our second project in Wrocław since completing Bulwary Książęce –the Czysta 4 apartment building. In Poznań, we have completed the environmentally friendly Vilda Park development and are now building two new investmentsPanoramiqa and, with our partner Revive, the multi-stage Cavallia project on the site of the former military barracks.

With regard to changes in the Polish market, it is also worth mentioning that modern Polish cities are generating demand for sustainable mixed-use projects that combine residential, retail, and office functions. Examples of such an investment include the Cavallia project in Poznań or our latest project in Warsaw - Chmielna Duo, consisting of apartments and a green retail and service arcade connecting Chmielna Street with Złota Street.

Another change, particularly noticeable in recent years, has been the growth of the rental market. More and more people

are choosing to rent an apartment instead of buying one. At the same time, Poland has become an attractive market for foreign investors, influencing the development of the apartment rental market, especially in city centers. Accordingly, our company has adjusted its investment strategy to consider these changing dynamics. All of our projects currently under construction in top locations in Warsaw (Chmielna Duo), Wrocław (Czysta 4), Poznań (Panoramiqa and Cavallia), and Gdynia (Bernadovo) are responding to the visible increase in the purchase of residential properties for rent.

These insights reveal the dynamic nature of the Polish real estate market and highlight our ability to adapt to changing trends and customer expectations. We are proud of our contribution to the development of this sector and are ready to continue our mission of delivering highquality, inspiring development projects in key Polish cities.

The premium segment of the Polish residential market is especially strong at the moment. Could you provide examples or elaborate on your latest projects that confirm this trend?

Indeed, we consider the top segment of the residential market in Poland to be the most stable. Our portfolio of ongoing projects includes several premium developments that reflect our commitment to creating exclusive yet sustainable living spaces.

One example of these types of projects is the Chmielna Duo development currently under construction in Warsaw. The project is not only aligned with the aesthetics and functionality of the city, but it also provides future residents with multifaceted living comfort and the unique experience of living in a prestigious location in the heart of Poland's capital. The development will include 243 apartments, an underground parking garage, and six retail units in a shopping arcade. Residents will also enjoy a communal garden on the roof of one of the buildings.

Located in the center of Wrocław, the Czysta 4 apartment building is another excellent example of our commitment to developing the premium segment in Poland. The development offers high-quality apartments near the Renoma shopping center near the Old Town. The project provides 183 apartments as well as three commercial units. Each apartment will have

WBJ.PL 19

Czysta 4, Wrocław

INTERVIEW BY MORTEN LINDHOLM

COVER INTERVIEW

a smart home system, and most will have access to gardens, balconies, or terraces. The project's design also includes underground and above-ground parking spaces for cars and storage units, a bicycle room and a bicycle workshop. Additional perks for future residents include a public coworking space and a green terrace with a relaxation zone on the roof.

The Bernadovo eco-friendly development in Gdynia is an excellent example of our strategy to discover new attractive locations in key markets in Poland. This luxury development is being built on Gdynia's Bernadovo Hill, within the buffer zone of the Tricity Landscape Park, in accordance with BREEAM certification at the Very Good level. The estate has been designed following the principles of sustainable development, focusing on aesthetics and functionality to create an ideal living space for individu-

als seeking to combine urban comfort with proximity to nature.

As part of the Bernadovo project, 18 intimate, two-story buildings are being constructed, housing 108 apartments, featuring spacious gardens, balconies, or terraces. Over half of the plot's area is dedicated to a forest area with walkways and relaxation zones exclusively for the residents' use. The investment project incorporates numerous ecological solutions, such as green roofs, photovoltaic panels, and a specially designed system to utilize rainwater fully.

All of these projects reflect our commitment to creating beautiful spaces and comprehensive residential experiences that meet the high expectations of our customers in the premium segment.

Regarding your customer base, are Polish buyers and investors your main target audience, or do you also attract international buyers? Investments carried out by BPI

Real Estate Poland have garnered interest from a diverse group of buyers, both from Poland and abroad. The trend of market recovery observed in the last quarter of 2022 continues. Economic stabilization and the geopolitical situation have increased customers' confidence, including investors, in investing capital in the real estate sector. This, in turn, has contributed to increased interest in our investments.

Currently, more than 95% of our clients are individuals purchasing properties with cash. This demonstrates their confidence and trust in the quality and investment potential of our projects. However, recently we have noticed the impact of the introduction of subsidized loans on the real estate market, including on the sales of apartments in our projects. This is particularly noticeable in the case of our Panoramiqa project located in the

20 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

Panoramiqa, Poznań

PRESS MATERIAL

Starołęka district of Poznań. This positive change heralds a promising sales growth trend for the third quarter of 2023.

Our offerings also attract investors and apartment buyers from abroad who recognize the potential and development prospects of the Polish real estate market. We are creating unique projects that deliver value for residents and the entire neighborhood.

With increasing emphasis on ESG regulations and sustainable building investments, how do you incorporate these aspects into your projects? Can you highlight some specific initiatives or features?

Principles of sustainable development lie at the heart of BPI Real Estate Poland's business strategy, and adhering to them forms the foundation of every development investment in our company's portfolio. We have already achieved significant milestones in this area.

We are undoubtedly helped by the fact that BPI Real Estate is part of the Belgian CFE Group. In the previous year, our company (operating in three European

markets: Belgium, Luxembourg, and Poland) utilized 17,795 tons of recycled materials in our investments, initiated the revitalization of premises spanning 25,535 square meters, and obtained permits for construction and constructed a total of 81,085 square meters of space without using fossil fuels.

BPI Real Estate Poland's residential investments are a testament to our company's commitment to realizing ambitious plans here in Poland.

In all our new projects, we implement eco-friendly solutions, such as green roofs, photovoltaic panels, ample bicycle parking spaces, and a rainwater harvesting irrigation system. Whenever possible, we preserve the majority of existing trees or plant new ones on our development sites. And also incorporate solutions such as nesting boxes for birds. Two of our recent investments, Chmielna Duo in Warsaw and Bernadovo in Gdynia, are being developed in accordance with BREEAM environmental certification at the Very Good level. In our Wrocław project, Czysta 4, we focus on recycling construction materials

and reusing a portion of materials salvaged from demolishing a former shopping gallery historically located at that address, including elements of the stone façade. Elements that couldn't find a new purpose were recycled during demolition. Meanwhile, in the Cavallia project in Poznań, we are revitalizing former military barracks buildings, seamlessly integrating them into a unique multifunctional project.

Cavallia is the largest investment in your portfolio so far, yet it's not being carried out solely by your company but also in partnership with Revive Poland. What sets this project apart?

Indeed, the project stands out due to its scale – it's currently the largest endeavor by BPI Real Estate Poland, but its complexity also marks it in terms of multifunctionality. After all, on a 5.5-hectare site, in the center of Poznań, there will be modern office buildings and over 8,000 sqm of service and relaxation zones. Of course, the residential buildings with 850 apartments will form the most significant part of the investment.

One of the critical aspects that makes Cavallia unique is the skillful integration of modern architectural buildings into the historical fabric of former cavalry barracks. Three historic buildings on Grunwaldzka Street will be revitalized and repurposed as well-designed office spaces. The stables and indoor riding arena will become cafes, restaurants, boutiques, and other public facilities.

The investment comprises a total of 10 residential buildings. The first phase is currently available for sale, including four buildings with 269 apartments. This phase also includes two intimate buildings on the side of Matejki Street with apartments of a higher standard.

WBJ.PL 21

Cavallia, Poznań

COVER INTERVIEW

The land on which Cavallia is being developed, acquired in collaboration with Revive Poland, was once home to the renowned 15th Poznań Uhlans Regiment's cavalry barracks. To incorporate the history of the area, we launched the historiawartapoznania.pl project, which included, among other things, a series of films with historical reconstructions. This online platform showcases the heritage of this area that is so important for the residents of Poznań while also highlighting the remarkable energy of the place.

As you plan for further expansion and continue to invest in land acquisitions, are there still promising opportunities available in the big urban cities of Poland? How do you identify and evaluate such opportunities?

Poland remains a key market for BPI Real Estate. We are currently developing five ambitious projects that will deliver a total of more than 900 modern residential units to the market. We see the current pace of sales as confirmation that our projects enjoy the trust of our customers. It is a clear signal of the attractiveness of our properties to people looking for high-quality housing in convenient locations. There are still promising investment opportunities in major Polish cities. We aim to identify these promising areas through careful market analysis, trend research, and insightful assessment of customer needs and preferences.

We have ambitious plans for the second half of the year. We are focusing our activities on acquiring new plots in the top end of the residential market

in Poland and have applied for a building permit for another premium development located in Mokotów, Warsaw. We aim to start construction work on this prestigious project in Q1 2024. We are confident that our continued expansion and consistent investments in land acquisition will further strengthen our presence in the Polish real estate market while providing customers with exceptional living spaces that satisfy their expectations and aspirations.

BPI Real Estate Poland's slogan "Urban Shapers" signified a strong vision for your company's projects. Can you elaborate on the actions or strategies you employ to bring this vision to life and positively impact the urban landscape? Our corporate motto is deeply rooted in the philosophy of BPI Real Estate Poland. As "Urban

22 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

Bernadovo, Gdynia

PRESS MATERIAL

Shapers," we focus on actively shaping urban space. An essential element of this vision is the concept of the 15-minute city. Investments like Chmielna Duo in Warsaw and the Czysta 4 project in Wrocław align perfectly with these principles. Future residents can conveniently and swiftly commute to work, school, or shopping. Executing thoughtful and functional projects in city centers contributes to the density of the urban fabric, which also positively impacts the environment.

In the case of the Cavallia project in Poznań's Łazarz district, nearly all residents' daily needs can be fulfilled within the investment itself or via a 15-minute stroll. Similarly, the Bernadovo project in Gdynia and Panoramiqa in Poznań reflect our mission to create attractive living spaces through innovative, sustainable, high-quality development projects.

About:

BPI Real Estate Poland

BPI Real Estate Poland is a real estate development company owned by the Belgian CFE Group, founded in 1880, which operates in several areas, including real estate BPI Real Estate’s projects are executed in three European markets - Belgium, Luxembourg and Poland. They are distinguished by their innovation and attention to detail - in aspects related to urban planning, good architecture, and energy efficiency. BPI Real Estate Poland's mission is to implement the principles of sustainable develop-

ment at all stages of investment, with the goal of realistically reducing effectively reducing the carbon footprint attributed to the real estate and construction sector worldwide.

BPI Real Estate Poland's activities began in Gdańsk where a four-stage residential complex called Cztery Oceany was developed in the Przymorze district. BPI Real Estate Poland has also achieved success in Warsaw with projects such as Wola Tarasy, Wola Libre, wolaRE, and Rezydencja Barska which were developed

consecutively. Other completed projects include the Bulwary Książęce complex in Wrocław and the Vilda Park estate in Poznań. New projects in the developer's portfolio include the Bernadovo investment in Gdynia, Panoramiqa in Poznań, Czysta 4 in Wrocław and Chmielna Duo in Warsaw. In 2022, the company launched a total of four new investments in Poland. In addition, in cooperation with Revive, BPI Real Estate Poland is developing the multi-phase Cavallia investment in Łazarz, Poznań.

WBJ.PL 23

The Polish real estate sector has matured significantly, and customers now place a much greater emphasis on energy efficiency, sustainable materials, and smart solutions in their homes

SIX NEW GATEWAYS FOR EUROPEAN TRANSPORT

2023 has brought groundbreaking changes to the structure of the European logistics operator - Raben Group. Six locations in Germany, Poland, and Czechia were awarded the Eurohub status and competence to manage transport across Europe. Due to this consolidation of groupage cargo and faster and more efficient operational processes, these Eurohubs can successfully meet the needs of European customers.

Raben Group has reorganized its current structure in Europe. Six warehouses now function as Eurohubs. These Eurohubs are central points in the Raben network and are responsible for consolidating groupage cargo for European line traffic. They are designed to complement the company's regular, direct transport routes and guarantee well-timed connections between its European warehouses.

"The Eurohub structure allows us to respond more flexibly to changes in freight volumes and, above all, to reduce lead times. We can offer all our customers the added value of reaching all European destinations as quickly as possible - within 24 to 96 hours, depending on the distance. According to the lean philosophy, this organization of processes ultimately translates into a more efficient and reliable supply chain. We are closer to the customer and

24 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

PARTNER SPOTLIGHT

as the comprehensive integration of all European regions

designing a delivery network with greater resilience," explains Ewald Raben, CEO of Raben Group. "An additional benefit is the reduction of CO₂ emissions, which is also very important for us as a sustainable company."

The following locations were assigned the new status: Sarstedt (routes to Scandinavia), Mönchengladbach (northern France, Benelux, UK, Ireland), Fellbach (Spain, Portugal, rest of France) and Aichach (Austria, Italy, Poland, Czechia) in Germany, Legnica in Poland (connections inside this market and to the Baltic countries) and Rokycany in Czechia (south-eastern Europe). Implementing the Eurohub concept will further strengthen the logistics operator's presence in Germany - one of the strongest economies in the European Union - while securing the strategic role this market has to play in Raben's European network.

Eurohubs are characterized by significantly higher capacity, excellent location, and infrastructure. The foundation for operations and future success is, among other things, more than 130 direct connections between the locations above, a total of 600 connections per day, 40,000 sq m of capacity for cross-dock warehouses alone, and full traceability supported by a single Transport Management System (TMS). These standards apply to the whole of Europe, i.e., both markets where Raben has its own transport network and those where the company operates through its reliable partners.

All these changes have been made possible by achieving milestones the company has worked on over the past years. Systematic acquisitions have resulted, on the one hand, in entry into new markets (Austrian freight forwarder Bexity acquired in 2022; Greek logistics provider Intertrans in 2021) and, on the other hand, in the strengthening and densification of national networks. This change also applies to the region from which Raben originates - a fourth depot in the Netherlands, in the Maastricht area, was opened at the beginning of April 2023.

Four of the six Eurohubs are located in Germany, Europe's largest market, where Raben Group has been operating with its own groupage network since 2018. A substantial direct contribution to the creation of the Eurohub network has been infrastructure investments in the country.

Sarstedt is Raben Group's new warehouse in Germany - the operator moved there from Langenhagen in 2022. With a total area of up to 27,000 m2 (5,500 m2 of capacity with 52 cross-dock ramps), this facility has allowed the logistics capacity to be increased more than tenfold compared to the previous location.

Earlier this year, a new depot was opened in Aichach, northwest of Augsburg. The new site with 25,000 sq m capacity (of which 4,000 sq m with 42 cross-dock ramps), operating from the start as Eurohub, is located directly near the A8 motorway. It is an essential hub of the European network Raben uses for its daily

connections to Southern and Eastern Europe.

The same is true of the Rokycany facility in Czechia, which started operations in April this year. The warehouse covers 6,000 sq m of cross-dock capacity and has 56 ramps to facilitate the handling of goods, including those covered by the ADR convention on the carriage of dangerous goods and cargo by road. The site is located near the D5 motorway and provides a fast connection to Germany and other European road networks. It has the potential to accelerate and improve the flow of shipments significantly and, thanks to its flexibility, to contribute to the future development of connections not only in Czechia and Slovakia but also in other Raben Group countries: Hungary, Romania, Bulgaria, or Greece.

The Eurohub concept is a priority for Raben Group. At the moment, the company has no plans for further geographical expansion, however, it intends to densify its existing network and invest in digitalisation. The project to develop and reorganise the international lines in all fifteen Raben countries is still ongoing:

"Through targeted and systematic cargo consolidation, we want to stimulate the expansion of the network and the development of Eurohubs, as well as the comprehensive integration of all European regions. This will ensure that we can make better use of existing resources and thus make our transport operations more economically efficient and environmentally friendly," concludes Ewald

Raben.

We want to stimulate the expansion of the network and the development of Eurohubs, as well

WBJ.PL 25

CEE & SEE summit in London

in association with EBRD (6-7 February, 2024, London)

Overview

Entralon Club and EBRD are bringing CEE and SEE real estate leaders closer to the western capital. It is vital to keep the conversation going and advocate for the region as a sustainable and promising destination for investment especially now. The war in CEE affects its reputation and perception as a stable region. The current world is becoming less and less predictable. The real estate sector is bracing for some really tough times. Discussing the future of real estate, macroeconomics, global affairs, risk of major market crisis or even crises - is essential for decision-makers.

So we invite key real estate professionals to this annual gathering for high-level networking and deal flow in a truly business-facilitating environment. Meetings upon request are available to all participants of this event aimed to connect CEE real estate leaders to their Western European peers. This the place to be for pension funds, private family offices, asset owners, asset managers, funds, developers, lenders - everyone involved, active and interested in the real estate sector in CEE & SEE www.entralon.club/ceelondon

LOKALE IMMOBILIA

Wrocław Secures Silver Medal in Office Market Performance

According to a report by Knight Frank, the initial half of 2023 witnessed remarkable dynamism in both tenant activity and developer initiatives within Wrocław's office market, contributing to the establishment of nearly 151,000 square meters of new office spaces.

During the second quarter of 2023, the Wrocław office market expanded by an additional 11.7 thousand square meters, courtesy of the Brama Oławska project led by Tower Investments. Throughout January to June, approximately 32.6 thousand square meters of office areas were completed by developers, constituting over 28% of the total office space delivered within regional cities. The cumulative office space available within the capital of Lower Silesia reached a total of over 1.31 million square meters by the end of June, upholding its position as the second-largest market among regional counterparts.

Notably, the lion's share of this growth, accounting for more than 68%, originated from new lease contracts. Renegotiations represented nearly 28% of the transaction volume, while the remaining 4% was related to expansion endeavors. The robust demand played a pivotal role in reducing the vacancy rate by 1.2 percentage points on a quarterly basis, resulting in a vacancy rate of 16.1% at the close of June. This figure was 1.3 percentage points higher compared to the same timeframe in 2022.

As of June 2023, rental prices in Wrocław remained steady in comparison to the preceding quarter, spanning from €10 to €16 per square meter per month. Sustained elevated construction costs, coupled with ongoing expenses related to construction loans, have restricted investors' room for negotiation. Consequently, there is a possibility of rent hikes, particularly for newly constructed properties. Service charges ranged between PLN 16 to PLN 31 per square meter per month.

WBJ.PL 27 >>>

REAL ESTATE INDUSTRY NEWS (covering) Hospitality, Investment Market,Logistics , Mixed-use, Office, Residential, Retail Find more daily at wbj.pl/real-estate

Facade of a high-rise building in the "Centrum Południe" in Wrocław

RESIDENTIAL Develia and Grupo Lar launch Ursynów#22 construction in Warsaw.

Develia and Grupo Lar Polska have begun construction on the Ursynów #22 project in Warsaw, a joint venture that will result in the creation of 174 apartments. The role of general contractor has been entrusted to Erbud. The first apartments are expected to be handed over to buyers by the end of 2024. Develia is one of the largest developers in Poland, involved in residential and commercial projects in Warsaw, Wrocław, Kraków, Gdańsk, Łódź, and Katowice. Since 2007, Develia (formerly LC Corp) has been listed on the Warsaw Stock Exchange (GPW) and is part of the mWIG40 index. In 2022, the company generated PLN 1,067.9 million in sales revenue.

RESIDENTIAL Buda sees significant interest in housing loans beyond 2% mortgages

In the second quarter, 97 companies went bankrupt, 21.3% more compared to the same period last year, the Central Statistical Office reported. The number of company registrations in the second quarter amounted to 88,549, a decrease of 5.5%. The Central Statistical Office reported that an increase in the number of bankruptcies was recorded in the industry, services, accommodation and catering, and other sections. On the other hand, the decrease in the number of bankruptcies took place in trade; repair of motor vehicles, construction, and information and communication. In transport and storage, the number of bankruptcies has not changed.

Poland is the CEE leader in commercial real estate investments – Colliers

CONSTRUCTION

The heavy concrete prefabrication market will grow to PLN 4.6 billion in 2023 – Spectis

The value of the heavy concrete prefabrication market will reach PLN 4.6 billion in 2023 and then increase to PLN 5 billion in 2025, according to a report by the research company Spectis. In 2021, the value of the market was PLN 3.5 billion, and in 2022 it is estimated at PLN 4.2 billion. For a decade, the prefabrication sector has been consistently increasing its share in the economy, both in terms of GDP and the value of the construction market, except for the weaker years 2019-2020. Compared to the Scandinavian countries or the German market, however, this share is still small, which proves the great potential for further growth.

The volume of investments in the commercial real estate market in Central and Eastern Europe amounted to €2.02 billion in the first half of this year, of which 42% (€801 million) accounted for Poland, according to Colliers' data. The Czech Republic came second with a share of 34%. Bulgaria was the only market in the region with year-on-year investment increases, while other markets recorded volume decreases ranging from 42% to 87%.

Colliers expects that in the third quarter, the market in Poland will continue to search for an appropriate price level, and activity will remain low due to the summer period. In the coming months, experts anticipate the finalization of several office and logistics transactions, as well as a slight increase in interest in commercial assets.

28 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA NEWS

PHOTOGRAPHS TOP PRESS MATERIAL, BOTTOM UNSPLASH

DOKI AND MONTOWNIA –BREATHING NEW LIFE INTO THE HISTORICAL CENTER OF GDAŃSK

On the historic lands in Gdańsk, the multifunctional DOKI Project is being built by the developer Euro Styl. London's Docklands or HafenCity in Hamburg are prime examples of reclaimed post-shipyard lands in Europe. In Gdańsk, their counterpart will be Młode Miasto, encompassing, among others, the grounds of the former Gdańsk Shipyard. This is the location of DOKI, recognized by the European Property Awards 2021-2022 as the best Mixed-Use Project in Poland.

Thanks to its significant scale and multifunctionality, the DOKI investment functions as a small district with a diverse structure including both a residential function and, in MONTOWNIA hotel and gastronomic once. They perfectly align with the concept of the 15-minute city.

The project is situated in the center of Gdańsk and is adjacent to the former shipyard wharves and The European Solidarity Center. Within a 10-minute walk, one can get to the beautifully renovated Main Railway Station, the Museum of the Second World War, and other tourist attractions.

Apartments with marvelous views and investment historic lofts

DOKI includes comfortable flats designed in line with the latest architectonic trends. Residents can enjoy a beautiful view of the water, the historical port cranes, and the panoramic Gdańsk cityscape. Two first residential buildings have already been completed.

MONTOWNIA, an integral part of DOKI, is a historic building with art elements that received a distinction in the Commercial Renovation/Redevelopment category in the EPA contest mentioned above. The building accommodates 114 serviced and fully equipped hotel lofts with floorage ranging from 37 to 45 or 51 sq m – each with a kitchenette and dedicated living room. The object started operating in April 2023 and has received excellent reviews from guests.

The entryway to the apartments (lofts) passes through a lobby with a 24-hour open reception desk. A professional operator belonging to the Dom Development Group, of which Euro Styl is also a member, is responsible for managing MONTOWNIA.

Breathing new life into a historical place

DOKI and MONTOWNIA are exciting proposals for those who want to live in this unique place and those looking to invest their capital in a real estate property. The exceptional character of the entire DOKI complex and the improvement in nearby areas are why this area's attractiveness will grow in the coming years – it is becoming the new center of Gdańsk.

More information can be found at: montowniagdansk.pl/en/

WBJ.PL 29

BUSINESS SPOTLIGHT

WARSAW EMBRACES THE OFFICE RENTAL MARKET REVOLUTION

The office market in Poland’s capital stands out as cities globally struggle with declining demand

BY ANNA RZHEVKINA

LOKALE IMMOBILIA OFFICE MARKET

The office market in Warsaw has been growing dynamically in recent years as more international companies choose the Polish capital for their business activities. According to a recent report by a consulting company Kearney, Poland has ranked second in Europe and 13th globally in terms of attracting investments in modern business services, thanks to the high digital competencies of employees and attractive labor costs.

On the other hand, the demand for office real estate is projected to decrease globally due to the shift towards remote and hybrid work. McKinsey revealed that office attendance in major cities across the globe has stabilized at 30% below the pre-pandemic norm. By 2030, McKinsey anticipates a 13% decline in office attendance in these cities compared to 2019 in a moderate scenario.

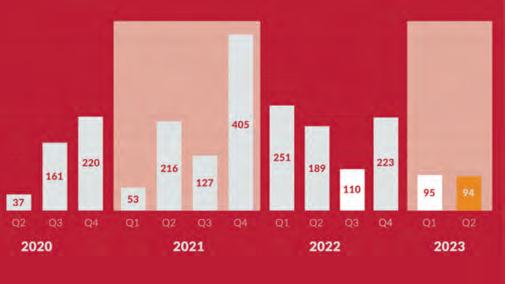

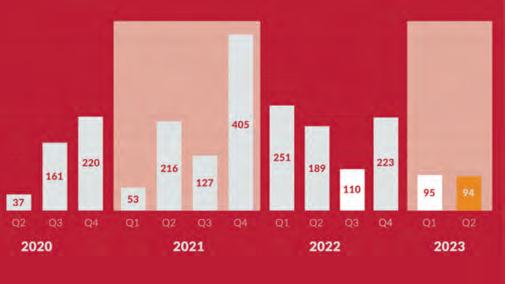

Major cities worldwide, including London, Munich, and Paris, are grappling with challenges, and Warsaw is no exception. Daniel Czarnecki, Head of Office Agency - Landlord Representation at the real estate services provider Savills, stated that in 2020-2021, demand significantly dropped, oscillating between 600,000-650,000 square meters. In 2022, as businesses adapted to the new reality, demand rebounded, reaching 860,100 square meters. However, in the first half of this year, it has plummeted by 32% year-onyear to 325,700 square meters.

Czarnecki specified that prolonged inflation and the revolution in office space usage, with a preference for smaller spaces, are influencing this decline in demand. He further explained that most companies have adopted a hybrid work model in Warsaw. Working from home a day or two per week is not only the norm but often a requirement. He added that the situation across the eastern border may be one of the reasons why, as in the case of the pandemic, tenants are holding back on further decisions.

DEMAND IN WARSAW'S CITY CENTER REMAINS STRONG

Vacancy rates vary significantly among the city districts. Over the past two years, the vacancy rate has steadily decreased in central zones. In contrast, it has been on the rise outside the city center. For instance, in Służewiec, which is the largest office district in Poland and offers more than 1 million square meters of office space, the vacancy rate grew to 20.6% at the end of June, according to real estate agency AXI IMMO. In Warsaw, the average vacancy rate outside the center was 11.4%, whereas, in central zones, it was 9.9%.

Jakub Potocki, Associate Director, Office Leasing Department, AXI IMMO, said landlords hold significant bargaining power due to high demand, especially for modern office space in the center. This status quo has made it challenging for tenants to negotiate lower rents, reduce other costs, or secure appealing incentives like rent-free periods. At the end of the second quarter, asking rents ranged from €18 to €27.50 per square meter in prime office buildings in the city center and started from €10 per square meter outside the center.

Czarnecki from Savills also highlighted that since 2020, the majority of demand has been concentrated in the center. He expects this trend to continue, despite high prices that may occasionally exceed €27 per square meter for the most attractive office spaces.

Warsaw is the largest office market in Poland, followed by Kraków, Wrocław, and the Tri-City. At the end of this year's second quarter, the total modern office stock in the eight major regional markets amounted to 6,513,800 square meters, a recent report by the Polish Chamber of Commercial Real Estate (PINK) showed. The new supply reached 48,100 square meters of office space. Interestingly, the largest projects were outside the capital: Nowy Rynek E in Poznan and Brama Oławska in Wroclaw.

Predictably, the regions' average vacancy

WBJ.PL 31

>>>

rate is higher than Warsaw's. By the end of the second quarter, it had risen to 17.1%, indicating a 1.9 percentage point increase from a year ago. However, there are cities with notably less available space when compared to the capital. A prime example is Szczecin, boasting a vacancy rate of merely 4.4%. In contrast, Łódź stands out with a vacancy rate of 23.4%, the highest among the regional markets.

CAN OLDER BUILDINGS STAY ATTRACTIVE?

As more modern office space expands rapidly across Poland, both in Warsaw and the regions, a question arises: can aging office blocks maintain their appeal? Tenants are becoming increasingly discerning, as they not only require facilities crucial for running their businesses but also consider sustainability criteria. Czarnecki emphasized that tenants, particularly corporations obligated to reduce their CO2 emissions in the upcoming years, are eager to select the most contemporary properties boasting certifications like BREEAM, LEED, or WELL. These certificates confirm that buildings create a healthy environment for employees and are eco-friendly.

Notably, Warsaw has one of Europe's highest levels of green-certified buildings. More than two-thirds of buildings in the Polish capital possess BREEAM, LEED, or WELL certificates. Czarnecki highlighted that tenants are typically eager to pay a premium for such spaces, considering that these properties help reduce service charges, which have recently been an increasing burden for tenants.

In the current year, demand for buildings constructed after 2015 constituted 47% of the total demand. However, does this imply that older buildings lack competitiveness? Not necessarily, as the escalating costs of conducting business prompt companies, especially small and medium-sized enterprises, to seek more cost-effective office spaces. "An important advantage of older buildings is their potentially more appealing location and lower costs, factors that are likely to attract tenants when the conditions are suitable," Czarnecki explained. He stressed that the key is to "make the right decision at the right time" to ensure the building is attractive to potential tenants.

However, Warsaw has witnessed several cases in which companies have made drastic decisions to demolish entire buildings that no longer meet their standards, opting to replace

them with new structures. One notable example is the demolition of the iconic nearly 100meter PZU tower, which used to be one of the most modern constructions in Poland, in 2000. The insurance company replaced it with a new 140-meter-high skyscraper, emphasizing that the new building is designed to cater to the needs of employees and align with an ESG strategy.

Another example is the demolition of Atrium International, less than three decades after its completion. Critics have pointed out that the building was relatively young and fully functional, despite being abandoned for an extended period. The new project - Upper One skyscraper - will consist of two partsa 131-meter-high office building and a hotel section, with completion scheduled for 2026.

Warsaw seems to be well-prepared for changes in the office market brought about by the increasing popularity of remote work compared to other major cities. Despite ongoing new completions, the vacancy rate remains stable, underscoring the continued demand for new office spaces.

Moreover, as the global demand for flexible office solutions continues to rise, Warsaw holds a strategic advantage due to its skilled workforce and attractive location. According to Czarnecki, the saturation rate of flexible office space in Poland's primary office hubs is around 2.6%, with Warsaw having the highest rate at 3%. This rate is still notably lower than Western Europe's, suggesting substantial potential for expanding this type of service in Poland.

32 AUGUST - SEPTEMBER 2023 WARSAW BUSINESS JOURNAL

LOKALE IMMOBILIA OFFICE MARKET

MORE THAN TWO-THIRDS OF BUILDINGS IN THE POLISH CAPITAL POSSESS BREEAM, LEED, OR WELL CERTIFICATES

EXPERT VIEW

How have inflation and the rising costs of running a business impacted the office market so far, and what trends do you expect in the future?

Last year's record inflation, not only in Poland but also in the Eurozone, contributed to significant rises, whether in the form of rent indexation (over 8% inflation in the Eurozone in 2022, which will impact most Polish leases) or service charges - here, according to our forecasts from early 2023, potential rises could reach 30%-60%. Currently, charges exceeding PLN 35 per square meter a month are no exception. Furthermore, tenants are facing another indexation based on inflation in the Eurozone, which, according to Oxford Economics analysis, could reach over 5%.

The situation should stabilize in 2025. Higher inflation translates into higher fit-out costs. In recent years, tenants have been used to receiving a finished office to a high standard. At current prices, five-year contracts, which were the norm in the market some time ago, make it difficult for landlords to pin down their budgets and reduce the profitability of the investment. Therefore, to compensate for the high expenses incurred by landlords, we see contracts being extended to, for example, seven years, although ten-year contracts are appearing on the market.

What are the recent projects in the market worth keeping an eye on?