March | April 2024 | Vol. 20 No. 2 A publication of the Wisconsin Institute of CPAs | wicpa.org Plus: New ERC program | 14 CTA filing requirements | 18 Reaching next-gen talent | 28 Employee handbooks | 40 Dominic Ortiz, CPA, CGMA | 8 Big Breaks

THURSDAY, APRIL 25

NEW BERLIN ALE HOUSE

REGISTRATION INCLUDES

3 Games of Bowling

Shoe Rental

Food & Beverages

*

EVENT AWARDS & PRIZES

$250+ in Team Awards & Prizes

$100+ in Individual Prizes

Bowling Gift Card Package

For more information and to register, visit wicpa.org/BowlingNight

must be present when awards and prizes are announced to receive an award or prize.

*Attendee

8

Features Columns

8 Big breaks

Dominic Ortiz, CPA, CGMA, started building his career at a new casino in Kansas and ultimately became the current CEO of Potawatomi Casino & Hotel in Milwaukee. Read about his journey as a Native American CPA.

By Marcia Tillett-Zinzow

14 Voluntary disclosure program for ERC claims

A new IRS program presents an opportunity for employers to repay the IRS for ERC claim refunds for which they were ineligible. Deadline to apply is March 22

By Jim Brandenburg, CPA, MST

18 What every CPA should know about the CTA Failure to file a Beneficial Ownership Information report, required for some companies by the Corporate Transparency Act, can result in significant civil and criminal penalties.

By Randy S. Nelson, CPA, JD

24 8 critical elements of an effective engagement letter

To help protect yourself and your firm, make sure your engagement letter has these eight elements.

By Deborah K. Rood, CPA, MST

28 HUMAN RESOURCES

Reaching next-gen talent with high school visits

Hosting high school students plays a pivotal role in helping to change perceptions of the accounting profession among young people.

By Victoria Spencer

32 PROFESSIONAL DEVELOPMENT

5 commonsense steps to successful networking Networking might not be an instinctual skill, but it is vital for seeking new business and expanding your network.

By Daniel Kochka, CPA, CFE, MBA

36 EMPLOYEE RELATIONS

14

Departments

The ethics of DEI: Cultivating a positive workplace Committing to diversity, equity, and inclusion initiatives is more than an ethical consideration.

By Elizabeth Pittelkow Kittner, CPA, CGMA, CITP

40 PRACTICE MANAGEMENT

Key employee handbook policies for 2024

Employee handbook policies should be drafted with care and kept up to date to avoid legal entanglements.

By Jill

Pedigo Hall,

JD, and Erica A. Storm, JD

3 Outlook | chair’s letter

4 In Touch | president & CEO’s message

22 Kudos | members in the news

31 Welcome | new members

34 Memorials | departed members

1 On Balance March | April 2024 wicpa.org

Vol. 20

2 A publication of the Wisconsin Institute of CPAs | wicpa.org

March | April 2024

No.

28

On Balance is published five times a year by the Wisconsin Institute of Certified Public Accountants (WICPA). Change of address should be sent to: Membership, W233N2080 Ridgeview Pkwy, Suite 201, Waukesha, WI 53188; Phone: 262-785-0445 or 800-772-6939; Fax: 262-785-0838; email: comments@wicpa.org. Statements and opinions expressed are those of the authors and not necessarily those of the WICPA. Publication of an advertisement does not constitute an endorsement of the product or service by On Balance or the WICPA. Articles may be reproduced with permission. © Copyright 2024 On Balance

2023-2024

WICPA OFFICERS/BOARD MEMBERS INSIDE

STAFF

Chair

Matthew J. Schaefer, CPA, CGMA

Chair-elect

Ryan J. Hanson, CPA, CGMA

Past Chair

Steven A. Pullara, CPA, CGMA

Secretary/Treasurer

Lucien A. Beaudry, CPA, JD

Directors

Christopher M. Cholka, CPA, CGMA

Jessica B. Gatzke, CPA, MST

Tori M. Morrow, CPA, CGMA, MBA

Donna R. Scaffidi, CPA

Stacy A. Stinson, CPA

AICPA Council

Ruth A. Kallio-Mielke, CPA

Neil R. Keller, CPA/ABV, CVA

President & CEO

Tammy J. Hofstede

Design & Layout

Brett Stallman

Advertising

Sue Daniels

Editor

Marcia Tillett-Zinzow

Printing

Special Editions

EPSA

EPSA USA is focused on helping companies of all sizes take advantage of the R&D tax credit at the federal/state level. Our experts help identify qualified research expenses that yield a large tax benefit for our clients.

A complimentary assessment is available at www.us.epsa.com.

Pearl Insurance

Pearl Insurance has provided professional liability insurance to accountants for 60 years with comprehensive and competitively priced coverage. By continuously evolving insurance plans, we stay ahead of the curve as an industry leader with coverage that is responsive to the needs of accounting professionals.

Waukesha State Bank

Established in 1944, Waukesha State Bank is one of the largest locally owned and independent community banks in Wisconsin, with full-service offices in Brookfield, Delafield, Menomonee Falls, Mukwonago, Muskego, New Berlin, Oconomowoc, Pewaukee, Sussex and Waukesha. For more information, visit www.waukeshabank.com. Member FDIC.

These affinity partners and more can be found at wicpa.org/discounts.

On Balance March | April 2024 2 wicpa.org

online!

Join us

H NEW Affinity Partner H

Check out our featured member benefit providers

OUTLOOK | CHAIR’S LETTER

“As your WICPA board chair this past year, I have been humbled by your trust, professionalism and eagerness to focus on the needs of CPAs within our state.”

Wrapping It Up

By Matthew J. Schaefer, CPA, CGMA

Over the past months, I have typically spent a couple of nights a week at a small community library reviewing emails, updating my calendar, and writing articles for this magazine. And every couple of months, when I open my email on my phone in the reading and study area, a timely reminder has arrived from our editor, stating that my article’s due date is near. I find as I write these words that there has been an evolution from a sense of fear of not being able to convey my thoughts to anticipation of what to include within the next article.

These past few months, my topics have continued to build on the evolution of the profession and the theme of change. I have been in many meetings and seen multiple participants ask difficult questions on how to adopt and adapt to the constant change in our profession. Through the committees, board meetings and staff conversations, there has been a continued focus on what “we” can do for the membership. This focus includes popular topics of discussion, including pipeline development, tax initiatives, organizational changes, legislative updates or promoting our profession’s value. These discussions include not only what this organization can do for the profession today, but also an additional focus on what those needs will be in the future.

We will always need the young, inquisitive and energetic members as well as the mature professionals with an invaluable resource of experience. We have no doubt seen an evolution and change of needs within our firms, organizations, businesses and agencies. As CPAs, however, we continue to evolve with the changes that are presented not only to our organizations but also to the profession. The WICPA continues to focus on many membership needs, from small offices and startups to sophisticated firms and established businesses to organizations within not only large metropolitan areas but also small and rural geographies.

The past few years have not provided easy solutions to the complex issues facing our profession and related organizations. However, this period of time has provided all of us a diversity of viewpoints in order to create an organic understanding of those issues. This diversity is one of the greater strengths of this organization. We focus on the mission of the WICPA and strive to find everyday solutions for our members and stakeholders.

As your WICPA board chair this past year, I have been humbled by your trust, professionalism and eagerness to focus on the needs of CPAs within our state. As I wrap up my year of service, I thank you and wish you all the best. Stay well — and keep moving forward.

3 On Balance March | April 2024 wicpa.org

Matthew Schaefer, CPA, CGMA, the 2023–2024 chair of the WICPA board of directors, is senior vice president/chief credit officer for the Bank of Wisconsin Dells. Contact him at 608-254-3624 or mschaefer@dellsbank.bank.

“Together, we are shaping the future through networking, educational opportunities, legislative activities, building the pipeline, and diversity initiatives to ensure the WICPA is the innovative and trusted resource for the accounting profession in Wisconsin.”

WICPA 2023

As we move toward closing out our fiscal year-end on April 30, I would like to reflect on our accomplishments — which were made possible by your support. I am excited to highlight and share our successes with you.

Advocacy

Advocacy promotes the profession and protects its credibility, and it is a powerful benefit of your membership. We were actively involved in a number of legislative bills and issues over the last year, including the following:

• Exempted CPAs from two bills that that would have disrupted licensing and mobility (due to educating and relationships built with legislators who now understand the structure of CPA licensure in Wisconsin)

• Provided input on legislation for a tax-free retirement exemption and consolidating tax brackets; adopting federal tax provisions related to depreciation; and increasing audit limits for charitable organizations

• Supported and passed the personal property tax elimination

• Provided input and introduced legislation in February to equalize the interest overpayment and underpayment rates in Wisconsin, as well additional cleanup, clarity and consistency

• Supported and passed (along with 24 other states) the high school graduation requirement of a one-half financial literacy credit, starting in 2028

• Opposed changing the name of the Wisconsin Earned Income Tax Credit (EITC), which would have created confusion and inconsistency with the federal EITC name

• Collaborated with the Wisconsin Department of Revenue (DOR) to review, support and pass legislation to adopt federal changes to the internal revenue code for state tax purposes

Took an entourage of WICPA representatives to Washington DC, where I attended an AICPA Council meeting, and we all visited our Wisconsin legislators on Capitol Hill to discuss and support establishing accounting as part of STEM, the Simplify Automatic Filing Extensions (SAFE) Act, the Freedom to Invest in Tomorrow’s Workforce Act, and the Fiscal State of the Nation resolution

• Provided testimony on the Department of Safety and Professional Services (DSPS) customer service issues and concerns that members, CPA candidates and licensees continuously voice to me

We also kept members up to date on the new Beneficial Ownership Information (BOI) Reporting requirement. We have been working with the State Bar Association to determine where the line between the practice of law and the practice of

On Balance March | April 2024 4 wicpa.org

IN TOUCH | PRESIDENT &

MESSAGE

CEO’s

Gov. Evers signed Wisconsin Act 60 to require one-half credit of personal financial literacy to graduate.

accounting is drawn and whether CPAs in Wisconsin can help clients with BOI reporting without attorney supervision. We currently have an April meeting set with the State Bar Association and WICPA members, where we hope to discuss this topic and create clarity and guidance for Wisconsin CPAs.

Focusing on the CPA pipeline

Along with the governor’s proclamation for November as “CPA Appreciation Month,” we successfully launched the CPA pipeline initiative Level Up With Accounting! Our volunteer members went into classrooms to talk about accounting and reached over 1,000 high school students. We created a membership category for high school students as well as new marketing materials and a high school and college online community. We have produced several membershipand accounting-related videos — which highlight diversity in the profession among other things — and enhanced website pages that provide everything students and educators need to know about becoming a CPA. We also launched an Instagram account specifically for students.

school (grades K–4) classrooms, reading a book to the class, and discussing the basics of money and savings. The WICPA Educational Foundation provides everything you need: a moneythemed book, a teacher/parent guide and a gift for each student.

COVID and the CPA Exam

The WICPA Educational Foundation awarded nearly $30,000 in accounting awareness grants for teachers to take their classes to visit organizations and learn more about accounting through conversations with their CPA staffs. Many firms and organizations assisted with this effort by completing forms we created to host accounting-related presentations, tours and activities, which were then provided to the high school educators to help them plan their activities.

We continue to collaborate and support colleges and high schools by bringing in members to discuss their careers, and we continue to attend DECA and FBLA events to create awareness of accounting career opportunities.

To continue our outreach to younger students, the Reading Makes Cents program is back for Financial Literacy Month in April and Money Smart Week. These financial literacy activities involve simply visiting one of your local elementary

One of the problems created by COVID was the loss of parts of the CPA Exam by exam candidates. We’ve been hearing these concerns from Wisconsin candidates, firms and educators, and we know that 34 other states provide relief to their CPA candidates who lost parts of their exams. In response, the WICPA strongly advocated for Wisconsin to do the same. Through my relationships and efforts with key legislators, state administrators and NASBA, I was able to obtain the list of 249 candidates who were impacted by COVID and lost exam parts and, accordingly, created guidance (according to the statute) so they could request relief from DSPS and the Accounting Examining Board. I personally contacted and have assisted more than 30 candidates who were impacted by COVID, enabling them to finish their exams and be on their way to becoming licensed CPAs — without additional time and cost. I am currently working with the Accounting Examining Board to develop a process with DSPS to process these requests timely and efficiently.

In addition, over the last year we kept students and educators updated with the significant changes to the CPA Exam that became effective Jan. 1. The WICPA also strongly advocated for a rule change to extend the timing to complete the exam from 18 months to 30 months, as several other states have already implemented.

Diversity

The WICPA and WICPA Educational Foundation continued their 27-year partnership with and support of the Young Entrepreneurial Scholars (YES) program. The goal of the YES program is to expand opportunities for minority students and increase diversity in the accounting profession.

5 On Balance March | April 2024 wicpa.org

CRIMINAL JUSTICE SPORTS & ENTERTAINMENT PUBLIC INDUSTRY GOVERNMENT ENVIRONMENTAL FASHION TECHNOLOGY NONPROFIT Scan this QR Code to access videos, resources, and sign up for student membership. Audit: Travel around the world for a variety of business types. Business Valuation: Tell people what their business is worth. Entrepreneur: Start your own business. Financial Forensics: Investigate financial crimes. Financial Planning: Advise the rich and famous. Information Technology: IT, data analytics or cybersecurity. Managerial: Handle investments, budgets and forecasts. Sustainability: Analyze a company’s social and environmental impact. Tax: Help clients increase savings and avoid tax penalties. WICPA CAN HELP YOU LEVEL UP IN ACCOUNTING! AUDIT BUSINESS VALUATION FINANCIAL PLANNING ENTREPRENEUR SUSTAINABILITY FINANCIAL FORENSICS INFORMATIONTECHNOLOGY MANAGERIAL TAX CHOOSE YOUR INDUSTRY CHOOSE YOUR SPECIALTY You can choose from a variety of specialty areas based on your interests and skills! Every type of organization needs accounting professionals! Become a CPA Become the most trusted and respected player in the game. Choose the career of your dreams You’ve unlocked a career full of adventure. Internships Get in the game with an accounting related job. College Earn a WICPA scholarship and graduate from college. Join the WICPA Start your quest by joining a community of accounting pros. PERKS LARGE EARNING POTENTIAL MAKE AN IMPACT FLEXIBILITY HIGH DEMAND JOB SECURITY WI CPA H ME ACCOUNTING ACCOUNTING JOBS 00 00 00

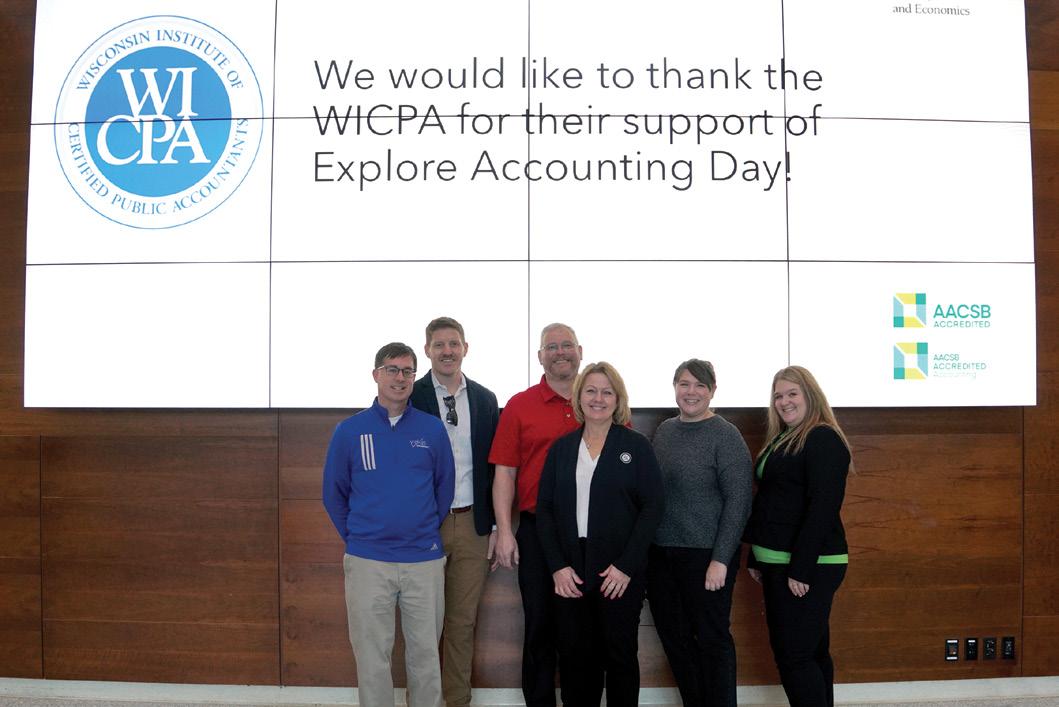

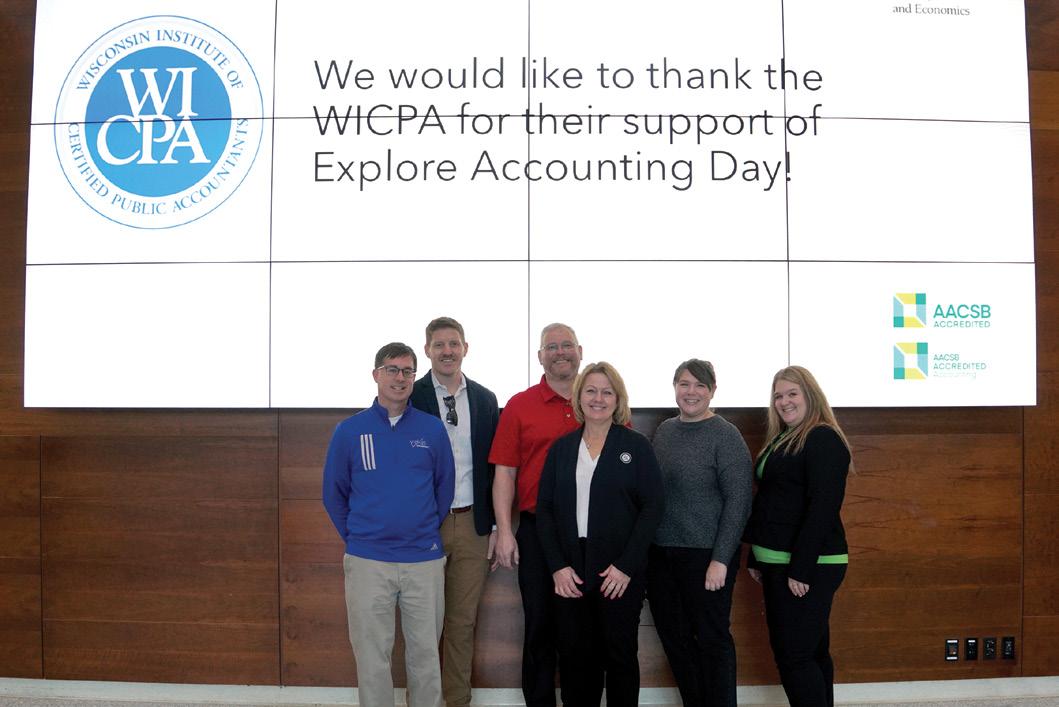

WICPA members served on an accounting panel to over 100 high school students at UW-Whitewater Explore Accounting Day.

We are continuing to develop relationships with Milwaukee Public Schools, and we are exploring how we can work together to bring accounting into the district’s classrooms. Several of our new videos will feature the topic of diversity in the profession, including one about the YES program.

With the relationship built with the DOR, I was able to have a meeting to connect DOR Secretary Peter Barca with Bill Coleman, CPA, of the YES Program, so they could discuss the opportunities for YES participants to intern with the DOR.

Continuing professional education (CPE) and events

We continue to add value to WICPA membership by providing over 20 free CPE credits to members. We continued to hold all our conferences in person with livestream and on-demand options.

With nearly 300 attendees, the Member Recognition Banquet last May honored the Excellence Awards recipients and recognized membership milestones with new awards presented to 25-, 40- and 50-year members.

Our New CPA Banquet, held in June, was a hit with our newly licensed CPAs. The banquet featured casino-themed entertainment and a presentation by the VP of finance for the Green Bay Packers — including photo opportunities with his Packer Super Bowl ring!

And in September, the Annual Golf Outing was again SOLD OUT.

Our breakfast programs remained (and will remain) virtual so more can attend from around the state, but we kept the popular Individual Income Tax Update as an in-person event

with livestream and on-demand options. We also offered more one-, two- and four-hour livestreamed seminar and webinar programs to continue the trend of shorter CPE increments with the ease of fitting CPE into members’ schedules without necessitating travel.

Our members are the backbone of the WICPA. Without you, we wouldn’t be able to achieve our goals. Together, we are shaping the future through networking, educational opportunities, legislative activities, building the pipeline, and continuing diversity initiatives to ensure the WICPA is the innovative and trusted resource for the accounting profession in Wisconsin.

On Balance March | April 2024 6 wicpa.org

On Balance needs subject matter experts like you to write articles that are relevant, timely and informative for our member readers! Here’s what you get: • Visibility for yourself and your organization • CPE credit for the time you spend writing an article! • Sharpened writing skills: Our editor will make sure your article is clear, concise and correct. • A great addition to your LinkedIn page or your organization’s website u Are YOU our newest author? t Contact Marcia Tillett-Zinzow at mtzinzow@icloud.com. Tammy J. Hofstede is president & CEO of the WICPA. Contact her at 262-785-0445, ext. 4518, or tammy@wicpa.org. Plus: CTAandBOIreporting | 12 EntityselectioninWisconsin | 18 SBIRprogramissue 32 Workforceofthefuture 34 March April2024 Vol.20No.2 ApublicationoftheWisconsinInstituteofCPAs wicpa.org Plus: NewERCprogram 14 CTAfilingrequirements 18 Reachingnext-gentalent 28 Employeehandbooks | 40 Dominic Ortiz, CPA, CGMA | 8 Big Breaks

WICPA members and guests enjoying the 2023 WICPA Member Recognition Banquet.

7 On Balance March | April 2024 wicpa.org Spectrum Investment Advisors, Inc. is an SEC registered investment adviser located in Mequon, WI. Registration with the SEC does not imply a certain level of skill or training. Our Privacy Notice, as well as our Form ADV Parts 2A and 2B and our Form CRS are available for you to view at: https://spectruminvestor.com/disclosures/ Spectrum Investment Advisors 6329 West Mequon Rd. Mequon, WI 53092 262-238-4010 | www.spectruminvestor.com Wealth Management Financial Wellness Retirement Plans At Spectrum Investment Advisors, we guide our clients on their journey toward a brighter financial future. Our core services are built to empower, support, and educate, enabling our clients to make confident and well-informed decisions throughout their financial journey. Are you getting the most from your financial advisor? From tax strategies and wealth management to retirement planning, we cover the spectrum of your financial needs.

On Balance March | April 2024 8 wicpa.org

By Marcia Tillett-Zinzow

By Marcia Tillett-Zinzow

As an enrolled member of the Prairie Band Potawatomi Nation of Kansas, Dominic Ortiz, CPA, CGMA, is passionate about his heritage. And he’s equally passionate about the CPA profession and the CPA societies that helped him on his path to success. Today, at age 46, he is not only a CPA but also CEO of the Potawatomi Casino & Hotel in Milwaukee. He was recently named CEO of the Year by BizTimes Milwaukee and was one of five nominees for an award of the same name sponsored by the Milwaukee Business Journal.

Ortiz gained small business experience while he was in college at Haskell Indian Nations University, where he earned an Associate of Arts degree in 1998. He had gotten acquainted with Native people of all different tribes there, and when he met some people from the Southwest, they started a business together selling Native American-made jewelry. They even had a business plan, which eventually won Ortiz an award from American Indigenous Business Leaders,1 a nonprofit organization whose mission is to “equip young Indigenous Business Leaders to lead enterprise in their own communities.” The award would bring Ortiz visibility that would later seal his fate.

Understanding “CPA”

When he was in college at Haskell, the letters “CPA” meant nothing to Ortiz. He didn’t know what a CPA was. Then he was introduced to Dr. Tom Clevenger, an associate professor of accounting at Washburn University in Topeka, Kansas.

Clevenger had come to the reservation as a consultant to tribal gaming, which was new to the Prairie Band tribe at the time. Ortiz’s father had been elected to the tribal council, which was running the new Prairie Band Casino, so he worked with Clevenger. When Clevenger was diagnosed with cancer, he sought spiritual guidance from Ortiz’s Native grandmother.

“He came to the house to talk with her, and I just happened to come in,” Ortiz said. “He was introduced to me as a CPA — I still didn’t really know what that meant.”

At the time, Ortiz’s brother, Stephen, was studying accounting at Washburn University. Deloitte was doing the audit for the tribe, and Clevenger knew people there. So he was able to open the door for Stephen to get an internship with the Big 4 firm. Ortiz was impressed with that, and when he decided to get out of the jewelry business, he recalled the wise words of Dr. Clevenger.

“He said that if you are able to study financial statements, understand how a business really operates, and be able to read and look through these kinds of key aspects, it could

9 On Balance March | April 2024 wicpa.org

Photography by John Sibilski

(www.aibl.org)

1 Formerly American Indian Business Leaders

ultimately make you into a very powerful business leader and help launch your career into something bigger and better — however you want to see that path,” Ortiz said.

After completing his associate degree at Haskell, Ortiz enrolled in a dual-degree program at the University of Kansas (KU), graduating in 2001 with master’s degrees in accounting and information systems. He was on his path to CPA.

Big break #1

Toward the end of his KU studies, providence stepped in, appearing as then-President of the United States William J. Clinton. When President Clinton was planning to address all the tribal leaders in the United States, he asked for a young tribal entrepreneur to introduce him. Ortiz’s business plan award had put him in the spotlight, and he was chosen to introduce the president.

“So I flew out to Washington and spent a half-day with the president. I addressed about 80,000 people there, introducing President Clinton as the best leader of the free world, and I presented the president with a handmade, sterling silver storyteller bracelet.”

Clinton was so impressed with Ortiz that he pulled him out of the line of tribal leaders and asked him to walk around with him. He also offered to write him a letter of recommendation — which would open an important door for Ortiz a few months later as he was wrapping up his college education.

Not having known any CPAs prior to meeting Dr. Clevenger, Ortiz didn’t understand what it took to get into a Big 4 firm. But he had watched his brother achieve an internship and job as a consultant with Deloitte and set his sights on trying to get a Big 4 accounting job.

He succeeded in getting interviews with all of the Big 4 firms, but the first three turned him down flat. “What I finally realized after the third interview was that I didn’t understand the pathway to get there — I didn’t join any clubs; I didn’t have the 4.0 GPA — but I felt I had grit and a very positive experience with the president of the United States behind me,” he said.

Ortiz thought if he could just tell his story, he might get a chance at an entry-level position. Unfortunately, the first three firms never gave him that chance. Feeling discouraged and expecting another rejection, Ortiz walked into the last interview, which was with Ernst & Young (EY), where a pleasant surprise awaited him. As he walked in, he saw the recruiter reading a newspaper.

“The University of Kansas had done a full front-page profile and a big in-depth story on my selection to meet the president of the United States and introduce him. So I walk in the door, and I’m not feeling real big right now. But I walk in, and he puts the paper down, and he says, ‘That’s you!’ I said, yeah, that’s me.”

“

Unless you’re in the society that knows the CPAs, you don’t know that you need to study; that it’s methodical and it’s dedication above all else; that it’s harder to pass than the LSAT, and it’s one of the most difficult credentials in the United States to achieve.

None of the other firms had given Ortiz a chance to tell his story, but this recruiter wanted to hear all about it. Once he shared his experience, the recruiter thanked him for coming in and told him he was hired. “I was just blown away,” he said.

From failure to success

EY supported Ortiz in his quest to take the CPA Exam and become licensed — but he was unaware of the review courses that could help him actually pass the four exam components.

“I failed miserably,” he said. “I didn’t know how to get there. Unless you’re in the society that knows the CPAs, you don’t know that you need to study; that it’s methodical and it’s dedication above all else; that it’s harder to pass than the LSAT,2 and it’s one of the most difficult credentials in the United States to achieve.

On Balance March | April 2024 10 wicpa.org

The Forest County Potawatomi named Ortiz as CEO and GM of Potawatomi Hotel & Casino in July 2021.

2 Law School Admission Test

“And then they said CPA review.”

The Prairie Band Potawatomi Nation paid for his CPA review course, and Ortiz finally passed all four parts of the exam. He spent two years with EY, being trained in technology, risk services and financial audit. Then came a tough call from the Prairie Band Potawatomi Nation, who asked if he would come back and learn to manage casino operations from Harrah’s Entertainment. He accepted, eventually working his way up to CFO of the casino. Together with his brother in executive management, they helped the Nation assume full casino operations from Harrah’s.

Big break #2

Ortiz ultimately joined the Kansas Society of CPAs, and at their first meeting, the executive director encouraged him to represent the Kansas Society in a program the AICPA was putting together: the AICPA Leadership Academy.

He found many mentors there, including current AICPA CEO Barry Melancon and past AICPA chairs Rich Caturano and Paul Stahlin — all of them influential in the profession. Eventually, he was selected to serve on the AICPA Governing Council, where he served for three years before being asked to serve on the AICPA’s board of diversity and inclusion. He served on that board for another three years.

“Then I got a call from Barry Melancon, who said, ‘The nomination committee has voted, and they have chosen you to be on the global board of directors of the AICPA.’ So here I

come, one of the youngest members and the first Native American to ever join the global board of directors of the AICPA,” Ortiz chuckled.

And it all started with one visit to the Kansas Society of CPAs.

“I was lost in the middle of nowhere, with no involvement, not knowing what I could do or how I could give back,” Ortiz said. “And lo and behold, people who care — like the state societies and the AICPA — and who want to reach out and bring people in did that, and they brought me into that circle — helped me understand and gave me confidence, and they continued to educate me and position me for success.”

When he came to Milwaukee, Ortiz came with a plethora of experience running casino gaming operations: Prairie Band Casino & Resort in Mayetta, Kansas; Kickapoo Lucky Eagle Casino in Eagle Pass, Texas; and Soaring Eagle Gaming Properties in Mount Pleasant, Michigan, which consisted of numerous casinos as well as the Saginaw Chippewa Indian Tribal Government Corporate Services.

At Potawatomi, he is engineering a $190 million renovation of the casino with the end goal of making it a jewel for Milwaukee and a national entertainment destination.

Anyone want to bet he succeeds?

11 On Balance March | April 2024 wicpa.org

Potawatomi Casino & Hotel hosts the Annual Hunting Moon Pow Wow, a three-day annual celebration of Native culture, with cash prizes for singing, drumming and dancing.

Marcia Tillett-Zinzow is a freelance writer and editor who lives in Wisconsin. Contact her at mtzinzow@icloud.com.

Photo courtesy of Potawatomi Casino & Hotel

William Ahlstrom

Karl Ahonen

Michael Akers

Ronald Altenburg

James Anderson

John Andres

Laura Arnow

Richard Barry

James Behrend

William Beisenstein

Charles Benjamin

David Benner

Michael Berns

Lawrence Bittner

Karla Blair

James Blinka

Jennifer Bogli

Richard Boulay

Richard Braatz

James Brandenburg

Dana Brunstrom

Myron Buss

Charles Cedergren

David Chapman

John Chidester

Chris Cholka

Timothy Christen

Edward Cichurski

Michela Cobb

William Coleman

Robert Cook

Jonathan Crowell

Powers Daren

Curtis Day

Tyrone Deacon

Gerald Denor

Suzanne Denzine

Patti Desrosier

Jeff Dewane

Linda Dicks

Sean Donahue

Dale Ebert

Kathy-Ann Edwards

Kathryn Erickson

Gary Ertel

Deidre Erwin

Jennifer Fahey

Fred Farris

Delores Fischer

David Fohr

Robert Foulks

Jeffrey Frank

Michael Friedman

Anthony Fuerst

Jessica Gatzke

David Geertsen

Sharon Geertsen

W. Richard Gerhard

John Gerold

Charles Gierl

Charles Gietzel

Alan Giuffre

Robert Goldie

Kathryn Golsteyn

William Goodman

Michael Grams

Kurt Gresens

William Grimmer

Randall Grobe

Douglas Haag

Michael Hablewitz

Ryan Hanson

Walter Harmann

Robert Hartzheim

Scott Haumersen

Katherine Hauser

John Heindel

William Heinrich

Keith Helm

John Hicks

Kathleen Hoffman

Allyson Hofstede

Tammy Hofstede

Steven Hollmann

Katy Hook

Wayne Huberty

Patricia Huettl

Joseph Imhoff

George Jaloviar

Mark Janke

Bradley Jansen

Christine Janssen

Maria Jarvi

Mark Johannsen

David Johnsen

Bryan Johnson

David Johnson

Elizabeth Johnson

Carl Kantner

Lawrence Kean

Jeremy Keil

John Kellerman

Paul Kersten

Kenneth Klemm

Fr. Kurtis Klismet

Michael Konecny

Thomas Koops

Thomas Koplin

Rosanna Kopling

Thomas Kortas

Frederick Kraegel

Nicole Kraus

Dennis Krautkramer

Jason Krentz

Glenn Krieg

Bernard Kristal

Arthur Kronenberg

John Kuhn

Keith Kwaterski

Gregory LaFreniere

David Lauer

Jack Lee

Richard Lindgren

Thomas Luken

Patrick Lyons

Muriel Marx Hoffmann

Lucretia Mattson

Krista McMasters

Michael McNamara

William Merrick

Thomas Mickelson

Howard Miller

James Miller

Tori Morrow

Jean Mosher

Chad Neumann

Terence Niewolny

William O’Loughlin

Jade Olson

Gerald Ontko

Dana Outhouse

Melanie Patterson

Jeffrey Peterson

Ray Petkovsek

Thomas Polacek

James Possin

Gerald Powers

Steven Pullara

Michelle Puls

Keith Radke

Arnab Ray

Richard Reale

Mary Repka

Joseph Rock

Betty Roethle

Douglas Rogers

James Rose

Kenneth Rose

Henry Rueden

John Sawtell

Matthew Schaefer

Thomas Scheidegger

Ruth Schenning

David Schlichting

Eli Schmukler

Robert Schneider

James Schommer

Harold Schroeder

Richard Scott

Steven Seymour

Dan Smith

Derek Smith

Jane Somers

Richard Spencer

Donald Stacy

Josephine Stahl

Jeffrey Steren

Thomas Stolper

Terry Strittmater

William Tatman

Michael Temp

Angela Thomas

Martin Thomas

Dennis Tomorsky

Lawrence Totsky

Scott Tracy

Kim Tredinnick

Debra Trost

Susan Vetrovsky-Goldstone

Lynn Visser-Young

James Wagner

Roberta Ward

Paula Wegner

Thomas Weingarten

Joseph Wenzler

Lori Wermuth

Sarah Whyte

George Wiesner

Susan Wilcox

Raymond Wilson

Robert Wittke

James Woloszyk

Michael Zongolowicz

On Balance March | April 2024 12 wicpa.org Show your commitment and support of the accounting profession today at wicpa.org/EdFund. Your donation to the WICPA Educational Foundation sends a clear message that you believe in the future of the accounting profession. We appreciate your commitment and THANK YOU FOR YOUR SUPPORT.

THANK YOU 2023 Donors!

Special thanks to donating organizations: Deloitte & Touche LLP Ernst & Young LLP Grant Thornton LLP KPMG LLP PwC Wipfli Foundation Inc.

Reading Makes ¢ents Volunteer this April for

Sponsored by the WICPA Educational Foundation

Help Students Get Money-Smart

April is National Financial Literacy Month and a great opportunity for you to help students get smart about money by reading to an elementary school class (K - 4th grade) about the basics of money.

The WICPA Educational Foundation will provide everything you need. For more information and to volunteer, visit wicpa.org/ReadingMakesCents.

13 On Balance March | April 2024 wicpa.org

Voluntary disclosure program for ERC claims

On Balance March | April 2024 14 wicpa.org

By Jim Brandenburg, CPA, MST

By Jim Brandenburg, CPA, MST

On Dec. 21, 2023, the IRS announced a new Voluntary Disclosure Program (VDP) for the Employee Retention Credit (ERC). This is the latest move by the IRS to address what it considers “dubious ERC claims.” The program presents an opportunity for employers to repay the IRS for ERC claim refunds they received if they have learned they are no longer eligible for the credit. It allows qualifying businesses to repay ERC claim refunds at 80% of what they received and also avoid penalties. The IRS issued Announcement 2024-3 this new program. This is the latest chapter in the ERC saga, which is going on its fourth year now.

In providing this ERC relief, IRS Commissioner Danny Werfel stated:

The disclosure program provides a much-needed option for employers who were pulled into these claims and now realize they shouldn’t have applied.

… From discussions we have had with taxpayers and tax professionals around the country, we understand that there are many employers eager to correct their error but who remain concerned about their ability to pay back the portion of the credit that has been lost to the promoter that brought them into this mess. This new option, with an opportunity to get right with a lower financial cost, provides the relief these taxpayers requested. The new initiative will also help with our ongoing efforts to gather information on promoters who created this situation by aggressively pushing people to apply for the credit.

The details

Employers must apply for the VDP by March 22, 2024.

As outlined in IRS Announcement 2024-3, there are certain qualifications employers must meet to be eligible for the VDP (see below). Businesses or employers that qualify for the program must repay 80% of the tax credit they received. However, if the IRS paid interest on an employer’s initial ERC refund claim, the interest does not have to be repaid.

A business that already received the credit for a prior tax period but now believes it does not qualify for the ERC can apply for this program only if all of the following are true:

“

Recipients of an ERC refund who now are having second thoughts about their eligibility for the credit should closely review the provisions in IRS Announcement 2024-3.

• The employer is not under criminal investigation (and has not been notified that they are under criminal investigation).

• The employer is not under an IRS employment tax examination for the tax period in which they are applying the VDP.

• The employer has not received an IRS notice and demand for repayment of all or part of the ERC.

• The IRS has not received information from a third party that the taxpayer is not in compliance or has not acquired information directly related to the taxpayer’s noncompliance from an enforcement action.

15 On Balance March | April 2024 wicpa.org

1 https://www.irs.gov/pub/irs-drop/a-24-03.pdf

closely review the provisions in IRS Announcement 2024-3. Here are a few other considerations for ERC recipients who are thinking about registering for the VDP:

• IRS disclosure-type programs (like this program for ERC) must be approached with care. While this program offers some favorable ERC settlement terms, if the taxpayer comes forward to register and is not accepted into the program by the IRS, it could put the full 100% of the ERC claim they received at risk. Prior to registering for this program, consider contacting legal counsel to evaluate your situation and the specifics of the VDP.

• The IRS chose 80% as a repayment factor (and thus, a 20% savings for the taxpayer), as 20% was the percentage many third-party firms charged as a fee for an ERC refund claim. The 20% reduction is available to the taxpayer, regardless of what fee, if any, a taxpayer paid to an ERC third-party provider. If a taxpayer registers for the VDP and settles their ERC claim with the IRS at 80%, they can then decide with legal counsel whether to pursue repayment of any fee paid to a third-party provider.

• If a taxpayer has not yet amended their 2021 and/ or 2020 income tax returns, the IRS announcement states that under the VDP the taxpayer is not required to amend their 2020 and/or 2021 tax returns if they pay the IRS the required 80% of their claim.

• Those who meet all the conditions and are interested in signing up for the VDP should not necessarily wait until the March 22 deadline to register. They may

Hypothetical example

Tailor Inc. is a distributor of office supplies. In 2021, Tailor had spoken with Araz, its diligent Wisconsin CPA, who said the company was not eligible for the ERC for two reasons: (1) It did not have a sufficient reduction in gross receipts in 2020 or 2021, and (2) it was not impacted by a government order leading to a full or partial shutdown of its operations.

In 2022, Swipht Corp., an ERC provider, approached Tailor and claimed the company was eligible for the ERC for 2020 and 2021. Swipht stated that due to some OSHA and CDC guidelines related to COVID-19, this constituted a government order resulting in a full or partial suspension of Tailor’s business operations. Tailor actually had experienced an increase in sales during this period and was not shut down during the pandemic. Tailor, however, was persuaded by Swipht to pursue the ERC, and Swipht assisted Tailor with filing refund claims totaling $500,000 for the 2020 and 2021 years. In 2023, Tailor received ERC refunds of $500,000 plus interest of $10,000 for a total of $510,000 and, in turn, paid Swipht $100,000 for its efforts in securing these ERC refunds.

In the fall of 2023, Araz and Tailor met to review 2023 operations, and Tailor informed Araz about the ERC refunds of over $500,000 it had recently received

On Balance March | April 2024 16 wicpa.org

with the assistance of Swipht. Araz was shocked that Tailor had gone ahead with this ERC refund without Araz’s knowledge. Araz informed Tailor that the IRS issued guidance in October, in a “Generic Legal Advice Memorandum,” stating that OSHA and CDC guidelines did not constitute a government order for ERC purposes. Tailor was conflicted on this matter, as one person (Swipht) was stating that Tailor was eligible for the ERC, and the other (Araz) was claiming he was not eligible. Early in 2024 Araz, still smarting from the surprise ERC filing by Tailor, shook it off and explained to Tailor about a new IRS Voluntary Disclosure Program for the ERC. Tailor would need to repay only $400,000 (80%) of its ERC refund, avoid any penalties, and could keep the $10,000 of interest income it had received. Tailor consulted with legal counsel, determined it qualified, opted to register for the VDP, and thanked Araz for being persistent and fearless in trying to remedy this ERC matter.

“

The Voluntary Disclosure Program is a significant development with the ERC.

Closure

The Voluntary Disclosure Program is a significant development with the ERC. Impacted employers should evaluate their situations carefully, determine whether they are eligible for the VDP, and then decide if they want to apply by the March 22 deadline. CPAs can play a valuable role in this process.

17 On Balance March | April 2024 wicpa.org

Jim Brandenburg, CPA, MST, is a tax director with Sikich LLP in Brookfield. Contact him at 262-754-9400 or jim.brandenburg@sikich.com.

www.bank-a-count.com 1-866-385-6316 KEEPING COSTS DOWN FOR YOUR CLIENTS We are a Wisconsin-based company, focused on one thing: our customers We take pride in boasting the lowest prices and the very best customer service, and have been doing so since 1956. Bank-A-Count Corp. offers a variety of computer, manual, and blank stock checks and accessories. Our business checks are guaranteed to be compatible with your accounting software. We also offer a full range of Pre-Inked Stamps, Deposit Products and Accessories. Our Philosophy Our Products Business Checks Deposit Tickets Pre-Inked Stamps “I have used Bank-A-Count for several years. Their website is easy to use and their prices are very right!” - Google Review, February 2021 4.9 Google Customer Reviews

What Every CPA Should Know About the Corporate Transparency Act

In the January/February 2024 issue of On Balance, we featured in-depth articles on the Corporate Transparency Act and Beneficial Ownership Information Report. This article provides further information and serves as a reminder of critical deadlines and penalties associated with the Act.

By Randy S. Nelson, CPA, JD

By Randy S. Nelson, CPA, JD

The Corporate Transparency Act (CTA) is a federal law with a filing requirement for almost every corporation, limited liability company (LLC) and limited partnership. The CTA requires that reporting companies file a Beneficial Ownership Information Report (initial report) with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Treasury. Failure to comply with the CTA’s reporting requirements can result in significant civil and criminal penalties.

Deadlines

The due date for the initial report for your organization depends on when it was formed:

• Jan.1, 2025, for entities already in existence on Dec. 31, 2023

• 90 days after creation if the entity is created between Jan. 1 and Dec. 31, 2024

• 30 days after creation if the entity is created on or after Jan. 1, 2025

Perhaps the most challenging due date occurs when there is a change in any of the information previously reported by the reporting company or a beneficial owner, such as a change of address. An updated report is due 30 days after the change occurs, not 30 days after learning of the change.

When the reporting company becomes aware or has reason to know that an error was made on the initial report or an updated report, a corrected report is due 30 days after that.

“

Failure to comply with the CTA’s reporting requirements can result in significant civil and criminal penalties.

Penalties

There are civil and criminal penalties for willfully failing to timely file a complete and accurate initial report and any required updated or corrected reports. The civil penalty is not more than $500 per day. The criminal penalty is a fine of not more than $10,000, imprisonment for not more than two years, or both.

Purpose of the CTA

The requirement to file the initial report and any required updated or corrected report comes from the CTA passed by bipartisan supermajorities in the United States Congress on Jan. 1, 2021. The purpose of the Act is to fight money laundering and terrorist financing, which are often run through small companies to mask the identities of the owners. Europe has had a similar measure in operation for many years.

Terms

When completing the initial report, keep in mind the following three important terms from the CTA:

The reporting company is the entity required to file the initial report, updated reports and corrected reports with

On Balance March | April 2024 18 wicpa.org

FinCEN. A “domestic reporting company” is created by filing a document with the secretary of state or a similar office. A “foreign reporting company” is created in a foreign country and registered to do business in any state by filing a document with the secretary of state or a similar office.

A beneficial owner is an individual who directly or indirectly owns or controls at least 25% of the reporting company or an individual who directly or indirectly exercises substantial control over the reporting company, even if they do not have an ownership interest in the company — such as a trustee of a trust that owns an interest in the reporting company or senior officers of the reporting company, even if they do not own an interest in it.

Keep in mind that a beneficial owner is always a natural person, never an entity. As a result, when an entity owns an interest in the reporting company, you must keep drilling down to get to the natural persons who will be treated as the beneficial owners. Even after consulting the FinCEN website, you will find there are many unanswered questions when you are examining the facts and circumstances, trying to determine who the beneficial owners of a reporting company are. Because of the potential penalties for failure

to include a beneficial owner, a conservative approach may be the best.

A company applicant is an individual who filed with the secretary of state the document that created the reporting company and an individual who was primarily responsible for directing or controlling the filing. There will be no more than two company applicants.

Information to report

The Beneficial Ownership Information Report filed by the reporting company must include the following information:

• For the reporting company – the full legal name, any trade name or “doing business as” name, the complete current street address of the principal place of business of the company, the state of formation, and the employer identification number.

• For each beneficial owner – the full legal name; date of birth; complete current residential street address; and a photocopy of a nonexpired U.S. passport, a nonexpired state driver’s license, a nonexpired state

19 On Balance March | April 2024 wicpa.org

ID with a picture on it, or if none of those exist, a nonexpired foreign passport.

• For each company applicant as for a beneficial owner (but if the company applicant formed the reporting company in the course of their business, then use the street address of the business). If the reporting company was already in existence on Dec. 31, 2023, then the company applicant’s information is not included in the initial report.

FinCen ID

Alternatively, beneficial owners and company applicants may provide that information directly to FinCEN instead of to the reporting company and obtain a FinCEN ID number, which is then included on the initial report instead of the detailed information. The online application form for a FinCEN ID became available on Jan. 1 at https://fincenid.fincen.gov/landing and requires that the individual first create or sign in to a Login.gov account.

The FinCEN ID may be particularly useful to simplify the reporting process for:

• Beneficial owners who have interests in many reporting companies.

• Beneficial owners and company applicants who do not want to disclose confidential information to the reporting company.

• Company applicants who frequently form reporting companies.

• Reporting companies with many beneficial owners or those with at least one beneficial owner for whom it will be difficult to keep track of updated information for an updated report.

Because the FinCEN ID shifts the responsibility for updating the filed personal information to the beneficial owner, it may also shift the penalties for failing to do that.

Exemptions

There are 23 listed exemptions for entities that are not required to file an initial report. Most exemptions are for entities already subject to disclosure rules, such as publicly traded companies, banks and tax-exempt entities.

The exemption for large operating companies may provide some relief. To be a large operating company, the following three tests must all be met: (1) must have more than 20 full-time employees, (2) must have operating presence at a physical office within the U.S., and (3) must have filed a federal income tax or information return in the U.S. for the previous year, demonstrating more than $5 million in gross receipts or sales, excluding those from sources outside the U.S.

Action items

1. Have reporting companies establish CTA compliance procedures and clearly designate an owner, employee or outside professional who will have responsibility for timely filing the initial report and being the repository to receive the necessary information to file updated reports.

2. Beneficial owners and company applicants should obtain a FinCEN ID.

3. If the reporting company has individuals who are not owners but are senior officers or others with substantial control of the reporting company, have an analysis done of the facts and circumstances to determine if they have to be included as beneficial owners on the initial report or updated reports.

4. Update shareholder agreements, LLC operating agreements, limited partnership agreements, and nonowner employment agreements with employees who have substantial control to require that beneficial owners provide and update the appropriate person with the information needed for filing an accurate and timely initial report and for filing accurate and timely updated reports — or require that they obtain and keep updated a FinCEN ID, and provide that ID to the appropriate person designated by the reporting company.

Randy S. Nelson, CPA, JD, is a shareholder with von Briesen & Roper s.c. in Milwaukee. Contact him at 414-270-2507 or randy.nelson@vonbriesen.com.

On Balance March | April 2024 20 wicpa.org

YOUR PROPERTY TAX PARTNER

The Property Tax Section of von Briesen & Roper, s.c. has extensive experience and is your comprehensive resource for property tax issues. From public to private entities, the Property Tax Section has assisted clients in contesting and defending property tax assessments, chargebacks, tax exemptions, and advising on PILOT agreements and TIF/TID districts. Our creative approach to the most complex matters has positioned us to be your trusted advisor on property tax. The bottom line? We get results.

To learn more about our Tax Section, please contact Dan Welytok at daniel.welytok@vonbriesen.com.

21 On Balance March | April 2024 wicpa.org

Milwaukee • Madison • Neenah • Waukesha • Green Bay • Chicago • Eau Claire

vonbriesen.com/tax

Paul Baniel, CPA, CGMA, has received the CFO of the Year 2023 Lifetime Achievement Award from Insight on Business magazine. He retired in 2023 from his position as vice president of finance and administration for the Green Bay Packers.

Jamie Barwin, CPA, has joined von Briesen & Roper s.c. in Milwaukee as a shareholder in the Trusts and Estates Section.

Brian Ellenbecker, CFP, EA, CPWA, CIMA, CLTC, has been promoted to partner and financial advisor at Shakespeare Wealth Management in Pewaukee.

Stephanie de Groot, CPA, has been promoted to principal at BDO USA P.A. in Milwaukee.

Paula Haferman, CPA, has been promoted to partner at Hawkins Ash CPAs in Neenah.

Adam Hanson, CPA, has been promoted to partner at SVA Certified Public Accountants in Madison.

Mandy Hein, CPA, received a Top 10 Under 40 award from the Rhinelander Chamber of Commerce and Forward Rhinelander in recognition of her impact on the community.

Cassie Kurek, CPA, has advanced to the role of principal at CliftonLarsonAllen (CLA) in Stevens Point.

Kevin LeMahieu, CPA, CFO at Bank First, has received the CFO of the Year award in the community service category from Insight on Business magazine.

Erika Nowak, CPA, MBA, has been promoted to executive vice president and chief financial officer at Ixonia Bank.

David Schlichting, CPA, PhD, has been reappointed as a CPA representative to the Wisconsin Accounting Examining Board for a second term.

Carver Smith, CPA, managing partner at Wisconsin-based staffing and executive search firm Truity Partners, has been recognized as a Wisconsin Titan 100. The national Titan 100 program recognizes the top 100 CEOs and C-level executives in a region.

Sacia Wheeler, a personal finance and accounting teacher at Vel Phillips Memorial High School in Madison, spoke with Spectrum News 1 about the new half-credit financial literacy requirement for high school students.

On Balance March | April 2024 22 wicpa.org

Want your new job, promotion or award mentioned in Kudos? H Email your announcement and photo in JPG format to mtzinzow@icloud.com. H Vanden Heuvel & Associates CPAs LLC, business specialists in the Greater Madison area, and Vesta, a CPA-led advisory firm formerly known as Huberty, are pleased to announce their merger, effective Jan. 1. FIRM NEWS

kudos

Adam Hanson

David Schlichting

Jamie Barwin

Cassie Kurek

Paul Baniel

Mandy Hein

Stephanie de Groot

Kevin LeMahieu

Brian Ellenbecker

Carver Smith

23 On Balance March | April 2024 wicpa.org Whether you’re looking for a new career or a new employee, the WICPA’s Career Center can help you make the most of your search. Post Job Openings l Upload Your Resume l Apply For Jobs WICPA Career Center Find or post a job today at wicpa.org/CareerCenter.

Engagement timing

Client name Scope of services

8 Critical Elements of an Effective Engagement Letter

Deliverables

CPA firm responsibilities

Client responsibilities

An engagement letter is critical to the success of any CPA. To help protect yourself and your firm, make sure your letter has these eight elements.

By Deborah K. Rood, CPA, MST

One of the best tools a CPA can (and should) consistently employ to help manage their professional liability risk is an engagement letter — a document that defines the contractual obligations between the CPA and their client.

Of course, it can’t just be any engagement letter — it needs to be an effective one. An effective engagement letter identifies the services to be performed, each party’s

responsibilities, and the terms and conditions of the engagement. Ineffective engagement letters are overly brief, absent of key elements, and poorly written.

While most CPAs understand the significance of engagement letters, there’s evidence that supports the need for practice improvement throughout the accounting profession. According to CNA, the endorsed insurer of the AICPA Professional Liability Insurance Program, only 50% of tax

On Balance March | April 2024 24 wicpa.org

&

Termination & withdrawal Billing

fees

claims asserted against CPA firms in the program in 2022 had an engagement letter related to the underlying service. For consulting services claims in the same year, only 68% had an engagement letter (better but not where it should be).

To help you protect yourself and mitigate risk, these eight critical elements should be included in every engagement letter.

Client name

The first critical element may seem obvious — the identities of the parties involved in the engagement. However, it’s important to remember that identifying all engaged parties provides a defense to third parties asserting that the engagement was performed for their benefit.

In your engagement letter, ensure that the client’s proper legal name is used, including subsidiaries and other related parties (if services are to be delivered to those parties). Within the body of the letter, consider identifying a specific point of contact you’ll take direction from and to whom questions and requests should be directed. Identifying a singular client point of contact has proven to be beneficial, particularly when business owners are in conflict with one another or if a request is made of you by an owner who’s not the primary contact.

Scope of services

Often, disputes arise when the client’s understanding of the services to be rendered differs from yours. To reduce the likelihood of an expectation gap and avoid misunderstanding or misinterpretation, your engagement letter should clearly delineate the services to be provided with sufficient detail.

Although such detail may be fairly straightforward for an attest or tax compliance engagement, it’s commonly less so for consulting and tax services other than tax compliance. Work with your client to articulate the specific scope of the service they require, and include such details in your engagement letter.

For example, “Consult regarding the individual income tax implications of the current year sale, installment sale, or likekind exchange of the real property located at 123 Main Street, City, State, based upon a sale price of $X,” is preferable to a brief summary. For instance, “Minimize the tax on the sale of the rental property” is far too brief and may raise questions regarding which rental property or if tax was truly minimized if another planning strategy resulted in less tax.

After the scope of services is drafted, consider asking a colleague or an impartial party to read your engagement letter to help evaluate whether it’s sufficiently specific.

CPA firm responsibilities

Your CPA firm’s responsibilities are generally limited to performing the services identified in the engagement letter

in accordance with the professional standards outlined in the letter. Why include relevant professional standards? Doing so helps identify the specific duty of care to which you’ll be held in the event of a dispute, and it provides a defense to the plaintiff’s counsel suggesting that a different standard applies.

This section of your engagement letter should also include limitations of the engagement, which, for most services, includes no responsibility to detect theft, fraud or weaknesses in your client’s internal controls.

Client responsibilities

Experience demonstrates that clients who deflect their responsibilities related to your services are quick to blame you if problems arise. Therefore, clearly defining their responsibilities is an important element of every engagement letter for any service. Client responsibilities may include, but are not limited to:

• Providing requested information and responding to inquiries in a timely manner.

• Maintaining a system of internal controls.

• Making management decisions.

• Accepting responsibility for the results of your firm’s services.

• Providing certain representations when requested.

25 On Balance March | April 2024 wicpa.org

1

3

2

4

Deliverables

The deliverable is the result or work product of the service you’ve been engaged to perform for your client (e.g., an audit report, a tax return, or a written memo summarizing recommended process improvements). Written deliverables are preferred to oral ones since they provide evidence of the work you’re expected to perform. However, if oral advice is provided, the deliverable could be an email to your client summarizing the oral advice you provided. Of course, like the scope of services, it’s important to be specific in your engagement letter. Be sure to:

• Describe the anticipated deliverable and its format.

• Identify tax form names and numbers to be prepared (if applicable).

• Attach a template of the deliverable (if additional clarity is needed).

• Note any restrictions or limitations on the use and distribution of the deliverable. With the exception of

“ What’s important to take away is that engagement letters help protect you and your firm from disputes and offer clients clarity of what they can expect while working with you.

attest engagements, most CPA firm deliverables are solely for client use, not for third parties, which should be clearly stated in the engagement letter.

Identify when services will begin and any contingencies, such as receipt of client documentation, engagement letter or retainer, that may affect the start date. This clarification helps reduce the risk of a misunderstanding with your client

The same is true for the service’s end date. Identify when the services are expected to conclude, whether it’s a milestone, such as delivery of the engagement work product, or a specific date or length of time. This clarification helps determine when the statute of limitations begins, which can aid in your defense in the event of a professional liability claim.

Termination and withdrawal

While nobody likes to contemplate ending an engagement before work is complete, it can and does occur. You may wish to terminate an engagement if your client insists that you take an unreasonable tax position or if your client hasn’t paid you for your services. So, make sure to include a statement in your engagement letter that notes you may withdraw from the engagement at any time without completing the services. If you feel providing examples is necessary, be sure to include the phrase “including but not limited to,” to convey that other circumstances may result in termination or withdrawal.

Billing and fees

Including the fees or fee estimate in your engagement letter helps clarify, in writing, the anticipated cost to your client. This specificity increases the likelihood of being paid and reduces the likelihood of a fee dispute. You should also

On Balance March | April 2024 26 wicpa.org

8

7

5

identify contingencies that may result in fees that differ from the estimate provided.

Simply put, engagement letters often serve as written records of discussions or mutual understandings that’ve already transpired. What’s important to take away is that engagement letters help protect you and your firm from disputes and offer clients clarity of what they can expect while working with you. If a client balks at signing an engagement letter, consider drawing a parallel to their business or everyday life. Would an architect start designing a home without an understanding of what the homeowner wanted? Would an individual turn a car over to a mechanic without first approving what is to be repaired and at what cost? Obviously not. The same should be true for CPAs — engagement letters should be the foundation of our business.

27 On Balance March | April 2024 wicpa.org

Deborah K. Rood, CPA, MST, is a risk control consulting director for CNA Insurance in Chicago.

Reprinted from Insight magazine, a publication of the Illinois CPA Society. Used with permission.

WI business

for Accounting Firms & Accounting Executives Hire top talent for Bookkeeping, Accounting, Tax, Audit, Payroll, Backoffice! OFFSHORE STAFFING SOLUTIONS globalskillbench.com/wicpa 25 years of offshore staffing experience info@globalskillbench.com 414-877-7218 Save 75 % on FTE costs Hire young, experienced professionals Faster turnaround with client deliverables Save time with hiring, focus on business growth

Founded

by and for CPAs

Reaching Next-Gen Talent With High School Visits

By Victoria Spencer

By Victoria Spencer

The accounting industry is undergoing rapid transformations in response to technological advancements, changing regulations and evolving business landscapes. To help ensure a steady influx of talented professionals, it’s crucial for public accounting firms to actively engage with the next generation early on.

We believe Wipfli has found a solution by interacting with local high schools through hosting class visits at our firms. These visits play a pivotal role in bridging the gap between early academia and the real-world demands of the accounting industry. In this article, we share our experiences in the interest of the profession as a whole.

The benefits of hosting school visits

Hosting school visits helps firms foster relationships with local high schools, identify and nurture young talent, and create a pathway for students to pursue accounting-related degrees and certifications. Establishing these connections early on can lead to internships, scholarships and mentorship programs, making a seamless transition from education to employment.

One of the primary reasons for hosting high school visits is to provide students with firsthand experience of the profession. Traditional classroom settings may not fully capture the dynamic nature of accounting, but exposing high school students to real workplace environments can ignite their interest and passion for the field. Witnessing professionals in action and engaging in interactive sessions can make the abstract concepts they learn in class more tangible and relevant.

Many high school students are also uncertain about their career paths and lack awareness of the diverse opportunities

“

To help ensure a steady influx of talented professionals, it’s crucial for public accounting firms to actively engage with the next generation early on.

within the accounting industry. Visiting firms allows students to explore various roles, from tax and audit to forensic accounting and advisory services. And exposure to the breadth of the profession enables students to make informed decisions about their educational paths and future careers.

Changing perceptions

When people think of accounting, they think of numbers. But accounting isn’t just about crunching numbers — it requires strong communication, digital fluency, critical thinking and problem-solving skills. High school student visits allow them to develop these essential skills by interacting with professionals in a real-world setting. Activities such as open networking time, mock-client interactions, discussions around technology use, and educational presentations can help students cultivate skills necessary for success in the accounting industry.

During these visits, students also hear firsthand from associates in a panel setting about internship programs, culture, variances in career trajectory and more.

Making the most of your visits

When we host visits, Wipfli sends a local partner to share more about Wipfli’s history and the future of the accounting

On Balance March | April 2024 28 wicpa.org

{ Human Resources | Recruiting }

profession. We use breakout groups with a career-fair style industry rotation so that students can see our variety of services and what it’s like to work in those areas. And we always include an office tour and open networking.

Here are a few quotes from one of our recent high school visits that show how impactful a visit to a public accounting firm can be:

• As a senior in high school, [I feel that] visiting Wipfli was an enriching experience, and I am appreciative of the time, insights and warm hospitality extended to us

by the Wipfli staff. I enjoyed gaining an understanding of the expertise of the Wipfli team and the diverse range of positions and projects that are undertaken within the company. Learning about the inner workings of a CPA firm and the various intersections of accounting with other industries — such as computer science — has ignited my enthusiasm to pursue a future in this field. I am now more informed about the many opportunities and possibilities in the business world, and I am eager to explore this path further!

29 On Balance March | April 2024 wicpa.org

• I very much enjoyed the field trip. I am glad I got to learn about all of the different roles and types of accountants that come into play at Wipfli. My favorite topic was definitely the audit accountants and how they look through other companies’ financial statements and inventory to make sure everything they have is documented.

• The field trip to Wipfli has helped me better understand what it looks like to be an accountant. I learned more about different fields within accounting, including auditing, tax accounting and consulting. I learned about internships and the CPA Exam and how important they are. This field trip helps reaffirm the importance of networking, so I plan to make my own LinkedIn account. It was very interesting to learn more about auditing and how people get to travel to different Wipfli locations across the U.S. and abroad. I learned more about 1040s and the difference between a 1099 and a W-2. I enjoyed listening to the different presentations!

The future of talent

School visit initiatives not only benefit the students but can also drive your firm’s continued success and the sustainability of the accounting industry. Actively engaging with local high schools can contribute to your firm’s corporate social responsibility efforts by demonstrating your commitment to education and community development — something prospective employees say they are looking for.

Hosting high school visits can also act as a strategic investment in the industry’s future. By providing experiential learning opportunities, fostering career exploration, developing skills, and engaging in community outreach, your public accounting firm can play a crucial role in shaping the next generation of professionals.

If you want to learn more about connecting with high schools and hosting high school visits, contact the author, whose contact information appears below.

Victoria Spencer is a senior talent acquisition specialist at Wipfli in Milwaukee. Contact her at 414-290-8056 or vspencer@wipfli.com.

On Balance March | April 2024 30 wicpa.org

{ Human Resources | Recruiting }

Perspective changes everything. Bring your why. Come work with us. wipfli.com/careers

Elena Aviles

Jesse Becker

Keystone Tax LLC

Madison Behlke

Menomonee Falls High School

Kalea Biddick

Mineral Point High School

Rori Bossert

Mineral Point High School

Jacob M. Boyer

Baird Private Wealth Management

Aaron Brown

UW–Platteville

Veena L. Brown

UW–Milwaukee Lubar Business School

Braedyn Budde

UW–Platteville

Erica J. Buechel

BDO USA P.C.

MacClain Busser

Mineral Point High School

Joseph D. Byrne

Jack Ceplina

Menomonee Falls High School

Poonam Chawhan

Brooke Chromy

Carter W. Cousland

UW–Milwaukee Lubar Business School

Michael Croasdaile

Elena Curtis

Baker Tilly

Patricia Davies

Colton Dochnahl

Mineral Point High School

Jonathan Doria

Denise Durkin

Williams Bay High School

Clayton K. Fields

Fields Tax and Accounting LLC

Grady Finley

Mineral Point High School

Tieranny N. Frassetto

Deloitte & Touche LLP

Owen Friedow

UW–Platteville

Nicole A. Gamroth

SVA Certified Public Accountants S.C.

Caiden Garcia

Mineral Point High School

Jake Gathje

UW–Platteville

Maisie M. Gelhar

UW–Milwaukee Lubar Business School

Julio Gonzalez

Cara Greene

Madison Grulkowski

Franklin High School

Justin Guagliardo

Dave A. Haas

De Forest High School

Michael Hanke

Marshfield High School

Elizabeth Hedges

Madison Community Foundation

Alexis Hentrich

Mineral Point High School

Anthony Hoeflich Jr.

UW–Milwaukee Lubar Business School

Roseanna M. Hoffman

Hoffman CPA

AnnMaree Hooper

Noelle Hurula

UW–Platteville

Jennifer Jacobs

Wilson Kerschner

Menomonee Falls High School

Hasaan A. Khan

Cameron Klein

UW–Whitewater

Sabrina M. Kloehn

Goodwill Industries of North Central Wisconsin Inc.

Reed Kluesner

UW–Platteville

Ellie Klun

Menomonee Falls High School

Jonathan Kollen

Devyn Korish

Hawkins Ash CPAs LLP

Zachary D. Kosidowski

Erika Kott

Full Spectrum Solutions LLC

Stephanie Kurtzweil Mosinee High School

Shawn M. Lanser

Landon R. Lemke Concordia University

Erica Rose Ludlum

Mineral Point High School

Pawandeep K. Mann

Jenesis Marquez

UW–Milwaukee Lubar Business School

Valerie Martin

Mineral Point High School

Justin R. Muth

Michael L. Nehs

Quangdat Nguyen

UW–Milwaukee Lubar Business School

Jennifer L. O’Leary

Northwestern Mutual

Jayda Padulla

UW–Platteville

Matthew S. Pappas

Max P. Paul

Grant Thornton LLP

Merisa Paynter

Mineral Point High School

Jaedyn Paz

Menomonee Falls High School

Natalie Prudhomme

Menomonee Falls High School

Garrett L. Pynckel

Deloitte & Touche LLP

Ryley Reichling

Mineral Point High School

Nathan Reynebeau

Gardner Denver

Alex Ross

Mineral Point High School

Hanna Rott

McFarland High School

Abbey Rowe

UW–Platteville

Charles Rutter

Franklin High School

Joseph Sadowski

Menomonee Falls High School

Harman Saini

Kapur and Associates

Gretchen Schmook

Michael Schrank Jr.

Slinger High School

Hudson Schroeder

Mineral Point High School

Kylie B. Schwingle

Nordic Consulting Inc.

Beth Senger

Chortek LLP

Jalen Sims

UW–Platteville

Steven D. Sobocinski

Alecia Swenson

BDO USA LLP

Taylor Tousey

Yeye S. Trawicki

CliftonLarsonAllen LLP

Emma Tuescher

UW–Platteville

Zachary J. Walsh

Violette Walter

Dale Yoo

Menomonee Falls High School

Aaron K. Young

Spectrum Tax Wealth Advisors

Jesus Zamudio

UW–Milwaukee Lubar Business School

31 On Balance March | April 2024 wicpa.org

newest

December 1, 2023 – January 31, 2024

Welcome new members! Get to know the

members of the WICPA.

5 Commonsense Steps to Successful Networking

On Balance March | April 2024 32 { Professional Development | Networking }

By Daniel Kochka, CPA, CFE, MBA

As business professionals in an increasingly competitive field, the role of the CPA is ever expanding. Networking might be neither a traditional nor instinctual skill, but it is vital for seeking new business and expanding your network.

If the thought of networking is uncomfortable, rest easy, because the best way to grow your client base or business network is also the easiest. You don’t have to take a course in selling or learn a series of pressure tactics. The most critical component of networking is connection. Every CPA has multiple relationships in their daily lives and, through these connections, can build significantly larger networks.

Networking can be easy, comfortable and even enjoyable when you follow these five steps:

1. Know yourself