STEVE CHU

Co-Owner and Chef, Ekiben

Co-Owner and Chef, Ekiben

McCormick Culinary can help save you time on the line, delivering consistent, vibrant flavors for your dishes. With 130+ years of expertise, our variety of blends, herbs, spices, and seasonings are crafted without compromise to offer quality you can trust in your back of house.

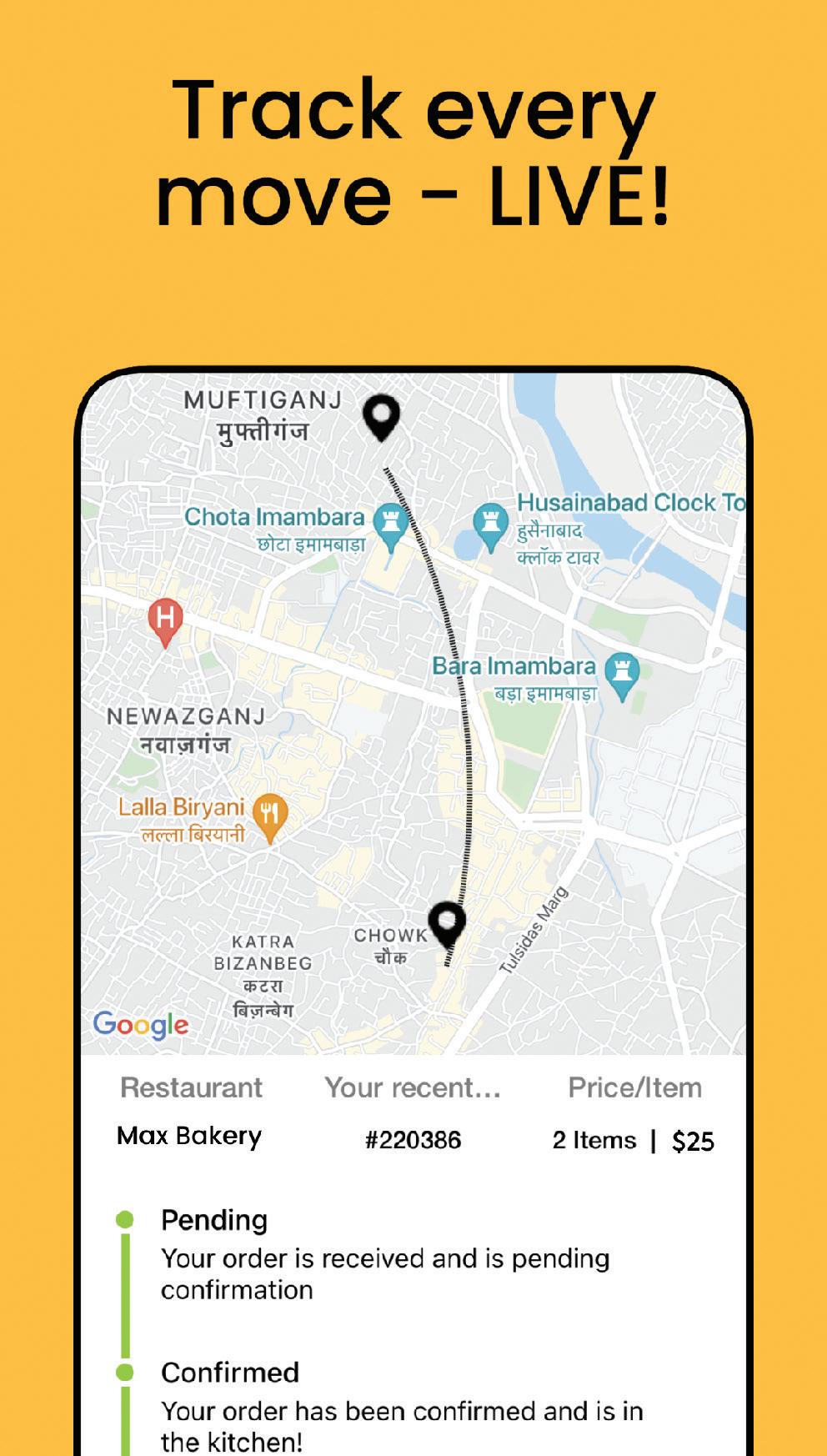

Dodo Pizza’s dedication to artificial intelligence knows no bounds. BY SATYNE DONER

What's in a Name?

These concepts describe what goes into a total rebrand, including what to call the restaurant. BY SAM DANLEY

15

IDEAS Barbecue Brands Keep Putting Stores in the Queue

The cuisine has regional hotspots, but certain chains are confident in national whitespace. BY BARNEY WOLF

22 ONES TO WATCH Dirty Dough

The rising cookie chain has fuel to grow after a big acquisition. BY SAM DANLEY 26 WOMEN IN LEADERSHIP

The Black-owned business is making delivery services easier for local operators. BY SATYNE DONER 98

KLEINThe Craveworthy Brands executive provides insight on growth opportunities for the accelerating restaurant group.

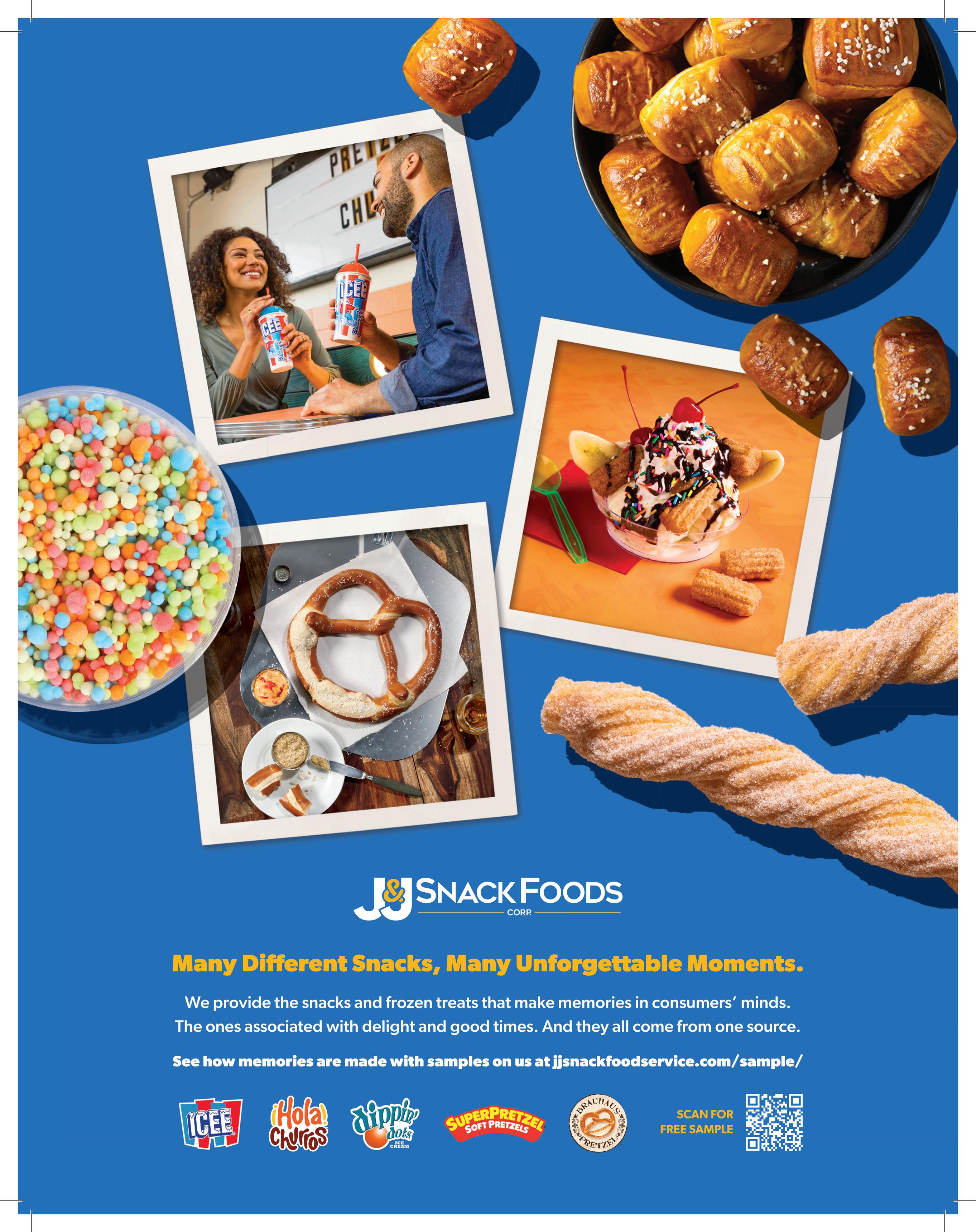

Portable: Ideal for QSRs and customers on the go.

All-day appeal: Popular for breakfast, lunch, dinner and late night.

No additional training or equipment required.

Serve Up Local Flavor to Drive Big Engagement How Ansira helps quick-service restaurant brands spice up their local marketing.

Bojangles’ Key Ingredients in its Recipe for Marketing Success How Digital reader boards have revolutionized the brand’s customer engagement. SPONSORED BY WATCHFIRE 87 The Future of Foodservice: Supply Chain Optimization in the Post-COVID Era SPONSORED BY CH ROBINSON

EDITORIAL

EDITORIAL DIRECTOR

Danny Klein dklein@wtwhmedia.com

QSR EDITOR

Ben Coley bcoley@wtwhmedia.com

FSR EDITOR Callie Evergreen cevergreen@wtwhmedia.com

ASSOCIATE EDITOR

Sam Danley sdanley@wtwhmedia.com

CONTENT STUDIO

VICE PRESIDENT, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO

Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO

Olivia Schuster oschuster@wtwhmedia.com

ART & PRODUCTION

SENIOR ART DIRECTOR Tory Bartelt tbartelt@wtwhmedia.com

FSR ART DIRECTOR Erica Naftolowitz enaftolowitz@wtwhmedia.com

SALES & BUSINESS DEVELOPMENT

GROUP PUBLISHER Greg Sanders gsanders@wtwhmedia.com

NATIONAL SALES DIRECTOR Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES MANAGER Edward Richards erichards@wtwhmedia.com 919-945-0714

NATIONAL SALES MANAGER Amber Dobsovic adobsovic@wtwhmedia.com 919-945-0712

NATIONAL SALES MANAGER John Krueger jkrueger@wtwhmedia.com 919-945-0728

CUSTOMER SERVICE REPRESENTATIVE Tracy Doubts tdoubts@wtwhmedia.com 919-945-0704

CUSTOMER SERVICE REPRESENTATIVE Brandy Pinion bpinion@wtwhmedia.com 662-234-5481, EXT 127 FOUNDER Webb C. Howell

ADMINISTRATION

919-945-0704 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. who meet subscription criteria as set forth by the publisher.

REPRINTS

The YGS Group 800-290-5460

Reduce overall operational expenses without sacrificing quality! Our two-in-one drivethru headset system comes complete with drive-thru SOS timing metrics

drive-thru timing measurements directly from the base station or stream the data to any monitor

The media landscape has faced harsh times for several years now, and with the advent of social media, there has been pressure for some journalists to move quickly for the sake of accuracy or mischaracterize stories to generate more clicks.

This nature is what fueled the ire toward Wendy’s and its dynamic pricing strategy earlier this year.

The burger giant held its fourth quarter and fiscal 2023 earnings call on February 15—the first one for new CEO Kirk Tanner. On the call, he mentioned that as early as 2025, Wendy’s will start testing dynamic pricing, AI-enabled menu changes, and suggestive selling.

QSR and other restaurant trade publications covered the earnings call initially and mentioned the news around dynamic pricing. Needless to say, there wasn’t any sort of pushback.

But nearly two weeks later, national media publications twisted the words to mean “surge pricing” and compared it to how Uber and other rideshares hike prices during busier periods. The news made its rounds on TikTok, Twitter, and other platforms, and customers were not happy.

“How could Wendy’s take advantage of guests like this?”

But Wendy’s isn’t. They never planned to. The purpose was to test value offers and discounts during notas-busy shoulder periods to bring in more guests, not the other way around.

And here’s where the issue with the media comes in. Wendy’s never used the term “surge pricing.” That was the interpretation of writers, not the company. Because of that misframing, the com-

pany was faced with a massive wave of negative publicity and had to clarify its positioning.

What’s also disappointing is that several within the actual restaurant industry truly believed Wendy’s was going forward with surge pricing. I even saw comments suggesting the company floated it out there to test the waters and decided to backtrack once it got negative attention. Just another layer of misinformation being spread across social media without any effort to try to learn what’s really going on.

The purpose of this editorial letter is not to stand up for Wendy’s. To be fair, the company should’ve offered more definition around what it meant by dynamic pricing so there wouldn’t be any confusion. I’m sure a lot of lessons were learned by the internal PR team after the fiasco.

I desire that writers—whether it’s B2B or traditional newspapers— take their role more seriously. I understand that if you aren’t writing about restaurants every day, you may not understand most of the nuances. That’s why it’s important to ask questions and confirm instead of assuming and putting it out to the public. It’s a disservice to anyone truly seeking knowledge.

I can’t sit here and say I’m perfect either. I’ve made mistakes in writing stories before. I’m just hoping we all can be better for our audiences going forward. That’s my promise to all of you reading this right now.

Ben Coley, Editor

CULINARY LITES®

Versatile sizes, create visual appeal that sells

CRISP FOOD TECHNOLOGIES® CONTAINERS Keeps food hot & crispy for 30 minutes on the go

CULINARY SQUARES® Two-piece perfect for fresh-serve, hot or cold case

CULINARY TAMPER-SAFE™ Tamper-Evident Solutions Secure Sales

DINE-IN QUALITY TO GO

Keep food hot & crispy for 30-minutes on the go, maintain presentation, and provide tamper-evident security to serve a great food experience.

PROTECT PROFIT

Clear lids prevent costly order errors, compartmented packages control portions, and enhanced ventilation and secure closures help avoid costly comps and win great reviews.

PROTECT CUSTOMER EXPERIENCE, TOO

Leak-resistant closures, re-closable lids, secure stacking, and multi-compartment design options protect presentation and food quality.

REDUCE WASTE, NOT TASTE! Superior performance protects food quality to prevent waste Consumer reusable and recyclable after use.

SAMPLES FREE

Reusable. Recyclable. Made in the USA.

Reusable. Recyclable. Made in the USA.

REGISTRATION IS OPEN for the second annual QSR Evolution Conference and NextGen Restaurant Summit, hosted by WTWH Media.

The event is scheduled for September 4-5 at the Atlanta Marriott Marquis, kicking off with a welcome reception on September 3.

The QSR Evolution Conference, presented by QSR Magazine, offers quick-serve restaurant operators a unique platform for face-to-face networking within the industry. Meanwhile, the NextGen Restaurant Summit, presented by FSR Magazine, focuses on connecting emerging full-service restaurant brands shaping the industry's future.

The event promises an even bigger lineup of speakers and insights compared to last year. Keynote speakers include industry heavyweights from Burger King, KFC, Popeyes, Tim Hortons, First Watch, and more. Over 100 accomplished leaders from both sectors are set to share their expertise.

In March, Qu—a POS platform company—released its fifth annual State of Digital report on enterprise fast-food and fast-casual brands. The data covers 179 concepts and 62,000 U.S. locations. Each participant came from a brand that had at least 20 locations in the U.S. Many were from multi-concept portfolios. Fifty percent were VPs or directors, 34 percent were C-suite executives, 12 percent were managers, and 1 percent were franchise owners.

42% OF BRANDS SURVEYED, DIGITAL SALES MIXED BETWEEN 26 & 50 PERCENT

• According to Qu, digital and off-premises sales settled into a predictable growth pattern in 2023. For 42 percent of brands surveyed, digital sales mixed between 26 and 50 percent.

40% BRANDS PLAN TO ADD KIOSKS AS A NEW ORDERING CHANNEL IN 2024

80% OF RESPONDENTS SAY LOYALTY ISN’T WORKING

46% SAID LOYALTY IS A PRIORITY

44% ARE WORRIED ABOUT LABOR AVAILABILITY

49% AIDRIVEN ANALYTICS IS THE BIGGEST PRIORITY IN 2024

65% PLAN TO OR ALREADY HAVE NEXT-GEN UNIFIED POS PLATFORMS

are Poised

• Experts believe fast casuals and fast-food restaurants will see 5 percent year-over-year growth in 2024

• Operators foresee the economic climate (47 percent) as the biggest challenge to sales growth. After that, 44 percent are worried about labor availability, and 41 percent are concerned about new guest acquisition.

• Breaking it down between segments, 50 percent of fast casuals had a digital mix between 26 and 50 percent, compared to 24 percent of fast-food restaurants.

• Forty-four percent of brands plan to add kiosks as a new ordering channel in 2024, followed by mobile apps (25 percent), expanded delivery partners (25 percent), phone AI ordering (20 percent), and voice ordering in the drive-thru (16 percent).

• Qu predicts the idea of loyalty will be reinvented and redefined this year. Eighty percent of respondents said loyalty isn’t working. As for potential upgrades, 45 percent want to improve engagement, 39 percent want frictionless sign-up, 28 percent want guest payment variety, and 27 percent want redemption innovation.

• Forty-six percent said loyalty is a priority. Trailing that is digital menu boards (31 percent), POS (29 percent), kiosks (28 percent), online ordering (28 percent), mobile apps (28 percent), customer data platforms (23 percent), and marketing solutions (20 percent).

• Sixty-five percent of brands plan to or have already transitioned to next-gen unified POS platforms that connect all of their data.

• Forty-nine percent believe AI-driven analytics is the biggest priority in 2024. That’s followed by voice ordering (46 percent), dynamic pricing (39 percent), kitchen and production optimization (27 percent), computer vision (20 percent), and robotics (13 percent). Fast casuals prefer analytics, while fast-food companies want voice ordering, which makes sense given the latter’s reliance on drive-thru lanes.

Stay

Beverage programs are widely recognized as one of the most profitable aspects of a restaurant due to lower labor costs and the ability to o er a variety of drink options. However, challenges such as a tight labor market, inflation, and customers' expectations for diverse drink options could potentially impact the profitability of beverage programs if not managed effectively by operators. Implementing beverage solutions that allow operators to do less with more is ideal for creating a beverage program that appeals to all customer demographics.

“The quality and consistency of beverages sold is a variable impacted by both the o erings and the process for executing that o ering,” says Rich Shuey, executive director of sales for dining, hospitality, and leisure at Sunny Sky Products. “Brands that o er the right number and mix of beverages consistent with their customer demographic tend to have good overall results. Those that also include easy-to-execute new beverages in line with trends see the best results.”

Operators are busy enough without the constant pressure to identify current trends, and a beverage partner can help ensure operators' beverage programs stay profitable and on-trend. “At the end of the day, Sunny Sky Products is big enough to handle any volume but small enough to listen to our client’s feedback and adjust to what we hear,” says

Juan Carlo Mato, travel and resorts regional sales manager for Sunny Sky Products.

Sunny Sky Products stays on top of current trends by leveraging consumer research platforms and o ering a wide variety of products that satisfy diverse demographics and operators' needs. “Tropics Beverages o er restaurant operators a convenient and reliable solution for streamlining their beverage programs while still providing variety and quality to customers,” Mato says.

Tropics is an ideal solution for operators looking to serve fresh, consistent, and streamlined beverage o erings whether alcohol is added or not. The brand unlocks the ability to keep up with alcoholic menu counterparts while appealing to consumers seeking low and no-alcohol beverage options with on-trend flavors.

“Tropic’s mixers increase productivity by streamlining the process of drink making,” Mato says. “With pre-mixed bases and flavors, sta can minimize wait times for the customer and improve overall flow.” Along with improving flow and processes, Tropic Beverages speaks to millennials and Gen Z, who value high-quality ingredients.

“Our clean-labeled, real-fruit-based, delicious Tropics Beverage mixes provide our customers with a way to provide an array of high-appeal beverage o erings, in a relatively easy-to-execute format,” Shuey says. “Everything from cocktails and mocktails to smoothies and dessert toppings can be made using Tropics, enabling brands to do more with less.”

Through its focus on quality, versatility, and ease of execution, Tropics Beverages o ers a compelling advantage for restaurant operators striving to maintain profitability and customer satisfaction in a challenging market environment. “Tropics Beverages is an overall beverage experience dedicated to helping operators thrive in a competitive market,” Mato says. “We have a proven track record, fantastic customer support and service, and our commitment to quality is unmatched.”–By Ya’el McLoud ◗

Scaling the popular cuisine isn’t easy, but it’s possible with the right growth and menu strategy.

BY BARNEY WOLFThe ability to grow a restaurant concept into a multipleunit enterprise is tough enough, but when the art, science, and craft of barbecue are added in, the degree of difficulty rises a couple notches.

Issues such as establishing operating protocols, supply chains, and hiring plans are certainly important to scaling any chain. However, teaching future pitmasters to create great barbecue— preparing, smoking, and even slicing or chopping meats—is a complexity most other concepts just don’t have.

In many cases, smokers at these restaurants are running nearly around the clock, with cooking times based on the type and size of the protein. While brisket is ubiquitous, most of these units also offer smoked items like chicken, ribs, turkey, pork, and sausage, along with some specials.

That’s one reason—along with regional preferences—few barbecue joints a quarter century ago were more than a single unit. These days, however, the segment features statewide, regional, multi-regional, and national players. And leaders of these aspire to be “the best barbecue” wherever they are.

“We want to be the best neighborhood barbecue in Texas,”

says Craig Haley, chief executive of Smokey Mo’s, which has 19 units in the Lone Star State. Larry Ryback, chief executive of Jim ‘N Nick’s, which has 47 restaurants in six Southeast states, notes that despite definite regional differences in barbecue styles and sauces, “We focus on making the barbecue great.”

For the most part, none of these entities began with any thought of expansion.

“I just wanted to start a great barbecue joint and be a member of the community,” states Rick Malir, founder of Columbus, Ohio-born City Barbeque, which has 70 stores in nine states. “I could have never fathomed where we are today.”

Even Dallas-based Dickey’s Barbecue Pit, which has grown to be the segment’s leader in size with more than 400 stores in 41 states and eight countries, had humble beginnings in 1941. “We didn’t start growing until the 1960s,” says chief executive Laura Dickey, adding that the expansion was “very organic” with “no great brand design” until ramping up this century.

Most of these brands, as with many other restaurant companies, faced early growth difficulties. For City Barbeque, it was opening the second store. “I almost lost the company,” Malir says,

noting operations weren’t in place and costs of opening a new unit siphoned profits from the original. For Dickey’s, the struggle was with the third store and a weight of growth issues.

“We have truly learned from the difficulties,” Dickey notes. “If necessity is the mother of invention, then challenges are the parent of creativity.”

As these companies began scaling, a decision eventually had to be made: whether to accomplish this by the company alone or via a franchise route. Dickey’s and suburban Austin’s Smokey Mo’s chose the latter, while City Barbeque and Jim ‘N Nick’s retain company ownership of all units.

“I think the biggest decision was to franchise,” Haley explains. “We made the decision that in order to grow outside Austin, you need to partner”—and select the right business relationship.

City Barbeque actually franchised a few units early on, but Malir and his partners bought them back. “It was an experiment and didn’t fit who we are,” he says.

Dickey’s—with mostly franchised units—has had acquisition offers but remains a family-owned parent company. Growth for others is being aided by private investment capital: Birmingham-based Jim ‘N Nick’s was acquired by Atlanta restaurant giant Roark Capital Group, and Smokey’s Mo’s was bought by Austin’s Switchback Capital LLC. City Barbeque received an investment from Freeman, Spogli & Co., which is headquartered in Los Angeles.

Barbecue restaurants faced a particular impediment to growth years ago due to the historical regional nature of the business. It was a common belief that ‘cue had to be one style, and that Texas, North Carolina, Alabama, Memphis, or any other type couldn’t thrive in another region.

That’s not necessarily a determining factor now, although Dickey’s and Smokey Mo’s still hew closely to their Texas roots.

“There are a lot of similarities across the country these days,” says Malir, pointing out that City Barbeque features different regional styles among its proteins and sides. American consumers move from one place to another regularly,

and “If the barbecue is great, they’re going to buy it.”

At Jim ‘N Nick’s, “we like to look at broad appeal,” Ryback notes, “so it doesn’t just appeal in Memphis or Birmingham. Today, “People are really accepting of different types of barbecue.”

As the companies grew, there were plusses and minuses. Menus tended to expand as well, and like other restaurant enterprises, those had to be trimmed during the pandemic. At the same time, some chains launched new regional side items or even better side versions than the originals.

Key to any growth plan is having systems in place to foster the expansion, including operations, real estate, marketing, and labor, among others. The fact that a barbecue joint needs to have long lead times and smokers running long hours with workers manning them requires unique systems.

“Whether it’s one or two or, like us, trying to grow to 90 [stores], you have to be ready, and have the right people in place” who are aligned with the company’s core values, Ryback says. “And it is equally important to have the right systems in place, day in and day out.”

The inherent intricacies and difficulties in barbecue cooking and preparation are logical reasons behind these companies’ focus on their employees as engines for their growth. Training in all the particulars of barbecue generally takes weeks of long days.

“I think barbecue is a skill,” Haley says. “It’s a trade, and so the cooking of the meat is so important. It’s not something you can teach in a week.” Dickey says that her company’s training involves three weeks of “intensive” instruction, and that franchise restaurant operators, as well as their pitmasters, must go through this course.

That focus on people, the companies say, goes beyond the pit to the entire crew and is key to their expansion. “We want all of our staff to grow with us,” Malir says. “One thing that inspires us to grow as a company is that growth provides opportunities. It’s the only way to scale up.”

77% Preferthetaste of freshguacamole comparedto processedoptions.1

Amountcustomers arewillingtopay fordisheswith freshavocados. 2

Just a scoop or two of the right guac can turn a regular menu item into something that’s simply heavenly—not to mention, your customers are willing to pay up to $2 more for it!2 From creative new twists like Piri Piri Guac to entirely new dishes like Avocado Ranch Smash Burgers, there are countless profitable, flavorful, and easily executable ways to bring divine menu innovation into your operation.

VISIT GUAC HEAVEN AT THE NRA SHOW, BOOTH #424, FOR TRULY DIVINE MENU INSPIRATION.

Whether it’s our extensive library of educational tools and workshops, or our divine menu innovations that extend guac beyond Mexican, when you partner with Avocados From Mexico, you get the support you need in every aspect of your operation—every step of the way. It’s what we call a match made in Guac Heaven.

SCAN THE QR CODE TO SEE HOW WE CAN TAKE YOUR RESTAURANT TO NEW HEIGHTS.

AVOCADO PIMENTO GUAC

SMASH BURGER

CHICAGO STYLE GUAC DOG

ITALIAN AVOCADO SALSA VERDE

AVOCADO PIMENTO GUAC

SMASH BURGER

CHICAGO STYLE GUAC DOG

ITALIAN AVOCADO SALSA VERDE

A delicious option for environmentally conscious diners.

As dietary preferences shift and environmental concerns grow, quick-service restaurants face the urgent need to evolve their offerings. Finding the best products that meet this demand can be difficult, especially when working with new foods that haven’t been previously available at quick-service restaurants.

Impossible Foods stands at the forefront of a culinary revolution, catering to the ever-evolving concerns of consumers worldwide as more individuals pivot towards plant-based diets. Whether for health reasons, ethical considerations, or environmental sustainability, the demand for plant-based options in quick-service restaurants has skyrocketed.

Impossible Foods meets this demand head-on by offering a wide range of delicious, nutrientdense products which are better for the planet and mimic the taste and texture of meat. “When developing our products the traditional animal product is our benchmark,” says J Michael Melton, head of culinary at Impossible Foods. “We don’t put out any product unless it’s as good or better than its animal counterpart.”

This innovative approach satisfies the cravings of omnivores looking to diversify their diet with more plants, without sacrificing flavor. “We’re redefining the meat category and elevating the dining experience,” Melton says. “Consumers can now have a burger or hot dog that tastes like an animal product but comes from plants.”

By incorporating Impossible Foods’ products into their menus, quick-service restaurants can attract a broader customer base, adapt to changing consumer trends, and play a part in promoting a more sustainable food system. “Sustainability is our number one driver,” Melton says. “Our Impossible Sausage Patties generate 73 percent less greenhouse gasses and use 46 percent less land area and 80 percent less water versus traditional pork sausage from pigs.”

The versatility of Impossible Foods’ products is a game changer. The products seamlessly integrate into a wide array of culinary creations

making a perfect fit for any menu. “Many of our products lend themselves to versatility,” Melton says. “For example, our breakfast sausage can be served whole on an english mu n or chopped up and incorporated into a breakfast sausage gravy or omelet. Our products can be used in different dishes in all dayparts and in many ways, allowing for seamless integration onto any menu.”

Impossible Foods continues to grow, focusing on innovative products while maintaining good relationships with its quick-service restaurant partners. “We’re more than a product, we’re also an extension of our partners and their teams striving to attract new customers through versatile products,” Melton says. “Our products will continue to evolve with consumer trends, and we will continue striving to put the best products out.”

“We’re not done here,” Melton says. “We keep striving to be the benchmark in plant-based meat alternatives.” This forward-thinking approach highlights dedication to staying ahead and meeting evolving needs. As dining habits shift towards sustainability, Impossible Foods leads, embracing the future with innovative plant-based products.

–By Abby WinterburnYep, your guests—not just vegetarians—have come to expect modern and delicious plant-based menu options. Adding Impossible™ Meat From Plants

*See impossiblefoods.com/nutrition-disclaimers

The dessert chain is battling for market share in the red-hot cookie category with some help from a burgeoning platform company.

BY SAM DANLEY

FOUNDERS: Bennett Maxwell

HEADQUARTERS: Lindon, Utah

YEAR STARTED: 2018

ANNUAL SALES: $13 million

TOTAL UNITS: 80+ locations open with 16 food trucks in operation

FRANCHISED UNITS: 460 territories sold

SIX YEARS AFTER LAUNCHING INSIDE AN ARIZONA

State apartment, Dirty Dough is surpassing 80 brick-and-mortar locations with dozens of units in development and 460 franchise territories sold.

It also has the support of a fast-growing platform company that’s opening new horizons. The cookie chain joined Craveworthy

Brands earlier this year, tapping into its supply chain, franchise development, and marketing muscle to gain a strategic edge in the so-called “cookie wars.”

Founder Bennett Maxwell credits Dirty Dough’s rapid ascension to three key factors. First and foremost is the flagship product. The brand’s indulgent treats are baked with layers, mix-ins, and fillings in the dough. Think sugar cookies filled with raspberry jam and coated with icing and sprinkles, or fudge brownie cookies loaded with Reese’s peanut butter chips and stuffed with peanut butter protein nougat.

The second factor is a simple operating model. The company opted to centralize production at a manufacturing facility early on instead of having stores prepare their own dough. That goes a long way

toward maintaining consistency and a low cost of goods for franchisees. It also helps lower the barrier of entry as far as upfront costs go since stores can run as small as 600 square feet with a single employee and minimal equipment.

“We found specialized machines that do stuffed cookies as well as two- and threelayer cookies, so you can have peanut butter dough on the outside, chocolate dough in the middle, and hot fudge filling inside,” Maxwell says. “You can mix thousands of cookies at a time and then ship those out to franchisees to be baked onsite. You don’t have any downside in the freshness, but you have a large upside in quality control.”

The third factor is a highly publicized legal dispute with one of its primary competitors. That may seem counterintuitive, but Maxwell says Dirty Dough gained national attention after Crumbl—the largest player in the cookie space—filed a lawsuit accusing it of copyright infringement two years ago. It ended up selling hundreds of franchises because of the exposure.

“People would go to our website to find out who this company is that Crumbl was suing,” he says. “They’d find a more unique cookie and a simplistic business model, and then they’d inquire about franchising.”

The cookie chains reached a settlement last fall, paving the way for Craveworthy to acquire an undisclosed but significant interest in Dirty Dough. It was one of the platform’s largest deals to date and marked its first foray into the snacking category.

Dirty Dough is the 11th brand to join Craveworthy. Led by founder and CEO Gregg Majewski, the platform of emerging and legacy fast casuals formed in late 2022 when it acquired two existing chains, Wing It On! and The Budlong, and created two new brands, Krafted Burger + Tap, and Lucky Cat Poke Co. It later added Genghis Grill, Flat Top Grill,

2009 was the last year physical bank locations increased. There were nearly 100,000 branches across the U.S. Now, there are fewer than 80,000. In 2023, an additional 1,409 bank branches in the U.S. closed according to S&P Global Market Intelligence data. The COVID-19 pandemic accelerated bank closures because of the push to decrease face-to-face interactions, and since then, physical bank locations have continued to decline.

Merger and acquisition activity has been another factor driving bank branch closures with bank deal value surging to a 15-year high in 2021. As financial institutions merge, redundant branches are closed leaving many local businesses in cities and rural areas alike in the lurch.

Operators are tasked with finding workarounds and new solutions. That might mean never going into a branch at all.

“It’s forcing operators to either drive further to make their bank deposits or open up new accounts with di erent banks,” says Lenny Evansek, the senior vice president of retail business development at Loomis. “The result is more relationships to manage, more administrative work to sift through, and potentially higher fees by having smaller but more bank relationships.”

Each bank account comes with its own set of statements, transaction fees, and customer service requirements, which means more paperwork and complexity. The accumulation of fees across several accounts

can erode profits, especially for smaller businesses. The complexity of managing multiple relationships can lead to errors and oversight, which can negatively impact a business’s e ciency and financial health.

To manage cash-handling tasks more e ciently, Loomis o ers an automated system. SafePoint is a cutting-edge smart safe that securely stores and validates cash until it’s ready for deposit. With the bundled solution, operators gain access to trusted cash transportation services, convenient change order capabilities, and detailed reporting tools.

“Loomis gives customers the ability to virtually work with their banks,” Evansek says. “They can deposit their money whether their bank is within 10, 100, or even 1000 miles. This enables them to consolidate their bank relationships from many down to one.”

Loomis SafePoint also provides significant operational advantages that can lead to cost savings and improved e ciency. “It potentially saves on labor,” Evansek says. “It can help operators schedule more eciently by not having to schedule an extra employee knowing someone has to leave the restaurant to go make a bank deposit.”

Operators using SafePoint can manage all their information under one platform using their mobile devices or laptops, bringing consistency to their finance and accounting departments. “They can see their cash deposits and cash positions for all their restaurants at any given time,” Evansek says. “It enables them to troubleshoot any issues that might be out in the field when it comes to balancing. It saves operators a significant amount of time by being able to do all this remotely rather than calling each restaurant individually or sifting through many di erent bank portals and reporting solutions.”

Loomis's innovative approach helps businesses save on labor, streamline operations, and improve their financial e ciency, proving essential in adapting to the new norms of banking and cash handling. –By Olivia

Schuster

SafePoint—The Solution to Operational Pains

Manual cash handling is not only timeconsuming but also leaves your business vulnerable to theft and human error.

SafePoint by Loomis is here to alleviate your operational pains. Our smart safes and cash recyclers offer a secure, efficient way to manage your cash, so you can focus on what matters most—growing your business. Plus, with features like provisional credit, you could have access to your funds overnight.

Save on labor and training costs.

Reduce the risk of internal theft and external threat.

Gain real-time visibility into your cash flow.

Eliminate the need for daily trips to the bank.

Partner with cash handling experts.

Launched at the tail end of 2023, the food delivery app is centered around empowering and educating underrepresented restaurant owners nationwide.

BY SATYNE DONER

It’s not surprising to find Ashley Loveless Cunningham associated with the term “entrepreneur”—she’s had a knack for business since her days selling candy to classmates in second grade. After successfully launching a colored contact lenses business in high school, she ventured into various business endeavors before finding her niche in the financial industry. She accumulated over 18 years of experience assisting others in building personal credit and achieving financial wellness.

Cunningham launched a coaching business aimed at helping entrepreneurs elevate their brands and achieve financial success by imparting knowledge on financial literacy, payroll management, and accessing working capital—essential elements for any entrepreneur’s journey, and potentially bottlenecking factors for those in underserved communities.

During the pandemic, Cunningham observed the struggles faced by the restaurant industry, particularly in small towns, where establishments grappled with declining sales, labor shortages, and supply chain disruptions.

“I’m a very observant person, and I noticed these businesses

didn’t have a foundation in place to help them stay open in a crisis,” Cunningham says. “They didn’t have any type of excess funding, whether through an institution or their personal credit, to keep the doors open. I wanted to be able to help not just on the financial side, but I also wanted to help them push more traffic into their stores [ post-pandemic ].”

Motivated to provide a solution, she conceptualized ChewTyme, a Houston-based food delivery app that debuted in late 2023. ChewTyme not only facilitates seamless restaurant-to-customer deliveries but also offers access to Cunningham’s “Business Credit University,” which provides invaluable resources for financial wellness and growth.

Despite lacking a background in the foodservice industry, Cunningham approached ChewTyme from a consumer’s perspective. Dissatisfied with the excessive costs associated with third-party delivery aggregators, she spent over a year researching and developing ChewTyme to offer a more cost-effective solution for both consumers and restaurants. She also wanted to find a way to help others with her financial expertise in an industry she believes needs it the most.

“I checked my bank statements, and I said ‘woah, this is crazy’,” Cunningham says. “I started looking for a better solution [for restaurants and consumers]. I researched for a good year and a half before I reached out to developers and started building ChewTyme.”

ChewTyme distinguishes itself from competing third-party services by charging a lower commission fee of 17 percent for restaurant delivery orders ( compared to other apps, which charge between 20 and 22 percent ), with no monthly fee until an operator has been on the platform for two years—a period aligned with Cunningham’s credit-building program. On the consumer side, ChewTyme offers a flat delivery rate of $4.95 and attractive discounts and promotions.

The app functions similarly to other food delivery applications, providing a streamlined ordering process and timely delivery with a notification system in place. However, for local restaurant operators, ChewTyme offers more than just delivery services; it provides access to financial advice and a network of potential lenders, aiding in the establishment of a busin ess credit profile.

Communications. Customer satisfaction and convenience are at the forefront of the quick-service restaurant industry. Complications can arise when employees have to manage multiple ordering channels while moving customers through the drive thru.

“With AI taking and processing all drive-thru orders, crew members are enabled to support other key areas of the operation like supporting the front counter or processing payments and handing out orders,” Mullica says. “Plus, AI provides outstanding accuracy and never forgets to upsell.”

Voice AI integration is important to consider as technology is constantly evolving. Ease of integration can be indicative of how e ective a communication platform will be in the long term. Its ability to be easily installed, maintained, and updated as technology advances is paramount to quick service success.

“Other communication solutions on the market need additional audio boxes or adaptors to integrate with a voice AI provider, but these added components can quickly become points of failure,” Mullica says. “Unlike other systems, NEXEO | HDX is a restaurant communication platform uniquely designed to deliver the best drive-thru audio and seamlessly integrate with an AI provider when you’re ready to implement the technology.”

As drive-thrus experience increasing demand, operators face the challenge of balancing e ciency with evolving consumer expectations. According to Quantum Pulse: Drive Thru Survey, approximately 70 percent of fast food sales are drive thru. The growth of ordering channels and the domination of drive-thru sales necessitates advanced technology solutions–particularly AI— in restaurant operations. With AI managing orders, sta can move to roles where personal interaction more significantly enhances customer service and satisfaction.

“Not only are drive-thrus busier than ever, but now crew members have to juggle pull forward, curbside, third-party delivery, and mobile order wait areas,” says Scott Mullica, senior director of product management and innovation at HME Hospitality & Specialty

Customers, employees, and operators' priorities often align when it comes to fast, accurate, and friendly experiences. AI ordering can increase all of these components and alleviate friction points by increasing order accuracy and always providing friendly and clear communication that leads to operational e ciency.

“Voice AI technology is evolving at a rapid pace,” Mullica says. “You want a communication solution that can evolve with it like NEXEO | HDX. Our platform provides a world-class drive-thru experience with every order whether it’s AI or an employee handling the order taking.”

The technology a quick-service operator uses has a dramatic impact on the speed of service and the value customers receive— especially in the drive thru. “The expectation for a fast drive-thru experience is now coupled with a fast and friendly experience at every customer touchpoint,” Mullica says.

Mastering e ciency without compromising accuracy is a tall order for drive-thru services. With platforms like NEXEO | HDX delivering a powerful AI solution, operators can seamlessly ensure swift and precise service empowering employees to excel during in-person interactions. Finding the drive-thru technology that works best for employees, operators, and customers can help build relationships and loyalty, ultimately redefining the standards of convenience and satisfaction in the industry. –By Ya’el McLoud

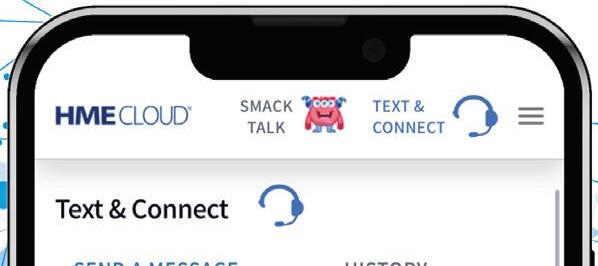

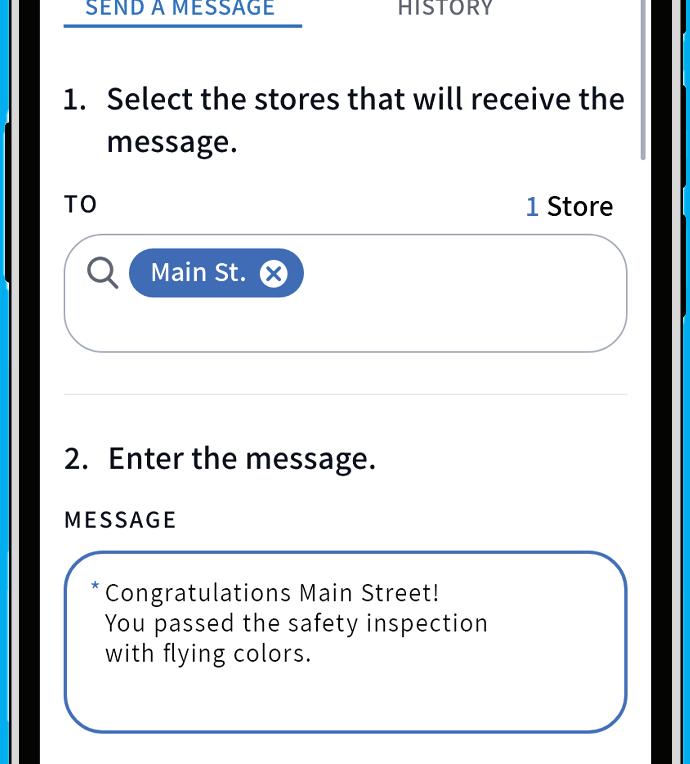

Whether you’re congratulating a store for a job well done or alerting managers about a change in a process, the NEXEO | HDX™ communication platform delivers your messages in real time. Send your kudos or updates with Text & Connect in HME CLOUD® and broadcast them to select headsets in the store, without interrupting the drive-thru and enabling managers, supervisors, and owners to stay in contact with their teams at any time and from anywhere.

Covering every segment with unmatched turnkey solutions, we're not just leading the industry — we're transforming it. Elevate your expectations with us.

BRANDS SPEND BILLIONS OF DOLLARS ON advertising each year, with national campaigns playing a significant role in building brand awareness and driving sales. However, these campaigns may fall short when it comes to connecting with local franchisees and their diverse markets. Enter Ansira, a marketing technology platform company, that specializes in helping brands find success at both the national and local levels.

Ansira’s end-to-end proprietary technology platform makes it easy for brands to manage, track, and distribute marketing funds to their franchisees to empower a more hyper-local marketing approach. Its media and ad technology also scales budgets and creative to maximize campaigns, creative, and performance at the local level.

ANSIRA’S WORK WITH WENDY’S FRANCHISEES IN JACKSON, MISSISSIPPI, IS A PRIME EXAMPLE OF HYPER-LOCAL MARKETING AT PLAY.

“Di erent franchisee locations serve diverse markets with varying demographics, preferences, and needs,” says Catie Cryder, executive vice president of media at Ansira. “A strategy that works well in one location may not be as e ective in another. Once you have a true understanding of your local markets, it opens a world of opportunity for enterprise brands to reach their target audiences e ectively.”

Taking the time to understand the specific needs and characteristics of each market can help brands tailor their marketing e orts in a way that resonates with local customers. Partnering with local influencers or organizations can help brands create authentic connections with these communities, which is key to building trust and loyalty among local customers.

Ansira’s work with Wendy’s franchisees in Jackson, Mississippi, is a prime example of hyper-local marketing at play. To better connect with the Jackson community, Ansira crafted a media campaign that focused on partnering with local influencers to reach customers in a more authentic way.

These micro- and nano-influencers highlighted Wendy’s menu items, like their late-night munchies and two for $3 breakfast menu. By choosing influencers with di erent personalities and styles, Wendy’s was able to reach a wide range of audiences within the Jackson community.

“These types of local media campaigns are a great way to generate engaging and unique content that still aligns with your brand’s national strategy,” says Cryder. “Think about ways you can create di erent messaging, o ers, or even promotions based on local preferences and trends to show these target audiences that you truly know them and their needs.”

Enhance your franchisees’ marketing efforts with Ansira. Enable your brand to authentically connect through media campaigns that highlight local preferences or trends. Drive awareness and sales with hyper-local marketing initiatives that protect brand equity.

READY TO SUPPORT YOUR FRANCHISEES LOCALLY?

/ BY DANNY KLEIN

/ BY DANNY KLEIN

Fresh off a major milestone, the category icon is eyeing 50,000 locations worldwide, with zero signs of slowing down.

KFC Global CEO Sabir Sami travels about two weeks of every month. A recent trip brought him to his home country of Pakistan, where a new store was reporting 10,000 transactions per week. It was still the opening month. Sami, a Yum! Brands vet since 2009 who’s worked at each of the world’s largest restaurant group’s flagships—Taco Bell and Pizza Hut included—during his time as GM of Yum! Canada, cautioned the honeymoon wouldn’t last forever. Maybe it would level out at 6,000 or 8,000. Calmly, the operators disagreed. “They said, ‘no, no, no, no, we think it will plateau at 14,000 a week,’” Sami recalls. “That’s where they think it will go up to. That is insane numbers … It just shows the strength of the brand in every part of the world.”

The story of Colonel Harland Sanders selling fried chicken from a roadside restaurant in Corbin, Kentucky, is a well-worn piece of American fabric. At age 65, he began franchising with a $105 monthly Social Security check and opened the first partner unit in 1952 in Salt Lake City with Pete Harman. There isn’t another restaurant, or retail brand for that matter, as visually aligned and recognizable as the Colonel and KFC. Norman Rockwell even painted Sanders and his famed white suit in the early 1970s. The portrait hangs in the brand’s Louisville, Kentucky, museum that adjoins the threestory colonial style building known colloquially as the “White House.”

But in the 1960s is when KFC’s larger imprint took its first steps. It was one of the original U.S. quick-service chains to expand internationally as it headed to the U.K., Mexico, and Jamaica.

These days, Yum! CEO David Gibbs refers to KFC International as one of the company’s “twin growth engines” (the other is Taco Bell U.S.)

Some recent statistics feel like entire history books for many. In 2023, KFC International opened nearly 2,700 new restaurants (2,682 to be exact, alongside 415 closures), reaching 10 percent growth as units opened across 96 countries. That’s a location every 3.3 hours. If you tried to wedge that number onto a U.S. map, KFC’s global expansion last year alone would outsize the entire domestic footprints of Jimmy John’s, Jack in the Box, Panera Bread, and Panda Express, just to count a few.

The big milestone, however, arrived in January as KFC crossed the 30,000-unit mark with an opening in Rome, Italy.

When you dig in, Sami says, is when you really begin to decipher the tangible scale and potential of KFC. More than 80 percent of 2023’s growth stemmed from 14 publicly trade franchisees. Of the 30,000 venues counted to start 2024, about 22 percent were built in the past three and a half years.

Again, fitting that into America’s fast-food landscape, those 6,600 or so locations would be good enough to represent the U.S.’s eighth-largest restaurant brand, behind Domino’s and a tick ahead of Pizza Hut.

Sami says KFC should be in 150 countries by the end of this year. KFC Global chief development officer, Nivera Wallani, adds the 22 percent stat, in particular, is one that illustrates the tailwinds in KFC’s global business. Not only did the brand open all those restaurants, but it upgraded or renovates somewhere in the range of 4,000–5,000 per year.

India, Thailand, Africa, and Central and Eastern Europe all hit 1,000 during that stretch. Mexico is up to 500. Turkey 300.

East/ Turkey/ North Africa: 6

2 %

What’s worth noting as well is 3,791 of KFC’s 29,900 restaurants at yearend 2023 were in the U.S. That domestic arm opened 34 locations and closed 161 as it continues a “Re-Colonelization” campaign that began in 2016 and centers on returning KFC to its quality roots, while also evolving its asset base toward Next Gen builds.

SYSTEM SALES

China: 20 %

U.S.: 2 %

Europe: excluding U.K. 17 %

Asia: 8 %

Australia: 9 %

Latin America: 17 %

U.K: 6 %

Middle East/ Turkey/ North Africa: 21 %

Africa: 15 %

Thailand: 13 %

Canada: 7 %

India: 19%

In India, to microscope one example, KFC eclipsed that four-digit figure with Devyani International Limited, a Yum! partner for more than two decades. It took the brand nearly 25 years to build its first 500 locations there. The next 500 arrived in less than five. And to spotlight how much whitespace remains, India accounted for 2 percent of KFC’s total system sales last year, which counted $33.9 billion, with same-store sales growth of 7 percent versus 2022. Internationally, KFC’s comps lifted 9 percent in 2023 while the U.S. rose 2 percent. System sales hiked 14 and 2 percent, respectively. The ultimate picture: A pathway to 50,000 global KFCs long-term.

“It’s something we’re very proud of,” Sami says of reaching 30,000 restaurants. “Our consistency as a global brand and being in the corporate world for over 50 years, we clearly have a model that works. And it works because of the great partnerships we have with franchisees around the world. Many of our franchisees are second- or thirdgeneration types of franchisees who understand what this business is all about.”

Additionally, he notes, KFC’s growth remains fueled by the reality it’s creating wealth for operators and careers for employees. Building north of 8,000 restaurants in the past five years allowed KFC to bring in 200,000 team members, “which is a staggering stat in itself,” Wallani says. 2023

“So over the past three years, we are the fastest-growing retail brand in the world,” she explains. “And we expect to go ever faster.”

The equation for KFC Global drops into three buckets: strategy, model, and localization. That latter point, as you’d imagine, keeps management busy given the breadth of the chain’s reach. KFC’s localization, Sami says, gets down to the trade zone, not just the country. That’s one of the main reasons it works.

In Latin America last year, KFC targeted new consumers and dayparts using value offers. It also expanded nuggets. Africa boosted breakfast with fresh beverages, including signature coffees. Thailand bumped transaction growth with value offerings across all dayparts.

You can travel the globe and find KFCs that serve shawarma ( Romania), Wraps, Twisters, even Poke Bowls. The spice levels don’t stagnate, either.

“If you travel to Africa, Asia, Europe, South America, Australia, U.K., you'll see the strength of the brand,” Sami says. “And not just in terms of assets, but the consumer loyalty and affinity for the brand as well.”

Wallani adds fried chicken as a category is one of the fastest growing globally in terms of consumption. According to a

report by Market Research Future, the worldwide takeout fried chicken market was valued at $6.85 billion in 2023. It’s estimated to scale at a compound annual growth rate of 5.5 percent from 2023 to 2032 and reach a valuation of $10.5 billion.

That’s just takeout.

“Whether it’s bone-in chicken or boneless chicken, I mean, that’s what we do. That’s in our DNA,” Wallani says. “That’s what we’ve done for a really long time.”

Wallani says KFC searches for some critical traits in global partners to guard that standing. No. 1, passion and commitment to grow the brand, “We’re not only a chicken business, but we’re a people business as well,” she says.

The second is capability. That means experience in hospitality or foodservice so KFC can rest assured restaurants are run by world-class operators “every single time,” Wallani notes. And lastly, while not unique to KFC’s model by any means, it does pulse here given the big picture. The brand seeks operators with capital to invest in KFC and drive that growth engine.

Speaking of that, though, a perhaps understated part of KFC’s journey circles back to what’s happened more recently. Wallani says KFC views units through an “80/20 rule.”

“When you consider restaurant design, menu, digital, what

we try to do is keep a larger portion of that core to what works for the brand,” she says. “Because we’ve been doing this for many decades. And then, we localize and tweak a little bit for what’s relevant in every business unit or market, or as Sabir said, each particular trade zone.”

In other terms, KFC balances its DNA with a modern tilt, as well as adjusting market-to-market to address local consumer needs.

It’s not only about having franchise partners, but also getting scale to drive KFC’s economic model. “I think the challenge is you need to start planting the seeds and it takes time for the business to get scale and get growth. … Patience is working with local

partners and investing for the long run,” Sami says. “Then once you start getting scale, then I think businesses take off in every single market. We are successful in almost every market we go into.” KFC’s model can look a bit different based on CapEx trade zone to trade zone, from the volume of transactions to cost of commodities. One thing KFC and Pizza Hut boast is marketing-mapping data. Taco Bell International, Yum! announced in Q4, was planning to temporarily slow growth so it could stabilize comps in emerging markets and partner with franchisees to optimize site selection, leveraging the tool KFC and Pizza Hut deploy.

Wallani says market mapping helps identify potential growth, what the brand calls either “whitespace” or “info opportunities.”

“What this data-driven market mapping does, and you can just imagine the volumes of data that go in, whether it’s demographics, competitors, growth expectations, mobile data, anything that you can think of goes into this box and what it spits out is quite amazing,” she says.

Here’s where it evolves: This system doesn’t merely show KFC where to expand—it clarifies the type of asset the company should build for that trade zone; it pieces the jigsaw of Yum!’s innovation engine together.

“So we’re not only building an asset for the guest,” Wallani says, “but also optimizing that asset for our franchisee.”

KFC is one of the global leaders in this category. There is no cookie-cutter box. There are urban inlines, double drive-thrus, stores that fit into stone arches, and a One Bangkok flagship that’s going to be massive in scale and serve a tidal of visitors.

The 30,000th store that opened in Rome showcases doublesided kiosks and digital menu boards.

KFC Latin America markets recently began the rollout of kiosks using Yum!’s proprietary Tictuk platform (it acquired the Tel Aviv-based business in 2021) and plans to triple the restaurant count in 2024. “That’s the way we look at it,” Wallani says. “What’s the occasion? And then what is the right asset to go after that location?”

“

I think the challenge is you need to start planting the seeds and it takes time for the business to get scale and get growth. … Patience is working with local partners and investing for the long run.

”

“It is easy to think of a restaurant as the four walls of the restaurant,” she adds. “And that’s not necessarily a bad thing— that’s where everything happens. But if you start to think about the restaurant as the center of the brand experience, where everything comes to life in the restaurant, it really gives our development team and our development engine the opportunity to work cross functionally across our brand and to accelerate our global strategy, of which development plays a role.”

The occasion for KFC changes globally. Of course, one of the most recognizable reflections is Japan’s Christmas affinity. KFC entered that market in the 1970s. In 1974, it launched the first KFC Christmas campaign, selling a bucket of fried chicken along with a bottle of wine. The original idea came when a foreign customer who visited KFC in Tokyo on Christmas said, “I can’t get turkey in Japan, so I have no choice but to celebrate Christmas with Kentucky Fried Chicken.” A local employee overheard the remark and used it as inspiration to launch the project and the tagline, “Kentucky for Christmas.”

Today, you’ll see Colonel statues dressed in Santa attire and Christmas-exclusive menu items like premium roast chicken

“

“R.E.D.”

for KFC Global boils down to

“making the brand easily accessible and then distinctly KFC. ”

that’s hand-prepared and stuffed with cheese and mushrooms. Preorders and reservations can begin as early as late October.

Sami says KFC’s agility, from assets to menu, hasn’t taken a day off. In markets like the U.K., Middle East, and India, it’s a chicken-on-the-bone business. Move to other parts of Europe and sandwiches, strips, tenders, and boneless offerings dominate.

In Australia, the U.K., and North America, drive-thru, and eating while driving overall, is a big phenomenon. Other areas, like India, don’t have many drive-thrus since a good portion of the population don’t drive and the traffic is so congested sites simply aren’t big enough to develop them. So those tend to be more in-line hotspots where guests dine-in and enjoy the environment.

“There are many variations of the menu, the design, the team members who work for our stores, the franchisees, each of them has adapted to the local market,” Sami says. “The look and the feel of the brand is very similar, it’s still the KFC marketing elements in terms of the Colonel, the three stripes, the ‘Finger Lickin’ Good’ slogan, the colors are the same as well, the bucket is also very, very familiar in many markets as well.”

Whether it’s assets or message, KFC Global operates within the “R.E.D.” framework Yum! uses broadly to support a scalable model. It’s defined as a brand that must have something

that is particularly Relevant ( R ) to a consumer need; that is Easy to get ( E); and that stands out as Distinctive in the consumer’s mind ( D).

There’s an old story of how KFC in South Africa used this guideline to reinvigorate sliding sales. KFC is about five times or so the size of McDonald’s there. About 10 million South Africans reported eating at KFC at least once in the past four weeks, according to a study by Eighty20.

Yet it endured a prolonged dip Yum! couldn’t quite crack. So the company sent CMO Ken Muench and another strategist over for a few weeks. They dug into culture. Checked out competitors. Sat in consumers’ homes for hours each day. Talked to local professors and artists. What the duo concluded was KFC worked when South Africa’s “Rainbow Nation” movement emerged in a post-apartheid era. The brand’s family position, buckets, and marketing around togetherness helped it capture a broader spirit. And sales exploded. But a new generation ushered in a mindset of individual goal chasing.

That learning inspired a repositioning around “independent success,” and speaking to a fresh core of customers. It’s been a rocketship since.

Wallani says “R.E.D.” for KFC Global boils down to “making the brand easily accessible and then distinctly KFC.”

“What also makes us really unique is the relationship we have with our franchisees and the culture that we built across

our organization,” she says. “I would expect if you experienced it, it would feel very different and unique than other brands in our history.”

Sami agrees. Operating in so many countries attracts a plethora of voices, up and down the ladder. “The diversity of teams, franchisees, and employees that we have around the world makes us a really unique place to work,” he says. “… I was recently in Africa, Kenya, and South Africa, the sheer talent of people that we have and the passion for the brand in stores as well as the consumers, it fills your heart with pleasure and pride in the way we operate in those markets.”

Internally, about four years ago, Yum! decided to ratchet up

its diversity and inclusion efforts when it came to staffing. Why was it when you visited KFC stores the majority of team members were women, but when you looked at above-restaurant leadership, they weren’t? Or why, in the U.K., most area coaches were Asian, yet not above that tier? “That just provoked the question to say, ‘Hey, wait a minute, there’s clearly some invisible barriers,’” Sami says. “I love the last two to three years we’ve started challenging some of these other paradigms and started unlocking opportunities for people, whether they’re women, people of color, people of minorities or disabilities, or other discrimination factors.”

KFC announced in March it achieved parity between women and men globally across its corporate offices, with women now constituting 51 percent of the collective team.

In terms of what’s next, there aren’t many constraints. Wallani says those 20,000 additional opportunities en route to 50,000 will cover everything from infilling markets like Australia and the U.K. to tackling runway in sub-Saharan Africa. “I would expect that instead of seeing us slow down, you’re going to see us ramp up,” she says. As this unfolds, the brand will continue to lean into community involvement, Sami says. That’s been an anchor of KFC’s development over the decades. In South Africa, KFC runs an “Add Hope” program that feeds children who are less privileged. That’s been going on 15 years and is the largest corporate feeding program in the country. It’s given $54 million from KFC and customer donations since 2009. The locals know it well, he says. “[ It’s] seen as a brand that cares for the community,” Sami says. “It creates job opportunities. It creates educational opportunities. It creates wealth for franchise partners and our franchisees there are a part of the local communities. … Consumers see KFC in the holistic sense and say, ‘OK, this is a brand that does care and does the right thing.’”

Wallani adds KFC considers global scale a responsibility. “When it comes to our food, our planet, our people, we are making progress across each one of those to ensure that we are building with responsibility, with purpose, and that we’re not only using our strategy, which is our head and our tools, which is our hands, but we’re also using our hearts as we spread across the world,” she says.

When you welcome American Express® Cards, you have access to benefits, services and programs to help your business, including:

• Curated offers & discounts to help you get more out of your business.

• Solutions & tips to help attract new customers.

• Order free signs for your business that highlight inclusivity and community: AmericanExpress.com/signage/artistseries

65% HIGHER TRANSACTION SIZE

3X HIGHER SPEND 99% CARD ACCEPTANCE In 2022, annual spend of American Express® Card Members was, on average, 3X that of non-Card Members. 2 American Express can be accepted at 99% of places in the US that accept credit cards. 1 In 2022, the average transaction size of American Express Card Members was 65% higher than that of non-Card Members. 3 Scan the QR code for more information on resources for your business.

1. Based on the Feb 2023 Nilson Report.

2. Nilson Report #1,235, February 2023. Spend per card derived from U.S. year-end purchase volume divided by year-end cards in force (CIF), not from individual consumer-level data. CIF represents the number of cards issued and outstanding with cardholders. Average Non-American Express spend per card includes Visa, MasterCard and Discover credit and charge card card volume and CIF and excludes debit and prepaid volume and CIF.

3. Nilson Report #1,235, February 2023. Transaction Size derived from U.S. year-end purchase volume divided by year-end purchase transactions, not from individual consumer-level data. Average Non-American Express transaction size includes Visa, MasterCard and Discover credit and charge cards and excludes debit and prepaid volume and transactions.

Bojangles has been a fast-food mainstay in the Southeast for almost half a century, renowned for its delicious chicken and breakfast o erings. Over the past decade, the Bojangles team has made use of digital reader boards to help propel the brand into an era of unparalleled growth.

The impact of digital reader boards on Bojangles’ success cannot be overstated from a marketing perspective. These boards provide a dynamic platform for Bojangles to showcase its delectable offerings through stunning, high-resolution imagery, e ectively highlighting new promotions and limited-time o ers in a visually captivating manner. In a world where visuals speak volumes, these digital displays have emerged as a potent tool for attracting hungry customers and driving sales.

“Watchfire digital reader boards have revolutionized the way we engage with our customers,” says Toni Tolbert, marketing manager for Bojangles. “Locations equipped with these boards consistently experience a notable uptick in foot tra c, underscoring their indispensability in our marketing strategy. Wherever zoning permits, integrating these boards has become a unit standard for Bojangles.”

As Bojangles embarks on plans to open 50 new restaurants this year, digital reader boards serve as a pivotal conduit for conveying the brand story and showcasing its menu to fresh audiences. Whether announcing store openings, sharing recruitment messages, or capitalizing on cultural or community events, these digital reader boards o er instantaneous, real-time messaging capabilities that manual reader boards and traditional printed materials simply cannot replicate.

The partnership between Bojangles and Watchfire spans over a decade for some franchisees, with corporate locations embracing the

technology approximately five years ago. Since then, the use of cuttingedge digital reader boards in new and remodeled locations has become a hallmark of Bojangles’ commitment to innovation and customer engagement.

Beyond providing cutting-edge technology, Watchfire’s proprietary software, Ignite OPx, empowers Bojangles’ field marketing team and franchisees with real-time access to brand-approved content, ensuring consistency across locations and maximizing the digital reader boards’ e ectiveness. The overwhelmingly positive feedback from franchisees regarding the flexibility and user-friendliness of Watchfire’s software speaks volumes about the value of this partnership.

In addition to driving increased foot traffic and ensuring brand consistency, Bojangles attributes a significant portion of its rapid return on investment to the quality and durability of the digital reader boards.

“Not only do Watchfire digital reader boards set the industry standard, but the Watchfire team exemplifies excellence in customer service,” Tolbert says. “They possess an innate understanding of our brand, and their collaborative approach ensures that our messaging resonates with our audiences. They are truly an integral part of the Bojangles family, and we eagerly anticipate the future strides we will make together.”

Bojangles’ strategic and creative use of digital reader boards is a powerful fusion of cutting-edge technology and marketing prowess, propelling the brand to new heights of success in an ever-evolving industry landscape.

Increase your QSR’s foot traffic and boost sales by promoting new menu items, menu specials, and rewards program perks. Display eye-catching, dynamic brand-approved messages that uphold your QSR’s brand standards.

Maintain message flexibility with our Ignite OPx content management software. Ignite OPx allows users to program messages months in advance or make last-minute changes and streamline your sign messaging for one location or many.

Our reputation is built on your digital reader board looking and performing great, not just for one day but for its lifetime.

Known across the Southeast for its fried chicken and biscuits, Bojangles is looking to grow beyond its home turf and establish itself as a national player in one of fast food’s most crowded categories. The expansion strategy starts with a big change to the menu. While items like legs and wings still mix at a healthy rate in the brand’s legacy stores, all future new-market growth will feature a streamlined menu that doesn’t offer any bone-in products. Instead, the chain is leaning into its signature chicken sandwich and revamped tenders.

The category is still on fire, thanks to America’s ongoing obsession with its favorite protein.

“When you look at consumption patterns, boneless chicken is like a hockey stick on the graph,” says CEO Jose Armario. “So, we need to be where the consumer is.”

Bojangles is hardly alone on that front. Boneless items have been booming on menus since the so-called “chicken sandwich wars” broke out five years ago, but consumer preferences were already heading in that direction before the social media hype started. Bone-in brands largely stayed in their lane for years while boneless competitors like Chick-fil-A and Raising Cane’s reaped impressive gains. Then Popeyes introduced a chicken sandwich in 2019 that became a blockbuster hit, triggering an industry-wide trend toward more handheld, boneless poultry options.

Popeyes has been building on the sales layer with new variations of the viral product and the nationwide launch of chicken nuggets. KFC hopped on the sandwich bandwagon in 2021 and

added nuggets to the mix last year, selling 100 million of them in the first eight weeks. Many brands are finding success with similar strategies, tapping into the growing demand for boneless chicken to attract a younger demographic.

Wingstop CEO Michael Skipworth told investors earlier this year the company is seeing an influx of new customers, mostly Gen Z and millennials, who are “coming in through the chicken sandwich occasion initially.” Those newer, younger guests also tend to place larger orders and favor boneless wings, which now account for half of Wingstop’s sales.

“I can’t tell you how many people I’ve talked to over the last five years that have family members that have never bitten into a bone-in product,” Armario says. “We live in a world where a lot of Gen Z grew up with nuggets and tenders. That’s all they know. That’s where their comfort is.”

Along with matching current demand, boneless offerings are more efficient from an operational perspective, he adds. One major advantage is the expedited recovery time. Replenishing bone-in products can lead to lengthy delays, sometimes spanning 30 minutes or even an hour, but teams can bounce back in just a few minutes when they run out of tenders.

“When you look around at the brands that are winning, they’re the ones that have cut back on some of their offerings and really focused on quality,” Armario says. “There’s no question that if your menu is more condensed, and you’re focused on a few things and doing them really well, then you’re going to satisfy your customers more often by virtue of a happier team member.”

The company paired the streamlined menu with a new prototype. Key features include a dual-lane drive-thru with digital menu boards and a biscuit station where guests can watch items being prepared, plus an ergonomic kitchen to improve the back-of-house workflow. There’s fresh equipment like thawing

cabinets, daypart-specific holding zones, and induction cooktops that are programmed to ensure consistency. The stoves cut down on the number of steps involved and make for a better employee experience by lowering the average temperature in the kitchen.

“It’s about elevating our experience and elevating our level of consistency,” Armario says. “That requires us to be more thoughtful about how we can put the best of the Bojangles menu in front of today’s consumer in a way that allows us to execute at a higher level.”

Some of the world’s biggest chicken chains are using blue-

prints from their international operations to enhance their performance in the U.S. Executives at Yum! Brands say KFC’s success in selling boneless options domestically was influenced by strategies developed in global markets, which comprise 85 percent of its business. Leaders at Popeyes are actively studying global markets for best practices, using those insights to bring new kitchen equipment, streamlined procedures, and digital enhancements to stores in the U.S.

Church’s Texas Chicken also is using insights from international operations to improve execution across its domestic system. Namely, it’s working to consolidate multiple battering

systems for tenders, sandwiches, and bone-in products.

That’s one of several initiatives driving the brand’s resurgence under a largely new executive leadership team. Along with the focus on kitchen efficiency, the company is ramping up efforts to reimage existing restaurants under its Blaze concept, which features fresh design elements connected to its Texas roots. More than 100 stores have already received the update. CEO Joe Guith says the company is seeing a notable uptick in sales and traffic. Plans are underway for another 400 remodels over the next three years. Additionally, Church’s has increased visibility into its units through third-party audits and invested in improvements to the digital experience, transitioning to a new white label app and offering increased customization options.

also is gearing up to launch an updated digital experience that includes a loyalty program—something it hasn’t offered before. And there’s a lower-cost prototype rolling out this year that shaves 700 square feet from the traditional build. The compact design features new equipment geared toward efficiency and throughput as well as multiple points of ordering.

“ There was this aspirational notion of moving higherincome and getting guests that we didn’t have, but the reality is that because we weren’t executing very well, we were just alienating the guests who already loved us.

”

–CHURCH’S CEO JOE GUITH

Guith says momentum started surging throughout the business last year. Church’s surpassed $1 million AUVs in the U.S. for the first time in 2023. It also posted a threefold increase in the number of domestic new deal signings.

The most important factor driving the turnaround is a sharper focus on value. Easing commodity pressures and “a lot of work on the supply chain” helped with the pricing equation. More importantly, making accessible price points a key priority marked a return to the core strategy that has shaped the business for most of its 72-year history.

“Two-thirds of our guest bases are multicultural and they’re significantly lower-income relative to our primary competitors. We want to own that instead of running from it,” Guith says. “There was this aspirational notion of moving higher-income and getting guests that we didn’t have, but the reality is that because we weren’t executing very well, we were just alienating the guests who already loved us.”

He points to Church’s $2.99 two-piece and a biscuit meal. The bundle launched in 2022 as a limited-time offering but was extended throughout 2023 because it was so successful in driving transactions. It brought back individual meal occasions and helped the chain achieve its highest-ever traffic levels last year.

“Having that compelling price point is super important for our guests in particular,” Guith says. “It’s something we got away from over the last five years or so in chasing competition and trying to launch premium chicken sandwiches. We were trying to beat someone at their game versus playing our own game on boneless. That’s really where we needed to pivot.”

The chain is cooking up plans for new boneless items that align with the return to value, he adds. And while bonein chicken isn’t a “super growth category” like sandwiches, Church’s still sees plenty of upside to its core product.

Going forward, the company will focus on menu development that unlocks double or triple benefits. Take the new spicy platform as an example. Guith says it tastes better and eliminates another unnecessary battering system. The company

Church’s has been trimming its domestic footprint for the better part of a decade, but Guith believes it will have enough commitments to return to positive restaurant growth in under two years. Short-term, the company is targeting a 2-3 percent net unit growth run rate. Longer term, Guith says that could accelerate to 50 percent.

Other top players in the category are ramping up development. Popeyes anticipates adding 800 venues in the U.S. and Canada by 2028. Wingstop netted a record 255 new stores last year and is targeting even more in 2024. Raising Cane’s wants to double its footprint to 1,500 stores in the next few years. And while KFC’s domestic store count has been shrinking lately, it saw 2,300 international openings last year and surpassed 30,000 units worldwide earlier in 2024.

Plenty of smaller chains are plotting aggressive expansion, too. From growth-minded upstarts like Hot Chikn Kitchn and Red Chickz to emerging national brands like Slim Chickens and Chick’nCone, fast-casual concepts of all shapes and sizes are riding the wave of America’s ongoing obsession with its favorite protein. Some, like Huey Maggoo’s and Dave’s Hot Chicken, are finding success with menus that specialize in specific product formats or flavor profiles. Many boast robust development pipelines and ambitious plans for the future.

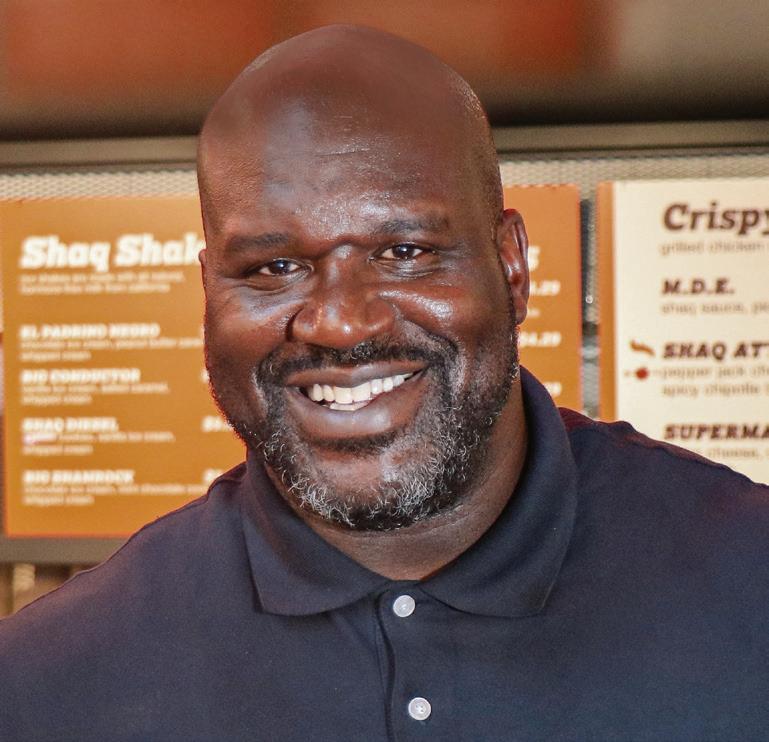

Take Big Chicken as an example. Cofounded by Shaquille O’Neal in 2018, the brand is approaching 40 units less than two years after getting into the franchising game. It also is gearing up for international expansion with plans to enter Central America, Canada, and the U.K. this year.

The chain’s flavor-forward menu offerings—think sandwiches topped with mac and cheese or jalapeño slaw—have helped it maintain a $24 per-person check average, even with inflation pushing more consumers to trade down or cut back on discretionary spending. Still, CEO Josh Halpern says there’s an imperative for everyone to maximize value, whether it’s dropping the price or giving guests more reasons to keep coming back.

Big Chicken is tackling the value equation in a couple of ways. It beefed up its tech stack with geofencing, digital advertising, and customer feedback capabilities to better understand and engage with guests. It also is gearing up to launch a loyalty program later this year. Those investments, along with a host of community engagement and consumer research projects, are all geared toward fostering more experiential and personalized interactions.

Designed specifically for QSR applications, the XL has a higher wash chamber, 50% faster cycle time, faster dry time, and delivers productivity and food safety at a lower total cost.

“We’ve also undertaken a rather large initiative to get food costs down without affecting quality,” Halpern says. “The key for us has been understanding what claims matter to the consumer and what they’re actually willing to pay more for. Do they understand and buy into claims about antibiotics or hormones? We really need to be able to justify why a franchisee is spending more on things like that to protect their unit-level economics.”