APRIL 2023 / NO. 302 ® EVOLVING QUICK SERVICE FOR THE FUTURE The Inflation Playbook P. 34 Dynamic Pricing: Myth or Magic? P. 40 PLUS: Shake Shack’s Katie Fogertey is leading the brand through its most transformative time yet.

/ P.24

Shaking Things Up

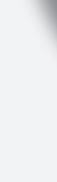

Ghirardelli Chocolate Company, 1111 139th Avenue, San Leandro, CA 94578 U.S.A. ©2023 Ghirardelli Chocolate Company Crafted with rich dutched cocoa and real milk powder, Dark Chocolate Chip Frappé Mix features premium chocolate chips perfected by Ghirardelli for an extra bold chocolate experience. Simply add your signature ingredients, blend and impress. Order your FREE samples at 800.877.9338 or professionalproducts@ghirardelli.com Bold FROM BEAN TO CHIP TO BEVERAGES GROW YOUR SALES WITH GHIRARDELLI BRAND POWER

SUCCESS WITH MULTI-UNIT FRANCHISE OPPORTUNITIES

BUILD NEW OR ACQUIRE EXISTING LOCATIONS

INVEST IN MODERN, FRESH FORWARD RESTAURANT DESIGNS

LEVERAGE MULTIPLE REVENUE STREAMS

ENGAGE WITH BRAND LEADERSHIP FOCUSED ON FRANCHISEE PROFITABILITY

12.5%

SAME SALES GROWTH

7.8% FULL SYSTEM GROWTH 2021

EXPAND YOUR PORTFOLIO AT SUBWAYFRANCHISE.COM

Say ¡ Hola! To Your Menu’s New Favorite

The #1 fastest growing snack is now available for your menu! ¡Hola! Churros™ are a delicious, easy-to-prep choice that adds creativity to your menu with all the versatility and customization you look for in delectable desserts. Wondering what you could create with ¡Hola! Churros?

Scan the QR code or visit our website at Churros.com/ideas-guide to find out!

D E PARTM E NTS

20

FRANCHISE FORWARD

Lessons from a Young Operator

How a rising Inspire Brands franchisee is changing the game. BY CALLIE EVERGREEN

67

OPERATIONS

The Real Price of Real Estate

While there’s space to grow on the backend of COVID, doing so can come at a cost. BY BARNEY WOLF

FRESH IDEAS

The Great Value Proposition

Offering consumers more for less is an easy way to bring them through your doors.

BY AMANDA BALTAZAR

18

ONES TO WATCH

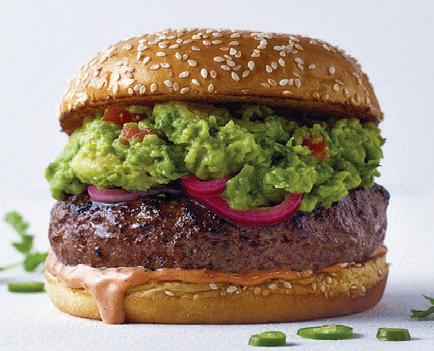

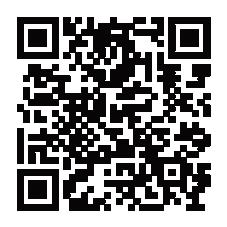

Killer Burger

The growing franchise stands apart using party vibes and creative signature burgers. BY BEN COLEY

69

OUTSIDE INSIGHTS

The Design of Inflation

Menus are hardly free and clear of the impact. Here’s where to start. BY TOM COOK

88

START TO FINISH

Jane Abell Grote

As Donatos continues to innovate, its philanthropy has followed suit.

April O N TH E COVE R Katie Fogertey

on innovation

Shack

ahead.

LIZ EIDELMAN N E WS

has her sights set

as Shake

surges

PHOTOGRAPHY:

I N S I G HT

13

QSR / LIMITED-SERVICE, UNLIMITED POSSIBILITIES TA B L E O F C O N T E N T S A P R I L 2 0 2 3 # 3 0 2 FE ATU R E S LIZ EIDELMAN 4 BRANDED CONTENT 4 EDITOR’S LETTER 9 SHORT ORDER 71 ADVERTISER INDEX 34 Shortages, Supply, and Relief BY CALLIE EVERGREEN Operators are clamoring to cut expenses through value engineering menu items, leveraging supplier relationships, and more. 40 The What, Why, and Where of Dynamic Pricing BY SHERRI KIMES A suddenly buzzing topic brings forth plenty of debate, but also no shortage of opportunity. QSR is a registered trademark of WTWH Media, LLC. QSR is copyright © 2023 WTWH Media, LLC. All rights reserved. The opinions of columnists are their own. Publication of their writing does not imply endorsement by WTWH Media, LLC. Subscriptions (919) 945-0704. www.qsrmagazine.com/subscribe. QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher. AAM member. All rights reserved. No part of this magazine may be reproduced in any fashion without the express written consent of WTWH Media, LLC. QSR (ISSN 1093-7994) is published monthly by WTWH Media, LLC, 1111 Superior Avenue Suite 2600, Cleveland, OH 44114. Periodicals postage paid at Cleveland, OH and at additional mailing offices. POSTMASTER: Send address changes to QSR, 101 Europa Drive, Suite 150, Chapel Hill, NC 27517-2380. 24/ KATIE FOGERTEY DIDN’T TAKE YOUR TYPICAL JOURNEY TO SHAKE SHACK’S C-SUITE. IT MIGHT JUST BE WHY THE CFO HAS MADE SUCH AN IMPACT DURING ONE OF THE MOST TRANSFORMATIVE TIMES IN BRAND HISTORY. plus: P.72 www.qsrmagazine.com | QSR | APRIL 2023 3

16

This Massive Korean Fried Chicken Concept is Catching Fire in the U.S. bb.q Chicken continues to grow rapidly across American markets. SPONSORED BY bb.q

THE FAST TRACK /

Tory Bartelt tbartelt@wtwhmedia.com GRAPHIC DESIGNER Erica Naftolowitz enaftolowitz@wtwhmedia.com PRODUCTION MANAGER Mitch Avery mavery@wtwhmedia.com

Greg Sanders gsanders@wtwhmedia.com

NATIONAL SALES DIRECTOR Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES MANAGER Edward Richards erichards@wtwhmedia.com 919-945-0714

NATIONAL SALES MANAGER Amber Dobsovic adobsovic@wtwhmedia.com 919-945-0712

NATIONAL SALES MANAGER John Krueger jkrueger@wtwhmedia.com 919-945-0728

SALES SUPPORT AND DIRECTORY SALES Tracy Doubts tdoubts@wtwhmedia.com 919-945-0704

F O U N D E R Webb C. Howell

A D M I N I S T R AT I O N 919-945-0704 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. who meet subscription criteria as set forth by the publisher.

R E P R I N T S

The YGS Group 800-290-5460 FAX: 717-825-2150 qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided to the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed at sponsoredcontent@qsrmagazine.com.

WTWH MEDIA LLC RETAIL, HOSPITALITY, AND FOOD GROUP

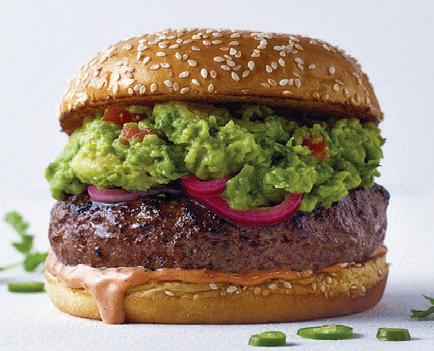

MENU ENGINEERING 4 Advantages of Using Hand-Scooped, Pitted Avocados Operators are digging this solution for several reasons. SPONSORED BY MEGAMEX FOODS BACK OF HOUSE The Printing Solution Helping Modern Kitchens Become More Efficient Thermal printing provides clearer, faster tickets. SPONSORED BY STAR MICRONICS DATA INSIGHTS Here’s the Story Behind This Brand’s 38 Percent Habitual Guest Rate Groucho’s Deli has seen positive outcomes with hyper-specific marketing. SPONSORED BY BIKKY ONLINE SEE THESE STORIES AT QSRMAGAZINE.COM/SPONSORED IN

ISSUE BRAND STORIES FROM QSR BRANDED CONTENT E D I T O R I A L EDITORIAL DIRECTOR Danny Klein dklein@wtwhmedia.com QSR EDITOR Ben Coley bcoley@wtwhmedia.com FSR EDITOR Callie Evergreen cevergreen@wtwhmedia.com ASSOCIATE EDITOR Sam Danley sdanley@wtwhmedia.com C U S T O M M E D I A S T U D I O DIRECTOR OF CUSTOM CONTENT Peggy Carouthers pcarouthers@wtwhmedia.com ASSOCIATE EDITOR, CUSTOM CONTENT Charlie

cpogacar@wtwhmedia.com ASSOCIATE EDITOR, CUSTOM CONTENT Kara Phelps kphelps@wtwhmedia.com A R T & P R O D U C T I O N ART DIRECTOR

S A L E S & B U S I N E S S D E V E L O P M E N T GROUP PUBLISHER

THIS

Pogacar

bb.q MEGAMEX FOODS STAR MICRONICS BIKKY 4 APRIL2023 | QSR | www.qsrmagazine.com SmartChain / p. 47 SmartChain New Options Tech and Data Engagement Key Players 64 Off-premises and drive-thru programs are changing quickly. ■ THE FAST TRACK

OFF-PREMISES

DRIVE-THRU PROGRAMS ARE CHANGING QUICKLY. 48 Expanding Off-Premises Options Operators are adapting to new guest behavior. 54 Better Tech, Better

New innovations are improving overall success.

to customer engagement?

the

of

and off-premises.

AND

Data

60 Engagement in Line What’s the best approach

64 Key Players Here are the biggest names in

world

drive thru

Our mission is to ignite and nourish flavorful experiences, invigorate great brands, and supercharge their long-term growth. And we need passionate franchisees to do it. Learn more about franchise opportunities at inspirebrands.com/franchising A Restaurant Company Unlike Any Other. $30B+ in Global System Sales 2nd Largest Restaurant Company in the U.S. 70 Countries 32,000 Restaurants 650,000+ Company and Franchise Team Members 3,400+ Franchisees

Restart the Connection

Afew weeks back, I made the (maybe ill-advised) decision to share two charts on social media. Both were maps of America you often see where each state gets highlighted by a winner. In this case, a breakdown of which casual-dining chain was America’s favorite, marketby-market. That one stirred light-hearted debate. But then, came the fast-food one. Comment after comment everyone disagreed—except for In-N-Out in California—with roughly 97 percent of people informing me I was personally off-base, despite a disclaimer I had no stake in this data. “There’s no chance Chick-fil-A doesn’t win Georgia!” “How can Whataburger not reign in Texas!” And on it went. Ultimately, I deleted the post to save some shred of sanity after somebody suggested that, even for an exsportswriter, I should of known better.

Once that combative dust settled, though, I think you’re left with some important takeaways. For one, as somebody told me years ago, fast food is the heartbeat of the American consumer, and you can’t tell me otherwise. But it is interesting to watch how regional bias has evolved as scale has. It’s one reason I’m not sure In-N-Out or White Castle will ever try to become truly national. There’s upside in exclusivity. Or why a brand like Whataburger can be so well received in Florida (a state the chart claimed it won) as demographic migration connects markets. Are younger consumers as tied to brands as older ones were? In other words, many of us, at least in my generation, favored restaurant chains our parents brought us to as we grew up. Yet will we now take our children there? I’m not sure it’s so simple. This was a topic that came up recently

when I was chatting with Duncan Smith, the U.S. CEO of Journey Further, a brand agency working alongside Sizzler on revamping its media. It’s a story this industry has witnessed on repeat. Sizzler was a 700-unit-plus brand globally. There’s now about 73 in the U.S. When it arrived in the late 1950s, this accessible and affordable service model was a trailblazer that drew a roadmap competitors would follow for decades. However, these same markets and communities the chain planted flags in changed around Sizzler faster than Sizzler could adapt. Everything from the makeup of local diners to how they access information (and restaurants) And so, the task of taking Sizzler from memory bank, “our parents took us here when we were kids” to action—“and now I’ll take my kids here, too” is a multifaceted journey a lot of legacy chains find themselves on. The good news is the industry has more connective tissue than ever. We’re well past just broadcast TV, radio, posters, and placing coupons in the mailbox—not that these don’t still work. But the ability now to find and speak to guests where they are is broader than even pre-COVID days. And the channels are more accountable. Digital media can tailor toward users, and restaurants have the power to tap CRM for things like reorders, one-toone offers, and really the ability to anticipate when people are going to want to connect and, in turn, data to capitalize on that moment. For generations old and new, familiar and discovery, it’s a chance to bring them all in.

Danny Klein, Editorial Director

ROSIE

Brand loyalty is hardly dead. Yet activating it might need a second look.

ROSENBROCK

DKLEIN@WTWHMEDIA.COM QSR MAGAZINE 6 APRIL2023 | QSR | www.qsrmagazine.com EDITOR’S LETTER

Packaging That Delivers Repeat Business

Protecting Meal Quality Brings Customers Back for More

PROTECT TEMPERATURE & TEXTURE TO DELIVER THE BEST TASTE

Cross-flow ventilation protects taste by maintaining temperature and texture for up to 30 Minutes.

SERVE APPEALING PRESENTATION, EVEN OFF-PREMISE

Durable & stackable single and multi-compartment table-ready designs, so meals arrive looking great.

INCREASE PROFIT BY REDUCING

ORDER ERRORS

Clear, anti-fog lids help the kitchen avoid order errors without opening the packages and releasing heat.

PROTECT FOOD, SERVE SUSTAINABLY

Protecting food quality reduces food waste. Reusable, microwave & dishwasher safe, and recyclable after use.

TEST & TASTE THE CRISP FOOD DIFFERENCE FOR YOURSELF

CRISP FOOD TECHNOLOGIES® CONTAINERS ©2023 Anchor Packaging® LLC - St. Louis, Missouri

anchorpac.com

REQUEST FREE SAMPLES

SHORT ORDER

For Sheel Mohnot and Amruta Godbole, one of their first dates took place over a romantic beachfront meal at Taco Bell’s famed Pacifica location.

Vows in the Metaverse

LIFELONG TACO BELL CUSTOMERS Sheel Mohnot and Amruta Godbole said “I do” in late February with an out-of-this-realm wedding celebration in “Decentraland,” a 3D browser-based platform that allows for shared virtual exploration.

Winning out over 300 couples who applied to win the Taco Bell metaverse wedding of their dreams, Sheel, a co-founder of Better Tomorrow Ventures, a venture capital firm and Amruta, a lawyer at Instagram, worked closely with Taco Bell and their partners to plan an other-worldly event.

Organizing a wedding in the metaverse allowed for the maximum level of creativity and customization to authentically tailor the event to the couple, Taco Bell said. This included a special “Master of Ceremonies” to facilitate the wedding. Kal Penn, an American actor who shares the couple’s Indian heritage, joined in.

TACO BELL (4) www.qsrmagazine.com | QSR | APRIL 2023 9

Taco Bells were ringing for one lucky couple.

As of Q1 2022, Starbucks had more than $3.3 billion loaded onto “Starbucks Cards” across the U.S,exceeding a company record.

In fact, the java giant’s gifting business was so strong the unit sales of Starbucks Cards were greater than the next four brands of gift cards combined, executives said.

Paytronix recently released its Restaurant Gift Card Report: 2023, which found restaurants have moved on from the pandemic, yet still face challenges thanks to inflation. Those changes a ect both how operators sell cards and how consumers purchase them.

The Big Point:

In 2022, dollars spent on gift cards rose 6 percent over 2021, a high-water mark for gift card value. But, the overall number of gift cards sold fell.

Why? People loaded on more value, choosing more cards of over $25 and fewer that are under $10. Consumers also showed a preference for digital gift cards, not only by purchasing more, but loading them with higher values than on their physical counterparts.

It’s Not Just About Guests

Restaurant marketers are targeting this behavior, too. “Brands themselves may be influencing the trend of higher-value cards by only selling higher-value cards or by making lower value cards less available,” Lynch adds.

The Analysis:

“Gift card purchasing appears to mirror that of loyalty guests. Our research shows that loyalty guests’ checks match inflation. From the beginning of 2020 to the present day, restaurant loyalty guest check size grew in tandem with menu prices,” says Kirstin Lynch, Paytronix’s strategy and analytics director.

Other Findings:

Average dollars loaded per gift card increased 8 percent from 2021.

Digital cards outperformed physical cards in terms of value, with the average digital card loaded $82 more at a fine-dining establishment than a comparable physical card.

Third-party retail sales grew, while in-store sales dropped, indicating a channel shift.

A Final Point

Card sales also showed a shift toward full-service restaurants, with that segment showing significant growth, even as quick-serves, the segment that best weathered the pandemic, showed a 5 percent drop in revenue. This trend was particularly apparent for fine-dining restaurants.

“Fine-dining gift card sales have not only recovered completely from the pandemic, they’ve also been the only concept to see an increase over 2019 numbers. This indicates a channel shift in consumer preferences—as guests emerge from the pandemic, they prefer to gift experiences at fine-dining establishments,” Lynch says.

ADOBE STOCK: STARBUCKS GIFT CARD / ILZELUCEROPHOTO, INCREASES DOLLARS ICONS-STUDIO, RECEIPT ICON LOVEMASK, DIGITAL CARD BLANKSTOCK, CHEF ICON YURII, EXPENSIVE ICON / ICONS-STUDIO

10 APRIL2023 | QSR | www.qsrmagazine.com SHORT ORDER

Your world is complicated. Weˇre helpingsimplifry it.

In the restaurant world there’s never a dull moment, which means you rarely get a free moment. So when it comes to finding the perfect fry for your guests, we’ve helped make it a little easier. In fact, we’ve reorganized our entire portfolio with you in mind and simplified it, so you can quickly and intuitively navigate by category or style. And whether you have a specific guest need or operational need, you can easily find the perfect potatoes.

Your world is complicated—weˇre here to help simplifry it.

© 2023 Lamb Weston, Inc. All rights reserved. See for yourself at go.lambweston.com/simplifry

The Great Value Proposition

Offering

Higher prices or shakiness of the economy notwithstanding, people still have to eat. But quick-serve and fast-casual restaurants have had to rethink the definition of “value" against the ever-evolving backdrop.

“Both guests and restaurateurs alike are price sensitive at this moment, so everyone is looking to create and communicate value, and bundled or value meals make that possible,” says Sean Willard, a menu engineering specialist in San Diego, California.

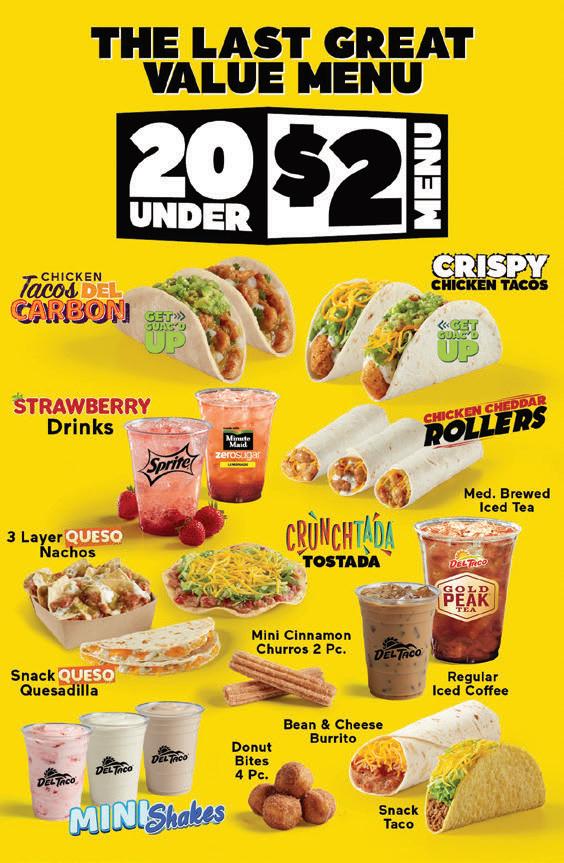

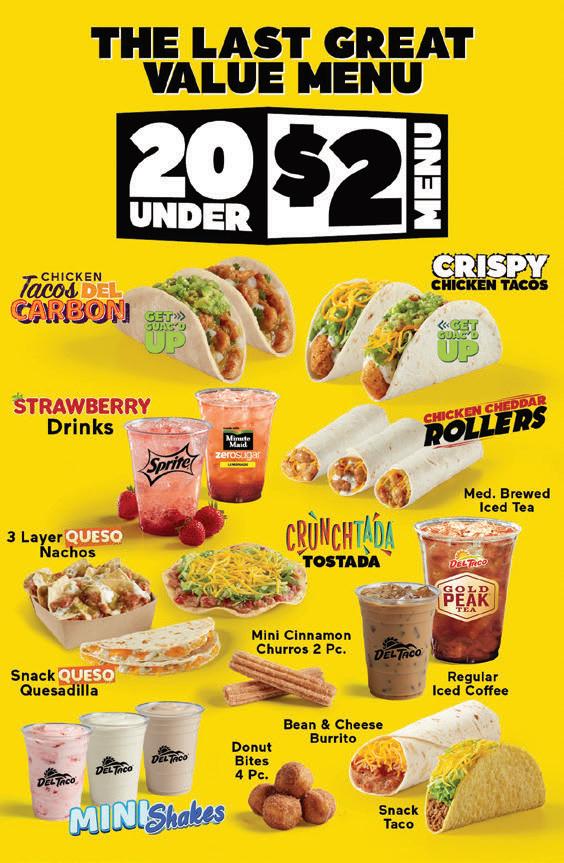

Del Taco is one brand that welcomed 2023 by offering more value. Every day in January, the brand presented a “20 under $2” menu, featuring items like Chicken Tacos Del Carbon and 3

BY AMANDA BALTAZAR

BY AMANDA BALTAZAR

Layer Queso Nachos. And in case that wasn’t enough, the 600unit chain also offered a free item from that menu to any of its Del Yeah! Rewards members with a $3 purchase through its app, which helps encourage consumers to sign up.

“We know when inflation is coming and we saw this and said here’s a really great opportunity for us,” chief marketing officer Tim Hackbardt says.

While historic value menus focused on the $1 mark, Del Taco decided to make its slightly more expensive “to offer products with a little more flavor or were a little more interesting,” Hackbardt says. “We know consumers tend to think value menus are less exciting menu items.”

MENDOCINO FARMS

| V A L U E M E N U S R E I M A G I N E D |

Mendocino Farms has introduced group deals to entice at-home diners.

freshideas

consumers more for less is an easy way to bring them through your doors

www.qsrmagazine.com | QSR | APRIL 2023 13

Along with food choices, Del Taco displayed iced drinks, mini shakes, and dessert items like churros. “We knew if you could deliver variety for the consumer, they liked it. What they didn’t like was a value menu with just a couple of items. They would frequent a brand with variety and decent quality much more often,” Hackbardt says.

Del Taco’s 20 for $2 menu has a very high take rate, he says. “It’s a good portion of our menu so we know it’s popular. This also works well to make the brand more appealing for your meal occasion. And it’s interesting because every time you come in you can pick something different off this menu.”

Subscription drops

Urban Plates also decided to start 2023 with a value bang, upgrading its signature Plate Pass program to include more savings on additional menu items. The program offers 20 percent off a guest’s entire check; it includes purchases made on the company’s app and at the cash register; and the new subscription price was sliced in half, to $5 a month.

“People are cutting back. And we want to make Urban Plates an easy choice; we don’t want them to feel they have to cut back on our food,” says Steve Greer, the fast casual’s chief marketing officer. “It’s better that they come with a discount than they don’t come.”

To raise awareness, Urban Plates relied heavily on in-store signage. Customers can make back the $5 subscription cost in one trip if they’re buying more than two entrees, Greer explains.

And it’s easy to sign up new members in the store—they can join while buying a meal and start saving immediately.

Information on the program is also disseminated on social media. “We want it to be across the brand story,” Greer says.

The specials are not valid for delivery due to the hefty commissions third-party companies charge. “It would be really hard and not financially feasible to make Plate Pass available for delivery,” he adds.

Focus on large orders

Other restaurant operators are focusing on offering value to larger groups.

“Offering complete meals including side dishes, bread, beverages, and dessert for a fixed price is extremely appealing,” says Arlene Spiegel, a restaurant consultant in New York City. “It also helps the homemaker feel less guilty for not cooking from scratch

while providing a home cooked-style meal for the household.”

These meals are beneficial for operators, too, she adds. “Large orders have a higher ticket average than single-serve. With the curation of a fixed-price menu, with limited choices, operators can control and predict their food costs and associated delivery fees.”

Fazoli’s is focusing its value menu toward family bundles, notes Tisha Bartlett, its vice president of marketing.

“Bundles are a great value but we also have a la carte so they can add pasta or a salad which are great for add-ons,” she says. The most popular offering is the Super Family Meal ($30), which serves eight people and includes two pasta dishes, a pizza, lemonade or tea, and breadsticks. “That’s a differentiator for us,” she says. “Most [quick-service restaurants] serve four. Ours is a hearty meal plus leftovers. And we do have different levels so they can pick and choose what they want.” The biggest one is Super Family Meal that serves eight.

Family meals are 6–7 percent of Fazoli’s menu mix, so it makes sense to offer something that caters to this group.

Mendocino Farms rolled out group order deals starting on Super Bowl Sunday, which offered 25 percent off catering orders of $100 or more.

“Super Bowl Sunday is not a big day for us but it is a big gathering day,” COO Steve Mintzer says. “But how do we get into their houses? Pre-COVID catering was a significant part of our business and during COVID it was zero but we’ve been climbing back into it. We have always been recognized for great value so how do we get people to think of Mendocino Farms when they’re outside the restaurant?”

As an added plus, Mintzer says, catering consumers often convert to in-store guests.

Mendocino Farms is featuring something for individual orders, too, menuing the reformulated Countryside Cobb Salad for $8 (normally $13.95) to its My Mendo members. “It’s important right now for people to focus on value and we wanted to surprise and delight our My Mendo members,” Mintzer says.

The company is promoting both of its value offerings on social media, with some in-store signage. It also sends out email blasts to My Mendo members, which, Mintzer says, “is our way to stay connected.” q

DEL TACO, URBAN PLATES, FAZOLI’S

| V A L U E M E N U S R E I M A G I N E D |

Amanda Baltazar is a regular contributor to QSR and is based in Washington.

14 APRIL2023 | QSR | www.qsrmagazine.com freshideas

Del Taco (above), Urban Plates (middle), and Fazoli’s continue to engage customers through multi-faceted value—not just price.

On-the-go flavor.

Texas Pete ® is taking its flavor on the road with convenient, easyto-enjoy portion control packets! Whether it’s a Texas Pete ® dip cup or sauce packet, your customers will be able to enjoy bold flavor for a better on-the-go dining experience—anywhere, at any time. Ask your broker for the #1 portion control hot sauce and request a free sample today!

TO REQUEST A SAMPLE SCAN HERE ©2023 Texas Pete® and Sauce Like You Mean It® are registered trademarks of TW Garner Food Company. 1007-121222

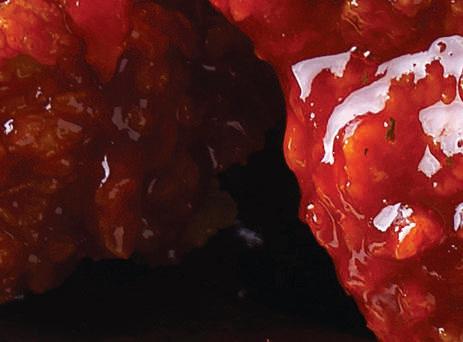

This Massive Korean Fried Chicken Concept is Catching Fire in the U.S.

/ BY CHARLIE POGACAR

South Korean-based franchise bb.q Chicken

is widely known on an international level. Now, the brand is making a name for itself in the U.S., too. The Korean Fried Chicken brand has over 3,500 locations across 57 countries worldwide and has grown to 160 stateside locations.

The brand has forged a unique identity by leaning into its authenticity. At bb.q (pronounced bee-bee-que), marinades arrive directly from Seoul. All recipes, processes, and ingredients are exactly the same in the U.S. as they are in South Korea, which means the food eaten at a local bb.q in the U.S. tastes exactly the same as it does in Seoul.

“Our brand is authentic as it gets,” says bb.q Chicken USA CEO Hyongbong Kim. “We don’t try to ‘Americanize’ our food in the way other international brands do. We stay true to our Korean traditions because we want the dining experience to be as consistent and authentic as possible.”

The menu boasts fried chicken marinated in a unique blend of spices, fried in a way that makes it lighter, less greasy, and crispier than other fried-chicken alternatives. bb.q customers can choose to have their chicken tossed in an array of bold signature sauces, o ering a great degree of customization. Other menu favorites include tteokbokki and kimchi fried rice.

The brand has four different service models with something for every type of consumer—or franchisee. The original and core concept is bb.q Chicken Express, which focuses on takeout and delivery channels. This model has floor plans between 1,000–1,500 square feet, making it ideal for urban areas.

The bb.q Chicken & Beer full-service model has floor plans that range from 2,500–5,000 square feet. Customers can order chicken and other Korean food, as well as drinks from a full bar. Also a full-service model, the bb.q Chicken Cafe o ers beer and the entire menu, with layouts ranging from 1,500–5,000 square feet.

The brand’s newest model is the tech-forward bb.q Smart Kitchen (bsk), o ering electronic ordering and carryout orders fulfilled using

touchless lockers. BSK locations can be built into spaces as small as 800 square feet and require only a handful of employees per shift.

“The new BSK concept will be perfect for high-density areas where square footage is more expensive but foot traffic is high,” Kim says. “It’s a streamlined way of doing things, allowing for faster service and helping sta focus on fulfilling orders instead of managing the takeout counter.”

The Korean brand is looking for franchisees to incrementally grow a portfolio. “We hope franchisees start with a location in a metro area and then grow to two, three, or more locations after each successful launch,” Kim says. “We are interested in working with all franchisee types—from those who are deeply experienced to those who are new to restaurant franchising.”

Those interested can look for the bb.q Chicken booth at both the Multi-Unit Franchising Conference in Las Vegas in late April, as well as the International Franchise Expo in New York in early June. ◗

bb.q (2)

Interested in franchising with bb.q? Visit franchise.bbqchicken.com.

SPONSORED BY bb.q

16 APRIL 2023 | QSR | www.qsrmagazine.com

“Our brand is authentic as it gets.”

FOUNDERS: TJ Southard

HEADQUARTERS: Portland, Oregon

YEAR STARTED: 2010

ANNUAL SALES: $21.96M, 2023 system sales projected at $26M

TOTAL UNITS 20

FRANCHISED UNITS: 8

Killer Burger

six openings, which would put Killer Burger at around 25 locations.

Additionally, this is the year of the chain’s first leadership summit since preCOVID. Dikos says the meeting is crucial for alignment purposes. Executives can discuss goals and meet inside restaurants, but nothing compares to getting an entire group together to digest the long-term roadmap. The highlight of the meeting is returning to hospitality, the CEO says. Pandemicforced circumstances pushed Killer Burger to be more of a digital business, but at its core, serving a customer face-to-face is in its DNA. The concept wants to elevate execution and develop team members so it can drive that point home to new and existing guests.

The momentum is already present. Same-store sales were positive to end 2022, and that continued into the early part of this year. Sanders expects high single digits to low double digits.

“It helps us get to a point of better financial stability and the ability to start growing organically a lot faster,” Sanders says.

FOR KILLER BURGER, 2022 SET UP THINGS TO COME in

the next five to seven years.

The fast casual significantly upgraded its tech stack, including a transition to Olo for online ordering and Paytronix for loyalty membership. It also switched its accounting software and began using a new real estate analytics tool for more predictable

growth. CEO John Dikos and vice president of finance Adam Sanders are fairly new to the brand as well, with Dikos joining in July 2021 and Sanders following in December of that same year.

“Across the board, everything’s been upgraded, so really putting all the systems in place and team in place to let us grow going forward and facilitate that growth,” Sanders says. “I mean financially it was a challenging year a little bit because of that, but I think a necessary step.”

After making those investments in systems and people, Dikos says 2023 is the year to start showing improvement in terms of efficient processes and unit economics. After jumping from 50 percent staffing levels to 80 percent and opening three restaurants in 2022, the goal is to double development to

Killer Burger is part of a swiftly growing fast-casual burger segment—one in which differentiation is table stakes. The box is typically 2,400 square feet, but the brand can dial that down to 1,500-1,800 square feet for its digital-centric, pickup locations with fewer tables and chairs. Although Killer Burger’s unit count is small, it’s already demonstrated success in multiple venues, including two locations in prominent professional sports facilities ( Moda Center and Providence Park), a freestanding unit with a drive-thru pickup window, and a handful in high-end suburban neighborhoods, urban locations, endcaps, and inlines.

One of the first things Dikos did when he joined Killer Burger was move to an architectural company

KILLER BURGER

B Y B E N C O L E Y DEPARTMENT ONES TO WATCH CONTINUED ON PAGE 70 18 APRIL2023 | QSR | www.qsrmagazine.com

The growing franchise stands apart using party vibes and creative signature burgers.

From doughnuts to cafes to fine dining, Nationwide® has the experience and expertise to insure a wide range of food-service businesses. We have an appetite for food services To learn more, scan the code with your smartphone or visit nationwide.com/restaurantprotection. Need help finding a local agent? Call us at 1-800-730-8347. Products are underwritten by Nationwide Mutual Insurance Company and affiliated companies, Columbus, Ohio, and are subject to underwriting guidelines, review and approval. Availability varies. Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide CMO-1814AO (02/23)

Lessons from a Young Operator

How a rising Inspire Brands franchisee is changing the game

very competitive segment. Typically, we see the ones that cannot staff delivery employees are the ones that don’t offer competitive wages.”

Though raising wages can be expensive upfront, having a higher percentage of delivery roles staffed allows restaurants to be able to handle a greater volume of delivery sales, versus having to shut off delivery because of staffing shortages, Fulton explains.

“People in this industry constantly highlight how tough staffing is, but is your franchise appealing to be employed at?” Fulton says. “I think people have to look in the back lens and look at their business and employees and say, ‘Would I want to have a job here? And what can I do to make it appealing from a benefits, from a life-balance perspective, and from a compensation perspective.’”

Fulton knew he had more to learn before becoming a franchisee himself, so he became a franchise operations consultant for Burger King’s parent company, Restaurant Brands International, in the U.S. southeastern division for 250 locations.

As a 24-year-old Jimmy John’s franchisee with eight restaurants and counting, Maxwell Fulton doesn’t want anyone to think he simply inherited his success. “Sometimes people think, ‘Oh it’s a young franchisee, he must have been handed this,’” he explains. But Fulton’s experience says otherwise.

When Fulton became a general manager at Taco Bell at 18 years old, he already had his career path mapped out. He knew he wanted to “be in this business and make something of myself” as a future franchise owner, and he knew he had to align himself with the right leaders to help get him there.

After joining Domino’s in 2020 as a district manager, Fulton quickly rose through the ranks and began running stores in the Washington, D.C. area as manager of corporate operations. There, he learned the important skill (alongside the rest of the restaurant industry) of managing staff during a global pandemic and subsequent tough labor market.

“[Concepts] in the pizza segment are some of the ones having the toughest time staffing delivery,” Fulton says. “A lot of it comes down to what kind of schedules and wages you can offer them, as it’s a

“From that point, taking that step into franchising is not as challenging as it seems, and I always had people who wanted to back me financially, who wanted to back restaurants but remain absentee,” he says.

While looking into opportunities towards the end of 2021, Fulton came across Jimmy John’s, which he saw a lot of potential in to grow across the East Coast.

“I wanted to join a concept that had a solid backing, and I liked it was owned by Inspire,” Fulton says. “I wanted the Inspire family and beliefs, advantages from a tech standpoint, and leading the competition in a sense.”

So in an impressive roll-up acquisition that took about five months, Fulton consolidated seven Jimmy John’s units—six in Maryland, and one in York, Pennsylvania—from three franchisees, which meant adjusting three separate teams to one set of systems, a challenge for even the most seasoned entrepreneur.

“It was definitely unique and challenging to consolidate three franchisees and close them. We bought all of them on the same day, so that was fun,” Fulton says. “But it’s definitely paid off, and we’re seeing quick positive movement. We’ll be a success story when it comes to Jimmy John’s in this section of Mary-

ADOBE STOCK / WOLTERKE

B Y C A L L I E E V E R G R E E N DEPARTMENT FRANCHISE FORWARD CONTINUED ON PAGE 70

20 APRIL2023 | QSR | www.qsrmagazine.com

Jimmy John's has room to grow across the East Coast.

Join the Family

Be part of a brand and community built through earned experience with a culture of strong leadership, innovation, operations, and growth.

We have opportunities in select, prime markets and non-traditional venues for qualified restaurant operators and developers with varied incentives for development.*

• Part of Dine Brands Global, a publicly traded company and one of the largest full-service restaurant groups in the U.S.

• An iconic brand with an integrated franchise support system—operations, training, new restaurant openings, marketing, site selection, design, food innovation, and technology*

• Strong franchisee collaboration and feedback in various corporate committees to keep the brand relevant

*Subject to Franchise Agreement and Development Agreement Terms © 2023 IHOP Franchisor LLC. This is not an offer to sell a franchise. An offer can be made only by means of a Franchise Disclosure Document that has been registered and approved by the appropriate agency in your state, if your state requires such registration, or pursuant to availability and satisfaction of any exemptions from registration.

CONTACT

US

Katie Fogertey didn’t take your typical journey to Shake Shack’s C-suite. It might just be why the CFO has made such an impact during one of the most transformative times in brand history.

24 APRIL2023 | QSR | www.qsrmagazine.com

/ BY DANNY KLEIN

Shaking the Statu s Quo

KATIE FOGERTEY WAS ALREADY WELL KNOWN WITHIN SHAKE SHACK CIRCLES. As Goldman Sachs’ lead analyst covering restaurants, she wrote a bull report for the fast casual during a time when few pundits agreed. How investors saw the company, Fogertey felt, wasn’t reflective of Shake Shack’s unicorn position among quick-serves, or its growth potential. ¶ There were 297 systemwide Shacks at this time—end of Q2 2019. Today, there’s more than 430. ¶ Going back, Fogertey held a number of “big conversations,” she says, about how she came to that conviction and buy rating. It earned her a measure of notoriety. ¶ But soon enough, Fogertey was having an entirely different discussion around Shake Shack’s prospects. ¶ When COVID-19 arrived (good luck trying to model sales), Fogertey decided she wanted to get off the sidelines. “I wanted to be part of the solution and the path forward,” she says. “It felt like it was just something that was inside of me.”

LIZ

EIDELMAN

www.qsrmagazine.com | QSR | APRIL 2023 25 BRAND LEADERSHIP

Shake Shack’s chief financial officer positioned opened and Fogertey told her husband, “That’s the job I want.”

She called the next day and pitched herself.

For a brand founded in 2004 as a hot dog cart to benefit New York City’s Madison Square Park, spearheaded by hospitality guru Danny Meyer, Shake Shack has never quite operated within fast-food convention. Its original openings catered toward younger consumers and a vibe inclusive of a changing generation. The food took longer to come out. Quality, ethos, and experience were placed out front from the initial step to the first bite.

So the idea of tapping a CFO who had spent more than 15 years at Goldman Sachs and wasn’t carousel-ing around the industry C-suite ranks, fit Shake Shack’s disruptor DNA. “I have this very different background than others do, but coming in and them really embracing my ability to—and my desire— to statistically model out sales in a company that, frankly, is not very well understood by investors, there’s a lot of different drivers out there,” says Fogertey, who has a bachelor’s degree of business administration in accounting, finance, and international business from Washington University in St. Louis ( Meyer’s hometown, fittingly). “It’s been really exciting.”

And perhaps it was destined. Fogertey was a colicky baby growing up in St. Louis. The only song that calmed her? Frank Sinatra’s “New York, New York.” She came up to the Big Apple in high school for an internship, took a college course at The New School, and knew exactly where she’d move when she got the chance.

Now, stepping into the CFO role in June of 2021, New York City—and Shake Shake—had a COVID crater to climb out of. The brand’s average weekly sales sunk to $32,000 out of the pandemic gates, in April 2020. They were now up $69,000. It was a fast evolution. If you took all 126 locations in the company’s comp base at the time and removed the bottom 25 performers, the brand’s same-store sales in April 2021 improved from negative 15 percent to just under 3 percent. Simply, the urban footprint presented major challenges. Its Theater District and Herald Square locations—two of the busiest stores ever opened—were fractions of themselves. Shake Shack’s Grand Central unit remained closed. Q1 comp sales, year-over-year, were up 5.7 percent overall; in April, they boomed 86 percent off the pandemic floor.

However, to get a sense of the full picture Fogertey took her skillset to, Shake Shack’s April performance was 15 percent lower than 2019 as suburban stores were flat. The brand hadn't quite yet recovered.

Meanwhile, an interesting dynamic was taking shape industry-wide.

By mid-May 2020, 25 of the largest public restaurant chains more than doubled aggregator cash holdings, from $9.4 billion pre-pandemic to nearly $20 billion, according to financial services company Rabobank. All of them carried more cash suddenly than pre-virus.

Shake Shack was definitely one of those. CEO Randy Garutti described the industry’s stock-piling as a “moment where no company was unsinkable.”

Shake Shack conducted an equity transaction and brought in a significant sum. The brand saw the convertible debt market reach “incredible opportunities,” Garruti said, and issue debt for $250 million at a zero percent coupon for seven years. As Garruti noted, “we may never see numbers like that in our lifetime.”

The result was Shake Shack fortressed its balance sheet in a way it never had before. Come May 2021, the brand had more than $400 million in cash. In Baird analyst David Tarantino’s words, it represented “probably more than [Shake Shack will] ever need to grow the business.”

Yet it was impossible for Tarantino, or any analyst for that matter, to guess just what Fogertey and Shake Shack had in store.

DEEP IMPACT

“They needed somebody who had a very strategic mindset,” Fogertey says of those early days on the job. “Having your classic CFO who might not be as strategic minded wasn’t going to do anybody any favors.”

Sure, Shake Shack could use more support and rigor in defining its finance function overall. But when Fogertey looked at the wider opportunity, there were ample places her forwardthinking vision could be levered at Shake Shack. She jumped into stores and spent weeks working with employees. “Getting to understand the company,” Fogertey says, “from soup to nuts.”

It was clear to Fogertey Shake Shack’s culture was its launch pad. “Thinking about the long-term growth trajectory, what we’re doing every day is not just providing great experiences,” she says. “We’re really building up our people from the ground up.”

We’ll get more into the labor side of Shake Shack later, but the operational transformation locked into place quickly. The brand’s omnichannel efforts predated COVID, as was the case for a plethora of quick-serves. However, the gravity of digital infrastructure was muted in comparison, to put it lightly. In addition to the chain’s heavy urban base, one of the reasons Shake Shack’s battle out the pandemic trough was so steep owed to many of its differentiators. The brand debuted as a social, hospitality-forward concept that encouraged guests to stick around. It wasn’t as transactional as some of its peers, or as streamlined across channels—core traits you might expect from a fast casual founded by a Michelin-starred restaurateur.

That urban drag coupled with a lack of drive-thrus plunged Shake Shack’s U.S. sales as much as 90 percent at some U.S. venues in the opening COVID weeks. The average of 70 percent felt closer to full-service counterparts than counter-service ones.

Beyond an easing in regulations and improved mobility as recovery progressed, Shake Shack turned course by finding its customers. And few have done it better. In March 2020, digital sales mixed 23 percent of the business. That climbed to 81 percent by May and settled to 59–62 percent by the final six months of 2020.

Of late, much of the chain’s gains result from in-store dining flooding back. People want to hang out in Shake Shacks again. And yet, this increased foot traffic layering on top of “dig-

26 APRIL 2023 | QSR | www.qsrmagazine.com BRAND LEADERSHIP

Serving ketchup and our country. Red Gold is a registered trademark of Red Gold, LLC. Elwood, IN RG-1352-0822 Ketchup with a Cause. You can’t beat the taste of Red Gold Ketchup, and now you can get it in a convenient 1 oz. dunk cup! With its thick, tangy tomato flavor and the perfect balance of sweet and sour notes—it’s a delicious flavor As proud supporters of the Folds of Honor Foundation, Red Gold helps to provide educational support to the spouses and children of deceased or disabled U.S. service members. That means, when you serve Red Gold, you’re serving the families of our fallen troops, too. you can feel good about serving. Request a sample today of the 1 oz. Red Gold Ketchup that’s easy to love and easy to share at Redgoldfoodservice.com/sample-requests RedGoldTomatoes.com/FoldsOfHonor

ital channels that never existed a few years ago,” Garutti said in December, pushing the brand to optimistic heights. Shake Shack’s total revenue in Q4 rose 17.4 percent, year-over-year, to $238.5 million as same-store sales upped 5.1 percent.

Shake Shack’s future unfolds across new, dynamic buckets— the expansion of its delivery services, kiosk, digital, drive-thru,

and multiple format investments. The total addressable market for Shake Shack today versus 2019, frankly, isn’t comparable.

Digital and kiosk sales are up 330 percent since 2019, from $147 million to $494 million. Digital guests spend 20 percent more than traditional ones. They boast higher frequency and offer Shake Shack access to new occasions.

Fogertey refers to the movement as “migrating people into the omnichannel.”

“We want to make sure what we’re seeing is that they might be coming to the app sometimes, they might be coming into the Shack at other times, and we want to meet them wherever they are,” she says.

For Shake Shack, this meant leveraging and improving what was already built to provide a compelling guest experience. In Q3 of fiscal 2022, Shake Shack ballooned digital app purchasers by 40 percent, year-over-year ( more than a million app installs since the beginning of the calendar) From March 2022 forward, it gathered more than 4.5 million unique first-time digital app purchasers, feeding the base with offers like giving digital users first access to LTOs. Shake Shack’s digital guests spent, average, 25 percent more per visit than non-digital users that quarter, and digital mix was 36 percent of sales.

Switching lanes, Shake Shack launched direct delivery in March 21—a decision that triggered a 70 percent increase in delivery order volume through its app in one year. Also, going native allowed Shake Shack to put its best brand foot forward. “Our strategy in the delivery wars is to own the guest ordering, regardless of pickup or delivery mode, and ensure our guests have a uniquely Shake Shack experience, even if they order delivery and never walk into our Shack. The guest ordering experience is the best presentation of our full menu—we highlight imagery, descriptions and modifications a way that provides the optimal guest experience,” says Steph So, head of digital experience. “While third-party apps offer a wide range of restaurant choices and are a great way for guests to try Shake Shack the first time, they create a ‘sea of sameness’ with the number of restaurants surfaced to a user, and our unique brand voice and interactions are not able to shine through. We also want to offer our guests the best value, which we can control most directly on our channels, and be transparent with fees.”

Shake Shack first piloted nationwide delivery via its iOS app

LIZ EIDELMAN

28 APRIL2023 | QSR | www.qsrmagazine.com

“We want to make sure what we’re seeing is that they might be coming to the app sometimes, they might be coming into the Shack at other times, and we want to meet them wherever they are.”

VISIT US AT BOOTH #3961 DISCOVER MORE!

oh, and streamline your operations too, with ( ) FIFO Bottle™ DISPENSING, REINVENTED! a FRANKE company a FRANKE company www.fifoinnovations.com

SQUEEZE MORE SAVINGS

in New York City and Miami. It then rolled nationwide as part of an exclusive deal with Uber Eats. That’s when the jump in delivery order volume took shape and led Shake Shack to plant firmer roots. The brand built out its technology development team in collaboration with Uber Eats fulfillment, allowing for more direct contact with guests, So says, and “ensuring the ultimate, frictionless experience.” Alongside, Shake Shack launched a mobile-first web redesign and introduced delivery in the Android Shake app as well as new payment options, including Apple Pay, Google Pay, and contactless options. The overall value proposition was a lure, too. “Our app menu is our lowest price menu compared to all nationwide delivery apps, and we don’t require subscription fees to access our low delivery fees,” So says. Fees don’t change, there’s no surge pricing, or menu markups. Shake Shack is rewarding direct guests in an effort to bolster its base and get personal. “We’ll regionalize their experience and target offers based on their behavior, which we cannot see if guests are ordering via third party,” So says.

For instance, if a guest is based in New York City, Shake Shack can share local events and relevant news, everything from chef collaborations, events, and new openings.

GETTING PHYSICAL

Returning to the point of in-store traffic, this might be where Shake Shack is most visibly evolving—inside and outside. Starting with the former, the brand in November committed to retrofitting all locations with kiosks by the end of 2023. At that point, roughly half of units had them. Fogertey says kiosks “are a really important part of our story right now,” and it’s easy to grasp where she’s coming from. On paper, they’re a great

the merchandising is. “We’re selling more LTOs,” Fogertey says. “We have more of a higher premium attach rate on those [ kiosk] channels.”

Spun another way, kiosks empower Shake Shack to optimize labor to other parts of its guest journey. They provide operators flexibility during peak traffic and staffing challenges.

Additionally, kiosks represent Shake Shack’s highest-margin channel, which doesn’t hurt, either. In restaurants where it has kiosks, about 75 percent of sales flow through kiosk and digital channels. As noted, digital plus kiosk mix 57 percent of total sales today for Shake Shack. In 2019, the figure was 26 percent. “We have the ‘Stand For Something Good [mantra],’” Fogertey says. “We’re hopeful the kiosks will make you stand not as long for something good.”

Shake Shack doesn’t generally lack for buzz. One trip to the Times Square store and the boisterous lines that wrap around, will prove that. But the reality is Shake Shack remains a brand relatively young in its growth journey.

Back in January 2020, ahead of the crisis, 60 percent of the burger chain’s domestic units were less than 3 years old. Twentyfour percent had been on the market for 12 months or less. The average age of restaurants across 163 U.S. corporate venues was 2.9 years. Twenty-three of Shake Shack’s 31 markets at the time boasted five or fewer locations. And this isn’t even getting into the global and licensing picture (the brand ended 2022 with 182 licensed Shacks and expects 25–30 openings in 2023)

The 430-plus global locations today cover 32 states, plus Washington, D.C., and 16 countries. Shake Shack opened 36 new domestic corporate stores last fiscal year, 22 of which landed in Q3. It debuted 33 licensed Shacks, 13 in the final period. There are 23 airport Shakes open worldwide; four roadside travel plaza spots, with three to five more on deck for this year. Ahead as well is Shake Shack’s first licensed opening with a resort partner in the Bahamas, at the Atlantis Resort.

In all, Shake Shack’s roadmap has a vast Atlas in front of it. Fogertey says the kiosks play a key role here as well, given they visually lay out the brand’s differentiators from the outset. What makes Shake Shack’s menu unique? Guests can see instead of read it.

A recent note from Fogertey’s past shop in Goldman Sachs expressed excitement over the brand’s “diversification of store formats and think this will be key in driving unit growth for the company.”

This sentiment, as much as any, illuminates Shake Shack’s promise. COVID and all of its disruption, as well as the brand’s relatively small footprint compared to its overall projection, means the future is rife for innovation.

return on capital. You can put four to five-plus in each location and take out cash registers (there will always be at least one of those, Fogertey says, for guests who use cash or for the sake of alcohol purchases). The brand can redirect labor within stores and appreciate a nice lift on ticket sales given how superior

The fast casual launched “Shack Track” at the start of the pandemic in response to the digital boom. “Many of the fast pivots in the early days of the pandemic soon became permanent functions,” Fogertey says. And this included implementing multi-channel delivery, enhancing digital pre-ordering, and expanding Shake Shack’s fulfillment capabilities. Shack Track, dressed down, is the brand’s digital pre-ordering and fulfillment experience. It manifests across pickup shelves, curbside pickup, pickup windows, and more. The need to enhance the physi-

BRAND LEADERSHIP SHAKE SHACK 30 APRIL 2023 | QSR | www.qsrmagazine.com

SHAKE SHACK'S ASSET EVOLUTION MIGHT BE THE MOST VIVID PART OF ITS JOURNEY FORWARD.

Polypropylene Packaging for Hot Food Applications Scan to learn more Tamper Protection Proven patented technology gives consumers confidence that food has remained sealed. Great for delivery! Full Transparency Exceptional clarity because shoppers like to see the food they buy. We strongly recommend that customers test products under their specific conditions to determine fitness for use. InlinePlastics.com/hot Sustainability You will be ready as the shift away from black carbon plastics continues.* *usplasticspact.org

cal restaurant to meet the needs of digital was so important to Shake Shack, Fogertey says, that all new restaurants the company opens now have some aspect of Shack Track.

A resounding illustration is Shake Shack’s drive-thrus. There were 11 open to start 2023, nine of which arrived in 2022. Ten to 15 more are expected for 2023.

Shake Shack is targeting drive-thru economics of $4 million-plus average-unit volumes, $2.4–$3 million build costs, and store-level operating profit margin on par or better than company averages. The higher development cost of drive-thrus, coupled with inflationary pressures, drove Shake Shack’s 2022 class up about 15 percent, year-over-year. Last year, total Shack net build costs were an estimated $2.4 million, above the historical $2–2.1 million.

Garutti, however, wasn’t fazed. “Some of the best sites we’ve ever had will be there for decades to come because we chose to invest. That’s how we’re thinking about drive-thru,” he said in January.

Shake Shack generally grows across three buckets: the standard that’s been erected hundreds of times at around $2 million; small-format units under 3,000 square feet that target dense urban environments, food courts, and higher traffic suburban locations (this is where the nontraditional business is unfolding); and now, drive-thrus.

What’s intriguing about the drive-thru is how it’s enabled Shake Shack to rethink its market density. Since 2021, the company opened two stores in Orlando less than a mile apart—a drive-thru in Vineland Pointe and a food court in Orlando Premium Outlets. The drive-thru served an audience where 45 percent of guests were local, living within 10 miles. It generated $86,000 in average weekly sales and $4.5 AUV. The location recorded about 20 percent store-level operating profit margin in Q4 as well.

The food court spot, however, greeted less than 15 percent of guests who lived within that same radius. Still, the store turned in average-weekly sales of $75,000 and $3.9 million AUV. Operating profit margin was 35 percent.

Simply, having a drive-thru format in the arsenal offered Shake Shack the chance to serve a new guest and increase the sales opportunity for a small target area. It’s representative, Fogertey says, of how the brand views ultimate market expansion as it right-sizes formats to each location.

The final calculation: Shake Shack pulled $8.5 million of sales in less than a mile.

Fogertey adds the roadside angle is one that shouldn’t be slept on. They’ve given Shake Shack another chance to steamroll the status quo. “People are so excited when they’re going to the Jersey Shore, or wherever they’re going, and they stop and they say, ‘oh my gosh, I can eat at Shake Shack here?’” she says. “The lines at these places are really, really big, and we’re just providing them an elevated experience that they wouldn’t be able to get otherwise.”

One of Fogertey’s first decisions as CFO was to set up a business intelligence unit so Shake Shack could study and analyze factors driving success, not just in sales, but also in real estate. “That’s just an important element, baseline, for scale,” she says.

The result is what you’re seeing across all of these designs—a deliberate, data-driven approach to fitting Shake Shack where it wants to expand. And when the brand gets there, it’s going to deploy customer relationships and tools, like kiosks, to get the message across.

“We’re going to be leaning on those kinds of things that make us truly differentiated and special,” she says, referencing the brand’s premium, no hormone, no antibiotic products and culinary spins, like white truffle, “because I think that’s the key to continuing to grow our sales. And make sure we stay relevant and that consumers keep us in their mindset.”

BUILDING FROM WITHIN

Shake Shack raised its starting wages more than 20 percent since 2019. The company earned a 100 percent score on Human Rights Campaign’s Corporate Equality Index (fourth straight year) and hosted a biannual leadership retreat in May to develop more than 1,000 employees. This past year, 52 percent of overall hires were women; 81 percent people of color. Fifty-five percent of promotions were women and 77 percent people of color.

Over the past couple of years, Shake Shack expanded its Shift Up platform, which is a leadership development initiative that provides shift managers with tools to advance to managers. The brand doubled the number of graduates from the ongoing cohort. Additionally, GMs are offered equity grants.

There’s a lot going on behind the curtain, Fogertey says.

On a granular level, the brand offers about $15 per hour as an average national starting wage and invests in diversity and inclusion in part through a formal program called, “All In,” which housed Shake Shack’s “Stand Together Series in June 2020.” The online platform enabled employees to share stories and included 36 independent speakers at all levels. More than 2,000 people participated as the company addressed social issues and broader themes, such as how to overcome dependencies and racial issues. Shift Up is a pillar of All In. Employees asked for a more defined career ladder and the skills to climb it, so Shake Shack invented the 18-week paid development option with the goal of eventual promotion within Shake Shack’s corporate structure.

Shake Shack recently expanded benefits to include mental health resources and now provides access to an Employee Assistance Program (eap) to the entire company upon hire. Shake Shack also continues to explore alternatives to a traditional workweek. Throughout 2018 and 2019, it launched and piloted a four-day setup in select stores. It’s currently testing with hourly employees and managers along the West Coast.

All of these efforts, Fogertey said, are what struck her most coming over. “The thought of what Shake Shack was from the outside looking in, you think about this great growth opportunity, you think of amazing burgers, amazing shakes, and everything, but when you’re there, and you see the magic of how this company really supports its people,” she says, “that’s eye-opening.” q

32 APRIL 2023 | QSR | www.qsrmagazine.com BRAND LEADERSHIP

Danny Klein is the editorial director of QSR and FSR. He can be reached at dklein@wtwhmedia.com

The WORLD'S FIRST TANKLESS, heat pump water heater for commercial applications.

Cost Effective, for both capital and operational expenses bring CFO's on board.

Clean, near zero GWP with no fossil fuels, more than satisfies regulators.

Reliable, on demand hot water with backup eases the minds of facility managers.

Easy, installation and remote monitoring make contractors big believers.

Safe, tankless heating defends users against Legionella.

Scalability and built-in redundancy fit the plans of engineers.

See how it works

An Inflation Notebook: Shortages, Supply, and Relief / BY CALLIE EVERGREEN NOTEBOOK: ADOBE STOCK / САША МЕЛЬНИК, ONE HUNDRED DOLLAR: ADOBE STOCK / OLEKSANDR 34 APRIL2023 | QSR | www.qsrmagazine.com INFLATION

OPERATORS ARE CLAMORING TO CUT EXPENSES THROUGH VALUE ENGINEERING MENU ITEMS, LEVERAGING SUPPLIER RELATIONSHIPS, AND MORE.

The restaurant industry continues to prove how resilient it is in tumultuous climates, most recently (and obviously) during the pandemic. From COVID-mandated closures and labor shortages to beefing up off-premises channels, operators have navigated a seemingly never-ending cascade of hurdles—a trend that appears to be continuing. What doesn’t kill you makes you stronger, right?

But when the U.S. inflation rate hit 9.1 percent in June 2022, even non-alarmists took note and began to panic. For context, the average inflation rate in 2021 was about 4.7 percent. Consumer prices for all items rose 6.5 percent from December 2021 to December 2022, according to the U.S. Bureau of Labor Statistics, with food categories experiencing even higher inflation.

Prices for food at home increased 13.5 percent for the year ended August 2022—the largest 12-month percentage increase since the period ending March 1979. Meanwhile, prices for food away from home increased 8 percent in

OBSTRUCT IMAGE: ADOVE STOCK / ANDRII YALANSKYI, RED PAPER PLANE: ADOBE STOCK / WORAWUT www.qsrmagazine.com | QSR | APRIL 2023 35 INFLATION

the period ended August 2022, the largest over-the-year percentage increase since an 8.4-percent jump in October 1981. And with a looming economic downturn, consumers began cutting back on restaurant spending, all while restaurants continued dealing with headwinds coming from all directions.

For example, restaurants experienced supply chain shortages in core items such as eggs and poultry in 2022, but niche items were also disrupted, leaving restaurants scrambling to find cost-effective menu item replacements, says Zach Goldstein, CEO of restaurant loyalty platform Thanx.

“The restaurant industry supply chain faced critical disruptions which resulted in huge COGS [cost of goods sold ] increases, requiring upheavals in operations including changes in suppliers and price increases at the customer level,” he adds.

Yet, passing those costs along to customers by increasing menu prices should be a restaurant’s last resort, says Paul Reynish, CEO of Gong cha. The bubble tea brand managed to keep prices stable in 2022 by leveraging volume growth to negotiate lower costs with suppliers. Gong cha grew its store count by 17 percent yearly since 2020, adding nearly 750 stores globally, and increased its revenue by 20 percent last year alone, selling 108 million bubble teas.

LEVERAGING SUPPLIERS AND VALUE ENGINEERING MENUS

For Reynish, it boils down to the brand’s long-term relationships with suppliers, many of which have partnered with the brand since it had 50 stores. “Now we have 2,000 [stores], and they’ve grown their factories, lines, and teams, and we’ve seen that loyalty over time as they’ve helped us keep our wholesale prices low, for the most part,” Reynish says.

While fuel, transportation, and labor costs have inevitably trended higher during the last couple years, the value discounts Gong cha has received allowed the brand to offer consistent wholesale prices to franchisees.

Another key to Gong cha’s success is value engineering new products at strategic price points. Can a new menu item main-

tain high quality, but use one less ingredient and have the same flavor impact?

“Menu innovation has been huge for us. We make sure we have a menu that is balanced to maintain profitability, and therefore not put prices up,” Reynish says.

For example, the brand’s new peach-based tea can be served in various formats: A regular tea, a frozen beverage, and a smoothie. Using one flavor profile in three different ways spreads out the daypart impact, he notes.

“Peach is not really well known or a high-index flavor, but we managed to work with suppliers and get real fruit by going to them, and we said, ‘How do we invent something we haven’t been doing before using peach as our core flavor?’” says Reynish, plus it’s a good way to increase volume while exciting customers with new products.

At the same time, promoting value beverages within stores and in the media—such as ice-based drinks—also helps maintain lower prices, he adds.

Maximizing every dollar spent on food costs has become more important than ever, and restaurants should keep an eye on food waste and cross-utilize products whenever possible, adds Yury Krasilosky, executive chef of Barilla America’s Foodservice R&D. “These days, operators have to make every ounce of protein and produce count [ by] using what’s in season in the produce category and other items across the menu.”

For example, adding steak cuts and chops on winter menus and braising cuts in the summer can reduce costs and decrease the likelihood of product delays or shortages, notes Doug McNicholl, North America regional manager for Australian Beef & Lamb. “Consider cuts ‘outside the middle’ for both lamb and beef, where supplies are more available and operators can find value,” he says.

A word of caution: Beef supply from the U.S. will likely be constrained in 2023 and 2024, a leftover impact from droughts across the middle and midwestern parts of the U.S., which caused ranchers to offload cattle due to lack of grass, McNicholl says. Wise operators will keep alternatives in mind.

GONG CHA MILK FOAM TEA: ANGELA ROWLINGS, PEACHS: ADOBE STOCK / 5SECOND 36 APRIL 2023 | QSR | www.qsrmagazine.com INFLATION

GONG CHA MANAGED TO KEEP PRICES STABLE BY LEVERAGING VOLUME GROWTH TO NEGOTIATE LOWER COSTS WITH SUPPLIERS.

THE INDUSTRY’S MOST INFLUENTIAL EVENT

Quick Service Restaurants are the go-to for millions of consumers who crave consistently delicious meals, the latest must-have menu items, reliable service, and value they can count on. At the 2023 National Restaurant Association Show, you’ll discover strategies, products, and partners to continue to find your next big thing. As the industry’s most trusted resource, the Show is your go-to for the leading brands and minds in the business, connecting you with insights and innovations to streamline your operations, optimize your menu, strengthen your supply chain, and drive profitability while staying wildly popular with customers.

Tap into the potential that awaits on the legendary Show floor — all 10 football fields’ worth — filled with future-forward suppliers showcasing new-to-market food, beverage,tableware, technology, equipment, and over 900 product categories powering automation, efficiency, safety, sustainability, and sanitation.

Be where big brands walk away with bigger ideas.

REGISTER TODAY nationalrestaurantshow.com

DRIVING SALES WITH LOYALTY AND DATA

If increasing menu item prices is unavoidable, restaurants can choose to offer a loyalty perk to offset the impact for customers, Goldstein says, or place at-risk menu items on a “VIP-only” menu—but it all depends on knowing who your guest is and what kinds of rewards they value most.

Analyzing guest behaviors and tracking that data has become a crucial way many restaurants make decisions. Tailoring loyalty programs to individual guests’ behaviors is the next step.

“Customers have come to expect hyper-personalization, so rewarding vegan guests with a free meat item or gluten-free guests with a bread-based item are mistakes brands cannot

afford to make to retain customers,” Goldstein advises.

“Giving guests options in how they can redeem accrued loyalty progress allows customers to choose perks that they value the most,” he continues. “For some guests, that may be a free item or dollar-off discount. However, for customers who value their time or the feeling of exclusivity, a ‘skip the line’ pass or access to a hidden menu item rewards customers without overdiscounting.”

Restaurant brands, as well as operators, should test all offers and incentives to make sure they’re not losing money. “You could be giving away a $5 off promotion when a $3 off works just as effectively, or perhaps a campaign does not need a discount attached at all to drive engagement,” he says.

Additionally, integrating non-discount rewards into loyalty programs can have a significant impact. After launching a VIP hidden menu, one of Thanx’s restaurant clients experienced a 275 percent increase in customer engagement, Goldstein notes.

Meanwhile, Gong cha began rolling out ordering kiosks in South Korea that allow the brand to efficiently track what products guests are ordering most, plus how often guests are coming in and their average tickets.

The company also recently introduced a metric tool called CUPS, which stands for cleanliness, will “you” come back, product quality and presentation, and service. A QR code on receipts leads customers to a simple eight-question survey and rewards them for completing the task with a free topping on their next drink.

The brand receives more than 200 CUPS customer feedback datasets per month, per store in Japan, where there are 130 Gong cha stores.

“Best-in-class restaurants do maybe two mystery shops per week per store, which is eight data points,” Reynish says. “With such a dipstick analysis, it’s hard to drive any true trends you can act on. Whereas if you listen to customers and get that many people, you can really create macro trends and use that data to become a bigger business and brand.”

The brand plans to roll CUPS out to Australia, the U.K, California, Mexico, and more regions in the near future, Reynish says. But, he adds, there’s nothing worse than getting bogged down with a lot of data and not knowing what to do with it.

“At their core, the value of loyalty programs is to capture and activate guest data at scale, helping to identify your most valuable customers and what their behaviors are. If you know who these guests are and what they are most likely to order, you can take action in the face of supply chain disruptions,” Goldstein adds. q

GONG CHA (2), BUBBLE TEAS ANGELA ROWLINGS 38 APRIL 2023 | QSR | www.qsrmagazine.com INFLATION

Callie Evergreen is a Senior Editor at QSR. She can be reached at cevergreen@ wtwhmedia.com TECH, LIKE KIOSKS AND QR CODES ON RECEIPTS, CAN HELP BRANDS BALANCE COSTS.

VITO Fryfilter, Inc. 847-859-0398 | info@vitofryfilter.com | www.vitofryfilter.com VITO oil filter system Ensure optimal oil quality Highest safety at work Less workload Save up to 50% of your frying oil AWARD WINNING PRODUCT - START BENEFITING NOW! Excellence in oil filtration - proven by over 50,000 satisfied customers

WHERE

THE , & ADOBE STOCK / INK DROP 40 APRIL2023 | QSR | www.qsrmagazine.com MENU INNOVATION

DYNAMIC PRICING

/ BY SHERRI KIMES

buzzing

polled yet surface—the Perhaps has happy hour. Dressed down, restaurants adjust pricing based on a specific ( the bar ) the reality of dynamic

But pricing is a lot more nuanced, and far more vital today given what’s taking shape exter-

it’s

nally from an inflation angle.

All said, we wanted to know how operators defined the method, where they saw potential, and what challenges they foresaw. Do they find it likely dynamic pricing is headed for widespread adoption?

Before getting into results, let’s start with the bigger picture. Dynamic pricing has become quite the hot term, but what exactly is it (beyond happy hour)?

topic plenty but also no shortage opportunity.

to

www.qsrmagazine.com | QSR | APRIL 2023 41 MENU INNOVATION

When I go back and look at pricing from a revenue management perspective—something I’ve been doing for over 30 years—there are two fundamental pricing questions that need to be addressed: One, what prices should be charged? And two, how to determine who pays what prices? Answers to both are equally important, but I would argue that even if the prices aren’t exactly optimal, a company can achieve significant revenue increases from having a reasonable (as in OK ) set of prices if they’re able to do a good job of segmenting their customers, as in determining who gets which price.

Let’s begin with what prices should be charged. That’s essentially what dynamic pricing is all about. So, what is it? We asked just that question. Pretty much everyone thought that dynamic pricing means prices vary based on demand, but they had all sorts of thoughts on what that meant. The responses ranged from quite general (“changing prices based on a number of factors”) to quite specific (“personalized prices … served up to a consumer.”)

I decided to ask some of the dynamic pricing companies what their definitions were. Carl Orsbourn and Ashwin Kamlani of Juicer told me “dynamic pricing is ensuring the right price at the right time for each sales channel to optimize a restaurant’s profitability and the guest experience,” while Colin Webb, from Sauce, explained “dynamic pricing is the practice of updating prices in response to variable inputs.” Revenue Management Solutions’ Jana Zschieschang stated, “dynamic pricing is the process of adjusting prices based on customer demand.” Javier Espinosa of DynamEat said they consider dynamic pricing to be a strategy in which every item on the menu is priced differently “depending on factors like demand level or customer profile in order to obtain the maximum profitability while driving demand.”

Axel Hellman told me Priceff considers dynamic pricing to be “fully automated pricing based on real time demand and available capacity.”

Essentially, dynamic pricing is all about prices varying based on demand. The concept makes sense, but how is it done? Specifically, one, how are the prices determined, two, how frequently do they change, and three, how are they communicated to customers?

HOW ARE PRICES DETERMINED?

The dynamic pricing companies mentioned above tend to use a combination of forecasting and price elasticity to determine the “optimal” price for each menu item.

That being said, it’s not always 100 percent necessary to have the “optimal” prices. For example, up until a few years ago, hotels and airlines didn’t even have optimal prices, but instead had a range of prices they systematically opened and closed based on demand. They were also extremely effective at using rate fences to segment their customers.

HOW FREQUENTLY ARE PRICES CHANGED?

Opinion on the frequency of changes also varied. For example, in a LinkedIn poll we conducted, 35 percent of 274 respondents opted for hourly price changes, about a quarter for daily changes, about a sixth for weekly changes, and another quarter for monthly price changes. Similarly, in the survey, clearly, there’s a variety of opinion.

Theoretically, prices can be changed as frequently as a restaurant wants to change them, but in practice, they’re usually changing at most a few times a day. For example, with DynamEat, restaurants can change prices as many times as they want, but most opt to change them by meal period. At Juicer, prices change at most a few times a day, while at Sauce it largely depends on what the restaurant group wants. Priceff changes their delivery prices every 10 minutes while at Revenue Management Solutions, they typically change prices several times a year.

HOW ARE PRICES COMMUNICATED TO CUSTOMERS?

Let’s go back to the fundamental pricing questions of revenue management. The first question was about determining which prices to charge and the second is on determining which customers pay the different prices.

The answer to the first is more based on math (forecasting, elasticity, and the like) while the answer to the second is more based on market segmentation and consumer psychology. This segmentation can be done by things like day of week, time of day, by meal period, by loyalty status, and by frequency of purchase. Essentially these are the reasons why customers pay different prices (in revenue management, we refer to these as rate fences). When there isn’t a particular reason—other than high or low demand—why customers pay different prices, customers may view the prices as unfair and choose not to patronize that restaurant. As the airline and hotel industries have learned, the way different prices are communicated to their customers so that guests have some control over the price they pay is crucial for the success of dynamic pricing and revenue management.

THE WHY OF DYNAMIC PRICING

So, in general, dynamic pricing is all about prices varying based on demand. OK, but why would a restaurant adopt the approach? Given my experience in the hotel and other industries, I can think of many reasons, but decided to ask the survey respondents what they thought. Not surprisingly, the top reason (92 percent of respondents) was to increase revenue. But reasons No. 2 and No. 3 might surprise you.

The second-most chosen response (82 percent) was to spread demand to slower periods, while the third was to better manage capacity (70 percent). To me, this indicates a good understanding of the fact dynamic pricing is not just about increasing prices during busy periods.

REASON NO. 1: INCREASE REVENUE

The hotel and airline industries typically achieve 3–5 percent revenue gains with revenue management and dynamic pricing. Dolan and Simon, in their cross-industry study on pricing,

ADOBE STOCK PIXELROBOT 42 APRIL 2023 | QSR | www.qsrmagazine.com MENU INNOVATION

DYNAMIC PRICING IS ALL ABOUT PRICES VARYING BASED ON DEMAND