FC 2020 April - 2.qxp_FC December 06 16/03/2020 15:37 Page 1

Volume 24 Issue 4 2020

™

ACTIONABLE INTELLIGENCE FOR BUSINESS AVIATION

THIS MONTH Turboprop Comparison: Piper M600 vs Daher TBM 910 What Does it Cost to Operate a Light Jet What’s the Real Cost of Financing Your Aircraft? www.AVBUYER.com

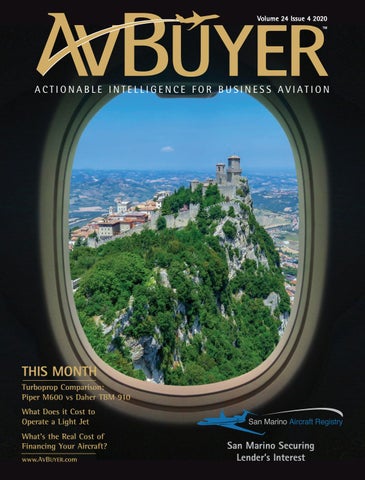

San Marino Securing Lender’s Interest