FC Jetcraft May.qxp_FC December 06 15/04/2019 12:22 Page 1

Volume 23 Issue 5

™

ACTIONABLE INTELLIGENCE FOR BUSINESS AVIATION

THIS MONTH Jets Comparison: Dassault Falcon 8X vs Bombardier Global 5000 proudly presents

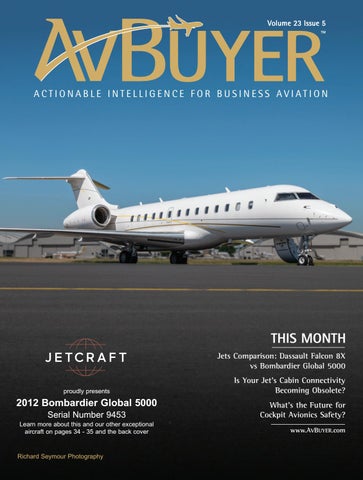

2012 Bombardier Global 5000 Serial Number 9453

Learn more about this and our other exceptional aircraft on pages 34 - 35 and the back cover

Richard Seymour Photography

Is Your Jet’s Cabin Connectivity Becoming Obsolete? What’s the Future for Cockpit Avionics Safety? www.AVBUYER.com