INSPIRE AND INNOVATE

Inside the evolution of a restaurant company built unlike any other. JUMP TO THE RANKING OF AMERICA’S BIGGEST LIMITED-SERVICE CHAINS COVER STORY: SPECIAL ANNUAL ISSUE QSR 50 ➽ P. 80 | P. 26 | | P. 38 |

Scan to learn more. Crafted with rich dutched cocoa and real milk powder, Dark Chocolate Chip Frappé Mix features premium chocolate chips perfected by Ghirardelli for an extra bold chocolate experience. Simply add your signature ingredients, blend and impress. Order your FREE samples at 800.877.9338 or professionalproducts@ghirardelli.com Bold FROM BEAN TO CHIP TO BEVERAGES GROW YOUR SALES WITH GHIRARDELLI BRAND POWER ©2023 Ghirardelli Chocolate Company

Serving ketchup and our country. Red Gold is a registered trademark of Red Gold, LLC. Elwood, IN RG-1352-0822 Ketchup with a Cause. You can’t beat the taste of Red Gold Ketchup, and now you can get it in a convenient 1 oz. dunk cup! With its thick, tangy tomato flavor and the perfect balance of sweet and sour notes—it’s a delicious flavor As proud supporters of the Folds of Honor Foundation, Red Gold helps to provide educational support to the spouses and children of deceased or disabled U.S. service members. That means, when you serve Red Gold, you’re serving the families of our fallen troops, too. you can feel good about serving. Request a sample today of the 1 oz. Red Gold Ketchup that’s easy to love and easy to share at Redgoldfoodservice.com/sample-requests RedGoldTomatoes.com/FoldsOfHonor

COSTA COFFEE SMART CAFÉ WINS 2023 KITCHEN INNOVATION AWARD! SIMPLY MIXOLOGY WINS A 2023 FABI AWARD! ©2023 Simply Orange Juice Company. “Simply Mixology” is a trademark of the Simply Orange Juice Company. ©2023 Costa Limited. “Costa” and “Costa Co ee” are registered trademarks of Costa Limited. “Costa Co ee Smart Café” is a trademark of Costa Limited.

DEPARTMENTS

22

FRANCHISE FORWARD

Coffee Chains

Bring the Intensity

Several brands are finding success with energy drink lineups. BY SATYNE DONER

101

INNOVATE

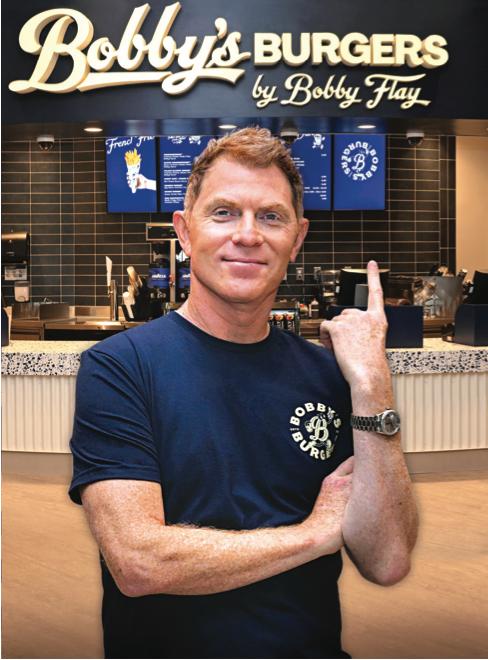

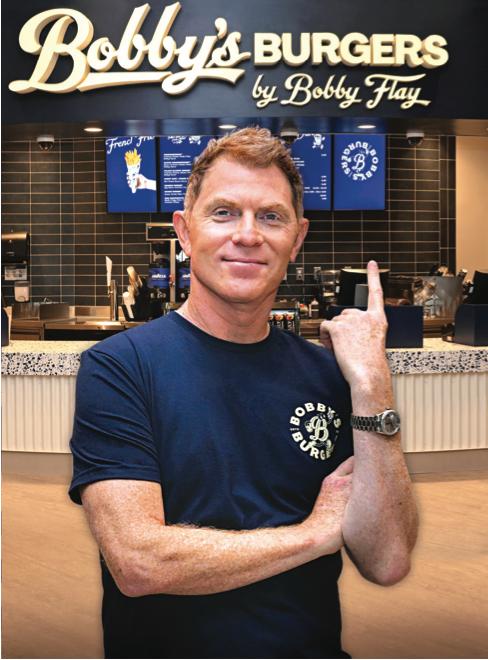

Navigating the Stars

Celebrities often help restaurants promote products, but how do those relationships work exactly? BY SAM DANLEY

INSIGHT

15

FRESH IDEAS

The Great Chicken Debate

Wings and tenders are beloved by most, but is there a preference among operators?

BY SAM DANLEY

20

ONES TO WATCH

Foxtail Coffee

This rising chain wants to be different than the typical drive-thru concept.

BY

SATYNE

97

Innovation that Inspires

BY DANNY KLEIN

Inspire Brands might just be the fastest-growing restaurant group on record. But that doesn’t mean the Dunkin’ and Arby’s owner

DONER

OPERATIONS

A Robotic Pizza Party

Automation has arrived, and pizza seems to be the go-to dish.

BY SATYNE DONER

104

START TO FINISH

Mary Jane Riva

Learn how the restaurateur joined the industry and became a CEO and franchisee of Pizza Factory.

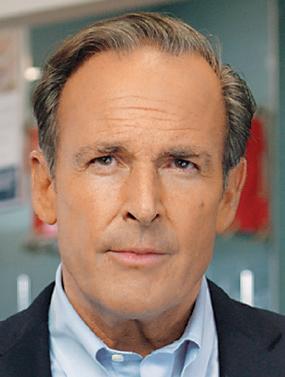

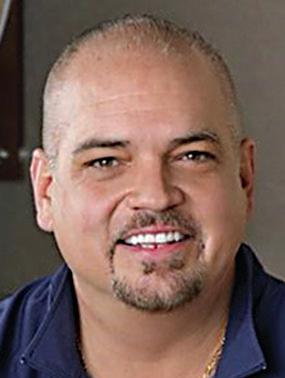

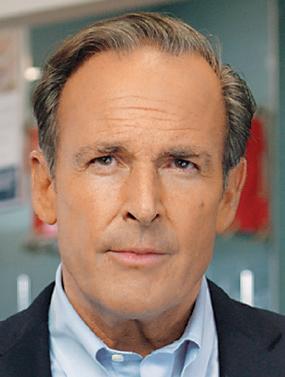

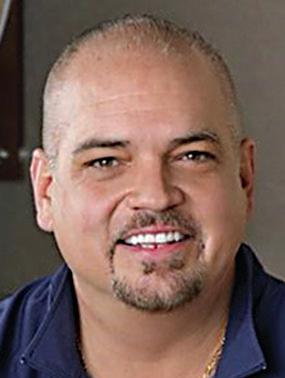

Inspire Brands CEO Paul Brown leads growth for several successful chains. PHOTOGRAPHY:

Au

ON THE COVER

INSPIRE BRANDS NEWS

QSR / LIMITED-SERVICE, UNLIMITED POSSIBILITIES TABLE OF CONTENTS AUGUST 2023 #306

INSPIRE BRANDS 4 BRANDED CONTENT 6 EDITOR’S LETTER 9 SHORT ORDER 103 ADVERTISER INDEX

FEATURES

26

plans to slow down anytime soon. 38 QSR 50 BY QSR STAFF With COVID seemingly in the rearview, the U.S.’s biggest quickservice companies are jostling for share of customers’ stomachs and wallets. See how the top earners compare after another year in a unique operating environment. QSR is a registered trademark of WTWH Media, LLC. QSR is copyright © 2023 WTWH Media, LLC. All rights reserved. The opinions of columnists are their own. Publication of their writing does not imply endorsement by WTWH Media, LLC. Subscriptions (919) 945-0704. www.qsrmagazine.com/subscribe. QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher. AAM member. All rights reserved. No part of this magazine may be reproduced in any fashion without the express written consent of WTWH Media, LLC. QSR (ISSN 1093-7994) is published monthly by WTWH Media, LLC, 1111 Superior Avenue Suite 2600, Cleveland, OH 44114. Periodicals postage paid at Cleveland, OH and at additional mailing offices. POSTMASTER: Send address changes to QSR, 101 Europa Drive, Suite 150, Chapel Hill, NC 27517-2380. gust QSR50 26 GUIDED BY CEO PAUL BROWN, ALL OF INSPIRE BRANDS’ QUICK-SERVICE CONCEPTS ARE ON THIS YEAR’S QSR 50. www.qsrmagazine.com | QSR | AUGUST 2023 3

up to better food, retaining customers, and helping out the bottom line.” Is staff skimming oil enough? Are they switching oil out on a designated day at a designated time rather than when oil no longer has any fry life left? These are questions Stratas helps address with its offering of products, as well as exper-

tise in the field. For example, the company sells high performing high-oleic oils that typically have a longer fry life when compared to commodity oils. Stratas Foods also offers a Fry Test

Kit, a tool that helps operators and team members follow certain protocols to ensure fry life is maximized. Each kit comes with bilingual instructions that outline best practices when it comes to filtering and skimming oil. The kit is part of Stratas Foods’ ongoing efforts to educate its client partners on how to extend fry life and ultimately lower costs.

“We try to educate the operator and their entire staff,” Guentz says. “That could be a single one-off operator, a local chain, a regional chain, or a national chain. We will commit to go in and train the staff and train the people in the trenches. Because the people who work

EDITORIAL

EDITORIAL DIRECTOR

Danny Klein dklein@wtwhmedia.com

QSR EDITOR

Ben Coley bcoley@wtwhmedia.com

FSR EDITOR Callie Evergreen cevergreen@wtwhmedia.com

ASSOCIATE EDITOR

Sam Danley sdanley@wtwhmedia.com

BRANDED CONTENT STUDIO DIRECTOR OF THE BRANDED CONTENT STUDIO, FOOD AND HOSPITALITY Peggy Carouthers pcarouthers@wtwhmedia.com

ASSOCIATE EDITOR, BRANDED CONTENT

Charlie Pogacar cpogacar@wtwhmedia.com

ASSOCIATE EDITOR, BRANDED CONTENT Kara Phelps kphelps@wtwhmedia.com

ART & PRODUCTION

ART DIRECTOR

Tory Bartelt tbartelt@wtwhmedia.com

GRAPHIC DESIGNER Erica Naftolowitz enaftolowitz@wtwhmedia.com

SALES & BUSINESS DEVELOPMENT

GROUP PUBLISHER

Greg Sanders gsanders@wtwhmedia.com

NATIONAL SALES DIRECTOR Eugene Drezner edrezner@wtwhmedia.com

919-945-0705

NATIONAL SALES MANAGER

Edward Richards erichards@wtwhmedia.com

919-945-0714

NATIONAL SALES MANAGER

Amber Dobsovic adobsovic@wtwhmedia.com

919-945-0712

NATIONAL SALES MANAGER John Krueger jkrueger@wtwhmedia.com

919-945-0728

CUSTOMER SERVICE REPRESENTATIVE Mitch Avery mavery@wtwhmedia.com

919-945-0722

CUSTOMER SERVICE REPRESENTATIVE Tracy Doubts tdoubts@wtwhmedia.com

919-945-0704

FOUNDER Webb C. Howell

ADMINISTRATION

919-945-0704 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. who meet subscription criteria as set forth by the publisher.

REPRINTS

The YGS Group 800-290-5460

FAX : 717-825-2150 qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided to the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed at sponsoredcontent@qsrmagazine.com.

HIRING How a Dairy Queen Owner Raised Employee Retention to 86 Percent Find quality employees with this modernized approach to the hiring process. SPONSORED BY SPROCKETS TRAINING Ford’s Garage Is Using This to Help Scale Its Unique Franchise Concept With plans to annually open 10–15 new locations, the brand has been emphasizing training consistency. SPONSORED BY OPUS DATA INSIGHTS 3 Ways to Get More Out of Restaurant-Specific Data Business intelligence helps restaurants make better, faster decisions. SPONSORED BY RESTAURANT365 ONLINE SEE THESE STORIES AT QSRMAGAZINE.COM/SPONSORED

ISSUE

STORIES FROM QSR BRANDED CONTENT

IN THIS

BRAND

MEDIA LLC RETAIL, HOSPITALITY, AND FOOD

12 Why Operators Should Think of Oil Management As a Controllable Expense Costs have inflated. Are operators thinking about their deep-fryer oil enough? SPONSORED BY STRATAS 24 Preparing for the Future of Automated Order-Taking Voice AI is helping restaurants meet changing demands. Lay the groundwork to upgrade when you’re ready. SPONSORED BY HME 49 Craveworthy Franchising Details on three concepts and why they might be attractive franchise opportunities. SPONSORED

CRAVEWORTHY BRANDS SPONSORED BY STRATAS

Operators

Management

a Controllable Expense Costs have inflated. Are operators thinking about their deep-fryer oil enough? BY CHARLIE POGACAR A ccording to recent data from the National Restaurant Association, 94 percent of operators said their operating costs—including supplies—were higher in 2022 than they were in 2019. The National Restaurant Association found that operating costs were up an average of 16.7 percent since 2019 across the entire foodservice industry. This has left operators grasping at straws, looking to cut costs in any possible place. There’s one area that John Guentz, director of sales at Stratas Foods, believes hasn’t received enough attention: deepfryer oil management. There is no shortage of ways the average oil management program could be improved, Guentz says, to help cut operating costs and improve overall profitability. In the process, food will have better flavor, and oil will need to be changed less often. “There are so many ways that could help save them money in the long run, but it would also help them develop that operational excellence they’re all striving toward,” Guentz says. “It all adds

WTWH

GROUP

BY

Why

Should Think of Oil

As

with the food ultimately are the ones who are going to maintain oil.” With everything continuing to inflate, it makes sense why operators are hesitant to spend more on goods right now, Guentz says. But thinking of it as spending more is the wrong way to look at it, he adds. The way a customer should view it, is not cost per case—but cost per day. “We provide a valuable service,” Guentz says. “We tailor our solutions to what each client’s biggest pain points are. This isn’t a one-size-fits-all oil program. If we sell an operator an oil program, we look after your food quality and your bottom line.” è FOR MORE, VISIT STRATASFOODS.COM. “It all adds up to better food, retaining customers, and helping out the bottom line.” 26 MAY 2023 FSRMAGAZINE .COM 113custom-2-page Stratas.indd 26 4/11/23 1:28 PM OPUS FORD’S GARAGE RESTAURANT365 ADOBE STOCK SPROCKETS ADOBE STOCK HME THE BUDLONG HOT CHICKEN SmartChain / p. 89 SmartChain VENDOR RESOURCES TRENDS NEW PRODUCTS Adapting to Change Advancing Tech Key Players THE CUTTING EDGE Innovations in kitchen tech are bringing greater back-of-house efficiency. /BY KARA PHELPS THE CUTTING EDGE / INNOVATIONS IN KITCHEN TECH ARE BRINGING GREATER BACK-OF-HOUSE EFFICIENCY. 90 Automatic Success Brands are investing in automation to adapt and thrive. 94 The New Kitchen Advanced equipment is transforming the kitchen. 96 Key Players Here are the biggest names in the world of kitchen equipment solutions. 4 AUGUST 2023 | QSR | www.qsrmagazine.com

Exploring the Quick-Service Powerhouses

Working at a restaurant-focused trade publication fills you with pretty interesting facts.

For instance, being in the space for a few years now, it seems common knowledge that Subway has the largest U.S. footprint among any restaurant chain. But outside of my career, when quizzing friends and family, it’s not quite as wellknown. Typical answers are Starbucks or McDonald’s ( No. 2 and No. 3 in U.S. store count, respectively), and that makes complete sense. It just goes to show that this job does provide you with a certain level of awareness. And our main objective every day is to spread that awareness to our readership. There may not be a better example of that than the annual QSR 50, a list of the top 50 quick-service chains in America, ranked by U.S. systemwide sales.

The report is such a wealth of information. It’s a great way to look at the bigger picture and see where everyone stands after another year passes. Granted, for the most part, there aren’t a lot of changes at the top. McDonald’s— no surprise here—still earns the most sales out of any chain. But I think there are some notable shifts, and I’ll start by shining a light on newcomers. Crumbl, founded in 2017, made its debut on the QSR 50 at No. 38. The cookie company earned $1 billion in sales last year for the first time, with an AUV of $1.8 million. That’s not even the most impressive part. The brand opened a net of 363 shops in 2022 to reach 688 locations. Meaning, its unit count grew by more than 100 percent in one year. No one else of Crumbl’s

scale in the U.S. can make that claim.

Another first-timer is Dutch Bros at No. 33. The chain gathered more than $1.1 billion in sales in 2022 and reached 671 units after opening a record 133 locations. In terms of the snack category, the coffee chain ranks fourth in sales, following Starbucks, Dunkin’, and Dairy Queen. Not too bad for a brand that started as a pushcart in Oregon 30 years ago.

Other facts to note: Chick-fil-A once again dominated when it came to AUV. The chicken chain hauled in $6.7 million per store on average. The next closest was Raising Cane’s at $5.4 million. Also, McDonald’s opened a net of six U.S. locations in 2022—the first time it’s seen positive unit growth in eight years. In 2021, it shut down a net of 244 units domestically.

I would be remiss not to mention our annual Contenders list, which features a group of restaurants outside the top 50, but still making plenty of noise. There are many familiar names among them, like Potbelly, Captain D’s, Krystal, Smashburger, and Hungry Howie’s. More emerging concepts are highlighted as well, such as Smalls Sliders, Pepper Lunch, and Wing Snob.

My advice is to pore through this data. It has so many stories to tell.

Ben Coley, Editor

QSR MAGAZINE

The annual QSR 50 is back, and it’ll give you plenty to think about.

BCOLEY@WTWHMEDIA.COM

6 AUGUST 2023 | QSR | www.qsrmagazine.com EDITOR’S LETTER

Packaging That Delivers Repeat Business

Protecting Meal Quality Brings Customers Back for More

PROTECT TEMPERATURE & TEXTURE TO DELIVER THE BEST TASTE

Cross-flow ventilation protects taste by maintaining temperature and texture for up to 30 Minutes.

SERVE APPEALING PRESENTATION, EVEN OFF-PREMISE

Durable & stackable single and multi-compartment table-ready designs, so meals arrive looking great.

INCREASE PROFIT BY REDUCING ORDER ERRORS

Clear, anti-fog lids help the kitchen avoid order errors without opening the packages and releasing heat.

PROTECT FOOD, SERVE SUSTAINABLY

Protecting food quality reduces food waste. Reusable, microwave & dishwasher safe, and recyclable after use.

TEST & TASTE THE CRISP FOOD DIFFERENCE FOR YOURSELF

REQUEST FREE SAMPLES

CRISP FOOD TECHNOLOGIES® CONTAINERS ©2023 Anchor Packaging® LLC - St. Louis, Missouri

anchorpac.com

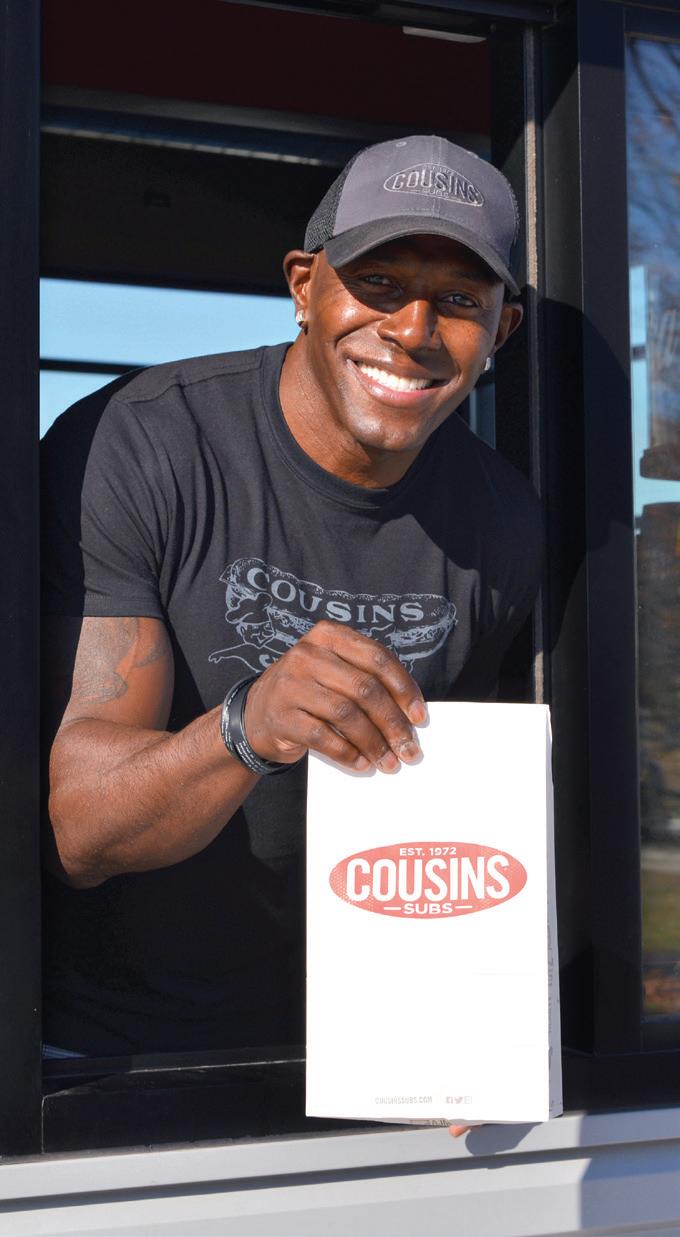

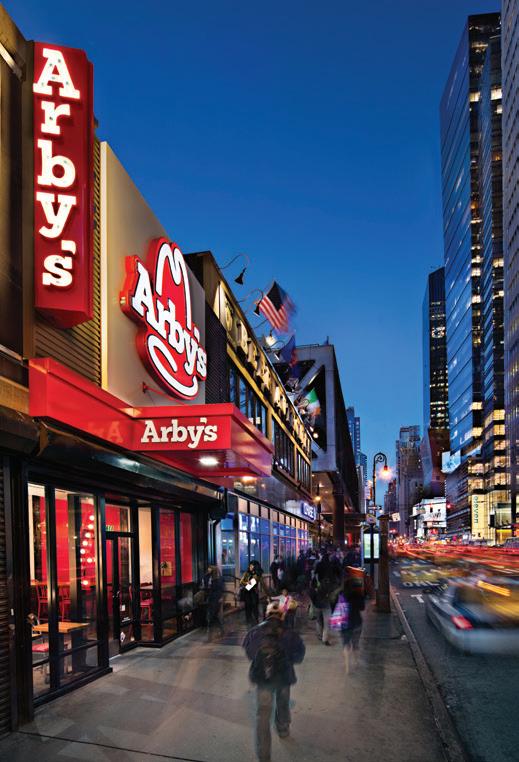

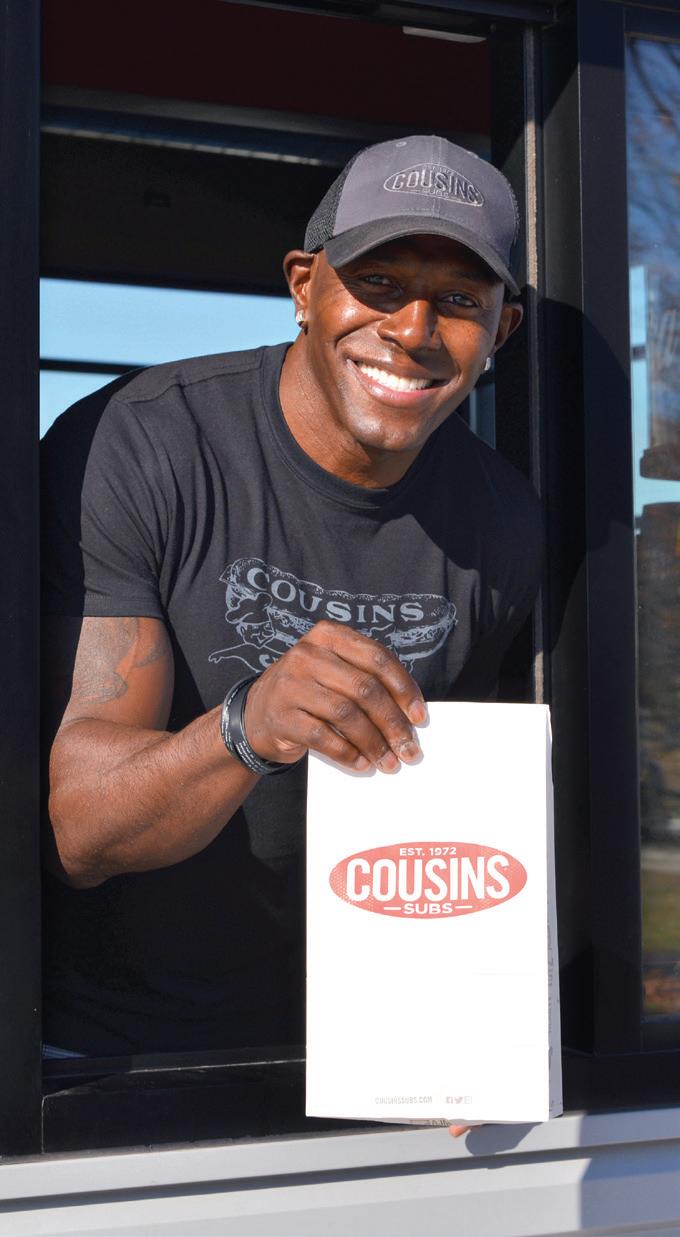

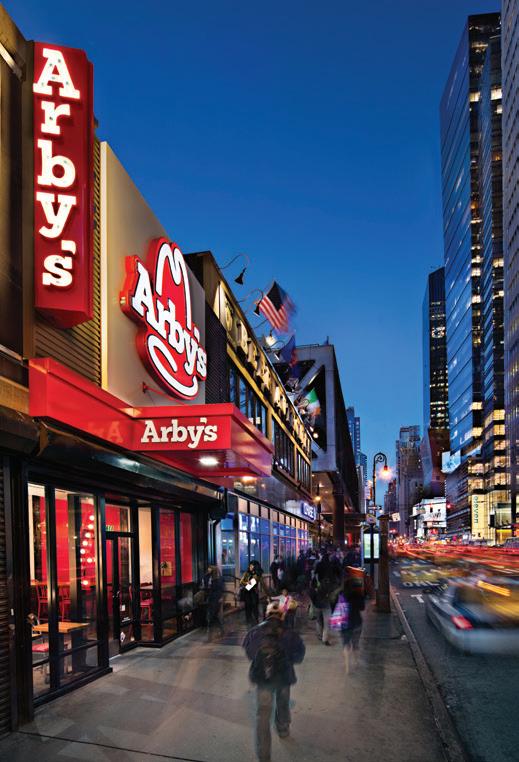

Raising a Flagship

The 740-unit chicken tender concept wowed customers with its latest restaurant in New York City.

SHORT ORDER

IN

LATE

JUNE, RAISING CANE’S officially opened its Global Flagship in Times Square, New York. The 8,000-plus-square-foot restaurant features exclusive merchandise, a custom mural by artist Timothy Goodman, and unique design elements paying homage to its mascot, Cane the yellow lab. Situated at 1501 Broadway, the location aims to provide an immersive “Chicken Finger state of mind” experience with notable attractions like a Lady Liberty-themed statue and oversized replicas of menu items.

Ordering kiosks cater to busy visitors, and the prime Times Square location aligns with the brand’s ambition to be a top U.S. restaurant.

“The Times Square Global Flagship marks a monumental moment for our brand,” says Raising Cane’s founder Todd Graves. “Not only is this our first within New York City, but it provides yet another opportunity to serve our craveable chicken finger meals to those who love us and those who have yet to try. “

RAISING CANE’S PAOLO JAY AGBAY

www.qsrmagazine.com | QSR | AUGUST 2023 9

Raising Cane’s founder Todd Graves prepares to cut the ribbon at the chain’s new store in Times Square.

In May, Delaget—a restaurant data solutions firm— released its 2022 QSR Operational Index, which included key trends in sales, delivery channel growth, losses, staffing, customer experience, and other areas. The goal of this annual report is to give operators the requisite data they need to benchmark and improve performance, according to CEO Jason Tober. Here are some of the highlights:

SALES

• Delaget found that overall transactions per store were down 2.35 percent year-over-year, but revenue and average check lifted 3.57 percent and 7.5 percent respectively, versus 2021.

This is primarily due to franchisors increasing pricing to mitigate the impacts of higher labor and commodity expenses.

• The average number of beverages per transaction decreased 10 percent year-over-year to 0.63.

The top 10 percent came in at 0.85 and the bottom 10 percent was 0.41. Also, on average, drinks mixed 9.53 percent, a drop of just 0.63 percent compared to 2021. For the top 10 percent, beverages accounted for 12.96 percent of sales. For the bottom 10 percent, it was 2.73 percent.

• Drive-thru continuously dominated sales across quick service.

It accounted for 65.53 percent of sales in 2022, after reaching 82.38 percent in 2020 and 76.34 percent in 2021. The next-highest is counter sales, which mixed 14.44 percent in 2022.

DELIVERY

• The delivery channel has grown 1,343 percent since 2019, according to Delaget’s data.

It went from mixing 0.72 percent on average four years ago to 10.39 percent in 2022.

COSTS

• The average food cost as a percentage of sales was 28.44 percent in 2022, with the top 10 percent at 24.77 percent and the bottom 10 percent at 31.95 percent.

In terms of labor costs, the average was 21.70 percent, with the top 10 percent at 16.67 percent and the bottom 10 percent at 28.37 percent.

• Quick-service menu prices rose by an average of 8 percent last year to help with growing expenses.

CUSTOMER EXPERIENCE

• Scores for Voice of Customer—a method for collecting guest feedback— have declined in recent years as delivery sales mix has increased. This is because operators have less control over the customer experience when third-party delivery aggregators are involved.

To resolve this, Delaget recommends operators shift their mindset around delivery drivers by treating them as customers instead of middlemen. This means calling their name, confirming their final order, and educating them on any details before handing over the meal.

• These orders come with higher average checks because of upselling and markups to offset third-party delivery fees.

Delaget found that delivery customers paid $20.37 per order on average, compared to $13.59 at kiosks, $13.30 via web/mobile, $12.48 at the counter, and $12.47 at the drive-thru.

• Customer satisfaction was at 78.79 percent on average in 2022, down from 79.63 percent in 2021 and 80.64 percent in 2020.

For the top 10 percent, it was 89.84 percent, and for the bottom 10 percent, it was 58.36 percent.

ADOBE STOCK MAST3R 10 AUGUST 2023 | QSR | www.qsrmagazine.com SHORT ORDER

Why Operators Should Think of Oil Management As a Controllable Expense

Costs have inflated. Are operators thinking about their deep-fryer oil enough?

BY CHARLIE POGACAR

BY CHARLIE POGACAR

tise in the field. For example, the company sells high performing high-oleic oils that typically have a longer fry life when compared to commodity oils.

Stratas Foods also offers a Fry Test Kit, a tool that helps operators and team members follow certain protocols to ensure fry life is maximized. Each kit comes with bilingual instructions that outline best practices when it comes to filtering and skimming oil. The kit is part of Stratas Foods’ ongoing efforts to educate its client partners on how to extend fry life and ultimately lower costs.

According to recent data from the National Restaurant Association, 94 percent of operators said their operating costs—including supplies—were higher in 2022 than they were in 2019. The National Restaurant Association found that operating costs were up an average of 16.7 percent since 2019 across the entire foodservice industry.

This has left operators grasping at straws, looking to cut costs in any possible place. There’s one area that John Guentz, director of sales at Stratas Foods, believes hasn’t received enough attention: deepfryer oil management. There is no shortage of ways the average oil management program could be improved, Guentz says, to help cut operating costs and improve overall profitability. In the process, food will have better flavor, and oil will need to be changed less often.

“There are so many ways that could

help save them money in the long run, but it would also help them develop that operational excellence they’re all striving toward,” Guentz says. “It all adds up to better food, retaining customers, and helping out the bottom line.”

Is staff skimming oil enough? Are they switching oil out on a designated day at a designated time rather than when oil no longer has any fry life left? These are questions Stratas helps address with its offering of products, as well as exper-

“We try to educate the operator and their entire staff,” Guentz says. “That could be a single one-off operator, a local chain, a regional chain, or a national chain. We will commit to go in and train the staff and train the people in the trenches. Because the people who work with the food ultimately are the ones who are going to maintain oil.”

With everything continuing to inflate, it makes sense why operators are hesitant to spend more on goods right now, Guentz says. But thinking of it as spending more is the wrong way to look at it, he adds. The way a customer should view it, is not cost per case—but cost per day.

“We provide a valuable service,” Guentz says. “We tailor our solutions to what each client’s biggest pain points are. This isn’t a one-size-fits-all oil program. If we sell an operator an oil program, we look after your food quality and your bottom line.”

SPONSORED BY STRATAS

è FOR

STRATASFOODS.COM.

MORE, VISIT

“It all adds up to better food, retaining customers, and helping out the bottom line.”

26 MAY 2023 FSRMAGAZINE .COM 12 AUGUST 2023 | QSR | www.qsrmagazine.com

ADOBE STOCK

B A K I N G • G R I L L I N G • S A U T É I N G • D R E S S I N G • D I P P I N G WE'VE GOT FRYING COVERED FRYMAX® AND MAZOLA® HAVE BEEN THE DEEP FRYING GOLD STANDARDS FOR OVER 65 YEARS. SCAN NOW WWW.STRATASFOODS.COM NATIONAL LEADING BRANDS Making Food Better, Everyday

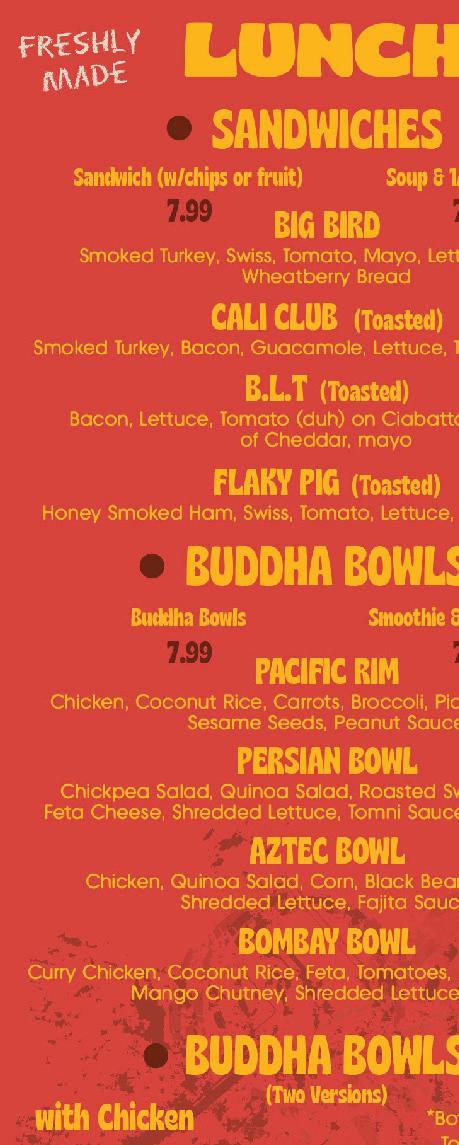

The Great Chicken Debate

BY SAM DANLEY

Wing It On! calls itself the wing joint for wing fanatics, but a better description might be the chicken joint for chicken fanatics. Tenders have been on the menu since day one.

“I always saw them as table stakes for getting into the chicken game,” says founder and president Matt Ensero. “There’s a certain percentage of consumers out there who just do not eat bone-in chicken products like wings, so tenders are the perfect magnet to avoid that menu veto.”

Originally, the product was listed on the menu as boneless

wings. They’re still covered in the brand’s award-winning sauce, but today, they’re simply called tenders.

“It was a point of differentiation for us at first,” Ensero says. “When you’d go to a competitor and order boneless wings, they’d serve you those tiny little nuggets, while we’d serve you a full-sized tender. Over time, we noticed that the phrase ‘boneless wings’ was getting some pushback from wing fanatics, so we decided to get ahead of that and switch the name.”

From Wing It On!’s perspective, those diehard wing fanatics are concentrated in the South, where the sales mix skews heavily

ADOBE STOCK / DPVUE .IMAGES fresh

|MENU INNOVATION|

ideas

Chicken tenders are a popular menu item among quick-service consumers.

Three chains weigh in on which item reigns supreme— wings or tenders.

www.qsrmagazine.com | QSR | AUGUST 2023 15

toward bone-in wings. Further north, the sales mix is pretty even. Regardless of the regional preferences, diversity within the menu mix has helped Wing It On! hedge against volatile wing prices.

“For wings, the big advantage over tenders is simplicity in terms of kitchen operations, while the major disadvantage is the supply chain,” Ensero says. “We’ve seen several major shortages and sharp price fluctuations over the years, which makes it incredibly difficult to forecast long-term profitability.”

Wings typically carry higher costs than tenders, which helps explain the broad-scale push toward boneless options over the past decade. And while the price trend has inverted coming out

of the pandemic, with costs for tenders significantly outpacing costs for bone-in wings, boneless products still have a more consistent supply chain.

“If I’ve learned anything these past 12 years, it’s that the chicken wing market is a roller coaster,” Ensero says. “You never really hear about chicken tender shortages, so that’s one major advantage. The other advantage is on the consumer side. They tend to hold up really well in a takeout and delivery environment, where it can be hard to maintain that perfect crisp on the wings. The disadvantage is that they’re a little more involved in terms of processes in the kitchen because we batter every tender fresh to order.”

Operational complexity has prevented Cowboy Chicken from adding tenders to its menu in the past. At one point, the fast-casual, wood-fired rotisserie chicken chain developed and tested a tender product called Rotissafried, where employees would batter and fry meat that was taken off the rotisserie chicken.

“Although it was delicious, it was super laborious from a kitchen perspective, so we shelved it,” says CMO Kim Jensen-Pitts. “We always kept our eye on a great tender product. They were the top items people requested when we did research with our customers.”

Cowboy Chicken revisited tenders last fall when it launched Smackbird, a virtual brand offering Nashville hot chicken tenders and sandwiches for delivery and pickup only. The concept was developed to help restaurants weather the pandemic and proved to be a hit with customers.

“Since we were already bringing this really high-quality chicken tender product into the building for Smackbird, we figured we’d leverage it for Cowboy Chicken, too,” Jensen-Pitts says. “We launched the platform in March, and it’s just been gangbusters ever since.”

COWBOY CHICKEN (2) |MENU INNOVATION|

16 AUGUST 2023 | QSR | www.qsrmagazine.com fresh ideas

COWBOY CHICKEN REVISITED TENDERS

LAST

FALL WHEN IT LAUNCHED VIRTUAL BRAND SMACKBIRD.

“NO” GOOD this tasted never When we say “NO ANTIBIOTICS EVER,” we mean NEVER EVER. Unlike some of the other guys, we don’t use them in any life stage. Not in the egg. Not in the hatchery. And certainly not in our exclusive All-Veggie Feed crafted with NO Animal By-Products. It all adds up to great tasting PERDUE® HARVESTLAND® and PERDUE® NO Antibiotics Ever Chicken and Turkey with the premium menu claims that can command higher price points. Menu Mouthwatering TURKEY with: NO Antibiotics Ever, Never Ever NO Animal By-Products NOTHING But Veggie Feed Visit PERDUEFOODSERVICE.COM ® for More

LOADED TURKEY BURGER

Tenders already account for half of the brand’s kids meal sales and a “very high percentage” of its adult entree category, she says. They’re outperforming previous efforts to diversify the menu beyond rotisserie chicken, including a brisket offering that launched last summer to strong results.

Cowboy Chicken hasn’t ruled out the possibility of adding wings down the road. It’s a common request from customers, but something the brand isn’t pursuing too seriously yet.

“When you’re doing wood-fired rotisserie chicken that’s all-natural and isn’t full of steroids, you don’t get the biggest wings,” JensenPitts says. “Our concern is always erosion of the brand, but you can never say never. We’ve done things that I would’ve never expected five years ago, like adding tenders and brisket. It’s been a pleasant surprise the way guests have gone along with us on those rides.”

Andy Howard is well-versed in the benefits that come from widening a menu to include multiple parts of the chicken, but today, he’s focused squarely on tenders as the CEO of Huey Magoo’s. The industry veteran has spent nearly three decades in the poultry game, working with restaurants that specialize in just about every part of the bird.

After focusing on the whole chicken at Kenny Rogers Roasters and chicken breast at Ranch One, his third stop was Wingstop, which only sold wings when he arrived back in 2003. He was the driving force behind the brand’s expansion into boneless tenders. The move came in response to dramatic fluctuations in prices for bone-in wings.

“When wing prices went through the roof, we had to try something rather than just waiting around for the market to drop,” Howard says. “The bottom line was that you can’t run a business

off a 40 percent cost of goods and make a profit.”

Boneless offerings drove topline sales and reduced the bottom line at Wingstop. They put the brand in front of a new segment of customers, with sales nearly equaling those of the bone-in wings.

“Knowing the success of what boneless did at Wingstop, I started looking for my next venture,” Howard says. “I thought, ‘Boy, if I could find the world’s greatest chicken tender with a Wingstop business model, that’d be the chain I want to buy.’”

That quest led him to Huey Magoo’s, a Florida-based fastcasual brand founded in 2004. Howard purchased the company in 2016 alongside former Wingstop executives Michael Sutter, Wes Jablonski, and Bill Knight. At the time, it was a three-unit concept operating in Florida. Now, it’s approaching its 50th store with locations spanning 10 states.

Howard credits the growth to the flagship product, which the company bills as the “filet mignon of chicken.” Starting with a precise tenderloin cut, the chicken is prepared from scratch, battered and breaded with a proprietary recipe, and served with a secret Magoo’s sauce. The menu is simple, featuring only handbreaded, grilled, or sauced tenders. They’re served as meals and used in sandwiches, wraps, and salads.

“As far as the center of the plate, we’re very careful about not getting too far off of that beautiful tender,” Howard says. “From a customer demographic perspective, I think the product has a much wider appeal than wings. Don’t get me wrong, people still love a great wing, but I like to think that I saved the best for last with my fourth stop around the bird.”

WING IT ON!, HUEY MAGOO’S

Sam Danley is the associate editor of QSR. He can be reached at sdanley@wthwmedia.com

18 AUGUST 2023 | QSR | www.qsrmagazine.com |MENU INNOVATION| fresh

WING IT ON! (LEFT) AND HUEY MAGOO’S GO BIG ON FLAVOR, WHICH STARTS WITH A QUALITY PRODUCT.

ideas

CHICKEN POTATO ROSTI

Meet CHICKEN Raised on Better Feed NO Antibiotics Ever, Never Ever NO Animal By-Products 100% Vegetarian Feed Visit PERDUEFOODSERVICE.COM ® for More YES to better feed and greatchickentasting

We believe that if you wouldn’t feed it to your guests, we shouldn’t give it to our animals. That’s why we give them a healthy diet of wheat, soybean, corn, barley, fresh water, vitamins, minerals and probiotics. All so you can menu great tasting proteins that show your commitment to simple, high-quality ingredients.

Foxtail Coffee

The emerging brand wants to separate itself from the routine drive-thru chain.

BY SATYNE DONER

“I feel like there’s a missing hole in the coffee world at this moment,” Tchekmeian explains. “A lot of it has been value-engineered ... and that is the kind of result we see in that fast-food category of coffee. I feel like there is a lot to stand out on.”

Foxtail’s craft beverages are organic and sustainably sourced from farmers around the world. The Farmhouse blend, a bestseller, is a medium roast harvested from Honduras or Mexico. Other blends include Ethiopia Guji, Colombia Decaf, and Mexico Chiapas.

“We want to push the limits of craft coffee, and that means pushing the limits of the quality of coffee we continue to procure,” Tchekmeian says. “We do work directly with the farms and have a team that travels around the world to find the best quality coffee out there.”

FOUNDER: Alex Tchekmeian

HEADQUARTERS: Winter Park, Florida

YEAR STARTED: 2016

TOTAL UNITS: 54

BEFORE ALEX TCHEKMEIAN BECAME FOUNDER

and president of Foxtail Coffee, he spent over two decades in the music industry, focusing on arena merchandising. While traveling worldwide, he often worked out of local coffee shops and quickly became enamored with the industry.

He settled in his hometown of Winter Park, Florida, and began working on a fastcasual café concept. After the nearby auto body shop shuttered in 2016, Tchekmeian

used the building as his brand’s first café and roasting facility. Foxtail, which aims for a neighborly feel, is a culmination of Tchekmeian’s global experiences.

“One of our bigger goals [in the beginning] was to focus on the development of premium coffee in terms of roasting,” Tchekmeian says. “But we also wanted to have that welcoming community café atmosphere as well.”

With revenues in the coffee segment amounting to over $495 billion in 2023 according to Statista, competition between chains is constantly brewing.

Tchekmeian says Foxtail is “going in the other direction” compared to larger corporations, which he believes are leaning further into drive-thru service and inexpensive, quick production.

The fast-casual coffee concept features an emphasis on retail. Guests can purchase mugs, shirts, and coffee beans to take home. While other brands may shrink their square footage into a smaller space, Tchekmeian encourages in-store shopping as part of the Foxtail experience.

The brand has also partnered with Kelly’s Homemade Ice Cream, another Central Florida-based company. Several Foxtail locations have successfully integrated with Kelly’s, with more on the way.

Tchekmeian has already seen a 20-25 percent uptick in revenue in stores that have both coffee and ice cream.

“Foxtail is busiest in the early morning and afternoon, while Kelly’s focuses on the later hours,” Tchekmeian says. “We’ve had a lot of fun with this partnership, and I think it is an example of things to come ... as we look at how we can continue to maximize profitability and bring other things to the community.”

Tchekmeian is always looking for ways to connect directly with

FOXTAIL / GRIZZLEEMARTIN

DEPARTMENT ONES TO WATCH

ON PAGE 102] 20 AUGUST 2023 | QSR | www.qsrmagazine.com

[CONTINUED

*Source: Circana, CREST®, Commercial Foodservice, excludes ready-to-drink coffee, 12 months ending March 2023. Visit mother-parkers.com for more. Order-up a new way to serve your customers. From quick service to dine in, Mother Parkers Tea & Coffee solutions offer your customers cold, hot and everything in between, plus our premium services and support: • Brands that meet a variety of tastes • Surety of supply • Insights to drive growth Get in touch with us at mother-parkers.com/contact-us to learn how we can help. TOTAL ICED COFFEE SERVINGS ARE GROWING 3X FASTER THAN HOT BREWED IN THE MORNING DAYPART.*

Coffee Chains Bring the Intensity

A growing number of concepts are finding success with energy drink lineups.

BY SATYNE DONER

Pruitt says. “So, you can make things like piña colada and blue raspberry. They are very vibrant and exciting.”

Since launching the Ellianos Edge drinks, sales have spiked by 22 percent. Pruitt says it’s not just the energy drinks surging in sales—it’s all of their products, from coffee to breakfast sandwiches.

Ellianos is not the only chain to experience an uptick in revenue from blending energy drinks into the menu.

Bad Ass Coffee, known for its premium Hawaiian coffees, introduced energy drink infusions to its lineup of products as well. Also powered by Lotus, the new handcrafted beverages (called Mana) add to the brand’s unique experience.

Flavors include Sunrise Swell, Reef Racer, and Pipeline Plunge. According to the company’s website, these new flavors offer customers a “natural wave of energy” that will keep them going throughout the day.

Bad Ass Coffee CMO Chris Ruszkowski shares that the new drinks are “opening up the door for cross-selling to get a better check average.”

It’s no secret that functional beverages have created quite a buzz in recent months. Brands like Ellianos Coffee, Ziggi’s Coffee, and Bad Ass Coffee of Hawaii have all revitalized their menu with energy drink infusions to boost sales, attract new consumers, and increase diversification.

According to Statista, the energy drink market hit $159 billion in 2021 and is expected to grow to $233 billion by 2027.

Ellianos, a drive-thru chain founded in 2002 by Scott and Pam Stewart, is ready to meet the demands of busy Americans in a different way.

In early April, the brand announced its new plant-based energy drink in partnership with Lotus Energy Drinks. The Ellianos Edge comes in six fruity flavors, such as Razzleberry and Mango Tango.

While Ellianos has offered a Red Bull-infused concoction for the past two years, Greg Pruitt, vice president of marketing and strategic communications, says the brand wanted to expand into different taste profiles. Red Bull’s distinct flavor prohibited this.

“The good thing about [Lotus] energy bases are that they don’t have much flavor, which allows you to create more combinations,”

The chain is also seeing an upward trend in guest visitation at various times of day. The marketing executive has noticed that while energy infusions sell from morning to close, they tend to bring in more guests during the afternoon.

For Ruszkowski, the trickle-down effect of the beverage additions will create new consumer opportunities, and he sees it playing a role in the brand’s evolution as a premium coffee shop.

“Customers want to take a break from their day to get something that’s handcrafted and going to recharge them,” Ruszkowski says. “They are finding reasons to come later in the day … There are a lot of extended benefits to that daypart growth.”

Meanwhile, Ziggi’s sees the addition of handcrafted energy drinks as a way to give back to a growing guest base.

On April 14, the brand revealed the launch of Ziggi’s Energy and Ziggi’s Energy Zero Sugar, with five flavors, such as Cosmic Blast and Shock Melon.

Ziggi’s CEO Brandon Knudsen says the goal was initially to make the beverage more approachable. Much of that is about price. At $2 a drink, the item is budget-friendly amidst

ZIGGI’S COFFEE, ELLIANOS COFFEE, BAD ASS COFFEE OF HAWAII

DEPARTMENT FRANCHISE FORWARD [CONTINUED ON PAGE 102]

22 AUGUST 2023 | QSR | www.qsrmagazine.com

Energy drinks are proving to be a strong sales driver for coffee chains.

HOT FRIES, SIZZLING PROFITS n A proven and resilient concept with over 35 years experience in the Hamburger QSR space n Sleek new image creating more efficient kitchens, double drive-thru’s and no indoor dining rooms n Small footprint to take advantage of real estate opportunities other brands can’t fit onto n Technology, innovation and e-commerce lanes that drive the bottom line ©2023 Checkers Drive-In Restaurants, Inc. 4300 W. Cypress St., Suite 710, Tampa, FL 33607. 1. Checkers & Rally’s 2022 Franchise Disclosure Document (FDD). Written substantiation will be provided on request. This advertisement is not intended as an offer to sell, or the solicitation of an offer to buy, a franchise. It is for information purposes only. The franchisor, Checkers Drive-In Restaurants, Inc. is located at 4300 West Cypress Street, Suite 710, Tampa, Florida 33607, and is registered as file number F-4351 in the state of Minnesota. In New York, an offering can only be made by a prospectus filed first with the Department of Law, and such filing does not constitute approval by that Department. 20230643 Visit owncheckersfranchise.com/QSR or Call 888-913-9135 CAPITALIZE ON OUR FRIES BURGERS AND

Preparing for the Future of Automated Order-Taking

Voice AI is helping restaurants meet demands for greater efficiency. Lay the groundwork to upgrade when you’re ready.

/ BY KARA PHELPS

front counter, kitchen, or anywhere around the restaurant that needs their friendly and enthusiastic nature.”

Choosing a communication platform with voice AI integration helps future-proof a restaurant, setting it up for success whenever the time comes to upgrade. According to Mullica, planning ahead allows a restaurant to move at its own pace when it’s ready to start implementing voice AI ordering. Without built-in voice AI integration, operators need to customize the equipment and connection to their chosen voice AI provider.

Restaurants had to evolve quickly at the onset of the pandemic— and they’re still transforming. Footprints are shifting and shrinking, even as customers expect the same lightning-fast service with greater say in how they pick up their orders. “Your crew is serving more customers in new ways—drive thru, mobile order pickup, curbside pickup, walk-up windows, third-party delivery, dine-in service, and more. As a result, operators are being challenged to figure out how to manage multiple touchpoints successfully and smoothly,” says Scott Mullica, senior director of product management at HME Hospitality and Specialty Communications.

Once upon a time, it was enough to serve customers in the drive-thru lane quickly and e ciently. Today, operators also need to meet service expectations at every additional touchpoint, and some are now turning to artificial intelligence (ai) in the drive thru to help fill the gaps and maintain e ciency even when sta ng fluctuates.

“While an AI bot greets your guests, takes their orders, and inputs the order on the POS, your crew is empowered to provide better service in other areas,” Mullica says. “Your sta can multitask and support the

NEXEO | HDX, on the other hand, is a communication platform designed to alleviate those roadblocks. When operators are ready to upgrade to voice AI ordering, the process is e cient and streamlined. “The NEXEO | HDX platform is purpose-built for drive-thru voice AI integration,” Mullica says. “Other communication solutions on the market need additional audio boxes or conversions to integrate with your voice AI provider, but NEXEO | HDX provides for a seamless integration, resulting in the best voice AI ordering experience available for customers and sta .”

NEXEO | HDX’s direct integration makes for a wonderfully e cient system. It’s quick and easy for crew members to take over the AI ordering process at any point, while also supporting system escalation that alerts a crew member if the voice AI system needs help completing an order. Whether the order taker is a person or AI-driven, HDX Digital Audio delivers the industry’s first fully digital end-to-end audio, which helps eliminate hum and noise throughout the system. Plus, advanced telemetry continuously monitors and evaluates the system interconnection to ensure it is always operating at peak performance.

The NEXEO | HDX platform is a high-quality drive-thru audio solution, while also uniquely designed for operators who want greater e ciency at every customer touchpoint—with the ability to integrate seamlessly with preferred voice AI providers. “Even if you’re not quite yet on the market for AI-driven ordering, you’ll enhance your operation with HDX Digital Audio, hands-free voice commands, integrated timerto-headset alerts, one-to-one calling, group communication, targeted alerts, and more,” Mullica says ◗

HME HOSPITALITY AND SPECIALTY COMMUNICATIONS

SPONSORED BY HME HOSPITALITY AND SPECIALTY COMMUNICATIONS To learn more, visit hme.com/vaio.

24 AUGUST 2023 | QSR | www.qsrmagazine.com

“Operators are being challenged to figure out how to manage multiple touchpoints successfully and smoothly.”

NEXEO takes communication beyond the drive-thru and into key areas of your restaurant, increases efficiency with voice commands and group conversations, and seamlessly supports voice AI ordering. And that’s just the beginning.

The Fully Digital Solution for Drive-Thru and Beyond 866.577.6721 | www.hme.com/nexeo © 2023 HM Electronics, Inc. The HME logo and product names are registered trademarks of HM Electronics, Inc. All rights reserved. Voice AI Ordering is Just the Beginning. “ OK NEXEO, Talk to Lane 1.” “ OK NEXEO, Volume 10. ” “OK NEXEO, Change Lanes.”

NEXEO | HDX™

Meet

QSR 5 0 COVER S T O R Y QSR 50 | GROWTH

AND LEADERSHIP

26 AUGUST 2023 | QSR | www.qsrmagazine.com

INSPIRE BRANDS AND CEO PAUL BROWN HAVE A METICULOUS GROWTH PLAN IN PLACE.

Innovation That Inspires

/ BY DANNY KLEIN

Inspire Brands might just be the fastest-growing restaurant group on record. But that doesn’t mean the Dunkin’ and Arby’s owner plans to slow down anytime soon.

Christian Charnaux worked with Paul Brown when the two were executives at Hilton. So the phone wasn’t exactly cold when it rang. But the notion of restaurants? That was a thought that needed to thaw. Beyond being a convincing guy, Brown pitched a vision with a hook Charnaux couldn’t resist—there was no playbook.

Five years later, Charnaux, Inspire Brands’ chief growth officer, sits in a glass-walled office overlooking what’s colloquially called “400” by locals. It’s a view of US-19/GA-400 that sits above Atlanta traffic and, on clear days, you can see mountains in the backdrop. Charnaux’s shelves are stacked with paraphernalia, including a Jimmy John’s sign unsuited for a PG audience.

When asked if he could foresee this manifestation— a 1,000-person HQ in Sandy Springs, Georgia—with floors decked for every brand, beer taps and ice cream in the common room, and a 15,000-square-foot Innovation Center, Charnaux offers one word: “No.”

To understand the logic that sprouted Inspire’s empire, it’s worth tracing back the timeline. In February 2018, Arby’s Restaurant Group closed a $2.9 billion deal for Buffalo Wild Wings—a blockbuster that gave rise to the company’s new name. Yet Inspire was already stirring behind the curtain. The headline: “Arby’s Buys Buffalo Wild Wings,” welcomed a wave of social media noise, much of it muddled. Can I order roast beef with wings now? “That doesn’t make any sense,” Charnaux says. “But no, this was a family approach and a family of

MAGAZINE LINE ICON: ADOBE STOCK SIR.VECTOR. INSPIRE BRANDS www.qsrmagazine.com | QSR | AUGUST 2023 27 GROWTH AND LEADERSHIP | QSR 50

brands that we were putting together. That’s why Sonic was such an important acquisition for us.”

The Sonic Drive-In deal ($2.3 billion) arrived in December 2019. Come October, Inspire added Jimmy John’s for an undisclosed amount, transferring the business from one entity of Inspire-backer Roark Capital to another (Roark bought a majority stake in 2016). Then, Inspire struck its headliner roughly a year later when it locked up an $11.3 billion move for Dunkin’ and Baskin-Robbins. It marked the highest-dollar restaurant acquisition since 3G Capital LP, Burger King Worldwide Inc., acquired Tim Hortons for $12.64 billion in August 2014.

And it simply carried Inspire to rare air. The company, at a recent count, totaled roughly 31,700 restaurants and $30 billion in system sales, making it the second largest restaurant conglomerate in the U.S. behind Taco Bell, KFC, Pizza Hut, and Habit Burger owner Yum! Brands. Aaron Allen, CEO and chief global strategist of

his eponymous Aaron Allen & Associates, once called Inspire, “the fastest-growing foodservice company in the history of the world.”

It’s a difficult point to argue.

And so, this brings us back to Charnaux’s chat with Brown, the prior president of brands and commercial services of Hilton Worldwide (Charnaux’s was most recently SVP of corporate finance at the hotelier). Surveying the restaurant field, Charnaux observed a $6 billion business that, unlike the hotel space, was “crazy fragmented.” In hospitality, following Marriott International’s 2015 deal to buy Starwood Hotels & Resorts Worldwide, giving it 30 brands and more than a million rooms under operation, the sphere had “maybe six” real players globally. “You have, just in the U.S. alone, 20 [restaurant] players you could name that were at national scale. If you look at the opportunity of everything that we learned in the hospitality business, that whole disruption that happened 10,

QSR 50 | GROWTH AND LEADERSHIP

INSPIRE BRANDS HALES PHOTO 28 AUGUST 2023 | QSR | www.qsrmagazine.com

CHRISTIAN CHARNAUX, INSPIRE BRANDS’ CHIEF GROWTH OFFICER, SEES PLENTY OF WHITE SPACE AHEAD.

Upgrade your menu with Baja Salsa— a fresh mixture of peppers, avocado, cilantro, and ¡Sabor! by Texas Pete® Mexican-Style Hot Sauce to give any starter, meat, or fi sh dish that spicy citrus kick it was missing.

Scan the QR code below or visit TexasPeteFoodservice.com/SimpleAs to get the full recipe and more ways to Sauce Like You Mean It® with Texas Pete.®

GET THE RECIPE

©2023 Texas Pete® and Sauce Like You Mean It® are registered trademarks of TW Garner Food Company. 1023-01-062023

15 years ago of digitalization; basically keeping up with what customers want and how they interact with you, plus, OTAs and the thirdparty delivery rise, there’s a comparative there,” Charnaux says. “Clearly, multibrand makes sense like it does in hospitality.”

Inspire also had Roark Capital. Brown and Neal Aronson, founder and managing partner of the fund, partnered to form the framework you see today, which is designed to acquire major concepts and develop a shared-services structure that enables each brand to pull from a center of strength for the collective good. That, in a certain manner, is not unlike hotels.

But the starting point, before there even was one, was scale. “You can’t do all the fun stuff unless you have the shared scale,” Charnaux says.

Pre-COVID, restaurants faced digital disruption from more corners than a city square. Hospitality knew the feeling all too well (booking sites come to mind), and Charnaux and Brown navigated it firsthand. While a global pandemic wasn’t on the whiteboard, Brown understood change was coming. Wherever the world went, companies with scale and brands that served different needs, times, and occasions, would be positioned to win. Or, as Charnaux explains it, you’d have a leg up by becoming an organization with “tightly integrated scale.”

“Where you’re touching a lot of different customers and brands and you’re able to leverage that shared knowledge across brands,” he says. “If you can do that, you’re going to be more relevant to the customer, you’re going to be where the customers wants, in the right channel, at the right time, with the right message, and leverage those insights across all those brands.”

The diner isn’t likely to understand Sonic and Jimmy John’s share the same parent group. That was never the intention of Inspire. Customers aren’t taking three left turns to go to Arby’s so they can use reward points at Buffalo Wild Wings like they might with Hampton, Hilton, and DoubleTree.

At Inspire, you’ll see (without noticing) an app that may have the same shared infrastructure as Buffalo Wild Wings and Arby’s but is more relevant to users since it crosses occasions. That’s how Inspire drives incrementality.

Scale and consolidation, generally, isn’t a new con-

cept to restaurants. But Inspire’s approach veered in key areas. For one, it’s a 93 percent franchised business. Most companies at this size don’t have nearly as much skin in the corporate game. So, much of Inspire’s innovation is a test-and-learn model that directly impacts the company’s P&L and affects how it approaches change.

Take Buffalo Wild Wings as a case. At the onset of COVID, the 1,200-unit-plus sports bar had online ordering and an app for loyalty. However, 79 percent of business occurred within the four walls.

The shared tech support of Inspire allowed it to scale the chain’s digital platform and get back in front of guests. And then came a leap to becoming a tech-enabled concept through what Inspire dubbed, the “choice model.” Buffalo Wild Wings customers now have the option to scan an integrated QR code at the table and decide how they want to engage with employees. They can order, add to their order, and pay on their own. Or, they can take a hybrid approach with some team member interaction. Conversely, if they want a full-service restaurant experience, it’s available, too.

When Inspire approached franchisees about the fundamental shift, which boils down to a model with more runners than servers, it did so through a lens of personal investment. “I don’t think Buffalo Wild Wings would be doing that if they were still an independent company,” Charnaux says. “It would be a lot harder for them to do that versus leveraging infrastructure that we have and are already using at different brands.”

It would also ultimately lead to Inspire’s counter-service “BWW Go.” The initial store debuted 2020 in Atlanta at 1,800 square feet, with a walk-up counter, digital menu boards, and a small seating area with TVs to entertain customers while they wait for their order. Order-ahead guests pick up via heated lockers.

The typical size ranges from 1,100 to 1,600 square feet, with the average thus far being 1,501. At the end of last year, the top third of 35 reporting BWW Gos averaged $25,707 in weekly sales, or about $1.3 million AUV. The full system average was $992,000. In total, there were 41 BWW Gos year-end 2022, up 25 from the prior year.

Inspire did the first 50 itself, Charnaux says. “We wanted to make sure the economics worked, the returns were there. It just allowed us more freedom to tweak,” he says. “And now, we’re opening it up broadly to franchising.”

Charnaux says Inspire believes it will tout “hundreds” of BWW Go outlets in the U.S. in “very short order.” The company found it could fortress markets with both formats, which resulted in additional share, not less.

QSR 50 | GROWTH AND LEADERSHIP 2022 U.S. SYSTEMWIDE SALES: $11,279 mm 2022 U.S. SYSTEMWIDE SALES: $ 5,499mm 2022 U.S. SYSTEMWIDE SALES: $ 4,535 mm INSPIRE BRANDS (6) ARBY’S IMAGE: ©HAIGWOOD STUDIOS PHOTOGRAPHY 30 AUGUST 2023 | QSR | www.qsrmagazine.com

Lower Cost. Better Service. Now that’s the Recipe. We’ve helped restaurant franchisees save money on their commercial insurance for over 10,000 locations nationwide. Property | General Liability | Auto | EPL | Hired & Non-Owned Auto | Workers' Comp | Umbrella

FLEXIBLE OPTIONS Expect Better. That's Our Policy.

A+ Intrepid Insurance Company is rated A+ (Superior) Financial Size Category XV by A.M. Best.1 Our financial strength means customers can trust us to always be there when they need us the most.

intrepiddirect.com/qsr

Save up to 20% by going Direct Expect Better. That's Our Policy. *We currently accept Mastercard, Visa, and Discover. Intrepid Direct Insurance operates as Intrepid Direct Insurance Agency, LLC. 1 Products and services are provided by one or more insurance companies that are rated A+ (Superior), Financial Size Category XV by A.M. Best Company, Inc. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. Certain coverage’s may be provided through surplus lines insurance companies through licensed surplus lines brokers. Surplus lines insurers do not generally participate in state guaranty funds and insured’s are therefore not protected by such funds. Industry Experts Intrepid is not everything to everyone. By working in a few targeted industries, we are able to walk in the shoes of our customers to offer the best coverages and services. INDUSTRY EXPERTS Direct Pricing Get a better policy at a lower price. We’ve cut out the middleman, creating a leaner, simpler, and faster experience while passing the savings on to you. DIRECT PRICING DIFFERENCE Easy Process We’ve simplified insurance. Our new and renewal application processes and online portal make working with Intrepid Direct simpler than the traditional model. EASY PROCESS Flexible Payment Options 12 equal monthly payments with no finance charges. ACH or credit cards with no fees. You can also split your

payment into various sources via our online payment portal. 1 Intrepid Direct Insurance operates as Intrepid Direct Insurance Agency, LLC. CA License 0K95913. Products and services are provided by one or more insurance company subsidiaries of W. R. Berkley Corporation rated A+ (Superior) Financial Size Category XV by A.M. Best Company, Inc. Not an offer of coverage, or contract. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. Certain coverages may be provided through surplus lines insurance companies through licensed surplus lines insurance brokers. Surplus lines insurers do not generally participate in state guaranty funds, and insured are therefore not protected by such funds.

And again, the wide potential lies in the shared vision. Inspire operates in casual dining, quick service, and all varieties of delivery—captive, third party, even hybrid with Jimmy John’s and DoorDash to fulfill. Digital to in-store, there are learnings to unlock and cross-pollinate.

Additionally, Charnaux says, the fact Inspire is a private entity allows it to make longer-term bets.

“The real story of Inspire,” he says, “is you’re getting all of these pieces together and really taking the time outside of the root gaze of public scrutiny and being a public company, and tightly integrating them in a way that’s very hard for anyone else to do and hasn’t been done before.”

Inspire produced U.S. digital sales growth over 35 percent in 2021 versus 2020 to $6 billionplus—good for more than 20 percent of domestic system sales. It also surpassed $1 billion in sales via third-party marketplaces. The loyalty user base hiked to nearly 50 million members.

“Most of it is actually a tech capabilities platform play, right?” Brown says of how Inspire helps acquired chains. “That’s really where the majority of the benefits are. We’re making really good progress on that. We’re not done, obviously. We haven’t even finished building all those platforms. Even if you look at our digital platform. We have two of the brands on a common one: Arby’s and Buffalo Wild Wings. We’ll have Sonic on before the end of the year. But that’s a journey as well.”

Where Inspire moved faster was demand generation. Joint media buys and planning, and analytics, Brown says.

Much of Inspire’s ability to boost performance stems from focus as well. Jimmy John’s never tried LTOs before the sale, or combos. It didn’t attempt a lot of beverage innovation, either. “It’s killing it right now with content,” Brown says. “A lot of it is just because we’re releasing those constraints.”

The No. 1 success metric

Inspire’s blueprint is a visible beacon and one that’s busting at the seams. You can tell just strolling through HQ the company is growing outward in a hurry. But now that Inspire has reached scale unrivaled by all but one restaurant giant, where does it turn the page? For Charnaux, it’s a straightforward spin: Is Inspire attracting outside capital for franchisees to build out restaurants? That organic growth is the proof. “Because they’re getting a better rate of return doing our brands than any of the others—that’s the ultimate metric of success,” he says.

Here is where Charnaux feels Inspire’s differentiation pulses. Even at 31,700-plus locations, he says, Inspire believes each one of its brands has room to double in size. This is a multi-front sketch. Pre-Dunkin’, just 2 percent of Inspire’s stores were outside the U.S. Today, it’s closer to 30 percent. Overall, the company saw a “record number of commitments” in 2022, Charnaux says. “I think we’re going to outpace ourselves for domestic development, again, on commitments,” he adds of 2023.

There’s runway across numerous buckets. Operators are re-upping. New ones are coming in. There’s crosssell at work—say a Dunkin’ franchisee tapping out a market and deciding to buy a BWW Go or Jimmy John’s. This past year, of Inspire’s commitments, about 30 percent were legacy 1 franchisees signing up for another opportunity.

Charnaux says it’s an industry-wide development. Franchisees are becoming more sophisticated, consolidating and buying brands. One example: SSCP Management, a franchisee of Sonic and Applebee’s, spent $15 million in June to acquire Corner Bakery Café out of bankruptcy.

Operators are striving toward scale and seeking groups that have scale benefits themselves. A decade or so ago, Charnaux says, developers targeted hotel partners who could drive outside returns through a family of brands. Now, the dynamic is coming to restaurants amid a choppy cost market. “So who do you want to work with? Do you want to work with a siloed entity or a singlebranded company or do you want to work with a multi-brand company that gives you more options of great brands that you can do in your background or beyond,” he says.

And to note, Brown adds, Inspire can go forward entirely from its core.

“We’re already at a scale, I think Dunkin’ put us at a different level than we were pre-Dunkin’,” he says. “I think it’s a good spot to be in. We don’t have to do anything else. If the right thing comes along, it’s a high bar. The worst thing I think a company could do is a bad acquisition. We will not do that. And it’s great because we’re not under any pressure to do that. If you see us doing anything else, it would be a really great brand in a great space that’s complementary in nature to what we already have.”

Speaking of Dunkin’, Inspire is just about finished

2022 U.S. SYSTEMWIDE SALES: $2,364 mm

INSPIRE BRANDS (6) JIMMY

A

QSR 50 | GROWTH AND LEADERSHIP 32 AUGUST 2023 | QSR | www.qsrmagazine.com

2022 U.S. SYSTEMWIDE SALES: $ 685 mm 2022 U.S. SYSTEMWIDE SALES: $ 3,937mm

JOHNS: MARK

STEELE PHOTOGRAPHY INC, BASKIN-ROBBINS: VINNI HOKE, BUFFALO WILD WNGS: HAIGWOOD STUDIOS PHOTOGRAPHY

JOIN THE QUICK-SERVICE EVOLUTION

Join us for two days of informative sessions, expert speakers, and networking opportunities. Discover the latest industry trends, gain insights into customer behavior, and learn about cutting-edge technology that can help take your business to the next level.

KEYNOTE SPEAKERS:

Don't miss out on this exciting opportunity to connect with fellow industry professionals and gain a competitive edge in the ever-changing world of quick-service restaurants. Register now and secure your spot at the QSR Evolution Conference—the must-attend event of the year!

QSREVOLUTIONCONFERENCE.COM

CO-LOCATED WITH: SCAN FOR MORE INFORMATION

ANDREW CATHY CEO Chick-fil-A

CHRIS TOMASSO CEO First Watch

TREVOR HAYNES President North America Subway

CHRISTIAN CHARNAUX Chief Growth Officer Inspire Brands

NETWORING IMAGE: ADOBE STOCK TAMANI CHITHAMBO/PEOPLEIMAGES.COM SILVER SPONSORS: GOLD SPONSORS: FOUNDING SPONSOR: DIAMOND SPONSORS:

integrating the java behemoth. That was a “huge unlock,” Charnaux says, for everything discussed thus far.

“If you want to get real scale benefits, it’s got to be the same for a franchisee working with Jimmy John’s as it is working with Sonic,” he says.

“… That’s easier said than done. Because five years ago, we were five different companies. And all of sudden, you say, yeah, we’re Inspire. Poof. There’s processes. Systems. All of those things that we’re grinding through. But that’s the great opportunity. If we’re successful, we have something that’s really different than I would say the rest of the industry has. In some ways, more common with what a hospitality company has, if you think about a Marriott and Hilton and how they’re tightly integrated behind the scenes with their commercial engines and their view of the customer.”

Like Jimmy John’s, Inspire let Dunkin’ loose by solidifying its building blocks. Before, Brown says, the brand was often chasing its next LTO, with no real overarching theme or brand idea behind it. “And I think the team has done a great job over the past couple of years of what is the Dunkin’ story we’re trying to tell,” he says. “And how do we focus in on innovation a little bit more around platforms versus sort of the next LTO. And you’re going to see more of that.”

On the international front, the majority of Inspire’s overseas venues today are actually Baskin-Robbins— north of 5,000. Dunkin’ has produced same-store sales over 20 percent for more than 20 months outside the U.S. As a company, Inspire hosted more than 800 new restaurant openings internationally in 2021.

Presently, there are over 600 Dunkin’s in Saudi Arabia. That’s nearly more stores than you’d find west of the Mississippi. Inspire opened its first Saudi Arabia Arby’s in May, which broke sales records. Perhaps even more telling, though, and a signal of what’s to come, it’s a location operated by Shahia Foods Limited Company, a company that runs more than 700 Dunkin’ units across Saudi Arabia, Bahrain, and Germany. On October 1, the same company opened a record 30 Dunkin’ restaurants in one day in Saudi Arabia, an unprecedented number in the brand’s 72-year history.

“There’s a huge opportunity on this cross-sell, but also multi-brand unlocks,” Charnaux says.

What Charnaux means by “multi-brand unlocks” speaks to another realm of whitespace. Real estate has shown little to zero signs of getting cheaper, he notes. So if companies can offer franchisees opportunity to “maximize the throughput of that dirt,” there are gains to be had. Walking into Inspire’s HQ lobby, employees and visitors pass a Dunkin’-Jimmy John’s co-branded outlet that opened in February 2022.

And it’s merely a taste of the company’s non-traditional potential. While Charnaux is not saying there will be 50,000 non-trad outlets for Inspire, he does feel the opportunity is there. The approach should represent 15

percent of what the company does on an annual net unit growth basis, Charnaux adds. Also, Inspire is currently testing a modular, 650-square-foot build that can be used for any of its brands. It’s built off site, fitted to whichever chain is needed, and brought to market.

Charnaux broadly imagines a universe where the company can work with colleges, airports (Jimmy

John’s recently launched in Sarasota, Florida’s, airport), and more, on presenting packages of brands that stretch the full daypart gamut. He says Inspire talked with turnpike operators on creating a space that offers something for everyone. And this isn’t just a matter of having multiple concepts. Inspire spent ample time innovating around how to operationalize this kind of approach collectively and in a way that saves space and resources.

Answers it found through another industry-first approach.

Welcome to Alliance Kitchen

In fall 2021, Inspire unveiled “Alliance Kitchen.” You could call it a “ghost” or “dark” kitchen, but, in truth, the label doesn’t do it justice. The space claims the distinction as the first fully developed, owned, and operated multi-brand ghost kitchen in the industry. Or spun differently, nobody has ever melded brands together at this level, for this purpose.

The main split is it’s a one-central-kitchen model that maps product preparation and creation, which allows Inspire to curate different orders for various concepts (in this case, everything but Dunkin’). The segmented kitchen features workspaces that blend to fulfill as opposed to having five separate areas.

There’s also WiFi, charging stations, and free Dunkin’ coffee for couriers.

In many respects, Alliance Kitchen is the digital, virtual manifestation of the co-branded spaces that have long infiltrated quick service. Past offering choice, though, Alliance Kitchen reduced labor requirements

INSPIRE BRANDS (5) 34 AUGUST 2023 | QSR | www.qsrmagazine.com QSR 50 | GROWTH AND LEADERSHIP

ALL IDEAS SPROUT FROM INSPIRE BRANDS’ HEADQUARTERS IN SANDY SPRINGS, GEORGIA.

Our Bavarian Pretzel Bites are on track to be one of the most profitable products for menus everywhere. A delightful taste, these bites have the versatility to fit on any menu and be served in every daypart. Oh, and they’re good at making customers smile.

by 54 percent, cut square footage needs by 19 percent, decreased equipment costs by 45 percent, and sliced energy consumption north of 50 percent, compared to having five spots.

Vans Nelson, Inspire’s SVP of Operations Innovation, a company vet whose been with Arby’s and Inspire more than 13 years, credits Alliance Kitchen’s development to many of the company traits Charnaux highlighted. The 2,000 or so corporate units. The shared knowledge. “It’s a unique situation that only we could do,” Nelson says. “We start out at the Innovation Center, we might test some

interesting to operators.” In sum, Alliance Kitchen’s real unlock was learning how to integrate the back of the house across a multi-brand portfolio. Would Inspire have tried that as a pure franchisor? Charnaux doubts it. “We want to do those things because those learnings impact the corporate stores,” he says, “as well as create something for franchisees to get a better return.”

Charnaux is calling this future phase of Inspire’s development “co-location,” versus “co-branding.” Customers aren’t confused and the true drive is efficiency and productivity over breadth of options.

“I love Mexican. I love fried chicken. Do I want to see both together? No, maybe not,” Charnaux says. “But if they have separate dining rooms and areas and are appropriately branded, I think there’s some opportunity there.”

things there, do a proof of concept there. We move it into Alliance Kitchen where it’s a real-world environment, continue to refine, test, and validate, and then deploy to our restaurants into the field and through that process we don’t ask our franchisees to invest until we’re ready and we’re thorough with our testing process.”

When Inspire began conceptualizing Alliance Kitchen, the innovation wheel was ahead of its time. Nelson says it would have been simple to take Arby’s, Buffalo Wild Wings, Sonic, and so forth, and just house them under one roof with independent approaches. It would have tapped into the digital ordering and on-thego trends of today’s consumer and provided a relief valve for nearby stores. But that would have been one bubble in a lexicon full of them.

Alliance Kitchen was a practice in efficiency, from equipment to utilities to labor, designed to understand how collective, yet different parts could make each one better. Picture a grill where all of the brands’ grill-cooked products are produced in that station. Now, everything flows one direction toward the guest and locker system. Not to mention, cross-trained workers.

And then, couple this concept with what Charnaux portended with non-traditional. “All these non-trad places, these are folks who want plug-and-play kinds of solutions,” he says. “And if you can go to an airport and say, ‘I’ve got coffee, I’ve got sandwich, I’ve got wings, I’ve got Sonic, I’ve got all those things … With Alliance Kitchen, we figured out ways behind the scenes we could man those with shared equipment, shared resources so it’s more productive. That now becomes really, really

“If you think about the importance of non-traditional locations, because of our learnings in Alliance Kitchen, it enables us to take two brands, three brands, and be able to develop a workflow and a deployment from a kitchen design and layout standpoint that makes everything more efficient,” Nelson adds. “So now you can collaborate from a workforce management standpoint and be much more effective.” Because Inspire was created with diversification central to its DNA, the company is staring down non-trad growth with limitless horizons. It doesn’t need to go brand-by-brand; it can mix-and-match or address a specific need. “Then, if we have an operating model that allows that to be much more efficient, then we can give them that, too,” Nelson notes.

Broadly, Nelson says, the spirit of Alliance Kitchen exists across the company’s directives. Recently, his team spent a good deal of time fine-tuning team member engagement. They focused on details such as restaurant design, workflow innovation, facilities and equipment upgrades, and placement, in an effort to boost performance and satisfaction.

The Innovation Center is where it all takes shape. Nelson says Inspire worked on “operations complexity model innovation,” which set out to define complexity in a “common language that can be spoken throughout the building and throughout the teams.”

Nelson adds these are ambitious times for Inspire, especially when you consider how COVID accelerated many of the trends the company anticipated ahead of it. “From an Inspire Brands standpoint, because of our portfolio of brands and uniqueness of them, and our ability to touch every daypart, it just gives our team a lot of innovation to go after. And so, from an equipment innovation, facilities innovation, process, workflow, innovation, engineering and design, food safety, all of those allows us to be resourced to work across all of our brands to bring solutions to. And that’s what we’re most excited about.”

Danny Klein is the editorial director of QSR and FSR. He can be reached at dklein@ wtwhmedia.com

INSPIRE BRANDS (3) 36 AUGUST 2023 | QSR | www.qsrmagazine.com QSR 50 | GROWTH AND LEADERSHIP

INSPIRE BRANDS GAINS MUCH INSIGHT FROM ITS ALLIANCE KITCHEN CONCEPT.

QSR 50

/ BY QSR STAFF

/ BY QSR STAFF

Within the past year, the top quick-service chains experienced a mix of challenges and opportunities as they navigated the ever-changing landscape of foodservice. These brands, known for fast and convenient dining experiences, had to adapt to shifting consumer preferences, technological advancements, and global events that impacted operations.

QSR 5 0 PROFIL E S

STAFF ARE RETURNING, AND GUESTS ARE NOTICING / P 68 THE CHARTS / P 80 38 AUGUST 2023 | QSR | www.qsrmagazine.com QSR 50

One thing is for certain—automation is coming sooner rather than later. A host of companies are tinkering with robotics in the back of house, on the phone, and at the drive-thru. Not for the sake of replacing human bodies, but for the benefit of relieving an already stressful job that suffered greatly from recruiting and retention issues during the pandemic.

The restaurant industry is often labeled as a sector slow to adopt technology. But COVID remapped the minds of operators nationwide. Ideas that were once seen as innovative and cutting edge are quickly becoming table stakes. Onlookers should buckle up—the pandemic appears to be in the rearview, and the quick-service segment is preparing for another transformation unlike anything it’s seen before.

1 McDonald’s

$ 48,734 MM

The world’s largest burger chain is experiencing a renaissance of sorts thanks to its overall transformation plan, Accelerating the Arches, which calls for modernization, emphasis on core menu items, and the three Ds—digital, delivery, and drive-thru. At the start of 2023, McDonald’s systemwide sales had grown by nearly $20 billion since the onset of COVID, despite losing nearly 850 stores in Russia. The brand’s U.S. comps increased roughly 25 percent on a three-year basis in 2022. And now, McDonald’s is using those bigger sales to enhance its development outlook. The company finished last year with 13,444 restaurants after gaining a net of six locations. It marked the first time McDonald’s grew its domestic footprint in eight years. All of it was company-owned growth, with the footprint moving from 663 to 693, while the franchise base dipped 24 units to 12,751. The chain is drawing in customers with constant product news, like the announcement of its improved Big Mac, McDouble, cheeseburger, and hamburger, which will come with softer buns, gooier cheese, and more onions. At the same time, McDonald’s isn’t shying away from new ventures. The chain reportedly tested the meatless McPlant sandwich and the chicken Big Mac in the U.S. and began piloting Krispy Kreme doughnuts in about 160 Louisville-based restaurants. However, McDonald’s didn’t entirely escape macroeconomic pressures. In April, multiple media outlets said the brand planned to lay off hundreds of employees as part of an organizational restructuring. CEO Chris Kempczinski hinted at the move in January, saying “This will help us move faster as an organization, while reducing our global costs and freeing up resources to invest in our growth.”

2022 U.S. SYSTEMWIDE SALES:

➽

FLIPPING PAGES ICON: ADOBE STOCK / ZAE, ADOBE STOCK RAWPIXEL.COM M c DONALD’S (4), AERIAL DRONE PHOTO OF: ADOBE STOCK FELIX MIZIOZNIKOV www.qsrmagazine.com | QSR | AUGUST 2023 39 QSR 50

M c DONALD’S SITS ATOP THE QSR 50 BECAUSE OF ITS ABILITY TO INNOVATE.

2 Starbucks