17 minute read

Vietnam EU Pharma's strategic imperative

Vietnam

EU Pharma's strategic imperative

Advertisement

Vietnam's rising middle-class and increased modernisation of healthcare had already made it a key market for pharma. Now with the EU Vietnam FTA, winning in Vietnam is a strategic imperative for EU-Pharma. To be successful in Vietnam, EU pharma should consider a range of initiatives.

Aditya Agarwal, Principal, Roland Berger

Vietnam is the European Union's (EU) second largest trading partner in ASEAN and close to 10 per cent of EU exports to Vietnam are pharma products. For various mid-tosmall sized EU pharma players, Vietnam has remained an alliance or a distributor led market. With increase in demand, positive economic prospects, increase in per capita healthcare spending and the boost of EVFTA, Vietnam is a strategic imperative for EU-Pharma.

The time is ripe to prioritise Vietnam

Growing demand and COVID dividend

Vietnam is one of the few economies in Asia which is expected to see a net growth in GDP per capita and income in 2020. It's enjoying a COVID dividend and leading cos across sectors, and is seeing Vietnam as a promising location for supply chain diversification. Healthcare spending in Vietnam is expected to grow at nearly 6.5 per cent annually, with an encouraging sign that portion of public expenditure is rising faster. While traditionally, the market has seen strong growth in branded and unbranded generics, Vietnam lately has shown a higher appetite for patented

products, driven by better affordability and improved market authorisation protocols. The pharma market is expected to see a stronger growth than the healthcare services market.

Other factors contributing to growing demand for pharma products is the rising middle-class, and ageing—it is expected that by 2038, 20 per cent of Vietnamese people will be over 60 years old.

Modernisation of healthcare with new investments

In addition to rising demand, a few factors are leading to increased modernisation of healthcare:

A. Medical tourism: Vietnam has been positioning itself as a medical tourism destination. As per official statistics, nearly, 350,000 foreign visitors sought medical treatment last year. Treatments span the full range of medical services, with the most common choices of services including dental care, cosmetic surgery, cardiology intervention and fertility treatment. Medical tourism plans, also call for driving increased modernisation and international standards for outpatient and emergency care services

B. Privatisation: International and regional private players are keen to tap into the growth. Until recently, most of the healthcare services were provided by public hospitals. In the last few years though, public health stakeholders, have shown an interest in driving privatisation of healthcare to reduce fiscal pressures; this led to stake sales in public hospitals and, a positive outlook towards private financing and partnerships by public hospitals

C. Increased sophistication of

public players: Public players, especially leading educational institutions have been forming cross-border partnerships to increase industry know-how and improve the talent pool Similarly, beyond use of simple tools of external pricing referencing, pricing of the products in recent years has started including other tools like cost plus method. Government policy has also fostered a burgeoning health platform industry with several players emerging.

EU-Pharma can take advantage of these trends: exchange of information, engagement of the broader set of stakeholders is easier for them compared to their non-EU peers, due to the strengthening of trade relations between EU and Vietnam.

EU-Vietnam FTA provides a clear boost

The real boost for further interest in Vietnam, though, comes from EVFTA. The recently auctioned FTA has 3 clear benefits for EU pharma players:

Reduction of most tariffs and barriers, leading to a competitive positioning with pricing and afford-

ability of drugs: about 70 per cent of the tariffs have been reduced, additionally some non-tariff barriers like direct pharma imports which was previously not allowed, is now permitted. EU investors are now allowed to establish a foreign invested enterprise to import pharmaceutical products and sell to local distributors or wholesalers EU FIEs would also have a specific exception that they can build their own warehouses. Post decree 55, FIEs were not permitted to own warehouses.

Increased market access under the national procurement schemes:

Certain pharma bidding packages which were previously only open to local distributors and pharma players, shall now also be accessible by EU pharma. These include marquee national tenders at Vietnam’s social insurance program, the Ministry of Health, the Hanoi and Ho Chi Minh City Department of Health, and 30+ hospitals. The share reserved for domestic suppliers/ producers will diminish over 15 years to a final share of 50 per cent.

Reduced requirements of local

clinical trials: EU players can now selfconduct or manage trials in Vietnam; additionally, Vietnam will withdraw existing clinical trials requirements on ethnicity which were not in line with international standards Faster market authorisation or longer patent protection by additional years if authorisation process crosses threshold

Key considerations in Vietnam's Pharma market

Hospital channel management:

Hospitals are a key dispensing channel facing a multitude of challenges - talent, budget and capacity. EU-pharma players, especially those which are mid-sized could go beyond the usual engagement techniques and adopt a solution driven approach to win share and advocacy, such an approach might have a higher return on investment rather than deploying a large sales force. Additionally, KOLs in Vietnam are looking for better content, and a targeted approach focusing on their needs; digitisation of HCP engagement provides a strong opportunity to address this.

Solution oriented approach:

From outdated equipment to shortage of medical staff; from budget shortages to overcapacity – public hospitals are looking at solutions across the board. Private hospitals too while benefiting from demand require help.

A leading private hospital CEO said,

"Young qualified doctors often choose to work for public hospitals to get more clinical experience and opportunities

to study abroad"; Led by MedTech players, a solution driven model has been working well with public and private hospitals. For example, a leading device player in clinical microbiology realised the lack of trained staff on advanced tests and set up an education program with public hospitals.

Due to long reimbursement cycles, hospitals are forced to manage working capital pro-actively, further accentuating the affordability challenge. Innovative financing of treatments, some already being piloted need to be launched at scale; private insurance players have

expressed a strong interest in developing companion products or indication specific offerings, as such products help with driving distribution for some of their core offerings.

During bidding and tenders, some of these unique offerings can be combined as value added services, to gain nonprice related advantages; With their strong experience of developed markets, EU-pharma could create a differentiated value proposition for its customers.

The four broad themes of solutions for hospitals which can be considered: i) infrastructure support; ii) financing (including working capital) support to enable better treatments; iii) training HCPs; iv) new treatment protocols and design of workflows

Tailored KOL engagement: while KOLs have adopted digital engagement, a lot more is desired in terms of tailoring content for Vietnam. In a recent survey, nearly 60 per cent KOLs felt that they were not informed enough about the recent breakthrough drugs or indications, in their respective TA's. Further, KOLs expressed following expectations which were less visible to them:

Latest information

– Latest clinical trials – Other related topics like discovery, adverse events

> Various information

– Drug information (efficacy, side effects…) – Other disease management

> Timely and appropriate

– Quick response to demands for information – Appropriate information according to treatment stage

Collaborating with distributors

With decree 54, FIEs had to rely and work closely with local distributors or work with regional ones to manage them. While EVFTA allows for FIEs to establish warehouses, and participate in tenders, distributors would continue to play a pivotal role, especially for small to midsized players. FIEs will need support from distributors on provincial tenders, engaging with KOLs and increasing footprint in new channels. While working with regional players is an option, regional players also rely on local players due to factors like reach, presence and regulations. Working with local distributors at least for a part of the portfolio is recommended, to increase local footprint and manage risks of decree 54. Local players though might lack some capabilities, hence collaborating with them or investing is a key strategic consideration. For example, one leading specialty pharma has been arranging for training to improve KAM capabilities of the distributor.

Bespoke models of distribution:

Given the varying nature of distribution reach and capability, established pharma players in Vietnam, also tend to adopt bespoke distribution models. For example: a multi-speciality player with generics and innovative drugs, has chosen 3 different models:

Best of breed for vaccines: to distributors that have vaccine experience and adequate cold chain infrastructure

Up-country agency: a distributor who holds the agency for its portfolio in up-country

National distributors for

prescription drugs: A national distributor who does not have reach in up-country region, but services for various distribution needs others for its prescription drugs

Drug affordability

A large part of healthcare spending in Vietnam continues to be out of pocket. While price regulations have ensured that prices are regulated and managed effectively, affordability of patients continues to be a challenge.

Decree 54, local trials and related protocols for working through additional layers for drug import, have led to an increase in compliance and drug supply costs, impacting competitiveness.Given the strong market access allowance through bidding packages, reduction in requirements for local trials and reduced drug import hand-offs, EU-Pharma might be able to command a certain cost advantage which could be used for driving patient affordability or adherence.

Additional considerations

Government and policy shaping:

Like other emerging markets, working closely with the government on policy shaping for new innovative treatments can prove to be valuable. Vietnam has been trying to reduce dependence on neighbouring markets for providing advanced treatments; EU-pharma should consider bringing knowledge from home markets and also facilitate exchange of ideas.

Impact investing: Vietnam has been seeing a surge in impact investments in education and healthcare. EU-pharma could try to contribute and participate in these investments to develop the overall health ecosystem.

Setting up M&A's / JVs has been a proven way for various MNCs to enter the market, but EU-pharma could also set up a trading company to avail the benefits of EVFTA. Investors are required to obtain an import license along with other certifications, obtain proof of origin for EU pharmaceutical products. While several challenges in winning the market exist, starting now provides an opportunity to work with different stakeholders and shape the market.

AUTHOR BIO

Aditya is a Principal with Roland Berger in Singapore. He is a core member of the Healthcare and Life Sciences practice, serving clients on a range of strategic and performance improvement issues. You may reach him at aditya. agarwal@rolandberger.com

SUEZ Solving the toughest water and process challenges

Geert Verstraeten, General Manager, Analytical Instruments business and Sievers product line, SUEZ – Water Technologies & Solutions

What is your background in the industry?

I’m originally from Belgium and I studied to be a chemical engineer with a specialisation in biochemistry and biotechnology. When I started out, it was my goal to get into the biochemistry or biotechnology industry as a plant director but when I graduated from university, my first job was teaching chemistry, biology, and math. Teaching was a very good experience because it helped me to understand leadership. I realised how important it was to influence, motivate, and empower the students. I learned that this type of leadership role was a good fit for me so I decided to change my career path.

I joined Analytical Instruments in 1999, as the European Sales Manager. At that time, it was part of IONICS*. I had several fantastic and inspirational mentors where I learned the ropes and started building the sales team. We had success in growing the business and I moved up the ranks. Analytical Instruments was acquired by GE and finally by SUEZ. I’ve been with the company for 21 years, so I must love it! The things that motivate me are still the same:making the world a cleaner place, environmental sustainability, and most importantly, developing our fantastic people.

Geert Verstraeten is the General Manager for the Analytical Instruments business and Sievers* product line at SUEZ – Water Technologies & Solutions. Sievers is a market leader for ultra-pure water instrumentation in the life science, industrial & environmental industries.

A native of Belgium, Geert graduated from the University of Ghent as an Industrial Engineer in Chemistry. Geert began his tenure with Sievers instruments in 1999 and for over 21 years and now as part of SUEZ, has developed increasing responsibility holding roles in sales, service, marketing and management.

What does the Sievers product line represent?

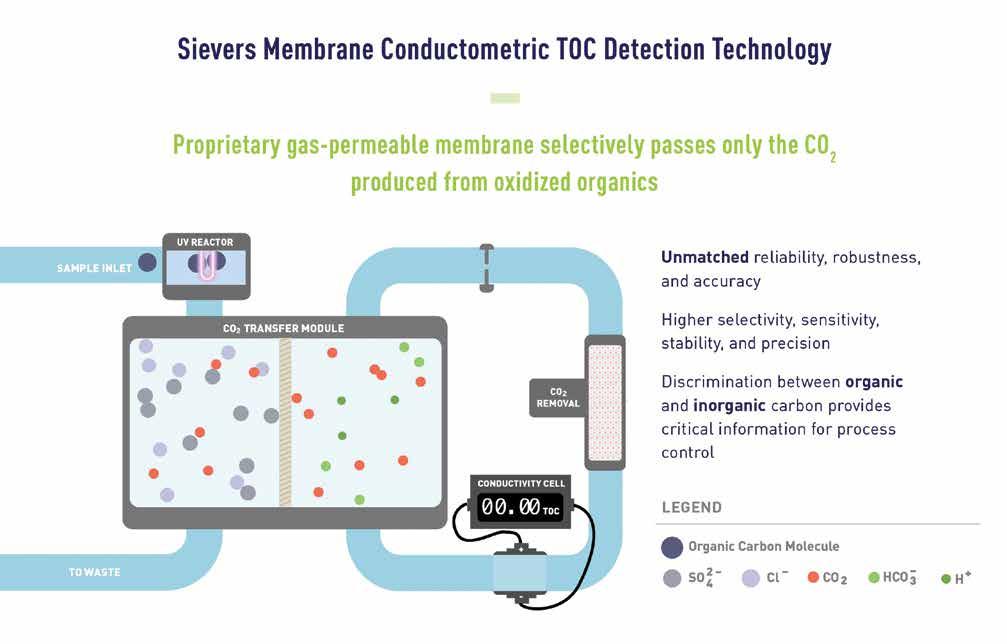

When I think about Sievers, I think about innovation and being at the forefront of technology to help our customers. We really listen to our customers and find creative technical solutions to solve their issues. This mindset comes from our heritage. Sievers has been a pioneer in the analytical instrumentation industry since introducing membrane conductometric Total Organic Carbon (TOC) detection technology to the market in 1993. Developing a better, faster and more efficient solution for our customers was our goal then, and it is still our goal today.

The newest product in the Sievers portfolio is the best example of what Sievers represents. Using our expertise in compendia water testing, we have launched groundbreaking technology for endotoxin detection.

Launching the Sievers Eclipse* Bacterial Endotoxins Testing (BET) platform was driven by finding a better, faster solution to endotoxin testing. We listened carefully to our customers about their challenges using the 96-well plate. We went back to the drawing board and developed a faster, simpler, and more environmentally sustainable solution.

Sievers 500 RL

All of those things working together are the reason we launched Eclipse and we’re very excited about the future of endotoxin testing.

Why is pharmaceutical water testing so important?

The global pharmaceutical industry has four fundamental parameters that are used to measure the chemical purity of water for production: conductivity, TOC, endotoxin, and bio-burden. Those parameters are used in a wide range of pharmaceutical applications and are highly regulated. TOC, conductivity, and endotoxin are metrics that manufacturers must monitor

to comply with regulations, but compliance is only the beginning. They also allow you to go beyond compliance and achieve optimisation, process understanding, and process control. When using accurate and reliable technology, TOC, conductivity, and endotoxin data are valuable tools that can help improve cGMP processes and product quality.

What are the trends for analytical instrumentation in the life sciences industry?

The pharmaceutical industry has always searched for ways to improve product quality. Water quality became a focus since it is a key input for product quality. As a result, the analytical instrumentation industry focused on improving TOC analysis in the laboratory. The industry measures TOC on the parts per billion, or ppb level. When measuring a drop of water in an Olympic sized swimming pool, accuracy is critical. In the past, the analytical instrumentation industry focused on improving the accuracy, precision, and robustness of TOC analysers.

Over time as instrument accuracy and precision continued to improve, the industry began focusing more on efficiency. Lab analysis required a huge amount of grab samples. The analysts were sampling, waiting for results and then finally analysing the results to report back to quality teams so they can release water. The time and resources to do the work also increased as regulations became stricter. How can a pharmaceutical facility improve efficiency? One of the ways is by increasing automation.

One of the key trends in the industry is moving from laboratory monitoring to online monitoring to save time, money, and human resources. Sievers technology is used in both laboratory and online environments. This like-for-like technology makes moving from lab to online easier. The transfer of technology and methodology allows for better and faster implementation when making the transition.

Why is online monitoring technology so important?

Laboratory-based testing requires human resource time for sampling and analysis while online TOC analysers report data in real time. Online monitoring means plant supervisors don’t need to wait to get results so companies can move faster. The overall water monitoring process becomes more efficient.

Online water monitoring is becoming more and more important because the industry has realised it saves time and money, reduces errors, and improves product quality. Manufacturers can use the data to drive greater process understanding and process control. The benefits of automation, process understanding and process control are outlined in the FDA’s guidance document on Process Analytical Technology (PAT). Online monitoring fits well within the framework for PAT.

What is next for online monitoring?

The next evolution of online water monitoring for pharmaceutical grade water systems is facilitating Real Time Release Testing (RTRT). It is important to highlight that RTRT is not simply about installing an online TOC analyser. RTRT means much more than having access to data. It is only when the data is used to release the water, when the real improvements in speed, cost and efficiency begin.

The validation of instruments is important for RTRT. Without proper validation, the value of real-time data is lost. One should consider the underlying TOC technology and the extent to which it can be validated against quantitative ICHQ2 (R1) guidelines. This level of validation can only be achieved with an analyser, compared to sensor technology. Without comprehensive validation, how can you trust the data generated from the instruments?

SUEZ offers Validation Support Packages (VSPs) for Sievers instruments that make validation easy. This gives you the assurance that the data can stand up to close scrutiny. To use real-time data and PAT to its full potential, technology must be qualified, and methods must be validated per regulatory requirements.

ASTM E2656 is an important guidance document outlining the aspects of RTRT implementation. RTRT is a powerful tool to improve efficiency, reduce costs, save time, and stay compliant to regulations, but the technology and implementation play a key role.

What are the application trends in the life sciences industry?

Historically, TOC data was measured in purified water systems and it continues to be a critical parameter. One of the growing trends is using TOC and conductivity in Cleaning Validation processes. Cleaning validation is not new to the industry. However, companies are evaluating ways to make their cleaning validation processes more efficient to reduce equipment downtime.

TOC and conductivity have become important quality metrics for determining cleanliness of cGMP equipment. They also offer several benefits compared to product-specific methods such as HPLC. TOC and conductivity give a more holistic view of cleanliness

Sievers Technology

compared to other methods that only measure specific components.

TOC methods are also easier to use than HPLC, allowing more people to be trained, and trained faster. Anyone can be taught to operate a TOC analyser. The ease of use of TOC for cleaning validation allows organisations to manage human resources more efficiently, save time, and improve productivity.

What’s next for cleaning validation?

Similarly to how the industry is advancing with water monitoring, the next trend in cleaning validation is moving from laboratory-based cleaning validation to Online Cleaning Validation. The FDA released its guidance document on PAT in 2004. Since then, we have seen the steady movement from lab to online water monitoring systems. We see the same trend in cleaning validation. PAT lays the foundation for greater understanding and control for cleaning validation programs. Using TOC data enables further cleaning validation process automation and has become the best practice. Cutting-edge online monitoring technology is here today. The facilities that have not adopted TOC and conductivity for cleaning validation, and are not planning for the transition from lab to online, risk falling behind the competition.

What’s the future for analytical instrumentation in the pharmaceutical industry?

The pharmaceutical industry is very demanding and forward-looking. We believe PAT is the future. PAT has been around for a while.It provides continuous process understanding, process control, and efficiency gains. Online analytical instrumentation technology and automation fit well with PAT and have clear, quantifiable benefits.

We at SUEZ focus on finding the most efficient solutions for our customers. Our vision is to focus on our customer’s needs and use our technology portfolio to help them. We started with improving TOC and conductivity instruments for the lab. Next, we added more support and services to those offerings to deliver more value. Most recently, we expanded our portfolio to next-generation bacterial endotoxin testing.

Now, it is our goal to partner with our customers to bring them to the next stage in their technology journey. That could be transitioning from lab to online water monitoring, RTRT, endotoxin, or online cleaning validation. SUEZ is focused on bringing technical expertise to our customers. Our customers can trust us to be a partner and to deliver results they can count on.

*Trademark of SUEZ; may be registered in one or more countries