FC October 2012_FC December 06 19/09/2012 16:36 Page 1

WORLD

www.AvBuyer.com ™

The global marketplace for business aviation

October 2012

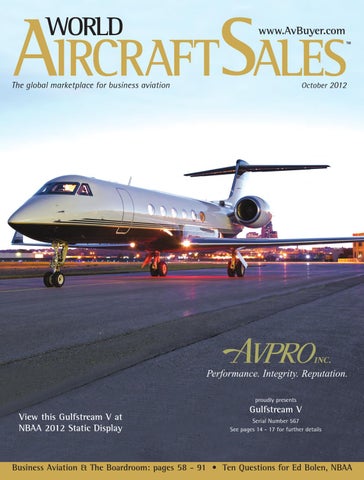

Performance. Integrity. Reputation. proudly presents

View this Gulfstream V at NBAA 2012 Static Display

Gulfstream V Serial Number 567 See pages 14 - 17 for further details

Business Aviation & The Boardroom: pages 58 - 91 • Ten Questions for Ed Bolen, NBAA