confidence that our ongoing explorations can have a profound effect on your future success. Here are but three examples of groundbreaking new technologies we currently have in development:

O.R. Net – This dramatic new technology will allow a single foot switch to control multiple medical devices from a single user interface. No other product will be able to provide the enhanced safety and security your customers want in what were traditionally cluttered O.R environments.

OPtimal – This unique innovation evaluated the benefits of voice control, gesture control, touch control and control by eye movement (eye tracking) and is now being developed to provide the best multi-modal operation, ie: “task sharing” between foot and voice control for a more integrated O.R.

KliNet5G – We have been researching the use of 5G and low-energy sensors within the computer network to better locate the controlling devices as well as the devices to be controlled everywhere on the hospital grounds.

Contact us today, so that together, we can plan solutions for you for a better (and more profitable) tomorrow.

Maurizio Lauria, Brand Manager Maurizio.lauria@steuteusa.comSteute is, first and foremost, a technology company, not just a foot switch company.

EDITORIAL

TUESDAYS

DIGITAL MARKETING

WEB DEV/DIGITAL OPERATIONS

DeviceTalks Tuesdays is a weekly virtual event that brings the insights and energy of our in-person events to your desktop.

Each DeviceTalks Tuesday will kick off with a quick briefing from the editors of MassDevice and Medical Design and Outsourcing. These presentations will give attendees insights on what trends will be moving medtech in the days to come.

Be sure to check back frequently as new live events continue to be added.

Executive Editor Chris Newmarker cnewmarker@wtwhmedia.com @newmarker

Managing Editor Jim Hammerand jhammerand@wtwhmedia.com

Senior Editor Danielle Kirsh dkirsh@wtwhmedia.com

Pharma Editor Brian Buntz bbuntz@wtwhmedia.com

Associate Editor Sean Whooley swhooley@wtwhmedia.com @SeanWhooleyWTWH

Editorial DirectorDeviceTalks Tom Salemi tsalemi@wtwhmedia.com

Managing EditorDeviceTalks Kayleen Brown kbrown@wtwhmedia.com

Senior Vice President Courtney Nagle cseel@wtwhmedia.com 440.523.1685

CREATIVE SERVICES

VP, Creative Director Matthew Claney mclaney@wtwhmedia.com @wtwh_designer

Senior Art Director Allison Washko awashko@wtwhmedia.com @wtwh_allison

Senior Graphic Designer Mariel Evans mevans@wtwhmedia.com @wtwh_mariel

AUDIENCE DEVELOPMENT Director, Audience Development Bruce Sprague bsprague@wtwhmedia.com

Web Development Manager B. David Miyares dmiyares@wtwhmedia.com @wtwh_webdave

Digital Media Manager Patrick Curran pcurran@wtwhmedia.com @wtwhseopatrick

Front End Developer

Melissa Annand mannand@wtwhmedia.com

Software Engineer David Bozentka dbozentka@wtwhmedia.com

Web Dev./Digital Production Elise Ondak eondak@wtwhmedia.com

PRODUCTION SERVICES

Customer Service Manager Stephanie Hulett shulett@wtwhmedia.com

Customer Service Rep Tracy Powers tpowers@wtwhmedia.com

Customer Service Rep JoAnn Martin jmartin@wtwhmedia.com

Customer Service Rep Renee Massey-Linston renee@wtwhmedia.com

Customer Service Rep Trinidy Longgood tlonggood@wtwhmedia.com

Digital Production Manager Reggie Hall rhall@wtwhmedia.com

Digital Production Specialist Nicole Johnson njohnson@wtwhmedia.com

Digital Production / Marketing Designer Samantha King sking@wtwhmedia.com

Marketing Graphic Designer Hannah Bragg hbragg@wtwhmedia.com

VP, Digital Marketing Virginia Goulding vgoulding@wtwhmedia.com @wtwh_virginia

Digital Marketing Manager Taylor Meade tmeade@wtwhmedia.com @WTWH_Taylor

Digital Marketing Coordinator Matthew Kulkin mkulkin@wtwhmedia.com @WTWH_Matt

Webinar Manager Matt Boblett mboblett@wtwhmedia.com

Webinar Coordinator Halle Sibly hkirsh@wtwhmedia.com

Webinar Coordinator Emira Wininger emira@wtwhmedia.com

EVENTS

Events Manager Jen Osborne josborne@wtwhmedia.com @wtwh_jen

Events Manager Brittany Belko bbelko@wtwhmedia.com

Event Marketing Specialist Olivia Zemanek ozemanek@wtwhmedia.com

VIDEO SERVICES

Lead Videographer Garrett McCafferty gmccafferty@wtwhmedia.com

Videographer Kara Singleton ksingleton@wtwhmedia.com

FINANCE Controller Brian Korsberg bkorsberg@wtwhmedia.com

Accounts Receivable Jamila Milton jmilton@wtwhmedia.com

devicetalks.com

MISUMI mechanical and electrical configurable components can cover up to 90% of your bill of materials with material certification available upon request.

MISUMI’s configurable component solution allows you to choose the material, surface treatment, dimensions, and alterations of a component, and see instant pricing and lead time online.

Learn more about MISUMI’s capabilities.

The results are in from our annual Medtech Big 100 ranking of the largest medical device companies, and while total sales and R&D spending are up, it doesn’t feel right to celebrate.

That’s because our analysis shows a 5% decline in employment across the industry. This is no surprise to anyone who is active on LinkedIn, given this year’s headlines about layoffs and posts from friends and co-workers seeking new opportunities.

It’s not the first time that’s happened. Last year’s analysis captured job cuts due to the COVID-19 pandemic that delayed procedures, snapped supply chains and sickened or killed millions of patients, healthcare providers and medical device employees globally.

But our latest tally shows aggregate employment for the 100 largest medical device companies is at its lowest level since our prepandemic analysis in 2019, which included employment counts from late 2018 and early 2019.

Some of this is likely due to the number of spinoffs in recent years as business units go independent and take up their own spot on the Big 100 for the first time, leaving their parent company with a smaller workforce. There could also be some job loss due to role redundancy from mergers, and other factors like automation and outsourcing allow device developers and manufacturers to do the same work with fewer employees on their payroll.

Jim Hammerand | Managing Editor | Medical Design & Outsourcing | jhammerand@wtwhmedia.com

Whatever the reason, let’s keep the champagne on ice for another occasion. Maybe you’ll celebrate a former colleague’s new job after you’ve provided them with a referral or reference. Or perhaps we’ll raise a glass the next time we meet and pledge to be there for friends in need. Our industry is built on relationships, and this is an opportunity to get in touch and show each other how much we care.

Go deeper into our Big 100 analysis with reporting from Senior Editor Danielle Kirsh not only on the list’s big movers and shakers, but an analysis of medtech compensation for CEOs and median workers as disclosed under relatively new securities regulations.

On top of that, Executive Editor Chris Newmarker has ranked the world’s largest orthopedic companies and offers a preview of the growth they expect in the months ahead, while Pharma Editor Brian Buntz offers a taste of his Pharma 50 ranking.

Two of our articles this month focus on Medtronic, the longtime No. 1 company on the Medtech Big 100. In Product Development, we explore the design defect that’s likely to blame for the company’s massive defibrillator recall. Later, in our Regulatory department, we dive deep into the Medtronic conflict minerals program that investigates red-flag suppliers.

Other coverage this month includes a conversation with Vicarious Surgical’s new operations chief about its robotics technology, along with a roundup of digital health startups that might just one day join the Medtech Big 100 whether through organic growth or acquisition.

And on the cover is Mike Mahoney — CEO of Medtech Big 100 No. 12 Boston Scientific — who offers perspective from the helm of a device manufacturer that’s growing and innovating. We interviewed him at DeviceTalks Boston in May, and if you missed out, make sure you get to DeviceTalks West in Santa Clara, California this Oct. 18–19. It’s a unique opportunity to build relationships that you can count on when the going gets tough — and a great chance to toast the innovators, risktakers and reliable partners that help us advance medtech’s mission.

As always, I hope you enjoy this edition of Medical Design & Outsourcing — and thanks for reading.

PW5548

• Touch Screen Interface

• Bag Stretcher

• Vacuum (optional)

PackworldUSA Medical Impulse Heat Sealers come equipped with TOSS Technology and the advanced PIREG ® Series temperature controllers. The PIREG ® controller monitors the resistance on the heatseal band and responds in milliseconds to assure precision temperature control over the entire heatseal band without the use of thermocouples. available worldwide

Truly are the EXPERTS AT IMPULSE HEAT SEALING! 15 minutes with a TOSS engineer and I learned more about impulse heat sealing than I have in my 30 years of designing V/F/F/S machines... THANKS TOSS!!

Technology is simply

GENUINE TOSS Alloy-20 ® impulse heat seal bands.

• Touch Screen Interface

• Horizontal Orientation

• Stand Mounted (as shown)

• Vacuum (optional)

All sealers meet the standards of ISO 11607-2 and the Touch-Screen line is compliant to 21 CFR Part 11.

Fantastic. The PIREG ® Temperature Controller controls the time and temperature of the impulse heat seal band flawlessly. Truly performs as advertised…

HERE’S WHAT WE SEE: A mixed year for the Medtech Big 100 — and an opportunity to show we care

ORTHOPEDICS: The 10 largest orthopedic device companies in the world

PHARMA:

2023 Pharma 50: The largest pharma companies in the world

PRODUCT DESIGN: Too risky to replace: The design flaw that likely caused Medtronic’s massive ICD and CRT-D recall

PRODUCT DEVELOPMENT: How LivaNova developed a next-generation perfusion system

REGULATORY:

How Medtronic’s conflict minerals program investigates red flag suppliers

ROBOTICS: These surgical robotics arms are destined for the trash — by design

TUBING: Four gastroenterology device innovations doctors need now

MEDTECH BIG 100: THE LARGEST MEDICAL DEVICE COMPANIES IN THE WORLD

Our latest list ranks the giants of medtech manufacturing by annual revenue, R&D spending and employee headcount.

BIG 100 BREAKDOWN RANKED BY REVENUE

JUST MISSED THE LIST BIG 100 ANALYSIS R&D SPENDING RANKINGS RANKED BY EMPLOYMENT HEADQUARTERS LOCATIONS

HOW DOES MEDTECH CEO COMPENSATION STACK UP TO THE RANK AND FILE?

Major medical device companies are now disclosing how much their median employees make — and comparing it to CEO pay.

5 KEYS TO MIKE MAHONEY AND BOSTON SCIENTIFIC’S SUCCESS

Boston Scientific’s market capitalization has grown nearly 10 times larger since Mike Mahoney joined as CEO in 2011. He shared key insights about corporate strategy at DeviceTalks Boston in May.

DIGITAL HEALTH STARTUPS YOU NEED TO WATCH

Keep an eye on these startups as Big 100 medtech firms race to build — or buy — digital technology.

• Resolution ≤5 mV

• Accuracy ±0.25% of full scale

• Real-time adjustable PID control

• Integrated 0 to 10 VDC, 4-20 mA signal, or 3.3 VDC serial communication

• 0 to 10 VDC feedback pressure monitor

• Virtually silent

• No integral bleed required

• Multiple pressure ranges from vacuum to 150 psig

• 2.7 to 65 l/min flow control

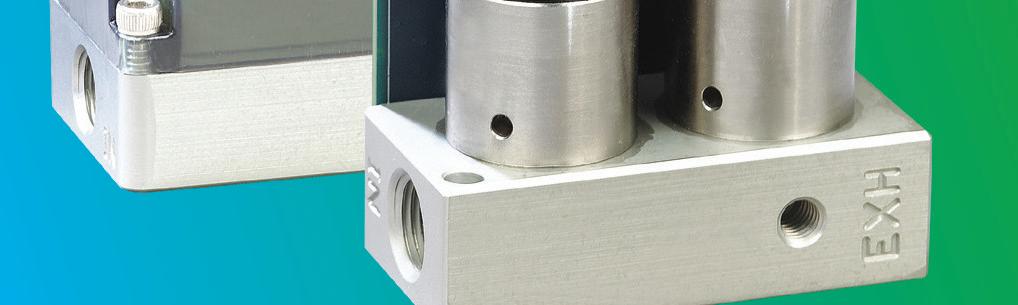

The future of proportional control has arrived— and it’s digital. The Clippard Cordis is a revolutionary microcontroller primed for escape velocity from a proportional control market that has grown stagnant.

With unparalleled performance and flexibility not possible with current analog proportional controllers, the Cordis makes everything from calibration, to sensor variety, to future development opportunities more accessible and less complicated.

Contact your distributor today to learn more about how the Cordis can provide precise, real-time control for your application, or visit clippard.com to request more information.

877-245-6247

CINCINNATI

CINCINNATI

Each year, Medical Design and Outsourcing collects thousands of data points to rank and analyze the largest medical device companies in the world, including publicly traded companies and privately held firms.

The Medtech Big 100 includes annual revenue, R&D spending, headcount, CEOs and key leaders, headquarters locations and descriptions of each company.

Typically, we gather the data from regulatory disclosures filed with the U.S. Securities and Exchange Commission. Some companies, such as privately held firms, share data directly with us.

A majority of these companies operate on a standard calendar year, but some have fiscal years for which we’ve collected data as recently as April 2023.

We used fiscal 2022 data for companies with fiscal years that end in June or September such as Accuray, Asahi Intecc, BD, Cardinal Health, Carl

Zeiss Meditec, Cochlear, Electromed, Embecta, Hologic, ResMed and Siemens Healthineers because their annual reports don’t come out before production time. Also note that companies that report their financial results in foreign currency have been converted to U.S. dollars using standardized Federal Reserve rates for the revenue ranking.

While the industry awaits the upcoming spinoffs of 3M Health Care and Baxter’s Vantive kidney care unit, completed spinoffs like Embecta , GE HealthCare and ZimVie have made their way into the 2023 Medtech Big 100. Last year, Zimmer Biomet’s dental and spine spinoff ZimVie was among the largest companies at No. 69. Some medtech applications perform better than others each year, and oftentimes that can be apparent in how companies rank among the 100 year-over-

year (see our Medtech Big 100 analysis for more). Notable changes this year include ICU Medical, which moved 10 spots up the list versus last year after its merger with Smiths Medical. Haemonetics also rose nine spots, having grown revenue by 17%. Most notably, Shockwave Medical, which is highlighted in our annual analysis, jumped 11 spots up the list. Inspire Medical, which didn’t make the list last year, is now at No. 94 as sales grow for its implantable sleep apnea devices. However, as the effects of the COVID-19 pandemic on medtech settle, some companies have fallen to lower spots in the Medtech Big 100. Dräger’s medical division, which makes ventilators and other medical supplies, dropped nine spots. Fisher & Paykel Healthcare, which also develops respiratory care devices, dropped 10 spots down the list.

– Senior Editor Danielle Kirsh

(continued from page 12)

(continued on page 16)

PSN is an ISO 9001:2015 certified engineering firm, providing services in all areas of product development.

We have three main Laboratories comprised of our Engineering Design Center, Material Processing Lab, and our ISO/IEC 17025:2017 certified Testing Laboratory.

Our teams of highly qualified engineers, scientists, and SMEs work across each lab to provide a unique advantage to our clients.

PATIENT SAFETY IS THE #1 PRIORITY

• Work directly with our SMEs

• Customized programs to fit your device

• ISO 10993/ISO 18562 Testing

• Toxicological/Biocompatibility Risk Assessments

• FDA 510(k) Submission guidance

PSN Labs has the experts to isolate confounding variables and provide clear analysis to guide the commercialization of existing and new medical devices.

www.psnlabs.com

DESIGN AND DEVELOPMENT WITH BIOCOMPATIBILITY IN MIND

Dublin, Ireland (operational HQ in Fridley, Minnesota) United States

$31,227,000,000*

*Fiscal year ended 4/29/2023

2022 rank: 1

R&D spend: $2,696,000,000

Employees: 95,000

Company CEO: Geoff Martha

MEDTRONIC has had its share of setbacks over the past year, but the world’s largest medical device company has also made moves that could set it up to make a difference in the treatment of chronic health conditions such as atrial fibrillation. Fiscal 2023 revenue was down 1.4% compared to the previous year. Analysts are taking a wait-and-see approach to Medtronic’s performance in fiscal 2024. Even as it spins off some businesses and engages in significant cost reductions, including layoffs, Medtronic is now spending more annually than before the pandemic on R&D. It’s also engaging in tuck-in acquisitions to gain new, innovative tech. For example, it doubled down on its commitment to boost its diabetes business by announcing plans in May to spend $738 million to buy EOFlow and its tubeless, wearable and fully disposable insulin delivery

device. Medtronic officials also predict they’ll be one of the first companies to the U.S. market with a pulsed-field ablation catheter — a technology that has generated excitement in the cardiology space when it comes to treating atrial fibrillation (AFib). In addition, the company has reported positive momentum in rolling out its Hugo robotic surgery system internationally. Medtronic’s next big opportunity seemed to be its renal denervation (RDN) technology for treating hypertension. RDN could be a billiondollar business for Medtronic after two failed trials in the past decade, but an unfavorable FDA review panel vote in August left Medtronic less likely to win FDA approval. Meanwhile, Medtronic is facing yet another challenge: a major recall of ICDs and CRT-Ds. –CN

www.medtronic.com

New Brunswick, New Jersey United States

$27,400,000,000*

*Fiscal year ended 1/3/2023

2022 rank: 2

R&D spend: $2,488,000,000

Employees: Not available

Company CEO: Joaquin Duato, CEO; Ashley McEvoy, EVP and J&J MedTech worldwide chair

JOHNSON & JOHNSON will have a new focus on medtech and pharmaceuticals now that it’s spinning off its consumer business as a new public company called Kenvue. In December, J&J boosted the profile of J&J MedTech inside the company through its $16.6 billion acquisition of Abiomed and its Impella heart pump portfolio for treating coronary artery disease and heart failure. Meanwhile, EVP and MedTech worldwide chair Ashley McEvoy joined the ranks of J&J’s top-paid executives and started a two-year term as chair of the trade group AdvaMed. Another bright spot is Biosense Webster, which has a new president, Jasmina Brooks. Biosense Webster launched an atrial fibrillation (AFib) mapping catheter called Optrell with TrueRef technology, and

is also moving forward with its investigational Thermocool SmartTouch SF dual energy catheter for treating AFib. The system enables doctors performing an ablation to toggle between two types of energy: pulsed-field and radiofrequency. It appears to be Johnson & Johnson MedTech’s answer to Affera, which competitor Medtronic acquired for $1 billion last year. As for the DePuy Synthes ortho device business, it has a new major partnership with GE HealthCare in the spine surgery space. On the flip side, the company remains mostly quiet about its Ottava surgical robotics system, with surgical robotics among the areas where J&J MedTech cut jobs earlier this year. –CN

www.jnjmedtech.com

$22,799,700,000*

*Fiscal year ended 9/30/2022

(€ 21,714,000,000)

2022 rank: 3 R&D spend: $1,874,250,000

Employees: 69,500

Company CEO: Bernd Montag

SIEMENS HEALTHINEERS management has pared back some businesses as they seek to continue revenue growth in the present economic environment. The German medtech giant scaled back its robotic surgery ambitions, announcing in May that it plans to discontinue the use of its Corindus surgical robotics for cardiology procedures. Siemens Healthineers spent $1.1 billion on Corindus in 2019. In addition, Siemens Healthineers is streamlining its diagnostics business. In November 2022, it announced plans to halve the number of diagnostic platforms it offers in coming years as it seeks to overcome supply chain and other external challenges. CEO Bernd Montag said

during a recent earnings call that he was excited about diagnostics after FDA clearance of the Atellica CI Analyzer, which he called a missing puzzle piece to complete what he described as the youngest platform on the market. He said savings from diagnostics portfolio simplification are kicking in. Meanwhile, Siemens Healthineers is working through some temporary logistics challenges at Varian Medical Systems. Spun out of Siemens to become its own publicly traded company in 2018, Siemens Healthineers became even larger after closing its $16.4 billion acquisition of Varian in 2021. –CN

www.siemens-healthineers.com

$21,200,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 5 R&D spend: Not available Employees: 35,000

Company CEO: Charlie Mills (until Oct. 1, 2023); Jim Boyle, incoming CEO

MEDLINE sales were up roughly 5% year-overyear to $21.2 billion in 2022, enabling the privately held medtech giant to move up one spot in the MedTech Big 100 rankings. Medline announced in June that it is promoting from within to fill CEO and president positions. Jim Boyle is taking over the corner office at Medline, effective Oct. 1. Boyle has been at Medline since 1996 and served as EVP since 2018, managing the company’s customer base of over 5,000 healthcare providers. Meanwhile, Jim Pigott will become president and chief operating officer. After more than 26 years of leadership, CEO Charlie Mills, President

Andy Mills and COO Jim Abrams will retire from their current positions. They’ll continue to play important roles in the company, however, with Charlie Mills as board chair and Andy Mills and Abrams as vice chairs. Blackstone, Carlyle and Hellman & Friedman made a multibillion-dollar investment in Medline in 2021, with the Mills family remaining the largest single shareholder. The company used the investment to fund new distribution centers, manufacturing capabilities and IT upgrades. –CN

www.medline.com

Your patients deserve truly custom solutions to their unique health needs. Halkey-Roberts has the expertise, financial resources and product knowledge to deliver major customization at a minor per-unit cost.

Your patients deserve truly custom solutions to their unique health needs. Halkey-Roberts has the expertise, financial resources and product knowledge to deliver major customization at a minor per-unit cost.

Experience the difference for yourself. Scan the code to learn more and request free sample product or visit www.halkeyroberts.com/landing1

Experience the difference for yourself. Scan the code to learn more and request free sample product or visit www.halkeyroberts.com/landing1

$18,718,350,000*

*Fiscal year ended 12/31/2022 (€ 17,827,000,000)

2022 rank: 4 R&D spend: $2,208,150,000

Employees: 77,233

Company CEO: Roy Jakobs

The all-consuming story for PHILIPS over the past year remains its massive recall involving millions of CPAPs, ventilators and other respiratory devices. The recall has removed the Dutch medtech giant from the respiratory devices market for the past two years. Reports of problems continue. The devices — used for sleep apnea therapy and more — had sound abatement foam that could potentially degrade and get into the airways. FDA presently has more than 100,000 reports of problems — including 384 mentioning deaths. Philips CEO Roy Jakobs has said the Dutch medtech giant is deeply sorry about the recall. Philips remains in the midst of

consent decree talks with the U.S. Department of Justice and the FDA. Meanwhile, Philips continues to engage in major belt-tightening. It cut at least 6,600 jobs in 2023 and planned a total of 10,000 cuts by 2025. The company announced in July that it is raising its full-year 2023 outlook to mid-single-digit comparable sales growth. Said Jakobs: “I’m very confident that our innovation portfolio is well-positioned to help hospitals worldwide address their staffing shortages, enhance productivity and improve patient and staff experience.” –CN

www.philips.com

Kalamazoo, Michigan

United States

$18,449,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 7

R&D spend: $1,454,000,000

Employees: 51,000

Company CEO: Kevin Lobo

STRYKER is proving itself to be a leader in medtech’s transition to digital healthcare. It’s little wonder, then, that the ortho device giant moved up a spot to No. 6 in this year’s Medtech Big 100. Stryker’s popular Mako robotic surgery systems are more than just a robot when it comes to knee and hip surgeries. They also offer preoperative data modeling and planning, plus software and displays that assist the surgeon with navigation during the surgery. On top of that, Stryker is tapping health data and artificial intelligence (AI) to improve surgical robotics outcomes. The idea is that data collection and analysis can help surgeons personalize procedures for individual patients to

improve outcomes. Stryker plans to expand the reach of Mako even more next year with new spine and shoulder applications. “There are no robots in total shoulders right now. When that gets released, that runway is so large. There are so many different things we could do in shoulders with the existing Mako platform,” Robert Cohen, president of Digital, Robotics and Enabling Technologies at Stryker, told MDO in January. In light of Street-beating Q2 results, Stryker has raised its full-year 2023 outlook, predicting net sales growth within the 9.5% to 10.5% range. –CN

www.stryker.com

$18,341,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 6 R&D spend: $1,026,000,000

Employees: 50,000

Company CEO: Peter Arduini

During its first six months as a stand-alone company, GE HEALTHCARE’S revenue grew nearly 8% year-over-year. The Chicago-based medtech giant’s second quarter was strong enough that it upped its full-year guidance to 6-8% revenue growth. Imaging, patient care solutions and pharmaceutical diagnostics served as significant growth drivers in Q2. GE HealthCare has been has been on a tear when it comes to forging partnerships to boost its business. In June, it announced that it would work with Johnson & Johnson’s DePuy Synthes in the spine space, pairing its OEC 3D Imaging

System with the J&J unit’s extensive product portfolio. In March, GE HealthCare announced a long-term joint venture with Sinopharm as it seeks to make additional inroads in China’s medical device market. It’s also inked a 10-year medical device maintenance deal with Advantus Health Partners worth $760 million. Other top news this year included the acquisition of Caption Health and its AI-powered image guidance tech. The FDA also cleared its Carescape Canvas patient monitoring platform. –CN

www.gehealthcare.com

$15,887,000,000*

*Fiscal year ended 6/30/2022

2022 rank: 8

(Note: We’ve used the same figures as our 2022 Big 100 ranking because more recent figures were not available in time for our analysis.)

R&D spend: Not available

Employees: Not available

Company CEO: Jason Hollar, CEO; Steve Mason, medical segment CEO

One of the most significant medical device stories out of CARDINAL HEALTH over the past 12 months involved the launch of a pilot supply chain network to enable hospital-level healthcare in people’s homes. The Dublin, Ohio–based medical device and pharmaceuticals supplier announced in November 2022 that it was kicking off the Velocare supply chain network and lastmile fulfillment service through a strategic partnership with Boston-based Medically Home. (Cardinal Health is an investor in Medically Home.) Since the launch, Cardinal Health at-Home Solutions has grown the offering to support several hospital-at-home programs around the country. Velocare is creating critical infrastructure and scalability to make hospital-at-home programs work

and grow. It offers a wide range of needed medical products and supplies, oxygen or medical gas, technology, and medically approved meals. It also goes into patients’ homes to perform services, such as providing and installing technology and collecting and disposing medical waste. The goal is to enable safe and consistent hospital-level care in the home. Overall, Cardinal Health continues to work on turning around its medical segment, which as of early August had seen declining revenue and profits this year. CEO Jason Hollar said in May: “In medical, we continue to see improvement in underlying performance and remain confident in our Medical Improvement Plan initiatives.” –CN

www.cardinalhealth.com

$15,113,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 10 R&D spend: $605,000,000 Employees: 60,000

Company CEO: José Almeida

Count BAXTER among the major medical device companies seeking to refocus through divestitures. In January, Baxter announced plans to spin its renal care and acute therapies units into an independent, publicly traded company. Baxter expects the new, independent, publicly-traded company — called Vantive — to launch by July 2024. Meanwhile, there is uncertain timing around the sale of Baxter’s biopharma solutions (BPS)

business. Baxter recently said it plans for the BPS sale to complete toward the end of the third quarter. Said Baxter CEO José (Joe) Almeida: “These initiatives are focused on enhancing strategic clarity, increasing market responsiveness and accelerating innovation, in an effort to drive greater value for our stakeholders.” –CN

www.baxter.com

Learn how our dedicated First Step team and resources, paired with over 100 years of manufacturing expertise, pays off for our customers. When you need to deliver on your NPI/NPD project, First Step enables project teams to truly unleash innovation!

• 100+ machining centers & advanced applications engineers

• Next-level metrology and inspection capabilities

• Sound DFM input, rapid precision prototypes

• The broad capabilities of a vertically integrated manufacturer

Hobson & Motzer are highly skilled engineers, toolmakers, and quality professionals. We are makers of precision metal components with a remarkable depth of knowledge in med device, with a proven track record of adding value to some of the most challenging applications.

Abbott

(medical device segment)

Abbott Park, Illinois

United States

$14,687,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 9

R&D spend: Not available

Employees: Not available

Company CEO: Robert Ford, chair and CEO; Lisa Earnhardt, medical devices EVP

ABBOTT has now had two straight quarters of double-digit organic sales growth in its underlying business. Even as COVID-19 test sales continue to decline and hammer overall revenue, Abbott officials are betting on a productive, innovative pipeline to build momentum — especially in its medical device business. Its FreeStyle Libre continuous glucose monitors (CGMs) are one of the most important growth drivers. The addressable market for the sensor keeps increasing, with massive coverage expansions all around the globe. Medicare’s coverage update kicked in this past spring. The FDA cleared Abbott’s next-generation FreeStyle Libre 3 last year. Abbott plans for a 15-day sensor launch in the U.S. in the second half of this year, as well as integration into Tandem Diabetes Care’s insulin pumps. Abbott’s other recent

medical device wins include receiving FDA approval of its TactiFlex Ablation Catheter, Sensor Enabled. The company describes it as the world’s first ablation catheter with a unique flexible electrode tip and contact force sensing technology to treat patients with atrial fibrillation. Abbott aims to increase the safety and efficacy of radiofrequency ablation tech to treat atrial fibrillation (AFib). In July, Abbott announced FDA approval of its Aveir dual-chamber leadless pacemaker system. The company says it’s another first — a dual-chamber leadless pacing system that treats people with abnormal heart rhythms. Earlier this year, Abbott completed its $890 million acquisition of atherectomy technology developer Cardiovascular Systems. –CN

www.abbott.com

Franklin Lakes, New Jersey United States

$13,305,000,000*

*Fiscal year ended 9/30/2022

2022 rank: 14

(Note: This year’s analysis added BD’s interventional sales.)

R&D spend: Not available

Employees: Not available

Company CEO: Tom Polen, chair, CEO and president; Mike Garrison, EVP and medical segment president; Richard Byrd, EVP and interventional segment president

Marlborough, Massachusetts United States

$12,682,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 12

R&D spend: $1,323,000,000

Employees: 45,000

Company CEO: Michael Mahoney

Melville, New York United States

$12,647,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 11

R&D spend: Not available

Employees: 22,000

Company CEO: Stanley Bergman

BECTON, DICKINSON & Co.’s medical and interventional segments played an important role in BD’s Street-beating results for its quarter ended June 30, 2023. Medical sales grew by 11.1% year-over-year in the quarter, and interventional increased 6.7%. The growth in the medical segment largely stemmed from robust performance in areas such as medication management and pharmaceutical solutions. Meanwhile, advances in the interventional segment were due to improvements in surgery and peripheral intervention, as well as urology and critical care. BD also recently achieved what CEO Tom Polen said was its No. 1 priority: FDA clearance of updated BD Alaris infusion systems. The clearance ended a hold on shipments of new Alaris systems that had been in place since a Class I recall in 2020. Other recent BD news included the sale of its surgical instrumentation assets to Steris for $540 million and expanded availability of its PosiFlush SafeScrub syringe with an integrated disinfection unit. (Note that we've added BD’s interventional segment to this year's ranking. The medical segment alone was No. 14 last year with nearly $9.5 billion in revenue.) –CN

www.bd.com

Amid unpredictable economic times, BOSTON SCIENTIFIC has stood out as one of the positive stories in the medical device industry. Its sales grew 6.7% to $12.7 billion in 2022, and CEO Mike Mahoney and other top company officials expect it to grow another 10.5–11.5% this year. He said at our DeviceTaks Boston event in May that he sees the company continuing to expand into more interventional procedures where patients receive sameday treatments and go home. “What we try to do is disrupt general surgery,” he said. To get there, Boston Scientific is hiring, and it plans a $170 million expansion in Minnesota. It also continues to make acquisitions to pick up innovative technologies. One of the latest was its $615 million purchase of Apollo Endosurgery and its devices, used during endoluminal surgery (ELS) procedures to close gastrointestinal defects, manage gastrointestinal complications and aid in weight loss. Boston Scientific also continues to benefit from its nearly $300 million acquisition in 2021 of Farapulse and its pulsed-field ablation technology for treating atrial fibrillation (AFib). The system is already available in Europe, where demand is strong, and positive data continues to roll in as Boston Scientific plans to seek FDA approval. –CN www.bostonscientific.com

HENRY SCHEIN is a major distributor of healthcare products and services, with a presence in 32 countries and 3.8 million square feet of distribution and manufacturing space globally. It boasts a selection of more than 300,000 branded products and Henry Schein corporate brand products sold to more than 1 million dental practices, laboratories, physician practices, ambulatory surgery centers, and more, according to its most recent annual report. Recently, it announced it would acquire a majority stake in homecare medical products supplier Shield Healthcare. Henry Schein officials see the move as bolstering the company’s commitment to facilitating a continuum-of-care delivery model. The company is also seeking to support more telehealth, collaborating with Medpod to develop Medpac — a lightweight, portable telediagnostic offering. The companies say Medpac bridges the gap between remote telemedicine consultations and in-person office visits. –CN

www.henryschein.com

Mechanicsville, Virginia United States

$9,955,475,000*

*Fiscal year ended 12/31/2022

2022 rank: 13

R&D spend: Not available

Employees: 20,000

Company CEO: Edward Pesicka

OWENS & MINOR accompanied mixed Q4 results in February with an announcement that it would engage in a corporate realignment. At the time, Owens & Minor said the realignment would include sourcing and demand management, organization structure redesign, network rationalization and operational excellence, and commercial excellence and product profitability enhancement. There was no mention of potential job cuts associated with the restructuring, but a mass layoff notice filed with the Massachusetts state government showed 61 employees let go at a distribution center in Franklin. While recently detailing Q2 results, CEO Edward Pesicka said the company has already started to see financial benefits from the restructuring. Founded in 1882, Owens & Minor provides product manufacturing, distribution support and technology services in roughly 70 countries, according to its most recent annual report. –CN www.owens-minor.com

Drawing from our IN-DEPTH EXPERIENCE in the medical device eld, our in-house wiredrawing, wire-forming, coating, torque and assembly technologies provide a BROAD RANGE of OPTIONS for your device.

Product

CDMO / CMO Services

Minimally Invasive Device Solutions

Co-development Opportunities

Access, Delivery, & Retrieval Systems

Wire & Catheter Based Devices

Contract Manufacturing

Vascular Access Devices

Guidewires, Therapeutic & Diagnostic

Braided & Coiled Catheter Shafts

Class 8 Clean Room

(U.S. HQ in Bethlehem, Pennsylvania) United States

$8,924,895,000*

*Fiscal year ended 12/31/2022

(€ 8,499,900,000)

2022 rank: 15

R&D spend: $568,260,000

Employees: 65,000

Company CEO: Anna Maria Braun, CEO; Jean-Claude Dubacher, U.S. CEO

Alcon $8,717,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 17

R&D spend: $702,000,000

Employees: 25,178

Company CEO: David Endicott

No. 17

With employees in 64 countries, B. BRAUN MELSUNGEN manufactures over 5,000 medical devices and pharmaceutical products, which it supplements with an extensive range of services. According to the German company’s most recent annual report, the offerings include digital components that improve customers’ processes, increase safety and ease the burden on medical professionals. B. Braun products and services cover 15 therapeutic areas and applications grouped into three divisions: Hospital Care, Aesculap (surgical and interventional), and Avitum (chronic disease treatments). Multiple generations of the Braun family have owned the company since its founding in the 19th century, with Anna Maria Braun presently serving as CEO. In the company’s most recent annual report, she described the company’s Spaceplus infusion pump system, which can be connected to hospital data management systems. There’s also the Aesculap Aeos robot-assisted surgical microscope for the operating room. Said Braun: “New technologies offer possibilities for treating people around the world using the highest medical standards, while also ensuring the affordability of health care through greater efficiency.” –CN

www.bbraun.com

Formerly a subsidiary of pharmaceutical giant Novartis, ALCON spun out as a separate eye care business in 2019. The company was founded in 1945 by Robert Alexander and William Conner as a small pharmacy in Fort Worth, Texas. Its U.S. headquarters remain in Fort Worth, with global operations run out of its Geneva, Switzerland headquarters. As of the writing of this description in early August, the company said it expects revenue to grow 7–9% on a constant currency basis this year. In January, Alcon introduced its Total30 reusable contact lens for people with astigmatism. Total30 is made of a proprietary water gradient material that enables a gradual increase to nearly 100% water on the outermost surface. –CN and SW

www.alcon.com

3M Co. $8,421,000,000*

(healthcare segment)

Maplewood, Minnesota United States

*Fiscal year ended 12/31/2022

2022 rank: 16

R&D spend: Not available

Employees: Not available

Company CEO: Bryan Hanson (effective Sept. 1, 2023)

3M officials say they remain on track to spin off the company’s healthcare business by late 2023 or early 2024. “We’ve made good progress … including regulatory filings and system updates in preparation for a soft spin [in November],” 3M CEO Mike Roman told analysts during the manufacturing giant’s Q2 earnings call in July. In August, 3M hired Zimmer Biomet CEO Bryan Hanson to lead the healthcare spinoff as CEO. The healthcare business will stay headquartered in Minnesota during the transition period, but 3M told the Star Tribune of Minneapolis in April that the new company’s management will decide on a headquarters location in the future. –CN

www.3m.com/healthcare

Celestica’s collaborative design and manufacturing process delivers innovative solutions that exceed the highest performance, safety and reliability standards.

With our engineering expertise, advanced manufacturing, and rigorous quality control processes, we help you design, develop and deliver innovative medical devices that enable better patient outcomes.

www.celestica.com/healthtech

No. 18

Fujifilm Holdings

Tokyo Japan

*Fiscal year ended 3/31/2023

(JP¥917,900,000,000)

2022 rank: 18

R&D spend: $371,218,685

Employees: Not available

Company CEO: Teiichi Goto

No. 19

Warsaw, Indiana United States

$6,939,900,000*

*Fiscal year ended 12/31/2022

2022 rank: 19

R&D spend: $406,000,000

Employees: 18,000

Company CEO: Ivan Tornos

No.

Olympus $6,618,266,241*

(healthcare only)

(medical business)

*Fiscal year ended 3/31/2023

(JP¥870,030,000,000)

2022 rank: 20

R&D spend: $509,649,784

Employees: 22,756

Company CEO: Stefan Kaufmann, president and CEO; Gabriela Kaynor, therapeutic solutions global division head; Frank Drewalowski, endoscopic solutions global division head; Richard Reynolds, president, Medical Systems Group, Olympus Corporation of the Americas

www.fujifilm.com/us/en/healthcare

ZIMMER BIOMET is pushing innovation and better execution as elective procedures at health providers recover from the pandemic and younger people opt for orthopedic procedures. During ZB’s Q2 2023 earnings call, former CEO Bryan Hanson (who’s joining 3M’s healthcare spinoff as CEO) noted that Zimmer Biomet has 40 planned product launches between this year and the end of 2025, the majority in 4%-plus growth markets. For example, ZB officials said they plan a full market release of their Persona IQ smart knee implant by Q1 2024, and they still expect to be first-to-market with a robotic shoulder surgery application with their Rosa platform. Zimmer Biomet continues to enhance its ZBEdge Dynamic Intelligence platform for hip and knee surgeries. In March, it announced a definitive agreement to acquire Ossis, a maker of personalized 3D-printed implants. –CN

www.zimmerbiomet.com

OLYMPUS faced a challenge in March 2023 after the FDA sent it a warning letter over its endoscope and endoscope accessories plant in Tokyo. The company also received two separate letters at the end of 2022. On the positive side, includes Olympus planned to establish a series of digital excellence centers following its acquisition of Londonbased Odin Vision and its cloud AI-enabled applications for endoscopy. Olympus also recently launched its next-gen EasySuite ES-IP system for procedure room visualization and integration in the U.S. Olympus medical devices primarily serve gastroenterology, general surgery, pulmonology, bronchoscopy, urology, gynecology, otolaryngology, bariatrics, orthopedics and anesthesiology. –CN

www.medical.olympusamerica.com

At Canon Virginia, Inc., we’ll help you solve your most daunting challenges while engineering new levels of quality and process improvement. Because when it comes to helping you succeed, doing the impossible is all in a day’s work. Learn more at cvi.canon.com/mfg.

Tokyo,

$6,239,280,870*

*Fiscal year ended 3/31/2023

(JP¥820,209,000,000)

2022 rank: 21

R&D spend: $468,458,203

Employees: 30,207

Company CEO: Shinjiro Sato

www.terumo.com

Sunnyvale, California, United States

$6,222,200,000*

*Fiscal year ended 12/31/2022

2022 rank: 22

R&D spend: $879,000,000

Employees: 12,120

Company CEO: Gary Guthart

Medtech companies large and small appear to be learning what INTUITIVE figured out a long time ago: Innovating in surgical robotics is hard. It’s probably why Intuitive remains the dominant company in the soft-tissue robotics space with its da Vinci and Ion systems — and why Intuitive’s top executives are staying quiet about potential timelines for next-generation robotic platforms. During the company’s Q2 earnings call in July, CEO Gary Guthart noted that it’s possible to build features quickly but longterm validation is arduous. For example, the company has initiated a phase 1 launch of Case Insights, a tool that works with the da Vinci system and hospital data to build AI models that find correlations between surgical technique, patient populations, and surgical outcomes. But Guthart noted that it will take several quarters before Intuitive sees material revenue from Case Insights. Intuitive officials also see opportunities for Ion, which has a fully articulating catheter making its way through the lungs for cancer biopsy. In May, Intuitive promoted Dave Rosa to the role of president. –CN

www.intuitive.com

No.

$5,382,400,000*

*Fiscal year ended 12/31/2022

2022 rank: 24

R&D spend: $945,200,000

Employees: 18,300

Company CEO: Bernard Zovighian

Strong transcatheter aortic valve replacement (TAVR) sales backed 10% yearover-year revenue growth for EDWARDS LIFESCIENCES during the first half of 2023. In the U.S., improved hospital staffing levels aided TAVR sales, as did the launch of the Sapien 3 Ultra Resilia. The company has upped its full-year sales guidance to between $5.9 billion and $6.1 billion. “Looking beyond 2023, we remain confident that our foundation of innovative therapies along with a differentiated technology pipeline positions us well for continued longer-term success,” said Bernard Zovighian, who took over as CEO for Michael Mussallem in May 2023. –CN

www.edwards.com

*Fiscal year ended 12/31/2022

2022 rank: 25

R&D spend: $345,000,000

Employees: 19,012

Company CEO: Deepak Nath

SMITH+NEPHEW expects 6–7% revenue growth in 2023. “The continued outperformance in Sports Medicine and Advanced Wound Management — representing 60% of our business — has continued,” CEO Deepak Nath recently said. “In Orthopaedics, our actions to improve product supply and execution have increased our ability to benefit from strong elective procedure volumes.” –CN

www.smith-nephew.com

$4,957,839,000*

*Fiscal year ended 3/31/2023

2022 rank: 26

R&D spend: $101,581,000

Employees: 17,100

Company CEO: Daniel Carestio

Expect STERIS — with its emphasis on infection prevention — to continue to rise in the Medtech Big 100 rankings. The company recently closed on its $540 million acquisition of surgical instrumentation assets from BD. Steris previously bought Cantel Medical for $4.6 billion in 2021. –CN

www.steris.com

Marlborough, Massachusetts, United States

$4,862,800,000*

*Fiscal year ended 09/24/2022

2022 rank: 23

R&D spend: $283,400,000

Employees: 6,944

Company CEO: Stephen MacMillan

HOLOGIC revenue declined in fiscal 2022 but was still above prepandemic levels. The decline of COVID-19 testing slashed the women’s health and diagnostics company’s sales by 21% year-over-year during the first three quarters of fiscal 2023, which wraps up at the end of September 2023. However, Hologic’s breast health business grew revenues 27.4% year-over-year in Q3, aided by higher capital equipment revenue and an improving semiconductor chip supply environment. Said CEO Steve MacMillan: “Our results once again highlight that Hologic’s transformation and post-pandemic performance is durable.” –CN

www.hologic.com

Shenzhen, China

$4,513,300,639*

*Fiscal year ended 12/31/2022

2022 rank: 32

R&D spend: $474,067,469

Employees: 16,099

Company CEO: Li Xiting, chair

MINDRAY announced earlier this year that it launched the TE Air, its first wireless, handheld ultrasound system. Shenzen, China–based Mindray said it designed the TE Air system to meet the global demand for a high-quality, portable ultrasound device. Other launches in recent months include the mWear system for wireless, wearable patient monitoring of a range of vital signs. –CN and SW

www.mindray.com

No. 29

Bad Homburg, Germany

$4,179,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 27

R&D spend: Not available

Employees: Not available

Company CEO: Helen Giza

There have been a lot of changes in top management at FRESENIUS MEDICAL CARE. When Carla Kriwet left after being the division’s CEO for only two months, the renal disease treatment products and services provider promoted then-Deputy CEO and CFO Helen Giza to the corner office. In July, Fresenius Medical Care converted from a legal form of a partnership limited by shares into a German stock corporation. Martin Fischer, head of finance for Siemens Healthineers’ diagnostics division, becomes CFO on Oct. 1. –CN

www.freseniusmedicalcare.com

Charlotte, North Carolina, United States

$3,922,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 29

R&D spend: $174,000,000

Employees: 15,000

Company CEO: Simon Campion

DENTSPLY SIRONA recently reported Street-beating Q2 results and upped its full-year guidance, citing solid performance across its business segments. It was welcome news for the dental tech company, which saw a top management shakeup last year amid questions over use of incentives to sell products to distributors. Eventually, a board audit committee found no evidence of intentional wrongdoing or fraud on the part of its former CEO or CFO — but said their actions still violated the company’s ethics code. Former BD executive Simon Campion became the new CEO. –CN

www.dentsplysirona.com

No. 30

Stäfa, Switzerland

$3,914,136,126*

*Fiscal year ended 3/31/2023

2022 rank: 34

R&D spend: $254,450,262

Employees: 17,608

Company CEO: Arnd Kaldowski

Founded in 1947, SONOVA is a developer of hearing instruments and cochlear implants and other products. Its product brands include Phonak, Unitron, Hansaton, and Advanced Bionics. –CN

www.sonova.com

(RMB¥30,370,000,000)(€ 3,980,000,000) (CHF3,738,000,000) (healthcare products)

• Miniaturization Experts—Micro molded components and assemblies with micro features, tight tolerances, and/or thin walls up to 400:1 aspect ratio

• All In-House—Micro 3D Printing, Micro Tooling, Micro Molding, Micro Automated Assembly, and CT Scanning

• Experienced—Over 30 years as a trusted micro solutions provider to the medical and pharma markets

• Risk Mitigation—Quick-turn prototyping, DfM, DfA, and DfX for early detection with over 1,000 successful projects

• Fully Automated—Simple to complex automated assemblies achieving <1.5 micron positional accuracy

• Materials Expertise—All thermoplastic, long-term implantable, bioresorbable, silicone, and fluoropolymer resins

No.

Otawara, Japan

$3,904,878,255*

*Fiscal year ended 12/31/2022

(JP¥513,331,000,000)

2022 rank: 28

R&D spend: Not available

Employees: Not available

Company CEO: Yuji Hamada

CANON announced the establishment of its Canon Healthcare USA subsidiary in late 2022 to strengthen its presence in the American medical market. In April, it said it had kicked off clinical research in Japan with its next-generation X-ray computed tomography (CT) system. Canon’s business strategy includes boosting its competitiveness in diagnostics such as CT, magnetic resonance imaging (MRI), and diagnostic ultrasound systems — as well as medical component businesses such as X-ray tubes, X-ray detectors and key MRI components. –CN

global.medical.canon

No. 33

No.

Tempe, Arizona, United States

$3,734,635,000*

*Fiscal year ended 12/31/2022

2022 rank: 31

R&D spend: $305,258,000

Employees: 23,165

Company CEO: Joseph Hogan

ALIGN TECHNOLOGY is the maker of the Invisalign clear aligner orthodontics system, an alternative to traditional braces. Founded in 1997, Align Technology pioneered the invisible orthodontics market with Invisalign. The system combines digital treatment planning and mass customization. The company also makes Vivera retainers, iTero intraoral scanners, and Exocad computer-aided design and computeraided manufacturing. Align Technology says it has treated more than 14 million people. –JH

www.aligntech.com

Tokyo, Japan

$3,610,466,846*

2022 rank: 33

R&D spend: Not available

Employees: Not available

Company CEO: Eiichiro Ikeda, group president and CEO

HOYA’S offerings in the life sciences include eyeglasses, contact lenses, intraocular lenses and technology that provides minimally invasive treatments using endoscopes. –CN www.hoya.com/en/business/lifecare

No. 34

San Diego, California, United States

$3,578,127,000*

2022 rank: 35

(Note: We’ve used the same figures as our 2022 Big 100 ranking because more recent figures were not available in time for our analysis.)

R&D spend: $253,575,000

Employees: 8,160

Company CEO: Michael Farrell

Founded in Australia in 1989 by Peter Farrell, RESMED is now led by his son, Mick Farrell, as CEO since 2013. Specializing in cloud-connected respiratory devices, the company offers CPAP machines for sleep apnea and ventilators for conditions like COPD. With competitor Philips facing a major recall that effectively pulled it out of the respiratory devices market, ResMed has rapidly expanded sales within its supply chain’s capacity. In November 2022, it opened a 270,000 ft² plant in Singapore to meet skyrocketing demand better. The same month, it completed its nearly $1 billion acquisition of German healthcare software company Medifox Dan. –CN

www.resmed.com

San Ramon, California, United States

$3,308,400,000*

*Fiscal year ended 10/31/2022

2022 rank: 41

R&D spend: $110,300,000

Employees: 14,000

Company CEO: Albert White

COOPER COS. has two business units — CooperVision and CooperSurgical — that provide products and services to advance vision care and women’s health. CooperVision is a significant manufacturer of contact lenses, while CooperSurgical’s portfolio focuses on women’s health, fertility and diagnostics. In 2022, Cooper announced an $875 million deal to buy Cook Medical’s Reproductive Health business but terminated the acquisition in August 2023 after the Federal Trade Commission launched an anticompetitive practices investigation. –JH and CN

www.coopercos.com

$3,189,755,036*

2022 rank: 38

R&D spend: $122,340,576

Employees: 13,650

Company CEO: Kristian Villumsen

COLOPLAST develops ostomy, continence, interventional urology, wound and skin care products and services. Coloplast announced in June 2023 that it entered into an agreement to acquire Kerecis, a developer of biologics for the wound care market. Coloplast sees Kerecis as an “attractive opportunity” to strengthen its presence in the advanced wound care market. –CN and SW

www.coloplast.us

$3,194,587,814*

*Fiscal year ended 03/31/2023

(JP¥419,957,000,000)

2022 rank: 36

R&D spend: $70,250,093

Employees: 27,220

Company CEO: Yoshihiko Sano

NIPRO offers medical devices in five product areas: renal products, interventional catheter-delivered products, hospital products, cardiopulmonary products and enzymes. The Japanese company’s medical device business has been especially focused on dialysis and artificial organs. Nipro says it is one of the leading manufacturers of dialyzers in the world. –CN

www.nipro.com

$2,909,800,000*

2022 rank: 45

R&D spend: $484,200,000

Employees: 7,600

Company CEO: Kevin Sayer

DEXCOM, a developer of continuous glucose monitoring (CGM) technology, continued its rapid growth in 2023 with the launch of its next-generation G7. Soon after, a new Medicare guideline implemented in April increased the addressable market for the company’s CGM. The San Diego-based company is now shifting its focus toward using its technology beyond diabetes management, with eyes on bringing its sensors to even more users. –SW

www.dexcom.com

Hercules, California, United States

$2,802,249,000*

*Fiscal year ended 12/31/2022

2022 rank: 40

R&D spend: $256,889,000

Employees: 8,200

Company CEO: Norman Schwartz

This Hercules, California–based clinical diagnostics company has been in business for more than 70 years, catering to a customer base that includes universities, research institutions, hospitals, biotech firms, pharmaceutical companies and public health and commercial laboratories. BIO-RAD will be an interesting company to watch as the demand for the COVID19-related diagnostics that boosted business over the past few years continues to fall. The company this year initiated a $500 million share repurchase program. –SW

www.bio-rad.com

No. 41

Gothenburg, Sweden

$2,796,287,694*

*Fiscal year ended 12/31/2022

(28,292,000,000 SEK kr)

2022 rank: 37

R&D spend: $117,121,480

Employees: 11,000

Company CEO: Mattias Perjos

GETINGE’S ventilators and extracorporeal life support technologies were in high demand due to COVID-19 in recent years, but the Swedish medtech company has continued to innovate. Getinge launched a new mechanical ventilator system in January, then picked up FDA clearance for a noninvasive mechanical ventilator in July. However, the company has faced regulatory issues, with two recalls within a month for its Datascope subsidiary earlier this year. –SW

www.getinge.com

Wayne, Pennsylvania, United States

$2,791,041,000*

*Fiscal year ended 12/31/2022

2022 rank: 42

R&D spend: $153,819,000

Employees: 15,500

Company CEO: Liam Kelly

TELEFLEX specializes in critical care and surgical technologies. Its portfolio spans vascular and interventional access, surgical, anesthesia, cardiac care, urology, emergency medicine and respiratory care. It picked up where it left off last year in terms of M&A with a urology play in the form of its $650 million deal to acquire Palette Life Sciences in July. –SW

www.teleflex.com

No. 42

Smørum, Denmark

$2,633,995,423*

*Fiscal year ended 12/31/2022

(DKK kr18,645,000,000)

2022 rank: 39

R&D spend: Not available

Employees: Not available

Company CEO: Søren Nielsen

Healthcare and audio technology company DEMANT’S history stretches back to 1904. Demant provides hearing aids, hearing implants and diagnostic equipment and services to hearing care professionals and users in more than 130 countries. The majority of Demant A/S shares are held by the William Demant Foundation and are listed on Nasdaq Copenhagen as a blue-chip stock. –CN

www.demant.com

Brea, California, United States

$2,569,100,000*

*Fiscal year ended 12/31/2022

2022 rank: Not applicable

R&D spend: $100,100,000

Employees: 12,700

Company CEO: Amir Aghdaei

ENVISTA has a global family of more than 30 dental brands, including Nobel Biocare, Ormco, Dexis, and Kerr. Its dental implants and treatment options, orthodontics, and digital imaging technologies cover a wide range of dentists’ clinical needs for diagnosing, treating, and preventing dental conditions and improving the aesthetics of the human smile. –CN

www.envistaco.com

Billerica, Massachusetts, United States

$2,530,700,000*

*Fiscal year ended 12/31/2022

2022 rank: 47

R&D spend: $235,900,000

Employees: 8,525

Company CEO: Frank Laukien

BRUKER says its high-performance scientific instruments and high-value analytical and diagnostic solutions enable scientists to explore life and materials at molecular, cellular and microscopic levels. Its employees work at over 90 locations globally. German experimental physics professor Günther Laukien helped start the company in 1960, providing what the company says were the first high-resolution systems for analytical chemistry in the U.S. –CN

www.bruker.com

Singapore and Lynge, Denmark

$2,468,550,000*

*Fiscal year ended 09/30/2022

(DKK kr2,351,000,000)

2022 rank: Not applicable

R&D spend: $170,100,000

Employees: 12,000

Company CEO: Eric Bernard

WS AUDIOLOGY is a leader in the hearing aid space. It has a global customer network of thousands of hearing care providers, and also reaches the hearing impaired through consumer-facing businesses. –CN

www.wsa.com

Posi-Hex™ Ceramic Ball Plungers

The non-magnetic ceramic ball is ideal for medical imaging and MRI equipment.

Stainless Steel Knurled Knob Plungers and Knurled Press-Fit Plungers

• Quick-release Knurled Knob Plungers enable precise alignment

• Knurled Press-Fit Plungers allow efficient installation

manufacturers worldwide insist on Vlier for precision-engineered standard and custom components that deliver reliability, accuracy, cleanroom compatibility and time-tested quality.

Heidenheim an der Brenz, Germany

$2,427,180,000*

*Fiscal year ended 12/31/2022

(€ 2,311,600,000)

2022 rank: 43

R&D spend: Not available

Employees: 10,290

Company CEO: Britta Fünfstück

THE HARTMANN GROUP’S history goes back to the early 19th century, with a legacy of medical advances in wound care and skin health. Its focus includes wound care, incontinence management, infection management and more. The company has offices in 36 countries around the world, but its products are available in over 130 countries through a network of distributors. –CN

www.hartmann.info

San Clemente, California, United States

$2,279,997,000*

*Fiscal year ended 12/31/2022

2022 rank: 57

R&D spend: $92,984,000

Employees: 14,500

Syringe and infusion technology company ICU MEDICAL is climbing up the Big 100 ranks following its $2.35 billion acquisition of Smiths Medical last year. With Smiths Medical’s offerings including syringe and ambulatory infusion devices, vascular access, and vital care products, the merger created an infusion therapy company with estimated annual revenues of roughly $2.5 billion. The company could grow even more with rumors swirling earlier this year that it was one of the contenders for some of the business units that Medtronic wants to divest. –SW

www.icumed.com

Milan, Italy Basel, Switzerland

$2,225,055,000*

*Fiscal year ended 12/31/2022

(€ 2,119,100,000)

2022 rank: 49

R&D spend: Not available

Employees: 19,400

Company CEO: Enrico Vita

AMPLIFON is a major hearing aid provider, offering products and services such as Ampli-easy, Ampli-mini, Ampli-connect, Ampli-energy, the Amplifon App, and Companion smart support. –CN

www.amplifon.com

No. 50

$2,216,555,000*

*Fiscal year ended 12/31/2022

(CHF2,321,000,000)

2022 rank: 50

R&D spend: Not available

Employees: 10,400

Company CEO: Guillaume Daniellot

STRAUMANN is a global provider of tooth replacement and orthodontic products and services. Its brands include Anthogyr, ClearCorrect, Dental Wings, Medentika, Neodent, NUVO and Straumann, and it has other fully/partly owned companies and partners. In May, Straumann announced the full acquisition of GalvoSurge, a Swiss medical device manufacturer in the dental field with a specialization in implant care and maintenance solutions. –CN

www.straumann.com

Bloomington, Indiana, United States

$2,200,000,000*

*Fiscal year ended 12/31/2022

2022 rank: 48

R&D spend: Not available

Employees: 10,270

Company CEO: Carl Cook

Privately held COOK MEDICAL has faced some setbacks in 2023. Cooper Cos. abandoned its planned $875 million acquisition of Cook Medical’s reproductive health business after scrutiny from the Federal Trade Commission. Cook Medical in May announced it would lay off 500 workers — about 4% of its global workforce — amid a strategic realignment. –CN

www.cookmedical.com

No. 51

Reading, England, United Kingdom

$2,073,500,000*

*Fiscal year ended 12/31/2022

2022 rank: 51

R&D spend: $92,000,000

Employees: 10,000

Company CEO: Karim Bitar

CONVATEC provides technology for advanced wound care, ostomy care, continence and critical care and infusion care. It offers design and manufacturing services for infusion set technologies and insertion devices for insulin pump treatment. Convatec announced in May that it partnered with Beta Bionics on the launch of the FDA-cleared iLet Bionic Pancreas for automated insulin delivery. The Beta Bionics iLet uses its inset and contact detach infusion sets for subcutaneous insulin administration. –SW and CN

www.convatecgroup.com

888.868.2900 | sales@ableelectropolishing.com

WWW.ABLEELECTROPOLISHING.COM

Precise, consistent and reliable results for a wide array of critical metal parts, with benefits that include:

• Deburring

• Ultracleaning

• Resistance to Bacterial Growth

• Microfinishing

• Fatigue Life Improvement

• Improved Corrosion Resistance

We specialize in electropolishing services for a variety of common and specialty metal alloys including:

• 300 Series Stainless Steels

• 400 Series Stainless Steels

• Copper Alloys

• Tool Steels

• Aluminum

• Titanium

• Nitinol

• Precipitating Hardening Grades

• Unusual Stainless Steels

• Specialty Alloys

• Nickel Alloys

• Specialty Steels

• Carbon Steels

• And others

Send Us Your Part to Process for Free

Irvine, California, United States

$2,035,800,000*

*Fiscal year ended 12/31/2022

2022 rank: 58

R&D spend: $191,400,000

Employees: 4,000

Company CEO: Joe Kiani

MASIMO shareholders ousted two members of the device developer’s board after a heated battle by activist investor Politan Capital Management. Politan called for more board oversight and was critical of Masimo’s $1 billion acquisition of Sound United and its high-end music and entertainment system brands. Masimo founder, Chair and CEO Joe Kiani and his team argue that the deal will enable Masimo to turn millions of home entertainment systems into health hubs. Analysts wonder whether there could be a strengthened case to separate Sound United. Other top Masimo news includes the unveiling of its Freedom smartwatch for continuous health tracking earlier this year. –CN

www.masimo.com

Jena, Germany

$1,997,977,800*

*Fiscal year ended 09/30/2022

(€ 1,902,836,000)

2022 rank: 52

R&D spend: $305,970,000

Employees: 4,224

Company CEO: Markus Weber

CARL ZEISS MEDITEC products and workflow solutions support the diagnosis and treatment of eye diseases. It also provides technology for visualizing minimally invasive surgical treatments in neurosurgery, ENT, spine, pathology, oncology and dentistry. –CN

www.zeiss.com/meditec-ag

Tokyo, Japan

$1,984,650,716*

*Fiscal year ended 03/31/2023

(JP¥260,900,000,000)

2022 rank: 44

R&D spend: $73,026,627

Employees: Not available

Company CEO: Shigekazu Takeuchi

HU GROUP focuses on lab testing, related services and in vitro diagnostics. It also has a part of the business that provides support services related to hospital administration work. –CN

www.hugp.com

No. 55

Lübeck, Germany

$1,912,575,000*

*Fiscal year ended 12/31/2022

(medical division) (€ 1,821,500,000)

2022 rank: 46

R&D spend: Not available

Employees: Not available

Company CEO: Stefan Dräger, chair

DRÄGER’S medical division has fi ve business units: therapy (anesthesia devices and ventilators, as well as thermoregulation equipment), hospital consumables and accessories, workplace infrastructure (supply units, lights, gas management systems), monitoring (patient mon itoring), and data business (software applications, system products, and new services). Its focus in 2022 was on expanding its product portfolio in the intensive care customer area and in the operating room, with activities centered on developing system solutions, according to the company’s most recent annual report. –CN

www.draeger.com/en-us_us/Hospital

Stockholm, Sweden

$1,667,276,160*

*Fiscal year ended 04/30/2023

(16,869,000,000 SEK kr)

2022 rank: 54

R&D spend: $140,150,429

Employees: 4,587

Company CEO: Gustaf Salford

ELEKTA in February said an FDA 510(k) clearance marked a new era in precision radiation cancer therapy in the U.S. The new Comprehensive Motion Management (CMM) with True Tracking and automatic gating is part of Elekta’s Unity MR-Linac radiotherapy system. The new features enable Elekta Unity to continuously calculate the movement of a tumor anywhere in the body and account for it automatically. Also this year, Elekta entered into a joint venture with Sinopharm to increase the adoption of radiation therapy in China. –CN

www.elekta.com

Tokyo, Japan

$1,571,616,680*

*Fiscal year ended 03/31/2023

(JP¥206,603,000,000)

2022 rank: 53

R&D spend: $47,163,030

Employees: 5,751

Company CEO: Hirokazu Ogino

Yoshio Ogino founded NIHON KOHDEN in 1950 with a vision of bringing the power of electrical engineering to medicine. Over the decades, this Japanese company has been a pioneer in pulse oximetry, cerebral artery pressure meters, ECGs, heart monitors and fetal monitors. It operates subsidiaries in Santa Ana, California; Irvine, California; Guilford, Connecticut; Alachua, Florida; Charlottesville, Virginia; and Cambridge, Massachusetts. –CN

www.nihonkohden.com

$1,563,101,000*

*Fiscal year ended 12/31/2022

2022 rank: 56

R&D spend: $60,800,000

Employees: 6,800

Company CEO: Matthew Trerotola

ENOVIS recently upped its 2023 revenue growth projection to 7–7.5% from the prior year. CEO Matt Trerotola says the orthopedic device company is focused on innovationdriven share gain, operational improvement, and compounding impact from M&A. Recent acquisitions include Novastep and its foot and ankle minimally invasive surgical (MIS) platform. In May, Enovis signed a definitive agreement to acquire the Seal external fixation product line from DNE. –CN www.enovis.com

$1,557,666,000*

*Fiscal year ended 12/31/2022

2022 rank: 55

R&D spend: $101,193,000

Employees: 3,722

Company CEO: Jan De Witte

INTEGRA LIFESCIENCES was founded in 1989 after the acquisition of an engineered collagen technology platform that was designed to repair and regenerate tissue. The company has since expanded its regenerative technology product portfolio to include surgical instruments, neurosurgical devices and advanced wound products. Its brands include AmnioExcel, Aurora, Bactiseal, BioD, CerebroFlo, CereLink Certas Plus, Codman, CUSA, Cytal, DuraGen, DuraSeal, DuraSorb, Gentrix, ICP Express, Integra, Licox, Mayfield, MediHoney, MicroFrance, MicroMatrix, NeuraGen, NeuraWrap, PriMatrix, SurgiMend, TCC-EZ, and VersaTru. –JH, DK and CN

www.integralife.com

$1,376,096,000*

*Fiscal year ended 12/31/2022

2022 rank: 60

R&D spend: $60,918,000

Employees: 10,000

Company CEO: Joseph Dziedzic

INTEGER sales rose nearly 18% year-over-year to nearly $779 million during the first half of 2023. The medtech contract manufacturing giant’s strong results caused Integer to boost its full-year sales outlook to 12% growth at the midpoint. In Integer’s Q2 earnings news release, CEO Joseph Dziedzic said: “Integer delivered another strong quarter of sales and profit growth supported by an improving supply chain and labor environment.” –CN

www.integer.net

$1,201,942,000* Acton,

$1,305,300,000*

*Fiscal year ended 12/31/2022

2022 rank: 65

R&D spend: $180,200,000

Employees: 2,600

Company CEO: Jim Hollingshead

INSULET develops wearable automated insulin delivery devices, such as its flagship Omnipod patch pump, which is one of the market leaders in the space. Insulet became a member of the S&P 500 this year, replacing Silicon Valley Bank in March. The company also received FDA clearance for a basal-only insulin delivery system this year, expanding the company’s reach within the diabetes patient population. –SW

www.insulet.com

*Fiscal year ended 12/31/2022

2022 rank: 64

R&D spend: $98,524,000

Employees: 3,000

Company CEO: Chris Barry

NUVASIVE recently reported mixed Q2 results ahead of its planned merger with Globus Medical. As of the writing of this description in early August, officials at both companies were sticking by plans to complete the deal — even as the Federal Trade Commission continues to scrutinize the merger. Combining NuVasive and Globus Medical would create the second-largest spine tech company in the world behind Medtronic. –CN

www.nuvasive.com

Boston, Massachusetts, United States

$1,168,660,000*

*Fiscal year ended 04/01/2023

2022 rank: 72

R&D spend: $50,131,000

Employees: 3,034

Company CEO: Christopher Simon

HAEMONETICS technologies serve medical markets including blood and plasma component collection, the surgical suite and hospital transfusion. News this year included FDA clearance of advancements to its NexSys PCS plasma collection system. Haemonetics also invested €30 million in Galway, Ireland-based Vivasure and its portfolio of fully absorbable, patch-based, large-bore percutaneous vessel closure devices. The agreement includes an option for Haemonetics to acquire Vivasure. –CN and SW

www.haemonetics.com

South Jordan, Utah, United States

$1,150,981,000*

*Fiscal year ended 12/31/2022

2022 rank: 66

R&D spend: $75,510,000

Employees: 6,846

Company CEO: Fred Lampropoulos

MERIT MEDICAL SYSTEMS in June announced $132.5 million worth of acquisitions to expand its offerings. Merit Medical spent $100 million on Angiodynamics dialysis portfolio products, including DuraFlow, DuraMax, Evenmore, Schon XL, Trio-CT and Vaxel Plus hemodialysis catheter brands. The deal with Angiodynamics also included the BioSentry tract sealant system biopsy brand. In addition, Merit spent $32.5 million on the Surfacer inside-out access catheter system from BlueGrass Vascular Technologies. –CN

www.merit.com

Sydney, Australia Wilmington, Delaware

$1,140,728,610*

*Fiscal year ended 06/30/2023

(AU$1,641,100,000)

2022 rank: 59

(Note: We’ve used the same figures as our 2022 Big 100 ranking because more recent figures were not available in time for our analysis.)

R&D spend: $146,457,570

Employees: 4,500

Company CEO: Dig Howitt

Founded in Sydney in 1981, COCHLEAR develops ear implants to help people with hearing loss. The company says it has provided more than 600,000 implantable devices. –CN

www.cochlear.com

(operational HQ in Parsippany, New Jersey) United States

$1,129,500,000*

*Fiscal year ended 09/30/2022

2022 rank: Not applicable

R&D spend: $66,900,000

Employees: 2,000

Company CEO: Dev Kurdikar

Since its spinoff from Becton, Dickinson & Co. (BD) last year, EMBECTA says it continues to make progress on the development of a closedloop insulin delivery system for type 2 diabetes. The system utilizes its proprietary patch pump system, which holds FDA breakthrough device designation. Additionally, Embecta has an ongoing collaboration with Tidepool on automated insulin delivery. –SW

www.embecta.com

CGI Motion standard products are designed with customization in mind. Our team of experts will work with you on selecting the optimal base product and craft a unique solution to help di erentiate your product or application. So when you think customization, think standard CGI assemblies.

Connect with us today to explore what CGI Motion can do for you.

Kyoto, Japan Tokyo, Japan

$1,080,946,212*

*Fiscal year ended 03/31/2023

2022 rank: 61

R&D spend: Not available

Employees: Not available

Company CEO: Junta Tsujinaga

OMRON is a major manufacturer of home blood pressure monitors. In 2023, it is celebrating the 50th anniversary of the introduction of the HEM-1, its first manual and manometer-type blood pressure monitor. The company says it has continuously worked to improve the technology to make it more accurate and user-friendly. Omron has sold over 350 million units in more than 110 countries. –CN

www.omronhealthcare.com

$1,048,236,369*

*Fiscal year ended 03/31/2023

2022 rank: 71

R&D spend: Not available

Employees: Not available

Company CEO: Toshimitsu Taiko