Cut pizza. Not corners.

In a challenging year, pizzeria owners kept up with offpremise demand and proved that pizza is recession-proof and pandemic proof.

16

In a challenging year, pizzeria owners kept up with offpremise demand and proved that pizza is recession-proof and pandemic proof.

16

When it comes to your pizza, quality matters. The same is true for the box that delivers it. WestRock takes food safety as seriously as you do. Materials sourced and pizza boxes manufactured in North America to the strictest quality and food safety standards. Available through distributors nationwide.

westrock.com/pizza pizzaboxes@westrock.com

©2020

In a challenging year, pizzeria owners kept up with offpremise demand and proved that pizza is recession-proof and pandemic proof. PAGE 16

IT

GOOD KNOWING ONE INGREDIENT ISN’T DEBATABLE. JUST GO WITH THE BEST. END OF DISCUSSION.

What’s your declaration of independence?

Grande is championing operators who have an independent spirit and shared passion for excellence. By providing the finest all natural, authentic Italian cheeses, along with an unwavering commitment to quality, we’ll continue to advocate for independents and their love of the craft.

STUDY: ROBOTS WILL REPLACE HUMANS IN RESTAURANTS SOONER RATHER THAN LATER

A recent study found that most respondents believe there’s no stopping automation from taking over the foodservice industry— but they’re not keen on the idea.

PMQ.COM/ROBOTS-IN-RESTAURANTS

DOORDASH INITIATIVE AIMS TO HELP RESTAURANTS REBOOT FOR DELIVERYONLY MODEL

Not every restaurant was primed to switch to delivery and carryout when the pandemic broke out in March. Many struggled with logistics and with menu items that simply weren’t meant to travel. As the National Restaurant Association predicts the loss of 100,000 dining establishments by the end of the year, third-party platform DoorDash has launched an initiative to help restaurants survive the crisis by matching them with ghost kitchens for delivery-only service.

PMQ.COM/DOORDASH-REOPEN-FOR-DELIVERY

3 REASONS WHY YOU SHOULD ADD GLUTEN-FREE DESSERTS TO YOUR MENU

As restaurants grapple with the economic fallout from COVID19, gluten-free diners represent an underserved market for desserts, especially during the holidays.

PMQ.COM/GLUTEN-FREE-DESSERTS

THIS UNIQUE PIZZA STYLE HAS PUT WINDSOR, ONTARIO, ON THE CULINARY MAP

Not only does Windsor, a city in Ontario, Canada, claim to have its own unique pizza style—it has launched a campaign to promote independent pizzerias and tourism.

PMQ.COM/WINDSOR-STYLE-PIZZA

MARKETING MASTERS: HOW TO DEVELOP A BESTSELLING MENU

In this exclusive video interview, Gregg Rapp, one of the restaurant industry’s best-known consultants, shares the secrets of menu engineering for higher restaurant profitability.

PMQ.COM/MENUS-THAT-SELL

Faced with unprecedented challenges in 2020, the pizza industry showed that it’s both recession-proof and pandemic-proof. As operators continue to adapt and innovate, we review the past year’s trends and offer suggestions for

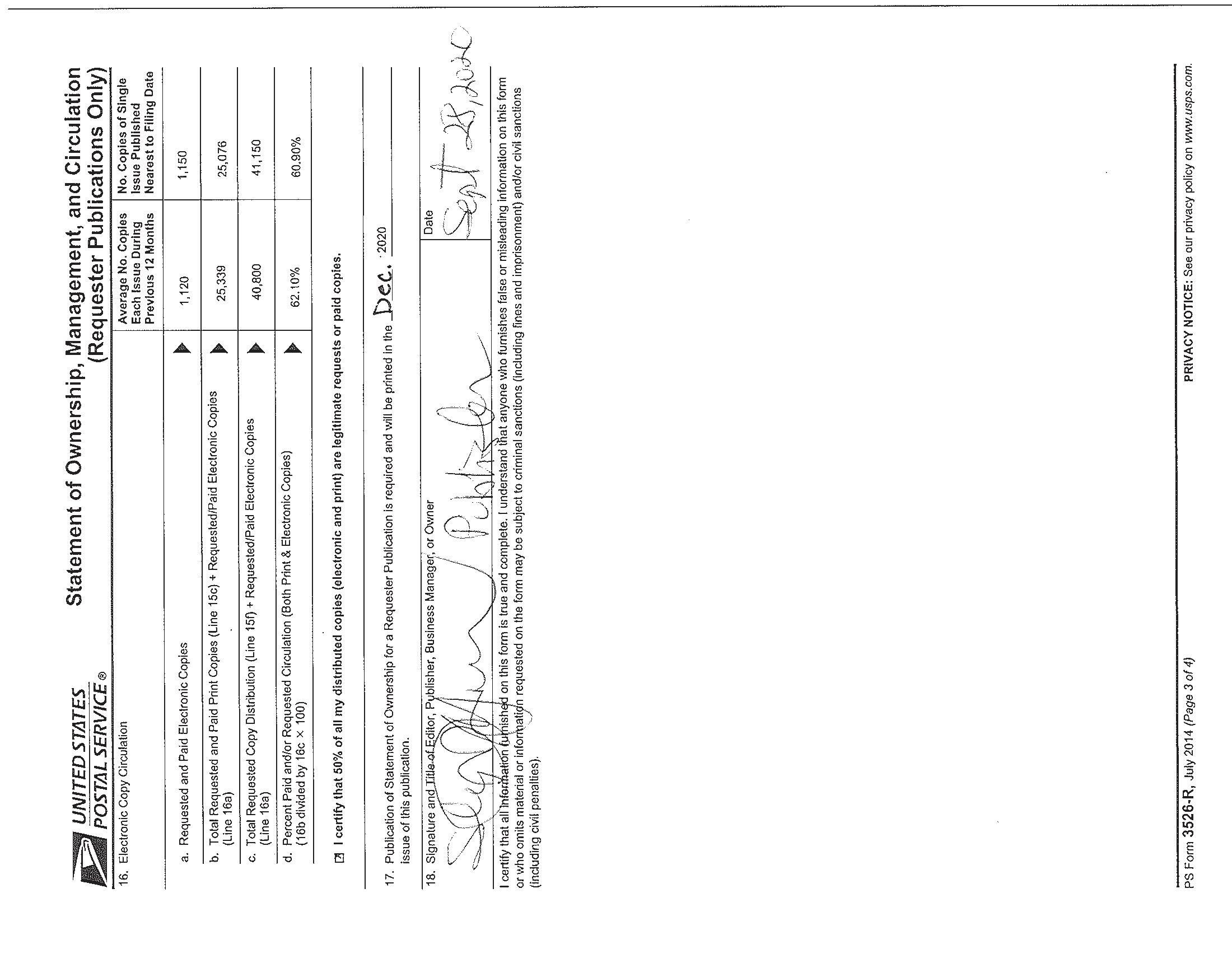

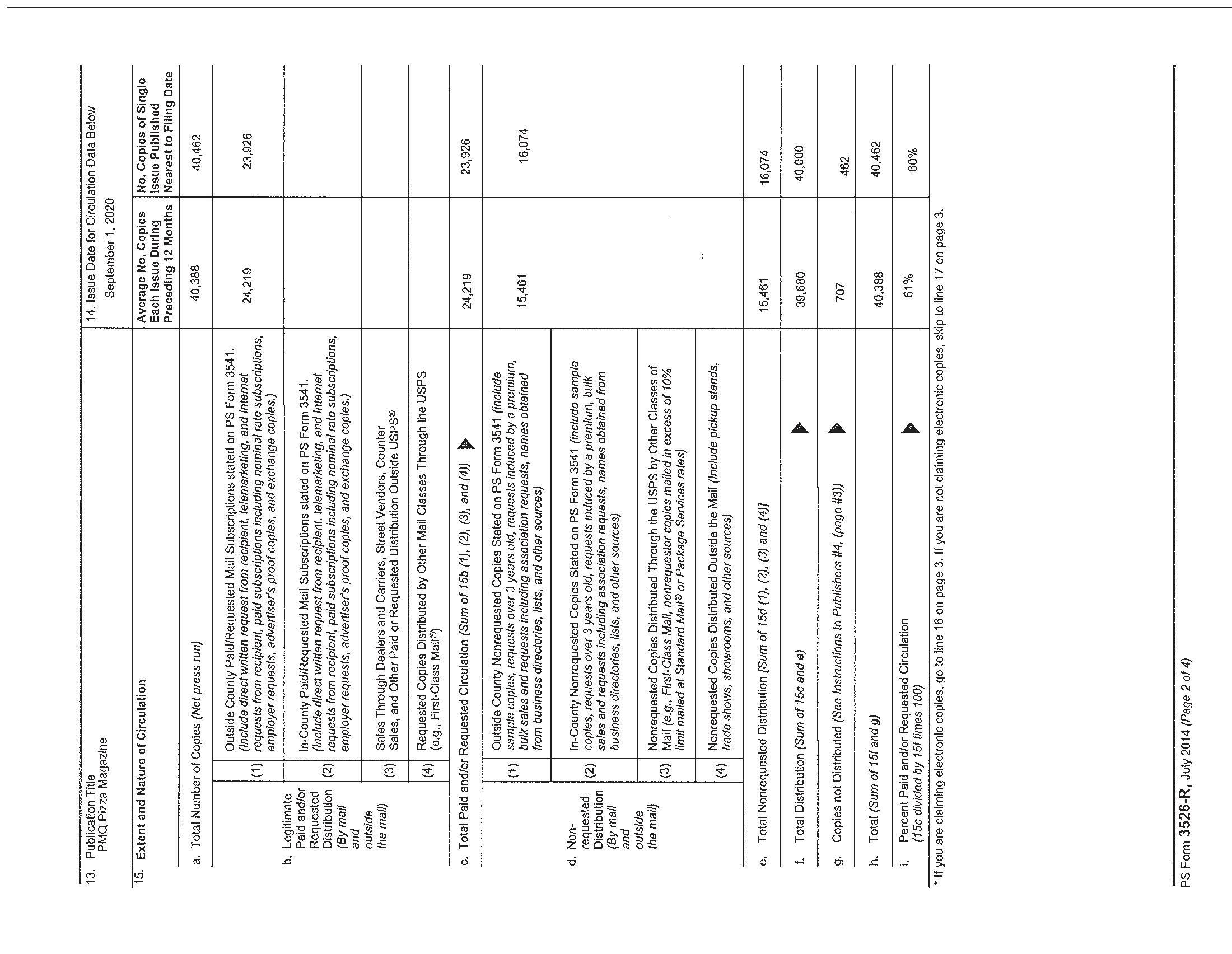

A Publication of PMQ, Inc.

662-234-5481

Volume 24, Issue 10

December 2020

ISSN 1937-5263

PUBLISHER

Steve Green, sg@pmq.com ext. 123

CO-PUBLISHER

Linda Green, linda.pmq@gmail.com ext. 121

EDITOR IN CHIEF

Rick Hynum, rick@pmq.com

ART DIRECTOR

Eric Summers, eric@pmq.com

SENIOR COPY EDITOR

Tracy Morin, tracy@pmq.com

IT DIRECTOR Cory Coward, cory@pmq.com ext. 133

DIRECTOR OF RESEARCH

Blake Harris, blake@pmq.com ext. 136

TEST CHEF/USPT COORDINATOR

Brian Hernandez, brian@pmq.com ext. 129

SOCIAL MEDIA DIRECTOR

Ingrid Valbuena, ingrid@pmq.com ext. 137

FOOD PHOTOGRAPHER

David Fischer, david@pmq.com

CHIEF FINANCIAL OFFICER

Shawn Brown, shawn@pmq.com

ADVERTISING

SALES DIRECTOR

Linda Green, linda.pmq@gmail.com ext. 121

SENIOR ACCOUNT EXECUTIVE

Tom Boyles, tom@pmq.com ext. 122

SALES ASSISTANT

Brandy Pinion, brandy@pmq.com ext. 127

PMQ INTERNATIONAL

PMQ CHINA

Yvonne Liu, yvonne@pmq.com

PMQ RUSSIA

Vladimir Davydov, vladimir@pmq.com

PMQ PIZZA MAGAZINE 605 Edison St. • Oxford, MS 38655 662.234.5481 • 662.234.0665 Fax

PMQ Pizza Magazine (ISSN #1937-5263) is published 10 times per year.

Cost of U.S. subscription is $25 per year. International $35. Periodical postage pricing paid at Oxford, MS. Additional mailing offices at Bolingbrook, IL. Postmaster: Send address changes to: PMQ Pizza Magazine, PO Box 9, Cedar Rapids, IA 52406-9953.

Opinions expressed by the editors and contributing writers are strictly their own, and are not necessarily those of the advertisers. All rights reserved. No portion of PMQ may be reproduced in whole or part without written consent.

Crafting everything from psychedelic T-shirt designs to garden gnomes, more than a dozen artists contributed thousands of original works to help Mellow Mushroom close out 2020 with flair. The Atlanta-based chain unveiled its new Art of Mellow sweepstakes campaign in late October. Every guest who places an online order can opt in to enter the sweepstakes for a chance to win a piece of signature art commissioned from 13 artists. Even better, every entrant automatically receives a digital gift for Zoom backgrounds, Instagram and Snapchat filters, wallpaper and more. Sweepstakes prizes include limited-edition prints, T-shirts, pullovers, coasters, and other wearable and displayable art, created by artists from around the world. The campaign, which runs through January 3, promotes the chain’s new online ordering system and website. Anne Mejia, Mellow Mushroom’s vice president of brand development, says the promo “brings Mellow Mushroom out of the stores and into customers’ phones to be a part of their everyday lives.”

Angelo’s Pizzeria South Philly fired up Philadelphia 76ers fans in October with a pie honoring Alan Horwitz, the team’s superfan and so-called “Sixth Man.” For every order of The Sixth Man Pizza—a half-sausage and half-pepperoni combo—Horwitz, a local businessman, donated $1.76 to Philadelphia Youth Basketball, a nonprofit organization that uses hoops to help young people in underserved communities develop their potential as studentathletes and leaders. Horwitz has attended Sixers games since the 1960s, always seated courtside wearing his #76 jersey—and he just happened to turn 76 in January. Angelo’s also promised free pies to the first 25 frontline workers who ordered The Sixth Man Pizza on October 15, the first day of the promotion.

You make careful choices about the ingredients in your food. WestRock makes careful choices about the ingredients in our boxes. We resource raw materials domestically and manufacture our boxes in North America to meet the highest quality and food safety standards.

westrock.com/pizza pizzaboxes@westrock.com

Barro’s Pizza presented a $10,000 check to Kaylee Kallas, the winner of last year’s Dr. Pepper Tuition Giveaway, in January.

Scraping up money for college tuition is a challenge in this pandemicravaged economy, but your chances are slightly better if you’re a fan of the 40-store Barro’s Pizza chain in Arizona. As a corporate partner in the Dr. Pepper Tuition Giveaway, the family-owned company, which opened its first location in 1980 in Mesa, will award $10,000 to one lucky scholar for college expenses at the end of this year. Any Arizona resident over 18 can enter the contest once a day through December 14, and the winner will be selected at random. The Barro family takes philanthropy seriously, raising money through dedicated lunch specials for the Arizona Cancer Foundation for Children every June and donating all proceeds from store sales to St. Mary’s Food Bank Alliance on the first Tuesday of every December. “Helping others in our community is the foundation of who we are as a company,” says co-owner Ken Barro.

With more than 200 locations in 29 states, BJ’s Restaurants, headquartered in Huntington Beach, California, has been testing a beer subscription service at eight locations in Northern California. BJ’s Brewhouse Beer Club was created to boost off-premise sales during the pandemic. Members receive a special Intro Pack that includes one 750mL bottle of BJ’s Imperial White Ale; their choice of a 64-ounce growler or a six-pack of the company’s handcrafted signature beers; and a 2020 Founding Member beer glass. Additionally, members can purchase a fourpack of exclusively brewed beers, a large deep-dish pie, one appetizer and one dessert every two months for $30. They’re also automatically registered for BJ’s Premier Rewards PLUS loyalty program, earning one point for every dollar spent and a $10 reward for every 100 points. If the beer club program is successful, BJ’s Restaurants hopes to roll it out nationwide sometime next year.

Barro’s describes its pizza as “a combination of thick and fluffy crust paired with a perfected tangy and sweet, spiced sauce.”

Domino’s and Pizza Hut have both seen rising same-store domestic sales in 2020, but that’s not the only good news for the two top chains. Customer satisfaction is also up for both companies, according to an American Customer Satisfaction Index (ACSI) study conducted from April 1 through September 30, 2020. Compared to the ACSI 2019-2020 Restaurant Report (which covered April 2019 through March 2020), Domino’s ACSI score rose by 1%, to a score of 80. That put Domino’s in the No. 2 spot among limited-service restaurants, trailing top-ranked Chik-fil-A. Pizza Hut fared even better, with a 3% ACSI jump, to a score of 79 and a tie for third place with fellow Yum! Brands franchise KFC. Papa John’s saw its score drop by 1%, to 77, while Little Caesars’ score also lost one point for a score of 75. Surprisingly, the ACSI study found that customer satisfaction with full-service restaurants increased by 1.3%, to an overall score of 80, despite dine-in shutdowns around the country. “Given the shutdowns and setbacks, it’s pretty remarkable that the restaurant industry was able to meet customer demand and, in many cases, go above and beyond,” says ACSI managing director David VanAmburg.

Many restaurant customers, rattled by the pandemic, said no way to buffets in 2020. Pizza Inn has responded by shifting to a new concept called the Right-Way Buffet. Starting in May, the Dallas-based chain began offering table service at some locations, while team members served guests cafeteria-style at other stores. Some stores kept the standard buffet bar but allowed only one-way traffic to adhere to social distancing guidelines. Every store has a dedicated “Sanitizer Captain” who’s responsible for enforcing heightened cleaning and sanitation standards. Many locations also began offering pay-at-the-table options to limit touch points for guests. For customers who are still leery of dine-in, Pizza Inn added a new Contactless Buffet-to-Go option, offering takeout meals sized to feed two to six people. Starting in late October, Pizza Inn also offered three value-priced meal deals for delivery or carryout. Each deal, ranging in cost from $12.99 to $32.99, featured half-pizzas (medium pizzas with up to two toppings on each side) and side items, such as garlic rolls, cheese bread, salads or Cinnamon

Stromboli.

To avoid traffic congestion and parking challenges, Domino’s started testing e-bikes for pizza delivery at a number of corporate-owned stores in Houston, Miami and New York last year.

Domino’s order tracking technology is just one of the tools that has helped boost customer satisfaction.

Pizza Hut’s American Customer Satisfaction Index score has climbed by three points during the pandemic.

Stromboli.

To avoid traffic congestion and parking challenges, Domino’s started testing e-bikes for pizza delivery at a number of corporate-owned stores in Houston, Miami and New York last year.

Domino’s order tracking technology is just one of the tools that has helped boost customer satisfaction.

Pizza Hut’s American Customer Satisfaction Index score has climbed by three points during the pandemic.

In a year full of surprises and setbacks, the pizza business showed it was recession-proof and pandemic-proof, offering hope—and lessons in survival—for other segments of the restaurant industry.

BY RICK HYNUM

BY RICK HYNUM

Looking back on 2020, it’s hard to tally up everything that went wrong. The pandemic cast a gloomy shadow over the nation, while civic unrest heated up and spilled into city streets. Wildfires raged across the western United States. Beloved heroes, from Ruth Bader Ginsburg, Herman Cain and John Lewis to Little Richard and Kobe Bryant, shuffled off their mortal coils. We even lost Eddie Van Halen, for heaven’s sake. And then there were the hurricanes—so many hurricanes.

The news wasn’t that much better for many in the restaurant industry. While politicians in D.C. bickered and postured over COVID-19 relief packages, municipal and state leaders faced well-nigh impossible choices for dealing with outbreaks. At a loss, they resorted to ofttimes draconian restrictions and lockdowns that put a choke hold on restaurateurs already barely getting by on the thinnest of margins. Many stores planned to shut their doors only temporarily but never reopened. Others made a go of it by pivoting to delivery and carryout while also innovating with meal kits and even groceries for their stuck-athome customers.

It has been our spring, summer and fall of discontent, with winter coming on. Yet most pizzeria owners bounced back, and many thrived, displaying a fighting spirit and resilience

that powered communities through an unprecedented period of crisis. Independent operators in particular proved their mettle, as this year’s sales figures show. While their non-pizza restaurant counterparts struggled to deliver food that simply wasn’t meant to travel, pizzeria operators stood at the ready with the world’s most delicious comfort food. Many saw their sales hold steady or even shoot up.

Yes, 2020 was bad, and it was scary. But it could have been much worse for the pizza industry. Let’s take a closer look at the numbers.

Back in May, when dine-in service had been shut down around most of the nation, market research company Sense360 reported that pizzerias had experienced a 5% drop in year-overyear sales while recording a larger per-dollar order increase compared to quick-service and fast-casual competitors—an 11% jump for pizza vs. 9% for quick-service and 8% for fastcasual. Around the same time, a Datassential survey found that 63% of consumers said they were seeking out pizza during the pandemic—comfort food indeed.

Sales figures from research firm CHD Expert show that pizza sales rebounded as the country reopened for business. Total U.S. pizza industry sales for the period from October 2019 through September 2020 came to $46,247,156,519, a mere 0.20% decline from $46,337,969,390 for October 2018 through September 2019. That’s barely a smidgen of difference.

And here’s the better news: Total sales for independent pizzerias actually went up by 0.58%, from $18,531,653,876

Source | Euromonitor International (Including a forecast through 2021, updated November 2020)

All outlets that specialize in pizza, including fast-food pizza, pizza full-service restaurants, pizza 100% home delivery/takeaway.

North America | $48.6B

Latin America | $12.5B

Asia Pacific | $11.7B

Australasia | $1.9B

Middle East/Africa | $4.1B

Western Europe | $49.3B

Source | Euromonitor International (Including a forecast through 2021, updated November 2020)

All outlets that specialize in pizza, including fast-food pizza, pizza full-service restaurants, pizza 100% home delivery/takeaway.

North America | $48.6B

Latin America | $12.5B

Asia Pacific | $11.7B

Australasia | $1.9B

Middle East/Africa | $4.1B

Western Europe | $49.3B

in the October 2018 to September 2019 period to $18,639,852,788 this year. Sales for the pizza chains didn’t fare quite as well, dropping 0.72%, from last year’s $27,806,315,514 to $27,607,303,732 this year.

At the same time, average pizza store sales went down a wee bit across the board. Total average store sales ended up at $592,214, down 0.67% from the October 2018 to September 2019 figure of $596,181. Average store sales for independents fell 0.15%, from $445,762 to $445,088. The chains’ average store sales took a slightly harder hit, dropping from $769,171 to $762,359.

Closures of hometown pizzerias often made headlines this year, but newcomers waited in the wings. CHD Expert found that the total number of pizza locations nationwide actually went up—from 77,724 to 78,092, a nudge of 0.47%. The number of independent pizzerias rose from 41,573 to 41,879, while the chains added a few stores, too, from 36,151 to 36,213.

In other words, the pizza industry as a whole turned out to be both recession-proof and pandemic-proof. Sadly, we can’t say the same for non-pizza restaurants. A National Restaurant Association (NRA) survey released in September found that, across all segments of the restaurant industry, nearly one in six stores had closed either permanently or for the long term since March. That comes to nearly 100,000 eateries erased from their communities six months into the pandemic. Nearly 3 million employees were still out of work at that time, and the restaurant industry as a whole was on track to lose $240 billion in sales by the end of 2020.

“Technomic projects that the pizza category will register the strongest sales performance of any menu type in 2020,” says Kevin Schimpf, Technomic’s senior research manager. “Going into the pandemic, the pizza category was clearly better positioned to deal with dine-in restrictions than other menu categories.”

Worse news: Forty percent of restaurateurs surveyed in September said their restaurants would likely shut down in the next six months if they didn’t get help from the federal government. And that help never came. “This survey reminds us that independent owners and small franchisees don’t have time on their side,” said Sean Kennedy, NRA’s executive vice president of public affairs, in a statement. “The ongoing disruptions and uncertainty make it impossible for these owners to plan for next week, much less next year.”

Pre-pandemic, to no one’s surprise, the major pizza chains continued to lead the nation’s independent and small-chain pizzerias in total sales. According to 2019 year-end sales figures (the latest available at press time) from Technomic, the big chains accounted for $27.6 billion in overall national sales, while independents and small chains raked in $18.6 billion. The top performers among the chains were the usual suspects—Domino’s at No. 1, followed by Pizza Hut, Little Caesars, Papa John’s and Papa Murphy’s.

But Seattle-headquartered MOD Pizza has the edge in terms of fastest growth, Technomic reports. MOD’s sales climbed from $390.7 million in 2018 to $483.5 million in 2019, an increase of 23.75%. MOD added 52 units, growing from 395 to 467 stores. Founded by Scott and Allie Svenson, MOD Pizza is known as much for its philanthropy and focus on social change as for its pizza—an important

consideration for socially conscious millennials. The company and its franchisees donated nearly $2 million to more than 9,000 local and national charities in 2019 while deepening its commitment to hiring low-income youths, the formerly incarcerated, and people with intellectual and developmental disabilities.

Domino’s remained at the top of the heap in terms of overall sales, with more than $7 billion, followed by Pizza Hut ($5.58 billion), Little Caesars ($3.77 billion), Papa John’s ($2.63 billion) and Papa Murphy’s Pizza ($748.35 million).

Pandemic or no pandemic, Domino’s fared so well in 2020 that it went on a hiring spree, adding 10,000 workers shortly after the crisis began and 20,000 more in the late summer.

Papa John’s also took on 30,000 more employees in 2020 while mounting a comeback for the ages. After a prolonged slump that started with scandals surrounding founder John Schnatter in 2018, Papa John’s sales stats have steadily grown this year. For its second quarter in 2020, the company reported that its margins and profits were “the highest they have been in several years,” while unit closures remained low.

For Pizza Hut, 2020 brought good news and bad news. The company reported a record-breaking week of off-premise sales in early May and, like Domino’s, added 30,000 employees to meet increased demand. But it had to temporarily close more than 1,000 Pizza Hut Express units due to the pandemic. Perhaps the hardest blow came when NPC International, Pizza Hut’s largest U.S. franchisee, with more than 1,200 stores, filed for Chapter 11.

If 2020 taught us anything, it’s that offpremise dining—Domino’s and Papa John’s bread and butter—is the way of the near-future. “COVID-19 has accelerated

the growth of the delivery space [by] several years,” says Alex Blum, founder and CEO of Relay, a back-end delivery service that offers an alternative to third-party giants like Grubhub and Uber Eats. “Both customers and merchants that were reluctant [about] delivery are now accustomed to it. This behavior will likely continue, even after COVID-19.”

Demand for delivery had been surging long before the pandemic hit, even among fast-food chains. According to research firm Euromonitor, global delivery sales more than doubled between 2014 and 2019. “Five years from now, it will be rare to find a restaurant that does not offer delivery in some capacity,” Blum says.

That means smaller pizza operators need to get up-to-date on ordering technologies, stat, or risk losing to the Taco Bells and Burger Kings down the street. Tech company Bluedot’s “The State of What Feeds Us” survey, released in August, found

Because if your phones and web ordering are down, you may as well send everyone home. We become your phone company and provide a backup Internet connection

Increase revenue and lower cost

• No Busy Signals

• Call Recording

• Call Queuing / Auto-Answering

• Multiple (random) start-of-call upsell messages

• On-hold music/message loops

• Detailed reports—hold times, lost calls etc

• Callerid delivered to POS system

• Auto-attendants—”If you have arrived for curbside pickup press one”

• When your Internet fails our cellular backup router keeps your phones, credit card processing and web orders all working.

• The backup kicks in automatically in seconds. So quickly you will not even drop calls in progress when your primary Internet goes down!

• The same router can be used to create chainwide virtual private network to connect your locations.

• SD-WAN LTE/LTE-A (4G/5G) modems.

Ask us how we can make your life easier and improve your customer ’s experience during these difficult times. Our rapid response support team averaged almost 500 custom changes per week in April-June. As “the rules” changed for our clients, we updated messaging and call flow to minimize impact, maximize revenue. Let PizzaCloud do the same for your stores.

Maintain control, and get the calls off the front counters. For a small chain all you need is a large office at one location. Cut labor hours up to 50% and/or shift labor to lower cost regions while increasing average ticket . Eliminate the constantly ringing phones at the front counters! Tight integration allows calls to overflow to stores, so you can choose when to staff the call center.

The same tight integration, same detailed reports and call recordings in your hands, same ability to overflow back to the stores, but you let some one else hire and manage the staff. We can provide this service to you or work with your existing call center provider.

If you have any interest in call centers call us to discuss options or visit www.pizzacloud.net to register for a webinar.

$46.24 BILLION

a significant spike in usage of restaurant mobile apps during the pandemic. Bluedot’s April survey found that 51% of customers were using a mobile app; that number shot up to 64% by July. Overall, 88% of the survey’s respondents said they now use mobile apps more often to order food, groceries and other products.

A big chunk of that food-delivery windfall is going to thirdparty aggregators, which have been both a well-documented boon and a bane to the pizza industry. In a June study by Service Management Group, a global customer, patient and employee experience management partner, nearly half of the respondents had ordered delivery from a third-party service in the past three months. But the study also found the majority of restaurant customers still preferred to pick up their orders. Seventy-five percent reported using a drive-through in the previous 90 days, 55% had tried carryout, and 51% had given curbside pickup a go.

These numbers suggest customers trust their favorite restaurants more than the big aggregators. And they also suggest that pizzerias offering a wide array of contactless

78,092

$592,214

options—from curbside and drive-through pickup to oldschool doorstep drop-offs—are on the right track and should stay the course in 2021.

Speaking of the off-premise boom, 2020 turned a little spooky as ghost kitchens—specialized facilities for delivery-only restaurant models—materialized around the country. A September 17 article in The Washington Post reported that the pandemic-related surge in food delivery “has made ghost kitchens and virtual eateries one of the only growth areas in the restaurant industry.” Michael Shafer, Technomic’s global lead for food and beverage, told the newspaper that there were about 1,500 ghost kitchens operating in the U.S., and Euromonitor International predicted this model could create a $1 trillion global market by 2030.

Ghost kitchens—also called cloud kitchens or virtual kitchens—go hand in hand with virtual restaurants, which exist only online. Case in point: CEC Entertainment, owner of the kid-friendly Chuck E. Cheese chain. When CEC

filed for Chapter 11 bankruptcy in June, it had an ace up its sleeve—Pasqually’s Pizza & Wings, a new delivery-only brand that snuck in under the radar on third-party platforms nationwide in 2020. Most customers who ordered from Pasqually’s initially knew nothing about its relationship with Chuck E. Cheese—and CEC Entertainment wasn’t telling. But guess what? Virtual brand Pasqually’s shares kitchen space with brick-and-mortar brand Chuck E. Cheese, making for a cozy arrangement that has enjoyed some success thus far.

Still, switching to an efficient delivery-only model isn’t as easy as it sounds, says Deb Friar, field marketing manager for New Port Richey, Florida-based Welbilt, which provides equipment for ghost kitchens. “Many operators believe they can simply transfer equipment and processes to make the move from dine-in to delivery-only, but they often fall short in meeting the unique customer expectations for delivery,” Friar notes. Speed and

consistency are essential to delivery success, she says, “but traditional restaurant kitchens have not traditionally been designed for speed.”

Marco’s Pizza, headquartered in Toledo, Ohio, hopes to solve that problem as it pilots ghost kitchens for franchisees in California, North Carolina and Houston. “These virtual or ghost kitchens are all about efficiency in a shared kitchen space, which also allows us to easily use third-party delivery drivers and provide a quick-to-open format,” says Ron Stilwell, Marco’s vice president and chief development officer.

Nili Malach Poynter, who co-founded Denver-based ChefReady with her husband, Robert, would surely agree. In July, ChefReady unveiled a facility that offers 10 high-tech, customizable ghost kitchen spaces under one roof—all for deliveryonly concepts. The company says its facility “offers a way for restaurants to maximize their delivery footprint” and “also decreases risk to restaurants during financial crises.” Their first client is a pizza shop, no less: McKinners Pizza, which already has a brickand-mortar location in Littleton, Colorado.

ChefReady’s kitchens are “plug and play,” equipped with commercial hoods, sinks, electric and gas hookups, even pest control. The company provides software that aggregates third-party delivery platforms as well as food runners to bring the orders from individual stations to delivery drivers. “For years, Robert and I watched restaurantowner friends close their brick-and-mortar restaurants due to declining profit margins and rising rent, so we were excited to hear about the ghost-kitchen concept,” Nili says. “But we realized that many operate with a ‘churn and burn’ mentality, resulting in an unprofitably high tenant turnover. We

decided to create a company that offers the convenience of a ghost kitchen, but with more of a mom-and-pop, personalized level of customer service, greater efficiency and a greener footprint.”

As trends go, the ghost-kitchen concept is warming up, but it’s not red-hot yet—at least not industry-wide. “One of the big lessons of this pandemic is that restaurant brands need to rethink how much physical space they really need,” says Brittain Brown, president of Givex, a platform for gift cards, loyalty programs and POS solutions. “Pizza is uniquely suited to the delivery-only model, so cloud kitchens make a lot of sense in certain areas. But we have yet to see any chain scale significantly on cloud kitchens alone.”

Still, John Stetson, owner of four Stoner’s Pizza Joints in Fort Lauderdale, Florida, and Savannah and Warner Robins, Georgia, believes it’s inevitable. “Cloud kitchens will become much more prevalent over the next 10 to 20 years due to appealing economics,” Stetson says. “Cloud kitchens offer a unique opportunity for pizza operations to open a space in a fraction of the time it takes to build [a brick-and-mortar store], minimize overhead costs and improve logistics.”

Some American restaurant-goers think foodservice robots are inevitable, too, although they’re not keen on the idea. Dina Marie Zemke, a professor at Ball State University, and fellow researchers held focus groups with 30 fast-food consumers earlier this year to gauge public opinion on robots in restaurants. In August, she published the results in a paper titled “How to Build a Better Robot for Quick Service Restaurants.” The focus-group participants expressed “a high level of resignation about the inevitability of QSRs incorporating robots” into their operations. “This finding is similar to the acceptability of routine societal change,” Zemke says. “Participants felt that [it’s] a question of when rather than a question of if.”

And the answer to the “when” question seems to be “probably sooner than later.” As we’ve reported in the past, Redmond, Washington-based Zaucer Pizza last year pilottested a robot from Picnic that can reportedly assemble 300 pizzas in an hour. Not to be outdone, White Castle announced this July that it would start piloting a new version of Miso Robotics’ burger-flipping Flippy the robot, called Flippy

Massimo Noja De Marco, founder of pizza automation innovator Piestro, was a restaurateur before he segued into the robotics business.

Piestro, a fully automated pizza making unit, can be paired with Kiwibots for contactless delivery.

Massimo Noja De Marco, founder of pizza automation innovator Piestro, was a restaurateur before he segued into the robotics business.

Piestro, a fully automated pizza making unit, can be paired with Kiwibots for contactless delivery.

ROAR (Robot-On-a-Rail). Flippy ROAR, which attaches to a rail under the kitchen hood and glides back and forth, can run a burger grill and fry side items, like fries and onion rings. It can even cook up an Impossible Burger, which takes a

Now, you’re probably saying to yourself, “How could I ever afford a robot?” Flippy can be yours for $30,000, which isn’t cheap, but financing options are available. For twice that much, you can soon own a pizza making machine that handles everything but making the dough. Developed by Piestro, located in Santa Monica, California, these units have robotic arms; dispensers for the cheese, sauce and toppings; and spinning disks that move the pie from one stage of the process to the next. The machine even boxes the finished pizza before ejecting it.

But Piestro takes automation one step further, thanks to a partnership with Kiwibot, a Colombian-owned company specializing in contactless robotic delivery. A Piestro unit can be integrated with a loading mechanism designed for Kiwibots, which then collect the pies and deliver them. Cute if not exactly cuddly, Kiwibots have already been making deliveries in San Jose and Buena Vista, California.

In other words, the Piestro/Kiwibot process is automated from the pizza prep stage to the last mile of delivery. And, interestingly, Piestro’s CEO, Massimo Noja De Marco, serves on Miso Robotics’ board. He’s also a former restaurateur and co-founder of Pasadena, California-based Kitchen United, a pioneer in (wait for it) ghost kitchens. De Marco says it will likely cost about $60,000 to “open” a Piestro location. “[That’s] a steep drop in comparison to the $700,000 to $1 million it costs to open a small traditional pizzeria location,” he says. “While the profit margins of a traditional pizzeria are only 22% in terms of food costs, labor, real estate and other expenses, the profit margin of Piestro is around 48%.”

So how long will it be before automation becomes common in the pizza industry? “Like all technology, adoption speed can vary by several factors,” De Marco says. “But we see the pandemic as having created an urgent need to bypass obstacles in order to enable businesses to reopen and grow…Right now, the real obstacle is building fast enough to meet the new accelerated need for adoption. The faster we build, the more common automation in restaurants and delivery will become—because there’s a new undeniable need to make food more

As far as food trends, let’s get down to the meat of the matter—or, rather, the matter of meat-free or plant-based proteins. A 2020 survey by OnePoll found that 60% of Americans have started eating a more plant-based diet (flexitarian or semi-vegetarian) since the pandemic began. Moreover, OnePoll reported that 39% of respondents aged 18 to 25 and 23% of those aged 26 to 41 said their diet “already excludes animal products.”

Of course, that doesn’t mean they’re vegans/vegetarians for life. We’ve all known someone who swore off meat for a few weeks, months or even years, only to eventually succumb to the allure of a bacon cheeseburger. Still, independent pizzeria owners need to wake up and smell the tofu. A 2019 Technomic survey found that 50% of consumers eat vegetarian or vegan dishes at least once per month, but most of them said restaurants did a lousy job of providing tasty menu options for them.

Some pizza chains tried to rectify that in 2020. Just in time for the pandemic, Los Angeles-headquartered Fresh Brothers debuted a plant-based pie—topped with pepperoni made from soy protein, spices and rice flour—to celebrate Pi Day on March 14. By July, Wisconsin chain Toppers Pizza had teamed up with vegan chef Melanie Manuel of Celesta Restaurant in Milwaukee on three plant-based pies with artisanal flair: the Buffalo Chicken-Less Topper, the Vegan Korean BBQ Chicken-Less Topper and the Vegan Tuscano Topper. And California Pizza Kitchen jumped on board the meat-free train in October with its BBQ Don’t Call Me Chicken Pizza, featuring Chicketts from Worthington Foods.

Major meat-substitute brands like Beyond Meat and Impossible Foods have also infiltrated fast-food brands. There’s an Impossible Whopper at Burger King, while Carl’s Jr. offers a Beyond Sausage Burrito and Beyond Sausage and Egg, plus its Beyond Famous Star and Beyond BBQ Cheeseburger. Customers can even dig into plant-based tacos at chains like Chronic Taco and Del Taco.

The future looks bright for these manufacturers of plantbased proteins. Dublin, Ireland-based Research and Markets projects the global market will grow from $10.3 billion in 2020 to $14.5 billion by 2025. Looking further ahead, the Swiss

With growing numbers of consumers embracing plantbased diets and shunning products of animal origin, the demand for vegan options is greater than ever— especially within America’s favorite food category, pizza!

To help operators meet this demand, on November 1, PMQ launched its new website, PizzaVegan.com, to establish the first-ever community designed to connect veganfriendly pizzerias (and the vegan-curious) with consumers.

In this new online space, we’ll highlight:

• Pizzerias and innovative menu items that cater to vegans and vegetarians

• Vegan experts, influencers and bloggers who share their insider knowledge

• Informative articles about making and marketing vegan/vegetarian pizza

• Products and recipes that help take the guesswork out of vegan-friendly foods

1. Offer value, but watch your bottom line. Many of your customers will still be hurting for money. Fortunately, as Niko Frangas, president of Rascal House in Cleveland, Ohio, points out, pizza is already a great value in hard times. So don’t panic and start slashing your prices if things get worse again. “If you feel like you need to create value, pushing loyalty and rewards is a must and a great place to start,” Frangas says. “Find a way to reward frequency, whether it’s with punch cards, point systems or a full-on loyalty app. Get creative without discounting or cheapening what you do. There are better ways to draw customers in and increase sales without lowering your profit.”

2. Stay touch-free. Customers will still want contactless delivery in 2021, and demand for touch-free at-the-table ordering will be higher than ever, says Mary Jane Riva, CEO of Pizza Factory, a chain based in Oakhurst, California. “Touch-free is very important and will be around permanently,” she says. “We have table ordering via cell phone, so there is no interaction with the employee working the register.”

investment firm UBS predicts the market will expand to a whopping $85 billion by 2030.

So just how meat-like do plant-based proteins need to taste? According to research firm Mintel, more than half of American consumers want meat alternatives to “closely mimic the taste of meat.” Fifty-two percent of diners who eat plant-based proteins choose them because of their taste, outranking concerns about health (39%), the environment (13%) and animal protection (11%).

“Flexitarians and curious consumers represent a sizable opportunity, as they are open to trying more plant-based options on menus,” Mintel noted in a blog post titled “Foodservice: 5 Ways to Stay On Top of the Plant-Based Trend.” Mintel recommends appealing to diners with “familiar and proprietary menu items [they] can’t find anywhere else. While diners are attracted to plant-based items for their perceived health benefits, they also like to indulge while dining out. Balance healthy and indulgent items, as well as manufactured and plant-forward dishes, to appeal to a spectrum of dining occasions.”

3. Use social media chatbots for digital ordering. Chatbots are automated programs that engage customers looking to place an order from a social media platform. They can answer questions, resolve complaints and even set up reservations. For his Stoner’s Pizza Joint stores, John Stetson has been using chatbots to speed up the digital ordering process and assist customers on social media. “We believe this will become the future of online ordering,” he says.

4. Simplify your menu. Many restaurant chains have slimmed down and optimized their menus for delivery and takeout. Take a good, hard look at your menu items, weed out the weaklings and keep your customers’ favorites. Scrutinize your food cost on each item and determine its profitability. Call attention to the high-profit items on your menu with photos or callouts. “Another tip is to make sure you have a good grip on your loss leaders versus valued add-ons,” says Ryan Goldhammer, co-owner of Noble Pie Parlor in Reno, Nevada. “Use this understanding of your business to put together combinations of products and packages that increase your price-per-guest and overall margins.”

5. Take it outdoors. If your city and climate allow it, outdoor dining could give your sales a shot in the arm. If it’s just too cold out, start planning now for al fresco dining in the springtime. “The No. 1 recommendation we give to clients is to add outdoor seating,” says Joshua Zinder, a managing partner at JZA+D, a Princeton, New Jersey-based restaurant design firm. “Most localities will allow pizza restaurants to expand outdoor seating into the curb lane, if requested, or add seating to sidewalks or parking areas. Now is [also] the time to add or improve your drive-through pickup areas [and] improve online ordering.”

As tough as times have been for the restaurant industry in 2020, pizza has been a shining beacon in the darkness. But let’s face it: No one knows what’s coming next year. As this report was being prepared, COVID-19 cases were ticking upward quickly around most of the United States. As of early November, Oregon, Michigan and San Francisco had once again put a pause on indoor dining, while Illinois Governor J.B. Pritzker banned dine-in service in many parts of the state, including Chicago. Many states and cities continued to limit indoor capacity and operational hours.

That means off-premise business will remain key to any restaurant’s survival, and if you’re a PMQ reader, you’ve already got that covered. You’re positioned better than your non-pizza competitors to weather the storm. Stay in touch with your customers, offer them value for their money, stick with your marketing, and give back to your community, just like you’ve been doing ever since this whole mess began (and probably long before then).

Matt Vannini, president and CEO of consulting firm Restaurant Solutions in Denver, put things into perspective nicely in a September article he penned for PMQ.com. “The only experience similar to the pandemic that any restaurateurs have ever had is when they were opening for the first time,” he wrote. “That was the last time where the operator had no sales and cost history, no brand awareness and no consumer base. Restaurant operators need to believe that their past experiences and obstacles within the industry have prepared them to overcome whatever the pandemic can throw at them.”

In other words: You’ve got this.

Rick Hynum is PMQ’s editor in chief. MOD Pizza added 52 new stores in 2020, while its sales soared by 23.75%, making it the fastest growing pizza chain in the country for the fourth year in a row. With a strong focus on inclusivity, MOD Pizza hires employees based on the 4 Gs: Grit, Growth, Generosity and Gratitude. In this photo taken before the pandemic, a group of customers enjoy a pizza party at MOD Pizza, the fastest growing pizza chain in the U.S.

Join us weekdays from December 8 to December 23, 2020, for 12 days filled with gifts and prizes!

Starting Tuesday, December 8th, at 9 a.m. EST / 8 a.m. CST, visit our Facebook page for a Daily Pizza Quiz! Answer a different question each day to enter our daily giveaways. Winners will be announced after 24 hours, when the next question is revealed.

INSTRUCTIONS:

To participate, head over to facebook.com/PMQPizzaMag or scan the QR code to the left. Tune in on Facebook every weekday morning, from Tuesday, Dec. 8th to Wednesday, Dec. 23rd at 9 a.m. EST / 8 a.m. CST for the Daily Pizza Quiz.

Enter the giveaways by answering the Daily Pizza Quiz every day. The final Grand Prize winner will be pulled from all the participants of all the quizzes. The more Daily Pizza Quizzes you answer, the higher your chance for winning the Grand Prize. Celebrate this Christmas with PMQ!

Learn the ins and outs of how different flour types affect your finished dough—and what tweaks may be necessary to ensure optimal performance.

BY TRACY MORIN

BY TRACY MORIN

Though today’s manufacturers offer up an entire world of alternative flours derived from nuts, legumes, grains and more, experts note that there are plenty of variations even among old-school flour basics, such as white and wholewheat. “In the pizza industry, we usually look at what we consider as a standard white flour—also known as a bakers patent grade flour—and whole-w heat flour,” explains Tom “The Dough Doctor” Lehmann, a pizza industry consultant based in Manhattan, Kansas. “But we also talk about 00 flour, which is just one category. Once you start digging deeper, you find out there’s a myriad of different types of white flour, and they’re not necessarily interchangeable.”

To understand the ins and outs of white and wheat flour, Lehmann walks us through some common variations and how they can affect a pizza dough’s finished characteristics.

Within the category of white flour, pizza makers traditionally deal with two types: standard and 00. Standard bakery grade white flour, also called bakers patent grade flour, works well for most styles of pizza. This type often has a protein content of around 11% to 14% or more and is the variety often stocked at the local supermarket. “These flours are very predictable in performance, but they may or may not be treated at the mill,” Lehmann says. “Especially in the 13% or 14% range, they may contain additional treatment in the form of potassium bromate, which may or may not be desirable.”

While there’s nothing wrong with the addition of potassium bromate from a performance standpoint, this ingredient can raise health concerns for some. For example, Lehmann notes that in the state of California, a warning must accompany products made with bromated flour, so using this type can force an undesirable stigma right onto your menu.

Another additive that is commonly used, ascorbic acid, is designed to accelerate the time from milling to usability.

“When flour is first milled, it’s not the best for baking; it needs 30 days of aging to perform well,” Lehmann says. “But this process can be sped up at the mill with the addition of ascorbic acid.” Ascorbic acid is not a harmful additive; it’s another name for vitamin C. But the flour isn’t labeled with this name, due to the fact that vitamin C is denatured, or destroyed, during the baking process.

“Especially in the 13% or 14% range, [standard bakery grade flour] may contain additional treatment in the form of potassium bromate, which may or may not be desirable.”

— TOM LEHMANN

In an anaerobic environment (i.e., in a vacuum), ascorbic acid is a reducing agent, which allows a dough to develop faster. But in the presence of oxygen, it’s actually an oxidizer, or a strengthener for the proteins. The amounts used in flour are at extremely low levels— usually about eight to 12 parts per million—but ascorbic acid allows the product to be used within hours of milling with solid performance.

Malt or fungal enzymes may also be added to white flour. Malt is usually sprouted barley flour, which is high in amylase, an enzyme that attacks starch and converts starch into sugars. Those sugars are then metabolized by the yeast during fermentation. “There’s also residual sugar after baking, which is then used in the Maillard browning reaction, so caramelization takes place,” Lehmann adds. “That’s important, because you can also buy organic flours or some types of 00 flours that have no treatment at all. So if you were using a white flour that’s been malted and simply switch it with a 00 flour, depending upon your formulation—for example, if you don’t have any sugar in your formula—you might find that your dough stops fermenting on its own, or that you don’t get any color (browning) on the crust when baked.”

Therefore, if using 00 flour, you might need to add a small amount of malt. Malt is labeled by Lintner value

(measured in degrees, and abbreviated as L), which measures the activity of amylase present. If using a 20°L malt, you’ll need to incorporate only 0.25% with a nonmalted flour like 00. Do not add more than 0.5%—if you add too much malt, you’ll convert too much starch into sugar, creating a crust that doesn’t properly set (since starch is what firms the crust). If you’re using a malt with a higher Lintner value, do the

necessary math: For a 60°L malt, you’d need to use only 1/3 as much as a 20°L malt. Malt that is diastatic (enzymatic) will indicate the Lintner value so that you’ll know the correct amount to use.

There is one exception: If you’re using untreated 00 or organic flour and baking at 800°F or more, you probably won’t need additions like malt. Finally, Lehmann advises, when selecting a 00 flour, make sure the type is compatible

Chef Leo Spizzirri, master istruttore at The North American Pizza & Culinary Academy in Lisle, Illinois, shares his methods for matching the appropriate flour protein to the expected fermentation time of the dough:

Selecting the right flour is critical to the final textural attributes of the pizza. Generally speaking, the shorter amount of maturation time between mixing and baking the dough, the lighter the flour should be. In most cases, a dough with a total maturation of 24 hours, for example, should contain a protein percentage of no more than 12% to 12.5%. As the maturation time increases, so will the protein.

As a common rule, we use the following guidelines in our classes at The North American Pizza & Culinary Academy for doughs:

12 hours: 10.5% to 11% protein

12 to 24 hours: 11.5% to 12.5% protein

24 to 48 hours: 12.5% to 13% protein

48 to 72 hours: 13% to 14% protein

72 hours or more: 14% or more

As the dough matures, it is important to remember that the strength of the flour affects more than just the structural attributes of the dough; it also affects the amount of color the final baked pizza will get. Using a flour that is too weak for the process will show signs of gumminess in the crumb and look white on the exterior. Selecting a flour with too much strength will cause the exterior of the pizza to appear dark-brown or even burnt, sometimes before the crumb has a chance to finish baking properly and release its moisture or humidity. A heavy flour for the process will also be difficult to stretch and will seem dense or heavy after baking.

“When flour is first milled, it’s not the best for baking; it needs 30 days of aging to perform well. But this process can be sped up at the mill with the addition of ascorbic acid.”

— TOM LEHMANN

with your dough management procedure, including fermentation time. (Check out the sidebar for more information on matching flour with fermentation.)

Wheat flour also includes two basic types. Stone-ground is a coarser flour, with rougher-hewn particles and a more rustic appearance— it’s the variety that most consumers associate with wheat baked goods. Another type is fine-ground whole white wheat, which offers the appearance of “regular” flour and can even lend a finished appearance quite similar to white flours. “They’re now growing varieties of white wheat, as an alternative to hard red wheat,” Lehmann says. “White wheat is predominantly grown in Australia, while red wheats are predominantly grown in the United States, Canada, Venezuela, Argentina, Russia and even Saudi Arabia.”

Red wheats are so-called because their kernels, or berries, are dark in color, due to a high tannin content. Tannins create a certain bitterness, which turns off some customers, so hard white wheat varieties (with less tannins) offer a more consumer-friendly taste with the exact same nutritional properties. Both of the options also contain the same amount of bran, but thanks to a finer ground for whole white wheat, the typical wheat characteristics, in both taste and texture, are less noticeable. Larger bran particles are, of course, easier to see and taste.

“The kneejerk reaction is to make your wheat dough with the same amount of water you’d normally use, and the dough will feel normal at first. But when the bran starts to absorb water, it will absorb a lot, and the dough will get stiffer and stiffer.”

— TOM LEHMANN

Regardless of the type, however, wheat flour contains the bran, and white flour does not. When milling 100 lb. of flour, manufacturers must remove 18 to 20 pounds of bran to make it white—so about one-fifth of the product is bran. And, when working with wheat flours, it’s important to remember that bran absorbs water, but not as quickly as starch or protein does. “The kneejerk reaction is to make your wheat dough with the same amount of water you’d normally use, and the dough will feel normal at first,” Lehmann notes. “But when the bran starts to absorb water, it will absorb a lot, and the dough will get stiffer and stiffer. If you try baking with it, you’ll find out the meaning of ‘cardboard crust.’”

As a rule, use about 15% more water in a wholewheat crust vs. a white crust. So, if you’re using 60% absorption with a white flour, increase to 75% instead. A whole-wheat dough should feel slightly wet or tacky after mixing; otherwise, there isn’t enough water in the formula. To assist when working with the wet dough, simply use a little oil on your hands or work surface.

9th

Giovanni Labbate, The Zesty Sicilian, Billy Bricks Wood Fired Pizza, Chicagoland area, IL

EVENT SPONSOR

FibraMent offers top-quality baking stones for commercial use across North America and Europe. Precision-engineered from a patented blend of kiln-fired high-temperature and conductive raw materials, FibraMent is NSF-tested and -certified. The company stocks a wide selection of sizes to fit most commercial oven makes and models. FibraMent can also provide custom, precision-engineered manufacturing solutions to meet your unique requirements. 708-478-6032, FIBRAMENT.COM

Saputo Premium Gold Mozzarella Cheese is a high-quality, low-moisture mozzarella offering a butter flavor; smooth, moist texture; superior stretch; uniform melt; and less burning and oiling under heat. Make your menu stand out with mozzarella that’s crafted to perform in professional kitchens and hold up to delivery. 800-824-3373, SAPUTOFOODSERVICE.COM

Pizzerias can now offer vegans and other health-conscious customers Veggie Power’s allvegan pizzas, made with Violife 100% vegan mozzarella cheese as well as the company’s plant-based pepperoni topping. Offer these sumptuous plant-based versions of the most popular pizza toppings to become known as a vegan-friendly pizza destination. Veggie Power’s all-vegan pizzas are non-GMO, gluten-free and all-natural, with only seven grams of carbs and 80 calories per serving. 732-803-2925, TDSPECIALTYFOODS.COM

Versa-Flex has been making premium hot bags since 1991. Its line includes the new BB-1519.04 Premium Bag with the new hard bottoms. They are machine-washable and designed to hold four ½-sheet pizzas. All of Versa-Flex’s bags can be customized with your pizzeria’s logo. Versa-Flex is a Disabled American Veteran-owned and operated company, and all products are made in the USA. 440-327-2333, VERSA-FLEX.COM

For more than three generations, the Uhlmann Company has been producing Heckers and Ceresota unbleached flours for the finest pizza restaurants in Chicago and New York City. Now they’ve introduced Ceresota Napoli “00” flour. Milled in Italy from the finest European and Italian soft wheat, it’s authentically Italian and designed to meet the needs of the most seasoned pizzaiolos. HECKERSCERESOTA.COM

» Fiberglass strength and durability outlast plastic trays

» Color matching available

» Interlock stacking with or without lids to ensure dough quality

» Secure stacking with no bending or sagging

» Easily cleaned in any standard or commercial high-temp washer

» Snap-on lids and heavy-duty dollies available PH

DOUGH

Balancing old-school charm with millennial-friendly updates, this still-expanding SoCal enterprise celebrated 65 years in 2020.

BY TRACY MORIN

BY TRACY MORIN

La Bella Pizza Garden in Chula Vista, California, was the brainchild of Tony Raso, a Purple Heart-decorated war veteran and dairy farmer, and his wife, Kitty, who honed her service charms as a waitress in Manhattan. Escaping the harsher winters of New York, they ventured together to Southern California, where Tony continued working as a farmer—until his boss gave him a loan to open the doors of his own business, La Bella Pizza Garden, in 1955. “We’re the oldest in the South Bay—halfway between downtown San Diego and Tijuana, Mexico,” explains Tony Raso Jr., current owner with his son; his brother, Joe; and his dad’s longtime right-hand man, Stan Dale. “We’re not in a Little Italy-type area; we are the Little Italy!”

The way La Bella Pizza Garden has grown over the decades, it can certainly make that claim. Today, the business occupies two storefronts on two parallel streets: the old-school original and now La Bella Cafe & Games, which spans 20,000 square feet and houses pool tables, arcade games and TVs for sports watching. An always-booked banquet facility seats 150, while indoor and outdoor seating packs in crowds year-round, from seniors returning regularly during breakfast hours and families sharing dinners to kids and millennial revelers enjoying the laid-back games area. “We’re an

event center, where people meet to eat,” Tony Jr. says. “We’re always busy one way or another.”

Today, the third generation joins in, as Tony Jr.’s kids have developed their own areas of expertise. Son Matthew helps run the games room, while Michael manages back-of-the-house and prep areas. Like her grandma Kitty, his daughter Phyllis shines as a server, hosting parties. Since his brother Joe retired five years ago, Tony Jr. steers the ship and always keeps an eye out for expansions and improvements (he’s now eyeing a new event center a few miles away). “You have to be able to stay proactive,” Tony Jr. says. “I see a big future for us.”

Tony Sr., whom everyone in the area knew simply as “Papa,” would be proud—he was a fixture at the business until his dying day. A smooth communicator with a whole lotta heart, Tony Sr. was known for being a loving team leader, and that love flowed back to him from employees and community members alike. “He was so good with his staff, and that’s how La Bella grew,” Tony Jr. recalls. “Offering great-quality food at a fair price is important, but it’s all about the interaction.”

Tracy Morin is PMQ’s senior copy editor.