Seeking multi-unit operators and developers to continue IHOP’s growth in travel centers nationwide and offering varied incentives for development.*

• Develop/operate a nationally recognized and trusted brand that will broaden your customer appeal

• 65+ years of giving guests the good comfort food they love and the updated favorites they want to try… at a great value

• A variety of menu options serving all dayparts, giving guests the flexibility of choice

• Updated exterior and interior restaurant design to provide all travelers a comfortable environment at any daypart

• Portable menu items and digital ordering offer a convenient guest experience

Interested in learning more…

Contact Us franchising@ihop.com

*Subject to Franchise Agreement and Development Agreement Terms.

© 2023 IHOP Franchisor LLC. This is not an offer to sell a franchise. An offer can be made only by means of a Franchise Disclosure Document that has been registered and approved by the appropriate agency in your state, if your state requires such registration, or pursuant to availability and satisfaction of any exemptions from registration.

EDITORIAL

VICE PRESIDENT, EDITOR-IN-CHIEF

John Lofstock jlofstock@wtwhmedia.com

EXECUTIVE EDITOR

Erin Del Conte edelconte@wtwhmedia.com

ASSOCIATE EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Marilyn Odesser-Torpey

EDITORIAL ASSISTANT/INTERN

Kevin McIntyre

CONTRIBUTING EDITORS

Anne Baye Ericksen

Mel Kleiman

Howard Riell

COLUMNISTS

Thomas Briant

KJ McCann

Mark Radosevich

SALES TEAM

PUBLISHER

John Petersen jpetersen@wtwhmedia.com

(216) 346-8790

VICE PRESIDENT, SALES

Tony Bolla tbolla@wtwhmedia.com

(773) 859-1107

REGIONAL SALES MANAGER

Ashley Burk aburk@wtwhmedia.com

(737) 615-8452

REGIONAL SALES MANAGER

Patrick McIntyre pmcintyre@wtwhmedia.com

(216) 372-8112

REGIONAL SALES MANAGER

Jake Bechtel jbechtel@wtwhmedia.com

(216) 299-2281

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER

Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Jane Cooper jcooper@wtwhmedia.com

LEADERSHIP TEAM

MANAGING DIRECTOR Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES Mike Emich memich@wtwhmedia.com

EVP Marshall Matheson mmatheson@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE SERVICES

Mark Rook mrook@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

ART DIRECTOR Matthew Claney mclaney@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

EVENTS MANAGER Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST Olivia Zemanek ozemanek@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Garrett McCafferty gmccafferty@wtwhmedia.com

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

WTWH MEDIA, LLC

1111 Superior Ave., 26th Floor, Cleveland, OH 44114

Ph: (888) 543-2447

EDITORIAL AND NAG

1420 Queen Anne Road, Suite 4, Teaneck, NJ 07666 Ph: (201) 321-5642

SUBSCRIPTION INQUIRIES

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

WEBINAR COORDINATOR Halle Kirsh hkirsh@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Lender nlender@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Johnson njohnson@wtwhmedia.com

VICE PRESIDENT, STRATEGIC INITIATIVES Jay Hopper jhopper@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Lisa Dell’Alba, President and CEO

Square One Markets • Bethlehem, Pa.

Raymond Huff, President

HJB Convenience Corp. • Lakewood, Colo.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Patrick Lewis, Managing Partner

Oasis Stop ‘N Go • Twin Falls, Idaho

Reilly Robinson Musser, VP, Marketing & Merchandising

Robinson Oil Corp. • Santa Clara, Calif.

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services

Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations

Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Vice President/General Manager

Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement

Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Food Service Director Warrenton Oil Inc. • Warrenton, Mo.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

2011 - 2020

To enter, change or cancel a subscription, please go to: http://d3data.net/csd/indexnew.htm or email requests to: bsprague@wtwhmedia.com

Copyright 2023, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian

Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher. Circulation audited by Business Publications Audit of Circulation, Inc.

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Caroline Filchak, Director, Wholesale Operations

Clipper Petroleum • Flowery Branch, Ga.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Daillard Paris, Director of Petroleum Supply and Trading Sheetz Inc. • Altoona, Pa.

This will be my final editor’s memo, ending my 27 years in trade publishing, the last 18 of which were spent here at CStore Decisions.

It’s not joy that makes us grateful; it’s gratitude that makes joy possible. But I can’t acknowledge everyone to whom I owe a debt of gratitude without writing a tome that extends for thousands of words. As my fellow journalists understand, brevity is a virtue.

So many of you have enriched my life, but I must give a special shoutout to my friend, Maureen Azzato. It all started one morning in 1996, when a young Navy veteran with no magazine experience walked into an office building in midtown Manhattan and left with the title of staff writer, Convenience Store News. There were no cell phones or social media for me to tell the world. Just an excited trip home to get my suits to the dry cleaners to begin a new journey.

That was nearly three decades ago, but I remember my interview with Maureen as if it were yesterday. It was an inflection point in my life having grown up in the industry.

My father was an Esso/Exxon dealer in Mount Vernon, N.Y., for some 40 years, before retiring from the family business — started by his older brothers, my

Uncle Martin and my Uncle Vinnie — when I was off in the Navy. I always felt I would come home to the family business, but life got in the way, as it often does, and had other ideas for my career.

I spent the summers of my youth pumping gas and checking oil long before I took a writing class. One of my favorite memories from those days was getting the “big stick” to measure the inventory in

the underground tanks. It was hidden on the side of the building during the day, but in the twilight hours before close, it roared to life as big as the Empire State Building in my eyes. Wrestling with the 15-foot monster was seconded only by riding shotgun in the tow truck or going to dinner with my dad, uncles and cousins. Fortunately, my father Ed and older stepbrother Eddie are still with us, but the others in these great memories have passed on, my Uncle Vinnie most recently in October. Such great men who taught me a lot about having a great work ethic.

Professionally, Maureen drilled into me two important lessons: 1.) always be prepared, and 2.) try to be smarter than the people across the table from you. These were skills that I honed serving aboard the nuclear submarine USS Providence (SSN-719) during the Gulf War. She was spot on, and you guys always made sure I brought my A game.

You folks are more than friends; you’re like family to me. As I move onto the next chapter, I look forward to making new friendships, but maintaining my close ties with all of you.

I hope I lived up to your standards and you were proud of the work we did. Most of all, I appreciate that you trusted me, because that’s what this is all about — trust. You knew I would never treat any of you wrongly.

Without trust, there is nothing. But with trust, a small group of people like us can move mountains, and that’s what we did for 27 years.

To the greatest industry with the greatest people…thank you.

As history has proven, there comes a time when innovative technology reaches a pinnacle, trickling down until it becomes common practice. It’s generally assumed that electric vehicles (EVs) are on the path toward market dominance in the automotive industry, and with that, mass consumption must ensue. With c-store chains like Road Ranger on board, the future looks bright — electrifying, some might say.

Since its inception in 1984, the Road Ranger brand has continuously kept up with the innovative trends of the future. That’s why it comes as no surprise that we celebrated the grand opening of our first EV charging station on March 8 at our new travel center in Waco, Texas.

The Waco Road Ranger travel center is the closest DCFS (directcurrent fast charger) charging hub

near the Waco airport. Waiting to enter the market until now allowed us to jump in when the technology was much more advanced.

Road Ranger selected a Boost Charger. This type of charger has a maximum output per connector of 150 kilowatt-hours (kWh), delivering approximately 200 miles in 15 minutes. A single EV can charge at 150 kWh, or two EVs can

charge simultaneously at 75 kWh. Road Ranger’s Waco travel center features four fast-charging EV stations with eight lanes and has the capability to charge up to eight EVs at one time.

From its infancy, Road Ranger’s goal has always been to create a brand that was there to serve travelers, providing innovative solutions, modern approaches and fresh alternatives to keep the consumer happy, fueled and sent safely back on the road. Today, Road Ranger operates 46 travel centers throughout the Midwestern corridor.

As the Road Ranger fuel network continues to grow, we aspire to play a much larger role in building an EV infrastructure for the future.

Road Ranger enters the electric vehicle (EV) charging market and evaluates the future of EV adoption.

Road Ranger enters the electric vehicle (EV) charging market and evaluates the future of EV adoption.

How does the addition of one EV charging station make an impact on consumer adoption of EVs?

According to recent surveys, it is estimated that, to achieve mass consumer conversion, the manufacturer suggested retail price of an EV needs to average $36,000. Today, three of the best-selling EV base models are already within that price point. So, if the price of EVs isn’t holding the

future back, what is?

Consumer research shows that efficient travel range must also be considered. The average consumer reports that to feel comfortable when considering an EV purchase, roughly 300 miles of range would be necessary. So, what is limiting the rangeability of these vehicles? It’s a no-brainer — battery charge. Although the ability to build a larger battery is viable, inevitably the cost of

that battery increases the cost of the vehicle. Yet again slowing down mass consumption.

So, the larger question persists: What is keeping consumers from buying electric vehicles? Mass consumption will not happen until widespread fast charging is easily accessible. The obstacle to widespread adoption is known, but let’s look at the actual data: The average American lives five minutes from the local gas station. That same individual is reported to live 30 minutes away from the nearest supercharging station, according to an analysis by UBS.

Obviously, this is not a feasible infrastructure to increase the widespread adoption of EVs. You can’t sell the cars without the infrastructure.

So why don’t we see charging stations popping up at every momand-pop convenience store and travel center around the U.S.?

Although the offering of additional amenities at locations sounds appealing, most retailers are not jumping at the chance to get on board simply due to the high cost of utility fees and electrical installation costs. The cost to the operators can vary on several factors, including permitting, on-site electrical upgrades, supplemental fees, demand charges and more.

Nonetheless, as the world becomes more conscious of the various effects of carbon emissions and vehicle pollution, sustainability is at the forefront of Road Ranger’s business practice. Road Ranger is committed to improving the quality of life for the communities we serve, and that starts with being conscious of our effect on the environment and realizing electric mobility options play an important part in helping mitigate climate change.

As an effort to place value on environmental consciousness, installing EV charging stations at a Road

Ranger location helps to establish forward movement in Road Ranger’s internal sustainability initiative.

Beyond building a cleaner future, by adding this additional amenity to our already extensive collection of offerings, Road Ranger hopes to continue to grow a loyal customer base.

As any retailer will tell you, the goal is to build relationships with consumers and retain happy return customers by simply reaching their needs and providing a high standard of service.

As our proprietary app, Ranger Rewards, continues to evolve, Road Ranger looks forward to adopting loyalty perks for our members who choose to charge at Road Ranger stations in the future, deepening the customer relationship and building stronger brand loyalty.

Road Ranger has committed to opening six EV charging stations in 2023 to support the connection of EV charging infrastructure.

By using EV consumer-specific technology platforms, Road Ranger is now able to connect with EV drivers throughout the U.S., allowing them to easily find, access and securely pay for charging at our locations. These stations are open and available to consumers 24/7/365 to ensure that the consumer can get back on the road as quickly and safely as possible. Road Ranger has committed to opening six EV charging stations to continue the goal of supporting the connection of the EV charging infra-

structure, while also supplying the energy that our consumers are looking for when they show up at a Road Ranger travel center. All EV sites are set to be available to the public by the end of 2023.

KJ McCann is the digital & loyalty marketing manager for Road Ranger. She can be reached at KMcCann@ roadrangerusa.com.

KJ McCann is the digital & loyalty marketing manager for Road Ranger. She can be reached at KMcCann@ roadrangerusa.com.

Coming off a strong 2022, ARKO finalized its 23rd acquisition since 2013 in March, with another set to close in Q2.

Erin Del Conte • Executive EditorARKO Corp., a Fortune 500 company based in Richmond, Va., that owns GPM Investments, had a strong year in 2022 and is fresh off a string of acquisitions. It now represents the sixth largest convenience store operator in the U.S.

In late February, ARKO reported record profitability for fiscal 2022, with operating income of $167 million compared to $142.1 million in 2021, and net income of $72 million compared to $59.4 million for the prior year.

In 2022, which marked ARKO’s second year as a public company, ARKO was named to the 2022 Fortune 500 list, which ranks the largest companies by total revenue in the U.S. ARKO ranked at No. 498. The company also secured a $1.15 billion real property commitment from Oak Street Real Estate Capital and announced four planned acquisitions. These are Quarles Petroleum and Pride Convenience Holdings (which both closed in 2022), WTG Fuel Holdings and Transit Energy Group (TEG).

Last month, ARKO closed on its

acquisition of TEG, which added approximately 135 convenience stores and 190 wholesale sites, among other assets, for $370 million. The acquisition increased ARKO’s store count to more than 1,500 c-stores in 33 states. TEG brings to ARKO well-known banners such as Corner Mart, Dixie Mart, Flash Market, Market Express and Rose Mart.

Last year, ARKO fully remodeled six stores and began the planning and engineering of a new-to-industry store in Atlanta, Texas, which is expected to be completed in 2024. ARKO also installed 548 bean-to-cup coffee machines across its retail locations.

CStore Decisions spoke with ARKO Corp. Founder and CEO Arie Kotler to learn more about the chain’s recent acquisitions and its plans for the year ahead.

CStore Decisions (CSD): Why was the time right for these four acquisitions and why did these chains appeal to ARKO?

Arie Kotler (AK): Capital allocation is one of our many strengths, and we always think about the best areas to deploy capital. The company’s return on invested capital across our many acquisitions underscores that continued mergers and acquisitions (M&A) is an effective use of capital.

We announced four highly accretive acquisitions in 2022, of which we already closed three — Quarles Petroleum, Pride Convenience Holdings and Transit Energy Group (TEG). The fourth, WTG Fuel Holdings, is expected to close in the second quarter of 2023.

Quarles added a fleet fueling segment to our company, which is an excellent business. The timing of the Quarles acquisition and our rapid integration could not have been better. We realized strong cash flow because of fuel price volatility in the second

half of 2022 since closing, and the segment contributed incremental adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) in 2022 of $20 million.

Pride expanded our New England territory into Massachusetts. The TEG acquisition added approximately 135 convenience stores and expanded our southern retail territory into Alabama and Mississippi. And WTG would significantly enhance the company’s footprint in the attractive Permian Basin market, with 24 company-operated Uncle’s Convenience Stores across western Texas. We add value to these stores with a larger assortment and new promotions that we believe resonate with our customers.

CSD: Will the newly acquired convenience stores retain their banner names or will they be converted to another banner?

AK: We acquire brands with histories in their communities and brand

equity. We like to retain these banner names, which are familiar and have meaning to their customer base. Our teams have been very effective at improving marketing, in-store mix and offerings to drive sales at our newly acquired stores while maintaining brand equity. We create value by expanding merchandise mix in these stores. For example, after we acquired Handy Mart in 2021, we added over 700 items into the stores.

CSD: We’re seeing a lot of consolidation in the c-store industry today. What does it mean for the industry as a whole?

AK: Our industry continues to be highly fragmented. As a result, the overall deal pipeline is still strong, and we expect to expand our core convenience store business through our acquisition strategy. ARKO has closed 23 acquisitions since 2013, with our 24th expected to close in the second quarter. We believe there will be continued consolidation in the industry.

CSD: What are ARKO’s 2023 goals?

AK: We have many goals for the year. We are in the process of rolling out our new fas REWARDS loyalty app, which has many exciting and new high-value features for the benefit of our existing and new loyalty customers.

We also are working to expand our food offerings, including pizza, chicken, prepared sandwiches and many other options. We are making progress identifying food offerings at a price point that will resonate with our customers and that we can use across our stores.

And, of course, the M&A pipeline continues to be strong, with potential opportunities to make accretive deals. We believe we will continue to grow through acquisitions.

Customers are returning to in-store shopping habits. Being able to ask employees for help with questions and purchases is a key driver bringing shoppers back to stores. Happy employees make for happy customers. Those searching for new jobs cite increased income and flexibility as the top reasons.

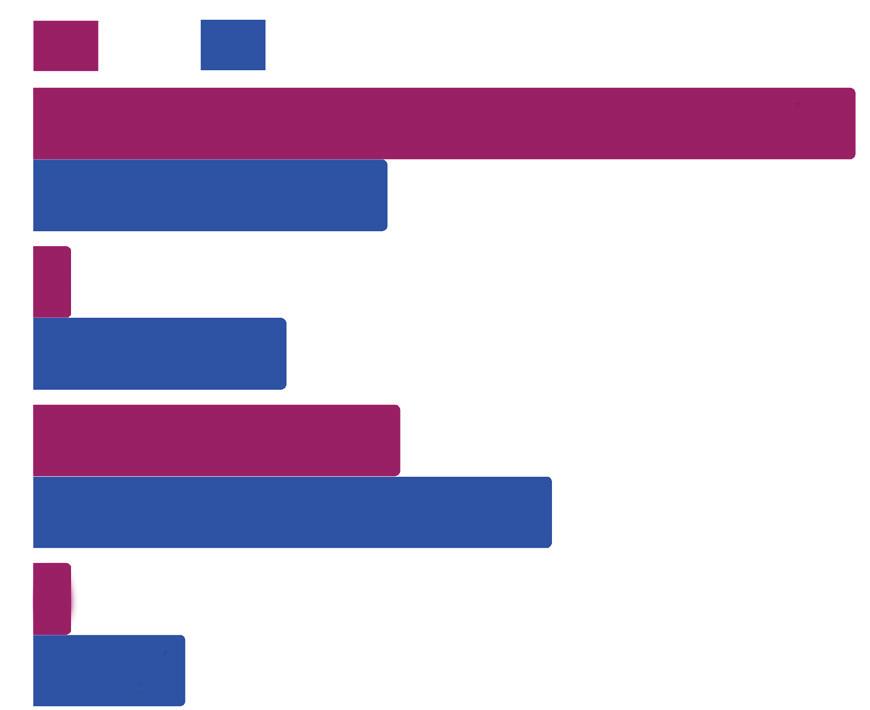

Some 60% of U.S. adults say they prefer cashiers to self-checkout kiosks, up from 54% two years ago.

If both a self-checkout kiosk and a cashier are available at a store, which one do you prefer to check out with?

Theatro's “2023 Retail Customer Experience Survey” highlights the reasons consumers enjoy shopping in stores.

• 76% said they prefer in-store shopping because they like being able to see and touch the product.

• 44% said they like the immediate gratification of taking the products they buy home with them.

• 25% said they like the social aspect of shopping.

• 21% said they like being able to ask questions and get help with purchases from in-store employees.

• 20% said that it's easier to return items at a physical store.

Source: Theatro's, “2023 Retail Customer Experience Survey,” February 2023

Both remote and in-person workers cite increased income and flexibility as reasons why they’re searching for a new job.

What would you say is the top reason you are searching or planning to search for a new job?

Source:

Based on a National Association of Convenience Stores (NACS) survey, nearly three in four customers hold a favorable opinion of convenience store jobs.

• 86% say convenience stores are good first jobs for those looking to enter the workforce.

• 83% say c-store jobs are good for those re-entering the workforce, such as retirees or veterans.

• 83% say c-store employees can work their way up to become managers or even run their own stores.

Source: NACS survey, October 2022

Theatro's “2023 Retail Customer Experience Survey” also shows:

• 91% of consumers said they do at least half of all their shopping in physical retail stores compared to online.

• Nearly two-thirds said they do most (37%) or all (27%) of their shopping in stores.

• 28% of respondents said they do about half of their shopping online and half at physical stores.

Source: Theatro's, “2023 Retail Customer Experience Survey,” February 2023

On July 19, 2022, Food and Drug Administration (FDA) Commissioner Robert Califf issued a public statement directing the Reagan-Udall Foundation to engage an independent expert panel to evaluate the operational aspects of the FDA’s tobacco regulatory program.

In the statement, Commissioner Califf stated that “the agency has confronted a series of challenges that have tested our regulatory frameworks and stressed the agency’s operations, prompting me to take a closer look at how we do business.”

The expert panel carried out an evaluation process that focused on how the FDA’s Center for Tobacco Products (CTP) operates regarding the proposal and adoption of tobacco regulations and guidance, product application review, compliance and enforcement, and communication with the public and other stakeholders.

In December of 2022, the expert panel issued its report titled “Operational Evaluation of Certain Components of FDA’s Tobacco Program.” From an overall perspective, the report included, in part, the following findings:

The application of new tobacco regulations to an existing industry is difficult, and the FDA’s task has been made more difficult due to the large volume of product applications, changes in the FDA’s leadership and numerous lawsuits brought against the agency. Some of these challenges have resulted, in part, due to the FDA’s own policy choices, including the expansive regulation adopted in 2016 extending the agency’s regulatory authority to cigars, pipe tobacco, electronic cigarettes/vapor products, oral nicotine products and hookah tobacco.

Industry members have experienced a lack of consistent implementation of the FDA’s tobacco policies, particularly with respect to less harmful tobacco products and to finalize requirements and standards for reviewing pre-market tobacco applications (PMTAs).

The Family Smoking Prevention and Tobacco Control Act that authorized the FDA to regulate tobacco products was structured to create a pre-market authorization framework for tobacco products but, in reality, the FDA operates in a post-market regulatory environment. That is, rather than not allowing new tobacco products with tobacco-derived nicotine to be sold while a PMTA is under review, the agency has exercised its enforcement discretion to permit such new tobacco products with tobacco-derived nicotine to be sold while the PMTA review process is taking place.

Since being created in 2009, the FDA’s CTP has issued 16 proposed rules/regulations, 16 final rules/ regulations, 35 draft guidance documents and 50 final guidance documents, as well as acted on 96% of some 8.9 million tobacco-derived nicotine product PMTAs with approximately 329,000 tobacco-derived nicotine products remaining under PMTA review.

Millions of tobacco products, primarily electronic cigarette and nicotine vapor products, have entered the market without pre-market authorization and remain on the market today, and other new products continue to enter the market without the required FDA authorization.

Based on its review, the expert panel made a number of recommendations for the FDA to consider implementing to improve the operational aspects of regulating tobacco products. Some of these recommendations are as follows:

The CTP needs to pivot from a reactive mode to a proactive mode by creating a plan that identifies strategic objectives and puts into place operational changes over the next five years to achieve the objectives.

The CTP should increase its use of the Tobacco Product Scientific Advisory Committee to obtain expert input on scientific issues and policy development, including regulations, guidance and data needed for effective product regulation.

The CTP should develop a clearer and more predictable framework for high-quality PMTA and Modified Risk Tobacco Product (MRTP) applications by setting scientific standards for such applications, simplifying and standardizing application review procedures, and providing more details in public summaries of orders authorizing or denying a product application.

The FDA should seek higher level Biden Administration involvement to establish a multi-agency task force

to make enforcement of the tobacco laws a government-wide priority, particularly to address the marketing of illegal tobacco products and the risks of youth tobacco use. The task force could include the FDA, the Department of Health and Human Services, the Department of Justice, the Bureau of Alcohol, Tobacco, Firearms and Explosives, the Department of Homeland Security (Customs and Border Protection) and the Department of the Treasury (the Alcohol and Tobacco Tax and Trade Bureau).

The CTP should utilize public communications to provide greater transparency about the agency’s approach to compliance and enforcement, including posting and maintaining a list of legally marketed products to facilitate voluntary compliance and discourage the sale of illegal products by manufacturers, wholesalers and retailers.

On Feb. 24, 2023, the FDA’s CTP issued a written response to the Reagan-Udall Foundation report recommendations, which included the following:

The CTP will initiate the development of a comprehensive five-year strategic plan with interim strategic goals published by the summer of 2023 and the full strategic plan to be released to the public by December 2023.

The CTP will hold more frequent meetings of the Tobacco Product Scientific Advisory Committee to obtain input on scientific issues related to regulatory tobacco products.

The CTP will convene a summit related to enforcement with senior officials from the Department of Health and Human Services, FDA and the Department of Justice.

The CTP plans to create a comprehensive webpage for all enforcement activities for products that are illegally marketed without FDA authorization.

FDA CTP Director Brian King stated in the response to the Reagan-Udall Foundation report that the agency is “committed to implementing these activities as expeditiously as possible” and that implementation “will not be at the expense of continued progress” on other FDA actions.

Lorissa

Martin has held her current HR position for 13 months, but she’s worked in retail since she was 16.

“(I was) a store manager, and, of course, managing operations and hiring and loving all of that aspect. And then (I transitioned) into HR on the staffing side,” said Martin. “It’s a totally different kind of ballgame with staffing. You get really great foundational skills (such as) recruiting and how to manage processes. …”

In 2019, Martin began her tenure with the Wills Group, which operates 60-plus Dash In convenience stores in Delaware, Maryland and Virginia, as well as 50-plus Splash In Eco Car Washes and SMO Motor Fuels.

She started with the company as a recruiting coordinator and found a quick career path into management.

CStore Decisions is recognizing Martin with an HR Award for her drive to give employees the tools needed to succeed at the company and her commitment to improving everyday processes.

“I love having the ability to interface with so many different people on a given day,” said Martin. “Taking the feedback and the wants and needs from our hiring managers and being able to interpret those into either process improvements or new programs, that’s what brings me a lot of joy. I also love the fact that I get to really help with people’s career path and development.”

Martin manages talent acquisition for the retail stores with both Dash In and Splash In as well as the headquarters positions; she also handles the entire performance management process.

“A lot of development gets woven into there; how we connect the dots between our company’s culture, values and competencies all into performance,” she said. “For me, (performance) makes me super excited. … And it ties in so well with talent acquisition because it’s that hand off.”

In her role, Martin also oversees onboarding and compensation, in addition to the constant evaluation and iteration of new processes with

the solutions that are in place.

In 2021, Martin created the LEAD program, which stands for Leadership, Excellence, Achievement and Development. It gives assistant managers a path toward store manager positions.

“We recognize that there is a gap for our assistant managers to really be successful as store managers. And so, I wanted to create a program that gives them that foundation to really be able to hit the ground running and gives them real-life application and exposure into the role prior to actually moving into it. It gives them also a lot of tools to prepare them for that,” said Martin.

Since its start, four assistant managers have been transitioned into store manager positions after

The Wills Group has just been re-certified as a great place to work through the Great Place to Work survey.

completing the year-long program. Another development Martin is proud of is the General Education Development Test (GED) program offered to hourly employees that haven’t received a high school diploma or GED. The Wills Group pays for 100% of the cost, and through a partnership with GEDWorks, these employees are given hands-on, oneon-one guidance with a counselor to support them through the process.

In the past year, Martin also helped revamp the talent referral program.

“Now, for every sales associate re-

ferral, an employee receives $500 all the way up to $2,000 in a referral bonus based off of the specific position,” said Martin. “We are all fighting to get the best talent, and some of the best talent that you can get is from referrals. So being able to revamp it with a better incentive program has really worked out in our favor.”

This year, Martin is launching the Wills Group’s first formal internship program.

“I’m beyond excited. I feel like I have all those nervous excitement butterflies in my tummy each time I think about it. But we have a lot of fun stuff coming up to really just help continue driving our organization forward,” Martin said.

The company’s new Series 3 modeling concept, an initiative every department has had

a hand in, is one of these upcoming moves. A soft open for Dash In’s new c-store concept just launched in a brand-new market for the company in Virginia.

One of the biggest HR challenges Martin has noticed aside from attracting talent is retention. She believes it’s important to have programs in place focused on employee development, recognition and engagement.

“We feel like if we have those things in place, we typically will see increased feelings of connection and belonging. And that’ll result in better improvement of retention,” she said.

To boost retention, the Wills Group uses engagement surveys twice a year to gather employee feedback. The company then takes the data and turns it into action plans that will resonate with employees’ exact needs.

The Wills Group has just been re-certified as a great place to work through the Great Place to Work survey and has seen an increase in employee ratings and participation.

Alison Abbey relies on her vast HR experience as she ensures employees’ voices are heard and develops plans that improve retention.

Zhane Isom • Associate EditorAlison Abbey, human resources (HR) manager at Stewart’s Shops, which operates 357 shops in upstate New York and southern Vermont, brings 17 years of HR experience to her role and excels at building relationships, prioritizing employees’ needs and ensuring they are set up for success at the company.

At Stewart’s Shops, employees are referred to as “partners” because they own 40% of the company through its employee stock ownership plan. But the term is also one of the many ways Stewart’s Shops conveys its respect for the important contributions of its front-line workers.

“I really enjoy being a resource for people. It is important for me to create an honest and trusting relationship with our partners,” said Abbey. “It is important to give people a voice and allow them to be heard. Listening and having empathy goes a long way in building relationships with partners.”

CStore Decisions is recognizing Abbey as one of our HR Award recipients because of the way she connects with partners, ensures their voices are heard and supports their needs, while continuing to create a safe and comfortable work environment.

After graduating from the State University of New York with her bachelor’s in business management, Abbey began working with the recruiting company Robert Half International. While with the company, it was her job to identify the best overall fit for a company and candidate. This is where her passion for helping people began.

After spending a few years as a recruiter, Abbey wanted to do more in HR, which landed her a position at Stewart’s Shops.

“My first position at Stewart’s Shops allowed me to be part of the entire process of onboarding someone from applicant to partner,” Abbey explained.

Now in her current role as the personnel HR manager, she is responsible for overseeing all of the day-to-day operations related to payroll, training and benefits administration for Stewart’s Shops’ partners. Along with managing the HR department, Abbey works with district managers when they are dealing with partner situations. She also works with the operations team to understand turnover trends, ensuring pay is fair and creating ways to improve partner retention.

When the pandemic hit, people were forced to decrease their communication with others. Once

everything returned to normal, Abbey ensured that the voices of Stewart’s Shops’ partners and customers were heard and respected.

“Stewart’s created an ice cream flavor called ‘civility’ to emphasize that understanding and respect towards one another can go a long way in improving interactions with both customers and fellow partners,” said Abbey. “We are in a people business and interacting with customers keeps our partners’ jobs interesting and stimulating.”

Also, when gas prices increased, Abbey and the HR department made sure partners were able to get back and forth to work when needed.

In 2022, Stewart’s Shops partnered with a local transportation company to offer free bus rides to its partners. This benefit was available whether employees were commuting to and from work or taking the bus for personal reasons.

“The high price of gasoline was one reason we created this program, but we also share partners between shops, and this allowed our walkers to help in shops that were not in walking distance,” said Abbey. “This helped with both recruiting and retaining partners, knowing they can save money on gas and limit how often they drive their vehicles.”

“The goal of the HR department is to support our shops operations team and try to make their work life as easy as possible,” said Abbey. “We have an advantage over other companies because we are in control of the human resources process, which allows us to help our partners without having to rely on a third party.”

All-in-all, Abbey wants to continue ensuring Stewart’s Shops remains a desirable employer by understanding its partners’ needs and making changes as necessary.

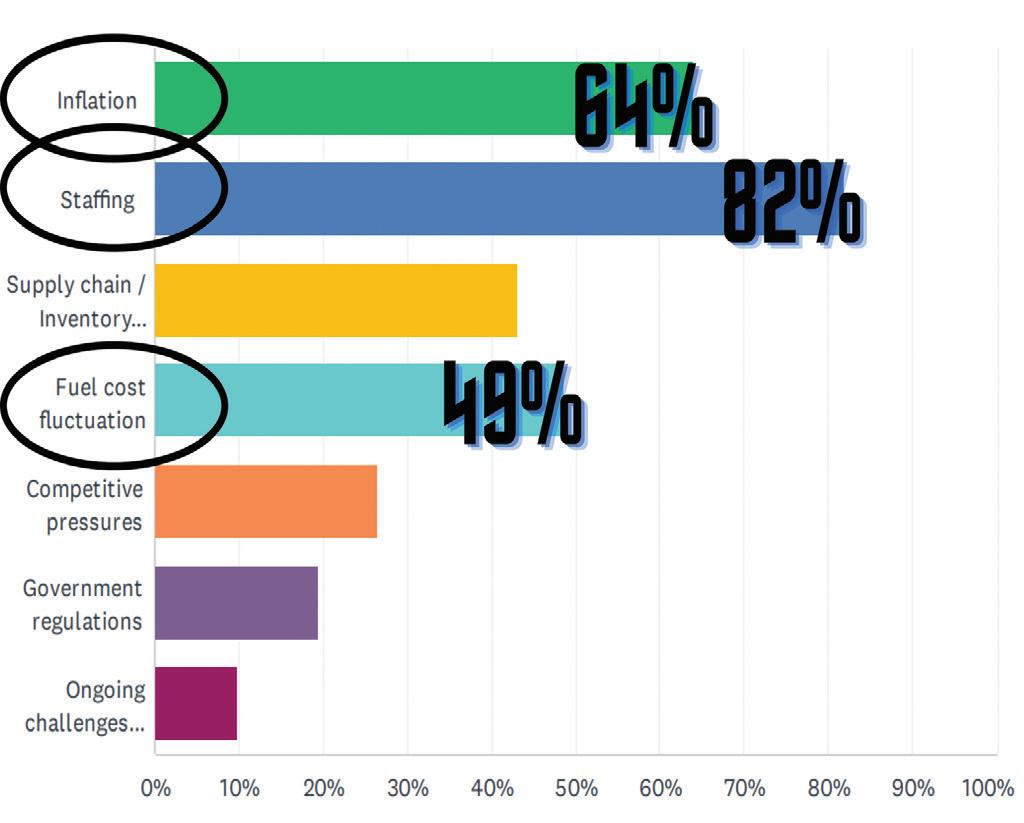

The COVID-19 pandemic may no longer be a primary concern in 2023, but its impact on the economy and the workforce lingers. In fact, staffing ranks as the top concern for c-store retailers in 2023, followed by inflation.

CStore Decisions and Humetrics, for the 15th consecutive year, have collaborated on the Human Resources (HR) Benchmarking Survey, which polled c-store retailers between Jan. 4, 2023, and March 1, 2023, about HR practices, labor challenges, economic outlook and more.

The survey consisted of 40 questions, designed to compare, predict or estimate the most common HR issues impacting the convenience store industry. This year’s participants included: store managers (37%); corporate HR (16%); owners (15%); general, regional or operations managers (15%); corporate other (13%); and assistant store managers (5%). Less than 7% of responding chains had annual revenue over $500 million, and the majority (53%) fell within the $1 million to $10 million range. Of remaining respondents, 53% had 1-10 locations, 24% had 11-50 locations, 10% had 51-100 sites, 11% had 101-500 stores and 1.5% had more than 500 stores.

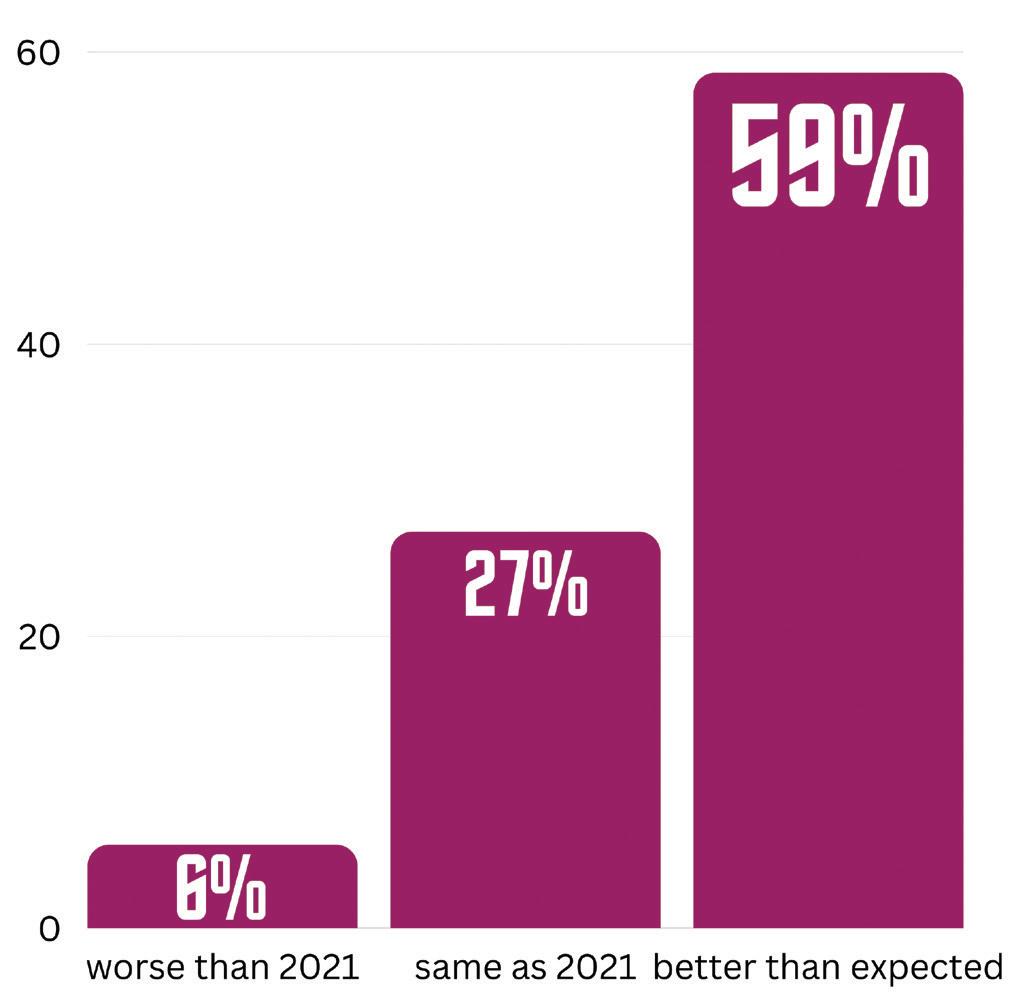

The survey began by asking participants: “How was your overall business in 2022?” More than half (59%) of retailers surveyed shared that business for them in 2022 was better than expected.

How was your business overall in 2023?

But it was no surprise that survey participants still rank staffing as one of the industry’s most exhaustive and repetitive challenges. Attracting and keeping workers remains a struggle for store owners and managers.

While the pandemic has exacerbated staffing issues, the rising costs of food, supplies and fuel have also presented new challenges.

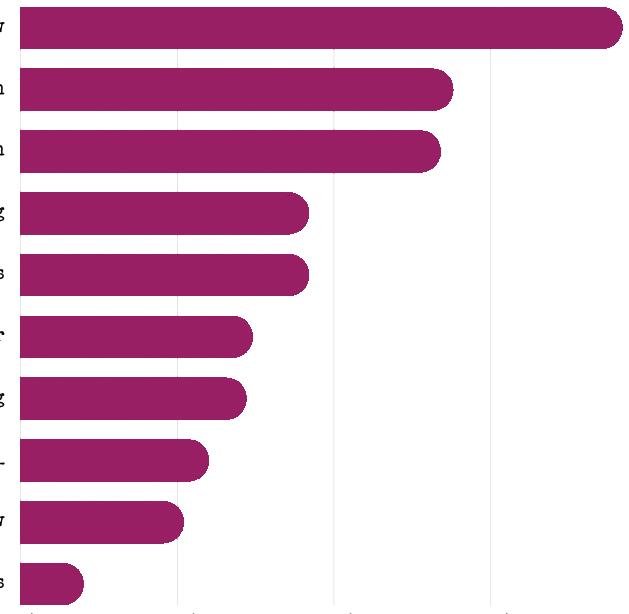

What are the top 3 most significant challenges you see ahead of you in 2023?

Consumers are looking for ways to stretch their dollars further. C-stores are finding creative ways to entice consumers with coupons, promotions, loyalty programs and BOGO (buy one get one) offers to keep dollars inside their stores.

On the bright side, the average in-store purchase increased 6.3% in 2022 and has grown 22.4% continually over the past two years.

And more positive news is that USAWire.com reported that 51% of Americans want to travel in 2023, and out of that number, 67% are planning road trips. The majority of those are planning out-of-state travel, and 40% are taking staycations, which will still require stocking up the pantry, refrigerator and adult beverage cooler. With kids and adults on the road, that means more pit stops and purchases along the way — all excellent news for the c-store industry.

Retailers were asked: “How do you think your business will be in 2023 compared to 2022?”

Responses included: “We are growing and have high hopes for 2023.” “(We) struggle hiring individuals that have strong work ethics and want to work.” “We are on track to have our best year ever, but worried about 2023.” “No more COVID handouts.” “I think staffing challenges will ease due to layoffs in other industries.” “Recession will be the deciding factor.”

Meanwhile, remnants of the pandemic are still creating HR challenges. As shown in the graph below, retailers ranked recruiting challenges (66%), retention/turnover (54%) and not enough shift coverage (49%) among the top business impacts of the pandemic.

Retailers reported that recruiting, hiring and retention remain the most significant HR concerns overall, with employee compensation close behind in fourth place: 1.

Retailers were asked, “In 2022, approximately what percentage of new hourly hires quit within the first 30 days?” Some 31% of respondents reported seeing a quitting rate of 0-10% among new hires in the first 30 days, while 27% of retailers saw a quitting rate of 21-30%. Compared to last year, the average quitting rate from 0-30%, is up by only 4%.

Employee referrals have reclaimed the No. 1 position as the most effective recruiting tool. Referrals have long been a valuable source of high-quality, cost-effective candidates, leading to faster hiring and better retention rates.

Employee referrals tend to be high-quality candidates because they have been recommended by someone who knows the company and the job requirements well and believes the candidate is a good fit.

Craigslist (less than 5%), job fairs (4%) and the local newspaper (less than 2%) ranked among the least effective recruiting tools, according to respondents.

In 2022, the majority of respondents experienced a turnover rate between 11-50%, with 18% of retailers reporting a turnover rate of 31-40%. Some 55% of respondents noted that their experience with turnover was about the same as the previous year, while 23% said turnover was higher and 22% responded that it was lower.

A surprising 49% of retailers reported that they are not using any incentives or referral rewards at this time. Of those who do offer these perks, about 40% find them moderately to highly effective.

To better attract new talent, 87% said their starting wage in 2022 went up, and no retailers reported that their wage decreased. Some 11% of retailers reported that their chain’s

It costs about one-third of an employee’s annual salary to replace and train a new hire, according to C&D Restructure and Taxation Advisory. But often, the hiring process misses critical red flags, or the organization is desperate and has to hire anyone to fill vacant positions. This puts c-stores at risk for high turnover.

Compared to 2022, online job applications are down 17% in 2023, and in-person interviews are up 11%. Conducting a pre-screening telephone call is down from 54% in 2022 to 30% in 2023. In-person interviews were the top hiring and onboarding practice used by retailers.

starting wage stayed the same, while 1.5% didn’t know.

Retailers were asked: “If you increased your starting wage in 2022, in dollars and cents, how much was the increase per hour?” Responses included: $3.25 per hour; $2 per hour; $10 per hour; $1.50-$2.50; $2-$4, depending on experience; $2 per hour; $1.50, plus merit increases for team; $1 per hour; and 50 cents per hour.

The benefit packages offered to full-time hourly employees saw changes compared to last year. In comparison to last year, more employers offered paid vacation and sick leave than the previous year, while wellness programs, education benefits and paid personal time decreased in benefit packages:

↓ 9% — Wellness programs

↑ 31% — Paid vacation/sick leave

↓ 10% — Education benefits

↓ 22% Paid personal time off

With staffing challenges ongoing, retailers seem more open to hiring from often overlooked demographics. Some 27% of respondents reported their chain is hiring workers with disabilities, up 8% from 2022. The largest jump in hiring area was for those with criminal records. Some 33% of chains are hiring workers with criminal records, up 27% from 2022. Of those who hired associates with criminal records, 10% reported it did not work out.

Older workers 43% (up 4% from 2022)

33% (up 27% from 2022)

People with disabilities

27% (up 8% from 2022) Veterans 39% (up 4% from 2022)

After the hiring process comes the necessary effort of employee retention.

Retailers were asked, “What actions did you take in 2022 to tackle the problem of employee retention?” The No. 1 answer was pay raises at 86%. This was followed by more flexible scheduling at 72% and enhanced employee recognition programs at 41% in third place.

Respondents were also asked, “Other than raising wages, what else are you trying to do to reduce employee turnover?” This was an open-ended question in the survey and the responses included: flexible scheduling, improved training, more paid time off, incentives with dollar value, employment stability and careful selection of new hires. Incentives such as a better environment, contests for selling items, funding things employees are passionate about, and benefit solutions like health insurance and paid vacation time were listed. Other responses included employee engagement programs, more employee recognition, employee meals via a DoorDash account, holiday bonuses and awarding employees with in-store coupons when they go above and beyond. And, one retailer responded, “lowering standards.”

In 2022, short-term employees who quit or were terminated were down by 27% compared to 2021, which could reflect increased wages, better working conditions and the end of the pandemic.

C-stores have traditionally been a high-turnover industry, with many employees leaving within the first few months. Today, many c-stores are putting more emphasis on building a positive work culture, which can help increase employee retention and reduce turnover costs. As seen in the next chart, some 27% of respondents describe their work culture as family-friendly, while 16% pointed to a teamwork environment and 14% said they offered a flexible and adaptable environment.

Training remains a key part of employee retention. In 2023, only 29% of retailers reported using online learning, compared to 41% in 2022. Some 90% of retailers pointed to hands-on training as their preferred method.

This shows how we are coming out of the pandemic, and the preferred method is once again to train in person at the store. Humetrics has identified the following benefits to in-person training.

1. Personalized attention: In-person training allows for direct and personalized attention from the trainer, who can observe and adjust the trainee’s actions in real time, provide feedback and answer questions immediately. This can be especially helpful for complex or hands-on tasks that require precise movements or equipment handling.

2. Interactivity and collaboration: In-person training can facilitate greater interactivity and collaboration between trainees, who can engage in group activities, discussions and role-playing exercises. This can foster a sense of camaraderie and teamwork that may be harder to achieve online.

3. Accountability: In-person training can also create a greater sense of accountability and commitment to the training process. Trainees may be more motivated to

attend and participate in sessions when they are physically present and engaged with others.

Retailers were asked about the retention tools they currently have in place and those they plan to add in the future. The Top 3 retention tools currently in use are: standardized onboarding/orientation program (89%), informal employee recognition program (85%) and performance reviews (82%). Retention interviews, pre-shift huddles and social media were among retention tools retailers said they expect to add in the future.

Humetrics has identified five proven ways to retain needed valuable employees.

1. Set them up for success at the start. Take the time to prepare a solid onboarding system. It provides security and creates a welcoming environment. Some 89% of respondents currently have an onboarding process.

2. Listen to employees and make them feel understood. Have regular meetings or send out surveys to get feedback. Some 70% of respondents are currently using employee engagement surveys.

3. Support work-life balance and well-being. Make it easy for employees to create a schedule that works for them. Provide them with answers needed to do their job to alleviate the stress of not knowing how to do things. Fortysix percent of respondents have formal training.

4. Invest in them — and show it. Provide training opportunities, share new open roles they could advance into, help set goals and support their desire to learn. Seven percent of respondents have educational benefits.

5. Communicate. When you communicate with your employees, they feel valued and are more driven to do their best work. Some 64% of respondents have pre-shift huddles.

Retailers were asked, “Have you or do you plan to add robotics, self-checkout or any other tools or technology in order to minimize human contact, reduce labor costs or increase efficiency?” While 57% reported they are not adding additional technology, a few participants noted they have added at least one self-checkout lane.

Becoming a five-star employer is essential for attracting top talent, retaining employees, boosting productivity and building a positive reputation for your company. It will take some adjustments internally, but once those changes have been made, you can have a transformational impact on your organization.

Attracting top talent: In a competitive job market, being a five-star employer can help attract the best and brightest candidates. Potential employees will look for companies that offer great benefits, a positive work culture and opportunities for growth and development.

Retaining employees: Once you’ve hired top talent, it’s important to keep them. A five-star employer will create an environment that employees enjoy and feel valued in. This can lead to increased job satisfaction and, in turn, reduce employee turnover.

Boosting productivity: Happy employees are often more productive. If employees feel that their contributions are valued, they are more likely to be engaged and motivated to do their best work. A five-star employer will provide the resources and support necessary for employees to thrive.

Building a positive reputation: Being a five-star employer can help build a positive reputation for your company. Word of mouth travels fast, and employees who enjoy

working for your company are likely to share their positive experiences with others. This can help attract more customers, clients and potential employees.

Almost half (45%) of the participants rated their organization with four stars, while 28% gave their company five stars, 25% gave their organization three stars and 3% rated their company with two stars.

In 2021, 57% of respondents answered “Yes” to a question asking if their organization was taking advantage of work opportunity tax credits. This year only 29% stated they were using these, and 44% were not sure.

The Work Opportunity Tax Credit provides tax credits to employers who hire individuals from certain targeted groups. This program provides employers who hire individuals from targeted groups with incentives or resources, such as tax credits, training programs or other forms of support. By doing so, they aim to promote diversity and inclusion in the workforce, while also providing opportunities for individuals who may have historically faced discrimination or other obstacles to finding employment.

In 2023, Humetrics recommends that retailers update their retention plans in the following ways:

Provide opportunities for career development. Employees are more likely to stay with an organization if they feel that they are growing and advancing in their careers. Offer training, mentoring and career development programs to help employees develop new skills and advance their career paths.

Create a positive work environment. Employees are more likely to stay with an organization if they enjoy coming to work. Create a positive work environment by fostering a culture of respect, collaboration and appreciation.

Recognize and reward employees. Employees want to feel valued and appreciated for their hard work. Recognize and reward employees for their contributions, whether it’s through bonuses, promotions or other incentives.

Foster a sense of community. Employees are more likely to stay with an organization if they feel they are part of a community. Encourage social interactions among employees through team-building activities, company events and other initiatives.

Provide meaningful work. Employees want to feel that their work is meaningful and contributes to a larger goal. Ensure employees understand how their work fits the organization’s mission and purpose.

Listen to employee feedback. Employees want to feel that their opinions are heard and valued. Encourage

employees to provide feedback on their experiences and take their feedback seriously.

Retailers are feeling uncertain about the economy in 2023, as seen in responses below. Retailers were asked, “How was business overall in 2022 and how do you think 2023 will compare in each of the three categories listed below?” Some 47% felt the economy stayed the same in 2022, with 49% saying the same for the c-store industry, while the majority of retailers (42%) felt their company fared better in 2022.

In 2023, only 33% of retailers expect the economy will stay the same, with 29% expecting it to be worse. But they’re bullish on their own company’s expectations, with 41% expecting business to stay the same and 39% expecting business to be better.

The Positive Top 3 Trends for 2023 include:

1.) 59% of business was better than expected in 2022.

2.) 67% of respondents are offering flexible work schedules to recruit great employees.

3.) Almost half of respondents predicted a better year for business in 2023.

The Negative Top 3 Trends for 2023 include:

1.) 82% predicted significant staff challenges in 2023.

2.) 44% said they feel competitive pressures in general and in losing candidates to incentives offered by other c-stores.

3.) 29% said they believe the U.S. economy is worse and inflation will impact sales.

Thank you to those who took the time to answer the survey questions and provide insightful comments. CSD

Howard Riell • Contributing Editor

Howard Riell • Contributing Editor

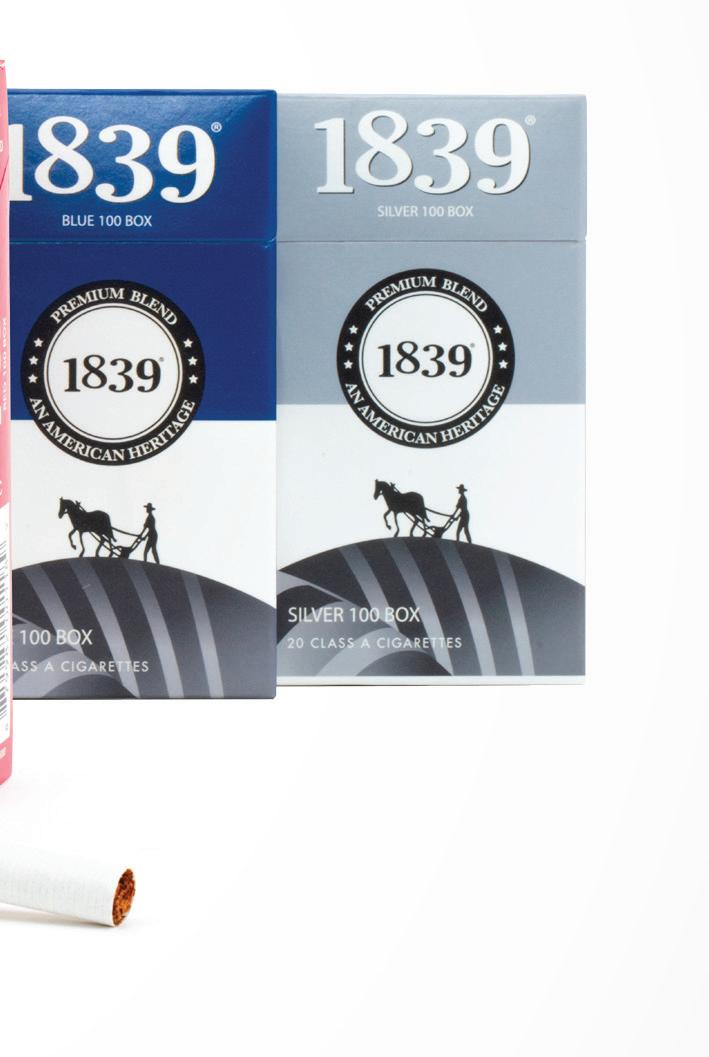

The convenience store channel saw the overall smokeless tobacco category record sales of $8.95 billion, up a respectable 4.9% for the 52 weeks ending Jan. 29, 2023, according to Chicago-based research firm IRI. Within that category, spitless tobacco proved the growth driver, registering sales of $1.9 billion, a whopping gain of 34.5%. At the same time, chewing tobacco/snuff notched sales of $7.03 billion, down 1.1%.

Trends show that more consumers are turning to nicotine pouches and lozenges, which contain not tobacco but nicotine, flavorings, sweeteners and plant-based fibers. Some of the leading brands include ZYN, On! and Velo.

“A rising number of smoking restrictions will further encourage tobacco consumers to explore smokeless options, and the introduction of new smokeless products will also spur demand,” said Corinne Gangloff, marketing manager for The Freedonia Group, a division of MarketResearch. com. “A growing preference for products that can be consumed discreetly will support demand for products in this category.”

“I would say that spitless tobacco will continue to grow in 2023, but whether it will be at the current rate is hard to determine,” said Hussein Yatim, vice president for Marlborough, Mass.-based Yatco Energy, which operates 18 stores in Massachusetts, Rhode Island and Connecticut. “As the cigarette tobacco category has shrunk in the recent couple of years, consumers have looked toward an alternative, and specifically a nicotine

• Spitless tobacco offers a discreet smoking alternative in the face of continued smoking restrictions.

• Spitless tobacco dollar sales grew by 34.5% for the 52 weeks ending Jan. 29, 2023, per IRI.

• Promotions are helping to drive sales at c-stores.

fix, that is discreet.”

Yatim pointed to poly-usage — using a combination of nicotine products, such as cigarettes and spitless tobacco — and promotions from manufacturers as two elements helping to boost sales of the category.

“Promotions help a tremendous amount in getting eyes on these products, and oftentimes offering a great retail price or promotional bonus,” he said.

He urged convenience store retailers to make full use of pointof-purchase signage and backbar headers — and to maximize facings — in their efforts to heighten product awareness.

Mark McCarty, director of category management for Clark’s Pump-nShop Inc., which operates nearly 70 c-stores across Kentucky, Ohio, West Virginia and Florida, also believes the smokeless category is set to grow in the year ahead.

“As there continue to be more restrictions in the workplace, as well as within municipalities in regard to smoking, more individuals are looking for a suitable alternative to cigarette usage,” McCarty said.

“As the unemployment numbers continue to drop, this also brings more people into the workforce, and in turn more customers looking for that alternative for use during work hours,” he added.

In the beginning, McCarty explained, spitless tobacco manufacturers were using aggressive single price points as well as free-can promotions to spur trial in the category.

“Now the manufacturers are doing more in the way of two-can or roll promotions to encourage multiple

can purchases at a substantial savings over the single can purchase,” he said. “I have seen a lot of success with these promotions in our locations over the past year and have several more lined up in 2023.”

When it comes to leading brands, McCarty noted, ZYN leads the way in his locations, capturing more than 60% of the volume sold. He also pointed to On! and Rogue as strong selling options.

ZYN retails in his stores for $4.94, or two cans for $6.98. Rogue is priced at $5.39, or two cans for $7.98, while On! goes for $3.99, or two cans for $5.18, he said.

Bolstering consumer confidence that they will always find the brands they like and beneficial deals lends strong support to the spitless tobacco category.

“I believe that the key to selling more is having a home for the category, as well as continued promotions and signage,” McCarty insisted.

Clark’s Pump-n-Shop dedicates a two-foot section of the backbar at its c-stores to the smokeless category, ensuring there is ample space for each manufacturer.

“This lets the customer know that we are in the business of selling these items,” McCarty explained. “Signage is also a key in making the c-store customer aware of the two-can or roll promotions that offer them savings.” CSD

Even

The cold and frozen dispensed beverage sections at c-stores have been making great strides in sales so far in 2023.

In fact, according to Datassential’s “2023 C-Store Keynote,” 79% of c-store retailers offer some type of fountain soft drink, and 8% of retailers are considering adding these beverages to their stores.

However, as consumers get ready for the spring and summer months, they are wanting more variety and the ability to customize drinks to make them their own, especially now that consumers are wanting healthier options when it comes to foods and beverages.

Curby’s Express Market, which operates one location in Lubbock, Texas, is one c-store seeing the trend of customers wanting more options to customize their cold and frozen beverages to fit their lifestyle.

“We are seeing customers wanting healthier options when it comes to sodas and other drinks. They are reducing their sugar intake and going for our other beverage options like tea,” said Tony Sparks, head of customer wow at Curby’s Express Market. “We are also seeing more craft

though cold and frozen dispensed beverage sales are at an all-time high in c-stores, allowing customers to customize their beverages can increase sales even more.

More retailers are considering adding cold and frozen dispensed beverages inside their c-stores. About 16% of retailers are considering offering iced tea from a fresh-brewed tea machine.

sodas being bought and new dispensers that allow for more customization in flavors and beverage brands.”

Curby’s also noticed a demand for made-to-order (MTO) energy drinks and fresh condiments such as limes, lemons and berries.

Curby’s is able to meet these trends and demands head-on by offering customers 20 self-serve fountain drinks, 40 self-serve iced tea dispensers, MTO energy drinks and craft sodas.

Another c-store noticing the high demand for customization in the dispensed beverage category is Cliff’s, which operates 19 c-stores in New York.

“We are starting to notice customers wanting more unique bold flavors and a variety of flavor enhancement options to allow customers to create a beverage they can call their own,” said Derek Thurston, director of foodservice operations at Cliff’s. “Customers are even wanting more c-stores that are clean, accessible and affordable.”

Cliff’s offers customers a variety of dispensed beverages, including frozen options to keep customers intrigued and keep them coming back into the store.

“We offer a variety of fountain beverages along with a Pure Craft Bubbler Program,” said Thurston. “We route the offerings in the bubbler to keep customers interested. The bubbler flavors also tend to be a bit unique in flavor profiles.”

Thurston also stated that Cliff’s offers a raspberry hibiscus tea, blackberry lemonade, ginger pear and orange passionfruit. On top of that, most of Cliff’s locations carry between four to six heads of frozen dispensed beverages. Cliff’s even partners with Sunny Sky and uses its Jolly Rancher-branded slush program.

Cliff’s and Curby’s are both adding more cold and frozen dispensed beverage options to meet the needs of customers.

“We are adding the fresh condiments customers are demanding with an iced tea program,” said Sparks.

“We added the new Frazil Energy program to four locations to gauge customers’ interest in a frozen-dispensed energy option,” added Thurston. “We brought in the Smash Berry and Piña Colada. We have also added our cold-brew program to a couple additional locations, and we continue to offer seasonal flavor shots to accommodate customers’ tastes and preferences.”

Even though some c-stores are having trouble convincing iced coffee drinkers to purchase cold and frozen dispensed beverages, the category is set to continue to do well in the years to come.

“Our biggest challenge is pulling in the customers that love iced coffee and cold brew,” said Thurston. “However, I expect both our cold and frozen dispensed beverage categories to be up over 20% for the year. For the first two months of this year, both our cold and frozen dispensed beverages were up over 30% in both sales dollars and units sold.”

Curby’s even expects its MTO beverage program to be up 200% in the next 12 to 18 months.

Altogether, the cold and frozen dispensed beverage category will continue to increase in sales and units sold as long as c-stores keep meeting customers’ needs when it comes to offering beverages that work best for them and their lifestyles. CSD

With a combination of thoughtful product selection, high-level service and creative promotion, retailers are growing their proprietary foodservice segments.

Marilyn Odesser-Torpey • Associate EditorAs foodservice becomes a bigger focus at convenience stores, retailers are leaning into menu innovation, offering more customization and better promoting their food options to customers.

Over the past six to eight months, Duchess convenience stores, which has 120 locations in Ohio and West Virginia, has experienced double-digit growth in its proprietary foodservice segment. Duchess’ Director of Marketing, Nathan Arnold, attributes this healthy hike to the company’s “food-centric focus,” including an emphasis on consistent freshness and always having customers’ favorite core items.

“We recognized that we could do a better job at telling customers our freshness story,” Arnold pointed out. “For fiscal year 2023, we are posting more videos on how our products are made in our on-site kitchens to social media, advertising and on the TV screens we have in many of our stores.”

Duchess’ food-centric focus includes an emphasis on freshness and providing customers’ favorite core items.

Arnold added that Duchess has also recently undergone a major audit of all its foodservice and beverage equipment. Analysis of food merchandising led to the move of the pizza sales area to the front counter where customers will see it as they go to check out.

A couple of years ago, the company added a Mexican concept called Tic Tac Taco to four of its stores. The concept has been well received by customers, and expansion into other Duchess stores is planned for the future, Arnold noted. Chainwide, Duchess features either a new product or price point every two months.

The company’s Crown Card rewards program helps entice regular gas-only customers to come into the stores for foodservice items by offering them a high-value or free offer. Arnold noted that a recent rewards campaign achieved an almost 40% redemption by customers who had never come into the stores before.

EMPHASIZE CUSTOMIZATION & LTOS

GetGo Café + Market, with more than 260 locations throughout western Pennsylvania, Ohio, northern West Virginia, Maryland and Indiana, prides itself on always being on point with what customers are craving.

“Our guests can enjoy an indulgent meatball sub, or they can choose something light for an afternoon snack,” said Farley Kaiser, senior director of GetGo fresh foods and beverage.

GetGo emphasizes customization of ingredients, sauces and toppings to give customers exactly the flavor profiles they want. Seasonal specialties also keep the menu interesting, Kaiser noted.

“Looking ahead this summer, we expect our barbecue offerings, including a bourbon-glazed barbecue sandwich, to be a big hit,” she elaborated. “And we’re bringing back our popular onion rings.”

She added that limited-time offers (LTOs) like this are “a huge part of the business” at GetGo. The

Fast. Up to 80% quicker than a conventional oven.

Quiet. Doesn’t interrupt customer engagement.

Easy to install. UL certified ventless, no extraction hood needed.

Easy to use. Intuitive touchscreen for high quality, repeatable results.

company has found that popular core items provide a “safe place” for people to try new flavors.

“For example, if we launch a new barbecue sauce, guests may try it first on a burger, and once they find that they like it, the next time they’ll get a pulled pork sandwich with that same sauce,” she continued.

GetGo’s advertising is also food centric. A current commercial shows off the extensive menu and ends by saying, “Oh, and we have gas, too.”

Rutter’s convenience stores, with 84 locations and growing in Pennsylvania, West Virginia and Maryland, offers something for everyone on the menu, ranging from a four-ounce Angus burger to Asianinspired wok bowls.

“Our goal for the future is innovation either through growth in our menu or cross-utilization of products we already have to create new items,” according to Chad White, food category manager.

Aside from a wide assortment of “staple items” such as egg rolls, burgers, pizza and breakfast sandwiches, the company is always trying new items “out of our comfort zone,” whether plant-based products or unique regional items like sweet bologna and red beet eggs, he noted.

Rutter’s has run a quarterly promotion on Spam — prepared a variety of ways — during the past two years and is scheduled to repeat it again this year. Customers can have Spam on an egg-andcheese breakfast sandwich, with mac and cheese, with cheese on a pretzel roll or in a breakfast bowl.

He explained that the company would be doing more bundling through this year. For March Madness, for example, a Big Game Bundle consisting of 12 wings, 10 chicken strips, 12 mozzarella sticks, a liter of soda and a big bag of chips for $29.99 quickly gained traction, he said. A buy-one-getone-free Taco Tuesday promotion offered through the Rutter’s Rewards loyalty program also resonates with customers, White said. CSD

• Consistent freshness is key for c-store foodservice programs.

• Retailers recommend auditioning new flavor profiles on popular core items.

• Loyalty program rewards can entice gas-only customers into the store.

C-store retailers looking to add seafood options — from sushi to tuna sandwiches to shrimp — to their menus should take customization and promotions into account.

Emily Boes • Associate Editor

Emily Boes • Associate Editor

Convenience stores have been rapidly elevating their foodservice programs, experimenting with new food innovations, limited-time offers (LTOs) and menu overhauls. In the process, less common c-store foodservice options are being offered to customers, including seafood.

At York, Pa.-based The Rutter’s Cos., which operates 80-plus locations in Pennsylvania, Maryland and West Virginia, customers can choose from crabcakes, sushi, cod and shrimp in the seafood category.

Each of these options, apart from sushi, is sold through the chain’s touchscreen ordering kiosks and can be customized with different offerings. The sushi is sold out of the cold case.

Rutter’s uses in-store signage and spotlight deals to market its seafood options.

“Currently we have sliders four for $5, and crabcake sliders are a part of this promotion. Each of these products performs very well, with the topselling offering being our shrimp tacos,” said Chad

White, food service category manager, Rutter’s.

Headquartered in Oklahoma City, Love’s Travel Stops, which has 600-plus locations in 42 states, offers two different tuna salad sandwich SKUs in its open-air coolers.

“One is a freeze/thaw retail sandwich from Hillshire Farms that is supplied by our wholesale distributor and is located at approximately 400 convenience stores. The other sandwich is a Love’s-branded item that is prepared on-site in our Fresh Kitchen locations at approximately 200 stores,” said Bryan Street, manager of deli for Love’s.

The sandwiches have been part of bundling opportunities in the past and will continue to be considered for them based on data analyses Love’s leverages. According to Street, the tuna sandwiches perform well and provide variety for customers.

Irving, Texas-based 7-Eleven, which operates, franchises and/or licenses more than 13,000 stores in the U.S. and Canada, offers its customers a fish sandwich as well as a tuna salad sandwich.

The tuna salad sandwich is made with yellow fin and albacore tuna blended

Texas Pete ® is taking its flavor on the road with convenient, easyto-enjoy portion control packets! Whether it’s a Texas Pete ® dip cup or sauce packet, your customers will be able to enjoy bold flavor for a better on-the-go dining experience—anywhere, at any time.

SCAN HERE

TO REQUEST A SAMPLE

All of Rutter’s seafood offerings, apart from sushi, can be customized with different offerings.

with reduced-fat mayonnaise, sweet relish and Dijon mustard.

The chain partnered with the Association of Genuine Alaska Pollock Producers on its fish sandwich. Its garlic herb Wild Alaska Pollock filet is topped with American cheese and tangy tartar sauce and served on a warm brioche bun.

In fact, for the Lenten season, 7-Eleven is offering a deal on the sandwich to its 7Rewards and Speedy Rewards members. These customers can purchase the garlic herb Wild Alaska Pollock filet for $2 on the chain’s Fish Sandwich Fridays.

In terms of seafood, Datassential’s “2023 C-Store Keynote” report showed that 3% of c-store operators currently offer store-made sushi, and 13% plan to offer it. However, at least 18% of customers would be interested in store-made sushi being integrated into their local c-store.

Among those who offer sushi, 67% of c-store retailers reported sales of the food item increased, and 33% noted that sushi sales remained flat.

“It’s exciting to see the (seafood) channel evolve. Customer tastes and demands constantly change, and you must be ready to move quickly before those trends change again,” said Street. “Going to market with innovation continues to be a challenge

as the supply chain is still recovering. For us, there is a real opportunity for expanding seafood items in our space.”

Based on Love’s current capabilities, Street continued, he sees opportunity in the hot sandwich and/or taco format as an LTO, allowing the chain to understand product performance and consumer feedback. This will help Love’s build a foundation to expand that product space into additional product offerings.

White agreed that there is room for the seafood category to grow.

“I believe this category will continue to grow. …” he said. “I do see the base items similar to what we carry being the workhorse, with other items such as scallops and clam strips being more limited-timeoffer-type features.”CSD

• Of c-stores offering sushi, 67% reported sales increased, per Datassential.

• Limited-time offers are a great way to introduce seafood to menus in the form of hot sandwiches or tacos.

Automation can help reallocate labor to more important tasks, but maintaining a human touch is key in a ‘people business’ like convenience stores.

Erin Del Conte • Executive EditorAs labor shortages continue to cause issues for c-stores, automation is offering stores the ability to streamline tasks and processes, refocusing employees on more important responsibilities.

This January, Kum & Go introduced the Ice Cobotics Cobi 18 robot, which can clean 5,000 to 7,000 square feet of floorspace per hour, ensuring customers experience a clean environment anytime they enter a Kum & Go store. But the robot is also a boon for labor management, freeing up staff to focus on stocking shelves and coolers, delivering fresh food offerings and engaging with customers.

“All an associate must do is push a button and Cobi 18 does the rest,” said Marty Roush, vice president of operations for Kum & Go, which operates more than 400 stores in 13 states. “There is limited manual labor involved, which includes filling and emptying the tank and some minor maintenance cleaning of the robot.”

Cobi, which can be deployed multiple times a day, is being rolled out at all of Kum & Go’s new builds and is also replacing floor scrubbers at existing stores when they reach the end of their lifespan, Roush explained.

“We’re projecting Cobi to be in at least 20 and up to 50 stores by the end of this year. At this time, we don’t have plans for all of our 400-plus locations,” he said.

In addition to offering labor savings and support to stores during times of staffing challenges, Cobi is also a novel and fun addition for both employees and customers.

“Kum & Go’s continuous improvement culture drives us to find equipment and process improvements that make it easier for our store associates to execute,” Roush said. “Our associates and customers think Cobi is fun, which means it gets used more than any scrubber we have utilized in our stores to date.”