We have opportunities in select, prime markets and non-traditional venues for qualified restaurant operators and developers with varied incentives for development.*

• Widely recognized and loved brand in family dining where guests feel welcomed and can enjoy classic favorites and craveable menu innovations any time of day

• A powerhouse brand that is a part of Dine Brands Global, a publicly traded company and one of the largest restaurant groups in the U.S.

• A dynamic brand that aims to deliver on popularity, relevancy, adaptability, and support

• An established franchise system with a business model and flexible design from conversions to freestanding, endcap, in-line and non-traditional—adaptable across varied venues

As restaurants automate to fi nd cost and labor savings, cash management is often

SPONSORED BY LOOMIS

Naftolowitz enaftolowitz@wtwhmedia.com

Mitch Avery mavery@wtwhmedia.com

PUBLISHER Greg Sanders gsanders@wtwhmedia.com

NATIONAL SALES DIRECTOR Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES MANAGER Edward Richards erichards@wtwhmedia.com 919-945-0714

NATIONAL SALES MANAGER Amber Dobsovic adobsovic@wtwhmedia.com 919-945-0712

NATIONAL SALES MANAGER John Krueger jkrueger@wtwhmedia.com 919-945-0728

SALES SUPPORT AND DIRECTORY SALES Tracy Doubts tdoubts@wtwhmedia.com 919-945-0704

F O U N D E R Webb C. Howell

A D M I N I S T R AT I O N 919-945-0704 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. who meet subscription criteria as set forth by the publisher.

R E P R I N T S

The YGS Group 800-290-5460 FAX: 717-825-2150 qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided to the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed at sponsoredcontent@qsrmagazine.com.

WTWH MEDIA LLC RETAIL, HOSPITALITY, AND FOOD GROUP

Ijoined QSR Magazine in January 2020 not knowing much about restaurant operations.

I was naive about same-store sales, barbell menu strategies, EBITDA, and the like. The learning curve was steep. And that was before March when the entire industry changed forever.

The past three years have been one entirely teachable moment for my editorial colleagues and me. Not only did we report on an unprecedented global pandemic (and still are to an extent), but we were privileged to tell stories of how so many restaurateurs fought their way through restrictions, delays, and a changing consumer base. Drinking from a firehouse, baptism by fire, between a rock and a hard place— we’ve heard all the euphemisms from executives in recent years.

Being part of the restaurant world for only a couple of months, it was an opportunity for me to gain a first impression. I was left marveling at operators’ ability to adjust against an obstacle so unfamiliar and widespread. Last year was my first visit to the annual National Restaurant Association Show, which had been canceled the previous two years due to COVID. Chicago’s McCormick Center was full of buzz and excitement around people being together again. To say it was fascinating and captivating would be an understatement. The show is truly a maze of innovation, and I look forward to an even bigger spark this year.

I now find myself in the position of QSR editor, with greater control over telling the best stories this beautiful industry has to offer. As I look back on where I came from, no topic seems more fitting than growth and develop-

ment. That may seem odd, considering the word “recession” has been used countless times by economists and government officials in the past year. But we’re talking about restaurants here. Drive-thru, digital, and delivery—they always seem to find a way forward.

With that said, it’s quite appropriate that Dutch Bros (page 30) takes centerstage as our cover feature for the May issue. Cold beverages are the brand’s main sales driver, but metaphorically speaking, the chain is hotter than ever. The company finished 2022 with 671 shops, and it expects to eclipse 800 units this year, making good on a promise to do so back in 2018. In terms of unit count, Dutch Bros is the third-largest beverage chain in the U.S., following Starbucks and Dunkin’; $1 billion in annual sales and 1,000 units are well within reach, recession be damned.

I’m also excited about what’s to come for my own team. My colleague Callie Evergreen assumed leadership of FSR Magazine, our sister publication. Sam Danley, who took the pulse of the quick-service pizza wars in this month’s issue (page 42), joined as our associate editor earlier this year. Last, but certainly not least, is our fearless leader Danny Klein, who is leaning heavily into his role as editorial director and organizing the bigger picture.

Brighter days are not ahead, they’re here. Witness it. Hear it. Heck, even smell it. The restaurant industry is alive and well.

Ben Coley, Editor

Restaurants proved resilient during COVID, and that’s not going to change now.

The beverage chain is innovating and giving customers more options.

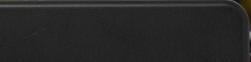

DUNKIN’ OFFERED A NEW WAY to enjoy its menu in late March with the debut of its Breakfast Tacos.

The Breakfast Tacos are made using a warm flour tortilla, scrambled eggs, melted sharp white cheddar cheese, fire-roasted corn, and a drizzle of tangy lime crema. For an extra flavor boost, customers can choose to add crispy crumbled bacon on top. Setting the tacos apart is the blend of spring-forward ingredients, with fire-roasted corn as the star. According to Dunkin’, the product is good for breakfast, a midday snack, or the evening.

The tacos are designed to be convenient for customers to eat on-the-go, served in a Dunkin’ taco holder.

“Our culinary team has expertly crafted these Breakfast Tacos with the vibrancy of spring in mind, delivering a taste sensation that can be enjoyed any time of the day, not just for breakfast,” says Jill McVicar Nelson, Dunkin’s chief marketing officer.

Dunkin’ made a splash with its Breakfast Tacos.In August 2022, the National Restaurant Association released a DEI survey report that took stock of how well employers were handling diversity in the workplace.

What are the keys to closing this gender gap? Let’s ask some of the top female leaders in the restaurant industry.

In the restaurant world there’s never a dull moment, which means you rarely get a free moment. So when it comes to finding the perfect fry for your guests, we’ve helped make it a little easier. In fact, we’ve reorganized our entire portfolio with you in mind and simplified it, so you can quickly and intuitively navigate by category or style. And whether you have a specific guest need or operational need, you can easily find the perfect potatoes.

Your world is complicated—weˇre here to help simplifry it.

aren’t being met, and 42 percent of that group says they’ll leave if they aren’t being rewarded quickly. “Those numbers tell us that people are hungry for personalization,” Byrnes says. “They want their needs anticipated. They want rewards built on an understanding of their purchase behavior and menu preferences, and the big challenge is they expect this kind of loyalty o ering from the very first signup. They expect a reward before you’ve even had any time to collect a scrap of data on their purchase behavior or what they like o the menu.”

/ BY KARAIn the wake of COVID-19, quick-service restaurant customers have completely changed how they interact with their favorite brands. They want—and expect—loyalty programs to be an “Amazon-like experience,” says Tom Byrnes, senior vice president of marketing at PayiQ. Customers are looking for intensely personalized experiences, and brand executives aren’t always sure how to o er it to them.

PayiQ recently commissioned a survey on loyalty programs from the independent research firm Wakefield Research. The survey sheds light on just how much consumers love loyalty programs today, and, on the flip side, how challenging these programs are to grow.

A massive 91 percent of customers say a personalized loyalty experience is worthwhile, and 50 percent say they can’t live without it. At the same time, however, 69 percent say they’ll drop a program if their needs

The survey also reveals the challenges executives face when growing personalized loyalty programs. Of course, properly integrating systems into the back o ce is a major undertaking in itself, but as the results of the survey suggest, that’s when the going gets really tough. Forty-two percent of executives say they’re struggling to convey the value of their rewards to customers. “Customers now expect a lot of value up front, so that creates a conundrum. Loyalty programs today have to be able to convey that value immediately, or they run the risk—as we’ve seen—of near-term abandonment and attrition,” Byrnes says. “Customers have a desire to have a more personal relationship with the brand, and that hasn’t been lost on leadership. Because of this shift in the landscape, nine out of 10 executives surveyed now feel that losing loyalty members is inevitable if they can’t find a way to provide a more personalized experience. What’s more, 75 percent of these executives say that diners are leaving loyalty programs because they don’t feel valued.”

Even with a strong loyalty program laser-focused on customer preferences, there are still limits to what brands can do. Customers might only open their loyalty apps—and self-identify—to get points or redeem rewards on large orders. “You’re missing out on learning who your customers really are,” Byrnes says.

Payments Intelligence® by PayiQ allows restaurants to securely gather first-party data on every customer who pays at a restaurant with a card. “Payments Intelligence augments your current loyalty program to identify customer behavior patterns,” Byrnes says. “It gives you the ability to leverage data to reach your customers in the highly personalized ways they want to see, with the infrastructure you’ve already created, without requiring any extra e ort on the part of your employees or the customer.”

Customers love personalization, but it’s tough to manage at scale.

PHELPS

“Customers now expect a lot of value up front, so that creates a conundrum.”

BUILD NEW OR ACQUIRE EXISTING LOCATIONS

INVEST IN MODERN, FRESH FORWARD RESTAURANT DESIGNS

LEVERAGE MULTIPLE REVENUE STREAMS

ENGAGE WITH BRAND LEADERSHIP FOCUSED ON FRANCHISEE PROFITABILITY

12.5%

SAME SALES GROWTH

7.8% FULL SYSTEM

Cookies are baking in more than just chocolate chips these days. The popular confections comprise America’s latest dessert-based store craze, joining past favorites like artisan ice cream, cupcakes that trended in the early 2000s, and frozen yogurt, which has been in expansion mode a couple of times.

Gourmet cookie operators have exploded onto the scene, expanding both internally and through franchise deals that could add hundreds of new stores across the country. The burgeoning

competition has led some observers to say the “Cookie Wars” have begun.

That phrase took a more literal turn last year after fast-growing national chain Crumbl, based in Linton, Utah, filed lawsuits against two smaller Utah-based players, alleging copyright infringement. These actions eventually garnered the social media hashtag “#UtahCookieWars.”

Using a combat term seems a bit overdramatic for the humble

cookie, even if multiple chains are intent on growth.

“It depends on who is using the term and how it is being used,” says Chris Wyland, chief executive of Cookie Plug, based in Riverside, California. To him, the phrase is a quick way to describe the sudden creation of many fresh-baked cookie chains and the resulting frenemies.

Cookie Plug, which features a hip-hop vibe and cookies that are 4 inches in diameter and an inch high, has three dozen company and franchised units. “I don’t think anyone is going to confuse us with Crumbl,” which has more than 700 bakery stores nationwide, he says.

There are several reasons why cookie chains are increasingly taking center stage.

“These operations are attractive now as they can operate in a much smaller footprint, require less labor, have tight stock so management is easier, and can be more flexible with their hours,” explains Maeve Webster, president of Vermontbased foodservice consultant Menu Matters. Initial investments for these franchised units are relatively low.

Young consumers remain willing to spend on decadent items like big, gooey, rich cookies that offer the “full, immersive sensory experience” and can play with colors and textures, Webster notes. Plus, “cookies are nostalgic, but infinitely variable,” appealing to various customers.

That last point is basically echoed by almost everyone in the cookie business.

“I think that cookies are timeless,” says Sarah Wilson, chief executive of yet-another Utahbased cookie company, Chip Cookies, which launched in 2016 and has about a dozen units in several states. The cookie “is more American than pie. It is embedded in our communities and our diet.”

Jenn Johnston, Quick Service Division president of Great American Cookies’ parent FAT Brands, agrees, noting, “Almost everybody loves cookies to some degree, so it is a fun business model.”

Unlike newbies like Chip Cookies, Cookie Plug, and Crumbl, Great America Cookies is a veteran. The franchised gourmet cookie chain, which claims about 370 bakeries, launched in 1977 with its original chocolate chip cookie recipe.

In that time, the company has seen several dessert trends come and go. “Different concepts have their time,” Johnston says, and the recent growth in gourmet cookies accelerated due to post-pandemic consumer behavior. “People have been turning to indulgent treats,” adding this response extends beyond individuals to families and groups.

Great America Cookies focuses on all these factions, not only through its many scoop-and-bake cookie varieties, but also its popular—and high revenue—cookie cakes, which are “a point of celebration and sets us apart,” she adds. Additionally, the company is increasingly co-branding units with FAT Brands’ Marble

Slab Creamery, creating multi-option dessert outlets.

Chip Cookies is among the originators of the recent boom of fresh-baked gourmet cookies, born in Wilson’s off-hours cravings—while pregnant in Los Angeles—for a warm, hot chocolate chip cookie delivered to her home. The business began in 2016 as

a gourmet cookie delivery service and since has added physical stores.

When Wilson and her husband, Sean, launched the company, “we saw a gap in the market for a warm gourmet cookie,” she says. “When we started we thought our customers were going to be pregnant women,” but they quickly discovered it could be much more inclusive.

Chip has four standard big, hot cookies—the OG (original chocolate chip) and Biscoff Chip among them—plus hundreds of recipes for one more that rotate weekly, and all stand up well in delivery. Wilson states product quality is key to the company’s growth beyond its 11 original, company-owned units to new franchised stores in the 50-plus territories it has sold.

“You have one product, so it better be the best cookie,” she says. That extends to delivery, including experimenting with drone service. “We historically have done our own delivery,” she notes. “We find that with third party that last mile doesn’t always work out. Controlling the quality is important.”

Cookie Plug’s chocolate-chip cookie is also named OG, and that moniker—urban slang for something original— fits in nicely with the company’s hip-hop ambiance. The stores feature 15 daily thick cookies, including three keto, called “phatties”—another takeoff on urban lingo—with names like SnooperDoodle, a snickerdoodle referencing well-known rapper, Snoop Dogg.

An advantage of a concept like Cookie Plug, CEO Wyland says, is the relatively low cost to open and operate stores. Cookies are prepared off-site and baked in shops, requiring only a few employees daily to run each 800- to 1,000-square-foot unit. The average ticket is $23, as most customers buy several cookies to take away.

Cookie Plug has some 180 units in development and projects 50 openings this year, Wyland states. “It’s always great to sell deals, but we want to be strategic and open successfully.”

At this point, “There is room for multiple players, and room for everyone to play well,” he notes. Still, “You need to have a great product; you can’t just throw it out there.”

Eventually, a shakeout may come, according to analyst Webster.

“There’s always the danger of over-saturation of the marketplace when too many operations focus on only one category,” she explains. There’s also a danger that chains that grow too quickly “will result in variability, availability, etc.” that can damage a brand.

Smart operators will constantly look to create experiences that will tie consumers to the brand, including creating a social media presence, as Crumbl has done. “If it’s just a good cookie, that going to be less compelling,” Webster says, “because there are a lot of good cookies out there.”

ong after pandemic lockdowns, drive-thru and off-premises orders continue to take a larger slice of total sales—and restaurants are changing to accommodate their customers’ needs. Some brands are expanding and perfecting drive-thru lanes, while others are focusing on mobile orders via third parties and loyalty programs. Operators must figure out how to provide the same level of excellent service in these new configurations while managing the current ongoing fluctuations in labor.

To navigate the challenges of higher tra c through multiple order points, it’s more important than ever for restaurant teams to be able to communicate seamlessly with each other. “Restaurants are evolving in shape and size, which means communication needs are changing, too,” says Jason Bertellotti, president of HME Hospitality and Specialty Communications. “A total solution for restaurant communication enables operators to manage the significantly higher volumes more effectively at every touchpoint—mobile order and curbside pickup, walk-up windows, drive-thru lanes, front counter, dine-in service, and any additional service areas.”

Brands are also beginning to test the capabilities of artificial intelligence (ai) voice ordering systems. Amid sta ng fluctuations, voice

AI allows teams to increase operational e ciency and focus on other important duties while the system automatically takes customers’ orders and sends them to the POS to process. Crew members can be relocated to stations where personable, face-to-face interactions will have the greatest impact on customer service and satisfaction. “By integrating AI voice ordering solutions with your NEXEO | HDX platform, you provide an additional tool to help your team succeed,” Bertellotti says.

A comprehensive restaurant communications platform keeps crews connected to key areas of the operation, and it can integrate with other solutions like voice AI providers and timer systems. “A total solution is about providing critical information to key sta when it matters most,” Bertellotti says. “Whether you’re calling a crew member to clean up a spill in the dining area or delivering alerts from your timer to your headset, a total communication solution enables your team to increase e ciency and provide a greater customer experience.”

The NEXEO | HDX platform is one such solution. It delivers fully digital end-to-end audio, eliminating hum and noise even to voice AI systems. NEXEO | HDX’s Digital Audio enhances the drive-thru ordering experience, allowing the AI system to “hear” customers in high-definition audio—critical to ensuring order accuracy. Cloud connectivity also helps operators remotely manage and future-proof their entire store base. As their business and technology needs grow, NEXEO | HDX will grow with them, delivering advanced technology and functionality to support their ever-changing needs.

Other features of the NEXEO | HDX platform include tap-toconnect headset registration, unlimited headset pairing, color touchscreen display, system diagnostics, and integration with the HME ZOOM Nitro Timer, which audibly alerts team members when certain metrics need their attention. “NEXEO | HDX delivers critical information—from other systems and team members—to key employees when it matters most,” Bertellotti says. ◗

NEXEO takes communication beyond the drive-thru and into key areas of your restaurant, increases efficiency with voice commands and group conversations, and seamlessly supports voice AI ordering. And that’s just the beginning.

FOUNDER: Derrick Hayes

HEADQUARTERS: Atlanta

YEAR STARTED: 2014

TOTAL UNITS: 4 restaurants in Atlanta, 3 kiosks in Mercedes-Benz Stadium, and a food truck

FRANCHISED UNITS: 0

ATLANTA ISN’T

when you think about cheesesteaks, but it’s where Derrick Hayes built a name for himself with his take on the classic sandwich.

The West Philadelphia native launched Big Dave’s Cheesesteaks in 2014. What started with a single location in a small gas station outside of Atlanta has expanded

into one of the region’s fastest-growing businesses. Its footprint now spans four stores across the city, along with a food truck and three units in Mercedes-Benz Stadium, home of the NFL’s Atlanta Falcons.

Hayes has become a rising star in the restaurant industry with his award-winning take on West Philly fare. In 2021 he was named to the Forbes Next 1,000 List. Last year, he graced the cover of Essence Magazine alongside his partner and fellow restaurateur Pinky Cole, founder of Atlantabased Slutty Vegan. Hayes has also been nationally recognized by Good Morning America, Black Enterprise, RevoltTV, People Magazine, Red Table Talk, and more.

Success hasn’t come easy. In fact, it almost didn’t come at all. Hayes ran into trouble with the law as a young adult. At one

point he faced a potential jail sentence for drug trafficking, but a stroke of luck helped him avoid spending time behind bars and gave him an unexpected second chance.

Hayes started Big Dave’s to honor his father, David Hayes, who he watched die from cancer in 2009. Before moving to Atlanta, he promised the patriarch that he’d turn his life around and start his own business. He made good on that pledge when he set up shop in a 750-square-foot gas station in the northern suburb of Dunwoody. It was there that he started serving up flavors from his hometown in the form of beef, chicken, and salmon cheesesteaks.

“I want people to know that they’re getting something authentic, because I’m from West Philly,” Hayes says. “The marriage between that authenticity and the special way I do things is what sets us apart.”

He points to the signature Dave’s Way sandwich as an example. It comes with onions, sweet peppers, banana peppers, and mushrooms, plus American cheese, provolone cheese, and Cheese Whiz, all served on a traditional Amoroso’s roll. That’s different from what you’ll find in Philadelphia, where the sandwiches come with just one type of cheese. Hayes also prides himself on Big Dave’s seasoning, which is now sold as a standalone product in-store and via the company’s website.

Beyond the flagship cheesesteaks, the menu includes hand-rolled egg rolls, wings, Philly fries smothered in cheesesteak fixings, and a selection of Philly-inspired salads and beverages.

Hayes says it didn’t take long for Big Dave’s to develop a loyal following. Still, those early days at the gas station weren’t a walk in the park. He was cash-strapped, learning how to run a restaurant in realtime, and dealing with faulty equipment. A passion for cooking and

THE FIRST CITY THAT COMES TO mind

Texas Pete ® is taking its flavor on the road with convenient, easyto-enjoy portion control packets! Whether it’s a Texas Pete ® dip cup or sauce packet, your customers will be able to enjoy bold flavor for a better on-the-go dining experience—anywhere, at any time. Ask your broker for the #1 portion control hot sauce and request a free sample today!

Ben & Jerry’s franchisee Primo Partners proves it’s more than just an ice cream shop.

North Carolina. From there, they have opened 14 more in metro areas such as Chicago, Tampa, and Houston. From the beginning, Primo Partners used its business to educate and develop young leaders. Its goal is to change Black business as we know it.

“We’ve always looked for ways to tackle difficult issues or have difficult conversations, and we really see ice cream as a vehicle for doing so,” McBroom says. “It’s something that brings people together.”

Through its Ben & Jerry’s platform, Primo Partners has established a growing internship and scholarship program. It donates 1 percent of its revenue back into the community, supporting Black entrepreneurship and marginalized communities. Additionally, it has commitments to foundations, such as Habitat for Humanity and United Way.

In addition, Primo Partners sets aside 2 percent of its revenue for staff development. Through the pandemic, the company poured resources into professional enhancement activities and coaching.

When Primo Partners—Ben & Jerry’s largest and only Black-owned multi-unit franchise group—began its growth path, it felt the need to choose between business and education, says Antonio McBroom, the company’s CEO.

“But we saw the genius of ‘and,’” McBroom says. “We saw that we could be business leaders and make major contributions educating people about business; our business could be our classroom.”

Consisting of long-time friends McBroom, Eric Taylor, and Phillip Scotton, the journey of Primo Partners is one of passion and mentorship. In addition to Ben & Jerry’s, the company also has development endeavors in real estate and just this year was awarded a Starbucks licensing agreement.

When McBroom had the opportunity to buy the Ben & Jerry’s shop he was working at during his senior year in college, he felt like it was the right time to take the entrepreneurial leap.

“As a brand, Ben & Jerry’s has always been a justice company. They use ice cream for their platform,” McBroom explains. “That allowed the company to connect with us at even deeper levels.”

The friends’ first Ben & Jerry’s location opened 15 years ago in

“Coaching is what we love to do. If you think about the original coaches or carriages from the early centuries, they got valuable assets from where they are to where they need to be,” McBroom explains. “We look at Primo as a coach to transfer these leaders from where they are to where they want to be.”

Furthermore, February 16 ushered in a new era for Primo Partners. The group opened its first Starbucks location at the University of South Carolina, and McBroom is eager about the partnership.

“We thought that this would be the ideal complement to the Primo brand as we become a multi-unit, multi-brand organization,” McBroom says. “I’m excited to grow within the Starbucks ecosystem and be a key partner across multiple markets in the Southeast.”

For McBroom, Starbucks felt like the right fit not just for its products but also for its justice-minded approach to equity. Since its inception, Starbucks has never shied away from taking stances, something McBroom looks for in an organization.

The Starbucks store at the University of South Carolina adds to Primo Partners’ portfolio of campus locations. The franchise group has Ben & Jerry’s locations at the University of North Carolina, the University of South Carolina, and the University of Georgia. While McBroom looks forward to expanding

/ BY KARA PHELPS

/ BY KARA PHELPS

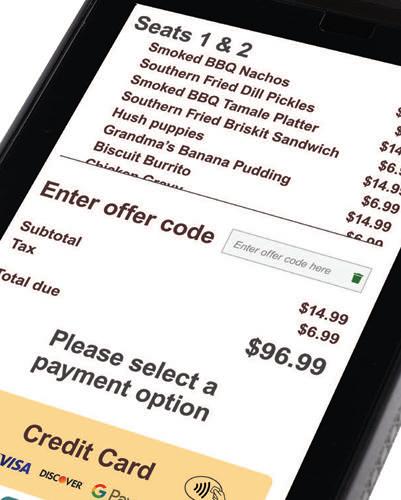

Restaurant operators frequently underestimate the time and labor commitment they’re making to cash handling. From counting and recounting to depositing, reconciling, and delivering cash to the bank, it adds up quickly.

“Manual activities, such as the handling and depositing of cash receipts, distract restaurant managers from the core of their business, which is providing a great experience for customers and a positive working environment for their employees,” says Lenny Evansek, senior vice president of SafePoint business development at Loomis. “That’s why accepting cash payments is more important than ever. Cash is and will remain a strong method of payment within the quickservice restaurant industry as the needs and characteristics of its consumer can vary across many geographic areas and social metrics.”

Given ongoing challenges with labor and the supply chain, it may be time for restaurant operators to re-evaluate how they manage cash handling, Evansek says. Solutions put in place five–10 years ago may no longer serve the modern world as e ectively as operators need.

Manual cash counting, for example, leads to increased cash discrepancies, shortages, and errors—not to mention the increased security risk when cash is openly handled and vulnerable. The risk of internal theft rises, as cash can’t be tracked, and the location also becomes a target for external robbery or burglary, potentially putting customers and employees in harm’s way. Since employees also need to arrive early and stay late for manual cash handling tasks, labor costs increase, and supervisors must take time away from other revenue-generating responsibilities to oversee cash handling and visit the bank if needed.

“On-site store observations, comparing what is actually happening in the restaurant versus the standard operating procedure, can reveal many ine ciencies which can be corrected by implementing an automated and standard way of handling and depositing cash,” Evansek says.

When a restaurant adds new automation technology and begins a new cash handling process, training and providing resources for ongoing training of employees is essential, Evansek says. Operators should ensure there’s always a paper trial, which is easy for managers to maintain and view if their smart safe and cash recycling solutions come with a customer reporting portal. Finally, operators should assess their new cash handling process at 60-, 180-, and 360-day intervals, evaluating the compliance of the transition and making improvements as necessary.

In fact, a case study conducted by Loomis found that restaurants can save more than 30 hours per month in labor and another $50–$100 in bank depository and change order fees by automating cash management.

“Operators that choose an automated way to handle and deposit cash can count on time and money savings from eliminating or reducing bank trips, deposit prep, drawer reconciliation, and benefits within corporate treasury, accounting, and loss prevention,” Evansek says.

To learn more and download Loomis’s Ultimate Guide to Restaurant Cash Handling, visit loomis.us/restaurant-guide.

As restaurants automate to find cost and labor savings, cash management is often overlooked.

“Accepting cash payments is more important than ever.”

Cash handling can be a huge time and labor commitment – something restaurant operators don’t have enough of. SafePoint is comprised of smart safe technology, change order management, armored transportation, and our customer reporting platform, and is designed to make your in-store cash handling quick and easy. Leave it to the pros!

download the Ultimate guide for restaurant Cash Handling

Everything you need to know to increase e iciency, mitigate risk, and reduce costs associated with in-store cash handling.

Across 30 years, Dutch Bros has grown from a pushcart to the third-largest coffee chain in the U.S. It wouldn’t have gotten there without its not-so-secret weapon— building a people-first culture.

On September 15, 2021, Dutch Bros cofounder and executive chairman Trav Boersma stood center stage on the floor of the New York Stock Exchange, donning sunglasses and a “Rage Against the Machine” T-shirt—emblematic of his company’s rebellious beginnings. With a gavel in his right hand, Trav used his left to count down and prepare a chant. He and the team surrounding him shouted “DUTCH” while the crowd responded “BROS.” Shortly after, he reared back the gavel well above his head and smashed it against the sound block four times. He then lifted the gavel straight into the air and turned to both

sides, making sure everyone understood the gravity of the moment. Judging by the smiles, claps, yells, and cheers, it was clear they did.

Dutch Bros was now a public company, marking one of the chain’s greatest achievements.

CEO Joth Ricci, who stood behind Trav, recalls Wall Street as an “eye-opening” experience, and one that he couldn’t be more proud of. The celebration wasn’t restricted to top brass either. Dutch Bros brought about 100 team members to the New York Stock Exchange, many of whom had never been to

the Big Apple. It was an opportunity to not only share a special occasion with employees but to allow them to witness a different side of the business.

It was representative of a culture that hadn’t waned in three decades.

“To be with Trav and his family and to celebrate the event with them, and to really have respect for the 30-year journey basically that the family had been on to get to this point and to have them see this brand that they started and that they cultivated and they loved, to be able to be put on really the national—if not the global—stage of going public was really great,” Ricci says. “And to watch Trav ring the bell was a moment in my career that I will never forget.”

In 1992, 21-year-old Trav and his 38-year-old brother Dane were in different places in life. Dane was a father of three, while Trav was “footloose and fancy-free,” he says.

They were third-generation dairy farmers in Oregon facing

We specialize in creating drive-thru systems that are tailored to your specific needs, ensuring that your brand’s messaging is effectively conveyed to your customers. From the color scheme to the menu design, our team will work with you to create a system that is not only aesthetically pleasing but also delivers a seamless customer experience.

HIGHQUALITY CONSTRUCTION FULLY

HIGHRESOLUTION DISPLAYS

MADE IN THE USA

For more information call us at 1-614-850-2540, email us at sales@natsignsys.com or visit our website www.nationalsignsystems.com.

new mandates that would’ve required $150,000 worth of investment. The two were hardly paying the bills as it was.

When it came time to sell the herd, Dane was left at a crossroads. He earned in the neighborhood of $50,000 to $60,000 from the sale and lived a frugal life, but he wanted to make sure his kids could get Air Jordans or make trips to Disneyland. Dane considered getting a job at Walmart or West Coast-based grocery chain, Fred Meyer.

“I was like, ‘Hold up. What? You can’t go do that,’” Trav says. “‘I mean we’ve had all these ideas man. I mean we should at least explore one of them, see what happens.’”

At the time, Trav routinely drank vanilla lattes and suggested they open an espresso cart. To which Dane responded, “what’s an espresso?”

So Trav took him to a local drive-thru called Western Expresso, run by a “hokey, but super smiley” woman who was barefoot and knew customers by name. Dane received his drink first, and Trav couldn’t have asked for a better reaction.

“I look over and he’s licking the milk foam off,” Trav says. “This is unbelievable. I’m like, ‘That’s what I’m talking about dude.’ And so I got mine and we started talking about it. We just dove in.”

In search of an equipment supplier, the brothers drove through the I-5 corridor jamming to the Beatles, Led Zeppelin, Jimi Hendrix, Cream, and Chicago. They stopped in Portland to meet with Boyd’s Coffee, but the pitch sounded too similar

to a used car salesman. Trav and Dane then met with a company in Seattle that showed promise, but the true prize came in Eugene, Oregon, when they met Paul Leighton—a future mentor and friend. He taught the brothers how to pull shots, steam milk, and make cappuccinos, and provided them with several coffee varietals to play with.

Now fully supplied, they invited friends and family to serve as guinea pigs for their budding espresso business.

“It was some of the best times ever as I look back on them, man,” Trav says.

At this point, Dane’s expertise became paramount. He owned a Dairy Queen franchise at 22 years old and understood the importance of speed, simplicity, and how to put together a menu. Perfecting the mocha was crucial. It was the early 90s and espresso was not well known, especially not in Grants Pass, Oregon, where the two were looking to plant their first flag. They were tasked with educating others. The siblings tested Mrs. Richardson’s Hot Fudge, Nestlé Quik, Hersey’s syrup, and Guittard Chocolate—everything one could imagine, Trav says. They settled on chocolate milk from down the street, and it proved to be the game-changer.

“We thought, well, this is a slam dunk,” Trav says. “It’s going to be easy.”

The menu began with a Double Dutch Mocha and Single Dutch Mocha. The price was $1.25 for an 8-ounce drink and $1.75 for 12 ounces. Following the lead of other coffee carts,

Provide your customers with a safer, more convenient food pickup experience. Our Pickup Pod™ offers a streamlined, contact-free way to get delivery without taxing staff or taking up a lot of space. Pickup Pods keep food secure and fresh, and each cubby is individually insulated and features interior lighting to showcase food. And our Pickup Pod is designed to accommodate both hot and cold foods. Customers simply order online and set delivery to the Pickup Pod for pickup at their convenience. Our Pickup Pod is the high-tech way to help attract and retain your customers.

Discover the innovation that fuels our products and drives your success.

Trav and Dane hoped to open their first station at Fred Meyer. They were hyped after applying. A week passed, and there was no phone call. Silence remained after two, then three weeks. So finally Trav called. The store confirmed it received the application and asked the brothers to be patient. A few more weeks flew by, and Trav decided to call again. This time, the response was more snarky. Trav told Fred Meyer about how anxious he and his brother were and that they were ready to go. The store official, not moved, said, “Yeah, well, we’re not ready to go and when we are, we’ll let you know.”

In light of that debacle, Trav and Dane searched for another site and found one in downtown Grants Pass on 6th Street near the U.S. Post Office. The brothers sealed an agreement with the landlord for $150 per month. They were positioned beside an old billboard sign with power outlets, a convenient spot to plug in a grinder and refrigerator.

The Dutch Bros team was set, but nervous—at least one of them was.

“I remember Dane tripping on the first day, like, ‘I don’t know if I can do it, man. This just feels too weird,’” Trav says. “We had a little building behind us that we had set up as our backdrop and our storage facility that we could roll the cart into and lock everything up at night. And he stood back there and I go, ‘Hey dude, I’m gonna make you a mocha and I’m gonna put on some Led Zeppelin and we’ll start rolling here.’”

The pushcart earned around $65 that first day. Trav and Dane were indeed rolling, until the store manager of Grocery Outlet—which shared a parking lot with a strip mall and the cart—directed all of his ire toward the brothers. Full of not-sonice profanities, the Grocery Outlet representative demanded they leave.

“‘I don’t give a f*** who you talked to,’” says Trav, recalling the unadulterated rage from the store manager. “‘This is my parking lot, and I’m gonna move your sh** unless it’s out of here tomorrow. Is that clear? and I’ll do it with my forklift if I’ve got to.’ And I’m like, ‘OK, we don’t want any problems.’ And he’s like, ‘Yeah me either so beat it out of here.’ It’s just like hardcore.”

Undeterred, the brothers returned the next day, making the store manager even angrier. This time, Trav followed him into his office and convinced him to let the pushcart stay for 30 days as an experiment. During one of those days, some of Grocery Outlet’s corporate leadership pulled into the parking lot. One lit up a cigarette, another ordered a cappuccino, and a third received a mocha. Trav and Dane set the tone by offering the beverages for free. The group enjoyed their drinks so much that they praised the store for allowing the pushcart to be in the parking lot.

Thus, Dutch Bros was born—for real this time. A couple of years later, the company opened its first drive-thru. Expansion continued from there. The concept opened its first franchise in 2000. In 2005, Dane was diagnosed with ALS, at which point Trav strapped the business on his back and carried it forward. The biggest change came in 2008 when the chain decided to stop selling franchises to operators who didn’t grow up in the company. They were good people, Trav says, but they just didn’t understand the culture.

Dane passed away in 2009, and the brand honored his legacy by pushing past the Great Recession and kickstarting a new, successful growth path. In 2017, Dutch Bros shut off franchising completely so it could be the sole judge of getting “the best of the best” people in its system.

“Then we could build a pipeline of people and a ladder for them to climb and pay them extraordinarily well and they could build their teams and do leadership development and cultivate culture like nobody’s business,” Trav says. “That people system that we developed I think is one of the best things that we’ve ever done.”

Dutch Bros ended 2022 with 671 shops, making it the third-largest coffee chain in the U.S. in terms of unit count, only trailing Dunkin’ and Starbucks.

In 2023, the brand plans to open 150 stores. That would put the company past 800 units, a goal it set back in 2018 when it received an investment from TSG Consumer Partners. Dutch Bros is also expected to earn $1 billion in revenue on a trailing 12-month basis in late 2023 and surpass 1,000 restaurants by 2025.

Ricci is often asked how Dutch Bros scales culture from Boise, Idaho, to El Paso, Texas, and Knoxville, Tennessee. The company does this through an internal development model in which a team member can’t run a Dutch Bros in a new market without being part of the brand for a long time. He estimates that on average, it takes seven to nine years for people to get promoted into a trade area. Growth is predicated on the availability of talent. The pipeline has to be strong because when Dutch Bros enters a new market, it opens multiple stores as part of an overall fortressing strategy.

At the start of 2023, there were roughly 275 people in the pipeline ready to build new trade areas.

“As I tell people, we’re not a real estate company plugging people into it,” Ricci says. “We’re a people company plugging real estate into it. … We’re taking the best of the best of the leaders that we have currently in the system and then we’re moving them in to basically create what people view is so special with Dutch.”

Valuing experience starts at the top. In February, Christine Barone, formerly the CEO of True Food Kitchen and an executive with Starbucks, joined the company as president. She’s tasked with leading operations and leveraging her knowledge of coffee, service industries, and digital marketing. Her first impression: everyone on the leadership team is genuine, and that carries throughout the organization.

She views Dutch Bros as a company that recognizes employees want to work in places where they can have fun, make connections with colleagues, and go home in a good mood.

“It felt to me like Dutch Bros really just was getting a lot of things incredibly right,” Barone says. “And I also have three teenagers, and so they think I’m very cool now and that was an exciting part of the journey of joining Dutch as well.”

In Q4, shop-level turnover improved about 3 percent quar-

Proven

Exceptional

ter-over-year and sat in the mid-70 percent range. Manager turnover was in the low double digits and operator turnover was basically nonexistent. In 2022, the chain promoted more than 2,500 workers in the field, up from 1,700 in 2021. And on January 1, Dutch Bros increased wages across all jurisdictions that rely on the federal minimum wage as their standard.

In Barone’s short time with the brand, she’s watched decisions being made through the lens of the broista ( Dutch Bros’ play on words for barista). How will they feel about this? How will this look inside the shop? How do we make time to understand the hopes and dreams of people on our team?

“Taking the time to really listen and understand where someone’s coming from—it feels like that’s throughout the organization,” Barone says. “So to me it’s the special sauce that’s hard to put your finger on exactly what it is, but it’s absolutely a feeling that you get everywhere from the shop window, up into the headquarters of Grants Pass.”

The same care is given to customers. In 2021, the company launched its first loyalty program, called Dutch Rewards. By Q4 2022, 64 percent of transactions came from rewards members, and there’s room to expand that further in newer stores. Locations open since 2019 have roughly 5 percent lower rewards penetration than restaurants opening before 2019.

Within the loyalty program is Dutch Pass, a feature that allows users to pre-load funds and pay through the app. The

benefit is twofold—customers are offered a contactless form of payment and drive-thru speeds improve. In the fourth quarter, Dutch Bros promoted the Dutch Pass, which doubled the daily average of loads. “I think as we look at the loyalty pro-

“Taking the time to really listen and understand where someone’s coming from— it feels like that’s throughout the organization,”

CHRISTINEBARONE SAYS.

Bring operational efficiencies to your restaurant and elevate your self-ordering experience with ACRELEC’s kiosk solutions, equipped with Glory Cash Payment Systems. The industry leader with over 80,000 installations worldwide, ACRELEC’s innovative technology and personalized AI-driven ordering optimizes your customer journey while increasing the average check by up to 30% more.

acrelec.com/kiosk | marketing.KIOSK@acrelec.com

Copyright 2021 Acrelec. All rights reserved.

gram, it’s really about understanding our guest more and our customers more and what do they want from us,” Barone says. “And so part of that program I think is just learning more about the habits and what people like and helping them understand, well, if you’re someone who really likes to try a lot of different drinks, here’s something you might want to try next and how can we help you do that.”

More than 80 percent of the menu is cold beverages. Dutch Bros’ proprietary energy drink, Blue Rebel, is 27 percent of net sales and helps anchor afternoon and evening dayparts. In the rolling 12 months through Q3, net sales distributed pretty evenly throughout the day: 10 A.M.-3 P.M., 37 percent; before 10 a.m., 27 percent; 3 P M.-8 P M , 27 percent; and after 8 P M , 9 percent. This year, the brand is testing tap systems that will dispense cold brew and Blue Rebel, which should increase throughput and significantly reduce waste throughout the company’s distribution system.

Dutch Bros is a beverage-led concept in every sense of the word. There are a handful of food items, and Ricci doesn’t

expect it to ever become more than that. The chain tested breakfast burritos a few years ago, but they didn’t hold up to company standards.

“I think Trav said it best, he said, ‘So what’s special about opening up plastic wrap around the burrito that was heated in a TurboChef?” Ricci says. “‘How does that make the experience any better?’”

In the next 10–15 years, Dutch Bros wants to break 4,000 locations.

It’s not a baseless prediction, Ricci says. That came from scientific modeling, and the company only kept to promised geographies. The brand uses a smiley face growth strategy where it seeks expansion along the mouth of the smile. Meaning from the Pacific Northwest, California, and the Southwest to the Southeast and Mid-Atlantic. Tennessee was the first state on the East Coast to welcome Dutch Bros. It will be followed by Kentucky and Alabama in 2023 and Florida sometime in 2024.

“I believe the beverage concept is a very scalable concept,” Ricci says. “And just about everywhere you go throughout the country, it is very different from food, where food becomes more regionally based and more regional in how people consume it. Beverage has a much broader base of consumption across big categories.”

It wasn’t always like this. Amid the IPO process, Ricci spent a great deal of time explaining to people what Dutch Bros is and where Grants Pass is located on the map. Not many had heard of it. But during a media tour he conducted after the company’s Q3 2022 earnings call, every interview ended with, “When are you coming to New Jersey?” “Can I get the rights to Long Island?” “How fast will it take to get there?”

Ricci says it’s a testament to what the brand has earned. But Dutch Bros isn’t heading into the Great Lakes or the Northeast. It’ll most likely go as far north as Southern Virginia, according to today’s roadmap.

More attention doesn’t mean a change in plans. The culture is stronger than that.

“I would say that a lot of other people who we work with every day now are just like, ‘Hey bring this to New York, it would be great,’” Ricci says. “But we’ll stay disciplined to what we want to do.”

A rare bright spot for the restaurant industry during the pandemic, the quick-service pizza category has seen its sales momentum dissipate after several years of COVID-driven tailwinds. Domino’s, Pizza Hut, and Papa Johns reported weaker sales in 2022 amid a challenging delivery environment.

Higher-priced delivery orders were among the first things consumers cut last year as they tightened their wallets, according to Domino’s CEO Russell Weiner.

“As we saw in the last recession, delivery moves with the economy, especially for customers with lower disposable income, who represent a significant portion of our business,” he told investors during the company’s Q4 and full-year earnings call in February. “We expect the economy to be a headwind for our delivery business in 2023.”

A slew of headwinds has category leaders rethinking their playbooks.

Staffing shortages have taken a significant bite of pizza delivery, too. Capacity constraints limited Domino’s and Pizza Hut’s ability to fully meet orders in the channel last year. The impact of staffing shortages on delivery was evident in the first quarter when domestic same-store sales fell 6 percent at Pizza Hut and 3.6 percent at Domino’s. Pizza Hut ended the year with same-store sales down 1 percent. Domino’s saw same-store sales decline 0.8 percent, marking the company’s first negative comps result on an annual basis since 2008. Papa Johns’ same-store sales were up 1 percent for the year, making it the only one of the big three publicly traded pizza chains to deliver positive comps in 2022.

Pizza Hut pivoted and embraced third-party delivery, inte-

grating white-label delivery into its point-of-sale platform and expanding access to the brand via aggregators’ online marketplaces.

“The integration of third-party delivery apps has enabled Pizza Hut team members to process delivery orders with new levels of ease while also giving us the ability to win new guests and compete for new occasions that a customer may have not previously considered Pizza Hut for,” Pizza Hut president David Graves says. “Aggregators brought incremental customers into our business, and we’ve seen meaningful improvement on delivery sale trends since we started working with them more intentionally in late 2022. In early 2022, we saw approximately five transactions per store through aggregators, and at the end of 2022, we had increased to nearly fifty—based on a weekly total—so, these transactions certainly show a significant lift.”

Franchisees are deciding for themselves how they want to work with aggregators. Increasingly, they’re opting to gain access to both the mobile platforms and the outside delivery drivers to bolster fulfillment during peak times when they need the extra capacity. And since the brand worked to ensure economics are roughly the same across channels, it’s more or less indifferent in terms of where the sales fall.

While Weiner has hinted that Domino’s

may be considering softening its hardline stance on third-party delivery, the company remains reliant on its drivers to fulfill orders. That means it has had to look within the organization for solutions to the labor challenge.

“We found one answer to the delivery driver shortage by looking inside our own franchise operations,” says Joe Jordan, president of U.S. and global services at Domino’s. “After speaking to some of the franchisees who use their own fleet of vehicles, we found that they provide more opportunity to potential drivers who don’t have a car of their own. So, as a brand, we launched a fleet of more than 800 Chevy Bolt electric vehicles.”

The move, which gave Domino’s the country’s largest electric vehicle delivery fleet, provided several advantages for Domino’s stores, including ample battery life with the potential to have days of deliveries, zero tailpipe emissions, and lower average maintenance costs than nonelectric vehicles, without the financial impact of high gas prices.

Staffing shortages have had a less pronounced impact on Papa Johns, which started working with third-party delivery providers in 2019, and Little Caesars, which got into the aggregator game in 2020. Still, both companies have worked to improve operational efficiencies and ease the burden on team members.

Patrick Cunningham, vice president of U.S. development at Little Caesars, says the company hasn’t been immune from staffing challenges, but it’s benefited from a business model that requires “a significantly lower level of labor.”

“From the back of the store to the front of the store, from delivery of our raw materials all the way through delivery to our guests, the way the store is designed is extremely efficient, and we’ve been able to capitalize on that from a labor perspective,” he says.

Little Caesars has ramped up investments in technology, emphasizing automation, digital menuboards, and other proprietary technology that helps further streamline operations. It also increased wages across the board and offered more flexible schedules for team members.

“Many people who are at higher levels of the organization started as crew members in the store, so we’ve shown that opportunities exist for growth, not only at the restaurant level, but outside of the restaurant level,” Cunningham says. “Those factors have certainly helped us mitigate what’s happening out there right now.”

Pizza Hut adjusted its hiring practices to attract more drivers. It also continues to expand its Dragontail platform, which automates kitchen flow and driver dispatch processes.

“This AI enables us to sequence how we prepare and deliver pizzas, so it is both more seamless for the Pizza Hut team member while also allowing us to get orders to our guests faster and hotter,” Graves says. “It’s been hugely impactful from an operations and team member standpoint and globally, we expect to have Dragontail in over 7,000 stores by the end of 2023.”

Domino’s, meanwhile, is leaning into call centers to field phone orders and free up employees in the store to focus on other tasks. Similarly, Papa Johns has continued to leverage its PapaCall initiative, which brought artificial intelligence into its call centers. CEO Robert Lynch says the technology has reduced the number of dropped calls and lost orders.

Papa Johns also has taken steps to improve its make-line efficiency and streamline its operational models when it comes to dispatching both internal and

Fast. Up to 80% quicker than a conventional oven.

Quiet. Doesn’t interrupt customer engagement.

Easy to install. UL certified ventless, no extraction hood needed.

Easy to use. Intuitive touchscreen for high quality, repeatable results.

Flexible. One appliance to cook, toast, grill and reheat.

external delivery drivers. A renewed focus on efficiency and execution helped it shave 10 minutes off its out-the-door time for orders taken in corporate restaurants.

Building on those efforts, the company late last year unveiled a “Back to Better” operations initiative.

“It really is about us returning to one of the things that made this brand great to begin with, which was great company operations,” Lynch says. “During the pandemic, we were so focused on keeping everyone safe and keeping these restaurants open, that we moved a little bit away from some of the really important KPIs that drive operational productivity and performance.”

Inflation comes and goes, and most pizza chains reported improvements in staffing levels heading into 2023. Challenging year-over-year comparisons offer a partial explanation for the softness in delivery, too. But the normalization of consumer behaviors and a return to in-person dining experiences could

be a longer-term headwind for pizza delivery.

Data from The NPD Group show demand for quick-service delivery in general, not just pizza, declined in the high-single digits last year.

“As consumers returned to many of their pre-COVID eating habits, some of the sit-down business that was a source of volume for restaurant delivery orders returned to that channel,” Weiner told investors in February.

He added that because Domino’s business model is focused on carryout and delivery, the shift back to dine-in has bigger implications for the company compared to non-pizza restaurants that already offered sit down and carryout, but added delivery to their distribution channels during the pandemic.

Pizza’s ease and affordability made it a go-to meal for cashstrapped and homebound consumers as stay-at-home orders and mandated dining room closures swept across the country in 2020. Now, the category is doubling down on value plays in a different environment marked by new macroeconomic and external roadblocks.

With inflation and changing consumer dynamics weighing on delivery, brands are emphasizing deals and promotions to engage price-sensitive consumers in a time of soaring costs.

Pizza Hut launched Menu Melts, a handheld item featuring two slices of pizza that are folded, baked, and served with a dipping sauce. The product, which Graves says was specifically crafted with an individual meal occasion in mind, is priced at $6.99.

“Melts over-indexed to pre-dinner time frames and individual occasion tickets and helped to recover more value-conscious customers due to its strong value proposition,” Graves says. “The success from Melts in Q4 2022 included driving meaningful improvement with transactions, which is a difference maker from what we’re seeing in the category.”

Domino’s also is doubling down on value as it seeks to regain its momentum following one of its most challenging sales years in over a decade. The company took 5.4 percent of price last year, and it turned to promotions and limited-time offers to generate traffic. Last fall, it launched an inflation relief deal, offering 20 percent off menu-priced items ordered online. It also moved its $5.99 Mix and Match deal to $6.99 while expanding the platform with a new Loaded Tots offering.

“They’re actually the first potato items that we’ve offered on our national menu, and they perfectly complement pizza, which we’re always looking to do,” Jordan says. “They’re also part of Domino’s Mix and Match deal, so not only are we bringing a delicious new product to customers, but at a great price.”

Along with filling delivery positions, maintaining a strong value proposition while adjusting to higher food costs is a top concern he’s hearing from conversations with franchisees.

“Whether it’s an inflationary environment or a non-inflationary environment, we need to be the best relative value out there in the quick-service restaurant industry,” Jordan says.

Little Caesars raised the price of its signature Hot-N-Ready Pizza platform from $5 to $5.55, but it also added 33 percent more pepperoni to sweeten the deal. The additional 55 cents is a temporary change while the extra toppings are permanent. Beyond raising prices, Cunningham says, the brand manages macroeconomic headwinds because it controls its own foodservice distribution company.

“The inflation portion continues to be top of mind,” he says. “But from a supply chain perspective, we’re very well positioned. We have a vertically integrated supply chain here that keeps the operators at ease and gives us an edge on the industry.”

Papa Johns is taking a different approach. Instead of aiming for the lowest possible price point, it’s channeled much of its menu innovation efforts toward premium offerings, namely its stuffed crust platform. The company earlier this year debuted its Crispy Parm Pizza, featuring baked cheese underneath the crust.

“We like pushing the envelope on innovation, and customers are really responding,” Lynch says. “We’re going to keep innovating on the premium side.”

That doesn’t mean the company isn’t courting price-sensitive consumers. Papa John’s launched Papa Pairings to compete with Domino’s, Pizza Hut, and Little Caesars on the value front. The platform allows customers to choose two or more items for $6.99 each. Among the offerings included in the deal are medium one-topping pizzas, bread sides like cheese sticks and garlic knots, Papadias, wings, and desserts.

“We’ve been pretty happy with the way our Papa Pairings platform has performed,” Lynch says. “We look at that ‘value’ platform as not just a discount, but a way to drive people to products they may not typically try or even be aware of.”

Papa Johns is optimistic about its outlook for 2023, guiding 2–4 percent growth on an annualized basis. Domino’s lowered its short-term outlook but still expects sales will grow between 2–4 percent over the next two to three years.

While pizza may have to fight harder for its share of the stomach going forward, Cunningham says the classic category’s growth story is far from over.

“I believe that this segment is one of, if not the best, segments to be in,” he says. “It’s seen growth for many years, and it’s going to continue to see growth for many years to come. It’s a segment that is on the top of consumers’ minds seven days a week.”

Sam Danley is the associate editor of QSR He can be reached at sdanley@wtwhmedia.com

Sam Danley is the associate editor of QSR He can be reached at sdanley@wtwhmedia.com

POTBELLY IS MAKING NOISE WITH ITS RENEWED FRANCHISE STRATEGY.

Bob Wright’s impression of Potbelly had a familiar tone to it. Few brands draw from bases as deep as the sandwich brand, which opened in 1977 in Peter Hastings’ Lincoln Park antique shop. It didn’t begin growing until a regular, Bryant Keil, purchased the concept from Hastings and scaled it from one to 250 stores over the next 12 years. It first reached double-digits in 2002 as Potbelly left Chicago for the first time, opening in Washington, D.C. Unit 100 arrived three years later, and the company went public in 2013.

/ BY DANNY KLEINPotbelly has never lacked for brand affinity. But it’s just now starting to realize that massive potential.

Along the way, Potbelly carried its Underground Menu, freshbaked cookies, and hand-scooped milkshakes to fresh audiences as it worked to stoke that history.

Yet Potbelly’s cult-like fanbase hasn’t always flowed to topline success. When Wright, a former EVP and COO of Wendy’s, assumed his CEO post in summer 2020, it was a brand known

the first 10 weeks and yet still finished down 10.1 percent—a sign of how steep the COVID cliff truly was.

But all told, the chain Wright took helm of that summer was more than just a pandemic recovery project. It was a comeback years in the works. Potbelly’s fan-centric differentiation was a line circulated to investors for years—one that had yet to cash in.

Wright set course. “I think it’s important to [ know] that before I was approached [for the CEO role], this is a brand I’ve always had a really strong affinity for,” he says. “… The brand is terrific. The food is great. The experience is unique. And when you get that combination of things in the same company, it’s a very defensible point of differentiation and that’s what gets you to grow.”

Wright began with a five-pillar strategy announced publicly in fall 2020: food quality at great value, positive work environment, customer experiences that drive growth, digitally driven awareness, and franchised-focused development. It was taking root behind the curtain. Company-owned same-store sales declined 21 percent in Q3 2020 and 19.4 percent in October, an improvement from a 41.5 percent slide in Q2. Additionally, the brand reached unit-level profitability and traffic soared 21 percentage points.

Those 100 potential store closures? It ended up at just 28, with 321 leases getting renegotiated.

Potbelly has been a rocket since.

as much for its potential as its performance. “For whatever reason,” Wright says, “It just hadn’t realized it.”

Wright arrived in the mouth of the pandemic. Potbelly wasn’t alone with its troubles, which were more pronounced across café-style fast casuals than fast food. Potbelly’s same-store sales dropped nearly 70 percent that March and the company cautioned investors it could permanently shutter up to 100 corporate units. Before getting into what actually happened, it’s worth flipping back another chapter. Potbelly’s turnaround wasn’t a COVID-triggered task.

The brand had a plan called “Project Aurora” in place previrus. Aided by a consulting firm, Potbelly built a “state of powerful tech-based consumer insights” to drive progress. This included everything from menu optimization to quality control to revamped advertising. Also, a “Shop of the Future” model that closed the circle. Sales on the top line dipped 3 percent across 2019 and ran negative every quarter from Q1 2017 to Q4 2019, before the COVID crisis entered the picture. Growth halted in Q3 2019 as the company redirected efforts.

Things had begun to improve somewhat on the doorstep of lockdowns. A Q4 2019 comps decline of 0.1 percent was Potbelly’s best quarter in three years. The brand outperformed the industry in traffic and comps for 11 of 13 weeks, per Black Box Intelligence, and projected a return to positive same-store sales in Q1 2020.

Naturally, nothing about that opening period would prove to be in Potbelly’s crystal ball. Comps rose 2.6 percent across

Total revenues in full-year 2022 increased 19 percent to $452 million. Same-store sales climbed 18.5 percent and units averaged $22,464 per week—a record figure. Potbelly’s Q4 comps of 18.9 percent represented its seventh consecutive quarter of positive gains. Weekly average sales closed the year even higher—at $24,144 (or about $1.2 million on a yearly view). That number was $19,455 in Q1 2022.

On the topic of growth, Potbelly headed into 2023 with signed development area agreements for 51 new shop commitments over the next seven to eight years.

The genesis, Wright says, dials back to the same DNA that hooked him as a customer. If Potbelly couldn’t replicate craveable, high-quality food at a great value, it was going to drown in a beehive of sandwich chains. All of that equity curated over 46 years would become more nostalgia than reality.

“We had to focus on those experiences that would bring people back,” Wright says. “And frankly, our operations needed some attention, and we weren’t necessarily giving people the best reasons to come back. That’s where traffic growth comes from—your own experiences.”

Just like the entire restaurant field, Potbelly had to make the brand digitally available to do so.

The 12 months leading up to the end of fiscal 2021 were a turning point. Potbelly launched a simplified, value-enhancing menu (more on this later), upgraded its tech stack with a revamped app, website, digital ordering integration, and Perks loyalty program, as well as filling out its leadership team with a crop of new hires. In a perhaps less sexy, yet no less vital move, the chain fortified its payment solution as well.

“But it was all in recognition of where the customer was going,” Wright says. “We wanted to make sure we were more

accessible to them, that they could use our digital assets.”

Potbelly’s previous app was a white-label version of somebody else’s—not an uncommon move for restaurant brands. The chain skinned an existing model and branded it. But it wasn’t designed for Potbelly. That flip can’t be understated, Wright says.

The new app and web experience mimics how customers progress when they order in-store. It flows through the same steps, which include picking a sandwich, choosing a size, and selecting the bread. “We’re having this dialogue with you when you come through the shops,” Wright says. “We needed to build a way that could happen in the digital environment and be smooth, with a lot less clicks, but still reflect the way that you would step through if you came inside the restaurant.”

Potbelly’s Perks loyalty program was rebuilt to unlock better data. The ability to earn points and redeem them isn’t where the flip happened for Potbelly; rather it was the ability to foster connection. There are tiers now that offer different experiences. Potbelly can pulse incentives to diners based on how they behave. There’s Perks-only promotion activity, like digital-exclusive deals—such as you see on National Cookie Day—that nurture a VIP-like experience over a straight discount. “And what we found is the brand love that we always knew was there, really comes to life with our Perks consumers,” Wright says. “And so, when you give them special treatment, they turn around and give us additional traffic.”

Digital represented 38 percent of revenue in Q4. Prior to the pandemic, it was single digits. Headed into the final stretch of 2022, Perks boasted north of 2.2 million members and added 115,000 users in just Q3. “It’s digitally targeted in ways that fit [customers’ ] usage of the brand. That’s when it feels like the customer has that experience and they start to feel like the brand really understands me and how I’m using their brand, and therefore it has a lot more upside in terms of frequency,” Wright says.

It’s a formula unfolding across the sector. Use digital promotions to spike acquisition and then follow through with a nurturing campaign that treats consumers differently as they start to develop a frequency pattern. To put in plainly, for Pot-

belly and countless others, it’s a capability that just wasn’t in the playbook a couple of years ago.

Another unique trait of Potbelly, especially among its public, competitive set, is the brand’s makeup. As of December 25, 2022, there were 429 locations. Only 45 of them were franchise shops. The franchising program began around 2010 or so but never quite pieced together. Wright, who’s worked at Charley’s Philly Steaks, Checkers & Rally’s, and Domino’s, and was navigating operations for more than 6,000 North America Wendy’s at the end of his tenure, has been in the franchising space his entire career. He decided early on Potbelly would lean into franchising going forward. The company set a previous goal to refranchise roughly 25 percent of its corporate footprint midterm and eventually ramp up annual franchise unit growth to at least 10 percent.

The big ticket: reach 2,000 stores in the U.S. over the next eight to 10 years and become at least an 85 percent franchised system.

This four-digit target didn’t emerge from the abyss. Potbelly conducted market holding capacity research for the entire country before it let investors in on the plan during a March 2022 quarterly call. The combination of shop development area agreements and refranchising forms the basis for the growth Potbelly has in mind. And all across a diverse lineup of inline, endcap, drive-thru, and nontraditional venues.

Wright says Potbelly used its 2020 stall to prepare to grow again. It started with going for the biggest return items on that five-pillar approach. There were two Potbelly bet on: the tech stack outlined earlier, and the menu.

Potbelly came into COVID already having done extensive work with the latter. In fall 2018, the company tested new menuboards at 58 locations and piloted, for the first time, the inclusion of combos and bundle offers. There was a pick-yourpair option and a make-a-meal choice. By February, the new, enhanced menuboards were systemwide. The biggest change,

if you look at Potbelly’s center panel of the menu, was to take it down from 55 price points to 18. Management at the time called it, “one heck of a complicated thing.” It was referred to internally as “mission impossible.”

The reason boiled down to simple math. With 486 locations at the time, Potbelly had 680 unique menuboards in terms of size. It had to reprogram the point of sale, redo the company’s app, redo its website, change the loyalty program, and update the catering and delivery functionality for how customers pay.

When Wright walked in, customer data was pointing to a new roadblock—guests had a problem with Potbelly’s value equation.

“The reason we had been bleeding traffic was deeply rooted in what we had done to the value of the Potbelly experience,” he says. “It was with the food. And, basically, what do you get for what you pay.”

In some cases, guest feedback noted they didn’t like what they were paying (prices had gone up). But more vitally, they didn’t feel like the experience had kept up with the hikes. And in just as many instances, Wright says, people felt the food itself wasn’t matching the price point and Potbelly’s past. Again, it flashed the brand drift alarm Wright wanted to guard at all costs.

So Potbelly got to work. Unveiled in August 2021, the brand added a “skinny,” smaller size that lowered the entry point and enabled customers to create pick-and-pair options that better fit their appetites. Alongside, Potbelly made its original size bigger and its “big” even larger. It put more meat and cheese per inch in the larger sandwiches and “just dove in to give the customer more,” Wright says. “And course correct.”

Potbelly tested the platform “for months and months.” Data suggests the brand got it right. The skinny option in particular helped to reshape Potbelly’s accessibility. There were a fair number of lunch consumers who didn’t consider the brand approachable from a price perspective before, Wright says.

Potbelly took some 60 SKUs out in total—a move that ultimately shielded it a bit from commodity chaos in 2021 and 2022, and the inflationary pressures that remain in flux today.

“We kind of reset our base with the new menu,” Wright says. “That gave us a chance to take some modest price increases. I say modest compared to competitors—they’re very high price increases versus what we’ve done in the industry in the past [about 13 percent last year for Potbelly]—but we did it without hurting the value equation.”

Another hallmark of Wright’s leadership is that he’s been a top-line-first operator for more than 35 years. At the foundation, he says, there’s no better way to grow profitability than to grow sales. And getting Potbelly’s unit-level economics to a desirable point was critical to pushing franchise expansion. The brand drove Q4 shop-level margin expansion up 14.2 percent and finished 2022 with shop margins at 10.5 percent. The goal on the whiteboard today is 16 percent.

And it’s rooted in guest response. “That’s why things like Perks and the digital advertising that we’ve done and what we did with the menu, we went right to the heart of the relationship with the customers with the value part of the menu,” Wright says.

In recent history, he adds, the company underinvested when

it came to advertising. CMO David Daniels, who joined the brand in August 2021, previously serving as SVP of marketing at The Food Hall Co. in Dallas, fine-tuned Potbelly’s creative, from refreshed logos to social media placements. Last year, the investment was still only about 2 percent of sales. Video content is on deck. And the new brand work laid down has the potential to work even harder for the brand, Wright says.

There’s also Potbelly’s Digital Kitchen plan, or “PDK,” which supports order accuracy, speed of service, and throughput. The in-shop platform was designed to improve a restaurant’s ability to sort orders, present them to employees, and coordinate processes.

Essentially, what Potbelly did was take advantage of the fact it already had two make-lines and digitized them. The chain can monitor stores with the system and troubleshoot against operational gaps. It can also use data to better deploy labor.

As the calendar turned to 2023, PDK was live in 38 locations, with plans to end the year closer to 100. “We’re getting very, very nice returns on the customer experience,” Wright says. “We’re measuring those shops against control shops for overall customer experience, for order ready on time, which is really critical for digital orders—it’s as important as accuracy … we’re actually seeing some of our early measures on things like food quality, which makes sense on time. It’s ready, it’s hot, and the accuracy is there.”

“And here’s the thing that we’re really enjoying: it definitely is helping us with those more capacity constrained shops.”

PDK provided a boon in efficiency. Wright says it takes seven hours of labor out of shops. “Our managers and teams will tell us, ‘if you take this out, I’m going to leave,’” he says.

Potbelly prioritized other operational efficiencies across 2022, too. It implemented a streamlined training program and refined how managers staff stores with the help of a house-based labor guide. Digital tipping joined the line as well.