17 BEST FRANCHISE DEALS

These chains are a cut above the rest.

With Smalls Sliders, former NFL player Drew Brees scores again.

These chains are a cut above the rest.

With Smalls Sliders, former NFL player Drew Brees scores again.

A

For

Franchisees have such great stories to share about how they landed in the restaurant space.

For example, married couple Judd and Erica Wishnow own about 180 Taco Bell and Dunkin’ locations, and it all began with a meetup between the two during the Great Recession. Both entered the encounter feeling aimless about their lives. But as they conversed, a spark was lit, and an adventure toward franchising would come soon after. The duo named the business Southpaw in honor of the movie “Rocky,” which tells the tale of a left-handed boxer who doesn’t have much direction until he meets Adrian—the love of his life.

Another one is Nick Crouch, cofounder of DYNE Hospitality Group, which is Tropical Smoothie Cafe’s largest operator. His franchising journey started years ago when he entered a location in St. Johns, Florida, and fell in love with the brand. His experience was so great that he borrowed funds from his family and bought the store from the existing franchisees. Crouch joined forces with fellow Tropical Smoothie operator Glen Johnson in 2017 to form DYNE, which now has more than 100 shops.

Franchising is a business that brings people together from all paths. Former NFL quarterback Drew Brees spent 20 seasons playing football and now sees himself as an investor and franchisee of key food and beverage concepts. That includes Smalls Sliders, an emerging chain looking to expand across the South.

Crouch, the Wishnows, and Brees may work with different brands and food segments, but the entrepreneurial spirit remains the same. An unprecedented global pandemic did little to quench

that passion—that’s the story across the entire franchise industry. The International Franchise Association reported earlier this year that franchising will add approximately 254,000 jobs in 2023. Growing at 3 percent, total employment is projected to reach 8.7 million. Also, Oxford Economics found that franchises pay nearly 3 percent higher wages than similar independent companies, offer better benefits, and provide more generous leave.

For the 13th straight year, QSR published “Best Franchise Deals,” which highlights quick-service chains that have differentiated themselves in terms of costs, incentives, and other factors. The 2023 edition features 17 fast-food and fast-casual brands that are attracting new and existing operators alike.

Two new editions are part of the special report this year. First, we have “15 Franchisors to Watch,” honoring a group of brands that fell shy of “Best Franchise Deals,” but are knocking on the door. Additionally, we decided to establish a “Best Franchise Deals Hall of Fame” to celebrate concepts that have made several appearances on the list throughout the years.

There’s a reason why eight out of the top 10 quick-service brands in America (in terms of U.S. systemwide sales) are majority franchised. There are challenges (i.e. California’s proposed statewide fast-food council and talks around what defines a joint employer), but a major truth stands above all—franchising is a proven method of business that’s worked for decades, and it will continue to do so in the future.

Ben Coley, Editor

There are headwinds to face, but the industry has ‘growth’ written all over it.

Red Gold® is here to make your customers’ saucing experience easy and enjoyable with a variety of dunk cup options such as: ketchup, marinara, BBQ, and seafood cocktail sauces. The dunk cups are a convenient way to enjoy on-the-go, delicious sauces with menu items such as fries, burgers, chicken tenders, shrimp, and so much more!

Scan to request a free sample kit!

SHAKE SHACK ENDED NATIONAL PICNIC MONTH in July with an opportunity to reconnect guests with its Madison Square Park, New York, origins. To mark the debut of its plant-based menu items, the brand invited customers to embrace the outdoors and "veg out" with a specially curated picnic kit.

The "Veg Out" picnic kit was designed for two people and included the Veggie Shack, crafted from fresh, seasonal vegetables and grains. Accompanying this innovation was the Non-Dairy Chocolate Frozen Custard, a dessert made with NotMilk. The picnic kit came with an assortment of beverages, cutlery, dishware, napkins, and fun extras like a frisbee and playing cards. Guests were also supplied with picnic essentials such as the Dock & Bay Picnic Blanket, Supergoop! Play Sunscreen, S’well Ice Cream Chiller, and a Bluetooth speaker.

Customers were able to reserve a picnic kit ($60/kit, a $250+ value) via a microsite and pick it up at select locations across the U.S.

The fast casual found a clever way to release new plant-based items.

SevenRooms, a guest experience and retention platform, released its “2023 Dining Discovery Report” in June, which explored how customers are finding new restaurants and booking reservations.

THE COMPANY SEPARATED DINERS INTO FIVE SPECIFIC CATEGORIES:

Spontaneous Diner

25 PERCENT OF SURVEYED RESULTS

A person who visits restaurants frequently, but opts to walk in as opposed to scheduling reservations.

21 PERCENT

A person who prefers to order online instead of dining inside a restaurant.

19 PERCENT

A person who goes out to restaurants for special occasions and takes time to pick the right place and menu.

16 PERCENT

A person who has a list of restaurants he or she chooses from, and rarely strays from it.

8 PERCENT

A person who values new experiences and dines at numerous restaurants to try different menus and cuisines.

CONSUMERS AREN’T FINDING VALUE IN THIRD PARTIES:

Only a small percentage of customers reported using third-party platforms like OpenTable (9 PERCENT) and Resy (3 PERCENT) to discover new restaurants.

HOW CUSTOMERS ARE FINDING RESTAURANTS:

61% 22%

33% 14%

29% 13%

61+33+29+22+14+13

Friends, family, and coworkers

Google Social media Social media influencer Yelp Restaurant publications

GUESTS PREFER BOOKING DIRECTLY:

29 % say they receive better experiences at the venue when they book direct.

27 % say they feel restaurants prioritize their reservation when they book directly.

MAIN TAKEAWAY:

45 % will call the restaurant directly to book a reservation.

35 % will book through a restaurant’s website.

61% believe making a reservation directly rather than a third-party reservation platform is better for the restaurant.

29% want to do all they can to directly support restaurants.

17 % say third-party platforms are too expensive for restaurants, and customers don’t want them to incur that cost.

Restaurants must use each guest experience as an opportunity to build loyalty, with personalized touches from start to finish. Operators must control their own data and nurture relationships with guests based on preferences, past visits, and upcoming special occasions.

There comes a time for many young limited-service restaurant entities to choose whether—and when—to grow their businesses beyond one, two, or even a handful of units.

At about the same time, another important determination must be made: Whether to expand via company-owned stores or by taking the franchising route.

“It’s one of the fundamental decisions you have to make as a brand,” says Clay Dover, chief executive of Dallas-based Mexican chain Velvet Taco, which has about 40 company-owned units. “It reverberates throughout” the enterprise and is critical to the way the business operates.

Both growth directions have their advocates.

For some operators, the beauty of owning their stores is that it provides a stronger means of control—in everything from real estate to hiring to the supply chain.

“It allows you to create a guest experience that can be hard when you have franchisees,” states Matt Copenhaver, chief development officer at Salad and Go. As a farm-to-fork entity, having that control is key to vertical integration that creates leverage and pricing power over time.

Others, however, see faster growth possibilities and other benefits in franchising, which has “a proven playbook,” explains Chris

Concepts differ on whether to choose franchising or solely corporate development.

Ives, chief financial officer at Bubbakoo’s Burritos, based in Wall, New Jersey. “The overhead is much less, and you don’t take on all the liability.”

“At a very high level, there is no doubt that control is much higher by a company” that owns its stores, notes Michael Keller, chief executive of Jeremiah’s Italian Ice, which operated its own units for the first two decades in business before deciding to begin franchising.

“In franchising, you are adding a third party and that makes it more challenging,” he adds. “But that’s why a good franchising agreement needs to be in place.” Making sure the franchisees have strong controls gives great command over the product quality.

At Velvet Taco, company officials had a meeting about its growth potential and decided to expand by owning its restaurants.

As an upscale, chef-driven chain, the steps Velvet Taco can take and the flexibility it has—with the menu, food quality, technology, real estate, hiring, and equipment—means “we control all those elements and keep our hands around the brand,” Dover says.

“Obviously, the biggest benefit is we are getting 20 percent vs. 6 percent” royalty a restaurant franchising company receives on average, he adds.

Currently, the company operates in six states and is growing its restaurant count at a 25 percent annual clip. “We have a lot of unique items with specific ingredients,” including components for just one menu item, Dover says. “We think that is important for the brand. It doesn’t allow us to open 100 restaurants a year, but that is what makes Velvet Taco unique.”

At Phoenix, Arizona-based Salad and Go, which has soared to more than 105 units in four Southwest states, “franchising has never been part of the strategy,” says Copenhaver. He points out that the private company is nearly doubling its number of eateries every year.

Overseeing all phases of restaurant operations and growth— from forming relationships with a variety of farmers to choosing ideal real estate locations—“gives us the most flexibility” for the best guest experience and profitability, the chief development officer states.

In terms of logistics, for instance, “we know where every piece of lettuce came from, who touched it and how many times it was touched,” from fields to Salad and Go’s production facilities to the stores where it’s served, he explains. “We own that end-toend supply chain.”

As a drive-thru and grab-and-go operation—stores are small with no seating—real estate is important to the company’s vertical integration strategy. The company gains a mass presence in existing markets before moving on to the next one.

Of course, most restaurant entities that have chosen to franchise began as company-only businesses. That’s what happened at Bubbakoo’s Burritos, which was launched on the Jersey Shore in 2008 by two Johnny Rockets veterans.

The beach-themed chain had grown to nine units when its first franchised store opened in 2016 by established, locallybased restaurant owners. It’s a strategy that continues, as Bubbakoo’s has expanded to over 100 eateries in 16 states.

“They chose to do that for growth and financing,” says Ives, who joined the company last year. In addition to having a revenue stream from franchise fees and royalties, and letting franchisees make all the capital outlays, “the big benefit is we have stores in areas where those franchisees have much better knowledge of their markets. “

The challenge is finding the right operators, “It is critical. Forget about the money,” he states, “It is more the operational background,” ranging from knowing how to run a business to hiring good people. The parent maintains control through precise franchisee pacts and strenuous monitoring.

Many companies begin franchising after a few years, but Orlando, Florida-based Jeremiah’s Italian Ice went more than two decades before selecting that expansion route, teaming up in 2018 with growth and development consultant Pivotal Growth Partners.

As Jeremiah’s “closed in on a quarter-century, there were increased discussions on how to accelerate growth” beyond the company’s then 20 or so stores, mostly in Central Florida, Keller says. In the past four years, the chain has grown to six times that number in 11 states.

Unlike Bubbakoo’s, which has an extensive menu, Jeremiah’s offerings are simple—over 40 flavors of Italian ice, three ice creams, and a gelati layering of ice and ice cream. That lessens the need for franchisees to have an operational background if training and oversight are good.

“We put great care in quality training,” benchmarking, and providing feedback, Keller says. “Franchisors need to be protectors of the brand,” but issues like product development will remain inhouse to maintain brand control.

While franchised chains typically have corporate restaurants, company-owned ones usually don’t have franchises, although there are ways for company-owned enterprises to branch out a bit.

Velvet Taco, for example, has licensed units in two food halls owned by the chain’s founders and is adding a spot inside Houston’s Hobby Airport with a concessionaire. “These are one-offs,” Dover states. “They’re more of a hybrid at this point.”

was a full-service restaurant with long wait times,” Gemignani says. “It wasn’t convenient, it wasn’t fast, and it didn’t sell by the slice, so I listened to my customers and opened a fast casual right next to it.”

Slice House gradually expanded over the next decade. A second restaurant opened in 2016 in Walnut Creek, California. It now serves as the brand’s corporate headquarters.

Gemignani licensed three additional brick-and-mortar spots in the state and opened several licensed units in casinos. He also launched a concessions business, selling pizza by the slice in major league sports stadiums in San Francisco and Las Vegas.

Gemignani didn’t consider franchising until 2020 after the concept proved to be “almost COVID-proof.” Like many pizza brands, a longstanding focus on takeout and delivery carried it through pandemicrelated disruptions.

FOUNDERS: Tony Gemignani, George Karpaty, Trevor Hewitt, and Bill Ginsburg

HEADQUARTERS: San Francisco

YEAR STARTED: 2021 as franchisor entity

ANNUAL SALES: NA

TOTAL UNITS: 43 as a franchise company, 60 including licensed units at stadiums and casinos

FRANCHISED UNITS: 42 (8 open and 34 in development)

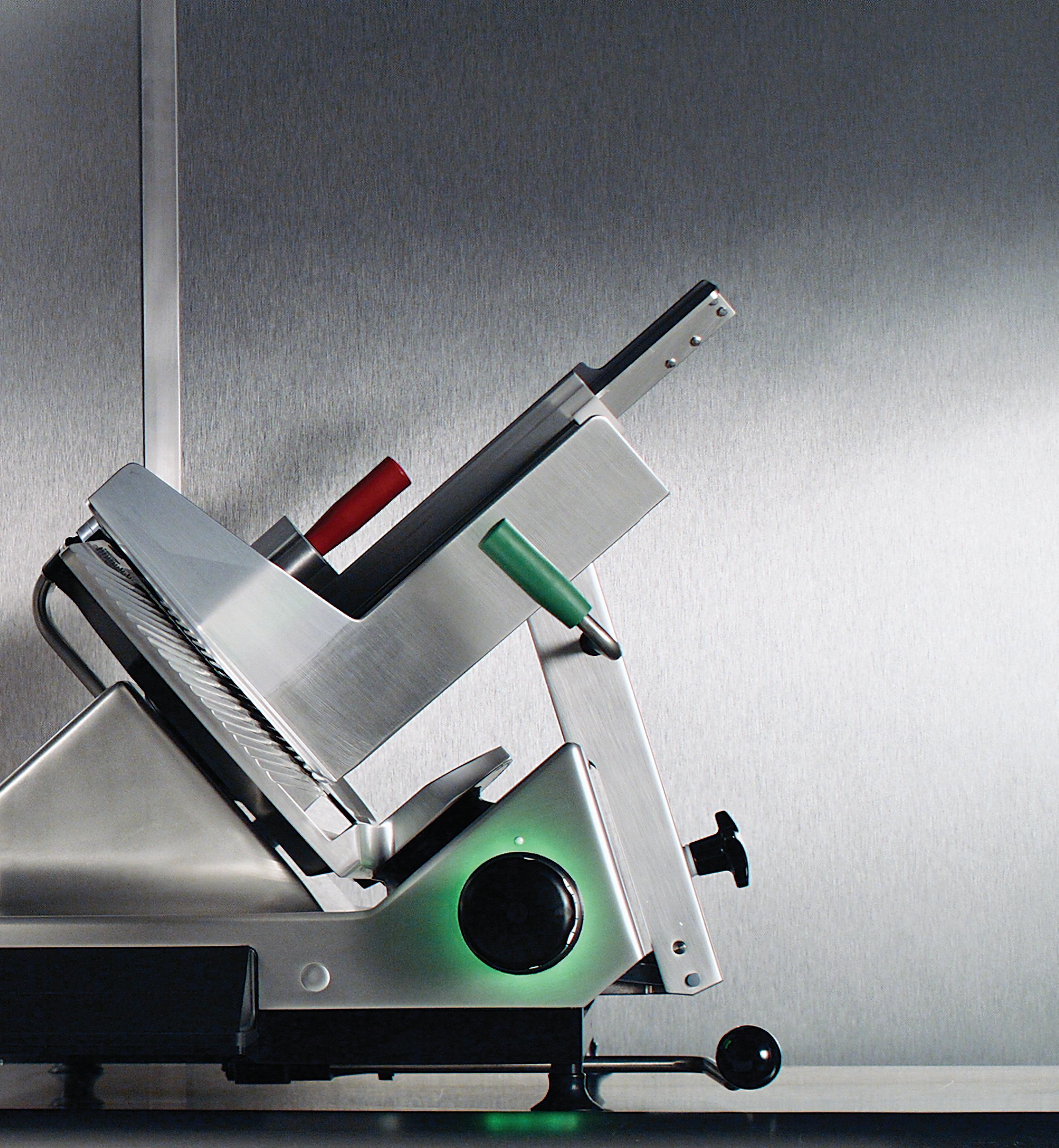

TONY GEMIGNANI CLOSED HIS ESTEEMED INTERnational Pizza School last summer, but he hasn’t given up on teaching the craft of pizza making. He now focuses on training the restaurant operators who are helping

expand his fast-casual pizza concept Slice House nationwide.

Owning 30 restaurants, including Tony’s Pizza Napoletana, Capo’s, and Toscano Brothers in San Francisco, as well as Pizza Rock in Las Vegas, Gemignani has been operating multiple pizzerias in California and Nevada for years. He also is a four-time Guinness Book of World Records holder and winner of “Food Network Challenge.” Franchising at this level is a relatively new venture.

The 13-time World Pizza Champion first opened Slice House by Tony Gemignani in 2010 next to his flagship restaurant, Tony’s Pizza Napoletana, in San Francisco’s North Beach district.

“You could say Slice House was everything people didn’t like about Tony’s, which

Slice House also benefited from an extensive menu that showcases multiple regional pizza styles, including New York, Detroit, California, Sicilian, and Grandma-style, which takes inspiration from home-cooked pies and features a distinctly thin crust.

“There’s been a renaissance of pizza styles over the past few years,” he says. “When you were bored with the same thing you always ordered during the pandemic, you could come to us and try something new, and it probably became your favorite pizza.”

Preparing the brand for expansion required some adjustments. The three licensed restaurants lacked a standardized design and equipment package. That meant Gemignani had to devise a franchise model that would preserve the brand’s scratchmade ethos while enabling consistent and easy execution.

“We have a variety of

“It wasn’t just an overnight decision,” CEO Jay Rushin says. “[ Franchising ] was always a long-term plan, but it took years of effort to get the brand to a place where we could expand nationwide.”

The chain streamlined its service model and franchise support systems before going public with the decision.

However, it did not take long for H&H Bagels to attract potential franchisees. According to Rushin, the labor model is attractive, with lower operating and rent costs. From the minute leases are signed, opening day is typically four to six months afterward, with assistance every step of the way.

“It’s a category which has been underinvested for years now,” Rushin says. “We think there’s a huge opportunity in the category itself … and it’s attracting new potential franchisees every day.”

These potential franchisees, Rushin says, are from a “wide spectrum,” including current and past operators of other brands or those who are new to franchising in general.

The world of franchising is a complex process, yet brand after brand has made the plunge to accelerate growth and explore new markets. The International Franchise Association cites the number of franchise establishments will grow by 1.9 percent in 2023, or almost 15,000 units.

For young companies, the strategy might have been planned from the get-go, but what of legacy chains, that after decades in the business, have decided to finally add a franchise program to the menu?

H&H Bagels has been a beacon of breakfast in New York since the 1970s, using the same recipe and artisanal water bagel method for over 50 years. The well-known brand has been featured in media hits such as “Seinfeld,” “Sex and the City,” and “The Office.”

Recently, H&H Bagels released its franchise program, providing turnkey operations and support procedures on everything from site selection to customized technology systems.

Already, the company has inked expansion deals in Florida, California, and Virginia, to name a few. This is all part of an aggressive growth spurt unlike any other in H&H Bagels’ history.

Restaurant franchising experience is a plus, but not mandatory with the right management team. If requirements are met, Rushin is open to those who “want to own and build something for themselves and their family.”

H&H Bagels is not the only legacy brand to reveal a franchise program during the pandemic. The Original Rainbow Cone, a Chicago staple, is headed in the same direction.

The company got its start in 1926 when “Grandpa Joe” Sapp combined slices of chocolate, strawberry, Palmer House ( New York vanilla with cherries and walnuts), pistachio, and orange sherbet ice cream on one cone. Since then, Rainbow Cone has become a fundamental part of Chicagoland.

When Joe Buonavolanto III joined the Rainbow Cone team as vice president of franchise operations, his vision was to expand the ice cream shop into as many markets as possible in a tasteful manner.

He serves in the same role for The Buona Companies. Buona, another Chicagoan icon, is the original Italian beef restaurant with four decades of operation under its belt.

Buona’s partnership with Rainbow Cone allowed the shop to grow, such as an ice cream truck concept in 2020 H&H

/ BY SAM DANLEY

/ BY SAM DANLEY

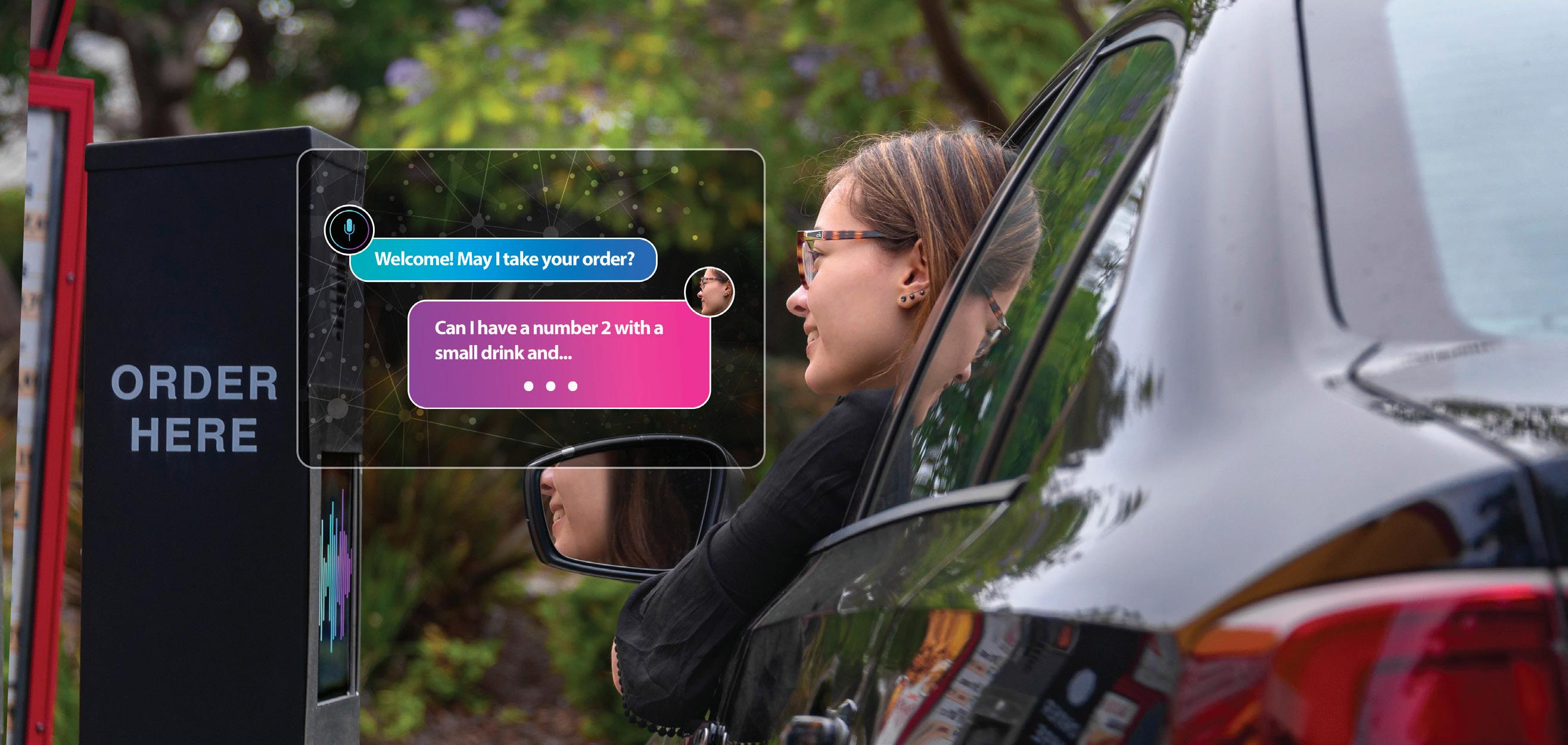

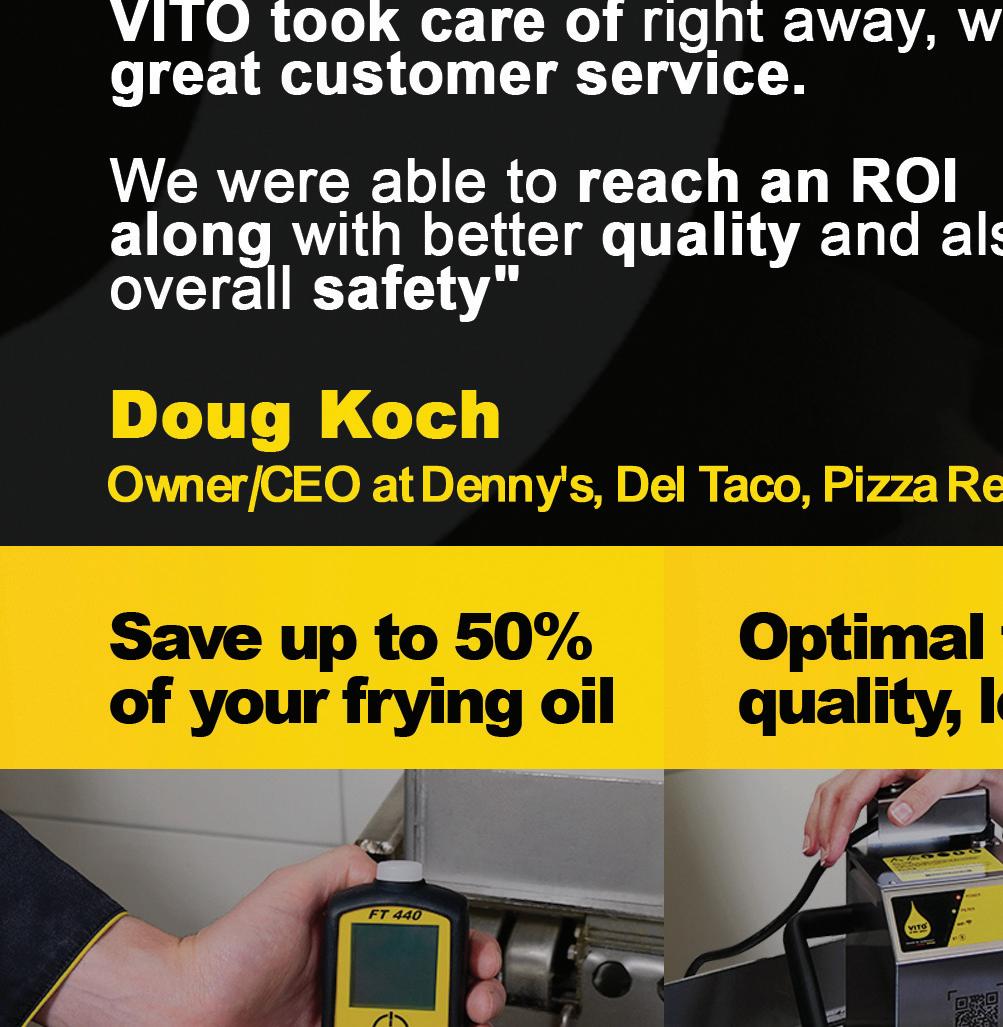

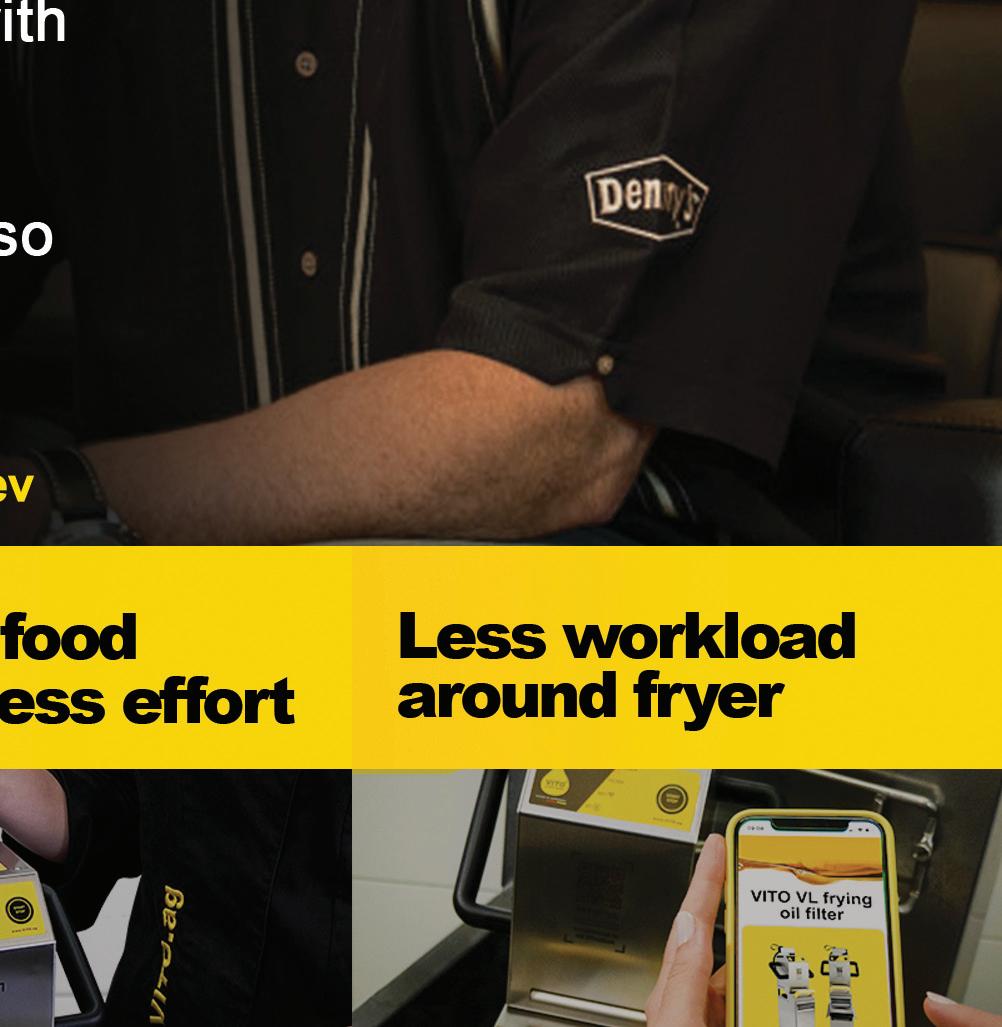

With NFL legend Drew Brees at the forefront as an investor and franchisee, the disruptive Smalls Sliders is grilling up plans for explosive growth.

Twelve years ago, Drew Brees was sitting in a Jimmy John’s near Purdue University, enjoying his favorite order (a No. 9, no cheese, add hot peppers) for what felt like the first time in ages.

He’d been a devoted fan for a decade, starting with his early days at the school’s freshman dorm, when he relied on the sandwich to fuel late-night study sessions. But neither San Diego, where he started his pro-football career with the Chargers, nor

New Orleans, where he cemented his legacy with the Saints, had any stores.

“I was ordering that sandwich three times a week during my college days,” Brees says. “After I left, I could only get my Jimmy John’s when I was visiting Purdue, which was only a couple times a year. Ten years after leaving college, I was back in the shop at Purdue, taking a bite out of a No. 9, and I finally said, ‘That’s it. I have to bring this to New Orleans.’”

He called a former teammate who worked in the corporate office and asked what he needed to do to get the sandwich chain down in The Big Easy. As luck would have it, the company had just opened up the territory for franchising.

That call was the first step in a journey that would see Brees become a franchisee, co-owner, or investor in a growing number of franchises, including Jimmy John’s, Dunkin’, and Everbowl, to name a few. It also set him on the path toward Smalls Sliders, an emerging quick-service chain on the precipice of explosive growth.

The brand serves a hyper-focused menu of cheeseburger sliders from a roughly 800-squarefoot shipping container affectionately dubbed “the can.” Brees is gearing up to open his first franchised location later this year, but he’s been at the forefront since day one. The former NFL quarterback and future Hall of Famer is an initial investor and co-owner alongside Brandon Landry, the founder of Walk-On’s Sports Bistreaux.

This isn’t the first time they’ve teamed up to drive the rapid expansion of a restaurant born in the Bayou State. Brees has been Landry’s partner at Walk-On’s since 2015. The sports bar had three corporate locations and was looking to grow through franchising when the pair first linked up eight years ago. Brees bought into the business on the franchisor side, taking a 25 percent stake and leveraging his perspective as a Jimmy John’s operator to support the brand’s rapid franchise expansion. Since then, the footprint has grown to more than 75 locations nationwide.

Brees says all of his business ventures begin with a genuine affinity for the brand. With WalkOn’s, it was the elevated menu, stellar customer service, and “incredible vibe” within the restaurant that caught his attention. He first encountered the brand after Landry opened a location in downtown New Orleans.

“I’d always wanted to open up a sports bar concept with a focus on great food,” he says. “The first time I walked into that Walk-On’s, I looked around and said, ‘I don’t think I could build it any better than it’s been built right here. I need to figure out who did this.’”

Brees reached out to Landry to find out more about the busi-

ness. He learned that the name stemmed from the founder’s time as a walk-on basketball player at LSU. Unlike star players on scholarship, Landry was an unrecruited and unsigned athlete. That meant he had to work hard and hustle to keep his spot.

Landry used that walk-on mentality–putting the team above everything else and persevering no matter what hand you’re dealt–as a theme to run his sports bar. The result was a people-first culture that feeds the organization from the top down and starts with humble leadership.

“That was something I learned through my time as an athlete, too,” Brees says. “It’s all about having the right people in the right places, and making sure everybody embraces their role and understands that they’re part of something much greater than themselves.”

Five years ago, Brees and Landry were on an airplane heading to the grand opening of a new Walk-On’s location. That’s when Landry laid out his vision for a sliders-themed restaurant.

“The idea started with the fact that sliders were one of the best selling items on the menu,” Brees says. “Brandon told me, ‘I think we’ve got something there. We could open up a sliders concept that has a really simple menu, but let’s take it to the next level with these repurposed shipping containers as the look and feel of the brand.’”

Brees jumped on the opportunity to help build something from the ground up. He came on board as an initial investor and put up the capital for the proof-of-concept restaurant, rounding out a team of entrepreneurs that also included Landry’s nephew, Jacob Dugas, and LSU professor Scott Fargason.

The team built Smalls with franchisees in mind. It’s all about keeping things simple and focused, starting with the limited menu centered around the namesake product. Customers choose from four combos, including one, two, three, or four sliders–made with premium beef and proprietary sauces–paired with fries, drinks, and milkshakes.

“We have less than 10 food ingredients in the restaurant, where a lot of quick-service restaurants have several hundred ingredients that they have to manage,” says chief development officer Richard Leveille. “Operators are really excited about that.”

Operators also are excited about the brand’s modular design. The shipping containers are equipped with walk-up windows, drive-thru lanes, and outdoor patios in lieu of indoor dining rooms. They operate with around half of the labor typically required in an average quick-service restaurant, and routine expenses like utilities and dumpster requirements are lower.

One of the biggest advantages of housing a brand in a shipping container is real estate flexibility since the footprint only requires around half an acre of land.

“There are companies out there that are well-capitalized and have great concepts, but they’ve been slow to grow in certain markets because they’re picky on real estate,” Leveille says. “We have to be picky, too, but most concepts can’t fit on half an acre, so our competition for real estate isn’t the traditional

quick-service segment.”

The cans also enable faster speed to market. They’re manufactured, permitted, and pre-inspected in Florida before being shipped across the country and dropped on an outparcel. Leveille says the process shaves anywhere from three to eight weeks off the typical construction schedule.

Smalls opened its first can in September 2019 in Baton Rouge, not far from the original Walk-On’s restaurant. Since then, it’s grown to nine units throughout the state as of early September. Brees says the units are consistently outperforming expectations, opening “anywhere from $65,000 to $85,000 a week,” with the latest debuts trending over $100,000. The system is tracking a solid AUV of over $2 million.

“When we started, we were thinking that if we could just do around $1.3 million in sales, we’d have a really good business,” he says. “All of the sudden, our average units are doing over $2 million. We’re really honing in on the unit economics piece. Could we push that to $2.5 million? Could we push that to $3 million?”

Smalls was built with a certain level of transactions in mind, but the first few cans quickly blew past those projections. And while the brand isn’t dealing with the same overhead expenses as its peer set, it’s still taking steps to make the four-wall economic model as strong as possible. The team is continually looking for opportunities to improve operations and unlock efficiencies with an eye toward increasing throughput and further reducing costs.

The first unit had one grill and one drive-thru lane, but subsequent locations have multiple stations and two lanes to better meet demand. Smalls experimented with the placement of its drive-thru menu board and how it communicates with employees inside the can. It landed on a model where workers take orders outside face-to-face instead of through a speaker. The company also has worked to decouple its supply chain from Walk-On’s and procure products further out in advance.

“We’re hyper-focused on operations, on systems, and on getting the build-out costs as low as we can,” Brees says. “We’re developing extremely strong vendor relationships and making these units and the business model as profitable as possible. We’re looking at all of those things on a daily basis and continuing to refine even more as the days go by.”

A big learning moment came last spring when the first franchised unit opened in Thibodaux, Louisiana. It was another debut that exceeded expectations, but the restaurant faced some product shortages and traffic problems that the company didn’t quite have the answers to.

“That unit just completely blew us away with the sales that it did, to the point where we said, ‘Whoa, this is even bigger than we ever thought it could be,” Leveille says. “We took a step back to really work on our foundation and make sure we’re offering franchisees world-class support.”

More pieces have come into place since then. Last summer, the brand secured an equity investment from 10 Point Capital,

a firm with an established track record of helping founders create thriving franchise brands. It was a natural extension of an existing relationship between 10 Point, Landry, and Brees. They joined forces four years ago to accelerate growth across WalkOn’s franchise system.

The company relocated its headquarters from Baton Rouge to Atlanta to gain access to a deeper talent pool. It also tapped Maria Rivera as its new CEO. The former Krispy Kreme executive joined late last year and quickly got to work assembling a team of leaders that will drive the brand into the future. Since taking the helm in November, she’s rapidly bolstered the support center staff and filled a slew of key positions across finance, IT, real estate, operations, marketing, technology, and more.

Smalls also finalized a growth plan that will see it head east toward the new headquarters and franchise support center. The expansion pipeline for 2023 targets markets throughout Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, and Tennessee. The goal is to sell a sizable portion of those territories in the Southeast by the end of the year. That shouldn’t be a challenge, given the surge of demand Smalls is generating from potential franchisees.

“We can’t field the calls and the level of interest fast enough,” Brees says.

Those calls are coming from seasoned, multi-unit operators. Smalls currently has more than 60 units in the development pipeline, but that number is expected to reach triple digits by the time the calendar flips over to 2024. That will likely mean 10-20 franchisees that come in and commit to a territory.

“I’ve been involved with four or five franchise concepts in my life and consulted with others, and I’ve never seen this type of momentum,” Leveille says. “Our ability to meet the numbers we’re looking for—which are potentially several hundred units in our pipeline by the end of the year—I’m completely confident with.”

In June, Smalls signed the lease for a new location at Clearview City Center in Metairie, Louisiana, part of the greater New Orleans metropolitan area. The can will drop in Q4 and is part of a four-unit agreement with Brees. Jason Loerzel and Ben Smith, his franchise partners and former college football teammates, will join as co-owners. Their second can is expected to drop in the first half of 2024.

“Things are definitely moving,” Brees says. “Just like with Jimmy John’s and all the other businesses I’ve been involved in, I want to bring them to New Orleans. I always want to bring the brands that I love to the city that I love.”

The Metairie location is one of a dozen or so new cans expected to drop in 2023. Expansion also is slated for several markets in Louisiana as well as Flowood, Mississippi, which will be the brand’s first can outside of its home state. That should push the footprint to around 20 units. From there, the pace of growth could accelerate to 20-30 new openings annually as the company works toward its long-term goal of reaching over 400 locations via franchising.

With a high-quality craveable product, a community-driven culture, and strong unit-level economics, Brees believes that level of organic growth is within reach.

“We started from scratch in building this business and putting it in a position where we have the support structure in place to guide franchisees and really scale the brand,” he says. “What that takes is great leadership. We’ve found the absolute perfect person with Maria Rivera as our CEO. She’s put together an incredible team that’s going to help grow this brand to be a national presence and the best-in-class in our segment. We want to be the best-in-class not just with the sliders we serve and the customer experience we provide, but also with the work environment, both in the corporate office and in the can, and in everything else that we do.”

Sam Danley is the associate editor of QSR. He can be reached at sdanley@wthwmedia.com

This group of chains is striking agreements and growing meticulously, no matter the headwind.

Economic headwinds seem to be doing little to stop the growth of franchising.

This year, the number of U.S. franchise locations is expected to increase by almost 15,000, or 1.9 percent, to 805,000, according to the International Franchise Association’s 2023 Franchising Economic Outlook report. Also, the business is projected to grow by 4.2 percent to $860.1 billion, up from $825.4 billion last year. The IFA reported that the top 10 states for franchise growth are Texas, Illinois, Florida, Georgia, Tennessee, North Carolina, South Carolina, Arizona, Colorado, and Indiana.

But here’s the fact to circle—quick-service restaurants are predicted to witness higher growth than other industries.

Corey Nicholson, founding partner and CEO of Cadence Franchising, agrees with IFA’s thoughts on the size of the franchise economy exceeding pre-pandemic levels. His company experienced a drastic decline in franchise inquiries and application volumes in 2020 and 2021, but that was followed by a sharp increase throughout 2022. And that’s continued into 2023.

“Not only are we witnessing faster growth; it’s better growth,” Nicholson says. “Technology-driven sales processes led to deeper engagement from prospects, leading to advancement from more qualified buyers, setting the stage for more successful franchisees. Those successful franchisees led to a better brand story to tell all of the others and more referrals. It’s a chain reaction sparked by ambitious development teams, and made possible by powerful (and affordable) technology in the form of cloud-based franchise development software.”

Quick-service chains are appropriately positioned to thrive in the post-pandemic world, says Graham Chapman, president of 919 Marketing. He adds that customers are gravitating toward four quick-service experiences (drive-thru, kiosks, mobile pickup, and delivery) and that concepts offering all—or most—of these avenues can operate with fewer staff members and provide better convenience for customers.

Additionally, Chapman highlights that private equity investment and multi-unit operations have continued

GRAHAM CHAPMAN PRESIDENT 919 MARKETING

LORNE FISHER

CEO/MANAGING PARTNER FISH CONSULTING

STAN FRIEDMAN

PRINCIPAL CONSULTANT SENSIBLE FRANCHISING

MIKE DRUMM

BEER AND FRANCHISE ATTORNEY/FOUNDER DRUMM LAW, LLC

COREY NICHOLSON FOUNDING PARTNER AND CEO

CADENCE FRANCHISING

LIANE CARUSO FRANCHISE MARKETING CONSULTANT AND OWNER HELLOCMO

MICHELLE ROWAN

PRESIDENT AND COO FRANCHISE BUSINESS REVIEW

ALEX OSWIECINSKI CEO AND FOUNDER PROSPECT DIRECT

to dominate the conversation. To his latter point, look no further than Subway, the largest franchisor in the U.S. As part of a multi-year transformation, the sandwich chain is moving away from single-unit franchisees to partners who already have experience running other brands. In some cases, it happens on a pretty big scale—two years ago, Papa Johns made noise by striking a deal with Sun Holdings to open 100 restaurants across Texas through 2029.

“As labor costs rise and supply chain/real estate challenges persist, it becomes more and more challenging to achieve the financial freedom most franchisees/entrepreneurs desire owning and operating just one restaurant (or even just a few),” Chapman says.

The franchise model is still proving fruitful. For more than a decade, QSR has highlighted fast-food and fast-casual concepts offering the best opportunities for entrepreneurs to thrive in the restaurant business. The most recent edition features 17 companies fitting that exact mold.

This is the 13th Best Franchise Deals in QSR ’s history. Once again, we tapped our Franchise Council of experts to share their choices. These brands are in no particular order. ➜

0 to 8 percent of total net sales

TOTAL START-UP COSTS: $366,693 to $820,026

FEE: $1,000 for each renewal

MARKETING FEE: Up to 2 percent of total net sales

FRANCHISEE INCENTIVES: 50 percent off initial franchise fee ($12,500 instead of standard $25,000); 0 percent royalty for initial six months (standard royalty rate thereafter)

THE SKINNY: Penn Station’s growth plan has proven itself successful over the past couple of decades. The Ohio-based brand uses a 350-mile radius from its headquarters in Cincinnati, and currently, that leads to more than 1,000 whitespace opportunities. COO Craig Dunaway told QSR in October that the chain is faring well in markets such as Nashville, Detroit, and Charlotte because of its off-premises availability and the growing number of cold handheld options—a menu category that’s grown three-fold since 2020, Dunaway said. As of April, the chain had more than 100 restaurants in its pipeline, with hopes of one day becoming a 500-unit company. Some of its targets for growth are Detroit, Chicago, Atlanta, Charlotte, and Raleigh, among several others. It’s also important to note that Penn Station doesn’t shy away from single-unit operators either. The brand has nurtured these growth opportunities by making key hires and promotions in the past couple of years. For instance, Dunaway, who joined Penn Station in 1999, was promoted from president to COO in early 2022 while Lance Vaught was bumped from senior vice president of operations to president. A few months later, Russ Smith—with nearly 30 years of experience with brands like The Athlete’s Foot, Planet Beach, REGUS Business Center, and Quiznos—was hired as director of franchise sales.

ALEX PORTER CEO LOCATION3

DANIELLE WRIGHT

CHIEF DEVELOPMENT OFFICER

PREMIUM SERVICE BRANDS

QSR magazine’s Best Franchise Deals for 2023 were selected from a nomination process that ran from mid-May to mid-June. Finalists were reviewed by the Franchise Council, which selected their top choices from shared information and FDD data. Their top choices comprise the final list. Brands cannot appear for back-to-back years, but can return after a year off.

New to this year’s edition, we recognized 15 rising franchisors that are on the outside looking in and created a Hall-ofFame for concepts that have graced the Best Franchise Deals list several times.

“Penn Station is in our Hall of Fame, meaning they have achieved high satisfaction from their franchisees for 10-plus years. In the most recent survey done in October 2022, 93 percent of the franchisees participated in the survey. Here are some areas that stood out: 97 percent of franchisees rated the overall opportunity as excellent, very good and good—19 percent higher than the food and beverage segment benchmark of data; 74 percent of franchisees agree/ strongly agree that the total investment into the business, including both time and money, is consistent with expectations set when they came into the brand—18 percent above the food and beverage benchmark; 95 percent of franchisees would ‘do it again’ when asked about investing in the brand, knowing what they know today—21 percent above the food and beverage benchmark.”

“To be honest, I previously had no clue who they were. After some review and conversation with colleagues, this sandwich franchise is taking that sector by storm. Their owners are a fast-growing multi-unit group of investors and are a diversifying bunch. Excited to see what comes for them in the next 18 months.”

pany history. She brings more than 20 years of experience, and has worked across quick service, fast casual, casual, and fine dining. Along with hiring Somerman, Bubbakoo’s modernized its app and loyalty program in partnership with Thanx. Customers have the ability to earn rewards that can be exchanged for discounts and free items and have access to exclusive offers and promotions, three new levels of loyalty membership, and a hidden Backstage Menu. Back in June, the fast casual launched a scavenger hunt via its app, giving 15 consumers a chance to win free burritos for a year. The promotion, titled “Surfin’ for Burritos” tasked fans to uncover facts and share findings on social media. However, don’t expect technological innovation to extend to AI anytime soon. CEO Bill Hart told QSR that he doesn’t envision a robotic make line, but he is interested in what phone AI ordering and Chat GPT could turn into.

(this includes franchised and company owned locations)

RENEWAL FEE:

The greater of $10,000 or 25 percent of the thencurrent initial franchise fee

TOTAL START-UP COSTS: $794,000 to $1,341,500

MARKETING FEE: 2 percent of net sales

to $700,000

THE SKINNY: Bubbakoo’s Burritos is enjoying plenty of momentum as it moves through the year of its 15th anniversary. After falling just shy of triple digits in 2022, the fast casual quickly surpassed 100 early this year with the help of multi-unit operators Gerry Miguel and Perry and Fenil Patel. With that opening, the chain entered Connecticut for the first time. The fast casual also enhanced its marketing capabilities by hiring Mimi Somerman as the first CMO in com-

THE SKINNY: Equipped with a drive-thru-only model for franchisees, speed and efficiency is the name of the game for Scooter’s Coffee. Craig Bowman, who was promoted to vice president of learning and process in February 2021, said it’s his mission to determine how cars can move through the drive-thru at a swifter pace. It starts with focusing on each transaction. Through research, Scooter’s discovered that interactions between customers and employees can add eight seconds to the order process. The brand figures if that can be eliminated, with 120 customers in an hour, that could lead to another 10 cars over 60 minutes. As Bowman explained, the key to doing this is simplifying the menu—offering a better presentation and layout, reducing LTOs, and remaining aware of how complicated an order is. On that last point, Scooter’s has a complexity rating of 1-6 based on a variety of factors, and the chain’s goal is for every item to be between one and three. If a recipe ranks too high, it won’t be added to the menu, for the sake of speed of service and accuracy. The strategy seems to be working quite well. In 2022, same-store sales grew almost 6 percent, and the chain averaged an 18.01 percent net profit margin across all locations. The brand recently opened its Scooter’s Coffee Innovation Lab where it can refine how it prepares signature drinks.

“Scooter’s has been on a tear for five-plus years, establishing themselves as the ‘it’ brand in the $48 billion coffee industry. Their unique and compact business model, both the kiosk and drivethru coffeehouse, allows franchise owners to sell high-quality, high-margin products via a fast and efficient drive-thru that’s per-

fect for the modern-day customer. Moreover, after initially focusing on building out the Midwest, Scooter’s still has plenty of territory available on both coasts which other notable competitors can’t offer—something that is, and should be, quite appetizing to savvy multi-unit candidates.”

“Scooter’s Coffee, with robust AUVs in the fast-growing $48 billion coffee industry, has an attractive model to enter the coffee and beverage space. Scooter’s is known for their high-quality, handcrafted drinks, and fast drive-thru service. Real estate and creative store design is a strength, allowing the brand to tap into prominent highvisibility, small-footprint standalone sites that keep the drive-thru lines turning all morning. Backed by a robust franchise support system and community involvement, they emerge as a noteworthy franchise opportunity.”

“As a non-essential service that involves people leaving the house, coffee shops were hit hard by COVID-19, but coffee is back, stronger than ever. And, among my favorites in our ever-growing ‘frictionless’ world, is Scooter’s, a drive-thru coffeehouse chain committed to high-quality coffee drinks and customer-focused, speedy service as captured in the company motto: Amazing People, Amazing Drinks … Amazingly Fast! Each and every coffee drink can be served up hot, iced, or blended, and the menu also includes tea and smoothies along with a selection of pastries, sandwiches, and burritos. Founded in 1998 and franchising since 2001, the number of locations has more than quadrupled in the past decade from 100 in 2012 to the current total of 467, of which 25 are companyowned and all are located in the U.S.”

percent of Mountain Mike’s then current initial franchise fee

percent Advertising Cooperative, if applicable

$417,850 to $798,500

FRANCHISEE INCENTIVES:

DISCOUNT: 50 percent off the franchise fee for existing franchisees investing in additional units

DISCOUNT: 50 percent off the initial franchise fee for qualified U.S. veterans

Includes 50 percent off second franchise fee and another 50 percent off the third franchise fee

THE SKINNY: This year marks Mountain Mike’s 45th year of business, and it couldn’t have gotten off to a better start. The first quarter featured the chain’s highest sales day in company history and increases in system sales and same-store sales year-over-year. The brand also opened three new restaurants and settled deals for 10 locations, including a five-store agreement in Las Vegas. Mountain Mike’s attributed its fast beginning to promotional efforts that led to a 518 percent increase in wing sales and a 130 percent jump in buffet sales compared to the year-ago period. Additionally, the company implemented a Valentine’s Day campaign around its heart-shaped pizza that led to a 33 percent rise in sales throughout February versus 2022 and 23.1 percent growth in same-store sales on Valentine’s Day against last year. The company is continuing to show digital strength as well. In March, Mountain Mike’s passed 300,000 loyalty members, which equated to an 83 percent increase in year-overyear membership. In the past five years, the chain has expanded by almost 100 units. Last year specifically, the chain opened 20 locations, reached 250 outlets systemwide, and signed more than 25 franchise agreements for 38 locations, including five multi-unit deals. Among those openings was Mountain Mike’s debut in Texas, which is projected to become the brand’s largest market behind California. It plans to open 30 restaurants by the end of 2023 and have more than 400 locations by the end of 2025.

“Just look at the numbers—Mountain Mike’s AUV is $1,608,631, putting it within the top 25 percent of franchised restaurants. Although not as well-known as other pizza franchise giants, Mountain Mike’s has been around for over 40 years and is poised to grow its system into a household name. With its tasty ingredients and operational experience, you can’t go wrong with a pizza from Mountain Mike’s.”

“Mountain Mike’s Pizza boasts excellent AUVs over $1.6 million, leading to a strong ROI potential. Quietly building their brand and following patiently over 40 years, they are a bit of hidden gem in the $46 billion pizza space. Controlled growth, seasoned leadership

NEXEO takes communication beyond the drive-thru and into key areas of your restaurant, increases efficiency with voice commands and group conversations, and seamlessly supports voice AI ordering. And that’s just the beginning.

team, and a solid economic model puts Mountain Mike’s as a top contender for the best franchise deal.”

“Delicious product, love their wings. They are a premium product, but well worth it, and shows up in the margins for their franchisees, growing quickly from west to east, good opportunity to get in still early[ish]. Consistently great quality.”

7 percent of gross monthly sales

MARKETING FEE:

50 percent of the then current initial franchise fee

2 percent of gross monthly sales OTHER

technology fee, $745 per month

“Crisp & Green is most definitely onto something—doubling its units in 2022 and on pace to do the same in 2023. What’s their secret? For one—quality. More than ever, customers want fast-casual health food, and no one is doing it better at the moment than Crisp & Green. By solving the challenge of doing fast casual health food right [where so many others have failed], coupled with the fact that the healthy lifestyle trend does not seem to be fading anytime soon, be on the lookout for continued growth from Crisp & Green.”

“Crisp & Green is making impressive strides in the burgeoning $1 trillion healthy fast-casual market. For over a decade, they’ve been catering to the health-conscious consumer with their chef-curated, made-from-scratch menu. Their comprehensive support system also sets them apart; covering everything from real estate to marketing, with a driven founder that has a passion for health and wellness. Consequently, Crisp & Green emerges as a compelling franchise opportunity blending growth, performance, and innovation.”

“Fast, quality, healthy is a great market and the produce delivers on the promise of fresh/good [delicious]. The corporate brand is focused on health holistically and this brand fits into their portfolio brilliantly.”

TOTAL START-UP COSTS:

$860,400 to $1,393,000

THE SKINNY: Crisp & Green had 29 restaurants at the end of 2022, but that total is expected to reach 65 restaurants before 2023 finishes and 130 outlets by the conclusion of 2024. An impressive feat, considering the chain didn’t start expanding beyond the Midwest until late November 2021. Crisp & Green’s mission is to help smaller towns lacking healthy options and larger cities that want another option. The fast casual’s real estate team recently identified more than 1,7000 additional markets that fit its site criteria, giving the brand room to open more than 1,000 shops systemwide. All existing franchisees have multi-unit agreements, and many have expanded their initial deals. Chief among them is Salads & Smoothies LLC, an operator that agreed to a company record 40-unit development contract. It includes several territories in Minnesota, as well as Phoenix, Milwaukee, Indianapolis, Cincinnati, Cleveland, and more. That’s an addition to a preexisting 11-store agreement. The franchisee currently operates a handful of locations in Minnesota, but is expected to have 50-plus restaurants open by 2028. In November 2022, Crisp & Green announced the hiring of CEO Kelly Baltes, who succeeded founder Steele Smiley. The industry veteran brings more than 28 years of experience, including stops at Maggiano’s, Good Smoke Restaurant Group, Cheddar’s Scratch Kitchen, Olive Garden, and Red Lobster.

These brands are officially retired from Best Franchise Deals, but will be highlighted in future editions. As chains reach four appearances, they will be added to the list.

ROYALTY: 4.5 percent of all gross receipts

RENEWAL FEE: $10,000

TOTAL START-UP COSTS: $794,254 to $2,523,239

$30,000

MARKETING FEE: 1.5 to 3 percent of gross receipts

FRANCHISEE

Industry-low combined royalty and marketing fees, along with exclusive regional territories

THE SKINNY: Freddy’s development took a big leap in 2022 when it nailed down more than 140 new restaurant commitments and opened 37 locations, including debuts in North and South Dakota. Thanks to the franchise agreements with new and existing operators, the fast casual will build its presence in Illinois, Nebraska, South Carolina, and Texas, among other key markets. Amid this growth,

Freddy’s is diversifying its footprint. In 2022 the chain opened its second casino location inside Table Mountain Casino in Friant, California. Then in April, the brand unveiled its latest traditional restaurant design in Belleville, Illinois. The format, now available to prospective franchisees, comprises 2,400 or 2,800 square feet, an improved kitchen, and drive-thru lanes for standard and mobile orders. CEO Chris Dull noted that with 70 percent of business being off-premises, the company has been focused on developing restaurant prototypes that increase convenience and ease. Freddy’s anticipates 60-plus openings this year in more than 15 states, like Louisiana, Virginia, California, and Wyoming. The long-term goal is to surpass 800 locations by 2026, and Freddy’s has the necessary commitments in its pipeline to reach it. The company said U.S. franchising opportunities remain in the Northeast, Upper Midwest, California, Florida, Oregon, Washington, and large metropolitan areas such as Pittsburgh. Freddy’s first and second franchisees opened their first restaurant in 2004 and 2006 respectively, and both are still developing stores today.

“Years ago, Freddy’s was this quiet success story from the Midwest. For the past several years and with Thompson Street Capital’s acquisition, the brand has opened dozens of stores a year, added 140 new units into its development pipeline, and is approaching its 500th location. The secret sauce for the brand seems to be its highquality product offering that [in some markets has a cult following], tight operations, and extraordinary service and genuine hospitality. Under Chris Dull’s leadership, the brand’s potential seems to be endless.”

“Investing in a Freddy’s is investing in the almost lost art of service and hospitality. Freddy’s is growing rapidly [140 new units in development over the past year] because it marries nostalgic culture, which offers a customer experience similar to old soda shop hamburger counters, with legitimate financial upside—industry low royalty/marketing fees and $1.8 million AUV. This is a brand to monitor as existing franchisees and multi-unit operators continue to sign on with Freddy’s, an excellent indicator of a healthy franchise system.”

“Freddy’s was named the No. 1 high-investment franchise by Forbes magazine in both 2018 and 2019 [high-investment means an overall initial investment that exceeds $500,000]. Freddy’s may be better known to some for its frozen custard, but it has a growing fan base that comes for their mouth-watering, smash-style burgers

served up in a fun classic 40s–50s diner style atmosphere. Their menu is diverse with eight different signature burgers on the menu along with a patty melt, three different chicken sandwiches, and three styles of hot dogs. Culturally, Freddy’s has a lot in common with Jersey Mike’s. It too, boasts a people-first culture that runs through every channel of the business, from HQ to vendors and suppliers and of course, the franchisees and their families. Under the leadership of president and CEO Chris Dull, a highly skilled restaurant and franchise leader, Freddy’s is one to watch, as their dominance in this space seems destined to continue.”

ROYALTY:

only)

6 percent of net sales for all stores, except: (i) 7 percent of net sales for robotic kiosks and (ii) 6 percent of net sales for Auntie Anne’s co-branded stores, which we may increase in our sole discretion up to 7 percent of net sales

MARKETING FEE:

3 percent of net sales, except 1 percent of net sales for robotic kiosks

FRANCHISE FEE: $35,500, traditional store

RENEWAL FEE:

20 percent of the then-current initial franchise fee, except for food trucks and robotic kiosks. For food trucks: 20 percent of the then-current initial franchise fee for food trucks. For robotic kiosks: 50 percent of the then-current initial franchise fee for robotic kiosks

TOTAL START-UP COSTS: $367,150 to $830,600, traditional store without a drive-thru

THE SKINNY: As customers demand convenience, restaurants have dived deeper into automation, and Jamba is squarely among that group. The beverage chain has launched several Blended by Jamba robotic smoothie kiosks across the country in nontraditional locales, such as universities and colleges, travel stops, and malls. Last year, Jamba worked with Gestalt Brand Lab to create a new persona for the robot, resulting in kiosks that feature a mural and bright colors reminiscent of fresh fruit. In addition to the robot, Jamba offers a lineup of prototypes for franchisees—traditional, drive-thru, nontraditional, in-line, and co-brand. The company found room for menu

innovation last year with the limited-time rollout of boba tea, with Strawberry Bursting Boba and Sweet Tapioca Boba Pearls. Jamba even added an in-app menu category, called Boba Favorites, where customers could view ways to add boba to smoothies, bowls, and iced beverages. The launch was part of the chain’s brand marketing campaign, “Just Gotta Jamba,” a promotion created to celebrate employees and guests and capture the attention of Gen Z consumers. And to better reach customers, Jamba began testing CLTV, or customer lifetime value. It involves using artificial intelligence to send tailored offers to individuals instead of sending generic messages to several customers.

signed three new agreements that awarded territory rights for Louisiana, Colorado, and Michigan. There are plans to open 60-plus locations across those three states. Gong cha is looking to expand growth opportunities even further by adding direct franchising to its arsenal. Henry noted in June that the brand has sold about 60 percent of the U.S., so there’s a lot of untapped markets for operators, such as Arizona, Nevada, New Mexico, Utah, Illinois, Indiana, Hawaii, and a couple of spots in the Northeast. Yearly U.S. expansion nearly tripled between 2018 and 2021, and the concept is aiming for 500 units by 2025. And as Gong cha continues this domestic journey, there’s plenty of international footprints with demonstrated success, like the 900-plus South Korea, where it can learn best practices about entering a new market or trying menu innovation. The ultimate goal is to become the clear leader of the bubble tea category in the U.S., and Henry believes the chain is well on its way.

ROYALTY:

6 percent reported and paid monthly

RENEWAL FEE: (50 percent) of the then-current standard initial franchise fee for a Gong cha unit franchise, or fifty percent (50 percent) of the initial franchise fee if franchisor or any subsequent franchisor is not offering Gong cha unit franchises at the time of renewal

“While bubble tea as a menu item is not completely new, the growth of bubble tea-only businesses in the U.S. is strong. Gong cha seems to be leading this growth as they’ve reported opening more than 190 stores domestically since 2014. Internationally consumers know bubble tea well and Gong cha seems to be educating the U.S. consumer on its appeal. Their relatively simple buildout, inventory shelf life and ease of operations seem to be driving the brand’s growth. Its potential seems to only be growing as well with reports that the industry will hit $5.5 billion by 2031.”

MARKETING FEE:

1 percent of the gross sales of the store for the prior month, will be contributed to the National Marketing Fund and up to 2 percent for a Regional Marketing Fund

OTHER REGULAR FEES:

GRAND OPENING PROGRAM: Franchisee shall spend at least $2,000 to conduct a grand opening of the store.

TRANSFER FEE: $5,000, payable only if you seek to sell or transfer your business or a majority interest in it

TOTAL START-UP COSTS: $159,200 to $566,000

THE SKINNY: Franchisees are attracted to Gong cha’s bubble tea framework because of lower investment costs and simple operations, said Geoff Henry, president of the chain’s Americas segment.

ANY NOTES ABOUT FEES:

MULTI-UNIT DEVELOPMENT OPPORTUNITY FOR EXPERIENCED OPERATORS

•$35,000 franchisee fee for the first unit (total due at signing)

•$25,000 for the second unit ($10,000 deposit due at signing)

•$15,000 for each additional ($5,000 deposit due at signing)

The executive added that the brand is “highly effective” in both 250-square-foot kiosk locations and 900-square-foot streetside units. In the kitchen, most ingredients are ambient, meaning they don’t require refrigeration, and typically there’s induction cooking without stoves and hoods. Since Gong cha has been in the U.S., growth has been run by master franchisees. Last year the chain

$325,567 to $696,000

FRANCHISEE INCENTIVES: The Veterans Discount (20 percent discount for active duty service members, first responders and qualified U.S. military veterans) and Multi-Unit Development Opportunity

THE SKINNY: Jeremiah’s entered a new era in 2023, and not just because it surpassed 100 locations in the U.S. In June, the brand announced Michael Keller as CEO and president, replacing Jeremy Litwack, who founded the company 27 years ago. Keller has extensive snack and dessert experience, including roles as CEO of Pearson Candy Company, CMO of Dairy Queen, vice president of marketing for Jamba, and senior vice president of Baskin-Robbins. Jeremiah’s also brought on Erin Buono as its first director of research and development, promoted Julianna Voyles to senior director of franchise operations, and added Adam Hing as supply chain direc-

We have opportunities in select, prime markets and non-traditional venues for qualified restaurant operators and developers with varied incentives for development.*

• Widely recognized and loved brand in family dining where guests feel welcomed and can enjoy classic favorites and craveable menu innovations any time of day

• A powerhouse brand that is a part of Dine Brands Global, a publicly traded company and one of the largest restaurant groups in the U.S.

• A dynamic brand that aims to deliver on popularity, relevancy, adaptability, and support

• An established franchise system with a business model and flexible design from conversions to freestanding, endcap, in-line and non-traditional—adaptable across varied venues

tor. Since the brand launched franchising in 2019, it’s awarded more than 280 franchise shops across 120-plus groups. It’s witnessed a more than 500 percent increase in new units in fewer than four years, including the opening of 38 stores and entry into four states (Colorado, Nevada, Tennessee, and Alabama) in 2022. The objective is to open a record 45 locations in 2023. Jeremiah’s prides itself on equipping franchisees with proper technological tools. The brand uses PUNCHH, a subscription-based, app-centric loyalty platform. Using this company’s resources, the company launched J-List Rewards and saw 100,000 guests sign up in the first year. Now there’s more than 350,000 customers on the app, with 27 percent using the app during their visit on average. The menu features 40 rotating flavors, such as mango, red raspberry, strawberry-lemon, pumpkin pie, and Scoop Froggy Frog (mint chocolate chip).

“Jeremiah’s reports strong AUVs, approaching $600,000, at a much lower investment cost than most in the quick-service restaurant sector [$325K at the low end]. The brand has awarded more than 280 locations since it started franchising in 2019 and is supported by a savvy and experienced leadership team. Jeremiah’s has been on the forefront of key technology innovations, such as their Revel POS system and World Manager communications/training program, that streamline operations and enhance the guest experience. Jeremiah’s is certainly the hottest franchise in the frozen dessert category and definitely one to watch.”

1 percent

TOTAL START-UP COSTS: $887,000 to $1,800,00

THE SKINNY: 7 Brew is one of the fastest-growing emerging chains in the quick-service industry. After being co-founded six years ago in Rogers, Arkansas, by Ron Crume, the company reached 40 shops by the end of 2022 and skyrocketed to 100 units by this summer. Drew Ritger, COO and director of franchising, told Arkansas Business in February that the chain hoped to have 200 to 250 locations before 2023 is over. Additionally, the publication quoted CEO John Davidson as saying the brand was approaching 3,000 units sold. The concept uses a roughly 500-square-foot building with two drive-thrus and no dining room. Similar to Chick-fil-A, workers come up to drivers to take their order for the sake of speed and building relationships. 7 Brews’ first franchise store opened in 2021, the

same year that Drink House Holdings—controlled by Jimmy John’s founder Jimmy John Liautaud and Lonestar Steakhouse founder Jamie Coulter—took over majority ownership. In 2022, a net of 23 franchise locations debuted. The beverage chain is plotting growth throughout the Southern, Midwest, and Northeast regions of the U.S., with recent examples like San Antonio; Springdale, Arkansas; and Traverse City, Michigan. There are more than 20,000 flavor combinations, including these menu highlights—Blondie (vanilla and caramel), Nightshade Energy (blue raspberry, pomegranate, and lavender), Georgia Peach Green Tea, and Key Lime Pie Lemon Freeze.

“With over 70 locations in 17 states and no signs of stopping, 7 Brew is certainly a franchise system on the rise. 7 Brew’s robust menu of hot and cold drinks is sure to suit customers of all types and customers love the convenience of the drive-thru model along with 7 Brew’s easy customization options. Big things on the horizon as brand recognition continues to increase.”

ROYALTY: 5.5 percent

TOTAL START-UP COSTS: $286,852 to $805,927

$6,250

7 percent

THE SKINNY: Marco’s Pizza is the fifth-largest chain in its food segment based on U.S. systemwide sales and locations. Future growth will be led by franchisees, who have more than 200 locations in various stages of development and signed more than 350 agreements. In the past six years, the pizza chain has doubled its footprint, and there’s more room to expand. Marco’s leadership identified white space for 4,200 domestic stores. To entice new and existing oper-

ators, the fast-food chain enhanced its franchise development program regarding financing, growth incentives, real estate, and design and construction. For instance, director of franchise finance Brad Fletcher and his workers established partnerships with eight preferred banks and lending institutions. Through quarterly meetings with banks, the finance team provides updates on the state of business, growth, and performance. Additionally, Marco’s partnered with a single architect to streamline the build-out process by roughly two weeks. The firm moves through permitting on behalf of the franchisee so there’s no additional responsibilities with local municipalities. The company has also brought forth several general contracting experts who provide franchisees with assistance in reviewing the bid, aligning pricing, conducting a pre-construction meeting, and reviewing schedules for project completion. When it comes to menu options, Marco’s kept things fresh with the limited-time rollout of pizza featuring Old World Sausage and boneless wings in buffalo, garlic parmesan, and barbecue sauces.

“In the pizza category, Marco’s Pizza was recently named ‘Pizza Chain of the Year’ in a Harris Poll EquiTrend survey of more than 77,000 people. The company was founded by Italian immigrant Pasquale ‘Pat’ Giammarco and is the only major American pizza chain that I know of actually started by a native Italian. Founded in 1978 and franchising since 1979, the number of locations has expanded rapidly in recent years to the current total of 1,103—up

from the previous total of 1,038—of which 45 are company-owned and 60 are located outside the U.S.”

“I have been a loyal Marco’s consumer since 2015. The quality of the product, the exceptional service, the support they provide owners, stands out for me. The investment level is in a good sweet spot for pizza and the profit margins are strong for single operators. They hold true to their quality standards and support. They are really pushing for a strong market share in this category and are truly pulling die hard pizza lovers to their fantastic options.”

2 percent (national advertising), 2 percent (local advertising)

chise Group (Round Table Pizza, Great American Cookies, Marble Slab Creamery, Hot Dog on a Stick, and Pretzelmaker) for $442.5 million. Pretzelmaker is run by brand president Allison Lauenstein, who previously worked as executive vice president of brand operations and marketing at Global Franchise Group. Prior to that role, she spent 13 years at Dunkin’ and Baskin-Robbins in various leadership positions.

ROYALTY: 6 percent

40 percent of current initial fee

MARKETING FEE: 2 percent (national advertising), 2 percent (local advertising)

$108,750 to $512,135

THE SKINNY: In an increasingly competitive snack space, Pretzelmaker stands out with an attractive bottom line. Growing same-store sales and low start-up/operating costs are combined with 20.8 percent cost of goods sold. Additionally, the chain offers multiple formats for operators, including its first drive-thru restaurant that opened in Mason City, Iowa, earlier this year. The prototype was made with the Fresh Twist branding that debuted in 2018. The reimagined restaurant style involves breakfast and late-night menu options and operations in as little as 250 square feet. Fresh Twist products, such as Pretzel Bites, breakfast sandwiches on pretzel rolls, pretzel flatbread pizzas, and specialty coffee beverages, are available all day. More drive-thru restaurants are on the way in 2023. Pretzelmaker was founded in 1991 by Jeffery Tripp. Over the years, it’s been owned by multiple companies, including Mrs. Fields. FAT Brands purchased the concept in 2021 when it bought Global Fran-

TOTAL START-UP COSTS:

$385,185 to $512,135

THE SKINNY: The cookie category has grown significantly in the past couple of years with up-and-coming chains, but Great American Cookies has been at it since 1977. CMO Jenn Johnston owed the upward trend to customers’ turning to indulgent treats amid the COVID pandemic. Great American Cookies aims to fill this demand and cater to individuals, families, and groups by offering scoopand-bake varieties, cookie cakes, and its co-branding proposition with Marble Slab Creamery. Similar to Great American Cookies, Marble Slab Creamery has been around for decades, getting its start in 1983. Parent company FAT Brands announced during its firstquarter earnings call that it signed a 10-unit agreement to open 10 co-branded Great American Cookies and Marble Slab Creamery locations in Puerto Rico. The stores are scheduled to open over the next five years, with the first couple coming in 2024. It also signed a

deal that will bring 10 co-branded outlets to Iraq. As for Marble Slab Creamery, it signed a development agreement to open franchised locations in Egypt. Those units will debut over the next decade. In 2022, FAT Brands announced that it was acquiring Nestlé Toll House Café by Chip for the purpose of converting stores to Great American Cookies. By May, the company had switched approximately 50 stores. Twenty additional conversions should be completed by late 2023.

7 percent of net sales which we may increase in our sole discretion to 8 percent of net sales, or all shops except: 6 percent of net sales for Jamba cobranded shops, which we may increase in our sole discretion to 7 percent of net sales

MARKETING FEE:

20 percent of then-current initial franchise fee.

1 percent of net sales for shops located in other locations; 3 percent of net sales for shops located in streetside locations; 3 percent of net sales for Cinnabon co-branded shops; 3 percent of net sales for Jamba co-branded shops, which we may increase in our sole discretion to 4 percent TOTAL START-UP COSTS:

$146,050 to $523,500

JAMBA CO-BRANDED SHOP: $395,050 to $804,500

$103,050 to $332,000

SHOP: $280,050 to $647,500

FRANCHISEE INCENTIVES: We participate in the International Franchise Association’s VetFran program. For qualifying veterans or members of the armed forces, the initial franchise fee for a full shop is $20,000.

THE SKINNY: To keep growing, Auntie Anne’s is exploring nontraditional locations like airports, train stations, travel centers, military bases, and universities as society moves on from the COVID pandemic. Additionally, the legacy chain is focused on streetside locations in the right markets. In 2021, the snack chain opened its first drive-thru location in Wylie, Texas, in partnership with sister concept Jamba. Auntie Anne’s told QSR in July 2022 that it would open another 12 drive-thru locations over the next year, bringing the total to 15 outlets. Those stores are scheduled to come in Texas, Idaho, Utah, Oregon, Georgia, and Michigan. Last year the brand announced on its TikTok account that more drive-thru shops were coming, and the video received more than 5 million views. Food trucks, which were launched about a decade ago, are serving as a viable option for franchisees, as well. And thanks to parent company Focus Brands, Auntie Anne’s can dual-brand and even tri-brand with Carvel, Cinnabon, and Jamba. In late 2021, Fresh Dining Concepts— Focus Brands’ largest franchisee—inked a deal to open 10 Auntie

Anne’s and Cinnabon co-branded units throughout New York City. A few months later, the operator announced that it bought 73 Auntie Anne’s locations from Double P Corporation.

FRANCHISEE INCENTIVES: Multi-unit franchise fee discount, 10 percent off franchise fees for veterans, active U.S. military members and first responders

THE SKINNY: This spring, Duck Donuts released a new prototype with the hopes of delivering better experiences for franchisees and customers. The box is 1,000 to 4,000 square feet, cuts build-out costs up to $75,000, and the inside will feature localized artwork, including an accent wall. Other modernized designs: 3D graphics, digital menu boards, and high-top barstools with a good enough

14.9%

IN NORTH AMERICA (TOP 75% OF SUBWAY LOCATIONS, ABOUT 17,000 RESTAURANTS)* * COMPARED TO SAME PERIOD IN 2022

view to watch the doughnut-making process. When customers walk in, there’ll be three ordering options—at the front counter, self-order kiosks, or pickup area for mobile orders and third-party delivery drivers. Duck Donuts said in April that Collierville, Tennessee, and Wyomissing, Pennsylvania, will be the first franchised locations to open. The updated prototype is paired with high-level growth. In the first quarter, Duck Donuts signed 10 franchise agreements for 25 shops and one food trailer. Among those deals, three were in global markets—five in Sydney, Australia; three in the Bahamas, and 10 in Iraq. In the U.S., operators inked deals in Greater West Palm Beach, Florida; Huntington and Babylon, New York; Queens, New York; South Manhattan, New York; Greenville, South Carolina; and Centerville, Virginia. Overall, the chain expects to open 35 locations in 2023. Duck Donuts is proving to be diverse in its franchise offerings, too. In March, the brand announced the opening of its first food hall location in partnership with Kitchen United. The location, operated by multi-unit franchisee Gary Kopel, opened in Santa Monica, California.

“Awesome founding story, and transition to the CEO is a great lesson in transition from founder/family to CEO. Delicious product, and I love Duck, North Carolina, so I’m a bit biased.”

“Duck Donuts, for me, has been the most interesting of the groups [on the list]. The donut sector has a dominant player—not players—for years. It is refreshing to see the trend that cookies is playing in the dessert space roll into the breakfast/donut category. Their numbers are strong, the market is huge, and the demand is something that stands out for consumers and franchise owners. From a franchise salesperson perspective, it is a niche that is taking a deeper dive into custom options and LTOs. Hard to make that work sometimes, but they are pulling it off.”

partnered with Qu, a cloud commerce platform, to improve order and operational efficiency. The pizza chain said the system helps with accuracy and kitchen fulfillment, thereby reducing labor costs and food waste. And from a customer perspective, the company underwent its largest first-party research project in history, which led to a new loyalty app and increased regular visits, more digital sales, and a 4.9-star rating. During Pi Day, the chain’s app downloads increased 660 percent from February to March thanks to its $3.14 pizza promotion, according to Apptopia. Blaze is now under the leadership of CEO Beto Guajardo, who entered the brand in 2023 with 20 years of experience in franchise development after overseeing international business at Focus Brands.

“As the longtime leader in the fast-fired pizza space, Blaze has shown that this segment is alive and well. Known for its high-quality ingredients and customizable pizzas, Blaze continues to invest in its processes—especially its technology—to help its locations grow. The brand’s rollout of Qu the cloud-commerce platform

ROYALTY: 5 percent of gross sales

MARKETING FEE:

2 percent of gross sales

50 percent of initial franchise fee, or $15,000 if Blaze is not offering franchises for sale

TOTAL START-UP COSTS: $605,400 to $1,086,500

THE SKINNY: Blaze Pizza is feeling momentum as it heads into the post-COVID era. Last year, the fast casual opened 13 restaurants and inked seven multi-store area development agreements that will bring 27 restaurants across markets like Maryland, Georgia, Tennessee, and Texas. Multi-unit operator Baryalay Razi—with 20 years of restaurant operations and management experience—is leading expansion in the Lone Star State. As part of his deal, he acquired four locations in Houston and agreed to develop five new locations. Razi is an example of most Blaze operators—71 percent of the franchise system are multi-unit franchisees. Opportunities remain across the U.S. including in Texas, Colorado, Virginia, and markets in the Northeast. To enhance the franchisee experience, Blaze recently