Red Gold® is here to make your customers’ saucing experience easy and enjoyable with a variety of dunk cup options such as: ketchup, marinara, BBQ, and seafood cocktail sauces. The dunk cups are a convenient way to enjoy on-the-go, delicious sauces with menu items such as fries, burgers, chicken tenders, shrimp, and so much more!

Scan to request a free sample kit!

EDITORIAL

EDITOR EMERITUS

John Lofstock

EDITOR-IN-CHIEF

Erin Del Conte edelconte@wtwhmedia.com

SENIOR EDITOR

Emily Boes eboes@wtwhmedia.com

ASSOCIATE EDITOR

Zhane Isom zisom@wtwhmedia.com

ASSOCIATE EDITOR

Marilyn Odesser-Torpey

ONLINE EDITOR

Kevin McIntyre

CONTRIBUTING EDITORS

Mark Battersby

Anne Baye Ericksen

John Geoghegan

Howard Riell

COLUMNISTS

Mike Maxell

Bruce Reinstein

SALES TEAM

KEY ACCOUNT MANAGER

John Petersen jpetersen@wtwhmedia.com

(216) 346-8790

VICE PRESIDENT, SALES

Tony Bolla tbolla@wtwhmedia.com

(773) 859-1107

REGIONAL SALES MANAGER

Patrick McIntyre pmcintyre@wtwhmedia.com

(216) 372-8112

REGIONAL SALES MANAGER

Simran Toor stoor@wtwhmedia.com

(770) 317-4640

CUSTOMER SERVICE

CUSTOMER SERVICE MANAGER

Stephanie Hulett shulett@wtwhmedia.com

CUSTOMER SERVICE REPRESENTATIVE

Jane Cooper jcooper@wtwhmedia.com

WTWH MEDIA, LLC

LEADERSHIP TEAM

CEO Scott McCafferty smccafferty@wtwhmedia.com

CO/FOUNDER, VP SALES

Mike Emich memich@wtwhmedia.com

EVP Marshall Matheson mmatheson@wtwhmedia.com

CFO Ken Gradman kgradman@wtwhmedia.com

CREATIVE SERVICES

VICE PRESIDENT, CREATIVE DIRECTOR Matthew Claney mclaney@wtwhmedia.com

CREATIVE DIRECTOR Erin Canetta ecanetta@wtwhmedia.com

DIRECTOR, AUDIENCE DEVELOPMENT Bruce Sprague bsprague@wtwhmedia.com

EVENTS

DIRECTOR OF EVENTS

Jen Osborne josborne@wtwhmedia.com

EVENTS MANAGER Brittany Belko bbelko@wtwhmedia.com

EVENTS MARKETING SPECIALIST

Olivia Zemanek ozemanek@wtwhmedia.com

EVENTS COORDINATOR Alexis Ferenczy aferenczy@wtwhmedia.com

VP, ASSOCIATION & COMMUNITY ENGAGEMENT Allison Dean adean@wtwhmedia.com

VIDEO PRODUCTION

VIDEOGRAPHER Garrett McCafferty gmccafferty@wtwhmedia.com

VIDEOGRAPHER Kara Singleton ksingleton@wtwhmedia.com

VIDEOGRAPHER Cole Kistler CKistler@wtwhmedia.com

DIGITAL MARKETING

VICE PRESIDENT, DIGITAL MARKETING Virginia Goulding vgoulding@wtwhmedia.com

DIGITAL MARKETING MANAGER Taylor Meade tmeade@wtwhmedia.com

DIGITAL MARKETING MANAGER

Kayla Polansky kpolansky@wtwhmedia.com

WEBINAR COORDINATOR Halle Kirsh hkirsh@wtwhmedia.com

WEBINAR COORDINATOR Kim Dorsey kdorsey@wtwhmedia.com

DIGITAL DESIGN MANAGER Samantha King sking@wtwhmedia.com

MARKETING GRAPHIC DESIGNER Hannah Bragg hbragg@wtwhmedia.com

WEB DEVELOPMENT

DEVELOPMENT MANAGER Dave Miyares dmiyares@wtwhmedia.com

SENIOR DIGITAL MEDIA MANAGER Pat Curran pcurran@wtwhmedia.com

DIGITAL PRODUCTION MANAGER Reggie Hall rhall@wtwhmedia.com

DIGITAL PRODUCTION SPECIALIST Nicole Lender nlender@wtwhmedia.com

1111 Superior Ave., 26th Floor, Cleveland, OH 44114

Ph: (888) 543-2447

EDITORIAL AND NAG

1420 Queen Anne Road, Suite 4, Teaneck, NJ 07666 Ph: (201) 321-5642

SUBSCRIPTION INQUIRIES

CStore Decisions is a three-time winner of the Neal Award, the American Business Press’ highest recognition of editorial excellence.

EDITORIAL ADVISORY BOARD

Robert Buhler, President and CEO

Open Pantry Food Marts • Pleasant Prairie, Wis.

Lisa Dell’Alba, President and CEO

Square One Markets • Bethlehem, Pa.

Raymond Huff, President

HJB Convenience Corp. • Lakewood, Colo.

Bill Kent, President and CEO

The Kent Cos. Inc. • Midland, Texas

Olivia Beck • Operations

Beck Suppliers Inc. • Fremont, Ohio

Reilly Robinson Musser, VP, Marketing & Merchandising

Robinson Oil Corp. • Santa Clara, Calif.

Bill Weigel, CEO

Weigel’s Inc. • Knoxville, Tenn.

NATIONAL ADVISORY GROUP (NAG) BOARD

Vernon Young (Board Chairman), President and CEO

Young Oil Co. • Piedmont, Ala.

Joy Almekies, Senior Director of Food Services Global Partners • Waltham, Mass.

Mary Banmiller, Director of Retail Operations

Warrenton Oil Inc. • Truesdale, Mo.

Greg Ehrlich, President Beck Suppliers Inc. • Fremont, Ohio

Doug Galli, Real Estate/Government Relations Reid Stores Inc./Crosby’s • Brockport, N.Y.

Derek Gaskins, Senior VP, Merchandising/Procurement Yesway • Des Moines, Iowa

Joe Hamza, Chief Operating Officer Nouria Energy Corp. • Worcester, Mass.

Brent Mouton, President and CEO

Hit-N-Run Food Stores • Lafayette, La.

Robin Hunt, Sales Hunt Brothers Pizza • Nashville, Tenn.

Kyle May, Director External Relations Reynolds Marketing Services Co. • Winston-Salem, N.C.

Tony Woodward, Manager Sr. Account McLane Company Inc. • Temple, Texas

YOUNG EXECUTIVES ORGANIZATION (YEO) BOARD

Kalen Frese (Board Chairman), Director of Merchandising

Warrenton Oil Inc. • Warrenton, Mo.

Jeff Carpenter, Director of Education and Training

2011 - 2020

To enter, change or cancel a subscription, please go to: http://d3data.net/csd/indexnew.htm or email requests to: bsprague@wtwhmedia.com

Copyright 2023, WTWH Media, LLC

CStore Decisions (ISSN 1054-7797) is published monthly by WTWH Media, LLC., 1111 Superior Ave., Suite 2600, Cleveland, OH 44114, for petroleum company and convenience store operators, owners, managers. Qualified U.S. subscribers receive CStore Decisions at no charge. For others, the cost is $80 a year in the U.S. and Possessions, $95 in Canada, and $150 in all other countries. Single copies are available at $9 each in the U.S. and Possessions, $10 each in Canada and $13 in all other countries. Periodicals postage paid at Cleveland, OH, and additional mailing offices. POSTMASTER: Send address changes to CStore Decisions, 1111 Superior Avenue, 26th Floor, Cleveland, OH 44114. GST #R126431964, Canadian

Publication Sales Agreement No: #40026880.

CSTORE DECISIONS does not endorse any products, programs or services of advertisers or editorial contributors. Copyright© 2023 by WTWH Media, LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, or by recording, or by any information storage or retrieval system, without written permission from the publisher. Circulation audited by Business Publications Audit of Circulation, Inc.

Cliff’s Local Market • Marcy, N.Y.

Megan Chmura, Director of Center Store GetGo • Pittsburgh

Ryan Faville, Director of Purchasing

Stewart’s Shops Corp. • Saratoga Springs, N.Y.

Cole Fountain, Director of Merchandise Gate Petroleum Co. • Jacksonville, Fla.

Alex Garoutte, Director of Marketing The Kent Cos. Inc. • Midland, Texas

Daillard Paris, Director of Petroleum Supply and Trading Sheetz Inc. • Altoona, Pa.

Fresh o its 24th acquisition, ARKO Corp., led by CEO Arie Kotler, earmarks over $2 billion for continued mergers and acquisitions (M&A) growth as it integrates recently purchased chains into its portfolio.

Seeking multi-unit operators and developers to continue IHOP’s growth in travel centers nationwide and offering varied incentives for development.*

• Develop/operate a nationally recognized and trusted brand that will broaden your customer appeal

• 65+ years of giving guests the good comfort food they love and the updated favorites they want to try… at a great value

• A variety of menu options serving all dayparts, giving guests the flexibility of choice

• Updated exterior and interior restaurant design to provide all travelers a comfortable environment at any daypart

• Portable menu items and digital ordering offer a convenient guest experience

Interested in learning more… Contact Us franchising@ihop.com

*Subject to Franchise Agreement and Development Agreement Terms. © 2023 IHOP Franchisor LLC. This is not an offer to sell a franchise. An offer can be made only by means of a Franchise Disclosure Document that has been registered and approved by the appropriate agency in your state, if your state requires such registration, or pursuant to availability and satisfaction of any exemptions from registration. IHOP Franchisor LLC, 10 W. Walnut St., 4th Fl., Pasadena, CA 91103. (866) 995-3463

For any questions about this issue or suggestions for future issues, please contact me at edelconte@wtwhmedia.com.

Today’s c-stores are facing more competition and industry shifts than ever before. Not only are they battling for customer attention against other c-stores, but they’re fending off heightened competition from other channels, including quick-service restaurants (QSRs), grocery stores, drugstores and dollar stores. Delivery apps and e-commerce across industries are also vying for share of customer wallets.

With tobacco regulations on the horizon, fuel efficiency growing and electric vehicle charging expanding, retailers across the industry are taking stock and planning ahead for tomorrow. After all, if there’s one thing this industry does with expert precision, it’s adapt to change and roll with the punches.

I’m reminded of that popular quote (the internet is divided on the author) about how some are lost in the fire and others are built from it. It’s evident that many c-store chains represent the latter. In response to attacks on their business, these c-stores are embracing innovation.

Increasingly, c-stores are adding or upgrading loyalty programs that act as the cornerstones of robust mobile apps and are more personalized to the customer. They’re also doubling down on foodservice as they invest in growing their menus through proprietary offerings. In 30 years, c-store food has gone from the punchline of a joke to high-quality fare that is now competitive with QSRs. Not an easy feat. Would we have reached this milestone if not for the competitive heat?

Alongside an increasing commitment to foodservice, c-stores are giving renewed attention to the dispensed beverage section as customer preferences evolve. As technology continues its rapid rise and stores are now tracking and, more importantly, better integrating and utilizing data, retailers have never had better tools for expertly crafting their planograms.

ARKO Corp., featured in this month’s cover story, is the perfect example of a company not only committed to growth but also focused on evolving its fleet of c-stores to meet the demands of tomorrow.

As it brings recently acquired chains under its umbrella, ARKO is focused on three key pillars: 1.) Focusing on core destination categories, such as candy, packaged beverages, salty snacks, packaged sweet snacks and beer; 2.) Leveraging its fas REWARDS loyalty program; and 3.) Expanding the foodservice and beverage offerings in its stores.

When it comes to the latter, ARKO is growing its proprietary foodservice offerings, including pizza, chicken and prepared sandwiches, roller grill and dispensed beverages, and identifying the price points that resonate with customers across the menu.

A quality loyalty program can especially set a c-store chain apart from the competition.

ARKO relaunched its fas REWARDS program in 2020, and this past March, it upgraded its fas REWARDS app. Its focus on loyalty is paying off. ARKO found its loyalty members took about six times more trips per month than non-loyalty members and spent on average about $60 more per month during Q2 2023.

This month’s Loyalty Program Awards article highlights Gulf Oil and Kum & Go for their recent loyalty program relaunches. Gulf Oil recently relaunched its mobile payments and loyalty program Gulf Pay in March to offer a more sophisticated and personalized loyalty offering.

Des Moines, Iowa-based Kum & Go, which was acquired by FJ Management, parent company of Maverik, at the end of August, revamped its app and loyalty program &Rewards and launched it on Aug. 1. The new app provides flexibility, personalization and a better opportunity for the chain to interact with its customers.

As c-stores look to the future, there’s a lot of uncertainty about just how the landscape will evolve, but savvy retailers, who are letting the competition fuel them, are monitoring trends, testing new innovations, considering how to increase their competitive edge and, most importantly, they’re not afraid of change.

Prasek’s Family Smokehouse, which operates two locations in Sealy, Texas, and El Campo, Texas, isn’t your average convenience store chain.

This smokehouse not only provides traditional cstore products, but it also offers a home-inspired interior, daily lunch specials, a robust bakery offering and a variety of fresh, frozen and smoked meat options.

Like most c-stores, Prasek’s offers convenient fuel pumps, snacks, dispensed beverages and coffee. However, the smokehouse also gives customers the option to shop online and provides other retailers, including 7-Eleven, H-E-B and Road Ranger, with wholesale meat products.

“Even though we fit into the c-store category, we don’t position ourselves as a c-store. We position ourselves as a smokehouse and a stop along the highway where people can come in and dine while offering all the c-store items,” said Duane Korenek,

general operations manager for Prasek’s Family Smokehouse. “We also produce our own smoked meat products and sell them in our retail outlets and across the country as well.”

“We are a destination to truly stop and relax. We want people to come in and feel like they’re at home and feel like family,” added Lannah Stoner, marketing manager for Prasek’s. “We like to say we are a destination for meat lovers, bakery enthusiasts, tourists and locals. Overall, the feel of our stores is what really sets us apart from other c-stores.”

Prasek’s Family Smokehouse started off as a small-town grocery store in Hillje, Texas, owned by Mike and Betty Jo Prasek in 1974. Over the years, the grocery store evolved into the smokehouse it is today, with the first Prasek’s opening in 1981. As the company grew, so did the generations of family members involved in the family business.

Prasek’s Family Smokehouse combines smoked and fresh meat options with traditional c-store fare in a comfortable, welcoming environment.

Zhane Isom • Associate Editor

Mike and Betty Jo went on to have three children who currently help run the business. Mike Prasek Jr. is in charge of product management, Michelle Korenek, Stoner’s mother, is in charge of accounting, and Troy Prasek is responsible for general operations.

“Pretty much all of the family members involved in the company joined as kids. However, I have been a part of the company for 30 years,” said Korenek.

Even though Stoner didn’t get involved in the family business until November of 2022, she was always around as a kid given that her grandparents founded the smokehouse and both her parents and in-laws worked there.

“As far as generations go, we are tapping into the third generation of family members working here, which is my sister and I,” Stoner said.

Prasek’s goal is for all its customers to feel like family and be able to relax while visiting the smokehouse. Prasek’s Western home-inspired interior and exterior are what really set it apart from other c-stores and keep customers returning.

“I would describe the outside of our locations to be a dressy Western style, while the interior of the locations is very homey feeling, warm and comfortable, and just a place to stop and relax,” said Korenek. “The interior also has warm tones and color schemes, along with many wood and stone finishes.”

Despite the El Campo and Sealy, Texas, locations offering a comfortable home environment, the two sites provide customers with slightly different features.

“The retail space at our El Campo location is about 19,000 square feet, while our retail space in Sealy is about 42,000 square feet,” said Korenek. “Each location also offers different brands of gas, including Shell and Exxon.”

To make the interior of both locations feel even more like home, both smokehouses offer aspects found in some homes for customers to enjoy and look at while shopping or sitting down to rest.

“Both locations offer fish aquariums, with one being 1,200 gallons and the other being 3,000 gallons, which are pretty big for aquariums,” said Korenek. “The idea behind them is to give our locations the homey feel we pride ourselves on.”

Prasek’s offers its customers a variety of different smoked and fresh meat options to choose from. Whether they are cooked on-site or pre-seasoned for customers to take home and cook, Prasek’s meat offerings are made fresh every day.

“Our fresh meat line is served at our Big H Grill, which comes from our mascot name, where the H stands for Hillje, in reference to where we are stationed. Also, in Big H Grill, we offer daily lunch specials, gourmet sandwiches and classic sandwiches,” said Stoner. “We also provide convenient meat items as well. We have cases and freezers of meat we prepare and season so customers can grab it to take home and cook.”

The smokehouse also offers a variety of barbecue meat, including brisket, ribs, chicken and smoked turkey. With those barbecue items, customers can

choose from a number of country-style sides like corn, green beans, pasta salad and butter potatoes. Prasek’s even offers gourmet cheeses and 27 different kinds of jerky.

Aside from its fresh and smoked meat options, Prasek’s provides its customers with numerous baked good options to choose from. However, its No. 1 seller is its kolache.

“Since we have a dense population of German and Czech heritage, we offer different flavors of kolache, including fruit- and cheese-filled ones,” said Korenek. “We also offer freshly made pigs in a blanket, cinnamon rolls, breakfast sandwiches, biscuits, pies and strudels.”

While Prasek’s focuses on providing smoked meat, fresh meat, barbecue and baked goods, consumers can still purchase grab-and-go items found in most c-stores.

“We do not offer bean-to-cup coffee machines, but we do offer coffee that is brewed fresh every day,” said Stoner. “We also have the option to make cappuccino, along with other coffee flavors, fountain drinks and ICEE.”

“One of the things we like to brag about our coffee program is we buy it from a local roaster in Houston. Our coffee beans are roasted so fresh that most of the time when it comes in a box, they are still warm,” added Korenek.

Stoner also mentioned that Prasek’s is known for its

sweet tea, which currently has its own billboard.

“We even have a selection of wine to choose from, along with our standard c-store beverages, including beer, water and other bottled drinks,” she said.

In terms of takeout, Prasek’s gives customers the option to order ahead and pick up inside the smokehouse.

“We like to tell people there is no order too big. If you need 200 cinnamon rolls from the bakery made fresh, just give us a couple of days’ notice, and we can take care of that order,” said Stoner.

Prasek’s is constantly looking for ways to improve its locations and brand, whether it’s potentially adding a loyalty program or eventually building new sites. Nonetheless, the main aspect Prasek’s is focusing on moving forward is expanding its brand so others can enjoy all of the fresh products it has to offer.

“Right now, we are in a brand awareness growth mode,” said Korenek. “We are distributing our products to over 1,000 different locations throughout Texas, Florida and the Midwest. We want to eventually offer our products in other states.”

Korenek also mentioned the possibility of opening smaller locations in urban areas in the years to come.

“Since both of our locations right now are in rural areas, we hope to eventually open Prasek’s smokehouses in more urban areas,” he said. “We just want to capitalize on what we have and what we know in a more urban setting.”

As Dash In focuses on its goal of creating “better experiences” for guests, employees and its communities, it’s implementing diversity, equity and inclusion practices, including two inaugural employee research groups.

Erin Del Conte • Editor-in-Chief

that says, “We grow and become leaders in our markets by delivering better experiences for our customers, each other and our communities.” To deliver better experiences we must know what our stakeholders value. (We also must) acknowledge who they are, understand their needs and experiences, learn what motivates and inspires them, and work together toward goal alignment. We try not to think of it as an “initiative,” but more a lasting cultural norm — a way of being, a way of working, a way of doing business and a way of engaging with our communities.

CStore Decisions caught up with Rayma Alexander, director of corporate communications & DEI for The Wills Group, to learn more about how the company is approaching DEI across its network. Dash In operates 55 stores — 41 franchise locations and 14 company-operated sites in Maryland, Virginia and Delaware. The Wills Group has another 225 locations that operate under the legacy gas station model; including Shell, Exxon and other major oil brands.

CStore Decisions (CSD): Why is DEI an important initiative for Dash In?

Rayma Alexander (RA): For us it all starts with what we call “The Simple Plan.” It’s our internal doctrine

CSD: How is Dash In approaching DEI today?

RA: The Wills Group and family of companies, Dash In, Splash In and SMO Motor Fuels, all operate under a single promise and intention.

Statement: At The Wills Group and our family of businesses, including Dash In, Splash In and SMO Motor Fuels, diversity and inclusion is core to achieving our mission of being the preferred choice for employees, customers and business partners in our chosen markets and geographies.

Promise: Our teams reflect the diverse communities we serve. We embrace the uniqueness of individuals and support equitable opportunities and belonging for all, leveraging employee voices in our

The Wills Group, the parent company of Dash In convenience stores, is working toward making diversity, equity and inclusion (DEI) a way of life for the chain, embedding DEI practices into the chain’s culture from the way it does business to how it serves communities.

business processes to deliver products, services and experiences that exceed our customers’ expectations.

Add to that a planned learning curriculum that includes courses like: The Business Case for Diversity and Inclusion; Managing Inclusion, Inclusive Leadership and Microaggressions. These trainings are biannual and offered with the intent of keeping DEI topics fresh and actionable.

CSD: I understand Dash In is starting employee resource groups. What are these, how are they beneficial and how do they work?

RA: The Wills Group and Dash In have already launched our two inaugural employee resource groups (ERGs). We held a session to help our employees understand the value of ERGs — affinity, personal and professional growth, business support, community outreach — and then we left it to them to decide which ERGs they wanted. They chose what is now Women of Wills (Professional Women) and Families in Motion, just as it sounds. They establish their own mission, vision and goals and are provided a budget to help execute.

We also have a Diversity Council, which meets a couple of times a year. It includes: the ERG officer teams, a DEI advisor, the executive vice president of talent and people operations, myself, and the president and chief operating officer. We review progress, policies and practices, and discuss challenges and opportunities as a group.

CSD: Dash In has been designated a Best Places to Work. How important is a diversity, equity and inclusion focus to being able to resonate with employees today? Is this something you think chains need to have? Why or why not?

RA: Yes, we have attained Great Place to Work (GPTW) certification for two years in a row now. We are immensely proud of this designation and the positive way it resonates with employees, potential hires, customers and our neighbors. What’s great about it is the submission process makes us introspect and take inventory of all the things we are doing for our employees. For us, richer benefits, a DEI learning track, diversity hiring and community engagement all make positive impacts. Absolutely,

it’s important to truly embrace diversity, equity and inclusion. It adds so much more depth to employee and community engagement, decision-making and the customer experience.

CSD: From an employee retention and satisfaction perspective, how is a focus on DEI making a difference at Dash In?

RA: Our employees know that we have something special going on at the company. That we are embracing DEI and holding ourselves accountable with things like the annual GPTW certification and our intention with diversity hiring and community engagement. Just the fact that I was brought in to lead this effort at The Wills Group and Dash In says something.

CSD: What are Dash In’s DEI goals going forward?

RA: We want to continue to be intentional in our hiring, promotion, learning and inclusion practices with a keen focus on culture, talent, communities and clients, such that good DEI practices are fully embedded into our culture, practices and actions naturally. We believe we are better when we celebrate differences and leverage them to grow as a team and a company.

CSD: What advice do you have for other chains interested in DEI programs?

RA: Do your research. Start by taking time to listen to your people at every level of the organization. Bring in neutral experts and DEI leaders to help you understand your talent flow, your customer proposition and your DEI opportunities. Be open-minded, patient and courageous. Take your employees on the journey with you.

CSD: For any c-store chain listening that is interested in doing more around diversity, equity and inclusion, where would you recommend they start?

RA: Gain buy-in in the C-suite. Influencers and decision-makers need to work together. Make the investment, and hire a consultant to guide your efforts initially. They will help you gain perspective and chart a course for DEI success that fits your organization. At the end of the day, it’s about advancing humanity and inclusion and equity for all.

® Tray Merchandising

Our revolutionary Tray and WonderBar Merchandising System is designed and manufactured with the most innovative accessories to increase facings, maximize visibility, enhance package billboarding, ensure product rotation, and reduce shrinkage for a full range of frozen, refrigerated and general merchandise products. Easy to install and adjust, this complete merchandising system also ensures quick restocking.

Radius or Square Tray Sidewalls

Trion will help you optimize your display space, attract customers, increase sales and cut labor costs—and our products are built to last. No wonder we’re the industry’s leading manufacturer and supplier, with more than 16 million trays earning high praise from retailers and shoppers every day!

—

WonderBar ®

Tray Merchandising

n Increases facings by 20% to 35% in many categories.

Automatically billboards and faces product.

n Automatically billboards and faces product.

n Reduces losses from bag hook tearout.

n Allows rear restocking and proper date rotation.

™

MODERNIZE YOU R MERCHANDISING — SELL MORE IN THE SAME SPA YOUR ™

n Dramatically increases sales in the same space.

Dramatically increases sales in the same space. Adjusts to accommodate various package widths. 3

When it comes to impulse buying, imagine how a substantial gain in product variety can boost sales. By enabling you to display hooked and tray packages as well as tall, wide and heavy products — WonderBar® helps you maximize the graphic impact of manufacturers’ colorful package designs.

n Dual lane tray accepts two narrow items for side-by-side merchandising.

n Specialized front stops add support.

n Seamlessly integrate signage into your display for better presentation and navigation.

n Reduced losses from bag hook tearout.

n Adds 25-35% more product in 12' set.

n Draw traffic to center aisle candy.

n Great for large lay-down bags, gum, gusseted bags, large family packs, candy bars, licorice, novelty candy, theatre packs and specially packed seasonal favorites.

n Consistently better product presentation with less labor time spent facing.

With the WonderBar® Tray and Bar Merchandising System, now you can bring related products neatly together like bagged salad, dressing and bacon bits in ways not previously possible. Fit many more items, sell families of products in different sizes and increase impulse buying with cross-sells and adjacencies.

n Dual lane tray accepts two narrow items for side-by-side merchandising.

n Unique design features separate paddles to push each lane forward individually.

n Asymmetrical lanes sell different-width products. Great for cross merchandising.

n Each lane adjusts to fit products as small as 1¾" wide.

n Mini and Standard width trays available. Mini adjusts from 3 3/8" to 6 1/2" wide and Standard adjusts from 5 1/2" to 8" wide.

Trion’s double-wide, adjustable tray expands beyond 17" to handle even your largest round, square and rectangular packages. With dual pushers and up to six heavy-duty springs, this tray empowers you to keep the heaviest products moving smoothly day after day, year after year.

n Optimally display round and square pizzas, family packs and multipack entrées.

n Maximize display space.

n Adjusts for packages from 10½" to 17½".

n Dual pushers ensure an even, steady push to the front of the tray.

n Heavy-duty construction.

n Easy to install, adapt and restock.

Trion’s WonderBar® solutions keep round, oval, loaf, square sliced meats and bologna optimally faced for enhanced shopability, easy product rotation, added freshness and reduced shrinkage loss. A wide range of depths, widths and package capabilities give you a strong competitive edge for all your refrigerated retailing.

n Ideal for bologna, bacon, hot dogs, tub meats, sausage, pepperoni and Lunchables.®

n Innovative bologna tray design solves inadvertent popout when first package is dispensed.

n Increase 6 rows / 42 facings to 7 rows / 49 facings in typical 4' set.

n Designed for easy stocking & re-planogramming.

n Optional locking pusher paddle.

n Trays lift out for rear loading.

n Unique baffle system ensures optimal air flow in open front coolers.

n Heavy-duty construction.

Nothing attracts shoppers better than fresh produce, and nothing displays refrigerated produce better than Trion’s Tray and Bar Merchandising System. Face more packages, accommodate a wider range of shapes and sizes, restock easily, and manage dated produce better.

n Air flow baffles maintain optimal product temperature and extend shelf life.

n Trays lift out for rear restocking and proper rotation.

n Versatile spring tension is gentle on delicate produce.

n Handles regular bags, pillow packs and gusseted bags.

n Space gains allow better cross-merchandising.

n Long-life, durable cooler-capable steel construction.

n Add rows of additional product.

The WonderBar® Tray and Bar Merchandising System is the new face of cheese and fresh pasta. Shredded, blocks, cubed, sliced, string and individually wrapped you name it, we tame it. Never before has it been this easy to billboard these delicate products, improve their rotation and reduce their shrinkage.

n The total bar solution for hooked and bagged items and tray displays.

n Typically adds 2 rows of product; optimizes merchandising space.

n Trays lift out for rear restocking and proper rotation.

n Air flow baffles maintain optimal product temperature and extend shelf life.

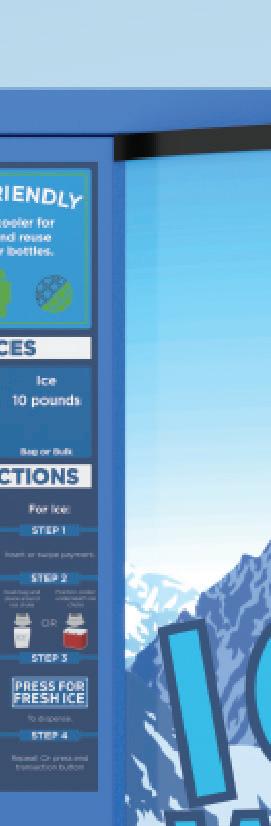

Trion improves shoppers’ perception of frozen foods, increases the amount of product on display, saves energy, and makes stocking, resetting and re-planogramming a breeze. By withstanding the demands of cold environments, our freezer-friendly system and materials have proven reliability. And, when your frozen foods are consistently billboarded in a tray, you’ll experience less product loss in back compared to shelves.

n Keeps entrées, dinners, bagged and boxed vegetables, novelties and large packages upright, faced and billboarded.

n Gain 12-17% product per door.

n Save 1-1½ hours of labor per day facing product.

n Better visibility and shopability; reduces door openings by 25% and saves energy.

Only Trion WonderBar® offers one solution that enables you to consistently face and easily stock virtually any product— hardware, soft goods, coffee, dry goods, air fresheners, light bulbs, pet treats and anything else your customers demand — and increase sales for any category.

n Full range of bars, trays, hook styles, pushers, spring tensions, label holders and signs adapt to any product, any size, storewide.

n Wire trays for shelf use available.

n Hybrid locking anti-sweep hook deters theft.

n Adjustable tray width addresses the demands of bags, boxes, clamshells, blister packs and oversize packages.

Simple design allows for one man installation. Universal Mounts quickly fit into both thick- and thin-walled gondolas, coolers and freezers.

WonderBar is compatible with most existing bar merchandising systems, bar shapes, and tool-free as well as threaded fastener mounts. Available in 30," 3' and 4' lengths.

Bar adjusts in 1" vertical increments for tool-free and threaded fastener systems. Saddle mount trays and hooks easily and infinitely adjust horizontally along the bar.

Includes pusher trays, saddle hooks, airflow baffle systems, adjustable labeling and sign options. Upgrade to plug-in hooks and label systems.

As many as 7 standard tray depths ranging from 13" to 24" to fit your exact merchandising needs. Plus custom trays and tray depths are available.

Trays adapt to fit the width of virtually all products and package styles with Oversize, Standard, Dual and Mini Trays accommodating lane widths from 1 3/ 4" to 17 1/ 2."

Metal-sidewall Bar Trays include front and rear anti-skid pads already installed, can be used directly on shelves and can be swapped from bar to shelf as needed.

Trion’s innovative solution keeps round, oval, loaf and square sliced meats and bologna faced and prevents popout of nested packages.

Dual Lane tray accepts two narrow items and allows them to be pushed forward individually. Each lane adjusts to fit products as small as 13/4" wide. Mini & Standard width trays available.

Two pushers keep large products of any shape forward & optimally faced. Trays can merchandise products from 10 1/ 2" to 17 1/ 2" wide.

Instant lift-out trays speed planogram changes and re-merchandising. Reset up to 48 facings in as little as 15 minutes. Easily create new cross-sells.

Horizontal & Vertical Sign holder systems allow easy categorization & promotion of products. Features an alignment bridge insuring consistent presentation across long displays.

Tray Label Holders are available to support drop-in, slide-in, and promo clip bib tag labels. All Holders snap directly to the front of all tray styles and sizes.

Six spring tensions and up to three mount positions in Standard Trays allow multiple combinations to fine tune push strength to any package style or product weight.

A range of standard product stops address your every need with special solutions and adaptors for more demanding package sizes and shapes.

Enhanced functionality with numerous standard pusher paddle sizes up to 6 3/4" tall, dual paddle configurations possible for Oversize and Dual Lane Trays. Imprinted paddles available.

Variety of sizes for all product heights. Features a built-in 2 1/2" x 11/2"recessed label holder. Dual paddle configurations possible for Oversize and Dual. Handles heavier product. Cooler & Freezer capable.

Fits standard size tray with pusher paddle height of 5". Optional locking pusher paddles will not lock without being engaged by user. Cooler & Freezer capable.

Minimize shrink, radically cut stocking labor, and guarantee freshness and customer satisfaction with easy lift-out trays. Load new stock at the back of the tray to insure proper product rotation.

Sidewall Extenders quickly snap-on to standard metal sidewalls to create taller lanes, better contain tall or oversize packages, and corral stacked items.

n Depth: 13" to 24"

n Adjustable width: 1¾" to 17½"

Radius or square Bar and shelf capable

n Open wire available for shelf placement

n Swap from Shelf to Bar

n Auto feed any product

n Molded pusher paddle available, both locking and non-locking styles

n Integrated signing capability

n Bridge for seamless long display

n Multiple spring/mount locations and dual-spring capability fine-tune push strength

n Integrated slide-in, drop-in and promo-clip label holders

Hooks

n Saddle-mount, anti-theft, pusher, plug-in and custom styles

n Integrate anywhere vertically within tray displays

Each component in Trion’s WonderBar ® Tray and Bar Merchandising System is designed for performance, durability, compatibility and ease of installation. Made from U.S. steel and heavy-duty wire frames, this versatile array of components will be faithfully pushing your products for many productive years to come.

n Range of heights and widths

gravity feed pouch hooks

Bars

n Lengths: 30," 3' or 4' and custom

n Saddle-mount or plug-in

n Retrofits major systems

n Tool-free installation, threaded mounts available

n Vertical 1" adjustability

n Specialized designs for round, square and oval tubs; all size bags and pillow packs; gusseted bags; boxes; bottles; clam shells; blister packs; and tall, narrow, small and/or oversize packaging.

n Radius or square metal sidewalls

n Bar and shelf capable

n Open wire sidewalls available for shelf placement

n Swap readily from Shelf to Bar as needed

n Auto feed any product

n Molded pusher paddle available, both locking and non-locking styles

©2023 Patents and patents pending. Product photography is a simulation of a retail environment and is not meant to imply endorsement by or for any brand or manufacturer.

The Deloitte Grocery Retail Executive survey asked,"What will grocery shopping be like for your customers in the next five to 10 years?" Top responses included:

Now that consumers are spending more money while shopping, due to inflation, they are relying on store brands when making purchases. 84.51° recently noted:

31% of consumers reported a strong store brand preference, while only 8% said they strongly preferred the national brand.

16% said they prefer the store brand but are open to national brands, while 29% said they like the national brand but are open to store brand.

17% reported no preference either way.

Source: 84.51°, August 2023

Based on 84.51°'s July Consumer Digest, items that shoppers are most likely to purchase during their shopping trip include:

Source: Deloitte’s Grocery Retail Executive Survey, August 2023

More consumers are using delivery services when shopping because it's convenient. However, using delivery services is starting to cost consumers more money. LendingTree's most recent survey stated that:

82% of Americans have used delivery services in the past year, spending an average of $407 a month on them. The most popular services are retail (54%), food (42%) and grocery delivery (34%)

65% of users agree they're willing to spend extra money to save time.

44% admit to spending more than they can afford on these services, with 27% doing so this past year.

68% of those who use these services believe there should be a minimum wage for delivery workers.

79% say they tip for convenience services when it's an option.

Source: LendingTree, August 2023

45% Produce

60% Ice Cream/Novelties

63% Fresh Bakery

67% Snacks/Candy

Source: 84.51 °'s July Consumer Digest

When it's time to shop, consumers look at product reviews before purchasing. As stated in PowerReviews' most recent survey of 17,500 grocery shoppers:

94% of shoppers reported reading ratings and reviews at least occasionally when shopping for groceries online, up from 90% in 2022 and 82% in 2021.

90% of consumers say they're more likely to purchase a grocery item for the first time if there are customer reviews available for it — up from 83% in 2022.

63% of online grocery shoppers pay attention to the volume of reviews for a product; 50% want to consult customers' questions and answers, 47% want customer-submitted imagery, and 24% want customer-submitted videos.

Source: PowerReview, July 2023

Consumers' spending habits are slowly returning to normal as shoppers spend more money on products they want, whether in-store, online or through delivery apps.

Fresh off its 24th acquisition, ARKO Corp., led by CEO Arie Kotler, earmarks over $2 billion for continued mergers and acquisitions (M&A) growth as it integrates recently purchased chains into its portfolio.

Erin Del Conte • Editor-in-ChiefARKO Corp., the parent company of c-store behemoth GPM Investments LLC, has been on a mergers and acquisitions (M&A) roll, aggressively growing its fleet of c-stores from 200 sites to nearly 1,550 locations over the past 10 years.

At the end of June, the company closed on its 24th acquisition since 2013. In 2023 alone, ARKO has added 159 company-operated c-stores to its portfolio through two major acquisitions.

Now, ARKO has its sights set on future growth as it folds its latest acquisitions into its portfolio. As it brings new chains under its umbrella, ARKO is focused on three key pillars: 1.) Focusing on core destination categories, such as candy, packaged beverages, salty snacks, packaged sweet snacks and beer; 2.) Leveraging its fas REWARDS loyalty program; and 3.) Expanding the foodservice and beverage offerings in its stores.

ARKO’s wholly owned subsidiary GPM Investments, the sixth-largest c-store chain in the U.S., operates in 33 states and Washington, D.C. Its more than 1,500 company-operated stores are comprised of more than 25 regional brands that have existed in their markets for an average of about 50 years. The company also supplies fuel to more than 1,800 dealer locations and operates 293 cardlock locations.

GPM, based in Richmond, Va., was founded in 2002 with 169 company-operated stores.

ARKO Holdings Ltd., under the leadership of Chairman, President and CEO Arie Kotler, acquired control of GPM in 2011. By 2013, GPM operated more than 200 Fas Mart and Shore Stop locations in Connecticut, Delaware, Maryland, North Carolina, Pennsylvania, Tennessee and Virginia.

In August 2013, ARKO Holdings began spearheading GPM’s growth path through acquisitions, starting with the purchase of 263 stores from VPS Convenience Store Group. The stores were located in North Carolina, South Carolina, Tennessee and Virginia, and included the brand names Scotchman, Young’s, Li’l Cricket, Quick & Easy Everyday Shop & Café, BreadBox and Cigarette City. The company continued to expand through acquisitions from there.

In 2020, ARKO Holdings Ltd. combined with Haymaker Acquisition Corp., a special purpose acquisition company, to become ARKO Corp., a publicly traded company on the Nasdaq Stock Market.

The company operates in four reportable segments: 1.) retail, which includes fuel and merchandise sales to retail consumers; 2.) wholesale, which in-

cludes supplying fuel to third-party dealers and consignment agents; 3.) GPM Petroleum, which sells and supplies fuel to GPM’s retail and wholesale sites; and 4.) Fleet fueling, which operates proprietary and thirdparty cardlock locations (unstaffed fuel locations) and issues proprietary fuel cards to provide customers access to a nationwide network of fueling sites.

In 2022, which marked ARKO’s second year as a public company, ARKO ranked 498 on the 2022 Fortune 500 list, which lists the largest companies by total revenue in the U.S. In 2023, ARKO again ranked on the Fortune 500 list at No. 460, moving up 38 places.

In 2022, ARKO secured a real property program agreement with Oak Street Real Estate Capital and announced four planned acquisitions: Quarles Petroleum and Pride Convenience Holdings, which both closed in 2022; Transit Energy Group (TEG), which closed in March 2023; and WTG Fuel Holdings, which closed in June 2023.

The purchase price for all four acquisitions totaled approximately $906 million, for which ARKO contributed just over $200 million.

In 2023, the company amended the Oak Street agreement, which extended the term through September 2024 and provided up to $1.5 billion in new funding.

“This was a very active 12 months. I think 2022 was the first year that we did four acquisitions in such a short order,” said ARKO’s CEO Arie Kotler. “We have a great team of people. In all of the acquisitions, we hired most of the people who worked for

those companies, and I’m very proud about that. We are adding more people. Today, all together, we have approximately 14,000 employees.”

The acquisition of Fredericksburg, Va.-based Quarles’ fleet fueling business closed in July 2022 and both complemented and grew ARKO’s core wholesale strategy, adding a mature fleet fueling platform and adding to its supply and distribution capabilities. Quarles represents the largest fleet fueling cardlock operator on the East Coast, with operations in Virginia, North Carolina, Maryland, Pennsylvania and Washington, D.C. The purchase included 121 proprietary and 64 third-party cardlock sites, which are unmanned fuel sites where customers buy fuel using fleet cards. The sites are situated on high-traffic corridors in the Mid-Atlantic region.

“Quarles was a very unique acquisition. It was a (nearly) 85-year-old company with an excellent operation,” Kotler said. “Quarles is one of the best operators, I will say, probably in the country, that I met. … And given their expertise, we felt that this was a great add-on to our company.”

Next, ARKO acquired Pride, with 31 c-stores in Connecticut and Massachusetts, for approximately $230 million, including the value of cash and inventory, in December 2022. Pride is known regionally for its fresh foodservice program and features many large-format stores, including two high-volume travel centers. At the time of the acquisition, Pride had recently broken ground on a new-to-industry (NTI) travel center in South Windsor, Conn.

The NTI Pride Travel Center measures 4,860 square

feet and opened on June 30, 2023. It features a Chester’s Chicken, a proprietary food offering, a drive-through, 12 fuel pumps, four diesel pumps and 10 high-flow diesel pumps.

The TEG acquisition, which closed in March 2023, added approximately 135 company-operated convenience stores and 181 wholesale sites, among other assets, to ARKO’s portfolio for $370 million, plus the value of inventory, and expanded the chain’s southern retail territory into Alabama and Mississippi. TEG brought new banners to ARKO such as Corner Mart, Dixie Mart, Flash Market, Market Express and Rose Mart. It also brought a transportation business with 58 trucks and 78 tanker trailers that supports the retail and wholesale business in the Southeastern U.S.

“TEG is another add-on in markets where we do business and in markets that are very close to markets where we do business. From an economy of scale standpoint, it was a great opportunity for us,” Kotler said.

ARKO closed the WTG acquisition in June 2023 for approximately $140 million, plus the value of inventory. The acquisition enhanced the company’s footprint in the Permian Basin market, with 24 companyoperated Uncle’s Convenience Stores across western Texas. The acquisition also included 68 proprietary GASCARD-branded fleet fueling cardlock sites and 43 private cardlock sites — one of the biggest fleet fueling operations in West Texas — as well as three parcels of land and nine independent dealer locations.

“This is another opportunity for us to expose ourselves to the customers that are visiting cardlocks,” Kotler added.

• Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect & engage with your ATCs 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

As ARKO integrates stores, it’s completing functional remodels, bringing stores into alignment from a merchandising and marketing standpoint.

As ARKO’s c-store business grows, its strategy is to acquire local, usually family-owned chains with long histories in their communities and substantial brand equity.

“We are in a lot of small towns,” Kotler said. “We are in a lot of rural markets, secondary markets. If you’re looking at our demographic, 40% of our retail stores are in towns that have 20,000 people or less.”

Especially in these small towns, the c-stores might be the go-to place for groceries and other products and are well known.

When ARKO acquires chains, it retains the banner names, which are familiar to the community and have meaning to their customer base.

However, when closing on particularly small acquisitions in areas where it has strong brands already entrenched, ARKO might convert the brand name to one of its well-known brands in the area.

“For example, we did a small acquisition in the Carolinas that included eight stores,” Kotler said. “One of the brands … that we have over there is called Scotchman — an over 50-year-old brand. And what we did, we converted some of those stores that we bought to the Scotchman brand because it’s a brand that customers recognize in this market.”

And make no mistake, ARKO isn’t about to pause its acquisition streak. It’s targeting continued expansion for the foreseeable future.

“Our plan is to continue to grow. We have a highly experienced team that works in-house on mergers and acquisitions,” Kotler said.

Meanwhile, ARKO is also focused on resetting its newly acquired stores, adding a larger product assortment and new promotions, and integrating the sites with its fas REWARDS loyalty program.

As ARKO integrates stores, it’s completing what it calls functional remodels of the locations, bringing the stores into alignment from a merchandising and marketing standpoint.

The move marks a shift in strategy for the chain, which in 2021 announced plans to invest $360 million over three to five years to bring 360 stores under a unified design. But when construction and supply costs skyrocketed some 40-50% post-pandemic, rather than wait for prices to come down, ARKO decided to focus on unifying the core offerings inside the stores through functional remodels.

“The idea is really what can we do inside the box, inside the store, for our customers versus just sit and wait just for a full remodel,” Kotler said.

Because ARKO usually leaves store banner names in place, it doesn’t change the façade of most stores.

“We usually go inside and try to planogram them in a way that most of our stores are being planogrammed,” Kotler said.

After the Pride acquisition, for example, it added more than 1,000 items to the stores.

“Given our size, economy of scale and our team behind the scenes, we use data and understand what exactly the customer is looking for,” Kotler said. “When I say, ‘added 1,000 items,’ it’s not that the store didn’t have any items, it’s just a matter of we added the right items. We are really trying to make sure we have the right assortment and the right product that the customers are looking for.”

As ARKO tweaks store assortment, it’s focused on its core destination categories, including candy, packaged beverages, salty snacks, packaged sweet snacks and beer. ARKO has been working to increase merchandise gross profit while decreasing its reliance on cigarettes. Since 2020, ARKO reduced its cigarette concentration from 38% to 29%, Kotler noted. The change meant it was able to offer other products to customers.

As ARKO has executed this strategy, its core destination categories, as a percentage of total merchandise sales, have increased from 38.4% in Q2 2020 to 44.6% in Q2 2023, according to the company’s 2023 Second Quarter Earnings Report. Same-store sales excluding cigarettes saw a 3.8% increase in Q2 2023 over Q2 2022.

One of ARKO’s key focus areas is expanding the food and beverage presence in its stores.

“We grew our same-store sales excluding cigarettes almost 4.6% on average over the past three years,” Kotler said. “And the reason I mention sales excluding cigarettes is because at the end of the day, the core business, it’s not cigarettes.”

Instead, ARKO sees its core business shifting to its destination categories and foodservice.

Another key change ARKO makes to stores is updating the pricing on all products to better appeal to shoppers.

“Our attractive pricing attracts the customers in the markets where we do business,” Kotler said. ARKO is also making big investments in equipment upgrades to help sites put their best foot forward on foodservice.

By the end of Q2 2023, ARKO had added beanto-cup coffee machines to more than 700 stores. So far bean-to-cup machines have already rolled out to the Pride locations, and ARKO is in the process of finalizing the bean-to-cup rollout at the TEG sites. WTG is set to follow. As it completes these rollouts it plans to add another 230 bean-to-cup machines by the end of 2023, for a total of 930 machines.

The company also has 160-plus hot grab-and-go units, 1,200 cold grab-and-go units, 700 freezers and 370-plus roller grills at the stores, with plans to add another 120 roller grills by the end of the year.

With ARKO’s model and expertise it can operate between 1,000- and 6,000-square-foot stores, Kotler explained. On average its sites measure between 2,500 to 3,000 square feet.

When it comes to the forecourt, ARKO is the third-largest Valero distributor in the country and has a relationship with all major gas brands.

“Different geographies have different supply dynamics. Having strong agreements with all of the major oil companies allows us to be very competitive,” Kotler said.

ARKO is investing in electric vehicle (EV) charging in areas where it sees an increase in EV penetration. Today, ARKO operates 15 EV charging locations totaling 62 charging ports across nine states and is set to launch another 24 EV charging sites by the end of 2024.

“We are moving with the market,” he said. ARKO plans to pursue any grants or subsidies available.

“Any market that we see an increase in EV penetration, we will assess the feasibility of adding a charging location,” Kotler said. ARKO is also working to ensure it features robust foodservice offerings at locations that feature EV charging.

While the core of ARKO’s strategy is acquisitions, it’s also taking advantage of opportunities to build NTI stores.

In addition to the Pride Travel Center that opened in June, in 2021 ARKO razed and rebuilt a Scotchman store in Rock Hill, S.C., that now measures nearly 5,700 square feet.

The company has other NTI stores “in the works right now in different stages of planning,” Kotler said.

ARKO is focused on growing its proprietary foodservice offerings, including pizza, chicken and prepared sandwiches, roller grill and dispensed beverages, identifying the price points that resonate with customers across the menu. It’s also expanding its frozen food offering.

“There’s a lot of effort being put together into the foodservice category right now,” Kotler said. “This is probably one of our biggest opportunities.”

After scaling the company rapidly over the past 10 years, ARKO is now turning its focus to developing a food offering that resonates with customers.

“We are actually peeling the onion right now. The opportunity for us is to spend more time in the stores, bring more fresh food offerings into our stores,” Kotler said.

Today, some 160-plus sites feature full-service delis that feature chicken, pizza and vegetables. ARKO also features 150-plus branded food franchise programs, including Dunkin’ and Subway. It offers a combination of proprietary and co-branded pizza programs in 200 stores.

The addition of the bean-to-cup coffee machines allows ARKO to sell fresh coffee 24/7.

“Since we did that, we have grown our coffee business substantially, especially with loyal customers. Loyal customers can come to the store today and they can buy coffee for 99 cents,” he said.

The company’s efforts are paying off. ARKO has seen a 13.4% year-over-year increase in retail graband-go sales in Q2 2023 as compared to Q2 2022 on a same-store basis.

Drive-through has not been a focus for ARKO, since it mainly focuses on acquisitions and hasn’t

ARKO’s wholly owned subsidiary GPM Investments operates in 33 states and Washington, D.C. Its more than 1,500 company-operated stores are comprised of more than 25 regional brands that have existed in their markets for an average of about 50 years.

built NTI stores until recently. However, its most recent NTI site — the Pride Travel Center in South Windsor — features a drive-through, and many of the company’s Dunkin’ locations offer drive-throughs.

ARKO’s fleet of c-stores provides delivery through DoorDash as well as through its recently upgraded fas REWARDS app that offers various third-party delivery options.

ARKO relaunched its fas REWARDS program in 2020, and this past March it upgraded its fas REWARDS app. The upgraded app includes memberonly “HOT deals” that aren’t available in stores, order and delivery, age-verified offers on tobacco and alcohol, a store locator with current gas prices, and a fas REWARDS dashboard where customers can monitor their rewards balance.

Today, ARKO boasts approximately 1.5 million enrolled fas REWARDS loyalty members and, as of July 31, had seen an increase of 205,234 enrolled, marketable members since relaunching the app in March.

ARKO’s 100 Days of Summer promotion, which kicked off on May 17, helped fuel the membership increase by giving customers $10 in “fas BUCKS” when they enrolled with their telephone number and correct email address. The program featured 16 unique deals on top of existing seasonal offerings — all for different limited times.

“You always need to figure out a way to engage more and more with your customers,” Kotler said. “We upgraded the app to make sure that we are communicating with our customers and providing them the different items they’re looking for.”

“For example, if you come to a store and you don’t buy fuel, we want to make sure that in the next purchase we are going to offer you some discount on fuel, so you become a fuel customer and vice versa,” he added.

ARKO found its loyalty members took about six times more trips per month than non-loyalty members and spent on average about $60 more per month during Q2 2023.

Looking ahead, ARKO has its sights set on continued expansion through acquisitions.

“Our DNA is M&A,” Kotler said. Still, ARKO is selective in the acquisition opportunities it pursues, he said.

As ARKO plans for continued growth, it reported as of June 30 more than $2 billion available for continued M&A funding, including $220 million cash on hand, approximately $602 million available under its credit lines, and up to $1.5 billion available from its amended Oak Street program agreement through September 2024.

“We are always looking to grow our base state by state by state. When we started, we started in seven states, and today we are in more than 30 states. We want to be consistent. We want to make sure that we are going to continue to grow through acquisitions,” Kotler said.

Kotler pointed out that ARKO has seen nearly 700% growth in company-operated store count over the past decade.

“We believe 2023 will be another year of strong performance and growth,” Kotler said. “We have a long runway for growth, and I am very proud of our continual progress as a company, executing our strategy of creating long-term shareholder value.”

Focusing on the three pillars — core destination categories, fas REWARDS, and food and beverage service — is a central part of the company’s expansion plans.

“The goal is to continue to grow, continue to invest money in our stores, continue to make sure we have the right offering within our stores and add more and more food and beverage offerings because … that is the No. 1 priority for us,” Kotler said.

“We are here to work with different chains, smaller chains, family chains. We are very unique,” Kotler said. “We usually not only keep their brand, we also keep their employees. We make sure that the chain that we are purchasing, that we’re keeping their legacy alive for many, many years.” CSD

Modern Store Equipment offers an unparalleled level of protection from theft with Secure Cooler and Secure Display. High power electromagnetic locks have the muscle to withstand hundreds of pounds of force per door. Access is easy with the swipe of a keycard or fob. The advanced app lets you program and control access from anywhere in the world 24/7. It’s easy to manage alcohol sales per your local laws with auto lock and unlock at the same time every day. Available on new cooler doors and can be retrofit on your existing cooler doors. Freestanding non-refrigerated displays available in 4 sizes.

C-store retailers eye seasonal opportunities this fall, as key candy segments enjoy dollar sales increases amid price hikes.

The pumpkin spice latte hails the unofficial onset of fall, but Halloween kicks off the holiday season, and convenience stores are in a prime position to gain sweet profits from the candy segment this time of year.

While some customers might not view cstores as the go-to channel for seasonal treats, the opportunity for convenience stores to capitalize on holiday candy sales continues to grow.

Consumers purchased, gifted and indulged in more than $22 billion worth of candy for Halloween, the winter holidays, Valentine’s Day and Easter in 2022, according to the National Confectioners Association’s (NCA) “State of Treating 2023” report.

Both gum and breath fresheners outperformed chocolate and candy in dollar and unit sales growth for the latest 52 weeks in the c-store channel, as prices surge.

In 2023, many c-store owners and category managers expect the upcoming holidays to further the momentum that’s been building throughout the year for many of the category’s brands.

Candy dollar sales have been trending upward, partly driven by price increases. Each of the four main product groups — chocolate, non-chocolate candy, gum and breath fresheners — posted dollar sales gains in c-stores over the past 52 weeks ending Aug. 13, according to market research firm Circana, a sign the segments have shed any lingering effects from the COVID-19 pandemic.

Gum and mints experienced more long-term reverberations from COVID-19 than many other candy offerings. As professionals continued to work from home or ease into a hybrid schedule, freshening one’s breath before meetings lost its value.

“Gum and mints were hit harder and have been slower to rebound. These products are often impulse buys and, with the reduction of foot traffic, in-store sales slowed,” said Lisa Olivares, a buyer for the Army & Air Force Exchange Service (AAFES). The retailer exclusively serves U.S. military personnel and their families on bases around the world and operates 10 distribution centers and more than 580 convenience stores.

Olivares also cited economic conditions such as inflation for customers pulling back on impulse buys. However, recent tallies pointed toward a

more positive shift for these two subcategories despite price bumps.

“The gum and mint category is bouncing back after seeing a drop-off during the COVID-19 pandemic. Sales started to come back in 2021, but (we) saw a stronger comeback in 2022,” said Carly Schildhaus, director of public affairs and communications for NCA.

Indeed, gum cashed in more than $1.1 billion in sales at c-stores over the 52 weeks ending Aug. 13, and unit sales climbed 6.1% in a year-over-year comparison, according to Circana. Breath fresheners also enjoyed sales gains, totaling more than $211 million and 4.5% growth in units.

Gum cashed in more than $1.1 billion in sales at c-stores, while breath fresheners also enjoyed sales gains, totaling more than $211 million.

Chocolate is seeing greater competition from non-chocolate confections. Chocolate banked more than $3.6 billion while nonchocolate candy earned more than $3.3 billion.

Meanwhile, chocolate is seeing greater competition from non-chocolate confections — chocolate banked more than $3.6 billion while nonchocolate candy earned more than $3.3 billion. Both subcategories incurred losses in unit sales, but less so for non-chocolate candy, which registered greater dollar sales gains than chocolate.

“Non-chocolate continues to drive growth in confections,” said Olivares. “It is currently outpacing chocolate sales by 3% and is now almost 40% of total confection sales — a 7% growth in share from 2019 to 2023.”

Some of that increased market share at AAFES could be tied to the introduction of several new products. In addition to Vegobears, vegan gummy bears, Olivares mixed in a variety of new chewy treats, including Haribo Berry Clouds and Swedish Fish Blue Raspberry Lemonade. She also stocked a selection of novelty items, such as Push Pop Gummy Pop-its and Juicy Drop Gummy Dip ‘N Stix. Her chocolate planogram welcomed Twix Cookie Dough and Caramel Cold Brew M&Ms.

“Innovation is central to the confectionery industry — including gum and mints — with

manufacturers seeking to offer consumers their classic favorites alongside brand-new treating experiences,” said Schildhaus. In fact, NCA’s research shows a majority of consumers are curious about candy, gum and mint innovations and are willing to act on those impulses. More than 60% of people will occasionally or frequently look for new candy options.

Additional market trends shaping the category include customer interest in ingredient sourcing and benefits beyond indulgence, such as gum with functional benefits.

As the days count down to Halloween, c-stores expect customers to stock up on all kinds of candy bars, bubble gum and other sweets. The trick for retailers is to keep that interest in treats piqued throughout the holidays and beyond. CSD

• Gum cashed in more than $1.1 billion at c-stores over the 52 weeks ending Aug. 13, per Circana.

• More than 60% of people will occasionally or frequently look for new candy options, according to the National Confectioners Association.

• Breath fresheners posted 4.5% growth in unit sales at c-stores, according to Circana.

f’real has the ideal self-serve frozen beverage program for you with our B6 blender. Take a look at this solution and just picture the labor-savings!

f’real’s self-service program lets customers blend their own milkshakes and plant-based smoothies with the push of a button. Save on labor with this program since all you need to do is keep the freezer stocked and let your customers blend, sip, and chill. It’s really that easy!

Let your customers do the work. They select a mouthwatering milkshake or plant-based smoothie flavor from the freezer, place the selected treat in the cup holder of the blender, select their preferred thickness, and hit blend! In about a minute, they have a blended, customized, indulgent shake or smoothie ready-to-go.

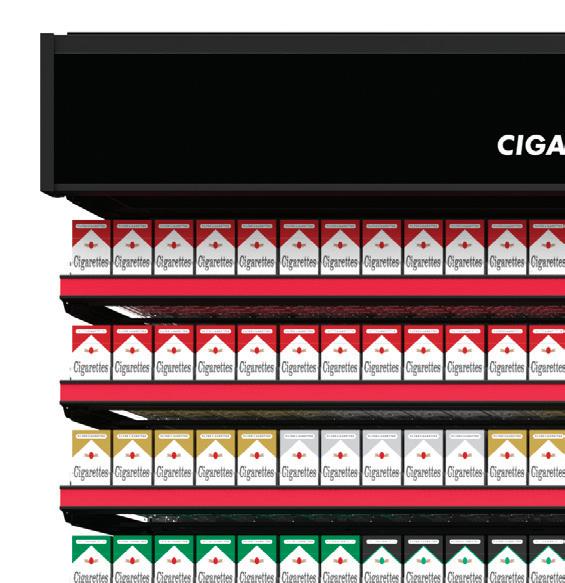

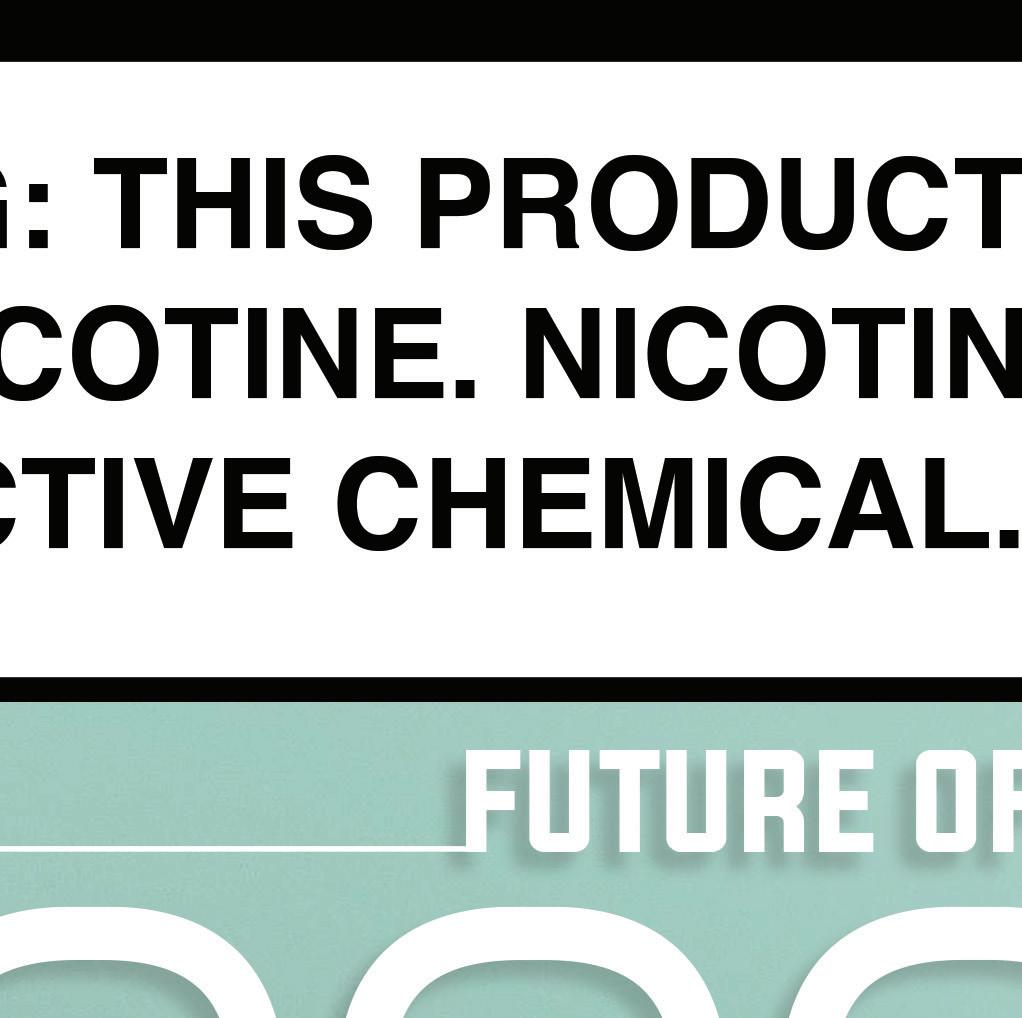

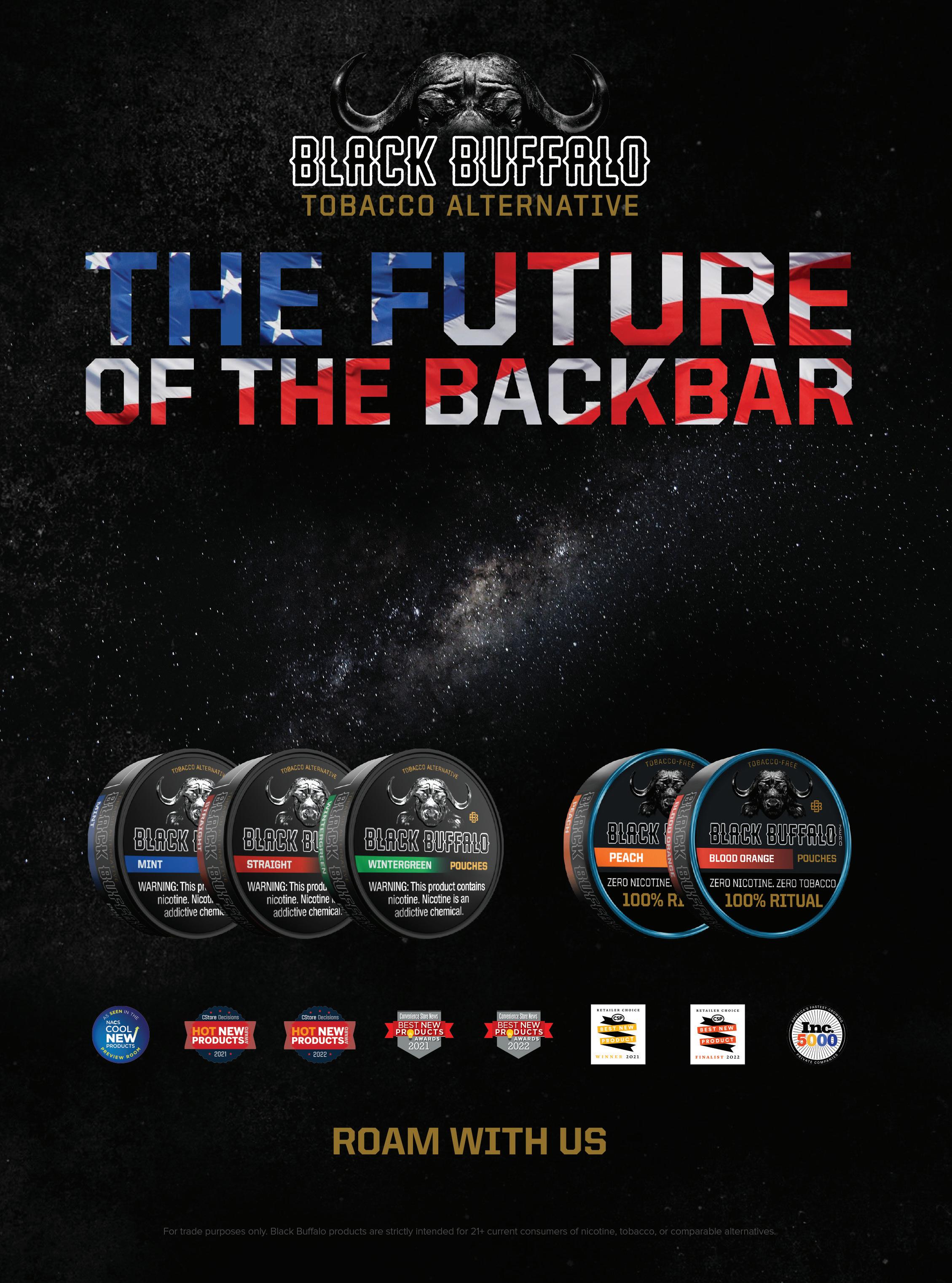

C-store retailers need to pay attention to emerging national trends as well as keep track of what their own customers are purchasing in the tobacco category to best utilize this segment of their store.

Emily Boes • Senior EditorDespite regulatory threats, tobacco remains one of the leading categories driving traffic inside c-stores, and bolstering sales for this evolving category is top of mind for many retailers.

“Success in maximizing tobacco sales revolves around having the right assortment and providing as much value as possible,” said Adam Long, senior category manager, The Rutter’s Cos.

The tobacco backbar at convenience stores is heavily influenced by FDA, state and local regulations, whether it be a statewide flavor ban or a marketing denial order on a vape product.

At press time, c-store retailers were still waiting for a finalized ruling from the FDA on a menthol and flavored cigar ban.

“In recent public comments, FDA Center for Products Director Brian King said that the final menthol rule will be published by the end of the year. In the final rule, it will likely have an effective date of one year later. This implementation could be further pushed out if there is litigation challenging the rule,” said David Spross, executive director of the National Association of Tobacco Outlets (NATO).

In addition to this, FDA has proposed a rule which would establish a maximum nicotine level. This proposed rule will be published after the final rule regarding menthol and flavored cigars is published. Spross noted that if there is also litigation, it could be years before it takes effect.

Curby’s, which has one site in Lubbock, Texas, but will potentially break ground on two more locations early in 2024, is not expecting these rulings to have an impact on sales or customer preferences as of this moment in time.

Love’s Travel Stops, however, with 644 locations in 42 states, has already seen sales drop in areas that implemented a ban and expects the trend to continue should a ban occur on the federal level.

“Customer preferences will have to adjust with regulations; they will not be allowed to purchase the items they traditionally did and will have to adjust if they want to consume nicotine,” said Victoria Sheppard, category manager, Love’s.

At The Rutter’s Cos., which operates 85 locations in Pennsylvania, Maryland and West Virginia, Long noted

As the price per unit increases across the board for tobacco, unit sales are dropping, apart from smokeless tobacco and smoking accessories. Dollar sales are also seeing gains in smokeless and accessories, as well as in electronic smoking devices (up 5%).

big brands in traditional segments continue to deliver volume and sales.

At the same time, “the engine for incrementality in tobacco continues to be next-generation products — with vapor and nicotine pouches continuing to deliver significant year-over-year growth,” he continued.

At Curby’s, with a primary demographic of 21-45-year-old females, the vape segment is “growing like crazy, with Vuse leading the way,” according to Ryan Suttles, director of operations at Curby’s.

Recently, it added Mr. Vapor to its backbar and had tested 10 SKUs earlier this year, all of which have been added to the set.

Total U.S. Convenience sales for the 52 weeks ending Aug. 13 show dollar sales for electronic smoking devices have increased by 5%, according to Chicagobased market research firm Circana. However, overall unit sales dropped 8.3% for the period, due likely to a 14.5% increase in price per unit.

The price per unit has increased across all tobacco segments, with smokeless as one of the only categories to see an increase in unit sales, particularly spitless tobacco (up 32%).

“Items in the white pouch category stand out. This area has grown exponentially year over year and continues to gain trial and adoption,” said Sheppard.

Vapor and smokeless tobacco products, including modern oral and heated tobacco products, are examples of reduced-risk products, said Spross.

“These products were introduced in the market at various times, but what it shows is the manufacturers’ commitment to innovate and provide smoke-free alternatives to the adult consumer. I expect this effort to continue,” he said.

Cigarettes, which is still the top tobacco category, has seen a 7.1% decrease in unit sales, per Circana.

Bonnie Herzog, senior analyst at Goldman Sachs, said in NATO’s recent “Current Trends in Tobacco and Nicotine: A Financial Analyst’s Perspective” webinar that there could be upcoming pressure on cigarette volume as gas prices return to higher levels and fuel demand declines. Additionally, innovation in the market and price elasticity are causing cigarette volumes to decline.

Right now, there is a wide gap between premium cigarettes and the deep discount segment.

“The (discount category) share has actually increased quite a bit over the last several years, and it’s, in my view, a function of that widening gap. Also, the deep discount category has continued to take share,” said Herzog.

“There has always been a deep discount tier, but the trends have been exacerbated in recent years due to macroeconomic factors (i.e., high gas prices) and the widening price gap between premium and discount. Those two factors will determine whether the trend continues,” said Spross.

Understanding the overall tobacco market is crucial to bettering sales at a single store or chain.

“Retailers have to be on top of trends in emerging subcategories as well as within established categories to be able to be first to market with innovation and to be able to present the customer with timely value propositions throughout the year,” said The Rutter’s Cos.’ Long.

• The ruling on the Food and Drug Administration’s menthol and flavored cigar ban should take place by the end of the year.

• Price per unit is increasing in all tobacco categories, per Circana.

• Tobacco innovation continues to grow, especially with reduced-risk products.

Sheppard also noted the importance of adjusting frequently to cater to new trends.

“Play with your affinities and place items that are frequently purchased together close to each other,” she continued. “Always follow legislative topics so you know what is coming down the pipeline and do not oversaturate categories that could be impacted.”

Curby’s Suttles emphasized that organizations of any size should overall also listen to customers, as they will communicate what they want. CSD

Now that the 2018 Farm Bill is up for renewal after five years, the fate of CBD and other cannabinoids is once again up for consideration.

Zhane Isom • Associate EditorThe opportunity for cannabidiol (CBD) sales in c-stores hangs in the balance as retailers wait to learn the fate of this growing category.

In 2018, the Agriculture Improvement Act (Farm Bill) removed hemp and hemp-derived CBD from the Controlled Substance Act. Also, since the Farm Bill has been in effect, the Food and Drug Administration (FDA) announced that CBD can’t be marketed as a food additive or dietary supplement.

However, the Farm Bill is up for renewal after five years, and CBD and other cannabinoids are again up for consideration. To help find a legal pathway for CBD and other hemp-derived cannabinoid products, Congress recently announced a Request for Information (RFI), which allowed individuals to provide input on a way to create an approach to regulate these cannabinoids through Aug. 18.

“I am waiting to see how Congress will tackle hemp-derived products in the Farm Bill. Every five years, the Farm Bill is renewed. One portion of the bill passed in 2018 reclassified and redefined cannabis sativa as hemp, making it legal to grow and sell in the U.S.,” said Leah Heise, constellation advisor to global strategy and management consultancy for Kearney. “Essentially, Congress defined a plant. They did not define what the finished products were, which created a booming industry based on ambiguity. It’s time for that ambiguity to be clarified for the public and the industry itself.”

Some experts also believe that the RFI is a great way for Congress to find a way to regulate CBD products.

“As Congress continues to deliberate reform for the 2023 Farm Bill, it’s important to hear from cannabis operators, scientists, nonprofits, indus-

try groups and advocates,” said Madeline Grant, business development manager for Management Science Associates Inc. “It’s important that members of Congress consider all these thought-out priorities as it would be instrumental in providing clarity and safety to the cannabis industry.”

Even though Congress and the FDA are still looking for a way to regulate CBD products, the CBD market continues to thrive.

“The market for CBD has grown rapidly since the passage of the Farm Bill. Today, the market is projected to be valued at $7.7 billion with a valuation in 2030 of $22.05 billion,” said Heise.

Heise pointed out that CBD vape products led CBD sales at convenience stores in 2022 with $74 million in sales, according to Statista.

Consumers use different cannabinoids for

many reasons, including anxiety, pain relief, inflammation and even lowering blood pressure. Nonetheless, once there is a way to regulate cannabinoid products, the use of these products could potentially increase even more.

It’s important to remember that before the 2018 Farm Bill, there was no legal market for hempderived CBD products in the U.S. Now that the Farm Bill is in place, the CBD market is booming in most states and countries, Heise noted.

As the FDA and Congress work together to regulate CBD amidst the Farm Bill renewal, they must consider many factors to ensure the products are used safely and correctly.