For daily news visit us at wbj.pl Since 1994 Poland’s leading business magazine in English WARSAW BUSINESS JOURNAL APRIL - MAY 2023 ~ No. 2 (77) CEEQA REPORT: HOW ESG IS CHANGING THE BUSINESS LANDSCAPE Towarowa Towers and Square Investments Without Compromise Developed by Asbud Group Karimpol announces: second phase of SKYLINER complex begins Navigating Industry 5.0: Insights from ifm electronic CEO Aleksandra Banaś Visit us online STEP ONBOARD THE HYDROGEN REVOLUTION

8 In Review

News

14 Opinion

Polish banks and Remote working by Sergiusz Prokurat

19

Lokale Immobilia

Exclusive: Karimpol Group Skyliner

Five Questions for Hadley Dean

Event Report: MIPIM by Morten Lindholm

Towarowa Towers and Towarowa Square developed by Asbud Group

29 Investing in Poland

Hydrogen Valleys by Beata Socha

Investing Insights

Interview: Łukasz Grabowski, PAIH

40 Features

Europe's Military Powerhouse by Sean Reynaud

Poland and South Korea by Sean Reynaud

Interim Management in a Family Business by Dr. Katarzyna Sobańska-Helman

51 Tech

Metaverse by Sean Reynaud

Interview: Aleksandra Banaś, CEO of ifm electronic

Opinion: by Beata Socha

Opinion: by Jacek Krawczak

61 Life + Style

Pani Jurek

Varietal of the Month by Wine

Expert Peter Puławski of dobrawina.pl

64 Events

2 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL APR/MAY

51 58 61 40 14 ALL IMAGES SHUTTERSTOCK EXCEPT TOP LEFT BY PION STUDIO

PUBLISHER'S NOTE

WHERE WE ARE NOW –THE STATE OF THE POLISH ECONOMY AFTER Q1 2023

The Polish economy faces a mixed outlook for the rest of the year and onwards, with various positive and negative trends emerging. While there are expectations of GDP growth in 2023 and 2024, real wage growth may only occur at the end of 2023 or early 2024 due to rapid price increases for goods and services.

According to data from the Central Statistical Office (GUS), inflation on goods and services in March was at a high of 16.2%. However, it is expected to decrease to 9% by the end of 2023.

One of the factors that could contribute to a slower decrease in inflation is the expected rise in fuel and oil prices following the announcement slashes in production by OPEC+ at the end of March. This could impact the cost of living in Poland, particularly in terms of transportation costs.

Despite these challenges, there are positive developments on the horizon for Poland's economy. For example, the country is not expected to enter a recession in 2023. Some experts are even forecasting GDP growth of 0.7-0.8% for the year and a much better outlook in 2024 with increases of 2.7-2.8%.

Ukrainian President Volodymyr Zelensky’s recent visit to Warsaw resulted in the signing of an agreement for cooperation in the reconstruction of Ukraine. Poland has over 100 companies ready to help with rebuilding, which could lead to new business opportunities and trade relationships between the two countries.

On the other hand, the outlook for job seekers in Poland may be less optimistic. While the unemployment rate was 5.4% in March, a significant difference from the 30-year low of 2.9% in 2022, the job posting portal Pracuj.pl has confirmed seeing fewer job postings in 2023 than in the previous year. This suggests the labor market may be experiencing a slowdown, which could impact the country's overall economic growth.

Finally, while Polish export numbers for 2022 were very positive, with a growth rate of 21.6%, expectations for coming years are less impressive, with growth rates of 14.5% in 2023 and 12.6% in 2024. These lower rates could be due to a combination of factors, such as global economic trends, changes in trade policies, and supply chain disruptions.

Times are still challenging, and predictions and forecasts are uncertain, but it could be much worse, so let's stay positive as we head into what should be three interesting months before the summer slows us down. Enjoy our collection of insights and behind-the-scenes stories about Poland and Polish businesses.

Have a great read and a productive spring business season!

MORTEN LINDHOLM

4 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL PORTRAIT BY KEVIN DEMARIA

24-26 April 2023 —

International Congress Centre in Katowice

XV EUROPEAN ECONOMIC CONGRESS

The biggest business event i n C entral E urope

Key topics:

Green Economic Transformation | Technologies, innovations, digitisation | EU funds – tapping the potential| Real estate market | ESG – requirements and str ategies

WWW.EECPOLAND.EU REGISTER NOW

GUESTS THIS ISSUE

Łukasz Grabowski

A graduate from the Warsaw School of Economics. He is a winner of the Deutscher Akademischer Austauschdienst scholarship at the Johannes Gutenberg University in Mainz, Germany. He has gained professional experience working at the Polish Oil and Gas Company, Deutsche Bank headquarters in Frankfurt am Main, the PwC Office in Warsaw, the Embassy of the Kingdom of Norway in Warsaw and STTAS, a UPS company, an advisory and consulting company in the area of international trade. He has been working for PAIH since 2019.

Interview on page 32

Deputy Mayor of Krakow, responsible for Sustainable Development. He has a background in law, having worked in the insurance industry from 1991 to 2003. In 2003, he joined the City Hall of Krakow as the Director of the Architecture and Urban Planning Department. Following this, he ran his own legal counsel practice from 2006 until 2018.

Interview on page 36

CONTRIBUTORS

Beata Socha

Journalist, editor, writer, blogger. During her seven-year stint as Warsaw Business Journal’s Managing Editor, Beata covered a number of beats, from public policy, economy and real estate, through to technology and society. She blogs about cloud computing and fiction writing, the rise of AI and the future of the job market. Economist and linguist by education.

Sean Reynaud

A former U.S. Air Force Signals Intelligence Analyst, with a degree in Computer Information Systems, History and Communications. Having spent 20 years overseas, including Japan, South Korea and Kosovo, he now lives and works in Poland. As a WBJ contributor, Sean covers geopolitics and global economy, green initiatives and technologies.

Morten Lindholm

Editor-in-Chief/Publisher mlindholm@valkea.com

Kevin Demaria Art Director kdemaria@valkea.com

Jessica Sirotin

Editor

Krzysztof Maciejewski Business & Web Editor kmaciejewski@wbj.com

Contributors

Nikodem Chinowski

Sergiusz Prokurat

Sean Reynaud

Beata Socha

Alex Webber

Sales Izabela Kaysiewicz ikaysiewicz@valkea.com

Katarzyna Pomierna kpomierna@valkea.com

Print & Distribution

Krzysztof Wiliński dystrybucja@valkea.com

Event Director, Valkea Events Magda Gajewska mgajewska@valkea.com

Contact:

phone: +48 22 257 75 00 fax: +48 22 257 75 99 e-mail: wbj@wbj.pl WBJ.pl

For enquiries,subscriptions-related

please email us at wbj@wbj.pl

WarsawBusinessJournal @wbjpl

All photographs used in this issue are courtesy of partners and companies unless specified otherwise.

Copyright © 2023 by Valkea Media SA

All rights reserved. This publication or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher.

Published by ul. Jerzego Ficowskiego 15 Valkea

6 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

Media S.A.01-747 Warszawa Tomasz Opiela, CEONIP: 525-21-77-350 www.valkea.com To subscribe through RUCH SA: www.prenumerata.ruch.com.pl, prenumerata@ruch.com.pl, 801 800 803

Jerzy Muzyk

DEGROWTH AS THE NEW NORMAL – PERSPECTIVES AND OPPORTUNITIES

19-21 of May 2023

THEMATIC WORKSHOPS

DISCUSSION PANELS

FAMILY PICNIC

GAL A DINNER AND CHARIT Y AUCTION

Register at: www.kongresmba.uek.krakow.pl

IN REVIEW

GERMAN TOURISTS RETURN TO POLAND

Around 2.8 million German tourists visited Poland in 2022, almost 47% more than in 2021. This is roughly the same number as before the outbreak of the coronavirus pandemic. Poland ranks eighth among the favorite foreign travel destinations for German citizens. They spent €1.7 billion in Poland last year.

8 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK

EXPORTS

Door and window exports up 32% in 2022

The export of windows and doors from Poland increased by 32% in 2022, reaching €3.96 billion compared to €2.98 billion in 2021, according to the Center for Industry Analysis (CAB). Polish companies sell more than twice as much as German producers on foreign markets. Since 2004, Polish carpentry exports have increased more than twelve-fold, and in 2022, 31% of the value of exports of all EU countries was from Polish firms.

QUOTE: Volodymyr Zelensky

He quoted Polish writer Jerzy Giedroyc who had said that

EXPORTS

Polish exports keep growing

Polish exports to Germany increased by 8.2% y/y to €7.6 billion in January 2023, while imports in the same period increased by 0.4% y/y to €5.5 billion, according to GUS data. Germany’s share in Polish exports decreased by 0.7 percentage points to 27.2%, while in imports, it fell by 0.8 percentage points to 20.6%.

The positive balance amounted to PLN 10.1 billion (€2.2 billion) compared to PLN 7.5 billion in the same period in 2022.

The largest turnover in imports was recorded with developed countries –PLN 94.6 billion, including PLN 84.6 billion with the EU, compared to PLN 84.1 billion (PLN 77.9 billion with the EU), in the same period of 2022.

ENERGY

EC grants €124 mln to gas pipeline construction in Poland

The European Commission has approved the transfer of more than €124 million from the European Regional Development Fund for the construction of a 253-kilometer section of gas transmission pipeline in the Mazowieckie, Łódzkie and Lubelskie regions.

These are funds from the 2014-2020 programming period. This section is part of over 300 km of gas pipeline from

Ukrainian President, Volodymyr Zelensky, held his first official diplomatic visit to Poland on on April 5-6 , during which he talked to PM Mateusz Morawiecki and made a joint appearance with President Andrzej Duda.

10 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

News

“there is no independent Poland without an independent Ukraine”, “And I would continue. Russia cannot prevail over Europe when a Ukrainian and a Pole stand shoulder to shoulder”

SHUTTERSTOCK (2)

IN REVIEW

Gustorzyn to Wronów. “This project is a concrete example of cohesion policy support for energy security in Europe. It will significantly contribute to Polish energy security by diversifying gas supply sources and will enable gas exports to Lithuania, Slovakia and Ukraine,” said Commissioner for Cohesion and Reforms, Elisa Ferreira.

PGE plans 6.5 GW of offshore power by 2040

Polish energy company Polska Grupa Energetyczna (PGE) aims to achieve 6.5 GW of installed capacity in offshore wind farms by 2040. The investment program will be funded both from Polish and international sources. In 2022, PGE’s investments amounted to PLN 6.7 billion, nearly PLN 2 billion higher than the previous year. PGE generates 41% of net electricity in Poland and has a 10% share in renewable energy.

INTERNATIONAL Half of Polish firms employ Ukrainian citizens

The number of Ukrainian workers in large companies is increasing, with almost every other employer now having a worker from Ukraine, up 7 percentage points compared to November 2022 and 15 percentage points up y/y.

The majority of Ukrainian workers (58%) are employed in companies with over 250 employees. Almost one-third of Ukrainian workers are employed as skilled mid-level staff, which is a 4 percentage point increase from the previous survey.

DOMESTIC New technological lines for ammunition production planned

Poland plans to launch new technological lines for ammunition production, Prime Minister Mateusz Morawiecki announced, stressing that production should start as quickly as possible. The PM also pointed to possible EU funding sources for ammunition manufacturing, as well as expressed hope for private sector initiatives.

Minumum Wage Around The World

From January 1, 2023, the minimum wage in Poland rose to PLN 3,490. It is set to further increase up to PLN 3,600 from July 1 this year, putting it PLN 590 above the minimum wage in 2022, and marking a 19.6% growth year-on-year.

JOB MARKET

Over 70% of Polish firms struggle to find employees

More than 70% of Polish employers have difficulty finding employees with the right skillset, according to ManpowerGroup’s “Talent Deficiency” survey. Companies from the communication industry struggle the most. Globally, the problem with recruiting the right talents is reported by 77% of companies versus 72% in Poland.

Compared to Poland, the situation is better in the Czech Republic (66%) and Slovakia (68%), while in Germany, 86% of the companies struggle to find adequate candidates.

FINANCE WSE trading volume drops 44.1% y/y in March

The total value of trading in shares on

the Warsaw Stock Exchange main market in March amounted to PLN 24.8 billion, 44.1% less than a year ago. The value of the WIG index at the end of March stood at 58,608.76 points and was 9.7% lower than a year earlier. In March, the NewConnect market recorded a decrease in the total value of trading by 36.8% y/y to PLN 201.9 million.

TRANSPORT PKP Intercity with record high passenger traffic in Q1

PKP Intercity carried a record number of passengers in the first quarter of 2023, more than 13.7 million, board member Tomasz Gontarz announced.

“Big news! Q1 2023 was the best in the more than 20-year history of @PKPIntercityPDP! We carried over more than 13.7 million passengers!” Gontarz wrote on Twitter.

WBJ.PL 11

Paraguay $323 Uruguay $424 Chile $369 Ecuador $407 Guatemala $383 U.S. $1,550 Canada $1,545 FRA $1,380 ESP $925 GER $1,584 Australia $1,866 Portugal $690 IRL $1,753 Saudia Arabia $958 Nigeria $68 S. Africa $226 POLAND $584 ROU $393 GRC $626 Turkey $457 UKR $146 CZH $643 BLR $189 EST $704 $1,385+ $645 $345 $205 $0 LVA $555 LTU $646 SVN $896 HRV $571 MNE $459 BIH $324 HUN $383 SVK $572 Russia $224 South Korea $1,333 Philippines $141 INDIA $95 Thailand $195 Hong Kong $959 UK $1,705

Sources: Picodi, U.S. Department of Labor

OPPOSITION PARTIES COULD WIN ELECTIONS, BUT ONLY TOGETHER

Despite being the second-largest party in terms of voter support, Civic Platform's chances of forming a government will largely depend on whom they decide to form a coalition with. Alone, their chances of forming a government are slim.

BY EWA BONIECKA

According to a recent poll by the daily Rzeczpospolita, if all political groupings were to enter the ballot separately, the ruling Law and Justice (PiS) would garner 34.4% of the vote, while Civic Coalition (led by the centrist Civic Platform) would collect 26.6% of the vote. The third spot would go to Confederation (9%), followed by the Left (8.5%). Finally, Poland 2050 and the Polish People's Party would take a mere 7.9% each.

The situation changes significantly if the parties with lesser support run together. A coalition of PSL, Poland 2050, and the "Yes for Poland" movement could get 15.5% of the ballot, throwing the established majorities off balance. In this scenario, the opposition would win 241 seats in the Sejm, allowing them to form a government. But it would require much effort on all sides to create a united front against the ruling party.

Interestingly, as many as 7.3% of Polish voters remain undecided, which presents both a challenge and an opportunity for all involved.

Grzegorz Schetyna: We will fight for society's trust and reach out to the younger generation, and I will continue this fight until the end of the elections. As opposition MPs, we travel across the country, talking to and supporting Ukrainian neighbors in their struggle for freedom and democracy against the Russians. We criticize the PiS government's actions, which have caused tension in Poland due to inflation and price increases, as well as in other European Union countries, to which the PiS government has not responded adequately. Its weak role in foreign policy has exacerbated the situation. Furthermore, tensions exist within PiS, as Zbigniew Ziobro, the Minister of Justice, and his group oppose PiS and promote their own ideas. Although the opposition also has internal divisions, they do not concern critical issues such as aid for Ukraine.

I am confident in our ability to win the elections, but it will require our unity and strength, and I will continue to fight for this until the end. Our local governments are a source of strength, and we must plan for the future, particularly in foreign policy. We must think beyond today and consider our relations with Russia, developing countries, and the future rather than only the present, as the government's foreign minister is barely visible in the European Union. During our future governments, we want to change this situation.

Grzegorz Schetyna, Civic Platform MP and former leader of the political group stepped down when Donald Tusk returned from his Brussels posting as the President of the European Council.

12 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL IN REVIEW Domestic

WBJ asked former Civic Platform leader Grzegorz Schetyna about the Coalition's chances in the 2023 parliamentary election.

SHUTTERSTOCK (2)

Prices on the rise

20.8% retail price growth in February, following increases of 20% in January & 24.8% in December 2022.

(y/y, UCE Research)

18,000

number of companies Ukrainian refugees created in Poland since the outbreak of the war.

(Minister of Family and Social Policy)

…as unemployment holds

5.5%

Poland's registered unemployment rate in February, unchanged compared to the previous month.

(GUS)

Manufacturing slows down…

19 out of 34 sectors recorded a decline in industrial production in February

(GUS)

Growth outlook steady 0.9% is Poland's 2023 economic growth forecast

(S&P Global Ratings)

…as industrial production prices soar

18.4%

is how much industrial production prices increased in February.

(y/y, GUS)

Wages chase inflation…PLN

Saving electricity

1.8%

drop in electricity consumption y/y in February, to 14,050 GWh. In JanuaryFebruary, consumption was 29,138 GWh, down 3.52% y/y

(PSE)

7,065.56

was the average gross salary in the enterprise sector in February, a 13.6% increase y/y.

(GUS)

$411

billion

is how much the World Bank predicts will be needed to rebuild Ukraine, including $14 billion later this year to finance critical and priority investments.

(World Bank)

WBJ.PL 13 IN REVIEW News in Numbers

BANKS ARE HAVING PROBLEMS… AGAIN

We are currently witnessing a level of turbulence in the global banking sector not seen since the 2008 financial crisis triggered by the collapse of the American investment bank Lehman Brothers. Now with some US and European banks facing difficulties, uncertainty in the banking sector has returned like a boomerang. Where does this leave Polish banks?

BY SERGIUSZ PROKURAT

we are living in tumultuous times. Information spreads at the speed of light on the internet with unforeseen yet inevitable consequences. Banks that purchased bonds listed on the market became lossmakers following a hike in interest rates. This triggered further consequences as banks began showing a decrease in assets. For instance, at the beginning of 2023, the total market value of the US banking system's assets was approximately $2 trillion lower than the book value of the asset portfolio.

BANKS ARE NOT BANKING ENOUGH

Inflation does not only impact consumers; it also affects enterprises, including banks. Following a long period of low-interest rates, banks were eager to play in the financial markets, but this strategy backfired when it became apparent that they had invested their money in the wrong assets. When a banking crisis arises, it’s like when low tide comes along and you can suddenly see who was swimming without their underpants. Investors inevitably noticed that there was a problem and got scared. The share prices of many banks fell, and, at the beginning of March, a large outflow of deposits began.

As always, the central banks came to the rescue. However, they are heroes with only one superpower. So yet again, we are witnessing an active support program for commercial banks from the Federal Reserve which simply means access to loans. This time it also includes support from the Bank Term Funding Program, under which the Federal Reserve will lend money to banks against treasury securities valued at a nominal price, rather than market price, to ensure adequate liquidity in the markets. Essentially, the Federal Reserve has committed to buying back the proverbial lottery tickets at the amount they were purchased for.

This is only the start and it will likely end with the internationalization of aid across the board. British banks will be able to apply directly to the Bank of England, which will borrow from the Federal

14 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK

OPINION

Reserve as well. It will work the same way for banks based in the Eurozone, Japan, and Switzerland. So in the end $2 trillion will go to the banks.

A SCARY MOVIE FOR POLISH BANKS

The problem of shrinking bank capital as a consequence of, among other things, discounts on government bonds, also applies to Poland, so some banks here should be worried. However, in Poland, banks also carry a heavier burden. Part of it is generated by the government before the elections, which results in things like, e.g. credit holidays – an unconditional temporary option to postpone the repayment of upcoming loan instalments. Additionally, Polish banks are also afraid of court cases regarding mortgage loans denominated in Swiss francs in regards to abusive, defective elements of the loan contracts (especially following the consumersupporting opinion of the CJEU Advocate General).

Another risk is that mortgage loan borrowers in Polish currency are looking for legal options in connection with undermining the Warsaw Interbank Offer Rate (WIBOR), on the basis of which the interest on loans are calculated. If it can be proven that WIBOR has been manipulated by the banks, it could end up on court and Polish bank problems will multiply. The government plans to replace the WIBOR with WIRON

In Switzerland, the takeover of Credit Suisse by UBS created a banking giant with assets worth around $ 5 trillion, equivalent to Japan’s GDP.

(Warsaw Interest Rate Overnight) from 2025, which could also lead to confusion. Banks in Poland may potentially be exposed to further losses.

The banking sector in Poland seems to be at least somewhat prepared for turmoil. Polish banks do not have the same structure of depositors as American banks (e.g. Silicon Valley Bank). A banking crisis in Poland could only arise in the event of an outflow of deposits and the need to sell bonds at a loss. The problem then would not concern the banks directly as the banking system is a key component of the market economy, which is a network of connected vessels. If this system were to enter a crisis, it would lead to deep recessions affecting the entire society. Moreover, not only is the capital of banks in Poland shrinking, they also currently have limited options to rebuild it. According to regulatory data from KNF, the banking sector recorded a profit of PLN 12.5 billion last year, which is not enough for the capital regeneration process. In addition, investors are not willing to buy new bank shares due to their low profitability, and the burden on the state will only increase as bank profits decrease. The fact that many banks in Poland are de facto state-owned does not help either.

NOT ONLY THE CRISIS IS GLOOMY

It was commonly believed, that banks have been doing really well in recent years. All over the world, government programs of various kinds have supported gigantic lending campaigns (including housing subsidies). Similarly, low interest rates were conducive to the pandemic funding of the banking sector and created very favourable conditions for them. There was so much cash that the banks became overliquid. If banks are currently in trouble and need to be refilled with money yet again, without any conditions, it is a very alarming sign for capital management, regulations and regulators, politicians, and actually for the entire structure of the financial system. It is clear now why banks do not seem to care about acquiring new credit customers. The saying “too big to fail” has not lost its meaning but what it really means is that in the event of a problem, central banks will provide liquidity, lend funds, and then eventually forgive the loans. Because, paradoxically, the banking sector cannot afford market risk.

WBJ.PL 15

If banks are currently in trouble and need to be refilled with money yet again, without any conditions, it is a very alarming sign for the entire structure of the financial system

REMOTE WORK IN POLAND IS NOW OFFICIAL

in the Polish legislature a few years ago, remote work was like a yeti. There were rumors that it existed (e.g. in the IT industry), but hardly anyone had seen it in real life. However, after the pandemic, many companies did not return to their offices or chose to work in a hybrid mode (3+2). This was not surprising as employers could save a significant amount of money through remote work, including renting and maintaining office space, and heating the office. Employees have also appreciated the fact that they do not waste time and money on commuting, which translates into more time to participate in family life. Furthermore, many have appreciated the flexibility of working hours and the ability to work from anywhere. After all, if you can work from anywhere, why not work from somewhere extraordinary? With today's technology, people can connect anytime, anywhere, and to anyone in the world. Some individuals have even planned "workcations," which combine work and vacation in charming places, without informing their employers.

OOPS, IT’S REGULATED NOW

BY SERGIUSZ PROKURAT

The effort to amend the labor law in Poland took quite a while and ended only at the beginning of this year. Apart from the new definition of “work” –understood as the complete or partial performance of duties in a place indicated by the employee and within a time agreed with the employer, including at the address of residence – the new law also

16 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

Times are changing – and so is the way we work. From 7 April 2023, Polish regulations on remote work, which have so far only been included in anti-COVID regulations, will come into force.

OPINION

SHUTTERSTOCK

Lawyers and HR departments face numerous challenges in managing this new approach to remote work. Based on average calculations, computers consume about 30 groszy worth of energy every hour, which translates to approximately PLN 50 per month per employee.

introduces occasional remote work upon request to perform duties remotely (24 days a year). An employer’s refusal to accept an application for occasional remote work cannot be discriminatory (due to, among others, gender, age, religion, etc.).

The entry of new regulations into force also creates new obligations. For full-time employees, employers will have to provide materials and work tools (a computer and perhaps even an armchair), cover the costs of installation, service, operation, and maintenance of work tools, electricity costs, and necessary telecommunications services. They must even cover other expenditures, such as electricity consumption and Internet, directly related to remote work. Additionally, the employer must provide the training and technical support required to perform remote work, i.e., the current costs associated with remote work have been transferred to the employer. In the act, these costs are listed in an open catalog. Exactly which costs will be covered by the employer will be regulated by an agreement between the employer and the employees, which is why all companies in Poland must now update their regulations, policies, and standards.

CHALLENGES AND THREATS

Companies are intensively preparing for the implementation of changes and have expressed doubts about how to apply certain aspects in practice. These doubts concern unspecified issues, such as how 24 days of occasional remote work are to be counted in the event of a change of employer. There are also other challenges. Remote work does not release the employer from obligations concerning defining personal data protection procedures and conducting training in this area, ensuring appropriate health and safety conditions, controlling the performance of remote work, health and safety, and information protection. It seems that in some cases the costs will be so high that some companies may force people back into their offices.

The Polish remote labor law has been drafted in such a way that putting formalized remote work into effect will require the preparation of extensive documents and statements. The most extreme opinions assess this act as a punitive measure, passed only for the purposes of wringing additional money out of employers as an additional tax. For its supporters, remote work offers a certain measure of freedom–it offers an escape from regulations, and formal dress codes. However, with so many strings attached, many companies may start to consider remote work as a last resort and not an element of corporate culture.

TO WORK REMOTELY OR NOT TO WORK REMOTELY?

From time to time, we see employees arranging yoga sessions at home during working hours. Seeing this, the financial giants like Facebook, Tesla, and Goldman Sachs – urge employees to return to offices, claiming that remote work is an aberration. They also raise the concern, that the lack of conversations in the corridor may inhibit innovation. Not without reason. In teamwork, silence isn’t golden; it’s lethal. Perhaps the office should exist for socializing and spending time with colleagues. At least that’s what Prithwiraj Choudhury, a Professor at Harvard Business School suggests.

On the other hand, Nicholas Bloom from Stanford, together with other researchers, has been conducting research on remote work since 2020. Recent results show that people working from home are 9% more efficient than those working in the office. However, data quoted by the British weekly "The Economist" indicates the opposite - that remote work reduces employees' efficiency despite working longer hours. So, which should we believe? Investigating the phenomenon of remote work is not easy, especially since it’s not always about the employee. Work efficiency also depends on management and on the technology people work with.

Remote work has the potential to antagonize employees and employers, as can be seen from the arguments on both sides. It’s interesting how humans are able to interpret things based on their own version of reality. Clearly, there is no golden mean or “one-size-fits-all” solution to this matter.

WBJ.PL 17

LOKALE IMMOBILIA

REAL

ESTATE INDUSTRY NEWS (covering)

Hospitality, Investment Market,Logistics , Mixed-use, Office, Residential, Retail

Find more daily at wbj.pl/real-estate

EXCLUSIVE

Skyliner’s Second Phase Begins

Karimpol Group has received a building permit for the second phase of the Skyliner complex which will see the construction of a 130-meter-high office building at Daszyńskiego Roundabout in Warsaw‘s Wola district next to the first phase of the Skyliner project. Construction on Skyliner II, also designed by the APA Wojciechowski Architekci studio, is scheduled to start in the autumn this year. The entire complex at 67 Prosta Street will offer 73,000 sqm of leasable space.

WBJ.PL 19

>>>

Section Partner

Warsaw‘s new Skyliner II office building will have 24,000 sqm of leasable space on 28 floors with the majority (23,000 sqm) allocated to offices, and the remainder (nearly 1,000 sqm) to retail and service units. From an architectural perspective, the building will look much like the first phase of the Skyliner complex. The two skyscrapers will be connected by a shared lobby. In total publicly accessible podium of the complex will have 4,500 sqm of space intended for a retail zone, which will be available to both tenants and local residents.

“Skyliner II is a natural continuation of the first phase of our investment at Daszyńskiego Roundabout. It will be a modern sustainable project in line with the latest ESG trends. The

interest aroused by the first phase of our investment in Wola has only strengthened our decision to start its second phase,” said Andreas Prokes and Harald Jeschek, Managing Partners of Karimpol Group.

“We have set the bar high for ourselves with the first phase of the Skyliner complex. It is an iconic and timeless building that has become a symbol of Wola’s business development. When designing the second office building, we wanted the two buildings to be mutually coherent, complementing each other architecturally and looking alike, but also for each to have its own character and be unique,” said Michał Sadowski, architect, co-owner and Vice-President of the Management Board, APA Wojciechowski Architekci.

Skyliner II will be filled with greenery from the entrance up to the roof. Garden terraces amounting to almost 900 sqm are designed on the top floors of the building. Each will have its own individual character and a variety of possible uses. The space around the project will also be green, publicly accessible, and designed to encourage users of the complex and surrounding buildings to use it in their spare time. Karimpol Group will apply for a BREEAM certificate rated Outstanding and, as with the first phase, plans to power the building from renewable energy sources. When arriving by car, motorcycle or bicycle, space for 200 cars and 100 bicycles is available in the 5-story underground parking.

20 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

EXCLUSIVE

LOKALE IMMOBILIA

TENANTS OF THE FIRST PHASE

Aon Bolt Booksy Capital.com

Coca-Cola Poland Services

Colonnade Insurance

X-Trade Brokers (XTB)

DXC Technology

ENATA Bread

iTechArt

Luxoft

Meet & Eat

MicroStrategy

Onwelo

Tarkett

Villa Foksal

Mindspace

Wento Noble Securities

Greenville

Werfen

0.8 ha the area of the plot on which the complex is located

73,000 sqm total leasable area

4,500 sqm publicly accessible retail zone on the podium of the complex

645 spaces for cars in a 5-story underground car park

430 parking spaces for bicycles with full infrastructure for cyclists

31 high-speed lifts

2 entrance lobbies

DISTINCTIVE INTERIORS

From an architectural perspective, the building will look much like the first phase of the Skyliner complex, filling the remaining space of the plot. The two skyscrapers will be connected by a shared lobby. In the second phase of the development project, the lobby will be a fully glazed entrance foyer with an open, illuminated, two-story hall and mezzanine. As in the first phase, the building will be entered via a representative staircase.

A UNIQUE "LIGHTHOUSE" Skyliner II will be crowned by a “lighthouse”, which also distinguishes it from the first phase, highlighting the tallest architectural feature in the northeast corner of the office building. As in Karimpol’s first project, the building’s dominant feature will be illuminated and highlighted by a distinctive blade of fluted concrete. As a result, both skyscrapers will be even more prominent in the capital city’s landscape while maintaining a coherent appearance.

WBJ.PL 21 KEY

OF

FIGURES

THE SKYLINER OFFICE COMPLEX

FIVE QUESTIONS FOR HADLEY DEAN

Warsaw Business Journal sits down with Hadley Dean, the founder of MDC2, to discuss the latest developments and trends in the CEE real estate investment market, including Poland's logistics/warehousing business, the impact of ESG regulations, and the potential opportunities in manufacturing, logistics, and nearshoring.

1.

What dominant trends are you observing influencing the CEE real estate investment market?

I have observed three key trends. The first is the slowing down of bank financing and a dramatic increase in interest rates in Western Europe. Fortunately for the CEE, this trend is less strong here than in Western Europe. Secondly, more and more investors are shifting away from office investments to industrial and residential-for-rent investments. Finally, the third trend is the end of friendly globalization and the beginning of an increasing impact on CEE production and the warehousing market.

2.

What is your forecast/expectation for Poland's logistics/warehousing business in 2023-2024?

The market in Poland will see over five million square meters of industrial investment transactions, which will be well over the five-year average, and it will increase as the e-commerce sector picks up and friendly shoring becomes a reality.

22 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA INTERVIEW PORTRAIT COURTESY OF MDC 2

3.

How will ESG regulations influence the logistic market, and are the players ready for this challenge?

By 2030, it is forecasted that close to 50 million square meters of warehouses will be unfinanceable/unlettable due to the new EPC ratings. Interestingly, only 3.5% of all industrial stock built in Poland is certified BREEAM Excellent. So traditional industrial developers need to recognize the importance of improving their performance.

4.

You have been very vocal about Poland's opportunities in manufacturing, logistics, and nearshoring. Please elaborate on your vision for this. Geopolitical instability leads all global companies to re-examine their supply chains from a security, single sourcing, decarbonization, and de-risking perspective. This is leading to a significant increase in inventory carried and a ten-year planning cycle to bring back manufacturing/production to each continent. With its increasing population and skilled and competitive workforce, Poland is ideally positioned to take advantage of this.

Rest&Move area at MDC2 Park Gliwice currently under construction; delivery Q3 this year

5.

Is the market experiencing rents hikes in logistics, or is this still to come?

In 2022, we saw a 20% increase in industrial property rents; this year's forecast is another 10% increase as inflation continues.

6.

We have times full of uncertainty. Does this situation open up many investment opportunities in Poland?

In times of change, the biggest opportunities present themselves. The trick is to focus on the opportunities and possibilities rather than be absorbed by the problems surrounding you.

In conjunction with our partnership with Entralon, the Warsaw Business Journal is conducting exclusive interviews with distinguished real estate professionals to exchange valuable insights and explore investment strategies that pave the way for a more prosperous future.

www.entralon.club

WBJ.PL 23

In times of change, the biggest opportunities present themselves.

POLISH REAL ESTATE TAKES CENTER STAGE

AT MIPIM 2023

Towarowa 22, the Growth of the Automotive Industry, and Warsaw's Future Plans Highlighted at Prestigious Real Estate Expo

BY MORTEN LINDHOLM

MIPIM is one of the largest and most prestigious real estate expos in the world, drawing in investors, exhibitors, and project developers from all corners of the globe. Despite the challenging economic climate, the event attracted a robust turnout in March 2023, with attendees eager to explore the latest trends and opportunities in the industry.

LARGE POLISH REPRESENTATION

The Polish delegation was particularly prominent, showcasing the immense potential of the country's various regions and cities to prospective investors. From bustling urban centers solutions to sophisticated logistic and modern multi-purpose destination opportunities, the Polish contingent offered a diverse array of possibilities for those seeking to capitalize on the country's thriving real estate market, land opportunities and vast talent pool.

ESG ON EVERYONE’S LIST, BUT …

It is obvious that companies in Poland (and elsewhere) are trying to improve their ESG performance as it is the talk in business these days, however it is not the most easy moment to keep the long term plan while challenged by the short term uncertain situation in markets. But leading Polish developers like Ghelamco, Panattoni keeps investing in the ESG direction.

24 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL LOKALE IMMOBILIA EVENT REPORT

PHOTOGRAPH THIS PAGE S. D'HALLOY / IMAGE&CO, OPPOSITE PAGE MORTEN LINDHOLM (2)

WARSAW IS GROWING

The city of Warsaw was also presented during the MIPIM event. Michal Olszewski, Vice President of the City of Warsaw, presented a vision for the city's future during the ‘Poland: Opportunities for International Investors’ conference. Some of the key information he provided in his speech included; The city aims to provide better commuting options. The city has already grown significant in terms of population since Ukraine was invaded, but the forecast are even higher standing at a population of 2.225 million and 230,000 commuting to Warsaw, This is a challenge also in terms of proper housing and residential solution, Warsaw delivered 16,000 apartments in 2022, with 20,000 permits given for future development, but this is far from enough compared to the need.

The city will focus to attract investors and talent by showcasing Warsaw as a sustainable and liveable city for all inhabitants with lots of green spaces and an ESG focus.

THE FUTURE OF THE CAR INDUSTRY SETTLING FOR POLAND

The real estate development sector is not the only industry that is experiencing growth in Poland. The automotive industry is also making significant strides. Mercedes Benz has opened a new factory in Jawor, Poland, which is set to produce electric vehicles (EVs) such as the EQC SUV. This is a significant development for the Polish automotive sector, as it represents a

major investment by a global automaker in EV production in the country. The factory is expected to create thousands of jobs and help to boost the local economy.

In addition, Volvo Cars has established a new research and development (R&D) center in Krakow, Poland, which is focused on software development and digital innovation. The center is expected to employ around 250 engineers and developers, and will work on

projects related to autonomous driving, electrification, and other cutting-edge technologies. This move is part of Volvo's broader strategy to expand its global R&D capabilities and stay at the forefront of the automotive industry's technological advances. Overall, these developments suggest that the Polish automotive industry is evolving and adapting to new trends and challenges, such as the shift towards electric and autonomous vehicles.

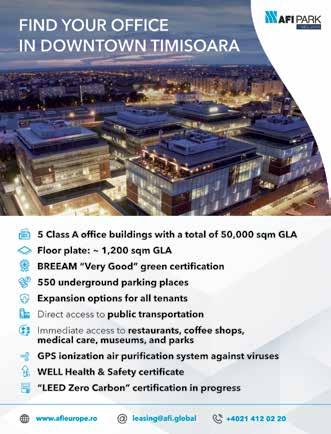

NEW LANDMARK PROJECT FOR WARSAW

One of the most significant Polish announcements at the event was the development of a 6.5-hectare mixed-use project called Towarowa 22, located in the Wola district of Warsaw. The project is a collaboration between Echo Investment S.A. and AFI Europe Poland and will comprise office towers, apartment buildings, rental housing, shops, cafes, and restaurants. Throughout the site there will be streets, footpaths, and cycle paths. The development will include a 150m office building. The remaining buildings will gently slope down to create a smooth transition from the metropolitan Daszyńskiego Roundabout area to Wola's historic buildings. The project aims to use green solutions and meet high environmental standards, making it a sustainable and functional development. Towarowa 22 will also incorporate historic factory building structures into a multi-level city park, creating a green enclave that the Wola district lacks.

WBJ.PL 25

DISCOVER UNIQUE LUXURY

RESIDENCES IN THE HEART OF THE CITY

Unique architecture, panoramic views, high quality, original motifs, and an unusual combination of a city center location and suburban privacy are just some of the many advantages of living in Towarowa Towers and Towarowa Square - investments without compromise developed by Asbud Group.

The entire complex of Asbud Group, carefully designed in the spirit of sustainable construction and complementing the architecture of the business center of Warsaw, will be composed of two 29-floor residential towers and three 7- to 12-story apartment buildings. The complex is a response to the demand for high-class premium projects in excellent locations, distinguished by sustainability and unique details.

26 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

LOKALE IMMOBILIA

PRESS MATERIAL

Towarowa Towers (marked with the letters A and B) and Towarowa Square (marked with the letters C, D, E) are other part of sustainable complex by Asbud Group, contributing to the development of Warsaw’s Wola.

TOWAROWA TOWERS – UNIQUE RESIDENTIAL TOWERS IN THE HEART OF THE CITY

Towarowa Towers is a first-class mix of modern architecture and high standards. The 95-meter towers will be made of high-quality materials - a minimalist combination of glass and aluminum. The character of the buildings is highlighted by colorful bay windows, creating a vivid cascade on the facade. At night, the towers will be recognizable by the decorative illumination that will shine on the exterior of the building, giving it a unique rhythm. Right from the doorstep, residents and their guests will be struck by the elegant lobby with its engaging and eye-catching graphic motif. A treat for aesthetes!

These projects offer a unique opportunity to those who want to combine what is paradoxically incompatible - the proximity of the bustling heart of the city and the amenities of a suburban home. This is possible, among other things, due to the vast terrace, which will occupy an impressive area of 900 m2, divided into two parts by a row of trees. Without leaving the building, residents can relax on its external portion, rest or chat in one of the lounge rooms, or train in one of the wellequipped fitness clubs.

TOWAROWA SQUARE - HIGH QUALITY AND OUTSTANDING AESTHETICS

Towarowa Square is a continuation of the quality and unique style of the first part of the complex –Towarowa Towers, but in a more intimate form. The project will consist of three 7- to 12-story apartment buildings made of high-quality materials – a combination of fiber-cement panels, glass, and wood. Towarowa Square buildings will house from 73 to 149 residential units, which will provide future residents with a large amount of privacy – something quite unusual in the city center!

The façade of the building will be varied with decorative elements around the windows, giving it a unique rhythm when arranged unevenly on the façade. In addition, colorful elements made of aluminum will create, on the one hand, a unique character of the building blocks, and on the other hand, a harmonious whole with the other part of the complex.

A UNIQUE LOCATION

This unique location is the hallmark of this complex. Towarowa Towers and Towarowa Square are the residential projects located next to the second metro line station – Rondo Daszyńskiego. The location in the heart of the capital city offers residents many opportunities. You decide what to do here and now. Just leave the house – you can easily reach the most important places on foot!

Towarowa Square and Towarowa Towers are other projects of Asbud Group that will develop the modern face of nearby Wola at Rondo Daszyńskiego in Warsaw while standing out with their original character and eye-catching details. The blocks of buildings, varied with additional, colorful window glyphs, will retain their individual style but will perfectly blend into with the modern development of this location.

The uniqueness of the Towarowa Towers project has already been recognized in international competitions. It became the Polish winner of the prestigious European Property Awards in two categories: Residential High Rise Development and Residential High Rise Architecture, and received an additional Five Stars award in the Residential High Rise Architecture category. The towers also boast the title of Gold Winner in the international Titan Property Awards 2022.

WBJ.PL 27

“The uniqueness of the Towarowa Towers project has already been recognized in international competitions”

PARTNER HIGHLIGHTS

Hydrogen – oil of the future

Safe, abundant, and green – hydrogen is indispensable in the energy mix of any country looking to meet climate goals. Between strong backing from the government and a host of highly motivated industry stakeholders, Poland has seen a rapid rise in Hydrogen Valleys. The two recently created Hydrogen Academies are another signal that Poland is serious about hydrogen and is ready to stake its claim in this growing industry.

BY BEATA SOCHA

in Poland INVESTING

Nearly 150 years ago, the grandfather of science fiction, Jules Verne, said that water will become the coal of the future. The man who posited the possibility of traveling to the Moon and underwater ocean exploration, proved to be a visionary on fuel sources too.

With the EU curbing coal emissions in the hope of slowing down climate change and perhaps even reversing some of its effects, energy companies have been pulling all the stops to meet the ambitious goals.

Even the ruling Law and Justice, though historically lukewarm on renewable energy, has been tossing pretty impressive figures around. The Minister of Climate and Environment, Anna Moskwa, recently stated that about 73% of Poland’s electricity production will come from renewable energy and nuclear power by 2040, as per the updated Polish Energy Policy.

H2 IS IN

One of the main prongs in the new energy strategy is going to be made of hydrogen, the latest “hot” energy source. State-backed players are pulling any and all market stakeholders into the hydrogen game.

Energy Group, a photovoltaics producer, and Hynfra, a manufacturer of energy storage batteries, signed a contract for €22 billion to produce renewable hydrogen, ammonia, and methanol. “Watching global and European markets, we see how fast investments related to the production of green hydrogen and ammonia are growing. In our opinion, both are essential elements of green transformation and decarbonization,” the Managing Director of Energy Group Marian Glita said.

Fuel giant PKN Orlen has announced its plans to invest PLN 7.4 billion in hydrogen, including opening three hydrogen refueling stations: in Poznań and Katowice in 2023, and in Wałbrzych at the beginning of 2025.

WBJ.PL 29

Polish hydrogen valleys

Polish hydrogen valleys in which ARP S.A. is participants

Gdańsk

Warsaw

Kielce

Rzeszów Kraków

Wrocław Opole Katowice

Poznań

Szczecin

West Pomeranian Hydrogen Valley

Greater Poland Hydrogen Valley

Silesia and Lesser Poland Hydrogen Valley

Subcarpathian Hydrogen Valley

Central Hydrogen Cluster

Pomeranian Hydrogen Valley

Masovian Hydrogen Valley

MAP

Lower Silesia Hydrogen Valley

SHUTTERSTOCK

in Poland INVESTING

INFRASTRUCTURE IS KEY

Outside of electricity generation, the number of industries interested in this virtually unlimited energy source is expectedly long. However, the transport industry is clearly one of the main contenders to the podium. Municipalities across the country are more than eager to attract hydrogen investments, knowing full well that to be competitive, you need to be accessible.

The city of Rybnik recently touted its plans to open a second commercial hydrogen fueling station, near a public transport station. “This will be Poland’s second commercial, publicly available hydrogen fueling station. The hydrogen supplied to the station will come entirely from renewable sources, from so-called green hydrogen. The investor plans to put the station into operation in the second quarter of this year,” said Agnieszka Skupień, a spokeswoman

INVESTING INSIGHTS

Green energy on the rise

With or without sufficient regulation, the green energy market appears to be booming in Poland. Power from micro-installations (99% of which are photovoltaic ones) generated over twice as much power in 2022 and the year prior. A photovoltaic company ED Energia Polska increased its solar power contracts tenfold. Green transport solutions are also on the rise. Solaris recently sold 100 new low and zero-emissions buses

to Sardinia and signed new deals in Germany.

PKP Intercity is building a green train wash in Kraków.

Micro-installation power generation up 109%

In 2022 micro-installations introduced nearly 5.8 TWh of energy into distribution networks, which is 109% more than in 2021, according to a report published by the Polish Energy Regulatory Office (URE). As of the end of 2022, over 1.2 million micro-installa-

tions were connected to the power grid, with a total installed capacity of over 9.3 GW, 99% of which were photovoltaic installations.

The report also highlighted the dominance of prosumerowned micro-installations, which accounted for 96% of the total installed capacity.

EDP with record solar power contracts

EDP Energia Polska (EDP EP) has contracted over 50 MWp of

electricity in 2022, the best result since the company started its operations in Poland and more than 10 times higher than the previous year.The company’s growth was possible due to organic growth and acquisitions. EDP, a global leader in renewable energy, announced its strategy for 2026, which includes investing in projects related to energy transformation. The planned value of EDP projects worldwide is €25 billion. EDP Energia Polska provides photovoltaic solutions for businesses in Poland,

for the Rybnik municipality.

A network of fueling stations is absolutely essential to make inroads into passenger and cargo transport, which is a lesson learned from building the electric car segment. After years of slow adoption, the market for electric cars nearly doubled last year. The number of new registrations for battery-electric and hydrogenpowered cars soared 91.2% in February 2023 year-on-year, and reached 1,155 units, based

which include PV-as-aService, a solution that enables companies to avoid investing their own funds.

100 Solaris hybrid buses to head to Sardinia

Solaris will deliver 100 Urbino 12 hybrid buses to Cagliari, the capital of Sardinia.The contract is part of a framework agreement signed in 2021 with the joint-stock company Consip, which belongs to the Italian Ministry of Economy and Finance (MEF). Under

this agreement, public transport companies TPL (Italian:Trasporti Pubblici Locali) can order vehicles directly or tender with selected suppliers. Solaris vehicles will arrive in Sardinia in 2024. Over 1,500 Solaris vehicles already operate on Italian roads. Almost 30 percent of them are zero-emission electric buses and trolleybuses. Soon, 100 units of ordered hybrid vehicles will also appear on the Apennine Peninsula. Solaris is a European

30 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

SHUTTERSTOCK

What is “green” hydrogen?

on data from the Polish Automotive Industry Association.

The growth is all the more impressive when compared to the more conservative options: the number of plug-in hybrids (PHEV) registered rose by 20.7% to 991 units in the same period. While the growth is noteworthy, the green car segment is still relatively small and accounts for approx. 3% of new passenger car registrations.

HYDROGEN-FUELED SOLARIS

The growing attraction towards hydrogen options is also observed among bus and coach manufacturers, as demonstrated by Solaris, a Polish bus producer that has been owned by the Spanish group Construcciones y Auxiliar de Ferrocarriles since 2018.

The Solaris Urbino 12 hydrogen has been contracted for more than 200 units, 100 of which are already driving on the streets of Bolzano in Italy, Cologne, and Wuppertal in Germany, the South Holland region, and Konin in Poland.

The company’s latest model, an 18-meter hydrogen-powered bus, premiered back in the fall of 2022. Solaris has already received its first orders from the German carrier Stadt-

werke Aschaffenburg Verkehrs. The German company purchased two Urbino-18 and 10 Urbino-12 hydrogen buses to be delivered in 2024. Municipal transport operator Hamburger Hochbahn has ordered five Solaris Urbino 12 hydrogen buses. The zeroemission vehicles are expected to appear on Hamburg's streets as early as the second quarter of 2024.

HYDROGEN VALLEYS

Any new technology requires brainpower and with the industry turning towards hydrogen, Polish companies are looking to source expertise and talent, which so far is scarce. This is why the energy giants have decided to partner up with universities and other stakeholders to educate their own future staff.

In late 2022, Orlen partnered up with Toyota and the Polish train manufacturer PESA, as well as several universities: Łódź and Warsaw technology universities, as well as a research center of the Polish Academy of Science. Between March and June 2023, the first Hydrogen Academy will educate cherry-picked grad students, lured by paid internships and a potential offer of lucrative employment in a very promising industry. “Hydrogen is the fuel of the future and we need specialists who will help build this future,” said Daniel Obajtek, Orlen’s CEO.

leader in low- and zero-emission buses.

Eco train wash for PKP Intercity to be built in Kraków

PKP Intercity is investing in modern infrastructure solutions as part of its largest investment program in history. In Kraków, the construction of an ecological seasonal automatic train wash has begun at the local train station. The facility will be built within a year of the start of construction, and the

contractor for the contract worth PLN 21.9 million gross is Budimex.

“The wash will be environmentally friendly, improve the quality of services for passengers, and improve the working conditions of the Kraków train station crew, which is very important. Stateowned companies must be leaders of change in this regard, and I am very happy about that,” Maciej Małecki, Secretary of State in the Ministry of State Assets, said.

Another industry-university partnership quickly followed suit: chemical producer Grupa Azoty joined forces with the West Pomeranian University of Technology and created a Hydrogen Academy in Szczecin, part of the West Pomeranian Hydrogen Valley.

Just like automotive and aviation valleys in the past decades, hydrogen valleys started cropping up in Poland’s industrial centers in rapid succession. There are currently eight hydrogen industry clusters and they are primarily located in western and southern Poland.

While eight may not be a staggering number, it has already exceeded the plans laid out in “Poland’s 2030 Hydrogen Strategy” adopted by the Council of Ministers in November 2021, which aimed at creating five hydrogen valleys by 2030. The document also envisaged putting 800-1000 new hydrogen buses to use, with up to 32 hydrogen fueling and storage stations.

In contrast to gray hydrogen, which is generated from natural gas, green hydrogen comes from water. It is produced through electrolysis, a process of separating water into one atom of oxygen and two atoms of hydrogen. Currently, green hydrogen makes up less than 1% of global hydrogen production, but that is poised to change.

Another advantage of green hydrogen is that it can be transported using the existing gas pipelines, so in many cases the existing infrastructure may be sufficient for the new fuel. And it can also be used to produce green ammonia, the main component of common fertilizers. In view of current fertilizer shortages brought on by the war in Ukraine, finding an alternative source of fertilizers is of paramount importance.

How is hydrogen safe?

After the 1937 Hindenburg disaster, in which the airship caught fire and crashed, the use of hydrogen as fuel was deemed too hazardous or impractical to be secure. What makes the current storage technology safe enough to use hydrogen in passenger cars?

Firstly, hydrogen is stored in tanks constructed from materials that are highly durable and less likely to rupture or ignite. These tanks are engineered to contain any probable leaks. Secondly, significant advancements have been made in the development of sensors that can identify hydrogen leaks, pressure relief systems, and shutoff valves. The substantial investment in research and the increasing knowledge in the field make hydrogen fuel cells not only safe for storage but also quite convenient for transportation without compromising power.

WBJ.PL 31

IN 2024 POLAND WILL STRENGTHEN ITS POSITION AMONG

THE WORLD’S TOP-20 EXPORTERS

“Polish exports may exceed $400 billion in 2024, after an all–time high of $363 billion in 2022, making it one of the 20 largest exporters worldwide,” states Łukasz Grabowski, director of the Centre for Exports at the Polish Investment and Trade Agency.

32 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

in Poland INVESTING

WBJ.PL 33

INTERVIEW BY NIKODEM CHINOWSKI PORTRAIT BY TOMASZ TOŁŁOCZKO

in Poland INVESTING

WBJ: How are primarily export-oriented Polish entrepreneurs describing their current situation? How significantly did inflation and high production costs reduce the competitiveness of Polish goods?

Polish exporters, like their counterparts in other countries, have witnessed higher production costs and costs of raw materials over the past few months. However, despite this, they are continuously increasing their sales, which means that their competitiveness persists, although it should not be taken for granted.

Fortunately, more and more entities have started to understand that it’s not easy to offer quality when they are only competing on a price basis. Therefore, they are increasingly looking at quality and delivery speed, with some are even working hard to improve their organizational structures to further increase their performance, all in the interest of staying competitive.

So, what are the other competitive advantages of Polish producers except for lower costs?

Some of the main competitive advantages of Poland are location, area, and population size. Furthermore, it possesses a diversified manufacturing base, a sizeable skilled workforce and a ready domestic consumer market. Last but not least, it has a modern infrastructure that supports economic activity and attracts international investors. All of that explains why Poland has recently become a manufacturing and logistics hub in Europe. Today our country is considered as a gateway to Europe by more and more businesses.

Which sectors will be more and more present on global markets in upcoming years?

Over the past several years, technology has completely reshaped the market. The COVID–19 pandemic

It’s worth stressing that local companies have learned to adapt multiple pricing strategies to increase sales, especially during times of uncertainty and everchanging market conditions. This shift can be seen in the export statistics. Our analysis indicates that the current global situation is not an easy one. However, what’s positive is that Polish companies are actively looking for new clients abroad, improving production processes, and searching for new product niches.

For years, Polish exports were based on lower production costs than in Western Europe and the USA. That’s true. However, please remember that countries where production costs are high, e.g. Switzerland, Sweden or the USA are still maintaining their lead as the most competitive economies in the world. One of the main reasons for that are the unit labour costs, defined as the average cost of labour per unit of output produced. What we really need in Poland is to boost productivity growth.

made companies and industries move faster than ever before. New services were offered within a matter of days. Numerous businesses went digital overnight. In coming years, it is likely that we will see continuous developments in green energy, digital services, sustainable food, sustainable mobility, sustainable urban development, advanced manufacturing, biotechnology, quantum information science, digital health and more. The competition is fierce. Start-ups, SMEs and large corporations are all seeking to innovate, go to market, and grow their businesses quickly, all while competing for scarce resources.

And which sectors that currently dominate Polish exports will be overtaken by companies from other countries?

It's hard to point out those sectors. One can assume though that labor-intensive industries might face greater challenges than others as unit labour costs are often viewed as a measure of price competitiveness.

34 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

Polish entities, if they are willing to be part of global value chains, need to pay greater attention to environmental, social, and corporate governance (ESG) programs as customers will increasingly start requesting these type of certifications.

What actions have the government and current administration taken to support Polish exporters in the face of such high inflation?

The Polish government has implemented certain tax cuts under the Anti-Inflation Shields. For several months, Poles have been paying less for fuel, basic foodstuffs, natural gas, system heating, as well as fertilizers. Further, the reduced VAT rate on electricity has been in effect for several months. It was one of the most extensive anti-inflation programs in Europe. In total, the government measures saved Poles nearly PLN 25 billion.

Okay, but most of that money went to final consumers and did not support exporters. What about PAIH’s activities? You are one of the leading government agencies whose goal is to support Polish companies in their foreign expansion. What projects and programs is PAIH currently directing towards Polish entrepreneurs?

We naturally see ourselves as the first point of contact for all Polish companies wanting to expand globally, whether through exports or investments. Currently, alongside our statutory tasks, PAIH is running the project “Polish Tech Bridges” which provides SMEs with professional tools that prepare them to expand outside the EU. The maximum grant for one SME is PLN 200,000.

Soon, we will have more information about the “Go To Brand” program. Micro, small and medium-sized enterprises registered in Poland and operating in highly competitive and innovative sectors such as IT/ICT, medical equipment, automotive and aviation components, biotechnology and pharmaceuticals can receive funding to participate in fairs, exhibitions, business missions or conferences abroad, as well as benefit from consulting services to help them promote themselves in foreign markets.

Additionally, I recommend checking PAIH’s website for the latest news and insights about PAIH’s upcoming events and information about foreign markets. It’s also worthwhile to bookmark trade.gov.pl. This portal provides useful information about exports and foreign trade.

According to PAIH, what are the biggest threats to exporters in the coming months and quarters?

We don’t quantify it as a threat but as a challenge. Polish entities, if they are willing to be part of global value chains, need to put greater attention to issues related to ethical and environmental, social, and corporate governance (ESG). National security rules and

human rights certifications will continue expanding into ESG programs. More customers may start requesting these types of certifications. At PAIH, we strongly recommend that Polish entities start carefully mapping their supply chains.

Other than that, we should not forget about environmental, societal, economic, and geopolitical threats that materialize every now and then such as climate action failure, extreme weather, biodiversity loss, human environmental damages and natural resource crises.

What about strictly economy-driven threats or challenges?

Economically, it’s worth observing how global economies develop, especially emerging ones. As of now, nine countries are in debt distress, twentyseven countries are at high risk, twenty-six countries are at moderate risk, and seven countries are at low risk of debt distress. Recently, Sri Lanka has defaulted on a massive debt. We may hear more such stories in the future.

Considering the above, what do you forecast for Polish exports in 2023 and 2024?

The value of Polish exports reached an all-time high of $363.3 billion in 2022, an increase of more than 6% compared to 2021. The more positive the growth prospects for the world economy are, the better the exports results of Poland may be in 2023 and in 2024. Any result close to $400 billion worth of products exported by the end of 2023 should be considered a success for Polish businesses. I assume the value of products exported from Poland may exceed $400 billion in 2024. Consequently, Poland will be strengthening its position as one of the 20-largest exporters worldwide.

ABOUT PAIH

The Polish Investment and Trade Agency (PAIH) –supports both the foreign expansion of Polish business and the inflow of FDI into Poland. PAIH also aims to boost Polish exports. PAIH supports Polish business in overcoming administrative and legal procedures related to specific projects and assists in developing legal solutions, finding suitable locations, reliable partners, and suppliers. The agency also implements pro-export projects such as "the Polish Tech Bridges" dedicated to the expansion of innovative small and medium-sized enterprises.

WBJ.PL 35

Kraków – Planning for an even more successful future

The Warsaw Business Journal interviews Deputy Mayor of Kraków Jerzy Muzyk about the city’s achievements in recent years, and how they are looking to build on their success.

WBJ: What is the status of the three strategic urban development projects in Kraków ?

Jerzy Muzyk:"Kraków Nowa Huta of the Future" (Kraków Nowa Huta Przyszłości) is a strategic project that will affect the functioning of the entire region. It assumes the implementation of four separate investment projects: the "Branice" Science and Technology Park, the "Ruszcza" Logistic-Industrial Center, the "Błonia 2.0" Large-Scale Outdoor Cultural Events Center, and the "Przylasek Rusiecki" Recreation and Leisure Center. The project's assumptions are based on the synergy of these areas, which will be connected not only spatially but also ideologically by the Nowa Huta Przyszłości Trail.

The "Wesoła" project concerns the creation of a multifunctional urban area, providing new spaces for residents and public life. The project's goal is to preserve the area's unique values, protecting the cultural and landscape environment, creating an attractive public space, and increasing the diversity and quality of the service program. One of the first buildings constructed in this area will be the headquarters of the Kraków Library, which will include both workshops and reading rooms.

The "Kraków Fast Tram" (Szybki Tramwaj) is part of the fourth stage of expansion and assumes the construction of a line connecting the loop in Mistrzejowice with the intersection of Meissner and Lema streets (the 4.5-kilometer route will be completed by the end of 2025 and will shorten travel time to the center by about 12 minutes). The entire investment is worth PLN 1.92 billion and will be implemented under a public-private partnership model.

Kraków is highly developed in terms of business service centers and R&D. How many people are employed in this sector, and how many of them are foreigners?

For several years, Kraków has been a European leader in attracting modern business service centers and, more recently, R&D centers. During the global crisis in 2007-2009, while others were losing, the capital of Malopolska was gaining more investors, showing increases not only in the number of companies but also in the number of employees. The same can be said about the difficult pandemic period, which did not weaken the potential of Kraków's companies but actually accelerated the development of innovation-based businesses operating in a highly competitive environment.

36 APRIL - MAY 2023 WARSAW BUSINESS JOURNAL

ICE Congress Center, Vistula River and Grunwald Bridge

TOP PRESS MATERIAL, BOTTOM SHUTTERSTOCK

Kraków Fast Tram

According to data collected annually by the industry association ABSL, there are more than 260 business service centers in Kraków employing over 92,700 people (including 43,100 in SSC/GBS, 17,900 in IT, and 19,000 in BPO). These numbers show that Kraków has been an employment leader for years (showing a 23.2% share of employment in the sector overall). Every fifth employee in these business service centers is a foreigner. That adds up to already more than 20,000 people from 50 countries. According to forecasts for 2023, further employment growth in this sector is anticipated.

Kraków is well-known for being a university city. What is the local government doing to promote education and attract students to Kraków ?

In 2021, following the conclusion of an agreement for a common goal between the Kraków Science and Academic Center and the Municipality of Kraków, a Council of Partners was established with the intent of making Kraków the most recognizable scientific and academic center in Central and Eastern Europe, attracting the best students and scientists from around the world.

The partners declared the intention to undertake actions aimed at creating new job opportunities, including for those with the highest professional competencies, through the development of student internships and professional internships in cooperation with academic career offices. In addition, the goal of the partners is to create scholarship programs for high school students, university students, and young scientists with outstanding academic achievements. These actions will be implemented in cooperation between the City of Kraków, higher education institutions, and businesses.

We are working on creating an electronic platform called iKONA, where information about competitions and scholarship programs for students and graduates of Kraków 's universities will be posted, among other things. The iKONA platform will also be a place to publish job and internship offers.

Many important business events take place in Kraków. Which ones are particularly important for the city?

It is important for Kraków to develop local business and promote the city as a modern center for research and development. Therefore, it is no coincidence that the next ABSL Summit will be held in our city. It is one of the most important socio-economic events in Central and Eastern

Europe, bringing together over 1,000 business leaders representing the largest companies in the world, representatives of public administration and academia, experts, and scientists.

This year also brings one of the most important congress events in Poland – the Copernicus World Congress. It is also the most important event of the Kraków part of the 550th anniversary of the birth of Nicolaus Copernicus. The congress will focus the attention of Poland and the world directly on Kraków, where our greatest astronomer lived, worked, but above all, studied. The congress, held on 23-26 May

It is important for Kraków to develop local business and promote the city as a modern center for research and development.

2023, will host the world's leading scientists. In 2023, the International Biennale of Architecture (MBA Kraków 2023) will also be held at the ICE Kraków Congress Center, organized by the Association of Polish Architects, Kraków Branch. As every year, we will also continue successful cyclical events, such as the Open Eyes Economy Summit, which deals with responsible business, and Digital Dragons - the largest gaming industry conference in this part of Europe.

I recently visited Kraków and noticed many Ukrainians on the city streets. How many Ukrainians currently live and work in Kraków,

and how have they and the city adapted to this new situation?

Currently, there are just over 30,000 refugees from Ukraine living in Kraków, and almost 10,000 refugees living in the immediate vicinity of the city (Kraków County) (data from the Border Guard as of January 2023). The growth rate of the foreign population is high, as seen, for example, in educational institutions: year-on-year, the number of foreigners has increased more than fourfold (from 4,120 in 2021 to over 17,000 in 2022) - 85% are Ukrainians.

Before the Russian invasion of Ukraine, estimates indicated that

Kraków employs over92,700 people (including 43,100 in SSC/GBS,17,900 in IT, and 19,000 in the BPO).

there were around 70,000 Ukrainians in Kraków, which would have meant that as of January 2022, Ukrainian immigrants accounted for almost 10% of the city's population. If the refugees who have stayed in Kraków will stay "longer," one can expect an increase in the share of foreigners in the city's population, even up to 20%.

The presence of refugees in Kraków is not only a major challenge for the housing, education, healthcare, and other systems, but also necessitates the accelerated development of a comprehensive policy for the integration of foreigners in the city, and thus for Kraków itself.

WBJ.PL 37 SPONSORED

International connections through acquisitions and investments

Although 2022 was a difficult year fraught with many challenges, Raben Group ended it with impressive results: revenues of more than €2 billion, the number of international lines increased by 10%, and monthly freight volumes reached almost a quarter of a million shipments.