50®5 AUGUST 2022 / NO. 294 THOUGHT LEADERSHIP FOR 25 YEARS THE INDUSTRY’S LEADING REPORT / P.26 SPECIAL ANNUAL ISSUE A Golden Era of Fast Food? P. 78 Cold Coffee Gets Hot P. 15 Plus JUMP TO THE RANKING OF AMERICA’S BIGGEST LIMITED-SERVICE CHAINS | P.50

RUNS

We are Coca-Cola and so much more, offering the preferred categories and leading brands to drive your sales and profit growth. Contact your Coca-Cola representative, call 1-800-241-COKE, or visit www.coca-colacompany.com.

REFRESHMENT

IN THE FAMILY

BY DANNY KLEIN AND BEN COLEY

In the first full year following the onset of COVID-19, the country’s highest-earning restaurant chains battled for market share once again. Who grew in 2021? Who slipped? And who is ready to accelerate on the other side? Let’s dive into the data.

78

Is a Golden Era of Fast Food Upon Us?

BY DANIEL P. SMITH

BY DANIEL P. SMITH

The restaurant world continues facing undeniable headwinds, but the impressive results and ambitious plans of industry power players suggest quick-serves are poised to become an even bigger part of daily life.

RACHEL PITTMAN

PERIODICALS POSTAGE PAID AT CHAPEL HILL, NC, AND ADDITIONAL ENTRY POINTS. ON THE COVER Starbucks clocks in at No. 2 in this year’s QSR 50 as it keeps scaling up. PHOTOGRAPHY: STARBUCKS / CONNOR SURDI NEWS 9 SHORT ORDER 24 FRANCHISE FORWARD Diversity from the Top Down Franchising can prove a powerful vehicle for restaurants to create career opportunities. BY

97 CLIMATE RESPONSIBILITY Shaking Up Sustainability Shake Shack is tackling the topic with a multifaceted strategy. BY

INSIGHT 15 FRESH IDEAS Cold Coffee Gets Hot Customers of all demographics are changing how—and when— they drink the habitual classic. BY

20 ONES TO WATCH Sarpino’s Pizzeria A bevy of offerings is drawing in guests, old and new, and prospective operators, as well. BY BEN

62 OUTSIDE INSIGHTS Why 2021 Was a Mixed Blessing for Top Brands Beyond the numbers and into consumer sentiment, there’s a lot this past year can tell us. BY ADAM LEFF 104 START TO FINISH Scott Snyder The CEO of Bad Ass Coffee of Hawaii on leading a rocket ship. 2 BRANDED CONTENT 4 EDITOR’S LETTER 103 ADVERTISER INDEX DEPARTMENTS QSR is a registered trademark ® of Journalistic, Inc. QSR is copyright © 2022 Journalistic, Inc. All rights reserved. 101 Europa Drive, Suite 150, Chapel Hill, NC 27517-2380, (919) 9450700. Printed in USA. The opinions of columnists are their own. Publication of their writing does not imply endorsement by Journalistic, Inc. QSR (ISSN 1093-7994) is published monthly. Periodicals postage paid at Chapel Hill, NC, and additional entry points. SUBSCRIPTIONS: (800) 662-4834, www.qsrmagazine.com/subscribe. QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher. ABC member since 2001. POSTMASTER: Send address changes to QSR, 101 Europa Drive, Suite 150, Chapel Hill, NC 27517-2380. All rights reserved. No part of this magazine may be reproduced in any fashion without the expressed written consent of Journalistic, Inc. 26

50

HILARY DANINHIRSCH

AMANDA BALTAZAR

COLEY

QSR

26/ McDONALD’S SITS ATOP THE QSR 50, AS USUAL. BUT WHAT’S CHANGED IN A YEAR? THE SHORT ANSWER: A LOT. QSR / LIMITED-SERVICE, UNLIMITED POSSIBILITIES TABLE OF CONTENTS AUGUST 2022 #294 ADOBE STOCK NITIPHOL August www.qsrmagazine.com | QSR | AUGUST 2022 1

FEATURES

How

EDITORIAL

EDITORIAL DIRECTOR, FOOD NEWS MEDIA: Danny Klein danny@qsrmagazine.com

MANAGING EDITOR, FOOD NEWS MEDIA: Nicole Duncan nicole@qsrmagazine.com

DIRECTOR OF CUSTOM CONTENT: Peggy Carouthers peggy@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Charlie Pogacar charlie@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Kara Phelps kara@qsrmagazine.com

CONTENT EDITOR: Ben Coley ben@qsrmagazine.com

STAFF WRITER: Trevor Griner Trevor@qsrmagazine.com

ART & PRODUCTION

ART DIRECTOR: Tory Bartelt tory@qsrmagazine.com

ONLINE ART DIRECTOR: Kathryn “Rosie” Rosenbrock rosie@qsrmagazine.com

GRAPHIC DESIGNER: Erica Naftolowitz erica@qsrmagazine.com

PRODUCTION MANAGER: Mitch Avery mitch@qsrmagazine.com

ADVERTISING

800.662.4834

NATIONAL SALES DIRECTOR // EXTENSION 126 : Eugene Drezner eugene@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 149 : Edward Richards edward@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 141 : Amber Dobsovic amber@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 148 : John Krueger john@foodnewsmedia.com

SALES SUPPORT // EXTENSION 124 : Tracy Doubts tracy@foodnewsmedia.com

CIRCULATION WWW.QSRMAGAZINE.COM/SUBSCRIBE

CIRCULATION COORDINATOR: N. Weber circasst@qsrmagazine.com

ADMINISTRATION

GROUP PUBLISHER, FOOD NEWS MEDIA: Greg Sanders greg@foodnewsmedia.com

PRESIDENT: Webb C. Howell

MANAGER, IT SERVICES: Jason Purdy

ACCOUNTING ASSOCIATE: Carole Ogan

ADMINISTRATION

800.662.4834, www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher.

REPRINTS

THE YGS GROUP

TOLL FREE: 800.290.5460

FAX: 717.825.2150

E-MAIL: qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided by the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed. Direct to sponsoredcontent@foodnewsmedia.com

FOOD NEWS MEDIA PROPERTIES

6 Improve Beverage and Dessert Sales on the Takeout Menu Off-premises, appearance is (almost) everything. SPONSORED BY RICH PRODUCTS 12 Ellianos Turned $100 into a Multi-Million Dollar Coffee Franchise The brand is searching for franchisees with fuel to grow. SPONSORED BY ELLIANOS COFFEE 18 How Actionable Insights and Improved Communication Make Drive Thrus More Profitable As drive-thru business continues to increase, efficiency is critical. SPONSORED BY HME HOSPITALITY AND SPECIALTY COMMUNICATIONS 22

Brands Are Enhancing CRM Data In Order to Target Customer Segments Inflation affects businesses and customers alike, but this solution offers a win-win. SPONSORED BY FETCH REWARDS 59 Quick-Serve Restaurants are Already Decarbonizing Menus Next up: decarbonizing parking lots while driving down the bottom line. SPONSORED BY CHARGENET STATIONS IN THIS ISSUE BRAND STORIES FROM QSR BRANDED CONTENT SmartChain / p. 81 SPONSORED SECTION AUGUST 2022 81 COVID Impact P82 Labor Changes P86 Tech and Design P90 Key Players P94 TOMORROW’S KITCHEN Futuristic tech is already here to increase back-ofhouse efficiency BY KARA PHELPS VENDOR RESOURCES TRENDS NEW PRODUCT S TOMORROW’S KITCHEN / FUTURISTIC TECH IS ALREADY HERE TO INCREASE BACK-OF-HOUSE EFFICIENCY. 82 The Post-COVID Kitchen Operators are finding innovative ways to do more with less. 86 Hail to the Chef Labor-saving technology can become a perk to help retain staff. 90 The Right Tech, the Right Space The kitchen of the future may have a smaller footprint with more automation. 94 Key Players Here are the biggest names in the world of kitchen equipment and solutions.

RICH PRODUCTS

ELLIANOS COFFEE

2 AUGUST 2022 | QSR | www.qsrmagazine.com

HME ADOBE STOCK MILENKO ÐILA CHARGENET STATIONS

One for the History Books

This August marks 25 years of the QSR 50. I spent a few dusty minutes the other day trying to track down the original copy. It was in the care of our art director, Tory Bartelt, who had to empty a few shelves before former Sonic Drive-In leader Clifford Hudson’s cover fell out of the pile. The inaugural QSR 50 actually didn’t feature a chart and ranking the way it has from Year 2 forward. It wasn’t even called the QSR 50, technically. We labeled the report, “America’s Hottest Chains” and essentially broke down the landscape from the top to the “Up and Coming.” To prove how long ago this was, Jersey Mike’s was on that list with 106 stores. Today? There’s 2,100 with systemwide sales north of $2.2 billion. The brand added 246 restaurants in just 2021.

In 1997, Chick-fil-A had sales of $671.95 million—a 17.9 percent jump from the prior year. The company’s stated goal was to hit $1 billion in systemwide sales by the year 2000. Feel old yet? Chick-fil-A crossed $16 billion in 2021. And its unit count has ballooned from 761 to over 2,700. A year later, Panda Express clocked in with $191.4 million in domestic systemwide sales and 269 units. It closed 2021 at $4.45 billion and 2,334 stores, respectively. For the most part, what stands out is the category’s resiliency. But, naturally, there are other sides. Blimpie boasted $300 million and 2,135 locations in 1998. The footprint was a 16.48 percent bump from 1,833. To be candid, I’m not entirely certain how many dot America today, but Mashed pegs the figure at about 156. It’s also interesting to see the inflection Subway stood at. There were 11,540 units after a relatively modest 3.36 percent,

year-over-year, rate. Before an 866-store decline from 2016–2017, Subway added 4,456 restaurants the previous six years combined. The concept finished 2021 with 21,147 U.S. outlets, a net decrease of 3,650 units versus 2019. Even so, it’s still the largest domestic brand by a good distance. Starbucks, at 15,450, is next. Back in 1998, the title belonged to McDonald’s, which had 12,472 U.S. stores and sales of $18.1 billion. It touted 13,438 locations in the U.S. year-end 2021. That sales figure, though, has ballooned to nearly $46 billion.

Let’s circle burgers and pizza. In 1998, the “Big 3” went as follows after McDonald’s: Burger King—sales of $10.241 billion and 7,691 locations; Wendy’s—sales of $5.6 billion and 4,676 units.

Fast forward: BK generates $10.03 billion across 7,105 stores. Wendy’s touts $11.1 billion and 5,938.

And pizza: Pizza Hut in 1998, $4.875B, 8,471; Domino’s $2.6B, 4,475; Little Caesars $1.75B, 3,905; and Papa Johns, $1.2B, 1,879. Current view: Pizza Hut, $5.5B, 6,548; Domino’s $8.6B, 6,560; Little Caesars $4.2B, 4,181; and Papa Johns, $3.45B, 3,164.

I could stare at these comparisons until my eyes twitch. When I first started covering restaurants (the QSR 50 had been going on for nearly 20 years by then), somebody told me I’d enjoy writing about fast food because it’s “the heartbeat of the American consumer.” Want to know what’s going on in the world? See how people are eating. If there’s a more accurate statement in this world, I haven’t found it yet.

Klein, Editorial Director

ROSIE

The QSR 50 turns 25, and we turn back the clock.

ROSENBROCK DANNY@QSRMAGAZINE.COM QSR MAGAZINE

4 AUGUST2022 | QSR | www.qsrmagazine.com EDITOR’S LETTER

Danny

SPRINKLE ON SOME magic

Introducing Dark Chocolate Barista Mini Chips in NEW 5LB. bags. Convenient and versatile, these mini chips deliver decadent chocolate flavor to your most delightful treats—steam with milk for a delicious hot mocha, blend in frappés for an extra chocolatey treat or create a magical topping for ice cream and beverages with just a little sprinkle.

Order FREE samples at 800.877.9338 or professionalproducts@ghirardelli.com

MOCHA SALES WITH GHIRARDELLI ON THE MENU.

©2022 Ghirardelli Chocolate Company

TECHNOMIC GHIRARDELLI BRAND EQUITY RESEARCH, 2020

DOUBLE

PREMIUM CHOCOLATE

Improve Beverage and Dessert Sales on the Takeout Menu

/ BY KARA

Today’s consumers are ordering out in record numbers. According to Datassential, nearly 40 percent of all consumers say they get food delivery at least weekly. Of course, these off-premise restaurant guests also expect their orders to look and taste the same as they would when dining in, which isn’t always easy to provide.

“One of the biggest overarching challenges for operators right now is to find products that actually travel well from point A to point

B,” says Katie Kozlowski, senior product manager for garnishes at Rich Products. “How can you preserve the integrity of your menu item from start to finish, especially now that so many more people are using delivery and ordering takeout?”

If quick-service restaurants include beverage or dessert programs on their takeout menus, these concerns become more

pressing. Most whipped topping, whether it’s used as a staple for upselling or just a basic customer expectation, isn’t capable of withstanding the delivery journey well. Many brands completely disintegrate into their carrier within a few minutes. In the past, operators could be sure most customers would consume their order before this happened. Today, it’s a safe bet that a customer who ordered milkshakes for the family through a third-party delivery app won’t be happy to see a melted mess when the items finally arrive. The same is true of whipped topping used as a garnish on a dessert.

Rich’s On Top® Whipped Topping, however, has proven it can survive long hold times, rough handling, and bumpy roads— whether the beverage or dessert is hot or cold. Rich’s On Top Whipped Topping arrives at its destination fluffy and intact, with Instagrammable appeal, every time. When 92 percent of consumers expect their delivered food to be prepared to the same standards as when they dine in-house, as Datassential has recently found, superior stability is important.

“It’s all about appearance,” Kozlowski says. “If the customers’ expectations are met, the operator will get repeat business. Rich’s On Top drives traffic, interest, and sales in a way that other whipped toppings can’t.”

It carries through to taste, as well. Rich’s On Top Original has a light, creamy flavor with a hint of vanilla. The On Top portfolio also offers a range of other flavors—from authentic cream and sugar-free to chocolate and marshmallow—allowing operators to customize their menus while ensuring product consistency.

“Rich’s On Top gives the customer exactly what they’re looking for,” Kozlowski says. “From the time you first grab the product to when you arrive at home or when it gets delivered to your door, you’re getting a consistent experience.”

This stability also gives operators an opportunity to increase the profitability of their beverage or dessert menus. “Some operators include an upcharge for whipped topping, in situations where it’s more of an add-on than a requirement,” Kozlowski says. “This offers a way for guests to customize their orders, which is a big trend right now. Customers are satisfied with the taste and stability of Rich’s On Top and are willing to pay extra, and operators can enjoy higher margins.”

SPONSORED BY RICH PRODUCTS

RICH PRODUCTS

Off-premises, appearance is (almost) everything.

TO LEARN MORE, VISIT RICHSUSA.COM/ONTOP. 6 AUGUST 2022 | QSR | www.qsrmagazine.com

PHELPS

PICTURE PERFECT, EVERY TIME.

RICH’S ON TOP ® PORTFOLIO

Add sweet, creamy flavor and visual appeal to any on-the-go creation with On Top. Available in a variety of flavors, colors and textures, On Top combines valuable versatility with superior stability to create experiences that will have customers saving your operation to their Favorites in their ordering app.

STAND UP TO EVERY DELIVERY JOURNEY. RICHSUSA.COM/ONTOP

© 2022 Rich Products Corporation

BACK TO RESTAURANTS COFFEE DRINKERS

47%

of lapsed customers say more variety of hot & cold specialty coffees and new brewed coffee options would entice them to increase food and beverage purchases at breakfast.

Whether you’re a quick-service coffee destination or full-service restaurant with a breakfast program, Mother Parkers is here to partner on your tea and coffee needs through:

• Blend & Product Development

• Insights to Drive Growth

• Surety of Supply

Get in touch with us online mother-parkers.com/contact-us to learn how we can help!

Find out more about our coffee and tea programs by visiting us at www.mother-parkers.com

BRINGING

McDonald’s Goes Camping

Retro meets loyalty in the fast-food chain’s summer promotion.

ORDER

IN JULY, McDONALD’S TURNED ITS APP into a summer ticket for fans to access events, deals, and revolving activations. Camp McDonald’s, a month-long virtual experience, featured a lineup of food offers, everything from Big Macs to fries, Chicken McNuggets, and more, menu mixups, merchandise collaborations, and music performances featuring artists such as blackbear, Omar Apollo, BIBI, and Kid Cudi. Customers had to check the app each day for details.

Among the merch launches was a Retro Grimace Pool Float ( pictured) and a “Don’t Trip” Camp McDonald’s Collection from Free & Easy. Menu Hacks showcased fresh spins on classics like the Apple Pie McFlurry (July 6) and a McFlurry Sandwich (July 20).

What says “summer” better than a Grimace pool float?

McDONALD’S Got timely and newsworthy photos?Submit them to ShortOrder@qsrmagazine.com.

www.qsrmagazine.com | QSR | AUGUST 2022 9 SHORT

Th roughout the pandemic bubble, the restaurant industry’s grapple with labor dynamics has hardly let up. The industry added 40,800 jobs in June, bringing the total to 11.9 million. W hile upward, the figure remained about 700,000 jobs below pre-COVID-19 levels.

Like hourly employees, restaurants have seen fluctuations in management-level support. Black Box Intelligence released a report on what it calls the “Moneyball Metric.” Put differently, why the No. 1 driver of performance for restaurants, pandemic conditions and all, is the GM. Here were some findings:

35% OF MANAGERS WERE NOT ENGAGED

● A pre-pandemic employee engagement report suggested 35 percent of managers were not engaged and depart within a year.

● The common culprit: work/life balance— a topic that’s only accentuated under the COVID spotlight.

● In fact, data from February 2022shows turnover for restaurant managers both in limited- and full-service restaurants increased during each quarter in 2021 and reached historically prominent levels.

● Total compensation for the median general manager in alimited-service restaurant increased by 3.7 percentage points between having a great impact on employee retention.

TIPS FROM BLACK BOX:

Managers should be sure to integrate tools and systems that make both front-of-house and back-of-house processes more efficient. Example: a manager working with antiquated print-out spreadsheets and schedules is likely wasting a lot of hours on manual labor, and today’s tech-savvy employees likely have a harder time navigating such.

Invest in online scheduling, inventory, and payment systems that save time for management and are easy to use for floor staff.

Ensure the team is properly staffed with multiple managers covering different aspects of the business. That way if one is burned out, you’re not left floundering. This also provides the opportunity for more intimate relationships with team members.

Many employees enjoy giving or receiving mentorships in their careers and the more levels of support available, the better.

ADOBE STOCK (2), MANAGER TALKING WITH CHEF: JACOB AMMENTORP LUND, CAFE MANAGER: 1001COLOR

IT’S A SAYING AS OLD AS HOSPITALIT Y: “Want to see a great restaurant? I’ll show you a great GM.”

10 AUGUST2022 | QSR | www.qsrmagazine.com SHORT ORDER

NEW YORK DETROIT CHICAGO

NO MATTER WHERE YOU’RE FR

Mike’s Hot Honey started out of a pizzeria in Brooklyn 11 y creating a whole new category of pizza topping that has been c changer by pizza fans and spawned best-selling menu items nationwide. Request a sample today to see what all the buz

mikeshothoney.com/sample

Ellianos Turned $100 into a Multi-Million Dollar Coffee Franchise

Brand seeks franchisees with fuel to grow.

Inspirational stories of how restaurant brands came to be abound in the foodservice industry, but Ellianos Coffee may have one of the most unique. Though the drive-thru coffee franchise now boasts multimillion dollar sales, with 23 locations open and over 80 more in development, it all started with just $100.

The Ellianos story began over 40 years ago when now-Ellianos-president and founder Scott Stewart received a $100 savings bond gifted to him by his grandmother. Inspired by a trip to the Pacific Northwest in the early 2000s, Stewart and his wife Pam returned home to Lake City, Florida, and decided to take that savings bond he had received 20 years prior and turn it into a coffee chain focused on serving “Italian Quality at America’s Pace.”

Having owned several of his own businesses, combined with his experience as a franchisee with a major national pizza chain, Stewart knew the ins and outs of the foodservice business. Thanks to his industry knowledge, the brand’s dedication to thoughtful growth, and its emphasis on hiring the right people, Ellianos is now a steadily growing chain. Yet while the brand is seeking new franchisees, the company hasn’t lost sight of its roots and is committed to maintaining the same thoughtful growth plans it has since its inception.

“We don’t want to grow just to grow; we want to grow the right way,” Stewart says. “My wife and I said 20 years ago that we’re going to do it right and take our time. We started that journey and built the framework, and while we want to expand, we’re prioritizing strong growth over just growing for the sake of growing.”

Rather than setting aggressive growth targets like other brands, the Ellianos team is committed to finding the right people first.

“More than past experience, we’re looking for genuine people with the right kind of fuel,” Stewart says. “We always start by asking people why they want to franchise. Some people’s fuel is helping others, to be busy, to make a difference, to feel successful, to take care of their family—this is all good fuel. Bad fuel is jealousy, pride, or arrogance. We don’t want people who just want to make money at all costs. Past experience is helpful, and the financial ability to get a loan and have enough equity is important, but it really all comes down to fuel.”

When a person has the right fuel, Stewart says, the goal is to find their passions and get out of their way so they can develop new skills

and take on new challenges while still offering support programs to help them in their journey. These strong support programs have, in part, resulted in very satisfied franchisees. In fact, in a recent survey of Ellianos’ franchisees conducted by a third party, over 90 percent said they would recommend franchising with the brand to a friend.

The second most important factor for a potential Ellianos franchisee is location. Though the brand has received interest from potential investors across the country, the coffee chain’s leadership team is committed to offering each of its franchisees one-on-one support, including in-person assistance. This means a new territory must be close enough to be supported by the existing Ellianos network, and potential franchisees must live close enough to their proposed stores to offer their own support to store staff.

Greg Pruitt, vice president of marketing at Ellianos, says the right franchisee is also community-oriented.

“We want to pick the right franchisees in the right locations,” Pruitt says. “A lot of our franchisees are very involved in their stores. In every organization, employees look from the top down to understand a brand’s goals and priorities. When you have friendly bosses who are enjoying work, you also have happy employees. We want to be a light in each community and help that community feel like they’ve got something special.”

-By Peggy Carouthers

To learn more, visit ellianos.com.

SPONSORED BY ELLIANOS COFFEE ELLIANOS COFFEE

12 AUGUST 2022 | QSR | www.qsrmagazine.com

COMPETE WITH COFFEE AND TEA

In today's environment, foodservice operators are facing ongoing challenges like inflation, labor shortages, r and supply chain issues - just to name a few According to Cleveland Research Company in their recent r “State of the Foodservice Industry" webinar, research shows that despite inflation, consumer demand for restaurants looks to remain strong and the outlook for dining r out is optimistic. However, with growing competition to win consumer loyalty, r how do you ensure you're standing t?

By providing a full-scale, top-quality coffee and tea program, you are laying the foundation to greatly enhance your food r offerings! By upgrading your coffee r and tea programs, your establishment r can become a destination for hot and iced coffee and tea all day long!

wmf-coffeemachines.com • schaererusa.com • wilburcurtis.com

freshideas

Cold Coffee Gets Hot

BY AMANDA BALTAZAR

BY AMANDA BALTAZAR

Servings of cold brew coffee ordered at quick-service restaurants climbed 27 percent in the 12 months ending April 2022, year-over-year, according to The NPD Group/CREST.

That equated to 373 million servings, which is no small figure. Servings of frozen/slushy coffee from quick-serves during the same stretch jumped 3 percent to 726 million, showing customers are open to cold coffee in myriad formats.

However, iced coffee remained the cold leader, as customers ordered 2.8 billion servings in the calendar up to April, up 11 percent from the year prior.

Roughly 70 percent of all sales at The Coffee Bean & Tea Leaf are cold coffee and cold tea. Sanjiv Razdan, president, Americas

and India, attributes it to several factors:

First, the consumption of coffee shop beverages has moved away from first thing in the morning “and become a pick-me-up treat, a recharge beverage that people consume across the day,” he says.

“As that daypart consumption has changed, people use the beverage very differently. Cold is more versatile and tends to be more suitable for various dayparts up until late evening.”

Secondly, the quality of these cold drinks has improved as consumers’ became more sophisticated. “There’s an appreciation for the craftsmanship that goes into these drinks,” Razdan says. And finally, cold beverages fit snuggly into the off-premises trend that

DUTCH BROS.

Dutch Bros. is using its loyalty base to promote cold offerings, but the message is getting out through word-of-mouth as well.

| COLD COFFEE |

Customers of all demographics are changing how— and when—they drink the habitual classic.

www.qsrmagazine.com | QSR | AUGUST 2022 15

MULTI-UNIT FRANCHISE OPPORTUNITIES

ACQUIRE EXISTING LOCATIONS

INVEST IN MODERN, FRESH FORWARD RESTAURANT DESIGNS REMODELS, RELOCATIONS, AND NEW RESTAURANTS

LEVERAGE MULTIPLE REVENUE STREAMS

ENGAGE WITH NEW BRAND LEADERSHIP FOCUSED ON DRIVING FRANCHISEE PROFITABILITY

GROW YOUR PORTFOLIO WITH US

S

*COMPARED TO 2019

boomed amid COVID-19 conditions.

More than 58 percent of Bad Ass Coffee’s business fits into the cold bill, which includes everything from cold brew to smoothies and blended drinks, with iced lattes being the hands-down top category. Bad Ass Coffee has 22 stores with eight under construction.

Cold drinks constitute 70–80 percent of sales At Dutch Bros. as well. “Cold travels better and more of our drinks are traveling with us as opposed to being enjoyed in the moment,” CMO John Graham says.

Innovation and LTOs

To succeed in cold beverages, it’s vital coffee shops innovate and continue to create excitement in this category.

Coffee Bean & Tea Leaf launched a summer LTO with three cold brew teas: watermelon mint; peach jasmine; and mango caramel. Previously, the brand focused innovation on lattes and iced drinks but switched to cold brew this year, Razdan says.

The brand also embraced decadence with its Belgian Chocolate Ice Blended Drink.

To generate engagement, Coffee Bean & Tea Leaf launches these beverages as LTOs, but adds them to the permanent menu if they do well. But limited runs really drive sales, he says. “We’re a society driven by the fear of missing out and we want to try new things and be the first to try something that our favorite brands are bringing to us,” Razdan says. “We create that buzz and it plays for us very well.”

Bad Ass’ summer LTOs included Beach Bonfire Latte (iced, frozen, or hot): espresso and milk with macadamia nut, toasted marshmallow, and dark chocolate swirl syrups; and Beach Bonfire Cold Lava Cold Brew: Hawaiian blend cold brew, macadamia nut syrup, and toasted marshmallow cold lava (cold lava is cold foam made with milk and syrup).

It’s essential to stay ahead of trends, CEO Scott Snyder says, because guests love customizing drinks. “Brands are listening and creating more and more innovation,” he says. “We have tea, coffee, cold brew, smoothies, and we use those as base elements and then listen to what our customers want. When you see a trend, you see innovation.”

Universal appeal

While customers of all walks are enjoying cold drinks, they do tend to skew more toward younger demographics, Razdan says, and are also proving an option for the much younger crowd—the tweens and teens who don’t yet drink caffeine but want a drink when their parents go to a coffee shop.

Younger consumers have grown up with coffee shops, Snyder adds. So they’re accustomed to ordering blended, non-alcoholic

drinks before they were adults, and are now comfortable with these options.

While hot beverages remain popular in the mornings, the customer who buys that often comes back in the afternoon for something cold, he says. “What we really see, especially with that younger demographic, is that afternoon bounce-back with a cold brew product,” Snyder says. “The cold brew packs quite a punch so you can make it straight up or with cream or flavors and it can be both a treat and a pick-meup. We see a bigger influx [of these] in the afternoon.”

Chilled out marketing

While Coffee Bean & Tea Leaf uses store menuboards and social media to promote cold drinks, especially new ones, the loyalty program is also great for this purpose. The concept sends members customized messages based on what they’ve previously drunk.

Bad Ass Coffee promotes its cold coffees with in-store tactics including posters, table cards, and menu highlights, as well as online marketing with geotargeted ads. Social media is exploding, too.

But most important is loyalty, Synder says. “It gives great access to the customers who are our best customers, who are also our best word-of-mouth and influencers,” he says.

Dutch Bros.’ loyalty base is also a great tool for promoting cold coffees.

“Our first stop in anything we do is our rewards program,” Graham says. “We back that up on the social side with text and email programs. We have a great customer data program and talk to customers the way they want.”

The future

Cold beverages aren’t going anywhere, Razdan notes. “We’ll see significant growth of cold brew teas and coffees with their more delicate flavor, more nuances. Cold is here to stay but the name of the game is innovation,” he says.

Synder echoes the thought. “The younger audience who grew up in these stores are creating that same family experience now with their kids,” he says.

“Diversity and creativity in your menu is also what customers are looking for. Everyone gets excited when there’s something new. By the same token hot isn’t going away; it’s where this all started.

“But I do believe that cold as the dominant percentage is here to stay,” Synder adds. q

DUTCH BROS., COFFEE BEAN & TEA LEAF

Amanda Baltazar is a regular contributor to Food News Media and is based in Washington.

www.qsrmagazine.com | QSR | AUGUST 2022 17 fresh ideas | COLD COFFEE |

THROUGH THE DRIVE-THRU, VIA MOBILE, OR IN-STORE, COLD DRINKS FIT THE INNOVATION BILL.

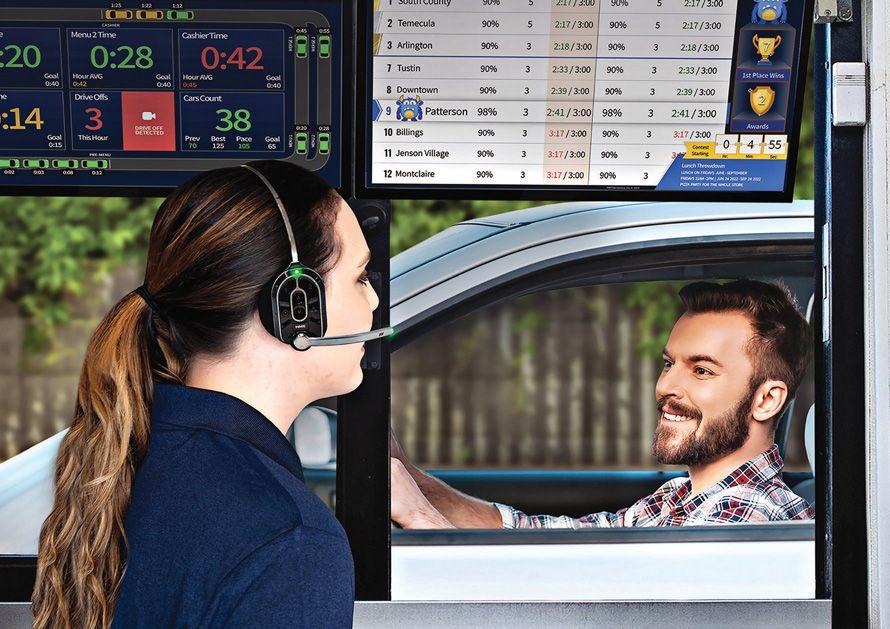

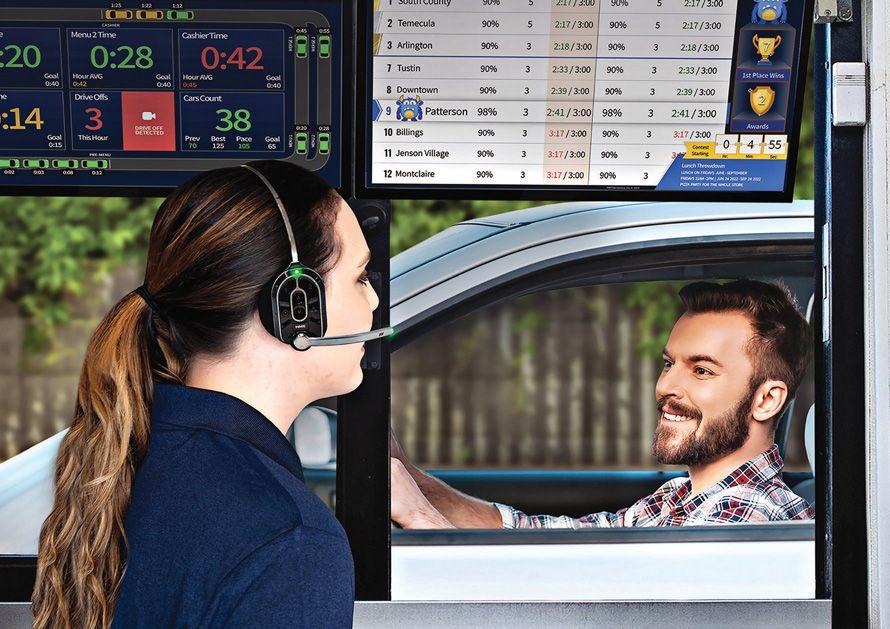

How Actionable Insights and Improved

he NPD Group recently reported drive-thru sales grew by 20 percent between February 2020 and February 2022. Digital ordering has also picked up in a big way, with the NPD Group reporting an increase of 117 percent since February 2020. That figure includes curbside pickup and other digital orders that are picked up at the drive-thru window, and is yet another reason why drive thrus are busier than ever before.

The growth in these areas have been a blessing and a curse for the industry. More revenue is always good, of course, especially as labor and food costs spike. But the challenges of integrating new ordering and pick-up channels, with the backdrop of an industry-wide labor crisis, means restaurant efficiency is a critically important challenge.

“Restaurants are severely understaffed,” says Scott Mullica, director of product management with HME Hospitality and Specialty Communications. “Managers are working six days a week, and operators are extending crews across multiple locations. But these temporary solutions are increasing employee burnout instead of alleviating pressure.”

Fortunately, there are tech solutions that can help maximize restaurant and employee efficiency. For example, HME Hospitality and Specialty Communications’ new NEXEO | HDX Crew Communication Platform integrates with the HME ZOOM Nitro Timer with video detection to enhance drive-thru efficiency. The platforms’ integration empowers restaurants with actionable insights delivered to the right person at the right time. Key staff members can receive headset alerts when it matters most, like each time a car arrives in a curbside pickup space in the parking lot, enabling your team to better serve guests across all order pickup locations.

“Actionable data and greater insights help managers make better

decisions in real time,” Mullica says. “ZOOM Nitro alerts to your NEXEO | HDX headset enhances awareness to key areas of your operation—the drive thru, mobile orders, and curbside—enabling your team to improve performance on the spot.”

The cloud-connected NEXEO | HDX platform has other competitive advantages that make it better suited for modern off-premises sales, too. Because of its multiple channels, the platform enables dedicated communication for outside order takers, mobile order groups, and more. Team members can use hands-free voice commands to perform certain tasks, such as connecting to a mobile order group channel. HME CLOUD connectivity also keeps NEXEO | HDX upto-date and prepared for the future of the industry. Plus, the system is ready to integrate with voice-AI providers.

“NEXEO | HDX is the total communication platform that is best suited to drive increased efficiency in your restaurant as your business grows,” Mullica says. “This platform provides more communication options and flexibility than other systems currently available and can grow with your business and its future needs.

For more on HME’s NEXEO | HDX, visit hme.com/nexeo.

SPONSORED BY HME HOSPITALITY AND SPECIALTY COMMUNICATIONS

HME HOSPITALITY AND SPECIALTY COMMUNICATIONS

With drive-thru business up 20 percent, greater efficiency is necessary.

18 AUGUST 2022 | QSR | www.qsrmagazine.com

/BY CHARLIE POGACAR

The Total Solution for Restaurant Communication 866.577.6721 | www.hme.com/nexeo © 2022 HM Electronics, Inc. The HME logo and product names are registered trademarks of HM Electronics, Inc. All rights reserved. NEXEO | HDX TM integrates with ZOOM Nitro® Timer to deliver actionable insights to key staff when it matters most. Maximize efficiency and stay on top of your operation’s performance even as you move around the restaurant. Notifications from ZOOM Nitro to the right employee’s headset provide critical information that enables immediate action and helps you improve performance on the spot. Actionable Insights to the Right Person at the Right Time FINALLY! Integration Between Drive-Thru Headset and Timer. 0:20 Menu 1 Time 70 Prev 0:42 Hour AVG 0:40 Goal 0:14 3 Service TimeDrive Offs 0:12 Hour AVG This Hour 0:15 Goal 0:28 Menu 2 Time 0:42 Hour AVG 0:40 Goal Casher Car 0:45 Hour DRIVE OFF DETECTED PRE-MENU CASHIER SERVICE HMEats’ #4321 620 200PM 00PM JUNE23 S Y DAYPART- 3 S CK S T- 2 COS G 200PM 800PM 1:25 1:22 1:12 1:42 0:12 0:08 0:03 0:02 0 e s r 5 u MENU 1 U ENU EN MEN N E M 2 MERGE 1 E RGE MERGE GE ERGE G RG MERG ME ERG R M 2 4:46:20 2:00 PM 5:00 PM JUNE 23 WEDNES ES A SDAY DA DAYPARTSNACK SHIFTCLOSING 12:00 PM 8:00 PM 0 0: 0:20 :20 20 0:28 :228 0 0::55 5 55 5 0:45 “Drive

” “Drive-thru

*requires ZOOM Nitro with video detection.

mobile order is waiting.”

off has occurred.*

danger zone alert.* ”

“Pull-forward

time has been exceeded.”

“A

Sarpino’s Pizzeria

BY BEN COLEY

way from pizza to pasta and tiramisu. And it’s all fresh.”

Nelowet was brought on in September 2021 to make sure the Chicago-based Sarpino’s is no longer a secret, both to operators, and by extension, consumers. The delivery/ takeout focused pizzeria entered the U.S. in 2002 and has since expanded to roughly 45 locations in Georgia, Iowa, Missouri, Texas, Florida, Minnesota, and Illinois. Sarpino’s USA acquired domestic franchising rights in 2005, and has been in charge of growth ever since. For the first time, the fast casual is moving forward with a national franchising push.

Sarpino’s USA president David Chatkin, who’s been with the brand for 20 years, feels the timing for expansion made sense, given how strongly the pizza chain’s operational model performed during the rush toward convenience. Sarpino’s has experienced double-digit increases in sales in the past few years, and systemwide AUV is almost $1.1 million.

FOUNDER: David Chatkin, CEO

HEADQUARTERS: Chicago

YEAR STARTED: 2005

ANNUAL SALES: 2021 U.S. system-wide sales of $45,988,768

TOTAL UNITS: 45

FRANCHISED UNITS: 45

SCOTT NELOWET, DIRECTOR OF FRANCHISE DEVEL opment for Sarpino’s Pizzeria, has been with the fast casual for less than a year. In that time, he quickly learned the key to reeling in prospective operators—the expansive Italian menu.

The brand boasts more than 60 specialty and gourmet pizzas. There’s also roughly 20

calzones and sandwiches each, 11 salads, 12 pastas, five bone-in wing flavors, and a variety of appetizers. Among those choices are several vegan options. All selections aren’t available at every restaurant, but the variety is still unmatched by most in the quick-service pizza segment, and Nelowet knows this.

“[Sarpino’s] hasn’t spent a lot of time doing press and conversations like this,” Nelowet says. “And so, when I’m talking to people, a lot of them have never tasted the product before. And what’s great about Sarpino’s for me is that’s the least of my worries. I know that once I move into the franchise process, I worry about all their stuff. I don’t have to worry about the food at the end of the day. We’ll sit them down, they’ll taste it. It’s a home run every time because they’ve got the full Italian restaurant menu all the

The brand’s expansion plan targets markets where it’s already having great success, including Florida and Kansas City, Missouri, where stores are making $1.3 million per year. Illinois, Colorado, Kansas, and the Southeast are under consideration, as well.

“We’ve been through COVID times for a couple of years,” Chatkin says. “It was a time of unknown. But we went out of this time much stronger than we used to be before COVID, and we see some good progress in the several states we are in, and we were able to prepare and build a franchising process internally. We’ve specialized in delivery for the last 20 years and after COVID time, it’s a good business to be in.”

In addition to the menu, Nelowet believes operators will be most attracted to Sarpino’s technological infrastructure.

In the back of house, there’s a monitor installed at every work-

SARPINO’S PIZZERIA (2)

A bevy of offerings is drawing in guests, old and new, and prospective operators, as well.

DEPARTMENT ONES TO WATCH CONTINUED ON PAGE 102 20 AUGUST2022 | QSR | www.qsrmagazine.com

1 2 3 4

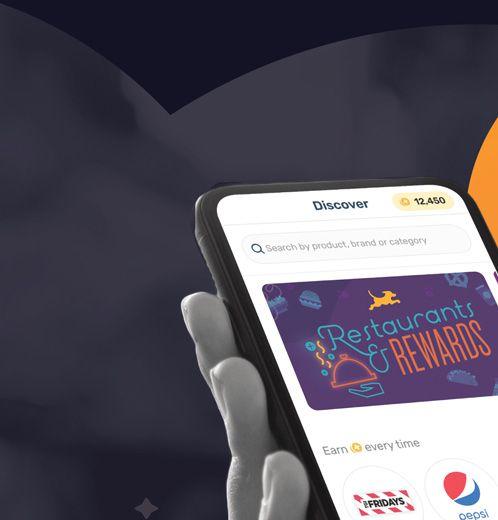

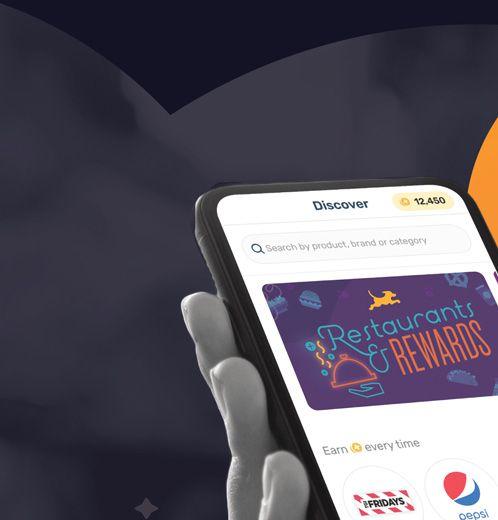

How Brands Are Enhancing CRM Data In Order to Target Customer Segments

With inflation affecting both consumers and businesses, this solution offers a win-win.

brands visibility into purchasing behavior, including on cash transactions, and allows brands to market directly toward customers.

Best of all, says Lindsay Eichten, head of CRM and loyalty at TGI Fridays, restaurants only pay for results. It’s why many of the leading brands are turning to Fetch Rewards.

“Fetch Rewards caught my eye with its commitment to pay-for-performance, hypertargeted customer opportunities,” Eichten says. “I didn’t have to just believe it from the sales pitch, I could actually evaluate for myself how a small investment could work hard for the TGI Fridays brand to deliver incremental value to our guests in a tough macro-economic environment.”

Customer relationship management (crm) software has traditionally offered restaurant brands insights into consumer behavior that can assist in running targeted marketing campaigns. But the practice of doing so has become increasingly challenging as the largest tech brands move to enhance privacy.

“The shift in the digital landscape toward privacy is in line with consumer demand, but it also means advertisements are becoming less effective,” says Phil Quackenboss, vice president of restaurants at Fetch Rewards. “It’s also more difficult to track ROI, because you may no longer have the ability to measure incremental behaviors that are driven by each campaign.”

On top of this, surging inflation means both restaurant brands and consumers are strapped for cash. That means that even if restaurant brands have a CRM, they have an uphill battle on multiple fronts in reaching and convincing customers that they should come dine out.

In many ways, Fetch Rewards was made

for this moment. Co-founded in 2013 by thencollege student and current Fetch Rewards CEO Wes Schroll, the company’s mission is to build customer loyalty while creating a win-win for the customer and brand alike. Fetch Rewards has since grown into the largest consumer rewards app in the U.S. with more than 15 million active users.

Here’s how it works: Users snap restaurant receipts in the app, building up loyalty points that translate into rewards. Restaurants gain actionable first-party insights that have the ability to enhance CRM data with no impact on unit economics. Customers pay full price for each purchase, and there are no changes required for in-store operations. Fetch offers restaurant

The investment has paid huge dividends for TGI Fridays. Eichten reports that she had high expectations for performance, but Fetch has exceeded her KPIs, “driving incremental sales lift.” The app has driven repeat visits from TGI Fridays’ loyal following, while also creating “new and engaged Fridays customers who can now double dip into Fridays Rewards to earn points from both platforms and maximize values from constrained wallets.”

Eichten says Fetch has become like an extension of her marketing team, helping bring data and insights to the challenge of connecting with a customer base dealing with the same inflation that is affecting restaurant brands. “The macro-economy factors will continue to be steep to overcome,” Eichten says. “Fetch is a waste-less, highly-effective, comprehensive app experience that supports the TGI Fridays brand goals while serving our guests additional value.”

SPONSORED BY FETCH REWARDS

ADOBE STOCK MILENKO ÐILA

For more on Fetch Rewards, visit partners.fetchrewards.com/qsr.

/BY CHARLIE POGACAR

22 AUGUST 2022 | QSR | www.qsrmagazine.com

“The shift in the digital landscape toward privacy is in line with consumer demand, but it also means advertisements are becoming less effective.”

15 MILLION engaged Discover how Fetch can help your QSR brand stand out and go further. OVER in captured annualized retail sales $120B With Fetch, your restaurant brand can billions GENERATE PRECISELY TARGETED OFFERS

COMMUNICATIONS PAY FOR OUTCOMES, NOT IMPRESSIONS USE FIRST-PARTY DATA TO UNDERSTAND CUSTOMERS Download America’s

CUSTOMIZE

Diversity from the Top Down

BY HILARY DANINHIRSCH

and measurable steps.”

Some of these steps she sees brands take include mentoring, recruitment, and programs specifically aimed at increase diversity.

“I think it’s almost like vision statements and core values. Everyone has them, but for a lot of brands, they sat in the drawer and were never referenced; that is where diversity was. Now, we’ve taken everything out of the drawers and put it on the walls and are focusing on it as an industry,” adds Gagnon, who is also the chair of the International Franchise Association’s Women’s Franchise Committee.

Traditionally, some of the obstacles to becoming a franchise owner was the startup capital, which could be cost-prohibitive to many potential business owners, as well as the educational opportunities and skills required. That is why some companies are taking proactive measures to break down barriers, many of which disproportionately affected minorities.

Diversity in the workplace is a goal for many restaurant franchisors, as the benefits are numerous, from attracting more talent to being better able to serve its customers to an improved bottom line.

The U.S. Census Bureau reported franchise businesses were more likely to be owned by minorities than non-franchised businesses. Specifically, just over 30 percent are minority-owned, compared to 18.8 percent of non-franchised ones. The good news is there has been a steady and significant increase in the minority and female ownership rate across the sector, but there is still work to be done.

Robin Gagnon is the co-founder and CEO of We Sell Restaurants, a company specializing in business brokerage specifically for the restaurant industry. Gagnon said for the first time in more than two decades, there is a real push to address the diversity issue rather than it just being a discussion point. “Now, it’s absolutely on everyone’s radar; everyone is discussing how we can embrace a platform of diversity to make us stronger as a company and how we can appropriately reflect the audience around us,” she says. “The main thing is this incredible focus, and with focus, comes specific

To be a successful entrepreneur, you also need a social network. “The IFA found that entrepreneurs of color have smaller and less connected networks. Also, there is discrimination: unconscious bias that these entrepreneurs are facing,” says Abigail Pringle, president of international and chief development officer with Wendy’s.

These capital, educational, and social gaps are gradually being recognized and rectified through various initiatives across the industry.

In January, Yum! Brands, a Louisville, Kentucky, company with more than 52,000 restaurants including KFC, Pizza Hut, Habit Burger, and Taco Bell, initiated the Yum! Franchise Accelerator, a fellowship designed to advance underrepresented people of color and women interested in the industry. “This is an important part of the Yum! Brands ‘Unlocking Opportunity’ initiative announced last year. The initiative knocks down current barriers to entry such as lack of franchising education, knowing the right key franchising contacts at a brand or in the industry, and access to capital,” says Wanda Williams, Yum!’s head of global franchising.

“One of the gaps we have identified in terms of opportunity for success among some franchisees is education, so we are taking steps to make this education widely available to students and franchise professionals worldwide through the Yum!

TACO BELL

Taco Bell has continued to invest in employee education, inside and outside restaurants.

Franchising can prove a powerful vehicle for restaurants to create career opportunities.

DEPARTMENT FRANCHISE FORWARD CONTINUED ON PAGE 102 24 AUGUST2022 | QSR | www.qsrmagazine.com

TECHNOLOGY & INNOVATION THAT DRIVES THE OM • A compelling growth opportunity fromap brand with plenty of white space to ep affordably with efficient buildings, sm strong growth incentives • A proven concept with strong return investment and competitive growth ice to grow your portfolio • Metrics-driven management style imp profitability by developing efficiencies the business model Visit owncheck QSR or Call 8889139135 ©2022 Checkers Drive-In Restaurants, Inc. 4300 W. Cypress St., Suite 710, Tampa, FL 33607. 1. Checkers & Rally’s 2020 Franchise Disclosure Document (FDD). Written substantiation will be provided on request. This advertisement is not intended as an offer to sell, or the solicitation of an offer to buy, a franchise. It is for information purposes only. The franchisor, Checkers Drive-In Restaurants, Inc. is located at 4300 West Cypress Street, Suite 600, Tampa, Florida 33607, and is registered as file number F-4351 in the state of Minnesota. In New York, an offering can only be made by a prospectus filed first with the Department of Law, and such filing does not constitute approval by that Department. 20220300 H E BOTTO M LI N E om a proven national expand and grow maller footprint s and on incentives mproves es across EVOLUTION OF EXPERIENCE THE CHECKERS & RALLY’S

YEAR 1 OF COVID-19 WAS DEFINED BY DIVERGENT REALITIES.

Quick-service outlets fared far better than competitors. Once the initial wave of uncertainty passed (was it even safe to get food at the drive-thru?), the sector’s long-standing strength outside its four walls crystalized. Not only that, however, but the agility and innovation that’s always defined the category. And now? You could argue quick service, especially drivethru, has become the hottest retail ticket in town. As this year’s QSR 50 shows, many concepts aren’t recalibrating in the wake of the pandemic; they’re rocketing upward. Major growth prospects—at times in the fourdigit realm—are on the table for fast casuals and fast-food icons alike.

But the coast isn’t free of obstacles. This past year provided frequent hurdles, from Omicron to a continued labor battle that’s stretching well past the crisis. Buzzing topics like robotics, AI, automation, and integration, have popped up in response and handed operators more threads to connect with guests than ever. And in the end, we might just be headed for a golden era of quickservice growth unlike anything we’ve seen in decades.

/ BY DANNY KLEIN & BEN COLEY

McDonald’s

The top-earner in fast food rewrote its own record book in 2021. McDonald’s systemwide sales bumped 21 percent to more than $112 billion—a new high mark in company history. Domestically, McDonald’s samestore sales climbed 13.8 percent against a 0.4 percent lap in 2020. This, too, raised the bar; it signaled the highest-recorded comps performance since McDonald’s began reporting the metric in 1993 (and the seventh consecutive calendar of positive U.S. same-store sales)

Naturally, the top-line burst worked through the franchise system, which comprises roughly 95 percent of McDonald’s domestic base. Operators posted recordsnapping cash flow, with average growth of $125,000 per restaurant. The end result: North of $500,000, or a 50 percent increase over the past three years. Additionally, McDonald’s posted unprecedented operating income of more than $10 billion.

How McDonald’s got there was a familiar tale for restaurants a year removed from COVID’s initial assault on routines. The chain’s same-store sales benefited largely from average check growth as pricing rose about 6 percent (this number was 8 percent

1

P.62 ADOBE STOCK WOLTERKE 26 AUGUST2022 | QSR | www.qsrmagazine.com

* & JUMP STRAIGHT TO THE CHARTS P.50 WHY 2021 WAS A MIXED BLESSING FOR QSR 50 BRANDS

higher in Q1 2022 versus the prior year). Traffic remained on pace with 2019, for the most part, with monthly dining visits rising 2.1, 3.8, and 1.1 percent in August, October, and December, respectively, according to mobile location analytics platform Placer.ai.

While in-store guest counts continue to adjust, McDonald’s digital sales surpassed $18 billion—also a record—and mixed more than 35 percent of its top six markets. In some, digital accounts for more than 50 percent of sales, like China and France. The single-biggest driver of digital adoption was MyMcDonald’s Rewards, which launched nationally in July. It lifted to more than 30 million loyalty members by year’s end, including 21 million active users. To date, the program has boosted frequency among members by more than 10 percent.

To start fiscal 2022, in those six markets, digital sales (mobile app, kiosks, delivery) accounted for more than 30 percent of systemwide sales. That equates to nearly 60 percent year-year-over expansion. In the U.S., McDonald’s generated over $2 billion in digital sales in just Q1 2022.

Delivery also ballooned to more than 33,000 restaurants in 100 countries. CEO Chris Kempczinski said in April McDelivery is now the largest quick-service delivery program in the world. Direct delivery is coming to the brand’s U.S. app later in the year.

McDonald’s, which in 2022 held its first worldwide convention in four years, ended 2021 with 13,443 domestic locations, a net decline of 239 stores. Globally, there were a tick more than 40,000 following net growth of 838 (China expanded by 608 units, the most of any country).

To sum up an eventful calendar, Kempczinski noted, “It’s clear there has never been a better time to be a part of brand McDonald’s than right now.”

Starbucks

Speaking of jam-packed years, few chains in quick service are undergoing as many changes as the java giant. It’s a conversation that starts at the top. In March 2022, Starbucks announced president and CEO Kevin Johnson’s plans to retire. Stepping into the interim role was none other than founder Howard Schultz, who previously served as CEO from 2008–2017 and 1985–2000 and as president from 2008–2015 and 1985–1994. In that wide stretch, Starbucks scaled from an 11-store brand with 100 employees to more than 28,000 locations in 77 countries.

And Schultz had no shortage of tasks ahead. He took a base salary of $1 and began tackling a topic Starbucks hadn’t quite faced before. The brand suddenly had more demand on its hands than it could serve to standard, which, from a certain angle, is a decent problem to have. But nonetheless, a rather expensive one to fix. As Schultz put it in May: “Simply said, we do not, today, have the adequate capacity to meet the growing demand for Starbucks coffees.”

Schultz credited COVID and the brand’s diverted focus to navigating the crisis. In turn, disruptions interfered with Starbucks’ ability to anticipate and invest ahead of the market. It didn’t adjust store designs, operations, infrastructure, or tech to service that “relentless demand.”

Perhaps the most publicized corner of this concerns

2

www.qsrmagazine.com | QSR | AUGUST 2022 27 QSR 50

DINE-IN RETURNED TO McDONALD’S, BUT ITS DIGITAL SALES ARE REWRITING THE RECORD BOOKS, UP TO $18 BILLION IN 2021. McDONALD’S, STARBUCKS MATT GLAC

labor and an ongoing union conflict. Organizing had spread to at least 150 locations by mid-summer.

In Q2 2022, Starbucks announced it would spend more than $200 incremental this year to investments already committed at domestic corporate stores. The total yearly bill: about $1 billion, with much of it going toward training, wage, and equipment updates intended to improve the company’s proposition, make jobs easier and more enjoyable, and yes, more lucrative.

Starbucks moved all U.S. employees to a $15 per hour floor on August 1. It then layered in incremental increases for domestic store workers. Average hourly pay at Starbucks hit nearly $17 per hour nationally, with every employee hired on or before May 2 getting either a 3 percent raise or $15 per hour (whichever was higher) Employees with two to five years of tenure got a 5 percent bump and those with five-plus years received a 7 percent hike. Starbucks doubled investments in store manager, assistant store manager, and shift manager pay for leaders hired on or before May 2.

Training for baristas jumped from 23 to 40 hours and Starbucks redesigned its “First Sip” training program alongside a fresh shift supervisor program as well. Training is no small point for Starbucks, as 70 percent of hourly employees were new to the brand last year.

Also notable: this suite of updates did not extend to stores mired in union activity.

Back on demand, Schultz wasn’t overstating. Starbucks’ mobile order and pay, a more than $4 billion business, is up 400 percent over five years (20 percent above 2021) and now mixes 70-plus percent of the chain’s U.S. store volume. The company’s $500 million delivery segment hiked 30 percent, year-over-year. Starbucks’ Card program, which boasts usage of about 120 million people, is alone larger than the entire gift card category. Starbucks’ consumers prepaid for $11 billion worth of purchases last year. Today, there’s north of $1 billion loaded on Starbucks Cards that hasn’t been redeemed. And the company’s rewards base in the U.S. last quarter lifted 17 percent over Q2 2021 to 27 million members. Rewards members delivered 54 percent of revenue— the highest level of engagement on record for Starbucks, and 2 percentage points up from last year. Handcrafted cold beverages now comprise roughly 80 percent of sales.

Going forward, Starbucks said 90 percent of new store growth will feature drive-thrus. And this coming fleet will integrate fresh store designs and technology, including more handheld devices and equipment improvements to boost throughput. Essentially, the line-busting tablets you see at an increasing number of brands coming out of COVID.

Drive-thru, mobile order and pay, and delivery col-

lectively totaled 75 percent of U.S. company-operated sales in Q2.

Across 2021, Starbucks’ Q4 global revenue reached $8.1 billion—22 percent higher than last year. The quarterly record closed out a fiscal-year best $29.1 billion.

“What we have to do is harness the issues that we have to deal with in terms of capacity, exceeding the expectations of our people,” Schultz said in May. “I’ve been here long enough to understand what the challenges are and long enough to understand the extraordinary opportunity Starbucks has in the marketplace domestically and around the world.”

Chick-fil-A

Anecdotes of packed Chick-fil-A drive-thrus (yet still efficient) were easy to find throughout the pandemic. So telling somebody the brand surged out of lockdowns doesn’t feel like some grand news leak. But just how high Chick-fil-A reached was eye-opening. Diving deeper into Chick-fil-A’s financials, of the brand’s 1,836 U.S. freestanding restaurants outside of malls (those open and operated for at least a full calendar year, from a total of 2,023), average annual sales volumes clocked in at $8.142 million last year, with 849 of those, or 46 percent, producing figures at or above. One operator pushed $17.16 million. Roughly 35 percent of the pool generated annual sales volumes under $7.2 million; 34 percent between $7.2 and $9 million; and 31 percent above $9 million.

Chick-fil-A’s AUV was also nearly 15 percent better than its 2020 result. So the brand’s upward mobility is clearly a long-term trend, not one born from the drivethru, COVID era.

Even mall stores (no drive-thru) generated AUVs of $3.2 million last year, nearly that of McDonald’s ($3.42M)

3

CHICK-FIL-A’S PACKED DRIVETHRUS WERE ANYTHING BUT A MIRAGE IN 2021: AUVs TOPPED $8M AT FREESTANDING LOCATIONS.

STARBUCKS / CONNOR SURDI (2), CHICK-FIL-A (3); TEA: ALI HARPER 28 AUGUST 2022 | QSR | www.qsrmagazine.com QSR 50

STARBUCKS PLANS TO SPEND UPWARD OF $1 BILLION THIS YEAR TO BOOST TRAINING, TECH, AND THE EMPLOYEE PROPOSITION.

The numbers don’t trail off. Chick-fil-A grew by 155 locations stateside in 2021. Revenue climbed to $5.8 billion, well ahead of the $4.3 billion it appreciated in 2020 and $3.8 billion the year prior. Comprehensive earnings of $1.198 billion sailed $715.9 million ($647 million in 2019). Systemwide sales over the past three years lifted from $12.2 to $13.7 to $16.7 billion.

Amid this boom, Chick-fil-A also underwent a change of leadership. Chick-fil-A executive Dan T. Cathy stepped down in November after an eight-year run. Andrew T. Cathy, Dan Cathy’s son, took over, while Dan Cathy remained chairman of Chick-fil-A.

Andrew Cathy, only the chain’s third CEO, began his Chick-fil-A career in 2005, working two years as operator of a store in St. Petersburg, Florida.

He’s now holding the reins of arguably the fastestgrowing (from a financial perspective) brand in fast food. In the future, this could include further international expansion into Toronto as well as continued growth in Puerto Rico, where the first Chick-fil-A opened

All told, Chick-fil-A is fronting a chicken category that shows no signs of slowing.

4 Taco Bell

This past year saw Taco Bell lean further into what’s historically set it apart—distinctive products, value, and an operational backbone that supports it all. The Yum! Brands chain’s 2021 system sales grew 13 percent, driven by 11 percent same-store sales growth and 5 percent unit expansion. In the U.S., Taco Bell finished with more than 7,000 locations and “ample whitespace for future developments,” CFO Chris Turner said in Yum!’s year-end review. Also, Spain became the first international market to surpass 100 units in the quarter.

Taco Bell’s overseas conversation is one worth tracking. It added more than 160 net new units on a base of just 600 coming into the year, or 26 percent growth. CEO David Gibbs called Taco bell’s international runway “probably one of the most exciting stories we have right now.”

The aim for Taco Bell is to reach scale in a few key markets and drive brand awareness, ultimately improving new unit returns to support accelerated growth.

In 2022, Turner said Taco Bell is on track for another record development year with next-gen assets in the U.S. and additional markets outside the country. One recent announcement being Yum! China’s commitment to expand the brand, which will give Yum! three markets above the 100-unit lever by the end of 2022 (Spain, U.S., China)

It was a banner calendar, development wise, across all of Yum! in 2021. The company debuted a net of 1,259 restaurants in Q4, pushing the year-end total to 3,057 net new openings. The previous record was 2,040 in 2019.

Overall, Yum! added 4,180 gross units, putting an exclamation mark on what Gibbs called “the strongest growth year in our history and setting an industry record for unit development.”

For perspective, the company opened a new restaurant on average every two hours. Taco Bell represented 12 percent of those net new openings with 364.

Returning to the ops angle, Taco Bell’s drive-thru times last year were 2 seconds faster, year-over-year, with Q4 marking the eight consecutive period of average sub-4 minute times. That became nine straight in Q1 2022. “This is truly an impressive performance considering labor availability challenges,” Turner added.

Taco Bell’s domestic digital sales rose nearly 20 percent as Yum! collectively pushed a record $22 billion. Following KFC’s lead, Taco Bell is currently in the process of rolling pickup shelves into stores. Thus far, early tests are freeing up drive-thru capacity. Yum! is also installing a new kitchen display system and smart hub, and leveraging its cloud-based point-of-sale in Taco Bell stores with the hope of modernizing the employee experience. The systems separate delivery orders from standard drive-thru ones.

This year marks Taco Bell’s 60th anniversary. Gibbs noted in May the chain would continue to stay relevant by championing customer value, including the introduction of $2 burritos on Taco Bell’s new Cravings Value Menu, which joined the chain’s existing $1 offering.

And on the marketing side, Taco Bell had plenty to talk about, as usual, with crispy chicken wings hitting stores for a limited time, as well as Nacho Fries. It then mic dropped the buzzy return of Mexican Pizza, cut in 2020 for simplification and sustainability reasons, with artist Doja Cat at Coachella (a musical featuring Dolly Parton premiered on TikTok in late May as well )

Taco Bell’s Q1 2022 system sales hiked 8 percent on 5 percent unit growth and 5 percent same-store sales expansion. Domestic comps increased 5 percent. All were among the top tier of quick-service results industry-wide to start the year.

TACO BELL (4) 30 AUGUST 2022 | QSR | www.qsrmagazine.com QSR 50

TACO BELL CARRIED AMPLE MOMENTUM INTO ITS 60 TH ANNIVERSARY AFTER ANOTHER STELLAR YEAR.

Deliver Dine-In Quality When You Protect Temperature and Texture, Your Customer Will Taste the Difference The only container that keeps food hot & crispy for 30-minutes on the go Consumer Reusable • Microwaveable • Curbside Recyclable • Full Assortment of Shapes and Sizes Made in the USA CRISP FOOD TECHNOLOGIES® CONTAINERS anchorpac.com ©20 ©2 22 Anc hor Pa cka g in g ® LLCSt. Lou is, Mi sso uri FREE SAMPLES TEST & TASTE E FOR OR YOURSELF EL

Wendy’s

Wendy’s labeled 2021 a “breakthrough year” as it notched its 11th consecutive run of global same-store sales growth. In Q4 specifically, Wendy’s U.S. comps accelerated to 11.6 percent on a two-year basis. The chain’s breakfast sales—a daypart that launched on the doorstep of COVID in March 2020—expanded roughly 25 percent across the year ( breakfast recently launched in Canada on May 2, 2022 as well)

Wendy’s digital business reached 10 percent of sales globally in Q4, with its loyalty program upping total membership by about 75 percent and monthly active users 25 percent throughout the course of the year.

With expansion itself, Wendy’s delivered 121 net new restaurants—it sixth straight year of net new restaurant growth and its highest figure in nearly two decades. This included the opening of Wendy’s first U.K. restaurants and its 1,000th international store. Also, the debut of 30 Wendy’s delivery kitchens with REEF across the U.S., Canada, and the U.K.

Worth noting, too, roughly 50 percent of Wendy’s growth came via nontraditional means (REEF included)

On the latter topic, REEF’s units boast average-unit volumes in the $500,000–$1 million range, with Wendy’s collecting about a 6 percent royalty rate income compared to its typical collection of 4 percent. So the higher number turns in similar economics, despite lower AUVs. But the REEF path, as much as the dollar figures, will help Wendy’s narrow what’s historically been a significant gap relative to peers—an underpenetrated footprint in urban markets.

In 2022, Wendy’s expects to debut 150–200 REEF kitchens globally—about 65 percent in the U.S.; 10 percent in Canada; and 25 percent in the U.K. And nontraditional, broadly, will continue to mix 40–50 percent of the brand’s path.

As significant a growth stretch as 2021 was for Wendy’s, it still came in at about 2 percent. That’s about to step up to as high as 6 percent in 2022. Already this year, Wendy’s kicked off Q1 by opening a net of 67 locations (45 domestic). That was a meaningful bump from Q1 2021 when Wendy’s expanded by a net of 10 stores and “one of our best quarters in in our history for unit growth,” CEO Todd Penegor said at the time.

And despite inflationary challenges and other external hurdles, Wendy’s stretched its streak of growing or maintaining category burger dollar share to 11 quarters.

Elaborating on breakfast, the daypart represented about 7 percent of sales in Q1, which was down from 7.8 percent a quarter earlier due to Omicron and weather setbacks. But the brand feels confident in its plan to reach $3,000–$3,500 in average weekly sales per store (it was about $2,500 in Q1) and grow the business by 10–20 percent for the full year. A reason for optimism—legacy stores that offered breakfast pre-2020 launch are pushing $4,000–$4,500 per unit.

As Wendy’s tacks on new units, it’s also reimaged about 75 percent of its 7,000 locations globally. Revenues in Q1 climbed 6.2 percent to $488.6 million.

Domestic same-store sales gained 1.1 percent to begin 2022 against a prior-year lap of 13.5 percent. Globally, the brand achieved its second consecutive period of double-digit two-year comps at 15.4 percent. Internationally, Wendy’s same-store sales gained 14.1 percent, which helped elevate the systemwide figure to 2.4 percent.

Dunkin’

The first change in this year’s QSR 50 comes at No. 6, with Dunkin’ moving up a slot. The brand spent most of 2020 sprucing up its footprint, including the exiting of 450 Speedway stores along the East Coast, which represented less than 0.5 percent of U.S. sales. Overall, Dunkin’ closed a net 547 units that year; these were stores that had low average weekly sales, couldn’t support beverage innovation or a NextGen remodel, or were based in areas where traffic shifted and they couldn’t relocate or add drive-thru. Former Dunkin’ CEO Scott Hoffman called it a “good scrubbing of the portfolio.”

But 2021 told a different story. Under new owner Inspire Brands—which spend $11.3 billion to acquire the chain at the end of 2020—Dunkin’ debuted a net of 161 outlets last year. Same-store sales rose 15.5 percent in 2021 year-over-year and increased 10.4 percent on a two-year basis.

The beverage and doughnut chain continued its momentum in February, opening its first co-branded

6

5

WENDY’S HAS TURNED IN SIX STRAIGHT YEARS OF NET NEW GROWTH.

ADOBE STOCK

32 AUGUST 2022 | QSR | www.qsrmagazine.com QSR 50

DUNKIN’ SAW ITS SAME-STORE SALES POP 15.5 PERCENT IN 2021.

ROMAN TIRASPOLSKY, WENDY’S, DUNKIN’

Imagine if your dining tables wouldn’t wobble even in places like this. FLAT® Table Bases and Equalizers can adjust to almost any surface to bring stability to your operations. Learn more at FlatTech.com or call 855-999-3258.

Stable. Even here.

location with Jimmy John’s inside the main lobby of Inspire’s Global Support Center in Atlanta. The kiosk is digital only, meaning all orders are placed ahead of time through either the Dunkin’ or Jimmy John’s app.

7

Burger King

Throughout 2021, RBI CEO Jose Cil and his executive team acknowledged Burger King wasn’t performing up to expectations. To close last year, the brand’s U.S. samestore increased 1.8 percent year-over-year, but slid 1.1 percent on a two-year basis. In Q1, comps declined 0.5 percent compared to the year-ago period.

But the quick-service giant put a turnaround strategy in place, starting with promoting previous COO Tom Curtis to president of U.S. and Canada. The industry veteran, who previously spent multiple decades at Domino’s, was charged with leading a comprehensive agenda spanning multiple areas, including operations, digital enhancements, menu innovation, and refresh branding.

Two of the biggest accomplishments in 2021 were the nationwide launch of the Ch’King Sandwich and the unveiling of Royal Perks, the company’s new rewardsbased loyalty platform. The brand also looked to elevate multiple metrics, including hours of operation, staffing, speed of service, and average complaint ratios.

More progress was made through the first part of 2022. Burger King not only hired a new creative agency of record—a company that’s also worked with the likes of Chili’s, Nike, Taco Bell, Pizza Hut—to improve effectiveness of its messaging, it also put more focus on premiumizing the Whopper. The brand removed the burger from core discounting and rolled out the Whop-

Subway

For Subway, 2021 was one of the most impactful years in recent memory. The chain said it beat sales projections by almost $1.4 billion and reached its highest annual AUV in seven years. More than 16,000 locations, or about 75 percent of the U.S. system, experienced a 7.5 percent increase in same-store sales versus 2019. Domestic comps rose sequentially throughout 2021 and were positive from Q2 to Q4. In the final month of the year, same-store sales lifted 8.7 percent compared to 2019.

The sandwich chain owed its success to “Eat Fresh Refresh,” the biggest menu update in the brand’s 56-year history. The launch involved 11 new ingredients, six new or returning sandwiches, and four revamped signature products. Paul Fabre, senior vice president of culinary and innovation, said Subway spent 18–24 months enhancing the bread alongside a panel of bakers, including Nancy Silverton, who won the James Beard Foundation’s Outstanding Chef Award in 2014.

In addition to the menu innovation, the fast-food chain debuted an updated mobile app with a new dashboard and less friction and partnered with DoorDash to roll out direct delivery through its website and app. Subway’s digital sales surpassed $1.3 billion in 2021, which is three times as much as 2019.

In terms of U.S. development, the brand is continuing to clean its portfolio. Subway shed a net of 1,043 restaurants in 2021, after cutting a net of roughly 1,600 in 2020.

per Melt, which proved to be incremental to the burger platform and showed strong messaging with highquality ads. The product was teased as the first of more Whopper-centric innovation to come.

The efforts haven’t been in vain either. In early May, Cil said Burger King narrowed the gap between its peers by a few hundred basis points in Q1 and that guest satisfaction has elevated sequentially over the past three quarters.

Domino’s

Last year was a mixture of positive and not-so-positive news for Domino’s.

From the optimistic perspective, unit economics remained best in class, with U.S. stores earning $1.3 million in AUV and more than $170,000 in store-level EBITDA. Full-year same-store sales rose 3.5 percent—14.7

8

SUBWAY’S EAT FRESH REFRESH CAMPAIGN HELPED LIFT AUVs TO LEVELS NOT SEEN IN SEVEN YEARS.

9

BURGER KING ASYLAB, SUBWAY 34 AUGUST 2022 | QSR | www.qsrmagazine.com QSR 50

Leave Your Ice to the Ice Machine Experts

Take the stress out of your ice supply with an Easy Ice subscription.

Our subsciptions include:

An Easy Ice subscription is the perfect solution for the business owner who doesn’t want to think about ice. It’s also the best way for restaurant brands with multiple locations to streamline their ice supply.

percent on a two-year basis—marking the 13th consecutive year of positive growth. Additionally, CEO Russell Weiner said no one in the pizza category has opened as many U.S. restaurants as Domino’s in the past few years. The brand, which already earns more U.S. sales than any other pizza chain, surpassed Pizza Hut as the biggest when it comes to domestic footprint, with 6,560 stores.

However, in the background of all those successes has been an ongoing labor shortage that’s carried over into 2022. After 41 straight quarters of positive U.S. comps, Domino’s saw decreases of 1.9 percent in Q3 2021 and 3.6 percent in Q1 2022, driven by shorter operating hours, disruption in customer service, and lapping federal stimulus. In the first quarter, the number of combined lost operating hours equated to the entire U.S. system being closed for six days. To mitigate increased labor and commodity costs, Domino’s switched its $7.99 carryout deal to only online, a more profitable sales channel for the brand. And for its $5.99 Mix and Match deal, it increased the price by $1 for delivery orders.

Prior to the macroeconomic issues, no company rejected third-party delivery companies more than Domino’s, however, Weiner noted in late April that “nothing is off the table” when asked about future potential partnerships.

Weiner took over as CEO in May for the retiring Rich Allison, who joined the company in 2011. 10

Chipotle

Count Chipotle among the quick-serves rocketing growth out of the pandemic. The brand announced in Q4 it was tacking on 1,000 North America locations to its previous long-view goal, meaning there could be at least 7,000 stores in time. What’s giving Chipotle confidence is a multifold story. For starters, you can look at the stock market to get a sense of how far it’s come since ex-Taco Bell leader Brian Niccol grabbed the CEO reins in winter 2018. When he did, Chipotle traded for $314.72 on February 1, 2018. As the fast casual reviewed Q4 earnings with investors this past year, the figure was north of $1,560 per share.

Along the way, Chipotle accelerated several pillars of its business while shoring up operations. It’s simply figured out a way to get food out quicker. The most talked-about element of this has been digital, where the chain’s full-year sales hit $3.4 billion last year. For reference, the figure is nearly three-and-half times what Chipotle reported pre-COVID in 2019. And that despite the fact two-thirds of guests still use in-restaurant as their exclusive channel, Niccol said in February.

In other terms, there are still occasions to chase. The consumer base deploying both digital and in-store remains relatively small. Chipotle expanded from 8.5 million rewards loyalty members in February 2020 to north of 26 million by year-end 2021.

What’s more, though, is how Chipotle continues to integrate channels with asset development, which really began with second-make lines for digital orders. Of late, it’s taken on more visible, guest-facing forms. Chipotle opened 215 new restaurants last year, including 78 in Q4 alone. Of those, 174, or 81 percent, included the brand’s order-ahead pickup “Chipotlanes.”As 2022 arrived, Chipotle had 355 of them. Still, while growing and spreading quickly, Chipotlanes represent a fraction of Chipotle’s 2,966-unit system.

But going forward, Chipotlanes are going to take on a larger role. The brand plans to open 235–250 stores in 2022, and north of 80 percent will be equipped with the feature.

Chipotle’s broader growth appears to have crossed an inflection point that it’s not turning back from. It opened just 40 locations in the three-month period that ended December 31, 2018, or Q4 of that year. The same timeframes ending March 31, June 30, and September 30 (all in 2019) saw openings of 15, 20, and 25 locations, respectively. In June 2018, Chipotle announced a revamp that included closing 55–60 stores. The chain had 2,408 restaurants on December 31, 2017 and 2,491 a year later. More than half of Chipotle’s stores have built in the past decade.

So this growth journey evolved quickly. Chipotle arguably saved its biggest innovation for last with the opening of its first Chipotlane Digital Kitchen in Cuyahoga Falls, Ohio. In addition to the mobile order drive-thru lane, the location includes a walk-up win-