READ THE WASHINGTON INFORMER YOUR WAY:

n In Print – feel the ink between your fingers of our Award Winning Print Edition

n On the Web – www.washingtoninformer.com updated throughout the day, every day

n On your tablet

n On your smartphone

n Facebook

n Twitter

n Weekly Email Blast – sign up at www.washingtoninformer.com

202-561-4100

For advertising contact Ron Burke at rburke@washingtoninformer.com ...Informing you everyday in every way

In Memoriam

Dr. Calvin W. Rolark, Sr. Wilhelmina J. RolarkPUBLISHER

THE WASHINGTON INFORMER NEWSPAPER (ISSN#0741-9414) is published weekly on each Thursday. Periodicals postage paid at Washington, D.C. and additional mailing offices. News and advertising deadline is Monday prior to publication. Announcements must be received two weeks prior to event. Copyright 2016 by The Washington Informer. All rights reserved. POSTMASTER: Send change of addresses to The Washington Informer, 3117 Martin Luther King, Jr. Ave., S.E. Washington, D.C. 20032. No part of this publication may be reproduced without written permission from the publisher. The Informer Newspaper cannot guarantee the return of photographs. Subscription rates are $45 per year, two years $60. Papers will be received not more than a week after publication. Make checks payable to:

THE WASHINGTON INFORMER

3117 Martin Luther King, Jr. Ave., S.E Washington, D.C. 20032

Phone: 202 561-4100

Fax: 202 574-3785

news@washingtoninformer.com

www.washingtoninformer.com

Denise Rolark Barnes

STAFF

Micha Green, Managing Editor

Ron Burke, Advertising/Marketing Director

Shevry Lassiter, Photo Editor

Lafayette Barnes, IV, Editor, WI Bridge DC

Jamila Bey, Digital Content Editor

Austin Cooper, Our House Editor

Desmond Barnes, Social Media Stategist

ZebraDesigns.net, Design & Layout

Mable Neville, Bookkeeper

Angie Johnson, Office Mgr./Circulation

REPORTERS

Kayla Benjamin, (Environmental Justice Reporter) Stacy Brown (Senior Writer), Sam P.K. Collins, Curtis Knowles, Brenda Siler, Lindiwe Vilakazi, Sarafina Wright, James Wright

PHOTOGRAPHERS

Shevry Lassiter, Photo Editor, Roy Lewis, Jr., Robert R. Roberts, Anthony Tilghman, Abdula Konte, Ja'Mon Jackson

We are proud to be the Presenting Sponsor of the 2024 Washington Informer Homeownership Special Section.

The homeownership journey is just that – an ongoing process that doesn’t simply start and end when you get the keys to your first home. In my role as the Head of the African American Segment with Wells Fargo’s Home Lending Diverse Segments team, I am responsible for creating and implementing strategies to address the disparity in wealth and homeownership that we face as a nation, with a specific focus on advancing Black homeownership. We are deeply committed to working hard to close the gap and create a more inclusive housing system. One way to do this is through education. In this year’s publication, we explore opportunities to build the knowledge and leverage the tools available to help provide confidence and support at each stage of homeownership.

We start with a spotlight on an exciting new partnership that underscores Wells Fargo’s commitment to Historically Black Colleges and Universities (HBCUs) and the importance of laying a strong foundation of financial literacy on the path to future homeownership. The “A Different World tour,” visiting HBCUs throughout the country this year, aims to raise awareness and enrollment for HBCUs. Wells Fargo’s sponsorship celebrates HBCU culture and helps us offer college students helpful resources about scholarships, career opportunities, and building generational wealth.

Next, an interview with HomeFree USA shares the importance of getting prepared to buy a home before you’re ready to make an offer. Ensuring you’re ready to take such a huge financial step is easier with the information you need.

We round out this series with a focus on two topics that face those who already own a home. The first provides advice to help homeowners keep their home if they are facing financial hardship; the second outlines the importance of passing along assets, including real estate, to build generational wealth for future generations.

We hope this information provides a helpful framework for wherever you or your loved ones are on the path of homeownership. We’re proud to collaborate with industry, governmental, and local stakeholders in markets across the country to do what we can to address the racial homeownership gap and look forward to continuing this important work together. n

The homeownership journey is just that –an ongoing process that doesn’t simply start and end when you get the keys to your first home.

By Zerline Hughes Spruill WI Our House Editor

By Zerline Hughes Spruill WI Our House Editor

Today’s housing market can easily take “a whole lotta tryin’ just to get up that hill” of owning a home.

For many in the U.S. who have the financial means, buying a home is a rather simple activity, particularly–plainly stated–when you’re white.

On the contrary, for Black homebuyers around the country–even those who are financially secure–the process of buying a home can often mimic a defensive driving course due to discrimination in lending, racist home appraisals, and lack of resources. The process is oftentimes so layered with barriers, that one could call it a trivial

pursuit of property, calling back to the original Declaration of Independence phrase penned by John Locke.

Despite the vestiges of American history and the time period when Black people were, in fact, considered said property, the movement around homeownership inclusivity has been growing since the introduction of the Fair Housing Act of 1968, making space for more Black homeowners to join the big leagues and get a turn at bat to acquire and maintain homes, and pass down estates.

National and local programs and initiatives, accommodating loan products, and ongoing advocacy and education have contributed to an upward trend in Black homeownership, but the numbers are still not near

those of other racial and ethnic groups. As of 2022, the rate of Black homeownership in the U.S. came in at 44%, while the rate for white homeownership was 72.3%, according to the National Association of Realtors.

Hispanic and Asian homeownership rate is at 51.1% and 63.3%, respectively.

It is critical the percentage for Black homeownership increases because the path to becoming home secure leads to long-term financial wellbeing, stability, and the opportunity to legacy build.

The federal government, and specifically, Washington, D.C. and Prince George’s County administrations have implemented several initiatives to specifically ensure Black residents have an opportunity to finally get a piece of the pie. Knowing what those

programs are, who is eligible and how to access them is key.

To keep you up-to-date, this 2024 Homeownership Month edition includes insights on breaking through as a first-time homebuyer, tips on keeping a home in the family, and resources around selling to upgrade, downsize or become a nomadic traveler.

Our sponsors, partners, policy makers and organization leaders provide a plethora of information for prospective homeowners, homeowners and those who may inherit property to feel empowered and experience the Black joy that is home ownership in the DMV. In the lyrical words of Ja’Net Du’Bois, ‘there ain’t nothin’ wrong with that.’

Here’s to ‘movin’ on up.’ n

As the leading large bank lender to African Americans Wells Fargo understands that our strength comes from working together across the country to achieve racial equity in homeownership.

Our close collaboration with prominent African American civil rights organizations, real estate trade groups, and housing counseling agencies helps bring home buying information and resources to more communities.

At Wells Fargo we also continue to optimize our teams to better serve you and help you create a home buying journey that is right for you and your family.

Scan to learn more about our Home Lending Priorities

For many Black families, Thursday night in the late 80’s and early 90’s meant gathering around the TV to watch A Different World. This iconic series, inspired by student life at historically Black colleges and universities (HBCUs), was a cultural force that continues to influence Black audiences, in part because of its honest portrayal of social and political issues.

This year, the show’s cast is reuniting for the “A Different World (ADW) Tour” and visiting select HBCUs. Their goal: raise awareness and enrollment for HBCUs nationwide using the star power and cultural impact of the show. Inspired by this goal and building on a commitment to HBCUs and the Black community, Wells Fargo stepped up as the premier financial partner of the tour to celebrate HBCU culture and offer helpful resources about scholarships, career opportunities, homeownership and building generational wealth.

“It’s so important to lay a strong foundation of financial literacy during the formative college years,” shares Dewey Norwood, Wells Fargo Senior Lead Diversity & Inclusion Consultant, Enterprise HBCU Strategy. “Investing in HBCUs and organizations that support them is essential at Wells Fargo, and working with the A Different World cast and tour team aligns with our efforts to make a meaningful impact with students, alumni and community supporters of HBCUs.”

This spring, the Wells Fargo team was on-site for the tour events in

Washington D.C., hosted by Howard University. The first event was a reception held at the Black, women-owned Salamander Luxury Hotel where student DJ Madyson Patterson (aka DJ Wild Child) set the tone for the event and guests enjoyed food created by James Beard Award winner chef Kwame Onwuachi. Attendees included ADW cast members and staff from the tour, Wells Fargo employees, and partners in the Diverse Segments space, such as HomeFree USA, the Mortgage Bankers Association, and Bowie State University student mentees from a university leadership program.

“The reception was a great way to kick off this stop of the ADW tour,” emphasized Ewunike Brady, Head of the Home Lending African American Segment for Wells Fargo. “Seeing HBCU students and future leaders alongside the partners that we work so closely with to help empower Black communities and close the homeownership gap was truly inspiring.”

The next day, the “Hillman Takeover at Howard” began at midday and included music, swag giveaways, and more as students lined up for hours to enter the auditorium. That evening, with a packed house, the ADW cast held a panel discussion covering a wide range of topics and student questions.

“Our commitment to this tour demonstrates the significant impact that we know homeownership makes for the future success of Black Americans,” emphasizes Brady. “We’re proud to be part of this community of partners working together to inspire future generations – to celebrate our past and build for tomorrow.” n

A life of hard work and sacrifice offers the opportunity to leave a legacy that lifts up not only your family, but your community. There are important considerations as you approach financial planning to transfer wealth to future generations.

Creating an estate plan is a foundational step. While it can seem intimidating, a team of trusted professionals, including a financial advisor, estate planning attorney, and accountant, can ask the right questions and help you avoid potential pitfalls.

“Developing an estate plan is about taking control. You are directing how the assets you have accumulated over your lifetime are passed on to the people and organizations that you care about,” says John Ripoll, Senior Vice President for Wells Fargo Advisors. Your situation’s complexity will determine which documents your plan

requires; however, these five are often included in an estate plan:

A will provides instructions for distributing your assets to your beneficiaries when you die. In it, you name a personal representative (executor) to pay final expenses and taxes and distribute your remaining assets.

A durable power of attorney lets you give a trusted individual management power over your assets if you can’t

manage them yourself. This document is effective only while you’re alive.

A health care power of attorney lets you choose someone to make medical decisions for you if you are unable to communicate your wishes, or don’t have legal capacity to make treatment decisions for yourself.

A living will expresses your intentions regarding the use of life-sustaining measures if you are terminally ill. It doesn’t give anyone the authority to speak for you.

By transferring assets to a revocable living trust, you can provide for continued management of your assets during your lifetime and after your death — possibly for generations to come.

Establishing a plan is only the beginning. Significant life events are likely to call for changes to your plan.

Ripoll explains, “It’s important to regularly review your plan to ensure it continues to meet your needs. You want to consider whether your estate planning documents, asset titling, and

beneficiary designations have been coordinated to allow your assets to be distributed according to your wishes. A regular review of who you have named

as agent, executor, guardian for minor children, and trustee is important to ensure those named are still willing and able to serve when needed.”

Investment and Insurance Products are:

• Not Insured by the FDIC or Any Federal Government Agency

• Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

• Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company.

©2019-2023 Wells Fargo Clearing Services, LLC. All rights reserved.

Considerations and tips to help retain homeownership amid challenging situations.

Once the dream of homeownership has become reality, some may find themselves facing the challenge of staying in their home. Whether it’s unexpected medical bills, job loss, or changes in the market, there are resources available to assist families in the face of hardships.

How important is it to contact your mortgage company if you happen to run into financial challenges?

Wells Fargo and other servicers engage with customers through emails, letters, and by phone to help address payment challenges. It is important that customers respond to this outreach or contact their servicers. Often, there are programs that might be available to help – but we can’t help homeowners unless they work with us.

What is the best advice you would give to someone who has fallen behind on their mortgage?

Please do not wait until the mortgage is severely past due. Call your mortgage servicer as soon as you know you cannot make your monthly payment. The phone number is listed on your monthly bill. Explain why you cannot make your monthly payment

and ask the servicer for assistance.

What resources are available to help homeowners who are faced with payment challenges?

In addition to some programs through your servicing provider, United States Department of Housing and Urban Development (HUD) certified housing counseling agencies are a trusted resource for homeowners who are looking for local assistance. If you need help dealing with broader financial challenges, reach out to a local HUD-approved, non-profit housing counseling agency for financial education, mortgage help services, and other free assistance. You can find a local, trusted HUD approved housing counseling agency at: http://www. hud.gov/counseling. n

Purchasing a home is the ultimate goal for many U.S. households. The thought of choosing to paint rooms any color under the rainbow, hammer nails into the walls to hang favorite photos and art pieces, and simply having a safe space that doubles as a personal investment is shared by many.

In pricey markets including the DMV area, many think the prospect of becoming a homeowner is far-fetched. Rising home prices, increasing interest rates and the harsh reality of real estate race disparities can be discouraging setbacks. Luckily, homebuying guidance and preparation can turn those obstacles into homeownership opportunities, according to Milan Griffin, Chief Operating Officer of HomeFree-USA. HomeFree-USA, in collaboration with lending partners like Wells Fargo, are helping renters become homeowners.

“When people are ready to start the homebuying process, they usually call a realtor or loan officer first, instead of a HUD-certified Homeownership Advisor,” said Griffin. Doing so, hurts homebuyers by limiting their access to money-saving mortgage programs and increases the likelihood of loan denial. There are so many things’ people don’t know about the process,” Griffin added.

“Homebuyers get stuck because they are overwhelmed with the amount of required paperwork, lender requirements, programs, steps, etc. Homeownership Advisors make the process easier by helping homebuyers overcome the four biggest obstacles to homeownership – credit, debt, savings, and downpayment.

“Studies show Black mortgage applicants are denied a mortgage 84% more often than white applicants. Credit is the biggest barrier to approval but it’s not just a low score holding buyers back. Surprisingly, we see buyers who come to HomeFree-USA with a 700-credit score after being denied for a mortgage because their debt is too high. A quick financial review with a Homeownership Advisor, before meeting with a loan officer, helps to ensure buyers are

truly ready for mortgage approval. Ninety-six percent of buyers that HomeFree-USA refers to lenders are approved the first time.”

“When homebuyers go straight to realtors, they run the risk of being connected to one lender instead of being presented with additional mortgage options.

“When people are ready to start the homebuying process, they usually call a realtor or loan officer first, instead of a HUD-certified Homeownership Advisor,” said Griffin. Doing so, hurts homebuyers by limiting their access to money-saving mortgage programs and increases the likelihood of loan denial

Starting with homeownership guidance positions buyers to research, qualify

for, and access affordable loan and downpayment programs many don’t know exist. More options mean bigger savings and money to cover expenses as a new homeowner. HomeFree-USA members secure an average of $18,000 in downpayment assistance.”

Founded 30 years ago by her parents, Marcia and Jim Griffin, CEO and Co-CEO respectively,

HomeFree-USA is a nonprofit organization created to build the foundation to close the wealth gap by educating and developing financially-prepared, sustainable homeowners. Approved and certified by the U.S. Department of Housing and Urban Development (HUD), HomeFree-USA offers an array of services including stepby-step homeownership guidance, foreclosure prevention counseling, property development, neighborhood revitalization, and training for emerging real estate developers.

HomeFree-USA’s Center for Financial Advancement (CFA) provides financial education and recruitment for HBCU students.

Thanks to partners like Wells Fargo, 12,000+ students from 15 HBCUs have learned the tenants of credit, homeownership, and leadership while accessing internship opportunities in the mortgage and real estate finance industry.

Wells Fargo’s latest effort to help homebuyers is its Homebuyer Access Grant totaling $10,000 [https://sites.wf.com/ accessgrant/]. For those eligible, repayment is not required, and the grant can be combined with additional programs. For this and

most grants, housing counseling is required to qualify.

Today’s housing market is expensive. A recent Forbes Magazine article [https://www.forbes.com/ advisor/mortgages/real-estate/ median-home-prices-by-state/], shows the median home prices by state. Despite the fact that home prices and interest rates may seem prohibitive, Griffin says that should not deter those considering homeownership.

“When it comes to high-priced markets, like D.C. and Atlanta, there’s still opportunities to purchase a home,” she said. “When you speak to a Homeownership Advisor, they will strategize ways to reduce debt and suggest downpayment programs to boost your buying power. Even those receiving a Housing Choice Voucher (formerly known as section 8), can use it to buy a home and receive monthly assistance to meet homeownership expenses.

For more information on HomeFree-USA’s homebuying program, visit https://homefreeusa.org/homeowners/ or call 855493-4002. n

D.C., Prince George’s County and Biden-Harris Administration Working to Increase Black Wealth

By Zerline Hughes Spruill WI Our House EditorSixty percent of individuals and families in the U.S. own their homes. The race disparity in housing across the country, however, is stark, causing a major home ownership gap between Black and white families. So stark that, according to research, 5,000 Black individuals and families would have to buy a home every week over the next 10 years in order to close the gap.

The numbers don’t lie: 73% of homeowners are white, compared to 44% of Black homeowners–a 29% gap, according to the 2023 Census. In Washington, D.C., the white home ownership rate is 47%, while Black home ownership comes in at 39%–an 8% gap. This disparity not only tells a story of disproportionate access and the impact of discrimination, it explains the overall wealth gap between the two racial groups and how Black people continue to be left behind.

The government–from the Biden-Harris Administration, to DMV-area jurisdictions–is working to overhaul housing discrimination, make home buying more affordable, and build wealth for Black buyers. Responding with policies, programs, products, and partnerships, government agencies in Washington, D.C. and Prince George’s County, Maryland, are prioritizing the needs of Black people to ensure homeownership is woven into the legacies of Black households starting now.

“Particularly for our FHA products, we know that we’ve already helped just in the past couple years, 160,000 Black homeowners avoid foreclosure and 250,000 new Black homeowners buy a home,” HUD Interim Secretary Adrianne Todman told The Washington Informer. “We have worked really hard to make sure Black families keep their homes. Even

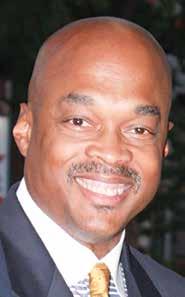

5 HUD Acting Director Adrianne Todman this month announced new FHA funding to promote fair housing and root out discrimination.

(Courtesy Photo)

in the midst of the roller coaster of the past few years with the pandemic, home rates increasing, interest rates increasing, HUD is really proud of that number. Many of our consumers of our FHA mortgage insurance tend to be Black and Brown folks who have a difficult time in the conventional market.”

The administration has budgeted $10 billion for the 2025 budget to help first generation homeowners to help nearly a half million families purchase a home. Todman said this is key in decreasing the racial gap.

“It’s an idea we hope will get some uptick in congress,” she said. “We are helping to reduce fees for firsttime homeowners who are Black and Brown in order for them to get access to their dream of earning a home,” said U.S. Department of Housing and Urban Development (HUD) Acting Secretary Adrianne Todman. “President Biden made sure we pri-

Submitted by DC Housing Finance

This year DC Housing Finance Agency (DCHFA) is celebrating 45 years of service to the District. Homeownership is one of the cornerstones of our legacy, present and future.

DCHFA’s Single Family Programs division creates homeownership opportunities in the District by providing low-cost single-family mortgages and down payment assistance, made possible through the issuance of mortgage-backed securities. The agency offers a variety of programs for current and potential homeowners with the goal of expanding and retaining homeownership opportunities through DCHFA’s homeownership resources.

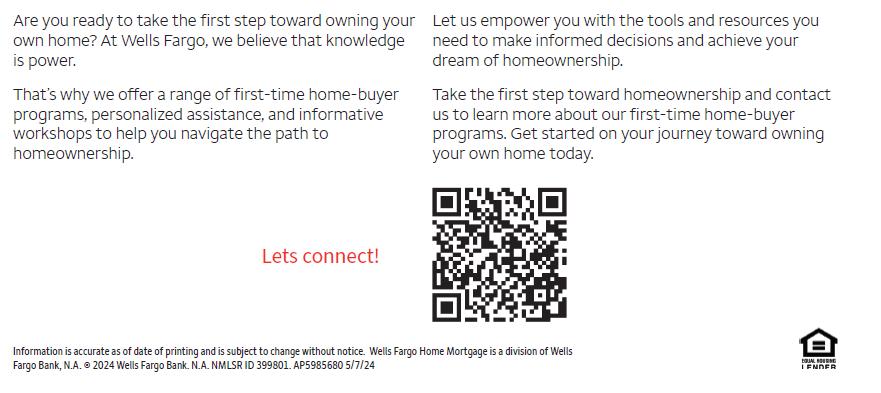

DC Open Doors

DC Open Doors makes homeownership in Washington, D.C. affordable by offering qualified buyers home purchase loans, down payment and closing cost assistance. The program offers deferred repayable loans for a homebuyer’s minimum down payment requirement in addition to first trust mortgages for the purchase of a home. Qualified first-time and repeat homebuyers are eligible for the program.

DC Open Doors can be accessed

by working with DC Open Doors participating lenders who offer DCHFA’s mortgage loan products. Over the past decade DC Open Doors has lent more than half million dollars in first trust loans and down payment assistance that have helped over 1,800 people become D.C. homeowners. Visit www. DCHFA.org for the list of participating lenders and full DC Open Doors qualifications.

DCHFA launched DC4ME in 2019 to provide D.C. government employees mortgage assistance in the form of a zero percent deferred subordinate loan. Qualified District government employees can receive a reduced interest rate first trust mortgage with optional down payment assistance.

DC4ME is offered to full-time District government employees, including those may not meet the criteria for the Employer-Assisted Housing Program administered by the DC Department of Housing and Community Development. Under DC4ME, all D.C. government-based instrumentalities, independent agencies, D.C. public charter schools and organization that fall under the oversight of the Council of the District of Columbia qualify for the program. Happy Homeownership Month!

On Saturday June 22, we invite future D.C. homeowners to join us for DCHFA's Homeownership Fair, 10 a.m. to 3 p.m. at Gallaudet University’s Kellogg Conference Hotel (800 Florida Avenue NE, Washington, DC 20002). Attendees will have the opportunity to connect with local lenders, real estate agents and DC government agencies while learning more about D.C. homebuying programs, credit repair options, and much more. This day will be filled with valuable information and helpful resources on buying a home. The event is free and open to the public. Attendees may registered via the QR code in our ad or at https://www.eventbrite.com/e/dchfa-homeownership-conference-tickets-910665734727.

Homeownership plays a pivotal role in building intergenerational wealth but largely remains elusive in the African American community. To understand why, we must examine the obstacles that have prevented the growth of Black wealth.

Where We've Been

Michael Innis-Thompson, Head of Community Development and the Fair Lending Center of Excellence at TD Bank, said, “In college, when I studied American history and the New Deal, I learned about a positive series of programs to support a fallen economy. But I didn't learn until later how one of these government-sponsored agencies — the Federal Homeowners Loan Corporation (HOLC) — was one of the most detrimental decisions to impact Black homeownership in American history.”

HOLC established uniform ap-

praisal methods to help people keep their homes. It also created a legal system that considered race as a fundamental factor in deciding the value and desirability of a neighborhood, and redlining began. Neighborhoods with high minority populations were shaded red for high risk, so lenders avoided those areas. This discriminatory practice prevented many Black families from buying during the 1950s and 1960s boom, while those who received loans often had very high interest rates, equivalent to predatory lending.

The Fair Housing Act (FHA) of 1968 made redlining illegal, but the economic impact had already taken root.

The homeownership and wealth gaps are wider today than in 1960, when housing discrimination was still legal. Some data to consider:

• According to the U.S. Census Bureau, as of Q4 2023, the white homeownership rate was 73.8% while the Black homeownership rate was 45.9%.

• Median wealth for white families is $184,000 compared with $23,000 for Black families, reported the Federal Reserve Bank of St. Louis.

• Freddie Mac found that Black and Hispanic individuals are more likely to have a credit score of 660 and below than white and Asian individuals. That translates to higher costs for credit like car and home loans.

TD has committed to increasing homeownership by further diversifying its mortgage salesforce in Philadelphia and other communities. The bank launched a Special Purpose Credit Program — TD Home Access Mortgage — designed to increase homeownership for Black and Hispanic individuals. The Equal Credit Opportunity Act and Regulation B permit lenders to extend credit to persons who may not otherwise qualify and can be based on factors like race.

TD Home Access Mortgage offers a $10,000 lender credit toward closing costs or a down payment for purchases that do not need to be repaid. Along with a greater debt-to-income (DTI)

ratio and expanded underwriting requirements, it provides a pathway to make homeownership more affordable.

Other steps include:

• Expanding FICO score requirements, DTI and loan-to-value qualifications for TD Bank Right Step Mortgage

• Reducing home equity loan minimum from $25,000 to $10,000

• Launching TD Essential Banking, a low-cost, no overdraft fee deposit account

• Creating TD's Fair Lending Center of Excellence to further reinforce and advance its commitment to fair and responsible banking.

Meaningful work is being done to increase opportunities for Black families to buy homes and build generational wealth. But it will take every one of us to make changes and repair the damage. The best way to accelerate Black homeownership is to provide more equity and to actively be a part of the change. n

https://www.td.com/us/en/about-us/communities/investment

At United Bank, our goal is to make your home buying experience as seamless as possible. We have highlighted key guidelines to help keep your finances in order as you prepare for your journey home. If you have questions, you should always speak with a credit counselor or other credit professional.

Keep in mind any changes to your current financials, could affect your current financial picture. We are always here to provide guidance and advice as you begin your home buying journey.

DO

• Find a Realtor® you love

• Stay current on your rent and all monthly bills

• Remain with your current employer

• Keep your credit line below 30% of their maximums

• Check your credit score

• Find and organize financial documents

• Contact us if you have any questions

DON’T

• Apply for new credit cards, loans, or purchase offers

• Deposit or withdraw large amounts of cash

• Change jobs, your pay structure, employment status or shift any investments

• Change banks or transfer c redit card balances

• Make large purchases

At United Bank, we strive to make the mortgage process as simple and straightforward as possible. It all starts with reaching out to a member of our mortgage team or filling out our easy online application. From there, one of our knowledgeable mortgage loan officers can help you find the best loan option for your needs, then continue to work with you every step of the way on your home-buying journey—through closing day and beyond.

United Bank | NMLS ID 522399 (www.nmlsconsumeraccess.org) | Member FDIC | Equal Housing Lender | BankWithUnited.com n

Do you dream of owning a home, but have limited funds for a down payment and closing costs? United Bank’s Journey Home Grant* may be the answer to your home buying dreams.

UP TO $10,000 FOR DOWN PAYMENT & CLOSING COSTS

Begin Your Journey. Start an Online Application Today.

*Journey Home Grant is only available in select market areas. All loans subject to credit approval. For all loan requirements and full loan disclosures visit BankWithUnited.com/Mortgage-Disclosures.

United Bank NMLS ID 522399 (www.nmlsconsumeraccess.org). Advertising

Notice Not a Commitment to Lend - Subject to Program Availability. All loan applications subject to credit approval. Annual Percentage Rate (APR), programs, rates, fees, closing costs, terms and conditions are subject to change without any notice and may vary depending upon credit history and transactions specifics. Other closing costs may be necessary. Flood and/or property hazard insurance may be required. To be eligible, buyer must meet minimum down payments, underwriting and program guidelines.

NMLS ID 459546

While it’s fun to go house-hunting and dream about moving into your future home, it’s important to keep in mind that buying a home is one of the biggest investments most of us will make during our lifetime.

Becoming a homeowner is a longterm commitment that costs much more than just the down payment. Before you dive in, take the time to do your research. There’s a lot to

know, and you can avoid many mistakes simply by being informed.

Here are some recommendations to help you prepare:

1) Define what you want and need in a home.

First decide on your non-negotiables: How many bedrooms do you need? What about backyard size and features, proximity to schools or work, or neighborhood features?

Then decide what would be nice to have, but isn’t necessarily a dealbreaker, like landscaping, a pool, or specific décor.

When defining your wants and needs, think about which items are personal preference vs. which would add value to your home.

Before your first house-hunting appointment, make a wish list or search online for a helpful home-buying checklist. Some of the nice-tohaves can be added later when your budget allows.

2) Understand how the home-buying process works.

• Determine your budget and what you can afford, especially your cash reserves for a down payment. A good rule of thumb is to look at homes priced at two to three times your annual income, keeping in mind that each homebuyer’s financial scenario is unique. Be careful not to take on a mortgage you’re not comfortable you can afford.

• Prepare for your house-hunt. Write down your wish list, including features you must have vs. features that would be nice to have and location and/or neighborhoods you want to consider.

• Find a good mortgage lender with an excellent reputation and get prequalified. You can get started by researching United Bank’s mortgage loan officers.

• Research homeowner’s insurance. Do you need additional coverage for floods, tornado, wind damage and wildfires that aren’t covered by basic insurance?

• Consider hiring a real estate agent to help you in your search or start house-hunting on your own.

• When you find the right home, make an offer.

3) Compare mortgage rates.

There are many options for comparing mortgage rates. The easiest way to start is by searching online. Two common mortgage types are fixed-rate mortgages and adjustable-rate mortgages (ARMs). There are also low-down payment programs that provide greater flexibility to meet your financing needs.

Make sure you completely understand the rates, terms and whether the mortgage comes with a prepayment penalty or not. Don’t be afraid to ask questions. If you’re unsure

where to begin, speak with a mortgage loan officer on our team.

4) Is buying a fixer-upper a good idea?

You might find a home in your dream neighborhood that needs work. Know that a fixer-upper can easily take you over your budget.

If you’re willing to spend extra on renovations (with confidence that you have the funding you need and that you know a trustworthy contractor), then maybe a project home is a good fit for you. However, beware of additional expenses, such as electrical upgrades and labor costs.

Every homebuyer should get a thorough home inspection and get at least three quotes before hiring a contractor. Consider an additional inspection when it’s raining, to thoroughly check the basement and foundation.

What if you discover one problem that leads to another? Do your research and ask a lot of questions to make sure you understand everything, especially worst-case scenarios. At United Bank, we strive to make the mortgage process as simple and straightforward as possible. It all starts with reaching out to a member of our mortgage team or filling out our easy online application. From there, one of our knowledgeable mortgage loan officers can help you find the best loan option for your needs, then continue to work with you every step of the way on your home-buying journey—through closing day and beyond.

United Bank | NMLS ID 522399 (www.nmlsconsumeraccess.org) | Member FDIC | Equal Housing Lender | BankWithUnited.com n

Do you dream of owning a home, but have limited funds for a down payment and closing costs? United Bank’s Welcome Home Grant* may be the answer to your home buying dreams.

Begin Your Journey. Start an Online Application Today.

*Welcome Home Grant is only available in select market areas. All loans subject to credit approval. For all loan requirements and full loan disclosures visit BankWithUnited.com/Mortgage-Disclosures. United Bank NMLS ID 522399 (www.nmlsconsumeraccess.org). Advertising

Notice Not a Commitment to Lend - Subject to Program Availability. All loan applications subject to credit approval. Annual Percentage Rate (APR), programs, rates, fees, closing costs, terms and conditions are subject to change without any notice and may vary depending upon credit history and transactions specifics. Other closing costs may be necessary. Flood and/or property hazard insurance may be required. To be eligible, buyer must meet minimum down payments, underwriting and program guidelines. UP TO $10,000 FOR DOWN PAYMENT & CLOSING COSTS

If you are a first-time homebuyer, you could be eligible for up to $25,000 in down payment and closing cost assistance toward the purchase of your first home. Pathway to Purchase is a 0% interest, deferred payment loan. The loan is forgiven after 10 years as long as the home is your primary residence and you do not sell or transfer the home during the 10 year period.

If you are a first-time homebuyer, you could be eligible for up to $25,000 in down payment and closing cost assistance toward the purchase of your first home. Pathway to Purchase is a 0% interest, deferred payment loan. The loan is forgiven after 10 years as long as the home is your primary residence and you do not sell or transfer the home during the 10 year period.

The Prince George’s County’s home ownership assistance program, “Pathway to Purchase,” has issued new guidelines for eligible first-time home buyers. The program now offers up to $25,000 in down payment and closing cost assistance toward the purchase of a home. Home buyers can purchase a home anywhere in Prince George's County. Eligible residential properties include new construction, resales, and foreclosures.

land’s Mortgage Program and eligible home buyers can receive an additional $6,000 toward the down payment and closing cost. Additionally, if the home buyer participates in the State’s Partner Match, they can receive a dollar-to-dollar match of up to $2,500.

If you are a could be down payment assistance toward the purchase Pathway to payment is forgiven after 10 years as your primary transfer the period.

If you are you could payment toward the purchase Pathway to payment 10 years your primary the home period.

If you you could payment toward the purchase Pathway payment after 10 your primary the period.

The maximum price for homes purchased with Pathway to Purchase assistance is $432,000 for re-sale homes and $499,000 for new construction. The home must pass a Housing Quality Standards (HQS) Inspection as part of the application process.

“This important partnership with Maryland Department of Housing and Community Development and the private sector allows us to meaningfully address affordable homeownership” said Aspasia Xypolia, Director of the Prince George's County Department of Housing and Community Development. “This dedicated funding will help people get on the path to home ownership. We are eager to continue our progress in helping families begin their pursuit of the American Dream.”

the buyer(s)

Eligible homebuyers using the Maryland Mortgage Program can now receive even more assistance! To learn more, visit the Maryland Mortgage Program at www.mmp.maryland.gov For more information, visit the Redevelopment Authority at www.princegeorgescountymd.gov

$432,000 Resale $467,000 New Construction Any residential property including: New Construction Resale Purchaser may pay back the loan in full when the home is sold, transferred or ceases to be the primary residence of the buyer(s)

Eligible homebuyers using the Maryland Mortgage Program can now receive even more assistance! To learn more, visit the Maryland Mortgage Program at www.mmp.maryland.gov

Eligible homebuyers using the Maryland Mortgage Program can now receive even more assistance! To learn more, visit the Maryland Mortgage Program at www.mmp.maryland.gov

Pathway to Purchase is a 0% interest loan program that must be paid back when the home is sold, transferred, or ceases to be the primary residence of the buyer(s). However, if the home buyer resides in the home for 10 years, the loan is forgiven, and the lien is released.

The Department of Housing and Community Development (DHCD) has partnered with the State of Mary-

The Redevelopment Authority of Prince George's County administers the program. Home buyers must work with an approved mortgage lender to submit an application. More information can be found on the Pathway to Purchase website. n

For more information, visit the Redevelopment Authority at www.princegeorgescountymd.gov

For more information, visit the Redevelopment Authority at www.princegeorgescountymd.gov

There has been a lot of news lately about pending changes coming to the real estate industry and what these changes mean for homebuyers and sellers. With over 50 years as a dedicated REALTOR® in Prince George’s County Maryland, I’d like to address the subject.

Some media outlets have suggested that home prices will drop, and home sellers will save money. Think about it, those statements are contradictory. Lending affordability, inventory, and location, location, location, are the determining factors in home price evaluations. Not industry business models and court settlements.

Because of a recent settlement agreement between the National Association of REALTORS® and home sellers two things are changing. First, properties listed on the multiple listing service or MLS (the database used by real estate professionals) will no longer include an offer of compensation to buyer’s agents.

While broker commissions have always been negotiable, this new rule clarifies that buyers and their broker representatives will need to negotiate compensation directly, without relying on offers made through an MLS. Meaning, real estate professionals will no longer communicate offers of compensation via the MLS.

However, to help attract buyers, sellers can still offer buyer concessions, such as covering closing costs, which can be listed on the MLS.

Second, homebuyers who want to work with a broker will need to sign a written agreement before touring a home.

In Maryland, nothing changes, real estate licensees are already required to use a written buyer’s representation agreement when working with potential buyers. This document establishes a clear understanding of the broker’s role, responsibilities, and compensation from the start. Buyers will discuss and agree on these details before beginning their home search. This upfront agreement helps ensure that there are no surprises regarding fees or services provided.

Historically, nearly 9 in 10 homebuyers have opted to work with a real estate agent or broker, as they navigate the complexities of

purchasing a home. REALTORS® help their clients navigate a maze of forms and complex paperwork; coordinate with lenders, inspectors, appraisers, escrow companies, and other professionals to ensure a smooth transaction. They represent consumer interests in pricing, negotiation, and closing, making the process less daunting and more efficient.

While the recent settlement brings changes to our industry, it reinforces the importance of clear communication and agreement

between brokers and their clients. Homebuyers are encouraged to ask questions about their agent’s services and compensation, and to feel confident in negotiating terms that work best for them. As REALTORS®, our commitment to serving your best interests remains steadfast.

For more information or to find a REALTOR® who can help you navigate these changes, please visit our website (PGCAR.com), or contact the Prince George’s County Association of REALTORS®.

The Voice for Real Estate in Prince George's County PGCAR is the voice for REALTORS® in Prince George's County, Maryland. Representing more than 3,500 real estate professionals in the national capital area, PGCAR is an affiliate of the Maryland and National Association of REALTORS®. We are proud to serve our members and our community and work to ensure professionalism in the industry. We proudly endeavor to promote and protect homeownership and private property rights. n

oritize equity and how we think about programs and rules,” said Todman. “He said we need to do everything we can to help first-time homebuyers and first generation homebuyers, folks whose parents or grandparents didn’t own a home. That has been our true north from the beginning when he was sworn into office and we have been in lockstep.”

Formerly known as Chocolate City, increasing Black homeownership in Washington, D.C. may sound like a dichotomy. Nevertheless, Mayor Muriel Bowser in 2022 introduced the Black Homeownership Strike Force (BHSF) to increase Black homeownership for 20,000 people by 2030.

When Bowser made the announcement, she said the goal of the Strike Force was an effort to undo “the lasting legacy of discriminato-

ry housing laws that locked many Black families out of homeownership throughout the 20th century,” with the goal of building generational wealth.

Operated by the Deputy Mayor for Planning and Economic Development (DMPED), the Strike Force published a report with 10 recommendations including holding the District accountable for providing estate planning resources and legal services to assist with the transfer of ownership of homes, and discouraging the conversion of older housing stock into unaffordable homes for Black homebuyers, and instead ensures quality housing rehabilitation. The report also recommended the District support Black homeowners at risk of foreclosure, and protect them from unwanted solicitation regarding the sale of their homes.

An additional program available to all, regardless of background, is the D.C. Inclusionary Zoning Affordable Housing Program which can help increase Black homeownership, in addition to getting prospective homeowners used to the idea of owning a home.

Established in 2009, this program provides units for rent and sale to eligible individuals and families in new units throughout the District in the burgeoning D.C. Wharf neighborhood on Water Street, SW, or the centrally located Gibson and Seven Shepard Park condos on Georgia Avenue.

Prince George’s County, made up of 27 municipalities, was once deemed “A Livable Community.” In 2006, the county was known as the wealthiest majority-Black county in the U.S., Ebony magazine reported. Less than 10 years later, leaders changed the county’s motto to better market the area to potential homebuyers and businesses to, “Experience, Expand, Explore Prince George’s County.” Today, however, Prince George’s County is no longer the leader, having lost many residents to the neighboring Charles County and, as a result, Black homeownership could use a boost.

Prince George’s County Department of Housing and Community’s (DHCD) created the Pathway to Purchase First-Time Home Buyer Assistance Program (P2P).

“The County uses its HOME Investment Partnership Entitlement funds from HUD to administer this downpayment and closing cost assistance program to income eligible, first-time homeowners in the County,” said DHCD Agency Director Aspasia Xypolia. “From July 2020 to present the P2P has provided assis-

tance to 36 households of which 31 were African American households.” In late 2023, the County revised its P2P guidelines to align with DHCD’s Maryland Mortgage Program (MMP). This revision increased the county’s maximum assistance amount from $10K to $25K and provides the homebuyer the opportunity to access another $8,500 through the MMP, according to Xypolia.

Read more on washingtoninformer.com.

The DC Department of Housing and Community Development (DHCD) is proud to invest in the long-term economic stability of District families and communities.

National Homeownership Month gives us an opportunity to emphasize the benefits of owning a home and to encourage responsible homeownership. We do this by creating pathways to homeownership for first-time homebuyers and providing established homeowners opportunities to stay in safe, familiar surroundings.

Housing is a basic need, and the demand for affordable housing in the District remains high. Yet this past April, the median sale price for homes in the city climbed above $700,000. A home at that price may require a buyer with a high annual income, significant savings for a down payment, and strong credit to secure a mortgage. DHCD views homeownership as the launch pad that provides the necessary stability for families and communities to thrive. Because of Mayor Muriel Bowser’s leadership, the District remains at the forefront of most cities when it comes to putting homeownership within

reach of first-time homebuyers.

Since October 2022, our Home Purchase Assistance Program (HPAP) has supported more than 700 first-time homebuyers with about $93 million in downpayment and closing cost assistance to achieve their homeownership goal. HPAP offers up to $202,000 in downpayment assistance to eligible first-time homebuyers based on their income.

For many people buying their first home is not just a financial investment, it can create an emotional connection as well. Achieving homeownership can be an extremely proud and life-changing moment at the beginning; but the diligence and patience required to maintain a home for a long period of time can become challenging for some households.

Homes whose condition have declined over time could potentially have safety hazards that could severely burden homeowners with additional costs. The lack of home maintenance may lead to the loss of some key long-term benefits of homeownership such as stable housing costs, retaining equity, safety, convenience, or the property itself.

DHCD offers income eligible households grants of up to $20,000 for roof and gutter repairs outside of the home and up to $30,000 for modifications inside the property for homeowners with limited mobility through its Single-Family Residential Rehabilitation Program (SFRRP). The repairs are made to ensure that homeowners can remain safe in

their homes.

The emotional connection to a home could extend beyond the homeowner to other family members. However, transferring real property to potential heirs without a will after an owner’s death can be a lengthy and complex process.

Last October, DHCD launched the Heirs Property Assistance Program to assist low-income individuals or households in the District with obtaining clear legal title of real estate upon the death of their family member.

It’s estimated that black families have potentially lost billions of dollars in home equity across multiple generations when attempting to transfer real property from a deceased family member. The term ‘generational wealth’ is used quite often, but the work of obtaining

clear and legal title to a property through the courts can be challenging for someone who is unfamiliar with the probate process.

Thus far, the Heirs program has helped more than 50 clients begin the process of protecting and preserving or transferring property through the probate court; the combined worth of these District properties has a tax-assessed value of more than $160 million.

Creating long-term economic stability can be challenging, but the indelible impact of our work has its rewards for the families and communities we serve. DHCD will continue working to help renters become homeowners, assist current homeowners who are struggling, and better support families in passing on their homes from one generation to the next. n

DHCD views homeownership as the launch pad that provides the necessary stability for families and communities to thrive.

At the DC Department of Housing and Community Development (DHCD), we are always breaking new ground with our investments in affordable housing.

Now, we have a new home of our own!

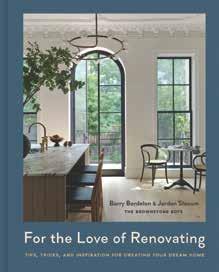

Whether you’re currently renting, considering a home purchase, settled in your forever home or preparing to relocate, a good book (or two) can always be a handy resource to spruce up your living space. Because rent and mortgages are still skyhigh, consider upgrad ing your residence with some do-it-yourself projects with guidance from these books.

Renovating your home is easier when you've spent a few hours browsing through "For the Love of Renovating" by Barry Brodelon & Jordan Slo cum (Union Square, $49.50). From the idea, to living with it and lov ing it, this book takes you through the process of making your current home into a whole new living space.

There are a lot of great ideas (with pictures!) in this book, as well as step-by-step, easy-to-do instructions on DIY projects. This is a great book for new homeowners, owners of fixer uppers, and anyone who wants a fresh new look for their forever home.

If your home has too much stuff, you'll get help downsizing with "The Afrominimalist's Guide to Living With Less" by Christine Platt (Simon & Schuster / Simon Element, $16.99). This book turns mainstream minimalism (which the author indicates is too "white") and adapts it to be a life with less, but with an honor to African American life. This unique book helps readers to rid their lives of clutter, while also keeping in mind and honoring their Blackness, background and ancestry. You don't have to live with mounds of stuff and unneeded belongings anymore. Now in paperback, this book helps you tame the mess.

Need a place for mom or want to be a landlord? Then check out "ADUs: The Perfect Housing Solution" by Sheri Koones (Gibbs Smith, $40). ADU, in case you haven't heard, is the latest trend in housing: the letters stand for Accessory Dwelling Unit, which is shorthand for an extra home or apartment in the extra yard or lot you happen to have on or attached to your current property or even your current home.

This book offers a look at how homeowners across the nation have created new spaces for income, or to keep parents close. For sure, this book will give you a fresh look at your property and it may improve your wallet, too.

Bring on the green with "Houseplants and Succulents for Dummies" by Steven A. Frowine (For Dummies, $24.99) and you'll never "leaf" your house. This easy-tofollow, easy-to-use book will help you have houseplants that everyone will envy. Wonder ing how to go from watering to transplanting, rooting to root rot? Do you need to know which plants will like which window in your home, and what plants are safe to have in your home? Don't let the "for Dummies" part scare you; the smart plant parent will want this book on their shelf.

The young people in your home who want to put in some sweat equity will love to have "Woodworking: The Complete Step-by-Step Manual" by DK (DK Publish ing, $40). Kids who want to work with wood will get a good start with this book, which features ideas, how-tos on measuring, choosing the wood, and how to safely use the right tools for the job. Once a kid knows what's what, this book offers 25 DIY projects so they can make useful, purposeful items around the house and garden. If dad, mom, grandpa or grandma is a woodworker, this book is perfect for handy, crafty kids ages 8 to12. Bonus: you can help, too!

n

When it comes to Miranda laws, you have a right to remain silent. But when buying or selling a home, silence is not golden.

From prospective buyers, and homeowners looking to refinance, to heirs getting the family’s property appraised, knowing your rights will give you peace of mind and decrease the anxiety that comes with homeownership.

Everyone has the right to live in housing that is free from discrimination, and federal and local governments are poised to protect homeowners when all signs point to housing discrimination.

The Equal Rights Center, a watchdog organization that identifies discrimination in housing, employment, and public accommodations in the DMV and nationwide, says signs of housing discrimination when paired with a realtor or meeting with a lender can including the following:

• “A realtor only shows you homes in certain neighborhoods, even though you expressed an interest in other neighborhoods within your budget.

• A bank or mortgage broker steers you to a particular loan product—for example, an FHA loan—without knowing your financial qualifications.

• A bank or mortgage broker denies your loan application or offers you less favorable terms because you are on or about to take maternity leave.

• A realtor, bank, or mortgage broker provides you with bad customer service—for example, they ignore you or send repeated requests for the same information.

• A real estate agent, lender, or insurance company tells you that they simply do not sell, lend, or insure houses in the neighborhood where you’re interested in living.”

When it comes to lending, people of color are more likely to get worse terms, higher interest rates, and varied information about conventional loans, according to Fannie Mae Advisor, Tamara Newman. Client choices may

be restricted by real estate agents based on assumptions, so be assertive and be ready to call out your agent or call on an advocate.

Another prospect to watch for is appraisal discrimination, which is when a Black homeowner’s property is categorically undervalued because it is either located in a Black neighborhood, owned by a Black person, or is thought to be owned by a Black person based on the home’s decor, like photographs and art. This type of discrimination is recognized by the FHA and it has established a hotline for homeowners to report this illegal tactic, according to HUD Assistant Secretary and FHA Commissioner Julia Gordon.

“Appraisal bias has been a problem for as long as there’s been a housing market,” she told The Washington Informer. “We know that even after redlining was declared illegal by the Supreme Court, the appraisal industry for many years–and up through this day–often values homes lower if they are in a community of color.”

As a result, the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) was created in 2021 to combat bias in home appraisals which is made up of 13 federal agencies and offices.

based on seven federally protected classes: race, color, national origin, religion, sex (including gender identity and sexual orientation), familial status, and disability.

In addition to those seven classes, in Washington, D.C., it is illegal to discriminate based on: age, marital status, sexual orientation, gender identity and expression, source of income, status as a victim of domestic violence, sexual assault, or stalking, family responsibilities, political affiliation, personal appearance, matriculation, place of residence or business, sealed eviction record, or homeless status.

In Maryland, additional protections include: marital status, sexual orientation, gender identity, source of income.

Fair housing laws prohibit the following activities in relation to housing-related transactions:

President Lyndon Johnson signed the Civil Rights Act of 1968, seven days following the assassination of Rev. Dr. Martin Luther King, Jr. The legislation expanded on the Civil Rights Act of 1964 and Title VIII of the Act is known as the Fair Housing Act of 1968 which protects people from discrimination related to the sale, rental, and financing of housing

• Refusing to rent or sell on the basis of someone’s membership in a protected class, including refusing to rent to an applicant because they use a housing voucher.

• Applying discriminatory terms and conditions on the basis of someone’s membership in a protected class, like when a larger security deposit is required because a family has children.

• Advertising a discriminato-

ry preference, including posting “perfect apartment for a mature couple.”

• Misrepresenting availability on the basis of someone’s membership in a protected class, including telling a Black prospective tenant that there are no apartments available, but telling a white prospective tenant that there is availability.

• Blockbusting which refers to how real estate professionals would play on White homeowners’ racist fears by telling them that Black residents would soon be moving into the neighborhood in order to pressure White homeowners to sell their homes for below market value.

• Steering, which is when a housing provider guides a prospective tenant or buyer toward or away from certain neighborhoods or homes based on their membership in a protected class.

• Harassment, threats, intimidation, or coercion.

• Retaliation including trying to evict a tenant for filing a housing discrimination complaint against the landlord.

• Any other conduct which makes unavailable or denies dwellings like not providing a tenant with accessible parking or reasonable accommodation or modification. n

If you think you may be experiencing a form of housing discrimination, contact the following:

FHA Housing Discrimination Hotline (800) 669-9777

Equal Rights Center

Report your experience at (202) 234-3062 or email info@equalrightscenter.org.

District of Columbia’s Office on Human Rights

Fill out a complaint form online ohr.dc.gov] and submit to OHR.Intake@DC.Gov, via fax (202) 727-9589 or deliver the completed form and deliver in person or mail to 441 4th Street NW, Suite 570N, Washington, DC.

Maryland Commision on Civil Rights

Fill out a form online mccr.maryland.gov and mail to mccr@maryland.gov, print the form and fax it to 410.333.1841 or, print the form and mail it to Maryland Commission on Civil Rights William Donald Schaefer Tower, 6 St. Paul Street, Suite 900, Baltimore, Maryland 21202-1631.

Submitted by Marshall Heights Community Development Organization, Inc.

Marshall Heights Community Development Organization, Inc. (MHCDO) is a HUD-Approved Housing Counseling Agency. MHCDO has a rich history of serving the residents of the District of Columbia, and particularly Ward 7. We are committed to serving District residents, opening doors of opportunity for individuals, and transforming both the lives and neighborhoods.

Babatunde Oloyede, President and CEO, is pleased to showcase housing counseling services that ultimately support generational wealth and not simply homeownership. Lessons learned from successful homeowners and empirical data are that they need counseling education for the purchase process and additional skills and knowledge throughout the homeownership experience. As a member of Mayor Bower's Black Homeownership Strike Force, I became acutely aware of the need for homeowners to have a long-

term relationship with housing counselors. The Strike Force aimed to identify actionable recommendations to increase and support homeownership for Black residents of the District of Columbia. Some residents could not actualize the benefits of homeownership, such as financial stability, financial strength, tax deductions, a permanent home, and a sense of belonging in their community. The number one recommendation from the strike force was the need for estate planning, as residents needed information to pass their

properties to family members or others.

MHCDO recommends a comprehensive prepurchase education component, a financial education component, and a post-purchase education component. Each element is vital.

Strong financial knowledge and decision-making skills help people evaluate options and make informed decisions throughout the homeownership experience. MHCDO's program topics include Credit Scoring, Savings Plan, Estate Planning, Financial Record Keeping, Borrowing Basics, and Predatory Practices.

The Prepurchase program trains individuals and families in homeownership readiness, how to shop for a home, get a mortgage loan, enhance their budget, and credit profiles, maintain their home, and increase financial resources after purchase.

The post-purchase program focuses on topics that help both new and existing homeowners manage their most important assets. These topics include home maintenance and repair, financial management and budgeting skills,

insurance, smart equity solutions, estate planning, early intervention programs to prevent delinquencies and default, and the pros and cons of refinancing. The post-purchase program also addresses climate change and emergency preparedness regarding uploading financial or other vital records into the cloud.

Other counseling services available at MHCDO are the Home Equity Conversion Mortgage (HECM) as a way to inform homeowners about the pros and cons of the reverse mortgage, Foreclosure Prevention to build strategies to prevent default or delinquency, and Emergency Preparedness counseling to shore up the homeowners and residents financially before a disaster as well as assist residents in developing an emergency plan. These programs expand MHCDO's influence beyond Ward 7, District of Columbia, and into neighboring States.

MHCDO is celebrating National Homeownership Month activities scheduled for June 17 through 21, 2024. Please watch for invites from Eventbrite, the MHCDO website, and other listservs. n

Anyone who is interested in buying a home now is likely to discover these are tough times. For many prospective homebuyers trying to navigate their way through the aftermaths of the mortgage crisis of 2008, the health and financial crisis resulting from the pandemic, high interest rates, limited affordable housing inventory, and inflation, finding the right home to buy affordably is tough. The best thing for a firsttime homebuyer to do is take a deep breath, get the lay of the land, and get help from a trusted resource: a HUD-certified, nonprofit counselor.

Housing counselors can assist in the areas of buying, preventing foreclosure, and refinancing homes. A HUD-certified, nonprofit housing counselor is specially trained to help consumers assess their financial situation, evaluate options if they are having trouble paying their mortgage loan, and develop a plan to get them help with their mortgage and/ or other payments. Their nonprofit status indicates their primary focus is to help the individual or family.

Buying a home is a complex undertaking with a lot of moving parts, terminology, and participants the average person is not familiar with. No shame in that. For that reason, the average person would be well served to enlist the assistance of a subject matter expert—someone who could guide them through the process, act as their coach, help them to achieve the best outcomes possible given their specific and unique financial situation. Sometimes, more often than you think, people are turned down when they apply for a mortgage loan. What many fail to realize is there is no shame in being denied. All that denial means is there is something in the applicant’s financial profile the lender feels should be addressed before extending their approval for a mortgage loan.

Sometimes a responsible “No” is a good thing. It allows the applicant to shore up their savings, credit, and/or downpayment so that, if an unforeseen financial crisis occurs, they can more effectively weather the storm.

There are many reasons why working with a HUD-certified housing counselor makes sense. A certified nonprofit housing counselor can:

• Give you access to a certified homebuying expert who can coach you through the homebuying process and help you avoid common mistakes that cost you money.

• Help reduce the stress of what is commonly a very stressful process.

• Allow you to improve your odds of being approved for an affordable mortgage loan.

• Connect you with experienced, certified, subject matter experts who will create a customized action plan tailored to your specific needs to get you to “mortgage-ready.”

• Help determine whether the applicant can qualify for Down Payment Assistance (DPA) to reduce the out-of-pocket expense of a downpayment.

• Connect you with resources to support homeownership beyond buying a home, to include the future possibility of refinancing a mortgage, home equity loans, a reverse mortgage, foreclosure prevention, and more.

What Should You Expect?

If you decide to explore the opportunity of working with a HUD-certified housing counselor, consider the following steps:

1. Go to the National Foundation for Credit Counseling’s website, nfcc. org, or HUD housing counselor locator sites to identify a certified counselor (sites listed below).

2. Connect with a HUD-certified housing counselor for a confidential consultation.

3. Participate in a one-on-one review of your financial goals and budget.

4. Develop with the counselor a personalized financial action plan.

5. Schedule regular follow-up meetings with the counselor to monitor, manage, and track progress until you achieve mortgage readiness.

How Can You Find A HudCertified, Nonprofit Counselor?

Do not be fooled! There are a lot of imitators out there. If you are interested in buying a home and want to enlist the assistance of a HUD-certified housing counselor, go to:

Links:

• https://www.nfcc.org/keystohome

• https://hud4.my.site.com/housingcounseling/s/?language=en_US or call:

• NFCC: (844) 865-3028

• HUD: 800-569-4287 or 202-708-1455

Some Things To Consider:

There are a lot of myths and misinformation being spread through our communities. One example is that, “They say black folk don’t do counseling.” Really? Before anyone takes this message to heart, here are a few questions to consider:

• Who are “they?”

• What makes “them” the experts?

• What gives them the right to dictate which resources you should use to improve your financial outcomes?

If your tooth was hurting, you

would go to a dentist. If your car was not working, you would go to a mechanic. If you had legal issues and you needed help, you would go to a lawyer. The common thread here is, when there is a problem, it is always a good practice to enlist the aid of a subject matter expert. The same is true when dealing with financial matters and creating better outcomes.

In many ways, managing your financial life is like mastering a video game—a game that, to win, you need to know the rules. What many people do not know is that there are resources available to teach you the rules of the game. Moreover, there are people who are dedicated to serving as your personal coach to help you succeed in achieving your goals.

The National Foundation for Credit Counseling (NFCC) is committed to helping you build a better financial future. Owning a home has proven to be a key cornerstone to wealth building. To learn more, go to nfcc.org. n

In a time where financial security continues to provide uncertainty, the dream of home ownership is still one of the primary ways to build generational wealth and create financial stability. I have had the pleasure of sitting at a closing table and watching people walk away with thousands of dollars from the sale of a home. This can be life-changing for many. Whether it is getting out of debt, purchasing another home, or financing college education, there are tremendous benefits to homeownership. For many, buying a home is not about finding a place to live, but establishing a legacy for future generations. Homeownership offers the opportunity to create a stable foundation, build equity, and secure financial growth.

The concept of generational wealth involves passing down assets, such as property, from one generation to the next, thus helping ensure long-term

Vice President/Residential Lending Industrial Bank

Vice President/Residential Lending Industrial Bank

financial stability. A home is one of the most significant assets that can be transferred through generations, while often appreciating in value. Research indicates that homeowners are likely to accumulate more wealth over time compared to renters. This is largely due to the benefits of property value appreciation, reduction of tax liability, and mortgage principal reduction. This can provide a safety net during market fluctuations.

Achieving homeownership and building generational wealth require informed decision making. Finan-

cial literacy is important in this process. Homebuyer counseling, such as credit and money management, understanding mortgage products, and being aware of market interest rates, equips borrowers with knowledge necessary for the process. Being informed enables buyers to make better decisions and avoid pitfalls.

Here are some key steps when considering building generational wealth and leveraging home equity:

• Education about personal finance, savings, and investment strategies. Understanding budgeting, credit scores, and the importance of maintaining good financial health is crucial for securing favorable mortgage terms.

• Savings Plan: Establish a dedicated savings plan for a down payment. This might include setting aside a portion of income, reducing unnecessary expenses, and utilizing savings accounts with high interest rates.

• Location and Growth Potential:

Choose a property in a location with strong growth potential. Areas with good schools, low crime rates, and amenities tend to appreciate more in value.

• Mortgage Options: Compare different mortgage options and choose one that best fits your financial situation. Fixed-rate mortgages provide stability while adjustable-rate mortgages offer low initial rates but can increase over time.

• Down payment: Aim to make a substantial down payment to reduce monthly payments and build equity faster. This will also help in avoiding private mortgage insurance (PMI) costs.

• Equity Growth: As a borrower pays down their mortgage and their home’s value appreciate, the equity increases. Home equity is an asset that can be used for various purposes, such as debt consolidation, starting a business, or investing in additional properties.

Industrial Bank plays a crucial role in building generational wealth and closing the wealth gap through a combination of accessible mortgages and tailored financial services. By empowering families with the resources and knowledge needed for sustainable homeownership, Industrial Bank can help to create long-term financial stability and economic growth in communities.

Industrial Bank’s Residential Lending Team is available to assist with your home buying process. We are more than just a lender; we are your trusted partners in achieving homeownership and building generational wealth. With our experienced team, comprehensive mortgage solutions, and commitment to financial education, you can trust us to provide you with the best options to meet your needs.

Contact us today to learn more about how we can assist you on your journey to homeownership and beyond at https:// industrialbank.mymortgage-online.com/ n

In 1865, over 159 years ago, the U.S. eliminated or outlawed slavery in the U.S. with the passage of the 13th Amendment to the U.S. Constitution. One of the promises and pledges to freed slaves was that each would receive 40 acres and a mule. This commitment would help former slaves with building a home, raising a family and growing wealth through land ownership and entrepreneurship. While some Black Americans were able to receive land in the 1860s and 1870s, unfortunately, many former slaves nor their descendants ever received land. In fact, many Black Americans that were given land were chased off their land with force and brutality from the Ku Klux Klan (KKK) and other white supremacy organizations.

Still to this day the dream of land and homeownership continues to be elusive for Black Americans from slavery, post slavery, the Jim Crow Era, the Civil Rights Era to the present. Whether it was the trick bag of sharecropping, land contracts, subprime loans, eminent domain policies or outright redlining of Black neighborhoods by banks and government organizations, it should not come as a surprise that there continues to be a persistent 30-point racial gap in homeownership rates in the U.S. Racial disparities in homeownership is at the core of wealth inequality in this country,

you can’t separate the two. America is anchored in home and land ownership, always has been, always will be. In fact, for many years, only white men that owned property could vote in the U.S.

Below are several strategies to help grow Black homeownership in the U.S.: Federal Student loan forgiveness for purchasing a home. African Americans are disproportionately impacted by student loan debt forcing many to forgo homeownership. A program that addresses this disparity and forgives student loan debt would help many Black Americans achieve their homeownership dreams.

Create down payment assistance and federal Housing programs for Black descendants of slavery. Currently there are initiatives and dedicated federal housing and mortgage lending programs and incentives for Native Americans, similar efforts should be established for Black Indigenous People of Color (BIPOC), those that are descendants of slaves in America.