THE TRANSFORMATIVE NATURE OF AI IN BFSI

Connecting the BFSI industry with businesses May 2023 | Issue 01

Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. Dummy Copy

DUMMY COPY

DUMMY COPY

Welcome to the Financial Integrator's debut issue! We are overjoyed that you have this magazine in your hands. This journal contains regionally relevant news and intriguing developments in the BFSI sector, as well as features on banking innovations and other well-received knowledge articles, interviews, and reports. We vow to be unlike any other publication in this field. This magazine will have a treasure mine of outstanding content that will give you the much-needed ability to comprehend the market and make deep-cutting observations in your businesses and daily lives.

A number of new inventions have emerged over the decade in the BFSI sector. This is the iPhone moment of AI technology and AI is the most pervasive and disruptive force in nature. AI is now increasingly being used by enterprises and governments to improve customer experience, operational efficiency, fraud detection, and cybersecurity.

We can also see a rise in start-ups in the fintech space of this region. The entrepreneurial vision of the Middle East's leaders is something to be reckoned with. The financial sector is at a crossroads and will shortly be dominated by some big trends. It's also an investment opportunity that the region hasn't experienced in a long time.

However, with each economic shift, new opportunities emerge for those who are informed, poised, and prepared. However, we stress that investing in innovation and good business modelling is always a good idea. This issue's focus is on where AI is headed and how fintechs are shifting the balance of powers from traditional banking companies. Fintechs are really exciting!

And, the horizon is bright and positive for this shiny, BFSI sector. Yes, the Financial integrator magazine too will be scaling new heights soon.

Let us know your thoughts - and stay healthy!

4 May 2023 | The Banking Integrator Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

EDITORIAL The Transformative Nature of AI in BFSI 14 COVER STORY SunMoney's SDBN2 asset-backed cryptocurrency token 17 Journey from to the Future Business Hub 22 AI – The value architect for Banking 18 INTERVIEW FEATURE Arthur D. Little Report: Strategies for UAE Banks To Build A Future-Proof Business REPORT For inquiry and sales: Email: jns@omaemirates.com Call: +971-56-4040503 DUMMY COPY

WANT TO GET AHEAD IN THE PAYMENTS SPACE RACE?

Legacy, disconnected systems no longer cut it in the highly competitive payments market. Whether you serve the enterprise or retail markets, FIS offers end-to-end services that help you unleash the power of modern payments networks. Deploy how you choose – in the cloud or as a fully-managed end-to-end service. Our payments solutions offer speed to market, robust resilience and complete compliance.

Retail Payments:

• Prepaid, Credit, Debit

• Digital • Payments as a Service

FIS in the Philippines:

• FIS works with top 6 out of 10 Philippine banks for Payments Technology

• Bancnet operates on FIS IST/Switch

• With over 60,000 employees globally, Philippines is fully supported by local employees

• Over 10 million cards have been issued from an FIS owned platform

Enterprise Payments:

• Open Payments Framework Hub

• Real-time payments

• ISO 20022-native solutions

• FIS IST/Switch is the world’s #1 open platform payments switch

• FIS has been around for more than 50 years and is a Fortune 300 company

• With over $12 Billion in annual revenues and $90 Billion in Market Cap, it’s the #1 FinTech provider globally

At FIS, we’re ready to make payments your competitive advantage. Let’s Power Next at fisglobal.com. Connect with us at getinfo@fisglobal.com.

©2021 FIS FIS and the FIS logo are trademarks or registered trademarks of FIS or its subsidiaries in the U.S. and/or other countries. Other parties’ marks are the property of their respective owners. 1432362 DUMMY COPY

DUBAI ISLAMIC BANK SHAREHOLDERS APPROVE

30% DIVIDEND FOR 2022

Dubai Islamic Bank (DIB), the largest Islamic bank in the UAE and the second-largest Islamic bank in the world, concluded its Annual General Assembly (AGM) with the approval of the bank’s 2022 financial statements and other tabled resolutions, demonstrating the confidence of the shareholders in the bank's Board and management's strategic agenda for the coming years.

The strong financial results reported this year are a further testament to DIB’s role as a leader in the development of Islamic Finance in a year of exceptional global uncertainty. Supported by a solid growth in the total income, the bank’s net profit reached the highest ever in the bank’s history with a 26% surge in 2022, and a balance sheet of AED 288 billion, culminating in a fiveyear CAGR of 7%. This significant profitability led to a 30% cash dividend aggregating to an amount of around AED 2.2 billion. Other agenda items concluded at the AGM included the announcement of the bank’s Board of Directions for the next three-year term, in addition to the reappointments of its Internal Sharia Supervision Committee and external Auditors for the year 2023.

Commenting on the bank’s performance and outlook, His Excellency Mohammed Ibrahim Al Shaibani, DirectorGeneral of His Highness the Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said: “DIB’s extraordinary progress mirrors the continued pace of growth across the UAE economy, which DIB is proud to contribute to. Through its role as a leading Islamic financial institution, the Bank

remains committed to transform and evolve the industry in the UAE and other major markets around the world. On the 2022 AGM conclusion, I would like to welcome the new elected Board members and we look forward to working closely with them towards further successes and achievements in the years ahead. We extend a huge thanks to the outgoing board members for their hard work that played a big role in the progression of the organization. Going forward, we are confident to continue to deliver a ground-breaking customer experience, revenue growth and sustainable returns for our valued shareholders.”

Dr. Adnan Chilwan, Group CEO of DIB, commented: “Yet again, DIB has posted spectacular results, delivering AED 5.6 billion in net profits, the highest ever in the Bank’s history. Given the rate environment and surplus liquidity, we made a deliberate tactical move focused on quality and structural sourcing of business. This led us to support large corporate and public sector entities in adjusting and aligning their balance sheet for the new medium-term environment, a winning combination for customers, the Bank and the national economy.

“I want to take this opportunity to thank the shareholders for their confidence and support which was critical for the bank to deliver such an outstanding performance within a very uncertain global environment, I look forward to working closely with colleagues and partners to further drive sustained growth and value creation over the coming years.”

6 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

NEWS // DUBAI ISLAMIC BANK

DIRECT TT GRANTED SCA LICENSE FOR FINANCIAL CONSULTING ANALYSIS IN THE UAE

AL ANSARI FINANCIAL SERVICES RECORDS MORE THAN 30% GROWTH

Al Ansari Financial Services, one of the leading integrated financial services groups in the UAE, is pleased to announce that during the first quarter of 2023, Al Ansari Exchange's digital channels recorded more than 30% growth in digital remittance transactions compared to the same period last year.

In March 2023, the company's digital channels broke records by achieving an unprecedented number of transactions, reaching 340,000 in total.

Direct TT, one of the world’s leading financial consultancy firms and part of the DTT Group, a globally recognized and regulated financial services provider, acquired the UAE Securities and Commodities Authority (SCA) license for Financial Consultancy and Financial Analysis. The DTT Group further announced its plans to invest USD 10 million over the next two years in its regional operations and fintech research and development.

As part of the acquisition, Direct TT will offer its clients regulated, reliable financial research and analysis, along with scientific data based on more than 25 years of experience, to forecast price trajectory and future trends for the forex, stocks, CFDs, precious metals, and energy markets. In addition, the license permits Direct TT to introduce customers to financial services from SCA-licensed entities and promote financial products through marketing and advertising. The move represents a significant step towards becoming a regional and global leader in the financial markets sector.

H.R.H Dr. Saif Al-Islam Bin Saud Bin Abdul-Aziz Al-Saud, Chairman of the Board, DTT Group commented: "The region has firmly established

itself as a global financial hub, with its strong and diverse economy, advanced financial markets, and pro-business policies, thereby attracting investments from around the world. In addition, the fintech and innovation sectors are experiencing a rapid boom as a result of the high demand from businesses upgrading their technology infrastructure to meet global standards.”

Walid Ead, CEO & Managing Partner, DTT Group, said: “Acquiring the SCA license is a major milestone for Direct TT, as it reaffirms our commitment to our clients in the UAE. Our mission has been to consistently deliver regulated, accurate, and reliable financial data to ensure that traders have access to the best financial products and information, as well as the security to invest with confidence.”

“We consider the GCC to be a key region for us, due to its position as a global financial hub. By making significant investments in the region, will look forward to better serving our clients and meeting the growing demand for quality services and cutting-edge fintech solutions. It further underscores our commitment to contribute to the empowerment of the financial sector across the region,” he added.

This remarkable growth is a testament to the convenience and reliability of the Al Ansari Exchange app and digital channels, enabling users to carry out various financial transactions at their convenience. The Al Ansari Exchange app has been designed with cutting-edge technology and user-friendly features to make money transfers and other financial management services more accessible and convenient for customers.

Commenting on the recent development, Rashed A. Al Ansari, Group CEO of Al Ansari Financial Services, said, "We are delighted to see such a significant growth in transactions made through our digital channels. This reflects our commitment to providing our customers with innovative, seamless money transfer solutions that meet their evolving needs."

7 Financial Integrator | May 2023 Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. DUMMY COPY

NEWS // DIRECT TT

Rashed A. Al Ansari Group CEO of Al Ansari Financial Services

MASHREQ-DIFC ‘GAMER CHANGER HACKATHON’ WINNERS ANNOUNCED AT SPECIAL AWARDS CEREMONY

Mashreq - a leading financial institution in MENA – has announced the winners of the 2022 Mashreq-DIFC ‘Game Changer Hackathon’ at a special ceremony at the Mashreq Global Headquarters, naming Mher Patvakanyan as the overall winner of the 1st Prize and Lune Technologies; Helal Lootah and Sarah El Masry as runner up.

The winners were selected using impartial and internationally accepted Model Accuracy scores - a well-known Machine Learning model validation method used in evaluating classification problems, which measures the number of correct predictions made by a model in relation to the total number of predictions made.

Participants were challenged to use artificial intelligence (AI) and machine learning (ML) to calculate the future probability of client churn and the likely profitability for individual customers. By being able to foresee customer behaviors using ML and AI, Banking industry gain the ability to make more accurate profit forecasts and develop hyperpersonalized products, services and solutions.

Participants come from more than 35 universities, of which 63% were from the UAE. Of those, 42% were freshers in their first year of studies, coming from some of the leading universities in the UAE. In addition to the student cohort, employees from 30 companies participated in the Hackathon.

The Hackathon also provided participants with a rare opportunity to meet and network with data scientists and business leaders to improve their skill sets and gain tips in developing new customer analytics ideas and solutions.

The Hackathon was held at

the DIFC Academy, a training and development platform established by the Dubai International Financial Centre (DIFC). The Academy partners with local institutions, companies based in the DIFC and educational providers, providing access to reputable financial services courses, executive education programs, internships, mentorships and graduate opportunities for UAE nationals and residents.

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq, said: “On behalf of Mashreq, I would like to thank all those who participated in the Mashreq-DIFC Game Changer Hackathon and for their contributions to innovating new customer analytics solutions. The entire banking industry benefits from the creativity and passion we have seen from those who took part and from the ideas put forward by the winners. They represent some of the most promising AI and ML professionals in the region whose ideas have the potential to help banks develop a greater understanding of their customer’s behaviors and needs.”

“As a digital challenger bank, we have led the development of AI and ML technologies throughout our digital journey. Whether through our

in-house innovation capabilities or participation in the wider fintech ecosystem, we have created multiple industry-leading and award-winning digital platforms – many of which have transformed financial services in our region and revolutionized how we innovate for our customers.”

Arif Amiri, Chief Executive Officer of DIFC Authority, commented, "DIFC continues to play a significant role in positioning Dubai as a global hub for FinTech and Innovation. As well as attracting start-ups, growth stage companies and unicorns to the Centre, DIFC enjoys partnering with organisations such as Mashreq on initiatives that enable the financial services workforce to innovate and contribute to the future of finance. The Mashreq-DIFC hackathon was an excellent example of helping talent within the industry advance their appetite to find new ways of using technology to anticipate and meeting the needs of customers and clients.”

This Hackathon is one of the ways in which Mashreq is supporting local talent, building awareness with the younger population on the practical application of emerging technologies and encouraging innovation in the country.

8 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

NEWS // MASHREQ-DIFC

REMOTEPASS LAUNCHES PHYSICAL DEBIT CARD FOR REMOTE TEAMS IN EMERGING MARKETS

RemotePass, a leading platform for remote work, has launched its physical debit card for remote teams in emerging markets. With this new service, remote workers with an active contract on RemotePass can receive instant payments with zero fees, avoiding the hefty SWIFT fees and delays typically associated with international transfers.

The card is powered by MatchMove, a leading financial technology company and a licensed and regulated Mastercard card issuer headquartered in Singapore. This state-of-the-art service will allow global remote workers to hold funds in USD, giving them complete control over their finances. The card can be used online and offline globally, wherever Mastercard is accepted.

Historically, remote workers — and especially those in emerging markets — have largely relied on SWIFT transfers to receive their money internationally, which can be lengthy and comes with high exchange and transfer costs. The physical card forms part of the RemotePass Super App for Remote Teams, which enables users to manage their contracts, subscribe to premium health insurance plans and cover dependents, track expenses, access a USD payroll physical and virtual cards, spend online and offline, and get paid instantly at zero transfer cost.

The RemotePass product offering is in line with the UAE government's vision of attracting global talent and establishing the country as a leading hub for remote work. Through its Employer of Record services, RemotePass handles the entire relocation, visa, and insurance process for foreign companies seeking to hire and/or relocate employees or contractors in the UAE.

TELR, FIRST PAYMENT GATEWAY TO ACHIEVE NESA CERTIFICATION IN THE UAE

Telr, the award-winning online payment gateway, has announced achieving the National Electronic Security Authority (NESA) certificate in the United Arab Emirates (UAE). This certification is an acknowledgment of the company's commitment to providing its merchants with the highest level of security. The National Electronic Security Authority, also known as (NESA), is a government agency responsible for protecting the UAE's critical infrastructure and national security from cyber threats. NESA certification for Payment Gateways is part of the requirements of the Central Bank of UAE Retail Payment Services & Card Schemes Regulations issued in June 2021. It strives to develop and implement policies and regulations for cyber security, as well as provide guidance and support for organizations and individuals to enhance their cyber security defenses.

By adhering to the standards set by NESA, the highest level of security is ensured in processing payments, in over 120 currencies and 30 languages, via various payment methods through Telr Payment Gateway’s

unique platform. This high level of security enables merchants to meet international standards, increasing their competitiveness and security in the global market. Telr is also the first PCI DSS Level 1 certified company in the Middle East, and it is listed in the Visa Global Registry of Service Providers (VGR).

Khalil Alami, Founder & CEO of Telr, said: "We are proud to be the first payment gateway to have received the National Electronic Security Authority (NESA) certification. We look forward to continuing to serve the UAE with the highest security and customer service level." Alami added: " As a payment gateway, from day one, we understand the importance of protecting our merchants' sensitive information and ensuring that their transactions are secure. Telr is also the first PCI DSS Level one certified company in the MENA region, in addition to being listed on the Visa Global Registry of Service Providers (VGR). All these certificates are a recognition of our efforts to meet the region's highest standards of cyber security”.

9 Financial Integrator | May 2023 Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. DUMMY COPY

NEWS // REMOTEPASS

Kamal Regged Co-Founder & CEO RemotePass

TURTLEFIN EXPANDS ITS PRESENCE IN UAE; PARTNERS WITH COMPASS BROKERS

Turtlefin, India’s leading Insurtech platform announced its partnership with Compass Insurance Brokers LLC, one of the biggest financial solution providers in the UAE, to create a unified and seamless platform to enhance their distribution capabilities in UAE markets. Through this partnership, Turtlefin will enable Compass's distribution teams to access the required information seamlessly and customize proposals for clients.

Turtlefin will provide access to its extensive, technology-driven solutions to become more efficient and provide cost-effective solutions. This will help in reducing proposal creation time by more than 50% and increase sales efficiency by 30% along with better customer experience.

Turtlefin will enable Compass's vast distribution network to access all retail insurance products on its platform. Additionally, Turtlefin is also looking at providing its capability of digital prospecting and E-skilling with a vision to support and empower its network of advisors. This will strengthen the engagement of Compass Advisors with their customers and empower them with the necessary tools to cater to their customer’s insurance

SPEND MANAGEMENT FINTECH QASHIO JOINS HANDS WITH ALINMA BANK

Spend management fintech Qashio has entered an exclusive partnership with Alinma Bank, the youngest and fast-growing bank in KSA, to launch its operations in the Kingdom. This is the first time that a KSA bank has joined hands with a fintech company to provide solutions to its corporate banking customers, a massive milestone for the country’s tech space.

With this partnership, Qashio can roll out both its

at developing a sustainable and thriving cashless society, increasing the share of non-cash transactions from 36% in 2019 to 70% in 2025. The primary method to achieve this is through uplifting fintechs present in the country. In fact, Mastercard’s report on ‘The Future of Fintech’ revealed that KSA funding increased by 1294% in 2021 from 2020, amounting to $91 million.

Alinma Bank has been at the forefront of digital financial services in Saudi Arabia, and Qashio has been enabling digital payments for businesses across MENA.

10 May 2023 | Financial Integrator Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

NEWS // TURTLEFIN C M Y CM MY CY CMY K

POWERING THE FINTECH REVOLUTION Our enterprise technology platform combines networking, edge cloud, collaboration, and security to protect, accelerate and modernize your financial applications. Let’s talk about our transformative technology services and strategies today. lumen.com/financial-services | 800-871-9244 © 2022 Lumen Technologies. All Rights Reserved. CMY DUMMY COPY

HISTORY OF AI

Think AI’s a new thing? Think again, as we look to the history books

BAYES

Yes, 1763. George Grenville takes office as the British prime minister. Haydn composes his Symphony No

13. And Thomas Bayes writes An Essay Towards Solving a Problem in the Doctrine of Chances, which would underpin Bayes’ Theorem. The maths behind AI is born.

MARKOV

Andrey Markov describes his technique for stochastic modelling, sequencing event probability based on previous known events. The mathematician’s explanation will lead to Markov chains, which are central to modelling real-world processes in statistical form.

TURING

Alan Turing puts forward his idea for a ‘learning machine’ that could become artificially intelligent. The Turing test, or imitation game, proposed how a machine might be able to evaluate data like a human. Turing’s 1950 paper opens with the words: “I propose to consider the question ‘Can machines think?’”

DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. 12 TIMELINE

1763 1950 1913 May 2023 | Financial Integrator

GAMES

Arthur Samuel begins designing programmes that can play chequers. In 1963, Donald Michie develops a ‘machine’ to play noughts and crosses using reinforcement learning. Backgammon came in 1992. In 1997, IBM’s Deep Blue defeated Garry Kasparov at chess. et?

COMMERCIALISATION

Axcelis releases Evolver, the first commercialised software package for PC to use a genetic algorithm. While the original software is not part of the permanent collection at the Computer History Museum in Mountain View, also home to Google, Evolver has been developed and sold ever since.

IMAGENET

It’s contentious in many ways, but ImageNet is also widely credited with ushering in the AI boom of the 21st century. The brainchild of Fei-Fei Li, it is a colossal image database used to train machine learning algorithms with realworld data.

Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. 13

Financial Integrator | May 2023

1952 1989 2009

THE TRANSFORMATIVE NATURE OF AI in BFSI

AI's perception has undoubtedly evolved over time. As technology has made inroads into our lives, whether at home with smart assistants or at business with technologies like robotic process automation (RPA), we've all realized that AI is genuinely transformative. Even governments around the world are becoming aware of the reality of AI and attempting to guide its growth.

Artificial intelligence technology, particularly Machine Learning and Deep Learning, has made and will continue to make significant inroads into the FinTech business. This includes retail banking, insurance, regulatory technology, asset management, and investment banking. With independent 5G networks and the Metaverse on the horizon, all areas of financial services will be impacted substantially, and even more so as AI continues to spread and develop across the Edge of the Network.

According to some researchers, Machine Learning could disrupt up to 40% of banking roles in the next years. One thing is certain: the AI journey for the FinTech field is about to embark on an exciting phase of fast digital transformation.

The fourth and perhaps most

essential application of AI in banking is risk detection and prevention. Fraud detection is one of the financial institutions' most crucial obligations, and AI is once again lowering the strain.

When it comes to harnessing the disruptive power of AI, the financial industry is far from alone. However, due to the size of the business and the volume of money going through, it is one area where the benefits of AI can be felt most acutely - whether in customer experience, digital banking, or risk identification.

AI & FINTECH

In FinTech, AI technology is applied towards improving the customer experience with:

• Machine Learning models that may enable improved customization and targeting of personalised services are used in FinTech to improve the consumer experience. Natural Language Processing (NLP) using virtual assistants such as chatbots and sentiment analysis improves customer experience.

• Computer Vision has been used in Regulatory Technology (RegTech) for customer onboarding with Face Detection and Recognition from documents such as a copy of the

customer's passport or driver's license and matching that with a selfie image for Know Your Customer (KYC) purposes, as well as for payment via face recognition or biometrics for mobile phone banking security.

• Risk management and credit automation: the very essence of Finance is to take a risk for an appropriate return (price). We may refer to this as a riskadjusted return. The greater the risk the higher the price and vice versa. AI can help financial firms assess risk, price it and manage it.

• Marketing and customer experience: chatbots using Transformers with self-attention mechanism, segmentation, targeted offerings, sentiment (Transformers with Self-Attention for NLP, K-Means and K Medoids for clustering and segmentation, K Nearest Neighbour (16), Logistic Regression for marketing campaigns)

DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. 14

COVE STORY // AI IN BFSI May 2023 | Financial Integrator

• Trading: trade execution, sentiment, identify patterns, risk management (Deep Reinforcement Learning, Evolutionary Algorithms, Transformers

• Portfolio and investment management: optimizing portfolios to maximize returns for a given risk. Automated portfolio management with passive index replication, and factor investing for alpha creation (or smart beta). This has an impact on Wealth Technology as well as roboadvisory services provided by asset management firms.

• Facial recognition for both payments and RegTech (KYC and AML passport or driver license document verification) may be impacted by Vision transformers in the future.

• Insurance and insurtech chatbots with Deep Neural Networks Transformers with self-attention mechanism, underwriting insurance plans with Generalized Linear Models (GLMs) for greater interpretability in underwriting pricing of risks and automating part of the claims

assessment process for example with auto insurance.

• Cyber Security is a key area for financial services. Techniques such as Light Gradient Boosting, Deep Neural Networks including Stacked Autoencoders Networks are examples of approaches that have been considered for Cyber Security.

AI & IT’S FUTURE

From fintech and investment organizations to commercial and retail banks, AI is enabling digital transformation across the financial services industry. Banks may use AI to better protect their customers' accounts, secure payments, boost ROI, and customize information, investments, and next-best-action recommendations for their clients.

Natural language will be used by AI assistants to fulfill consumer demands such as online bill payment, money transfers, and account opening. AI will be used by insurers to quickly handle claims and produce more accurate policies for its subscribers.

Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. DUMMY COPY 15

COVE STORY // AI IN BFSI Financial Integrator | May 2023

ORIENT FINANCE BROKERS ON THE TRANSFORMATION AND FUTURE OF THE TRADING INDUSTRY

Orient Finance Brokers is licensed and regulated by the Securities and Commodities Authority (SCA) to offer financial services, such as currencies, and monetary brokerage, trading nonregulated derivative contracts and currencies in the Spot market. The company aims to revolutionize conventional trading techniques and create customer-friendly online trading platforms. The Integrator spoke with Mr. Seraj Asad Khan, Managing Director of Orient Finance, to better understand the financial industry and its transformation thus far.

How has Orient Finance been able to transform traditional trading techniques over the last decade? We have been providing all investors, particularly retail investors, with a wide range of opportunities for trading and portfolio diversification across a variety of financial instruments through our platform. As a result, we have been able to revolutionize conventional trading methods and position our trading platform as a one-stop solution for all the trading and investing requirements in the financial markets. Furthermore, the present digital revolution has opened doors to numerous innovative opportunities, enabling us to utilise more sophisticated trading algorithms and tools to execute trades more swiftly, precisely, and at reasonable costs than traditional techniques. Additionally, by analyzing enormous amounts of data, our customers can diversify their trading strategies by determining the patterns, trends, and other insights. We are further able to access a wide range of markets, which enables us to diversify our portfolios and efficiently manage associated.

What technology does Orient Finance use to safeguard client information?

At Orient Finance, we are equipped with several state-of-the-art security technologies to ensure data protection and reliability. This includes firewalls, which is the software tool that continuously monitors & regulates both incoming and outgoing network traffic in order to prevent unauthorized access. Additionally, we use 256kb SSL encryption which transforms sensitive data into code to prevent unauthorized entry. Twofactor authentication which requires users to provide a security token, to access their accounts, is also among

the suite of security technologies we have adopted to safeguard client information. We have also installed intrusion detection and prevention systems for any signs and indications of malicious activities or unauthorized access, as well as conducted regular security assessments to determine and rectify any potential weaknesses in our processes or systems.

Can you tell us about the current trading trends and how most clients address the risk factor involved in trading?

Mazen Kanaan Co-founder and CEO of House of Pops

The financial markets are everevolving, with several factors including economic data, political events, and company earnings reports shaping the trends. The market conditions can cause some asset groups or sectors to perform well than the other asset category. For instance, investments like stocks and other assets may be favored over more volatile ones during a period of steady or continued growth. Clients can address risk factors associated with trading in a number of ways. Diversifying investments across various asset classes and sectors is an effective approach that can lower risks. Thus, by distributing your portfolio across a number of investments, your capital amount is preserved. Clients can also place stoploss orders to reduce potential losses if an investment goes against what they had expected. To assess the risks involved with various investments and help them determine trading strategies, clients can seek guidance from our trained market experts. It is crucial to keep in mind that trading is always associated with many risks, and clients should be prepared to accept and manage these risks appropriately.

16 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

INTERVIEW // ORIENT FINANCE

Seraj Asad Khan Managing Director of Orient Finance

SUNMONEY'S SDBN2 ASSETBACKED CRYPTOCURRENCY TOKEN

SunMoney Solar Group, which operates the world’s largest Community Solar Power Program, has recently opened applications for its SDBN2 token, following the successful sale of all SDBN1 tokens introduced previously. This cryptocurrency is backed by the SunMoney Solar Group’s growing solar power production capacity. The Integrator spoke with Peter Bahorecz, Partner, Chief Networking Officer, SunMoney Solar Group, to learn more about the token's purpose and benefits.

Please brief us about Sunmoney's expansion plans in the region. We are highly focussed on expanding the awareness of our latest assetbacked cryptocurrency token, the SDBN2, in the Middle East. We have recently opened applications for the value-producing token after the success of our previous token, the SDBN1, and are investing our efforts towards building on the same. Apart from that, we believe that engaging with local companies is the most effective approach to creating meaningful and lasting change in the Middle East and South Africa, as they possess the expertise of their environment that will be invaluable to us as we expand our reach across these regions.

How vital are green investments for making good on global ESG goals? Companies that do not invest in renewable energy or other green initiatives may have a negative impact on their local environment and the planet as a whole. Green investments not only help combat climate change but also increase economic opportunities for those living in developing countries by providing jobs related to solar panel installation and maintenance, among others. By investing in green initiatives, companies can take responsibility for their carbon footprint while simultaneously demonstrating their commitment to sustainability. This is an important step towards achieving global ESG goals that promote environmental protection and social development.

Can you tell us about the SDBN 2 token in detail, please?

The SDBN2 token is a revolutionary digital currency that operates on the Smart Digital Business Network

(SDBN), and it is backed by the increasing capacity of SunMoney Solar Group to generate renewable energy from their solar parks. By investing in the SDBN2 token, all investors can capitalize on a tangible, permanent resource with long-term value. It is a great green investment that generates dividends for its holders each month—automatically multiplying their wealth! Offering an established infrastructure with a dependable guarantor system, this digital currency has unlimited potential for growth and lucrative gains.

Is there a specific reason/benefit why SunMoney decided to foray into the blockchain platform?

Yes, we saw several distinct advantages of using blockchain technology. By integrating blockchain into their platform, we are able to offer a secure and transparent system that allows anyone from anywhere in the world to invest. Blockchain also ensures data integrity and protection against manipulation, increases system performance and efficiency, reduces transaction and administrative costs, improves efficiency, and increases investor confidence. This has resulted in more money flowing into the sector.

How is an asset-backed valuegenerating cryptocurrency token different from a regular cryptocurrency token?

An asset-backed value-generating cryptocurrency token is different from a regular cryptocurrency token in that it is backed by actual assets. This means that the value of the token is based on something tangible, which gives them an inherent value beyond just being a currency, thus, making them more lucrative investments for those looking to diversify their portfolios. The potential for growth through appreciation in price makes asset-backed tokens attractive investments for those looking to capitalize on market changes and trends.

17 Financial Integrator | May 2023 Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. DUMMY

COPY

INTERVIEW // SUNMONEY

Peter Bahorecz Partner, Chief Networking Officer, SunMoney Solar Group

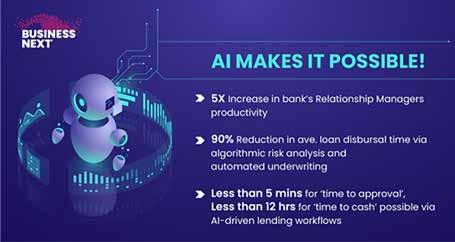

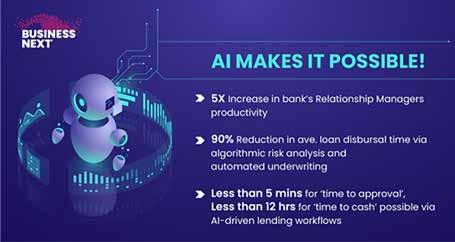

AI – THE VALUE ARCHITECT FOR BANKING

By: Vishal Khurana, Senior Vice President MEA, BUSINESSNEXT

structured banking ecosystem. Talking of specifics, right from delivering augmented analytics on customer data, enabling automation, and building intelligent customer 360 for hyper-personalization, AI can be used for fraud monitoring and real-time issue resolution!

• Facilitating hyper-automation for loan or credits decision to deliver efficiency with minimum to zero errors, compliance risks, and quicker decisions.

This article is not about discussing the potential of Artificial Intelligence (AI). I think much water has flown under that bridge and the consensus, worldwide, vouch for the colossal power it holds. Rightly put across via an estimate, the potential impact of AI for the Middle East amounts to US$320 billion by 2030! The UAE government also recognizes AI as one of the key tools to achieve its objectives of the UAE Centennial 2071.

UAE in fact has witnessed a fintech revolution of sorts propelled by the digital revolution over the last decade. AI is being leveraged across the back end to the front end of the banking tech stack for a variety of use cases, some more mature than others. Chatbots, biometrics, antifraud & risk assessment, complex legal and compliance workflows, credit underwriting, and smart contracts infrastructure, KYC to name some.

PRACTICAL AI USE-CASES

AI can be used to build a sustainable, real-time, hyper-personalized, and

It can help eliminate the risk of duplicate data entry, prepopulate customer information from multiple systems seamlessly, assist in accurate information capture, and speed up the identity verification process. Beyond this, it can cull out specific customer patterns to evaluate creditworthiness, and customer lifetime value and also alerts if there is a probability of default!

AI/ML models can power intelligent, customizable journeys and lending workflows, enable hyperautomation through robotic process automation (RPA) for speeding up operations, reducing operating risks, and keeping cost to serve within tight limits.

• Transformative customer experience vows to be the key differentiator amongst enterprises

across. For customers, convenience and quick redressal are given, however a wow service goes beyond this. Tailored financial products or services that match their financial goal, Voice stimulated banking service for efficiency, a completely digitized documentation process, auto-filling and data extraction with OCR capabilities, 24X7 omnichannel access to the banking services etc are fastturning benchmarks. Banks delight customers with speed, transparency, payment flexibility, and convenience.

GETTING READY FOR THE AUTONOMOUS BANKING

In the digital-first world, AI is only set to chart newer benchmarks for banking, an era of Autonomous banking - a ‘Zero Ops Model’ where BFSI delivers services with no human intervention and in real-time! For this banking services would have to be intelligently automated by reassembling, rearranging, and reorienting banking tech stacks to intelligently design customer journeys and anticipate customer needs better. The right suite of composable tools can enable a robust zero-ops model and reinvent customer expectations!

While this is a futuristic idea, the evolving infrastructure capabilities, and adoption of innovative.

18 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

FEATURE // BUSINESS NEXT

Vishal Khurana Senior VP, MEA Businessnext

Experience composable banking with Mambu's SaaS cloud banking platform.

Learn more

DUMMY COPY

REGIONAL BANKS & DIGITAL JOURNEYS: SHOULD THEY BUY

OR BUILD THEIR

INNOVATIONS?

By Nick Curran, Head of Endava MENA

In a study published last month, McKinsey showed banking to be one of the Middle East’s most digitised industries. The means of brand interaction among banking customers was 87% digital in the United Arab Emirates. Put plainly, this proportion of customers reported that their engagement was either fully digital or involved remote assistance. This proportion was even higher in Saudi Arabia (92%), a country that anticipates that 70% of its payment transactions will be digital by 2030. The McKinsey study also showed Egypt’s banking sector to have 82% digital interaction.

The GCC has always been out in front of regional peers with the digitisation of the FSI sector. Dubai’s Mashreq launched the appropriately named Neo, the first digital bank in the Middle East. And Kuwait Finance House developed KFH-Go, the region’s first e-branch — an unstaffed business unit capable of providing more than 30 services. Each of these innovative project teams faced a common question in their journey to “pioneerhood”: build or buy?

Today’s consumers wait for nothing and no one. If you drag your feet for too long, you miss the boat. One of your competitors will have done it first. In the early years of the digital era, building was the only option, but today the region is strewn with FinTechs. Their offerings are often API-first, which makes them highly customisable. However, if we consider the strides taken in cloud technology and software-development methodologies that make inhouse rapid deployment possible, we are back to the quandary: build or buy? Let us look at each in turn.

BUYING: A NO-BRAINER… WITH HEADACHES

There is a comfort to be had from procuring a tool or platform that just fits. CIOs are spared nail-biting months of business analysis and user workshops. All that need be done is integrate a solution that has been rigorously tested, albeit in isolation of one’s own business model. In a cloud-native environment, this is even easier. Even if the bank runs core systems on premises, softwareas-a-service (SaaS) solutions still end up being easier to bolt in and bed down. The cloud also adds a welcome element of predictability, not only for project management, but for upfront and ongoing costs.

Already, the “buy” option seems preferable. In a region with technology skills gaps, buying a ready-made solution — one that may be used by dozens if not hundreds of similar businesses across the region — is a great way of avoiding lengthy recruitment drives. But buying is not without its downsides. Try as they might, vendors of commercial

off-the-shelf solutions (COTS) design their products for a broad operational model and may not be a perfect fit. Even where the requisite amount of customisation is possible, it may come with a list of unacceptable side-effects, including a hefty price tag. COTS scaling is also challenging, as is its user-acceptance testing, maintenance, and upgrades, given the reliance on an external team.

Of course, I could write a whole separate article on the implications for cybersecurity of having a third party in the technology mix. And that is before we have even begun to discuss the impact of multiple vendors and FinTechs — which may be necessary to bring the organisation’s digital vision to life. The bank would need to employ someone full time to liaise with these business partners, negotiate and oversee SLAs, and police the fine line between these activities and regulatory compliance.

BUILDING: A DREAM FOR THE CONTROL-CONSCIOUS, BUT WHERE’S THE TALENT?

What CIO doesn’t relish the prospect of complete control over the IT stack? Building their own systems gives them that. Development and integration are theirs to command, and use cases can fully govern implementation, rather than the twist and bend that IT has to go through to accommodate even a 90% requirements-fit with a COTS purchase. Stakeholders can join the dots from aspiration to value for each business unit. CIOs and their teams know the business inside and out and can pivot from the needs of customers and customer-facing employees to cybersecurity and risk management and consider one while developing solutions for another — something COTS vendors cannot do to the same extent.

20 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

FEATURE // ENDAVA

Nick Curran Head of Endava MENA

BEST-IN-CLASS DIGITAL EXPERIENCES

“From the very start WM Reply have been more than just an agency. They’ve created an invaluable partnership with us that continues to drive us toward achieving our vision.”

Alex Black

Lead Product Owner - easyJet holidays

We design and deliver digital experiences for some of the world’s biggest brands. With services including UX Research, UI & Creative Design, Bespoke Development, and Project Delivery, we combine insight, creativity, and technical expertise to deliver tailored digital solutions.

Most importantly, we believe in results. Our job is to ensure not only the success of your project but your continued success after the initial delivery. We work with you as partners in knowledge sharing and common goals, providing the resources, processes, tools, and mindset to achieve and exceed your expectations.

As a part of Reply, a global network of specialised technology companies working together, WM Reply can provide instant access to over 10,000 specialist consultants, engineers, and

designers covering everything from Security and Solution Architecture to AI and Machine Learning from a single supplier.

Whatever your need, working with WM Reply is both flexible and scalable. We can deliver managed projects, specialist resource, consultancy, or team expansion on or off-site. Being a part of Reply means we have the capability of ramping up and adjusting any team to the required scale to meet your delivery timelines as needed. We’re a team with a foundation of experience in working together, ready to be an integrated part of your team.

Alex Reekie

Head of UX, UI & Product - WM Reply

a.reekie@reply.com

DESIGN DEVELO DELIVER. DESIGN DEVELOP DELIVER .

DUMMY COPY

DUBAI AND UAE – JOURNEY TO THE FUTURE BUSINESS HUB

By Vijay Valecha, Chief Investment Officer Century Financial

By Vijay Valecha, Chief Investment Officer Century Financial

The UAE has often been in the spotlight owing to its destination tag as a significant MENA region hub for the MNCs. With the legacy of being an oil-rich nation, the nation boosts highly efficient and well-developed infrastructure. Moreover, with a taxfree income environment, the nation's economy has diversified beyond oil. From sustainable finance to new-age technologies like blockchain, the UAE, led by Dubai, attracts human and financial capital in all significant growth areas. In addition, this region's ongoing housing market boom is attracting more rich emigres. At a holistic level, the rise of the UAE as a significant hub is due to the following key factors.

LEADING THE FDI GROWTH STORY IN THE MENA REGION

The capital and financial markets of the UAE have become the business base for the entire MENA region. The nation is now attracting talent and fresh investments from established brands and new fledgling startups willing to risk their initial seed capital owing to growth prospects over here. At an aggregate level, UAE has recorded 116% growth in FDI over the last decade. While the oil and gas

sector has received around 50 % of the FDI contributions, the non-oil sectors, led by IT, communications, and professional services, are fast catching up. It was evident from the UAE's non-oil foreign trade figure of AED 2 trillion last year. This represents a 17 % growth over the 2021 number. The UAE aims to attract $ 150 billion in foreign investments by 2031. The numbers could mean 50 % of the entire MENA region’s FDI.

RECORD RISE IN NEW BUSINESS SETUPS

The UAE governments and individual emirates' ease of doing business is finally bearing fruits. For instance, the Dubai Chambers reported a 20 % y-o-y increase in membership. As a result, the total trade value of members' exports and re-exports also rose by 20 % to AED 272 billion in 2022. Dubai Chamber of Commerce now counts 347,600 individual members. Abu Dhabi Chamber of Commerce and Industry is even going a step ahead and supporting the private sector in the emirate to enable the industry to reach its full potential. The chamber has signed MoUs with multiple agencies to this effect. As a result, the core industrial sector is projected to

have contributed more than AED 180 billion to the UAE GDP, compared to AED 151 billion in 2021.

UAE'S OPENNESS TO EMBRACING NEW TECHNOLOGIES

Exponential technologies are reshaping operations, motivating employees to learn, adapt and even think about how they contribute to the organisation’s success. The UAE is taking the lead in adopting new-age digital technologies like blockchain while providing and promoting a flexible working environment. Federal government departments and entities are exploring use cases or have already started implementing test models in areas like AI, Big Data Analytics and Robotic Process Automation. The UAE is now home to 1,600 + blockchain organisations, employing more than 8,000 people in this sector. In addition, Abu Dhabi's technology ecosystem.

22 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

FEATURE //

CENTURY FINANCIAL

Vijay Valecha Chief Investment Officer Century Financial

The effortless power of one platform

Give any part of your business an instant digital upgrade

The Backbase Engagement Banking Platform is the evolution of digital banking.

Built for fast implementation and ease-of-use, the platform allows financial institutions to rapidly deploy digital solutions that delight customers and empower employees.

With the power of one platform, you can:

Engage your customers

Create tailored customer journeys from account signup to product up-sell

Empower your employees

A 360° view of your customer helps you deliver personalized and instant service

Ready to get the full picture?

Talk to our specialists

Leverage a composable architecture Select best-of-breeds partners for your perfect end-to-end solution

DUMMY

COPY

TRADE FINANCING & THE GAMING INDUSTRY

By - Peter Maerevoet, Global CFO and Regional CEO for Asia, Tradewind Finance

By - Peter Maerevoet, Global CFO and Regional CEO for Asia, Tradewind Finance

The digital gaming sector is one that many compare to a rollercoaster; experts describe it as a hit-or-miss market. Similar to a roller coaster, the gaming industry experiences spikes in demand during certain seasons and drops to near-zero sales during other times.

As people were confined to their homes and had to turn to internet entertainment during the pandemic, the video game industry experienced a significant uptick in growth. The pandemic also witnessed multiple new gaming companies jumping into the pile to take advantage of the massive and sudden demand.

However, once everyone resumed their typical routine of returning to the office and most physical grounds and sections had opened up after the pandemic, most video game firms reported their lowest-ever quarterly profits. The gaming business previously reported a drop in its fortune due to the pandemic squeeze. The US gaming sector reported a dip in video games of 11%, with a further decline of 8.7% projected for this year.

How can gaming businesses ensure they have the proper financial support to capture the $3.14 billion MENA gaming industry?

Despite the ups and downs, it is predicted that the MENA gaming sector, particularly in the UAE, KSA, and Egypt, will increase to $3.14 billion by 2025. It is well known, however, that obtaining quick capital for a business is difficult despite the market potential, and it is critical to get your foot in the door when demand is high.

Opening a bank account specifically for an SME can take up to a year, and getting a loan is considerably more challenging because SMEs lack collateral and track records. This begs the question,

what is the best alternative method of securing funding, especially when time is of the essence?

3 things to consider when looking for financial solutions for the gaming industry:

1. Opt for accounts receivable financing rather than loans

In a general setting, most games go without promotions as developers usually put all their money into making the game/app and have nothing left for promotions. Obtaining loans in these cases is often complicated as, other than predicted revenue, there needs to be more proof or collateral for the banks to rely on. This is where accounts receivable financing or trade financing is the most beneficial. A trade finance company can pay you for the predicted income upfront, which generally takes at least 90 days.

2. Opt for simple and quick bankless finance methods

Banking has always been an intense procedure for new or upcoming businesses. According to a survey by the Pearl Initiative GCC in the first half of 2022, 39% of SMEs cited a shortage of cash or finance as one of their key challenges. A straightforward bank account can become complicated since banks see SMEs as a risky industry and have high minimum balance requirements and bureaucratic processes.

3. Choose a source that provides multiple injections of finance rather than just one major initial injection A steady income stream is essential if one is working in the "prone to hiccups" gaming industry. The major problem with traditional financing is that it never produces constant cash flow because traditional accounting is based on a one-time sizable initial investment in the company. This makes it challenging to keep the wheels running after the initial investment is used and the accounts receivables still need to be submitted.

24 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

FEATURE // TRADEWIND FINANCE

Peter Maerevoet Global CFO and Regional CEO for Asia, Tradewind Finance

Spreading our wings beyond the worksite

Aflac is now providing access to our important coverage outside of the worksite with consumer directed products.

• Products include dental (dental, vision, hearing), accident, critical illness and cancer.

• Polices are self-billed via credit card or ACH.

• Products are offered via a new proprietary digital platform with 100% online journey available.

• Co-branded sites can be set up for partners and their clients or APIs can be used to integrate with existing platforms.

For details on our new consumer directed strategy, contact Ward Garrett at wgarrett@aflac.com.

Oklahoma, Policy T71000OK. In Oregon, Policy T71000OR. In Pennsylvania, Policies T71100PA - T71400PA. In Texas, Policy T71000TXR. Cancer/Specified Disease - Policy Series T70000 (Not available in New York ). In Arkansas, Policy T70000ARR. In Idaho, Policy T70000ID. In Oklahoma, Policy T70000OK. In Oregon, Policy T70000OR. In Pennsylvania, Policy T70000PA. In Texas, Policy T70000TX. In Virginia, policies T70000VA & T70000GVA.

Coverage is underwritten by Tier One Insurance Company. NOTICE: The coverage offered is not a qualified health plan (QHP) under the Patient Protection and Affordable Care Act (ACA) and is not required to satisfy essential health benefits mandates of the ACA. The coverage provides limited benefits. Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999

This is a brief product overview only. Coverage may not be available in all states. Policies and riders may also contain a waiting period. Refer to the exact policies and riders for benefit details, definitions, limitations and exclusions. Z2201009

Dental - Policy Series T80000 (Not available in New York or Virginia). In Arkansas, Policy T80000AR. In Idaho, Policy T80000ID. In Oklahoma, Policy T80000OK. In Oregon, Policy T80000OR. In Texas, Policy T80000TX. Accident - Policy Series T37000 (Not available in New York and Virginia ). In Arkansas, Policy T37000ARR. In Idaho, Policies T37100ID, T37200ID, & T37300ID. In Oregon, Policy T37000OR. In Oklahoma, Policy T37000OK. In Pennsylvania, Policies T37000PA, T37300PA, & T37500PA. In Texas, Policy T37000TX. Critical Illness - Policy SeriesT71000 (Not available in Idaho, New York and Virginia ). In Arkansas, Policy T71100ARR. In

EXP 10/23 DUMMY COPY

EMPOWERING UAE’S WOMEN TO ACHIEVE FINANCIAL LITERACY AND INCLUSION

By Akshay Sardana, VP - Strategy & International Development, The Continental Group

Many studies over the years have established financial literacy as a determinant of socioeconomic conditions. Multi-generational financial literacy and planning have propelled many toward the upper echelons of the world. As often as not, in the absence of financial literacy, women get the short end of the stick because of certain entrenched gender inequalities and other distinct factors. That indeed explains the UAE’s growing efforts in advancing women’s financial literacy.

The Dubai Government-owned National Bonds have been at the forefront of such initiatives, recently partnering with the Arab Women Authority for a program to empower women with financial skills and tools. Evidence indicates that closing the financial-literacy gaps between men and women could have macroeconomic implications for a nation. The impact corresponds to the timeless quote, “if you empower a woman, you empower a nation.”

The following are the five probable positive outcomes.

1. SAVINGS FOR A RAINY DAY

A rise in online self-learning platforms and educational videos related to finance can be linked to that spike in interest and intent. Women have expanded their financial horizons, venturing beyond household accounts. Their primary objective is to build a corpus fund — a considerable amount of money kept aside for unforeseen emergencies — whose necessity continues to mount due to concerns of a recession.

2. DECOUPLING FROM DEPENDENCIES

A study found that, on average, women in the UAE retire with just 69% of the

wealth of their male counterparts. Such abject disparities in wages can be addressed only through structural changes in the corporate culture. With higher financial literacy, women can effectively plan their retirement by achieving risk-adjusted returns through strategic allocations of specific capital into savings, fixed-income products, equities, and insurance.

3. INCULCATING FINANCIAL DISCIPLINE

A few cross-sectional surveys seeking to demystify parental roles in money habits have found that children mostly take after their mothers’ approaches to finance. Such findings place a great onus on women to enhance their financial literacy. When financial discipline is inculcated early on, the strong foundations will go a long way in defining children’s monetary decision-making and related success. Besides money, women’s financial literacy sets good precedents for children to uphold the virtues of gender equality and the importance of patience and pragmatism in investments. No amount of money can parallel a legacy of financial discipline that mothers can bestow on their progeny.

4. DODGING CURVEBALLS

While there is no denying that women’s societal challenges have witnessed considerable legal recourse in recent years, it’s a long road before one can afford to be complacent. As often as not, women cannot break free from abusive marriages or families due to financial dependencies. In hindsight, about 59% of widows and divorcees said they wish they had been more involved in long-term financial decisions.

5. MARKET PARTICIPATION

Wealth creation stagnates when money is restricted to low-risk products such as savings accounts, fixed deposits, bullion, and provident funds. Statistics suggest that women tend to favour such asset classes due to a deep-seated aversion to risk — a by-product of less financial literacy. Some studies also suggest that when women participate in equity markets, they often edge out their male peers. The reasoning is that women are innately more pragmatic and grounded, which, when coupled with high financial literacy, create successful investors. So, by supporting women’s financial education, UAE policymakers are hoping to unlock an untapped segment in the financial market. It’s a righteous pursuit primed for long-term rewards.

26 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

FEATURE // THE CONTINENTAL GROUP

Akshay Sardana VP - Strategy & International Development, The Continental Group

Customer experience.

Consumers today expect simple, digital experiences that let them interact with your business when and how they want – whether that be in your office, on the phone or online. To win, you’ve got to be able to meet customers where they are because if you don’t, your competitor will. www.appliedsystems.com/innovationdrive

Are you ready to stand out from the rest? Let Applied help you differentiate and grow your business.

DUMMY COPY

FLAT6LABS AND WIO BANK SIGN MOU TO STREAMLINE AND ENHANCE SME-CENTRIC BANKING SERVICES FOR START-UPS IN ABU DHABI

In a bid to further strengthen Abu Dhabi’s entrepreneurship ecosystem, Flat6Labs, the MENA region’s leading seed-stage program and early-stage venture capital firm, and Wio Bank, the region’s first platform bank, have signed a Memorandum of Understanding (MoU).

Under the agreement, start-ups from Flat6Labs Ignite, a specialized seed program run by Flat6Labs in partnership with DisruptAD, will have the opportunity to take advantage of Wio’s innovative banking products and services under Wio Business, the bank’s first digital banking application, which is designed to provide a seamless and innovative experience tailored to the specific needs of start-ups and SMEs.

"There is potentially no other factor that more heavily decides the fate of a start-up than its ability to effectively manage its finances. These organizations need banking partners that have a start-up ethos — centred around agility, flexibility, and innovation. Our long-standing expertise in empowering startups to establish themselves in the

UAE and raise the funding they need to fuel their ambitions aligns perfectly with Wio Bank’s vision of not only providing world-class banking services but serving as a holistic banking management platform for the modern SME.” said Ryaan Sharif, General Manager at Flat6Labs UAE

Under its flagship seed program, Ignite, Flat6Labs is set to support up to 60 start-ups in Abu Dhabi by 2024, with 27 disruptive organisations already having successfully invested in the 3 cycles that have already concluded. By partnering with Wio Bank, Flat6Labs has ensured that start-ups selected for this program will now enjoy Wio Business’ prioritised processing of account opening applications, as well as around-the-clock access to dedicated support services.

“This is especially beneficial to the start-ups we attract from international markets as it enables them to seamless transition into establishing their headquarters in Abu Dhabi without any disruption to financial operations,” said Sharif.

Wio Bank has invested in establishing a team of high-qualified technology experts with a broad range of skills related to digital transformation and financial innovation. Under the agreement, Wio Bank will make these professionals available as subjectmatter experts and mentors to Ignite program start-ups, thereby further strengthening the value proposition of the program.

Prateek Vahie, Chief Commercial Officer of Wio Bank said, “Being a disruptor in the financial sector, we believe we have a critical role to play in supporting the start-up ecosystem and fostering entrepreneurship in the UAE. We are committed to ensuring that our SME customers find the most viable options for the support they need, be it through funding via traditional credits or loans, peer to peer lending, angel investments, or incubators. As we develop our offerings tailored to the SME sector, we will benefit from the insights and expertise of other major players in the ecosystem, such as Flat6Labs.”

28 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

Prateek Vahie Chief Commercial Officer, Wio Bank

NEWS // MOU SIGNING

AN ENTREPRENEUR’S TIPS: ADJUST YOUR BUSINESS BELIEFS TO SUCCEED

Spiritual communities often discuss the “law of attraction”, which is a belief that everything you believe in manifests in your reality. In other words, you attract it.

What if such beliefs were applicable to business and wealth?

Serial entrepreneur Christian Schroeder agrees. Building your wealth requires a mental adjustment to follow all the practical steps you have taken.

“Your expertise means nothing if you don’t have the network to cement what you are building or the vision to plan the work you are about to execute.” The angel investor asserts.

His experience allowed him to help startups such as Bullfinch turn into successful businesses.

The CEO channeled his belief in the law of attraction, his 10x strategy and his opportunity universe framework to build his empire.

Regarding the law of attraction, Christian Schroeder believes that engineering your success comes from combining healthy mental habits with hard work.

“Investing in your work goes beyond the financial aspect of it.” he observes. “You have to choose the right team for your business who will feed into your positive expectations for your business and actively trust that every contribution you make to your success will materialize.”

This initial belief has helped him plan out his 10x strategy which has been at the center of his investment company, 10x Value Partners which specializes in hightech investments.

“The 10x strategy basically encourages you to always scale up what you own with the means you have. For instance, if you only have 100$ in your bank account, your first goal is to save up until you get 1000$. After that, your goal will be to get to 10k so you might consider starting a side hustle. After a certain point, there is no point in just saving up, you need to invest or build your wealth.” Schroeder explains.

The proof is in the pudding here with him sharing his own debuts in the world of business, as he was starting to implement his 10x strategy.

“I actually used to live in a cramped apartment in Berlin before my business took off. It was a very good learning experience for me to survive on a budget whilst working over 80 hours a week in a company that wasn’t mine and still having to take care of all the domestic chores. It helped me appreciate the value of hard work and discipline, Although this lifestyle requires a lot of sacrifices at first, it only

cemented further my belief that anyone can build wealth.” He confides.

As the entrepreneur progressed in his 10x strategy, he was able to map out one of the key concepts that can help anyone achieve wealth: the Opportunity Universe Framework.

In his own words, the young angel investor told us that the Opportunity Universe framework he created is a mindset of looking out for the infinite amount of opportunities that we encounter at every minute of every day. “Just like ghosts, these opportunities aren’t always visible, but you need to be on the watch for any indication that they are near you. I actually made one of my biggest business deals after reconnecting with a friend on Instagram that I hadn’t spoken to in a while. I think this goes to show that even your personal environment is ripe with opportunities.” Christian says.

The key takeaways from these mindset shifts are that if you want to be successful in business, you should never close your doors to opportunity, expansion, and positivity.

29 Financial Integrator | May 2023 Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only. DUMMY COPY

FEATURE // 10X VALUE PARTNERS

Christian Schroeder CEO & Co-Founder, 10X Value Partners

BEYOND THE METAVERSE:

WEB3

By Prakash Somosundram

Co-founder and CEO of Enjinstarter

One of the common misconceptions about Web3 is its characterization as a set of technologies that, if implemented, will automatically result in organizational transparency and decentralization. While there may be some truth to this, the narrative doesn’t paint a complete picture. Web3 is just as much about the adoption of a mentality as it is about technology. While NFTs and the metaverse have garnered most of the headlines, other Web3 technologies have gone through a maturation process. Once considered difficult to use, technologies such as DAOs and smart contracts have now become a lot more user-friendly and accessible. Given the paradigm shift in stakeholder engagement that is underway, this maturation couldn’t have come at a better time.

But this is only half the battle. Organizations and their supply chain partners need a change in mentality to truly leverage these technologies and “future-proof” themselves. It’s this mentality shift that will enable organizations to leverage Web3 to adapt to changing customer needs and become better corporate citizens that are capable of confronting some of our most pressing global issues.

A closer look at Web3 Technologies

Web3 is much more than just NFTs and the metaverse. At its core, Web3 represents a philosophical shift towards decentralization, transparency, and user ownership— the idea that our experience with the internet in all of its forms should not be controlled by a select few. And while that meant clunky implementations and unproven concepts in the past, the last few years have witnessed a remarkable rise in the number of usable Web3 solutions. The kind of solutions that any organization can use without needing specialized knowledge.

Smart contracts - We have only begun to scratch the surface of the potential of smart contracts. When combined with AI, data oracles, and bots, they enable a level of transparent and traceable automation that can do things like pay out a flight delay insurance policy immediately upon learning that a flight has been delayed or release an escrow payment if conditions are met.

Decentralised autonomous organisations (DAOs) - In their simplest form, DAOs are a way for a group of stakeholders to collectively govern a treasury. They have emerged as an ideal way for organisations to introduce greater transparency,

particularly around CSR initiatives such as carbon offsets and charitable donations. But they also enable the decentralisation of ownership and voting rights. DAO shares can, for example, be distributed to customers or other key contributors.

Decentralized storage - Cloud storage has traditionally been the domain of tech giants and their massive data centers. Web3 tech has now made it possible to store data in a secure, redundant, and anonymized way. It works by allowing people and organizations to “rent out” their unused storage space. All transactions are accounted for on the blockchain, so the storage owners can be accurately remunerated in real time.

Asset tokenization - The representation of physical assets on-chain brings with it a number of benefits, with liquidity and efficiency being at the top of the list. You can imagine, for instance, how much easier it is to sell a tokenized property compared to its physical counterpart. No paperwork or intermediaries, just the transfer of a token from the seller to buyer. Of particular interest to organizations is the possibility of tokenizing assets such as accounts receivable invoices to unlock liquidity.

30 May 2023 | Financial Integrator DUMMY COPY Disclaimer: This is a dummy copy of a magazine and should not be distributed or reproduced in any way. All content and images are for demonstration purposes only.

FEATURE // ENJINSTARTER

ey.com/consulting DUMMY COPY

Arthur D. Little published a Viewpoint, “Pursuing Excellence in Corporate Banking” exploring challenges and opportunities that illustrate the lasting and even increasing importance of the corporate segment for banks in the United Arab Emirates. The Viewpoint reviews the impacts of recent disruptions and expectations and explores options for banks to strengthen and grow their corporate and investment banking (CIB) business.

CIB in the UAE represents close to $635 Bn. assets and $15 Bn. revenue. CIB assets are around 5 times the ones of retail banking. According to the report, regional banks however focus their external communication primarily on the consumer segment, whether it is fintech, strategy, digital transformation, products, or applications. Further, corporate banking is often perceived as a specialist area and, as a result, innovation is frequently thought to be focused in the retail banking sector. The report outlines an increasingly competitive, fast-evolving, and complex environment for CIB businesses, which includes a variety of challenges caused by structural trends, COVID-19, and the war in Ukraine.

ARTHUR D. LITTLE REPORT: STRATEGIES FOR UAE BANKS TO BUILD A FUTURE-PROOF BUSINESS

Philippe DeBacker, Managing Partner and Global Head of Financial Services, Arthur D. Little, said: “The region offers a positive and transformational environment for corporate and investment banking, which accounts for about 70% of assets in the GCC amid high hopes for the economy and enormous private and public sector spending. As highlighted in the Viewpoint, banks should anticipate further sector consolidation due to shrinking margins and high regulatory requirements.”

Stephane Ulcakar, Associate Director and Head of Corporate and Government Financial Services, Arthur D. Little, said:“ The digital transformation trend has caused widespread disintermediation and the need for scale across industries. As a result, banks must transform in much the same way that car manufacturers — and many other industries — did during the 20th century. This means moving away from an integrated model and outsourcing most value steps except a few strategic ones, such as design, assembly, and control.”

Developing a Sustainable Business Model

According to the report, there are four

common imperatives for banks to be aware of:

• Banks must rebalance their portfolios based on diversification, return, and risk targets, and monitor those at the client level. They must also anticipate balance sheet cleanup, impact on tier-one capital, develop treasury and liquidity management capabilities

• Banks must maximize revenue per customer by spotting all opportunities for (re)activation and retention, cross/ upselling, and pricing realization. They must also consider variable rates and facility nonusage penalties to reflect the upward rate trends.

• Banks should engage clients beyond credit, with distressed M&As, debt capital market (DCM), or ESG transformation financing. They must be ready to increase their nonperforming loan and restructuring management. Sectorial specialization will be required to properly assess needs and risk levels.