CROSSINGS AT EAGLE’S LANDING 167 UNITS | PREMIER APARTMENT HOMES Confidential Investment Summary

The following information is an investment summary provided to prospective investors. This information is not a formal offering to sell either a security or a solicitation to sell a security. At the request of a recipient, the Company will provide a private placement memorandum, subscription agreement and the Limited Liability Company Operating Agreement. The Managing Member in no way guarantees the projections contained herein. Real estate values, income, expenses and development costs are all affected by a multitude of forces outside the Managing Member’s This investment is illiquid and only those persons that are able and prudence in your decision is strongly suggested. Please consult your attorney, CPA and/or professional

D r.V ik ram R CEO/Founder

Dr.

Ravi Gupta COO/Founder

Table of Contents Executive Summary 8 Property Profile 24 Location Overview 44 Financial Analysis 60 Portfolio & Performance 68

Summary

Executive Summary Property Description Location Overview Financial Analysis Portfolio & Performance Executive

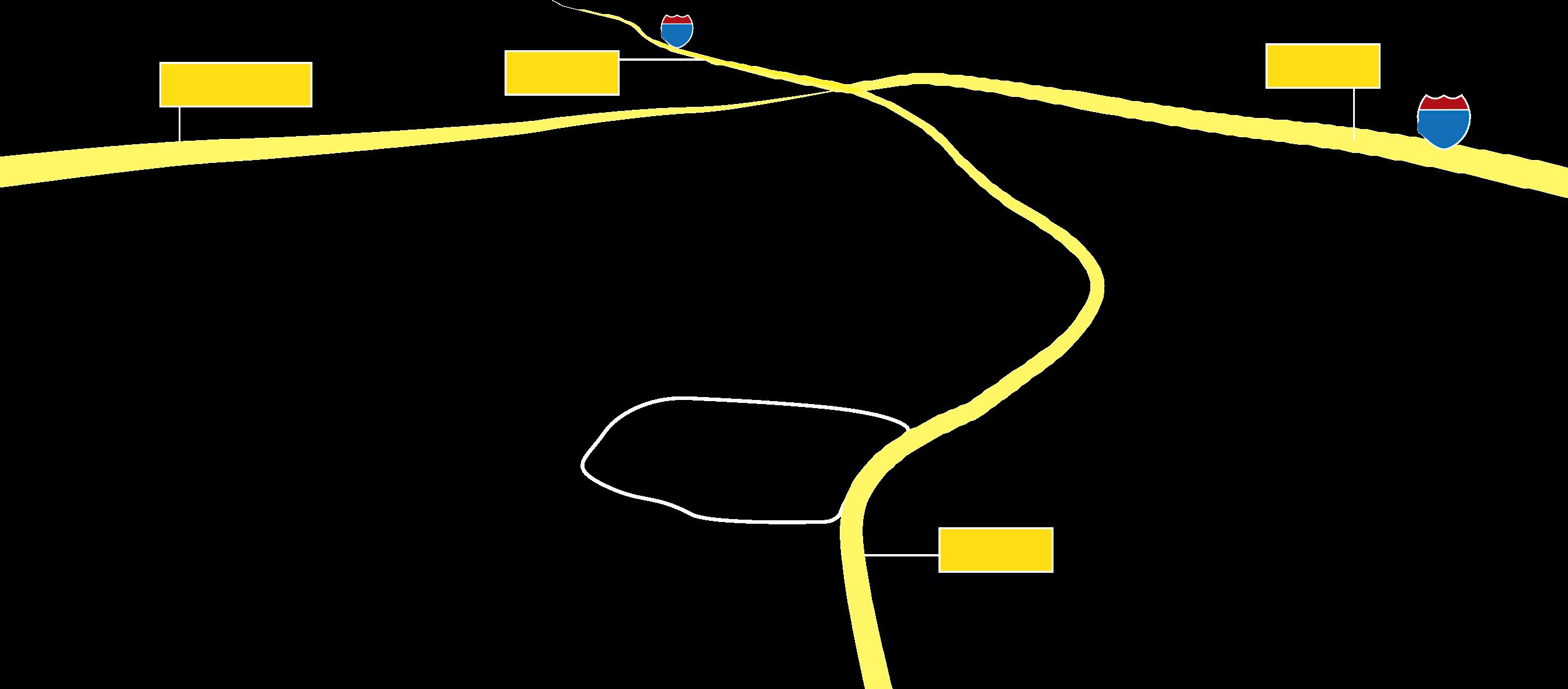

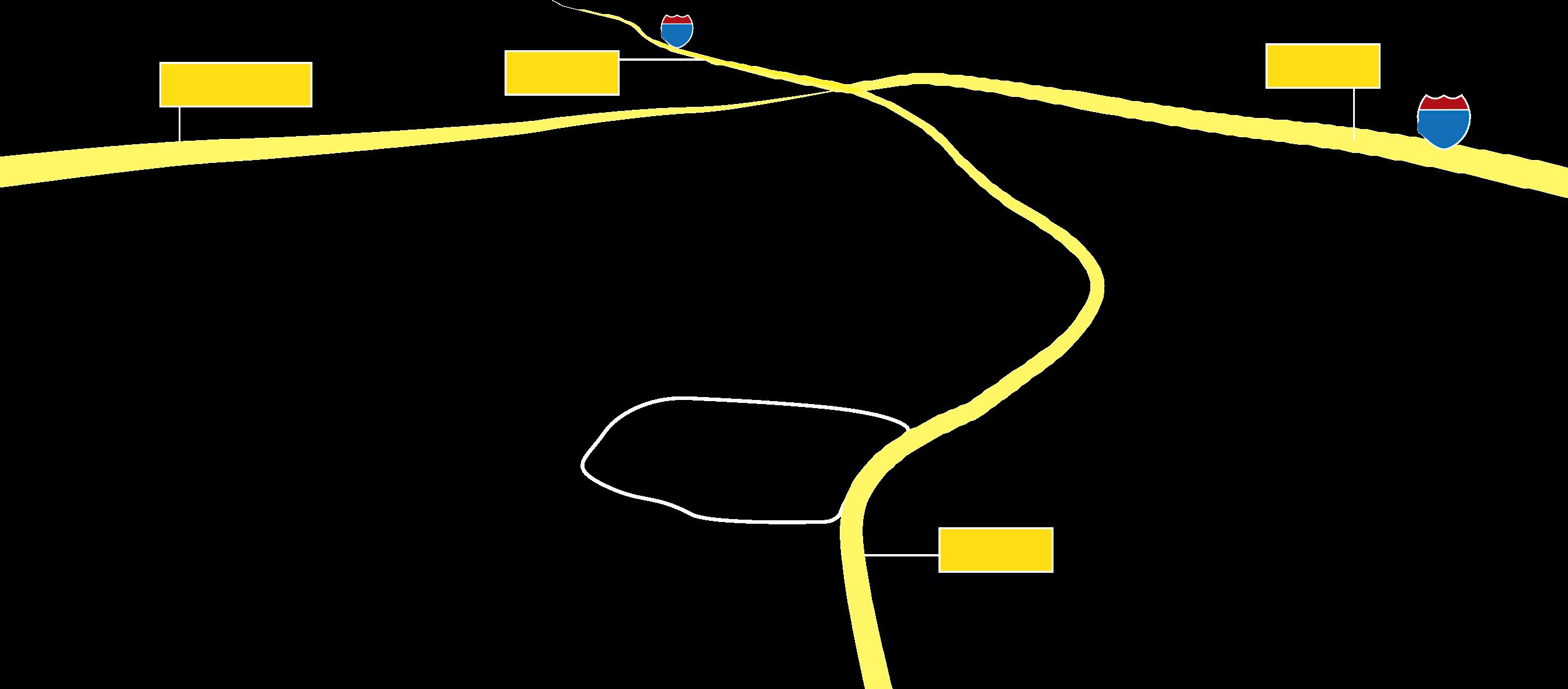

The Crossing at Eagle’s Landing comprises eight 2, 3 and 4-story residential buildings, one clubhouse and 4 garage structures, located in the heart of the rapidly growing South Atlanta Industrial Submarket, the second largest market in the Atlanta MSA. Easily accessible, the property is well-situated between major interstate I-75 and Route 23.

Through strategic management, Viking Capital aims to raise Eagle’s Landing $1,702 in-place average to the on-site $1,860 average rent achieved in 10% of the rent roll over the last two months. We will also look to renovate the partially renovated and classic units to the elite standard. The market has proven a demand for higher quality interior and previous owner has proven this out, earning $270-$400 in premiums- and comps indicate market surety of these rates. These renovations will compliment our efficient operations which leverage our best-in-class third party management team.

11 CROSSINGS AT EAGLE’S LANDING Investment Summary Cap (T 3/T 12) 5.51% Expense Ratio (T 12) 41% Physical Occupancy (Oct 2022) 92% DSCR Yr 1 1.38 DSCR avg. 1.55 Purchase Price $39,250,000 Hold Period 5 years Equity $16,150,000 LP Class A $1,615,000 LP Class B $10,497,000 Reserve Class $4,037,000

Offering Summary

13 14.1% New Lease Trade Out Since January (+$227) 10.6% Lease Renewal Since January (+$156) 13.9% Market Rent Growth from July 202 1 to June 2022 Zero Concessions on Property Successful Tax Appeal Freezing In - Place Taxes until 2025 92 Units in Need of Upgrade (56%) Sellers Renovations have achieved $270+ Monthly Rent Premiums Business Plan is to Upgrade Classic and Partial to Elite Level Washer/Dryer can be installed at a $45 monthly premium in all units ($1.6M of Value) In-Place Rents 10% Below Market 9‘ Ceilings Large 1,185 SF Units 2006 Built Well-maintained by institutional seller 21 attached 1-car garages with unit access Amenities include a pool, nature trail, fitness center, tennis court, grilling area, and more Well-maintained lowdensity site with 5.75 units per acre Investment Highlights Asset Financial Value-add

14 © Copyright 2022 Value-Add Upside Considerable Organic Rent Growth Progression Property Summary Year Completed 2006 Total Units 167 Average Unit Size (SF) 1,185 Physical Occupancy (Oct 2022) 92% Avg. Effective Rents (Oct 2022) $1,730 | $1.46 New Move-Ins (Last 60 days) $1,992 | $1.68 2BR & 3 BR % of Unit Mix 78% Units Primed for Upgrades 56% 700 Rock Quarry Rd, Stockbridge, GA 30281 Unit Mix (July 2022) Description # Units % Mix Avg SF Rent Rent/SF 1 BR 36 17% 908 $1,477 $1.63 2 BR 103 22% 1,202 $1,698 $1.41 3 BR 28 62% 1,479 $1,912 $1.29 Total/Avg. 167 100% 1,185 $1,686 $1.42

Three-Tiered Return Options

16 © Copyright 2022 A three-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tiers of equity Class A, Class B, Reserve Class or a combination of Class A and Class B. Diversifying in both A and B classes allows for a risk adjusted, blended returns.

17 Class B • 7% Preferred Return • 70/30 Profit Share Reserve Class • 8% Preferred Return • 80/20 Profit Share Class A • Prioritized Cash Flow • 10% Preferred Return • No Profit Share Three-Tiered Equity Structure Allows Investors to Match Investment Goals Minimum investment $50,000 Minimum investment $1,000,000 Minimum investment $50,000

18 © Copyright 2022 Investment Offering Capital Structure LP: RESERVE LP: CLASS B LP: CLASS A Debt $26.5M $16.15M Class A Class B Reserve Class LP Equity $1,615,000 $10,497,000 $4,037,000 Pref. 10% 7% 8% Hold Period 5 Years 5 Years 5 Years IRR 10% 12 - 15% 13 - 17% Equity Multiple 1.5x 1.6 - 1.9x 1.8 - 2.1x Avg. CoC 10% 5.5% 5.5% Purchase Price $39,250,000 Debt $26,500,000 Total Equity $16,150,000

19 Investor Returns: $100,000 Investment Year 1 Year 2 Year 3 Year 4 Year 5 Annual Percent Return 10.0% 10.0% 10.0% 10.0% 10.0% LP Annual Return $10,000 $10,000 $10,000 $10,000 $10,000 LP Return At Exit $100,000 Total Projected Return $150,000 Annual Percent Return 3.50% 4.00% 5.00% 7.00% 7.00% LP Annual Return $3,500 $4,000 $5,000 $7,000 $7,000 LP Return At Exit $167,180 Total Projected Return $193,680 Annual Percent Return 3.50% 4.00% 5.00% 7.00% 7.00% LP Annual Return $35,000 $40,000 $50,000 $70,000 $70,000 LP Return At Exit $1,805,632 Total Projected Return $2,070,632 Class A Class B Reserve Class $1MM *From Operations

Sensitivity

20.81%

5.20%

5.25% $58,702,661

5.30% $58,148,862

5.35% $57,605,415

5.40% $57,072,031

5.45% $56,548,435

$56,034,358

$55,529,544

$54,068,240

$53,598,082

5.80% $53,136,029

$52,681,875

$52,235,419

$51,796,465

23.77%

23.10%

22.45%

21.81%

21.18%

20.57%

19.96%

19.37%

18.79%

18.22%

17.65%

17.10%

16.56%

16.02%

15.50%

14.98%

Cap Rates Sale Price Deal Level IRR Equity Multiple AAR $56,753,085 16.61% 2.04x

$59,267,110 18.31% 2.19x

17.94% 2.16x

17.57% 2.12x

17.20% 2.097x

16.83% 2.06x

16.47% 2.03x

5.50%

16.11% 2.00x

5.55%

15.75% 1.97x

5.60% $55,033,745 15.39% 1.94x

5.65% $54,546,720 15.03% 1.91x

5.70%

14.67% 1.88x

5.75%

14.32% 1.85x

13.97% 1.83x

5.85%

13.62% 1.80x

5.90%

13.27% 1.77x

5.95%

12.92% 1.75x

Analysis

Crossings at Eagle’s Landing Stockbridge, GA 2006 Year Built 167 Units 92% Occupancy $1,730 Avg. Eff. Rent 29 Acres $2,031 Avg. Market Rent 1,185 Avg. Unit SF

Value-Add Business Strategy

Viking Capital's business plan is to raise current below market rents to the market. Viking will upgrade the property's exterior and strategically enhance the classic unit interiors. Our aim is to achieve optimal rents and attract high - quality tenants to increase Eagle’s Landings revenue and maximize value .

Executive Summary Property Description Location Overview Financial Analysis Portfolio & Performance Property Description

Property Description Crossings at Eagle’s Landing Location 2 miles north of Eagle's Landing Pkwy Access Road(s) I-75, Rock Quarry Road, Eagle’s Landing Pkwy Year Built 2006 Developer Davis Development, Inc Acres 29.051 No. of Buildings 1 Clubhouse, 8 residential, 4 Garage No. of Stories 2, 3 & 4 stories No. of Elevators N/A Ceiling Height 9' Exterior Materials Brick/ Stone/ Hardie Corridors Open, Non-Conditioned Breezeways w/ Concrete Stairs and Metal Railings Wiring Copper Plumbing CPVC

Parking / Garage /Storage Surface Spaces 350 Attached Garages 27 Detached Garages 22 Garage for Mgmt 2 Storage Units N/A Parking Charge $0 Garage Rental Charge $115 Storage Unit Fee N/A Washer / Dryer Connections All Units Stackable Sets Provided No Full Size Sets Provided No Laundry Contract N/A Utilities Heat Electric Water Heater Type Electric/Individual Water Meter Individually Metered Charges to Residents Electric Paid Directly to Provider Water/Sewer Based on Consumption Trash Fee Valet $25.00 + $5.00 per month. Both have to be accepted by residents Pest Fee $4.00 Alarm Fee $3.50 Service Providers Electric Georgia Power Gas N/A Water/Sewer Henry County Trash Removal Waste Management Valet Trash Valet Waste Billing Company YES Energy Cable/Internet Spectrum/Ditaro

28 © Copyright 2022 Amenities 24 Hour Fitness Center with Peloton Bike Tennis Court Basketball Court Attached Car Garages in Select Units Resort Style Swimming Pool Renovated Resident Clubhouse Business Center with Internet Cafe Poolside Kitchen and Outdoor Kitchen Baseball/Soccer Fields Gate Entrance Car Care Center Package Locker

29

7% Classic Units 49% Partial Units 81 Units 45% Elite Units 75 Units Value-Add Upside 167 UNITS Primed for upgrades 56% 92 units

31 Partial Units (P) 81 UNITS • New laminate countertops • Painted cabinets with new hardware • Black appliances • Faux-wood flooring • Upgraded lighting Elite Units (E) 75 UNITS • Quartz countertops • Painted cabinets with new hardware • Stainless-steel appliances • Faux-wood flooring • Upgraded lighting Classic Units 11 UNITS • Laminate countertops • White appliances • Original lighting • Original fixtures • Original brown cabinets • Faux wood or tile flooring in wet areas only

32 © Copyright 2022 Hwy I 75 163,000 VPD75 STOCKBRIDGE QUARRY Vulcan Materials Company: S&P500 2017: $50 investment into plant upgrades INDUSTRIAL WAREHOUSE PARK 200k+ SF ~500 Employees DOWNTOWN ATLANTA 30 min. Drive BUCKHEAD 45 min. Drive HARTSFIELD-JACKSON ATLANTA INTERNATIONAL AIRPORT 18 miles | 25 min. Drive STOCKBRIDGE SHOPPING CENTER 1.9M+ SF Retail ~4,500 Employees Walmart, Kroger, Lowe’s, Chick Fil A, CVS, QuikTrip MEMORIAL PARK Picnic Sites, Walking Track, Basketball Courts Rock Quarry Rd 9,100 VPD STOCKBRIDGE MIDDLE SCHOOL & ELEMENTARY SCHOOL STOCKBRIDGE HIGH SCHOOL

33 Hwy I 75 163,000 VPDEagle’s Landing Pkwy 34,500 VPD 75 Hwy I 75 163,000 VPD INDUSTRIAL WAREHOUSE PARK 200k+ SF ~500 Employees MCDONOUGH, GA 9 miles | 16 min. Drive EAGLE’S LANDING COUNTRY CLUB PRIVATE GOLF COURSE STOCKBRIDGE QUARRY Vulcan Materials Company: S&P500 2017: $50M investment into plant upgrades PIEDMONT HENRY HOSPITAL 259 Beds 1,600+ Employees 1.5 miles | 3 min. Drive BP GAS STATION Rock Quarry Rd 9,100 VPD

Property Metrics Description # Units % Mix Avg SF Rent1 Rent/SF1 1BR / 1 BA 1 1% 905 $1,245 $1.38 16 10% 905 $1,565 $1.73 11 7% 905 $1,442 $1.59 1 1% 920 $1,425 $1.55 3 2% 920 $1,457 $1.58 4 2% 920 $1,309 $1.42 2BR/2BA 8 5% 1,186 $1,611 $1.36 37 22% 1,186 $1,651 $1.39 44 26% 1,186 $1,676 $1.41 7 4% 1,303 $1,880 $1.44 7 4% 1,303 $1,929 $1.48 3BR/2BA 1 1% 1,479 $1,785 $1.21 12 7% 1,479 $1,848 $1.25 15 9% 1,479 $1,971 $1.33 Total / Avg 167 100% 1,185 $1,686 $1.42 1 Actual rents of occupied units, vacants at market rent

3 BEDROOM 28 UNITS 17% 1 BEDROOM 36 UNITS 22% 2 BEDROOM 103 UNITS 62% Unit Mix

Competitive Rental Set

36 © Copyright 2022

Crossings at Eagles Landing

The Abbey at Eagles Landing

1107 Rock Quarry Rd Stockbridge, GA 30281

Halston McDonough 745 GA 42 McDonough, GA 30281

Assembly Eagles Landing

860 Rock Quarry Rd

Stockbridge, GA 30281

100 South

100 Woodlawn Park DR McDonough, GA 30281

The Preston 100 Preston Creek DR McDonough, GA 30253

Crossings at McDonough

100 Crossing Blvd McDonough, GA 30253

37

Overall Competitive Rental Analysis

$ 1, 50 0 $ 1, 40 0 $ 1, 60 0 $ 1, 70 0 $ 1, 80 0 $ 2, 00 0 $ 1, 90 0 1 ,0 00 1 ,0 20 1 ,0 40 1 ,0 60 1 ,0 80 1,100 1 ,1 20 1 ,1 40 1 ,1 60 1 ,1 80 1 ,2 00 Asking Rent ($/Unit) Unit Size (SF) Overall Property Year Built # Units Avg Sf Avg Rent Rent/Sf 100 South 2004 240 1,057 $1,816 $1.72 The Abbey at Eagles Landing 2004 244 1,175 $1,802 $1.53 The Preston 2002 334 1,111 $1,758 $1.58 Halston McDonough 2005 263 1,161 $1,704 $1.47 Assembly Eagles Landing 2000 490 1,090 $1,673 $1.54 Crossings at McDonough 2005 252 1,147 $1,549 $1.34 Total/Avg 6,741 $1,717 $1.53 Eagle's Landing 2006 167 1,185 $1,686 $1.43 100 South The Assembly at Eagle’s Landing Halston McDonough The Abbey at Eagle’s Landing Crossings at McDonough The Preston Crossings at Eagle’s Landing

40 © Copyright 2022 1 Bedroom Competitive Rental Analysis $ 1, 25 0 $ 1, 35 0 $ 1, 45 0 $ 1, 55 0 $ 1, 75 0 $ 1, 65 0 $ 1, 85 0 $ 1, 95 0 7 50 8 00 8 50 9 00 9 50 1 ,0 00 100 South The Assembly at Eagle’s Landing Halston McDonough The Abbey at Eagle’s Landing The Preston Crossings at McDonough 1 Bedroom Property Year Built # Units Avg Sf Avg Rent Rent/Sf The Preston 2002 86 962 $1,851 $1.92 The Abbey at Eagles Landing 2004 56 880 $1,604 $1.82 100 South 2004 40 787 $1,582 $2.01 Assembly Eagles Landing 2000 180 801 $1,520 $1.90 Halston McDonough 2005 92 831 $1,419 $1.71 Crossings at McDonough 2005 40 908 $1,399 $1.54 Total/Avg 5,169 $1,563 $1.82 Crossings at Eagles Landing 2006 36 908 $1,477 $1.63 Crossings at Eagle’s LandingAsking Rent ($/Unit) Unit Size (SF)

41 $ 1, 40 0 $ 1, 30 0 $ 1, 50 0 $ 1, 60 0 $ 1, 80 0 $ 1, 70 0 $ 2, 10 0 $ 2, 00 0 $ 1, 90 0 9 50 1 ,0 00 1 ,0 50 1 ,1 00 1 ,1 50 1 ,2 00 1 ,2 50 1 ,3 00 2 Bedroom Competitive Rental Analysis 100 South The Assembly at Eagle’s Landing The Abbey at Eagle’s Landing Crossings at Eagle’s Landing Halston McDonough Crossings at McDonough 2 Bedroom Property Year Built # Units Avg Sf Avg Rent Rent/Sf Halston McDonough 2005 123 1,239 $1,840 $1.48 The Abbey at Eagles Landing 2004 140 1,188 $1,809 $1.52 100 South 2004 120 1,005 $1,703 $1.69 The Preston 2002 184 1,107 $1,689 $1.53 Assembly Eagles Landing 2000 222 1,193 $1,659 $1.39 Crossings at McDonough 2005 176 1,152 $1,500 $1.30 Total/Avg 6,884 $1,700 $1.49 Crossings at Eagles Landing 2006 103 1,202 $1,698 $1.41 The Preston Asking Rent ($/Unit) Unit Size (SF)

42 © Copyright 2022 $ 1, 85 0 $ 1, 95 0 $ 2, 05 0 $ 2, 25 0 $ 2, 15 0 1 ,3 00 1 ,3 50 1 ,4 00 1 ,4 50 1 ,5 00 1 ,5 50 1 ,6 00 1 ,6 50 $1,750 1 ,2 00 1 ,2 50 3 Bedroom Competitive Rental Analysis Crossings at McDonough 100 South The Preston The Assembly at Eagle’s Landing The Abbey at Eagle’s Landing 3 Bedroom Property Year Built # Units Avg Sf Avg Rent Rent/Sf 100 South 2004 80 1,271 $2,103 $1.65 Assembly Eagles Landing 2000 88 1,421 $2,021 $1.42 The Abbey at Eagles Landing 2004 48 1,479 $2,014 $1.36 Halston McDonough 2005 48 1,591 $1,901 $1.20 The Preston 2002 64 1,323 $1,833 $1.39 Crossings at McDonough 2005 36 1,390 $1,957 $1.41 Total/Avg 8,564 $1,964 $1.39 Crossings at Eagles Landing 2006 28 1,479 $1,912 $1.29 Crossings at Eagle’s Landing Halston McDonough

Price Per Unit - $272k vs Eagles Landing $235k (20% Discount)

44 © Copyright 2022 VIKING PURCHASE $52M 2021à $80M APPRAISAL 2022 The results of Viking Capital’s proven value-add business plan on Marbella Place (4 miles away from Eagle’s Landing)

Executive Summary Property Description Location Overview Financial Analysis Portfolio & Performance Location Overview

Stockbridge | Atlanta, GA - 19 miles southeastofAtlanta,Stockbridgeprovides the tranquil community outside of the bustling city center - Stockbridge evidenced by the extensive growth experienced over the last decade, with > 20% Growthrate inpopulationinrecent times - Eagles Landing is Close to restaurants, entertainment,andshopping. - Stockbridge is home to an award-winning Golf Course – Eagle’sLandingCountry Club(3 min from asset)

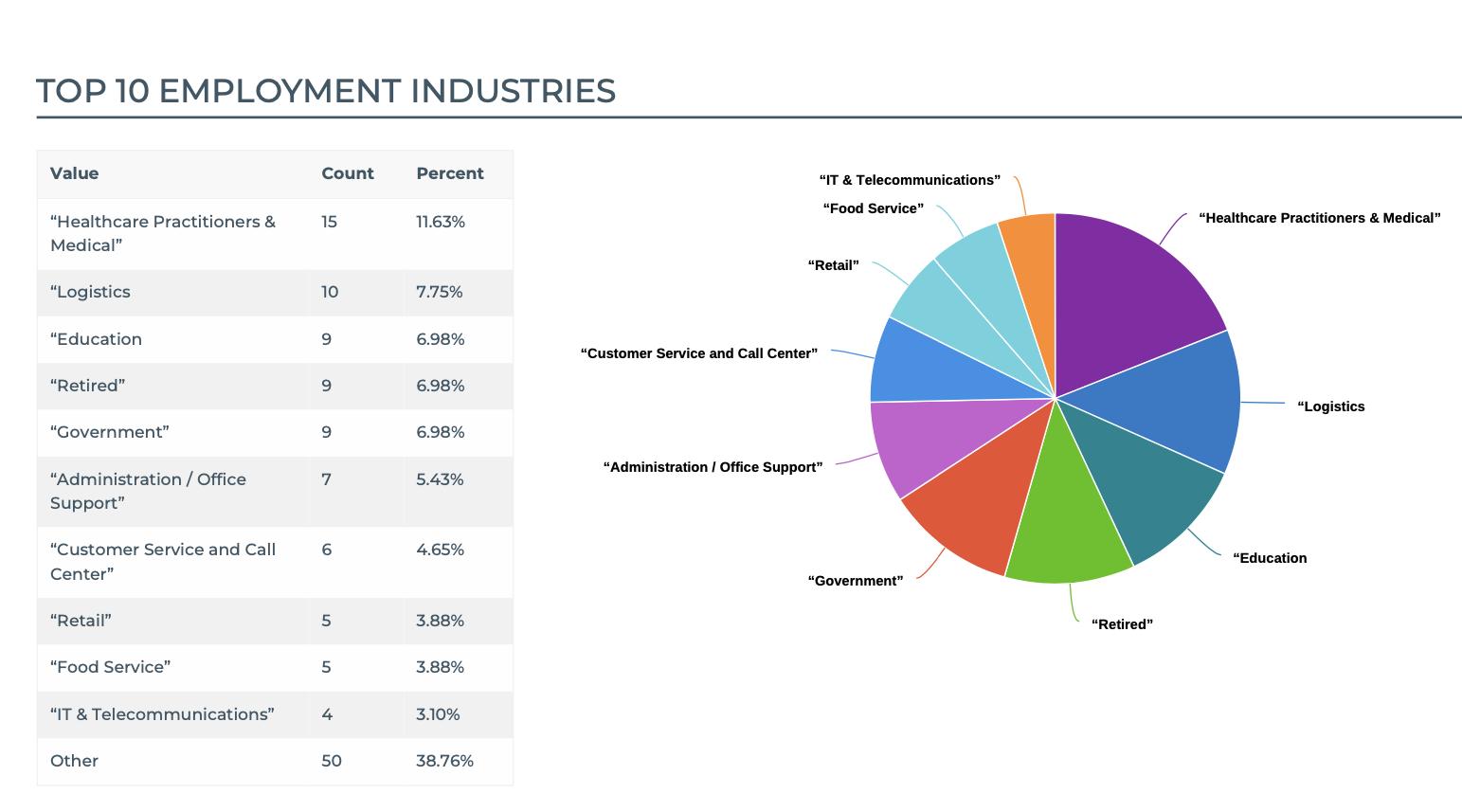

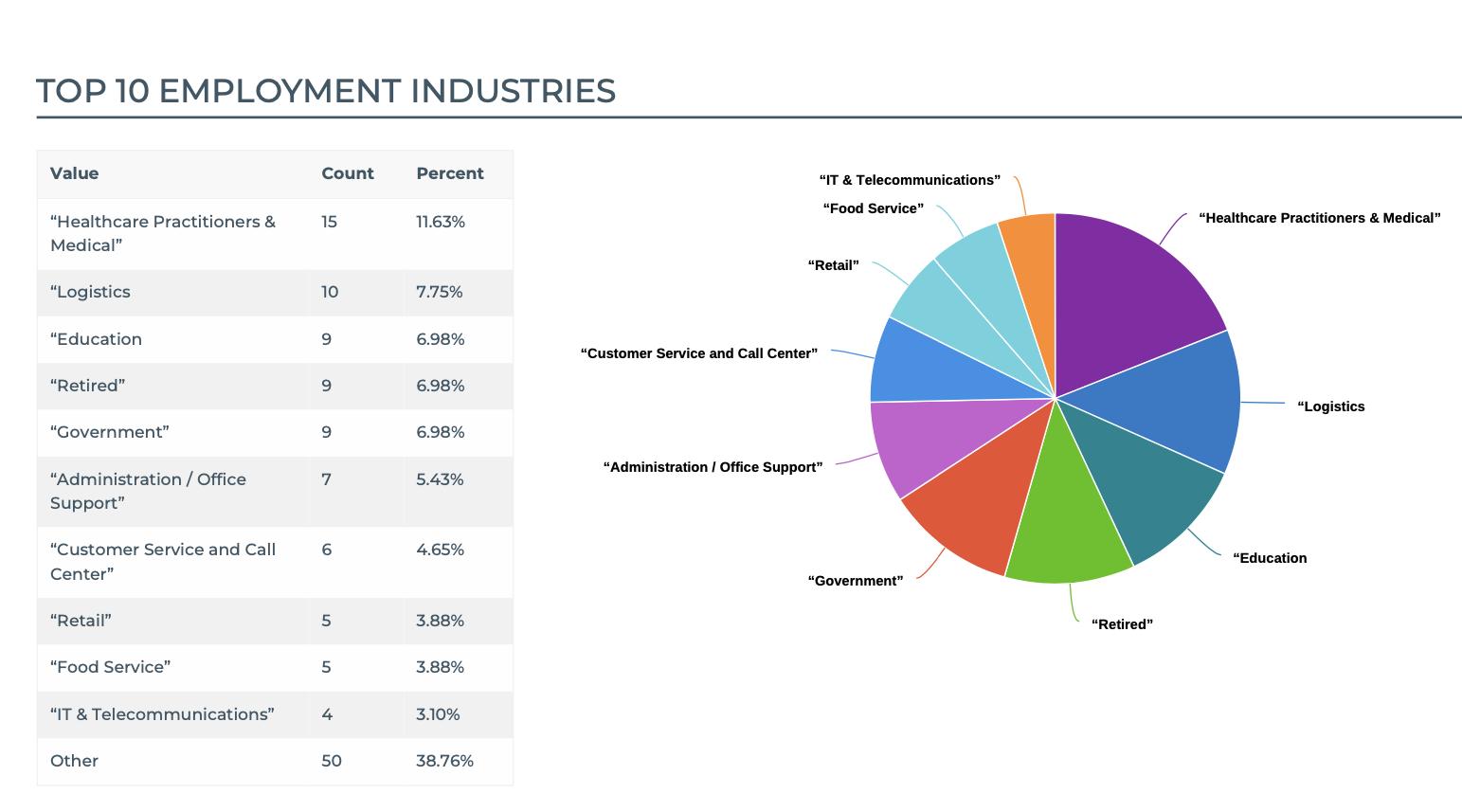

Current Tenant Profile

Our extensive due diligence reporting after reviewing every lease on property, revealed a high concentration of Health Care Professionals, Educators, Logistics Experts, and Upscale Renters by Choice

$78,300

Well Positioned to Benefit

51 © Copyright 2022

from South Atlanta’s Surge of Activity

ATLANTA GROWTH ENGINE

52 © Copyright 2022

ATLANTA | Leading Job Providers

Catalyst for South Atlanta’s Growth

#1 Busiest Airport in the World

Port of Brunswick

Nation’s Busiest for Auto Imports

Port of Savannah

Fastest Growing Port in the U. S.

Railroad Access

CSX’s Fairburn terminal is the company’s 9th largest

Record Industrial Warehouse Demand

Infrastructure

Over 80% of the U.S. is within a 2-day truck drive

54

Highway

Key Factors

55 © Copyright 2022 Air Cargo Volume Continues to Increase #10 in nation for cargo #5 Future ranking after plans to triple cargo capacity by 2030 +13% cargo traffic up in last two year with 705,000 metric tons$200M cost to add 1 MSF of cargo space Expected to reap the benefits of the state’s most significant, and ever - expanding economic driver Ideally Positioned Near Hartsfield-Jackson

$34.8 billion in metro Atlanta. The opening of the International Terminal, an economic stimulant for Georgia and the entire southeastern U.S., has positioned it as America’s new global gateway and is perfectly timed to

the

demand for international air service.

be

56 and

meet

growing

Hartsfield-Jackson is working to increase cargo capacity with more than $200 million worth of projects to

completed in 2021. $70.9 B total economic impact 275,000 passengers per day 63,000 employees 2,700 flights each day

57 © Copyright 2022 $6 Billion Expansion and Modernization Construction of a 6th runway Installation of canopies at entrances completed in 2020 Replacing and constructing new parking decks A new 4-star hotel with 60K of office space ü Adding 1 million SF of warehouse space for air cargo

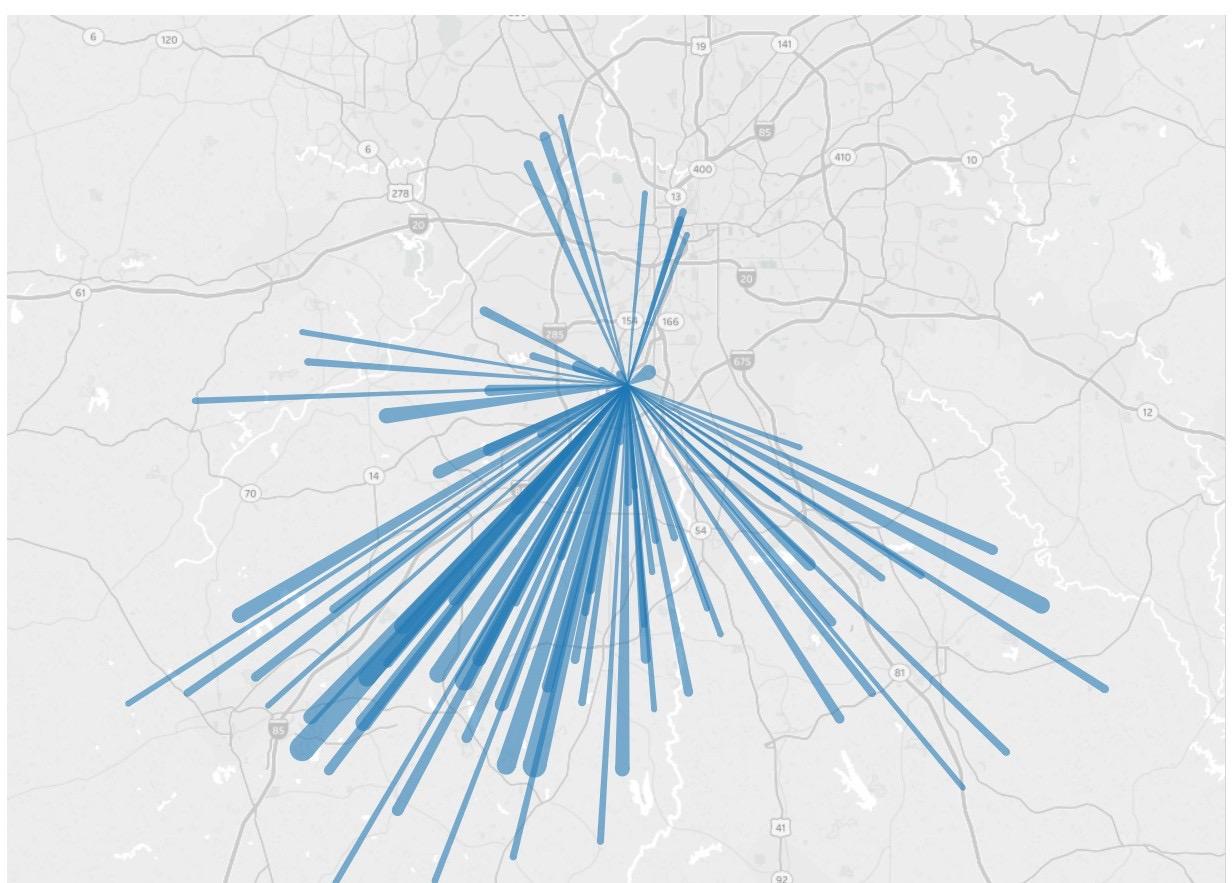

Robust Employment Living Near the Airport

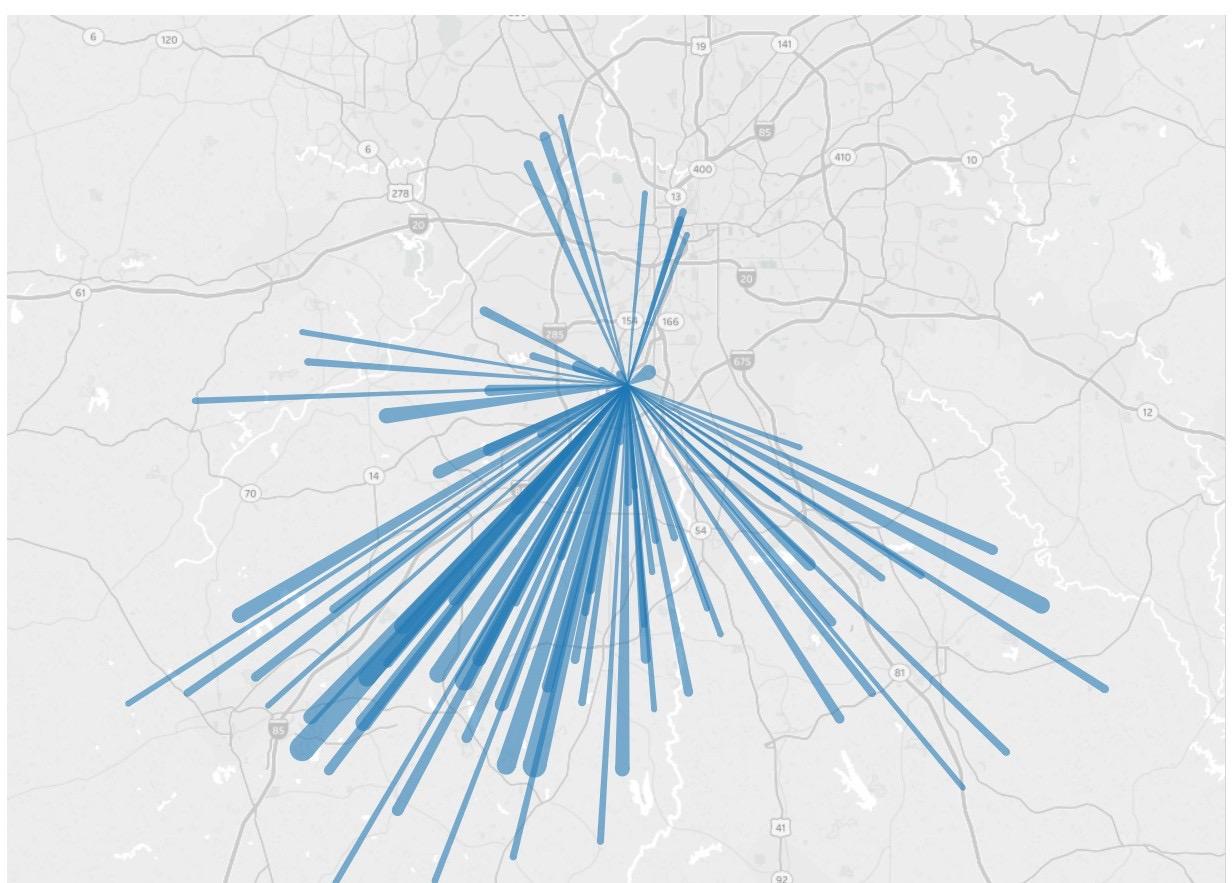

Most Common Home Locations Of Employees At/Near The Airport

Delta Airlines’ Headquarters, located at the airport, boosts the area’s total employment count with more than 5,000 people working at its home office.

58

Source: Census Bureau

Record Industrial Warehouse Demand in Henry

59 © Copyright 2022

County “On-Demand” World and Rapid Growth of ECommerce Bolstering Big-Box Warehouse Demand, Especially in Atlanta. • 5th largest industrial market in the U.S. • Makes up nearly 27% of Atlanta’s Total Industrial Stock • Atlanta remains Top 5 industrial market for rent growth • Net absorption has topped 100M SF since 2013, and almost 70M SF of new industrial space has delivered

Logistical/Industrial Job Centers along I-75

60

Eagle’s Landing

Neighboring McDonough: Hotbed for New Developments

The Bridges At Jodeco

The Bridges at Jodeco, a $400 million 158-acre, mixed-use project in south Atlanta, is underway in Henry County and being called “Avalon II”. The property encompasses the largest tract of undeveloped land south of Atlanta and will be the site of an ambitious effort to bring the ever growing live/work/play atmosphere to Southside Atlanta.

Purple Innovation

Premium mattress manufacturer

Purple Innovation announced that it is expanding its McDonough presence by 325,000 SF and more than doubling its workforce. This expansion will give Purple Innovation a total of 850,000 SF of space in McDonough with a workforce of 360 employees.

Feit Electric

Smart home and lighting company

Feit Electric announced plans to open a $25M distribution center in McDonough that will house 120 employees. This will be the first east coast distribution facility for the California based company.

61

Center of the Henry County Medical Corridor

department in addition to approximately 13,000 inpatient and 60,000 outpatient visitors each year.

In the last few years, Piedmont Henry has added a new 20 bed observation unit, a transitional care unit, a dedicated obstetric emergency department for expecting mothers and a state-of-the-art interventional radiology suite.

In the last few years, Piedmont Henry has added a new 20- bed observation unit, a transitional care unit, a dedicated obstetric emergency department for expecting mothers and a state-of-the-art interventional radiology suite.

63

Piedmont Henry’s emergency department, one of the busiest in the Piedmont Healthcare system and in the state, has also undergone several renovations and expansions to help improve patient flow and reduce patient wait times.

Downtown Atlanta Resurgence

According to the U.S. Census Bureau data, the south downtown census tract that includes City Hall has employees who mostly commute from further south, whereas the downtown census tract that includes CocaCola HQ has more employees that commute from north to the office. Therefore, a large portion of Downtown employees are living in Fairburn, College Park, and Stockbridge.

64

Downtown Home To 140,000 Jobs

Crossings at Eagle’s Landing is about a 20 min. drive away from downtown Atlanta.

The downtown Atlanta area has seen incredible growth and investment in the last 10+ years.

Notably, the new Mercedes-Benz stadium that opened in 2017 has a $100 million yearly economic impact and employs

2,000 people. The Turner Field/Summerhill redevelopment just south of the CBD is completely reenvisioning the old Atlanta Braves stadium into a walkable community of restaurants and residences. The project is estimated to cost $300 million and was awarded the “Best Overall Real Estate Deal, 2017” by the Atlanta Business Chronicle.

Additionally, there are significant projects that are currently undergoing redevelopment, or have been recently completed that are bring jobs and capital directly to the downtown area:

State Farm Arena, home to the NBA’s Atlanta Hawks and host to the biggest names in music every year - $193 million renovation that is the second largest of an NBA facility ever.

Centennial Yards - $1.0 billion mixed-use development by CIM Group out of Los Angeles. Plans call for millions of square feet of high-quality office space, along with hotels and retail space.

Underground Atlanta – a $300 million investment that will transform the downtown area, adding 2.5 million square feet of mixed-use space over 12 acres.

65

Financial Analysis

Executive Summary Property Description Location Overview Financial Analysis Portfolio & Performance

68 © Copyright 2022 Value-Add Upside Considerable Organic Rent Growth Progression Property Summary Year Completed 2006 Total Units 167 Average Unit Size (SF) 1,185 Physical Occupancy (Oct 2022) 92% Avg. Effective Rents (Oct 2022) $1,730 | $1.46 New Move-Ins (Last 60 days) $1,992 | $1.68 2BR & 3 BR % of Unit Mix 78% Units Primed for Upgrades 56% 700 Rock Quarry Rd, Stockbridge, GA 30281 Unit Mix (July 2022) Description # Units % Mix Avg SF Rent Rent/SF 1 BR 36 17% 908 $1,477 $1.63 2 BR 103 22% 1,202 $1,698 $1.41 3 BR 28 62% 1,479 $1,912 $1.29 Total/Avg. 167 100% 1,185 $1,686 $1.42

D e b t Loan Principal Balance $26,500,000 Loan to Value 68% Interest Rate (Fixed) 5.9% Interest Only (Years) 3 Term (Years) 7 Fixed or Adjustable Fixed Amortizing Period (Years) 30 Prepayment Penalty Step Down *Subject to change before closing

70 14.1% New Lease Trade Out Since January (+$227) 10.6% Lease Renewal Since January (+$156) 13.9% Market Rent Growth from July 202 1 to June 2022 Zero Concessions on Property Successful Tax Appeal Freezing In - Place Taxes until 2025 92 Units in Need of Upgrade (56%) Sellers Renovations have achieved $270+ Monthly Rent Premiums Business Plan is to Upgrade Classic and Partial to Elite Level Washer/Dryer can be installed at a $45 monthly premium in all units ($1.6M of Value) In-Place Rents 10% Below Market 9‘ Ceilings Large 1,185 SF Units 2006 Built Well-maintained by institutional seller 21 attached 1-car garages with unit access Amenities include a pool, nature trail, fitness center, tennis court, grilling area, and more Well-maintained lowdensity site with 5.75 units per acre Investment Highlights Asset Financial Value-add

71 © Copyright 2022 Income Year 1 2 3 4 5 Gross Potential Income 3,898,630 4,153,350 4,362,100 4,507,697 4,644,802 Loss to Lease (222,193) (79,212) (43,621) (45,077) (46,448) Vacancy (242,048) (249,201) (261,726) (245,933) (232,240) Concessions 0 0 0 0 0 Models, Office, Employee Units (35,699) (37,583) (39,472) (40,789) (42,030) Bad Debt (90,692) (83,067) (63,469) (45,077) (46,448) Effective Gross Rental Income 3,307,999 3,704,287 3,953,813 4,130,820 4,277,637 Other Income 466,802 481,000 495,630 510,705 526,239 Total Net Income 3,774,801 4,185,287 4,449,443 4,641,526 4,803,876 Expenses Real Estate Taxes 525,749 547,096 622,842 635,518 641,902 Insurance 78,111 80,487 82,486 84,151 85,850 Contract Services 44,447 45,799 46,936 47,884 48,850 Electric 48,469 49,943 51,184 52,217 53,271 Gas 0 0 0 0 0 Water and Sewer 111,049 114,427 117,269 119,636 122,051 Trash Removal 33,481 34,500 35,357 36,070 36,798 Other Utilities 32,807 33,805 34,645 35,344 36,057 Management Fee 113,244 125,559 133,483 139,246 144,116 Repairs and Maintenance 102,702 105,825 108,454 110,643 112,876 General/Admin 159,377 164,224 168,304 171,701 175,166 Advertising and Leasing 42,435 43,725 44,812 45,716 46,639 Payroll 271,582 279,842 286,794 292,583 298,488 Total Expenses 1,563,453 1,625,233 1,732,565 1,770,709 1,802,066 % EGI 41.4% 38.8% 38.9% 38.1% 37.5% Net Operating Income (NOI) $2,211,347 $2,560,055 $2,716,878 $2,870,817 $3,001,809 Proforma $800k in NOI Growth = $14M in Value Creation

Portfolio & Performance

Executive Summary Property Description Location Overview Financial Analysis Portfolio & Performance

Viking Capital Investments was founded in 2015 and has become a premier multifamily investment firm with agile investment sourcing, structuring, execution and asset management capabilities.

Viking is a highly skilled and deeply focused real estate investment firm with the flexibility to scale and cater to investor preferences. We invest in tier 1, secondary/tertiary markets across the United States. We have built a team of experts in acquisition, asset management, and disposition. Viking Capital was founded by Drs. Vikram Raya and Ravi Gupta to acquire, hold and manage multifamily real estate assets.

75

Viking Team

77 Vikram Raya CEO, Co-Founder Ravi Gupta COO, Co-Founder Amanda Loveless irector of Operations Matt Klejka Director of Asset Management Chris Parrinello Director of Investor Relations Colm McEvilly Investor Relations Manager Nathan Loy Senior Acquisition Analyst Amir Nassar Investor Services Manager Judah Fuld VP of Acquisitions Art Cordova Director of Finance Amber Butler Investor Concierge

Previous Projects

$15,317,506

$7,600,000

$5,900,000

$35,000,000

$7,000,000

$36,300,000

$41,000,000

78 © Copyright 2022 Current &

Property Sold / Current Market Units Market Value Wildcreek Sold 2018 Atlanta 242 $22,350,000 Villas of South Cobb I Sold 2018 Atlanta 188 $17,782,494 Villas of South Cobb II Sold 2018 Atlanta 152

Ascent at Riverdale I Sold 2019 Atlanta 118

Ascent at Riverdale II Sold 2019 Atlanta 62

The Hills at East Cobb Sold 2021 Atlanta 268

Town Oaks Townhomes Sold 2021 Tyler, TX 90

Reserve at Walnut Creek Sold 2022 Austin 284

The Avery Sold 2022 Dallas 304

Estates at Las Colinas Sold 2022 Dallas 415 $61,750,000 Park Village Apartments Current Dallas 350 $31,350,000 The Hype Current Atlanta 16 $6,700,000 Veritas at East Cobb Current Atlanta 192 $25,800,000 The Griffin Current Washington, DC 49 $19,300,000 Marbella Place Current Atlanta 368 $55,000,000 Elevate Twenty Three Current Atlanta 222 $41,000,000 Elevate on Main Current Indiana 400 $76,000,000 Elevate at the Pointe Current Atlanta 181 $37,000,000 Elevate at Huebner Grove Current San Antonio 210 $26,000,000 Kings Cove Current Houston 192 $34,000,000 Sky Ridge Apartments Current Atlanta 120 $19,600,000 Total 4,423 $620,000,000+

* The Hills at East Cobb returns total 10% over 3 years Exits & Performance Property Years Held Units Wildcreek 3.25 242 Villas of South Cobb I 2.5 188 Villas of South Cobb II 2.5 152 Ascent at Riverdale I 2 118 Ascent at Riverdale II 2 62 The Hills at East Cobb 3 268 Reserve at Walnut Creek 3 284 Estates at Las Colinas 3 415 The Avery 4.5 304 Total 2033

80 © Copyright 2022 Current Assets Under Management Property Units Purchase Price Equity Closing Current Performance Sky Ridge Apartments 120 $19,600,000 Fund Asset Aug-22 Recent Acquisition Distributions per proforma Kings Cove 192 $34,000,000 Fund Asset Apr-22 Recent Acquisition. Distributions per proforma Elevate at Huebner Grove 210 $26,000,000 Fund Asset Mar-22 Recent Acquisition. Distributions per proforma Elevate at the Pointe 181 $37,000,000 $11,500,00 Dec-21 Distributions per proforma Elevate on Main 400 $76,000,000 $20,750,00 Sept-21 Distributions per proforma Elevate Twenty-Three 222 $41,000,000 $11,000,000 Jun-21 Distributions per proforma Marbella Place 368 $52,700,000 $19,810,000 Jan-21 Distributions per proforma The Griffin 49 $19,300,000 $7,716,000 Jun-20 Distributions per proforma Veritas at East Cobb 192 $25,800,000 $11,250,000 Dec 19 Distributions per proforma

Sky Ridge Apartments

Background & Market

ü

120-unit apartment community built in 1986. Sky Ridge is supremely located in the Atlanta’s Platinum Triangle and just minutes from the retail, path of progress, luxury homes and jobs.

ü

With its excellent location and value-add potential, Sky Ridge is positioned well for long–term stability, future rent growth and value appreciation.

Plan

ü

The previous ownership has successfully renovated 40 units total that averaged $200 more per month than prior rents.

ü

With the opportunity to renovate 80 more units, Viking can potentially generate over $450,000 in additional revenue by averaging $10,000 per renovation. Interior renovations will not only result in immediate upside but aid significantly in tenant retention.

81 2022 Acquisition

Property Details Asset Class B Location Atlanta, GA Year Constructed 1986 No. of Units 120 Purchase Price $19.6M

Business

Kings Cove

ü 192-unit complex is located conveniently in the northeast Houston. The property sits within the heart of Kingwood, and is close to numerous options for a live, work, and play lifestyle, as well as numerous employment options.

Background & Market

Plan

ü

The unique location, the value add opportunity, and the enviable school system make Kings Cove an opportunity for long term stability, future rent growth, and value appreciation.

ü

By continuing the existing renovation scope, we can expect to achieve a premium of $225+/unit on the remaining 128 non upgraded units.

ü

A perfect comparable example of a successfully implemented renovation program is Town Center by Cortland, a rent comparable property to Kings Cove, which has achieved rent premiums of $225-$550 depending on the unit type.

82 2022 Acquisitions

Business

Property Details Asset Class A Location Houston, TX Year Constructed 2007 No. of Units 192 Purchase Price $34M

Elevate at Huebner Grove

Background & Market

ü

Supremely located near the South Texas Medical Center and just minutes from the I 10 as well as the USAA World Headquarters.

ü

In addition to its superior location, and favorable floor plans Tivona allows for us to achieve substantial rent growth.

ü

Liberty Pointe benefits from the ease of access to top employers and the continual increase of job creation.

Plan

ü

Previous ownership has successfully renovated 28 units total which averaged $150 more per month than prior rents.

ü

With the opportunity to renovate 182 more units, Viking can potentially generate over $660,000 in additional revenue by averaging $150 per renovation. Interior renovations will not only result in the immediate upside but aid significantly in tenant retention.

83 2022 Acquisition

Business

Property Details Asset Class B Location San Antonio, TX Year Constructed 1981 No. of Units 210 Purchase Price $26m

CONTACT US Investor Relations invest@vikingcapllc.com