FC July 2012_FC December 06 20/06/2012 12:57 Page 2

WORLD

www.AvBuyer.com ™

The global marketplace for business aviation

July 2012

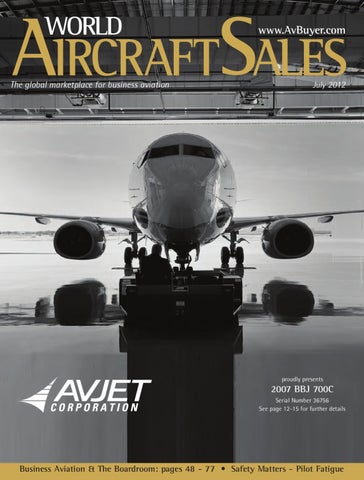

proudly presents

2007 BBJ 700C Serial Number 36756 See page 12-15 for further details

Business Aviation & The Boardroom: pages 48 - 77 • Safety Matters - Pilot Fatigue