EDITORIAL

EDITOR EMERITUS

John Lofstock

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Marilyn Odesser-Torpey

EDITORIAL ASSISTANT/INTERN

Kevin McIntyre

CONTRIBUTING EDITORS

Anne Baye Ericksen

Howard Riell

COLUMNISTS

Thomas Briant Abbey Karel

SALES TEAM

PUBLISHER

John Petersen jpetersen@wtwhmedia.com (216) 346-8790

VICE PRESIDENT, SALES

Tony Bolla tbolla@wtwhmedia.com (773) 859-1107

REGIONAL SALES MANAGER

Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER

Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE

Jane Cooper jcooper@wtwhmedia.com

LEADERSHIP TEAM

CEO

Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES

Mike Emich memich@wtwhmedia.com

EVP

Marshall Matheson mmatheson@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE SERVICES

Mark Rook mrook@wtwhmedia.com

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR

Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

DIRECTOR OF EVENTS

Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER

Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST

Olivia Zemanek ozemanek@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

VP, ASSOCIATION & COMMUNITY ENGAGEMENT, NAG Allison Dean adean@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Garrett McCafferty gmccafferty@wtwhmedia.com

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

WEBINAR COORDINATOR Halle Kirsh hkirsh@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Lender nlender@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Johnson njohnson@wtwhmedia.com

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Lisa Dell’Alba, President and CEO

Square One Markets • Bethlehem, Pa.

Raymond Huff, President

HJB Convenience Corp. • Lakewood, Colo.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Olivia Beck • Operations

Beck Suppliers Inc. • Fremont, Ohio

Reilly Robinson Musser, VP, Marketing & Merchandising

Robinson Oil Corp. • Santa Clara, Calif.

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO

Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Vice President/General Manager Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Food Service Director Warrenton Oil Inc. • Warrenton, Mo.

WTWH MEDIA, LLC

1111 Superior Ave., 26th Floor, Cleveland, OH 44114

Ph: (888) 543-2447

EDITORIAL AND NAG

1420 Queen Anne Road, Suite 4, Teaneck, NJ 07666 Ph: (201) 321-5642

SUBSCRIPTION INQUIRIES

2011 - 2020

To enter, change or cancel a subscription, please go to: http://d3data.net/csd/indexnew.htm or email requests to: bsprague@wtwhmedia.com

Copyright 2023, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian

Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher. Circulation audited by Business Publications Audit of Circulation, Inc.

Jeff Carpenter, Director of Education and Training

Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Caroline Filchak, Director, Wholesale Operations

Clipper Petroleum • Flowery Branch, Ga.

Cole Fountain, Director of Merchandise

Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing

The Kent Cos. Inc. • Midland, Texas

Daillard Paris, Director of Petroleum Supply and Trading Sheetz Inc. • Altoona, Pa.

Seeking multi-unit operators and developers to continue IHOP’s growth in travel centers nationwide and offering varied incentives for development.*

• Develop/operate a nationally recognized and trusted brand that will broaden your customer appeal

• 65+ years of giving guests the good comfort food they love and the updated favorites they want to try… at a great value

• A variety of menu options serving all dayparts, giving guests the flexibility of choice

• Updated exterior and interior restaurant design to provide all travelers a comfortable environment at any daypart

• Portable menu items and digital ordering offer a convenient guest experience

Interested in learning more…

Contact Us franchising@ihop.com

*Subject to Franchise Agreement and Development Agreement Terms.

© 2023 IHOP Franchisor LLC. This is not an offer to sell a franchise. An offer can be made only by means of a Franchise Disclosure Document that has been registered and approved by the appropriate agency in your state, if your state requires such registration, or pursuant to availability and satisfaction of any exemptions from registration.

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

In 2009, a few months after I joined CStore Decisions magazine (CSD), the Food and Drug Administration (FDA) was given the authority to regulate tobacco products when the Family Smoking Prevention and Tobacco Control Act was signed into law that June. That August it launched the Center for Tobacco Products (CTP).

In the 14 years that have followed, the industry has contended with ongoing regulatory hurdles. Now, c-store and other tobacco retailers are waiting for FDA decisions on the remaining premarket tobacco product applications (PMTAs), the fate of menthol cigarettes, flavored cigars and maximum nicotine levels in cigarettes.

Meanwhile, cities and states are taking matters into their own hands. Grassroots attempts are pushing various bans at the local and state levels.

In this month’s cover story, Thomas Briant, executive director of the National Association of Tobacco Outlets, told CSD that, as of press time, new flavored tobacco ban proposals have been introduced in 14 states, and Louisiana has introduced a proposed ban on vape flavors other than tobacco. The bans have been defeated in three of those states so far.

What’s more, states are coming for the right to smoke tobacco in general. California and Nevada, for example, failed in their recent attempts to phase out tobacco sales targeting customers born after a specific date — Jan. 1, 2007, in California and after Dec. 31, 2002, in Nevada.

California was successful in its attempt to ban flavored tobacco in the state, which went into effect in December 2022.

In the pages that follow, our June tobacco issue arms c-store retailers with an in-depth look at the legislative activity targeting tobacco, the sales trends and outlook for the key tobacco segments and firsthand accounts from retailers on what they’re observing to help retailers navigate the road ahead.

What’s certain is that local attacks against tobacco are expected to continue. It remains crucial that retailers engage with politicians to interrupt tobacco legislation at the local level.

During a session on political relationships at the National Advisory Group (NAG) Conference, Liz Bradford, founder and president of Bradford Public Relations, recommended that retailers can start building political relationships now, if they haven’t already, by signing up for representatives’ newsletters, inviting local or state lawmakers to their stores or events, and attending council meetings to get to know staff.

“Retailers should want political figures to know that they are paying attention as a business owner because the mayors and council members are paying attention to who shows up meeting after meeting,” Bradford said.

It’s always best to build political relationships before there’s an issue you need help with, so the relationship is already in place when you do.

C-store retailers can further elevate a political message using social media or newspapers. While technology has advanced, political staff members still comb through newspapers for references to political representatives. The NAG session also pointed out that when retailers are using articles to gain attention about a political issue, they should include the name of the mayor or governor in the article. That way it will catch the attention of the staff member whose job it is to monitor newspaper references.

The voices of those opposing tobacco are loud, and legislators don’t always hear the other side. They need to hear from local c-stores about the potential effects of proposed legislation and the aspects they’re not considering. So make that call. It could be one of the most important things you do for your business.

The Food and Drug Administration (FDA) noted earlier this year that its proposed very low nicotine regulation could be published by this fall. While a comment period and review would follow, if the regulation were to go into effect, it would prohibit the sale of almost all cigarettes currently on the market.

In July of 2017, the FDA announced a new comprehensive plan for tobacco and nicotine regulation. While the plan focuses on youth tobacco prevention efforts and public education campaigns about e-cigarettes and smoking cessation, the plan also includes a provision to propose a new product standard to set a maximum level of nicotine in cigarettes and other combustible tobacco products.

A “product standard” is a power that Congress granted to the FDA in the 2009 Federal Tobacco Control Act to reduce or eliminate an ingredient in a tobacco product or a constituent in tobacco smoke. Under the FDA’s comprehensive nicotine plan, the FDA plans to propose minimizing the amount of nicotine in cigarettes and possibly other combustible products.

Essentially, this plan will involve lowering nicotine in these tobacco products to what the agency refers to as a minimal or non-addictive level. This proposal has also become known as the very low nicotine standard. One of the goals of this plan is to reduce the likelihood that future generations become addicted to nicotine. Another goal is to make it easier for smokers to quit using combustible tobacco products.

Currently, cigarette nicotine levels range from approximately 7.5 milligrams of nicotine up to 13.5 milligrams of nicotine per cigarette. At this time, the FDA has not stated the maximum level of

The agency means to propose a cap on nicotine levels in cigarettes and combustible tobacco products.

Thomas Briant • NATO

nicotine per cigarette or other combustible product that the product standard would allow. From a timing perspective, the FDA announced in the Federal Unified Agenda and Regulatory Plan that was issued in January of 2023 that the proposed very low nicotine regulation could be published by October of 2023.

In the event that the proposed regulation is published, federal law requires that the FDA provide a period of time for the industry and the public to submit comments in response to the nicotine level product standard. Then, the FDA is required to review all the comments and make any changes that it deems appropriate to the product standard regulation.

In addition, the FDA would need to have the White House Office of Management and Budget review and approve proceeding with the proposed product standard before it is finalized because the regulation would have a significant impact on the U.S. economy. Only then can the FDA finalize the regulation and set a date for the regulation to go into effect.

A major reduction in the level of nicotine permitted in cigarettes would prohibit the sale of almost all cigarettes that are currently available on the market.

That is the case because the FDA has authorized the sale of only two very low nicotine cigarettes that are manufactured by 22nd Century Group — VLN King and VLN Menthol King, which have approximately 95% less nicotine than an average cigarette. A very low nicotine requirement would result in manufacturers having to use a tobacco plant that has been engineered to pro-

duce a very low level of nicotine in the tobacco plant itself.

It is important to note that reducing the level of nicotine in cigarettes and other combustible tobacco products does not mean that such products are safe or safer. This is the case because removing most of the nicotine from cigarettes and other combustible tobacco products does not remove the other constituents in the smoke.

As the FDA states on the agency’s website, nicotine is an addictive chemical found in the tobacco plant and is therefore present in all tobacco products. However, nicotine is not what makes tobacco use harmful. Rather, it is the other chemicals in tobacco and tobacco smoke — not nicotine — that cause health consequences in tobacco users.

Responsible retailers are seen as solution providers, offer your adult customers VLN® today.

Of adult smokers consistently show interest in using VLN®

Indicate they would use VLN® along with their usual brand

Of VLN® users would migrate to other higher margin in-store products

As inflation continues, customers are finding strategies to cut costs.

• Shoppers are changing priorities, switching to low-cost brands, especially when it comes to shelf-stable items (61%).

• 57% of households are cutting back on non-essential purchases, and 51% have switched to a lower-cost brand more often.

• Shoppers generally shop in the store for price and affordability (49%), for sales and promotions (46%), and to save money (41%)

• 70% of customers reported seeking more sales, deals and coupons.

After surveying 2,000 U.S. consumers, Attest noticed most respondents are buying private-label brands to keep costs down.

• 58% of consumers are very likely to buy from private-label brands.

• 27% of consumers are somewhat likely to buy from private-label brands.

• 4% of consumers are unlikely to buy from private-label brands.

• 74% of consumers would permanently make the switch from big-name brands to private-label brands, even if price wasn’t a concern.

Source: Attest’s “2023 U.S. Food and Beverage Trends Report”

Source: 84.51°’s “Inflation Special Report”

Crestline released a survey asking 2,300 Americans what money-saving tactics they used. Responses included:

• 84% of Americans wait on sales.

• 83% of Americans shop deals in multiple stores.

• 77% of Americans use loyalty accounts.

• 72% of Americans use coupons.

Source: Crestline, April 2023

In Snipp’s recent consumer survey, the company found customers are switching retailers in their quest to save money due to inflation. Have you recently switched from your usual retailers to save money?

84.51°’s “Inflation Special Report” also highlighted how consumers are saving on summer trips.

• 50% will pack/prepare their food rather than dine out.

• 48% will drive to their destination rather than fly.

Source: 84.51°’s “Inflation Special Report”

As inflation concerns mount for consumers, many are employing tactics to keep costs down as they shop for necessities.

Pilot Co. serves more than 1.5 million customers each day with help from its nearly 30,000 team members. Over the past 15 months, Pilot has increased its focus on improving its team member experience across policies, procedures and the environment, which has included developing diversity, equity and inclusion (DEI) practices.

CStore Decisions caught up with Angie Cody, director of inclusion, diversity & equity at Pilot Co., to learn more about how Pilot is approaching DEI across its network of more than 800 locations — 750 of which are part of its Pilot Flying J travel center network — in 44 states and six Canadian provinces.

CStore Decisions (CSD): Why is DEI an important initiative for Pilot?

Angie Cody (AC): Pilot’s team members serve as the heart and soul of our company. We’re proud to employ nearly 30,000 team members who come from incredibly diverse backgrounds and experiences. Pilot Co.’s success is driven by the strength of our team, which is why we strive to deliver a positive, inclusive and well-rounded experience for everyone. We know

we are stronger and better when we have an inclusive and respectful culture of diverse and empowered team members.

CSD: How is Pilot approaching DEI today?

AC: Because our team members and guests are so diverse, Pilot Co. is prioritizing DEI across the organization and has spent the past year formalizing a dedicated program to ensure we’re providing a better experience for all. To help inform these efforts, we recently launched five new business resource groups: Emerging Leaders, Building Relationships in Diverse Group Environments (BRIDGE), Pride of Pilot, Women of Pilot and Veterans of Pilot. These groups consist of team members throughout the organization to ensure a more inclusive experience for our team members and guests.

CSD: Tell me about Pilot’s business resource groups and how they work. What benefits have you seen?

AC: Pilot Co.’s business resource groups are team member-led and -governed groups that formed to recognize and celebrate the individuality of our team members and give our team members space to engage, enjoy the camaraderie of others and be themselves. Our business resource groups also help identify where we have gaps or opportunities and provide feedback on how we can better serve

As Pilot focuses on its people-first culture, it’s incorporating diversity, equity and inclusion practices to enhance the team member experience.

Erin Del Conte • Editor-in-Chief

our team members and guests. In addition, our business resource groups look for opportunities to serve their greater communities to facilitate positive changes outside of our organization — expanding the impact of our program.

CSD: From an employee retention and satisfaction perspective, how is DEI making a difference at Pilot? What has employee feedback been?

AC: While this program is still in its early stages, we’ve seen great results so far. Over the course of the past year, we’ve received extremely positive feedback from our team members and have high participation rates in our business resource groups — with that number growing rapidly. We’ve had long-term employees share that they are currently feeling more “heard” than they ever have before. We’ve also seen an increase in engagement across our social channels.

CSD: What are Pilot’s DEI goals going forward?

AC: Our primary goals are to advance a culture of inclusion through education and awareness, increase retention and engagement, and improve our guest experience. To that end, we’ll continue expanding upon our business groups, introducing them into new markets into 2024 to broaden the impact of Pilot Co.’s DEI program. We will continue to develop our cultural maturity and examine each element of the business through the DE&I lens.

CSD: What advice do you have for other chains that are interested in implementing DEI programs?

AC: The first piece of advice is to always ensure align-

ment with organizational and people goals. Your DEI program is established to support and enable your team members and your business. The second piece of advice is to start with talking about diversity, equity and inclusion. Education and communication are critical first steps to build the muscle needed to move the needle in the DEI space. Third, make sure that you set clear goals. Prioritization is so important. Find the few things you want to focus on and start there. While you may want to accelerate your program quickly, it’s important to sequence so you don’t get ahead of the business.

CSD: If chains aren’t ready to implement a whole program, are there any small steps you’d recommend they take?

AC: A great first step is to review your people policies, programs and processes and address any potential systemic barriers or bias. For example, organizations can review their dress codes and handbooks to remove gendered language. In addition, human resources can take a fresh look at their performance and talent review process to identify coded or biased language.

CSD: Is there anything else you want us to know that I didn’t ask?

AC: At Pilot Co., we value people above all else. When looking at any DEI program it’s so important to recognize that, while the program serves the business, your team is the most vital part of the equation. It’s easy to get lost in measuring your program against established metrics — but at the end of the day, it’s essential to never lose sight of the impact your program has at the individual level.

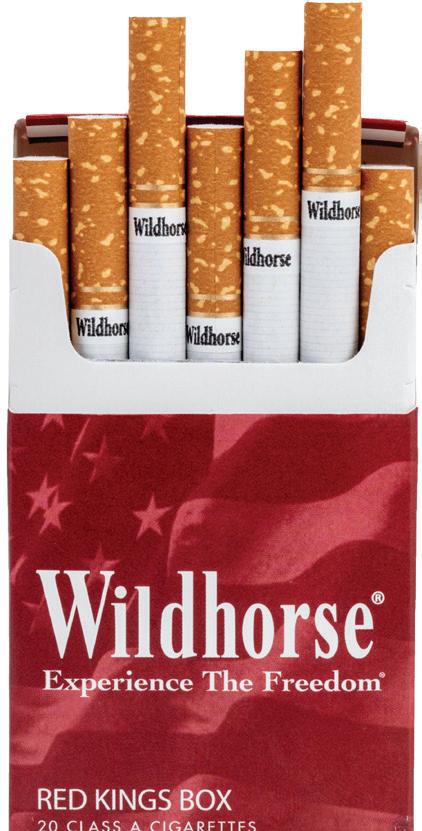

As tobacco fields pressures from regulatory headwinds and inflation, c-store retailers are taking stock of their backbars and strategizing to increase business.

Emily Boes • Senior Editor

Emily Boes • Senior Editor

As the battle against Big Tobacco continues to wage, c-store retailers are bracing against pending Food and Drug Administration (FDA) regulations, an onslaught of state and local legislation and rising inflation, all the while working to adjust their backbars to comply with the latest mandates and still maximize sales.

As potential restrictions from FDA on nicotine levels, menthol and characterizing flavors in cigars, as well as pending premarket tobacco product applications (PMTAs) and proposed local flavor bans, weigh heavily on c-store retailers, tobacco category managers are considering what they may have to replace on the shelf and how to fill the gaps.

“We are expecting a full flavor ban sometime in 2024 in our state, and by county level it could be sooner. We are definitely strategizing now to find options that can fill the backbar and ensure our customer has a good selection of available choices,” said Jon Manuyag, director of marketing for Plaid Pantry, which operates 106 stores in Portland, Ore., with three of those stores in Seattle and Vancouver, British Columbia.

“We are also looking at other categories outside of tobacco to fill up the tobacco backbar space,” he added.

On the federal level, the industry is anxiously awaiting decisions from the FDA on the future of menthol, as well as characterizing flavors in cigars.

“The FDA has announced that it intends to finalize regulations by August of 2023 that would prohibit menthol cigarettes, menthol roll-your-own (RYO) tobacco, menthol heat-not-burn products and all flavored cigars,” said Thomas Briant, executive director of the National Association of Tobacco Outlets.

“The effective date of these regulations will be announced when the final regulations are published. This means that the regulations would not go into effect in August of 2023, but at

Unit sales are down over the last year for most of the tobacco category, with price per unit increases across the board. Yet, cigarettes remain a powerhouse at $54 billion in dollar sales, and spitless tobacco has kept the smokeless category in the positives.

Source: Circana Total U.S. Convenience data for the 52 weeks ending April 23, 2023

some later date,” he continued.

State and city bans on menthol and flavored tobacco in general, however, may impact c-stores sooner.

At press time, new flavored tobacco ban proposals have been introduced in Pennsylvania, Indiana, Maine, Maryland, Minnesota, Nevada, New Hampshire, New Mexico, New York, Ohio, Oregon, Texas, Vermont and Washington, according to Briant. They’ve been defeated in Nevada, New Mexico and Washington. Louisiana is considering a ban on vape flavors other than tobacco.

Massachusetts has been dealing with a flavor ban on all tobacco products since 2020, and California enacted a flavor ban at the end of 2022. Recently, California proposed a bill to prohibit tobacco sales to those born in 2007 and later, but it’s been dropped in favor of pursuing more aggressive enforcement of the

flavored tobacco ban.

Nevada’s proposed flavor ban bill also would have prohibited anyone born after Dec. 31, 2002, from purchasing cigarettes. The bill failed to progress. But each bill emboldens other states to attempt similar legislation of their own.

C-store chains such as Yatco Energy, whose sites are primarily located in Massachusetts, have seen drastic changes with the onset of the flavor ban.

Yatco has 13 company-operated sites, with one location in Connecticut, one in Rhode Island and the remainder in Massachusetts, as well as six franchisees.

“(The flavor ban) has cut into our cigar business quite a bit here. We’re still seeing positive growth in the lower single digits, but we’re seeing double-digit — in the teens — growth in our Rhode Island and

Connecticut stores,” said Ed Oliveira, senior category manager, Yatco. “And I think part of the reason for that really is because of the flavor ban over the last two, two and a half years here in Massachusetts.”

The cigar planograms for Yatco’s Massachusetts stores have had to be different from those of its Rhode Island and Connecticut sites.

The ban not only affects cigars at Yatco, but it impacts moist snuff and vape, as well.

“The flavor ban in Massachusetts has hurt our sales in moist snuff. At best we’re flat right now … but if you look two years ago before the flavor ban, from the numbers I pulled, we were actually up 6-8% depending on the year. That’s all evaporated,” explained Oliveira.

Yatco’s Rhode Island and Connecticut stores see a healthier moist snuff business, partially due to the flavor

ban, and partially because the excise tax in Massachusetts for moist snuff is over 200%.

The inability to sell menthol in Massachusetts has particularly affected the cigarette business at Yatco stores in the state. “We’re down double, 20plus percentage points in cigarette pack sales over the past few years,” said Oliveira.

Oliveira noted that Yatco’s Connecticut and Rhode Island stores that still allow menthol are showing an increase in pack sales, with one store up 27%. Much of that percentage increase is due to menthol cigarette sales, and customers crossing state lines to stock up on the product is likely contributing to increases.

When flavor bans went into effect in California, manufacturers moved to introduce non-menthol varieties to replace former menthol products,

but the California Attorney General’s office sent Notices of Determination to the manufacturers, alleging such products would be misunderstood as flavored due to packaging style, color, etc. R.J. Reynolds Tobacco Co. has filed a lawsuit against the state officials in an effort to continue selling its new non-menthol Camel and Newport styles.

“It’s a shame they’re going after (menthol). You know what, if you’re selling cigarettes, why do they have to outlaw menthol? That doesn’t make sense. No. They allow you to sell marijuana. Now the cities are allowing marijuana. So, if you’re allowing marijuana, why not allow them to sell cigarettes anymore?” said Faiz Simon, president of Island Lane Capital, who operates Simon Xpress in Warren, Mich., as well as 14 other sites under a different banner name.

Oliveira expressed a similar sentiment, as cannabis is legal in Massachusetts.

As long as a city or state has a menthol ban in place, customers can choose to cross its border to find menthol cigarettes elsewhere, which Oliveira believes is the case, not only with cigarettes, but with menthol vapes, as well, which are included in Massachusetts’ menthol ban.

Babir Sultan, president of FavTrip, which operates three branded sites and nine leased sites in Missouri, as well as one in Kansas, also expressed frustration with local bans that send customers across city lines.

Last year, Kansas City, Mo., tried to establish a menthol ban that did not end up passing, Sultan explained.

“But I can’t imagine; what if it did?” he said. “Within 10 miles you could enter another city that would sell

(menthol). … We do have stores in multiple cities, and some could benefit and some could really be hurt that are caught on the wrong side.”

A local menthol ban is still a concern for Sultan, as it could be attempted again. He noted, however, that a nationwide ban could relieve the pressure from a business in a market with a local ban, as it will make the overall tobacco market “fair game.”

Oliveira agreed that the playing field would be more equal, but he noted that should a nationwide flavor ban of any sort be enacted, customers will succeed in finding these products elsewhere.

Harkening back to the Prohibition era, Oliveira said that “if they can’t go to another state, they’ll get it from another country or through a black market type of scenario.”

For now, experimenting with alternative products prior to a potential ban can possibly help save sales down the road.

Convenience store retailers would also be wise to start building relationships with their representatives now, before flavor legislation reaches their operating area.

“Start strategizing now for flavor ban discussions in your county or state. Being proactive now will only help you fight the potential loss in revenue and profits that these flavor bans will impact,” Manuyag advised c-store retailers.

At store level, retailers are seeing varying trends across the core tobacco segments.

Don Burke, senior vice president of data management and analytics

firm Management Science Associates (MSA), pointed to an overall decline in the total nicotine category, which he noted is significantly higher than in recent years.

“One of the factors influencing this decline are the low unemployment rates causing more consumers to be facing restrictions on the use of tobacco in the workplace. Other factors include the continued high inflation rate and gasoline prices that are restricting consumers’ disposable income,” he said.

While MSA data shows cigar sales are declining, Burke noted they’re faring slightly better than the total nicotine category, partially due to less pre-price promotion in the cigarillo category than in previous years.

However, at Simon’s stores, cigars are outperforming all other categories.

“People are smoking more cigars than before. I’ve been seeing that,” said Simon.

Vape sales are also increasing at his sites; however, not every store is seeing the same success. At Plaid Pantry vape sales are down by 5%.

“Part of that is due to no more promotional activity for JUUL in the Oregon market,” said Manuyag.

Altria recently settled at least 6,000 JUUL-related cases for $235 million. The lawsuits had alleged that JUUL’s flavors and marketing campaigns had targeted teens.

E-cigarettes have been and will continue to be one of the most watched categories as FDA decides on the remaining PMTAs. In May, 10 companies received marketing denial orders for an approximate combined 6,500 flavored e-cigarette and

At store level, retailers are seeing varying trends across the core tobacco segments, while MSA data indicates an overall decline in the total nicotine category that is higher than in recent years.

e-liquid products.

C-store retailers should note that of the 26 million PMTAs FDA received since spring 2020, FDA has acted on over 99%. Retailers should continue to watch for new marketing authorization decisions.

For Yatco, JUUL and Vuse carry the majority of its vape business, although Massachusetts’ flavor ban limits the amount of products from the brands that the stores in the state can sell. These stores still perform well with vape, but business is much

stronger at Yatco’s Connecticut and Rhode Island sites.

Also, as aforementioned, due to the flavor ban, sales of moist snuff for the chain are flat. Simon is seeing similar sales trends for moist snuff at his stores.

Burke noted that the smokeless category overall is seeing singledigit declines, but the one price tier showing some growth is the deepdiscount segment.

This suggests that emphasizing the lower-priced items, especially when facing increasingly price-conscious consumers, may be a noteworthy strategy for the foreseeable future.

In contrast, modern oral nicotine products are expected to grow at a double-digit rate in 2023, according to Burke.

This is certainly the case for Yatco, whose sales year over year are up by 100% for the category. At Plaid Pantry, modern oral is driving the other tobacco product category, with ZYN, On!, Rogue and VELO heading the charge. ZYN also holds over 70% of the market share of this category for Yatco.

Plaid Pantry is also seeing unit increases for RYO tobacco, as customers are looking to buy bulk tobacco and papers. Burke, however, noted there is a greater increase with pipe tobacco compared to RYO, as it offers a price advantage due to taxation levels.

One emerging category in the tobacco market retailers should keep an eye on is modified risk.

22nd Century Group is one company to have rolled out reducednicotine tobacco products. Its VLN King and VLN Menthol King have 95% less nicotine than traditional cigarettes and are so far the only very low nicotine cigarettes authorized by the FDA.

The FDA is currently considering maximum nicotine levels in cigarettes and possibly other combustible products, with proposed regulations

arriving potentially by this fall. Such a move would drastically reshape the whole category.

At the moment, Manuyag has VLN on his radar and FavTrip plans to further explore possibilities with the nicotine-free category.

As inflation pushes prices higher, the tobacco category has been feeling the pinch.

In the four weeks ending April 23 alone, the price per unit of cigarettes has increased by 4.8%, according to Circana data.

The same data shows price per unit increases for the 52 weeks ending April 23 for each tobacco category. For electronic smoking devices, the jump is as large as 13.8%.

This has likely contributed to unit sales decreasing 8.2% for electronic smoking devices and 7.5% for cigarettes over the past year.

Major manufacturers are also continuing to increase cigarette prices, which is “likely pushing more consumers to the black and gray markets for the purchase of their tobacco items,” said Burke.

Plaid Pantry has seen success offering discounts when customers buy multiple packs of cigarettes. Although, this could potentially lead to reduced trip frequency with these customers, Manuyag said.

At Yatco, premium cigarette brands are declining in sales, whereas lowertier brands like Montego and Eagle 20’s are growing in double digits in many stores.

“The low-end brands are growing for us, and American Spirit, ironically enough. American Spirit, even though it’s a premium line, is the only non-generic … cigarette brand that’s growing for us,” said Oliveira.

FavTrip is also offering low-tier brands to customers to combat high cigarette prices.

“Now it’s almost every quarter or less there’s always a notification of a price increase, especially with the top-tier big brands. …” said Sultan. “But we have some implementation in our back software that kind of raises the prices for us right now, because it got so frequent that we could be losing money and thinking we’re selling a bunch just to realize a few months later that we’re selling below cost.”

Despite inflation concerns and higher prices per unit, cigarettes continue to hold their place as the top-selling tobacco category for convenience stores. Circana data for the 52 weeks ending April 23 shows cigarette dollar sales topped $54 billion. For the four weeks ending April 23, the cigarette segment brought in $4.12 billion and was the only tobacco category to reach the billions in dollar sales, with unit sales outpacing other categories, as well.

Cannabidiol (CBD) remains a possible opportunity for the convenience store industry.

Plaid Pantry has experimented with CBD beverages and ingestibles, but the category is still an unknown with many consumers.

“This could be an opportunity in the future, but (not) until the major CBD combustible brands can get their products with the major convenience distributors. Then retailers would be more confident to sell if it’s being carried by their large distributor partner,” said Manuyag.

FavTrip and Yatco also offer CBD, which is seeing double-digit growth for Yatco’s three states, although the sales are coming off a small base.

In Massachusetts, however, Oliveira noted that CBD is “less of a player here,” which he believes is a result of legal marijuana in the state.

In addition to CBD, c-store retailers are recognizing the importance of investigating products and brands they don’t normally carry as legislation continues and inflation rises.

Simon is continuing to open his sites to new items as the year progresses.

“There’s always new things that come in, so we’re ready to know what new stuff comes in and we’ll try it,” he said.

As retailers look ahead in 2023, Burke noted one of the keys to success for c-store tobacco sales is having options.

“The tobacco retailer should keep in mind that the top-selling items in many tobacco categories are the premium brands, so keeping an adequate stock of these items is critical to maintaining a strong tobacco business,” Burke said. “In addition, to capitalize on the growing deep-discount price segments in many tobacco categories, an adequate selection of items in the deep-discount price tier will enhance the possibility of growing this important c-store category.” CSD

Cigarettes hold tight as the tobacco category leader as the segment adjusts to a changing economic climate and awaits key regulatory decisions set to define its future.

Anne Baye Ericksen • Contributing Editor

Anne Baye Ericksen • Contributing Editor

There are many ways to assess the state of the cigarette category within the convenience store industry.

On one hand, there’s no denying the customer base continues to tighten. In late April, the Centers for Disease Control and Prevention (CDC) released its latest findings of smoking rates and concluded that only 11% of adults currently smoke combustible cigarettes. It’s the lowest recorded rate since 1965.

While demographics are pertinent, convenience store owners and operators prefer to gauge the category by monetary means, and cigarettes prove to remain a steadfast profit producer. Last year’s National Association of Convenience Stores (NACS) State of the Industry report showed cigarettes accounted for nearly 27% of all inside sales in 2021, and more than 10% of in-store gross margin.

Despite some slippage in sales and units, cigarettes hold tight to the No. 1 position in the tobacco category.

More recently, Circana, a market research firm, confirmed that cigarettes contributed more than $54 billion to the U.S. convenience store channel for the 52 weeks ending April 23. Although that marks a decrease of 3.2% in dollar sales and 7.5% in unit sales, cigarettes still outperform all other tobacco/nicotine products.

Of course, another key category measurement

is price per unit, which continues to climb. Circana reported a 4.6% increase in price for the 52-week period. Multiple price hikes concern category managers, especially as proclamations still warn of a potential recession.

“Customer wallets are a little tighter from the prior year, especially with the pandemic-enhanced EBT (electronic benefits transfer) benefits that

Owned by a cooperative of proud American farmers using the best U.S.-grown tobacco blends among their competitors, Premier provides high-quality, value-priced cigarette brands for the adult consumer. C-stores across the country are buying in.

Premier Manufacturing, Inc. is the consumer products division of U.S. Tobacco Cooperative Inc. (USTC), an American grower-owned marketing cooperative based in Raleigh, NC.

500+ member farmers throughout the Southeast

Members maintain GAP Connections Certification Standards Ensures sustainable, ethical agricultural practices

Premier’s support staff prides itself on meeting customer goals with seamless execution in achieving the highest regulatory standards.

• Provides sales/service support across the U.S.

• Develops POS materials for high visibility

• Creates custom sales & merchandising programs

• Maintains strong relationships with top distributors

Trackable process includes all aspects of manufacturing under one roof Tobacco processing & stemmery Primary blending / Cigarette finishing

All products made in USA & 100% guaranteed

Premier products use only top-end tobacco blends.

The finest flue-cured tobacco in the world

• All U.S. grown

• Environmentally sustainable

• Compliant with every regulation

The best blend among competitors

• Highest concentration of flue-cured tobacco

• Partners with top national and regional retail chains

• Vibrant color

• Blends provide exceptional aroma and flavor experience

Manufactured on industry-leading equipment

• Laser perforation

• Inked code dating

• Latest high-tech advancements

Cigarettes contributed more than $54 billion to the U.S. convenience store channel last year, outperforming all other tobacco products.

went away in the earlier part in the year,” said Jon Manuyag, director of marketing for Plaid Pantry. The Beaverton, Ore.-based business operates more than 100 retail sites in the Pacific Northwest.

In its “Q1 Nicotine Nuggets” survey, Goldman Sachs analysts blamed increased costs for a decline in carton sales as well as boosted market share for lower-tiered brands.

“In our business, we have seen more customers shift to maximizing discounts by taking advantage of multipack and loyalty offers and stacking those discounts,” Manuyag said. “However, this also results in less visit frequency in stores due to customers stocking up.”

Indeed, comments to the quarterly questionnaire conveyed similar experiences. But the survey also suggested there are signs of more positive conditions for the category. More than half of respondents indicated spending per trip during the first few months of the year held steady or even improved. In fact, some businesses stated cigarette sales in February and March outperformed Q4 sales.

Regulations are another key indicator for the category. The industry is caught in a purgatory waiting for the Food and Drug Administration (FDA) to move on its proposed menthol ban and/or declaration to lower the maximum nicotine levels in all cigarettes.

“We remain concerned that a finalized menthol ban will push legal sales to the illicit market and create an unlevel playing field, undermining the efforts by

our responsible members,” said Anna Ready Blom, NACS’ director of government relations. “If products are legal, we want to sell them responsibly on a level playing field, and that has always been how we viewed the tobacco category.”

According to the CDC, 51% of adults between the ages 18 and 25 smoke menthol and 39% of smokers over the age of 25 reach for the flavor. However, more state legislatures are seeking to remove menthol from the marketplace. In response, cigarette manufacturers have introduced products that replaced menthol with artificial, flavorless cooling chemicals that create a menthol simulation.

Brands like Camel Crisp and Newport Non-Menthol Box have been racking up sales under California’s flavored tobacco ban that includes menthol: 1.4 million and 800,000 packs, respectively, per Politico.

“I believe R.J. Reynolds is trying to position to make those SKUs available in the state of Oregon,” said Manuyag. “If they do, we will definitely consider adding those SKUs to the sets.”

However, on April 25, California Attorney General Robert Bonta issued several Notices of Determination (NODs) to R.J. Reynolds Tobacco Co. and ITG Brands, alleging that several of their non-menthol brands currently being sold in California are considered flavored and therefore violate the California prohibition on the sale of flavored tobacco products. The products in question include Kool Non-Menthol, Kool Blue Non-Menthol, Camel Crisp, Camel Crush Oasis Silver, Camel Crush Oasis Blue, Camel Crush Oasis Green,

Newport Non-Menthol Green, Newport EXP NonMenthol Mix and Newport EXP Non-Menthol Max.

California law established a rebuttable supposition that a tobacco product is “presumptively” flavored where its manufacturer “has made a statement or claim directed to consumers or to the public that the tobacco product has or produces a characterizing flavor, including, but not limited to, text, color, images or all, on the product’s labeling or packaging that are used to explicitly or implicitly communicate that the tobacco product has a characterizing flavor,” the NODs explained.

At press time, R.J. Reynolds has filed a lawsuit against California state officials, including the attorney general, seeking declaratory and injunctive relief, asking that the NODs be rescinded.

Looking ahead, no one expects smoking rates to do a 180-degree turnaround in the near future, so the category’s prolonged viability could rely on adjusting planograms to welcome non-traditional formulations.

VLN and VLN Menthol King by 22nd Century Group

Inc., which boast 95% less nicotine than traditional cigarettes, earned the FDA’s modified risk status. Wild Brand recently introduced STEP non-tobacco cigarettes containing a flavor system that produces a traditional smoking experience. Additionally, a growing percentage of c-stores are filling backbars with herb or cannabis-derived cigarettes.

“This is definitely on the radar,” said Manuyag. CSD

• Cigarettes contributed more than $54 billion to the U.S. convenience store channel last year.

• “California compliant” formulations debuted in the shadow of the flavor ban, but face challenges from the attorney general.

•

The

•The fastest growing cigarette brand in the nation

•Lowest-priced cigarette available in most markets

• Lowest-priced

• No

•No tricky buy downs, contracts, or coupon schemes, just an everyday lowest price

• Striking

•Striking point of sale advertising, with over 25 unique items ranging from small indoor decals to large outdoor signage

• Proudly

•Proudly made in America, with expertise and painstaking attention to quality and consistency

• 8 varieties available, including a full range of 100s

•8 varieties available, including a full range of 100s

• Approved

•Approved for sale and distribution in 47 states

It’s been over a year since the FDA announced the proposed rule to prohibit all characterizing flavors (other than tobacco) in cigars. The agency is expected to finalize the rule as early as this fall.

“I believe the supply chain issues of the last few years are behind us, and the largest challenge right now is uncertainty,” said Mike Wilson, chief operating officer of Cubby’s Inc., which operates 36 stores throughout Iowa, Nebraska and South Dakota. “The FDA has not indicated it will exempt cigars from the proposed flavor ban. I don’t

know if a flavor-centric smoker will readily move to a nonflavored cigar.”

Meanwhile, a challenging economy and continued inflation are impacting customer purchasing habits when it comes to cigars.

Over the past year, cigar sales rolled in flat, down a slight 0.1% in dollar sales with a 0.8% dip in unit sales, according to Circana Total U.S. Convenience data for the 52 weeks ending April 23, 2023. Over the most recent four weeks, cigar sales dipped lower. Cigar dollar sales fell 1.9% during the four weeks ending April 23, 2023, while unit sales dropped 2.1% during that same period.

“Given what we have seen in the last two years, 2023 will be interesting,” said David Ozgo, president of the Cigar Association of America, referencing supply chain issues caused by the COVID-19 pandemic that caused instability in the category over the last two years.

To keep cigars in stock during that time amid supply chain uncertainty, many retailers were maintaining

While retailers hope cigar supply chain issues are in the rearview mirror, they’re now contending with inflation and local legislation as they await decisions from the FDA on the future of characterizing flavors in cigars.

Zhane Isom • Associate Editor

The cigar category continues to wait for Food and Drug Administration (FDA) decisions on the fate of characterizing flavors in cigars, causing uncertainty for c-store retailers regarding what the future of the category might look like.

Cigar dollar sales dipped 1.9% during the last four weeks ending April 23, while unit sales fell 2.1% for the same period.

Source: Circana Total U.S. Convenience data for the four, 12 and 52 weeks ending April 23, 2023

inventory above normal levels, which has since balanced out, Ozgo noted.

For popularly priced cigars and premium cigars, strong sales will depend on adequate inventory levels at stores in 2023, he added.

“While I do not believe stores are holding too much inventory, I will wonder how full home humidors are doing,” Ozgo added.

While supply chain issues have stabilized, inflation remains an ongoing challenge that is impacting c-store planograms as well as customer preferences.

“I am seeing a move away from pre-priced cigarillos because today’s wages cannot be paid on the profit margin of the 99-cent two-pack cigarillo,” said Wilson. “The cigar sales in our stores are dominated by multipack cigarillos. Premium cigars occupy very little space in our sets.”

While prices are on the rise, compared to other tobacco categories that have seen large upticks in price, cigar prices rose only 0.6% for the 52 weeks ending April 23, 2023, per Circana.

“Cigars are typically enjoyed as a leisure time activity,” added Ozgo. “Consumers are always looking for a quality product at a good price, and cigars are no different.”

Despite inflationary pressures, Cubby’s expects dollar sales of cigars at its stores to increase by nearly 18%. Wilson pointed to Cubby’s current strategy of quality over quantity, which it expects will help drive success for its cigar business this year.

“Instead of concentrating on carrying the full line of products from a few big players, this year we implemented a planogram that includes the top sellers from a large variety of brands,” said Wilson.

Ozgo added that some consumers are willing to spend a little more sometimes for good quality cigars.

“Take a look at higher-priced cigar products. Many cstores are likely selling more limited-time-only products,

which typically sell for two to three times what regular cigars are sold for,” he said. “This shows that the consumer is willing to trade up to something a little bit better.”

If the FDA flavor ban does go into effect for cigars, retailers are concerned about how that will impact cigar sales, as flavor experimentation is a huge driver in the category.

“Our customers are always looking to change up their daily smoking with new flavors. Like many of our other categories, the newest flavor is the best seller. Limitedtime offers are also trendy amongst our customers,” explained Wilson.

As retailers wait for the FDA, they must also stay aware of regulatory happenings at the local and state level, as some regions look to take regulatory matters into their own hands. In December 2022, California’s flavored tobacco ban went into effect, which includes flavored little cigars and cigarillos. The law does not apply to flavored premium cigars with a wholesale price of $12 or more.

In March, New York rejected a flavored tobacco ban proposal by Governor Kathy Hochul that would have banned the sale of all flavored tobacco products, including menthol, which was ultimately removed from the state’s budget bill. “There is still another standalone bill that would ban all flavored tobacco products. So, a flavored tobacco product ban bill is still under consideration in New York,” noted Thomas Briant, executive director of the National Association of Tobacco Outlets (NATO).

Ozgo urged retailers to stay up to date on the regulatory movement and to make their voices heard.

“Be vocal. We know that the youth usage rates for cigars are at all-time lows,” said Ozgo. “There is government data that shows 1% of 12- to 17-year-olds had a flavored cigar in the last 30 days. That number is so low, which makes any public health gains from a flavored cigar ban non-existent. Let your state-elected representative know the facts. The data is clearly on our side.” CSD

WARNING: This product can expose you to chemicals including tobacco smoke, which is known to the state of California to cause cancer and birth defects or other reproductive harm. For more information go to www.P65Warnings.ca.gov.

Smoking cigars casues lung cancer, heart disease, and emphysema, and may complicate pregnancy.

by 3.5%, and in a four-week review, the electronic smoking device subcategory registered a loss of 5.1%. Unit sales posted declines of 15.6% and 17% for the respective periods.

That’s a national overview. Some c-store businesses report more optimistic trends on the local level.

Between April 23, 2022, and April 23, 2023, electronic smoking devices — including e-cigarettes, vape kits and mods, for example — generated nearly $7 billion in sales for U.S. convenience stores nationwide, per Circana. The market research firm also noted the segment grew in dollar sales by 4.5% for that same 52-week period.

However, the data reveals more recent slough-offs in both dollar and unit sales. For the 12-week period ending on April 23, year-over-year dollar sales fell

“Vape continues to be a strong category for us,” said Nathan Arnold, director of marketing for Englefield Oil Co. “Our vape customers see us as a destination for their vape products, but also for the other products that help to fuel their day. We continue to see basket building with this category, and promotional opportunities with brands have increased.”

Headquartered in Heath, Ohio, Englefield Oil operates 119 Duchess c-stores, along with fast food franchises, commercial stations and bulk warehouses.

“We continue to be optimistic about the vapor category as it continues to perform at a high level with support at all levels from manufacturers to consumers. Same-store sales are up 23% over a year ago as

While some c-stores report strong vape sales, national data points to struggles in the category.

The vape category continues to cope with regulatory shifts, including ongoing premarket tobacco product application (PMTA) uncertainty. While some retailers are bullish on the category, recent data from Circana highlights challenges for the segment.

Bright LED floods interior with light.

Powerful magnetic locks stand up to 600 lbs. of pressure per door. Fast automatic relock with battery backup.

Low leverage door pulls.

Half inch acrylic doors are half the weight and 17x stronger than tempered glass.

Reinforced metal trim.

The Secure Display case from Modern Store Equipment offers an unparalleled level of protection from theft. Electromagnetic technology secures the acrylic French-swing doors and provides the strength to withstand up to 600 lbs. of force per door. All while presenting your merchandise in the best light.

Designed and built in America.

3 modes of entry: code, key card, key fob. Optional remote unlock.

Backlit panels make merchandise pop.

8 adjustable shelves with price tag moulding.

Heavy duty hinges.

French swing doors open independently.

Electronic smoking devices posted long-term sales gains with substantial price hikes.

manufacturers continue aggressive pricing and promotional programs, which have been well received by consumers,” said Tim Greene, category director for general merchandise and tobacco at Smoker Friendly. The company includes more than 150 retail outlets, including c-stores in seven states, along with an estimated 800 licensed independent retailers in 38 states.

Elsewhere, nicotine category managers relayed less positive anecdotes. Respondents to the Goldman Sachs “Q1 Nicotine Nuggets” survey, which questioned approximately 65,000 retail locations, expressed ongoing concerns regarding the fallout from flavored tobacco bans and negative media attention on JUUL. Additionally, they stated promotional activity remains consistent from the end of 2022 into the first few months of this year.

Other comments indicated sales of disposable vape products are in growth mode compared with other models within the subcategory. Of course, that feedback reflects the fact that disposable e-cigarettes were exempted from the Food and Drug Administration’s (FDA) 2020 ban on flavored vape products.

Currently, VUSE Alto reigns as the segment’s leader. Goldman Sachs, using data from NielsenIQ, reported VUSE sales for the 52 weeks ending April 8 totaled more than $2.1 billion from all retail channels, representing a 36.8% gain in dollar sales. Volume increased by more than 11% for the same 52-week period.

Also working in the brand’s favor is the fact that several non-menthol VUSE products have been among the 23 products to receive marketing granted orders from the FDA, out of the millions

of PMTAs submitted. NJOY and Logic are two more brands that had specific products make it through the process.

In fact, some Nicotine Nuggets participants expressed positive anticipation for a renewed consumer interest in NJOY now that Altria has acquired the brand.

However, it should be noted that states continue to pursue stricter regulations for this other tobacco product segment to further curtail underage usage.

“A concern in vape, and the entire tobacco category, is the constant change in federal, state and local laws. Flavor bans, menthol bans and other law considerations make it challenging,” Arnold admitted.

Greene agreed. “As we continue to support the category, we know things can change at any moment. We also continue to lead a grassroots fight against flavor bans and increased tax regulations at local and state levels so we can provide products that meet our customers’ needs.” CSD

• Dollar sales for vape grew 4.5% over the past year, per Circana.

• Retailers report that sales of disposable vape products are in growth mode.

• VUSE volume increased by more than 11%.

As tobacco-free nicotine pouch sales climb, retailers point to health perceptions, return to office and inflation as trends driving the increase.

Erin Del Conte • Editor-in-ChiefSmokeless tobacco sales at c-stores continue to rise, lifted by sales of tobacco-free nicotine pouches as sales of moist smokeless tobacco dip. As they look ahead, retailers are watching flavor regulations as well as inflationary pressures that are pushing customers to trade down both within the smokeless segment and the tobacco category as a whole.

Spitless tobacco sales grew 37.4% in dollar sales and 30.4% in unit sales for the 52 weeks ending April 23, 2023, per Circana.

Dollar sales for the smokeless tobacco category totaled $9.09 billion for the 52 weeks ending April 23, 2023, up 5.7%, per Total U.S. Convenience data from Circana. Unit sales for the category rolled in flat (up 1%). Chewing tobacco/snuff dollar sales dipped 1.1% for the period, with unit sales down 7.7%. Spitless tobacco saw dollar sales rise 37.4%, with unit sales up a whopping 30.4%.

Retailers are seeing these trends play out at store level. “Moist smokeless units continue to slowly decline while the nicotine pouches just keep growing. Customers are continuing to gravitate towards the nicotine pouch segment at higher rates,” confirmed Jesse Dix, category manager for Dandy Mini Mart, which operates more than 65 stores in Pennsylvania and New York.

“The tobacco-free nicotine pouches have really exploded over the last 18 months,” agreed Mike Jones, category manager for S&S Petroleum Inc., which operates more than 80 locations in Washington, Idaho and California, under the primary banner Royal Mart.

Jones attributed the trend toward tobacco-free nicotine to people returning to the office. Because smoking and vape are prohibited in most workplaces, customers are turning to tobacco-free nicotine pouches to discretely use nicotine, he suggested.

“Consumers want to be able to enjoy their products and — depending on their situation and local regulations — are moving to items that afford them that,” Jones said.

Health-conscious behavior may also be behind the trend toward pouches as some customers remove tobacco from their routine, noted Lenny Smith, vice president and general manager for Crosby’s, which operates 87 stores in western New York and northern Pennsylvania. “From my understanding, they feel it’s a healthier option

by not having the tobacco in there,” Smith said.

The rise in inflation has also been impacting customer behavior across categories, including tobacco, as shoppers have less expendable income, Smith pointed out.

“When you’re looking at the tobacco-free nicotine pouches, they’re also less expensive than tobacco/snuff,” Smith said. “We do have some people probably trading to still be able to get the nicotine, but not at the same cost as the tobacco (product).”

Prices of chewing tobacco/snuff increased 7.2% to $7.05 per unit during the 52 weeks ending April 23, 2023, while spitless increased 5.4% to $5.04 per unit, according to Circana.

Jones noted that while inflation is having an impact, he sees it positively impacting the smokeless segment.

“As cigarette prices continue to rise, consumers are looking to a more affordable option,” he said.

And that’s driving some cigarette customers to the smokeless category.

“When consumers can achieve the same function and flavor all while saving money, it is a great option,” Jones further elaborated.

At S&S Petroleum’s stores, customers are looking for flavor options from the smokeless category. Jones noted that core flavors like wintergreen and mint are leading the way, but customers are likely to try different flavors.

“ZYN from Swedish Match has really dominated the space, and with its products and flavor profiles has owned the tobacco-free nicotine pouch category,” Jones said.

ZYN is also leading the category for Dandy Mini Mart.

“(ZYN) accounts for over 50% of our total nicotine pouch

sales,” Dix said. “A new emerging brand that is starting to see positive growth for us is Black Buffalo. We have seen double-digit growth on the value-priced lines of moist smokeless such as Longhorn, Kayak and Stokers.”

While smokeless is still flying under the regulatory radar in most states, retailers are watching the effects of flavor regulation in California, while monitoring flavor ban proposals in 11 other states.

In December 2022, California’s Proposition 31 went into effect, banning flavored tobacco products, including menthol, in the state. Premium cigars and hookahs are exempt.

“It has caused some serious pain points,” Jones said. “I can see other states that we operate in soon following suit. Clearly this will be a challenge as we look to alternatives to move to. I have already had conversations and am working with products that are both nicotine and tobacco free, but have the same flavor profiles and mouthfeel, and mimic the functionality of the traditional product to introduce as an option for consumers. Time will tell, however, if this will actually resonate.”

Still, Jones expects the category to continue growing as retail price pressure and overall public sentiment pushes some customers to trade down to smokeless from traditional cigarettes.

“That said, regulations, like in California, regarding flavors could change the dynamic, and then we will see how the consumer and the manufacturer choose to respond,” Jones said.

Meanwhile, New York State recently rejected proposed legislation that had aimed to ban flavored tobacco, including menthol, wintergreen and mint.

“Anytime that there is a restriction of people being

able to buy stuff in the state of New York, consumers will potentially go to other states to buy the product,” said Crosby’s Smith. “You have the Native American reservations where they would be able to go (to buy the product), depending on where they’re located. So, they’ll still find a way to buy. We’ll just lose from the state standpoint of being able to sell it in our stores.”

While this flavor ban attempt failed, there is still another standalone tobacco flavor ban bill under consideration in New York, per Thomas Briant, executive director of the National Association of Tobacco Outlets (NATO).

Additionally, New York is set to raise the tax on cigarettes from $4.35 to $5.35 a pack as part of the state’s budget plan. Smith noted the tax increase could push some cigarette smokers to trade down to the smokeless segment as they choose to seek out a lower-cost alternative for nicotine.

Nonetheless, Smith expects the smokeless segment to trend down this year, as well as the entire tobacco category overall.

“I say that because even with people trading — if they’re going from cigarettes into smokeless — you’re not going to make up the difference,” Smith said. “I think New York has a very strong message against tobacco, and I think we have less people coming into the market that are tobacco users for that reason.”

With cost increases, taxes and manufacturer and vendor price increases, Smith noted the price of smokeless tobacco keeps rising, and some customers could be priced out of the nicotine categories due to the increases.

“People can only absorb so many price increases before they begin to look for other options,” Dandy’s Dix agreed.

As prices rise, Dix sees traditional moist smokeless customers, who have long been loyal to the category, starting to trade down.

Looking ahead, Dix expects the trends to continue.

“We (predict) moist smokeless will continue to decline based on costs, as well as the continued boom of the nicotine pouch segment,” Dix said. CSD

• Spitless tobacco dollar sales rose 37.4%, for the 52 weeks ending April 23, 2023, per Circana.

• Price increases may be inspiring some tobacco customers to trade cigarettes for smokeless tobacco, while others swap moist snuff for tobacco-free nicotine.

tion, lack of raw material availability and restrictions on the movement of goods during the pandemic.

said he foresees no erosion of the accessories business.

“Those people who smoke have to have these items,” he said.

In fact, many convenience store retailers spy an opportunity to expand business in the accessories segment inside the 22 states (plus Washington, D.C.) where adults can buy or possess cannabis recreationally.

The convenience store channel saw smoking accessories overall notch dollar sales of $507 million, up a strong 6.6%, according to Circana Total U.S. Convenience data for the 52 weeks ending April 23, 2023. Unit sales for the category grew 3.3% for the same period. Dollar sales of lighters totaled $613 million, down 1.2%, while match sales reached $277,501, down 8.1%.

The long-term view for tobacco accessories is positive. The global smoking accessories market should hit $6.3 billion by 2030, growing at a compound annual growth rate of 6.5% between 2021 and 2030, according to an analysis of the global smoking accessories market by Allied Market Research. The category has been negatively impacted, the report pointed out, by supply chain disrup-

Nissan Koroghli, a 7-Eleven franchisee whose heavily trafficked location sits near the famed Las Vegas Strip, said sales of accessories remain steady despite price increases.

His top-selling accessory is the BIC lighter, which retails for $2.49. But customers are likewise opting for lower-priced lighters at the $1 to $1.20 price point.

“I’d say prices on these items have risen by about 10% since December, due primarily to inflation. …” Koroghli said, also pointing to the steadily rising prices across tobacco product categories that can influence whether shoppers add on accessories.

Koroghli noted cigarette prices are similarly up by about 10%, to an average of $9.50 per pack and $99 per carton. He lamented the change. “I remember when I smoked a pack of Merit cigarettes was 80 cents or $1.” Circana confirmed that the prices of tobacco accessories are ticking up. Nationwide, prices on smoking accessories grew 3.2% for the 52week period ending April 23, with lighter prices up 4.5% and the price of matches up 12%.

Despite the increases, Koroghli

Others see the rising cost of tobacco products as naturally leading to less spending on accessories.

“We see the category as weak and declining as Big Tobacco continues to increase prices,” said Sam Odeh, president of Power Energy Corp. in Elmhurst, Ill., which has 1,359 sites in nine states, 96 of which are corporately owned under the Power Mart, Power Market and Powmaro’s banners.

Lighter sales naturally decline when retail prices are high, Odeh noted. He added he has seen many customers trading down to less expensive items. At the same time, he continued, rolling paper manufacturers are introducing multiple varieties, which is driving sales up. Cartridges are also seeing business expand.

Many in the convenience store industry see an opportunity to expand the tobacco accessories category to include cannabis accessories in states that have legalized recreational cannabis. Koroghli is among those considering expansion.

“People have to have something to smoke it in, which means sales of papers will go up,” he pointed out.

Prices are on the rise, but sales of tobacco accessories continue to trend up, as some retailers consider expanding the category.

Howard Riell • Contributing Editor

Tobacco accessories are holding their own in c-stores despite ongoing inflation and price increases in the segment and across the tobacco categories.

“The same is true for pre-rolled weed cones. There are also a bunch of varieties of papers, such as natural ones.”

Cannabis legalization should likewise bolster sales of vape cartridges, as well as lighters in every price range, Koroghli added.

While Odeh noted that gains are being driven, at least in part, by new entrants into the category, he does

not see an opportunity to expand the accessories in states that have legalized cannabis.

“Sorry to say I don’t think (cannabis legalization) will have a lot of impact,” agreed Steven Montgomery, president of b2b Solutions LLC in Lake Forest, Ill. “Every cannabis dispensary I have seen … has had a range of accessories from cigarette

papers, lighters and more to very high-end products.”

While dispensaries are fully stocked with accessories themselves, c-stores bullish on accessory expansion have pointed out that cannabis customers are coming to c-stores anyway for fuel or other items and are likely to purchase accessories during a one-stop shop. CSD

While the Food and Drug Administration (FDA) continues to evaluate cannabidiol (CBD) to determine a new regulatory pathway for CBD in foods and supplements, customers are nonetheless still purchasing CBD-containing products.

Ready-to-drink tea and coffee that contain CBD saw a 3.3% increase in dollar sales at convenience stores for the 52 weeks ending April 23, 2023, while bottled juices containing CBD saw a 17.8% increase in dollar sales for that same period, according to Circana Total U.S. Convenience data.

“Since 2018, CBD has been a high-growth channel for convenience stores and gas stations, as well as CBD stores, and remains a growing category,” said Leah Heise, constellation advisor to global strategy and management consultancy firm Kearney. “Between 2018 and 2020, stores saw greater than a 39% increase in the sales of CBD. In the past few years, that growth has slowed to 2.2%, but consumers continue to demand it.”

Other CBD products that have been trending upward include gummies, vapes and tinctures, noted Heise.

“Delta 8, 9 and 10 products have also seen an increase in consumption as consumers seek products with easier access and lower costs than tetrahydrocannabinol (THC) products,” said Heise. “Beverages, in particular, are seeing a spike in consumption because this form of consumption is familiar, and with California Sobriety (abstinence from all alcohol and drugs except cannabis) and Sober January (avoiding alcohol in the month of January) trending, consumers are looking for alternatives to alcohol.”

As CBD continues to become more popular among consumers, more c-stores have started or are considering selling CBD products.

Alimentation Couche-Tard, which operates more than 14,300 stores in 24 countries, has taken a unique approach to attracting cannabis customers to shop its c-stores.

Through its partnership with cannabis retailer Fire & Flower, it is positioning cannabis stores adjacent to Circle K c-stores in Canada. In April, Couche-Tard expanded its partnership with Fire & Flower, which operates 92 Canadian cannabis retail stores. Under the agreement, five Fire & Flower-branded retail cannabis stores will be located adjacent to Circle K c-stores in the Greater Toronto area. These locations are currently operating as MC Cannabis Inc. and will be rebranded to Fire & Flower.

“The current co-located cannabis stores adjacent to Circle K locations and anchored by convenience stores, fuel and car wash offerings are showing growth. ...” said Steve Pitts, vice president of operations, central Canada, Couche-Tard, in a statement.

Most c-store chains, however, are entering the category by offering a handful of CBD products to see if they gain traction with customers. Retailers have reported mixed results when it comes to sales.

“I pretty much only sell 15- and 30-milligram gummies,” said Anita Lang, co-owner of Lang’s One Stop Market in Edina, Minn. “However, the sales haven’t taken off as

CBD products in c-stores have experienced mixed outcomes during the 52 weeks ending April 23, 2023, per Circana. While vitamin dollar sales fell 49%, bottled juice dollar sales increased 17.8% and sports drink dollar sales grew 153.7%.

well as I hoped.”

Heise suggested that tweaks to the presentation and positioning of CBD items could help c-stores boost sales of the products.

“Placing CBD inside of kiosks, lockers or vending machines will make the products stand out and be more attractive to millennials and Gen Z, who are the largest demographic of CBD consumers at this time,” said Heise. “Positioning (CBD) with non-alcoholic beverages may be a way to merchandise the product without making health statements, but still aligning with a health and wellness brand message.”

Cannabis data company BDSA’s latest “Fall 2022 Consumer Insights Report” found 75% of inhalable categories — including flower, vape and pre-rolls — saw their usage increase, while gummies were the only non-inhalable cannabis category to see usage grow. Inhalables lead in both preference and usage among cannabis consumers, while topicals saw double-digit declines compared to the spring of 2022.

C-stores saw similar declines in CBD topicals, with external analgesic rubs down 27.8% in unit sales, per Circana Total U.S. Convenience data for the 52 weeks ending April 23, 2023.

BDSA’s report also noted nearly 90% of cannabis consumers in states where cannabis is legal expect to con-

tinue consuming cannabis in the next six months. In the 22 states where cannabis is legal, three out of four adults have bought into the idea of consuming cannabis and are either consumers or accepters.

As retailers continue to sell CBD products and wait for decisions from the FDA on CBD regulation, they should also keep an eye on local and state regulations.