WATOTO CHILD CARE MINISTRIES

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021

1. GENERAL

The Organisation was registered in April 2007 and its principal activity is managing activities of Watoto Child Care Ministries Uganda Office. The Organisation is a non profit making entity registered under the Non Governmental Organisation’s Registration Statute, 1989. The address of its registered office is:

Watoto Church Building P. O. Box 2311 Kampala

2 APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS FOR SMALL AND MEDIUM SIZED ENTITES (IFRS for SMEs)

The 2012 2014 review cycle

In conformity with its stated intent to review the IFRS for SMEs on a three years basis, the IASB commenced its first review in 2012. The vast majority of the changes concern clarifications to the current text and, hence, will not constitute changes to the way entities account for certain transactions and events.

In the current year, the company has applied all of the new and revised sections and interpretations issued by the International Accounting Standards Board (the “IASB”) and the International Financial Reporting Interpretations Committee (“IFRIC”) of the IASB that are relevant to its operations and effective for accounting years beginning on 1 January 2017. The adoption of the new and revised Standards and Interpretations has not resulted in changes to the company’s accounting policies and has no material effect on the amounts reported for the current, prior or future years.

The Directors anticipate that these IFRS will be applied on their effective dates in future years. The Directors have not yet had an opportunity to consider the potential impact of the adoption on these amendments.

New revisions to the IFRS for SMEs in issue but are not yet effective

The Company has not applied the following new and revised sections to the IFRS for SMEs that have been issued but are not yet effective:

Definition of an SME Clarification with regard to public accountability and clarification with regard to the use of the IFRS for SMEs in the parent's separate financial statements added

Concepts and pervasive principles Added guidance on the 'undue cost and effort' exemption

Statement of financial position

Statement of comprehensive income and income statement

Requirement to present investment property measured at cost less accumulated depreciation and impairment separately on the face of the statement of financial position added and relief from requirement to disclose certain comparative information provided

Clarification with regard to the single amount presented for discontinued operations added and alignment with changes made to IAS 1 on reclassifications

17

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

2 APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS FOR SMALL AND MEDIUM SIZED ENTITES (IFRS for SMEs) (CONTINUED)

Statement of changes in equity and statement of income and retained earnings

Consolidated and separate financial statements

Alignment with changes made to IAS 1 on OCI components

Clarifications on consolidation, guidance on dealing with different reporting dates, clarifications on disposal of subsidiaries, option to account for investments in subsidiaries, associates and jointly controlled entities in separate financial statements using the equity method, and amended definition of 'combined financial statements' added

Basic financial instruments

Several clarifications and 'undue cost and effort' exemption regarding the requirement to measure investments in equity instruments at FV added

Other financial instruments issues Clarifications on the scope of this section and clarifications regarding hedge accounting added

Property, plant and equipment

Alignment with changes made to IAS 16 on classification of spare parts, stand by and servicing equipment, exemption regarding the use of cost of the replacement, and option to use the revaluation model for property, plant and equipment added

Intangible assets other than goodwill Modified requirement that useful life of intangible assets should not exceed 10 years when entities are unable to reliably estimate the useful life

Business combinations and goodwill

Leases

Liabilities and equity

Share based payment

Impairment of assets

Employee benefits

Income taxes

Several minor amendments constituting clarifications, added guidance, and addition of an undue cost or effort exemption regarding the requirement to recognize intangible assets separately in a business combination

Clarifications added as to what arrangements (do not) constitute a lease

Some guidance, exemptions as well as alignment with full IFRSs regarding IFRIC 19 and IAS 32 added

Several clarifications added and scope aligned with IFRS 2

Clarification regarding applicability to assets from construction contracts

Clarification added and disclosure requirements on accounting policy for termination benefits removed

Alignment of key principles with IAS 12 as regards recognition and measurement of deferred tax and 'undue cost and effort' exemption regarding requirement to offset income tax assets and liabilities added

WATOTO CHILD CARE

MINISTRIES

18

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

2 APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS FOR SMALL AND MEDIUM SIZED ENTITES (IFRS for SMEs) (CONTINUED)

Foreign currency translation Scope clarified

Related party disclosures

Specialized activities

Transition to the IFRS for SMEs

Definition of 'related party' aligned with IAS 24

Certain disclosure relief for biological assets added and the main recognition and measurement requirements for exploration and evaluation assets aligned with IFRS 6

Several changes to IFRS 1 incorporated and wording simplified

Glossary Some definitions amended and five new terms added

Entities reporting using the IFRS for SMEs are required to apply the amendments for annual years beginning on or after 1 January 2017.

3 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of preparation

The financial statements have been prepared on a going concern basis and in compliance with the International Financial Reporting Standard for Small and Medium Sized Entities (IFRS for SMEs) issued by the International Accounting Standards Board (IASB) and the requirements of the Companies Act of Uganda, 2012. The measurement basis applied is the historical cost basis, except where otherwise stated in the accounting policies below. The financial statements are presented in Uganda Shillings (Shs) rounded to the nearest thousand.

For Uganda Companies Act reporting purposes, the balance sheet is represented by the statement of financial position and the profit and loss account by the statement of comprehensive income in these financial statements.

(b) Revenue recognition

The Organisation recognises revenue when the amount of revenue can be reliably measured, it is probable that future economic benefits will flow to the Organisation and when specific criteria have been met for each of the Organisation’s activities as described below. The amount of revenue is not considered to be reliably measurable until all contingencies relating to the sale have been resolved. The Organisation bases its estimates on historical results, taking into consideration the type of customer, the type of transaction and the specifics of each arrangement.

Revenue is recognised as follows:

i) Sales of goods are recognised in the period in which the Organisation delivers products to the customer, the customer has accepted the products and collectability of the related receivable is reasonably assured;

ii) Sales of services are recognised in the period in which the services are rendered, by reference to completion of the specific transaction assessed on the basis of the actual service provided as a percentage of the total services to be provided; and

iii) Interest income is recognised on a time proportion basis using the effective interest rate method.

iv) Donations income is recognised when received, based on the remittance advise that is received from the respective country office (partners).

WATOTO CHILD CARE

MINISTRIES

19

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(c) Functional currency and translation of foreign currencies

(a) Functional and presentation currency

Items included in the financial statements are measured using the currency of the primary economic environment in which the entity operates (‘the functional currency’). The financial statements are presented in Uganda Shillings which is the Organisation’s functional currency.

(b) Transactions and balances

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at year end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognised in profit or loss.

(d) Income tax

Watoto Child Care Ministries was previously a project of Kampala Pentecostal Church Limited which is tax exempt under the Income Tax Act, as it is a religious Organisation. The Organisation applied for a tax exemption status from the Uganda Revenue Authority and received this exemption effective 1 January 2015. This has since expired and the Organisation is in the process of renewing the exemption certificate.

Current income tax is the amount of income tax payable on the taxable profit for the year determined in accordance with the Uganda Income Tax Act.

Deferred income tax is recognised, using the liability method, on all temporary differences arising between the tax bases of assets and liabilities and their carrying values for financial reporting purposes. However, the deferred income tax is not accounted for if it arises from the initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit nor loss. Deferred income tax is determined using tax rates and laws that have been enacted or substantively enacted at the statement of financial position date and are expected to apply when the related deferred income tax liability is settled.

Deferred income tax assets are recognised only to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised.

(e) Unquoted investments

Investments are stated at cost less any impairment.

(g) Leases

Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made under operating leases are charged to the statement of comprehensive income on a straight line basis over the period of the lease.

WATOTO CHILD CARE MINISTRIES

20

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(h) Property and equipment

All categories of property and equipment are initially recorded at cost and subsequently at historical cost less depreciation. Historical cost includes expenditure that is directly attributable to the acquisition of the items.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Organisation and the cost of the item can be measured reliably. All other repairs and maintenance costs are charged to the statement of comprehensive income during the financial period in which they are incurred.

Freehold land is not depreciated. Depreciation on other assets is calculated using the straight line method to write down the cost to the residual value over their estimated useful life, as follows:

Buildings 4%

Motor vehicles and motorcycles 25%

Equipment 20%

Furniture, fixtures and fittings 20%

Computers 33.3%

Leasehold land Over 39 years

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each statement of financial position date.

Property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset’s carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash flows (cash generating units).

Gains and losses on disposal of property and equipment are determined by reference to their carrying amounts and are considered in determining the surplus for the year.

(i) Accounts receivable

Receivables are recognised initially at fair value and subsequently measured at amortised cost using the effective interest rate method. A provision for impairment of receivables is established when there is objective evidence that the Organisation will not be able to collect all the amounts due according to the original terms of receivables. The amount of the provision is the difference between the carrying amount and the present value of estimated future cash flows, discounted at the effective interest rate. The amount of the provision is recognised in the statement of comprehensive income.

WATOTO CHILD CARE MINISTRIES

21

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(j) Payables

Trade payables are obligations to pay for goods or services that have been acquired in the ordinary course of business from suppliers. Accounts payable are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of the business if longer). If not, they are presented as non current liabilities.

Trade payables are recognised initially at fair value and subsequently measured at amortised cost using the effective interest rate method.

(k) Retirement benefit obligations

National Social Security Fund

The Organisation operates a defined contribution retirement benefit scheme for its employees. The Organisation and all its employees also contribute to the National Social Security Fund, which is a defined contribution scheme. A defined contribution plan is a retirement benefit plan under which the Organisation pays fixed contributions into a separate entity. The Organisation has no legal or constructive obligations to pay further contributions if the fund does not hold sufficient assets to pay all employees the benefits relating to employee service in the current and prior periods.

Provident fund

The Organisation operates a defined contribution provident fund for all qualifying employees. The Organisation's obligations under the scheme are currently limited to 1% of the respective employee's gross emoluments. The Organisation's contributions are charged to the income statement in the year in which they fall due. The assets of the fund are held separately from those of the Organisation and are under the control of the fund's trustees.

(l) Cash and cash equivalents

For the purposes of the cash flow statement, cash and cash equivalents comprise cash in hand and in operating bank accounts.

(m) Comparatives

Where necessary, comparative figures have been adjusted to conform to the changes in presentation in the current year.

(n) Financial assets

(i) Classification

All financial assets of the Organisation are classified as loans and receivables, based on the purpose for which the financial assets were acquired.

WATOTO CHILD CARE MINISTRIES

22

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(n) Financial assets (Continued)

(i) Classification (Continued)

Loans and receivables are non derivative financial assets with fixed or determinable payments that are not quoted in an active market. They are included in current assets, except for maturities greater than 12 months after the end of the reporting period. These are classified as non current assets. The Organisation’s loans and receivables comprise ‘non current receivables and prepayments’, ‘trade and other receivables’ and ‘cash and cash equivalents’ in the statement of financial position.

(ii) Recognition and measurement

Regular purchases and sales of financial assets are recognised at fair value on the trade date the date on which the Organisation commits to purchase or sell the asset. Loans and receivables are subsequently carried at amortised cost using the effective interest rate method.

(iii) Offsetting financial instruments

Financial assets and liabilities are offset and the net amount reported in the statement of financial position when there is a legally enforceable right to offset the recognised amounts and there is an intention to settle on a net basis or realise the asset and settle the liability simultaneously.

(iv) Impairment

The Organisation assesses at the end of each reporting period whether there is objective evidence that a financial asset or group of financial assets is impaired. A financial asset or a group of financial assets is impaired and impairment losses are incurred only if there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset (a ‘loss event’) and that loss event (or events) has an impact on the estimated future cash flows of the financial asset or group of financial assets that can be reliably estimated.

Evidence of impairment may include indications that the debtors or a group of debtors is experiencing significant financial difficulty, default or delinquency in interest or principal payments, the probability that they will enter bankruptcy or other financial reorganisation, and where observable data indicate that there is a measurable decrease in the estimated future cash flows, such as changes in arrears or economic conditions that correlate with defaults.

For loans and receivables category, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows (excluding future credit losses that have not been incurred) discounted at the financial asset’s original effective interest rate. The carrying amount of the asset is reduced and the amount of the loss is recognised in profit or loss. If a loan has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate determined under the contract.

WATOTO CHILD CARE MINISTRIES

23

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(n) Financial assets (Continued)

(iv) Impairment (Continued)

If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognised (such as an improvement in the debtor’s credit rating), the reversal of the previously recognised impairment loss is recognised in profit or loss.

(o)

Deferred Income

Income received in advance is deferred at the reporting date. It is recognized in the income and expenditure statement when it falls due.

4 CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

Estimates and judgments are continually evaluated and are based on historical experience and other factors, including experience of future events that are believed to be reasonable under the circumstances.

The Organisation makes estimates and assumptions concerning the future. The resulting accounting estimates will, by definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are addressed below.

Property and equipment

Critical estimates are made by the directors in determining depreciation rates for property and equipment. The rates used are set out in note 2 above.

Receivables

Critical estimates are made by the directors in determining the recoverable amount of impaired receivables.

The Organisation’s activities expose it to a variety of financial risks: foreign exchange risk, credit risk and liquidity risk. The Organisation’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on its financial performance, but the Organisation does not hedge any risks

Financial risk management is carried out by the finance department under policies approved by the Board of Directors.

Market risk foreign exchange risk

The Organisation’s operations are predominantly in Uganda shillings. There is limited exposure to foreign exchange risk.

Credit risk

Credit risk is managed by the finance department, with oversight from the board of directors. Credit risk arises from cash at bank, fixed deposits, treasury bills and related party receivables. The Organisation does not have any significant concentrations of credit risk.

WATOTO CHILD CARE MINISTRIES

24

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

5 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

Credit risk (Continued)

The amount that best represents the Organisation’s maximum exposure to credit risk at 31 December 2021 is made up as follows:

Group WCCM 2021 2020 2021 2020 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000

Cash at bank 9,314,009 10,743,427 8,890,488 10,743,427 Receivables 579,038 2,891,015 579,038 2,891,015 Investments at amortised cost 30,338,232 25,120,052 30,338,232 25,120,052

Amounts due from related parties 4,549,503 9,006,730 4,549,503 9,006,730 44,780,782 47,761,224 44,357,261 47,761,224

No collateral is held for any of the above assets. All receivables are neither past due nor impaired and no receivables have had their terms renegotiated.

Liquidity risk

Prudent liquidity risk management includes maintaining sufficient cash balances. Due to the nature of the underlying businesses, funding is mainly derived from committed donor partners.

Management monitors rolling forecasts of the Organisation’s liquidity reserve on the basis of expected cash flow.

The table below analyses the Organisation’s financial liabilities that will be settled on a net basis into relevant maturity groupings based on the remaining period at the statement of financial position date to the contractual maturity date. The amounts disclosed in the table below are the contractual undiscounted cash flows. Balances due within 12 months equal their carrying balances, as the impact of discounting is not significant.

WATOTO CHILD CARE MINISTRIES

25

NOTES

TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

5 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)

Liquidity risk (Continued)

Less than 1 year Between 1 and 2 years Between 2 and 5 years Over 5 years Shs’000 Shs’000 Shs’000 Shs’000

At 31 December 2021: Payables and accrued expenses 8,753,264

At 31 December 2020: Payables and accrued expenses 9,606,326

Financial instruments by category Group WCCM 2021 2020 Shs’000 Shs’000

Financial assets loans and receivables Cash at bank 9,314,009 10,743,427 8,890,488 10,743,427 Receivables 579,038 2,891,015 579,038 2,891,015 Investments at amortised cost 30,338,232 25,120,052 30,338,232 25,120,052

Amounts due from related parties 4,549,503 9,006,730 4,549,503 9,006,730 44,780,782 47,761,224 44,357,261 47,761,224

Financial liabilities liabilities at amortised cost

Payables and accrued expenses 8,287,064 9,142,040 8,349,662 9,142,040

Capital risk management

The Organisation’s objectives when managing capital are to safeguard the Organisation’s ability to continue as a going concern in order to provide support to needy children and to maintain an optimal capital structure to reduce the cost of capital.

Notes

Group WCCM

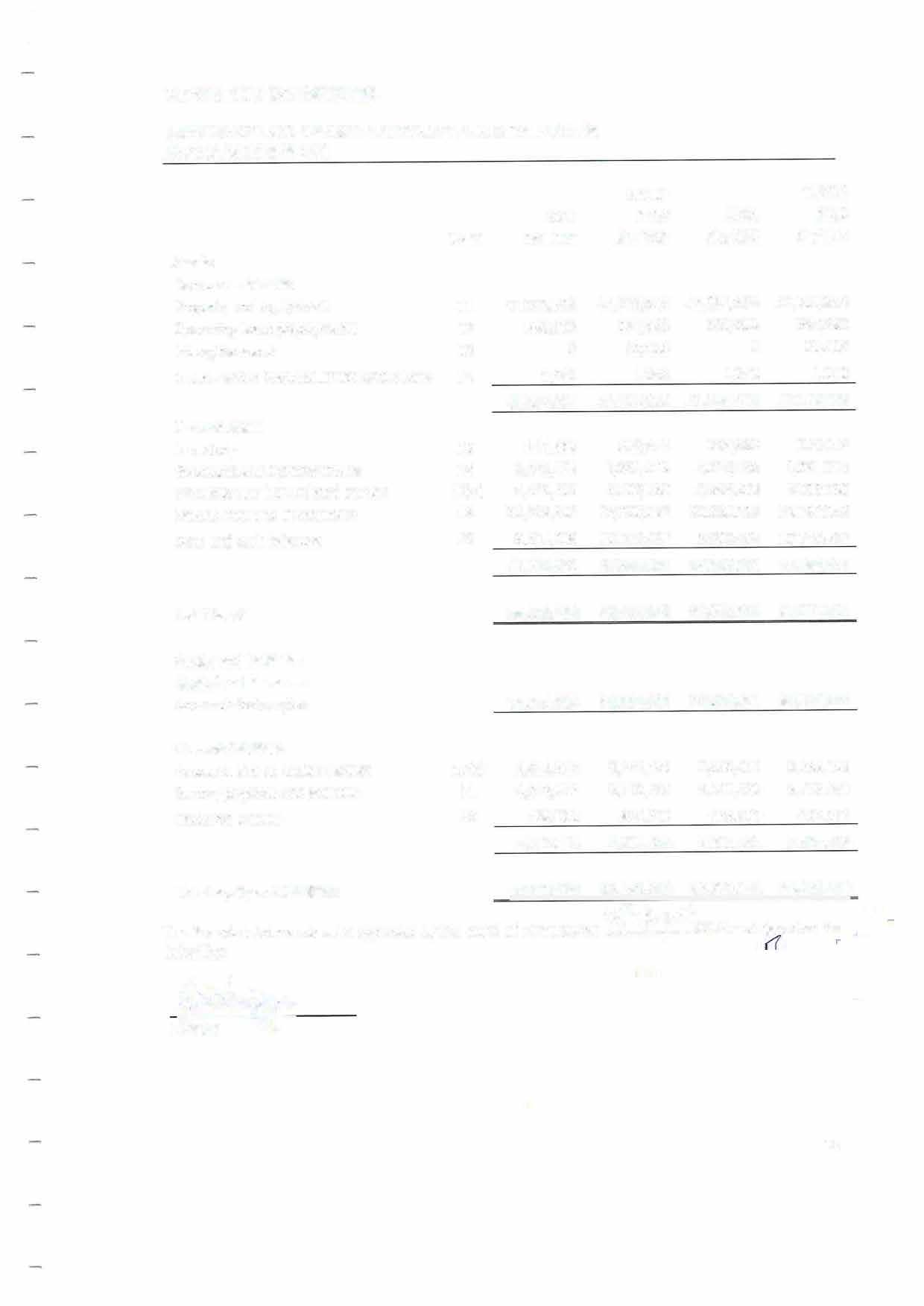

6(a) INCOME

2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Donations 51,244,415 56,212,907 51,213,883 56,212,907

Visit Watoto 451,509 1,099,996 451,509 1,099,996

Watoto Merchandise 85 65,497 85 65,497 Sales to Watoto Church 11,860 2,547 11,860 2,547

Agriculture sales 589,189 190,830 589,189 190,830

Neighbourhood Sales 143,230 922,453 143,230 922,453

Other Income 442,552 1,386,769 424,851 1,386,769 52,882,840 59,880,999 52,834,607 59,880,999

WATOTO CHILD CARE MINISTRIES

26

NOTES

TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

6(b) NET FINANCE INCOME

Group WCCM 2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Interest and other income 3,310,337 1,978,668 3,310,336 1,978,668 Foreign exchange losses (512,165) (1,056,221) (514,581) (1,056,221)

Net Finance Income 2,798,172 922,447 2,795,755 922,447

7. OPERATING SURPLUS/ (DEFICIT)

The operating deficit has been arrived at after charging the following items:

Group WCCM 2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Employee benefits expense 14,846,784 15,937,419 14,616,974 15,937,419 Depreciation (note 11) 3,063,938 3,301,044 3,058,445 3,301,044 Amortisation 40,134 22,218 40,134 22,218 Auditors’ remuneration 55,809 39,262 52,309 39,262 18,006,665 19,299,943 17,767,862 19,299,943

8 EMPLOYEE BENEFITS EXPENSE

Group WCCM 2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Staff salaries 13,318,432 14,126,730 13,168,614 14,126,730 National Social Security Fund 1,407,970 1,434,521 1,407,970 1,434,521 Provident fund contributions 120,382 376,168 118,684 376,168 14,846,784 15,937,419 14,616,974 15,937,419

The average number of employees during the year was 1,089(2020:1,056)

WATOTO CHILD CARE MINISTRIES

27

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

9 OPERATING EXPENSES

Group WCCM 2021 2020 2021 2020 Ush'000 Ush'000 Ush'000 Ush'000

Agriculture 2,492,615 1,922,998 2,492,615 1,922,998

Construction 38,873 74,734 38,873 74,734

Neighbourhood Business 590,795 792,364 590,795 792,364

Babies Home 4,205,091 2,871,956 4,205,091 2,871,956

Neighbourhood NGO Uganda 4,845,248 4,774,427 6,190,331 4,774,427

Visit Watoto 389,355 1,039,658 389,355 1,039,658

Education 12,273,787 6,779,640 12,273,787 6,779,640

Neighbourhood NGO Juba 824,758 283,380 283,380

Bad debt expense for Watoto Limited 3,718,631 3,718,631

Depreciation and amortisation (Other programs) 1,033,809 1,172,698 1,033,809 1,172,698

Depreciation and amortisation (Childcare) 2,064,313 1,935,842 2,064,313 1,935,842

Child welfare expenses 713,310 715,752 713,310 715,752

Choir Preparation 631,154 2,202,667 631,154 2,202,667

Choir Production expenses 203,668 203,668

Clinical & Medical Expenses 3,369,436 2,028,550 3,369,436 2,028,550

Estates 1,547,491 1,231,552 1,547,491 1,231,552

Homes & Mothers 10,193,185 8,945,711 10,193,185 8,945,711

Other program costs 211,388 359,945 211,387 359,945

Pastoral & Discipleship 1,383,398 1,116,839 1,383,398 1,116,839

Realised Exchange gain (54,190) (54,190)

Shared costs (2,170,264) (1,786,376) (2,170,264) (1,786,376)

Sponsorship 923,363 1,376,025 923,363 1,376,025

Sports Academy 650,287 488,479 650,287 488,479 Worship Academy 856,768 603,029 856,768 603,029

Write Off Account *** 522,272 (170) 503,734 (170)

Total Operating expenses 51,309,063 39,079,178 51,810,849 39,079,178

*** Write off account relates to the long outstanding balances that had always been carried in the financials The board approved their write off during this financial year.

WATOTO CHILD CARE MINISTRIES

28

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

10 ADMINISTRATIVE EXPENSES

Group WCCM 2021 2020 2021 2020 Ush'000 Ush'000 Ush'000 Ush'000

Accommodation 62,074 54,108 62,074 54,108

Advertising & Publicity Costs 56,713 7,168 56,713 7,168 Audit Fees 55,809 30,965 52,309 30,965

Bank Charges 27,862 17,714 19,350 17,714

Bereavement 490 490

Board Meeting Expenses 15,577 5,248 15,577 5,248

Buildings Maintenance 11,208 1,034 11,208 1,034

Cleaning & Maintenance 1,936 10,085 1,936 10,085

Clearing & Handling Charges 500 500

Computer maintenance 87,854 12,057 87,854 12,057

Consultation Fees 481,075 1,515,347 481,075 1,515,347

Depreciation and amortisation 5,493 214,722 214,722

Documentation/Photography Cost 229 5,227 229 5,227

Donations expense 17,000 17,000 Drugs & Treatment (10,093) (10,093)

Educational Supplies & Materia 215 157 215 157

Employer Provident fund 17,369 54,949 17,369 54,949

Equipment Maintenance 16,866 13,573 16,866 13,573

Expatriates Salaries 470,572 661,632 470,572 661,632

Fresh foods 1,192 1,192

Fuel Expenses 17,215 17,215

Furniture Maintenance 305 45 305 45

Hire of Facility/Equipment 10,800 120 10,800 120

Home/Office/School Supplies 180,470 6,889 180,470 6,889

Honoraria & gifts 13,480 226,479 13,480 226,479

Insurance costs 21,646 133,172 21,646 133,172

International travel costs 166,949 228,627 166,949 228,627

Internet/E mail 141,629 210,684 141,629 210,684

Legal Costs 126,937 215,090 125,162 215,090

Licenses & Permits 28,090 16,088 28,090 16,088

Mail &Postage 1,320 844 1,320 844

Meals & Refreshments 44,773 45,255 44,773 45,255

Medical expenses 4,000 140 4,000 140

Motor Vehicle Maintenance 227,802 180,207 227,802 180,207

NSSF Employer's Contribution 273,893 271,535 273,893 271,535

Passports and Visas 3,000 1,446 3,000 1,446

Photocopying & Printing 29,825 2,698 29,825 2,698

Rent 102,167 184,616 102,167 184,616

School Fees 8,217 8,217

Balance c/f 2,705,438 4,344,942 2,686,158 4,344,942

WATOTO CHILD CARE MINISTRIES

29

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

10 ADMINISTRATIVE EXPENSES (Continued)

Balance b/f

Group WCCM 2021 2020 2021 2020 Ush'000 Ush'000 Ush'000 Ush'000

2,705,438 4,344,942 2,686,158 4,344,942

Security 69,496 76,141 69,496 76,141

Seguku Operations 601 601

Staff Accommodation 14,365 12,957 14,365 12,957

Staff Benefits 101,041 71,931 101,041 71,931

Staff Meals 3,065 22,890 3,065 22,890

Staff Medical Expenses 122,548 137,824 122,548 137,824

Staff Retirement packages 2,397 141,415 2,397 141,415

Staff Salaries 1,779,149 1,911,633 1,779,149 1,911,633

Stationery & Supplies 14,553 14,979 14,553 14,979

Subscriptions 52,131 79,281 52,131 79,281

Taxes 18,035 3,694

Telephone & fax 49,421 53,482 49,421 53,482

Training Fees 2,713 10,385 2,713 10,385

Transport 164,176 156,041 164,176 156,041

Utilities 32,050 22,436 32,050 22,436

Workmen's Compensation Policy 18,308 32,240 18,308 32,240

Welfare Expenses 195,840 195,840

Birthdays & Gifts 5,204 5,204

Fines and Penalties 22,907 22,907

Total Administration expenses 5,373,438 7,088,577 5,339,817 7,088,577

WATOTO CHILD CARE MINISTRIES

30

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

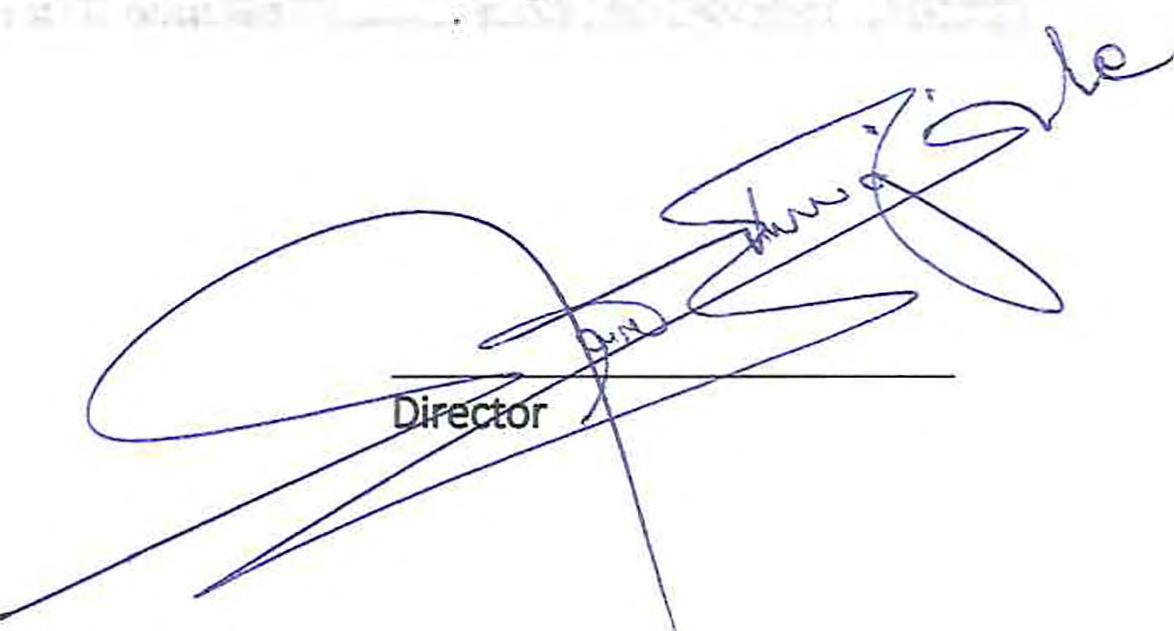

11a) PROPERTY PLANT AND EQUIPMENT WCCM

Property and equipment Free hold land Buildings Motor vehicles Motorcycles Computers Furniture Equipment Capital work in progress TOTAL Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000

Cost

As at January 2020

6,047,102 47,320,841 3,394,273 44,455 2,060,334 4,028,246 4,683,489 4,670,772 72,249,512 Additions 22,500 901,720 271,063 224,610 34,376 147,851 1,510,902 3,113,022 Disposals/written off (5,685) (565,532) (571,217)

At 31 December 2020 6,069,602 48,222,561 3,665,336 44,455 2,279,259 4,062,622 4,831,340 5,616,142 74,791,317

As at January 2021 6,069,602 48,222,561 3,665,336 44,455 2,279,259 4,062,622 4,831,340 5,616,142 74,791,317 Additions 229,067 15,900 703,304 106,081 81,548 1,209,801 2,345,701 Adjustment (5,621) (5,621)

Disposals/written off (8,425) (26,053) (105) (60,842) (121) (95,546)

Transfer to South Sudan (8,411) (20,229) (28,640)

At 31 December 2021 6,061,177 48,451,628 3,681,236 44,455 2,956,510 4,160,187 4,831,817 6,820,201 77,007,211

Accumulated Depreciation

As at 1 January 2020 18,314,555 2,869,310 42,594 1,601,617 3,367,633 3,536,919 29,732,628 Depreciation charge for the year 1,915,650 405,589 973 274,229 216,390 488,213 3,301,044

At 31 December 2020 20,230,205 3,274,899 43,567 1,875,846 3,584,023 4,025,132 33,033,672 As at January 2021 20,230,205 3,274,899 43,567 1,875,846 3,584,023 4,025,132 33,033,672

Depreciation 1,930,385 192,295 888 356,707 200,076 378,100 3,058,451 Disposals (18,476) (419) (2,600) (21,495)

Write off/ Adjustment (8,040) (58,242) (66,282)

At 31 December 2021 22,160,590 3,467,194 44,455 2,206,037 3,783,680 4,342,390 36,004,346

Net book value

At 31 December 2021 6,061,177 26,291,038 214,042 0 750,479 376,507 489,427 6,820,201 41,002,865

At 31 December 2020 6,069,602 27,992,356 390,437 888 403,413 478,599 806,208 5,616,142 41,757,645

WATOTO CHILD CARE

MINISTRIES

31

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR ENDED 31 DECEMBER 2020

11b) PROPERTY AND EQUIPMENT

GROUP

Freehold land Buildings Motor vehicles Motorcycles Computers

Furniture, fixtures, and fittings Equipment Capital work in progress Total Shs'000 Shs'000 Shs'000 Shs'000 Shs'000 Shs'000 Shs'000 Shs'000 Shs'000

Cost

As at 1 January 2020

6,047,102 47,320,841 3,394,273 44,455 2,060,334 4,028,246 4,683,489 4,670,772 72,249,512 Additions 22,500 901,720 271,063 224,610 34,376 147,851 1,510,902 3,113,022 Disposals/written off (5,685) (565,532) (571,217) At 31 December 2020 6,069,602 48,222,561 3,665,336 44,455 2,279,259 4,062,622 4,831,340 5,616,142 74,791,317

As at 1 January 2021 6,069,602 48,222,561 3,665,336 44,455 2,279,259 4,062,622 4,831,340 5,616,142 74,791,317

Additions 229,067 15,900 703,304 114,073 101,777 1,209,801 2,373,922 Adjustment (5,621) (5,621) Disposals/written off (8,425) (26,053) (105) (60,842) (121) (95,546)

Transfer to WCCM South Sudan (8,411) (20,229) (28,640)

At 31 December 2021 6,061,177 48,451,628 3,681,236 44,455 2,956,510 4,168,179 4,852,046 6,820,201 77,035,432

Accumulated depreciation

As at 1 January 2020 18,314,555 2,869,310 42,594 1,601,617 3,367,633 3,536,919 29,732,628

Charge on disposal Depreciation charge 1,915,650 405,589 973 274,229 216,390 488,213 3,301,044 Write off

At 31 December 2020 20,230,205 3,274,899 43,567 1,875,846 3,584,023 4,025,132 33,033,672

As at 1 January 2021 20,230,205 3,274,899 43,567 1,875,846 3,584,023 4,025,132 33,033,672

Depreciation charge 1,930,385 192,295 888 356,701 201,534 382,135 3,063,938 Disposals (18,476) (419) (2,600) (21,495)

Write off/Adjustment (8,031) (58,244) (66,275)

At 31 December 2021 22,160,590 3,467,194 44,455 2,206,040 3,785,138 4,346,423 36,009,840

Net Book Value

At 31 December 2021 6,061,177 26,291,038 214,042 750,482 383,041 505,621 6,820,201 41,025,592 At 31 December 2020 6,069,602 27,992,356 390,437 888 403,413 478,599 806,208 5,616,142 41,757,645

WATOTO CHILD CARE

MINISTRIES

32

NOTES

TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

12 OPERATING LEASE PREPAYMENTS

Group WCCM

2021 2020 2021 2020

Shs '000 Shs '000 Shs '000 Shs '000

At start of year 397,561 413,559 397,561 413,559

Additions 182,770 182,770 Amortization charge for the year (19,728) (15,999) (19,728) (15,999)

At end of year 560,602 397,560 560,602 397,560

13 INTANGIBLE ASSETS Group

WCCM

2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

At start of year 20,408 26,627 20,408 26,627 Additions during the year Amortization charge for the year (20,406) (6,219) (20,406) (6,219) At end of year 2 20,408 2 20,408

14 INVESTMENT IN SUBSIDIARY

Group

WCCM

2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Watoto Limited 990 990 990 990 Other shares 50 50 50 50 1,040 1,040 1,040 1,040

Watoto Child Care Ministries owns 99% of the shares of Watoto Limited. The amount above represents the Organisation’s interest in Watoto Limited. The Ministry was donated 50 shares by Omer Farming Company worth Ushs 1,000 each

15 INVENTORY Group

WCCM

2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Agriculture Inventory 294,080 221,496 294,080 221,496 Building materials 582 1,946 582 1,946 294,662 223,442 294,662 223,442

WATOTO CHILD CARE MINISTRIES

33

NOTES

TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

16 HELD TO MATURITY INVESTMENTS

Fixed Deposits

Fixed Deposits

Group WCCM

2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

5,974,868 22,982,783 5,974,868 22,982,783

Treasury bills 1,500,057 2,137,269 1,500,057 2,137,269

Unit Trusts 17,902,154 17,902,154

Bonds 4,387,800 4,387,800

Bonds Premium / Discount 573,353 573,353

Total Investments 30,338,232 25,120,052 30,338,232 25,120,052

17 RELATED PARTY BALANCES AND TRANSACTIONS

(a) Amount due from related parties Group WCCM 2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Receivable from Country 764,616 1,258,933 764,616 1,258,933

Watoto Church Ministries 3,806,951 3,423,705 3,806,951 3,423,705

Due from KPL 600 600 600 600

Due from Power Fm 1,108 573 1,108 573

Due from Bobi 444,091 444,091

Loan to Watoto Limited 476,930 476,931 476,930 476,931 Due from Watoto Limited 3,393,899 3,401,897 3,393,899 3,401,897 8,444,104 9,006,730 8,444,104 9,006,730

Less provision for bad debts relating to Watoto Limited (3,894,601) (3,894,601)

Net Receivables from related parties 4,549,503 9,007,730 4,549,503 9,007,730

(b) Amount due to related parties

Watoto Church Ministries 3,728,171 3,259,753 3,727,289 3,259,753

Kampala Playhouse 17,568 17,568 17,568 17,568

Due to Power FM 840 840 840 840 Due to Guest house 51,100 51,100 Watoto Limited 166,773 (407,896) 166,773 (407,896) Due to Bobi 444,090 444,091 Due Childcare Juba 85,602 3,913,352 3,365,455 3,998,072 3,365,456

WATOTO CHILD CARE MINISTRIES

34

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

17 RELATED PARTY BALANCES AND TRANSACTIONS (CONTINUED)

c) Key management compensation Group WCCM 2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000

Salaries and other short term employment benefits 497,543 1,123,612 497,543 1,123,612

Key management personnel include the executive director and leadership team. All transactions with key management personnel relate to payment for employment services and are limited to salaries and short term benefits. The reduction in 2021 resulted from changes in the organisation that led to a reduction of the number of leadership team staff under Childcare. No payments or allowances have been paid to the board members for the year 2021.

18 SUNDRY RECEIVABLES AND PREPAYMENTS Group WCCM 2021 2020 2021 2020 Shs '000 Shs '000 Shs '000 Shs '000 Prepayments 1,161,896 2,386,433 1,151,927 2,386,433

Other debtors 465,394 349,151 465,394 349,151 Accountable advance 1,584 162,024 1,584 162,024

Staff debtors 15,213 (6,593) 15,213 (6,593) Investment Interest receivable 579,038 579,038 2,223,125 2,891,015 2,213,156 2,891,015

Cash and Bank 9,314,009 10,743,427 8,890,488 10,743,427

20 DEFERRED INCOME

At 1 January 464,286 464,286 464,286 464,286 Deferred Donations 1,914 1,914 At 31 December 466,200 464,286 466,200 464,286

21 SUNDRY PAYABLES AND ACCRUALS

Payables 3,040,815 2,928,525 3,018,693 2,928,525 Accruals 1,332,897 2,848,059 1,332,897 2,848,059 4,373,712 5,776,584 4,351,590 5,776,584

WATOTO CHILD CARE MINISTRIES

35

19 BANK AND CASH BALANCES

NOTES

TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021 (CONTINUED)

22 COMMITMENTS AND CONTINGENCIES

The company had no commitments and contingencies as at 31 December 2021

23 EVENTS AFTER THE REPORTING DATE

The COVID 19 pandemic continued to affect business and economics at the timing of these financial statements. The lasting impact on the Organisation is assessed on a continuing basis.

There were no other events after the reporting period which require adjustment to or disclosure in the financial statements.

WATOTO CHILD CARE

MINISTRIES

36

DONATIONS, VISIT WATOTO AND WATOTO MERCHANDISE

1) Detail analysis of donation from Watoto Germany

Date Description

EUROS UGX

1/28/2021 Transfer from Germany 56,325 230,959,983 2/1/2021 Transfer from Germany 8,000 32,804,160 2/26/2021 Transfer from Germany 35,774 156,802,886 3/23/2021 Transfer from Germany 41,426 177,802,195 4/27/2021 Transfer from Germany 16,821 71,843,217 5/21/2021 Transfer from Germany 35,445 153,575,072 6/22/2021 Transfer from Germany 34,955 151,939,249 7/15/2021 Transfer from Germany 34,916 148,328,009 8/25/2021 Transfer from Germany 35,455 137,856,348 9/24/2021 Transfer from Germany 35,542 146,873,637 10/20/2021 Transfer from Germany 35,742 149,669,390 11/25/2021 Transfer from Germany 37,012 148,994,527 12/22/2021 Transfer from Germany 36,029 143,930,169

Sub total 443,443 1,851,378,842

2) Detail analysis of donation from Watoto Switzerland

Date Description EUROS UGX

1/29/2021 Transfer from Switzerland 6,435 26,385,328 4/27/2021 Transfer from Switzerland 5,241 22,383,928 7/15/2021 Transfer from Switzerland 5,311 22,561,988 11/16/2021 Transfer from Switzerland 12,525 50,605,112

Sub Total 29,512 121,936,356

3) Detail analysis of donation from Watoto Netherlands

Date Description USD UGX

1/19/2021 Transfer from Netherlands 34,975 143,413,760 2/22/2021 Transfer from Netherlands 22,704 100,260,114 3/22/2021 Transfer from Netherlands 23,474 101,033,085 4/20/2021 Transfer from Netherlands 22,495 96,076,273 5/11/2021 Transfer from Netherlands 40,323 174,710,481 5/18/2021 Transfer from Netherlands 22,446 97,256,341 6/23/2021 Transfer from Netherlands 22,216 96,566,639 7/21/2021 Transfer from Netherlands 29,673 126,054,382 8/10/2021 Transfer from Netherlands 22,209 86,637,090 10/18/2021 Transfer from Netherlands 22,113 92,599,326 11/22/2021 Transfer from Netherlands 22,027 88,670,349 12/22/2021 Transfer from Netherlands 21,941 87,648,868

Total of Transfers. 370,978 1,557,575,683

37 APPENDIX

1

APPENDIX 1

DONATIONS, VISIT WATOTO AND WATOTO MERCHANDISE (CONTINUED)

4) Detail analysis of donation from Watoto Norway

Date Description USD UGX

1/29/2021 Transfer from Norway. 65,834 240,097,947 3/1/2021 Transfer from Norway. 60,960 223,418,914 3/25/2021 Transfer from Norway. 62,531 229,175,822 4/26/2021 Transfer from Norway. 61,725 226,221,612 5/21/2021 Transfer from Norway. 60,890 219,448,914 6/28/2021 Transfer from Norway. 60,425 217,772,495 7/22/2021 Transfer from Norway. 73,515 261,332,722 8/24/2021 Transfer from Norway. 66,041 232,663,042 9/23/2021 Transfer from Norway. 79,694 281,160,467 10/27/2021 Transfer from Norway. 75,943 270,737,365 11/29/2021 Transfer from Norway. 65,223 231,672,132 12/31/2021 Transfer from Norway. 74,094 261,921,371

Sub Total 806,875 2,895,622,803

Less None Income: 33,067 116,964,112

Total Income 773,807 2,778,658,691

5) Detail analysis of donation from Watoto Hong Kong

Date Description USD UGX

1/21/2021 Transfer from Hong Kong. 231,398 843,907,267 2/25/2021 Transfer from Hong Kong. 196,545 719,748,596 3/22/2021 Transfer from Hong Kong. 201,338 737,499,666 4/22/2021 Transfer from Hong Kong. 185,910 681,358,575 5/24/2021 Transfer from Hong Kong. 215,555 790,007,244 6/22/2021 Transfer from Hong Kong. 162,771 586,634,167 7/21/2021 Transfer from Hong Kong. 169,766 603,484,034 8/20/2021 Transfer from Hong Kong. 161,680 569,437,875 9/28/2021 Transfer from Hong Kong. 159,008 560,819,489 10/28/2021 Transfer from Hong Kong. 162,176 578,158,866 12/17/2021 Transfer from Hong Kong. 162,003 572,681,631 12/17/2021 Transfer from Hong Kong. 169,586 601,181,981

Total 2,177,735 7,844,919,391

38

6) Detail analysis of donation from Watoto Sweden

Date Description USD UGX

1/27/2021 Transfer from Sweden 18,939 69,069,366 3/2/2021 Transfer from Sweden 17,562 64,329,606 3/23/2021 Transfer from Sweden 15,511 56,738,104 6/4/2021 Transfer from Sweden 16,331 58,858,406 7/14/2021 Transfer from Sweden 15,874 56,429,002 7/19/2021 Transfer from Sweden 15,075 53,589,676 8/31/2021 Transfer from Sweden 14,621 51,423,745 9/23/2021 Transfer from Sweden 15,858 55,946,283 11/1/2021 Transfer from Sweden 15,077 53,371,341

Sub Total 144,848 519,755,529

7) Detail analysis of donation from Watoto GDG

Date Description USD UGX

1/27/2021 Transfer from GDG 115,384 420,804,717 3/1/2021 Transfer from GDG 120,250 440,715,296 3/26/2021 Transfer from GDG 105,606 387,044,744 4/30/2021 Transfer from GDG 79,829 292,572,076 05/27/2021 Transfer from GDG 9,985 35,986,339 5/28/2021 Transfer from GDG 100,336 361,614,525 06/29/2021 Transfer from GDG 14,881 43,613,007 6/29/2021 Transfer from GDG 97,951 353,018,275 7/29/2021 Transfer from GDG 177,717 631,748,960 7/29/2021 Transfer from GDG 13,663 48,569,232 8/19/2021 Transfer from GDG 940 3,310,680 8/31/2021 Transfer from GDG 38,866 136,690,069 9/30/2021 Transfer from GDG 98,132 346,110,541 10/8/2021 Transfer from GDG 77,773 276,481,273 10/26/2021 Transfer from GDG 99,492 354,689,372 11/26/2021 Transfer from GDG 93,339 333,220,908

Total 1,244,142 4,466,190,014 Less Non Income 38,529 128,168,578

Sub Total 1,205,613 4,338,021,436

39 APPENDIX 1

DONATIONS, VISIT WATOTO AND WATOTO MERCHANDISE (CONTINUED)

APPENDIX 1

DONATIONS, VISIT WATOTO AND WATOTO MERCHANDISE (CONTINUED)

8) Detail analysis of donation from Watoto New Zealand

Date Description USD UGX

1/28/2021 Transfer from New Zealand

5,715 20,842,241 3/1/2021 Transfer from New Zealand 4,869 17,843,639 3/26/2021 Transfer from New Zealand 4,593 16,832,135 4/30/2021 Transfer from New Zealand 6,924 25,376,387 6/1/2021 Transfer from New Zealand 3,355 12,090,618 6/29/2021 Transfer from New Zealand 3,948 14,229,651 7/29/2021 Transfer from New Zealand 4,254 15,120,591 9/30/2021 Transfer from New Zealand 11,923 42,053,267 11/26/2021 Transfer from New Zealand 9,109 32,517,772

Total 54,689 196,906,301

9) Detail analysis of donation from Watoto Canada

Date Description USD UGX

1/27/2021 Transfer from Canada 224,498 818,743,914 2/19/2021 Transfer from Canada 222,774 816,021,528 3/19/2021 Transfer from Canada 223,975 820,422,183 4/21/2021 Transfer from Canada 229,648 841,660,617 5/11/2021 Transfer from Canada 20,295 73,143,343 5/19/2021 Transfer from Canada 241,044 883,424,904 6/22/2021 Transfer from Canada 238,735 860,408,974 7/16/2021 Transfer from Canada 233,705 830,775,602 8/19/2021 Transfer from Canada 217,978 767,717,425 8/20/2021 Transfer from Canada 1,561 5,497,842 9/21/2021 Transfer from Canada 187,540 661,642,283 10/27/2021 Transfer from Canada 213,833 762,314,039 11/12/2021 Transfer from Canada 1,575 5,583,375 11/23/2021 Transfer from Canada 204,308 729,378,740 12/21/2021 Transfer from Canada 195,760 694,949,106 Total 2,657,229 9,511,683,875

Add Program Costs 136,711 490,902,773

Sub Total 2,793,940 10,062,5686,648

40

APPENDIX 1

DONATIONS, VISIT WATOTO AND WATOTO MERCHANDISE (CONTINUED)

10) Detail analysis of donation from Watoto USA.

Date Description USD UGX

02/04/2021 Transfer from USA 371,681 1,368,014,647 02/25/2021 Transfer from USA 339,308 1,242,547,141 03/01/2021 Transfer from USA 50,000 183,250,000 03/16/2021 Transfer from USA 8,000 29,304,000 03/23/2021 Transfer from USA 346,760 1,268,449,653 04/21/2021 Transfer from USA 341,750 1,250,120,220 04/22/2021 Transfer from USA 5,000 18,020,200 05/03/2021 Transfer from USA 65,000 238,225,000 05/21/2021 Transfer from USA 322,493 1,181,937,066 06/16/2021 Transfer from USA 4,226 15,230,673 06/22/2021 Transfer from USA 340,462 1,207,269,954 06/24/2021 Transfer from USA 45,410 163,657,654 06/28/2021 Transfer from USA 75,000 270,303,000 07/22/2021 Transfer from USA 322,359 1,145,921,240 08/23/2021 Transfer from USA 330,362 1,163,865,538 08/26/2021 Transfer from USA 109,087 384,313,501 09/21/2021 Transfer from USA 301,087 1,062,234,194 10/04/2021 Transfer from USA 66,100 234,985,500 10/11/2021 Transfer from USA 1,904 6,806,800 10/26/2021 Transfer from USA 100,000 356,500,000 11/24/2021 Transfer from USA 297,454 1,061,911,459 12/31/2021 Transfer from USA 313,321 1,134,459,355

Total 4,540,143 16,348,324,589

Add: Program costs 390,769 1,399,420,118

Less: Non Income 23,397 83,909,427

Sub Total 4,907,515 17,663,835,280

11) Detail analysis of donation from Watoto Brazil

Date Description

USD UGX

Transfer from Brazil. 10,956 39,955,109 2/23/2021 Transfer from Brazil. 10,478 38,382,306 3/16/2021 Transfer from Brazil. 9,472 34,694,105 4/15/2021 Transfer from Brazil. 9,904 36,296,877 5/7/2021 Transfer from Brazil. 15,863 58,137,236 6/15/2021 Transfer from Brazil. 10,300 37,120,928 7/23/2021

1/21/2021

Transfer from Brazil. 9,421 33,488,314 8/13/2021 Transfer from Brazil. 9,810 34,531,587 8/31/2021 Transfer from Brazil. 950 3,263,250 9/16/2021 Transfer from Brazil. 9,326 32,828,189 10/20/2021 Transfer from Brazil. 9,178 33,150,286 11/12/2021 Transfer from Brazil. 9,138 32,394,281 12/22/2021 Transfer from Brazil. 8,511 30,212,524

Sub Total 123,305 444,454,992

Add: Program Costs 22,538 81,271,973

Total income 145,843 525,726,965

41

DONATIONS, VISIT WATOTO AND WATOTO MERCHANDISE

12) Detail analysis of donation from Watoto UK

Date Description Pounds UGX

2/15/2021 Transfer from UK 30,000 150,879,900 2/23/2021 Transfer from UK 3,886 19,773,393 4/28/2021 Transfer from UK 53,997 266,853,025 4/22/2021 Transfer from UK 57,411 283,726,743 4/30/2021 Transfer from UK 30,000 148,260,000 5/5/2021 Transfer from UK 23,075 115,153,154 6/18/2021 Transfer from UK 30,000 151,656,300 6/28/2021 Transfer from UK 30,000 151,656,300 7/8/2021 Transfer from UK 30,000 148,384,500 7/6/2021 Transfer from UK 16,858 83,381,405 7/5/2021 Transfer from UK 16,346 80,847,889 8/16/2021 Transfer from UK 30,000 137,708,100 8/12/2021 Transfer from UK 18473 84,956,225 9/3/2021 Transfer from UK 48,898 222,709,740 9/23/2021 Transfer from UK 30,000 145,032,600 11/19/2021 Transfer from UK 16,681 79,002,312 11/23/2021 Transfer from UK 30,000 143,996,100 11/17/2021 Transfer from UK 18,029 85,386,094 12/9/2021 Transfer from UK 44,563 211,955,459 12/22/2021 Transfer from UK 43,268 206,117,498 12/30/2021 Transfer from UK 42,934 204,526,889

Sub Total 644,419 3,121,963,626

Add: Program costs 15,400 75,337,947

Sub Total 659,819 3,197,301,573

Total International Incomes 50,658,602,695

13)

Detail analysis of donation from Watoto Uganda.

Uganda Donation WCCM 773,980,771

Uganda Donation BABY WATOTO 20,426,000

Uganda Donation Neighbourhood 7,416,000

Uganda Visit Watoto 2,310,000

Sub Total 804,132,771

14)

Merchandise Sales.

Watoto Hong Kong 5,827,382

Watoto USA 13,463,290

Watoto Canada 513,100

Watoto Australia 73,594,959 Uganda 493,926,755

Sub Total 587,325,486

The sum of receipts above, UGX 52,050,060,952 includes amounts recognised as receivable in FY20 but realised in FY21. These are not included in the recognised income in note 6.

42 APPENDIX 1

(CONTINUED)