CStoreDecisions

C-stores are embracing technological advancements to enhance customer experience and operational efficiency, shaping the future of the industry.

Taste the Essence of Authentic Asian Appetizers

Appetizers, Handhelds & Sides Crafted with Asian Heritage

Chef-Driven, Irresistibly Delicious Appetizers

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

Tobacco Product Scanned Prompt to Scan for Age Validation

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

Verify and Scan I.D. POS System Validates Transaction Continues

EDITORIAL

VP EDITORIAL — FOOD, RETAIL & HOSPITALITY

Greg Sanders gsanders@wtwhmedia.com

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Kevin McIntyre kmcintyre@wtwhmedia.com

COLUMNIST

David Spross

EDITOR EMERITUS

John Lofstock

SALES TEAM

VP SALES — FOOD, RETAIL & HOSPITALITY

Lindsay Buck lbuck@wtwhmedia.com (774) 871-0067

KEY ACCOUNT MANAGER

John Petersen jpetersen@wtwhmedia.com (216) 346-8790

SALES DIRECTOR Tony Bolla tbolla@wtwhmedia.com (773) 859-1107

SALES DIRECTOR

Patrick McIntyre pmcintyre@wtwhmedia.com (216) 372-8112

SALES MANAGER

Simran Toor stoor@wtwhmedia.com (770) 317-4640

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE Jane Cooper jcooper@wtwhmedia.com

LEADERSHIP TEAM

CEO Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES Mike Emich memich@wtwhmedia.com

EVP

Marshall Matheson mmatheson@wtwhmedia.com

CFO Ken Gradman kgradman@wtwhmedia.com

HR EXECUTIVE Edith Tartar etartar@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR

Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

DIRECTOR OF EVENTS Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST Olivia Zemanek ozemanek@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

VP, ASSOCIATION & COMMUNITY ENGAGEMENT Allison Dean adean@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

VIDEOGRAPHER Cole Kistler ckistler@wtwhmedia.com

WTWH MEDIA, LLC

1111 Superior Ave.

Suite 2600

Cleveland, OH 44114

Ph: 888-543-2447

SUBSCRIPTION INQUIRIES

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

DIGITAL MARKETING SPECIALIST Kayla Polansky kpolansky@wtwhmedia.com

WEBINAR COORDINATOR Lindsey Harvey lharvey@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Carnett ncarnett@wtwhmedia.com

BRANDED CONTENT STUDIO

DIRECTOR OF BRANDED CONTENT Peggy Carouthers pcarouthers@wtwhmedia.com

ASSISTANT EDITOR Ya’el McLoud ymcloud@wtwhmedia.com

ASSISTANT EDITOR Olivia Schuster oschuster@wtwhmedia.com

To manage current print subscription or for a new subscription: https://cstoredecisions.com/cstore-decisions-subscriptions/

Copyright 2024, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian Publication Sales Agreement No: #40026880. CSTORE DECISIONS does

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Olivia Beck • Operations Beck Suppliers Inc. • Fremont, Ohio

Nate Brazier • President and Chief Operating Officer Stinker Stores • Boise, Idaho

Robert Buhler, President and CEO Open Pantry Food Marts • Pleasant Prairie, Wis.

Herb Hargraves, Chief Operating Officer Sprint Mart • Ridgeland, Miss.

Bill Kent, President and CEO The Kent Cos. Inc. • Midland, Texas

Dyson Williams, Vice President Dandy Mini Marts. • Sayre, Pa.

Bill Weigel, CEO Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Real Estate/Government Relations Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO Hit-N-Run Food Stores • Lafayette, La.

Robin Hunt, Sales Hunt Brothers Pizza • Nashville, Tenn.

Kyle May, Director External Relations Reynolds Marketing Services Co. • Winston-Salem, N.C.

Steve Yawn, Director of Sales McLane Company Inc. • Temple, Texas

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Director of Merchandising Warrenton Oil Inc. • Warrenton, Mo.

Jeff Carpenter, Director of Education and Training Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

Ryan Faville, Director of Purchasing Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing The Kent Cos. Inc. • Midland, Texas

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

Technology today touches most aspects of a convenience store’s business, and that trend is only going to continue as artificial intelligence (AI) begins to offer new solutions for retailers.

As retailers look at the tech wave coming toward our industry, many are unsure of where, how and even if they should get started with tech innovation, while others are dabbling in multiple areas.

This month’s cover story, “Navigating the Digital Frontier,” outlines some of the technology trends c-store retailers are monitoring most closely or engaging with directly, from mobile-app integration and an omnichannel approach to artificial intelligence, self-checkout and autonomous checkout.

C-store retailers agreed that one of the biggest opportunities in tech lies in the data that can be collected but mining that data and figuring out how to apply the results is a behemoth task, however one that pays big rewards.

But even as c-stores start to embrace tech, they continue to face hurdles.

“I think the biggest issue … deals with integration challenges,” said Daniel Gaddy, VP of technology for TXB, which operates 50 stores in Texas and Oklahoma. “We have vendors that operate under closed architecture models with no APIs (application programming interface), and it creates huge delays in innovation.”

Choice Market, which operates three Choice Market locations and four fully automated Choice Mini Mart sites that feature camera-based autonomous checkout, has always been at the forefront of tech innovation given its unique urban concept. But Mike Fogarty, founder and CEO of Choice, pointed out that historically traditional c-stores have been slower to embrace tech because the core c-store customer wasn’t demanding it.

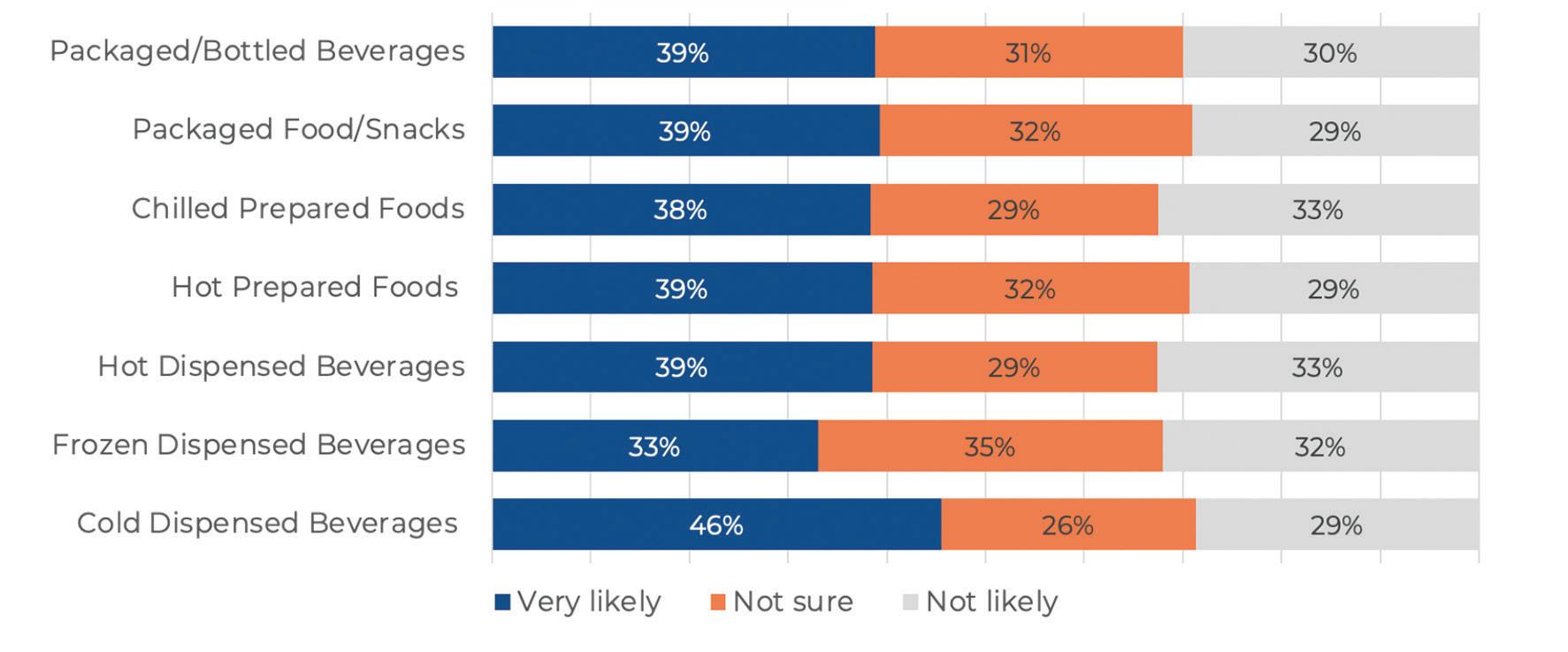

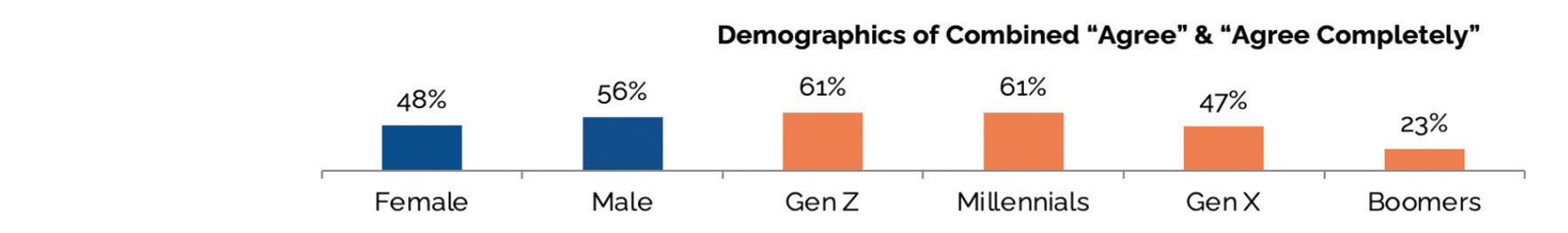

That’s beginning to change today as younger consumers, who are digital natives, increasingly expect a more digital-friendly experience. A recent FoodserviceResults report, titled “Understanding the Food-Focused Shopper,” and commissioned by NAG Convenience, found that 64% of food-focused Gen Z c-store shoppers would order online if they couldn’t get the food or beverage they wanted at a c-store compared to only 29% of baby boomers, and 71% of Gen Z shoppers are likely to use a self-checkout kiosk compared to 41% of boomers.

That said, being a slow follower isn’t a bad strategy for some c-stores. It all depends on your customer base.

“You don’t want to invest in tech just to invest in tech,” Fogarty shared with me. “You want to get a clear return on investment, whether that’s monetary or if it’s providing customers an enhanced customer experience or making their lives a little bit more efficient and convenient.”

This month’s Tech Innovation Awards recognizes Valparaiso, Ind.-based Family Express, which launched an updated app this year complete with mobile ordering, plus car wash and beverage subscription options; and Miami Beach, Fla.-based Re-Up, which uses AI-powered technologies to automate processes within its stores. It’s also in the process of adding robotic kitchens.

At the end of the day, deciding on which technological initiatives to pursue comes down to understanding the needs and wants of your customer base. But whether you choose to ride the front of the tech wave or be a slow follower, it’s important to monitor the advancements set to change the way customers shop across industries.

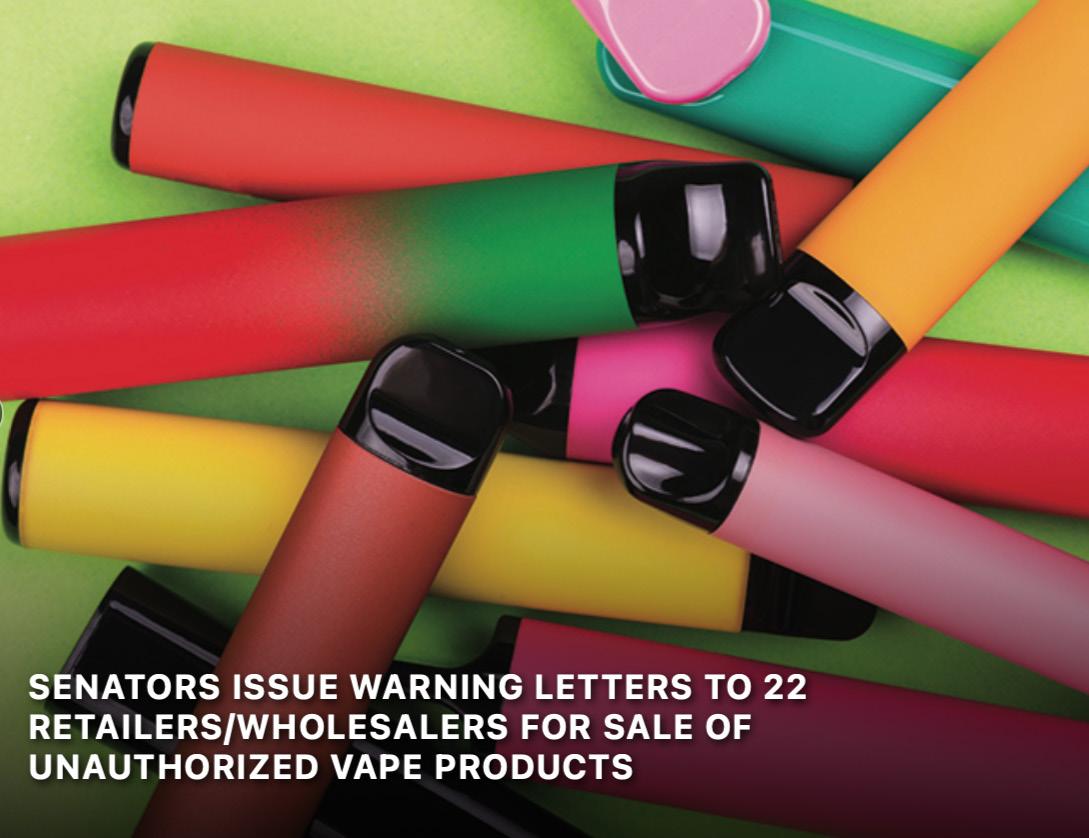

As the industry awaits final rules on a potential ban on menthol cigarettes and flavored cigars, a lawsuit has been filed to spur action.

David Spross • NATOWith spring here, the Food and Drug Administration’s (FDA) most recent estimated timeline for finalization of the proposed rules that would ban menthol cigarettes and flavored cigars has passed. In December 2023, FDA targeted issuance of final rules for March 2024.

The final rules have been under review by the White House’s Office of Management and Budget (OMB) since October 2023. This is step eight of the nine-step federal rulemaking process. During the review process, OMB evaluates whether to clear the rule for final publication or send it back to the FDA for further review. Usually, this review process lasts 30 to 90 days and includes meetings between

interested stakeholders and the OMB’s Office of Information and Regulatory Affairs (OIRA).

According to the OIRA dashboard, it has engaged in over 150 meetings with tobacco retailers, manufacturers, wholesalers and trade associations as well as policy groups and tobacco control organizations. The National Association of Tobacco Outlets (NATO) meeting took place in December 2023.

Additionally, over 250,000 comments were submitted to the FDA during the proposed rules’ public comment period, with the overwhelming majority opposing the implementation of these rules. Many comments focused on the unintended consequences of implementation, which include moving the annual retail sales of $29 billion in menthol cigarettes and $4-$5 billion in flavored cigars from responsible retailers to the already large illicit menthol cigarette and flavored cigar market.

Additionally the comments highlight how the proposed rules do not adequately account for and make no serious effort to outline a plan for containing the illicit market.

The FDA’s Center for Tobacco Products has continually said that finalizing these rules is a top priority for the Agency. Due to all of the engagement in opposition to these proposals, they have become an election issue, and as a result, one of the possible scenarios is that the rules will not be finalized until at least after the November election, if at all.

Just last month, tobacco control groups in response to the delay filed a lawsuit claiming that the FDA has unlawfully delayed finalizing the rule to ban menthol cigarettes. It remains to be seen if this will spur action by the FDA before the election.

Of note, if these rules are finalized in the coming weeks or months, and if FDA follows

through on its initial proposals, they will not take effect for at least one year from the date of each final rule’s publication. Courts reviewing industry challenges to the rules could also further delay these effective dates.

The delay in the finalization of the menthol and flavored cigar rules also likely affects the timeline of proposing a rule that would require lowering the amount of nicotine in cigarettes. As FDA has not even published a proposed rule relating to reducing nicotine in cigarettes, this rulemaking is in the very early stages of the nine-step rulemaking process, and it will therefore be years before it makes its way through the regulatory process, if at all.

NATO encourages all stakeholders who have a position on these rules to continue to engage your federal elected officials.

David Spross is the executive director of the National Association of Tobacco Outlets (NATO), a national retail trade association that represents more than 66,000 stores throughout the country.

As technology continues to evolve, retailers must keep an eye on the new tech trends that can help improve their stores and the customer experience.

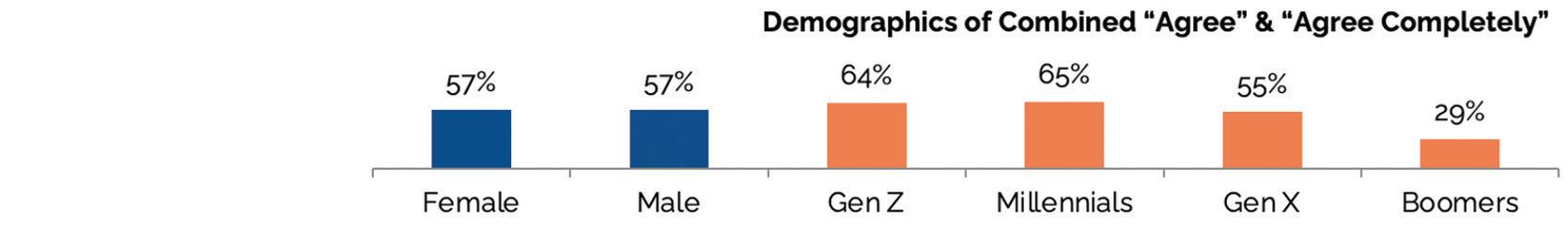

More consumers prefer to use online ordering when shopping at c-stores or ordering food. According to the “2024 Paytronix Online Ordering" report:

• 27% of restaurant and c-store orders were conducted online in 2023.

• Operators in the top 25% of online ordering volume saw online orders jump to 62% of all their orders last year.

• Guests who order both in-store and online have the highest order frequency, the best retention and 35% more lifetime value than customers who only order in-store.

Source: Paytronix, “2024 Paytronix Online Ordering" report, March 2024

Based on 84.51°’s “Grocery Retail Trends to Watch in 2024” report, consumers want to see technology being used more in stores while they are shopping. The report noted that:

38% of consumers want smart carts that calculate the cost of groceries in real time and allow them to skip checkout.

25% of consumers want digital screens on shelves that display ads, nutrition labels and pricing/ promotions.

20% of consumers want digital screens on cooler doors that display ads, nutrition labels and pricing/promotions.

15% of consumers want text-based customer service/smart appliances.

Source: 84.51°’s “Grocery Retail

As mentioned by Hennessey Digital in a recent study, the most social media-obsessed states are:

• Oregon

• Maine

• New York

• Washington

• Massachusetts

Source: Hennessey Digital, March 2024

The “2024 Paytronix Online Ordering" report also mentioned that the four areas where artificial intelligence can enhance online ordering and guest engagement include:

• Greater guest personalization

• Effective customer feedback response

• Faster, more accurate orders

• More consistent guest experiences

Source: Paytronix, “2024 Paytronix Online Ordering" report, March 2024

Loyalty programs play a significant part in whether consumers will visit a certain store. Loyalty programs allow consumers to earn discounts and rewards while shopping for items they need.

Which of the following incentives would make you most likely to join a customer loyalty program? Select up to three, broken out by age

Source: CivicScience, February 2024

C-stores are embracing technological advancements to enhance customer experience and operational efficiency, shaping the future of the industry.

Erin Del Conte • Editor-in-ChiefSince the arrival of the COVID-19 pandemic in 2020, technology evolution has been on fastforward for convenience stores. Overnight stores rose to new challenges, hitting the go button on tech initiatives such as mobile apps, delivery and order ahead. Four years later, c-stores are continuing to embrace tech. Many retailers are now modernizing those mobile apps and loyalty programs to stay relevant as technology advances, while others are testing artificial intelligence (AI) capabilities.

“Technology enables continuous operational improvement but, more specifically, ensures we are providing our customers with an excellent shopping experience,” said Raymond Dalton, SVP, information technology (IT), GPM Investments, which operates more than 1,540 c-stores across more than 30 states.

When asked about the technology trends they’re monitoring, c-store retailers consistently pointed to AI, mobile-app integration, selfcheckout systems, and the potential for leveraging loyalty programs and consumer analytics.

As far as new launches, most of them are currently focused in the mobile realm.

“Mobile has really taken the center stage,” noted Scott Smith, senior director of IT for Parker’s, which operates 84 stores in Georgia and South Carolina. “You constantly see all of the c-store chains rolling

out new features, functionality, new applications, mobile ordering and mobile payment.”

Parker’s launched its refreshed Parker’s Rewards app in March 2023.

“The great part about it is we still allow the customer to activate the fuel dispenser directly from their phone,” Smith said. “We have the 10-cent discount for every gallon you pump when you pay with ACH (Automated Clearing House). We’re doing mobile ordering, mobile pickup, and then allowing the customer to use their ACH card through the mobile app in-store by scanning a barcode.”

Apple Pay and Google Pay are also available in-app. “We’re looking to add that within the store as well,” he said.

Now the chain is looking into adding its loyalty card as a payment method via mobile wallet and allowing customers to add any credit card into the app.

“Hopefully as the point-of-sale (POS) companies continue to evolve, we can add more features to that mobile app that’ll directly connect to the POS,” Smith said.

Raymond Dalton, SVP of IT for GPM Investments, noted GPM relaunched its mobile app in April 2023 with upgraded features, including daily offers and savings for loyalty customers.

TXB, with 50 stores in Texas and Oklahoma, in late 2022 introduced its TXB Rewards app complete with a new loyalty solution, mobile pay at the pump, order ahead and delivery.

GPM Investments relaunched its mobile app with upgraded features, including daily offers and savings for loyalty customers, in April of 2023 “to enhance the customer experience and to help make our customers aware of daily value at our stores,” Dalton said. GPM’s fas REWARDS loyalty program is available in the app, and it features online or in-app ordering for the majority of its stores.

Road Ranger, a chain that operates 50 travel centers in seven Midwest states, launched its Ranger Rewards app in September 2021

alongside the rollout of its updated loyalty program.

Loop Neighborhood Market, with 135 stores in California, features the Loop app that includes its LoopBack loyalty program, car wash subscription, location finder and more. The chain offers online ordering via thirdparty delivery services. It doesn’t currently have mobile payment, but it’s in the works, noted Sanjit Bajimaya, the chain’s IT director.

Denver-based Choice Market, which operates three Choice Market locations and four fully automated Choice Mini Mart sites that feature camera-based autonomous checkout, is in the process of transitioning to a new mobile app that is expected to launch later this year. The new app will continue to feature in-app ordering, mobile payment capabilities and Choice Rewards.

“We’re building a more comprehensive kind of omnichannel app,” said Mike Fogarty, founder and CEO, Choice Market.

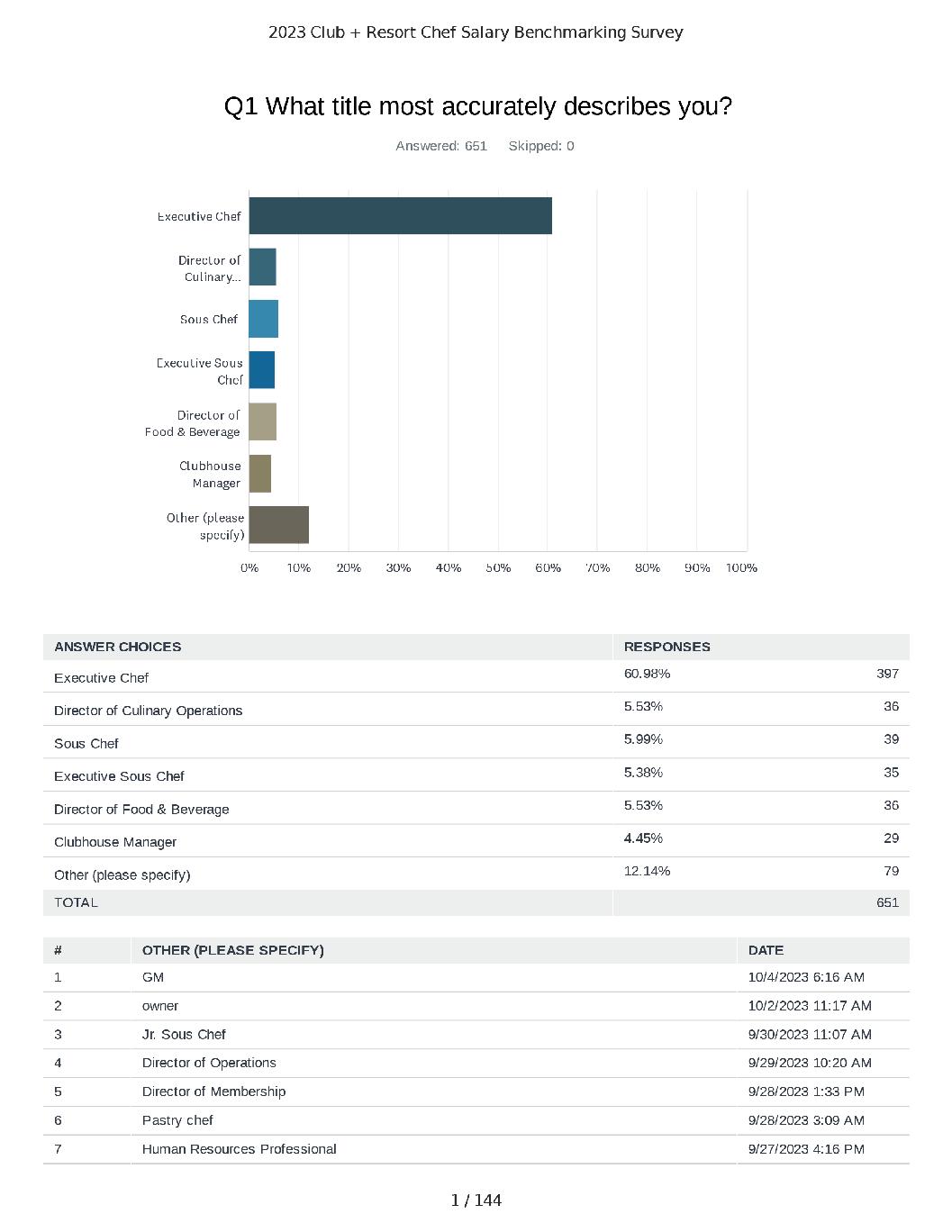

Food-focused convenience store shoppers were asked: “Over the next 12 months, how likely are you to use an app or online platform to advance order the items listed below from a convenience store?”

Source: FoodserviceResults, “Understanding the Food-Focused Shopper,” 2023, commissioned by NAG Convenience

Of food-focused c-store shoppers, 65% of millennials and 64% of Gen X would order food online compared to 29% of baby boomers.

Source: FoodserviceResults, “Understanding the Food-Focused Shopper,” 2023, commissioned by NAG Convenience

As they embrace mobile, many c-stores are realizing the importance of an omnichannel approach, which describes creating a seamless shopping experience across platforms — from mobile to online to in-store.

“We want the customer experience to be the same whether they’re shopping through the mobile app, through our website or through walking into one of our retail sites,” Smith said.

He pointed out that c-stores are unique among their competitors in that they have grocery, prepared food and fuel.

“We have all of these different channels that we compete with,” Smith said. “If we don’t have a seamless shopping experience across all of our channels — mobile, web, in-store — it really puts us at a disadvantage.”

Road Ranger also engages customers through multiple integrated digital and physical touchpoints, allowing customers to stay engaged through the company website, e-commerce site, social media and its Ranger Rewards app as well as in-store.

“We are the first travel center to

offer an e-commerce platform to allow online shopping and shipment direct to customer,” said Todd Hauptmann, VP of IT for Road Ranger. Road Ranger’s Shoproadrangerusa.com website carries a wide assortment of Ranger Racing products as well as Road Ranger accessories and apparel.

“As a truck stop / travel center, online shopping wasn’t something we thought we needed, but it’s been a fantastic learning experience and something that’s allowed us to reach a much larger audience than we would otherwise be able to target through just our brick-and-mortar sites,” Hauptmann said.

Choice Market is known for its omnichannel approach to retail.

“For us it was really important because our core customers, they’re digitally enabled,” said Fogarty. “They’re used to ordering on their phones or on the computer or through third parties, and so from the start, we always wanted to lean in and make sure we provided those options.”

Prepared food also makes up about 50% of sales for Choice, making the addition of order ahead and delivery key. But Fogarty noted

omnichannel doesn’t make sense for all c-store chains. “You have to know who your core customer is,” he said.

Peter Rasmussen, founder and CEO of Convenience and Energy Advisors, noted quick-service restaurants (QSRs) like Dunkin’ and Starbucks have taught customers the convenience of omnichannel, with the ability to order ahead via an app and skip the line.

“For a convenience store, you want somebody to be able to peruse around and fill the basket, and they still do that too, but you want to have the option to order ahead or have delivery,” he said. “What I’ve seen so far in being able to work with several chains and launching online ordering is if you have foodservice, those stores will perform better on online ordering.”

C-stores have an advantage with online and mobile ordering, he pointed out. Customers can order both foodservice and packaged goods at c-stores, plus c-stores are open later than the typical restaurant. It’s also helpful from a labor perspective, in that it gives employees advanced warning of what orders need to be filled.

“The way that I always look at it is work with an order aggregator to bring a first-party ordering system for pickup or delivery that you would dispatch to DoorDash, then aggregate to the third-party platforms. Do it in your foodservice stores, promote it and then try it in new stores that may not have foodservice,” he said.

Like many retailers, Road Ranger has been actively following the state of self-checkout for a few years. When Road Ranger has informally surveyed customers around self-checkout, shoppers appear split along generational lines.

“Our younger demographic has grown up in a digital world and looks for the convenience of selfcheckout — provided you can support a frictionless shopping experience for them,” Hauptmann said. “However, we see a much larger group that strongly opposes the technology, noting they feel they are already paying a premium and don’t want to also work as a cashier but also that they believe it delivers a very cold / impersonal shopping experience.”

While self-checkout has been deprioritized at Road Ranger, it’s still following the trend as a potential linebusting opportunity and kiosk solution for pre-paid fuel customers.

Parker’s, meanwhile, has self-checkout in 53 stores and continues to add the technology to all new builds and remodels. Given that its operating area is still cash oriented, it opted to use three cash-andcredit kiosk units per store, allowing multiple customers to check out at once to aid speed of service.

There’s retail gold to be discovered with the Placid Multideck Refrigerated Island Merchandiser from Southern CaseArts. Our engineers designed a dynamic three-tier unit that efficiently makes high-margin impulse items impossible to miss. Perfect for snacks & sandwiches, beverages, cheese, and prepared foods, these easy-to-maintain coolers provide reduced energy costs, feature brilliant LED lighting and adjustable shelving. Unearth a treasure trove of added sales, visit southerncasearts.com for more.

Some 62% of food-focused c-store customers are likely to use self-checkout at a c-store, with Gen Z leading the charge at 71%. Boomers lag with only 41% saying they’d use self-checkout.

“We have a manned POS that is at the end of the counter that we can use for overflow or if a customer doesn’t want to use self-checkout,” Smith said.

The cashier helps with age-restricted items and interacts with shoppers.

“The goal is that the cashier would stand behind the self-checkouts to help those customers and then, if they need to, they can walk down and use the manned register,” he said.

TXB features self-checkout in a handful of its newer stores.

“It works well,” said Daniel Gaddy, VP of technology for TXB. “I personally believe there are challenges around age-verified items, but I know there are ways around this too. I think, as these issues are accounted for, you’ll see some level of adoption as retailers feel the juice is worth the squeeze. The cost has been a bit prohibitive to this point.”

Choice features self-checkout kiosks in its Choice Market locations.

“Because we have the prepared food, people use it pretty heavily, honestly,” Fogarty said. Fogarty estimated that at the chain’s Bannock Street location about 80% of sales

go through the kiosk.

Loop Neighborhood has selfcheckout at five locations. “(The) technology is good, but fear of theft among the management and operations team is there,” Bajimaya said.

Indeed, a 2023 LendingTree survey found that 15% of self-checkout users report having stolen an item.

“I’ve worked with chains that have nearly an 80% take on the self-checkout rate, and well, yes, you could have an increase in theft in some cases, but most of our theft is internal and you mitigate a lot of

that,” Rasmussen said.

Recently, he has read about stores removing self-checkout. “I think that if you’re removing self-checkout, the right system or the right layout wasn’t done right,” he said.

He believes the technology is here to stay. “But I think it needs to be a choice,” he added. “If somebody wants to use it, they can, but they’re not forced to in any kind of way.”

With four autonomous Choice Mini Mart locations, Choice sees autonomous stores as a way to create a market almost anywhere from the lobby of an apartment building to the hallway of a hospital to a music festival parking lot.

“The definition of convenience is evolving. It’s not just being a gas station on the side of the road. It’s a very targeted and situational merchandising, tech and format strategy,” Fogarty said.

The goal might change depending on location, from providing graband-go to a long-term tech play to bringing grocery into a food desert, but it always involves bringing the right product at the right price to the

right site, he said. The Mini Marts have given Choice a better understanding of the customer, including why they’re shopping there, what products they want and don’t want, and real-time inventory insights.

“From an operations perspective, it’s a very efficient way to run the business because we know at all times every product on every shelf,” Fogarty said.

But the shift to autonomous isn’t right for every chain. While Loop’s Bajimaya sees autonomous coming, he pointed out that the technology is currently expensive, and most c-stores are still in a learning phase with autonomous checkout.

Rasmussen advised that retailers wait for the costs to come down. “I think there’s absolutely a market for it, but it’s got to get cheaper,” he said.

In terms of how frictionless checkout will change the shopping experience for retailers and customers, Hauptmann expects traditional stores will be more focused on customer service while those going autonomous will highlight speed of service.

“I think autonomous checkout is just another way that we can make it convenient for that customer to shop with us,” Smith said. “Nine times out of 10, that person just needs to stop,

Peter Rasmussen, founder and CEO of Convenience and Energy Advisors, noted that the way c-stores leverage their loyalty program for fuel gallons can offer a big opportunity for their business.

fuel up, get something in the store, and they don’t want friction. They don’t want it to take a long time.”

Across the board, retailers pointed to AI as a key area to watch. Fogarty anticipates AI playing a role across the c-store value chain, not only in terms of checkout, but from how the business is run, allowing chains to better grow margins through focus on the correct labor allocation at the right times and offering key products at the best price.

“We were on the front end of leveraging AI in terms of the checkout and the amount of data that we’re getting from these systems … it’s pretty impressive in terms of who’s coming in the door, how long they look at a product, what products they’re picking up and putting back,” Fogarty said.

Now Choice is strategizing how best to use the data it’s receiving. “We’re still in the very early stages of understanding how to leverage and use that data to make the customer experience better,” he said.

Choice is currently going through a detailed road-mapping exercise to chart how AI will be used in the future. “We’re looking at all elements of AI and how they can assist and make our business more efficient, create an enhanced customer experience and ultimately drive margins,” Fogarty said.

Fogarty expects AI to help c-stores better dial into their merchandising strategies. He pointed out machine learning models can help consider weather patterns, school schedules, holidays and other external data points to help retailers become more

targeted with their offering.

Fogarty also has an eye on AI potential that’s further out in terms of adoption, such as using a digital assistant while navigating the store or augmented reality to provide storytelling / information during the shopping experience.

At GPM, Dalton is watching potential use cases for monitoring in-stocks, theft reduction and shortening customer wait time. “We also understand that video analytics are being used to capture license plates to shorten time for customers at the pump, although we believe that more widespread use is further down the road.”

Parker’s has been using AI in the customer service realm by creating a chatbot to respond to customer questions. It also has an internal chatbot that can provide answers to questions on process, policy and procedures for employees.

“We’ve started to train that model that if it can’t answer, it can escalate it and create a service request or put them in touch with a real person,” Smith said.

At TXB, Gaddy noted that several solutions deploy AI in some capacity. “Some of which we live with and others that we’re demoing / piloting. I’ll just say we’re certainly focusing on it, aware of the trends and working to drive through the buzzword of it all to find the true ways it’s going to benefit a solution, etc. “

In terms of how AI and machine learning might impact the c-store experience for customers and retailers, Smith thinks customers will see the advantage of price optimization and targeted offers.

“How great would it be if I could be on a rewards program, and as I walk into the store, it’s dynamically changing the prices just for me because I’m part of that rewards program,” Smith said.

Hauptmann also pointed to AI’s potential in terms of dynamic pricing, noting Wendy’s February

announcement that it plans to roll out dynamic pricing as soon as 2025.

“As we see more stores adopt digital shelf labels and leverage AI to further enhance micro-marketing efforts, I think we’re going to see stores more broadly capitalize on opportunities to have both dynamic and personalized pricing,” Hauptmann said.

Fogarty sees AI as particularly useful to convenience stores to aid in knowing the customer and marketing to them.

“I think we’re just scratching the surface. And more retailers, big and small, can leverage these tools to grow margins, to increase traffic and to target their customers,” he said.

Rasmussen noted it’s becoming less expensive to use AI to take orders or give the initial response at a drivethrough. He’s also seeing good advancements around camera systems

that can integrate with the back office or POS and offer a quantitative and qualitative view of what’s happening in the stores around the clock.

Road Ranger is looking at opportunities for using AI to improve productivity, particularly when it comes to improving process documentation and corporate communication. Its digital team uses AI practices to create content, enhance consumer engagement online and to increase targeted personalization for its app platform, Hauptmann explained.

But Road Ranger is also aware of the darker side of AI. It’s considering how to use training to bring awareness to potential threats such as a malicious actor using AI to impersonate staff or generate false documents that look legit.

“Frankly it’s scary how quickly the technology is advancing and

Todd Hauptmann, VP of IT for Road Ranger, said the chain is looking at opportunities for using AI to improve productivity, particularly to improve process documentation and corporate communication.

Todd Hauptmann, VP of IT for Road Ranger, said the chain is looking at opportunities for using AI to improve productivity, particularly to improve process documentation and corporate communication.

Some 52% of surveyed food-focused c-store shoppers are willing to try biometric payment options.

Source: FoodserviceResults, “Understanding the Food-Focused Shopper,” 2023, commissioned by NAG Convenience

how easily you can take snippets of available data to digitally replicate someone’s likeness and voice,” Hauptmann said.

Retailers echoed that the most interesting aspect of AI is the highlevel data it’s able to deliver and the possibilities it offers.

“I think by now everyone has heard the anecdote about Walmart selling more Pop-Tarts during hurricanes and how that insight influences what they stock. AI has the power to make those types of observations at district, state, regional and even store level by date / time part, where I think you’ll see product mix and pricing being more broadly influenced by AI-driven recommendations going forward,” Hauptmann noted.

But challenges to AI adoption exist as well, such as the lack of integration with some current vendors. Smith, however, pointed to progress in this area with the recent partnership between PDI and Square 9 that will start integrating AI-driven solutions.

“But as we look at technology in the c-store space and some of the tech debt that we have and some of the applications we use, we really have to wait for those third-party vendors to really integrate,” he said.

Retailers were mixed on the technology set to bring the most impact to the c-store space, but widely pointed to mobile, AI, digitalization, loyalty program advancement and autonomous checkout.

For Rasmussen, how c-stores leverage their loyalty program for fuel gallons can offer the biggest impact.

“What I’m really starting to see is when loyalty ties with fuel, and (retailers) start to use that to create segments, get people into the program and find different ways to retarget them, interesting things start to happen,” he said.

If stores cross the threshold to where 70-80% of their gallons are tied to loyalty, suddenly the street price of fuel no longer matters because retailers can market an exclusive price to each person, he pointed out.

While biometrics isn’t a key initiative for most chains, it is on retailers’ radar. Choice is looking into it for liquor and age-restricted items. Parker’s has looked at it in the past for age verification too.

“We’re trying to understand exactly how it would work … and

how it would work if a customer had a twin, things like that,” Smith said. “It’s not something that’s really high on our priority list, but of course that could change in the near future.”

Road Ranger operates QSRs, some of which have deployed integrated biometrics. “It’s something we’re very interested in given the opportunity to eliminate buddy punching,” said Hauptmann.“We’re still navigating some of the legal requirements and challenges we may have in deploying biometric clocks across our full network.”

While retailers are at various stages of technological growth, most are evaluating many of the above technologies to determine the potential for their business. Because even if retailers opt to do nothing, they’re still going to be impacted by the digital disruption accelerating around them.

“These technologies are really going to become more prevalent across all industries,” Fogarty said.

C-stores that fail to embrace change and technology as it evolves are at risk of being left behind.

“If you love change, this is a great time to be involved in technology,” Hauptmann added. CSD

SafePoint—The Solution to Operational Pains

Manual cash handling is not only time-consuming but also leaves your business vulnerable to theft and human error. SafePoint by Loomis is here to alleviate your operational pains. Our smart safes and cash recyclers offer a secure, efficient way to manage your cash, so you can focus on what matters most—growing your business. Plus, with features like provisional credit, you could have access to your funds overnight.

Save on labor and training costs.

Eliminate the need for daily trips to the bank.

Reduce the risk of internal theft and external threat. Gain real-time visibility into your cash flow.

Ditch franchise fees in favor of high profits and consistent flavor without worrying about labor.

Pizza is one of the most popular foods in America. Many c-stores can boost profits if they adopt the right pizza program. But, making sure there is the physical space and the labor to operate a successful pizza program in any c-store is easier with some programs than others.

Hunt Brothers Pizza has been in business for 30+ years and prides itself on its ability to customize its “pizza shoppe” to almost any c-store space. “It’s a not one size fits all type scenario, it’s how we continue to provide c-store operators with options that fit in their space and allow them to have a foodservice program that an existing employee can work,” says Dee Cleveland, head of marketing at Hunt Brothers Pizza.

Customization is key to the success of foodservice programs for c-stores because often c-stores are working with limited space and labor. “Our setup makes us different because we customize and provide the marketing,” Cleveland says. “Hunt Brothers Pizza comes into operators’ stores and asks ‘How can we set this up best for you?’ Not, ‘This is what we do. Either take it or leave it.”

C-store operators sometimes worry about how to make their store fit the service they are interested in, but Hunt Brothers Pizza strives to flip this dynamic on its head. “We discuss their goals and based on their goals will recommend placement of Pizza Shoppe,” Cleveland says. “The closer

the Pizza Shoppe is to the register, the easier it is to operate the program especially if there is only one employee. Efficiency matters for a c-store. We want to ensure our program maximizes their profits.”

Pizza Shoppes’ square footage and layout can be made as small as 59 square feet to compensate for even the smallest c-store. Aside from physical space, Hunt Brothers Pizza also takes steps to ensure c-store operators have everything they need in place to run a successful pizza program.

“We make sure that operators programs are set up for success,” Cleveland says. “Our account managers will go in and check on the stores weekly. For the 30 minutes they’re in the store they become the store’s employee. They rotate their inventory, take out the garbage, help with training, and even clean ovens.”

Hunt Brothers Pizza also lends support to new c-store operators by offering free marketing to target key demographics in their community and lending in-person support on the opening day of the pizza program to make sure it is a success. “From a consumer perspective we try to build credibility and confidence in the customers so they know they can get good, safe, and quality food options from their c-store space,” Cleveland says.

Hunt Brothers Pizza maintains its mission to “be a blessing,” by enhancing convenience store profitability through tailored pizza programs, addressing space and labor challenges with customizable solutions and comprehensive support, thereby transforming the dynamics of foodservice in constrained retail environments.

- By Ya’el McLoud

Although inflation looks to still be impacting the chocolate segment nationwide, c-store retailers are looking to both future innovation and loyalty to the classics to keep sales steady.

Emily Boes • Senior Editor

With cost concerns still top of mind for many customers, c-store retailers are closely monitoring trends and finding ways to entice shoppers to the candy aisle and other impulse categories.

“Customers seem less inclined to make impulsive purchase decisions, and candy is certainly an impulsive category,” said Emily Ferguson, associate category merchant, GetGo Café + Market, which has approximately 270 stores in Pennsylvania, Ohio, West Virginia, Maryland and Indiana. “As such, sales are definitely challenged across the board.”

On a national scale, chocolate unit sales have dipped 4.4% for the 52 weeks ending March 24, although a 10.1% jump in price per unit pushed chocolate dollar sales up 5.2%, reaching $3.67 billion, according to Chicago-based market research firm Circana.

Gum sales ticked up 4.1% in unit sales and 15.9% in dollar sales for the 52 weeks ending March 24, per Circana.

Within the category, AO seasonal chocolate candy sales skyrocketed, with a 217.7% boost in dollar sales and 200.8% rise in units. Sugar-free chocolate candy sales dropped the most, down by 13.3% in units and 8.6% in dollars.

At GetGo, innovation is helping to drive chocolate growth with both existing brands and newer brands. Yet even still, the mainstay candy bars remain established as top go-to options for customers, Ferguson noted.

Farmers Union Oil C-Store also recognizes the importance of the candy bar classics.

“Reese’s is our top seller by far; it has shown up consistently in our top 25 sellers,” said Diane Meeks, c-store director for Farmers Union Oil Co. of Circle and Terry, which has a single c-store in Montana.

GetGo also sees traditional flavor combinations performing well within the chocolate space, such as peanut butter, almond and caramel.

That being said, “the more unique flavor combinations,” Ferguson stated, “are more prevalent in the nonchocolate categories.”

Additionally, the chain is finding success with its GetGo-branded chocolate bars, which over the last few months have experienced significant growth.

Ferguson noted this showcases the importance GetGo customers place on value.

“We’re leaning into creating enticing promotions across our biggest brands to reinforce value with our customers,” she said.

This has become especially important for retailers amid economic concerns.

For Farmers Union Oil, on the other hand, inflation isn’t having as much of an effect on candy.

“We have had a dollar store across the street from us for a little over a year now, and we have not seen much of an impact from that. As prices have risen, we have had customers comment on the price increases, but have not seen much of an impact from it,” said Meeks.

Meeks noted that the small community the store serves remains fairly consistent with its purchases. Even with the seasonal items, they don’t sell out more than other products.

“Consistency with our customers is always our best bet,” she continued.

At GetGo, seasonal candy has been historically successful.

“We know our guests are always looking forward to seeing those products hit the shelves,” said Ferguson.

For the 52 weeks ending March 24, gum has appreciated a 4.1% lift in unit sales and a 15.9% growth in dollar sales, per Circana. Unlike with the chocolate set, the uptick in the $1.2 billion gum segment is coming largely from sugarless options. In fact, regular gum saw a 17.4% decline in unit sales.

Breath freshener unit sales overall remained flat at c-stores (-0.5%), while dollar sales jumped 10.5%. Within the category, plain mint unit sales dropped by 7.9%.

At GetGo, gum and mint sales are increasing across all pack sizes and flavors. “We’re noticing sales continuing to return to what they were before the pandemic,” Ferguson said.

Wrigley Extra Spearmint is the No. 1 seller within gum and mints for Farmers Union Oil.

Overall, Ferguson believes innovation and new trends will play huge roles in the future of candy, gum and mints.

“The entire category will continue to benefit from the influence of social media trends and other trending products,” she said. CSD

• Customers are moving away from sugarfree options in chocolate candy but toward sugarless gum.

• Focusing on value is one way to bring attention to the candy segment.

• Customers in smaller communities might appreciate consistency within candy, opting for items with which they’re familiar.

■ Increased facings from 70 to 90, a 29% increase*.

■ Automatically billboards and faces product.

■ Reduces losses from bag hook tearout.

■ Cuts over 1 hour/day labor for restocking.

■ Allows rear restocking and proper date rotation.

■ Dramatically increases sales in the same space.

■ Adjusts to accommodate various package widths.

*

■ Increased facings from 99 to 121, a 22% increase*.

■ Automatically billboards and faces product.

■ Reduces losses from bag hook tearout.

■ Cuts over 1 hour/day labor for restocking.

■ Allows rear restocking and proper date rotation.

■ Dramatically increases sales in the same

■ Adjusts to accommodate various

Retailers are keeping tabs on new snack trends and inflation pressures as they look to enhance their snack aisles.

Zhane Isom • Associate EditorThe sweet, salty and meat snack categories continue to perform well at convenience stores despite inflation’s tight hold on these segments.

Salty snacks, for instance, have been a hit in the snack aisle, ringing in at $45.1 billion in dollar sales, a 4.5% increase for the 52 weeks ending March 16, according to NielsenIQ (NIQ).

Worcester, Mass.-based Nouria, with 175 locations throughout New England, expects its salty snack category to increase by 4%, as stated by Meghann Eaton, category manager at Nouria.

“Salty snack growth is coming from betterfor-you options, added protein and cleaner ingredients,” she said.

Sweet snacks have also seen slight growth in dollar sales at $9.23 billion, a 1.8% increase, even as it decreased 6% in unit sales for the 52 weeks ending March 16, per NIQ.

Eaton has forecasted a 6% increase in sales for the sweet snack category, especially considering Nouria’s fresh My Nouria line of pastries, cakes, cookies, muffins and brownies.

However, meat snacks have been feeling the effects of inflation the most when it comes to unit sales but continue to do well in c-stores.

• Incredibly Moist & Delicious

• Bright Eye-Catching Packaging

• Perfect Snack Anytime of Day!

Meat snacks dropped 6.3% in unit sales for the 52 weeks that ended March 16, noted NIQ, while its dollar sales held steady with a 0.8% decrease for the same period.

The inflation impact, while worth observing, is not stopping consumers from buying their favorite snacks. Consumers are still looking to try new flavors, trending snacks from social media and healthier options.

“Bold new flavors continue to be big wins within these categories, especially within salty snacks,” said Cameron Baer, center store category manager for Rutter’s, which has 85 sites throughout Pennsylvania, Maryland and West Virginia. “Both bold and spicy flavors continue to be the leader in 2024.”

Retailers have been seeing bold new flavor trends with meat snacks, as well.

“Shoppers want hot and spicy flavors in their meat snacks. Wild River Jerky and No Man’s Land Jerky are growing in popularity as ‘old-fashioned’ jerky that offer a longer-lasting flavor,” said Randy Demster, buyer for the Army & Air Force Exchange Service (AAFES). AAFES exclusively serves U.S. military personnel and their families on bases around the world.

Keeping these trends in mind, retailers are rearranging their snack sections while thinking of new ways to fight inflation.

Like Nouria, Rutter’s customers are looking for better-for-you snack options, in addition to value and flavor innovation.

“All of these are top of mind when planning assortment and promotions in 2024,” said Baer. “We are not in the business of simply continuing what we have

Salty snacks are a hot commodity in c-stores with $45.1 billion in dollar sales, which is a 4.5% increase for the 52 weeks ending March 16, 2024.

Source: NielsenIQ, Total U.S. Convenience data for the 52 weeks ending March 16, 2024

been doing. It is important to introduce some of these new offerings and flavors.”

With retailers offering deals and promotions, consumers are able to continue buying their favorite snacks while staying within their budget.

“Costs are up everywhere, so innovation and promotions that cause excitement are key to all categories this year,” said Eaton. “Consumers are wanting deals within the category while satisfying more than one need at once. They want salty and protein, sweet and fresh, and quality and price.”

Regarding meat snacks, consumers are continuing to change the way they purchase these products to help deal with inflation. At Rutter’s, for instance, customers have been moving from bags to sticks.

“Much of this is related to price sensitivity from

• Salty snacks lead the snack category with $45.1 billion in dollar sales, a 4.5% increase for the 52 weeks ending March 16, according to NielsenIQ (NIQ).

• Meat snacks have been feeling the effects of inflation with a decrease in unit sales by 6.3%, per NIQ.

• Consumers are demanding snacks that offer bold new flavors along with the better-foryou options.

the consumer as bagged products have continued to rise,” said Baer. “This makes pricing and promotion much more important within this category.”

As 2024 continues, retailers are willing to think outside the box to keep sweet, salty and meat snack sales up and further engage their customers who purchase these products.

“We are currently looking into brands that have a mission like Veteran owned, giving back to local heroes, supporting local communities or helping protect our environment,” said Eaton.

“The Exchange is looking at multipack meat snacks as a growth opportunity. Shoppers are looking for individually packed meat snacks that are low calorie,” added Demster. “We are adding new products for our planograms such as mini cannisters with new flavors from Frito-Lay, Rap Snacks, Planters and Hippeas.”

Jaco Oil Co.’s Fastrip Food Stores, which has 55 locations in California and Arizona, has even gone as far as working on adding new racking inside the stores while ramping up promotional activity, noted Fred Faulkner, director of sales and marketing at Jaco Oil Co.

Rutter’s, too, has been working to drive even deeper discounts for its customers.

“Meat snacks especially have experienced a lot of pricing action over the last few years, so we are working to provide promos to get these products to our customers at a discounted rate,” said Baer. CSD

As Hispanic food continues to flourish in c-stores, consumers are expanding their taste buds and asking for more authentic, fresh, customizable and flavorful Hispanic offerings.

Hispanic food has been the star of the show at c-stores that offer it due to its convenience and customizable options. Consumers hunger for grab-and-go items like tacos and burritos that they can customize to meet their specific cravings.

At Kwik Stop Convenience Stores, which operates 27 locations in Nebraska and Colorado, the most popular tacos in its Mexi Fresh program are the soft shell and Krispy tacos, according to M. David May, food service director at Kwik Stop.

Zhane Isom • Associate Editor

M. David May, food service director at Kwik Stop, changed the queso the chain offers on its menus to a higher-quality offering. Now, the queso is ranked at No. 13 in terms of sales.

“Our soft shell tacos were sold the most, with our Krispy tacos following behind with 66% of sales,” he said. “As far as our burritos go, our most popular one is our bean burrito, followed by our Grande burrito. Our Sunrise and All American breakfast burritos also perform well in the morning.”

Another c-store chain seeing its Hispanic food offerings do well is 7-Eleven with its Laredo Taco program. 7-Eleven has over 13,000 stores throughout the U.S. and Canada, with Laredo Taco offered at more than 550 of its c-stores.

“Breakfast tacos are our most popular item on our menu, with our average store selling more than 200 each day,” said Christopher Switzer, senior product director at 7-Eleven.

Rutter’s, too, has seen significant growth with its Hispanic food offerings.

“We’ve observed that many Hispanic items on our menu are conveniently suited for on-the-go consumption, which aligns perfectly with the needs of our constantly moving customer base,” said Philip Santini, senior director of advertising and food service at Rutter’s, which operates 85 locations throughout Pennsylvania, Maryland and West Virginia. “Coupled with the increasing demand for more flavor and variety, we see ample opportunity to further develop this category within our locations.”

However, consumers’ taste buds have expanded, and now they are looking for more authentic Hispanic food offerings made with fresh ingredients and that are full of flavor.

Rutter’s offers a variety of Hispanic options such as tacos, walking tacos, burritos and empanadas, and the cstore chain plans to introduce even more options to its customers in the future.

“It’s clear that our customers have a strong affinity for the Hispanic flavor profile, and we’re dedicated to satisfying their preferences by continually enhancing this section of our menu,” said Santini.

To keep up with consumer demands, retailers are looking at how they can further evolve their Hispanic offerings, whether by adding new items to the menu, adding new seasonings to their flavor profile or ensuring ingredients are prepared fresh daily.

For instance, May is looking for new items to add to the Mexi Fresh menu.

“I recently went to a food show where a company presented me with Spanish rice because we don’t have rice in our program, and I think that would be a great addition,” he said.

To improve the quality of items on the menu, May also changed the queso that was on offer.

“I went through a company called Marcos that has a good queso, and we started offering that. Now, our queso is ranked at No. 13 as far as sales go,” said May.

Quality food is important to customers, whether it comes from a traditional full-service restaurant, a convenience store or other foodservice options.

Rutter’s, on the other hand, is looking into introducing new flavor combinations, spicing up the menu, and maintaining its focus on high-quality items that are convenient for on-the-go consumption, noted Santini.

Elsewhere, 7-Eleven’s Laredo Taco program is

• Consumers are looking for authentic, fresh and flavorful Hispanic food.

• Consumers are still demanding customization when ordering Hispanic food from convenience stores.

raising the bar when it comes to offering consumers authentic Hispanic food.

“Laredo Taco is all about using authentic flavors from deep Texas culture,” said Switzer. “It starts with fresh flour tortillas hot off the grill, loaded with sizzling fillings and topped with fresh salsas.”

Even though authenticity, new flavors and fresh ingredients are at the top of the demand list for Hispanic food, consumers still want to have the option of customizing their orders.

Rutter’s has homed in on customization with its “Made for You” menu, allowing customers to tailor their orders to fit their needs.

“The ‘Made for You’ option is highly favored by our customers. We prioritize customization and catering to individual preferences, a strategy that deeply resonates with our patrons,” said Santini. “Our objective is to offer the highest-quality items and a wide variety to our customer base, ensuring they can create exactly what they want when they want it.”

He noted that customization enhances the customer’s overall dining experience.

As consumers’ demands change for Hispanic food, retailers must be willing to alter and improve their offerings to keep up with and continue to see growth in this area.

“With each store launch we’re seeing great responses from customers looking for fresh, authentic food, and we plan to continue to grow the brand as appropriate,” said Switzer.

Kwik Stop is currently offering a $6 Mexi Bag that comes with a beef burrito, a small peso and a side of queso.

“I encourage any convenience store out there looking to get into authentic Hispanic food to offer some type of promotion to grab customers’ attention,” said May. CSD

The last year has seen great progress in technology innovation and advancement in the convenience store space, from further implementation of self-checkout and mobile payments to app rejuvenation to steps taken to use artificial intelligence (AI) for security and operational efficiency.

Family Express, based in Valparaiso, Ind., operator of over 80 locations in Indiana, is one c-store chain that has taken advantage of the technology boom to pave a path of future success at its stores.

CStore Decisions is recognizing Family Express with a Tech Innovation Award for its work in launching a new mobile app, the ability to order food and in-store items at the pump and its goal to continue to focus on technology as a means of accelerating the business and offering convenience.

Family Express launches

a

new mobile

app

to cater to customers’ digital needs while remaining diligent in other areas of technology, as well.

Emily Boes • Senior Editor

LAUNCHING THE MOBILE APP

A few years ago, Family Express produced an app that included car wash integration. Earlier this year, however, the chain launched a new app to remain on the cutting edge of the industry.

“What we retired is probably substantially better than what most people are doing in this space today. But in order for us to maintain that qualitative differentiation, we have to continue to invent,” said Gus Olympidis, president and CEO of Family Express.

The latest app also includes an opportunity for customers to interact with the car wash, but it gives customers a completely new experience.

Car wash subscriptions are available through the app, where customers pay a monthly fee for various car wash services depending on the subscription they purchase. If a customer chooses not to buy a subscription package, they can still activate a single wash from the app; various single wash options are provided.

A beverage subscription is also available

Gus Olympidis, president and CEO of Valparaiso, Ind.-based Family Express, which operates over 80 locations in Indiana.

through the app. For a set monthly fee, customers can redeem one drink — from a list of options — every four hours.

“All we’re doing with the mobile app right now on the car wash side, with subscriptions of all kinds from packaged beverages to car washes, creates an environment that delivers to the consumer almost a subliminal expectation,” said Olympidis. “They don’t expect it from you because they don’t see it delivered by others in the convenience store space, but they see it delivered by others in other sectors.”

Customers are also able to use the app for mobile ordering. The app permits users to view their order history and save their favorite items, which allows for even speedier ordering.

Additionally, customers can sign into their F.E. Perks rewards account through Family Express’ app. Here, they can see their available rewards, possible discounts and club cards.

“Our customers are very loyal. We see some

of the best rates in the industry when we compare. That’s what brings people to our mobile app, as well, (apart from) the subscriptions. ... Our customers love us and they’re going to our app because of that,” said Clifton Dillman, VP and chief information officer for Family Express.

Family Express is heavily focused on investing in technology, and its initiatives lie in other areas aside from the app, as well.

For example, Family Express enabled encryption at the pump in a collaboration with Fiserv and NCR.

“Most breaches, if not all of them, don’t happen in front of a sales associate inside the store. … They do it outside, they do it at night. They do it where you can’t watch,” said Olympidis.

Family Express is also implementing the ability for customers to order in-store items or food orders in addition to fuel at the pump and have their purchases delivered to them. It’s working with NCR to establish curbside delivery at the pump.

“When we look at technology, we look at what we

can do to build relationships,” Dillman noted. Family Express prioritizes people — both its employees and customers.

“Our passion for technological innovation, going back now at least a decade and possibly beyond, is born out of the necessity to facilitate a differentiation because others do other things better than we do. So we do people better and we do technology better,” said Olympidis.

Further, the chain is interested in pursuing AI, specifically Microsoft Copilot. One of Family Express’ primary goals is looking into technology that makes it more efficient and resilient and able to offer a better customer experience.

For AI, the chain thinks of it as a two-track endeavor, Olympidis noted: early implementation of AI solutions and using AI to create a disruptive force that would be beneficial in the marketplace and exclusive to Family Express.

“That’s where we’re pushing the envelope with the existing technology to make it do things it doesn’t want to do, frankly. And we’re winning,” said Olympidis. CSD

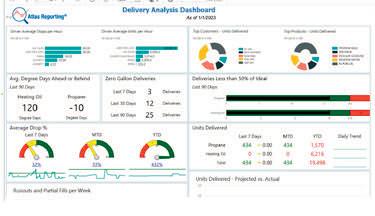

Re-Up is implementing artificial intelligence in its stores and preparing for projects ahead.

Emily Boes • Senior Editor

The level of technological advancement available to convenience store retailers is reaching new heights. With artificial intelligence (AI) being the talk of the tech scene in a way it never has before, c-store operators are actively researching how the technology can help them increase efficiency.

C-store operator Re-Up came onto the playing field already discussing how it can harness AI and use it to manage its stores.

“(The c-store is) a great place for retail tech innovation to happen. It’s easier for us to implement these crazy things. …” said Michael Salafia, co-founder

and CEO for Re-Up, which operates nine sites in Florida, Mississippi, Alabama and Georgia.

For its implementation of and vision to use AI in its stores, such as the development of a robotic kitchen, and its dedication to investing in technology down the line, CStore Decisions is recognizing Re-Up with a Tech Innovation Award.

Re-Up, headquartered in Miami Beach, Fla., hasn’t been on the scene for long. It opened its first six sites in 2023, and an additional three locations so far in 2024.

Salafia and Co-Founder and President Narendra Manney worked together to develop Re-Up and both brought strong backgrounds in technology to

the table. Manney, with over 20 years of experience in the gas station and convenience store industry, has owned 50-plus stores throughout his career.

The Re-Up team has made integrating AI a strong part of its mission.

“Re-Up applies multiple types of AI-powered technologies to automate processes within stores and guide business decisions,” said Salafia.

For example, Re-Up uses proprietary AI predic tive analytics tools in the business to assist with site selection and sales forecasting.

“We have our own proprietary algorithm for scoring these stores and figuring out a very high-level business plan. That’s how we’re able to sort through the market so fast and make all of these

acquisitions the way we’re doing it because we’re very good at analyzing the property, coming up with a business plan and sticking to a disciplined framework as to what will work and what will not work,” said Salafia.

Recently, Re-Up has also been preparing to open a self-contained, fully autonomous store in Miami. The chain has been providing input to the company responsible for the technology, and the store will be ready to launch in the next couple of months.

At the store, customers will tap a credit card, which preauthorizes them to enter. They can then begin to shop for the items they’re looking for.

“The ceiling has like a million cameras that all have this AI visual recognition technology. We’re clocking 98% accuracy rate on this,” said Salafia.

On a smaller scale, Re-Up decided to initiate a pilot program for a fully automated coffee machine that gives the customer the barista experience in 40 seconds.

“We’re very confident, if they’re a Starbucks customer, once they try (this new machine), if it’s more convenient, they’ll just go to the Re-Up,” said Salafia.

One of the largest endeavors Re-Up is currently in the process of is the installation of robotic kitchens in its stores.

Michael Salafia is the co-founder and CEO for Re-Up, which operates nine sites in Florida, Mississippi, Alabama and Georgia and is headquartered in Miami Beach, Fla.

The company partnered with Nala Robotics, which has spent years in research and development on solutions for touchless equipment. Re-Up was involved in many of the test runs, visualizing how to integrate the technology into the c-store space. And, in one or two months, the robotic kitchen equipment will be in ReUp stores.

“This can go only in selected stores. It depends on the size of the store, and there’s other logistics involved. Apart from that, we want to do as much as possible in all the stores,” said Manney.

“The beauty of the way we’ve designed our program is that it’s agnostic to the food product. Any individually flash-frozen food product can go. Anything that you put in the deep fryer can be prepared using our robot. So for our Re-Up food program, we focus on the gas station tried-and-true: french fries, fried chicken tenders and chicken wings,” added Salafia.

The first site with a robotic kitchen is in the process of being built inside of a self-contained food trailer in the parking lot of its Melbourne, Fla., site. Live ordering will be an option for customers, but a food warmer will be inside of the established Melbourne location, allowing customers to choose pre-prepared items.

“In this case, we’re really confident that people will drive up for the food cart experience, and we don’t have the square footage inside of the store. Now we’re starting our pilot project with solving a real challenge,” Salafia elaborated. “How can you add additional EBITDA (earnings before interest, taxes, depreciation and amortization) to a gas station that has a tiny convenience store?”

In addition to the robotic kitchens, another of ReUp’s goals is installing humanoid robots at the checkout counter.

The idea is that humans can focus on managing the store while the robot completes menial tasks.

“It’s a crazy idea, but we will allow (the robot) to test at one of our counters to help the checkout guy. And this will also drive a lot of traffic to us. … So we are confident about our business improvement,” said Manney. CSD

Convenience Distribution Business Exchange (CDBX)

September 23–26, 2024

Omni Louisville Hotel | Louisville, KY

Convenience Distribution Marketplace (CDM)

February 17–19, 2025

The Woodlands Waterway Marriott Hotel & Convention Center

The Woodlands, TX

Convenience Distribution Business Exchange (CDBX)

September 8–11, 2025

Arizona Grand Resort & Spa Phoenix, AZ

Convenience Distribution Marketplace (CDM)

February 16–18, 2026

Loews Arlington Hotel | Arlington, TX

Convenience Distribution Business Exchange (CDBX)

September 14–17, 2026

JW Marriott Miami Turnberry Resort & Spa | Aventura, FL

Convenience Distribution Marketplace (CDM)

February 22–24, 2027

Loews Arlington Hotel | Arlington, TX

HARIBO has launched a brandnew gummy variety: Unicorn-ilicious, a treat that is as colorful and cute. This new gummy features a rainbow array of adorable unicorns in six flavors: Apple, Blue Raspberry, Berry Punch, Banana and, for the first time, Cotton Candy and Tangerine. Unicorn-ilicious combines HARIBO’s signature chew with whimsical unicorn shapes, and consumers will be able to experience the gummy’s bouncy texture and juicy flavors. Unicorn-i-licious is available now at U.S. retailers nationwide.

Haribo www.haribo.com

Pringles has brought its Honey Mustard crisps back to the snack aisle. Featuring a savory blend of garlic and red spices, Pringles Honey Mustard perfectly balances tangy mustard notes with subtle sweet hints of honey to deliver a flavor-packed crisp that will keep consumers coming back for more. Each bite delivers the zesty and honeyed flavor experience that longtime fans remember. Fans can now grab Pringles Honey Mustard at select retailers nationwide.

Kellanova www.kellanova.com

Monster Energy Ultra has launched Fantasy Ruby Red, the latest zero-sugar flavor joining the Monster Energy Ultra lineup. Fantasy Ruby Red’s concoction bursts with bold flavor and an irresistible twist to set taste buds alight with its fusion of vibrant ruby red citrus and exhilarating energy. Packed with the same intense energy boost consumers expect from Monster, yet boasting zero sugar and zero calories, it’s an ideal solution for those seeking a healthier alternative without sacrificing taste or performance.

Monster Energy www.monsterenergy.com

Panasonic Connect North America has introduced its new Stingray JS988 POS Terminal, a new all-in-one point-of-sale terminal with a small footprint and lightweight design so users can move the devices and interact with the terminal. Easily customizable to fit a wide range of form factors, the modular terminal can also be integrated with a choice of peripherals, including a camera, customer-facing display, biometric magnetic stripe reader and more — all to enhance the purchasing experience to create personalized pathways for all customers.

Panasonic Connect North America www.na.panasonic.com/us

/ www.addsys.com

/ Phillip Morris USA

www.insightsc3m.com

703.208.1649 / JennF@cdaweb.net https://www.cdaweb.net/Events

/ salesinfo@kretk.com

LLC

www.krispykrunchy.com/marketing

As more customers come to expect enhanced foodservice from their c-stores, focusing on packaging reliability is paramount for success.Emily Boes • Senior Editor

Foodservice options such as roller grill items and hot coffee have long been expected at convenience stores, but recent years have seen a boom in the quality, variety and complexity of c-store food offerings. And, with foodservice becoming more of a priority for c-store operators, and the importance of differentiation in this area increasing, a mounting emphasis is being placed on packaging.

On-the-go packaging, especially, should be given care, as most c-store customers are on the move and choose to grab easy, efficient items they can consume while out and about.

To understand more about the packaging consideration process and how c-store operators are thinking about it, CStore Decisions spoke with Kevin Smartt, CEO of TXB, which has 50 locations in Texas and Oklahoma.

TXB offers its customers privately packaged meals to go and cold grab-and-go items, as well as other locally sourced private-label products such as jerky, meat sticks, juices, nitro cold-brew coffee, roasted peanuts and more.

CStore Decisions (CSD): How do you decide on packaging for different types of on-the-go items?

Kevin Smartt (KS): Our priority when it comes to packaging is convenience. Oftentimes when we get on-thego items or fast food, we receive a flimsy bag within a bag and the food loosely packed within — not ideal for people on the move! Our packaging is sturdy and box shaped, perfect for setting on your lap in the car or even placing in the cupholder. It’s also resealable to save for later. Our handheld to-go box has a lid with a “sauce holder” built in for easy storage and dunkage.

CSD: What’s trending in terms of packaging for onthe-go items at c-stores?

KS: Better-quality packaging as well as packaging that is better for the environment. Companies for years have

been turning away from single-use plastic and foam materials and opting for paper or biodegradable packaging.

CSD: How are sustainability initiatives impacting packaging choices?

KS: Our responsibility as retailers in creating a cleaner environment starts with minimizing single-use plastic and foam materials. TXB has transitioned to paper coffee cups, chicken boxes, sandwich wraps, straws and to-go containers with plans to introduce paper bags and side containers soon. We also have our new biodegradable straws in all stores.

CSD: Are post-COVID hygiene concerns playing a role in packaging considerations?

KS: Yes, guests are more vigilant in how sealed and secure their meals are. Down to the utensils being wrapped. The more secure the packaging is, the better.

CSD: What should retailers think about for packaging when it comes to delivery?

KS: When it comes to delivery, it’s important that the quality remains the same from the moment it leaves the store to the moment it’s handed over to the customer. This means ensuring that sauces/liquids don’t spill, food doesn’t flip around to the point where everything is falling apart, and the guest feels confident that their food was delivered sealed and secure.

CSD: What advice do you have for c-store operators as they consider packaging for on-the-go products?

KS: Always think of what unique-to-your-product adjustments you can make to packaging that will make your guests’ lives easier. The cheapest option is not always the best option. Quality packaging can give guests the perception of quality food.

Introducing Delectables™ tamper-evident dry snack containers — where sustainability meets intelligent design. The Delectables line is perfect for candies, nuts, trail mix and other dry snacks, and the tamper-evident hinged lid ensures that your containers are securely sealed. The containers’ square shape also makes for easy stacking and optimizes shelf space. Delectables containers come in sizes ranging from 8 oz – 32 oz, are made with our EcoStar ® post-consumer recycled PET material, and are recyclable with a #1 resin code to meet your sustainability goals.