FC June 2018.qxp_FC December 06 22/05/2018 15:24 Page 1

June 2018

™

B U S I N E S S

THIS MONTH www.AVBUYER.com

A V I A T I O N

I N T E L L I G E N C E

Aircraft Comparative Analysis: Beech King Air 350i vs Pilatus PC-12 NG Aircraft Finance – Enhance Your Chances

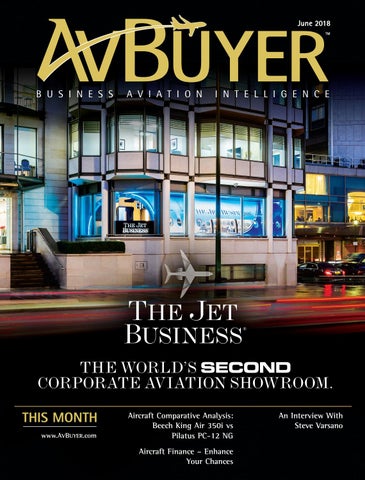

An Interview With Steve Varsano