THE FUTURE OF FAST

EDITORIAL

EDITORIAL DIRECTOR, FOOD NEWS MEDIA: Danny Klein danny@qsrmagazine.com

MANAGING EDITOR, FOOD NEWS MEDIA: Nicole Duncan nicole@qsrmagazine.com

DIRECTOR OF CUSTOM CONTENT: Peggy Carouthers peggy@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Charlie Pogacar charlie@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Kara Phelps kara@qsrmagazine.com

CONTENT EDITOR: Ben Coley ben@qsrmagazine.com

STAFF WRITER: Trevor Griner Trevor@qsrmagazine.com

ART & PRODUCTION

ART DIRECTOR: Tory Bartelt tory@qsrmagazine.com

ONLINE ART DIRECTOR: Kathryn “Rosie” Rosenbrock rosie@qsrmagazine.com

GRAPHIC DESIGNER: Erica Naftolowitz erica@qsrmagazine.com

PRODUCTION MANAGER: Mitch Avery mitch@qsrmagazine.com

ADVERTISING 800.662.4834

NATIONAL SALES DIRECTOR // EXTENSION 126 : Eugene Drezner eugene@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 149 : Edward Richards edward@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 141 : Amber Dobsovic amber@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 148 : John Krueger john@foodnewsmedia.com

SALES SUPPORT // EXTENSION 124 : Tracy Doubts tracy@foodnewsmedia.com

CIRCULATION WWW.QSRMAGAZINE.COM/SUBSCRIBE

CIRCULATION COORDINATOR: N. Weber circasst@qsrmagazine.com

ADMINISTRATION

GROUP PUBLISHER, FOOD NEWS MEDIA: Greg Sanders greg@foodnewsmedia.com

PRESIDENT: Webb C. Howell

MANAGER, IT SERVICES: Jason Purdy

ACCOUNTING ASSOCIATE: Carole Ogan

ADMINISTRATION

800.662.4834, www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher.

REPRINTS

THE YGS GROUP

TOLL FREE: 800.290.5460

FAX: 717.825.2150

E-MAIL: qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided by the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed. Direct to sponsoredcontent@foodnewsmedia.com

FOOD NEWS MEDIA

If I could pick a lane ( pun intended) that’s held my interest most over these past couple of years, it’s the so-called “Restaurant of the Future.” Pre-COVID, back when we were all rested, the idea of a major chain redesigning its entire model was, maybe, twice-a-year-type news. The reason was pretty simple—serious programs trailed massive price tags for operators/franchisees. So any change beyond refreshes had to carry a very clear ROI. McDonald’s back in August 2018, for instance, said it was giving its “Experience of the Future” project—perhaps known best for in-store kiosks—a $6 billion boost. And that was, without much question, one of the biggest stories for multiple years. Come 2020 into 2021, and this type of prototype drop became a near weekly headline. Every type of brand entered the fray, from Shake Shack and its drivethru entry to Chipotle’s Chipotlane-only model to Burger King even drawing up a unit where food came down a conveyor belt. In this issue, we explore the movement and what’s fueling it, and how much of it will prove reality versus fiction (page 28). Also, whether or not second-generation real estate truly provided the boon some believed it might (page 16).

For me, I find this corner of the COVID cycle to be the most alluring. So many of the changes afoot, from dual lanes in the drive-thru to pickup lockers to curbside spots powered by smart technology (to let restaurants know when guests arrive), are convenience elements consumers wanted before the crisis. But like robotics, it was one of those shifts brands constantly debated the price/payoff equation. And

it wasn’t clear. Now, given labor concerns and how the pandemic jolted guest behavior, a lot of these tech-centric updates make far more sense.

Arguably the most visible dynamic is the cutback of the dining room. We’ve all seen prototypes that shed seating in favor of a drive-thru-only box. Even socialforward Shake Shack has one in the works. This generally surfaces two sentiments from onlookers: Do guests actually want to sit in the dining room anymore? And, on the same token, is this one step too far when the dust settles? My view is taking extremes in that discussion could be misguided. There are some chains (Checkers & Rally’s and Sonic Drive-In) where the model is simply who they are. A Taco Bell adding one doesn’t mean it’s losing sight of decades of equity, however. In fact, the diversification in real estate is as much an infill play as it is a reimagining. This reality, triggered by COVID and digital-centric reactions, is going to allow brands to rethink markets they might have scratched off the map before. Chipotle can bring digital-only models into urban centers to support other locations. In other words, both sit-down and off-premises restaurants can complement one another more than cannibalize occasions. Starbucks has been doing this for some time, and it plans to dive even deeper with pickup stores nearby traditional cafes. Overall, quick-service’s new look, from fast casuals to the biggest fastfood icons, paints a future of possibility unlike anything we’ve seen. And that, in the end, might just be the lasting impact we’ve been hoping for.

Danny Klein, Editorial Director

The present and future of quick service don’t have to work against each other.

SCHLOTZSKY’S NEWEST MENU INNOVATION arrived with star power. The brand took its homemade bread, meats, and flavors and packed them into a lineup of freshly baked-from-scratch calzones. And it found the perfect Italian ambassador to do so. From being an international pop sensation with NSYNC to a TV host and established restaurateur, Joey Fatone is well-known in many fields. The only obvious choice left? Rebrand as Joey Calzone. Schlotzsky’s and Fatone teamed up to launch the Italian-inspired option with ham, Genoa and Cotto salami, pepperoni, and mozzarella and parmesan cheeses, alongside two additional choices, including the BBQ Chicken and the French Dip. “At Schlotzsky’s, we begin each day by baking made from scratch buns, pizza dough and now calzone dough in the restaurants across the county,” says Jennifer Keil, executive chef at Schlotzsky’s. “Using the fresh ingredients and bold flavor combinations creates unique and craveable menu items, like our new calzones, that you can’t get anywhere else.”

Joey Fatone has roots in the restaurant industry.

Joey Fatone has roots in the restaurant industry.

Schlotzsky’s used celebrity backing to introduce a fresh lineup to guests.

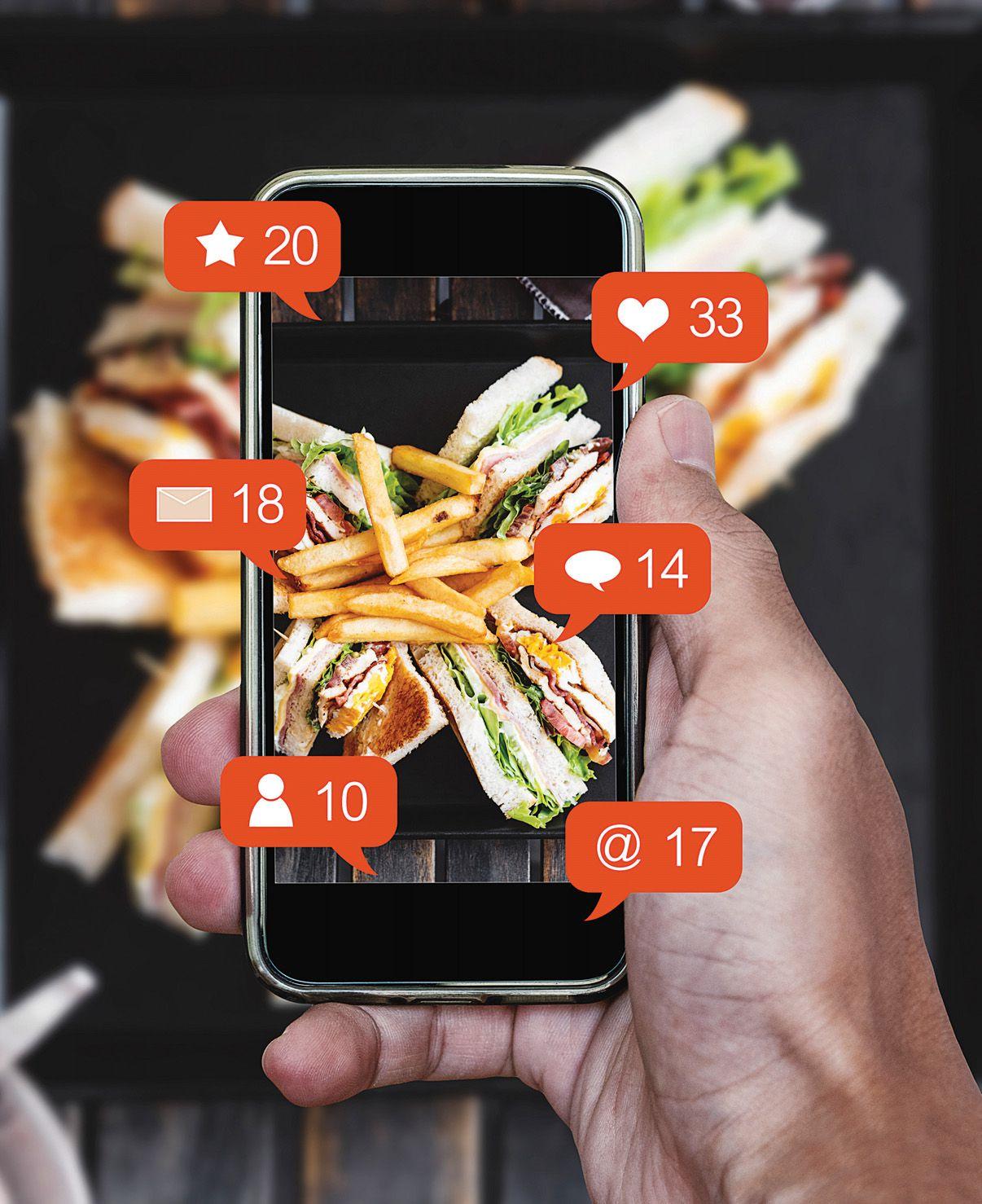

One of the commonly touted byproducts of the pandemic is that it increased trust between restaurants and consumers. At the least, it offered brands the chance to be there for diners when they needed them most. And it appears that resonated.

MBLM’s COVID Study, in its second year, found “Brand Intimacy” increased by 8 percent since the onset of COVID-19 for fast-food chains. Daily usage also upped 8 percent and willingness to pay 20 percent more for products and services also jumped 43 percent compared to last year’s edition.

“Despite having to shut down at some points and weather significant supply chain challenges recently, the fast-food industry has drawn consumers closer and created stronger emotional bonds over the last year,” says Mario Natarelli, managing partner, MBLM. “Brands in this industry have been able to capitalize on mobile ordering and digital drive-thru lanes during the pandemic. This has created a new reality within which fast-food brands provide even more comfort and convenience to stressed consumers—a position they can effectively continue to reference as we increasingly return to ‘normal life’ in the year ahead.”

The Brand Intimacy model measures the intensity of intimate brand relationships and is based on being a user of the brand, having a positive emotional connection with it, and performance on a series of archetypes and stages

Some other fi n

Fast food continued to perform better with men than with women, and with younger versus older consumers.

More than 32 percent of consumers reported an increased positive emotional connection with quick-service brands since MBLM’s 2020 COVID study.

Starbucks was the top brand with men, while Chick-fil-A is the top brand with women.

Overall, the fast-food industry clocked in at No. 6— the same position as the previous year (media and entertainment, automotive, retail, tech and telecom, and consumer goods were ahead). But it increased its average “Quotient Score” by 3.2 percent.

Add revenue streams with craft beverages for every daypart. Infused iced teas, avored lemonades, iced coffees and more!

Botrista leverages easy-to-use equipment (the DrinkBot) alongside a line of ingredients (BiBs) to deliver endless choices.

Automated. Limit labor and waste

Flexible. Customized menu and recipe options

Small. Reduced footprint at 5 sq. ft.

Quick. Order to pour in just 20 sec

Intuitive. Easy to use interface

craft beverage choices without the full bar.

The burger remains one of the top-selling foods nationwide, found everywhere from fast food to gastropubs, fairgrounds, and high-end eateries.

As other products come into vogue—the fried chicken sandwich being a recent one—the burger hasn’t ceded as much ground as onlookers might believe. Just consider the fact McDonald’s serves 1 percent of the world’s population every day. That’s 68 million people, or 75 burgers sold per second.

In the year ending 2020 (when the “chicken sandwich wars” raged on), burgers were still included in 13.5 percent of all restaurant orders, which translated to 7 billion servings, according to The NPD Group. Chicken sandwiches (breaded and grilled) were featured in 6.7 percent of all restaurant orders in the U.S, which

amounted to 3.5 billion servings.

But if burgers are so ubiquitous, and good burgers at that, what keeps customers coming back?

For Smashburger, it’s staying true to what the brand does well and guarding those traits: Every burger is smashed on the grill for 10 seconds before it’s left to cook. “We tell this story almost continuously,” says Scott Johnson, chief marketing officer for the Denver-based company.

This is not only an important branding piece but also caramelizes the patty and adds flavor. “Our procedure is as important as our ingredients. We have such a unique way of cooking our burgers and that’s always going to be our bread and butter,” adds Ty Goerke, leading chef and senior manager of operations. But the

While the chicken sandwich may have grabbed headlines in recent years, the burger remains a quick-service staple that isn’t going anywhere.

brand doesn’t just rely on a cooking technique—it also focuses on quality ingredients that include 100 percent Angus beef. Everything is prepared in house, and Smashburger makes meals to-order.

As a brand, Goerke says, Smashburger must continue offering customers’ favorite burgers but also constantly think ahead. “We have to keep developing … and creating what people want.”

Burgers are so important to Hopdoddy Burger Bar that in January it purchased another burger brand, Grub, adding 18 stores to its 32, largely in new markets.

Burgers remain popular because operators can constantly rethink them, says Jeff Chandler, CEO of Austin, Texas-based Hopdoddy.

The burger, he says, “is so uniquely positioned as a food vessel because of the flavors, food builds, and customization.” Add to that, he says, “the savoriness of burgers, the juiciness of burgers. You can be dynamic with the flavors and the ingredients.” Yet at the same time, he points out, burgers are a comfort food. “We embrace this concept of doing the familiar in an unfamiliar way. That means the type of burger build but also the sourcing part of it, the cooking, and prep.”

Within Grub’s and Hopdoddy’s menus, classic burgers and slight variations of them constitute 60 percent of burger sales, though the desire for customization has gone up during COVID, Chandler says.

you are. There are so many upstarts, so much noise. There has to be a story, you have to be authentic and not try to be something you’re not, be confident in who you are.”

Killer wants every bite of its burgers to be well-thought out: For the bacon to be crisp enough to break, not bend, when it’s bitten into, and for there to be some topping in every bite.

To achieve that, it places a lead focus on ingredients. “Every bite has to be a clean bite to make sure product that goes out of the door is good enough,” Dikos says. Killer Burgers’ teams, he adds, feel empowered to let waste increase in order to produce this perfect burger—even an imperfect pickle is discarded.

There’s no ignoring the fact that while burgers remain the lead act, the prevalence of plant-based eating has shaken up traditional menus.

Smashburger is very cognizant of this trend. It’s had a black bean burger on the menu for 12 years, but it’s time to reformulate it, Goerke says. The company is now removing the cheese and egg to make it vegan. It’s also adding some vegan shake options and sides. “Even though we’re a burger company we’ll be respectful of what is going on,” he says.

Smashburger also introduced a pulled pork tailgater in late 2020. “That not only was new and interesting and brought another protein ingredient to the burger but also showcased our culinary expertise,” Johnson says. “Having burgers in a lot of different forms is where we want to go and as consumers’ tastes evolve we want to move with them.”

Hopdoddy has leaned into Beyond Meat. “We are impressed with their team and their CEO has been an awesome resource so we see being more aggressive in that arena and introducing plant-based products when and were we can,” Chandler says.

Some consumers are shifting to plantbased foods due to concern for the environment, which has led brands to commit to better sourcing practices in order to make strides toward alleviating climate change through their beef as well.

Hopdoddy changed its practices in order to become a better steward of the environment. The company only works with farmers and ranchers that commit to regenerative farming practices. And it works with companies whose core values align with Hopdoddy’s. “We commit to investing in those ranchers and suppliers who share core values with us because it needs to be a sustainable ecosystem,” Chandler says.

Killer Burger stays true to its mission of being an oasis from life “and bringing back the nostalgia of having a burger on the grill in your backyard,” says John Dikos, president and chief development officer of the Portland, Oregon-based fast casual.

“In anything you do, you’d better clarify what you do and who

“Even the most conscious brands out there that are still using beef products are thinking about it,” Dikos adds. “We’re south of 20 stores and it’s not something we’re executing today but it’s something we need to be thinking about, to just see what we can do. And the bigger we get, the more thoughtful we need to be about our impact and putting some creative solutions together.” q

The dish that got chef Steve Chu from hot dog cart to full-fledged restaurant: Thai Chicken Meatballs. It’s got a little bit of everything – crisp mango slaw, tender, juicy chicken meatballs and of course, that phenomenal bite and texture of Cracked Black Pepper. Your Skills. Our Spices. Now that’s a potent combination. Learn more at: McCormickForChefs.com/McCormick-Culinary

TOGETHER, WE FLAVOR

our expectations,” Wyland says. “Quite frankly, coming into this, I assumed that if we got to a 25–50 max number of units sold during that six-month period, I would have been pretty happy. I’ve been with brands that we took a year just to start the first five or 10.”

More importantly, Wyland says, RollEm-Up wants to open 50 locations this year. Much attention will be directed toward putting tools in place to ensure franchisee success.

It starts with what he calls a “deceptively simple” menu. Taquitos are built with a corn or flour tortilla, and filled with either beef, chicken, potato, cheese, or avocado. Toppings include cheese, sour cream, guacamole, and a variety of house-made dipping sauces. The taquitos come in a three or five pack, and customers can mix and match ( i.e. beef taquito with flour tortilla, potato taquito with corn tortilla)

The hero item can be paired with seven different sides—street corn, rice, beans, chips/guacamole, chips/salsa, chips/queso, and a churro doughnut.

FOUNDERS: Ryan Usrey

HEADQUARTERS: Irvine, CA

YEAR STARTED: 2019

ANNUAL SALES: AUVs at $2.1 million

TOTAL UNITS: 3 (plus 4 under construction)

ROLLEMUP TAQUITOS INITIATED ITSFRANCHISE program in May 2021 with the loftiest of goals—sell deals comprising 100 restaurants by the end of the year. The five-year plan was to reach 500.

The 100-unit benchmark was far above the 40–50 range chief development officer Chris Wyland initially suggested, and that’s because of founder and CEO Ryan

Usrey, who consistently challenges him on the development side.

Wyland was more than up for it. Under his direction, the emerging fast casual reached 105 units in development by December. But the brand wasn’t finished.

Just before the curtains closed on 2021, Roll-Em-Up signed a massive, 315-unit master development deal to build stores in Texas and Oklahoma with franchisees David Weaver and Blake Terry. Counting that final agreement, the brand placed 420 restaurants under development in six months.

The new objective is to add another 500 stores to the development schedule in 2022.

“I’ve been involved in this industry for a long time and been with a lot of emerging fast-casual brands, so it absolutely exceeded

“I think what we’ve heard from a lot of our new franchisees coming in—and 95 percent of them are current multi-unit operators in the restaurant industry of other brands— the thing they really notice is how easy the operations are,” Wyland says. “And that creates low labor costs, low costs of goods, so I think that’s really a big focus. You talk to some other operators that are in brands where it’s very hard to execute their menu and do it at a cost that actually makes sense and they’re going to make money.”

To assist franchisees even further, RollEm-Up improved its digital infrastructure with five key partnerships—Olo, an online ordering platform, Punchh, a loyalty and engagement solution, Toast, a fully integrated POS system, Restaurant365, an all-in-one accounting, inventory, scheduling, payroll, and human resources

cheap,” the Fort Lauderdale-based retail specialist recalls. But while some of this occurred, “the wave of closures never came, much to the disappointment of chains that were flush with cash.”

The pandemic certainly caused damage to the dining industry. The National Restaurant Association estimates 90,000 eating establishments shuttered for good or long-term due to coronavirus setbacks. “It’s been hard to track closings caused by the pandemic separate of other business reasons,” says Association spokesperson Vanessa Sink. “The industry is still being disrupted.”

As the COVID-19 pandemic moves into its third year, an old real-estate saying seems to be easily transferrable to the limited-service restaurant industry: location, location, location.

Two years ago, as operators worried about worsening economic conditions, many experts predicted a huge shakeout that would result in a sizable number of quick-service and fast-casual closings, creating thousands of available second-generation locations.

According to thinking at the time, all these newly vacant sites would result in a depressed restaurant real estate market, which in turn would provide inexpensive growth opportunities for the strongest entities as well as lower costs for startups.

So, did this projected boom in second-generation sites occur? At this point, observers are split in their views, although the majority say the boom never happened. “Back in March, April, and May of 2020, there was a lot of talk about this flood of drive-thrus that were going to come available, and these great opportunities would be around the corner,” says Barry Wolfe, a senior managing director of national real-estate firm Marcus & Millichap.

“People thought they were going to get A-plus locations on the

Nonetheless, an annual average of 60,000 eating and drinking establishments opened and 50,000 closed for various business reasons before 2020, according to the organization’s research. Companies like McDonald’s and Dunkin’, for instance, announced plans before COVID’s spread to close hundreds of units in Walmarts and Speedway stores, respectively. Subway was struggling and closing hundreds of restaurants. Numerous operators shuttered older sites but opened others in better locations. With offices closed due to coronavirus mandates and precautionary measures, many urban core eateries did suffer. At the same time, consumers flocked to suburban and exurban limited-service units, especially those with drive-thrus. Based

The NPD Group, the number of full-service restaurants at the end of Q1 2021 slid 10.7 percent versus pre-pandemic units, but quickservice spots dipped just 3.7 percent and fast-casual stores declined only 1.5 percent. And while NPD found quick-service online and physical traffic was still off a percent at the end of 2021 compared with two years earlier, dozens of limited-service chains reported strong revenues and earnings last year.

“It speaks very positively of anything with a drive-thru, using it to survive and prosper,” Wolfe says. “These owners were also entrepreneurial and able to pivot quickly.”

Of course, as he and others note, federal and state government assistance also played a significant role in helping many restaurants stay above water. “If not for PPP [ Paycheck Protection Program], there would have been a more likely repeat of the dynamics of the [2007–2009] recession,” notes Don Fox, CEO

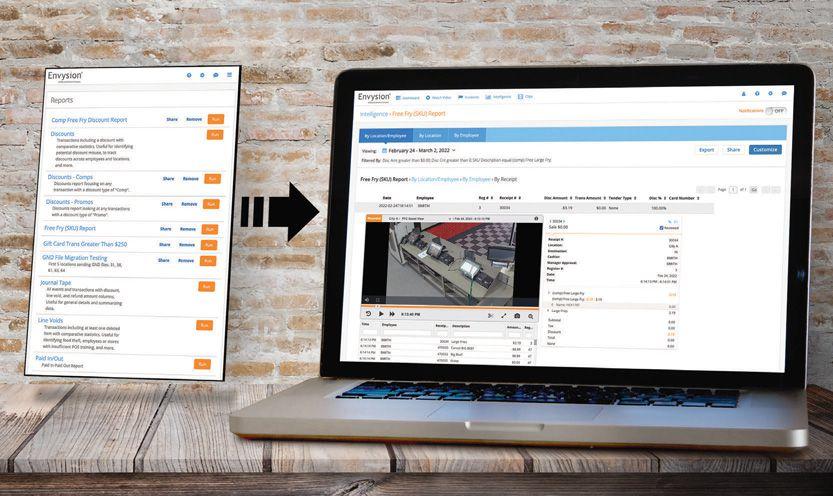

he labor shortage is one of the most difficult challenges facing the restaurant industry today. With management teams tasked with so much, no matter the size of their teams, reporting can become a massive time sink. The team may not have access to useful reports in the current system or may not understand how to customize them for specific needs. It can be easy to resort to sifting through undifferentiated POS data without a good grasp of what to look for—or to rely too heavily on video or transaction data alone. Small fraudulent transactions can even go unnoticed.

“With the current environment, even more so than usual, all companies—and all loss prevention or asset protection departments—are being asked to accomplish more with less. I like to refer to it as MacGyver Syndrome,” says Jeff Levitt, asset protection manager at Portillo’s, a publicly-traded chain of fast-casual restaurants (Nasdaq: PTLO).

Under this kind of pressure, quick-service and fast-casual operators and management teams need to be able to quickly prioritize and decide which events they need to address first. With their time and attention stretched to the limit, they need to monitor their locations quickly and thoroughly. Perhaps most of all, they need to be able to eliminate guesswork and focus on what matters most—protecting the bottom line.

Faced with these challenges, Portillo’s decided to integrate Envysion Restaurant Solution Suite with its POS system. Envysion’s video surveillance and loss prevention software solution ties reporting to

video verification to help clarify the unknown—and to help defeat “MacGyver Syndrome.”

“There are a lot of choices for exception reporting out there, but the Envysion product looks at true exceptions versus a preset standard,” Levitt says. “I’m able to see data that’s more actionable and that might not be flagged if we were using a preset. Envysion is always going to show me what bubbles to the top, even if that top changes.” For example, a series of voids for $35 might go unnoticed if the system was preset to flag voids over $40. Envysion is equipped to respond flexibly to what’s really happening in each location, surfacing true exceptions, such as a rash of smaller voided transactions.

“With Envysion, we’ve been able to have better visibility to address operational issues,” Levitt says. “It’s a cost-effective solution that can help us get great insights into the business. It’s also a twoway relationship and a true partnership. Not only does Envysion give us actionable data that we’d be hard-pressed to find anywhere else, but the company also listens to users’ feedback on its product and implements changes we suggest.”

Levitt keeps the Envysion app open on a separate monitor on his desk at all times. That way, he can browse and pull reports easily if he gets requests from law enforcement or a general manager. Envysion creates links to specific videos to send out to fulfill those requests, so there’s no need for Levitt to download and send large files. Aside from these quick duties, he spends about an hour a week reviewing exception reports.

“It’s all very efficient,” Levitt says. “Envysion is an important tool in the arsenal to support our business. We aren’t doing more with less; we’re doing more with more.”

Asset protection teams have stopped doing more with less— and started doing more with more. /BY KARA PHELPSPortillo’s Jeff Levitt uses the Envysion Restaurant Solution Suite to tie reporting directly to video verification.

COVID-19 didn’t tell Panera a digital revolution was bubbling to the surface. ¶ Long before the pandemic flipped trends upside down, the 2,100-unit chain crossed a threshold in which offpremises began mixing more than 50 percent of its sales. Consumers had spoken, and Panera needed to ensure it had the right restaurant to embrace modernization, says Chief Development Officer Rob Sopkin, who’s been with the brand since 2018. ¶ “We recognized that we had an opportunity to update our look and feel and find the design that we felt was more forward-thinking, more focused on the craft of what Panera is, and something that we felt would simultaneously improve our business model and better meet the needs of what we were already seeing from a trend line standpoint from our customers,” he says.

/ BY BEN COLEY

The bakery-cafe started by gathering a team to work on an innovative store layout. On one side was a group of Panera’s top franchisees. The other, a cross-functional unit comprising IT, operations, engineering, human resources, and other key departments.

The kickoff meeting occurred in the winter of 2020, just weeks before COVID put the country on lockdown. But effort on the prototype never stopped, and for good reason.

“Most of the work that ultimately took place, took place during really the worst of the COVID shutdown,” Sopkin says. “The assumption already was that we had an opportunity to better meet our customers’ needs through a new box. And then this really accelerated things a little bit, and if anything, put an exclamation point on what we were already working on.”

A few months later, Panera directed attention toward a warehouse in Chicago, which held a life-sized cardboard replica of the company’s vision, from the high ceiling exterior to the full kitchen with existing equipment. The company proceeded to walk through and search for greater efficiencies. A wider corporate group was brought into Chicago in waves, as well as additional franchisees—all in an effort to retrieve as much feedback as possible.

Panera ultimately landed on a 3,500-square-foot NextGen design in Ballwin, Missouri, just 7.6 miles away from its first restaurant. The fast casual brought the prototype to life in partnership with ChangeUp, a brand design agency that’s also worked with Taco Bell, Panda Express, Jimmy John’s, Nike, Cadillac, and Macy’s.

“The development of NextGen highlights how relentless we have been to satisfy the needs of not only guests, but also

our associates,” says CEO Niren Chaudhary. “Panera NextGen cafe is tech-enabled not only for our guests, but also in the back-of-house—using technology to simplify and optimize the associate experience.”

The store, which debuted in November 2021, features a double drive-thru, with one lane dedicated to mobile orders, or as the company calls it, “Rapid Pick-Up.” The enhancement lines up well with where the industry is headed. Drive-thru represented 52 percent of off-premises traffic in the year ending October 2021, and increased visits by 9 percent compared to the year-ago period and by 23 percent versus two years prior, according to The NPD Group.

Inside, customers can either wait in line, use a digital kiosk, pick up their takeout meal, or go straight to a table and use the app to order a contactless dine-in meal. Guests also have the option of pulling up curbside and waiting for a team member to bring their food and beverages. The brand first announced Panera Curbside in May 2020, which involves technology that automatically notifies restaurants when a customer arrives.

“Panera’s NextGen cafes signal our company’s vision for the future of fast-casual dining—a frictionless, tech-powered yet warm and personalized dining experience,” Chaudhary says. “It’s fully focused on taking pride in baking, our strong commitment to our food values, and continuing our leadership in technology.”

“In a post-COVID world, Panera is showing up for our guests and shifting with their ever-changing needs—whether they want to dine in or out, we have every possible option for them from rapid pick-up to delivery to curbside to contactless dine-in or drive-thru,” he adds.

When customers arrive, they’re greeted with an outdoor seating section and an updated “Mother Bread” logo that nods to Panera’s bakery legacy and its more than 30-year-old sourdough starter, says Chief Brand Officer Eduardo Luz. The insignia was refreshed to have the “Mother” directly facing customers, therefore “warmly inviting them to come break bread with us at Panera.”

The interior was developed with customer wayfinding in mind. The restaurant includes a pickup area near the door so to-go guests can enter/exit seamlessly without moving farther into the cafe and creating additional congestion.

“We were thinking about the efficiency of the entire experience for the customer and really at every single touch point that became the foundation of what we were trying to get accomplished,” Sopkin says. “We wanted this to be a more intuitive experience for our guests so that they fundamentally understand what the customer journey is, where they’re ordering, and how this flows, where they’re picking up there drinks. Take any of the guess work or confusion out of that.”

Placing an off-premises section near the entrance also signifies a shift in how Panera approaches delivery, Sopkin says. The chain built its own fleet of drivers in the years leading up to the pandemic, but the fast casual since moved toward an outsourced method. A little more than six months into the pandemic, delivery sales were up 100 percent, or more, depending on the market.

“We saw a pretty significant acceleration in that business overall as more and more people were migrating to the thirdparty delivery platforms,” Sopkin says. “Between the sales going up and then also changing the model and going to third party, that affected our design.”

Another goal, Sopkin notes, was to showcase what Panera was founded on—baking and fresh bread. An overhanging mirror reflects a multitude of treats, and bakery ovens and tables are in full view. In prior iterations, the process was more of a back-of-house discussion, but now, Sopkin says little is left to the imagination and baking has moved to the “heart of the experience.”

Although the restaurant industry is accelerating toward an off-premises-dependent world, Luz says, customers still value Panera’s dine-in atmosphere that “delights all their senses.”

“Our guests use our cafes as an extension of their own homes,” Luz says. “They cozily enjoy their meals by our fireplace. They love to watch our bakers create deliciousness right in front of their eyes and sample the latest creations. And of course, the aroma of freshly baked bread, straight from the oven, keeps our guests wanting to come back for more. The NextGen cafes incorporate all these rich dine-in experiences.”

For the back of house, the restaurant experimented with different layouts, but eventually opted for an integrated line, meaning food and beverages are produced in a centralized spot, regardless of how the customer orders.

The choice reduces labor costs and proved to be a more intuitive process for employees, Sopkin says. The size of the prototype can flex upward or downward depending on real estate, but in every box, the kitchen remains the same square footage; only the front of house and dining room seating changes.

In terms of drive-thru, Panera chose digital menuboards to ease friction and add a layer of engagement. Through geo-fencing technology, the restaurant is able to automatically pinpoint a MyPanera loyalty member when they arrive at the cafe. Once identified, the customer is greeted by name, and their experience becomes highly personalized.

For instance, consumers can easily re-order past favorites and Panera can leverage known preferences to offer recommendations and tips for better menu matches. In August, the fast casual reported 45 percent of sales were e-commerce, and its loyalty program comprised 44 million users.

During the pandemic, Panera’s pivot to more off-premises and digital orders was fueled by new deals like its MyPanera+ Coffee subscription program, which offers unlimited iced and hot coffee and hot tea for $8.99 per month—any size, any flavor, and redeemable every two hours. The company also debuted Flatbread Pizza, a portable food segment that saw record-breaking sales when dining rooms were restricted.

“Panera’s guests are very discerning,” Luz says. “They love delicious, chef-curated food that tastes amazing because it only uses the best ingredients. They also want omni-channel convenience as they live busy lives and don’t want to waste time.”

“With NextGen, we are making all these Panera traits even stronger, which in turn will further differentiate our experience,” he continues. “We believe that over time, this differentiation will continue to attract new guests, while we retain and delight

the already loyal ones.”

The DNA of the design will be represented in all Panera restaurants going forward, except for a handful of units that were conceptualized prior to the fast casual landing on its prototype. Sopkin says there may be some instances in which the company cannot implement a dual-lane drive-thru, but if the site works and it’s the right trade area, it is willing to move forward with a traditional drive-thru. Sopkin says the company saw double drive-thru sites enter the pipeline about 65 percent of the time.

Some elements, such as the exterior signage, fluted green tower, and frontal view of the bakery will also carry over to existing stores as part of the company’s remodel program.

The NextGen store in Missouri is about 20 percent smaller than Panera’s most recent standard prototype. Previously, locations required a $1.5 million to build, but the latest design is closer to $1.3 million.

“There’s a lot of noise and construction costs right now in terms of inflation and different things that are going on in supply chain,” Sopkin says. “But for the next year out forecasting, we’re going to be able to achieve our new store cost around that $1.3 million number.”

“That’s what it does do is allow us to get into some of the tighter, smaller footprints at 3,500 square feet,” he adds. “And there were certainly instances where finding a 4,500-squarefoot cafe with a drive-thru didn’t fit on certain site zones. So it actually gives us increased flexibility to get into more locations.”

Panera’s new restaurant is part of a significant transition in the fast casual’s history. In August, the bakery-cafe chain announced it was uniting with sister concepts Caribou Coffee and Einstein Bros. Bagels to form Panera Brands. Combined, the group encompasses nearly 4,000 locations and 110,000 employees in 10 countries, making it one of the industry’s larg-

est fast-casual platforms.

Chaudhary says the goal is to leverage core competencies and the scale of Panera—such as its digital program and expansive franchise model—to turbocharge growth of Caribou and Einstein Bros. Each restaurant is owned by German conglomerate JAB Holding, which purchased Panera for $7.5 billion in 2017, Caribou for $340 million in 2012, and Einstein Noah Restaurant Group for $374 million in 2014.

Then in November, Panera Brands revealed plans to go public with the assistance of restaurateur Danny Meyer and his special purpose acquisition company Union Square Hospitality Group Corp. “It’s a portfolio of complementary brands that are stronger together, bound by common values and each are well-positioned for growth,” Chaudhary says. “Together, the three brands form a powerhouse platform with common values and shared belief that we can be force multipliers for good. Panera Bread as the leader in food you feel good about eating, Caribou Coffee as a leader in delicious coffee, and Einstein Bros Bagels as a leader in craveable breakfast.”

As for Panera’s upcoming development plans, Sopkin can’t get into specifics because of the impending IPO, but he does feel bullish about both corporate and franchise growth, which each make up about 50 percent of the footprint.

The chain is energized by NextGen and drive-thru potential in suburbs, and also rethinking what the new era means for urban and nontraditional environments.

“We see our customers are excited about us in any of these environments, whether it’s urban or suburban, and what we’re trying to do is meet them where they want to be met,” Sopkin says. q

Ben Coley is Food News Media’s content editor. He can be reached at ben@QSRmagazine.com

Ben Coley is Food News Media’s content editor. He can be reached at ben@QSRmagazine.com

The Nolensville Hardee’s serves as a prelude to bigger changes afoot at CKE. In next-generation store designs from the Tennessee-based restaurant enterprise, Walls teases multiple drive-thru lanes, a walk-up window devoted to third-party delivery, and a redesigned kitchen focused on optimization with new equipment, technology, and layout considerations.

“As guests become savvier and there are more options available, it’s more important than ever to listen to their voice,” says Walls, CKE’s global chief development officer. “We had to stop the way we were developing to best meet guest expectations.”

And CKE is far from alone.

Across the U.S., quick-service brands are aggressively altering store designs to accommodate shifting consumer preferences, so many powered by the COVID-19 pandemic. In TD Bank’s 2021 Restaurant Franchise Pulse survey released earlier this year, 55 percent of restaurant operators said they planned to add more space for pickup orders, while 45 percent were plotting additional drive-thru locations, and another 43 percent were looking to add outdoor dining space. Those figures underscore the fast-changing world of restaurant design.

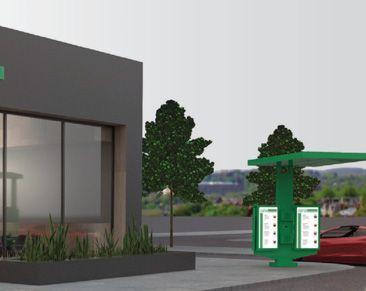

As quick-service brands hustle to fulfill guest demand for contemporary, convenient, and safe experiences, store models are evolving at a rapid pace. To capture results and ensure longterm viability, today’s restaurant prototypes are imaginative, progressive, and forward-thinking concoctions incorporating once-unthinkable elements, such as interiors eschewing dine-in capabilities, drive thru-only stores, and triple-lane drive thrus.

“No customer, no revenue,” says Sam Ballas, founder and CEO of North Carolina-based East Coast Wings & Grill. “You either figure out how to shift your lens or you miss out.”

Above all, the quick-service restaurant of the future is smaller. With lingering anxieties about dining in and a surge in off-premises orders, quick serves are slicing their traditional footprints to accommodate new and projected realities.

“We don’t need to build a 4,000-square-foot restaurant in an area in which we’re doing 95 percent drive-thru business,” CKE’s Walls says.

Smaller stores generally reduce construction time and expenses before shrinking occupancy costs. This positions brands, especially franchised concepts, to capture a lower investment cost while heightening ROI potential.

The conventional store at upstart Florida-based chain Chick’nCone covered some 1,200 square feet and featured about two dozen seats and an exhibition kitchen—the aptly named waffle theatre. Today, the brand touts a new 360-square foot shipping container prototype entirely devoted to off-premises traffic with a walk-up window and drive-thru lane. Two such units are already operating in Dubai, while the chain’s first such domestic unit will open this summer.

Compared to the company’s conventional restaurant design, Chick’nCone CEO Jonathan Almanzar says this new prototype slices upward of 40 percent off the costs and time needed to open the unit.

“You can’t argue with those numbers,” he says.

Mexican chain QDOBA, meanwhile, historically favored units of 2,400–2,600 square feet. With its new store prototype, however, it is reducing square footage about 20 percent to 2,000–2,200 square feet.

Notably, the push toward smaller-format concepts focused on off-premises orders is also being adopted by traditional full-service restaurant brands as well, which injects added competition into the quick-service marketplace. TGI Fridays’ “Fridays on the Fly,” for instance, is a 2,500-square-foot space with limited indoor dining and a hefty focus on processing takeout and delivery orders. Full-service giants like IHOP and Buffalo Wild Wings have similarly unveiled prototypes with reduced store footprints as has Ballas’ East Coast Wings. From the 4,500-square foot box it once inhabited, East Coast Wings now features a 2,100-square foot space with fast casuallike elements such as counter ordering.

See

“The smaller box size equals a reduced investment without a significant falloff in revenue,” Ballas says.

For years, fast-casual concepts like Panera and Starbucks fashioned themselves as a “third place”—a venue in which individuals could chill beyond their home or office. Many quick-service restaurants in small towns similarly celebrated their status as a hang-out spot.

The pandemic, however, battered the “third place” notion and prompted restaurant brands to question the need for indoor dining. Deloitte U.S. restaurant and food service leader Jean Chick says restaurant quick-service dining rooms are going to shrink and, in some cases, disappear.

“I wouldn’t be surprised if we see more and more quick serves close dining rooms altogether and move entirely to drive-thru and pickup-only footprints that offer the ultimate in convenience,” Chick says.

Indeed, prominent brands like McDonald’s, El Pollo Loco, and Jack in the Box have all unveiled prototypes reducing, if not wholly eliminating, indoor seating.

With Chick’nCone’s to-go and online ordering up 300 percent in 2021 and dine-in traffic trailing off, Almanzar says the value of a dining room declined, which is why his brand’s new prototype ditches indoor seating in favor of a walk-up window and drive-thru. Yet more, eliminating the dining room allows the growing chain to be more efficient with its human capital, thereby addressing another pesky challenge in the restaurant space.

“It makes more sense to remove the dining room element and focus on the kitchen,” Almanzar says.

Many brands, however, are offer-

ing a compromise to those who still want to dine on-site or hold anxieties about inside dining by delivering outdoor patios. Prototype renderings from the likes of KFC, Sweetgreen, Smashburger, and Pokeworks all include extensive patio seating.

In today’s quick-service environment, a drive-thru is a virtual necessity to accommodate guest demand for convenience and safety. It’s why so many brands that went years without drivethru restaurants—Shake Shack, Chipotle, and Sweetgreen among them—are racing to service vehicle-bound customers.

At the minimum, a single drive-thru lane is key, though recently unveiled quick-service prototypes are reaching beyond that standard with additional lanes designed to reduce wait time and accommodate delivery orders as well as digital purchases.

As Jack in the Box saw its drive-thru sales skyrocket throughout 2020 and into 2021, the brand crafted plans for a drive-thru-only prototype. Alongside more storage capacity and dual-assembly kitchens to accommodate off-premises sales, Jack in the Box’s MK12 prototype includes two drivethru lanes: a traditional lane outfitted with digital menuboards, LED lights, and overhead canopies, and a second dedicated to fulfilling online pickup and third-party delivery. The first two MK12 locations will open later this year in California and Oklahoma, says Jack in the Box chief franchise and corporate development officer Tim Linderman.

Similarly, Taco Bell’s “Go Mobile” prototype devotes a lane to mobile orders while Shake Shack’s design shows three lanes—two allotted to the conventional drive-thru customer and a third earmarked for app pickup and delivery orders.

As many Hardee’s and Carl’s Jr. stores capture 80–90 percent of their sales via the drive-thru, CKE is assigning more real estate to drive-thru operations. The brand’s latest pro-

KFC’S NEXT-GEN DESIGN DIVES INTO THE DUAL-LANE TREND.

KFC’S NEXT-GEN DESIGN DIVES INTO THE DUAL-LANE TREND.

Don’t let supply chain issues slow you down. We are fully stocked and ready to deliver!

6 MODELS TO FIT YOUR KITCHEN!

SAFE COUNTERTOP FRYER OIL DISPOSAL HAS ALWAYS BEEN AN ISSUE—WE ARE YOUR SOLUTION!

THE ISSUE: Safe fryer oil disposal.

THE SOLUTION: The Shortening Shuttles® allow you to safely and easily transport hot oil to the dumpster.

THE ISSUE: Limited space for necessary equipment.

THE SOLUTION: Small foot print of 14" x 19" x 37" tall. Generous capacity of 5.5 gallons. The new SS-645 MINI FITS!

THE ISSUE: Quality. There is so much junk out there folks are reluctant to buy ‘more junk.’

THE SOLUTION: 30+ experienced industry provider of PROVEN quality equipment.

+Menus might be shrinking, but comfort food is sticking around.

Worcester Industrial Products

SAFE WASTE OIL TRANSPORT

totype features two distinct lanes for ordering and delivering food to the guest—“a true double drivethru,” Walls calls it. Both lanes act like a traditional drive-thru while a gate system enables team members to safely deliver food by hand to guests in the outer lane.

“In this way, we’re not getting that bottleneck when two lanes converge into one,” Walls says.

While CKE explored conveyance systems for food delivery—something many others continue investigating, CKE leaders didn’t feel the technology fully addressed large orders and food safety concerns. Yet more, Walls says, the cost-effective gate design enables the brand to provide an important touch of human hospitality as a counter to machines and technology.

And though guests may never leave their cars and step into the restaurant, consumers nevertheless desire transparency and a little experiential flair. Leaning heavily into windows rather than brick walls, prototypes from the likes of Smashburger and Burger King make kitchen operations visible to vehicles in the drive-thru.

With so many restaurant concepts, not to mention retail players like grocery and C-stores, fighting for share of stomach, quickservice brands are turning to new store prototypes to elevate the guest experience in contemporary ways and distinguish themselves from the competition.

Many are accomplishing this by leaning even deeper into technology that ensures a modern customer-facing experience or streamlines back-of-the-house operations. As one example, QDOBA’s new store design includes both interior and exterior digital menuboards. This not only allows QDOBA store leadership to easily make real-time pricing adjustments and promote new offerings, but also improves order accuracy with order confirmation.

“It’s a more fluid way to connect with customers,” QDOBA chief development officer Jim Sullivan says of the digital

menuboards. “This is where we need to be today and it will continue to evolve.”

While the front of the house might differ in CKE’s newest restaurants, Walls says kitchen operations will be the same from store to store and embrace innovations like self-filtering fry vats and drink automation in the drive-thru. This uniformity, he continues, will ensure more efficient operational flow, standardize back-of-the-house training, and allow employees to move between stores.

Beyond technological integrations intended to enhance the guest experience, many quick-service brands are also unveiling prototypes with eye-catching exterior designs, a strategic move to capture attention and entice visits.

Chick’nCone’s new prototype consists of one shipping container stacked on top of the other. While the restaurant’s orange-colored lower level is dedicated entirely to kitchen flow and storage, the top container places the brand’s oversized orange logo and the words “Drive-Thru Here” against a white backdrop.

Other brands are turning to vibrant exteriors, too, ranging from the red and white stripes on the KFC prototype to the gradient sun-colored signage towering above El Pollo Loco’s latest store design. Meanwhile, Jack in the Box’s MK12 prototype includes signature red branding panels that turn purple at night to cajole late-night visits.

The move toward bold exterior designs comes with a stillimportant focus on sustainable materials and environmentally friendly choices. Chick’nCone’s prototype reuses shipping containers while bold prototypes from both Burger King and Sweetgreen incorporate solar-powered roofs.

“With more and more options in a competitive space, you need to make a statement with something modern and clean that also makes people feel good,” Chick’nCone’s Almanzar says. “The restaurant of the future can’t rely on any tired formula.” q

Daniel P. Smith is a regular contributor to Food News Media and is based in Chicago. WHETHER PICKUP, DINE-IN, OR DRIVE-THRU, KFC WILL HAVE BUILDS FOR EVERY DEMAND.

The chief marketing officer’s role at a quick-service brand is always shifting. But the pandemic hastened evolution up and down the C-suite of concepts nationwide.

Many patrons suddenly wanted to spend less time dining in, and more on picking up, getting delivery, and ordering via drive-thru windows and mobile apps to minimize contact. So the task sheet of the CMO boiled down to reaching guests despite guidelines that, in many cases, did everything possible to keep people apart.

Danielle Porto Parra, SVP of category marketing at Focus Brands, who oversees three of the company’s brands—McAlister’s Deli, Schlotzsky’s, and Moe’s Southwestern Grill—says introducing more analytic-driven marketing, coupled with digital platforms, transformed Focus’ ability to communicate in recent years. Her main aim today? Asking, “What can your business do to add value to your customer’s life?”

Is the marketing world more or less connected thanks to COVID? It depends on how you approach it.

The pandemic altered dining habits, increasingly toward digital, Parra says. “Customers,” she explains, “want to use multiple channels based on what’s most convenient, including delivery through our app for a family’s weeknight meal and coming back to dine at lunch.”

Parra sees the biggest change during COVID as an increasingly prevalent number of customers engaging with digital technology, which led to one of the biggest alterations at Focus from a marketing spin: the goal of reaching users on a one-toone basis.

“We’re able to provide the right offer to the right customer at the right time,” Parra says.

For instance, loyalty patterns today can reveal whether a brand is dealing with a mom who is feeding her family. That

can trigger an offer for a free kid’s meal. Or a business traveler who regularly stops in for lunch, which then amounts to a free side of guacamole or dessert.

Moreover, via loyal users, Focus’ marketing department tests free offerings and promotions to determine whether there’s ample or minimal interest, to either sustain or drop it.

Digital traffic and loyalty also enable Focus to get to know each consumer’s tastes and dining preferences. McAlister’s users at its 507 locations earn loyalty points for either a free kid’s meal or free entrée. They can also add a bread bowl with their soup order or become subscribers of a tea pass lasting a month for $7, entitling them to a complimentary daily tea.

Staying a step ahead of the customer during a pandemic is critical, Parra says. At McAlister’s, the fast casual introduced tableside dining where guests don’t have to go to the register to place an order. They sit down at a table, order their meal on their app, and wait for food to be brought out. Customers “pay a fast-casual price, but you’re getting a full meal with waiter service and drink refills,” Parra says.

Focus can target promotions using its repertoire of brands, including Carvel, Cinnabon, Auntie Anne’s, and Jamba to crossappeal to loyal customers. Schlotzsky’s loyalists, in one instance,

BETTER QUALITY FOOD

Less moisture lost in cooking process gives more succulent food and 50% less shrinkage than standard charbroiler

CALCULATE SAVINGS

Our easy to use calculator

Garland XHP Broiler could save you. Try it out! Scan QR code:

ENERGY SAVINGS

Patented gas burner

SAFE AND EASY TO USE to turn on. Flame failure

were offered two large Cinnabons for $5. Parra calls it a win/win because “we’re giving customers a reason to come back more frequently. We don’t want it to only be transactional.”

Additionally, customers are sent social media messages on Facebook, TikTok, and Instagram. To break through the clutter, McAlister’s introduced a contest where loyalists created their own spud images. A random drawing produced a winner that earned a free trip to an Airbnb in Idaho— a major potato supplier.

Asked how Parra expects business will shift when (and if ) the pandemic ever fades, she says, “One thing that won’t change is the adoption of digital messages and people wanting more choices. The pandemic helped accelerate that, but it won’t go away because they want the choices and personalized offerings.”

Ryan Ostrom, marketing chief at Jack in the Box, says the pandemic “expedited what CMOs are doing. It’s more than marketing, but understanding the guest’s journey and how the brand engages with the guest through digital, online, and social by providing the solution that the guest wants.” It all rolls back to age-old pillars: ease, affordability, and convenience.

Convenience, in particular, is what customers demand these days, Ostrom says. Is the drive-thru speedy enough? If the customer orders delivery, can it take 2 minutes to order? What role does marketing play in all of that?

Everything Ostrom does as CMO is geared toward making the customer’s life easier—how quick can a guest purchase on his/her app, and how can he equip franchisees to remove friction throughout the process?

If everyone is accelerating the pace of ordering via mobile, where do you stand out? Ostrom says Jack in the Box carved out a reputation as a “late-night brand,” so it leans into that equity. “We target the after-party and late-night crowd, for delivery, ordering for multiple people and when guests want a tacos or burger,” Ostrom says.

The brand’s Jack App enables its CMO and staff to know if someone is a late-night or breakfast customer, and can help identify if they want to stretch their time spent at Jack in the Box.

Marketing via streaming services such as TikTok was another change. “We are now majority digital in marketing,” Ostrom says. The chain uses the acronym “CRAVED,” meaning cultural, relevant, authentic, visible, easy and distinctive, to determine if its marketing offerings are targeted effectively.

At 770-unit chicken chain Bojangles, “convenience is here to stay and that involves making sure we have the right digital

means to access them, and the right digital tools available to our crew members,” says CMO Jackie Woodward.

About two years ago, Bojangles stepped up its focus on breakfast and dinner. But the pandemic forced it to “rebalance our marketing around drive-thru and delivery, and that has really paid off,” Woodward says.

Drive-thru became a spotlight since many of Bojangles’ clientele are essential workers who look for no-frills dining that fits their busy lifestyles.

Because of its Southern roots, breakfast was always a “hallmark of our business, where people dine on eggs, sausage, country ham, biscuit and our legendary iced tea,” Woodward says.

When Bojangles introduced its fried chicken sandwich, it orchestrated a giveaway publicity event out of a food truck around Times Square. “It gave us billions of impressions from a customer standpoint, and introduced Bojangles to a whole new crop of customers and brought a taste of home to many exiled Southerners,” she says.

Though Woodward has no crystal ball on the future, she’s emphatic “convenience is here to stay.” She says the launch of Bojangles’ app was crucial because it enables the brand to talk to its customers and personalize their experience.

It’s a sentiment shared by Wendy’s CMO Carl Loredo. “The changing meal routines challenged us to get creative with our marketing efforts, and think through how and when, we reach our customers,” he says.

Amid COVID, the burger giant adjusted messaging “and revisited our tools to intercept customers in their new ‘normal,’” Loredo adds.

As Wendy’s saw the culture of delivery and convenience accelerate, it moved from one delivery partner to four, launched rewards, introduced curbside and scheduled pickup, and rolled out in-app delivery in 2021 to bring food to customers’ doorsteps. Another critical target was to speed up drive-thru times and offer accelerated pickup options.

Too many of Wendy’s competitors, Loredo says, were serving “folded egg sandwiches, flavorless chicken sandwiches, and stale bagels.” So delivering food hot and tasty became the byword at Wendy’s. What does Loredo envision over the course of 2022, despite so much upheaval over a persistent pandemic? Regardless of how and where the message comes from, Wendy’s will remain “committed to building our breakfast and digital businesses. So fans can expect to see more craveable items hitting our menu,” he says. q

Gary Stern is a regular contributor to Food News Media and is based in New York City. RYAN OSTROM

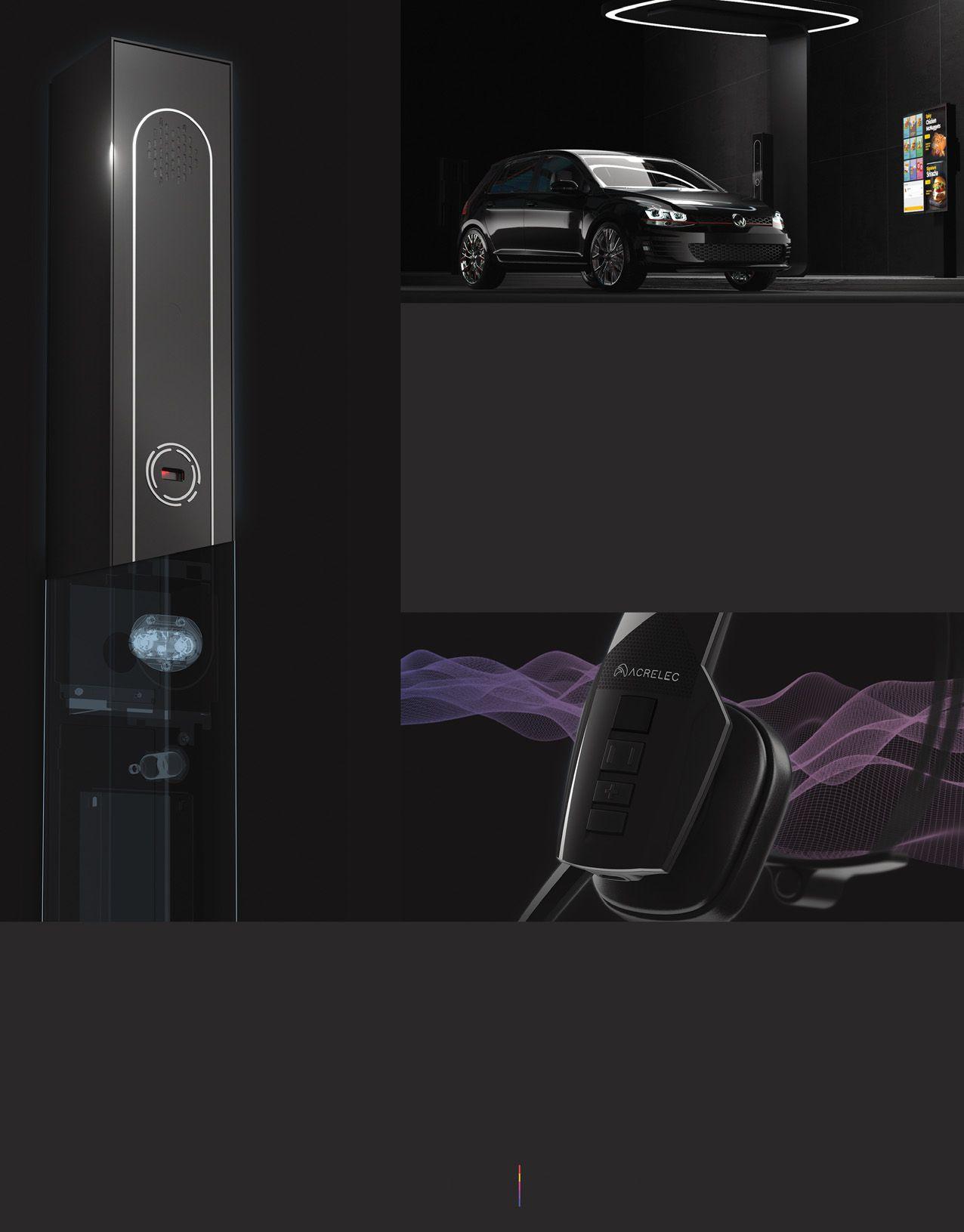

The new technology helping brands solve offpremises challenges.

BY DAVINA VAN BUREN

BY DAVINA VAN BUREN

When COVID-19 hammered the restaurant industry, drive thru windows saved the day. In many cases, drive-thru lanes became the sole source of revenue for quick-service restaurant chains.

While this ultimately kept restaurants in business with dining rooms closed, the lines, order errors, and overall customer dissatisfaction during the initial adjusthad to evolve quickly in order to keep up with new regulations and challenges brought on by the pandemic, but something else—something bigger—also hap-

for customer service.

“It’s no longer just about serving cus-ciently, but it’s also about meeting servicepoint,” says Paul Foley, president of HME Hospitality & Specialty Communications.

Historically, the restaurant industry lagged far behind others in terms of technology adoption. COVID forced quick-service restaurant operators to rethink customer-facing and operations technologies, pivoting toward reliance on the drive thru while also embracing more delivery options, investing in automation, and reducing human interaction.

and adoption of technology in the drivehead of hardware design and engineering at Coates Grouption is designed to combat increased wait times, deliver against competing ordering methods, facilitate the rise of mobile loy-

“Third-party delivery proves that the customer experience is no longer limited to within the physical walls of the restaurant or its immediate location.”

Delphi’s Insight Track™ timing systems provide QSRs with actionable real-time speed of service data in the drive-thru.

that need attention to keep the drive thru running at maximum based competition ranking leaderboard that allows multiple stores to compete on a variety of performance metrics.

Delphi delivers a wide variety of indoor and outdoor digital available in both LCD and LED formats.

Delphi’s indoor and outdoor digital menu board solutions are designed for QSR and Fast Casual business owners seeking to modernize their restaurant with full control over dynamic menu content via our Insight Engage™ 3.0 cloud-based content management system. The system supports on-screen order most point-of-sale systems. Engage 3.0 has been designed to be and programming requirements. 714.825.3495

video option to enhance communication with your customers.

Providing clear communications is key to quality customer experiences and productive teamwork in the drive-thru. Delphi as a key component of our total drive thru technology package.

Delphi’s Visera™ line of Interactive Smart Kiosks serve as ideal digital solutions for QSRs seeking to provide interactive engagement and self-service options for their customers or employees.

also needed, which requires clear signage and space to implement.”

In addition to streamlining operations and bringing in revenue, perhaps the most exciting aspect of all this technological innovation in the drive thru is the new and exciting opportunities it presents to -

interaction? What can you do to stand out when a person is scrolling through a third-party app, and you’re one out of a multitude of options?”

With drive thru playing such a large part in overall sales, many brands have dedicated extensive resources to optimizing their drive-thru operations. To ensure

times in drive-thru checkpoints, operators can gain a more holistic view of how this critical aspect of operations continues to change and evolve.

As the drive thru continues to evolve over the next few years, expect to see the incorporation of more integrated technol-

provide more information to serve customers, KPIs to track progress, and generally enhance the customer experience. Restaurants will morph into multi-faceted stations that can support several channels simultaneously, including self-serve kiosks, dine-in, curbside pick-up, storage lockers, and multiple drive-thru and walkup windows.

“When you layer on more advanced technology—wireless sensors, cameras, and AI—you can customize and personalize the drive-thru experience,” says Chris Riegel, CEO of STRATACACHEilar to the Amazon shopping experience that learns customers’ shopping preferences and desires over time. When you know more about your customers beyond POS data, you’re able to make a relevant, targeted suggestion in real time.” -

a return on this investment, it’s critical that restaurant operators track and measure these touchpoints just as they do in other areas of the drive thru.

“Automation, voice AI, analytics, and other innovations are sweeping the industry, and with scale and infrastructure to test out new technologies that can improve guest experience, labor optimi-

interact with loyalty apps, provide data analytics, and capture the trends of the individual customer. As that happens, the content displayed on the screens can be more personalized and engaging than ever before, making customers feel valued and want to return.

tomer experience provides opportunities to engage with customers without necessarily interacting with them in person.

customer experience is no longer limited to within the physical walls of the restaurant or its immediate location,” Foley says. “How will customers perceive you and your brand when there’s no face-to-face

restaurants are leading the charge,” says Ben Brown, vice president of marketing at ConverseNow

One step brands can take is to designate waiting areas for delivery drivers and track their wait times to help make theirers can pick up food and be on their way, with delivery services. By measuring wait

“Further IoT integrations will play key roles in the drive thru for both large brands and smaller restaurant concepts. System integration of loyalty apps with vehicle IoT systems, for instance, will allow drivers to safely place orders with audio commands,” Symon says.

AI menuboards are also on the way. Permission-based screen messages targeting customers prior to order placement on -

ible opportunity for the business and the -

ized content strategy that best matches the customer’s dietary requirements is the

“ When you know more about your customers beyond POS data, you’re able to make a relevant, targeted suggestion in real time.”

•Mobile

•Sensor-ready

•Curbside pickup solutions

next frontier for quick-serve restaurants.

“Operators should take the pandemic-driven changes as an impetus to future-proof their business.”

Drive thru has always been a key aspect of quick-service restaurants. Even pre-pandemic, as much as 70 percent of sales came through the drivethru window.

During the early days of the pandemic when dining rooms closed, the drive thru became the single most important way to serve customers. Unfortunately, many operators soon realized that their drivethru communication systems hadn’t been

“New business practices were needed to communicate with customers, deal with supply chain shortages, and take payment from customers who didn’t want to hand their credit cards to a crew person,” says Eric Symon, vice president of Panasonic Connect North America pushed both front-of-house and back-ofhouse technologies forward due to the delivery.”

Many quick-serve restaurants had been headsets, legacy point-of-sale ( ) sys-

“A successful drive-thru program combines strategy, technology, and psychology to enhance the customer journey,” says and

In order to address the rapidly-changing consumer landscape of the past two years, operators are stepping it up and bringing the latest technological advancements to the restaurant space—a colos-

ally lagged behind in this department. Major franchises are going all in on arti), smart signage programs, and Wi-Fi marketing to completely revamp the drive-thru experience.

It goes without saying that drive-thru areas should be kept clean, free of trash and debris, and have enough room for vehicles to maneuver through the propand quickly repaired when potholes or

days, the hot conversation revolves around digital.

installation of a digital drive-thru platformnology stack and platform selected can either empower or limit operators’ ability to deliver future customer experiences. It’s not necessary to have all technology or features enabled, but it’s critical to design a

“The number one component of a successful drive-thru program is having the right content.”

program that will keep the business competitive within the landscape over time.

“A modern drive-thru program starts by determining what the future of the restaurant experience might look like, then enough to support a plan for growth,” saysware design and engineering at Coates Group. “It’s important to have a robust

negative impact on guests’ experience. Unfortunately, this step is usually the last taken—if at all.”

It is absolutely critical that operators take the time to create a clear content strategy that aligns with the brand’s ethos and growth projections. Once the goals of adding digital to the drive thru have been developed (increasing order

experience for the customer long term.”

In addition to the clear content strategy, operators should put themselves in the customer’s shoes and experience the drive thru in the same way they do. What do you see when you enter the parking lot? Do customers have a clear view of garbage containers and dumpsters (which should be concealed behind visual barriers if at all possible) or are there appealing visual elements such as landscaping and modern hardware that provide a subconsciously

“It begins with a well-lit area, a restaurant exterior that is visually appealing, and a canopy that protects customers from the weather,” says Doug Watson, president and CEO of The Howard Company “While in line, the placement of equipment, the stacking space of vehicles, solutions that tell the brand’s story, menuboards that are easy to read, communication, timimportant elements.”

plan that considers the whole spectrum of transition to new digital experiences.

to continue to develop on the platform.” is a key component to a digital drive thru.grate with new technologies will enhance overall objectives and performance, save money over time, and help the restaurant stay competitive in an ever-changing consumer landscape.

-

cessful drive-thru program is having the right content,” says Robert Heise, executive vice president and general manager for Global Display Solutions. “All the displays in the world cannot improve bad content, which can end up having a

dayparting of the menu, for example), the

implementation, there are several details to consider: screen placement, number of screens, size, brightness, menu layout, tim-mercial leader at LSI Industries. “Because you can do more with digital, building

Every touchpoint plays a role, and can help or harm a customer’s engagement with the brand. “Providing a high level of engagement with the customer from the time they enter the drive thru to the time they leave improves the overall customer experience, reduces perceived wait times, and drives customer loyalty,” says Ken Neeld, president and CEO of Delphi Display Systems. “By leveraging digital presell and menu displays, operators can drive their brand message, provide visibility around new products and promotions, and create a dynamic experience that creates loyal customers.”

From an experience standpoint, speed of service, order accuracy, friendly service, food quality, and customer trust are all critical elements. Perceived speed is just as important—perhaps even more so—than actual speed. When customers are engaged, occupied, or entertained throughout the drive-thru journey, they perceive the overall wait time to be faster than it actually is.

“Reducing wait times is one of the most important elements of the experience,”

Central region, Peerless-AV achieved through order accuracy, commu-

“Reducing wait times is one of the most important elements of the experience.”

Peerless-AV PEERLESS-AV

nicating customer payment readiness, and

An old trick to decrease perceived them something to do while they wait,to smile and engage the customer versus being distracted while trying to take marketing manager at Ready Access

installation or rollout program requires detailed planning and organizational skills—a critical element when it comes to -

“A well-planned installation minimizes downtime and saves the owner time and -

Once brands have content and installation plans in order, it’s time to think about

imperative the presence sensor, microphone, speaker, and headset systems

Valyant AI ensures there are no communicationacting with brands and also that restau-leading restaurant brands adopting this industry standard in drive thru in the

branding is consistent throughout the driveUniStructures

tural designs should be included in every

“A well-planned installation minimizes downtime and saves the owner time and money.”Uni-Structures

“Investing in a drive-thru system without voice AI capabilities is akin to buying a TV that can’t link to streaming services,” says Ben Brown, vice president of marketing at ConverseNow

With curbside pickup being so popular, operators should have a third headset channel exclusively for managing these this feature is important. Ask about the sound quality and noise reduction capabilities—these features should be top shelf.

“Sound quality and noise reduction are critical to ensure accurate, stress-free order taking,” says John Bardeau, director of retail sales—North America at Quail Digital.

Another important aspect is timers. While timers have long been used incant advancements in this technology in recent years. Drive thrus that have speed of service timers already measure speed between the speaker and the window.

When restaurants use line busting to take orders, however, timing is more dif-

based timing systems, on the other hand, can measure any interaction anywhere within view of cameras.

“Drive-thru vision technology that what is happening in the drive thru is a Xenial, A Global Payments Company. “It queues cars on the POS for line busting, provides ani-

technology can automate two-lane mergesful drive-thru program is outdoor digimany capabilities, including promoting marketing campaigns and LTOs, displaying dynamic visuals that can persuade showing the customer everything added to their cart to ensure there are no mis-

“Using a combination of data and AI, digital signage can suggest a smaller number of items that it knows are less complicated to prepare in the kitchen,” Denolle says. “On the contrary, when there is no line at the drive thru, you can display premium products that take longer to prepare on the menuboard to entice customers to purchase higher-cost items.”

doesn’t start at the order point. Pre-sell boards can engage customers while they wait. For example, brands can promote their social channels, best-selling items, or even show weather updates, community news, or trivia questions.

“It’s very likely that customers are already on their phones as they’re sitting and waiting for the queue to move, so why not make it easy and fun to use their phones to engage with your brand?” says Paul Foley, president of HME Hospitality & Specialty Communications.

While the pandemic threw quick-serve restaurants for a (very long) loop, it’s exciting to see operators stepping up to the plate and embracing new, innovative technologies that help solve the industry’s

mated visualizations, and enables realtime digital menuboard interactions.”

ground loops for camera systems, also thru timing. Because the video technology tracks cars and orders them throughout the entire experience, digital menuboards can be repurposed for upselling during

is busier than ever, and, while a it can be challenging, it is a unique opportunity to grow and create loyal customers by delivering the right experience.

giving them the same personable, customtailored experience they’d have walking into the dining room—with some natural adaptations to do so from the comfort of their vehicle,” Brown says. SC

“Remember: The signage experience doesn’t start at the order point.’

Before the pandemic, a strong drivethru trend was to provide a more “human” experience. Face-to-face ordering and line busting were the norm. Not only did this provide a high level of customer service, it increased the speed and efficiency of the ordering process and improved overall throughput. -

ence has been shown to increase satisfaction and decrease the perceived wait time in the drive thru,” says Rachel Armstrong, director of sales and marketing for Uni-Structures

But post-pandemic, the drive-thru

two years, and many industry experts expect it to continue for at least the next 18 months as the U.S. grapples with ris-

the road are beginning to emerge—with almost diametrically opposed approaches to the drive-thru window.

On one hand, customers like the conpre-pandemic “hands-on approach’’ provided. When done well with genuine customer-centric service, it makes guests feel special. Restaurants were adapting their buildings with larger service openings to cars.

also has downsides, such as the need to balance HVAC considerations in cold climates, food safety from vermin and insects, and security,” says Anna Ellis, sales and marketing manager at Ready Access. “It is also dependent on a restauto conduct this type of operation.”

for safety and to use more automation to shortage has become an existential crisis for restaurant operators and has resulted in thousands of restaurants limiting hours, extreme cases, closing altogether. Drive thru has become the dominant order point since the pandemic started and provid-

ing solutions to make the experience as

“nice to have” to being a necessity in order to stay in business.

Obviously drive thrus have tremendous potential to help quick-serve operators cope with the labor shortage and other industry challenges. With less traf-

“

This more personal customer experience has been shown to increase satisfaction and decrease the perceived wait time in the drive thru.”

the kitchen can focus more on drive-thru and delivery orders, which skyrocketed over the past two years.

drive-thru stations in the same way as president of marketing at ConverseNow

more pronounced, since cars are of course much larger than people, and seeing a

According to a recent online survey of Poll, 65 percent of respondents who visited a drive thru in the preceding six months had an unpleasant experience. Twenty-answer to long lines.

Nearly half of respondents to the sur-inate all human interaction when visiting a quick-service restaurant, assuming

any other age group.

of people who visit drive thrus are ready to eliminate human interaction from the encounter suggests that more people than ever are primed for contactless experi-

ogy at Xenial, A Global Payments Companying operators to fully automate the drive-

online ordering with the personal touch of a traditional human conversation. While

is set to completely reshape the drive-thru experience as consumers know it.

are like the advent of the camera phone:

completely transforms the category and

sounding and emotionless, think again. Today’s technology mimics a natural conversation, speaks clearly with intona--