FC January AFC - black logo.qxp_FC December 06 20/12/2018 09:44 Page 1

January 2019

â„¢

ACTIONABLE INTELLIGENCE FOR BUSINESS AVIATION

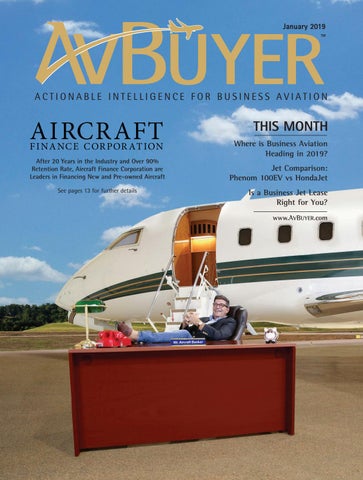

THIS MONTH Where is Business Aviation Heading in 2019? After 20 Years in the Industry and Over 90% Retention Rate, Aircraft Finance Corporation are Leaders in Financing New and Pre-owned Aircraft See pages 13 for further details

Jet Comparison: Phenom 100EV vs HondaJet Is a Business Jet Lease Right for You? www.AVBUYER.com