For daily news visit us at wbj.pl Since 1994 Poland’s leading business magazine in English WARSAW BUSINESS JOURNAL FEBRUARY - MARCH 2023 ~ No. 1 (76) PLUS: BACARDI-MARTINI BUILDING GROWTH THROUGH LOCAL TALENT AND UNIQUE WORK CULTURE WE STAND WITH UKRAINE ANNA DUCHNOWSKA Investment trends & opportunitues Exclusive: Neo-Świat's Managing Directors share insights on real estate market and company's success Ghelamco Poland's Jarosław Zagórski talks building sustainable office spaces in line with ESG principles The Future of AI: Can Self-Thinking Devices Upset the SEO Market? Visit us online

8 In Review

News

14 Opinion

A year of challenges for Poles and AI is coming by Sergiusz Prokurat

19

Lokale Immobilia

News

Five Questions for Anna Duchnowska

The future of Warsaw looks bright

Exclusive Interview: Managing Directors of Neo-Świat Paweł Brodzik and Rajmund Węgrzynek Interview by Morten Lindholm

Interview with Richard Hallward, CEO and founder of CEEQA

Thought Leader: Jarosław

Zagórski, Commercial and Business Development Director at Ghelamco Poland

37 Investing in Poland

Pomeranian investments

City in Focus: Łódż

PAIH

40 Interview

Managing Director CEEBB Katya

Chmykhova and HR Director CEEBB

Aleksandra Paramuszczak of Bacardi-Martini CEEBB

Company Spotlight: Raben Group

Viola von Cramon-Taubadel, MEP and vice-chair of the delegation to the EUUkraine Parliamentary Association Committee Interview By Nikodem Chinowski

Piotr Bujak, chief economist at PKO Bank Polski Interview By Nikodem Chinowski

52 Features

Poland Invests In Climate Tech

Start-Ups by Anna Rzhevkina

Is Poland ready for the Euro by Anna Rzhevkina

What to do and not to do in times of crisis.

by Karolina Klimek-Kaźmierczyk

by Karolina Klimek-Kaźmierczyk

65 Tech

News

On Turing-test with chatbots and blog writing by Beata Socha

69 Life + Style

A Historic Gem Reimagined for Modern Times by Alex Webber

Varietal of the Month by Wine

Expert Peter Puławski of dobrawina.pl

72 Events

2 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL PORTRAIT BY KEVIN DEMARIA FEB/MAR

16 60

52 69

IN A CHANGING WORLD, TOMORROW’S REAL ESTATE IS BUILT TODAY. Real Estate for a changing world DEFINE YOUR BUSINESS WITH US We will assist you with the following services: Capital Markets, Property Management, Transaction, Project Development and Consultancy, ESG, Dedicated Market Reports, Valuation. Visit us in our office at 78 Grzybowska Street, Warsaw Phone: +48 22 653 44 00 bnppre.pl

PUBLISHER'S NOTE

BRING SPRING ON…

It feels like the winter has been very long this year. The Warsaw gloom and cold have been upon us for about four months now, but it’s probably not just the weather that influences our emotions. The general mood of society seems burdened by the war next door, extreme inflation and a general uncertain outlook.

If we look at the data that Piotr Bujak, chief economist, presents in this issue of WBJ (pages 48-51) there is confirmation by data as to why my feelings are so tangled. The GDP drop YTY in Poland has been dramatic over 2022, ending in Q4 with a small plus, while the forecast for this quarter and the coming ones are around 0 (in 2022, Q1 was 8.6% growth YTY).

The biggest surprise in the calculation of GDP is the collapse in consumption. In Q4, it fell by 1.5% at a time when the Polish population is 2+% greater (due to immigration), and calculating the per capita consumption shows a dramatic drop. What is the reason for this?

Consumers reduced spending due to the rapid spike in inflation. The interests on loans and credit jumped high, and radical increases in energy prices may have also contributed to this.

Some moments of optimism from the last month

Biden’s visit to Warsaw - NATO’s support, Poland’s courage and engagement

More and more Polish-based companies are taking responsibility and investing in sustainable energy sources

The peak of inflation is behind us, prices of energy are decreasing, and unemployment data is stable

But what about companies, investments, and business? In our cover interview with Anna Duchnowska, (pages 22, 24), managing director of Investment Management Europe for Invesco Real Estate, she shares her thoughts on challenges and opportunities for Polish and CEE real estate investments.

During my talks with Neo-Świat’s Paweł Brodzik and Rajmund Węgrzynek (pages 28-31), we discussed that despite the current challenging moment, even now, and definitely in the mid and long term, there is still great potential in Polish real estate investments to catch up with demand. The new ESG regulations influencing the market should also impact this.

Polish cities and regions

Poland’s major cities and regions are still doing well, showing ambitions to improve the lives of its citizens, attracting strong foreign investments, delivering talent, and opportunities for companies to thrive. In our section “Investing in Poland” (pages 37-39), we shed light on a few of them.

It is an election year in Poland (autumn 2023). The Polish success story from the last three decades has been challenged over the last three years by political disruption, pandemic, and geopolitical issues. It is an important year for Poland, a year to set the agenda for the coming decade so Poland’s influence and prestige in Europe and the rest of the world can continue its rise.

I hope you will find our selection of articles and materials interesting and that spring will bring you lots of new energy and a positive impact.

4 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

MORTEN LINDHOLM

PORTRAIT BY PIOTR NAREWSKI, ICONS SHUTTERSTOCK

GUESTS THIS ISSUE

Anna Duchnowska

Anna leads the European Asset Management division of Invesco Real Estate, overseeing a team of 28 professionals in seven European offices. She is also a member of the Advisory Board of the Entralon Real Estate Club and will attend their CEE Retreat on 6-7 June 2023. She possesses 20 years of professional experience in real estate asset management, investment, leasing, and finance. She is a Fellow of the Association of Chartered Accountants (FCCA) and a Member of the Royal Institute of Chartered Surveyors (MRICS).

Interview on page 22

Piotr Bujak

Since 2016, Bujak has been the head of the Economic Research Department and Chief Economist at PKO Bank Polski, Poland's largest bank. Over his more than 20-year career, he has gained extensive experience in international financial institutions, including training in econometric modeling, forecasting, and mathematical methods in financial markets. He is also the co-author of several books and numerous articles on economics.

Interview on page 48

Viola von Cramon-Taubadel

As a member of the Greens/EFA, she has served in the European Parliament since 2019. She is a member of the Committee on Foreign Affairs (AFET) and a deputy chairperson of the delegation to the EU-Ukraine Association Parliamentary Committee. She is an agricultural economist from Germany.

Interview on page 46

CONTRIBUTOR

Peter Pulawski

A visionary wine merchant and negociant, Pulawski has built a chain of stationary and online specialty wine shops in Poland under the dobrewina.pl brand. He has made his mark on the dynamically growing Polish market by leveraging market data and consumer preferences in combination with meticulous product selection and inventive marketing communication. Since 2022, dobrewina.pl has also offered sommelier workshops and wine education in the company's refurbished 100-year old horse stable or at any chosen location.

Article is on Page 71

Morten Lindholm

Editor-in-Chief/Publisher mlindholm@valkea.com

Kevin Demaria Art Director kdemaria@valkea.com

Jessica Sirotin Editor

Krzysztof Maciejewski Business & Web Editor kmaciejewski@wbj.com

Contributors

Nikodem Chinowski Sergiusz Prokurat

Anna Rzhevkina

Beata Socha

Alex Webber

Sales Izabela Kaysiewicz ikaysiewicz@valkea.com

Katarzyna Pomierna kpomierna@valkea.com

Print & Distribution

Krzysztof Wiliński dystrybucja@valkea.com

Event Director, Valkea Events

Magda Gajewska mgajewska@valkea.com

Contact:

phone: +48 22 257 75 00 fax: +48 22 257 75 99 e-mail: wbj@wbj.pl WBJ.pl

For enquiries,subscriptions-related please email us at wbj@wbj.pl

WarsawBusinessJournal @wbjpl

All photographs used in this issue are courtesy of partners and companies unless specified otherwise.

Copyright © 2023 by Valkea Media SA

All rights reserved. This publication or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher.

Published by ul. Jerzego Ficowskiego

6 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

15 Valkea Media S.A.01-747 Warszawa Tomasz Opiela, CEONIP: 525-21-77-350 www.valkea.com To subscribe through RUCH SA:

prenumerata@ruch.com.pl, 801

803

www.prenumerata.ruch.com.pl,

800

C M Y CM MY CY CMY K

POLAND'S HIGH-SPEED RAIL NETWORK COULD BE EUROPE'S MOST MODERN IN 20 YEARS, SAYS EU OFFICIAL

Poland could have the most modern high-speed rail network in Europe within two decades, according to Kristian Schmidt, the head of the European Union's Directorate-General for Mobility and Transport. The Solidarity Transport Hub project envisages building a new airport and almost 2,000km of high-speed rail links, with CPK, the company behind it, signing a €1.5bn ($1.8bn) design agreement last year. Schmidt said that Poland will also play an important role in integrating Ukraine into the EU's transport network. However, some experts have questioned the viability of the project, including a new "mega-airport", in a post-Covid world.

8 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

IN

REVIEW

SHUTTERSTOCK

BUSINESS

Polish retail and industry under strain from war in Ukraine

The effects of the war in Ukraine are being felt by Polish companies, with the increase in the prices of materials and raw materials affecting 44% of Polish companies, and 42% pointing to an increase in operating costs, according to a recent report by the Polish Economic Institute (PIE).

“The inclusion of emigrants from Ukraine in the socio-economic development of Poland is becoming an opportunity for our country, but attracting them is still a challenge,” said Aleksandra Wejt-Knyżewska from PIE.

The research showed that nearly half of the companies felt the impact of the war on the employment of Ukrainian workers, with industries that use seasonal workers or workers without specialist qualifications experiencing an improvement in employment because of the influx of Ukrainians.

SOCIETY

Most Ukrainian refugees found jobs in Poland

Most working-age Ukrainians found employment in Poland, more than half of them within the first three months of their stay, Rzeczpospolita reports.

Almost one in three has already changed employers.

As much as 82% of adult refugees from Ukraine took up a job in Poland, and among people of working age, this percentage reaches 84%, the latest survey of the employment agency Migration Platform EWL showed. More than half of adult refugees (56%) found employment in the first three months of their stay, although only 8% of them had visited Poland before for work or business purposes.

“Such a high level of employment among Ukrainian refugees already in the first months of their stay in Poland proves not only their determination in taking up work, but also the openness of Polish entrepreneurs to new employees,” says Andrzej Korkus, President of EWL Migration Platform.

ENERGY Energy companies to add 22 GW by 2036

Energy producers will add 22 GW of generation capacity by 2036, according to the President of the Energy Regulatory Office. Sixty-nine energy producers had to submit investment plans in new generation capacity to the regulator for the years 2022-2036.

They plan the largest investments in natural gas (9.8 GW), wind farms (5.2 GW) and photovoltaics (5.7 GW) segments.

NUMBERS:

72.53% the drop in value of housing loans granted in Q4 2022

(y/y, AMRON-SARFiN)

5% unemployment rate in January

(GUS)

13.5% increase in corporate wages y/y in January

(y/y, GUS)

2.6% industrial production increase in January (y/y, GUS)

10 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

IN REVIEW News

QUOTE: Joe Biden

“...in the moments of great upheaval and uncertainty … knowing what you stand for is most important, and knowing who stands with you makes all the difference. The people of Poland know that. … Because that’s what solidarity means. Through partition and oppression, when the beautiful city was destroyed after the Warsaw Uprising, during decades under the iron fist of communist rule, Poland endured because you stood together.”

US President Joe Biden said during his visit in Warsaw, in February 2023.

ENERGY

Polish-Korean nuclear energy agreement expected in mid-year

Minister of State Assets Jacek Sasin expects Poland and South Korea to sign an intergovernmental agreement on cooperation in the field of nuclear energy in the middle of the year.

Polska Grupa Energetyczna (PGE) and ZE PAK together with Korea Hydro & Nuclear Power last year signed a letter of intent for cooperation in the construction of a nuclear power plant in Pątnów.

“In March, there will be another agreement …, which will provide for the appointment of an intergovernmental Steering Committee that will not only monitor the construction but also coordinate all activities on the government’s side,” Sasin said on Radio Zet.

ENVIRONMENT No coal furnaces in Warsaw from October

A ban on burning coal will come into effect in Warsaw from October of this year, with residents no longer allowed to use it as a heating source.

“The upcoming heating season in the capital should be without coal,” Magdalena Młochowska, the coordinator for Green Warsaw at the City of Warsaw Office, said. Since January of this year, unclassified coal-fired furnaces have been illegal. Around 4,400 of them still remain in the capital. Those who have not yet replaced their coal-burning furnaces with greener heating sources may face fines if they continue using them.

AUTOMOTIVE Electric cars sales up 56% in January

In January, there were 67,000 electric cars in Poland, an increase of 2,376 units on a monthly basis, and 56% more compared to January 2022, according to the Electromobility Counter report. Fully electric cars accounted for 51%

Global Growth Forecasts 2023

Despite adversity, the Polish economy continued on its growth path in 2022, propelled by strong labor market data. As expected, economic growth weakened in Q4, 2022. Yet net exports are expected to contribute to growth in 2023, supporting a positive outlook for the entire year.

of electric cars and the remaining 49% were plug-in hybrid vehicles.The managing director of the Polish Automotive Industry Association Maciej Mazur said that to maintain the upward trend, rules for granting subsidies for the purchase of electric cars should be updated.

ECONOMY Poland’s economic outlook stable – S&P

S&P Global Ratings agency has affirmed Poland’s long-term foreign currency rating at “A-”, the agency said in a press release. The rating outlook remained stable.

“We expect Poland to be able to withstand most war-related macroeconomic shocks over the next two years. This resilience is due to the diversification of the Polish economy, the flexibility of the labor and product

markets, and an educated workforce. We also note Poland’s membership in the EU and NATO as a favorable factor, as well as the relatively secure outlook for energy supplies, which is linked to the government’s actions directed at minimizing energy imports from Russia.” the report reads.

ECONOMY Over a quarter of Poles still work from home or in a hybrid model

In the fourth quarter of 2022, 28% of working Poles said they worked in a remote or hybrid model, 6% down from the first quarter of 2022, according to a Pracuj.pl survey. By comparison, in the fourth quarter of 2021, the percentage of workers doing fully remote or hybrid work was 35%.

12 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

News VISIT WARSAW

IN REVIEW

-3% Russia 0.3% Iceland 2.9% Ireland 4.0% UK -0.6% SE -0.1% FI 0.5% Norway 2.6% DE 0.1% France 0.7% Greece 1.8% Italy 0.6% Spain 1.1% RO 3.1% Poland 0.3% 0.2% 3.0% Japan 1.8% China 5.2% Australia 1.6% Libya 17.9% Brazil 1.2% Guyana 25.2% United States 1.4% Mexico 1.7% Canada 1.5% Chile -1.0% 0% 3% 6% 9%

India 6.1% 6.7% 7.3%

Sources: IMF Economic Outlook (Oct 2022 and Jan 2023 update), Macrotrends, Trading Economics

VISIT WARSAW

MIPIM 2023

Warsaw - smart people, smart technology, smart city

Our Partners at MIPIM 2023

um.warszawa.pl

AT STAND R8.D1

A YEAR OF CHALLENGES FOR POLES

Inflation, recession, elections – these are the keywords for 2023 in a nutshell. Unfortunately, the not very optimistic forecasts for the Polish economy may be of little importance compared to the upcoming election. The result will be crucial for the country's future, as it will decide in the long term which institutions will prevail.

BY SERGIUSZ PROKURAT

we like to know what's about to happen, don't we? It gives us a sense of being in control of our own destinies. After a temporary post-Covid revival, we have been facing many challenges. The Organization for Economic Cooperation and Development (OECD) has prepared a forecast entitled "Confronting the crisis," which contains an assessment of the global economic situation and member states, including Poland. The OECD pre-

dicts that global economic growth will slow to 2.2% in 2023. Even though OECD analysts expect Poland to face high inflation, growing unemployment, and further increases in interest rates next year, it doesn't need to end like this.

During the COVID-19 pandemic, it seemed that it could not be worse. However, according to a GfK survey, as many as 60% of Poles believe that their financial situation has deteriorated during 2022. Uncertainty is growing, which harms the economy because people inundated with disturbing information refrain from buying furniture, cars, or apartments. The most critical challenges in Europe include inflation, a potential escalation of Ukraine's war with Russia, a global recession, a possible increase in unemployment, and wage increases below inflation. In mid-December, the European Central Bank assumed that inflation in 2023 would fall to 6.3% from 8.4% in 2022. Significant increases in prices continue in Germany and Italy, as well as in France and Spain. Inflation will start to slow down in the second half of the year. According to the forecasts of the National Bank of Poland, the trend in Poland should be similar, contrary to OECD predictions. In the first half of the year, inflation will still be high. Only in the best possible scenario, in the second half of 2023, might it fall below 10% and gradually decrease. However, it will not be the case that one day we will wake up and there will be no more inflation. Unfortunately, it will be a slow and gradual process.

14 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK

OPINION

On the other hand, there is no reason to expect an increase in the unemployment rate in Poland –perhaps by only about 1 percentage point – political decisions to choose higher inflation over higher unemployment result in a poorer society. The unemployed group can be loud and visible, which is not something the ruling party is keen to face in the election year. Contrary to the situations we hear about in the US, redundancies will be a last resort in Poland due to the structural shortage of employees, resulting primarily from unfavorable demographic trends that are taking place not only in Poland but also in most European countries. As a result of the slowdown in the labor market, recruitment will freeze, and wage growth will be limited. Average nominal wage growth will remain below inflation.

Unfavorable conditions, higher interest rates, and higher inflation, which invisibly reduce the value of savings, mean many challenges for investors, borrowers, and ordinary consumers – which means different problems for everyone. For example, as consumers, we usually pay attention to the price of products before the purchase. Unfortunately, checking the price will not protect us from overpaying in the store. It's worth checking labels to ensure we are not falling victim to shrinkflation, which affects product downsizing. Reducing the volume of the product or using other forms of impoverishment of the product

while maintaining the same price will be visible in 2023. A famous example is the changing weight of a block of butter. Once a standard block weighed 250 g, then we became accustomed to 200 g. Now recently more and more producers are downsizing butter to 180 g.

Two fundamental events will impact the forthcoming year in Poland. In 2022, the world was irrevocably changed by Russian aggression, and it is not yet known whether it will not shake the world again; the second event is the elections in Poland, scheduled for Autumn 2023. They will decide whether Poles will reject the rule of PiS or give the party a third term. We may be witnessing specific election promises that will increase inflation –depending on the scale of the "gift" that the government is preparing. The upcoming elections in 2023 in Poland will be won by the party that manages to convince Poles that it can guarantee less uncertainty - greater security is beyond anyone's control at this point. The long-term struggle over whether Poland should be liberal or social has ceased to be valid since 2015. In politics, only gifts for society count – social benefit programs like the Family 500+ program, credit holidays, and 13th and 14th retirement pensions. Politicians no longer want to compete over ideas but rather with social gifts.

The 2023 elections will decide whether the institutions of social Poland – somewhat unwilling towards the EU, entrepreneurship, or religious and sexual dissimilarity – will strengthen. In the worst scenario, we may even witness a long-term "peronization" in thinking about the economy in Poland. The term comes from the name of a famous Argentine politician. In the 1950s, when Juan Peron, the leader of the socialist movement, took over the government in Argentina, he willingly nationalized the economy, supported state-owned companies with money, and pumped public funds into economic projects planned by politicians. The heads of large companies were elected not by managers but by people who obeyed the president's administration. What happened next? In the long term, state-owned companies ceased to be effective, resulting in inflation, currency depreciation, high budget deficits, difficulties repaying foreign debts, and finally, the economy's collapse and bankruptcy. The state budget generously financed social goals, but the state restricted democracy in return. Although Peron died a long time ago, it is still claimed that Argentina is ruled from "Peron's coffin" – his successors who continue to pursue a policy of social gifts because it is a path that is not easy to get off of. Considering the hypothetical direction in which Poland is heading, this comparison does not seem so improbable.

WBJ.PL 15

The upcoming elections in 2023 in Poland will be won by the party that manages to convince Poles that it can guarantee less uncertainty

AI IS COMING

BY SERGIUSZ PROKURAT

the development of Artificial Intelligence (AI) is something akin to summoning a demon. It's a lot of fun for everybody involved, there is a great deal of curiosity about how it will turn out, and everyone expects that somebody understands the consequences. The only thing needed to make to happen is a proper sacrifice, i.e., enough funding. So the question is, what if, in the end, against all odds, one day, this demon actually rises?

The race to create self-thinking devices and software is on. So far, such things don't exist. In late 2022, OpenAI released ChatGPT, a chatbot that answers questions in simple, concise language. However, it is not Artificial Intelligence but rather automated machine learning algorithms applied to a massive corpus of text to respond to users' requests. ChatGPT can pass a high school final or a university exam, and even write a scientific essay that could be published in a journal. Midjourney, Dall-E2 can create an original image. SynthesiaIO can generate a video. The effect of popularizing such tools will be a shift in the functioning of the education sector and the approach to content. The technology of generating images and content enables the creation of original photos from actual photos from social media, posing numerous opportunities and threats. Everyone wants to have Artificial Intelligence today – even if it is makeshift. As a result, the stocks of companies creating AI solutions are rising dramatically in value.

16 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

The race to create self-thinking devices is picking up speed and anticipation for the next generation of Artificial Intelligence is high. But what happens when it gets here?

OPINION SHUTTERSTOCK

Meanwhile, Artificial Intelligence is only a simple reflection of human intelligence. It will tell us what we want to hear or see – because it is supposed to work for us, right? One of the most ambitious government projects in history was inaugurated in Chile in 1970, when the presidency of Salvador Allende began. He wished to use intelligent computers to build a socialist utopia. The Chilean government at the time wanted to nationalize essential segments of the economy, control commodity prices, and expand the welfare state system. Cybersyn, a modern machine with a futuristic interface in a central control room reminiscent of the interiors of the Star Trek TV series, was intended to communicate via telefacsimiles sent by officials. The data was immediately transported hundreds of kilometers away to the hands of analysts who would set prices. Cyberfolk computers were supposed to analyze social moods and propose real-time actions to politicians. Yet, the failure of this project, and the subsequent economic and political catastrophe in Chile, have not discouraged politicians from similar solutions.

The appeal of disruptive innovation that might change the world forever has never faded. In particular, AI's potential is especially attractive to security services. Effective surveillance and intelligent eavesdropping on every telephone conversation is a worst-case scenario that will end only in the type of dystopia we know from sci-fi movies. This unbridled enthusiasm is why initiatives are needed to regulate the use of AI – nationally and internationally.

There is an AI race going on in the world right now. The competitiveness of economies leading in the race to construct technologically advanced solutions, including AI, closely correlates with their level of innovation. Poland has its own strategy with short, medium, and long-term goals. According to the government report "Policy for the Development of Artificial Intelligence in Poland from 2020," it is necessary to involve the public sector and the largest state-owned companies in financing AI projects due to the small number of large private companies. Belief in the causative power of the state is extremely strong in Poland. Will Polish entities invent AI with state money? Or will they end up like the Chilean government's economic management program?

Poles are becoming more and more interested in IT topics, and therefore also AI. In terms of the number of experts working on developing or implementing artificial Intelligence, Poland ranks first in Central and Eastern Europe. According to PARP's forecasts, the value of the global AI market will increase to over USD 190 billion by 2025. Unfortunately, other data on the AI ecosystem is not so optimistic – the State of Polish AI 2021 report (a comprehensive publication on the Polish AI ecosystem) shows that Polish companies still do not consider the potential for the development of AI and machine learning. Only 6% of the largest Polish companies use machine learning. Unfortunately, this is one of the lowest rates in the European Union. The cooperation between companies and scientific units is also weak. COVID-19 and its consequences, as well as the current high inflation, have negatively affected the implementation of new technologies in the Polish economy.

Artificial Intelligence has the potential to improve our quality of life. For example, by combining parametric dynamic imaging with Artificial Intelligence and telemedicine, early detection of breast cancer and estimation of the probability of contracting cancer are possible. A device called Ailis makes 250 measurements and performs advanced data analysis (using Artificial Intelligence), after which women immediately receive information about the health of their breasts. Doctors will soon use AI for treatment, and speech recognition applications will facilitate communication everywhere in the world. Artificial Intelligence algorithms will soon be able to converse like a human.

Of course, new technologies always raise thorny ethical questions that the world is not ready for. Of course, summoning a real demon is still years away. Currently, to get an AI model that recognizes a horse, you need to show it thousands of images of horses. However, if one day it is summoned, a place where its infernal powers cannot reach will probably be the safest location.

WBJ.PL 17

LOKALE IMMOBILIA

RESIDENTIAL Asbud Group Builds High-Class Investment in Warsaw's Towarowa Square with 331 Premium Apartments

Asbud Group is building a new high-class investment in Warsaw called Towarowa Square, located on Prosta Street near Rondo Daszyńskiego. The investment consists of three apartment buildings with a total of 331 apartments, ranging in size from 25 to 114 sq m and with 1 to 5-room layouts. The buildings will be made of high-quality materials and feature decorative elements around the windows. Future residents will have access to an open boulevard, wheelchair and bicycle rooms, as well as retail and service spaces on the ground floor. Towarowa Square is a continuation of Asbud Group's previous project, Towarowa Towers, and is being constructed by Hochtief Polska. The completion date is set for 2025.

WBJ.PL 19

>>>

REAL ESTATE INDUSTRY NEWS (covering) Hospitality Investment Market Logistics Mixed-use Office Residential Retail Find more daily at wbj.pl/real-estate

MIXED-USE

HB Reavis Receives Financing Counsel from Dentons for Varso Place

HB Reavis has secured €475 million financing for the development of Varso Place, a mixed-use building complex in Warsaw, with Dentons providing legal advice. The funding is the largest non-portfolio loan on record for Poland's commercial real estate market and one of the biggest in Central and Eastern Europe. A group of banks, including Santander Bank Polska, Bank Pekao, Helaba, and Berlin Hyp, provided the financing. Varso Place includes three buildings with a total of 144,000 sqm of leasable space, featuring offices, a hotel, an innovation centre, and retail units. Its centerpiece is the 310m Varso Tower skyscraper, completed in 2022, with a BREEAM Outstanding and WELL Gold certification. Dentons advised on tax and corporate matters, and prepared, negotiated and executed the finance documents. OFFICE

Demand for Warsaw offices as before the pandemic

Warsaw offices are spreading like before the pandemic. In 2022, demand totaled 860,000 sqm, 33 percent more than a year earlier and almost the same as in record 2019. Supply, on the other hand, is at its lowest level in a decade. Last year, 236,800 sqm of space was delivered to the market, and 179,700 sqm remains under construction, according to CBRE data. The emerging imbalance between supply and demand in the market is causing rents to go up, but this is an opportunity for B-class buildings, which have a significant vacancy rate. Overall, the capital's office vacancy rate is 11.6 percent. Katarzyna Gajewska, director of the consulting and market research department at CBRE, has said:

" There is rather little doubt that the low activity of developers in the Warsaw market will lead to a supply gap. On the other hand, it is currently still difficult to assess whether we will be at a point of equilibrium or scarcity in some time. Last year's demand and rising rental rates rather point to a shortage, but one must also take into account that companies are now in the process of solidifying their labor strategies in the new hybrid reality. We already know that employers are scrambling to get employees back into offices, but it will be some time before companies can assess what the final turnout is. What is certain is that the role of the office is evolving."

OFFICE

PINK releases data on the office market in Poland’s regions for Q4 2022

The Polish Chamber of Commercial Real Estate (PINK) has published figures summarizing the office market in Poland’s eight major regional markets (Kraków, Wrocław, the Tri-City, Katowice, Poznań, Łódź, Lublin, and Szczecin) for Q4 2022.

At the end of Q4 2022, the total modern office stock in the eight major regional markets amounted to 6,438,100 sqm.

In Warsaw, the total modern office stock accounted for almost 6,269,000 sqm

The other large office markets in Poland (following Warsaw) were Kraków

1,708,000 sqm

Wrocław

1,328,000 sqm

Tri-City

1,012,100 sqm

By the end of 2022, only 8,700 sqm of modern office space was delivered to the capital city market in one projectDPD HQ. The vacancy rate in Warsaw at the end of Q4 2022 reached 11.6%.

Over the course of 2022, demand for modern office space reached over 860,000 sqm. Between October and December 2022, the highest share in total take-up volume was attributed to new deals (including pre-let transactions) – 52%. The largest transactions of the fourth quarter of 2022, include a new agreement of almost 14,000 sqm by Lionbridge in the Konstruktorska Business Center.

20 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA NEWS TOP: SHUTTERSTOCK, BOTTOM: PRESS MATERIAL

THE DELUXE SIDE OF BUSINESS IN THE CENTER OF WARSAW

Gone are the days of impersonal office spaces with unflattering fluorescent lights and generic grey carpets. Likewise, downtown business centers are also a thing of the past, especially if you’re looking for a place that’s both exclusive and in a premium location. With all that in mind, Foksal 13/15 goes the extra mile and offers the most luxurious business premises the city has ever seen.

Close your eyes. Imagine a forged iron gate that opens at a gentle touch as you enter the most beautiful space you’ve ever laid your eyes on. Wherever you look, you see carefully renovated historical finishes, decorative moldings, mosaic parquets, polychromes, and stuccoes. There’s a concierge, a patio, and a back corridor leading you to the relaxing SPA area. As you take the elevator to reach the highest floor, you step onto the rooftop deck, and the outstanding view of the city panorama slowly takes your breath away. This is not a vacation spot, nor is it an apartment residence. Instead, these are the benefits of having your business premises at Foksal 13/15 – whether you’re a boutique owner, a designer, an art curator, or a lawyer. This is your business place.

Foksal 13/15 is your once-in-a-lifetime opportunity for a unique new office, concept store, or showroom in the heart of Warsaw. All within the immediate yet discreet vicinity of the city’s renowned hotels and high-end brands. These are exceptional commercial premises fully adapted to meet all modern requirements. The last three available offices offer surface areas ranging from 66 to 179 sqm and a selection of extraordinary amenities. Enjoy Foksal 13/15’s elegant lobby and concierge services, wellness and fitness space, rooftop terrace and city panorama, parking spot in the underground garage, and the guestrooms accessible through administration fees.

WBJ.PL 21 PARTNER HIGHLIGHTS

Find out more on foksal1315.com 600 113 113

FIVE QUESTIONS FOR ANNA DUCHNOWSKA

Warsaw Business Journal sits down with Anna Duchnowska, a member of the Advisory Board of Entralon Club and Managing Director – Investment Management Europe for Invesco Real Estate, to discuss her thoughts on real estate investment trends and how to find opportunity in uncertain European and CEE markets.

1.

Which trends have you observed dominating the European/CEE real estate investment market?

The trends affecting the European and CEE region are relatively similar, including geopolitical uncertainty due to the war in Ukraine, inflation hikes, and, as a result, a rise in interest rates. Additionally, we have experienced the 'denominator effect' whereby real estate allocation quotas for many institutional investors have been exceeded. If we add in the fluctuations in energy costs in 2022 and erratic construction costs, we have the perfect recipe for unpredictability. On the other hand, however, real estate as an investment class has always been an attractive alternative on a long-term basis. CPI-indexed leases provide a decent income yield in times of turbulence. Even if the valuations are under pressure, with yields adjusting to the new interest environment, similarly to many other real estate investors, we remain confident about the long-term attractiveness of this asset class.

2. What are your forecast/ expectations for 2023 from a CEE/PL perspective?

Clearly, the dominance of local and regional investors will continue, which is quite natural in times of uncertainty. However, I do not expect a substantial increase in the investment volume this year because real estate currently has to compete with other asset classes, which perhaps provide better risk-adjusted returns. At the same time, alpha-generation investors will see opportunities to access products at very attractive terms.

22 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA INTERVIEW

>>>

A UNIQUE HOUSING ESTATE IN KONSTANCIN

“Groen” means green in Dutch, while Ghelamco embodies perfectly executed real estate developments. Joining these two together could only result in one thing – modern residential housing units that reflect a passion for functional solutions and breathtakingly designed greenery.

All of this can be found now in Konstancin-Jeziorna, in the immediate vicinity of the city.

Does it sound too good to be true? Independence, freedom, greenery, and a safe neighborhood right on the border of War-

saw – all for the price of a city apartment? Well, it really exists. The perfect mix of a unique location and creative estate solutions allows for flexible price points, starting at 1,245,000 PLN for a house with a garden, with units ranging from 176 to 182 sqm.

Inspired by the Dutch building tradition, Groen’s terraced houses reflect the culture and heritage of the area’s former inhabitants by showcasing their love of openness, simplicity, and order. Bright facades stand out thanks to wooden or brick detailing. The sloping roofs are both functional and charming, and large windows highlight the spacious interiors. The houses have a floor to ceiling height of almost 3 meters and the attic ceilings reach a height of up to 4 meters.

The Kabaty Forest, Powsin Culture Park, and the Botanical Garden are

incredibly close and showcase the Warsaw region’s most lovely views and natural beauty. But even the common space of the estate reflects an outstanding union of idyllic design, greenery, and safety. With its grassy pitch and ponds with piers, complex shopping, and everyday services infrastructure, as well as proximity to the city’s best schools (e.g., The American School of Warsaw), Groen is a true enclave that offers all the best of modern city life. It is also the only offer of its kind on the local market.

It looks like dreams come true after all—and now they’re within your reach.

Find out more on groenkonstancin. com/en 600 113 113

WBJ.PL 23 PARTNER HIGHLIGHTS

3.

What sectors do you feel strongest about at this moment?

We are continuing our investment activity in the logistics sector in the region. This is predominantly driven by our convictions about the market's potential and growth. The trends around onshoring and nearshoring, e-commerce growth, and the supply chain's digitalization, coupled with the region's infrastructural development, provide sufficient comfort. We also see PRS sector opportunities due to demographic and urbanization trends. In addition, due to the high mortgage costs, we see a growing demand from tenants in the residential market. We are very active in the PRS sector in US and Europe, and there is also great potential in the CEE region going forwards.

4.

Rates are high, and it is a time full of uncertainty – does this situation open up investment opportunities in Poland?

As in other European regions, we see short-term opportunities to capture deep value in market dislocations. We could even see some gap financing opportunities to recapitalize assets or portfolios. However, we follow our conviction themes and continue to be cautious and selective.

5.

Has the war in Ukraine influenced your appetite for Polish assets?

In conjunction with our partnership with Entralon, the Warsaw Business Journal is conducting exclusive interviews with distinguished real estate professionals to exchange valuable insights and explore investment strategies that pave the way for a more prosperous future. www.entralon.club

The war in Ukraine is very traumatic. As a Polish citizen witnessing one of the most significant refugee crises in modern history, this has been a painful experience for me. At the same time, I am proud that Poles as a nation showed our solidarity with Ukrainians and provided meaningful humanitarian support to the extent possible. Naturally, this war has had negative consequences from the investment perspective, with geopolitical turbulences, inflation hikes, energy crises, interest rates increase, etc. All of those factors must be considered when investing in real estate in the region. However, we are a longterm investor who has been active in the CEE market for over 20 years, and we continue to believe that the long-term fundaments remain strong and reasonably resilient, even if we have to cope with many unpredictable factors and readjust our strategy in the short term.

24 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA INTERVIEW

I am proud that Poles as a nation showed our solidarity with Ukrainians and provided meaningful humanitarian support to the extent possible

AN ESG STRATEGY FOR EXISTING RETAIL PARK INVESTMENTS

As the cost of new constructions grow, reducing the carbon footprint of existing retail parks can be an very effective strategy for cutting costs and meeting the demands of tenants and customers - says Brain Kober, Project Manager, LCP Properties.

In 2023 in Poland, the modern retail park market will strive to meet the growing demands of tenants and customers. However, costs for construction and land purchases will continue to increase due to inflation and the geopolitical situation. According to Statistics Poland, the price indices for construction and assembly production have continued to grow at over 10% y/y since March 2022. It reached a high of 15.4% in December 2022 and has risen every month since then.

Increasing development costs will increase the importance of existing buildings located in convenient locations and fixed in the consciousness of the local

community. However, these existing structures, e.g., stand-alone, retail parks, and convenience stores from the 1990s and early 2000s, require a change in function, reconstruction, and adaptation to current trends in retail trade.

Remodeling a retail park is an excellent opportunity to implement solutions to reduce its carbon footprint. These measures include replacing old lighting with LEDs, collecting and using rainwater, photovoltaic panels, heat pumps, and building management systems (BMS). These are just a few ways to significantly reduce resource consumption and costs while positively impacting the environment.

The decision to remodel will also be dictated by issues related to the decision-making processes of the financing institutions. Implementing the ESG (Environmental, Social, Governance) strategy and obtaining environmental certification, e.g., BREAM or LEED, has become an essential element of the process, along with the decision to refinance the investment. All in all, lenders increasingly seem to prefer to allocate their resources to more ESG-compliant projects.

Retail’s green building landscape will continue to develop in the com-

ing years as investors and retailers realize the value of integrating highquality environmental, social, and governance into their store assets. Those who greenify their stores are using the opportunity to go above and beyond minimum requirements, sending a clear message about their stance on ESG.

PUTTING ESG INTO PRACTICE

LCP as a part of M Core Group is going to become more green in coming years. One of the assets to become more green and environmental friendly is M PARK Pisz. During the ongoing rebuilding of the M PARK Pisz retail park, we are implementing actions aimed at reducing energy consumption and increasing the comfort of tenants. We have built energy-efficient shopwindows with a lower thermal transmittance coefficient, installed parking LED lighting, replaced the old ventilation system with new air handling units with heat pumps and integrated everything within the Building Management System. The building is also being prepared for green certification.

Find out more on: www.lcp.pl & www.mcoreproperty.com

WBJ.PL 25 PARTNER HIGHLIGHTS

M Park Pisz

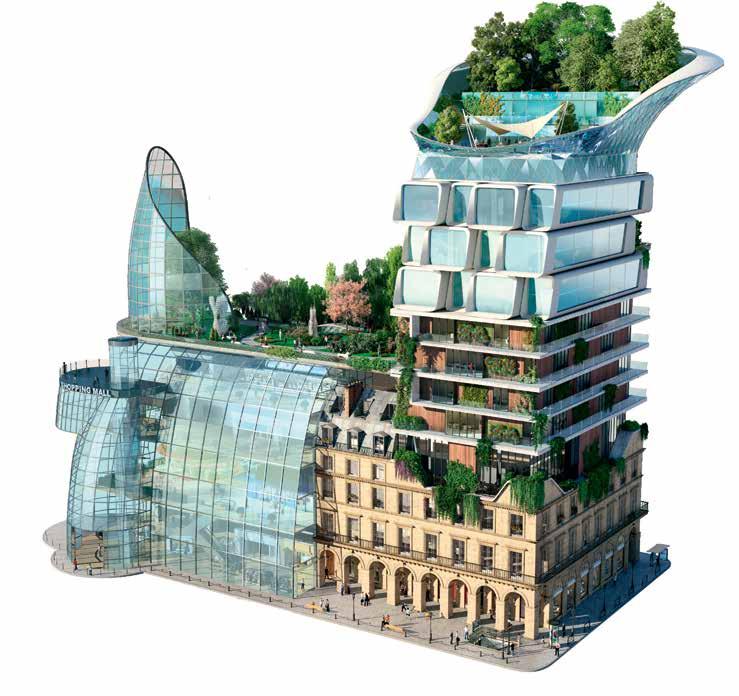

THE FUTURE OF WARSAW LOOKS BRIGHT

Warsaw needs to provide housing for an increasing population while making the city more resilient and energy-efficient. To deal with these challenges, city planners have utilized strategic city planning. As a result, the future of Warsaw will be green, dense, local, and convenient.

In 2023, Warsaw is about to adopt a new Studium – the city's most important planning document. The Studium is not a direct implementation tool. Instead, it provides a strategic framework for forthcoming decades of planning. It determines the future size of the city and coordinates the development of a few key aspects: mobility, greenery, public spaces, new development zones, and others.

HOUSING FIRST

Over the last three decades, Warsaw has seen unprecedented growth. But it has also experienced a drastic increase in housing prices, exacerbated by the recent refugee crises caused by the Russo-Ukrainian War.

The priority of the new Studium is to provide the city with new development zones while simultaneously increasing housing quality. In addition, the Studium will coordinate the redevelopment of centrally located brownfields while limiting suburban sprawl. As a result, up to 95,000 new apartments will be built on former industrial, commercial, and railway lands.

"Warsaw has multiple brownfields that need bold regeneration schemes. We already have outstanding examples of such mixed-use investments developed in a sustainable way that benefit the city and its inhabitants," says Mayor of Warsaw Rafał Trzaskowski

The Studium will abolish strict zoning. It will be easier to mix apartments with offices and shops, develop apartments for rent and create public-private partnerships. It will also make

26 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

LOKALE IMMOBILIA EXCLUSIVE

PHOTOGRAPHS COURTESY OF THE CITY OF WARSAW

“BY 2050, EACH RESIDENT WILL HAVE A HIGH-QUALITY PARK WITHIN

A 15-MINUTE WALK FROM THEIR HOME”

planning more flexible, allowing the city to react efficiently to rapid political, climate, and economic changes. As a result, the standard of housing will increase. A more compact and mixed-use city will provide its inhabitants with better public transport, various services, and more greenery.

A THRIVING LOCAL LIFE

According to local government data, 94% of Warsaw residents like their city. They particularly love their neighborhoods, defining their "neighborhood" as the area around them located within an 11-minute walk. Hence the ambition to design a 10-minute city.

By 2050, 93% of Warsaw residents will have all their daily services available within a 10-minute walk, including a local center, a school, a park, a bus stop, a shop, or a cafe. All peripheral districts will be within reach of a tram, a local train, or a subway. They will also receive any now-missing schools and parks. Limiting suburban sprawl will reduce the costs of building infrastructure by five times.

The thriving city center will expand into Wola and Ochota and to Praga on the right bank of the Vistula river. Additionally, 272 local- and 41 district-level centers will be created. The five most important railway stations will transform into five metropolitan gateways: comfortable mixed-use districts organized around transfer nodes.

Future Warsaw will also be more healthy. By 2050, every resident will be within a 15-minute walk of recreational areas and have direct access to green walking and cycling routes. Local neighborhood centers will also reduce the plague of loneliness threatening senior citizens. This is particularly important due to demographic changes: by 2050, every fourth person living in Warsaw will be over 65.

THE HEALING POWER OF NATURE

Warsaw is already among the top ten greenest cities in Europe. By 2050, every citizen of Warsaw will have a view of greenery from their window. Protection areas of the most valuable natural area will increase by 39%. Parks and squares will double in size, and forests will increase by 11%. Residents will have a highquality park only a 15-minute walk from their homes. The embankment of the Vistula and the adjacent escarpment will become one of the

largest green public spaces in Europe, distinguishing Warsaw's central district from other European capitals.

Robust natural zones will guarantee safety. Planning indexes introduced in the new Studium will provide more greenery throughout the whole area of the city. This improved system of natural zones will constitute blue and green infrastructure, which increases biodiversity, making cities more resilient to the adverse effects of climate change. It is also 28% more productive than traditional infrastructure and costs half as much. It will make Warsaw resistant to droughts and flooding and reduce the costs of fighting climate change.

Warsaw will also decrease energy use and develop clean energy sources. All new construction will be subject to new green standards and existing buildings will undergo thermal modernization. The city will also support creating a distributed network of renewable energy sources, decrease the energy consumption of air conditioning, and continue developing electro-mobility.

The new Studium will define the spatial development of Warsaw up to 2050. While working on this document, we have learned both from the rich local planning tradition and the best practices of contemporary European planning. As a result, Warsaw will become denser but greener. It will limit sprawl, providing areas for development in the inner city. It will form a robust system of green and blue infrastructure that will make the city healthier and more resilient. "By increasing the quality of life of its citizens without inhibiting growth, Warsaw will become one of Europe's most attractive cities of Europe in which to live and invest,"summarizes Mayor Rafał Trzaskowski.

WBJ.PL 27

LOKALE IMMOBILIA EXCLUSIVE INTERVIEW

28 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

MATCH-MAKERS - FITTING IN 23 YEARS OF EXPERIENCE IN THE POLISH/CEE MARKET

INTERVIEW BY MORTEN LINDHOLM

WBJ: Let's start by getting to know you – tell us about the history of Neo-Świat.

We started the company 23 years ago when we came here from Australia. We had a business in a similar industry there already, but we realized Poland offered massive potential for what we do best, so we decided to stay.

More than 20 years ago, workers on building sites did not take pride in their work. So when we began hiring people, we took the obvious approach, starting with training and a focus on building team spirit to help them feel pride and esteem in their work.

We have built our company on certain specific values, such as trust, respect for people, creative energy, and a positive approach for which nothing is impossible. We want to do things because we do them for and with our friends, our families, employees, and customers.

We run our company as a family business based on these fundamental values. Even when part of the company, including us as management, was purchased by JLL/Tetris, we continued this approach within the larger “corporate” organization. We worked in the corporate world for 6-7 years and created a very successful business within JLL and Tetris. Honestly, we think it was recog-

nized as number one in Poland in our industry, but in the end, the differences in our values were too significant, so now we are back as Neo-Świat.

We find that flexibility and agility in business is extremely important. We still manage our own team in NeoŚwiat. That brings immense value because flexibility in carrying out work is crucial when you fit-out complex projects, especially within an office, which is a place of business. You are working within a living organism. How much can you do at night? Can you work weekends or during public holidays? Obviously, the flexibility element is enormously important – it is a must in the fit-out industry.

Did Neo-Świat also exist while you were part of JLL?

When we decided to join Tetris, we only sold off part of the Neo-Świat business. The workers doing the on-tools work, connecting the cables, fitting the corners, and painting the walls remained part of the original Neo-Świat. But, of course, they were exclusively under contract to Tetris. So honestly, NeoŚwiat has existed before, during, and now after Tetris.

When we parted ways in October last year, we sat down here with the 30 or

so key people who came with us, and we asked them a simple question: “Are you serious about getting the business back on track?” They all said: “Yes, let's go for it.”

We are nothing without our people. We always say that this business is a relationship business, which is true for 80% of the customers who come to us through our network and contacts. But it is the same internally – our people are the company's primary asset. We know we can trust [them to hold up their end of the business.] Our job is to make ends meet; we are responsible for coming up with solutions. We are the ones sitting down with the owners, the developers, and the tenants. When we promise the best course of action and the right solutions, we must have complete confidence in our contractors, partners, and employees. Therefore, people and contractors – trust and relationships –are what we stand for.

So now we are again 100% devoted to Neo-Świat, together with the 120+ people who work for us.

Can you define your new challenges and goals?

Our job consists of interior decoration and fit-out, and this includes the interior of any space. So whether it's an office,

WBJ.PL 29

WBJ catches up with the Managing Directors of Neo-Świat Paweł Brodzik and Rajmund Węgrzynek to discuss the current real estate market outlook and what makes Neo-Świat stand out from the pack.

LOKALE IMMOBILIA EXCLUSIVE INTERVIEW

retail, residential, or hotel project, we do all the installation systems all the finishes and joinery. So we call ourselves "A general interior contractor."

Contacting clients since our return to Neo-Świat, has brought an amazing response—it has not been whether we can do business for them, but rather about how much business can we do for them. This enthusiasm highlights our point about the importance of relationships in this business. Our company is built on strong personal relationships. People want to do business with you when there is trust, reliability, and care.

Rajmund [Węgrzynek] has done a huge job on keeping the market up to date with the changes that are taking place around us. He hasn’t stopped for a moment, talking to our contacts for the last three months, explaining the news, what has changed, and how we are still here for them and have never ceased existing.

We believe that there are significant opportunities out there for us. Without getting into details and figures, the real estate industry is in a difficult situation, and everyone is looking to reduce costs even by 10 - 20% for interior fit-out. In this crazy world, the clue is to be always positive – a definite opportunity for us, as we are no longer a corporate company and carry less overhead, is that now we can offer our clients a more attractive (cheaper) offer than before.

What about opportunities in Poland and the CEE?

A good aspect of spending the last six years as part of Tetris is that it was a huge learning curve for us. We devel-

oped a lot of contacts and networks in the CEE during this time. We now see this as an opportunity – because we have a great deal of knowledge about these quite different markets.

We were responsible for the CEE market and part of Germany which gave us significant insight into the external markets around Poland. We have learned about opportunities, problems, people's mentality, what the markets can or cannot handle, etc. Today, for example, when we are speaking with a client about a nice residential project in Budapest, we are suddenly recognized as experts there. So, yes, there is an opportunity.

If you are (and we are) quite well connected with a huge network of contractors here in Poland, then finding somebody from the south of Poland to manage a project in Budapest is not a problem, it's less than 500 km away. There is another sad situation, but also an unknown for the future. Nobody knows what will happen with Ukraine, but we strongly believe that this country will win. After the war it will require a lot of support and rebuilding. However, we have Ukrainian-speaking staff, the experience needed in rebuilding (since the Polish market was in a rebuilding phase back in the 1990s), and the benefit of being located quite close to Ukraine.

What is the future of your market? What possibilities do you see?

Over the last 3-4 years, we have seen an enormous shortage of labor and in generał the labour force is getting older. Naturally, companies like ours must look for ways to attract and train young and motivated people—not just

30 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

As always, we are still committed to doing what we do best because we know that the market expects nothing less

the management side of the business but also the blue-collar workers. Furthermore, the fit-out industry must focus on technology and ways to reduce tedious on-site work, such improvements must increase the flexibility and efficiency of the fit-out process. Many buildings are getting older and will require adjusting to be compliant with current regulations and expectations. Considerable investment will be required to make this happen, for example, to follow or become aligned with the ESG regulations and sustainability practices.

So, even though the market has temporarily paused, demand will grow (and then so will the prices). Opportunities are still out there. Perhaps it could be more obvious, but, for example, [aging] shopping centers are destined to be rebuilt or converted into mixed-use properties. They don't have any other option to survive, and it has already slowly started. There are hundreds of these types of assets currently in Poland.

New investors are coming in, as the market is adjusting, so we are sure opportunities will grow. We are curious about the future of the office sector. It has yet to be determined what will happen with the hybrid work model and how many square meters companies will need to match their needs in the future. However, we will know this when Warsaw starts to be in low supply.

If we look back five years ago, 2018 was when the highest amount of stock was released on the market. Now the lease agreements signed then are coming up for re-negotiation. Tenants are facing quite different choices now, versus five years ago. What they choose

and how they adapt their new offices for the next five years will be different. It will definitely be an opportunity for companies doing interior fit-out to provide these new solutions. From your press release, I saw you are active in many sectors. Which ones are you most focused on? Office, retail, residential, and hotels are the four pillars of what we do. But, we are closely following changes [that the future may bring] regarding the industrial part of the market as a potential business line.

Looking at our pipeline, residential and hotel are the most significant drivers , and when I say residential, I mean the private rental sector (PRS), so it's not individual residential. This sector is undergoing a huge boom now. Residential with hotels is, I think, now 60-65% of the business. On top of this we also have quite a sizable retail project at the moment, which will probably take about 18 months to complete, and that will likely bring in around 20% of the revenue and the remaining 20-25% is going to be office related.

Do you have any final words? We are still committed to doing what we do best because we know that the market expects nothing less.

The market must know that we are still the same. We were Rajmund and Pawel when we joined Tetris – we are still Rajmund and Pawel now that we are Neo- Świat again. We bring the same great values and positive energy to the market. We build strong relationships, have skills and experience and have great people who are truly the key to our success in this market.

WBJ.PL 31

We have built our company on certain specific values, such as respect for people, creative energy, and a positive approach for which nothing is impossible

CEEQA GEARS UP FOR 2023

As the 2023 CEEQA Gala draws nigh, Warsaw Business Journal sits down with Richard Hallward, CEEQA’s founder and chairman, to discuss the ongoing planning for this year’s event and some exciting changes to the usual agenda.

WBJ: The appointment of international consulting firm PwC as the new Leader Partner and awards supervisor for 2023 certainly continues CEEQA’s evolution as one of the most trusted and valued industry awards platforms and one of the strongest sector showcase events in European business. But can you give us further insight about all of the “platform refreshments” you have announced as key targets for CEEQA’s 2023 campaign?

Richard Hallward: “CEE & SEE real estate in black and white”, is the promotional slogan of the 20th Anniversary edition of CEEQA. Known as the “business Oscars” for performance and achievement across 28 countries in Central & Eastern Europe and Southeast Europe, the 2023 campaign slogan highlights its reputation for the unstinting pursuit of transparency and fact in its awards processes and results - the Q in CEEQA stands for quality.

LOKALE IMMOBILIA INTERVIEW TOP: PRESS MATERIAL, BOTTOM: WIKICOMMONS 32 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

Central to this standpoint over the two decades has been the role of the awards integrity supervisor. Far from a ceremonial position, the role involves a deep and uncompromising audit of every aspect of CEEQA’s awards entry and selection processes throughout the campaign, from jury selection and judging to announcing the results. Moreover, it is a role familiar to PwC as the long-term supervisor of the Oscars.

We’re excited to be working with PwC as our new lead partner and awards supervisor and collaborating on some content areas for the 2023 campaign. Last year we were focused on getting the event over the line in recognizable shape as we returned from the pandemic’s disruption. Planning this year’s campaign, we saw an opportunity to step back and examine, improve, and, if necessary, transform each element of delivery and value. It has been a full quality audit.

Beyond this appointment, what further changes have the CEEQA team adopted to meet current market conditions?

We asked ourselves, “Is the CEEQA Gala format still best in class for current market conditions and purpose, or can it be improved?”

Do people still want to sit in a dark room, particularly at the more open outdoor Wyscigi location and new

date slot in mid-June, able to talk only to the person on the left and right for two hours under flashing lights? Or can the dining and awards ceremony format, the gala’s traditional centerpiece, be adapted to a more open and dynamic setup to enhance guest experience and business mixing value while retaining the hallmark prestige and quality of the dining and ceremony experience?

The CEEQA team put these questions into a pot and stirred. The result is a different formula, a kind of hybrid of the Grammy awards and a Buckingham Palace garden party, where companies have their own tables and meeting points, the usual exceptional hospitality and production quality, but guests are free to roam and mix.

Have ongoing events that have carried over from 2022, such as rising inflation or the invasion of Ukraine, also impacted your plans for CEEQA?

[With] Russia’s invasion of Ukraine and an escalating war on our borders affecting the cost of living and of business, [and] fuelling a current inflation crisis, who wants to hear that their prices are going up to account for rising catering and event delivery costs? [Our] new formula has enabled some cost savings on production, which CEEQA is passing on to customers with eye-catching price reductions for tickets and

commercial sponsorship.

Game, set and match. We’re confident in our skills and support to pull this off, and we know they will love it. It’s going down well with sponsors and ticket buyers so far, including a few new sponsors.

Are there any further changes we should expect? Are there any new projects or award categories on the horizon?

We’ve revamped the two Green Leadership award categories for companies and projects, one of the most competitive CEEQA categories. They’ve been renamed and restructured as the ESG awards. The campaign will also see further steps in CEEQA’s Ukraine Live Connect project launched in 2022, which aims to inform and connect regional real estate leaders with leaders in Ukraine, examining likely needs and collaboration opportunities in rebuilding post-war Ukraine.

There has been plenty of interest and suspense around the next CEEQA Gala entertainer. After all, the gala boasts a record of outstanding world-class entertainment, including recent shows by Gloria Gaynor, Morcheeba, and the Boomtown Rats. So which star will have top billing this year?

I don’t think I can reveal the full details of this year’s top act ahead of the formal announcement in March, but I am confident that it will be among the best yet. Let’s say she’s no small beer.

WBJ.PL 33

Definitely food for thought.

CEEQA23 takes place on 14 June at Wyscigi race course in Warsaw, entries for the awards close on 24 March.

We’re excited to be working with PwC as our new lead partner and awards supervisor with their high global profile and extensive experience in technical management of awards integrity processes

THOUGHT LEADER

ESG IS NO LONGER A CHOICE, IT’S A NECESSITY

Warsaw Business Journal discusses constructing sustainable office buildings in line with ESG principles and the market practices that create a competitive advantage with Jarosław Zagórski , the Commercial and Business Development Director at Ghelamco Poland.

WBJ: ESG is currently a leading trend in all real estate sectors. The key elements of ESG include sustainable development, energy efficiency, and CO2 emissions. Why is ESG currently such an important part of company strategy?

Jarosław Zagórski: ESG is today no longer a choice but a necessity. Listed companies are already bound by EU regulations governing ESG reporting. Many companies are still not aware that they will be obliged to do this. What's more, they are also not aware of when they will be required to report ESG, because it will result from the verification of the company's business activity against the requirements set. At Ghelamco, we are fully aware of this and have firmly orientated our strategy towards ESG. The health and safety of our buildings’ users remain our priority. For us, sustainable development and the environment are the most important issues, which is why we are taking concrete steps to reduce our CO2 emissions and achieve energy neutrality through investment in renewable energy sources. Both tenants and investors expect this from us. These days, it just simply doesn’t pay to build in a non-ecological manner.

How do you intend to achieve energy neutrality? Surely this is a huge challenge for a development firm?

Indeed, and up until now, no developer in Poland has succeeded. We intend to achieve this through our program to construct solar farms, which we launched last year. This is the first groundbreaking project of its type in Poland, and it is both a part of our ESG strategy and an answer to the energy crisis in Europe. Since 2015, we have been buying green-certified electricity, but this is not enough for us. We wanted to take the next step to significantly limit our carbon footprint, so we decided to generate clean energy. Our strategy is to generate electricity from our own renewable sources to power our office buildings, projects under construction, and own office. In the first stage, we will build a total of eleven systems with a combined generating capacity of 10 MW. The first three farms were built in the autumn of last year. Our ambition is to achieve energy neutrality as a business by 2025. The Warsaw UNIT will be the first office tower in Poland to be entirely powered by clean energy. Freeing ourselves from conventional energy and returning to clean energy from renewable sources is not only an ecological but also a strategic move to ensure the uninterrupted operation of our business. We are already planning the development of our next solar installation and looking at other renewable energy sources. How well does [Poland] match up with the rest of Europe in terms of green construction?

34 FEBRUARY - MARCH 2023 WARSAW BUSINESS JOURNAL

LOKALE IMMOBILIA

I think Poland is one of Europe’s leaders in green construction and modern solutions. The office buildings constructed here meet the highest standards, and their certifications under prestigious systems such as BREEAM and Well have already become the standard. Warsaw UNIT undoubtedly is an example of one of the most environmentally friendly and technologically-advanced buildings in the entire CEE region. With a height of 202m and 56,000 sqm of the highest standard office space, the building is the first tower block in Poland to be certified under BREEAM with the highest rating of “Outstanding.” Every day, the super-modern Building Energy Management System (BEMS) uses 40,000 sensors and 800 meters to ensure optimal energy use. As a result of this and many other technological solutions, energy usage is almost 30% lower than in a comparable high-rise office building. Because of our program to build solar farms, the building will also be the first office tower in Poland to be powered 100% by clean electricity. By using power from renewable sources, the building’s CO2 emissions over its entire life cycle will be lowered by over 50%, while its usage of utilities will be 70% lower. Warsaw UNIT is also to feature Ghelamco’s own patent operating system, Signal OS, which comes with its own app to help tenants monitor utility usage in real-time. Moreover, we have applied anti-pandemic solutions to the building, including virus-killing UV disinfection in the lift shafts and ventilation system.

Currently, two new Ghelamco office buildings are under construction in Warsaw. Will they also follow ESG principles, and what technology are you implementing in them?

I would say they are examples of the standard of ESG real estate. The Bridge on the European Square is currently the largest building under construction in Warsaw. It will provide users with a total of 47,000 sqm of the highest-class office space. The Bridge is the first development in the CEE region to have received the prestigious SmartScore and WiredScore certificates awarded to the most intelligent and technologically advanced buildings in the

world. We are going to use low-emission materials to construct the tower block, including low-emission concrete for the foundations, which will considerably reduce carbon dioxide emissions in comparison to standard concrete and, by this, limit the carbon footprint of the building under construction. We are currently working on implementing technology to minimize water usage in The Bridge. By the end of last year, we also began construction on the VIBE office complex, which is to be the first office building in Poland to be given its own musical identity. This will become part of how this project communicates, but it will also reverberate throughout its space. This complex has also been designed in line with our ESG strategy, and it is to be certified under, among others, Well, BREEAM, SmartScore, WiredScore, and Green Standard Building. For the first two certificates mentioned, our goal is to gain the highest possible ratings of “Platinum” and “Outstanding.” The Bridge and VIBE will ultimately be 100% powered with clean energy and equipped with a BEMS.

At the beginning of this year, Ghelamco joined the Science Based Targets initiative, which supports the most ambitious industries in their fight against global warming in accordance with the principles of the Paris Agreement. Why did you make this decision?

This is another extremely important part of our ESG strategy, demonstrating our ambitions and targets in this regard. We are the first real estate company in Poland and one of only 15 other companies in the country to have joined this worthy initiative, which over 4,000 companies across the globe support. It is led by the United Nations Global Compact, the WWF, the Carbon Disclosure Project, and the World Resources Institute. SBTi bases its activities on knowledge and science, and it promotes the best practices for decarbonization and reducing average global temperature rises on the Earth. Thanks to our joining the initiative, we will be able to act even more effectively to reduce greenhouse gas emissions and combat global warming since we are allied to some of the largest international organizations.

WBJ.PL 35

Our strategy is to generate electricity from our own renewable sources to power our office buildings, projects under construction, and own office

PROF. MARCIN PIATKOWSKI ON MACRO-ECONOMICS

Professor at Kozminski University, author of "Europe’s Growth Champion: Insights from the Economic Rise of Poland”

Prof. Marcin Piatkowski is Lead Economist at the World Bank in Washington DC. Previously, he was Chief Economist of PKO BP, economist in the European Department of the IMF and Advisor to IMF's Executive Director. He also served as Advisor to Poland's Deputy Premier and Minister of Finance. He was a visiting scholar at Harvard University, London Business School and the OECD Development Center.

CEE Chairmen's Retreat

(6-7 June 2023, GrandHotel Tiffi, Poland)

By invitation & referral only. For top decision-maker level investors, developers and lenders. Places are limited. Inquiries to be sent to admin@entralon.club

MARTIN HEALEY, ON THE REAL ESTATE TRENDS

Managing Director, Real Assets at CPP Investments:

Martin Healey delivers insights and actionable advice to Real Assets’ investment committees and transaction teams on issues impacting long-term investment performance. He serves on global investment committees for real estate. Martin joined the Real Estate investing team in 2005, founded the Private Real Estate Debt group in early 2010 and established the Listed Real Estate program.

WILLIAM ALBERQUE ON GEO-POLITICS

Director of Strategy, Technology and Arms Control at IISS (International Institute for Strategic Studies)

William Alberque is Director of Strategy, Technology and Arms Control, focusing on preventing the proliferation of nuclear weapons, weapons of mass destruction and related delivery systems, as well as risk reduction and arms control at IISS, one of the world's leading think-tanks. William previously served as the director of NATO’s Arms Control, Disarmament, and WMD NonProliferation Centre (ACDC).

“Bringing together top decision-makers to openly discuss the massive disruption in the world’s economics and shocking political turmoil affecting us all to a great extent is absolutely crucial. Anticipating upcoming recession’s scale and outcomes, trying to work it through with peers, visionaries in CEE real estate market - is what we all need at this moment in time.”

Hadley

Svetlana Fedosova, Founder of Entralon Club, added:

'It is an honour to have been entrusted with organising this Retreat and to have been supported by our Advisory Board. We are aiming to convene the very top investors, developers and lenders active in the CEE Real Estate landscape. Our special speakers from London, Washington and Berlin will bring a global perspective that will enrich the discussion among participants on the foreseeable future of the CEE real estate market.

www.entralon.club/ceeretreat

-

Dean, Founder - MDC²

Pomeranian investments in 2022

Last year proved to be an investment success for Pomerania. More than 20 international organizations and corporations started projects in the region, resulting in the creation of almost 2,400 jobs.