POPEYES, 50 YEARS YOUNG

The Massive Cost Restaurant Franchisees Can’t

SPONSORED

28 In

EDITORIAL

EDITORIAL DIRECTOR, FOOD NEWS MEDIA: Danny Klein danny@qsrmagazine.com

MANAGING EDITOR, FOOD NEWS MEDIA: Nicole Duncan nicole@qsrmagazine.com

DIRECTOR OF CUSTOM CONTENT: Peggy Carouthers peggy@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Charlie Pogacar charlie@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Kara Phelps kara@qsrmagazine.com

CONTENT EDITOR: Ben Coley ben@qsrmagazine.com

STAFF WRITER: Trevor Griner Trevor@qsrmagazine.com

ART & PRODUCTION

ART DIRECTOR: Tory Bartelt tory@qsrmagazine.com

ONLINE ART DIRECTOR: Kathryn “Rosie” Rosenbrock rosie@qsrmagazine.com

GRAPHIC DESIGNER: Erica Naftolowitz erica@qsrmagazine.com

PRODUCTION MANAGER: Mitch Avery mitch@qsrmagazine.com

ADVERTISING

800.662.4834

NATIONAL SALES DIRECTOR // EXTENSION 126 : Eugene Drezner eugene@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 149 : Edward Richards edward@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 141 : Amber Dobsovic amber@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 148 : John Krueger john@foodnewsmedia.com

SALES SUPPORT // EXTENSION 124 : Tracy Doubts tracy@foodnewsmedia.com

CIRCULATION WWW.QSRMAGAZINE.COM/SUBSCRIBE

CIRCULATION COORDINATOR: N. Weber circasst@qsrmagazine.com

ADMINISTRATION

GROUP PUBLISHER, FOOD NEWS MEDIA: Greg Sanders greg@foodnewsmedia.com

PRESIDENT: Webb C. Howell

MANAGER, IT SERVICES: Jason Purdy

ACCOUNTING ASSOCIATE: Carole Ogan

ADMINISTRATION

800.662.4834, www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher.

REPRINTS

THE YGS GROUP TOLL FREE: 800.290.5460

FAX: 717.825.2150

E-MAIL: qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided by the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed. Direct to sponsoredcontent@foodnewsmedia.com FOOD NEWS

Within a few months of being hired, I found myself at a table with three vaunted restaurant journalists. It was a fall Maine night and the host was taking coats. A fireplace glowed the entry. And then, I asked for a glass of rosé. Years later, our managing editor, Nicole Duncan, still tells this story to fresh employees. How at a restaurant that felt cozier than a Hallmark movie, I ordered pink wine. To be fair, for starters, I have no regrets. Rosé is never a bad choice. Yet truthfully, I just pointed to something that sounded “wine-y” and hoped for the best. I was a Brooklyn, New York, kid who had just spent a decade writing about high school football in Florida. My parents didn’t drink alcohol and the first meal I ever made for my wife was the beef stroganoff version of Hamburger Helper (she, too, often brings this up). I was trying to fit into a sphere I wasn’t even aware of.

This story, as glib as it might be, came to mind recently when my colleague, Ben Coley, was booking his flight to Chicago for the National Restaurant Association Show. We hired Ben in January 2020. So, as the calendar portends, he wasn’t going on any work trips anytime soon. It made me realize what he’s missed—the kind of interactions you can’t punch a time card for.

In the grand scheme of COVID, not being able to travel for a trade show feels miniscule. And it is. Ben and I communicated via screen for roughly a year as the industry faced the crisis from the tip of the spear. By the time we met again, it felt like decades had passed. I’m sure you all

can relate. I had gray hair and acted twice my age before. Now, it was (more or less) closer to reality. As the world recovers, however, so are events and the connective threads we seek out from face-to-face opportunities. We’re one step further on the road back to normal, or whatever that might be. And I’m happy Ben gets to see it; to meet with the people he’s been talking to on the phone/Zoom for two-plus years; to gather insights and feedback from the trenches; and yes, the moment to embarrass himself in front of grizzled vino vets if he gets the chance.

This recalibration is important for restaurants. Maybe more so than other industries. It’s been unnatural, and definitely out of character, for so many leaders I’ve spoken to in past months to huddle at home and try to flip the right switches. Hospitality is a universe where no matter what tech you invest in and how streamlined systems become, you simply can’t recreate the view from the front door. As Eggs Up Grill CEO Ricky Richardson once told me, “what you can’t ever defeat is what you see inside your restaurant.” The same is true of colleagues. So let the conversations flow at the industry’s biggest show, and come find us at our table to say hello if you’re attending. Just, whatever you do, don’t bring me the wine list.

Danny Klein, Editorial Director

The National Restaurant Association Show provides an opportunity to reconnect again, and brings us that much closer to life as we remember it.

47%

of lapsed customers say more variety of hot & cold specialty coffees and new brewed coffee options would entice them to increase food and beverage purchases at breakfast.

Whether you’re a quick-service coffee destination or full-service restaurant with a breakfast program, Mother Parkers is here to partner on your tea and coffee needs through:

• Blend & Product Development

• Insights to Drive Growth

• Surety of Supply

Get in touch with us online mother-parkers.com/contact-us to learn how we can help!

Find out more about our coffee and tea programs by visiting us at www.mother-parkers.com

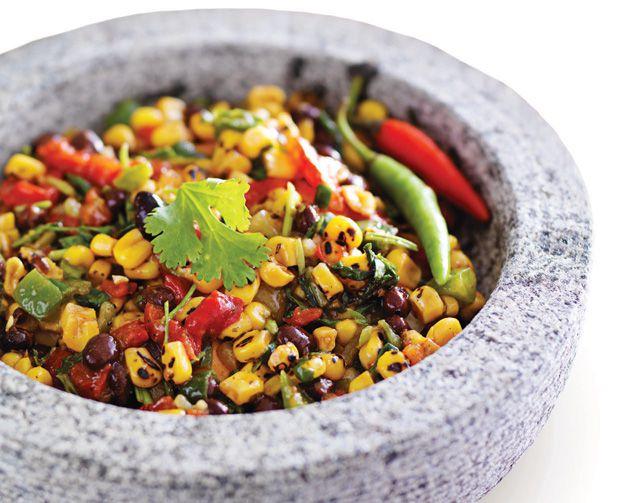

Honey bees are responsible for one in every three bites of food we eat, thanks to their pollination efforts. That includes the fresh lavender and blueberries in this delectable syrup. As an added bonus, honey bees produce pure, all-natural honey as part of the process. For this and other delicious recipes brought to you by bees, visit Honey.com.

SONIC DRIVE-IN CLAIMS IT HAS A SLUSH FLAVOR for “everyone and for every mood.” Now, it’s taking the guesswork out of the equation for consumers. The chain dropped a “Sonic Slush Ring” in March, which is designed to look like a Slush in one of the brand’s signature white cups. But they’re more than just design pieces; each ring comes with a guide that matches the indicated ring color to the “perfect Slush flavor to suit your mood,” the company says. If the ring turns purple, for example, a grape Slush might be in order. Pink? Try Strawberry. “Everything Y2K is on trend right now, and the Sonic Slush Ring lets us tap into that style in a fun way that’s uniquely Sonic,” says Lori Abou Habib, the brand’s chief marketing officer.

The Slush Rings sold for $9.99 online. Guests could also purchase canvas tote bags and T-shirts that read “My Slush Mood.” For every Slush Ring sold, Sonic donated all of the proceeds to supplies and learning resources for public schools.

What kind of Slush are you in the mood for? Sonic has the answer.

What kind of Slush are you in the mood for? Sonic has the answer.

The classic chain’s latest launch tapped into just the right amount of nostalgia.

It remains to be seen just how many locations will close during the pandemic era. Estimates in the 100,000 range feel like a good benchmark, but the dust continues to settle. However, the industry has progressed far enough to ask another question—who is ready to scale again?

Bank of America’s global research division released a report looking into the subject. Here were some highlights.

The overall reality:

While the pandemic wreaked havoc with the profitability of smaller restaurant operators, it proved beneficiary for large restaurant chains, particularly traditional fast-food restaurants.

For many quick-serves, average volumes are higher than pre-COVID, 10 percent across the board per BofA’s index. Along with lean labor models, many brands drove unit-level cash flows to all-time highs.

Examples:

“I’m excited to share that over the long-term we now believe we can operate at least 7,000 Chipotle restaurants in North America, up from our prior goal of 6,000 based on the success of small-town opportunities that are delivering unit economics at or better than our traditional locations.”

CHIPOTLE CEO BRIAN NICCOL

“ We now believe that our domestic footprint can scale to 4,000 restaurants [from 3,000 previously], and maintain our position for 3,000 international restaurants. That’s a potential of 7,000-plus total restaurants.”

FORMER WINGSTOP CEO CHARLIE MORRISON

“In 2021, we opened 3,057 net new units, driven by 4,180 gross unit openings, with meaningful contributions from each of our brands, marking the strongest growth year in our history and setting an industry record for unit development. To put that into context, as the world’s largest restaurant company, we opened a new restaurant on average every two hours.” YUM! BRANDS CEO

DAVID GIBBS

DAVID GIBBS

“Despite the exit of independents and smaller restaurant concepts, demand for the best real estate sites remains fierce,” BofA said. “In general, the concepts that closed during the pandemic had occupied subpar locations [a contributing factor to closures] and or pads that were too small for large chains. They also

may have lacked the capacity to accommodate the [double] drive-thru lanes or curbside pickup areas that became so integral to restaurant operations during the pandemic.”

Some historic concerns:

“While many large restaurant systems have emerged healthier from the pandemic accelerating growth is not without risk,” the company added. “Historically there has been an inverse relationship between unit growth and same-store sales for mature concepts as they risk cannibalizing their own existing operations. And in some cases, excess growth has precipitated the sharp declines in performance that necessitate turnarounds [which invariably include slowing or stopping unit growth].”

Brands to Watch:

BofA added while excess growth can stir setbacks for mature concepts, brands far from saturation are insulated from cannibalization and new stores propel not only top-line growth, but also the ability to scale up and leverage costs. Restaurants with significant whitespace and exceptional unit economics (Dutch Bros, First Watch, Krispy Kreme, Portillo’s and even Starbucks), have earned the “right to grow,” the company said. Dutch Bros has the added advantage of small boxes/plots of lands that can thrive in lower cost locations. Indeed, In the first year of being a public brand, Dutch Bros opened a record-breaking 98 stores systemwide, surpassing previous guidance of 92 units. This year, it expects at least 125 openings, or growth of roughly 23 percent.

Getting drive-thru operations right is critical, even more so in the current environment. “Right now, our top focus in our stores is on growing top line sales through drive-thru execution, with an emphasis on late-night operations,” Aiello says. “A lot of companies took a natural sales lift during the pandemic just because there were more consumers in general going through drive thrus, but to maintain it and to realize the true potential, you’ve got to have consistently outstanding operations.”

As Flynn Restaurant Group refocuses on meeting high demand at the drive thru, data is one main prong of its approach. The company holds weekly engagement calls with its store managers and area coaches to review outlier reports from Envysion Restaurant Solution Suite, a video surveillance and loss prevention software solution that ties reporting to video verification. The outlier reports show video footage and transaction data side-by-side, providing insights and context to dig deeper into the numbers.

“We get to have a good conversation every week about where the opportunities are, and that’s been really helpful,” Aiello says.

During the worst phases of COVID-19, a case could be made that drive thrus saved the quick-service restaurant industry. When dining rooms closed, drive thrus shouldered most of the revenue intake for many chains—and that trend shows no signs of stopping anytime soon.

“The increase in the percentage of drive-thru sales, pre-pandemic versus now, has been absolutely remarkable—not only for our company and our brand, but for the industry as a whole,” says Jon Aiello, market president with Flynn Restaurant Group. “The drive thru is the lifeblood of quick-service restaurants right now, and I feel like that change is here to stay. Companies that are able to operate drive thrus that are extremely efficient, extremely accurate, and friendly will have the advantage.”

Flynn Restaurant Group originally chose Envysion to help mitigate business risk. Beyond helping to reduce loss prevention, the platform has also proved valuable in other ways. “Initially, when we started with Envysion, our biggest gain was obviously loss prevention,” Aiello says. “The platform helped us see where we were missing the boat in terms of refunds, voids, promos—things going on that maybe shouldn’t be going on. But a hidden benefit that we’ve discovered along the way has been the operational improvements we’ve been able to make, just through the normal course of engaging with the videos and engaging with the outlier reports. We’ve become better as an organization as a result of it.”

Envysion has allowed Flynn Restaurant Group to identify key areas of their drive-thru operations and make measurable differences over time. “Everybody has more on their plate, and no one has time to watch video all day,” Aiello says. “Envysion integrates a high-tech video surveillance system into our POS and gives us real-time data. In five or 10 minutes over coffee, you’re able to identify where your pain points are—not only in terms of loss prevention, but also in terms of operational deficiencies. You’re able to go and address those immediately instead of being buried in a computer all day. It’s been a huge help to us.”

To learn more, visit envysion.com.

To take drive-thru operations to the next level, operators need to focus on what the data reveals.

/BY KARA PHELPS

“Companies that are able to operate drive thrus that are extremely efficient, extremely accurate, and friendly will have the advantage.”

Restaurant operators of late find themselves in a precarious position few have experienced: trying to figure out the best methods to price their menus amid a range of inflationary pressures.

The nation hasn’t experienced this level of inflation in 40 years, and, even then, restaurant operators were nowhere close to witnessing the type of labor shortages that are now joining with various supply issues to exacerbate more typical cost stresses, like rising energy prices.

“Pricing is really coming to the forefront,” says Tom Cook, principal at Westport, Connecticut-based restaurant consulting firm King-Casey. “Now, it’s not only the cost of goods that are going up, but the cost of labor that these operators have to face.”

Restaurants began encountering some of these concerns even before the economic turmoil created in the wake of COVID-

19. Ingredient shortages over the years forced changes in menus and recipes, while labor concerns started appearing several years before the pandemic.

Unlike the past, however, when owners could focus on one issue at a time, “this is occurring on a massive scale that has people thinking of it in a separate way,” says Dirk Izzo, senior vice president and general manager at NCR Hospitality, which provides fiscal technology solutions.

There’s no doubt inflation has impacted what the consumer pays at limited-service restaurants. According to the U.S. Bureau of Labor Statistics, prices for meals and snacks at these eateries jumped 7.2 percent for the 12 months ending in March.

The BLS estimates overall food prices could rise another 4 percent in 2022.

“For the majority of operators, it will be very difficult to avoid

seen in decades.

/BY BARNEY WOLF

raising prices, if not this year, then the next,” adds Maeve Webster, president of Vermont-based Menu Matters, a menu and strategic consulting firm. The issue then becomes, can quick-serves do so and not alienate customers?

Thus far, most experts suggest the best menu-pricing philosophy may to be to refrain from across-the-board or frequent price hikes, instead choosing more strategic increases. At the same time, they say guests have been largely tolerant of restaurateurs’ need to escalate prices.

“People have been more understanding than they’ve ever been,” says Jim Balis, managing director, Strategic Operations Group for CapitalSpring, which provides structured financing for the restaurant industry. Consumers are even willing to tip at fastcasual and quick-service units.

Observers also note some restaurants are making portions smaller as opposed to raising pricing multiple times, although that tactic is just as visible to customers as raising prices.

The trick going forward, as Webster suggests, is pricing menus in a way that will address the various cost increases facing operators without turning off so-far patient customers. And experts agree the key is a balancing act to protect margins without being hidebound.

“Operators need to be more flexible in terms of profit-margin objectives,” Cook says, admitting that’s easier said than done. While maintaining margins is the goal, eventually those may need to be relaxed or customers will feel exploited.

He suggests a three-pronged restaurant menu-pricing strategy that focuses on controlling costs—including through kitchen

tain items “have very good price value, so guests realize the price increase is not going to be a showstopper,” Cook says. Alerting guests to items with perceived value is just as important.

Izzo echoed the call to use technology advances to offset labor cost pressures, ranging from separate make-lines for digital orders in the kitchen to kiosks and QR code contactless ordering in the lobby. And “bots” can take orders in drive-thru lanes.

He is another proponent of gathering data to help make good menu pricing decisions, not only which items—particularly highprofit ones—can carry price increases, but also how to market those as value propositions.

“Every restaurant is trying to figure out the elasticity on price and how much of an increase it can take without losing customers,” he says. “Data will help. You must realize your costs and understand your customers and their requirements. Determining that sweet spot is important.”

Any pricing strategy should consider a discounting plan where it makes sense, Balis says, such as pricing a premium, limited-time offer higher but also offering it as part of a discount concept, such as a bundle—making sure all of those maintain acceptable margins.

After considering specific menu pricing, “the next step is to look at the revenue channel,” he says. “You may want to price differently across the channels,” such as charging separately mobile or drive-thru service than for dining in.

With an investment portfolio that covers some 3,000 restaurants, mostly limited-service, CapitalSpring works with all kinds of owners—chains, franchises, and independents. While some are adamant on certain pricing issues, others are more flexible toward regional pressures.

“A lot of times the brand will give you liberty on pricing, but, say, if there’s an LTO, you have to abide by their pricing,” Balis says.

Webster advises operators to be honest with customers, but refrain from countless price hikes, because guests “will lack confidence” in the brand. “They won’t know what to expect in terms of what they may be paying.”

The pandemic also has changed the way people view a value proposition. “It’s not so much the cost, but what am I getting for it,” she says. Value can be enhanced not just by low prices or deep discounts, but by other factors, including hospitality, loyalty benefits, and ease of ordering.

technology advances; ramping up data collection related to pricing and value; and communicating a brand’s value to guests.

Taking a “deep dive” of transactional data over recent years will provide necessary quantitative information, he adds, and an analysis of consumers’ attitudes regarding the value of products will let an operator know if an item has a “good perceived value and a chance to do a price increase.”

Having data also allows restaurants to let consumers know cer-

While automation can save costs, hospitality is still important, including at limited-service restaurants. Several experts pointed to the Chick-fil-A’s success with stationing friendly employees in its drive-thru lanes to take face-to-face orders, a tactic some others followed.

“It’s demonstrating that you appreciate guests when they visit,” Webster adds. She cautions against relying so much on technology that it removes the human touch. “Otherwise, you are nothing more than a higher-level vending machine.” q

before pickup without opening the lid and releasing the foods’ heat. PP excels here as reusable and remains recyclable after use.

Better packaging is an investment in protecting customer acquisition costs and securing the next order. It is also something consumers value. 58% of all adults say they’d be willing to pay a little more for upgraded packaging. This number jumps to over 70% for those that choose takeout and delivery most – consumers 18 to 41 (Gen Z adults and Millennials). A 2% premium on the order price will cover the increased investment in packaging for most operators.

their daily lives. Consider this: 54% of consumers report it is essential to the way they live, and over 60% say they will order more takeout and delivery in 2022 – a number that leaps over 70% for consumers 18 to 41 years old. Yet, Datassential found only 1 in 3 consumers feel takeout and delivery food quality has improved. Restaurants delivering the best meal experiences will win. Better packaging converts this opportunity into loyal growth.

After a takeout or delivery meal is packaged, the clock begins on preserving the meal experience. An average of 30-minutes pass as food waits for pickup, travels, and is brought to the table. Over that time, the meal must stay warm, delicate textures must remain crisp and presentation must be preserved. Test packaging on this timeframe, in a simulated delivery process, to identify the packages that perform best.

Polypropylene (PP) packages excel at holding heat. But for hot and crisp favorites, like breaded chicken or fries, the moisture this heat creates must be vented. Technomic consumer research found Crisp Food Technologies® was best at venting excess humidity to protect texture while retaining heat - even over 30 minutes. Because food stayed hot and crispy, consumers experienced better taste.

Alternatively, for rich and saucy meals, sturdy, compartmented packages with leakresistant closures prevent messy spills while retaining heat and keeping proteins and sides separated. Clear, anti-fog lids reduce

Improved packaging pays additional

through delivery or takeout? Packages that protect the meal experience longer enable their menu over a larger delivery radius. Better meals reduce costly comps for selected geometries convey larger servings while supporting portion control, enabling slight item quantity reductions to lower food costs and maintain or even improve

Better packaging is your key to unlocking delivering the best experience.

location within minutes. Designed to be userfriendly with a straightforward setup process, the platform can create detailed estimates for projects within a few minutes, compared to the two weeks it may typically take to generate bids the traditional way.

“Pretty much everything is on-demand,” Borisov says. “But in construction, if a project comes in 15–20 percent over budget and it takes the contractor four weeks longer than anticipated, that’s very typical. This has become the norm in franchising, in fact, where projects are late. Franchisees aren’t happy about that.”

Since BidVita eases some of the most common frustrations that franchisees experience, the platform can also help maintain positive franchisee-franchisor relationships.

When it comes to opening a new restaurant franchise, the biggest price tag is construction, especially in today’s market. But new franchisees often learn that obtaining a realistic estimate for construction costs is usually impossible until late in the process, which in most cases is too late, because the upfront commitment to cost is already made. Even franchise disclosure documents (fdds) reference a broad potential range.

This uncertainty isn’t ideal for franchisees, many of whom entered franchising to mitigate their risk as much as possible. One of the benefits of franchising is buying into an established system with no surprises, but the largest cost involved is often the least known upfront.

“If you are in franchising, construction can make up 60–70 percent of the cost of your entire project,” says Slava Borisov, CEO of

BidVita. “Like any large investment, you need data to be able to make an informed decision. Everything else in the franchise system is known with 10–15 percent deviation, but for construction, you’re given a range that in some cases is up to 10 times the lowest cost. That can be massively frustrating to franchisees.”

BidVita is a platform designed for franchises’ commercial construction that uses artificial intelligence (ai) to check construction costs, timelines, milestones, and qualifications in real time all over the U.S. and deliver more precise data without needing input from a contractor. Franchisors can use BidVita to increase royalties and decrease timelines to opening by an average of four months, and franchisees are happier knowing their costs, timelines, and milestones in the early phase of development and compare the construction costs for their

“The biggest issue in franchising is franchisee unhappiness,” Borisov says. “If franchisees are unhappy, the brand isn’t going to get referrals. Most of that friction happens during the franchise development process, when franchisees are in the market for real estate locations or making sure they sign a good lease. They need data points to work with their biggest investment. Even without construction plans, BidVita can tell them what a location is going to cost, how long it’s going to take to develop, what’s included and excluded, and the major milestones on that project. If they’re negotiating a lease, BidVita can tell them whether they have an appropriate tenant improvement allowance or if the landlord is not willing to upgrade the space. Franchisees or their real estate agents can learn all of this from their phone in less than six minutes.”

Time and foreknowledge can make a big difference. “We give our franchisees and franchisors a glimpse into the future with technology,” Borisov says. “The data our platform provides can help you see the finish line during all project phases.”

BY BEN COLEY

BY BEN COLEY

Since, Southern Grounds expanded to four locations throughout Florida, including its first nontraditional unit in the Jacksonville International Airport in partnership with HMSHost. To kick off 2022, the brand announced the beginning of its franchise program, with the goal of reaching 125 stores in the next decade.

“We wanted social consciousness to persist in our brand over low prices, poor quality, and the standard mix of flavors you would get in traditional coffeehouses. So, increasing both food and coffee quality was important in this new paradigm for us,” Janasik says. “Those were the things we were chasing in this new model. New coffeehouse and community focus lead to new energy in the communities, gentrification of sorts, and we wanted food and coffee to be spoken equally in the same sentence when consumers came to experience us.”

FOUNDERS: Mark Janasik & Shiju Zacharia

HEADQUARTERS: Jacksonville, Florida

YEAR STARTED: 2016

ANNUAL SALES: $6.3M company-owned shops; $2.1M AUV

TOTAL UNITS: 4

FRANCHISED UNITS: Licensing agreement with HMSHOST for two locations. One is currently open in the Jacksonville International Airport Terminal A, and a second location will open pre-security tentatively in Q4.

WHEN MARK JANASIK AND HIS TEAM ENVISIONED the opening of Southern Grounds seven years ago, they were advised against entering an already crowded coffee shop sector. But from their perspective, they had

studied big-time coffee brands and noticed a standardized experience that didn’t follow through on the promise of building community, which is an integral part of the movement, Janasik says.

Southern Grounds wanted to rebuild that gathering place and disrupt the way customers experienced their morning beverage. The best way to do so? Combine sustainably sourced food with a coffee bar to carve out an elevated, differentiated category.

The concept recruited local chefs to create scratch-kitchen recipes, learned from coffee roasting company Intelligentsia on how to form equitable trading relationships with farmers, and teamed with local artists and architects to deliver designs that reflect the aesthetics, color, and artwork of the neighborhood.

The restaurant features a sizable food menu featuring breakfast and brunch, hot items, tartines ( French open-faced sandwiches), cold sandwiches and wraps, salads and soups, and a kid’s menu. Some examples include Greek omelette, grilled goat cheese, salmon tacos, salmon toast, turkey club, and caprese salad.

The beverage lineup comprises cold brew, drip coffee, cappuccino, cafe con leche, chai latte, French press, and more. The typical menu mix is 55 percent food and 45 percent beverage.

The sustainable and non-GMO menu feeds into a growing trend among restaurant consumers. Thirty-eight percent of adults said availability of locally sourced food would make them more likely to choose one restaurant over the other, according to The National Restaurant Association’s 2022 State of the Industry. The sentiment is even higher among Gen Z (40 percent) and millennials (48 percent).

At the biggest cof-

The dish that got chef Steve Chu from hot dog cart to full-fledged restaurant: Thai Chicken Meatballs. It’s got a little bit of everything – crisp mango slaw, tender, juicy chicken meatballs and of course, that phenomenal bite and texture of Cracked Black Pepper. Your Skills. Our Spices. Now that’s a potent combination. Learn more at: McCormickForChefs.com/McCormick-Culinary

TOGETHER, WE FLAVOR

Bank branch numbers have been on a steady decline for the last few years, but the trend has only picked up speed since the COVID-19 pandemic began. A report from S&P Global found that more than 2,900 branches closed in 2021 alone. As consumers grew less comfortable with in-person interactions during the pandemic, they started using online and mobile banking apps much more. And as mergers and acquisitions (M&A) have increased to the highest levels since 2006, banks have closed duplicate branches within a 10-mile radius. These combined forces have led to noticeably higher bank branch closures in every part of the country, from cities to rural areas.

So, how do these closures affect quick-service restaurant operators? Several common issues tend to arise.

“The biggest impact to restaurants is that they now have to drive farther to make their bank deposit and to get their change order, so the employee is out of the restaurant longer,” says Lenny Evansek, senior vice president of national retail business development at Loomis. “Another side effect is that they need to open up new banking relationships, which means they now need to manage more of them. Also, banks are raising the fees on commercial deposits if those commercial-connected clients go into banking centers—so restaurants are now paying more to do over-the-counter banking. The cost of going to a bank branch has never been higher.”

As more and more bank branches close, operators are tasked with finding workarounds and new solutions to these problems. That might mean never going into a branch at all.

“Restaurants need to adopt a way to do more banking virtually,” Evansek says. “That is essential in today’s world. Loomis has a variety of solutions that can accommodate virtual deposits. We have the traditional armored car, where we just pick up and deliver deposits and

drop off a change order or use our smart safe technology solution called SafePoint. We also offer our own change order management platform called Loomis Cash Exchange, where clients can go online, place their change order, and then we deliver it. Many restaurants are starting to offer tip automation—our solution Kickfin can also send tips instantly to employees as soon as their shift ends.”

For operators who work in multiple states or regions, consolidating all of their banking activity into one vendor has distinct advantages. By simplifying to a single point of contact and implementing virtual deposits, operators can streamline processes and save employees’ time.

“Operators have a complete closed-loop system with Loomis,” Evansek says. “We differentiate ourselves by the high quality of the services we offer, our ability to implement solutions, and our ability to train effectively. We are the ones offering the safe; we manage the service and maintenance plan; we are our own armored car service. We offer automated tipping and change order management. As banking becomes more virtual, we can really become the one-stop-shop for operators for anything related to cash management within the four walls of a restaurant.”

›

›

›

Pandemic conditions or not, some brands are racing to get franchise programs off the ground and capitalize on growth opportunities.

BY BRYAN REESMANattorneys at Nixon Peabody and our consultants at MSA Worldwide are awesome. They focus strictly on franchising, and they’ve been doing it for 20 or 30 years. They showed us the ropes. Without that expertise, we would probably have launched in 2027.”

Beyond the various state and federal regulations that come with franchising, H&H built out its entire operational training, manuals, and brand standards with cloud-based operations software firm Friend Connect that the franchisees access. “We’re 90 percent of the way through and have been working on it for over a year,” Rushin says. “It’s all that underlying infrastructure stuff that you don’t really think about that takes a long time to think through and build off of. So when you do sign your first deal you have everything ready and you’re not floundering around putting something together at the last second.”

Once a restaurant brand becomes well established on a local or regional level, the natural next step for many is to dive into franchising. It’s a step easier said than done, especially during a pandemic when many businesses halted shop and huddled up. But some endured and even thrived during the COVID-19 crisis, and are progressing with their first franchise plans. It’s served up new lessons of its own—franchising requires patience and purpose.

Iconic New York City brand H&H Bagels, which has five locations and turns 50 this year, saw its domestic shipping swell 500 percent and global wholesale increase 400 percent. H&H CEO Jay Rushin says the company became a better team and operator as a result. After five years of planning—during which he became very aware of their positive brand image after starting their global wholesale business—the company started franchising last fall, with four to six new units planned for 2022, and more accelerated growth in store for 2023.

“We probably launched it about as fast as you could, at least at the quality level we’re looking to achieve,” Rushin says. “Our

Miller’s Famous Sandwiches is another 50-year-old brand looking to the franchising space. Over the decades, it’s established roots as a top-notch roast beef destination at two Rhode Island locations, which never closed during the pandemic. The chain’s original 1,500-square-foot main unit in East Providence did nearly $2.4 million in sales last year.

Gwendolyn Graham, president of Miller’s Famous Sandwiches, has been with the brand since 2006. Her husband, Roger Miller Jr., VP and chief operating officer, came onboard fully in 2010 when the company opened its second location. He’s a third-generation operator. Both were asked if they wanted to continue the tradition. They previously worked in IT, and Gwendolyn in accounting as well, which has helped through the transition.

Like H&H, Miller’s is choosing slow, steady growth at first, seeking both first-time and experienced franchisees with passion for their brand. They are not looking to add multiple units at the start for the sake of revenue. As of press time, Miller’s was close to signing its first franchisee in southeastern Massachusetts, about 25 miles from the chain’s East Providence location, and was looking at tertiary markets outside Boston where interest is strong and the brand resonates.

“Systems are important in franchising—to make sure that those can be replicated and duplicated,” Graham says. “We’re processoriented people, and that’s what running a quick

service brand in San Diego, Calif. “Integration between my headset and my drive-thru timer helps bring awareness to mobile order wait times and enables my team to make mobile customers a high priority so the customer doesn’t have to wait on us.”

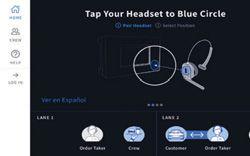

Equally important, more restaurants want drive-thru communication systems that enable newer technologies like ordering via artificial intelligence (ai) “Many brands have been successfully testing automated ordering in the drive thru and have seen that it enables their teams to multi-task,” Foley says. “While the AI takes orders, employees are freed from order taking and empowered to enhance the customer experience with personable, face-to-face interactions when it matters most.”

Although brands have experimented for years with small tweaks to their traditional drive-thru service, the COVID-19 pandemic forced rapid innovation to better serve the higher traffic volume. While drive thrus made up as much of 70 percent of sales before COVID, the drive thru quickly became a lifeline for quick-service restaurants. As a result, operators invested in new technologies to help meet higher-than-ever customer expectations. Today, crews serve more customers than ever before at multiple touchpoints—dine-in, the drive thru, mobile orders, and curbside—and customers expect a fast, seamless experience with each order.

“The COVID pandemic forced us all to reevaluate and adjust our business operations,” says Paul Foley, president of HME Hospitality and Specialty Communications. “Drive thrus have evolved into operations with multiple order and pickup points. It’s no longer just about serving customers in the lane quickly and efficiently. It’s also about meeting service expectations at every additional channel like curbside pickup spots.”

To better serve customers, restaurants need a communication solution that seamlessly connects drive-thru and crew communication, plus provides critical insights in real time. “We want mobile order customers to have a fast and flawless experience just like they do in the drive thru,” says Lupe Cabrera, a general manager for a major quick-

The NEXEO | HDX Crew Communication Platform, created by HME, delivers on all these points. It features all-new high definition HDX Digital Audio, optional system integrations that provide critical performance alerts to the right person at the right time, supports tight integration to highly accurate automated order-taking (aot) systems, and is cloud-connected for platform upgrades to meet the ever-changing restaurant needs. Team members can use voice commands to perform certain tasks like immediately connecting to a drive-thru customer, connecting privately to a team member via headset for coaching, and more. NEXEO also allows one-on-one calls and segments crews into groups for more efficient operations, all without disrupting drivethru communication with customers.

“Delivering a great customer experience starts with making key communication easy and fun throughout the restaurant while maximizing efficiency,” Foley says. “NEXEO | HDX is specifically created to be the total restaurant communication solution for today and tomorrow, elevating your operation to exceed your customers’ expectations and enable future changes in the rapidly evolving quick-service restaurant industry.”

To learn more, visit hme.com/nexeo.

Quick-service teams are looking for communication tech that can help meet higher-than-ever customer demand and expectations.

NEXEO | HDX enhances the drive-thru with all-new and unmatched HDX Digital Audio, increases efficiency with its capability for multiple crew conversations at the same time, enables seamless automated order taking, improves workflows with hands-free voice commands, and more. NEXEO is the unrivaled total solution, maximizing productivity and exceeding expectations across key areas of your restaurant. The Fully Digital Solution for Drive-Thru and Beyond 866.577.6721 | www.hme.com/nexeo

With custom programming, one-touch operation and precision performance, Vitamix® machines empower employees to achieve perfectly consistent results every time – even the first time. It’s just one reason we’re the industry’s most trusted blending partner.

See what else sets us apart at VITAMIX.COM/OURDIFFERENCE

Brand president Sami Siddiqui likes to say Popeyes is “50 years young.” While that might sound like something people profess at a weekend barbecue, there’s real weight behind it.

In the five decades since Alvin C. Copeland Sr. opened “Chicken on the Run” in the New Orleans suburb of Arabi, an area with just over 4,500 residents as of 2020, you could argue no three-year stretch has been more active or formative for the legacy brand. Perhaps only Copeland’s decision, after several months of tepid sales, to reopen the restaurant as “Popeyes”—named after Popeye Doyle from the 1971 film “The French Connection”—and switch from

Southern-fried chicken to spicy, New Orleans style, compares.

And this time, everything started by breaking the internet, Siddiqui says.

For two years, chefs in Popeyes’ Miami test kitchen quietly developed a buttermilk batter and tracked down a special flour to create a crunchy texture intended for a chicken sandwich. It used the same buttery topping found on biscuits to coat the bun and cut barrel-cured pickles thicker than competitors’.

Popeyes’ brass knew they were sitting on the biggest product launch in 30 years. Yet could the chain create buzz to match it?

By now, few customers, industry pundits, or anybody on

the grid, isn’t familiar with what came next. Popeyes sparked a social media battle with Chick-fil-A in August 2019 and the sandwich sold out in two weeks. The brand moved as many in 14 days as it expected to from August to September. According to mobile location analytics platform Placer.ai, traffic to Popeyes branches nationwide on August 20 and 21, rose a staggering 67.6 and 103.3 percent, respectively, above the company’s summer baseline. Placer.ai summed it up simply: “This is an outrageously high peak.”

Apex Marketing Group estimated Popeyes garnered $23 million in equivalent ad value across digital, print, social, TV, and radio in just the first 11 days (this number would eventually get to $65 million). More than 16 tweets per minute were fired off during the first month. Some restaurants sold 1,000 chicken sandwiches per day. Ad Age said Popeyes’ Chick-filA tweet earned more than 20 billion impressions worth some $220 million. Before the year closed, Popeyes more than doubled its Twitter following and generated enough word-of-mouth momentum to cancel an ad campaign scheduled for Labor Day.

What’s less known, however, is the effort actually began with a phone call. Kim Sánchez, owner of Sweet Dixie Kitchen, a trendy brunch spot in Long Beach, California, thought Popeyes was ringing to let her know she was being sued. In 2017, the restaurant grabbed notorious headlines when it got caught serving Popeyes chicken and presenting it as its own. Sánchez was

even spotted walking through the front door with Popeyes bags.

But Popeyes wasn’t threatening legal action. In a move that would come to illustrate the chain’s stance on the subject, it asked Sweet Dixie Kitchen to introduce the product. The idea being, “we promise our new sandwich is worth the visit.”

That was always the meat inside the bun, so to speak. Take a taste test and see who comes out on top. Over the next two years, the same company line darted in from every corner of the industry. Zaxby’s, McDonald’s, even Taco Bell (if you consider a “Sandwich Taco” a sandwich) created new offerings to enter the so-called “Chicken Sandwich Wars.” And it always came back to Popeyes.

By February 2021, the company revealed one of the more eye-popping statistics in quick-service history: From pre-chicken sandwich to present, average-unit volumes rose $400,000 to $1.8 million. Global crisis notwithstanding.

“I think what people often forget,” Siddiqui says, “is just a few months after the sandwich, COVID hit.”

From 2019 to 2020, Popeyes posted four of the best quarterly same-store sales increases in the quick-service industry over the last 10 years. One example—Q4 2019, when comps skyrocketed 37.9 percent.

Amy Alarcon, Popeyes VP of culinary innovation, who has

been with the brand since 2007, says the chicken sandwich “certainly changed the landscape for us internally as well.”

“We kind of instigated this shift where almost everyone in [quick service] suddenly changed how they were doing their chicken sandwich,” she says. “We like to think we set really high standards for ourselves and it was flattering that we established a standard for the industry.”

More recently, focus has turned to what Popeyes’ second act might look like. How can it leverage an indelible moment in fast-food history into something more lasting?

As the brand became, “quote end quote hot,” Siddiqui says, investor and franchisee demand popped across the globe. Prospective operators wanted in. Current ones wanted more. In fact, for many years, the brand didn’t have new franchisees entering the system. Today, there’s a waiting list, he says.

Siddiqui, formerly president of parent company Restaurant Brand International’s Asia-Pacific region before joining Popeyes in September 2020, led the launch of the brand in China and the Philippines. In both cases, he says, lines of four, five, even seven hours, snaked around openings. “I think part of that—much of that—is rooted in having an unbeatable product,” he says. “But also, a lot of the momentum we’ve seen here [in the U.S.].”

It’s a simple formula with wide-ranging implications: as Pop-

POPEYES’ CHICKEN SANDWICH HAS SPAWNED NO SHORTAGE OF COPYCATS THROUGHOUT THE INDUSTRY.

POPEYES’ CHICKEN SANDWICH HAS SPAWNED NO SHORTAGE OF COPYCATS THROUGHOUT THE INDUSTRY.

eyes turns 50, people are talking about the brand more than ever.

In 2021, it crossed the 3,000unit mark in the U.S. and Canada. Popeyes signed more development agreements around the world than at any other point in its history. It’s headed to India, the U.K., Saudi Arabia, Romania, France, South Korea, and, naturally, to more markets in the U.S., Mexico, and RBI’s Canadian base.

In guest surveys, which the brand hosts routinely, it asks consumers what their barriers to trial consideration for Popeyes are. “And what they always say is … actually convenience,” he says. “There’s just not a Popeyes close enough to me. And we think that is a huge opportunity.”

“I view that as my obligation—to build more Popeyes,” Siddiqui adds.

Just charting overseas, there are “a couple hundred” Popeyes in Asia today. Twenty-six percent of KFC’s total system sales stem from China alone. Yum!’s chicken giant has 26,934 restaurants, and only 3,953 of those are in the U.S.

“I think that highlights what the whitespace opportunity is out there,” Siddiqui says.

In many ways, Popeyes’ chicken sandwich gave RBI a trigger point it had been searching for in regard to the brand. On March 27, 2017, RBI acquired Popeyes for $1.8 billion. It was a significant move because it secured the Burger King and Tim Hortons owner (it now directs Firehouse Subs as well) a serious stake in chicken.

From acquisition to 2020, RBI posted cumulative net restaurant growth of 27 percent at Popeyes. As noted, 2021 represented the highest number of openings yet as the brand closed the calendar with 3,705 restaurants globally—a net of 254 stores, or unit growth of 7.4 percent. That total breaks down to 2,754 U.S. locations (net of 146 restaurants) and 951 international outlets (net of 108 restaurants).

“We’re just scratching the surface on opportunities for Popeyes,” RBI CEO Jose Cil said in February. “And I firmly believe that the brand is poised to become one of the fastest growing in the industry.”

Come year-end 2020, Popeyes exited as the country’s secondlargest chicken chain, just ahead of Chick-fil-A and about 1,300 units behind KFC. After Wingstop, which had more than 1,500 stores and continues to grow, recently upping its global target to 7,000 total stores, Church’s Chicken (913 units), Zaxby’s (905), and Bojangles (758) neared the three-digit club. Raising Cane’s (509) and El Pollo Loco (482) were climbing, too.

But as crowded as this category has stuffed, Siddiqui says, Popeyes doesn’t have any trouble standing out. It’s as much a race for access as anything else.

During COVID, opportunities for multi-channel business flashed for the brand, like it did for so many other restaurant chains. Siddiqui says internal insight, from the outset, focused on the comfort-food movement taking hold. Beyond pizza, Chinese cuisine and chicken are the two most commonly ordered products for home delivery, he says. Popeyes leaned into the notion and, in particular, the reality it could package chicken for family occasions. Party size increased and Popeyes’ business “thrived as the world moved toward eating at home,” Siddiqui says.

The brand got on all delivery aggregator platforms and built out its own mobile platform so its app and, ultimately, loyalty program could be active during COVID.

RBI, as a company, generated more than $10 billion in global digital sales in 2021, or more than 30 percent of its total systemwide take. Just four years ago, the company had virtually no digital sales in most of its major markets. Popeyes’ U.S. fleet reported 16 percent of sales from digital channels in Q4 2021.

Accentuating food and digital trends, coupled with the chicken sandwich draw, is what helped Popeyes produce two of the most historic years it’s had, Siddiqui says.

How Popeyes builds on it, from a physical angle, is changing, too. The brand is looking at smaller footprints. Ghost kitchens. Digital-only formats. In South Florida ( RBI also has a base in Miami), there was a trade area where Popeyes didn’t have any restaurants. Why? No availability for a large, freestanding res-

Mike’s Hot Honey® started out of a pizzeria in Brooklyn 12 years ago when its signature sweet-heat combo debuted on the menu. With applications from pizza and chicken to dessert and cocktails, Mike’s Hot Honey elevates any dish from ordinary to extraordinary. Request a sample today to see what all the buzz is about.

mikeshothoney.com /sample

taurants with a drive-thru—a point that would have slammed the door shut before.

Now, however, Popeyes has a digital-only concept with kiosks and no registers, and delivery, mobile order and pay at the ready. And in March, the chain reopened its historical Canal Street store in New Orleans, which marked the first unit in the U.S. built with a modernized layout inside and out, including self-order kiosks, order-ready boards, and dedicated areas for digital order pickup. “That really streamlines the digital experience for our guests,” Siddiqui says. “I think it’s those types of formats that we’ve now become a lot more flexible with. Those are going to be the future in terms of how we deliver Popeyes to our guests. It’s not going to be all digital formats. It’s not going to be all ghost kitchens. It’s going to be a balance of everything.”

While this unfolds, Alarcon and the culinary team aren’t going to rest on Popeyes’ chicken sandwich laurels. Take the brand’s nuggets, which launched nationwide in late July. Popeyes released them with a cease-fire campaign that called for an end to the Chicken Sandwich Wars. The Popeyes Foundation purchased the cash equivalent of a million nuggets from the chain, as well as competing brands McDonald’s, Wendy’s, Chick-fil-A, and Burger King, and donated funds to Second Harvest Food Bank of Greater New Orleans & Acadiana.

Notably, the nuggets came from the same recipe as the chicken sandwich, only in “poppable pieces.” The innovation was in the works since the introduction of the former.

“A lot of that was capturing the parts of the chicken sandwich that we all love, which was the chicken itself,” Alarcon says. “I mean, everything about that sandwich is amazing, but taking the chicken and the breading and then creating that as a vehicle for sauce.”

Nuggets had launched previously as LTOs, yet never with any real emphasis behind it. “I use the nuggets as an example to say the chicken sandwich may have driven a lot of traffic and put us on the map, in some sense,” Siddiqui says. “But I think what we also saw was there were other categories where we weren’t playing.” In other terms, the chicken sandwich opened the flood gates, like with bone-in chicken and seafood trial. “People come into our restaurants and they’re not just buying the chicken sandwich,” Siddiqui says.

The nuggets, which were an ideal launch for kids and customers not focused on heat, then “married over beautifully,” Alarcon adds, into a partnership with Megan Thee Stallion, including a signature hot sauce and merchandise line. The Grammy Award-winning rapper, who Siddiqui says was intimately involved from day one, actually signed a franchise deal with Popeyes to open up to five restaurants.

Cil said the initiatives played an important role in attracting new demographics ( just as the sandwich itself once did), specifically Gen Z and millennials, as well as expanding the brand’s p.m. daypart. Going back, market intelligence firm Numerator released data in the infant stages of the chicken sandwich that showed the social media-fueled item not only brought new visitors to the chain, but it also successfully pulled guests away from competitors. More than half (51 percent) of non-buyers during the shortage period—when Popeyes ran out of supply—

said they went to Popeyes with the intent to buy the sandwich. About 30 percent of Popeyes’ new chicken sandwich fans were purchasing crispy chicken sandwiches at other quick serves in the weeks prior to trying it. So the task becomes how to reward and keep the interest of now-loyal users, and continue to open the funnel for fresh guests to try Popeyes. Homestyle Mac & Cheese was one example, Alarcon says. It arrived in November, topped with shredded cheddar cheese and baked in the oven. Between the nuggets, Meghan Thee Stallion Hottie Sauce, and mac innovation, Alarcon says 2021 featured “a lot of firsts” for the brand. And it’s likely a sign of things to come.

But as much new news as Popeyes wants to create, it always returns to the core, which is something Alarcon says fits the 50-year anniversary vibe. Recently, she pulled up the original menu from Popeyes.

“The thing to think about in 1972 was what made the brand famous was spicy—spicy chicken,” she says. “And you think about how we kind of created this space in the industry that now everyone is leaning into, it’s part of our regular dinner and lunch occasions. It’s such a normalized thing now that I like to think that we did it best. And we did it before anybody else really brought spicy forward and made it a national treasure.”

“I think we’re just building on top of that foundation,” Siddiqui says of Popeyes history. “I think we really became part of that pop culture conversation [with the chicken sandwich]. What we’re trying to do when we’re in that conversation is really be authentic to who we are. And what does that mean? It means our Louisiana roots. Our culinary mastery. And, really, this 50-year brand’s roots.”

Popeyes has some celebrations cooked up for Year 50, but couldn’t share details just yet. In March, it brought franchisees together in New Orleans for a three-day party to not only “ground ourselves in the heritage,” Siddiqui says, “but to also talk about where we go from here over the next 50 years.”

Part of the conversation surrounds systems and ensuring the brand remains guest-centric while also striving to become more efficient. Alarcon says Popeyes’ blueprint used to be 70 percent new product development, 30 percent looking at maintenance and how to handle existing items. It’s shifted to where 50 percent of time is now dedicated to looking at what Popeyes currently sells and trying to find ways to make it easier to handle product, and yet still maintain the quality you get from hand battering and breading. “I don’t think we’ll ever walk away from that,” she says.

“As you think about that process and the love and care that goes into that prep process, it is unlike anything else and that’s what really differentiates us,” Siddiqui continues. “That’s what keeps our guests coming back and ultimately that’s what’s going to propel the growth of this brand.”

Broadly, the key will be to own life as a national chicken chain with no shortage of buzz behind it. The days of being a regional, best-kept secret are gone. “The last three years are the beginning of something really special for the brand,” Siddiqui says. q

Made from fresh, local milk gathered only a few hours after milking, BelGioioso Fresh Mozzarella begins with quality ingredients and care. The result is a delicate, Fresh Mozzarella with a soft texture and porcelain white appearance –the finest available on the market today. Available in waterpack tubs and cups, thermoform logs and balls, and slicing loaf. belgioioso.com

But the descriptor doesn’t fully capture what industry veteran Greg Flynn and his team have built across more than two decades.

The organization is the largest operator for Arby’s, Pizza Hut, and Applebee’s, the second-biggest for Taco Bell and Panera, and the fifth for Wendy’s.

That equates to 2,355 restaurants nationally, 73,000 employees, and $3.7 billion in annual revenue, making Flynn Restaurant Group the largest industry franchisee in the U.S. and potentially, globally. The company stretches more than 3,000 miles, from Portland, Maine, to Portland, Oregon.

Its most significant move came in 2021, with a $552.6 million purchase of 937 Pizza Hut and 194 Wendy’s stores from bankrupt operator NPC International—the largest franchise transaction in U.S. history.

“You add all this up, it completed our journey in a way that was 100 percent consistent with our strategy,” Flynn says.

/ BY BEN COLEYWhat does it take to build one of the biggest franchise companies in restaurant history? Discipline and a perpetual focus on the bigger picture, Greg Flynn says.

That journey Flynn speaks of began in the mid-1990s via World Wrapps, a restaurant that “started the whole wraps phenomenon,” he says. The company was founded by a classmate from the Stanford Graduate School of Business, and Flynn decided to make a small investment. The first unit opened in San Francisco in February 1995, with lines around the block.

“Everyone thought ‘oh my God, we’ve got the next Starbucks on our hands, and we need to bring this to market as fast as possible,’” Flynn recalls.

To accelerate development, Flynn agreed to build stores in Seattle, where he was growing a budding real estate business. Between 1995–1999, he opened 14 units, and was quickly introduced into the “school of hard knocks for running restaurants.”

He learned to be a jack of all trades working in the front of house, back of house, construction, and other various tasks. Flynn also recognized that because he was in the beginning stages of an independent restaurant transforming into a small chain, he was playing in the riskiest end of an already treacherous sector.

Nearly all aspects were inherently more difficult, whether it was convincing landlords to lease space, vendors to sell their equipment, employees to come work, or customers to try the food.

“And you can’t borrow a dime for it, except on a full recourse basis,” Flynn explains. “Basically, you have to come up with all the money to do this.”

But in the late 1990s, he became aware of a financing opportunity in which he could receive all the necessary funds to buy into a top-tier franchise restaurant.

“I looked at this and it’s like wait a minute, I can borrow all of the money on a non-recourse basis to do this,” Flynn says. “And then once you do it, the customers already know you, employees know you and want to work for you, the landlords know you and want to lease to you, vendors know you and want to sell you equipment. Everything about it is easier.”

In that era, the hottest segment was casual dining, and the leader in the category was Applebee’s, Flynn says. So he took out a loan and purchased eight stores in the Seattle market.

He bought those Applebee’s restaurants from Clevelandbased franchisee Don Strang III, who owned roughly 70 units in Minnesota, Ohio, and Indiana, and was starting to develop New Jersey and Delaware. His Seattle outlets, however, were struggling due to expensive real estate, construction, wages, and food. The restaurants earned about $45,000 per week.

Flynn entered the venture with Brad Pettinger, who he recruited to build the World Wrapps business. Neither had much knowledge on running a full-service restaurant, but that void was filled by Dan Krebsbach, who spent years working for Strang in the Minneapolis and Seattle markets. Subsequent to the acquisition, he joined Flynn’s company as director of operations.

“He is perhaps the best restaurateur I’ve ever met in my life,” says Flynn, describing Krebsbach. “Consummate professional. And he said, listen, we can make it here in this market, but we need to do things differently than the way they’re done in the Midwest.”

Flynn and Pettinger gave Krebsbach freedom to make operational and CapEx decisions. And to ensure everyone’s interests

were aligned, the duo shifted his compensation heavily toward profit sharing and gave him an equity interest. Krebsbach launched multiple initiatives, such as leaning into the bar and late-night business, shifting promotions to different lines or products, and stacking employment to meet higher sales volumes.

Within half a year, average weekly sales grew to $60,000. The group proceeded to open a ninth and 10th restaurant, which debuted with high volumes. It was at this point Flynn and Pettinger realized they were on to something major.

A couple of years later, Flynn contacted Strang again and bought the rest of his stores, swiftly expanding the footprint from 10 to 72 units.

“When you think of when was Flynn Restaurant Group founded, maybe it was when we first got in the restaurant business in ’95, but maybe it was when we first got into Applebee’s in one market in ’99,” Flynn says. “That’s what I normally think of it as, but maybe it was in 2001 when we assumed our current configuration of being a multi-market operator.”

Flynn and Pettinger handed off the World Wrapps restaurants and committed themselves to becoming a lead expert in running Applebee’s stores.

Flynn Restaurant Group did just that, growing to more than 400 in the next decade.

By 2011, Flynn felt the company had the requisite capital, experience, and industry knowledge to become a multi-brand platform. When deciding what chains to pursue, the organization listened to the marketplace and decided to model itself after the composition of the restaurant industry, which at the time was 60–70 percent fast food and 20–25 percent full service, Flynn says. The rest was filled by the small, but growing fast-casual space.

“The idea there is, we could guess at which segment is going to be the winner in the long run,” Flynn says. “But that’s hard to do and it comes and goes and it’s just that the safest bet is to diversify along the lines of what the market is saying to you. And that may change over time.”

The other key factor dated back to Flynn Restaurant Group’s origin—only associating with mature, proven brands that have been around for decades.

The company entered fast food through Taco Bell in 2012, and now operates 280 restaurants in nine states. For fast casual, the only true options, Flynn says, were Chipotle and Panera. Since Flynn Restaurant Group already operated Taco Bell and Chipotle didn’t franchise, Panera became the No. 1 option. The operation was established in 2014, and now includes 133 bakery-cafes in eight states.

“It took a while to actually get into the Panera system,” Flynn says. “Panera hadn’t had a new franchisee in 10 years at the time we finally entered, and it took getting to know [founder] Ron Shaich personally and convincing him that we would be good for the brand.”

Flynn Restaurant Group followed that up in 2018 with Arby’s, through an acquisition of nearly 370 restaurants in

Protect your image with FLAT.® Our selfstabilizing Table Bases eliminate wobbly tables and seamlessly align to make better use of spaces indoors and out. They also come in a variety of colors and styles to match any ambiance. Learn more at FlatTech.com or call 855-999-3528.

nine states. At this stage, the company had the quick-service presence it desired, but it was still outside two major sub-segments—burgers and pizza.

That is until NPC, a franchisee of more than 1,200 Pizza Hut and 390 Wendy’s restaurants, entered the fray. Hampered by COVID and steady declines in its Pizza Hut business, the franchisee declared bankruptcy in July 2020 and looked to facilitate a sale.

“We had to get comfortable that Pizza Hut as a brand was in a good place, going in a good direction, and we got very comfortable with that,” Flynn says. “All brands have good times and bad times in our experience, and Pizza Hut had a few really rough years. It’s one of the things that created the opportunity for us to buy NPC.”

Before the sale agreement, NPC shut down its worst 300 units, which Flynn calls “every restaurateur’s dream.” The 390 Wendy’s units were divided among Flynn Restaurant Group and a collection of Wendy’s franchisees.

The transaction closed March 2021. On a trailing 12-month basis, Flynn says both divisions have experienced record years.

“The portfolio that we bought was pristine,” Flynn says. “I mean there were almost no losers in it. The question was, was it going to stay that strong after COVID was over or once it subsided a little bit. Our view was that strength was actually going to continue. And we’ve seen it continue for the subsequent year after that transaction. Both are going to perform at about the same level, or a little bit better, post-COVID than they performed in ’20, which is to say very strong and right to our plan.”

Flynn compares the makeup of Flynn Restaurant Group to a federal/state system.

The “states” are clusters of 20–50 restaurants run by “governors,” or market presidents. The geography is tight enough for these executives to frequently visit restaurants and familiarize themselves with guests, vendors, and other assets. That puts them in the best position to make informed decisions, Flynn says.

The “federal” portion is the myriad resources Flynn Restaurant Group provides these clusters, like accounting, administration, finance, human resources, I.T., purchasing, training, and real estate—almost as if it were a franchisor.

Similar to how Flynn and Pettinger approached Krebsbach in the early days, market presidents have equity in the business and power to make key decisions.

“That part of our structure and our philosophy has mapped very well from our origins in full-service dining into our entry in quick service and fast casual,” Flynn says.

The fact Flynn Restaurant Group is the largest franchisee— or close to it—in all of its systems is deliberate, Flynn says. This is not only because of the beneficial scale economics, but also the meaningful seat at the table with franchisors. The objective is to serve as the best, most collaborative operator in each system.

The relationship is mutually beneficial.

Flynn Restaurant Group gathers intimate knowledge about ideas coming down the pipe, and in turn, the giant franchisee leverages valuable insight from multiple food segments.

“We respect confidentiality, but there’s a lot of general learnings we get from being very deeply inside multiple systems,” Flynn says. “And sometimes we have a broader view than our franchisors because of what we see.”

Flynn Restaurant Group participates in all of the notable franchise councils for each brand and remains significantly active in development.

Flynn says growth conversations between franchisee and franchisor go exactly as one may think—drive top-line sales, maximize operating profit margins, and determine where to go with futuristic, low-cost prototypes.

Flynn says the company is proactive when it comes to piloting new designs, equipment, and processes.

“We love to be a test partner because it’s helpful to the system, but also so that we can ourselves gain conviction around it through our own experience,” Flynn says. “And often, when we do that and we’re on board, it really helps bring other franchisees in the system along with us because as a large franchisee, we’re very diligent.”

“We have a whole data analytics team and then we have our own consumer insights team, as well,” he adds. “And so we do our homework very, very carefully on anything we look at. And so, once we’re on board, franchisors often find that helps get the whole system on board.”

The franchisee has a front-row seat to some of the most innovative brands in the restaurant industry. For instance, a Taco Bell operator in Minnesota is building a “Defy” concept—a 3,000-square-foot, two-story prototype with four drive-thru lanes (three for mobile orders)

There will also be a digital check-in screen where mobile order customers can scan their order via QR code and pick up their food via a “bell-evator” lift system.

Additionally, in November, Panera opened its first NextGen bakery-café, featuring a double drive-thru, automatic loyalty identification, digital menuboards, and a reorganized interior where the baking process is put on full display.

Flynn Restaurant Group voluntarily completed 10 Panera remodels to test new ideas. Some changes were good, some weren’t, but the important part is everyone learned from it.

“We were happy to be the one to try those things,” Flynn says. “We have enough scale that we can try 10 remodels and if it doesn’t work, OK. I mean, call it that, right? So I think, in all of our brands, everyone’s leaning more into digital, everyone’s leaning more into off-premise and convenience, and the physical assets will evolve to advance those goals.”

casual portfolio. However, Flynn says, the organization will be mindful of competitive restrictions and prioritizing expansion within its existing footprint.

In the future, it could potentially mean growth outside the U.S. “There are not many U.S.-based franchise operators that have any international presence, but there are franchise operators internationally that span multiple countries very successfully, and so I can see that being an evolution,” Flynn says. “I can see that being an opportunity for us that we start taking our experience, our platform, our capital, and take advantage of international opportunities.”

The organization would consider becoming the proprietary owner of a brand, but Flynn recognizes that takes a much different skillset.

Over the years, he’s seen successful franchisees become concept owners, but fail at taking the restaurant to the next level.

“There’s a certain hubris that sometimes franchise operators can fall victim to thinking—I’m very successful, and that success is me and so I can do anything,” Flynn says. “I can go buy a brand, and I’ll run that just as well. What they’re maybe not giving enough appreciation to is the fact that it’s not just us. We’re part of a system, and the system is successful, and you may be a great franchise operator, but that doesn’t mean necessarily you’re going to be great at running a brand.”

In some cases, larger operators—like Burger King franchisee Carrols Restaurant Group—go public and trade on the stock market. For Flynn, reasons to go public include needing capital that can’t be accessed in other ways and seeing a big valuation difference between serving as a public company and as a private one. Neither are close to true for Flynn Restaurant Group.

Flynn also notes that being public provides currency that can be used for acquisitions and allows a company to share equity with employees.

He sees those as legitimate reasons, but not enough for him to make that move.

“I actually love being a private business,” Flynn says. “It helps us keep a very long-term perspective and not worry about quarter-to-quarter results nearly as much as what’s the outcome in five or 10 years. Then there are restrictions we have in our franchise documents. I mean, it’s conceivable, I could get all of our franchisors on board to go public, but it would be a heavy lift. And, frankly, given that I don’t want to anyway, I think it’s highly unlikely we will ever be public.”

In terms of the industry as a whole, Flynn foresees more consolidation among franchisees, and for good reason.

In 2021, Flynn Restaurant Group was named Franchisee of the Year for Applebee’s and Arby’s because of its ability to invest in people and assets at a level smaller operators can’t replicate.

Although the NPC acquisition completed a 10-year quest toward becoming a multi-platform powerhouse, it by no means closed the door on future acquisitions.

The company will continue to be opportunistic by applying the same guidelines it used to obtain its quick-service and fast-

Flynn says franchisors have come to realize that big doesn’t mean bad. In fact, big could mean good, or in the case of Flynn Restaurant Group, extremely good.

“I’d like to think we are close to being the best partner for our franchisors, and our scale is part of that, it helps with that, it doesn’t hurt that,” Flynn says. q

KFC’s multi-year turnaround is taking a step up in 2022— with a look that both reflects its past and a future full of possibility.

/ BY DANNY KLEIN

/ BY DANNY KLEIN

KFC is riding eight consecutive years of positive same-store sales growth—a comeback that’s progressed beyond the turnaround stage into something more lasting. Now, it’s time to complement one streak with another, chief development officer Brian Cahoe says. KFC opened 55 new U.S. locations in 2021, for a net of four stores. Despite pandemic setbacks, delays, and closures, it represented the first time the chain has been net new unit positive in 17 years. ¶ And Cahoe says KFC will go back-to-back in 2022. ¶ “What you’re seeing in the U.S. is a continuation, and even a building, of momentum of all of the strategies we’ve been bringing to life and the foundation that we’ve put in place,” he says

In domestic markets, KFC’s same-store sales climbed 12 percent in Q4 and 13 percent for all of 2021, both on a twoyear basis.

Beyond coupling sales with unit expansion, KFC’s multiyear effort to reinforce its brand identity is coming into sharper focus as well. This past year, the chain hit a prior goal when it converted 70 percent of its system to the “American Showman” design, recognizable by bright red-and-white stripes ( like a chicken bucket), bucket chandeliers, and graphics that serve as an allusion to the Colonel’s hard-working background. A modern take on KFC’s roots.

Cahoe says the brand remodeled “hundreds of assets” over each of the last few years, pandemic conditions or not. However, during the chain’s sales climb, there’s been under-

lying innovation at work. KFC’s digital integration, via delivery, pickup, e-commerce, and app, was a development gaining relevance ahead of COVID. But it’s rushed to the surface, just as it has across Yum!’s portfolio and much of the sector. Yum! posted $22 billion in digital sales last year—a company record. KFC’s U.S. digital sales soared 70 percent, year-over-year, driven by its delivery service channel and e-commerce platform that launched nationwide early last year. In Q4, KFC also introduced “Quick Pickup,” where guests walk-in and grab mobile orders out of cubbies. Cahoe says the update, in essence, is rolled out nationally at this point.

All of it, though, is fueling where KFC goes next: the rapid introduction of the company’s “Next Generation” asset base, and all the connectivity that comes with it.

Transforming your vegetable creations into something amazing just got easier. Fire ‘n Ice™ fire-roasted individually quick frozen (IQF) vegetables offer sophistication, fresh flavor, and an indulgent culinary experience every time.

Fire ‘n Ice fire-roasted IQF vegetables deliver mouth-watering, artisan appeal that will make any finished product a culinary delight.

• Choose from a complete range of vegetables, from artichokes to zucchini

• Create unique customizable blends

• Consistent quality and fresh flavor without preparation costs or food waste

• Ideal for foodservice offerings, plant-based entrées, and better-for-you comfort foods.

KFC opened its first Next-Gen restaurant in Berea, Kentucky. Introduced in November 2020 and debuted in Q4 2021, it boasts a digital-forward and contactless experience, including the company’s first double drive-thru lane. Additional NextGen stores opened in Westfield, Massachusetts, and Detroit.