CStoreDecisions® Solutions for Convenience Retailers July 2023 • CStoreDecisions.com INSIDE Assortment Drives Beverage Sales ............32 Candy Still Reliable Mainstay .....................36 A Slice of Advice About Delis ....................42 CHAINS TO WATCH Northdale Oil plans continued acquisition growth as it develops proprietary foodservice and in-app payment, while Energy North debuts flagship Ha ner’s site with two new foodservice concepts as it sets sights on refreshing, building and acquiring stores. 2023

• Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect & engage with your ATCs 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

OR024 | ©2023 Altria Group Distribution Company | For Trade Use Only

the CSD Group

EDITORIAL

EDITOR EMERITUS

John Lofstock

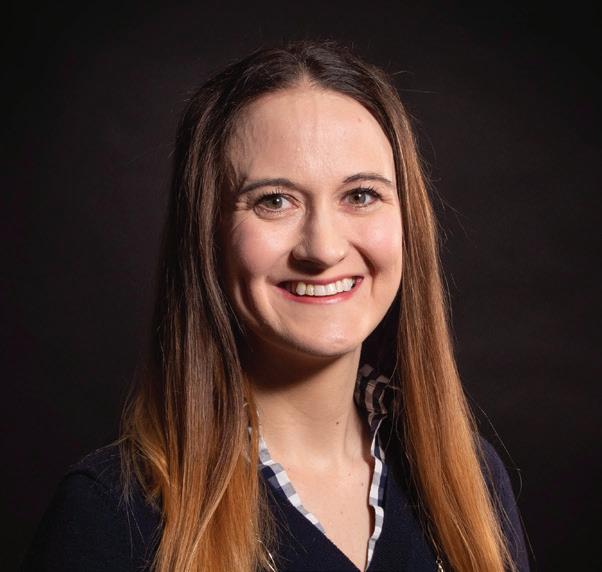

EDITOR-IN-CHIEF

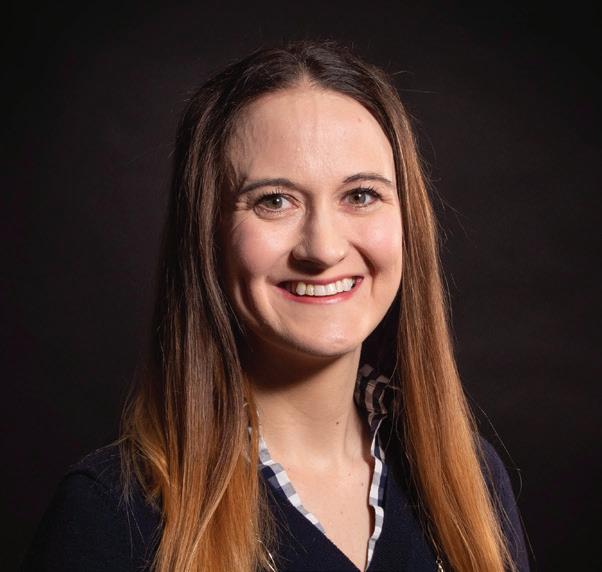

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Marilyn Odesser-Torpey

EDITORIAL ASSISTANT/INTERN

Kevin McIntyre

COLUMNIST

Peter Rasmussen

SALES TEAM

PUBLISHER

John Petersen jpetersen@wtwhmedia.com

(216) 346-8790

VICE PRESIDENT, SALES

Tony Bolla tbolla@wtwhmedia.com

(773) 859-1107

REGIONAL SALES MANAGER

Patrick McIntyre pmcintyre@wtwhmedia.com

(216) 372-8112

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER

Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE

Jane Cooper jcooper@wtwhmedia.com

LEADERSHIP TEAM

CEO Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES

Mike Emich memich@wtwhmedia.com

EVP Marshall Matheson mmatheson@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE SERVICES Mark Rook mrook@wtwhmedia.com

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR

Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

DIRECTOR OF EVENTS

Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST Olivia Zemanek ozemanek@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

VP, ASSOCIATION & COMMUNITY ENGAGEMENT Allison Dean adean@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER

Garrett McCafferty gmccafferty@wtwhmedia.com

VIDEOGRAPHER

Kara Singleton ksingleton@wtwhmedia.com

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

WEBINAR COORDINATOR Halle Kirsh hkirsh@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Lender nlender@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Johnson njohnson@wtwhmedia.com

WTWH MEDIA, LLC

1111 Superior Ave., 26th Floor, Cleveland, OH 44114

Ph: (888) 543-2447

EDITORIAL AND NAG

1420 Queen Anne Road, Suite 4, Teaneck, NJ 07666

Ph: (201) 321-5642

SUBSCRIPTION INQUIRIES

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Lisa Dell’Alba, President and CEO

Square One Markets • Bethlehem, Pa.

Raymond Huff, President

HJB Convenience Corp. • Lakewood, Colo.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Olivia Beck • Operations

Beck Suppliers Inc. • Fremont, Ohio

Reilly Robinson Musser, VP, Marketing & Merchandising

Robinson Oil Corp. • Santa Clara, Calif.

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO

Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations

Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Real Estate/Government Relations Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Robin Hunt, Sales Hunt Brothers Pizza • Nashville, Tenn.

Kyle May, Director External Relations Reynolds Marketing Services Co. • Winston-Salem, N.C.

Tony Woodward, Manager Sr. Account McLane Company Inc. • Temple, Texas

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Jeff Carpenter, Director of Education and Training

2011 - 2020

To enter, change or cancel a subscription, please go to: http://d3data.net/csd/indexnew.htm or email requests to: bsprague@wtwhmedia.com

Copyright 2023, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian

Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher. Circulation audited by Business Publications Audit of Circulation, Inc.

Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing The Kent Cos. Inc. • Midland, Texas

Daillard Paris, Director of Petroleum Supply and Trading Sheetz Inc. • Altoona, Pa.

4 CSTORE DECISIONS July 2023 cstore decisions.com

Leading Through Innovation www.cstoredecisions.com CStoreDecisions National Advisory Group for Convenience Retail NAG CONVENIENCE CStoreDecisions .com CStoreDecisions asbpe.org GOLD REGIONAL AWARD 2022 asbpe rg SILVER REGIONAL AWARD 2023 asbpe.org

Contact your local Advantage Rep on how to order or email Ed Baker at ed.d.baker@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Read and follow label directions. * Latest 52 Week Pd Ending 1/29/23 Total MULO. Did You Know? TUMS market shareis nearly 20 x bigger than Rolaids* TUMS Chewy Bites sales alone are Innovation is driving our growth! than all of Rolaids*! 4x larger Available in Convenient Rolls & Packs • Chewy Bites Assorted Berries - 8ct Bottle • Ultra Strength Assorted Berries - 12ct Roll • Ultra Strength Peppermint - 12ct Roll • Smoothies Assorted Fruit Extra Strength - 12ct Bottle • Chewy Delights Very Cherry Ultra Strength - 6ct Stick • Extra Strength Assorted Berries - 8ct Roll • Extra Strength Assorted Fruit - 8ct Roll

14 2023 Chains to Watch

Northdale Oil plans continued acquisition growth as it develops proprietary foodservice and in-app payment, while Energy North debuts flagship Ha ner’s site with two new foodservice concepts as it sets sights on refreshing, building and acquiring stores.

6 CSTORE DECISIONS • July 2023 cstore decisions.com CONTENTS FRONT END 8 Editor’s Memo: Climbing Toward the Summit 10 TXB Named CSD’s 2023 Chain of the Year 12 Quick Bites: Consumers Continue Snacking Despite High Food Costs CATEGORY MANAGEMENT 32 Assortment Drives Beverage Sales 36 Candy Still Reliable Mainstay 40 Snacks Continue to Dominate in 2023 FOODSERVICE 42 A Slice of Advice About Delis TECHNOLOGY 46 Frictionless Is Here to Stay COVER STORY

BACK END 50 Product Showcase 53 Ad Index 54 Industry Perspective: The Real Business Case Behind Delivery Apps July 2023 • Number 7 • Volume 34 CStoreDecisions® 36

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

Climbing Toward the Summit

Ten years ago this month I climbed Mt. Kilimanjaro, and I brought along a copy of CStore Decisions magazine for some light reading at the summit. My cousin and I made the trip together up Africa’s tallest mountain, one of the Seven Summits (which is comprised of the highest mountain on each continent). We opted for a seven-day climb, where we hit the summit at sunrise on the morning of the sixth day.

To ensure success, we first put the right team in place, selecting guides who were experts on the climb. We did our due diligence, reading about the mountain, equipment needs, signs of altitude sickness and what to expect. Rushing up a mountain is the surest way to succumb to altitude sickness. Taking it “pole pole,” which is the mantra of the mountain guides and means “slowly,” is the surest way to success.

It turns out, climbing a mountain and building a successful convenience store chain have a few things in common, as is evident in this month’s Chains to Watch cover story that features Northdale Oil and Energy North. Growing a c-store chain requires due diligence, strategic preparation, and a willingness to take your time in laying the groundwork and building a strong team to avoid bumps in the road when it’s time to scale.

CHAINS TO WATCH

As Jeff Black prepared to take the helm as CEO of his family-owned company Energy North (EN) in 2022, he took the time to slow down and ensure he had a solid senior leadership team in place that could help take the company to the next level. He also assessed the company culture and worked to develop it in line with the growing chain the company had become. This spring EN debuted its new flagship Haffner’s convenience store design with a new foodservice offering. And now, EN is set for expansion, both internally through a new loyalty program and self-checkout initiative, as well as through new-to-industry stores, raze and rebuilds and potential acquisitions.

As Northdale Oil eyes expansion through acquisitions and prepares to launch a proprietary food program and in-app payment, among other initiatives, it’s also taking the time to consider how it’s helping its employees and community to grow with it.

“We talk a lot internally about opportunity for our team members, for our communities, and we really take that responsibility on,” said Alayna Brown, retail operations manager at Northdale, in this month’s Chains to Watch cover story. “How can we give these people an opportunity to find fulfillment, to provide for their families, to have more community opportunities? We really take that as our responsibility.”

Our Chains to Watch feature highlights how chains today are growing in multiple directions, from the foodservice counter to the forecourt to the teams and culture that help propel business forward.

As you take inspiration from these expanding family-owned and -operated companies and plot your own growth trajectory, remember to take the time necessary to assess the best path forward with strategic planning, due diligence and careful preparation, all of which will help you find sure footing on your climb to success.

Erin Del Conte

Editor’s Memo

8 CSTORE DECISIONS • July 2023 cstore decisions.com

NEVER RUN OUT 76% of all nicotine pouch dollars come from ZYN. Stock up on America’s #1 Nicotine Pouch and keep your customers coming back. Call 800-367-3677 or contact your Swedish Match Rep to learn more. FOR TRADE PURPOSES ONLY. | ©2023 Swedish Match North America LLC

TXB Named CSD’s 2023

The Texas-based chain features a state-of-the-art store design and restaurant-quality food, while celebrating the diversity of Texas and its values of authenticity, hospitality and integrity.

A CSD Staff Report

A CSD Staff Report

The Spicewood, Texas-based family-owned chain exemplifies operational excellence, strong leadership and a people-centric culture.

“CStore Decisions’ Chain of the Year Award recognizes retail excellence, and TXB has earned a place in this rich tradition as the 34th winner of this prestigious industry honor,” said Erin Del Conte, editorin-chief of CStore Decisions. “While many c-stores are struggling to reinvent themselves in a way that meets the evolving needs of today’s customer, TXB has hit the mark with a state-of-the-art store design, a tech-forward mindset, friendly employees and a restaurant-quality food program, making it a powerful and growing competitor in the c-store industry.”

Kevin Smartt, president and CEO of TXB, had the vision for TXB as he considered what his company — then Kwik Chek — meant and where he wanted it to go in the future. Smartt first announced that Kwik Chek was rebranding to TXB in 2020, and the first rebranded site celebrated its opening in August of 2021 in Georgetown, Texas.

The rebrand included far more than just a new look and logo. It was a chance to focus on the company’s identity as a chain with fresh food, convenient technology, a clean environment and hospitable employees. The TXB brand celebrates the diversity of Texas and its core values — authenticity, hospitality and integrity — in everything it does. With the motto, “Leave ‘Em Better,” TXB strives to ensure its guests have a first-class experience starting with the chain’s commitment to building and maintaining a strong company culture.

“When we decided we were going to be TXB or Texas Born, we loved what our mission represented because we thought it was authentic. We thought it represented where we operated and who we were,” Smartt said.

Today TXB operates over 50 locations in Texas and Oklahoma, with plans for many more new-to-industry builds on the horizon. Over the past three years TXB has been aggressively remodeling all existing Kwik Chek sites to the TXB brand, while also growing through new builds and integrating technology, including an updated loyalty program and mobile app, self-checkout stations and electric vehicle charging.

In addition to a proprietary, restaurant-quality food program that includes hand-pressed tacos and chicken tenders made on-site, TXB also features a private-label line with TXB-branded jerky, water and iced tea. TXB is also committed to sustainability and prioritizing eco-friendly resources, as well as giving back to the communities where it serves.

“It’s an absolute honor to receive

FRONT END News

10 CSTORE DECISIONS • July 2023 cstore decisions.com

CStore Decisions is proud to announce Texas Born (TXB) as our 2023 Convenience Store Chain of the Year.

Chain of the Year

and be recognized for the Chain of the Year Award,” Smartt said. “It’s been a fun and pivotal journey to get TXB where it is today, and there’s so much more to expect in the future!”

C-store retailers are invited to join us in honoring TXB on the evening of Oct. 4 at the Fox Theatre in Atlanta. C-store retailers can RSVP at https://COY2023. eventbrite.com.

Supplier companies must be sponsors to attend. Suppliers interested in sponsorship opportunities should contact John Petersen, publisher of The Convenience Store Decisions Group, at jpetersen@wtwhmedia.com.

ABOUT THE AWARD

CStore Decisions’ Convenience Store Chain of the Year award annually honors a c-store or petroleum chain that has established itself as a superior retailer and innovator in the c-store industry. CSD’s first Chain of the Year award recipient was Wawa Inc. in 1990. TXB follows the 2022 Chain of the Year Winner Nouria Energy. Past winners of this prestigious award include Sheetz, Maverik, RaceTrac, 7-Eleven Inc., Kwik Trip, Alimentation CoucheTard, QuikTrip, Rutter’s and Family Express.

PAST CHAIN OF THE YEAR WINNERS

1990 — Wawa Inc.

1991 — SuperAmerica

1992 — QuikTrip Corp.

1993 — Casey’s General Stores Inc.

1994 — Sheetz Inc.

1995 — Diamond Shamrock Corp.

1996 — MAPCO Express

1997 — Speedway Inc.

1998 — Krause Gentle Corp.

1999 — Dairy Mart Inc.

2000 — Amerada Hess Corp.

2001 — Huck’s Food & Fuel

2002 — Petro-Canada

2003 — Exxon Mobil Corp.

2004 — Kwik Trip Inc.

2005 — 7-Eleven Inc.

2006 — Valero Inc.

2007 — Alimentation Couche-Tard

2008 — Chevron Inc.

2009 — Nice N Easy Grocery Shoppes

2010 — Rutter’s Farm Stores

2011 — Thorntons Inc.

2012 — Tedeschi Food Shops

2013 — Maverik Inc.

2014 — RaceTrac Petroleum Inc.

2015 — Family Express Corp.

2016 — QuickChek Corp.

2017 — Sheetz Inc. (Second Award)

2018 — Kwik Trip Inc. (Second Award)

2019 — Weigel’s Inc.

2020 — Parker’s

2021 — Yesway

2022 — Nouria Energy

2023 — TXB

cstore decisions.com July 2023 • CSTORE DECISIONS 11

QUICKBITES

CONSUMERS CONTINUE SNACKING DESPITE HIGH FOOD COSTS

Even though the price of food continues to rise, consumers are still purchasing their favorite food and snack products.

MOST POPULAR SNACKS

After polling shoppers, 84.51° found that fruits, cookies, yogurt, vegetables and granola bars are especially popular with households with children. Others are snacking on:

BETTER-FOR-YOU FOOD OPTIONS RISE

Respondents of Ingredions’ ATLAS survey self-reported that they have increased their activity in a number of areas when seeking “better” food and beverage alternatives. Some areas include:

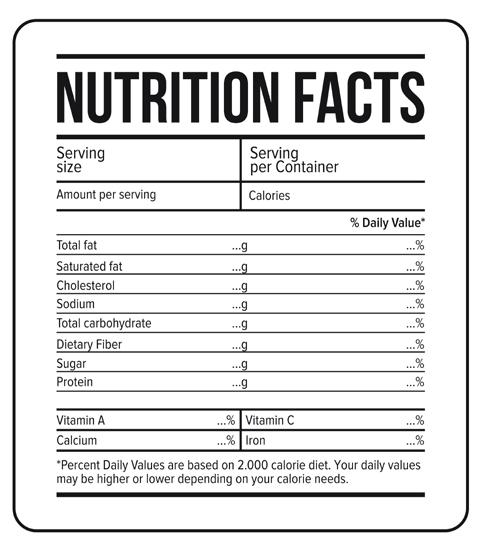

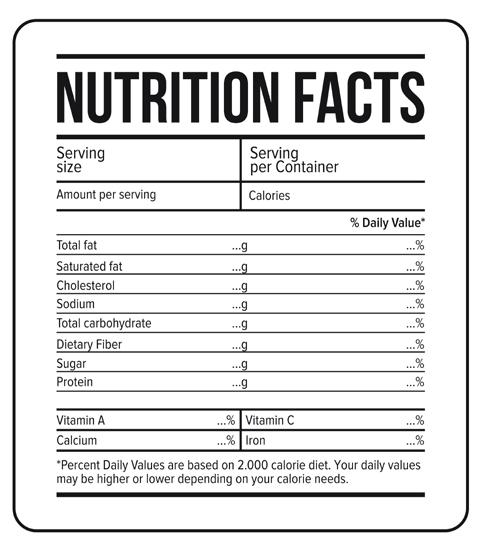

44% of consumers are checking ingredient labels.

45% of consumers are checking nutritional labels.

47% of consumers are buying foods with natural ingredients.

46% of consumers buy foods with reduced or no added sugar.

Source: 84.51°, May 2023

CONSUMERS WANT VARIETY

According to Circana’s “The Snacking Supernova” report, consumers are wanting a variety of snacks. The data shows:

Source: Ingredions’ “ATLAS Proprietary Consumer Survey,” 2023

CONSUMERS’ REASONS FOR SNACKING

48% of consumers state they look for multi/variety packs for more snacking options.

40% of consumers buy multi/variety packs so family members get the snack they want.

39% of consumers purchase multi/variety packs for more affordable options.

32% of consumers buy multi/variety packs because they are more convenient than large packages.

Source: Circana’s “The Snacking Supernova,” April 2023

GEN Z SEEKS CONVENIENCE

84.51° also found that consumers are snacking for a variety of reasons, including:

Source: 84.51°, May 2023

The most recent Consumer Sentiment Survey from NCSolutions found Gen Z wants quick snacks.

55% of Gen Z keep frozen meals on hand compared to 49% of older generations.

22% of Gen Z shop for food items at convenience stores.

18% of Gen Z look for food products in drugstores.

At the same time, only 8% of Gen X shop for food at a convenience store, and 6% seek food products at a drugstore.

Source: NCSolutions' "Consumer Sentiment Survey," May 2023

12 CSTORE DECISIONS • July 2023 cstore decisions.com

8%

69+67+5453 69% 67% 54% 53%

72% Taste/flavor 62% Fulfills a craving 48% Curbs the appetite 44% Convenience

Sell More Salty Snacks

Trion Industries, Inc. TrionOnline.com info@triononline.com 800-444-4665 ■ Increased facings from 99 to 121, a 22% increase*. ■ Automatically billboards and faces product. ■ Reduces losses from bag hook tearout. ■ Cuts over 1 hour/day labor for restocking. ■ Allows rear restocking and proper date rotation. ■ Dramatically increases sales in the same space. ■ Adjusts to accommodate various package widths. * Based upon average 8’ run by 5’ high salty snack gondola installations. Your results may vary. ©2020 Trion Industries, Inc.

WonderBar® Tray Merchandising VS BEFORE WONDERBAR® 99 FACINGS AFTER WONDERBAR® 121 FACINGS Gain Facings and Cut Labor with WONDERBAR® Tray Merchandising MODERNIZE YOUR MERCHANDISING SELL MORE IN THE SAME SPACETM

Chains to Watch

CHAINS TO WATCH 2023

Northdale Oil plans continued acquisition growth as it develops proprietary foodservice and in-app payment, while Energy North debuts flagship Haffner’s site with two new foodservice concepts as it sets sights on refreshing, building and acquiring stores.

100% RECYCLED PLASTIC* *Bottle only, 330mL and 500mL sizes **Projected total bottle volume per 2023 sales forecast © 2023 FIJI Water Company LLC. All Rights Reserved. FIJI, EARTH’S FINEST, EARTH’S FINEST WATER, the Trade Dress, and accompanying logos are trademarks of FIJI Water Company LLC or its affiliates. FW230523-07 FIJI Water is committed to sustainability and is proud to have launched its 330mL and 500mL bottles made from 100% recycled plastic* in 2022. This change replaces nearly 70% of FIJI Water’s plastic bottles.** Earth’s Finest Water is also Earth-Friendly FIJI Water is available direct. Contact your FIJI Water representative at 888.426.3454 or at FIJIWater.com .

Emily Boes • Senior Editor

16 CSTORE DECISIONS • July 2023 cstore decisions.com

Northdale Oil Third-generation, family-owned Northdale Oil plans continued acquisition growth as it develops proprietary foodservice and in-app payment.

Advancing

Chains to Watch / Northdale Oil

Family-owned Northdale Oil is currently in acquisition mode, with a goal to acquire 10 more locations by year’s end to expand its current footprint of 25 convenience stores in North Dakota and Minnesota. Having recently acquired eight Brother’s Market stores and two liquor stores, the Grand Forks, N.D.-based chain greets each new addition with a heavy investment in the store’s community.

First and foremost, the company’s commitment to its customers and core values are established at each new location. At the same time, Northdale identifies with each of its customer bases, forming individualized and lasting relationships that set it apart from its competition.

“Who we are as a company is I think what sets us apart,” said Alayna Brown, retail operations manager at Northdale Oil. “We just take a lot of pride in that. We talk a lot internally about opportunity for our team members, for our communities, and we really take that responsibility on. How can we give these people an op-

portunity to find fulfillment, to provide for their families, to have more community opportunities? We really take that as our responsibility.”

For its deep devotion to its customers and community and its dedication toward further growth in the c-store industry, Northdale Oil is one of CStore Decisions’ 2023 Chains to Watch.

A THIRD-GENERATION LEGACY

Northdale Oil was founded in 1967 by Dale Reck, who started with one bulk truck.

“My grandpa Dale was a Standard Oil dealer. He served local farms by delivering fuel in his bulk truck. It was really a couple-people show — just him and two people on his team,” said Brown.

In 1992, however, Dale tragically suffered a heart attack, which left him legally blind.

At this point Dale’s son, Scott Reck, and Scott’s wife Missy moved back home to Neche, N.D., to help with the business and eventually buy the company.

Brown, a member of the third generation of Northdale, daughter to Scott and Missy, joined the company in 2018. Her husband, Beau Brown, is the transportation maintenance supervisor. Recently, Scott and Missy’s daughter-inlaw, Brandi Reck, joined the family business.

cstore decisions.com July 2023 • CSTORE DECISIONS 17

Scott was an ironworker journeyman before purchasing Northdale Oil. Missy traveled with him around the country holding various jobs. When Dale sold them the company, they became invested in the industry and on expansion.

“We had an opportunity of a jobbership that had been established from my dad, Dale,” said Scott Reck, co-owner of Northdale Oil. “I had always been interested in the business, but it became a quick reality when he became ill and wanted to sell. We didn’t know a lot at the time, but through the years there have been some key people who have taught and mentored me, including my dad. Hard work, ambition and opportunities have definitely helped along the way.”

As well as managing its c-store operations, Northdale offers comprehensive petroleum solutions. It sells wholesale and retail propane for heating and industrial purposes and manufactures diesel exhaust fluid.

“If you have a petroleum need or an energy need, we can service that,” said Brown.

The chain is also always looking for ways to help grow the renewable fuel space in the industry.

C-STORE EXPANSION

Northdale Oil opened its first convenience store in 1994 in St. Thomas, N.D. Since then, the chain has been steadily building new and acquiring additional sites.

“(Branching into convenience stores) gave us a storefront to our business and put us on the map. Before going into convenience stores, we were a bulk fuel delivery company that had a small office but not really a public place of business. The convenience stores are the face of Northdale,” said Missy Reck, co-owner of Northdale Oil.

Northdale’s name was coined based on the company’s northern area of operation and the name of the founder, Dale.

Now, with the chain’s expansion into c-stores, the Northdale name is displayed prominently at its locations.

The c-store chain’s most recent acquisition of Brother’s

Market in 2022 also included two liquor stores called Sister’s Beer, Wine and Spirits.

At this point in time the Brother’s Market sites still have their own branding.

“(A brand realignment) is something that we are working on for our … brand as a whole,” said Brown. “Our (new) locations will be Northdale Oil. (Brother’s Market) has a nice brand image, a clean image, and they match our colors, so eventually they will be converted.”

Northdale was introduced to Brother’s Market through one of its vendors.

“It started with just a simple discussion, and with our growth mindset, they knew where we wanted to go. We just expressed interest,” Brown elaborated. “They thought we were a good culture fit of what their mission was. And it started to just play down from there.”

Brown credited skilled managers and genuine people for the success of the acquisition. “There’s a lot of legwork behind acquisitions, but we’re very grateful for a good aggressive team that gets it all done.”

GROWING PROPRIETARY FOODSERVICE

When a customer walks inside a Northdale c-store, the first thing they will notice is the open, airy floorplan with high ceilings and a foodservice emphasis.

Neutral colors broadly occupy the on-average 3,600-square-foot space.

Inside the store to the left of the entrance lies access to spacious restrooms with large windows to let in natural light. Additionally, customers will find coolers (with four locations offering a beer cave) and general merchandise located on this side of the store.

Northdale also offers bait and tackle, and customers can fill their propane tanks for grills and find local and regional clothing and merchandise at select locations.

On the righthand side of the store, foodservice dominates the space, as well as the checkout station.

“You’re going to notice a large made-to-order section

18 CSTORE DECISIONS • July 2023 cstore decisions.com

Chains to Watch / Northdale Oil

From left to right: Beau Brown, transportation maintenance supervisor; Alayna Brown, retail operations manager; Missy Reck, co-owner; and Scott Reck, co-owner

Contact your Tyson Foodservice Representative or visit tysonfoodservice.com for product info, resources and market-relevant solutions backed by our trusted brands.

with a seating area, an ordering kiosk, a couple of selfcheckouts, access to grab-and-go foodservice items and an expanded and open-air program (where) we offer a lot of fresh items — fresh fruit, fresh salads, wraps,” said Brown.

The seating area has the capacity to fit 12 customers.

Northdale plans to shine in the foodservice arena with a proprietary program it’s in the process of developing, with the Brother’s Market name potentially to be integrated into it.

“We’re really working on advancing (our foodservice program) and making it more collective and more café style, you could say,” said Brown.

Paninis will be the focus in the next generation of Northdale’s foodservice, and the chain currently offers pizza and paninis made to order in-house. Customers can also choose to order from Northdale’s taco program or its hand-breaded chicken program, plus other fried items, in addition to its fresh line of salads and wraps.

Northdale currently partners with co-brands Hot Stuff Kitchen, Champs Chicken and Hangar 54 Pizza.

It serves customers at each daypart and offers many lunch specials.

In addition to its food offerings, Northdale operates a proprietary coffee program called Grounded Coffee, where it utilizes bean-to-cup dispensers.

“The Grounded Coffee line was created with a vision of creating a greater impact while remembering our roots. The program signifies our commitment to being grounded and rooted in our relationships, our families, our faith and our communities,” said Brown.

The Grounded logo replaces the letter “o” with a coffee bean, with the Red River Valley cutting through it. Roots, the same number as the number of stores in operation at the time of the logo’s design, sprout from the

bottom of the logo, with a cross hidden within.

THE FORECOURT AND THE CAR WASH

In the forecourt, the design of the silo gives a very modern, contemporary feel. The canopy is white with two shades of blue and shelters anywhere from eight to 16 fueling positions in a well-lit space to allow customers to feel safe and comfortable approaching the store at all times of the day.

Customers have the option of purchasing among various ethanol-blended gasolines, premium offerings without ethanol, several diesel options and biodiesel choices. A few sites also offer racing gasoline, a high-octane, no-ethanol option. Northdale takes pride in offering the region-leading winter-blended diesel fuel, as well.

The company’s fuel is Northdale branded, with a few ARCO locations.

Northdale also offers two electric vehicle charging stations at its newest location.

When customers enter their loyalty information at interactive screens at the fuel dispensers, they are presented with personalized greetings and information.

Northdale’s loyalty program allows customers to earn points when they fuel up at the pump or when they purchase items in the store.

The most loyalty points, however, are given for foodservice purchases.

“When a customer comes in, they can either put their phone number or their loyalty card in the dispenser or at the till. They earn points on every transaction, on every gallon of gas. They can redeem them by either getting products or getting cash off,” said Brown.

Two years ago, Northdale launched a loyalty app where personalized discounts are offered for each customer.

20 CSTORE DECISIONS • July 2023 cstore decisions.com

Chains to Watch / Northdale Oil

Northdale Oil provides customers with an open, airy floorplan with high ceilings and a foodservice emphasis.

Additionally, the app features age verification for products such as tobacco.

Northdale is expanding the app further to include inapp payment capabilities. “This is in its infancy stages, but we’re hoping in the next year to have that accomplished,” Brown explained.

The chain also offers a Northdale proprietary card. Northdale primarily pursues fleets and local businesses, who can then take advantage of extra benefits, such as guest discounts.

“They can only use it at our locations, but because of our localness, in our region a lot of our customers can use that card as their sole fuel card,” said Brown.

In addition to convenience stores, Northdale operates nine car washes. Customers can download a separate app for a frictionless car wash experience and choose from different purchase packages, as well as individual washes or car wash bundles.

When customers buy the unlimited package, they receive free vacuums.

“When you pull up to the dispenser, you open up your app, you press ‘activate car wash,’ it opens the door, and you don’t have to roll down your window; you don’t have to interact with the kiosk at all,” said Brown. “It connects via Bluetooth, so everything for your whole car wash service can be done mobile.”

“We really push that interaction on the phone because it’s easy; it’s convenient to sign up for the unlimited car wash club packages,” she continued.

STANDING OUT THROUGH COMMUNITY INVOLVEMENT

Northdale prides itself on its community engagement and drive to be “stewards of goodness” in each community in which it’s located, according to Brown. This is the standard by which Northdale measures its success and fulfillment as a chain.

“Being located in the upper Midwest, we are able

to provide customers a more personal transaction. We truly know them; we know their families. …” said Brown. “I think what differentiates us from our competition, or what we really pride ourselves on, is that when we go into these communities — specifically rural communities — we are truly invested in them.”

Northdale is heavily involved in its communities, volunteering at homeless shelters; working with the Center for Domestic Violence; and volunteering at or donating to youth group programs, school events, church groups, T-ball teams and most local events ranging from the rodeo to the fair.

Additionally, the chain is developing a community reentry program in certain areas. It’s involved with workrelease programs.

Northdale is also planning the development of a scholarship program.

To further help students advance, the company works with developmental centers at schools, offering job placements for these students where they can gain hands-on experience and learn skills, including how a business operates or how to perform a certain job at one of the convenience stores.

“I think every person that comes in and out of our business has an integral part in where we are today and where we are going to go. We have several people, long-term team members, that have been with us for over 26 years,” Brown said. “So you can really put a lot of value in those who have grown with us and seen all the good, all the bad.”

“We’ve also had customers who have remained with us, and we’ve gotten to share our growth along with theirs simultaneously,” said Scott Reck.

Missy agreed and is proud of the people and relationships the company has developed along the way.

“(We hope) to continue to grow and improve our services and relationships. And for our family to continue to be a part of the future,” said Scott Reck. CSD

22 CSTORE DECISIONS • July 2023 cstore decisions.com

Chains to Watch / Northdale Oil

Customers can order from Northdale’s taco program and its hand-breaded chicken program, in addition to its fresh line of salads and wraps.

Since 1887, White Owl has delivered unmatched cigar innovation— from pioneering FoilFresh ® taste protection to award-winning, limited-time offers. FOR MORE INFORMATION CONTACT YOUR SWEDISH MATCH REPRESENTATIVE 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM WHITEOWLCIGAR.COM © 2023 SMCI Holding, Inc. ALWAYS FRESH SLOW BURN CIGARILLOS

24 CSTORE DECISIONS • July 2023 cstore decisions.com Energy North Poised for Expansion With Je Black at the helm, Energy North debuts new flagship Ha ner’s site with two new foodservice concepts and eyes future growth through new-to-industry stores, refreshed locations and acquisitions. Erin Del Conte

Chains to Watch / Energy North

• Editor-in-Chief

Energy North (EN) has had its sights set on growth since Jeff Black officially took the helm as CEO in 2022. Black, the second generation of the family business, has been busy developing the company culture, growing the leadership team and expanding the company.

This spring EN debuted a new flagship Haffner’s site that features a revamped design and two new foodservice offerings. Now it plans to refresh its full portfolio of stores to include elements of the new concept while rolling out the Haffner’s banner across its fleet of stores. As it looks to grow through new-to-industry (NTI) stores and acquisitions, the chain is also focused on its internal programs. It’s piloting a new loyalty program and introducing self-checkout kiosks, among other initiatives. At the end of June EN introduced the “It Kicks” foundation, named after the Haffner’s tagline “It Kicks.” The foundation offers a pathway for community service.

“Profoundly impacting the communities that we serve — that’s always been my No. 1 goal,” Black said. “I think that’s most important to me, and that’s why the launch of this foundation means a lot to me.”

For all these initiatives and more, CStore Decisions is recognizing EN as a 2023 Chain to Watch.

FROM THE BEGINNING

EN can trace its roots to 1981 when Black’s father, Ken Black, founded the company as a wholesale gas business in Massachusetts. In the mid-90s, EN purchased some of the dealer sites that were underperforming and began operating the convenience stores. In 1996, EN committed to the c-store business with the debut of its original flagship location in Everett, Mass. In 2008, EN completed its first big acquisition of eight stores in New Hampshire. That same year, Black’s father approached him about joining the business. When Black expressed interest, they decided to continue to grow the company.

In 2015, EN purchased the assets of Haffner’s.

“That was a big game changer for us,” Black said. “It allowed us to really start to accelerate our growth and become part of an iconic brand that’s been around since 1925, that was started by Jack Haffner, hence the name. That was a launching point for where we are today and the pride that we take in the Haffner’s name.”

From there, EN continued to grow through multistore acquisitions, including 11 sites in Massachusetts from VERC Enterprises in 2021.

Today, EN, headquartered in Lawrence, Mass., operates 71 sites in Massachusetts, New Hampshire and Maine. Twenty-five feature the Haffner’s banner, while seven are Tradewinds locations in Bangor, Maine.

cstore decisions.com July 2023 • CSTORE DECISIONS 25

“The Tradewinds name really spoke to the people around that area, so we decided to keep it and make that the banner for those sites up there,” Black said.

While the Tradewinds and Haffner’s sites feature unbranded gas, 31 of its sites are branded Mobil, seven are branded Gulf and one is branded Irving Oil. The stores don’t currently offer electric vehicle (EV) chargers, but new constructions will include the wiring for chargers, as Black expects EV to become more important in the future.

“We’re going to need to adapt to that. But we feel like right now there’s other areas that we would rather invest our capital into to make a better offering to our customers,” he said.

FAMILY OWNED AND OPERATED

Despite its growth, EN remains 100% family owned.

“I think that makes us really unique in today’s world of the growing large conglomerates,” Black said.

Black’s sister, Kristina Wood, now heads the It Kicks Foundation as executive director. His cousin, Kevin Riley, is the president of operations and finance. His aunt, Karen Riley, handles human resources and payroll. His mom, Kathy Black, works as a brand ambassador and does mystery shops. His father, Ken Black, is semi-retired, having stepped down from the CEO role three years ago, but still consults on major decisions.

Black grew up in the family business, accompanying his

dad on site visits from the time he was six years old.

Over the years, Black held various roles with the company, starting as a cashier in high school. He went on to manage one of the company’s liquor stores before serving as customer service rep for the dealer locations. When he came on fulltime in 2012, he ran the company’s supply and trade division. After the Haffner’s acquisition, Black became the chief operating officer (COO) of the heating oil division before being appointed COO of the full company, from retail and wholesale to trucking. By 2020, Black was handling the day-to-day operations for the company. When his father officially handed over the reins in 2022, Black took on the role of CEO.

Since taking the helm, Black has been focused on building the company’s culture and creating a more robust leadership team both at the executive and management levels that will be instrumental in helping the company expand.

FLAGSHIP DESIGN

This past May, Energy North debuted its new flagship Haffner’s location on Merrimack Street in Lawrence, Mass. The 6,000-square-foot store contains both a Sal’s Pizza and the first-ever Crack’d Kitchen Express and features murals that show off the history of Lawrence, which was an old mill town. Colorful, shiny glass tiling accent the various beverage sections.

26 CSTORE DECISIONS • July 2023 cstore decisions.com

Chains to Watch / Energy North

Energy North’s new flagship Haffner’s in Lawrence, Mass., contains both a Sal’s Pizza and the first-ever Crack’d Kitchen Express. The 6,000-squarefoot store, which opened in May, also features historical murals of Lawrence, which was an old mill town, as part of its design.

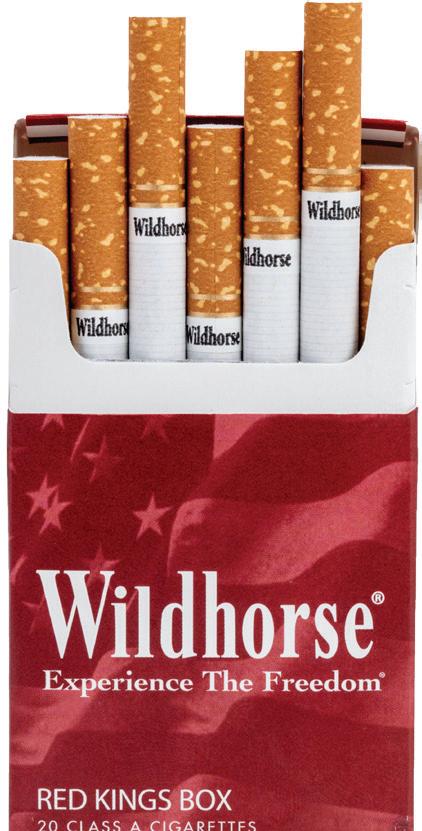

Premier Manufacturing: Brands Built on Integrity

Owned by a cooperative of proud American farmers using the best U.S.-grown tobacco blends among their competitors, Premier provides high-quality, value-priced cigarette brands for the adult consumer. C-stores across the country are buying in.

Commitment to Quality

Premier Manufacturing, Inc. is the consumer products division of U.S. Tobacco Cooperative Inc. (USTC), an American grower-owned marketing cooperative based in Raleigh, NC.

500+ member farmers throughout the Southeast

Members maintain GAP Connections Certification Standards Ensures sustainable, ethical agricultural practices

Robust Partnerships

Premier’s support staff prides itself on meeting customer goals with seamless execution in achieving the highest regulatory standards.

• Provides sales/service support across the U.S.

• Develops POS materials for high visibility

• Creates custom sales & merchandising programs

• Maintains strong relationships with top distributors

Trackable process includes all aspects of manufacturing under one roof Tobacco processing & stemmery Primary blending / Cigarette finishing

A Cut Above the Rest

All products made in USA & 100% guaranteed

Premier products use only top-end tobacco blends.

The finest flue-cured tobacco in the world

• All U.S. grown

• Environmentally sustainable

• Compliant with every regulation

The best blend among competitors

• Highest concentration of flue-cured tobacco

• Partners with top national and regional retail chains

• Vibrant color

• Blends provide exceptional aroma and flavor experience

Manufactured on industry-leading equipment

• Laser perforation

• Inked code dating

• Latest high-tech advancements

Your Trusted Premier Brands Choose the brand that suits your loyal consumers. Each brand features a variety of styles to satisfy every taste. Contact Premier Manufacturing today! www.gopremier.com/contact

“One of the big things with launching this new flagship site in Lawrence is we are going through a whole major brand redevelopment for the inside store itself,” Black said.

Now that the chain has begun to scale and develop some concentration in the New England marketplace, it plans to roll out the Haffner’s banner — or some variation of it — to the majority of its stores.

“A unified brand name for the stores is where we’re heading. That’s one of the big things we’re working on to make sure people know who we are because we’re not done at 71 (stores), and we’re continuing to grow,” Black said.

EN is set to roll the flagship design out to other locations, with two remodels already underway.

EN is working on a raze and rebuild at the entrance of Gloucester, Mass., an iconic fishing town, that is expected to open by the end of summer. The site is the second-oldest Mobil station in the country and will continue to fly the Mobil flag while the c-store sports the Haffner’s banner.

EN is also set to raze and rebuild a site in New Hampshire, and it has other sites on its radar for future razeand-rebuild projects.

“The plan is to have a refresh of basically every site in the portfolio, plus continue to build NTI stores, as well as continued acquisition growth,” Black said.

FOOD FORWARD

On the foodservice front, EN has partnered with Sal Lupoli, founder of Sal’s Pizza.

“Sal is iconic in Lawrence, Mass., but he’s also iconic in the New England marketplace,” Black said.

Sal’s Pizza is the exclusive pizza provider at Fenway Park and TD Boston Garden. The brand also services K-12 schools from Maine to Connecticut.

Jeff Black, CEO of Energy North, has been focused on building the company’s culture and creating a more robust leadership team both at the executive and management levels that will be instrumental in helping the company expand.

“I grew up eating his pizza,” Black said.

EN partnered with Sal’s Pizza to create a c-store specific concept, which it tested in its Littleton, Mass., store.

“It worked out unbelievably well,” Black said. “We are working on a joint partnership between our companies. Not only are we trying to roll out the Sal’s Pizza in our locations, but we are also having active conversations about rolling it out to other locations in New England, and eventually further out.”

Today the Sal’s Pizza program is available at six EN locations, including the flagship site. Pending space and permits, the chain plans to roll Sal’s Pizza out to as many of its locations as it can and then introduce the program to its dealer sites. The program features fresh ingredients and extra-large pizza slices. The store offers seven to eight different varieties of slices. Full 18-inch pies or personal pizzas are also available.

“We’re hoping to grow that for the lunch to dinner offerings,” Black said.

EN also embarked on a joint venture with Crack’d, a morning daypart concept with fresh coffee, breakfast sandwiches and eggs made to order. EN had been in search of a unique morning program.

“We wanted to create something special, but we wanted to be able to go to market quicker. Similar to what we did with Sal’s Pizza, we wanted to find someone that already knew how to do this, would train us to do it, had a great offering and program available that we could operate and had a brand name that’s already been developed,” Black said.

So far, Crack’d has been introduced to the flagship location and is scheduled to be added to future NTIs. As with Sal’s Pizza, EN plans to roll out Crack’d to as many of its locations as it can, and then, once the concept is developed, offer it to other chains.

“We’re going to take over the operations (of Sal’s and Crack’d), so we get to marry their knowledge of foodservice and our knowledge of the c-store space and how we need to make things move a little bit quicker than a traditional restaurant,” Black said.

28 CSTORE DECISIONS • July 2023 cstore decisions.com

Chains to Watch / Energy North

Chains to Watch / Energy North

Energy North has partnered with Crack’d, a morning daypart concept that offers fresh coffee, breakfast sandwiches and eggs made to order.

EN also offers Dunkin’ at some of its sites. It’s in the process of finalizing a Crack’d bean-to-cup offering for the locations that don’t sell coffee via its quick-service offerings. Most of the chain’s stores with a coffee program, whether it be Dunkin’ or the new Crack’d concept, feature drive-throughs.

“We try to put drive-throughs in wherever we possibly can,” Black said.

Customers can also order Crack’d or Sal’s Pizza through third-party delivery apps. EN also added touchscreen dispensers at the flagship site. Soon customers will be able to order food at the dispenser and have it delivered to their car.

GROWTH INITIATIVES

Because EN features a large heating oil and propane division, its stores are equipped to take orders and payments for its heating oil and propane customers.

EN also features a car wash business with 12 tunnel washes and 10 touchless car washes. All of the car washes are branded Haffner’s.

“Our objective is to continue expanding and strengthening that division,” Black said. He emphasized that Haffner’s has established a longstanding reputation for its exceptional car washes.

EN is currently working to develop a loyalty program that includes a discount on gas, car wash and heating oil propane. Within the loyalty program, it’s also building out its unlimited car wash program. It named the loyalty card the “Kick Card” after the Haffner’s tagline, “It Kicks.” EN is currently piloting the rewards program with its employees before it rolls it out to its locations.

EN is also in the process of adding self-checkout kiosks to all of its locations.

As the chain works to engage employees, it has also launched a texting app, called “Go Happy,” to better communicate with workers.

“It’s helped our turnover rate come down significantly since we launched it,” Black said.

EN works to be a destination for both customers and employees. A few years ago, it rebuilt its office and added a gym and a full kitchen as a way of providing more amenities to employees.

“Over the past two-and-a-half years, our focus has been on embracing our core values of family, doing the right thing and safety, while envisioning the future,” Black said. He noted that during this period, the company made significant progress by assembling a brand-new executive team. Additionally, as the chain expanded from a mere 25 employees to now over 1,000, careful attention was given to assessing and enhancing the company culture to align it with the broader chain it has become today.

Growing beyond its current 71 sites is a major focus for EN. EN has hired a construction team and created a building department dedicated to identifying pieces of land or opportunities to raze and rebuild stores or build NTI stores.

“I think we’re a very unique company that has a lot of different verticals, and to be able to marry that all together and bring it to a c-store offering, I think is very unique and something that we’re going to continue to lean on and grow within the company,” Black said. “I’m extremely proud of where we are and where we’re going; the team that I’m working with, what we’re doing in the community and the direction that we’re heading — I couldn’t be prouder. And again, I’m proud of the team that is making all this possible.” CSD

30 CSTORE DECISIONS • July 2023 cstore decisions.com

Contact your local ChapStick representative on how to order or email John.L.Hankins@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Carries our top 4 selling skus: Original Cherry Strawberry Moisturizer w/SPF 15 Fish Bowl 72pc Display You have the potential to make OVER 60% MARGIN! Save 29% $90 IN PROFIT from 1 Fish Bowl at $1.99 * @ $1.99 SRP

Assortment Drives Beverage Sales

Recent data from NielsenIQ showed dollar sales trending upward across beverage segments, but unit sales dipping across the board and inflation impacting prices in the category. Water dollar sales increased 15.4%

for the 52 weeks ending April 29, while unit sales dropped 4.2% and the price per unit rose 20.4%, according to NielsenIQ’s U.S. Convenience data. Energy drinks grew 10.4% in dollar sales and 2.9% in unit sales as prices rose 7.3% for that same period. Soft drinks saw a 14.4% rise in dollar sales, and dipped 1.1% in unit sales, as prices increased 15.6%.

Beacon & Bridge Market, which has over 20 c-stores in Michigan, is one chain seeing an increase in sales for water and energy drinks.

“Water and energy drinks will continue to grow and take over a bigger piece of the overall category pie,” said Eric Patterson, merchandising manager at Beacon & Bridge Market. “For the last 90 days, energy sales at our stores have surpassed soft drink sales. I anticipate our soft drink customers making a shift to either energy or a healthier option.”

Category Management | Packaged Beverage

Now that summer has arrived, consumers are gravitating toward the cold vault at their local c-store, and they’re reaching for the latest trends as they look to experiment with new flavors and varieties. Retailers are responding by increasing their beverage selection. Energy drinks and water are among the segments retailers have seen flying out of the cooler doors.

Retailers are stocking the cold vault with a variety of beverages as consumers demand options.

Zhane Isom • Associate Editor

32 CSTORE DECISIONS • July 2023 cstore decisions.com

Unique Blends + Superior Value = Unmatched Satisfaction Contact your E-Alternative Solutions Representative or visit EalternativeSolutions.com/Leap Featuring an unrivaled range of satisfying tobacco and menthol blends. High-capacity pods deliver better value with a smooth, long-lasting experience. 100% product guarantee. WARNING: This product contains nicotine. Nicotine is an addictive chemical.

Water Leads Beverage Dollar Sales Growth

While dollar sales are up for a number of beverage segments, unit sales declined for most beverages with the exception of energy drinks, which rose 2.9% for the 52 weeks ending April 29, according to NielsenIQ. Prices saw double-digit increases across most beverage segments.

Portland, Ore.-based Plaid Pantry, which has 108 c-stores in the Pacific Northwest, also expects packaged beverage sales to increase by the end of 2023.

“We’re expecting double-digit growth this year in our packaged beverage category,” said Mike Nelson, senior category manager at Plaid Pantry. “I’d think 15-20% would be realistic as people are slowly getting back to routines that thankfully involve a stop for beverages.”

VARIETY IS TRENDING

Retailers are also starting to notice consumers wanting a broader assortment of beverages to choose from.

“I think today’s customer wants variety,” said Nelson. “And they’re also looking for their drinks to ‘do something.’ Beverages with added functionality continue to grow.”

Beacon & Bridge Market has kept customers’ demand for assortment in mind by adding beverages that are trending to its cold vault.

“Our customers want assortment. A growing number of customers are demanding what they see their favorite celebrity touting on Twitter or Instagram. Prime is a case in point,” said Patterson. “This is a brand I barely considered; however, the Super Bowl,

Category Management | Packaged Beverage

Product Dollar Sales Unit Sales Price Per Unit Current 1-Year % Change Current 1-Year % Change Current 1-Year % Change Sports Drinks $10.1 B 12.3% $3.52 B -4.9% $2.86 18.0% Water $13.9 B 15.4% $4.46 B -4.2% $3.13 20.4% Smoothies $22.0 M -19.0% $8.00 M -15.4% $2.59 -4.3% Soft Drinks $38.8 B 14.4% $12.0 B -1.1% $3.23 15.6% RTD Coffee $2.78 B 7.1% $757 M -2.7% $3.68 10.1% RTD Chai Tea $71,093 -34.0% $17,520 -47.1% $4.06 24.7% Fruit Juice $3.25 B 10.5% $892 M -2.5% $3.64 13.3% Energy Drinks $19.2 B 10.4% $6.24 B 2.9% $3.09 7.3%

NielsenIQ Total U.S. Convenience data for the 52 weeks ending April 29, 2023 34 CSTORE DECISIONS • July 2023 cstore decisions.com

Source:

among other factors, has made them the hottest trend of the summer.”

Plaid Pantry also offers a wide assortment of beverages to meet the needs of its customers.

“As a company, we pride ourselves on selection, and the coolers are no different,” said Nelson. “Along with the usual, we offer lots of unique brands and categories. We do quite well with kombuchas, Yerba Mates and CBD beverages, just to name a few.”

While the latest trends are gaining traction, tried-and-true beverage favorites need ample space too.

“We focus most of our time and effort on the subcategories that really matter,” said Patterson. “Last year, we scaled back on dairy to add energy SKUs, and it paid off. So in 2023, we really took a look at underperforming categories and trimmed some low-hanging fruit to make room for even more energy drinks.”

All in all, retailers today need to have the cour-

FAST FACTS:

• Water dollar sales have increased by 15.4%, according to NielsenIQ’s U.S. Convenience data for the 52 weeks ending April 29.

• Energy drinks had a 10.4% increase in dollar sales for the 52 weeks ending April 29, per NielsenIQ.

age to take risks with their cold-vault assortment. Retailers should take the time to know their demographics to grow their overall cold-vault sales.

“For the last 90 days, we’ve been trending at about a 20% increase in total packaged beverage sales. Will this taper off toward the end of the year? Absolutely. However, I think the changes we’ve made to our assortment will help us have a fantastic 100 days of summer and more than offset whatever shortcomings we may encounter at the end of the year,” said Patterson. “Luckily, we are seeing both significant dollar growth alongside unit growth in the subcategories that mean the most to our business.” CSD

cstore decisions.com July 2023 • CSTORE DECISIONS 35

Candy

Candy Still Reliable Mainstay

Candy remains popular among consumers, with non-chocolate showing strong promise as it edges ever closer to chocolate in terms of sales.

Emily Boes • Senior Editor

Candy has managed to retain the loyalty of c-store customers as 2023 continues forward despite inflation dogging consumers’ steps.

Although unit sales might be subsiding marginally, sales dollars are elevated across all channels, noted Dan Sadler, principal, client insights at Circana, a market research firm.

“Before, probably eight to 12 months ago, we really saw that, even though candy in general is pretty insulated from inflation. ... Even with higher prices, (customers) might buy a little bit less, (but) they’re still going to buy confections; they’re not going to forego it,” he added.

NielsenIQ data corroborated Sadler’s observations. The 52 weeks ending April 29 shows candy dollar sales up by 11.9% at retail stores across the U.S., including c-stores. Unit sales dropped by only 2.2%, yet the average unit price has risen by 14.4%.

Tiger Fuel Co.’s The Market, which has nine locations in Virginia, has seen upward growth in the candy category.

“We are seeing year-over-year growth in units — not just sales dollars due to price increases. The growth is being led by bagged candy, and we have been working to expand our assortment to make sure we can keep up with the demand in this area,” said Nick Rogers, retail merchandising manager for The Market.

Reese’s has maintained its spot as the top-selling chocolate option at The Market.

In terms of dollar and unit sales, chocolate still reigns in the candy category despite its 4.2% dip in unit sales per NielsenIQ.

Chocolate also leads the category at Cliff’s Local Market, “but the gap is closing,” according to Bill Laraby, purchasing manager at Cliff’s Local Market, which operates 20 locations in New York, with its 21st location slated for this fall.

THE RISE OF NON-CHOCOLATE

Gummies and fruit snacks are trending at Cliff’s.

“We continue to see great growth in non-chocolate,” said Laraby.

In fact, he noted non-chocolate has driven the growth in dollar and unit sales for the candy category, “with an honorable mention to gum.”

Category Management | Candy

36 CSTORE DECISIONS • July 2023 c store decisions.com

Candy Sales Still Steady

Dollar sales continue to increase for candy, and unit sales decreases stemming from chocolate and confection are manageable despite price hikes. Chocolate remains the top segment in the category, although gum and mints jumped the highest in dollar sales and saw unit sales upticks.

Cliff’s has recently expanded its peg bag sets to include an additional 16 facings due to the popularity of the gummy segment and the number of new gummies that have entered the market.

“Sour Patch, Swedish Fish, Haribo, Trolli and Life Saver gummies are all doing well. We have seen a resurgence in the Nerds, Airheads and Gushers brands,” said Laraby.

Non-chocolate candy nearly reached $10 billion in dollar sales for the 52 weeks ending April 29 per NielsenIQ, having risen by 14.3%, while unit sales remained relatively flat (down 0.8%).

What could be contributing to candy sales is the widespread innovation Sadler has noticed.

“Within chewy candy you’re seeing different formats for some of the different candies. Just different ideas (to) make it fun and exciting for the users. A lot of it’s about experience and being able to touch and feel the products,” he said.

GUM, MINTS AND OTHER TRENDS

Gum and mints have begun gaining traction since in-person activities have resumed post-COVID.

Unit sales have ticked up 2.4% and 1.8% respectively, with dollar sales notching 17.1% and 15.5% gains respectively, per NielsenIQ.

Cliff’s, too, has seen post-pandemic growth.

“Gum took a big hit during the pandemic and has seen a nice bounce back this year. Pocket packs and bottled gum have been growing,” said Laraby.

Sadler predicted innovation will soon pick up in the subcategories. Already he’s noticed different attributes in gum offerings, although not as many as in chocolate and non-chocolate products.

“We are seeing innovation around vitamins in gum. You’re seeing a little bit more of some different characteristics that weren’t as prevalent before,” he said.

As for other trends, Sadler has seen a rise in better-for-you and zero-sugar products, as well as a higher demand for plant-based products. Limited-edition items are also popular in the candy category.

At The Market, customers have expressed a greater interest in novelty candy items, “and we have started to look to expand upon that segment,” said Rogers. CSD

FAST FACTS:

• Candy dollar sales jumped up by 11.9%, per NielsenIQ, while unit sales dropped by 2.2% for the 52 weeks ending April 29.

• Many new gummies have entered the market as the segment grows more popular.

• Innovations are prevalent with candy, such as vitamins in gum.

Product Dollar Sales Unit Sales Price Per Unit Current 1-Year % Change Current 1-Year % Change Current 1-Year % Change Candy, Gum, Mints $33.1 B 11.9% 12.3 B -2.2% $2.69 14.4% Chocolate $18.5 B 9.9% 6.18 B -4.2% $2.99 14.7% Confection $9.99 B 14.3% 4.38 B -0.8% $2.28 15.2% Gum $2.98 B 17.1% 1.19 B 2.4% $2.51 14.4% Mints $1.04 B 15.5% 439 M 1.8% $2.37 13.4% Snack Mixes $361 M 11.2% 98.8 M 1.6% $3.65 9.4% Source:

Total

NielsenIQ

U.S. grocery store, drugstore, mass merchandise store and convenience store data for the 52 weeks ending April 29, 2023

Category Management | Candy 38 CSTORE DECISIONS • July 2023 cstore decisions.com

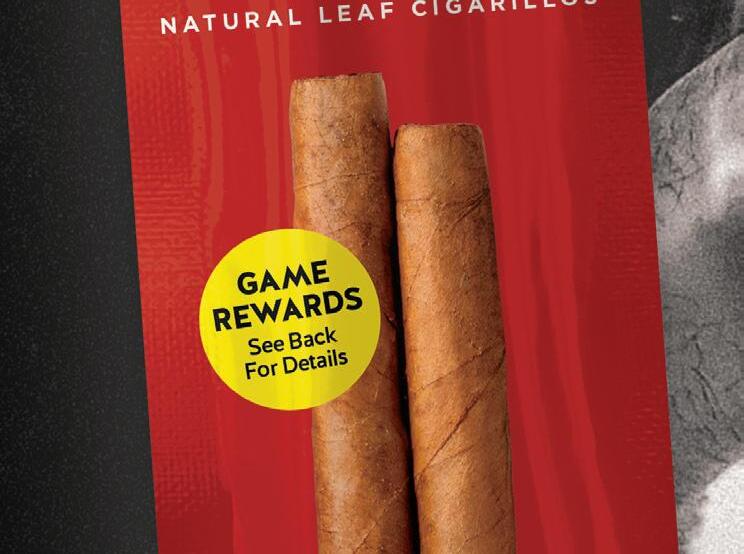

As the world’s leading natural leaf cigar brand, Game is driving more sales than ever with our groundbreaking Game Rewards customer loyalty program. That means when you stock Game, it’s a win-win for you and your customers. CONTACT YOUR SWEDISH MATCH REPRESENTATIVE 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM GAMECIGARS.COM ©2023 SMCI Holding, Inc.

GAME IS NATURALLY MORE REWARDING.

The salty, sweet and better-for-you snack segments are seeing strong dollar sales growth, partly driven by price increases in the category.

For salty snacks, pretzels led with a 17.5% increase in dollar sales and a 1.1% uptick in unit sales for the 52 weeks ending April 29, according to NielsenIQ. On the sweet snacks front, cookies dominated with a 28.3% bump in dollar sales and a 4.7% increase in unit sales, despite a price-per-unit increase of 22.5% for the same period. As far as healthy snacks go, multigrain snacks saw a 21.8% increase in dollar sales and 2.5% growth in unit sales for that same period per NielsenIQ.

“I am seeing the most growth within salty and alternative snacks. When it comes to flavors, I am seeing cus-

Snacks Continue to DOMINATE in 2023

Variety and flavor innovation in the snack category are driving purchases even as inflation pushes snack prices higher.

Editor

Editor

tomers go for more spicy, sweet and savory snacks,” said Meghann Eaton, category manager at Nouria Energy, which operates 170 c-stores in Maine, New Hampshire, Massachusetts and Rhode Island.

Eaton noted that customers are also gravitating toward brands that use clean ingredients.

INFLATION’S IMPACT ON SNACKS

Inflation has been driving food prices higher, and snacks are no exception. Even though dollar sales have increased, unit sales have decreased due to inflation.

For example, cupcake unit sales declined by 10.5%, while meat snack unit sales dropped by 9.9% for the 52 weeks ending April 29, noted NielsenIQ.

“Unit sales have flattened in both sweet and salty snacks due to the continuing increase in costs and the needed increases in retail to maintain margins,” said Mike Jackson, category manager at High’s, which has 60 stores throughout Maryland, Delaware and Pennsylvania. “Some categories, such as meat snacks, have seen a significantly higher increase in costs, so we have seen a decline in unit purchases for meat snacks.”

Zhane Isom • Associate

Category Management | Snacks 40 CSTORE DECISIONS • July 2023 cstore decisions.com

Snack sales are on the rise in 2023, and retailers hold a strong outlook for the category going forward as brands introduce continued innovation that keeps customers coming back for more.

Inflation Nudges

Snack Prices Higher

Dollar sales are up for snack products, led by cookies, which rose 28.3% for the 52 weeks ending April 29, per NielsenIQ. Unit sales saw mixed results as prices trended upward.

Inflation has caused some challenges for Nouria as well.

“One of our biggest challenges is how quickly costs are rising,” said Eaton. “With these high food costs, we are just trying to make sure customers feel good about shopping with us.”

VARIETY DRIVES SNACK SALES

As c-store customers purchase snacks, they’re seeking variety and healthy options.

Circana’s “The Snacking Supernova” report found 48% of consumers look for multi/variety packs because they offer more snacking options.

“Customers are looking for variety in snacking options while still expecting to see those staple brands available,” said Jackson. “There seems also to be an increasing demand for value-priced items in the snacking category. Something that offers a price value to the customer even though it may be a smaller-sized package.”

The Circana report also found 54% of consumers say snacks are an important part of their healthy eating plan throughout the day.

“Consumers want better-for-you items but are still

buying unhealthy items as well. They need the healthy options to still have full, rich flavors,” said Eaton. “Also, with costs climbing, they still want deals to feel like they are saving.”

Both Nouria and High’s are looking at trends closely to make sure they have the right snacks on their shelves.

Eaton mentioned that Nouria is offering keto-friendly chips, Planters cheese balls with cleaner ingredients and its private-label pastries.

“We try to offer the top-selling sweet snacks while still offering some healthier choices for the customers seeking out those types of products,” added Jackson. “We are also keeping a closer eye on planograms and making sure items that are not selling well receive placement more often.”

As retailers continue to stay on top of all the latest snack trends and keep their most popular snacks on shelves, they will continue to see snack sales grow despite inflation.

“We think if the category is managed properly, we could see a modest increase in dollar sales of about 10%,” said Jackson. “Unit sales are also expected to be slightly up or even flat towards the end of 2023.” CSD

Product Dollar Sales Unit Sales Price Per Unit Current 1-Year % Change Current 1-Year % Change Current 1-Year % Change Meat Snacks $4.47 B -1.2% $1.03 B -9.9% $4.34 9.7% Potato Chips $10.7 B 14.9% $3.71 B -1.0% $2.89 16.0% Pretzels $1.73 B 17.5% $441 M 1.0% $3.92 16.3% Snack Mixes $2.39 B 8.3% $599 M -3.7% $3.99 12.5% Variety Pack $3.44 B 15.1% $267 M -8.5% $12.89 25.8% Vegetable-Based Salty Snacks $735 M 3.0% $203 M -6.5% $3.62 10.2% Multigrain Snacks $540 M 21.8% $156 M 2.5% $3.45 18.9% Cookies $945 M 28.3% $363 M 4.7% $2.60 22.5% Cupcakes $443 M 3.6% $161 M -10.5% $2.75 15.8% Doughnuts $1.93 B 15.1% $643 M 0.6% $3.01 14.5%

cstore decisions.com July 2023 • CSTORE DECISIONS 41

Source:

NielsenIQ Total U.S. Convenience data for the 52 weeks ending April 29, 2023

A Slice of Advice About Delis

with 120 locations throughout Ohio and West Virginia, have been seeing double-digit growth in their deli sales, according to Nathan Arnold, the chain’s director of marketing.

“Focusing in on our core items to ensure quality and consistency has been the key,” he explained. “Then introducing one or two new items at a time for limited-time offers drives trial.”

Duchess’ proprietary program, simply called The Deli, offers a wide range of freshly made foods covering all meals and snacks. Arnold pointed out that the company chose the proprietary route because it offers the chain “maximum flexibility.”

“It gives us an opportunity to try new products, keep up with customer requests and promote alongside our own proprietary coffee, fountain, chips, snacks and other products,” he explained. “Throughout our marketing area we, of course, see some consistencies in customer trends, but our proprietary program allows us to hyper focus on product availability that our customers crave.”

Most of the Duchess stores have delis and, depending on store size, they feature the full food program or smaller offerings, Arnold commented. As the company continues to raze and rebuild stores, they are introducing more communities to the expanded deli program.

Boise, Idaho-based Stinker Stores has also seen success with its proprietary deli program.

For the past three years, Stinker’s foodservice has experienced 30% increases in its sales, reported Billy Colemire, leader of the chain’s category manager team. Stinker operates 110 locations across Idaho, Colorado and Wyoming.

Foodservice | Delis

As foodservice continues to grow as a major profit center for c-stores, retailers are increasingly looking to proprietary or co-branded deli programs to deliver the freshness and variety consumers crave.

Marilyn Odesser-Torpey • Associate Editor

42 CSTORE DECISIONS July 2023 cstore decisions.com

Whether proprietary or partnered with a co-brand, deli programs are playing a major role in making convenience stores top-of-mind freshfood destinations.

FAST FACTS:

• Proprietary delis offer maximum product and marketing flexibility.

• Co-brands provide a high level of support.

• C-store retailers should select some staff and customer influencers to promote the deli program.

cstore decisions.com July 2023 • CSTORE DECISIONS 43

Colemire attributed much of that growth to its proprietary Pete’s Deli.

“With proprietary programs the reward (and risk) seemed far greater,” he noted. “Although there are many successful branded food programs across the industry, choosing to go proprietary gave us more control from the start, and we feel that it enables us to create meaningful food and beverage destinations in each market we operate in.”

He stated that the proprietary concept enables Stinker to market, promote, innovate and change based on its own needs, wants and schedule. It also allows the company “to move quickly and jump on trends while they are still in the adoption or proliferation cycle of the menu adoption cycle.”

All but 10 of the Stinker Stores sites feature one of three Pete’s Eats concepts. They vary from a full program with an open kitchen and large menu to a Pete’s Eats Ex-

press with 60% of the full menu, most with open kitchens, to a Commissary Pete’s Eats Express for stores with space constraints. For the latter, the company works through a local commissary to get fresh products delivered a few times a week.

THE CO-BRAND ADVANTAGE

While being nimble is a big pro when it comes to proprietary deli, co-branding also has its advantages, Colemire said.

“With our own program the buck, with all our successes and failures, stops with us,” he explained. “Branded programs are also usually very recognizable and resonate with a large swath of customers.”

Operating a proprietary deli rather than a co-branded one also requires more effort to source the quality ingredients, paper products and containers, sauces and more to make and serve deli items, Arnold noted. A co-brand takes on these responsibilities and handles supply chain issues that might arise.

“Branded delis also provide recipes for the products on the menu, which can be beneficial if you do not have a foodservice team that can develop new products, use focus groups and other testing methods, and create mandatory things like nutrition facts and ingredient statements,” he said.

Whichever type of program you choose, make sure your staff is completely on board, Colemire recommended.

“The best designed programs often fail because employee and company buy-in isn’t there,” he said. “Finding some key influencers within the organization and community is integral to growing momentum and excitement.” CSD

Foodservice | Delis

Every Stinker Stores site, apart from 10, features one of the three Pete’s Eats concepts.

44 CSTORE DECISIONS • July 2023 cstore decisions.com

Duchess’ proprietary program, simply called The Deli, offers a wide range of freshly made foods covering all meals and snacks.

Technology | Frictionless

FRICTIONLESS Is Here to Stay

C-store chains across the globe have begun deploying versions of frictionless checkout solutions, from scan-and-pay apps to Just Walk Out technology, but the concept is still underutilized in convenience stores today.

While many c-store retailers report having their eye on frictionless checkout trends and technology, some aren’t sure where to start or why they should consider it.

Richard Crone, CEO of Crone Consulting LLC, noted that an effective frictionless checkout experience starts with retailers being able to connect with their consumers. Today, that means having a professional, easily navigated mobile app, he said.

“That’s your pre-authenticated identifier for knowing who the customer is and interacting with them,” Crone said. “The one who enrolls the customer for that app is the one who controls the upside from personalization and connecting with that customer, for not only frictionless checkout, but for a frictionless experience, for a personalized experience.”

Crone also noted that frictionless checkout systems come in many different varieties, and it is not always necessarily as complicated as it may seem to integrate them.

“The convenience store operator doesn’t have to reequip their store with cameras and sensors in order to enter this market. The easiest way for them to enter this market is with order ahead,” Crone said.

For many chains, especially smaller retailers, integrating a frictionless checkout system can seem both intimidating and expensive, and in some cases it can be. However, almost always the first step is figuring out a way to deploy technology that will allow c-store operators to get to know their customers’ tendencies, especially their spending habits. A mobile app is the retailer’s best opportunity to begin to understand those habits.

Once the mobile app is refined and easily accessible for users, then new tactics can be deployed to get the customer’s foot in the door and put frictionless checkout systems into practice.

“What most people don’t know about the convenience store or the grocery store industry is that the store operators actually make more money from the trade promotions than they do in profit,” said Crone. “So, if they can extend that placement inside their app, then they can provide an audit trail and prove the attribution for a net new sale, and that is more valuable than the spray-andpray advertising most convenience stores use today.”

Crone noted that the focus shouldn’t be on checkout, but on the check-in process. When customers check in through an app, it allows retailers to know their customer,