52 minute read

Comment period extended for use of passenger vessel SMS

from WorkBoat May 2021

by WorkBoat

MAY 2021 NEWS LOG

NEWS BITTS

Vineyard Wind to use DEME, Foss for installation

Belgium-based installation contractor will work on Vineyard Wind project.

DEME Offshore US will team with Foss Maritime to construct the 800-megawatt Vineyard Wind 1 offshore energy project, using the “feeder” concept of a foreign- ag wind turbine installation vessel (WTIV) supplied onsite by Jones Act-compliant U.S. vessels, Vineyard Wind developers announced in March.

The joint venture between Avangrid Renewables and Copenhagen Infrastructure Partners would be the first truly utility-scale offshore wind energy project in U.S. waters. Now on the verge of winning approval for its construction and operations plan from the federal Bureau of Ocean Energy Management (BOEM), the project could be begin delivering energy into the Massachusetts power grid in 2023.

Belgium-based DEME is the installation contractor, with of ces in Massachusetts to serve as the base of operations. A DEME WTIV jackup vessel working on the Vineyard Wind lease, starting 15 miles offshore from Martha’s Vineyard, Mass., would be supplied by Foss vessels from the port of New Bedford, Mass.

The feeder-vessel model was used in the rst U.S. pilot projects, the 30-MW Block Island Wind Farm off Rhode Island by Deepwater Wind/Ørsted and the 12-MW Coastal Virginia Offshore Wind by Dominion Energy. Dominion is backing construction of its own rst U.S.- ag WTIV, amid widespread concern in the industry that global demand for services of those heavy-lift vessels could slow the development of offshore wind projects in U.S. waters.

For Vineyard Wind, Foss Maritime, a longtime U.S. maritime service contractor with union labor, will provide the Jones Act-compliant feeder vessels. That’s a big political selling point for offshore wind in Northeast states, where organized labor has lots of clout with pro-wind energy governors and

lawmakers. — Kirk Moore

Biden’s infrastructure plan a boost to workboat industry

On April 1, President Biden unveiled an ambitious plan to improve the U.S.’s aging infrastructure that proposes funds for inland waterways, coastal ports, land ports of entry (border stations) and ferries.

Waterways advocates were happy to hear Biden lay out his vision for an infrastructure overhaul at a carpenters training center outside Pittsburgh, where three major rivers converge at one of the busiest spots for navigation along the inland river system.

“It is not a plan that tinkers around the edges,” the president said. “It is a once-in-a-generation investment in America.”

Among many other elements of the proposal, Biden calls on Congress to invest an additional $17 billion in inland waterways, coastal ports, land ports of entry and ferries, which, he says, “are vital to our nation’s freight.” No more details were immediately available about how that money would be spent, or what the president’s priorities would be in this sector.

It’s clear that his initiatives will put climate change and clean energy as priorities. He includes in his waterways initiative a “Healthy Ports program to BOUCHARD PAYS $375,000 TO MARINER

Bouchard Transportation Co. Inc. and three former and current management offi cials have paid $375,000 in restitution to the brother of one of two mariners killed in a barge explosion off the Texas coast in 2017. The mariner alleged the company fi red him for cooperating with investigators and reporting safety concerns to the Coast Guard. The explosion occurred on Oct. 20, 2017, off Port Aransas aboard the ATB Buster Bouchard/B. No. 255.

PASSENGER VESSEL SMS COMMENT PERIOD EXTENDED BY USCG

The Coast Guard is extending the comment period for the advance notice of proposed rulemaking (ANPR) published Jan. 15, 2021, that seeks comments on the potential use of Safety Management Systems (SMS) to improve safety and reduce marine casualties on board U.S.-fl agged passenger vessels. The Coast Guard is extending the comment period to June 1, 2021. Comments must be received by the Coast Guard on or before June 1.

MARAD MONEY FOR PORT INFRASTRUCTURE

Marad is encouraging states and port authorities to apply for $230 million in discretionary grant funding for port and intermodal infrastructurerelated projects through the Port Infrastructure Development Program (PIDP). Transportation Secretary Pete Buttigieg announced the funding at a White House offshore wind energy program event.

Go to workboat.com/news for the latest commercial marine industry news.

mitigate the cumulative impacts of air pollution on neighborhoods near ports, often communities of color.”

MARINE LUBRICANTS WITH THE POWER TO PROTECT

YOUR VESSEL, YOUR EQUIPMENT AND THE ENVIRONMENT

ATB BIOBASED EP-2 & ATB BIOBASED EP-2T GREASE

• These versatile greases meet U.S. EPA Vessel General Permit (VGP) requirements. • Passes U.S. EPA Static Sheen Test 1617 and U.S. EPA Acute Toxicity Test LC-50. • ECO-Friendly and Ultimately Biodegradable (Pw1) Base Fluid – 75.2%. • Designed for use on Articulated Tug Barge (ATB) notch interface, coupler ram and drive screws, above deck equipment, rudder shafts, wire rope, port equipment, cranes, barges and oil platforms. BIOBASED EP-2T is extra tacky.

BIO-SYNXTREME HF SERIES HYDRAULIC FLUIDS

• These fluids meet U.S. EPA Vessel General Permit (VGP) requirements. • High-performance, synthetic polyalkylene glycol (PAG)-based formula. • Non-Sheening – Does not cause a sheen or discoloration on the surface of the water or adjoining shorelines. • Provides long service life and operating reliability, lower maintenance costs, and reduced overall downtime. • Excellent anti-wear performance - rated as anti-wear (AW) fluids according to ASTM D7043 testing and FZG testing. • High flash and fire points provide safety in high temperature applications. • All season performance – high viscosity indices and low pour points. • ECO-Friendly and Readily biodegradable according to OECD 301F. • “Practically Non-Toxic” to fish and other aquatic wildlife according to the U.S. Fish and Wildlife Service hazard classification.

VGP COMPLIANCE STATEMENT LUBRIPLATE ATB BIOBASED EP-2 GREASES and BIO-SYNXTREME HF SERIES HYDRAULIC FLUIDS are Environmentally Acceptable Lubricants (EAL)s according to the definitions and requirements of the US EPA 2013 Vessel General Permit, as described in VGP Section 2.2.9

INCLUDED AT NO ADDITIONAL CHARGE Lubriplate’s

ESP

Complimentary Extra Services Package

COLOR CODED LUBE CHARTS & EQUIPMENT TAGS EQUIPMENT SURVEYS / TECH SUPPORT / TRAINING LUBRICATION SOFTWARE / FOLLOW-UP OIL ANALYSIS

Shot in the Arm

After months of waiting, mariners fi nally begin to get access to Covid-19 vaccinations.

Mariners are fi nally starting to receive their Covid-19 vaccines.

Capt. Randy Suttles

By Pamela Glass, Washington Correspondent

As Covid-19 vaccine supplies continue to increase and states begin ramping up their vaccination programs, maritime transportation workers are starting to get their turn at the jab.

But it’s been a long slog, demanding patience and continued safety vigilance for those working in the industry who want to be vaccinated.

Mariners have had to work through the pandemic, delivering barge tows loaded with supplies and cargoes without interruption along the inland and coastal waterways, guiding and of oading ships in the ports and navigating big cargo vessels. For this, they are considered essential workers, but they haven’t been deemed essential enough for priority vaccinations.

This is nally changing as states, who make their own vaccination rules, are either including mariners in priority groups, or opening up their entire population to vaccinations as the vaccine supply increases. President Biden set a goal that by April 19, 90% of U.S. adults would be eligible for shots, and 90% would have a vaccination site within ve miles of their homes.

PRIORITIZE MARINERS

According to a list compiled by the American Waterways Operators (AWO) in late March, Alabama, Arkansas, Delaware, Hawaii, Kentucky, Louisiana, Missouri, Tennessee and Virginia consider maritime transportation workers eligible for priority shots in their states. Other states have indicated that they will include mariners as their vaccine supplies and rollouts expand this spring.

For months, the maritime industry has been lobbying state and federal governments and various health agencies to secure priority Covid-19 vaccinations for U.S. mariners. But the effort has met with only partial success, as decisions are fragmented, with guidance coming from the federal government, but nal decisions on priority vaccination groupings being made by state health of cials and governors, or in some cases, local county of cials.

Some states, for example, prioritize grocery workers but others do not. Other states give the elderly the jab rst, while others do not. Same for teachers. In just about every state, mariners, often lumped together with other infrastructure workers, are omitted from priority groupings.

“What we’re seeing is a patchwork approach when high level guidance and decisions are made at the local and state levels,” said Caitlin Stewart, director of regulatory affairs at the AWO.

She said states have different drivers for setting their priority groups, such as protecting vulnerable people in nursing homes or immunizing teachers so that schools can reopen. “Our argument is that maritime transportation workers are critical to the national supply chain and the ability of other frontline workers to do their jobs. You can’t ll grocery

shelves without products to put there.”

Another complication for mariners is that they often live in one state, report to work in another, and get off their vessel in yet another location. Different vaccination rules among states can create a confusing mess.

At barge operator Campbell Transportation Co. in Houston, Pa., management is emphasizing vaccine education to its 470 employees, providing them with easy access to learn about eligibility in the states where they live or work through the company’s website.

“As with most operators, we have employees who live all around the place,” in states with differing vaccination rules, said Gary Statler, vice president of administration. He said there are employees who want to have the shot, others who don’t, and some that are hesitant. Campbell is neither encouraging nor discouraging vaccinations of its employees, leaving that decision up to the individual.

“We haven’t had a lot of employees who have reached out in frustration that they aren’t able to get it,” Statler said. “Right now, our approach is working with our employees as far as providing information on how to do it.”

NATIONAL STRATEGY NEEDED

While infections in the inland industry have been relatively small, and connected to exposure mostly off vessels, the situation is far more serious in the nation’s ports, where some 1,000 West Coast longshore workers have been infected with Covid-19 and over a dozen have died. Many more have been off the job because of the pandemic, causing port congestion and delays, according to the Maritime Labor Alliance.

Labor unions have offered educational and logistical support, including use of union facilities as vaccination sites.

For many in the maritime industry, the vaccination process has been far too slow in reaching them. AWO and other organizations have appealed to federal health agencies like the Centers for Disease Control to give mariners priority status on the guidelines they provide to state governments, while also reaching out to some two dozen individual states where mariners work. The industry has also contacted Congress, the White House, and appeared at congressional hearings.

www.AEF-Performance.com

www.PerformanceInflatables.com

www.Subsalve.com

HIGH-DURABILITY FLEXIBLES

• Liquid containment systems • Berm liners • Emergency water distribution

systems

• Air cushion vehicle skirts • Industrial diaphragms • Deployable solids management

BUOYANCY INFLATABLES

• Underwater lifting bags • Vehicle recovery systems • Pipe pluggers • Aircraft lifting bags • Proof load testing products • Ordinance disposal systems

Contact: Address: 113 Street A, Picayune, MS 39466 U.S.A. Phone: (601) 889-9050 Email: sales@AEF-Performance.com Contact: Address: P.O. Box 2030, North Kingstown, RI 02852 U.S.A. Phone: (401) 884-8801 Email: sales@Subsalve.com

Campbell Transportation provides its mariners with Covid-19 vaccine information through its website.

Cody Foster

“The response was varied. Some invited the conversation, while others had more of a closed process on vaccination allocation,” AWO’s Stewart said. “We’ve seen some breakthroughs but it has been a patchwork as states approach (vaccine allocation) differently.”

Nonetheless, maritime workers have not been given higher priority or categorized as frontline essential workers in the guidelines the CDC has given states, even though the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency and the Coast Guard consider mariners essential workers.

“This suggests that a national strategy for mariner vaccination, or at minimum, clear federal guidance for states, is urgently needed to ef ciently immunize these essential workers and ensure the safety and continuity of waterborne transportation,” Del Wilkins, president of Illinois Marine Towing Inc., Joliet, Ill., told a House subcommittee hearing in February. “We’re not asking to cut the line. We’re asking to work with you and the administration to ensure the timely and ef cient immunization of a relatively small segment of the country’s frontline essential workforce that has an outsize impact on our economy and security.”

To help mariners secure vaccinations, AWO has prepared two template letters for companies to give to their workers explaining to a vaccine provider that mariners are essential workers and live and work in congregate settings.

BRIAN GAUVIN PHOTO

DEC. 1 - 3, 2021 NEW ORLEANS

Morial Convention Center, Halls B, C, D, E & F

Produced by

Presented by We know that the WorkBoat Show is your annual chance to network, shop, connect, and get in the know among the best in the business. It is a maritime industry tradition. And through good times and bad, this is the marine industry’s show. With many things changing in the world right now, we want you to know that the International WorkBoat Show will be held as scheduled, December 1-3, 2021. For over 40 years the WorkBoat Show has been here for you and this year, more than ever, we cannot wait to host you in New Orleans.

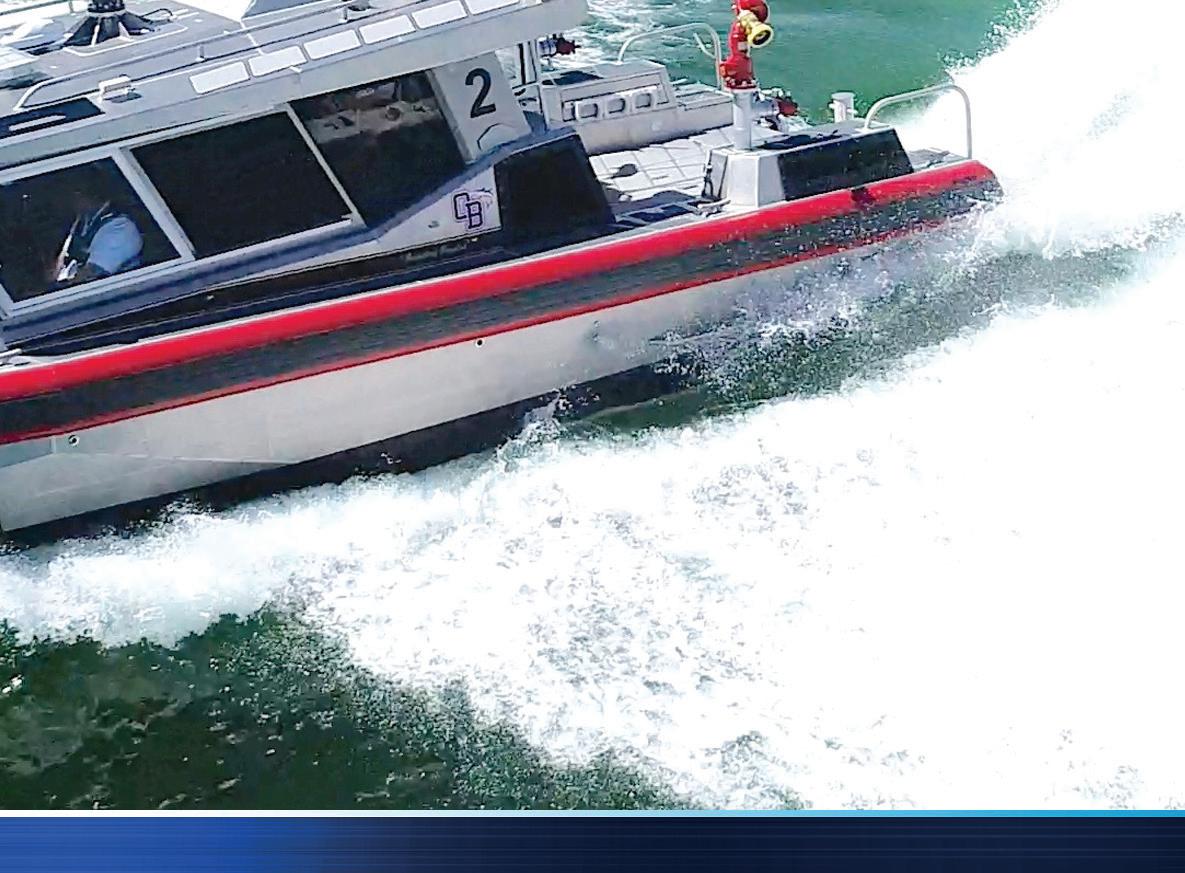

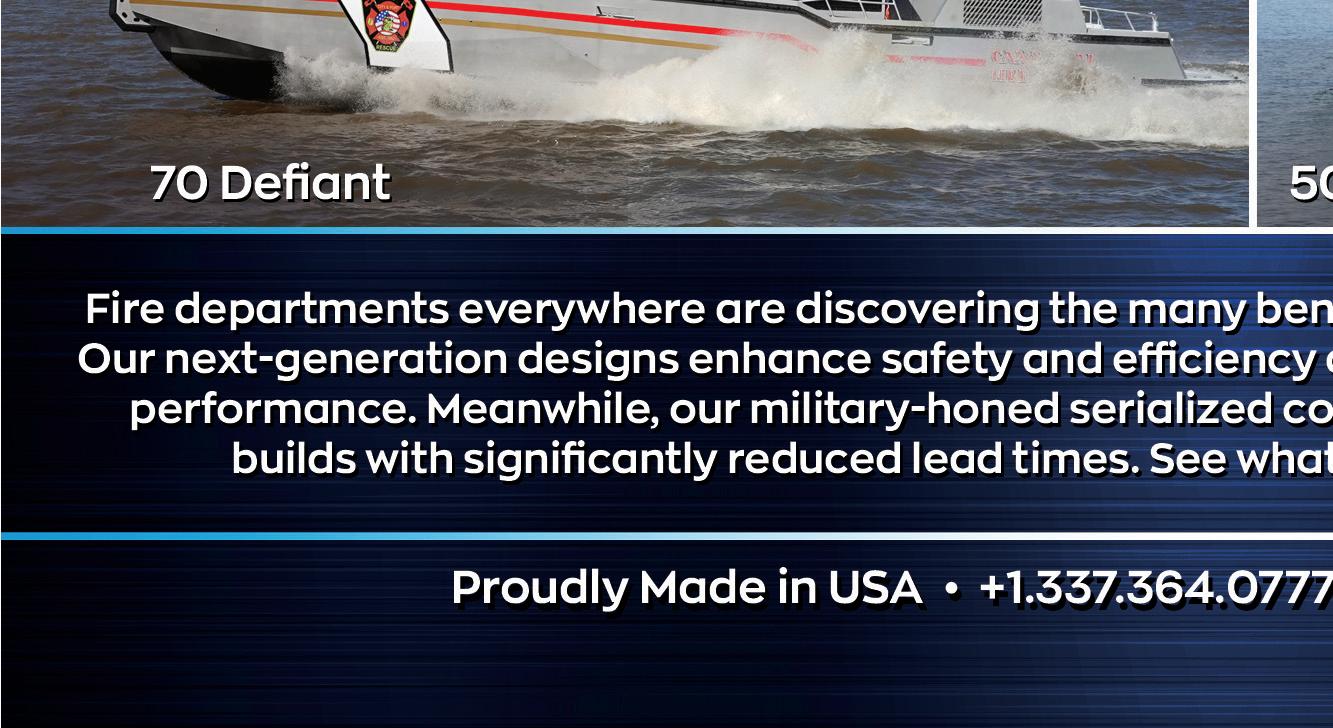

Fire Fighter

Prevention and protection against fi re at the Port of New Orleans is a big task.

The Port of New Orleans’ fi reboat Gen. Roy S. Kelley has a pumping capacity of 14,500 gpm.

By Ken Hocke, Senior Editor

No matter how you look at it, the Port of New Orleans (Port NOLA) is an impressive entity. It encompasses parts of three parishes on the Mississippi River. It’s made up of 30 miles of urban waterfront and generates $100 million in revenue annually through its four lines of business — cargo (46%), rail (31%), cruise ships (16%), and industrial real estate (7%).

Breakbulk and heavy-lift commodities remain a strong part of the port’s cargo mix and focus. Yet, according to port of cials, its containerized cargo growth has surpassed 600,000 TEUs annually. Port NOLA can handle vessels up to 10,000 TEUs in size. It currently has six container gantry cranes, with four new 100' gauge gantry cranes under construction, 3,000' of linear berth space able to accommodate vessels with drafts up to 45', and the ability to transload bulk from container to barge.

In addition, there is a twice-weekly containeron-barge service operated by Seacor AMH, weekly direct services to and from Asia, Europe, the Mediterranean, South America and Central America, a 140,000-sq.-ft. dockside cold storage facility, a planned cold storage expansion that will double its current capacity, and a refrigerated terminal.

For global ocean carriers that haul breakbulk commodities, Port NOLA offers 13,511' of berthing space available at six terminals for breakbulk cargo including heavy lift/project cargo and temperature sensitive cargo, and 1.6 million sq. ft. of transit shed area for the temporary storage of breakbulk cargo.

Cruise ships should resume calling on the port later this year. Port NOLA has two cruise terminals to handle passengers.

Overnight river cruises are already underway, offering cruises along the Mississippi River into America’s Heartland. In addition, there are also a number of day cruise tour boats and ferries that operate within Port NOLA’s jurisdiction.

All of this cargo, ships, boats, wharves, docks, and storage facilities have one thing in common — they can all burn. That’s why all of the port’s tenants pay for re and police protection.

FIRE PROTECTION

As far as re protection is concerned, the port’s 95'×26' reboat Gen. Roy S. Kelley handles those responsibilities. It’s been the lone ghter of res since the port’s other reboat, Deluge, which was built in 1923, was taken out of service in 1994.

Capt. Claude Klein began working on the port’s reboats as a captain in 1979 and became the master captain of the Deluge two years later. He was also the master captain of the Kelley from the time it was delivered in 1994 until he retired in 2019.

“When they were going to build the Kelley, the (Port of New Orleans) Dock Board got input from the reboat captains because we were the ones who worked aboard the boats every day,” said Klein.

He said he would tell his crew that when they got to a re the rst consideration went to the boat, then personnel, then property. “The boat comes rst because without the boat, the crew can lose their lives and you have no boat to ght the re,” said Klein. “If it’s too dangerous, pull out and nd another way in.”

Klein said safety is the operative word, whether its tenants, the boat’s crew or the general public, which has been more important since the old Warehouse District became gentri ed starting in the 1990s. “That gave us a lot more responsibility because now you had all these people who had no experience with the river down there moving around, not realizing how dangerous the Mississippi could be. I had to sh quite a few bodies out of there over my 40 years.”

Once, late at night when the reboat was tied up at Algiers Point across the Mississippi from the French Quarter, a young woman appeared alongside the boat, having swum from the other side — a distance of about a mile. “When we pulled her out, one of her legs was missing,” said Klein. “But it wasn’t what we rst thought. She told us she had taken her prosthetic leg off before she jumped in. By the time she nished swimming, she had sobered up.”

That’s a lot of responsibility for just one boat and nine crewmembers — three captains, three engineers and three deckhands that work three shifts — 24 hours on and 48 hours off. Klein said currently the Kelley is down one deckhand.

The scuttlebutt is port of cials are considering cross-training its Harbor Police of cers to split time between their police duties and deckhand duties on the Kelley. No decision has been made so far.

“In the name of safety, that would be a terrible idea,” said Klein. “Those deckhands train with that equipment every day. A policeman has his training duties for the Harbor Police Department. How is he going to do both? That’s just not enough time on the boat. It’s a safety issue.”

ABOARD THE KELLEY

The Gen. Roy S. Kelley is a robust re ghting machine, but after years of being on call 24/7, the boat was due for a refurbishment. Thus, at the end of 2014, the reboat went into Stewart &

BUILD SLOTS AVAILABLE

We Build All CTV Designs

Chartwell 24

BUILT TO SERVE BUILT TO LAST BUILT BY BLOUNT

401.245.8300

info@blountboats.com

BLOUNTBOATS.COM

It returned to service in early 2015 as a multipurpose public safety vessel.

“We actually worked up plans for a new boat and those plans are still there,” said Klein. “There just wasn’t enough money available.”

The Kelley has a total pumping power of 14,500 gpm. The boat’s re ghting system includes two North American 16HJ3 three-stage waterjets, operated through diversion valves into the water main system with variable PSI settings; four Stang 2,500-gpm re monitors capable of horizontal re stream trajectory of 300' each; four Stang 1,000 gpm under wharf re monitors; three multiple connection hose manifolds that accommodate 1.5", 2.5", 3", and 5" re hoses; a split delivery system to allow both monitor and hose operation at one time with different PSI settings; a fully automated system to allow one re ghter to operate all monitors at one time from the wheelhouse; and various lengths and diameters of re hoses. The foam system features 2,000 gals. of Ansulite 3x3 low viscosity alcohol resistant AFFF concentrate and two 2,500-gpm re monitors and three hose connections.

Klein said there had been talk at one time about possibly replacing the Kelley with one or two smaller aluminum fast response re/rescue boats. “If you go with a smaller boat, you’re downgrading the port’s assets,” said Klein. “For one thing those boats sit too low in the water for where we operate, and they can’t pack the pumping capacity of the Kelley.”

The Kelley also carries a full rst aid response package, 8'×25' sea rescue platform 1' above the waterline, a 3,000-lb. crane, 500' of storage space for oil containment, fore and aft towing bitts, 16' rescue boat, halogen oodlights on deck for night rescue, and a stern steering control console.

Though the Kelley is the only reboat at the port, there are other vessels in port that have re ghting abilities, such as some of the commercial tugs. But Klein said while it’s good to have that option, you can’t depend on it being there for you all the time. “No tug captain is going to risk damaging his boat,” he said. “They’ll do what they can but can’t get too close. Plus, there’s no guarantee the tug’s going to be able to drop everything and come running, if it’s on a job.” (Port NOLA has a Harbor Police patrol boat, but it has no re ghting abilities.)

Both Plaquemines (Parish) Port Harbor & Terminal District to the south and the Port of South Louisiana to the

Innovative Unique Proven

Capt. Claude Klein

The fi reboat Gen. Roy S. Kelley was delivered in 1994 and refurbished in 2015.

ALL AMERICAN MARINE

ALLAMERICANMARINE.com

GEN. ROY S. KELLEY

SPECIFICATIONS

Builder: Bender Shipbuilding & Repair Co. Inc. Refurbishment: Stewart & Stevenson Operator: Port of New Orleans Mission: Multipurpose public safety vessel — fi refi ghting, patrol, port tours, search and rescue, emergency response Length: 95' Beam: 26' Draft: 7' Firefi ghting System: (2) North American 16HJ3 three-stage waterjets, operated through diversion valve into water main system, variable PSI settings; (4) Stang 2,500 gpm fi re monitors capable of horizontal fi re stream trajectory of 300' each; (4) Stang 1,000-gpm under wharf fi re monitors; (3) multiple connection hose manifolds that accommodate 1.5”, 2.5”, 3”, 5” fi re hoses; split delivery system to allow both monitor and hose operation at one time (different PSI settings); fully automated system to allow one fi refi ghter to operate all monitors at one time from wheelhouse; various lengths and diameters of fi re hoses. Foam System: 2,000 gals. Ansulite 3x3 low viscosity alcohol resistant AFFF concentrate; (2) 2,500-gpm fi re monitors and/or three hose connections Navigation Equipment: (2) Furuno 1940 radars with open scanners; (2) Motorola H 5058R VHF radios; (3) 1.5 million candle power search lights — two forward, one aft, magnetic compass Special Equipment: Full fi rst aid response package; 8'x25' sea rescue platform 1' above waterline; 3,000-lb. crane; 500' of storage for oil containment; fore and aft towing bitts; 16' rescue boat; halogen fl oodlights on deck for night rescue; stern steering control console Main Propulsion: (4) Detroit Diesel 12V-92TA, 900 hp @ 2,300 rpm Propeller: (2) fi xed-pitch Waterjet: (2) North American 16HJ3 three-stage, 6,752 gpm @ 181 PSI each (inboard, steerable and also operate fi refi ghting system) Speed (knots): 20+ Crew: 3 Accommodations: 24 passengers in air-conditioned cabin; minigalley; (2) bathrooms; PA system Delivery Date: 1994 (original); 2015 (refurbishment)

north have boats with plenty of re ghting ability. But the needs of their own ports have to come rst.

The Lower Mississippi River is one of the toughest places to work, especially at this time of year when the water is high and the current is running at ve or six knots. “It’s pretty simple,” said Klein. “First and foremost is safety.”

(Port of New Orleans’ of cials agreed to take part in this story and a set of questions was sent to them; however, the answers were not returned as WorkBoat went to press. This story, if needed, will be updated on workboat.com.)

On TheWays CONSTRUCTION ACTIVITY AT WORKBOAT YARDS ON THE WAYS

Breaux’s Bay Craft delivers 90' pilot boat to Texas

90' all-aluminum pilot boat.

In early March, Breaux’s Bay Craft, Loreauville, La., delivered the 90'×23'×12'4" aluminum pilot boat Spindletop to the Sabine Pilots, Port Arthur, Texas. The pilots serve the Texas ports of Orange, Port Arthur and Beaumont.

“This is the biggest all-aluminum pilot boat built in the U.S.,” said Roy Breaux, the shipyard’s owner. “There are bigger ones in other parts of the world, but this is the largest in the U.S.”

Breaux’s Bay Craft has specialized in the construction of aluminum offshore crewboats for decades. However, the shrinking oil and gas industry in the Gulf of Mexico and the pandemic have forced the shipyard to further diversify. “We have produced hundreds of pilot vessels in the past, but we delivered our rst pilot boat with the New Generation DeepV bottom to the Tampa Bay Pilots Association, a 54-footer, in November 2019,” said Breaux. “This same bottom was used on the Spindletop.”

Designed by Breaux’s Bay Craft and C. Fly Marine Services, Mandeville, La., the new Spindletop has two boarding platforms on the bow, port and starboard, and two overhead on the pilothouse, port and starboard. Rescue assist equipment includes a SeaLift custom-built rescue platform on the transom with a 24-volt hydraulic unit and a transom jib pole with a 120-volt electric winch. The rubber bumper system is a combination of D bumpers and aircraft tires around the perimeter.

Coast Guard-approved equipment includes lifejackets for 16 people, Revere Coastal Commander life raft, are kit, battle lantern, and throw rings.

“The boat ran six pilots out in its rst hour of operation,” said Breaux.

The Herbert S. Hiller firefighting system includes one fixed CO2 suppression system with three bottles in the machine room. The Delta ventilation system includes four 11" blowers with temperature and speed control and Delta moisture eliminators with automatic vent dampers.

Main propulsion comes from four Scania DI16-82-M diesel engines producing 800 hp at 2,100 rpm each. The mains connect to four HamiltonJet HM461 waterjets through Twin Disc MGX-5146 marine gears. The propulsion package gives the boat a running speed of 27 knots and a top speed of 30.6 knots. The new pilot boat also features Humphree HA1100 interceptors with active ride plus stability within a vessel motion control system.

Inside the pilothouse are 15 NorSap 1600 chairs and one NorSap 1700 captain’s chair with controls, VHF speaker and microphone in headrest, steering and three VHF push to talk buttons on an armrest.

“We went to Breaux for a custom-built pilot boat that would maximize safety and comfort for our 17-mile stretch in the Gulf of Mexico and could not be happier with our choice,” said Kenneth Leslee Hurd, boat superintendent, Sabine Pilots. “The Spindletop with its four Hamilton jets coupled to the 4,800-hp Scania engines, Humphree active ride trim tabs, and Breaux’s new hull design, she cuts through our constant three-four-foot chop that we run on a

daily basis with ease. Another great feature from Hamilton is their new AVX (boat mouse) system that allows the operator to maneuver the vessel with ease in restricted areas.”

Accommodations include two double bunk staterooms, a settee seating area, full head and shower, and one head treatment unit with fresh-water ush. Ship’s service power is provided by twin Northern Lights gensets, sparking 38 kW of electricity each.

Tankage includes 4,000 gals. of fuel in two tanks — one 1,500-gal. forward tank and one 2,500-gal. aft tank; 360 gals. fresh water; and 100 gals. lube oil.

The electronics suite is made up of two 4' open array Furuno DRS12ANXT radar; four Furuno TZT19F 19" monitors; twin Furuno MCU004 remote control for MFD; Seatronx sunlight readable touch screen monitor; Furuno SCX20 satellite compass; Furuno FA170 AIS; Furuno DFF3D sonar; Furuno weather station; FLIR Systems M400XR stabilized thermal/visible camera with JCU; four FLIR thermal and visible imaging cameras for temperature measurement; three Icom M605 VHF radios with two Icom command microphones; one 10" monitor with six cameras with DVR for boarding areas — aft deck, machinery space and jet room; KVH Tracvision 3 motion satellite system, Sirius XM for weather overlay; three 32" TVs with DirectTV; and two Kingdel Windows 10 microcomputers.

“With our fth Breaux-built pilot boat, she will last us many years to come — disembarking and delivering pilots to ships safely,” said Hurd. “If any pilot groups would like to visit, they need to come and experience the ride, comfort, and quietness themselves.”

Breaux’s Bay Craft is currently building a 70' pilot boat for the Aransas-Corpus Christi Pilots in Corpus Christi, Texas. — Ken Hocke

Blount Boats

65' crew transfer vessel for operations and maintenance support.

Blount delivers second offshore wind CTV to Atlantic Wind Transfers

Blount Boats newest all-aluminum wind farm crew transfer vessel, the Atlantic Endeavor, was delivered late last year to Atlantic Wind Transfers, North Kingstown, R.I.

On Jan. 1, the new CTV was at Dominion Energy’s Coastal Virginia Offshore Wind Farm to provide operations and maintenance support for two Siemens Gamesa 12-megawatt turbines, 27 miles off Virginia Beach, Va.

The 65'×28.4' twin-hulled catamaran CTV was designed by Chartwell Marine, Hampshire, England. The design is a modi cation of Chartwell Marine’s Chartwell 24 to make it compliant with environmental regulations and right whale legislation.

The Atlantic Endeavor is the second Jones Act CTV built by Blount Boats, Warren, R.I., for Atlantic Wind Transfers. The Atlantic Pioneer, delivered in April 2016, was the rst, and also the rst CTV built for the U.S. offshore wind farm market. Together they make up two of the three wind farm boats built in the U.S., said Marcia Blount, president of Blount Boats.

The Atlantic Endeavor is similar to the Atlantic Pioneer but “a lot taller, a lot more volume,” said Blount’s Luther Blount III. The additional volume “is to reduce slamming and the negative effects in heavy sea conditions.” It also reduces the vessel’s tendency “to bob around so much” when at the wind farm’s tower.

The Atlantic Endeavor, with a two to three-man crew, can transport as many as 24 wind-farm technicians at a service speed of 24 knots and when needed a 29-knot sprint speed. Power for that comes from a pair 1,400-hp MAN V12s matched up with HamiltonJet HM651 waterjets through ZF 3050 gearboxes. Electrical power comes from a pair of Cummins Onan 29-kWgenerators.

On deck is a Pal nger PK6500M knuckle boom crane and a Nabrico

anchor winch. — Michael Crowley

Blakeley BoatWorks delivers 6,800-hp linehaul towboat to Cooper T./Smith

Blakeley BoatWorks delivered the 110'×33' linehaul towboat Gretchen V. Cooper to Cooper Marine & Timberlands Corp. (CMT) in March.

BBW and CMT, both located in Mobile, Ala., are wholly owned subsidiaries of Cooper/T. Smith. The company said the new 6,800-hp towboat, which has a maximum 8'6" working draft, is

the U.S.’s rst linehaul towing vessel powered by a Tier 4 Caterpillar highspeed engine system with selective catalytic reduction.

Currently, Tier-4 diesel engine standards are the strictest Environmental Protection Agency (EPA) emissions requirements for new engines found in inland marine vessels. Tier-4 compliant engines are designed to signi cantly reduce emissions of particulate matter, or black soot, and nitrogen oxides to near zero levels. The engines are also manufactured to save fuel and reduce emissions by more than 86% for large applications like marine vessels.

The new towboat is powered by two Cat C3512E 3,400-hp Tier 4 engines operating at 1,800 rpm and coupled to Twin Disc MGX-5600 gears.

DDR Flow Control, Gray, La., a joint venture between Louisiana companies Donovan Controls and The Del Rio Company, developed and produced a redundant dual pump DEF transfer skid so the towboat could comply with Tier 4 emission regulations.

“Our DEF skid was designed for these types of applications,” said co-owner Brad Del Rio. “Gretchen is pushing all the time, so all of the features we implemented into our product are proving that they are needed, and Gretchen is proving the Cat SCR system is the easiest way to comply with T4 regulations.”

The Cats are connected to Southeastern Propeller 88'×74'×9', 4-bladed stainless-steel wheels to provide thrust through twin J&S Machine Works 9" ABS Grade two propeller shafts with Cutlass shaft bearings, Thordon rudder bearings, and Kemel shaft seals. Gulf Coast Air and Hydraulics supplied the steering system for the two 9" main and four 8" flanking rudders.

Hydra Force LLC provided a pair of Quincy reciprocating air compressors, with ventilation fans from Donovan Marine. Schuyler Maritime LLC supplied varying sizes of rubber fendering around the perimeter of the vessel and push knees.

Thompson Caterpillar also supplied electrical power with two Cat C4.4 Tier 3 generators with R.W. Fernstrum keel coolers throughout.

Stone Construction provided a Mitsubishi mini-split HVAC system in all interior spaces. Blakeley BoatWorks provided all custom woodwork and interior nishes. Bozant supplied aluminum and rubber-framed windows.

On deck, Donovan Marine supplied a pair of Patterson 40-ton deck winches. Blakeley installed all electronics, communications, and an alarm system.

The towboat has a capacity of 44,200 gals. of fuel and 10,000 gals. potable water. The vessel is out tted with six crew staterooms housing eight

BOATBUILDING BITTS

All American Marine has been sold.

All American Marine (AAM) has been sold to Bryton Marine Group. The sale was announced by AAM in March. Bellingham, Wash.-based AAM is known for its aluminum vessel design and manufacturing. AAM builds highly specialized vessels including high-speed catamarans, monohull cruise boats, research vessels and passenger ferries. British Columbia-based Bryton Marine is a builder of 30' to 150' premium welded aluminum commercial, recreational and adventure boats. Family owned since 1992, the company’s portfolio includes Brix Marine and Weldcraft boats.

Austal USA, Mobile, Ala., broke ground on its new steel manufacturing line in March positioning the company to start steel production in April 2022. The addition of steel capability is designed to keep Austal USA as a major contributor to the U.S. shipbuilding industrial base, the company said. Austal USA plans to bring its manufacturing processes and facility design to the steel shipbuilding market, shipyard of cials said.

U.S.-based Crowley Maritime and Danish shipping company ESVAGT announced plans recently to boost purpose-built, Jones Act vessel availability in support of the emerging offshore wind energy market through a joint venture. The partnership will bring together two maritime solutions providers to serve the emerging industry. Consistent with the requirements of the Jones Act, Crowley will own

Austal USA

Austal will be able to build in both aluminum and steel.

crewmen, 4 1⁄2 baths and a full galley arrangement.

“Our customers expect Blakeley BoatWorks and Cooper Marine & Timberlands to drive industry innovation, and our building and operating one of the industry’s most environmentally friendly towboats marks our unwavering commitment to always exceed their expectations,” Angus R. Cooper III, president, Cooper/T. Smith, said in a statement. “Naming a boat after my wife Gretchen meant that we couldn’t just settle for building a standard towboat and therefore, the Gretchen V. Cooper will be one of the most powerful towing vessels operating on the Tennessee-Tombigbee Waterway and will lead the way for a new industry standard for reduced emissions on towboats.”

CMT has a eet of 20 towing vessels and more than 400 hopper barges. The company said it has one of the largest eet of dry bulk gantry and oating derrick cranes in the U.S. The company operates on the Tennessee-Tombigbee River system, Gulf Intracoastal Waterway, and the Ohio, Illinois, Arkansas, Cumberland, Black Warrior, Tennessee, Tombigbee, Mobile, and Mississippi rivers.

“The ongoing investments that CMT is making across our eet best ensures that our customers will continue to receive the safest, most environmentally friendly, and highest level of service in our region,” said James Fowler, managing director of marine and stevedoring operations for CMT and executive vice president for Blakeley BoatWorks. “As was true when BBW built some of the nation’s rst Subchapter M new construction towing vessels and now, as we deliver a new linehaul with the latest and most advanced carbon reduction technology, BBW eagerly stands ready to deliver on our industry’s newest and most challenging jobs.” — K. Hocke

Cooper/T. Smith

110’ linehaul towboat has Tier 4 engines.

and operate the vessels with its experienced U.S. mariners, while Crowley and ESVAGT will share in the economics of the venture. ESVAGT is a leading service operation vessel (SOV) operator in Europe and will provide technical advice on the design, construction, and operation of SOVs.

Conrad Shipyard, Morgan City, La., delivered a 240' ABS deck barge to Ashton Marine LLC, Muskegon, Mich., in early March. The 240'×60'×14' AM 3600 can carry 3,600 tons of bulk materials and project cargo throughout the Great Lakes area. The barge is equipped with two 50' spud well pockets for easy conversion into a spud barge. Ashton Marine has one of the newest eets on the Great Elliott Bay Design Group 240' deck barge will operate on the Great Lakes. Lakes, with two oceangoing tugs — the 4,000-hp Meredith Ashton and 2,600-hp Candace Elise — and two 200'×35' hopper barges capable of moving up to 1,900 tons of cargo each. Silver Ships, Mobile, Ala., recently delivered a 30'×10' re/rescue boat to the League City Fire Department in Texas and one to the Bayport Fire Department in New York. Both vessels are a part of Silver Ships’ Endeavor series and feature Darley fire pumps and twin outboards for efficient emergency response. Both boats feature Task Force Tips monitors and valves, bow doors, patient pass-throughs and

ESVAGT is the leading service operation re monitors on the bows.

vessel (SOV) operator in Europe.

Energy Mix

Biden administration charts different courses for offshore wind and oil and gas

By Jim Redden, Correspondent

The Olympus tension leg platform (TLP) in Shell’s deepwater Mars development.

Aweek after the inauguration, President Joe Biden of cially staked out his longsignaled position in the societal tug-ofwar between the offshore hydrocarbon and wind energy forces.

In fortifying a clearly de ned line of demarcation, Biden issued executive orders on Jan. 27 that at once called for an end to fossil fuel subsidies and froze new leasing off the Outer Continental Shelf (OCS), while simultaneously directing the Department of Interior (DOI) to review permitting processes and identify other steps the U.S. can take to double offshore wind capacity over the next decade. On March 29, Biden oated plans to offer $3 billion in federal loan guarantees for offshore wind developments.

The political climate leaves Gulf of Mexico oil and gas producers navigating a murky economic and regulatory quagmire, even as the rollout of Covid-19 vaccines is helping ease the pandemic’s assault on demand and prices. “Operators don’t have the willingness to go against the economics, which the industry historically has done at times, but it’s been done on the basis of con dence in the future,” said veteran energy analyst Allen Brooks. “Right now, you don’t have con dence in what’s going to be allowed in the Gulf.”

The regulatory path is much clearer off the blustery Northeast where the nation’s rst utilityscale offshore wind farm is on track to begin generating electricity by 2023 off Massachusetts. While other projects are in various stages of development, previous presidential disinterest, the pandemic, infrastructure limitations and other factors have tempered the aggressive timelines of the mainly European developers, said Alexander

Jackson Offshore Operators

The five-turbine Block Island offshore wind farm off Rhode Island.

Ørsted US Offshore Wind

After BHP exercised an option, the Transocean Deepwater Invictus drillship will likely continue working in the Gulf of Mexico throughout the summer at an increased day rate of $215,000.

Fløtre, offshore wind product manager for Norwegian consultancy Rystad Energy.

“The (growth) profile is steep and we see an acceleration and a gain in momentum due to the Biden administration and the focus they have on offshore wind. We do see a lot of growth coming from the U.S., but it will mainly be a 2025 and onwards story,” he said from Oslo. “We expect around 15 gigawatts (GW) of offshore capacity to come on line by 2030.”

Any attempt, however, to develop that capacity farther down the East Coast after July 2022 could create an intriguing plotline and place Biden in a political pickle. At the urging of coastal state governors, in September the fossil fuel friendly Trump administration, nonetheless, imposed a 10-year ban on oil and gas leasing and development along the Carolinas, Georgia and Florida. “Technically, wind is harvesting the resources of the offshore, so wind is covered by the OCS Lands Act and should be subject to the same moratorium,” Brooks said.

For now, after weathering a year punctuated by Covid-19, bankruptcies, thousands of layoffs and a record hurricane season, the offshore oil and gas industry now confronts a political storm emanating from Washington, D.C.

GULF BOTTOMS OUT

The banner headline across the front page of the Jan. 28 Houston Chronicle said it all: “Biden fasttracks shift from fossil fuels.” Despite the subsequent cancellation of a scheduled federal offering on March 17, the leasing moratorium, in and of itself, had little near-term impact on the Gulf of Mexico, where operators collectively hold more than 1,700 active leases not in production, according to the Department of Interior’s Bureau of Ocean Energy Management (BOEM). Earlier acquired leases and permits were not affected by the leasing interruption.

Though oil prices have risen, albeit unsteadily, political-driven uncertain-

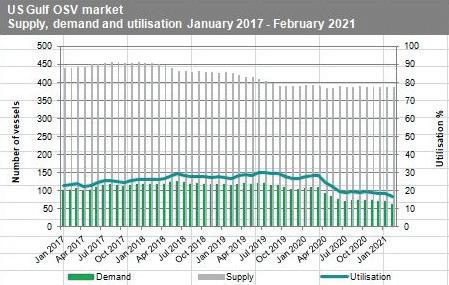

Workboat utilization rate in the Gulf of Mexico as of February 2021.

The start-up of the Vito floating production system this year in Mississippi Canyon will be Shell Offshore’s 11th producing asset in the largely deepwater Gulf of Mexico.

ties stand in the way of any respectable recovery. “I think the Gulf has several challenges,” said Brooks. “Yes, prices are up and that’s good. Cash flow for companies are improving and that’s good. But, then you have the unknown, which at the moment is what the heck is government policy going to be?

“Right now, I think the best we can hope for is that we’ve passed the bottom and things will be a little bit better.”

At issue is the regulatory environment going forward and concerns of a return to what many saw as the overly stringent permitting requirements under the Obama administration, where a number of functionaries are now aligned with President Biden. “If conditions in the U.S. become so onerous that it really disincentivizes investment, we’ve got other places where we can take those dollars,” Chevron CEO Mike Wirth said two days after Biden’s leasing pause. Apparently anticipating what could come, operators rushed through drilling permits while Trump was still in office. Between the Nov. 3 election and the Jan. 20 inauguration, BOEM sister agency, the Bureau of Safety and Environmental Enforcement (BSEE), issued 28 Gulf of Mexico new well drilling permits, more than double the approved permits issued between November 2019 and January 2020.

“We expect once the dust settles that permitting approvals will return to a process we can work with,” said Roger Jenkins, president and CEO of independent deepwater producer Murphy Oil Corp. “It’s not in the government’s best interest to halt operations in the Gulf for a host of financial and legal reasons.”

The market is currently calling the shots. In the Covid-19 and hurricaneravaged past year, Gulf oil production fell 13% to an annual average of 1.65 million bbl/day, according to the U.S. Department of Energy (DOE), which predicts production will average around 1.7 million bbl/day in 2021 and 2022.

Among the few projects still on schedule for first oil this year, Shell Offshore is set to begin production from its Vito floating production deepwater project in Mississippi Canyon, with peak oil equivalent production of around 100,000 boed. However, with carbon intensity and other environmental, societal and governmental (ESG) factors carrying outsized weight in investment decisions, Shell, like many of its contemporaries, said it will gradually begin reducing oil production and has no plans for further so-called frontier exploration. Mindful of carbon intensity, European-based oil companies also are among the leading developers of emerging U.S. offshore wind projects. “The U.S. leasing model, with option fees and high capital investments just to secure an area, kind of favors the big oil companies,” said Fløtre.

Meanwhile, with the U.S. benchmark West Texas Intermediate (WTI) oil price hovering around $60/bbl, only 11 rigs were active in the Gulf in March as of April 9, according to Baker Hughes, seven fewer than even those working a year ago, around the time the WTI price sunk to an historic negative value.

With every rig sidelined, the already distressed vessel support sector takes an appreciable hit. “Anytime one of those drillships, especially, finishes up, you’re looking at at least three boats being turned loose,” said IHS Markit Senior Marine Analyst

Royal Dutch Shell

Richard Sanchez. “And the jackup market has been extremely weak with no more than three or four working at any one time.”

In February the ramifications of the Covid-19 pandemic were clearly visible within the high-end offshore support and platform supply vessel (OSV/ PSV) fleet, with day rates across the Gulf as low as $15,000, Sanchez said. “Before Covid, things were looking good. Overall, in the Gulf, I want to say we had 100 to 105 boats working and after Covid, it fell to the mid- to low 70s,” he said.

One potential landing spot for Jones Act-compliant vessels can be found in the nascent wind energy sphere. Though far less vessel-intensive than oil and gas development, Sanchez said the early development stages of a wind farm could require from two to four vessels for foundation tests and another one to six vessels for various functions during and after installation. “Over the next five years, I think we’re going to see more demand from offshore wind,” he said.

THE SAUDI OF WIND

For the time being, the emerging U.S. offshore wind energy business is concentrated off the Northeast, where it has been said the typically perennial trade winds are to electrical power generation what Saudi Arabia is to oil. “There’s huge potential here and the technology is at the point right now where you’re talking about a level of capacity for generations that was more or less unthinkable even 10 years ago,” said Andrew Doba, spokesman for Vineyard Wind LLC, which is on pace to become the nation’s second, and by far, largest commercial offshore wind farm within two years.

Comprising 62 turbines, the estimated $2.2-billion, 800-megawatt (MW) project is expected to begin construction later this year, following a series of setbacks that included issues with commercial fishing and the December cancellation by the then lame duck Trump administration. “We have all the associated state and local permits, so the next step is for DOI to issue a record of decision,” Doba said in late March. “We’re set to reach financial close in the second half of 2021 and begin construction later this year.” A partnership of European-based Avangrid Renewables and Copenhagen Infrastructure Partners, the Vineyard Wind farm will be connected to the local utility grid by subsea cables running from a 160,000-acre site in OCS waters just south of Martha’s Vineyard, Mass. The project is second only to the much smaller five-turbine, 30-MW Block Island Offshore Wind Farm, which has been operational off Rhode Island since December 2016.

The Vineyard project was expedited under Biden’s BOEM, which resumed the review process in early February

Custom Monohulls and Catamarans

High-volume pumping systems Custom deck layouts Maximum visibility cabin Service, support, and training Custom nav and safety packages Midwest dealer: Renewed Performance Company Licensed, authorized builder of SeaArk Marine industrial and military vessels

A GE Haliade-X prototype, regarded as the most powerful wind turbine on the market.

and released the final Environmental Impact State (EIS) in March. On the way out the door, the previous administration terminated the entire permitting process after Vineyard requested a pause to review its initial design

ABSOLUTELY NO DISCHARGE.

INCINOLET incinerates waste to clean ash, only electricity needed. 120, 208 or 240 volts. INCINOLET – stainless steel, American made for years of satisfaction.

Used in all climates around the world.

Tested, listed by UL NSF USCG

Call 1-800-527-5551 www.incinolet.com

RESEARCH PRODUCTS • 2639 Andjon • Dallas, Texas 75220

upon switching turbine suppliers. After a technical review determined the selection of General Electric Renewable Energy’s new-generation Haliade-X turbine generators would not change the initial construction and operation plan (COP), Vineyard asked BOEM to reconsider the application on Jan. 25.

Vineyard may be getting a jump start on what could evolve into a significant gridlock in the next four years. Rystad’s Fløtre suggested European joint ventures entered the U.S. with overly aggressive timelines, hoping to seamlessly leverage their longtime offshore wind experience to a far less-developed market. “What we see is those timelines might be ambitious due to the fact there’s no value chain, no infrastructure in place and the grid needs to be tailored to take in all that capacity,” he said. “The Jones Act also poses an issue for that aggressive capacity deployment.”

If all goes well, Vineyard will be dwarfed later this decade by two projects off New York and Massachusetts awarded early this year to a joint venture comprising traditional European oil companies Equinor and BP. The latter paid around $1.1 billion on Jan. 29 for a 50% stake in the two-phase Empire Wind off New York, approximately 20 miles south of Long Island, and Beacon Wind 1, located south of Nantucket, Mass. First power from Empire Wind is anticipated by 2024 or 2025. Beacon Wind 1 is planned to begin operation in 2028 at an initial design capacity of 1,230 MW.

“Empire Wind is planned to be in operation in the mid-2020s, with a planned installed capacity of 816 MW,” according to an Equinor spokesman. “At this stage no decision has been made on turbine size or numbers for our U.S. wind projects.”

“With all these projects being pushed toward 2025, it gets a little bit congested, and we don’t expect the value chain to be able to handle those wind farms on top of the ones applying post-2025,” Fløtre said.

New Age

Expect to see more all-electric, low-emission, lower maintenance propulsion systems.

By Michael Crowley, Correspondent Sometimes it takes a bit of a nudge to try something different. The prodding might originate from afar or from a close-up encounter. That “nudge” away from reliance on the traditional diesel-powered vessel might have been provided to some workboat operators at the 2019 International WorkBoat Show in New Orleans when they boarded Harbor Docking & Towing Inc.’s Ralph, a new 93'×38'×15.5', 6,700-hp hybrid Z-drive tug designed and built at Washburn & Doughty, East Boothbay, Maine. “We had a tremendous amount of people in the engine room and on the deck,” John Buchanan, president of HDT, Lake Charles, La., recalled. A major part of the attraction was the Ralph’s propulsion system. The Ralph, along with its sister tug the Capt. Robb, are the fi rst tugs built in the U.S. with Caterpillar’s hybrid propulsion system, comprised of a pair 2,550-hp Tier 4 Cat 3512E main engines matched up with two electric thruster motors, rated at 800-hp each, from ABB Marine & Ports, Miramar, Fla. A pair of 565-kW Caterpillar C18 generators and a single 200-kW Cat C7.1 genset for on-demand electrical power to Cat MTA 628 Z-drives completes the power package.

From Buchanan’s standpoint, the problem a tug has when relying only on Tier 4 diesel engines is “it takes them longer to spool up, and sometimes with tugboats you need that power now.” In contrast, “that torque is instant” with the hybrid design with its electric thruster motors. That lets the diesels “spin up faster and allowed us to go with smaller main diesel engines without sacrifi cing bollard pull,” Buchanan said.

How responsive are the Ralph and Capt. Robb compared to more traditionally powered tugs? “They are more responsive than any other tug out there,” said Buchanan, and that gives them a label that’s probably never been given to a tug: “It’s a sports car.”

“The future,” is how Buchanan has referred to the shift to hybrid propulsion systems for the Ralph and the Capt. Robb. “Having a 6,000-horsepower big main diesel engine that you idle around

HDT’s hybrid-powered tug Capt. Robb is at the bow of the tanker Garibaldi Spirit and the tug Carl, a standard ASD tractor tug, is on the stern.

with all the time is really ineffi cient. I think those days are numbered.”

Whereas the hybrid package has the horsepower needed to work ships but also transit “super effi ciently and very environmentally friendly to and from the job.”

While Buchanan has been completely satisfi ed with the Ralph and the Capt. Robb’s hybrid propulsion system, he’s sounding as if he’s coming close to going one step further along the electrical power path to embrace a complete all-electric battery package. “I think our next two builds may be fully electric — not a hybrid,” Buchanan said. Up to this point HDT had stayed away from relying on battery power “because battery technology was just not here yet, but it’s getting close. We may entertain battery banks.”

ABB Marine & Ports

Maid of the Mist’s all-electric powered James V. Glynn takes passengers on a tour of Niagara Falls.

ELECTRIC, ZERO EMISSIONS

Another fi rst of its kind for this country’s traditionally powered workboat market — and one that relies on battery banks — took place Oct. 6, 2020, when passengers took the fi rst Maid of the Mist tour of Niagara Falls aboard the Nikola Tesla and the James V. Glynn. They are the fi rst new, all-electric, zero-emission passenger vessels built in the U.S. Propulsion Data Services, Marblehead, Mass., designed the 90'×32' catamaran tour boats and ABB Marine & Ports designed their electrical propulsion systems that feature lithiumion batteries.

It appears that the Maid of the Mist’s new boats probably nudged some vessel owners to consider different types of propulsion, for there “have been a lot of inquiries on commercial vessels,” said ABB Marine’s Ed Schwarz. Some have gone past the inquiry stage. Currently ABB is working on the design of an all-battery powered ferry for Washington State Ferries. “We should wrap up the design in the coming months,” said Schwarz.

In another case, ABB will provide the propulsion system for a diesel-electric hybrid ferry for Casco Bay Lines to operate out of Portland, Maine. Charging while docked in Portland and operating in battery-powered mode whenever possible, the new propulsion system will eliminate up to 800 metric tons of CO2 emissions annually.

In the coming months don’t be surprised to see announcements for harbor workboat vessels — Schwarz isn’t at liberty to say what type — some of which will be all-electric. Then throw in electrically propelled harbor vessels with hydrogen fuel cells.

Like the hybrid-powered Ralph and Capt. Robb, with the Nikola Tesla and the James V. Glynn’s all-electric power, “there’s immediate response. You have immediate torque availability,” said Schwarz. Plus, there’s no diesel emissions, noise or vibrations to distract passengers from enjoying and viewing Niagara Falls.

A reason to opt for battery dependent electrical propulsion is the batteries can be changed when needed. “The technology is not limited to today’s batteries,” said Schwarz. New battery types or new battery densities can be incorporated into a vessel’s electrical propulsion system, be it in fi ve years or 10 years.

“It’s a good investment,” he said, “because future costs will be less and you’ll either get more energy density for the same price or pay less for the

The Nikola Tesla and James V. Glynn are each powered by a pair of Spear Power Systems lithium-ion battery packs (316 kWh total capacity).

Casco Bay Lines’ new ferry will be powered by a diesel-electric hybrid propulsion system.

same energy density. It’s kind of future proof.” In addition, being electric, Maid of the Mist tour boats can be remotely monitored.

Why haven’t more workboat operators taken advantage of electric power options? For tug operators expense is a factor. “Tugs are expensive,” noted Buchanan, and tug owners know what works for them and aren’t willing to build something outside of their comfort zone. Another source of reluctance is the electric technology involved. It “scares a lot of people. It’s a different animal,” said Buchanan, and vessel operators worry their work force won’t be able to handle the electrical work.

From Schwarz’s standpoint, the workboat industry is one of “referencing.”

“People do what they see,” he said. Being the fi rst “to do it in the U.S. (such as building the Tesla and Glynn) is very inspiring for the market and probably made it a little more real.”

But even without the Nikola Tesla and the James V. Glynn examples, Schwarz feels it wouldn’t have been long before someone would have built an all-electric passenger vessel in the U.S. That’s because there are numerous examples outside the U.S., all part of a worldwide global transportation trend that’s shifting to electrically driven, low-emission, lower maintenance propulsion systems.

Introducing

+ Wind

WorkBoat + Wind is a brand new quarterly digital publication dedicated to the growing Offshore Wind Market in the United States from the only publication devoted to covering the entire U.S. workboat market.

In this issue, you can learn about the significance of the Biden administration’s calls to double offshore wind by 2030, explore the ways the Jones Act will impact the future of offshore wind, discover the potential offshore wind has for U.S. mariners as explained by OMSA and much more.

Download WorkBoat + Wind Vol. 1 now! >>> workboat.com/resources/wind

Interested in advertising? sales@workboat.com