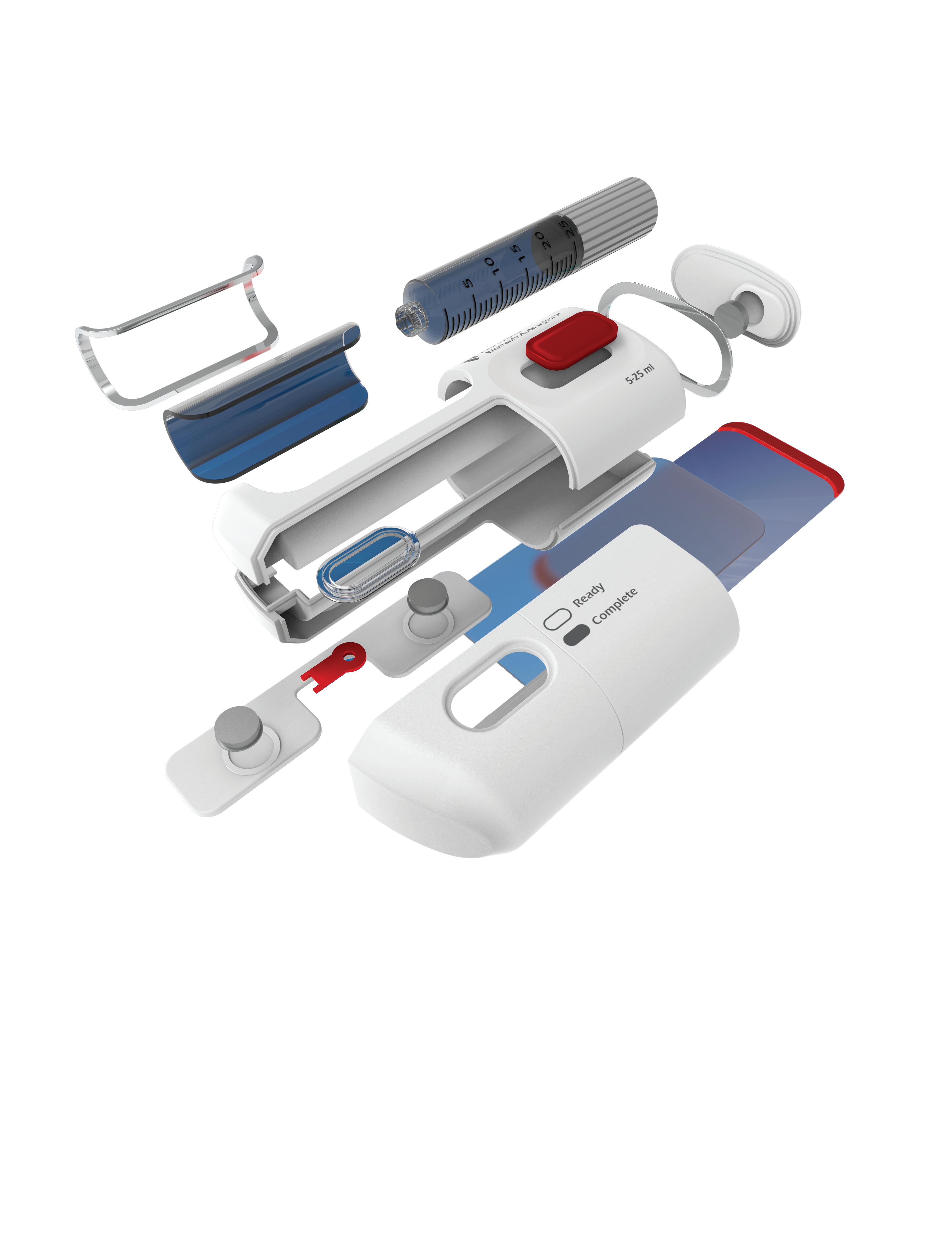

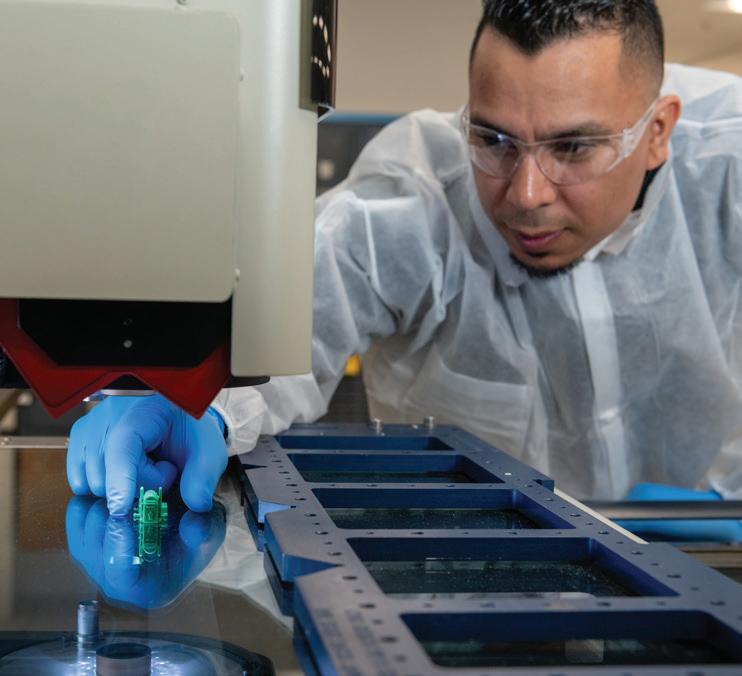

Our diverse technical experience and rapid-turn mindset adapt to changing project demands.

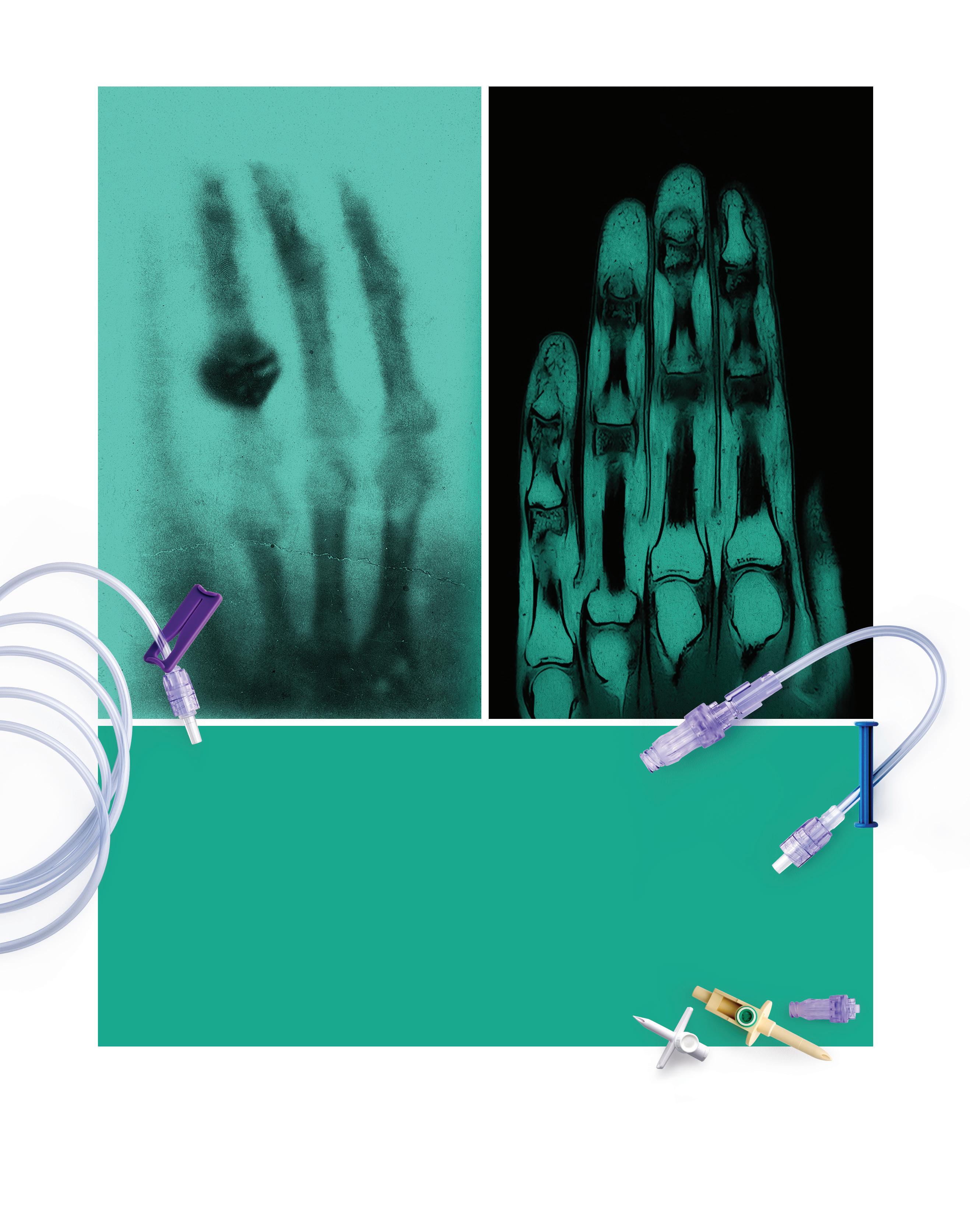

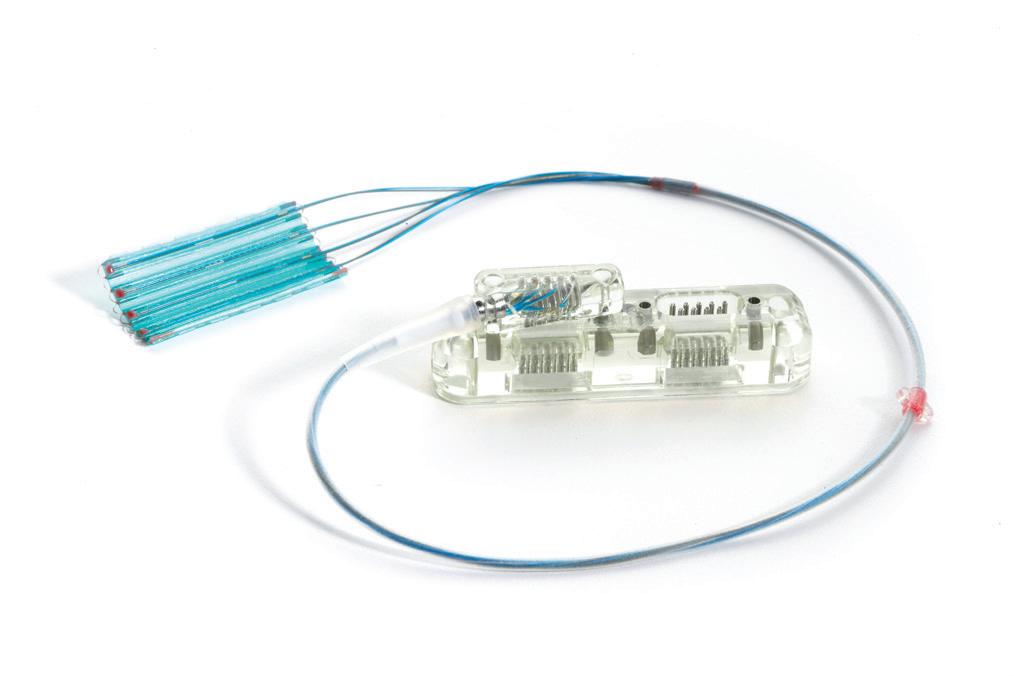

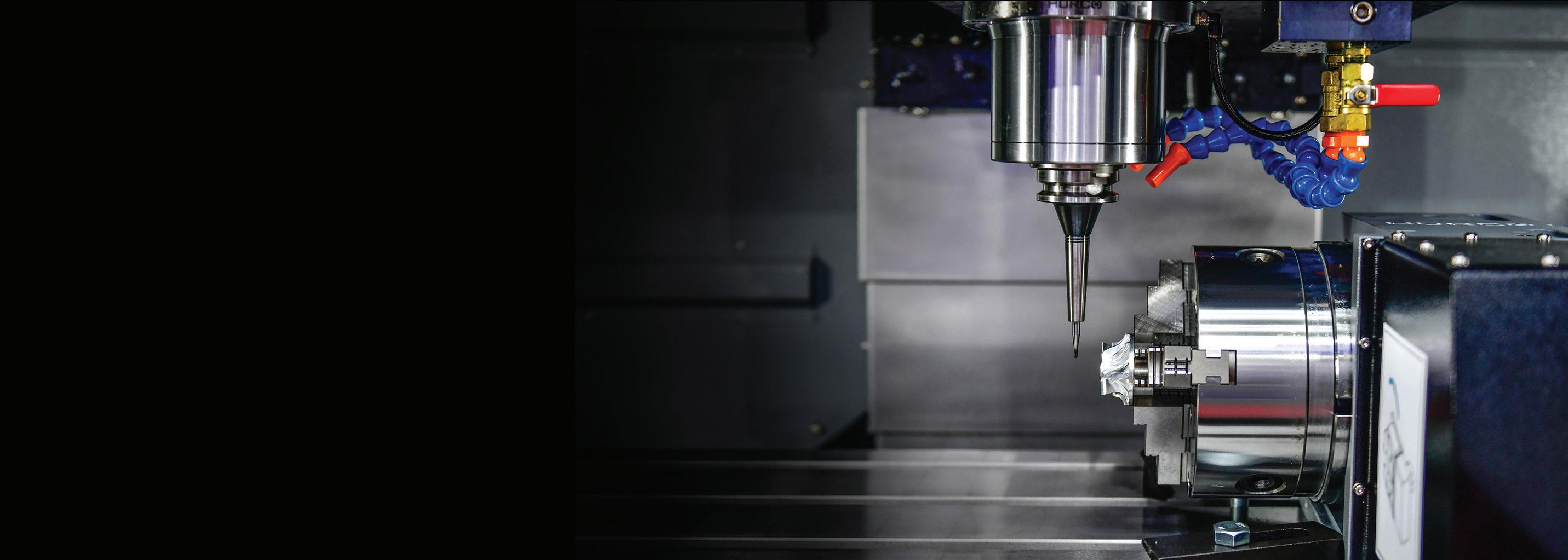

With deep expertise in complex catheter-based delivery systems—as well as electrophysiology, cryotherapy, and implants—our dedicated team of engineers can tackle engineering and manufacturing challenges at all phases of development. Together, we’ll help you advance your solution from concept to market, rapidly and cost-effectively, with the design documentation necessary for regulatory approval.

To learn more, visit resonetics.com/agile-product-development

EDITORIAL

Editor in Chief Chris Newmarker cnewmarker@wtwhmedia.com

WEB DEV/DIGITAL OPERATIONS

DIGITAL MARKETING

VP, Operations Virginia Goulding vgoulding@wtwhmedia.com

Web Development Manager B. David Miyares dmiyares@wtwhmedia.com

Managing Editor Jim Hammerand jhammerand@wtwhmedia.com

Digital Media Manager Patrick Curran pcurran@wtwhmedia.com

Digital Marketing Manager Taylor Meade tmeade@wtwhmedia.com

HELP US HONOR THE COMPANIES THAT HAVE PROVIDED THE MOST LEADERSHIP IN THE MEDICAL TECHNOLOGY INDUSTRY.

Senior Editor Danielle Kirsh dkirsh@wtwhmedia.com

Front End Developer Melissa Annand mannand@wtwhmedia.com

Digital Marketing Coordinator Matthew Kulkin mkulkin@wtwhmedia.com

Editor in Chief, R&D World Brian Buntz bbuntz@wtwhmedia.com

Software Engineer David Bozentka dbozentka@wtwhmedia.com

Webinar Manager Matt Boblett mboblett@wtwhmedia.com

Associate Editor Sean Whooley swhooley@wtwhmedia.com

Web Dev./Digital Production Elise Ondak eondak@wtwhmedia.com

Webinar Coordinator Halle Sibly hkirsh@wtwhmedia.com

PRODUCTION SERVICES

Webinar Coordinator Emira Wininger emira@wtwhmedia.com

The medical device industry just wrapped up another year with more blockbuster mergers grabbing headlines around the world and new, innovative technologies emerging seemingly every day.

DIGITAL MAGAZINE OF THE YEAR HONORABLE MENTION

Editorial DirectorDeviceTalks Tom Salemi tsalemi@wtwhmedia.com

This level of success wouldn’t be possible without the innovation, ingenuity and determination of the people who drive it: leaders. These individuals and companies are working for the growth of the entire medical device industry.

The future of medtech will build on the foundation of today’s efforts and Medical Design & Outsourcing would like to acknowledge such achievements.

We think they deserve recognition from you, too. Vote online for one or more of the companies listed through October.

NATIONAL GOLD FOR REGULAR DEPARTMENT

NATIONAL GOLD FOR OPENING FEATURE SPREAD DESIGN

Managing EditorDeviceTalks Kayleen Brown kbrown@wtwhmedia.com

Customer Service Manager Stephanie Hulett shulett@wtwhmedia.com

EVENTS

Director of Events Jen Osborne josborne@wtwhmedia.com

NATIONAL SILVER FOR COMPANY PROFILE

NATIONAL BRONZE FOR PUBLICATION DESIGN

Customer Service Rep Tracy Powers tpowers@wtwhmedia.com

REGIONAL GOLD FOR OPENING FEATURE SPREAD DESIGN

REGIONAL GOLD FOR REGULAR DEPARTMENT

REGIONAL GOLD FOR COMPANY PROFILE

REGIONAL SILVER FOR SPECIAL ISSUE

REGIONAL SILVER FOR PUBLICATION DESIGN

REGIONAL SILVER FOR FEATURE ARTICLE DESIGN

Senior Vice President Courtney Nagle cseel@wtwhmedia.com 440.523.1685

CREATIVE SERVICES

VP, Creative Director Matthew Claney mclaney@wtwhmedia.com

Customer Service Rep JoAnn Martin jmartin@wtwhmedia.com

Customer Service Rep Renee Massey-Linston renee@wtwhmedia.com

Digital Production Manager Reggie Hall rhall@wtwhmedia.com

Events Manager Brittany Belko bbelko@wtwhmedia.com

VIDEO SERVICES

Videographer Cole Kistler cole@wtwhmedia.com

FINANCE

REGIONAL BRONZE FOR DIVERSITY, EQUITY AND INCLUSION

REGIONAL BRONZE FOR ENTERPRISE NEWS STORY

Director, Audience Development Bruce Sprague bsprague@wtwhmedia.com

Digital Design Manager Samantha Goodrich sgoodrich@wtwhmedia.com

Senior Digital Designer Hannah Bragg hbragg@wtwhmedia.com

Controller Brian Korsberg bkorsberg@wtwhmedia.com

Accounts Receivable Jamila Milton jmilton@wtwhmedia.com

LEADERSHIP TEAM

EVP

CEO Scott McCafferty smccafferty@wtwhmedia.com 310.279.3844

CFO Ken Gradman kgradman@wtwhmedia.com 773.680.5955

Marshall Matheson mmatheson@wtwhmedia.com 805.895.3609

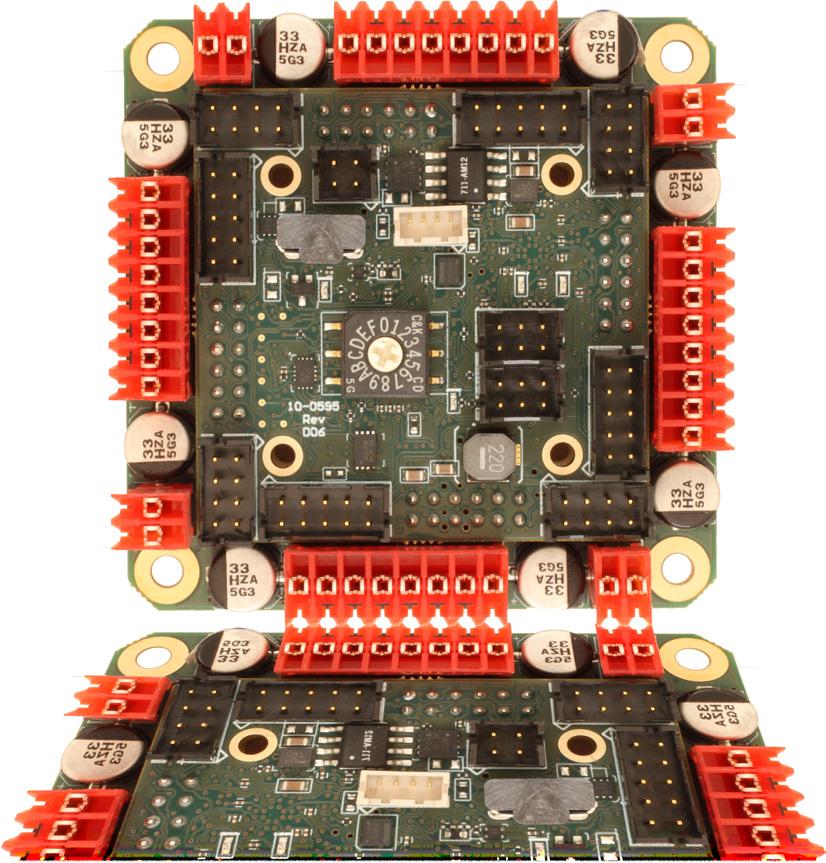

- brushed or bldc motors

- 5 amps per axis

- 16 analog inputs

- 16 on/off drivers

- home and limit in

- live tech support

- made in the USA

egadeals meant massive moves and new names on our 2024 Medtech Big 100 ranking of the world’s largest medical device companies.

The Medtech Big 100 is bigger than ever with a record-high $474.8 billion in sales for the 100 companies. And that figure is growing faster than the year before, partly a reflection of continued stabilization from COVID-19 pandemic shocks to suppliers and customers.

But M&A and spinoffs are another factor in our list’s accelerating growth, and we expect they’ll continue to be in the years ahead.

For example, Johnson & Johnson MedTech’s revenue jumped 11% from the year before, with nearly half of those gains coming from its Abiomed acquisition. And our latest ranking doesn’t yet account for J&J’s purchase of Shockwave Medical, which climbed 11 spots in its final year as an independent organization.

J&J MedTech hasn’t yet surpassed Medtronic to take the No. 1 spot, though it’s getting closer and closer. But J&J’s growth pushed it past Medtronic by another measure, taking the No. 1 spot on our ranking of the top R&D spenders.

This year’s Medtech Big 100 report includes company details, our aggregate analysis of the ranking, rankings by total employment and R&D spending as a share of revenue, and a look at five companies that almost made the cut.

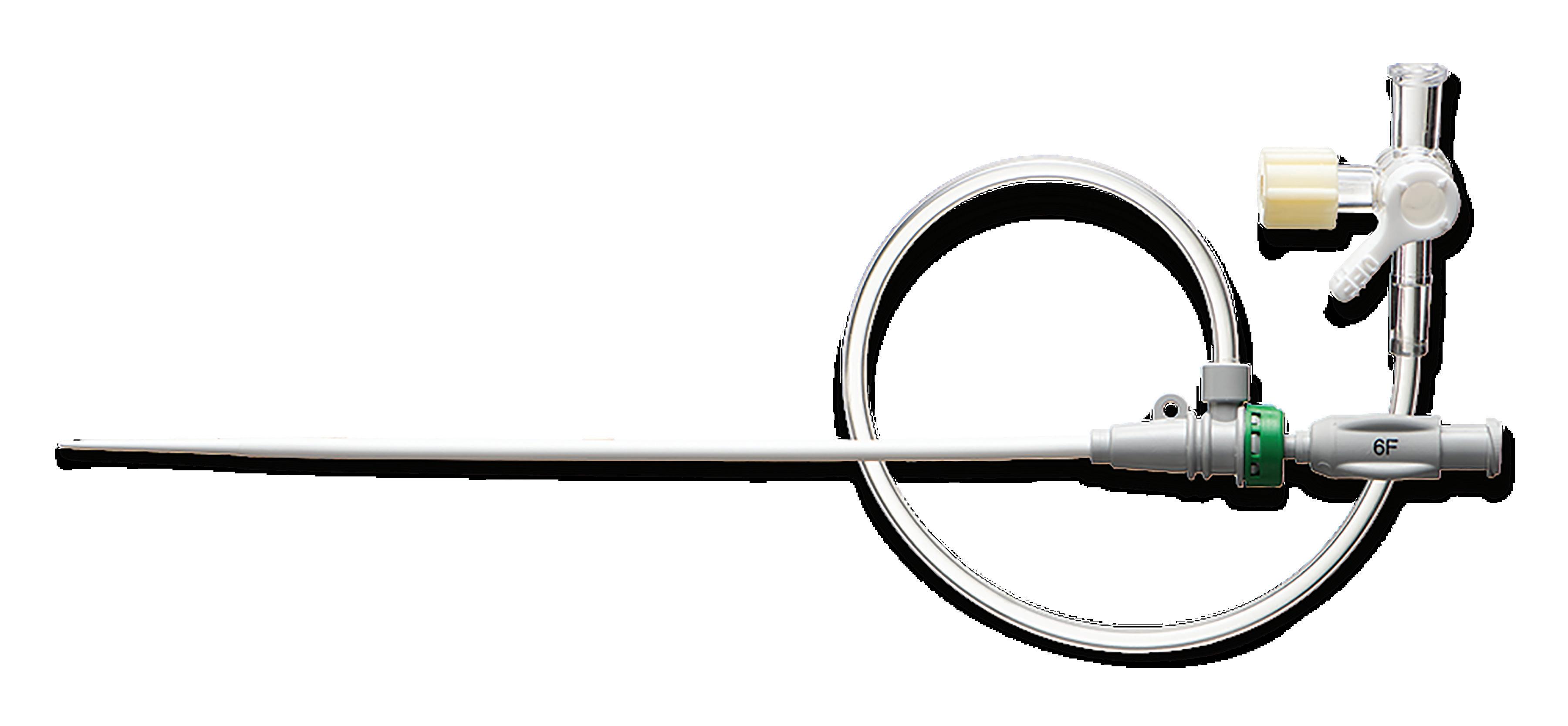

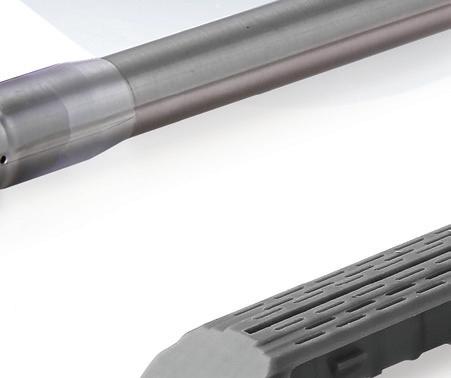

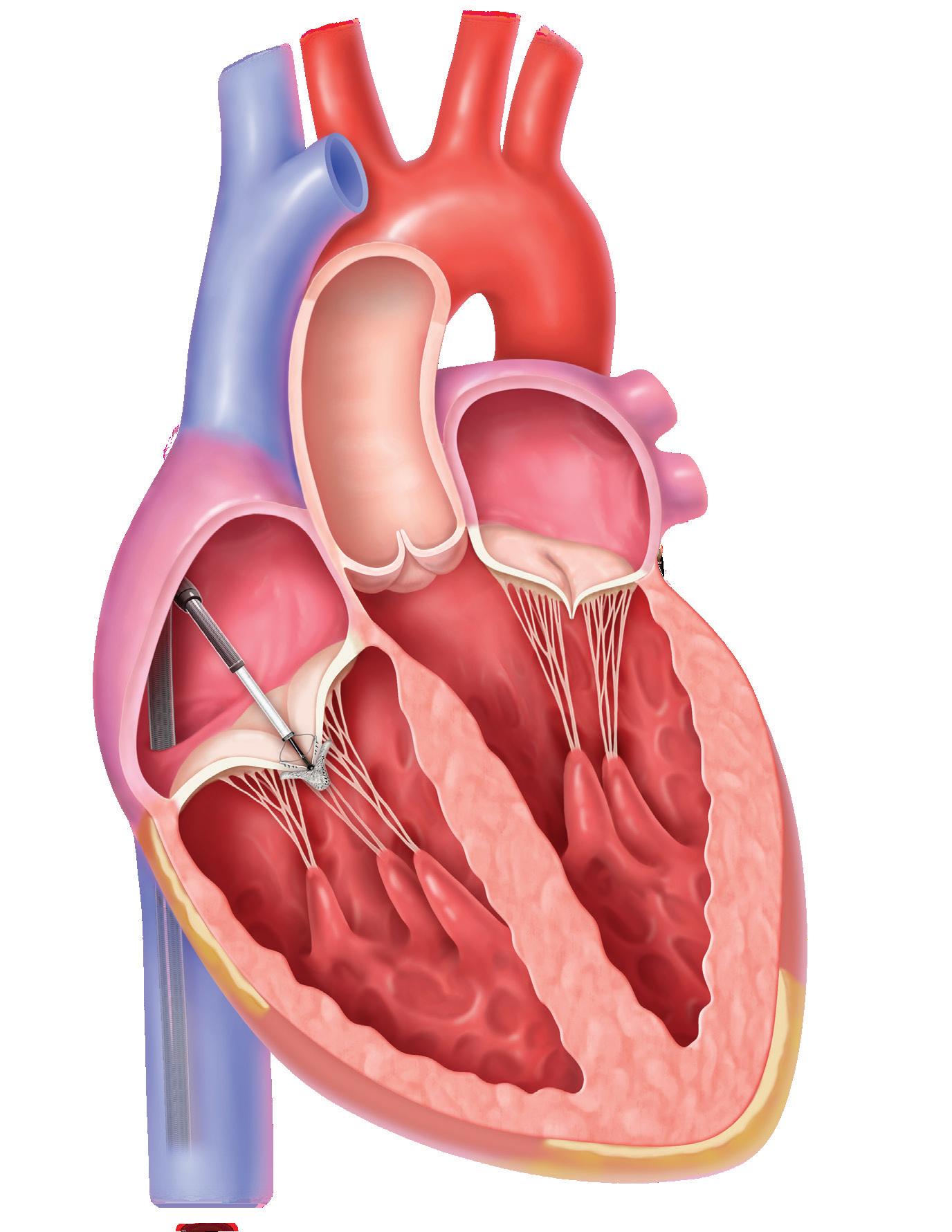

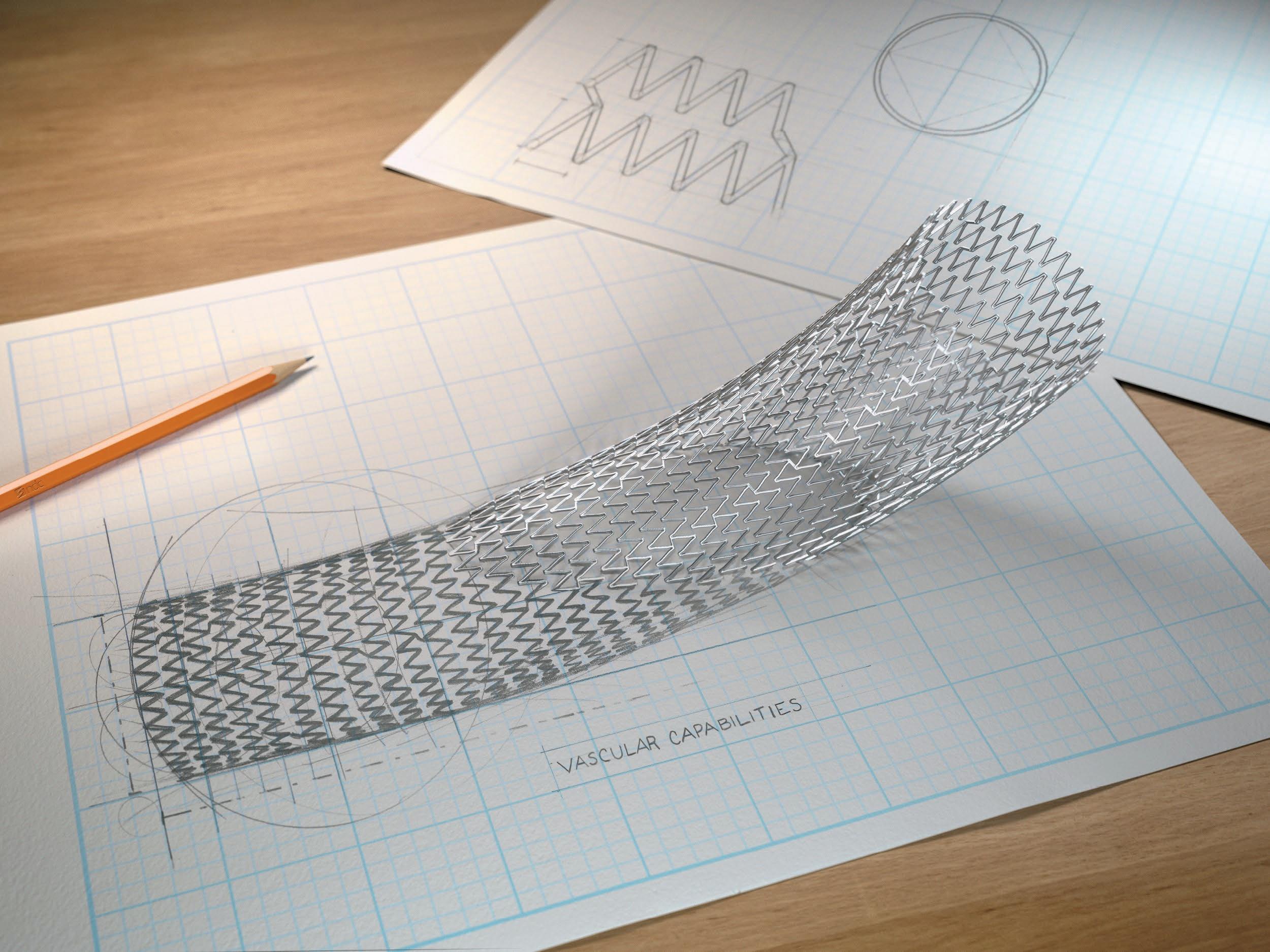

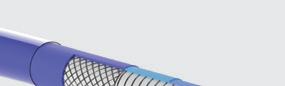

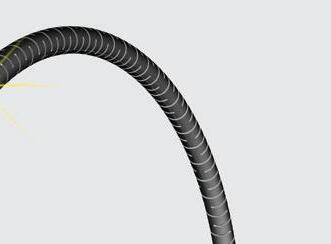

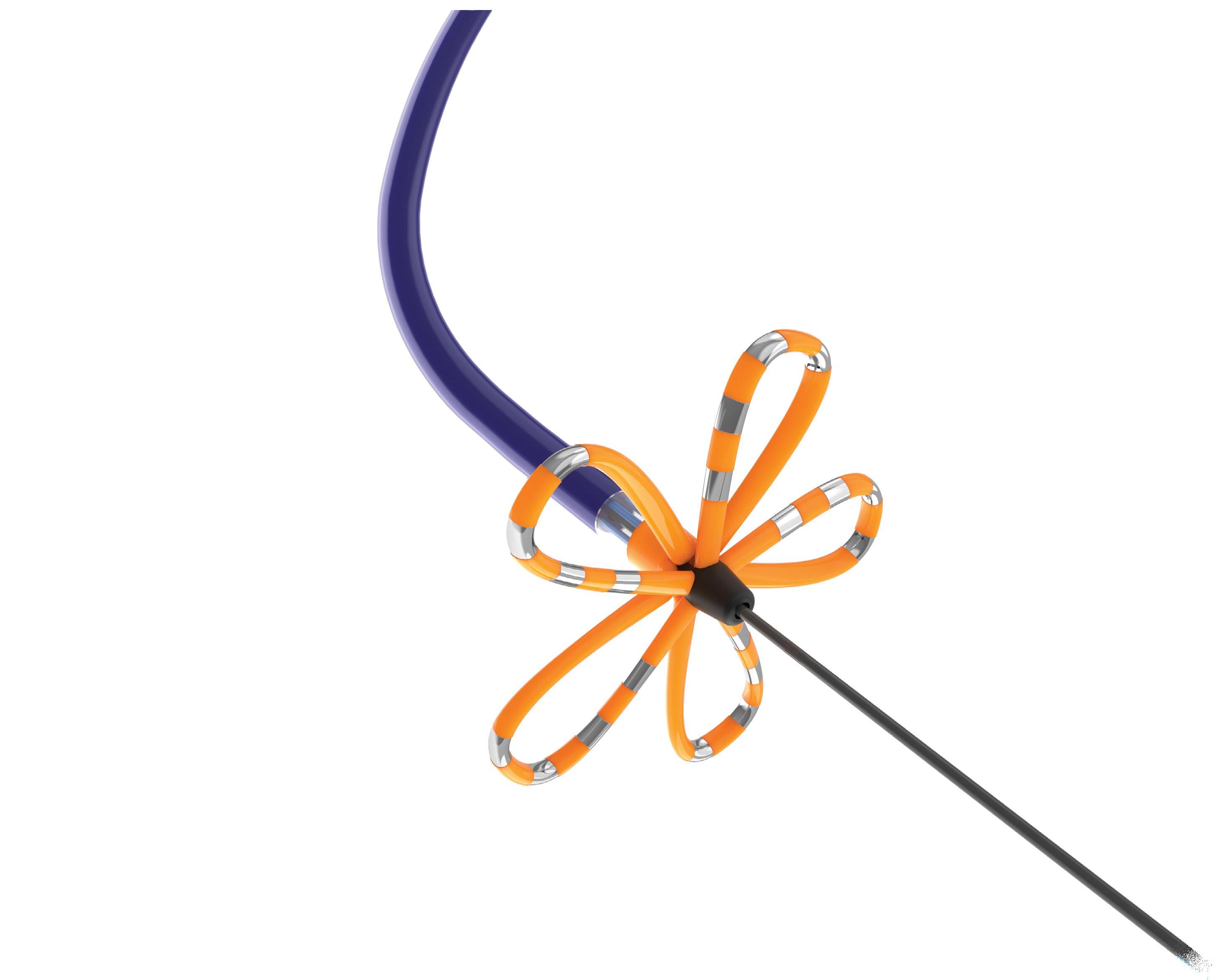

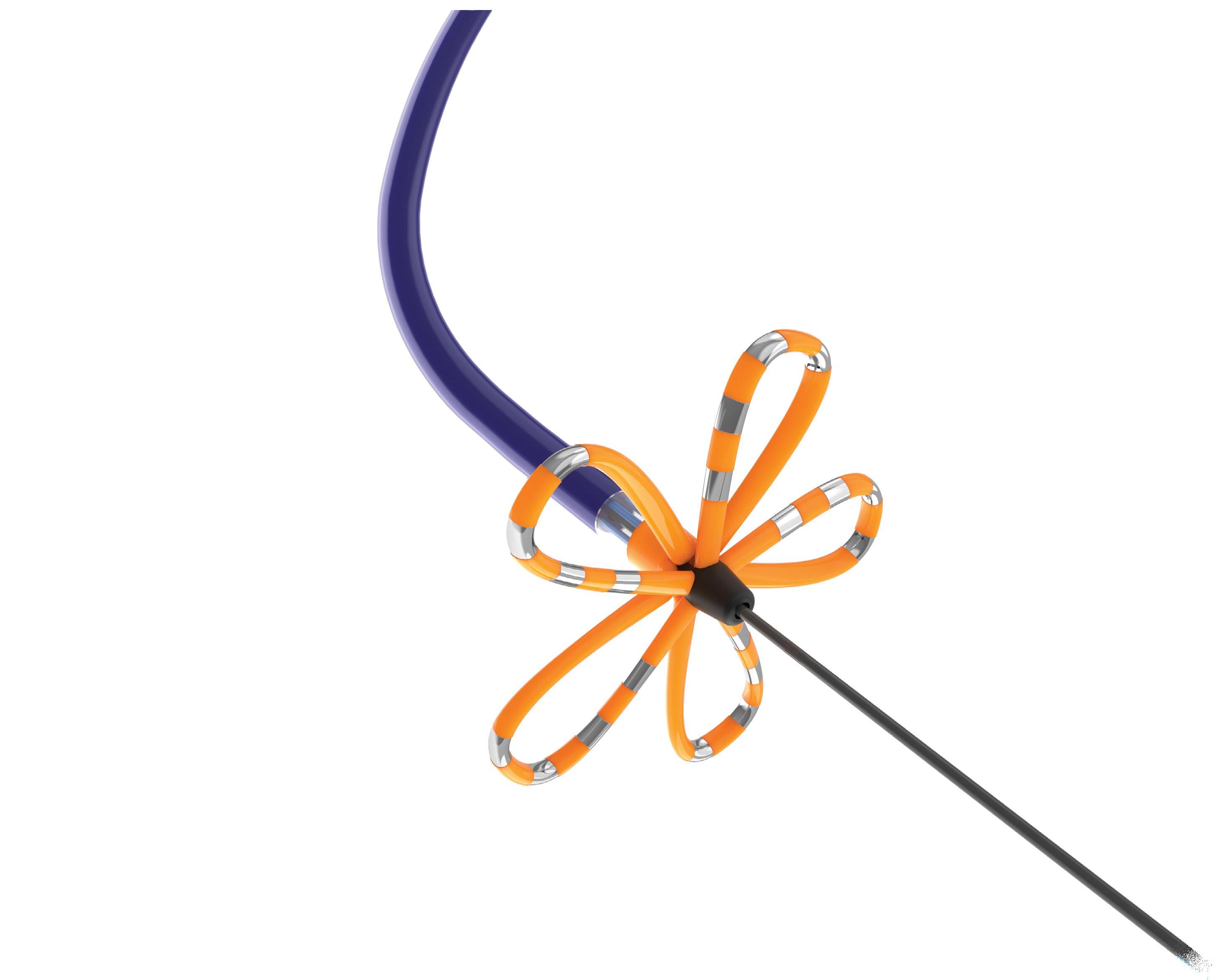

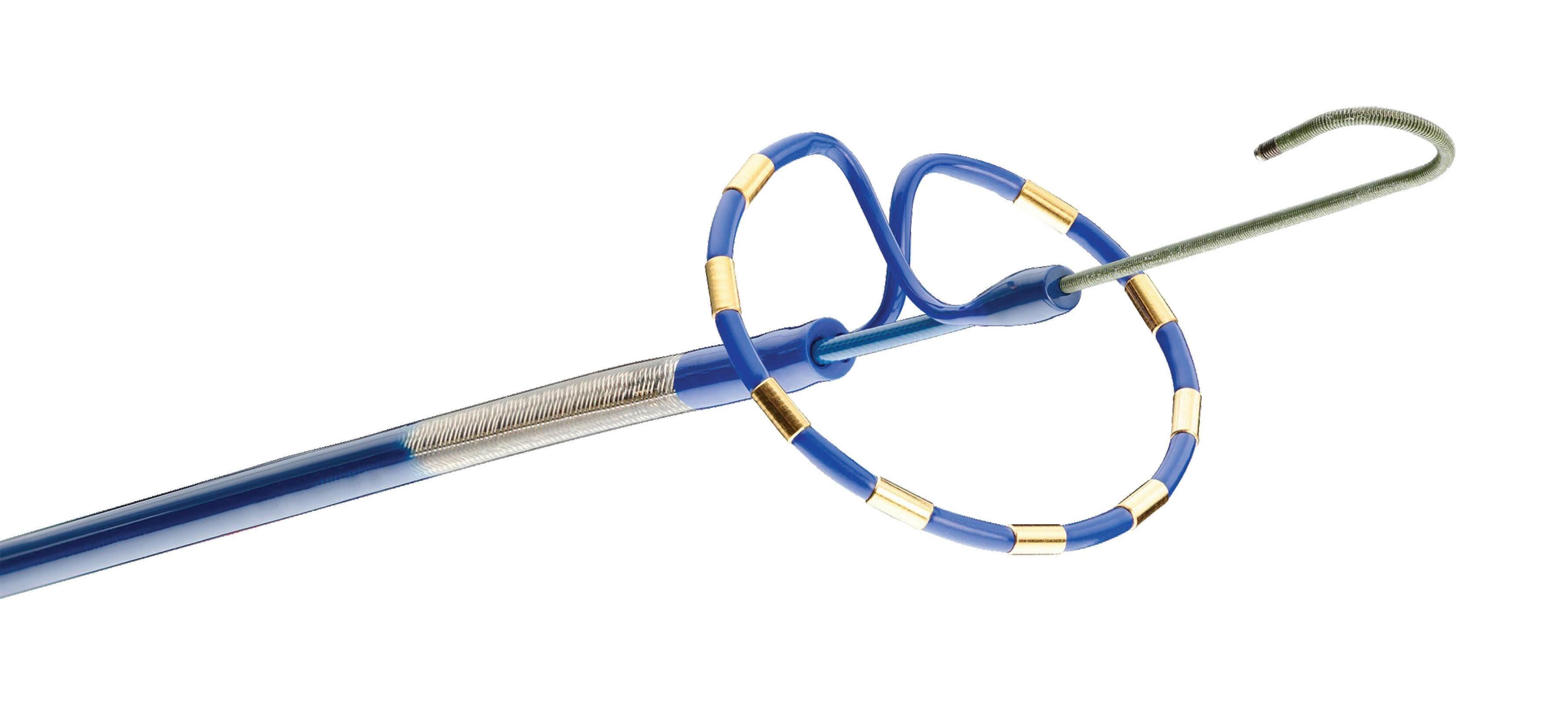

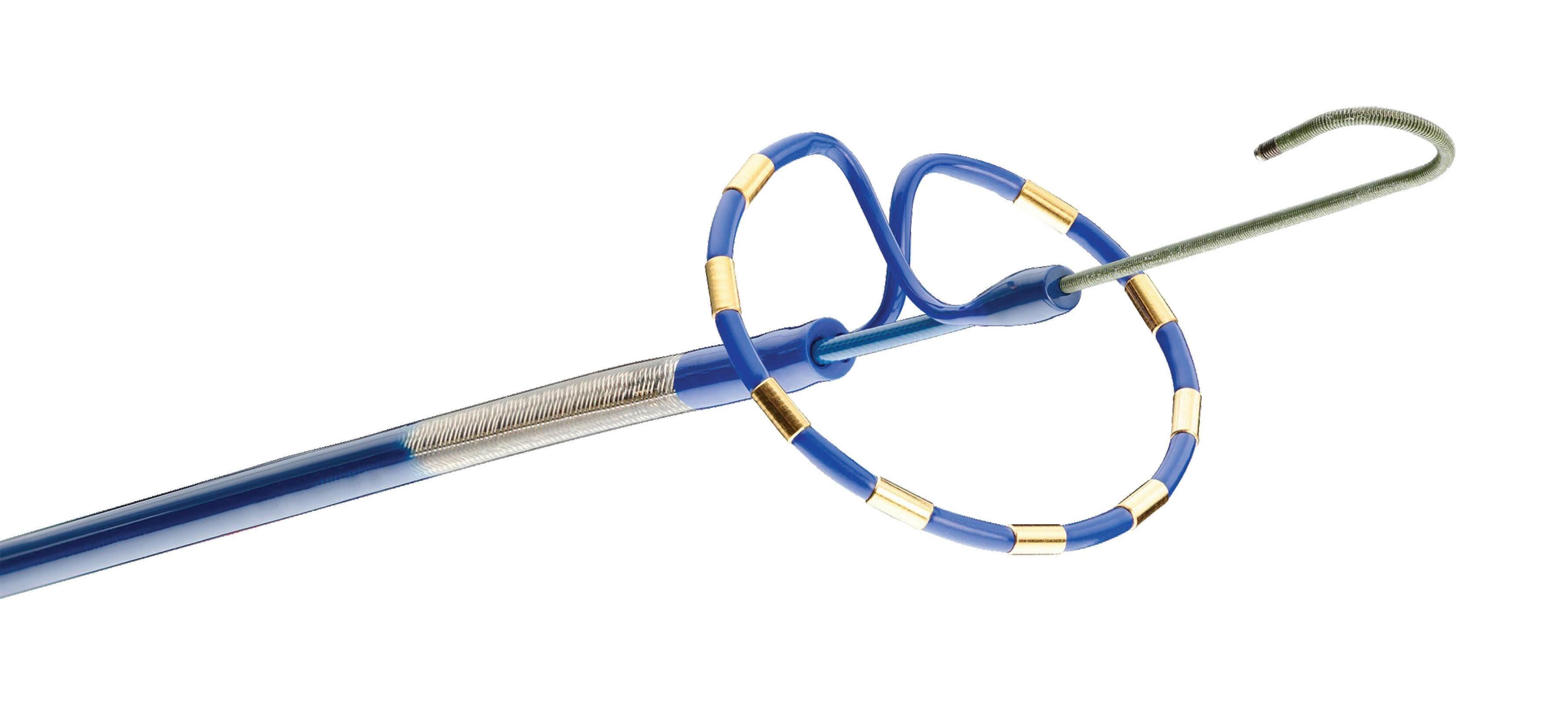

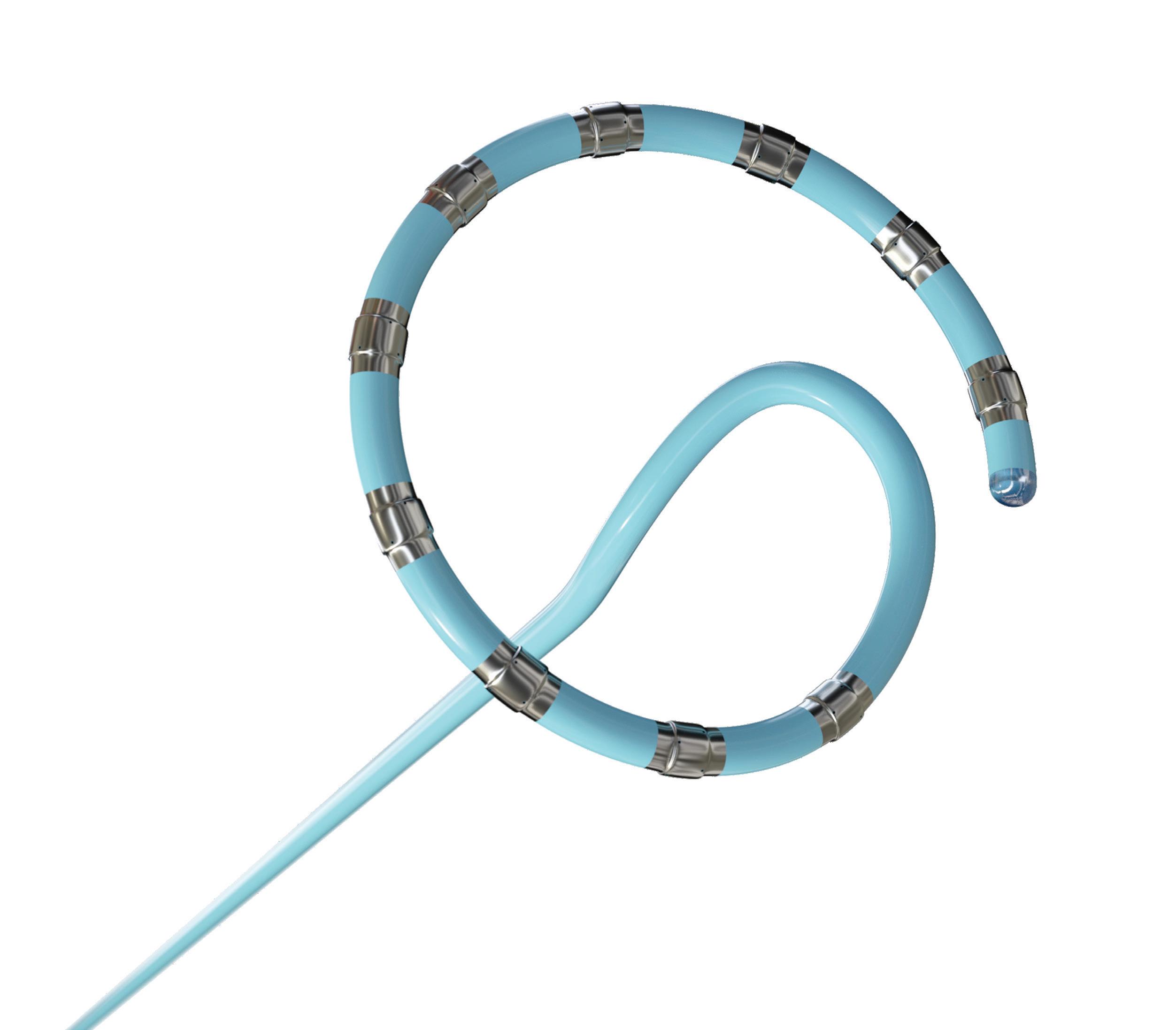

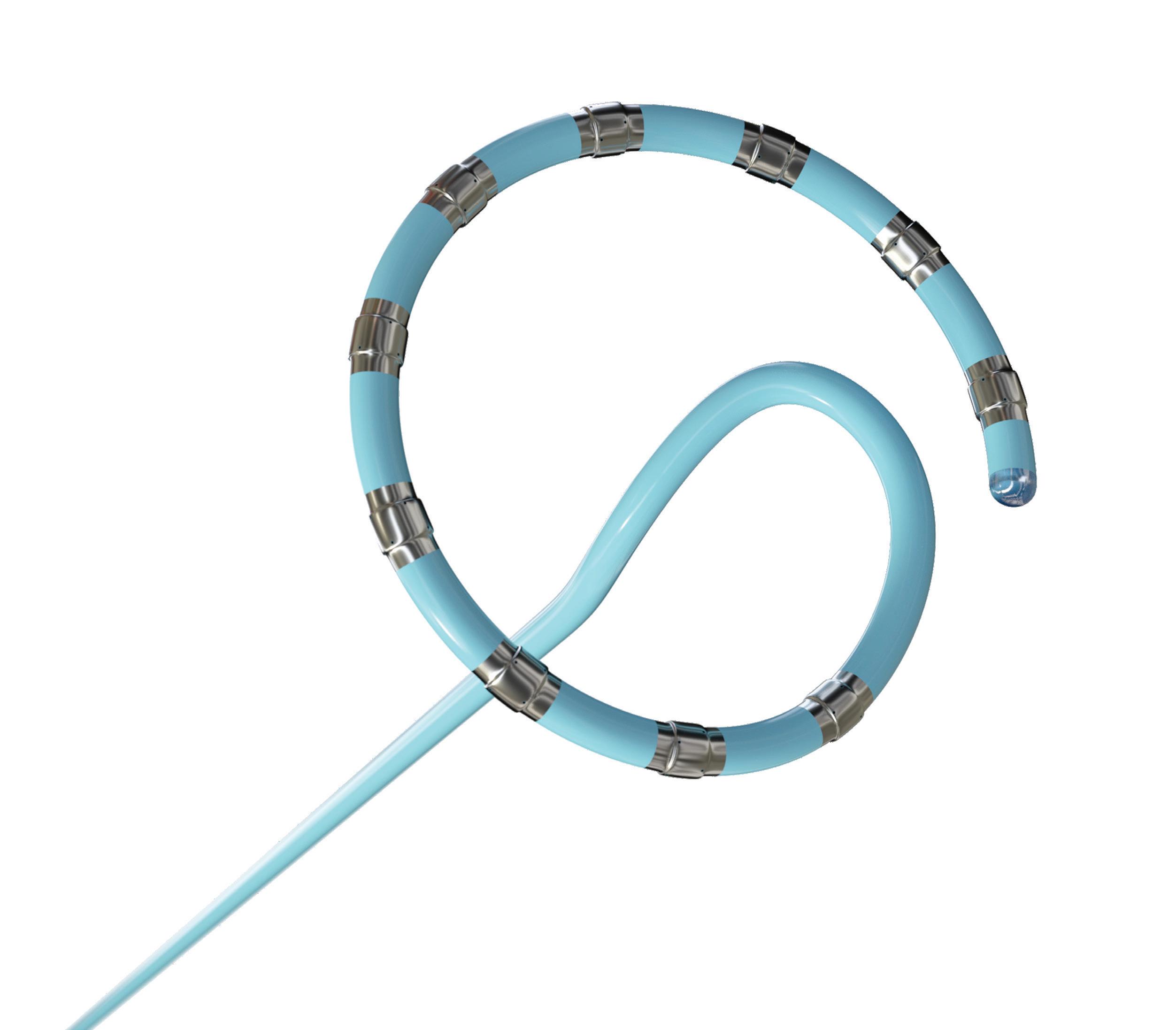

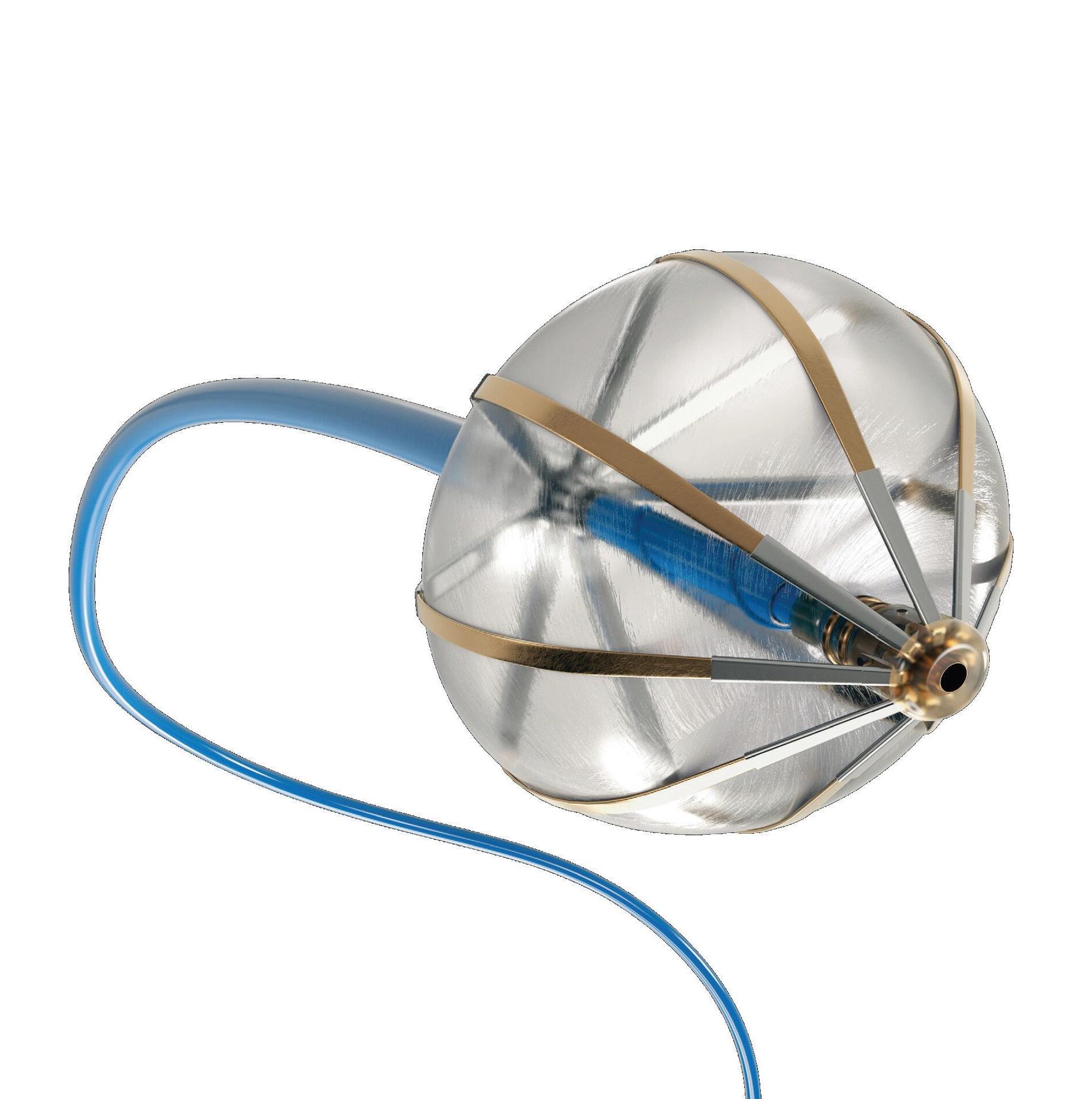

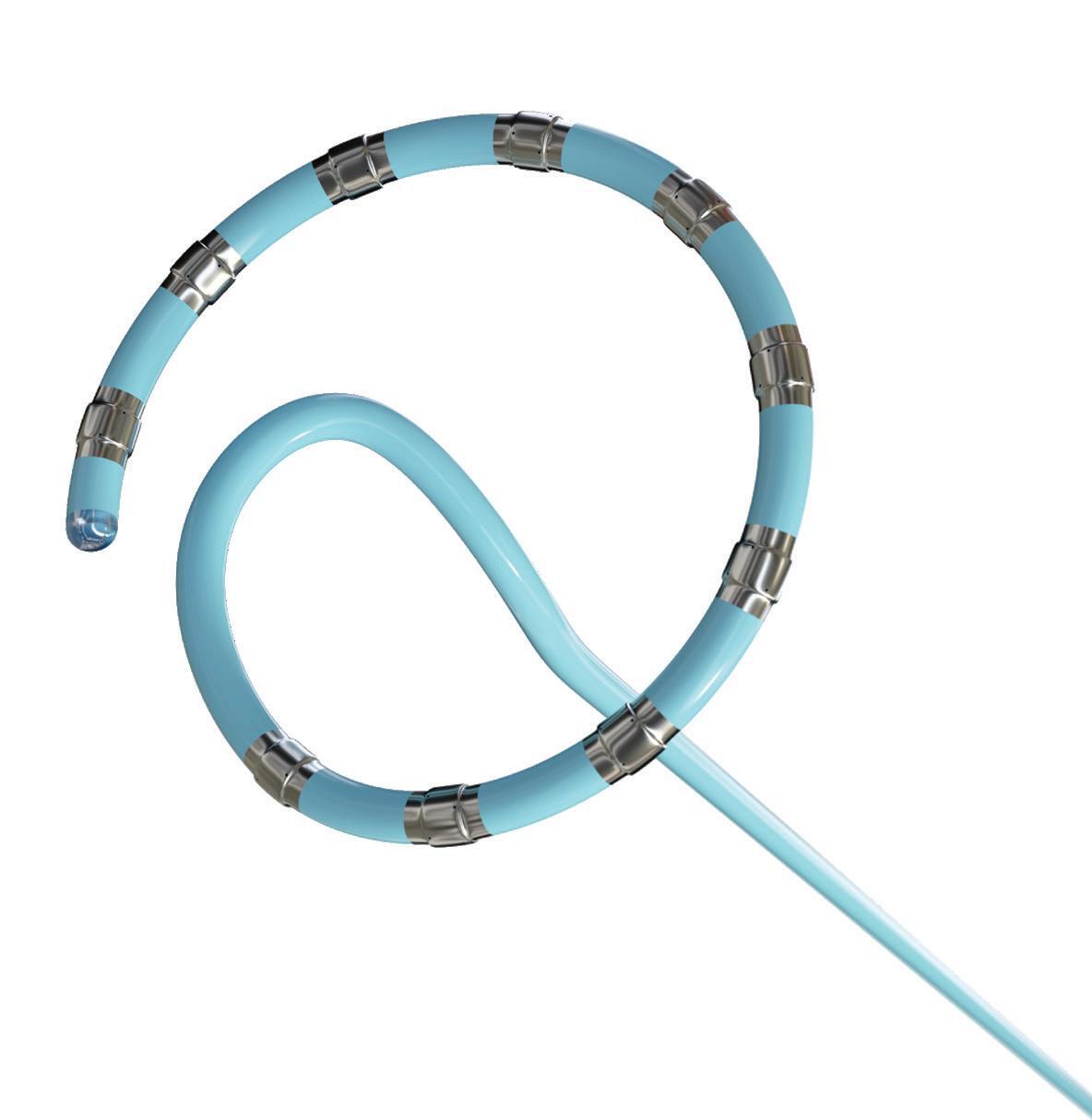

We’ve also got coverage of the technology coming out of the biggest of the big and companies that made big moves up our ranking. Medtronic, J&J MedTech, Abbott and Boston Scientific are all developing pulsed field ablation systems for minimally invasive catheter treatments of atrial fibrillation. For this month’s cover story, we interviewed experts at each of those Big 100 companies about the various shapes of their catheter designs and the advantages they offer.

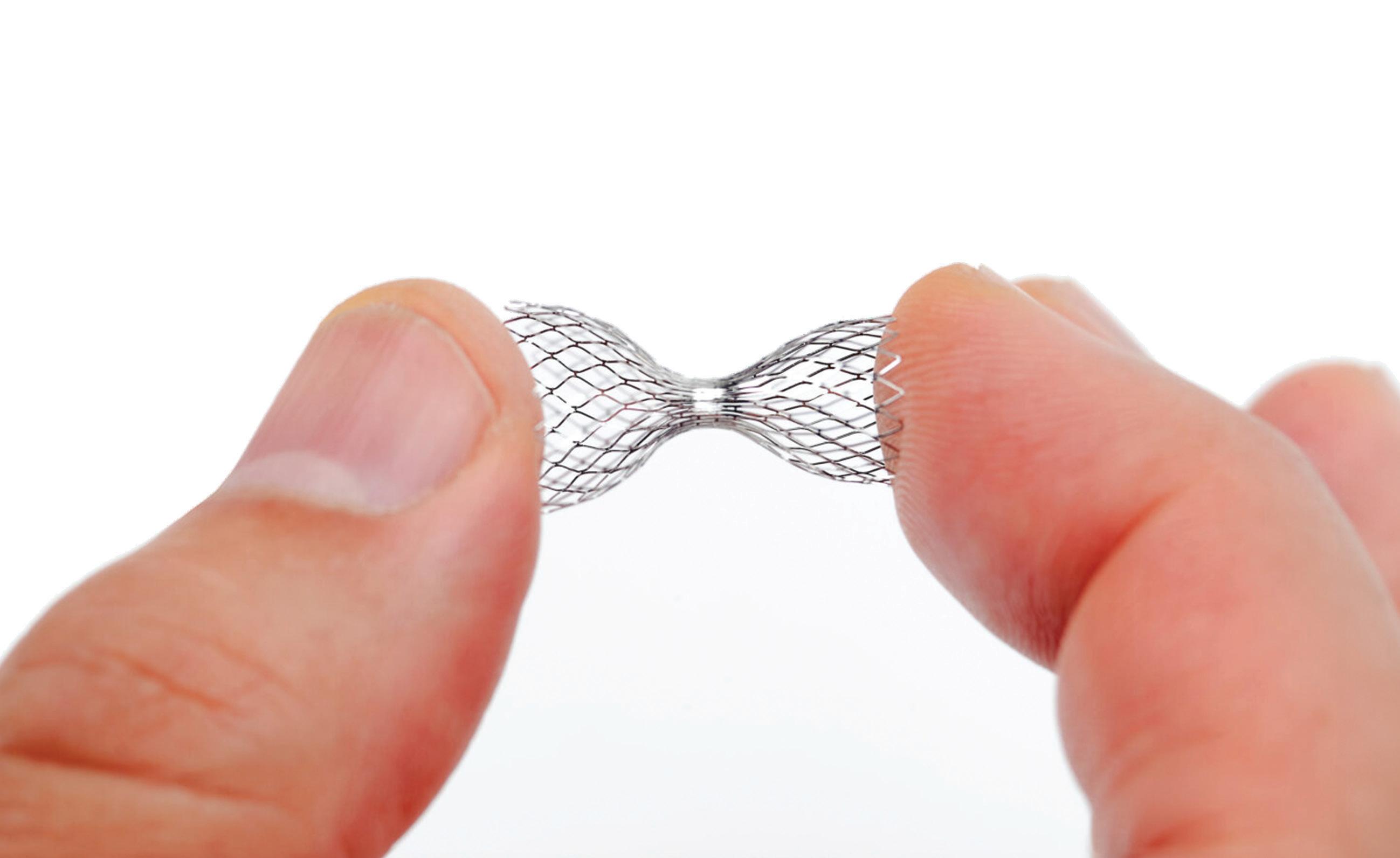

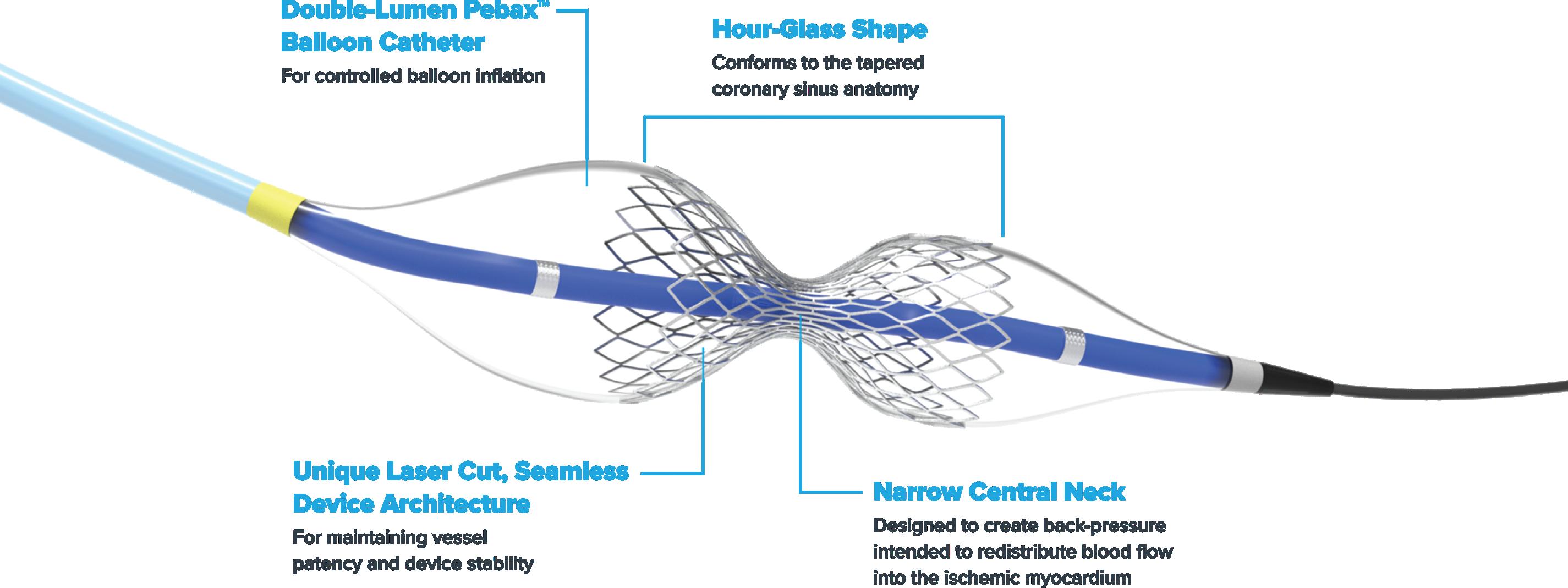

In another feature, we look at the challenge Shockwave — and now J&J MedTech — faces in explaining how its Neovasc Reducer works in the coronary implant’s second bid for FDA approval.

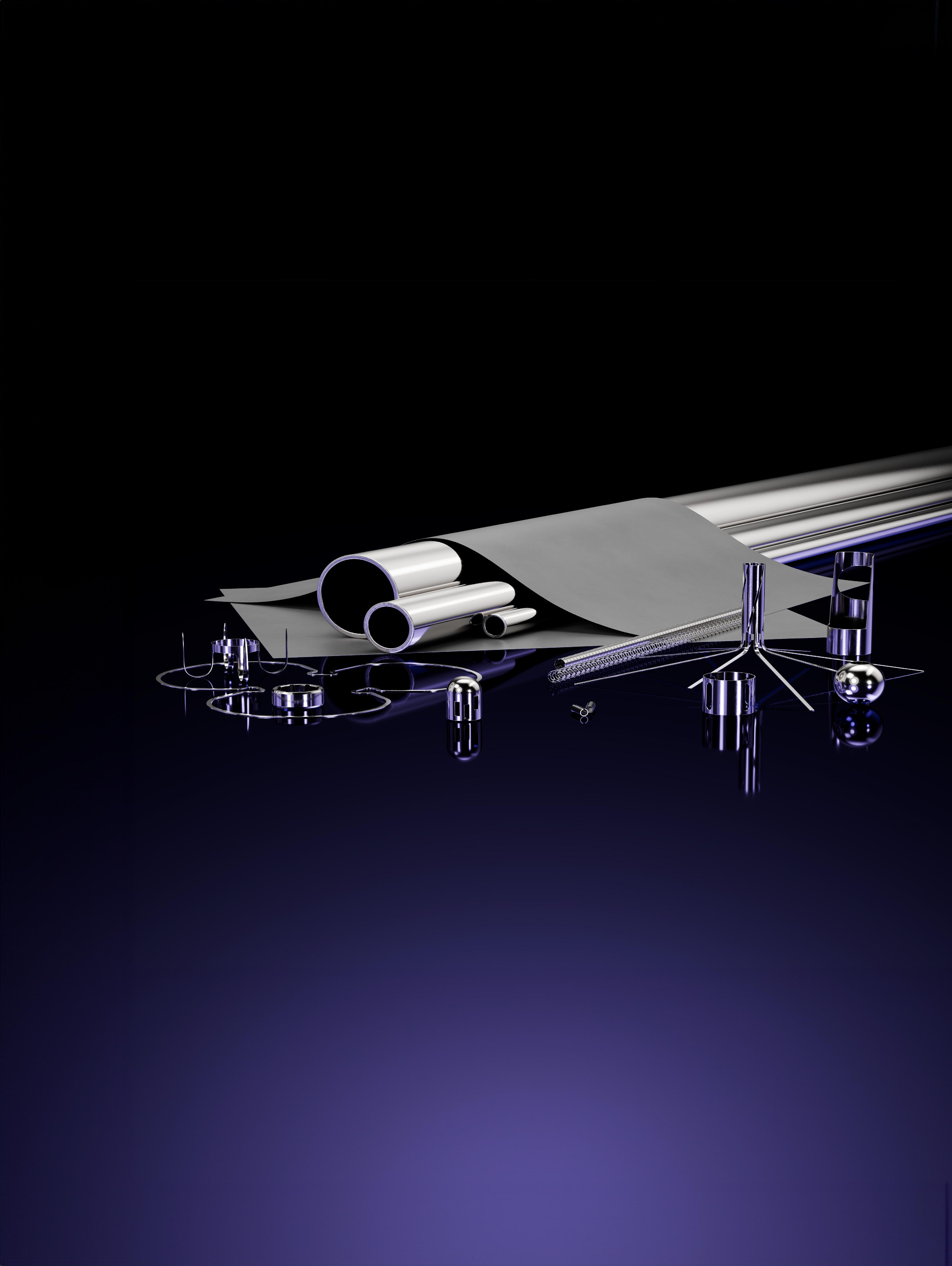

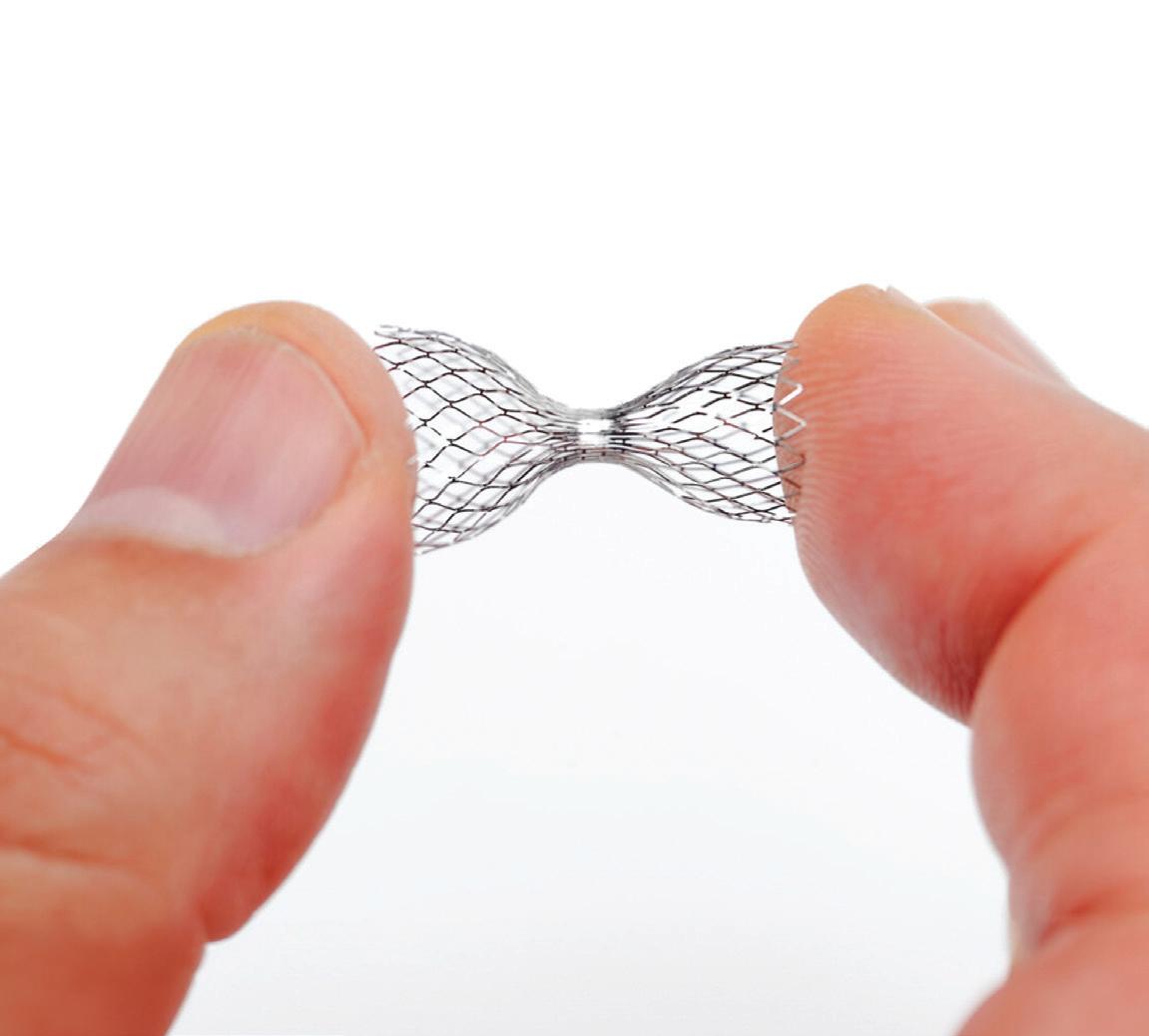

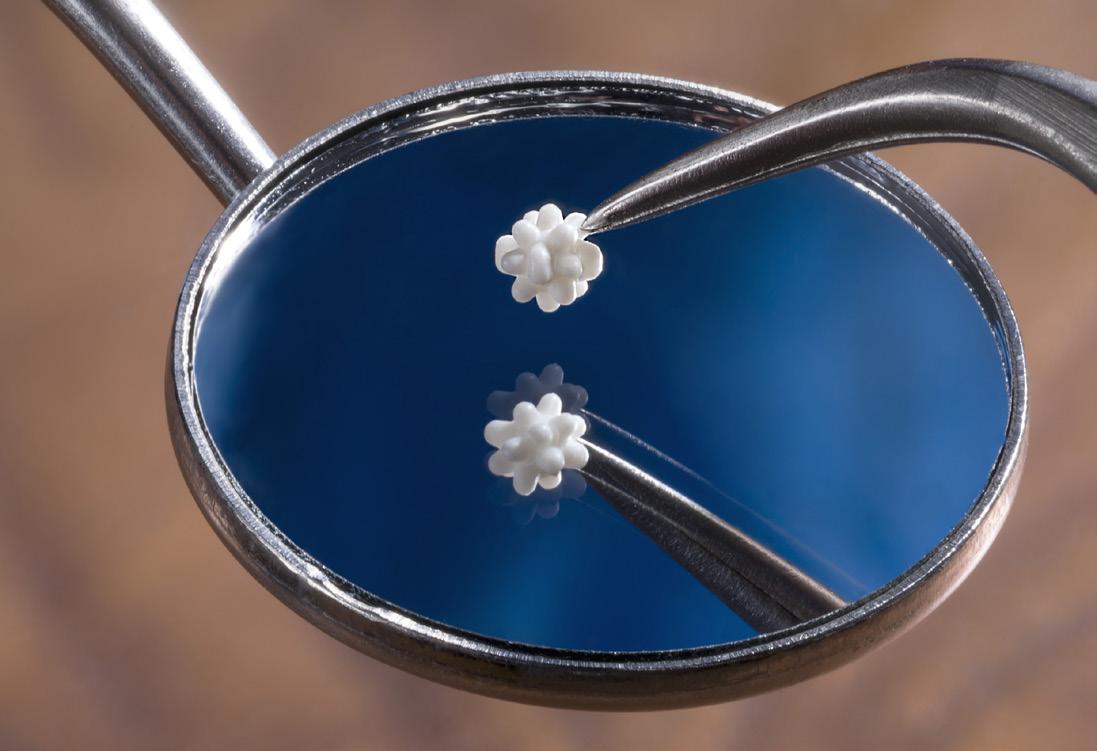

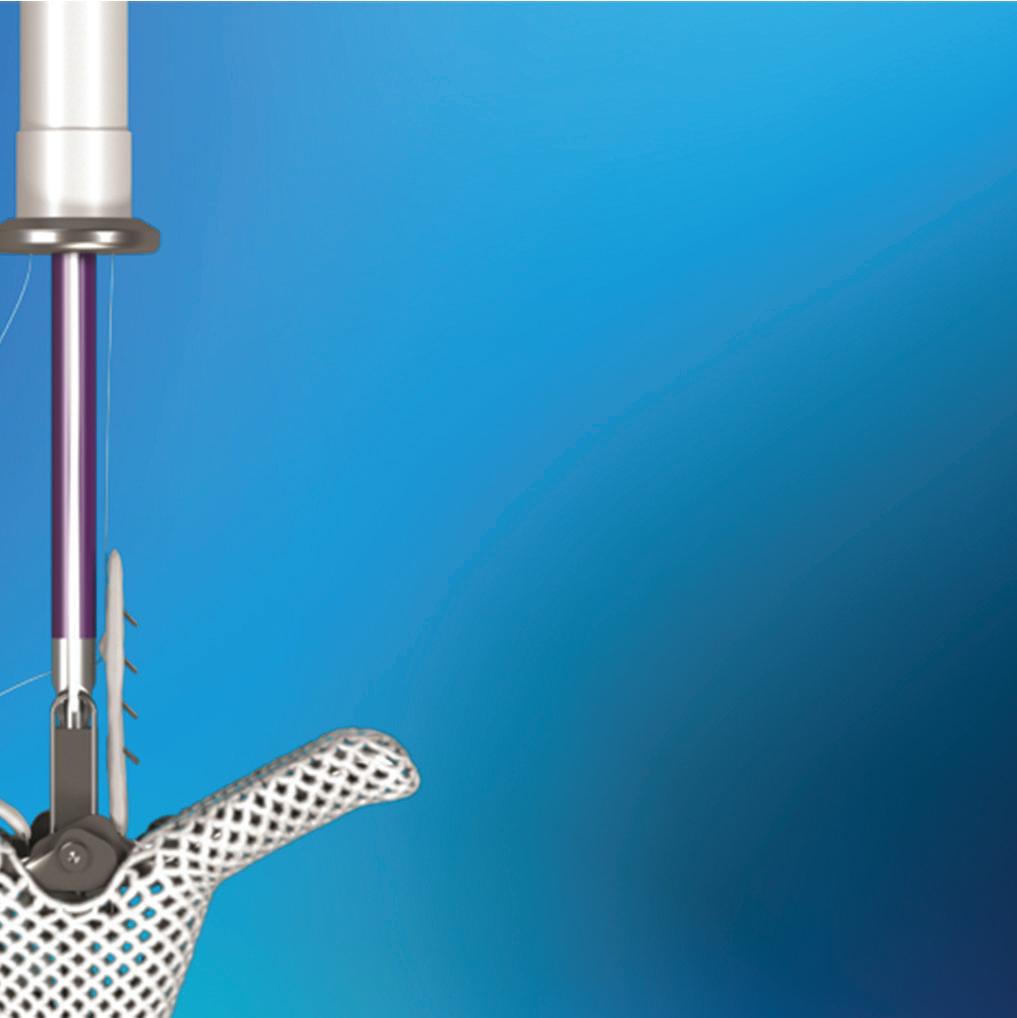

Our new Nitinol department digs into how Abbott switched to the uniquely useful alloy to anchor its MitraClip and TriClip transcatheter edge-to-edge repair (TEER) systems for heart valves.

ResMed’s been climbing our Medtech Big 100 rankings, and they’re hoping their new AirFit F40 continuous positive airway pressure (CPAP) mask will give them another push. In our Product Design department, ResMed officials discuss the device’s new features and development challenges.

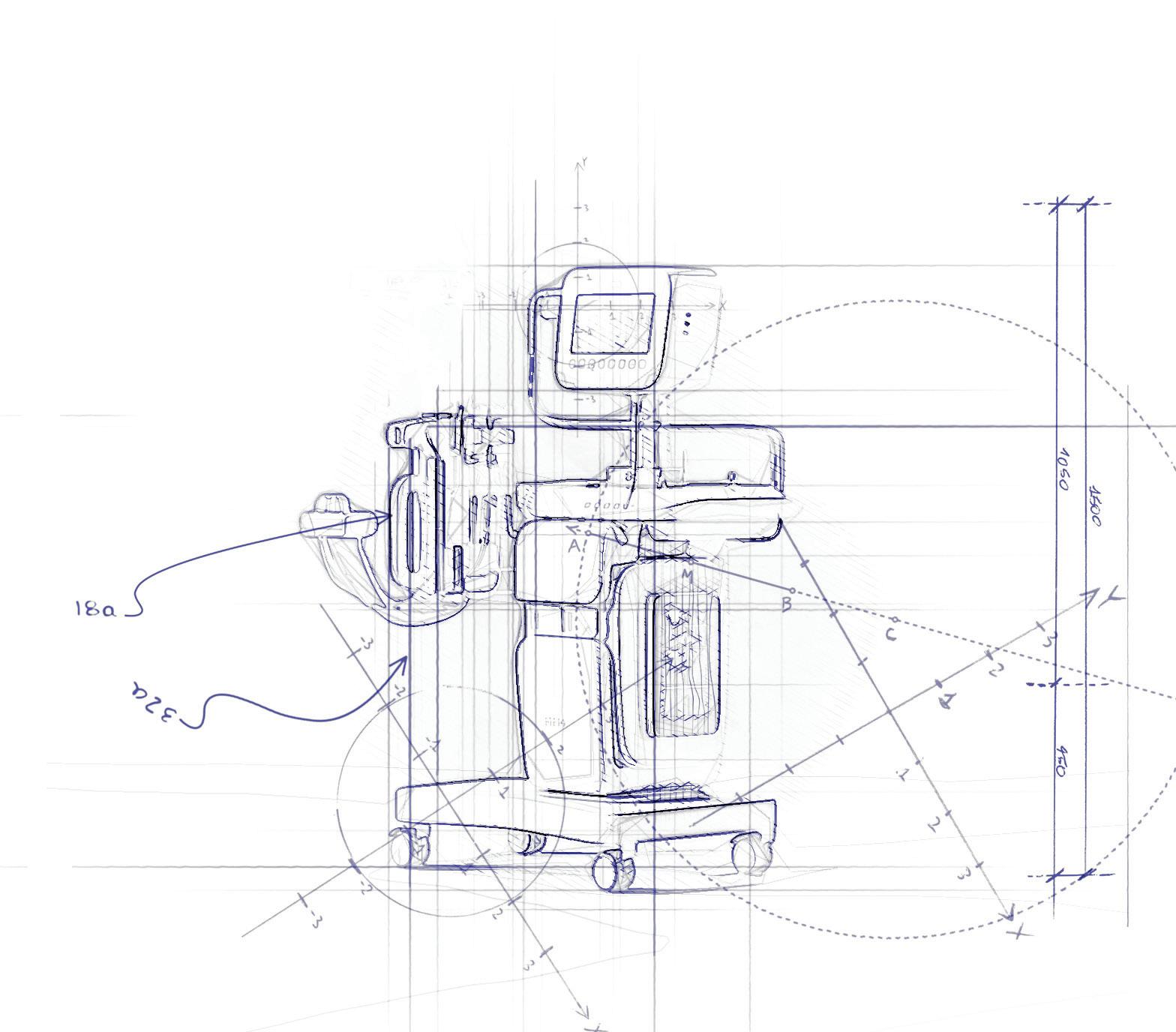

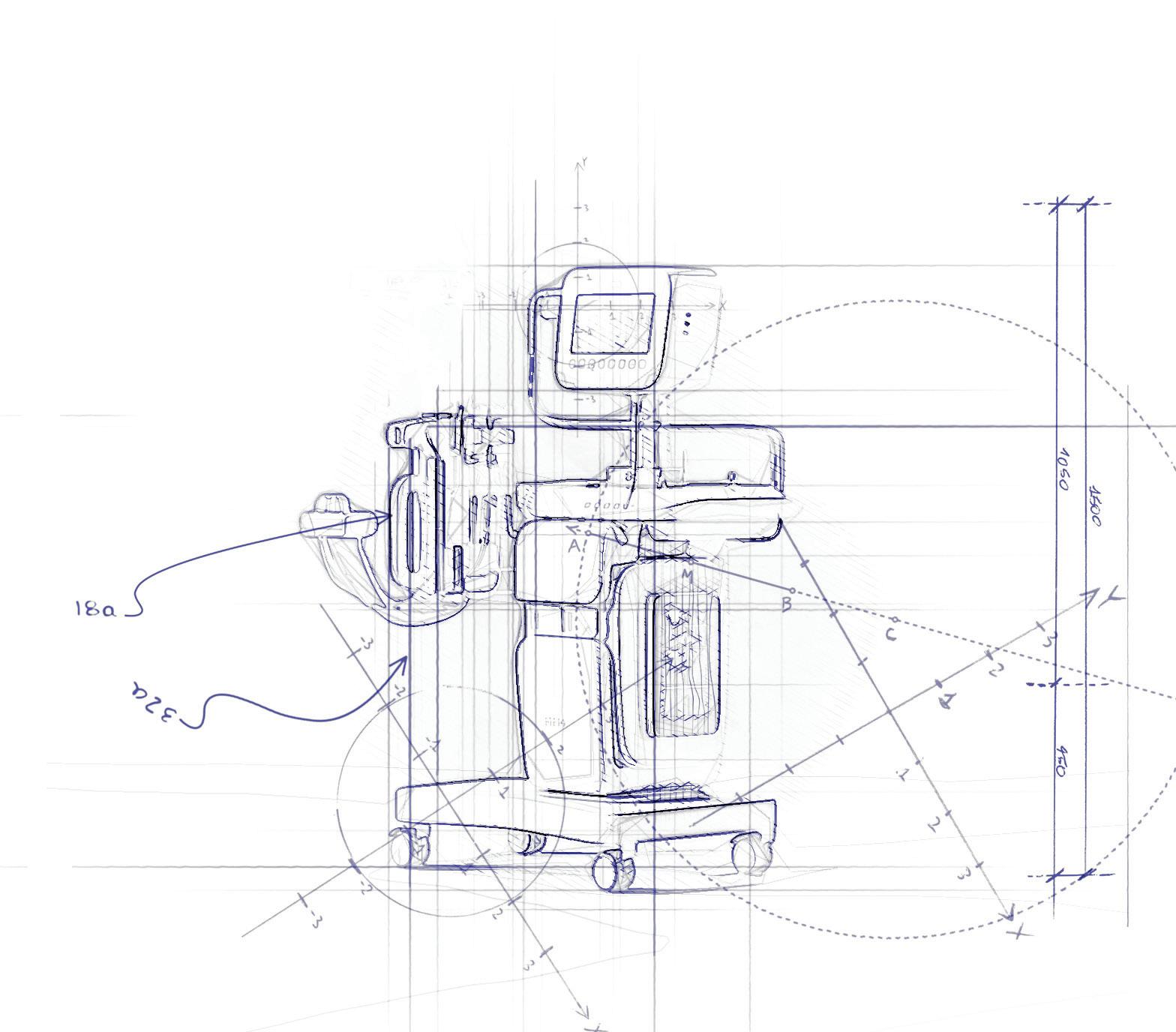

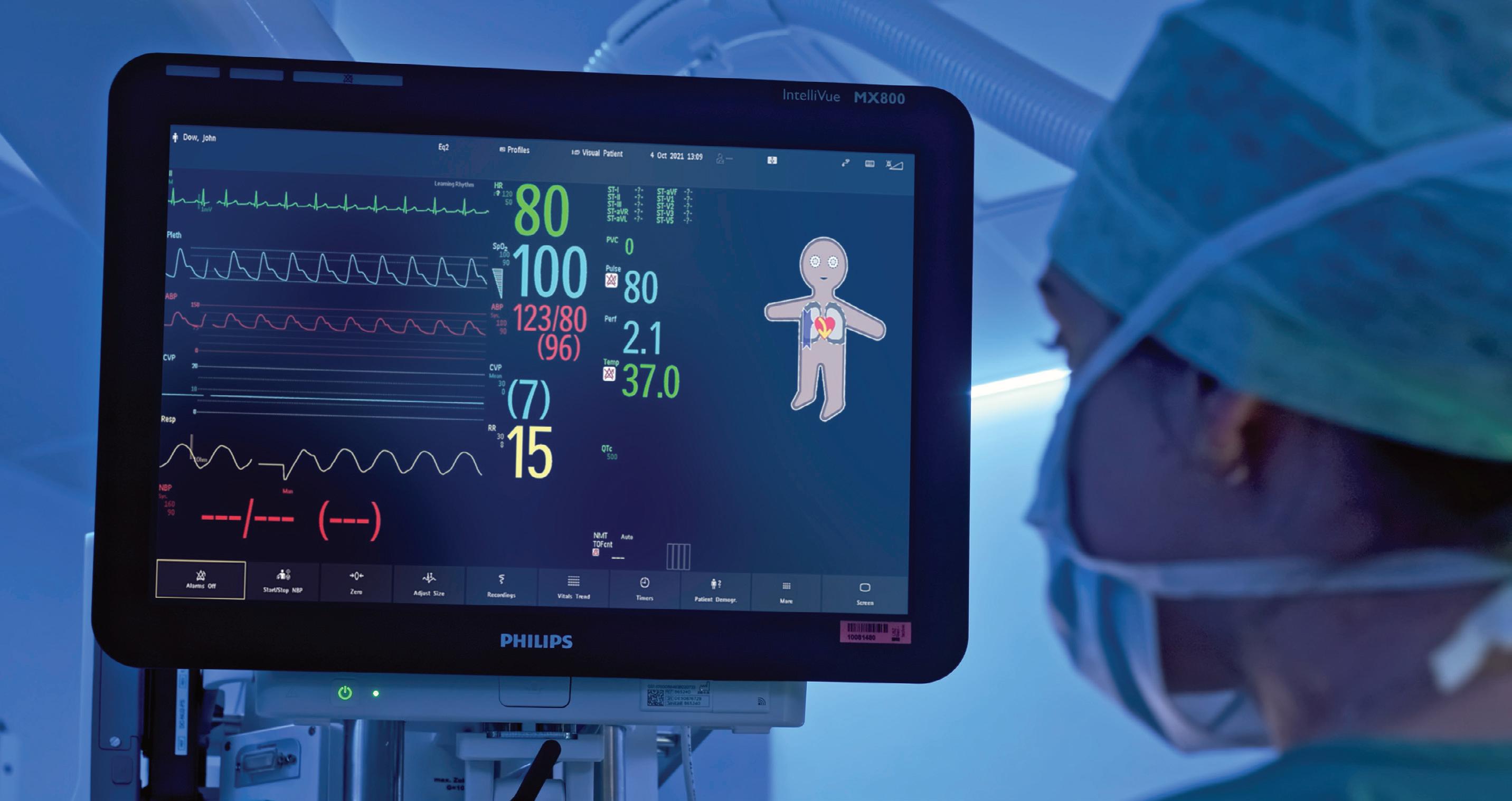

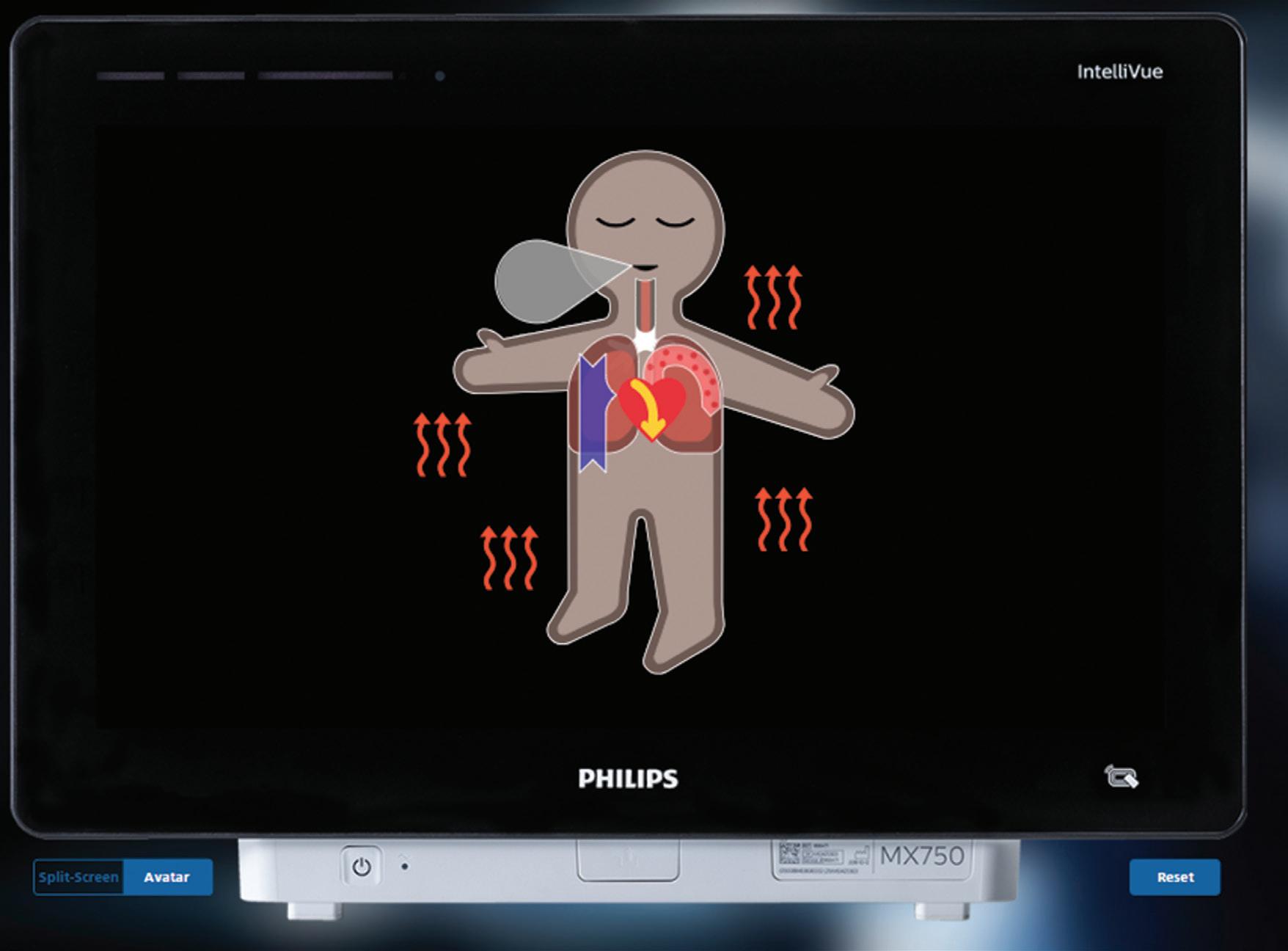

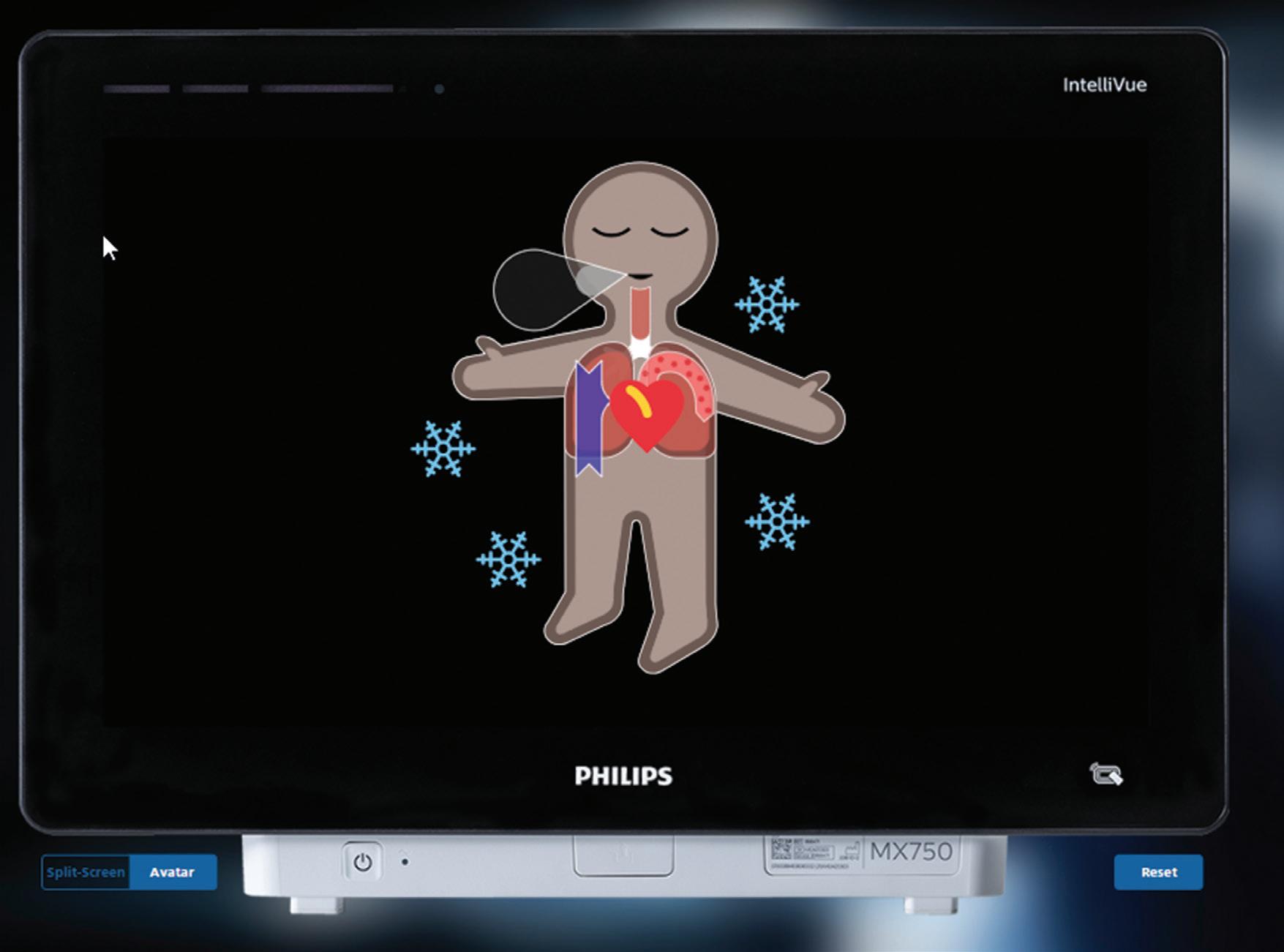

Philips explains in a contribution for our Product Development department how it collaborated with the University of Zurich on new technology to reduce anesthesiology-related mistakes due to cognitive overload in the operating room.

Intuitive — which just broke into the top 20 of our Medtech Big 100 ranking — offers commercial launch lessons for other device developers from the limited release of its new da Vinci 5 in our Surgical Robotics department.

Medtronic Endoscopy leaders, meanwhile, picked three technologies that they say will be key for advancing the field in our Tubing department.

And it’s still not too late to meet our team in Santa Clara, California for DeviceTalks West on Oct. 16-17. This issue concludes with a preview of our show, which as always will feature Medtech Big 100 companies and smaller device developers that will likely make our ranking someday, either under their own flag or after an acquisition by a Medtech Big 100 buyer.

As always, I hope you enjoy this issue of Medical Design & Outsourcing — and thanks for reading.

HERE’S WHAT WE SEE:

The 2024 Medtech Big 100: Mergers, acquisitions and spinoffs — oh my!

NITINOL:

Nitinol grips prevent slips in Abbott’s heart valve clips

PRODUCT DESIGN:

How ResMed designed its new AirFit F40 CPAP mask

PRODUCT DEVELOPMENT:

Addressing cognitive overload to improve patient safety in the OR

SURGICAL ROBOTICS:

What Intuitive’s limited da Vinci 5 launch can teach other device developers

TUBING:

Medtronic leaders pick three technologies that are key for the future of endoscopy

MEDTECH BIG 100:

Our latest list ranks the giants of medtech manufacturing by annual revenue, R&D spending and employee headcount. SPECIAL ISSUE

DEVICETALKS:

6 critical medtech areas of focus at DeviceTalks West 2024

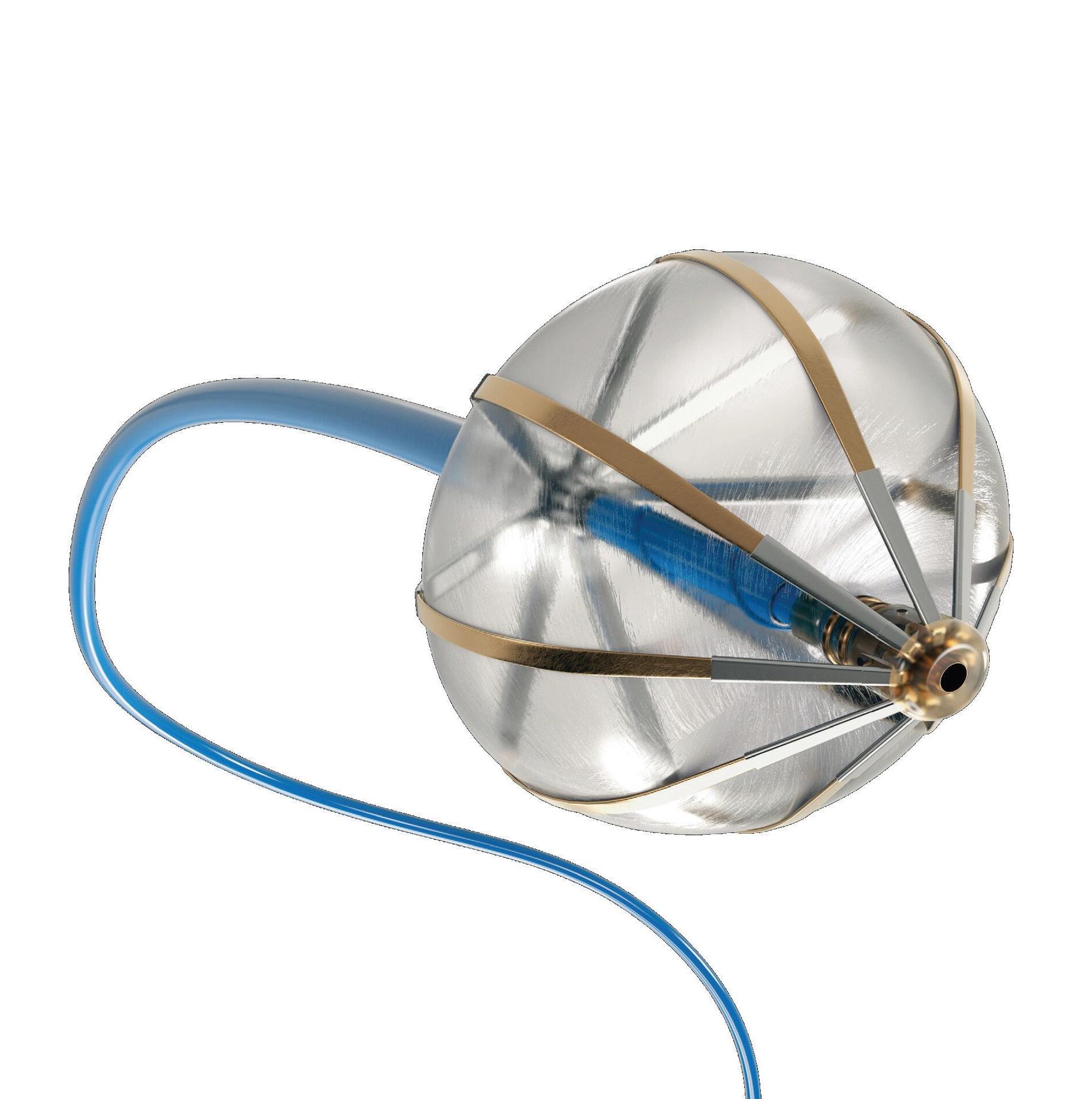

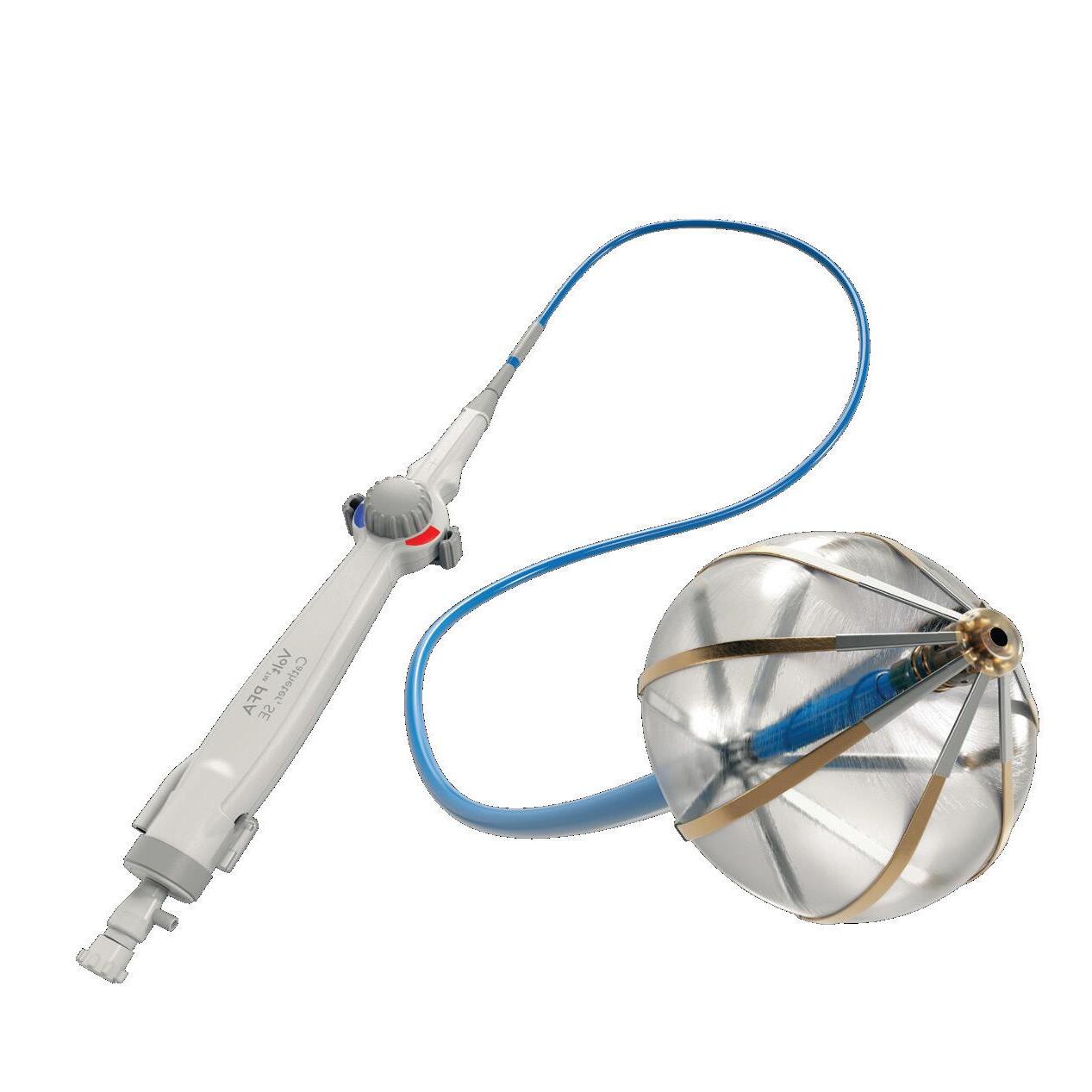

Experts from Medtech Big 100 device developers — Medtronic, Johnson & Johnson MedTech, Abbott and Boston Scientific — discuss the various shapes of their pulsed field ablation (PFA) catheters.

SHOCKWAVE CRACK THE CODE FOR FDA APPROVAL OF ITS REDUCER IMPLANT?

After buying the Neovasc Reducer, J&J Medtech’s Shockwave plans another attempt at FDA approval — and to explain how the implant treats refractory angina.

• Resolution ≤5 mV

• Accuracy ±0.25% of full scale

• Real-time adjustable PID control

• Integrated 0 to 10 VDC, 4-20 mA signal, or 3.3 VDC serial communication

• 0 to 10 VDC feedback pressure monitor

• Virtually silent

• No integral bleed required

• Multiple pressure ranges from vacuum to 150 psig

• 2.7 to 65 l/min flow control

The future of proportional control has arrived— and it’s digital. The Clippard Cordis is a revolutionary microcontroller primed for escape velocity from a proportional control market that has grown stagnant.

With unparalleled performance and flexibility not possible with current analog proportional controllers, the Cordis makes everything from calibration, to sensor variety, to future development opportunities more accessible and less complicated.

Contact your distributor today to learn more about how the Cordis can provide precise, real-time control for your application, or visit clippard.com to request more information.

Each year, Medical Design & Outsourcing collects thousands of data points to rank and analyze the largest medical device companies in the world, including publicly traded companies and privately held firms.

The Medtech Big 100 includes annual revenue, R&D spending, headcount, CEOs and key leaders, headquarters locations and descriptions of each company — or medical device business units within larger companies such as Abbott and Johnson & Johnson, which have significant pharma businesses.

We gather the data from regulatory disclosures filed with the U.S. Securities and Exchange Commission and annual reports from foreign and privately held firms. For many companies, we include data they share with us — straight from the CEO, in one case. This year we also opened an application process for companies to nominate themselves for inclusion among the 100 largest medtech companies.

A majority of the companies on the list have fiscal years that operate on standard calendar years, but some have fiscal years for which we’ve collected data as recently as April 2024.

We used fiscal 2023 data for companies with fiscal years that end in June or September such as Accuray, Asahi Intecc, BD, Cardinal Health, Carl Zeiss, Cochlear, Electromed, Embecta, Hologic, ResMed and Siemens Healthineers because their annual reports don’t come out before production time.

Please note that companies that report financial results in foreign currencies have been converted to U.S. dollars using standardized Federal Reserve rates for the revenue and R&D rankings.

Medtech Big 100 movers and shakers Mergers, acquisitions and spinoffs were the key trends in this year’s Medtech Big 100. Many companies near the bottom of our list in previous years — such as Silk Road Medical and Axonics — have struck

deals to be acquired by top 20 medtech companies. M&A also consolidated the revenue of companies that combined, such as the Globus Medical and NuVasive merger that moved Globus up our ranking.

We also saw spinoffs, including Solventum, fornerly 3M Health Care and now in its first year as a publicly-traded company. Zimmer Biomet spinoff ZimVie dropped down our list when it divested its spine and bone healing businesses to become a pure-play dental company — but the spine and bone healing businesses made their Medtech Big 100 debut as Highridge Medical.

One of the biggest stories in medtech — the ongoing Philips Respironics ventilator and CPAP recalls — pushed Royal Philips down a spot and allowed other companies to move up our list: Inspire Medical Systems grew its obstructive sleep apnea implant business significantly, while CPAP developer ResMed also increased its rank.

– Manging Editor Jim Hammerand and Senior Editor Danielle Kirsh (continued on page 14)

ACOPOS 6D allows you to move products freely through an open manufacturing space –unbound by the limits of one-dimensional production flow. Magnetic levitation provides six degrees of freedom for unprecedented processing density on a fraction of the floorspace.

No contact, no noise, no wear

Micron-precise positioning

11 shuttle sizes

Widest payload range on market

Most advanced planar software platform on the market

br-automation.com

PSN is an ISO 9001:2015 certified engineering firm, providing services in all areas of product development.

We have three main Laboratories comprised of our Engineering Design Center, Material Processing Lab, and our ISO/IEC 17025:2017 certified Testing Laboratory.

Our teams of highly qualified engineers, scientists, and SMEs work across each lab to provide a unique advantage to our clients.

• Specialized team of SMEs

• ISO 10993 and ISO 18562 series

• Toxicological Risk Assessment

• FDA Submission Assessment

PSN Labs has the experts to isolate confounding variables and provide clear analysis to guide the commercialization of existing and new medical devices.

from page 14)

Dublin, Ireland

(Operational HQ in Fridley, Minnesota) United States

$32,364,000,000

Fiscal year ended 4/26/2024

2023 rank: 1

R&D spend: $2,735,000,000

Employees: 100,716

CEO: Geoff Martha

www.medtronic.com

“Our top priority is restoring our earnings power — full stop,” MEDTRONIC Chair and CEO Geoff Martha said to start 2024. Over the following months, the world’s largest medtech company continued significant portfolio management moves, including the shuttering of its ventilators business. There was more discipline on headcount and expenses — including worldwide layoffs — and increased use of automation and digitization. Some high-ranking officials have left the company, too — including CFO Karen Parkhill, who resigned to take over as CFO at HP. At the same time, company leaders stressed that Medtronic is making strategic investments in research and development to boost future growth. They said in May that the company had achieved 130 product approvals in the last 12 months in key geographies. Recent wins include:

• The PulseSelect pulsed field ablation system becoming the first PFA system approved by the FDA to treat paroxysmal and persistent atrial fibrillation (AFib);

• FDA approval of the next-generation Evolut FX+ transcatheter aortic valve replacement (TAVR) system;

• FDA approval of its Percept RC deep brain stimulation system, which Medtronic described as the first DBS sensing-enabled, rechargeable device to treat movement disorders such as Parkinson’s disease;

• And the launch of the next-gen Micra AV2 and Micra VR2 leadless pacemakers, which were approved in 2023.

Medtronic is also seeking coverage and payments for its FDA-approved Simplicity Spyral renal denervation technology to treat hypertension. In August, it secured a CMS New Technology Add-on Payment (NTAP) win for the technology.

As of the writing of this profile in August, Medtronic was projecting 4–5% organic revenue growth in 2024. –CN

AI basics from Medtronic Chief Technology and Innovation Officer Ken Washington wtwh.me/Medtronic

New Brunswick, New Jersey United States

$30,400,000,000

Fiscal year ended 12/31/2023

2023 rank: 2

R&D spend: $3,122,000,000

Employees: Not available

CEO: Joaquin Duato, CEO; Tim Schmid, EVP and J&J MedTech worldwide chair

www.jnjmedtech.com

Now under the leadership of Johnson & Johnson veteran Tim Schmid after Ashley McEvoy’s announcement in October 2023 that she was resigning, JOHNSON & JOHNSON MEDTECH continues to grow. With its $13 billion acquisition of Shockwave Medical and its intravascular lithotripsy (IVL) technology completed in May, J&J’s medical device business could give Medtronic a run for the top spot in next year’s Medtech Big 100. On top of the Shockwave acquisition, recent developments at J&J MedTech include the unveiling of Polyphonic, its open and secure digital surgical ecosystem. Think data-source-agnostic software applications to deliver surgical insights. The first release included apps for surgical video, telepresence and planning. Watch for more artificial intelligence applications created through a partnership with Nvidia that the companies announced in March. Other recent J&J MedTech news includes:

• Its DePuy Synthes business has launched a spine surgery version of its Velys robot, created in collaboration with eCential Robotics.

• In April, the company sold its Ethicon business’ Acclarent ear, nose and throat treatment tech business to Integra LifeSciences for $275 million.

• J&J MedTech expects to submit its Ottava surgical robot for FDA investigational device exemption (IDE) in the second half of 2024.

• Its Biosense Webster business has submitted its AFib-treating Varipulse pulsed field ablation system for FDA approval.

J&J CEO Joaquin Duato spoke in July of the company having a “strong foundation for near and long-term growth.” –CN

$23,414,400,000

Fiscal year ended 9/30/2023 (€21,680,000,000)

2023 rank: 3

R&D spend: $2,015,280,000

Employees: 71,000

CEO: Bernd Montag

www.siemens-healthineers.com

SIEMENS HEALTHINEERS reported good progress in its third quarter despite ongoing order delays in China. The German medtech giant now expects 4.5–6.5% sales growth for fiscal 2024. “Varian and Diagnostics especially contributed to the strong operating performance,” CEO Bernd Montag said in late July. Recent innovations at the company include the FDA-cleared Syngo Virtual Cockpit, a platform that enables real-time collaboration between healthcare professionals across different locations. The FDA also cleared the Magnetom Cima.X 3 Tesla (3T) magnetic resonance imaging whole-body scanner. The company said that scanner has the strongest gradients ever for a whole-body scanner, which improve the visibility of smaller structures and accelerates image captures. Additionally, Siemens Healthineers announced in March that its selfdriving Ciartic Move mobile C-arm received an FDA clearance. Ciartic Move automates and accelerates imaging workflows in surgical environments Meanwhile, Varian in March announced clearance of its TrueBeam and Edge radiotherapy systems with HyperSight imaging. –CN

High voltage in the heart: PFA catheter design tips from Biosense Webster wtwh.me/JandJ

Northfield, Illinois United States

$23,200,000,000

Fiscal year ended 12/31/2023

2023 rank: 4

R&D spend: not available

Employees: 38,000

CEO: Jim Boyle

www.medline.com

MEDLINE revenue grew 9% in 2023. The privatelyheld medical supply manufacturer, distributor and services provider now operates in over 100 countries and territories, offering more than 335,000 medical products. Medline recently grew even more through its $950 million acquisition of Ecolab’s surgical solutions business. The deal gave Medline access to operating room equipment, Ecolab’s line of Microtek sterile operating room drapes and Ecolab’s fluid temperature management system.

“With this acquisition, we are eager to collaborate with healthcare providers and cutting-edge medical device companies to bring innovative solutions to the surgical suite,” Medline President and Chief Operating Officer Jim Pigott said. Medline recently spent $27 million to triple the size of its product testing and development lab in Mundelein, Illinois, to 74,000 ft². –CN

Portage, Michigan United States

$20,498,000,000

Fiscal year ended 12/31/2023

2023 rank: 6

R&D spend: $1,388,000,000

Employees: 52,000

CEO: Kevin Lobo

www.stryker.com

Still riding the success of its Mako robotic orthopedic surgery systems and digital surgery systems, STRYKER has gone on offense with M&A. Recent tuck-in acquisitions for the orthopedic and surgical tech giant include Artelon and its soft tissue fixation products for foot and ankle and sports medicine procedures, and Molli Surgical, which develops wire-free soft tissue localization technology for breast-conserving surgery. Stryker Chair and CEO Kevin Lobo recently indicated that the company has a very active deal pipeline for even more M&A. He said a soft-tissue surgical robotics play is a possibility, as well something in the neuromodulation space down the road. Notable updates include the myMako app for Apple Vision Pro, which enhances surgeons’ ability to visualize and plan surgeries. Stryker also introduced the Triathlon Hinge within its knee surgery offerings, aiming to simplify revision procedures Analysts expect Stryker to enjoy even more growth on shoulder and spine applications for Mako that are slated for later this year. –CN

Amsterdam Netherlands

$19,622,520,000

Fiscal year ended 12/31/2023

(€18,169,000,000)

2023 rank: 5

R&D spend: $2,041,200,000

Employees: 69,100

CEO: Roy Jakobs

www.philips.com

The fallout from PHILIPS’ massive, yearslong recall of CPAPs and other respiratory devices reached a critical point in 2024. In April, the Dutch medtech giant finalized a consent decree with the U.S. Department of Justice and FDA that provided a roadmap for resolving the Philips Respironics recall. Dr. Jeff Shuren, who was director of the FDA’s Center for Devices and Radiological Health (CDRH) at the time, said the agreement “marks the first time a device company is providing a remediation payment option for a recalled device under a consent decree.” Philips soon settled personal injury claims in the U.S. for $1.1 billion and is also paying at least $613 million to settle personal injury claims. By June, Philips announced the closure of its Respironics business’ Pittsburgh headquarters and elimination of hundreds of manufacturing jobs in the region. Exclude the impact of the Respironics recall, however, and Philips is still projecting 3–5% comparable sales growth in 2024. Said CEO Roy Jakobs: “We continue to focus on enhancing execution, improving endto-end supply chain resilience and increasing agility and productivity through simplifying our operating model. Patient safety and quality remains our number one priority.” –CN

How 3D printing and surgical robotics enable Stryker’s cementless knee implants wtwh.me/Stryker

Chicago, Illinois United States

$19,552,000,000

Fiscal year ended 12/31/2023

2023 rank: 7

R&D spend: $1,205,000,000

Employees: 51,000

CEO: Peter Arduini

www.gehealthcare.com

GE HEALTHCARE is facing headwinds in the market in China, which caused it in July to reduce its organic revenue growth projection to 1–2%, versus the previous projection of 4%. CEO Peter Arduini highlighted year-over-year sales growth and margin expansion in the second quarter: “We are pleased with our continued progress in advancing our margin goals, while continuing our investments for future growth.” GE HealthCare continues with new partnerships, products and tuck-in acquisitions, especially when it comes to medtech innovations enabled by artificial intelligence. Recent AI-related moves include:

• A joint development agreement with Volta Medical over AI-driven electrophysiology tech;

• Acquiring Intelligent Ultrasound Group’s clinical AI software business;

• The launch of the AI-enhanced Voluson Signature 20 and 18 ultrasound systems for women’s health imaging applications;

• A partnership with Biofourmis to use its FDAcleared, AI-guided algorithms to help deliver personalized healthcare and health monitoring in people’s homes.

In addition, GE HealthCare in May announced the launch of its “new era” of AI-enhanced oncology solutions, known as Revolution RT. –CN

Abbott Park, Illinois United States

$16,887,000,000

Fiscal year ended 12/31/2023

2023 rank: 10

R&D spend: not available

Employees: not available

CEO: Robert Ford, chair and CEO; Lisa Earnhardt, EVP medical devices

www.abbott.com

ABBOTT medical device segment sales were up more than 12% during the first half of 2024. Diabetes treatment tech — especially the Abbott FreeStyle Libre continuous glucose monitor (CGM) — played an important role fueling the growth. FreeStyle Libre sales totaled $1.6 billion in the second quarter alone, marking 18.4% growth year-over-year. A new partnership to combine FreeStyle Libre CGM technology with Medtronic’s automated insulin delivery systems could boost sales even more in the years ahead. In June, Abbott announced that it secured FDA clearance for two over-the-counter CGM systems, Lingo and Libre Rio. Electrophysiology is also an exciting space for Abbott. The company in June announced CE mark approval for its Aveir DR dualchamber leadless pacemaker system, nearly a year after Aveir won FDA approval. The company has seen recent launches and new indications for its Amplatzer Amulet, Navitor, and TriClip. When it comes to pulsed field ablation, Abbott continues to develop its Volt system, which has a balloon-in-basket design meant to enable efficient deployment of energy into the tissue during cardiac ablation to treat AFib. –CN

(medical segment)

Dublin, Ohio United States

$15,014,000,000

Fiscal year ended 6/30/2023

2023 rank: 8

R&D spend: not available

Employees: not available

CEO: Jason Hollar, CEO; Steve Mason, medical segment CEO

www.cardinalhealth.com

During CARDINAL HEALTH’S third-quarter earnings call on May 2, CEO Jason Hollar reported that the company’s Global Medical Products and Distribution (GMPD) business is seeing strong topline and bottom line performance, with growth accelerating as a turnaround plan accelerates. “GMPD’s quarter was overall consistent with our expectations and the team is already working hard on the continued ramp-up in Q4,” Hollar said. Cardinal Health said its U.S. Medical Products and Distribution Business won recognition from the HIRC Resiliency Badge program for its supply chain resiliency. –CN

Deerfield, Illinois United States

$14,813,000,000

Fiscal year ended 12/31/2023

2023 rank: 9

R&D spend: $667,000,000

Employees: 60,000

CEO: José Almeida

www.baxter.com

BAXTER continues to move forward with a separation of its Kidney Care business, which will be called Vantive. In mid-August it announced that it would sell Vantive to global investment firm Carlyle for $3.8 billion. The companies expect the transaction to close in late 2024 or early 2025, subject to customary approvals and closing conditions. “As a result of this proposed transaction, Baxter will emerge a more focused and more efficient company, better positioned to redefine healthcare delivery and advance innovation that benefits patients, customers and shareholders,” Baxter Chair and CEO José Almeida said. Meanwhile, the Baxter Medical Products & Therapies business has benefitted from positive pricing and demand. The second quarter also saw the first U.S. sales of the Novum IQ large-volume infusion pump with Dose IQ safety software. –CN

Harness our leading-edge vacuum technology . . . because lives depend on it.

Your high-value medical parts need special treatment. Solar’s leading-edge vacuum heat treating technology produces clean, bright, consistent results. From annealing to age hardening, rest assured knowing your life-critical parts were vacuum heat treated to your exact specs.

For your prosthetics, guide wires, stents, surgical tools, device and battery cases, hypodermics and hypodermic tubing, brazements for analytical devices...and more, trust Solar Atmospheres to provide you with uncompromising quality.

11 13 14 12

Marlborough, Massachusetts United States

$14,240,000,000

Fiscal year ended 12/31/2023

2023 rank: 12

R&D spend: $1,414,000,000

Employees: 48,000

CEO: Michael Mahoney

www.bostonscientific.com

BOSTON SCIENTIFIC has been enjoying a banner year in 2024. As of mid-August, its stock was up more than 31% year-to-date, and the company used its second-quarter earnings report to once again raise its sales guidance. The cardiovascular, endoscopy, neuromodulation, and urology device company — which seeks to positively disrupt the general surgery space — now expects 13.5–14.5% sales growth for 2024. Recent highlights for Boston Scientific include more positive data for its Farapulse pulsed field ablation system for treating AFib. Boston Scientific announced in January that Farapulse won FDA approval to treat drug-refractory, recurrent, symptomatic, paroxysmal AFib. In July, it announced Farapulse approval in China. Boston Scientific also recently announced plans for its $1.16 billion acquisition of Silk Road Medical, which develops products designed to prevent stroke in patients with carotid artery disease. Boston Scientific is also in the process of acquiring Axonics and its neuromodulation systems for treating urinary and bowel dysfunction; the nearly $3.7 billion deal is presently expected to close during the second half of 2024 pending review by the U.S. Federal Trade Commission. Late in 2023, Boston Scientific made an initial upfront payment of $850 million to purchase Relievant Medsystems, enhancing its position in the chronic pain management market. –CN

(medical and interventional segments)

Franklin Lakes, New Jersey United States

$14,238,000,000

Fiscal year ended 9/30/2023

2023 rank: 11

R&D spend: not available

Employees: 50,000

CEO: Tom Polen; Mike Garrison, EVP and medical president; Richard Byrd, EVP and interventional president

www.bd.com

Market disruptions in China appear to be creating some headwinds for BD, but company officials boasted of continued strong performance overall during the company’s thirdquarter earnings announcement in early August. BD’s medical segment is enjoying increased market position in vascular access management and hypodermic products. Plus, medication management systems posted especially strong growth following a 510(k) clearance for its Alaris infusion pumps in 2023 that enabled U.S. distribution of the pumps to resume following a yearslong recall. Expect BD’s medical device industry footprint to grow even more now that it’s agreed to pay $4.2 billion to acquire Edwards Lifesciences‘ Critical Care business. Other important BD news includes its announcement early in 2024 that it would boost U.S. syringe production after the FDA issued warnings related to syringes made in China. –CN

Catheter design was key for the Boston Scientific Farapulse pulsed field ablation system wtwh.me/BostonScientific

Melville, New York United States

Mechanicsville, Virginia United States

$12,339,000,000

Fiscal year ended 12/31/2023

2023 rank: 13

R&D spend: not available

Employees: 25,000

CEO: Stanley Bergman

www.henryschein.com

HENRY SCHEIN’S stock is down more than 10% in 2024 as the major healthcare products and services distributor continues to manage the fallout from last year’s cyberattack. According to filings with the U.S. Securities and Exchange Commission, the company has paid $19 million for remediation efforts alone: $11 million in 2023 and $8 million during the first six months of 2024. The company said in its second-quarter filing with the SEC that residual effects of the cyberattack included decreased sales to episodic customers. The company has operations in 33 countries, with products and services sold to more than 1 million dental practices, laboratories, physician practices, ambulatory surgery centers, and more. Other major news included Henry Schein’s purchase earlier in 2024 of a majority stake in Santa Clarita, California–based TriMed, a manufacturer of orthopedic devices for the lower extremities (foot and ankle) and upper extremities (hand and wrist).–CN

$10,333,967,000

Fiscal year ended 12/31/2023 (Foreign currency revenue)

2023 rank: 14

R&D spend: $13,200,000

Employees: 22,200

CEO: Ed Pesicka

www.owens-minor.com

OWENS & MINOR in July announced it would spend $1.4 billion to acquire Rotech Healthcare Holdings, a privately held home-based care business that provides home medical equipment in the U.S. “Rotech squarely fits into our existing Patient Direct segment and directly aligns with the strategy we outlined last December during our Investor Day, supporting our expansion in the very large and fast-growing home-based care space,” Owens & Minor CEO Edward Pesicka said in a news release. As of mid-August, Owens & Minor expected full-year revenue in the $10.5–10.9 billion range. The company provides product manufacturing, distribution support and technology services in more than 90 countries. –CN and DK

Henry Schein’s cyberattack offers lessons for others wtwh.me/HenrySchein

Melsungen

Germany

$9,455,400,000

Fiscal year ended 12/31/2023 (€8,755,000,000)

2023 rank: 15

R&D spend: $523,368,000

Employees: 63,011

CEOs: Anna Maria Braun, CEO; Rob Albert, U.S. CEO

www.bbraun.com

With more than 300 subsidiaries in 64 countries, B. BRAUN MELSUNGEN manufactures over 5,000 medical devices and pharmaceutical products, which it supplements with an extensive range of services. B. Braun has three divisions: Hospital Care, Aesculap (surgical and interventional), and Avitum (chronic disease treatments).

Geneva Switzerland

Multiple generations of the Braun family have owned the company since its founding in the 19th century, with Anna Maria Braun presently serving as CEO. Despite what company officials described as a demanding environment, sales were up 3% and earnings were up more than 15% in 2023. The U.S. HQ is in Bethlehem, Pennsylvania.–CN 16 18

$9,400,000,000

Fiscal year ended 12/31/2023

2023 rank: 16

R&D spend: $828,000,000

Employees: 25,000

CEO: David Endicott

www.alcon.com

Formerly a subsidiary of pharmaceutical giant Novartis, ALCON spun out as a separate eye care business in 2019. The company was founded in 1945 by Robert Alexander and William Conner as a small pharmacy in Fort Worth, Texas, where its U.S. headquarters remain. In 2024, Alcon expanded its glaucoma portfolio with the acquisition of Belkin Vision and broadened its cataract offerings with FDA clearance for two of its Unity offerings. The company anticipates around $10 billion in sales for fiscal 2024. –SW

(previously 3M Health Care)

Maplewood, Minnesota United States

$8,197,000,000

Fiscal year ended 12/31/2023

2023 rank: 17

R&D spend: $758,000,000

Employees: 22,000

CEO: Bryan Hanson

www.solventum.com/

SOLVENTUM — formerly 3M Health Care — completed its spinoff from 3M in April, with its shares trading on the New York Stock Exchange under the symbol SOLV. The company operates in 38 countries, with more than 300 offices and facilities. Its business segments include medical surgical, dental, health information systems, and purification and filtration. In its first quarterly report as an independent company, Solventum’s second-quarter results beat the expectations of Wall Street analysts; the company upped its full-year revenue guidance to 0–1% growth. “As we continue to execute a complex transformation, we’re encouraged by our first financial results as an independent company and early ability to maintain business continuity,” said Solventum CEO Bryan Hanson, who left the corner office at Zimmer Biomet a year ago to lead the spinoff. “We are starting from a solid foundation and remain focused on addressing historical underperformance and spinrelated topics to unlock significant value creation over time.” –CN

Warsaw, Indiana United States

$7,394,200,000

Fiscal year ended 12/31/2023

2023 rank: 19

R&D spend: $458,700,000

Employees: 18,000

CEO: Ivan Tornos

www.zimmerbiomet.com

ZIMMER BIOMET continues to expand its orthopedic surgical robotics and digital surgery offerings to boost its competitiveness against rivals such as Stryker and Johnson & Johnson’s DePuy Synthes. In June, ZB announced a limited distribution agreement with Think Surgical for Think’s wireless, handheld TMINI miniature robotic system for total knee arthroplasty (TKA). Zimmer Biomet officials see TMINI complementing its flagship Rosa surgical robot portfolio with a handheld robotic option. Earlier in 2024, the FDA cleared the Rosa Shoulder robotic surgery system, making it the fourth application for ZB’s Rosa. On the M&A front, Zimmer Biomet recently announced a deal to acquire OrthoGrid Systems and its AI-driven surgical guidance systems for total hip replacement. –CN

Sunnyvale, California United States

$7,124,100,000

Fiscal year ended 12/31/2023

2023 rank: 22

R&D spend: $998,800,000

Employees: 13,676

CEO: Gary Guthart

www.intuitive.com

INTUITIVE widened the moat against the host of the companies — including giants Medtronic and Johnson & Johnson — that sought to challenge it in the soft-tissue surgical robotics space. It opened 2024 announcing that it submitted its next-gen da Vinci 5 system for FDA review. Two months later, it had da Vinci 5 clearance secured, with a limited launch phase expected to last into 2025. Analysts have expressed confidence that the new system will fuel future growth. As of the writing of this description in mid-August, Intuitive’s stock value was up more than 41% year-to-date. The da Vinci 5 joins Intuitive’s existing da Vinci robotic surgical system portfolio alongside the multiport X and Xi systems and the single-port SP. There is also Ion, Intuitive’s robotic-assisted platform for minimally invasive biopsy in the lung. Da Vinci 5 has more than 10,000 times the computing power of da Vinci Xi to enable new system capabilities and advanced digital experiences, now and in the future. The next-gen system also introduces Force Feedback technology and optional instruments that enable the system to measure subtle forces exerted on tissue during surgery and relay that feeling to surgeons. “We strive to provide customers with technology that meets their needs and solves important problems,” said Intuitive Chief Medical Officer Dr. Myriam Curet. –CN

(healthcare only)

Tokyo Japan

$6,940,208,583

Fiscal year ended 3/31/2024 (JP¥975,100,000,000)

2023 rank: 18

R&D spend: not available Employees: not available CEO: Teiichi Goto

www.fujifilm.com/us/en/ healthcare

Healthcare is the largest operating segment within FUJIFILM, responsible for nearly a third of the company’s revenue in fiscal 2024, with sales for the segment up 5% for the year. Fujifilm’s healthcare products include diagnostic equipment such as X-ray systems, endoscopes and ultrasound systems, and medical IT systems. Fujifilm Healthcare Americas is headquartered in Lexington, Massachusetts. Top Fujifilm healthcare news in 2024 included the company picking Brainlab to exclusively distribute its Arietta Precision ultrasound for neurosurgery applications in the U.S. The companies said Arietta Precision combined with Brainlab’s surgical navigation system “becomes a powerful intraoperative neurosurgery solution.” Fujifilm also won FDA clearance of its CAD Eye AI-powered detection system for endoscopic imaging, a system that could compete against Medtronic and Cosmo Intelligent Medical Devices’ GI Genius for colonoscopies. –CN and SW

The Intuitive da Vinci 5’s top design changes: ‘This is groundbreaking for robotic surgery’ wtwh.me/Intuitive

Tokyo Japan

$6,663,411,627

Fiscal year ended 3/31/2024 (JP¥936,210,000,000)

2023 rank: 20

R&D spend: $614,718,424

Employees: 28,838

CEO: Stefan Kaufmann

www.medical.olympusamerica.com

OLYMPUS medical devices primarily serve gastroenterology, general surgery, pulmonology, bronchoscopy, urology, gynecology, otolaryngology, bariatrics, orthopedics and anesthesiology. Olympus started 2024 by closing on its $370 million acquisition of Taewoong Medical, a Korean company known for its gastrointestinal metallic stents. Olympus officials say the acquisition significantly strengthens its portfolio in a critical business segment. –CN

Tokyo Japan

$6,561,297,821

Fiscal year ended 3/31/2024 (JP¥921,863,000,000)

2023 rank: 21

R&D spend: $491,529,899

Employees: 30,591

CEO: Hikaru Samejima

www.terumo.com

TERUMO’S wide range of products include interventional cardiology, blood transfusion and cell therapy. In May 2024, Terumo Cardiovascular announced FDA 510(k) clearance of its CDI OneView cardiopulmonary bypass surgery monitoring system. The nextgeneration system measures or displays up to 22 vital patient parameters, including oxygen delivery, cardiac index, area under the indexed oxygen delivery curve, oxygen extraction ratio and measured flow. –CN

Irvine, California United States

$6,004,800,000

Fiscal year ended 12/31/2023

2023 rank: 23

R&D spend: $1,071,800,000

Employees: 20,000

CEO: Bernard Zovighian

www.edwards.com

EDWARDS LIFESCIENCES won FDA approval of its Evoque tricuspid valve replacement system in February 2024 and then announced a series of M&A deals. First, it said in June it would sell its Critical Care business (which it previously planned to spin off) to BD for $4.2 billion. Edwards then announced plans to spend $1.2 billion to buy JenaValve Technology and Endotronix. The JenaValve Trilogy Heart Valve System for aortic regurgitation could win FDA approval in late 2025, while the FDA already approved the Endotronix Cordella implantable pulmonary artery pressure sensor in June, with a CMS national coverage determination slated for early 2025. Edwards is also acquiring mitral valve company Innovalve for $300 million and entered into a series of licensing and development deals with Affluent Medical involving Affluent’s Kalios adjustable mitral annulus and mitral valve technology. –CN

Watford, England United Kingdom

$5,549,000,000

Fiscal year ended 12/31/2023

2023 rank: 24

R&D spend: $339,000,000

Employees: 18,452

CEO: Deepak Nath

www.smith-nephew.com

SMITH+NEPHEW is the world’s fifth-largest orthopedic device company. In 2024, S+N introduced new artificial intelligence features for its Cori orthopedic surgical robotic system to boost personalization and efficiency of knee and hip arthroplasty procedures. Other top S+N news for the year included the full U.S. launch of its Aetos shoulder system with additional FDA clearances, plus FDA clearance of its new Catalystem primary hip system. –CN

Dublin, Ireland

(Operational HQ in Mentor, Ohio)

$5,138,701,000

Fiscal year ended 3/31/2024

2023 rank: 25

R&D spend: $103,679,000

Employees: 18,000

CEO: Daniel Carestio

www.steris.com

STERIS provides contract sterilization, infection-control equipment and consumables, testing and validation services, and medical devices such as surgical instruments and endoscopes. The company has three business segments: Healthcare, Applied Sterilization Technologies (AST) and Life Sciences. AST’s sterilization methods include ethylene oxide, gamma beam, electronic beam, X-ray and vaporized hydrogen peroxide. In May, the company sold its Dental segment and announced a restructuring plan, saying fewer than 300 positions would be eliminated. –JH

(healthcare products)

Bad Homburg Germany

$4,384,455,480

Fiscal year ended 12/31/2023 (€4,059,681,000)

2023 rank: 28

R&D spend: not available

Employees: not available

CEO: Helen Giza

www.freseniusmedicalcare.com

FRESENIUS MEDICAL CARE announced FDA clearance for its 5008X hemodialysis system in February 2024, marking a step toward bringing a new standard of care in dialysis therapy to the U.S. Fresenius said it would start U.S.-based clinical evaluations and user studies ahead of a broad launch in 2025. Fresenius also has long-term aspirations to make kidney disease care more personalized and precise. –CN and SW

San Diego, California United States

$4,289,002,810

Fiscal year ended 12/31/2023 (RMB¥34,930,000,000)

2023 rank: 27

R&D spend: $533,830,445

Employees: 18,044

CEO: Wu Hao

www.mindray.com

MINDRAY offers patient monitoring, anesthesia, and ultrasound solutions. The company launched its two-in-one TE Air wireless handheld ultrasound device with multi-device connectivity late in 2023 and expanded its U.S. non-invasive liver care offerings in January 2024. –SW

$4,222,993,000

Fiscal year ended 6/30/2023

2023 rank: 34

R&D spend: $287,642,000

Employees: 10,140

CEO: Michael Farrell

www.resmed.com

RESMED was founded in Australia in 1989 by Peter Farrell and has been under the leadership of his son, Mick Farrell, since 2013. The company specializes in cloudconnected respiratory devices, offering continuous positive airway pressure (CPAP) machines for sleep apnea and ventilators for conditions such as chronic obstructive pulmonary disease (COPD). With a major recall still mostly keeping Philips out of the market, ResMed’s revenue has grown by double-digit percentages in recent years. –CN

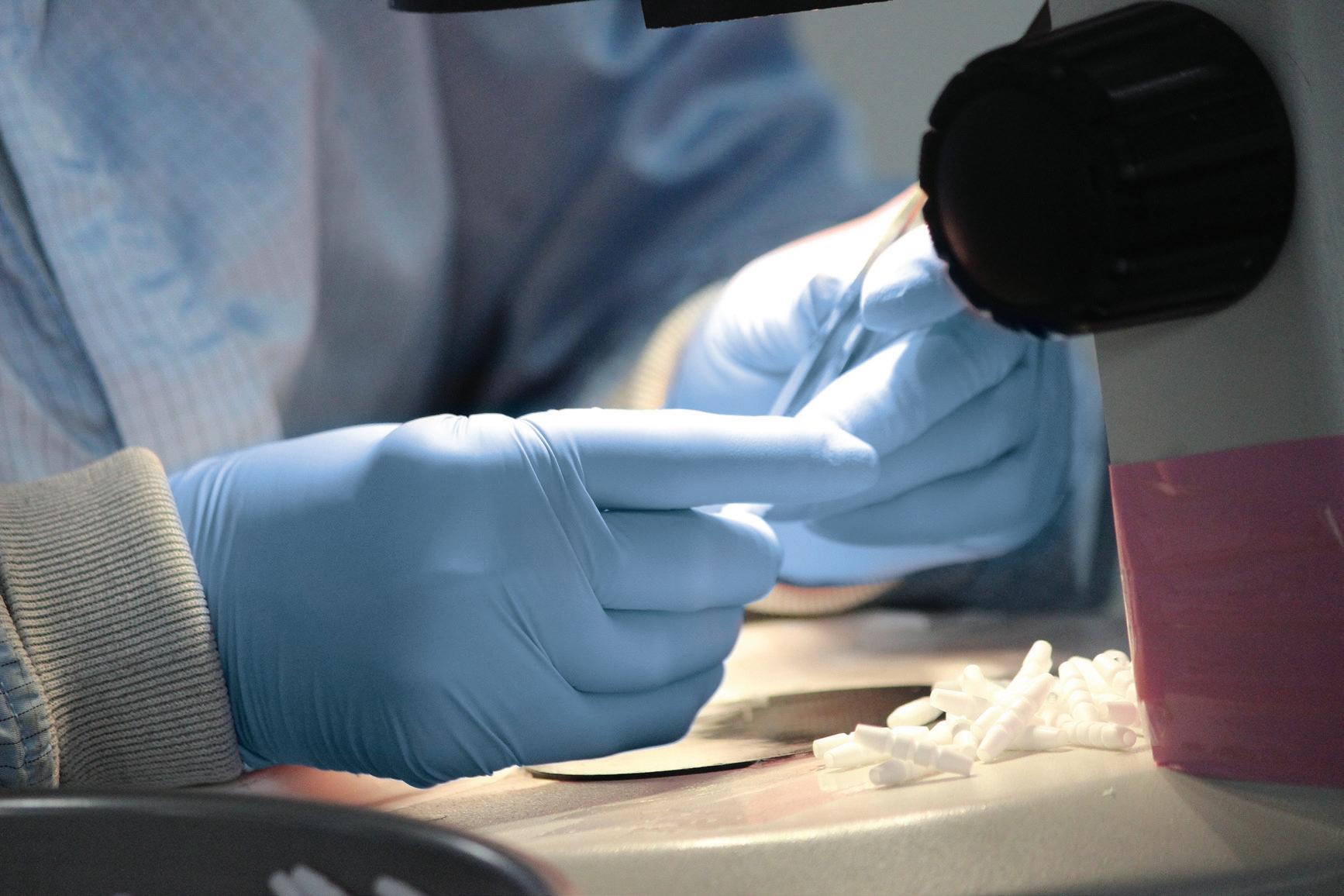

MTD’s advanced processes cater to the specific demands of these industries, from orthopedic and pharmaceuical to wearables and dental (as pictured above).

We ensure that vital components and devices meet the highest standards of precision, quality, and performance.

• Drug delivery devices with extremely tight tolerances and high-aspect ratio flow lengths

• Complex, intricate medical products that demand robust quality systems

• Bioabsorbable components that require consistent and minimal post-mold IV loss

• Overmolded components with ultra-thin walls encapsulating delicate substrates

LEARN MORE: mtdmicromolding.com

Stäfa

Switzerland

$4,037,177,204

Fiscal year ended 3/30/2024 (CHF3,627,000,000)

2023 rank: 30

R&D spend: $262,689,225

Employees: 18,151

CEO: Arnd Kaldowski

www.sonova.com

Founded in 1947, SONOVA specializes in developing hearing instruments, cochlear implants and a range of other hearing devices. The company’s product portfolio includes brands such as Phonak, Unitron, Hansaton and Advanced Bionics. –CN

Marlborough, Massachusetts

United States

$4,030,400,000

Fiscal year ended 9/30/2023

2023 rank: 26

R&D spend: $294,300,000

Employees: 6,990

CEO: Stephen MacMillan

www.hologic.com

HOLOGIC in February 2024 announced FDA clearance of its Genius digital diagnostics system, which uses AI to enhance the detection of pre-cancerous lesions and cervical cancer cells. The company said its the first FDAcleared digital cytology platform that combines deep learningbased AI with advanced volumetric imaging, marking an advancement in cervical cancer screening. In July 2024, Hologic paid $310 million to acquire Endomagnetics, which specializes in breast surgery localization and lymphatic tracing technology. –CN

Charlotte, North Carolina United States

$3,965,000,000

Fiscal year ended 12/31/2023

2023 rank: 29

R&D spend: $184,000,000

Employees: 15,000

CEO: Simon Campion www.dentsplysirona.com

DENTSPLY SIRONA manufactures and markets general dental supplies and devices, including CAD/CAM restoration systems (CEREC and inLab), dental restorative products, digital intra-oral, panoramic and 3D imaging systems, dental treatment centers, hand pieces, hygiene systems and dental specialty products for orthodontics, endodontics and implants. –DK

Ōtawara Japan

$3,941,634,205

Fiscal year ended 12/31/2023

(JP¥553,800,000,000)

2023 rank: 31

R&D spend: not available

Employees: not available

CEO: Fujio Mitarai, Chair and CEO; Toshio Takiguchi, president and CEO, Canon Medical Systems

global.medical.canon

CANON MEDICAL and Olympus in January 2024 announced a collaboration on endoscopic ultrasound technology. The partnership has Canon developing and manufacturing diagnostic ultrasound used in endoscopic ultrasonography, while Olympus handles sales and marketing efforts. The deal utilizes Canon’s Aplio i800 diagnostic EUS ultrasound and Olympus’ ultrasound endoscope. –SW and CN

San Diego, California United States

$3,622,300,000

Fiscal year ended 12/31/2023

2023 rank: 38

R&D spend: $505,800,000 Employees: 9,600

CEO: Kevin Sayer

www.dexcom.com

DEXCOM develops continuous glucose monitoring (CGM) technology. The company launched its latest-generation G7 in 2023. Dexcom expanded on G7 in 2024 by adding direct-to-watch capabilities with the Apple Watch. It also became the first company to bring an over-the-counter CGM to market with its Stelo system. –SW

Tempe Arizona

$3,862,260,000

Fiscal year ended 12/31/2023

2023 rank: 32

R&D spend: $346,830,000 Employees: 21,610

CEO: Joseph Hogan www.aligntech.com

ALIGN TECHNOLOGY is the creator of the Invisalign clear aligner system, offering an alternative to traditional metal braces. Established in 1997, the company disrupted the orthodontics market with its approach, combining digital treatment planning with advanced mass customization techniques. In 2024, the company announced its acquisition of Cubicure and its polymer additive manufacturing tech. Company officials said the deal expanded printing, materials and manufacturing capabilities for its 3D-printed product portfolio. –JH and CN

Tokyo Japan

Hoya (life care segment)

$3,772,410,126

Fiscal year ended 3/31/2024 (JP¥530,027,000,000)

2023 rank: 33

R&D spend: not available

Employees: not available

CEO: Eiichiro Ikeda

www.hoya.com/en/business/lifecare

HOYA Corp.’s life sciences division includes products such as eyeglasses, contact lenses, and intraocular lenses, which are crucial in eye care and ophthalmic surgery. Hoya also offers endoscopic systems and other advanced technology for minimally invasive treatments, as well as include prosthetic ceramic fillers, metallic implants, laparoscopic surgical instruments and automatic endoscope cleaning equipment. –CN

San Ramon, California United States

$3,593,200,000

Fiscal year ended 10/31/2023

2023 rank: 35

R&D spend: $137,400,000 Employees: 15,000

CEO: Albert White

www.coopercos.com

COOPER COS. operates through two main business divisions: CooperVision and CooperSurgical. CooperVision is a manufacturer of contact lenses, providing vision care products to millions of people in over 130 countries. CooperSurgical is focused on women's health, offering a portfolio of products and services that support fertility, diagnostics, and other aspects of women's healthcare. –CN

Humlebæk Denmark

$3,555,878,084

Fiscal year ended 9/30/2023

(DKK kr24,500,000,000)

2023 rank: 37

R&D spend: $126,560,232 Employees: 14,903

CEO: Kristian Villumsen

www.coloplast.us

COLOPLAST specializes in products and services for ostomy care, continence care, advanced wound care, interventional urology, and voice and respiratory care. The devicemaker is known for its ostomy bags, catheters, and advanced wound dressings. Coloplast has its U.S. headquarters in Minneapolis. –CN

Nipro (medical segment) Osaka Japan

$3,228,538,627

Fiscal year ended 3/31/2024 (JP¥453,610,000,000)

2023 rank: 36

R&D spend: $621,351,871 Employees: not available

CEO: Yoshihiko Sano

www.nipro.com

NIPRO offers medical devices across five areas: renal products, interventional catheter-delivered products, hospital products, cardiopulmonary products and enzymes. The company is one of the leading manufacturers of dialyzers globally. It also reports continuing results with artificial organs and in the new area of tissue engineering. –CN

Our range of Swiss Type CNC Machines and Fixed Headstock Automatic Lathes are ready to produce your most intricate part.

• 1mm to 38mm Bar Stock

• 5-axis machines with excellent cost performance to a high-end machine equipped with B axis and back spindle Y axis.

• LFV (low-frequency vibration) available on most models

• Barloaders “CAV” fully integrated through Machine Control

• Intuitive CITIZEN Controls offers ease of programming and operation

• Machining Solutions with Lifetime Customer Support

• 15 + models to choose from

• From simple single-spindle machines to twin-spindle, multi-turret turning centers covering the range right up to 80mm bar diameter.

• Accuracy, Rigidity and Durability

• LFV (low-frequency vibration) available on multiple models

• Large and accessible workspace

• On-machine program check

• Intuitive CITIZEN Controls offers ease of programming and operation

• Machining Solutions with Lifetime Customer Support

• 13 + models to choose from

• Fully integrated into the machine control for easier operation and total control from one single console

• Quick response between bar feeder and the machine sliding headstock

• A unique stabilizing mechanism: forces are evenly distributed, protecting the spindle from excess wear

• Automatic remnant retraction

• Hydrostatic oil support

• Quick channel change ( less than 35 seconds)

• One company to contact for parts and support

Smørum Denmark

$3,135,123,367

Fiscal year ended 12/31/2023

(DKK kr21,601,000,000)

2023 rank: 42

R&D spend: not available

Employees: not available

CEO: Søren Nielsen www.demant.com

Healthcare and audio technology company DEMANT’S has a history that stretches back 120 years to its founding in 1904. Demant provides hearing aids, hearing implants, hearing care products, diagnostic equipment and services to hearing care professionals and users in more than 130 countries. The majority of Demant A/S shares are held by the William Demant Foundation through the investment company William Demant Invest. Demant A/S is listed on Nasdaq Copenhagen. –CN

Gothenburg Sweden

$3,000,028,278

Fiscal year ended 12/31/2023

(31,827,000,000 SEK kr)

2023 rank: 40

R&D spend: $112,358,491

Employees: 11,739

CEO: Mattias Perjos

www.getinge.com

Wayne, Pennsylvania United States

$2,974,489,000

Fiscal year ended 12/31/2023

2023 rank: 41

R&D spend: $154,351,000

Employees: 14,500

CEO: Liam Kelly www.teleflex.com

BRUKER offers advanced scientific instruments and high-value analytical and diagnostic solutions that it says empower scientists to explore life and materials at molecular, cellular and microscopic levels. Its employees work at over 90 locations globally. German experimental physics professor Günther Laukien helped start the company in 1960, providing what the company says were the first high-resolution systems for analytical chemistry in the U.S. –CN 39

Founded in 1904, GETINGE provides ventilators, extracorporeal life support systems and other medical technologies. The company secured 2024 FDA clearances for its endoscopic vessel harvesting (EVH) solution and advanced clinical guidance support software. However, in May 2024 the FDA warned of “continued safety and quality concerns” related to its cardiovascular device recalls. –SW

TELEFLEX specializes in critical care and surgical technologies. Its portfolio spans vascular and interventional access, surgical, anesthesia, cardiac care, urology, emergency medicine and respiratory care. Highlights in 2024 included the launch of the UroLift 2 for treating benign prostatic hyperplasia (BPH) symptoms as an alternative to medications and major surgery. The company also initiated a serious balloon catheter recall related to reports of three deaths. –SW

Billerica, Massachusetts United States

$2,964,500,000

Fiscal year ended 12/31/2023

2023 rank: 44

R&D spend: $294,800,000

Employees: 9,707

CEO: Frank Laukien

www.bruker.com

Carl Zeiss (medical technology segment)

Jena Germany

$2,704,320,000

Fiscal year ended 9/30/2023 (€2,504,000,000)

2023 rank: See Page 14 footnote R&D spend: not available Employees: 7,736

CEO: Markus Weber, Carl Zeiss Meditec president and CEO and Zeiss Medical Technology segment head www.zeiss.com/meditec-ag/home.html

CARL ZEISS MEDITEC products and workflow solutions support the diagnosis and treatment of eye diseases. It also provides technology for visualizing minimally invasive surgical treatments. Carl Zeiss Meditec announced in April 2024 that it completed its $1 billion acquisition of the Dutch Ophthalmic Research Center (D.O.R.C.), which develops technology to address eye conditions such as retinal disorders, cataracts, glaucoma and refractive errors. –CN and SW

Lynge Denmark

$2,662,200,000

Fiscal year ended 9/30/2023 (€2,465,000,000)

2023 rank: 45

R&D spend: $193,320,000 Employees: 12,500

CEO: Jan Makela

www.wsa.com

WS AUDIOLOGY is a leader in the hearing aid industry, serving a global network of thousands of hearing care professionals. In addition to partnering with providers, the company connects directly with individuals affected by hearing loss through its consumerfacing businesses. –CN

43 44 45 46

Brea, California United States

$2,566,500,000

Fiscal year ended 12/31/2023

2023 rank: 43

R&D spend: $93,800,000 Employees: 12,700

CEO: Paul Keel www.envistaco.com

ENVISTA has a global family of more than 30 dental brands, including Nobel Biocare, Ormco, Dexis and Kerr. The company provides a comprehensive range of dental solutions, including dental implants, orthodontics and digital imaging technologies, catering to a wide spectrum of clinical needs. Envista’s products and technologies support the diagnosis, treatment and prevention of dental conditions, as well as enhancing the aesthetics of the human smile. –CN

Heidenheim Germany

$2,541,564,000

Fiscal year ended 12/31/2023 (€2,353,300,000)

2023 rank: 46

R&D spend: $91,908,000 Employees: 10,168

CEO: Britta Fünfstück www.hartmann.info

THE HARTMANN GROUP’S history goes back to the early 19th century, with a legacy of medical advances in wound care and skin health. The company focuses on areas such as wound care, incontinence management, and infection management. Hartmann has offices in more than 36 countries, and its network of distributors sell its products in more than 130 countries –CN

Milan Italy

$2,440,890,720

Fiscal year ended 12/31/2023

(€2,260,084,000)

2023 rank: 48

R&D spend: not available Employees: 20,300

CEO: Enrico Vita

www.amplifon.com

AMPLIFON is a major hearing aid provider. Its products and services include Ampli-easy, Ampli-mini, Ampli-connect, Ampli-energy, the Amplifon App, and Companion smart support. –CN

Bloomington, Indiana United States

$2,300,000,000

Fiscal year ended 12/31/2023

2023 rank: 50

R&D spend: not available Employees: 9,478

CEO: Carl Cook

www.cookmedical.com

COOK MEDICAL in July 2024 announced that it signed a letter of intent to sell its Reproductive Health business (Cook ART) to private equity firm Astorg. Cook Medical entered into this agreement nearly one year after a previous attempt to sell off these businesses to Cooper Cos. failed amid FTC scrutiny. Cook was able to sell select assets to Cooper for $300 million in late 2023. –CN

San Clemente, California United States

$2,259,126,000

Fiscal year ended 12/31/2023

2023 rank: 47

R&D spend: $85,344,000 Employees: 14,000

CEO: Vivek Jain

www.icumed.com

Syringe and infusion technology company ICU MEDICAL soared up the Big 100 ranks following its $2.35 billion acquisition of Smiths Medical in 2022. Smiths Medical provides syringe and ambulatory infusion devices, vascular access, and vital care products. With the addition, ICU Medical reported revenue of $2.3 billion in 2023. However, 2024 was rife with issues for the company, which closed multiple Smiths Medical plants and issued warnings on tracheostomy products, ventilators and syringe pump software. –SW

Basel Switzerland

$2,166,940,800

Fiscal year ended 12/31/2023 (CHF2,412,000,000)

2023 rank: 49

R&D spend: not available Employees: 11,000

CEO: Guillaume Daniellot

www.straumann.com

STRAUMANN is a global provider of tooth replacement and orthodontic products and services. Its brands include Anthogyr, ClearCorrect, Dental Wings, Medentika, Neodent, NUVO and Straumann, and it has other fully/ partly owned companies and partners. Straumann researches, develops, manufactures and supplies dental implants, instruments, CADCAM prosthetics, orthodontic aligners, biomaterials and digital tools. –CN

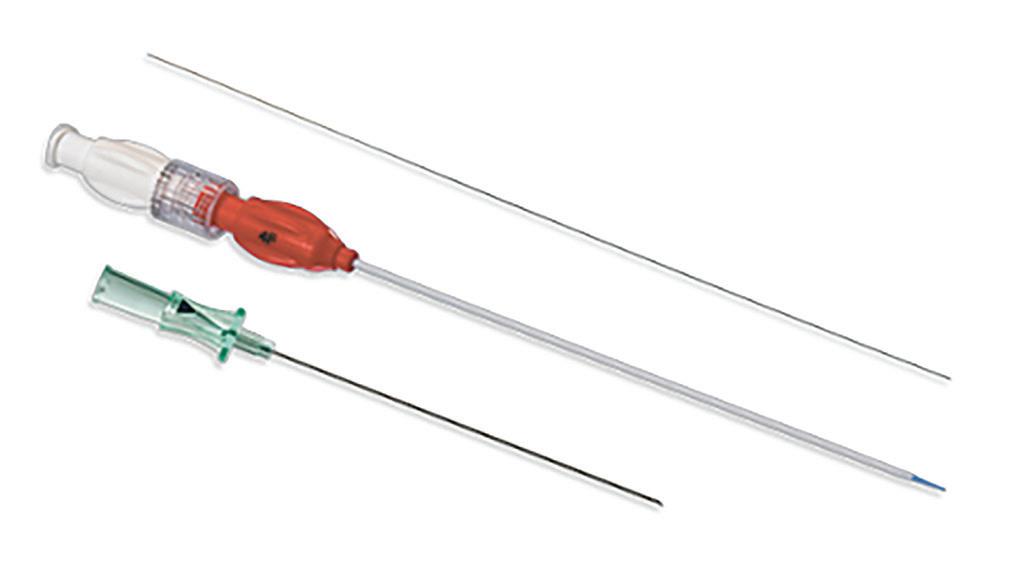

CDMO / CMO Services

Minimally Invasive Device Solutions

Co-development Opportunities

Access, Delivery, & Retrieval Systems

Wire & Catheter Based Devices

Contract Manufacturing

Vascular Access Devices

Guidewires, Therapeutic & Diagnostic

Braided & Coiled Catheter Shafts

Class 8 Clean Room

Reading, England United Kingdom

$2,142,000,000

Fiscal year ended 12/31/2023

2023 rank: 51

R&D spend: $104,000,000

Employees: 10,000

CEO: Karim Bitar

www.convatecgroup.com

CONVATEC provides technology for advanced wound care, ostomy care, continence and critical care and infusion care. It offers design and manufacturing services for infusion set technologies and insertion devices for insulin pump treatment. The company expects a 5–7% revenue increase in 2024. –SW

Lübeck Germany

$2,123,496,000

Fiscal year ended 12/31/2023 (€1,966,200,000)

2023 rank: 55

R&D spend: not available

Employees: not available

CEO: Stefan Dräger

www.draeger.com/en-us_us/hospital

DRÄGER’S medical division includes five business units: therapy (anesthesia devices, ventilators and thermoregulation equipment), hospital consumables and accessories, workplace infrastructure (supply units, lights and gas management systems), patient monitoring, and data business (software applications, system products and new services). –CN

Wilmington, Delaware United States

$1,707,197,000

Fiscal year ended 12/31/2023

2023 rank: 58

R&D spend: $75,331,000

Employees: 6,550

CEO: Matthew Trerotola

www.enovis.com

ENOVIS — the world’s sixth-largest orthopedic device company and parent company of the DJO brand — is getting larger as it integrates LimaCorporate and its patient-tailored, 3D-printed titanium implants for complex reconstructive surgeries. Enovis completed the $846 million acquisition in January 2024. Enovis is kicking off a multiyear cadence of new product introductions across its two business segments: Prevention and Recovery (P&R) and Recon. –CN

Acton, Massachusetts United States

$1,697,100,000

Fiscal year ended 12/31/2023

2023 rank: 61

R&D spend: $205,000,000

Employees: 3,000

CEO: Jim Hollingshead

www.insulet.com

INSULET develops wearable automated insulin delivery devices. Its flagship Omnipod patch pump is one of the leaders in the market, with the latest version — the Omnipod 5 — growing in popularity through the 2024 integration with the Dexcom G7 continuous glucose monitor (CGM). The company is seeking an expanded indication from the FDA for type 2 diabetes patients with a potential launch in 2025. –SW

Irvine, California United States

$2,048,100,000

Fiscal year ended 12/31/2023

2023 rank: 52

R&D spend: $175,200,000 Employees: 4,000

CEO: Joe Kiani

www.masimo.com

MASIMO’S fight with activist investor Politan Capital Managements continued as COO Bilal Muhsin threatened to quit if CEO and founder Joe Kiani is ousted. Pending litigation has delayed Masimo’s shareholders meeting until Sept. 19, 2024. Masimo said it received a bid for a majority stake in the consumer business that Masimo bought in 2022 — the deal that sparked the proxy fight. Meanwhile, Masimo continues to advance its monitoring technology, including the W1 watch. –SW

Plano, Texas United States

$1,596,673,000

Fiscal year ended 12/31/2023

2023 rank: 60 R&D spend: $63,771,000 Employees: 10,500

CEO: Joseph Dziedzic www.integer.net

INTEGER is one of the world’s largest medical device contract manufacturers, serving the cardiac rhythm management, neuromodulation, orthopedics, vascular, advanced surgical and portable medical markets. Integer’s stock price climbed more than 23% in 2024 as of mid-August. The company expects above-market sales growth of 9–11% for full year 2024. –CN

Stockholm Sweden

$1,707,905,626

Fiscal year ended 4/30/2024 (18,119,000,000 SEK kr)

2023 rank: 56

R&D spend: $132,341,713 Employees: 4,641

CEO: Gustaf Salford

www.elekta.com

ELEKTA develops precision radiation therapy devices and oncology software. In 2024, the company purchased Philips Healthcare’s Pinnacle Treatment Planning System (TPS) patent portfolio and expanded its radiation oncology software partnership with GE HealthCare. –CN

Tokyo Japan

$1,579,970,406

Fiscal year ended 3/31/2024 (JP¥221,986,000,000)

2023 rank: 57

R&D spend: $49,793,559 Employees: 5,891

CEO: Hirokazu Ogino www.nihonkohden.com

Yoshio Ogino founded NIHON KOHDEN in 1950 with a vision of bringing the power of electrical engineering to medicine. Over the decades, the company has been a pioneer in pulse oximetry, cerebral artery pressure meters, ECGs, heart monitors and fetal monitors. It operates subsidiaries in Irvine and Santa Ana, California; Guilford, Connecticut; Alachua, Florida; Charlottesville, Virginia; and Cambridge, Massachusetts. –CN

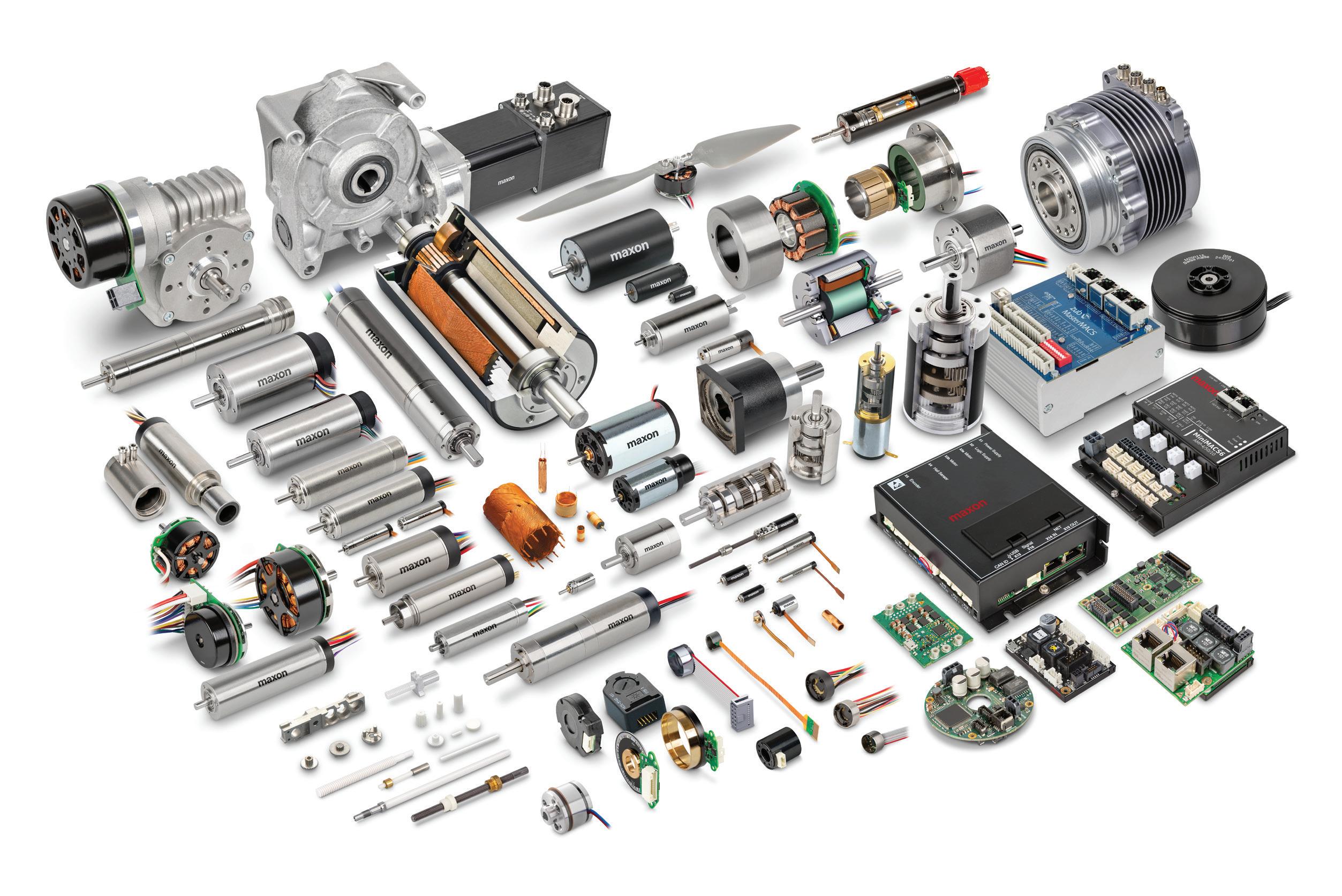

CGI Motion standard products are designed with customization in mind. Our team of experts will work with you on selecting the optimal base product and craft a unique solution to help di erentiate your product or application. So when you think customization, think standard CGI assemblies.

Connect with us today to explore what CGI Motion can do for you.

Audubon, Pennsylvania United States

$1,568,476,000

Fiscal year ended 12/31/2023

2023 rank: 71

R&D spend: $124,010,000 Employees: 5,000

CEO: Daniel Scavilla www.globusmedical.com

GLOBUS MEDICAL’S 2023 merger with NuVasive created the world’s seventh-largest orthopedic device company, but resulted in 157 layoffs at the former NuVasive headquarters at the start of 2024. In June 2024, Globus Medical took a big step forward in surgical robotics with FDA clearance of its Excelsius robot for total knee arthroplasty. However, the Excelsius system was at the center of an FDA warning letter in July 2024 that the company is working through. –SW

South Jordan, Utah

United States

$1,257,366,000

Fiscal year ended 12/31/2023

2023 rank: 64

R&D spend: $82,728,000

Employees: 6,950

CEO: Fred Lampropoulos

www.merit.com

As longtime MERIT MEDICAL founder and CEO Fred Lampropoulos prepares to retire in 2025, the business continues to plug along. In 2024, the company received FDA clearance for its surgical guidance system, partnered with Medtronic on its unipedicular, steerable balloon catheter, and expanded its endoscopy portfolio by purchasing the EndoGastric Solutions EsophyX Z+ device for gastroesophageal reflux disease. –SW

Princeton, New Jersey United States

$1,541,573,000

Fiscal year ended 12/31/2023

2023 rank: 59

R&D spend: $104,192,000 Employees: 3,946

CEO: Jan De Witte

www.integralife.com

Founded in 1989 after the acquisition of an engineered collagen technology platform designed to repair and regenerate tissue, INTEGRA LIFESCIENCES’ regenerative portfolio now includes surgical instruments, neurosurgical devices and advanced wound products. Its brands include AmnioExcel, Aurora, Bactiseal, BioD, CerebroFlo, CereLink Certas Plus, Codman, CUSA, Cytal, DuraGen, DuraSeal, DuraSorb, Gentrix, ICP Express, Integra, Licox, Mayfield, MediHoney, MicroFrance, MicroMatrix, NeuraGen, NeuraWrap, PriMatrix, SurgiMend, TCC-EZ, VersaTru — and now Acclarent, purchased in 2024 from Johnson & Johnson. –JH, DK and CN

Largo, Florida

United States

$1,244,744,000

Fiscal year ended 12/31/2023

2023 rank: 69

R&D spend: $52,602,000 Employees: 4,000

CEO: Curt Hartman

www.conmed.com

CONMED provides a wide range of surgical devices and equipment used in various medical specialties, including orthopedics, general surgery, gynecology, thoracic surgery and gastroenterology. –CN

Boston, Massachusetts United States

$1,309,055,000

Fiscal year ended 3/30/2024

2023 rank: 63

R&D spend: $54,435,000 Employees: 3,657

CEO: Christopher Simon www.haemonetics.com

HAEMONETICS technologies serve medical markets including blood and plasma component collection, the surgical suite and hospital transfusion. The company has been active in M&A, acquiring cardiologyfocused medical device company OpSens for $255 million in 2023 and esophagus-protecting devicemaker Attune Medical for $160 million in 2024. –CN and SW

London, England United Kingdom

$1,153,545,000

Fiscal year ended 12/31/2023

2023 rank: 72

R&D spend: $193,817,000 Employees: 2,900

CEO: Vladimir Makatsaria

www.livanova.com

Cardiac surgery and neuromodulation device company LIVANOVA has been under the leadership of Johnson & Johnson veteran Vladimir Makatsaria as CEO since February 2024. He was hired nearly a year after Damien McDonald resigned as CEO following some pipeline disappointments. During that interim period, the company decided to wind down its circulatory support unit to focus on its cardiopulmonary and neuromodulation businesses. –SW

Sydney Australia

$1,299,367,080

Fiscal year ended 6/30/2023 (AU$1,955,700,000)

2023 rank: 65

R&D spend: $162,711,560

Employees: 4,000

CEO: Dig Howitt

www.cochlear.com

Founded in Sydney in 1981, COCHLEAR develops ear implants to help people with hearing loss. The company says it has provided more than 750,000 implantable devices. –CN

Wilmington, Delaware (operational HQ in Parsippany, New Jersey) United States

$1,120,800,000

Fiscal year ended 9/30/2023

2023 rank: 66

R&D spend: $85,200,000 Employees: 2,200

CEO: Dev Kurdikar

www.embecta.com

BD diabetes spinoff EMBECTA submitted an open-loop, proprietary, disposable insulin patch pump for people with type 2 diabetes for FDA review in January 2024. It also has a closed-loop, automated version under development set to follow. In the meantime, Embecta looks like a potential acquisition target, as reports surfaced that the company enlisted advisers to look into a possible sale. –SW

Design | Engineering | Supply Chain | Manufacturing | After-Market

With Celestica’s engineering expertise, global manufacturing network, and stringent quality control processes, we help you design, develop, and deliver innovative medical devices that enable better patient outcomes.

Discover the Celestica Advantage:

ISO 13485 and FDA-registered sites

Extensive design and engineering expertise

Supply chain risk management and in-region supplier network

Leader in quality and regulatory compliance

Advanced manufacturing (automation and clean room finished goods production)

Auckland New Zealand

$1,070,602,040

Fiscal year ended 3/31/2024

(NZ$1,742,800,000)

2023 rank: 73

R&D spend: $121,754,260 Employees: 7,141

CEO: Lewis Gradon

www.fphcare.com/us

FISHER & PAYKEL HEALTHCARE designs and manufactures systems for acute and chronic respiratory care, surgery, and obstructive sleep apnea treatment. The company distributes its products in more than 120 countries. After two years of revenue decline, Fisher & Paykel boosted sales by 10% during its most recent fiscal year, moving up six spots on the Medtech Big 100. –CN

(healthcare segment)

Tokyo Japan

$988,611,396

Fiscal year ended 3/31/2024

(JP¥138,900,000,000)

2023 rank: 68

R&D spend: not available Employees: not available

CEO: Toshimitsu Taiko

healthcare.konicaminolta.us

KONICA MINOLTA Healthcare is a provider of medical diagnostic imaging and healthcare information technology, including X-ray, ultrasound and imaging management systems. The company’s Konica Minolta Healthcare Americas division is based in Wayne, New Jersey. –CN

$1,065,479,669

Fiscal year ended 3/31/2024

(JP¥149,700,000,000)

2023 rank: 67

R&D spend: not available Employees: not available

CEO: Junta Tsujinaga

www.omronhealthcare.com

OMRON is a major producer of home blood pressure monitors more than 50 years after introducing its first manual and manometer-type model, the HEM1. The company says it has continually advanced its technology to enhance accuracy and ease of use. Omron has sold over 350 million units across more than 110 countries. –CN

Ballerup Denmark

$987,227,866

Fiscal year ended 12/31/2023

(DKK kr6,802,000,000)

2023 rank: 75

R&D spend: $85,486,212 Employees: 4,349

CEO: Scott Davis, GN Hearing president

www.gn.com

Alameda, California United States

$1,058,522,000

Fiscal year ended 12/31/2023

2023 rank: 76

R&D spend: $84,423,000 Employees: 4,200

CEO: Adam Elsesser

www.penumbrainc.com

PENUMBRA was founded in 2004 by President, Chair and CEO Adam Elsesser and Dr. Arani Bose, who formerly served as chair, chief medical officer and chief innovator. Penumbra develops interventional devices for vascular and neuro therapies, including catheters, coils and clot retrievers. In 2024, Penumbra launched its Lightning Flash 2.0 computer-assisted vacuum thrombectomy (CAVT) system in the U.S. and its BMX81 and BMX96 neuro access catheters in Europe. –JH

$950,725,000

Fiscal year ended 12/31/2023

2023 rank: 77

R&D spend: $379,400,000 Employees: 8,230

CEO: Zhaohua Chang

www.microport.com

Tokyo Japan

$998,739,503

Fiscal year ended 3/31/2024

(JP¥140,323,000,000)

2023 rank: 70

R&D spend: not available Employees: not available

CEO: Kotaro Fukuda

www.fukuda.com

FUKUDA DENSHI is a worldwide manufacturer of electrocardiographs, patient monitors, and other advanced medical devices. Established in 1939, the company was a trailblazer in developing Japan’s first electrocardiogram (ECG) device. Its U.S. operations are headquartered in Redmond, Washington. –CN

Rancho Santa Margarita, California, United States

$815,000,000

Fiscal year ended 12/31/2023

2023 rank: 79

R&D spend: $156,000,000 Employees: 5,400

CEO: Said Hilal, CEO

www.appliedmedical.com

Founded in 1987, privately-held APPLIED MEDICAL RESOURCES provides technologies for minimally invasive and general surgery, as well as cardiac, vascular, urologic, colorectal, bariatric, obstetric and gynecologic specialties. It operates in more than 75 countries. –CN 71 72 73 74

GN HEARING develops and manufactures intelligent hearing technology as one of GN Store Nord’s two business units (the other is GN Audio). In 2024, GN Hearing launched a new line of Bluetooth-enabled hearing aids with an improved and more power-efficient way of wirelessly transmitting audio from one device to another. –SW

Founded in 1998 in a small office in ZJ Hi-Tech Park in Shanghai, MICROPORT has grown into a global medical device company. Its technologies can be found in a wide variety of medical fields, including orthopedics, cardiovascular intervention, cardiac rhythm management, electrophysiology, endovascular, and peripheral vascular intervention. –CN

Software plays a crucial role in the development, operation, and usage of medical devices. Qt's quality assurance solutions help ensure these devices meet the medical industry's rigorous standards for quality and safety.

Ensure your devices are safe, effective, secure and do what they do best: Save lives.

Miami Lakes, Florida United States

$790,545,000

Fiscal year ended 12/31/2023

2023 rank: not available

R&D spend: not available

Employees: 3,706

CEO: Scott Drake

www.cordis.com

Founded in 1957 and independent once again since its sale to private equity investors in 2021, CORDIS develops and manufactures medical devices for diagnostics and interventional procedures to treat coronary and peripheral vascular diseases. In 2023, the company expanded its business with the acquisition of MedAlliance and its drug-eluting balloon technology. In 2024, it picked up an FDA premarket approval for its Mynx Control venous vascular closure device (VCD). –SW

Reykjavík

Iceland

$786,000,000

Fiscal year ended 12/31/2023

2023 rank: 81

R&D spend: $38,142,000

Employees: 3,999

CEO: Sveinn Sölvason

www.ossur.com

San Diego, California United States

$747,718,000

Fiscal year ended 12/31/2023

2023 rank: # R&D spend: $169,667,000

Employees: 2,400