Our exceptional line of stand-up bags make it more convenient to prepare desserts and beverages with premium Ghirardelli Chocolate.

CONVENIENT Smaller bags are easy to pour and store.

ACCESSIBLE Flexible offerings let you mix and match different chocolate varieties.

VERSATILE Couverture chocolate formats are perfect for flavoring, coating, melting, and glazing. Non-couverture chips hold up well when baked.

Explore the new line and request your samples today.*

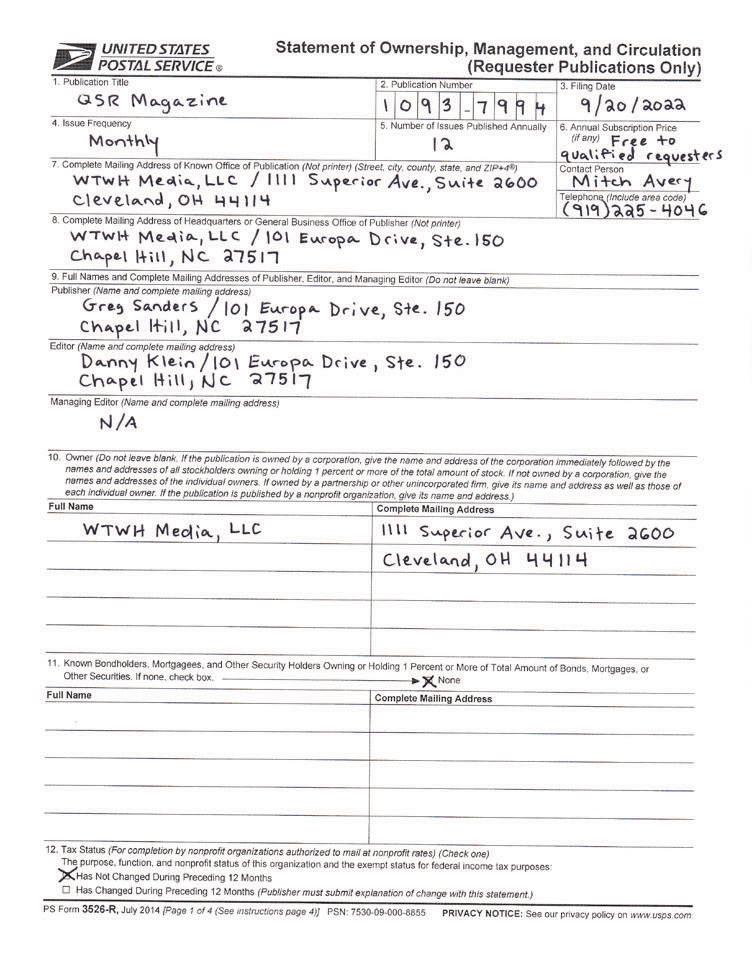

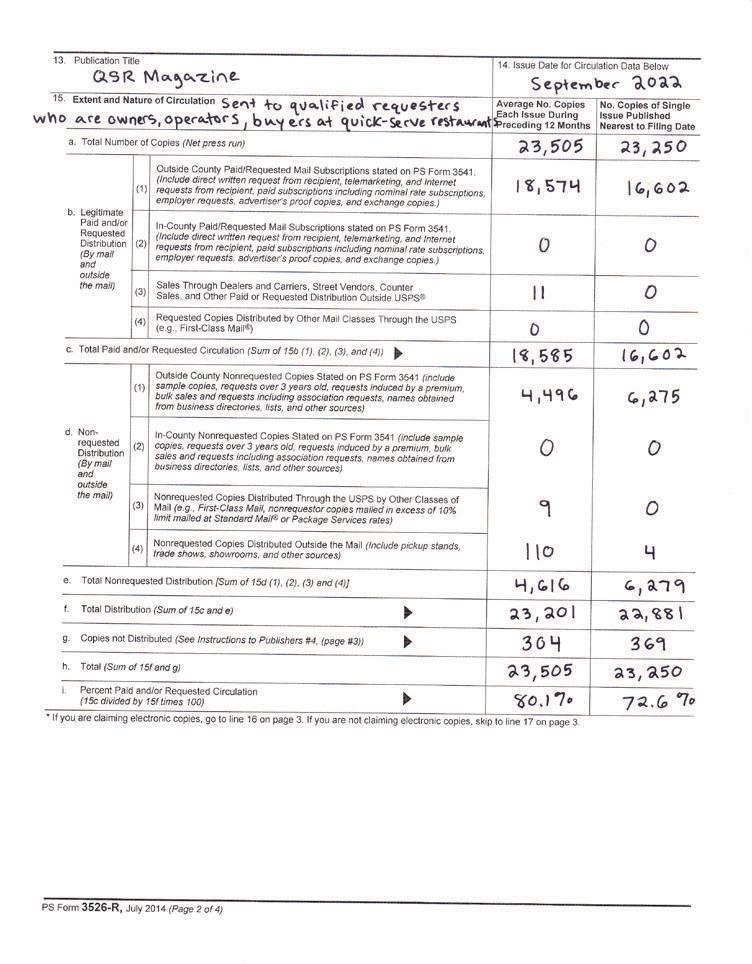

EDITORIAL

EDITORIAL DIRECTOR

Danny Klein dklein@wtwhmedia.com

MANAGING EDITOR

Nicole Duncan nduncan@wtwhmedia.com

SENIOR EDITOR

Ben Coley bcoley@wtwhmedia.com

SENIOR EDITOR Callie Evergreen cevergreen@wtwhmedia.com

CUSTOM MEDIA STUDIO

DIRECTOR OF CUSTOM CONTENT Peggy Carouthers pcarouthers@wtwhmedia.com

ASSOCIATE EDITOR, CUSTOM CONTENT

Charlie Pogacar cpogacar@wtwhmedia.com

ASSOCIATE EDITOR, CUSTOM CONTENT Kara Phelps kphelps@wtwhmedia.com

ART & PRODUCTION

ART DIRECTOR Tory Bartelt tbartelt@wtwhmedia.com

GRAPHIC DESIGNER Erica Naftolowitz enaftolowitz@wtwhmedia.com

PRODUCTION MANAGER

Mitch Avery mavery@wtwhmedia.com

SALES & BUSINESS DEVELOPMENT

GROUP PUBLISHER

Greg Sanders gsanders@wtwhmedia.com

NATIONAL SALES DIRECTOR Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES MANAGER Edward Richards erichards@wtwhmedia.com 919-945-0714

NATIONAL SALES MANAGER Amber Dobsovic adobsovic@wtwhmedia.com 919-945-0712

NATIONAL SALES MANAGER John Krueger jkrueger@wtwhmedia.com 919-945-0728

SALES SUPPORT AND DIRECTORY SALES Tracy Doubts tdoubts@wtwhmedia.com

919-945-0704

FOUNDER Webb C. Howell

ADMINISTRATION

919-945-0700 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. who meet subscription criteria as set forth by the publisher.

REPRINTS

The YGS Group 800-290-5460

FAX: 717-825-2150 qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided to the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed at sponsoredcontent@qsrmagazine.com.

WTWH MEDIA LLC

RETAIL, HOSPITALITY, AND FOOD GROUP

Iwant to preface by saying I’m writing this in late September. You have to put that caveat out there whenever you talk about foodservice. Monday’s problem is often Tuesday’s long-forgotten fire. One of the reasons we all embrace restaurants is because you wake up with no clue what’s ahead. But with that said, restaurant labor has stuck to the priority board since the day I made my first call at QSR Will it get better a week after I type this letter? Hard to say. Yet it won’t lose relevancy. That much I can promise. Earlier in the month, some operators told me application flow was up. One even mentioned they had the unique task of suddenly coaching GMs on how to manage labor. Through the pandemic, it’s mostly been a crash course in skeleton crew survival. And yet, as a consumer, a local fast casual recently stopped opening on the weekends and another took 45 minutes to fulfill a digital order because they were strapped.

It’s an unstable topic. But one thing I think we can agree on is COVID spun the wheel. Brands are now more attentive to workers’ needs and to higher pay, and the reality they’re facing as much competition to lose employees from other sectors as they are from each other.

In platform Toast’s recent Voice of the Restaurant Industry report, 32 percent of operators said they had a difficult time hiring in 2022. Six percent cited “extreme challenges;” 26 percent moderate; 36 percent slight; 23 percent few; and 8 percent none.

Among the top tech hurdles at hand, inventory and scheduling employees saw the biggest year-over-year increases—22 percent picked managing inventory and cost of goods; 19 percent scheduling

employee shifts and time; 19 percent managing online ordering; 18 percent integrations with third-party platforms causing workflow issues; 17 percent managing and leveraging guest data; and 17 percent managing multiple order sources.

It’s an intriguing combo. Operators surveyed noted they have an average of seven service models today. Some, as many as double-digits (counter, hybrid, table, takeout, delivery, catering, retail, wholesale, food hall, and drive-thru).

Not surprisingly then, the No. 1 area of focus for restaurants in the next 12 months was employee training, at 45 percent.

Simply, restaurants are trying to deliver experience through a bevy of channels. Meanwhile, they’re flipping staff over at higher rates ( as much as 200 percent at some brands) So technology arrives on two fronts: One, to automate duties so employees can work on consumer-facing tasks; and two, to bring employees up to speed faster. And that latter point is why simplified operations are a buzzing topic, too.

Where we’ve arrived, it appears, is a world where restaurants are trying to catch their breath from a breathless run of innovation, and to take these evolutions into an environment where they improve human interaction rather than replace it. Software to boost employee productivity and make the quick-service restaurant a more desirable place to work. Can it all come together? That’s what 2023 is going to show us.

Hiring and retaining workers remains at the forefront of running a successful restaurant. But the tools are changing.

percent—want to see more seafood on quick-service restaurant menus. Additionally, only 42 percent of consumers are satisfied with seafood offerings in the quick-service space, leaving many opportunities for restaurants to create innovative LTOs featuring seafood. This is particularly true among diners who want to reduce their red meat consumption, as the survey found 61 percent of consumers believe fish or seafood is healthier than plant-based meat alternatives.

Leah Krafft, foodservice marketing manager at ASMI doesn’t find these results surprising. “Diners know how healthy seafood is and believe it to be much healthier than plant-based meat alternatives,” she says. “I think there is just so much noise about plantbased dishes, but, in reality, the desire is for seafood on the menu. It’s the number one protein diners want when avoiding meat or reducing meat consumption.”

The restaurant industry is already highly competitive, but amid high inflation, rising interest rates, and staffing and supply chain shortages, it’s no surprise operators are feeling the pressure. Additionally, as margins shrink, it’s become increasingly important to not only draw in and retain more customers, but also to increase check sizes to bring in revenue.

It’s no secret that striking the right balance of menu offerings is crucial to drawing in customers, and its menu offerings is one of the major operational elements entirely under the control of the restaurant brand. Yet a recent online survey conducted by Datassential on behalf of the Alaska Seafood Marketing Institute (asmi) highlights a major menu opportunity for quick-service brands.

Notably, the survey found 59 percent of customers want to increase their seafood consumption. Meanwhile, the majority of customers—54

Yet the type of fish available on a restaurant menu is also important to consumers. Datassential reports consumer preference for Alaska seafood has grown since 2019, and items labeled “Alaska seafood” are now preferred two-to-one over seafood that is not labeled as “Alaska.” In fact, the study found 91 percent of diners were more likely to order seafood when “Alaska” is called out on the menu, meaning marketing the origin of seafood could be a significant boon to restaurants.

”Consumers see Alaska seafood as fresh, wild, and tasty, as well as offering strong health benefits,” Krafft says. “And consumers prefer the term ‘wild’ over ‘farm-raised’. ‘Wild’ boosts interest likely since it’s seen as more climate-friendly. Emphasizing how Alaska seafood is wild-caught helps establish Alaska’s connection to these key criteria in consumers’ minds.”

With these lessons in mind, adopting Alaska seafood can help quickservice restaurants generate positive consumer sentiment, as well as drive sales. Additionally, with a wide variety of fish hailing from Alaska, operators have nearly endless menu options.

“With inflation and increased costs to today’s operator and diner, menuing seafood is still an important answer to consumer demand for eating healthy, delicious foods,” Krafft says. “There are affordable ways to menu seafood without sacrificing on innovation. It’s clear that menuing and calling out ‘Wild-caught Alaska’ is of the utmost benefit to operators.” ◗

restaurants.

/BY

Want the best fish tacos? Go to the source. Alaska Seafood is always authentic - wild flavor from a wild place.

AlaskaSeafood.org

IN SEPTEMBER, MOE’S SOUTHWEST GRILL unveiled “Queso Incognito,” a portable speaker-shaped container that keeps the brand’s “liquid gold” undetectable— so customers don’t have to share, the brand explained. Guests could now sneak queso into restaurants, movie theaters, or even family dinners. Moe Rewards members were able to enter to win one of three limited-edition devices along with a “Liquid Gold Queso Card” that unlocked a flood of queso for the remainder of 2022 (more than three kegs of beer worth).

“Our three-cheese queso—fondly referred to as ‘liquid gold’ by our fans—is a Moe’s staple, and we think something this iconic deserves to be celebrated,” says Tory Bartlett, chief brand officer. “This year, we’ve gone bigger than ever before to give our most loyal queso enthusiasts a chance to enjoy their favorite treat, wherever and whenever. We’re excited to kick off the queso festivities and to give our customers more of what they’re craving.”

Moe’s “Queso Incognito” container appears as a speaker from the outside.

Moe’s “Queso Incognito” container appears as a speaker from the outside.

Moe’s gave cheese lovers a new way to enjoy the fan-favorite add-on, anytime, anywhere.

And when you tackle one crisis, another is waiting. In the fall, a survey from Alignable.com found 9 percent of operators were laying o workers and another 55 percent suspending recruitment e orts altogether in light of rising costs and broader economic challenges. But still, the high-turnover reality of running a restaurant keeps this topic central to every playbook in every segment this industry has to o er.

So let’s ask the experts.

What are you accepting that you thought you’d never allow? “The no-call no-show. Used to be two no-shows and you were out, but those days are gone And the second thing is not holding people to the brand’s standards for uniforms. Now we’re letting people wear jeans with a Cousins branded shirt or hat. It’s more everyday wear that they choose rather than a strict uniform.”

How are you recruiting? “We’re using everything: Digital billboards in markets where we need immediate hires, social media, and—as far as job boards go—Indeed is still one of our best sources. And, we put stickers on every sub: “Work for Cousins Subs!”

Where are we failing and how do we fi x it? “In the restaurant industry, we’re just stealing from each other, and our industry is going to have to adapt to how the workforce has shifted since the pandemic. We have to figure out how we can take advantage of the gig economy and those part-time workers who want to work multiple places. The franchise groups that own multiple brands may have a huge opportunity parsing out employees across all of their brands.”

Jennifer

CEO, Wetzel’s Pretzels

Is there a way to ease the pain of employee turnovers? “Keep your business model simple. For most store-level staff, this is a starter job; they’re young students working part-time so keep the menu streamlined and training easy. Turnover becomes more painful as complexity increases. For instance, don’t bring out a new item in the holiday season. LTOs and new items add complexity to the supply chain and to training. We decided to postpone introducing a new item until February timeframe because our stores will have 4Q traffic even without adding new items, and franchisees will be better equipped to manage the holiday traffic if we keep it simple.”

Why do your employees quit? “We asked 3,700 restaurant employees why they quit and the top three answers were wages, schedule flexibility, and school— in that order.”

How do you get employees to show up and stay put?

“When employees choose their own schedules, they’re more likely to show up for the shift. No-shows happen for many reasons including scheduling conflicts, a desire to avoid working with specific people, and illness—but self-scheduling allows employees to trade shifts to prevent these types of no-shows. Flexible self-scheduling can also be a powerful recruiting and retention tool.”

What’s the best way to ramp up for 4Q / holiday labor demands?

“Refine your hiring strategy to be enticing and resonate with workers. You should incentivize your existing staff for referrals and get creative around how you market your brand— think videos of your team, pitching the vision and giving folks a glimpse into what it’s like working there.”

co-founder , Beyond Juicery + Eatery

How can corporate make sure franchisees get staffing right? “When a potential investor comes in and wants to franchise, my question is: ‘Who’s your operator?’ You need someone with skin in the game who is dedicated and loves what they do.”

What’s your best advice for hiring? “Act fast. If you don’t hire them when they’re in front of you, they’re gone. If you call them two days later, they’ve already taken another job. That goes for managers too; you need to move fast to check references, do background checks, and extend an offer. And if you put off orientation until next week, they may have taken a better option.”

The labor challenge for restaurants today has more layers than a wedding cake.Jason Westhoff president, Cousins Subs Jordan Boesch CEO, 7shifts

/ BY

/ BY

The demand for plant-based foods has risen astronomically. It is a trend being driven by the growing number of consumers adhering to a flexitarian-style diet, as well as those with food sensitivities and intolerances.

For some, the words “plant based” might evoke images of one-forone swaps, but Richard Hoelzel, corporate executive chef at Idahoan® Foodservice, sees something else coming into focus.

“Consumers are discovering that there’s more to making plantbased alternatives better for you,” Hoelzel says. “Rather, clean-label products are something people are really starting to prioritize, along with plant-based alternatives.”

To meet the demand for clean-label, plant-based foods, chefs are turning toward potatoes. Potatoes are a nutritious vegetable that can be used in a variety of dishes, dayparts, and cuisines. They can be served mashed or shredded in traditional sides, or used as a comforting, healthy base in creative bowls or salads.

“The potato is a vehicle,” Hoelzel says. “That’s how I look at it. When you talk about innovation, there are so many options when you are working with potatoes.”

The downside of raw potatoes, however, is their relatively short shelf-life and the high labor costs associated with preparation. That’s why chefs love Idahoan’s Honest Earth® line of clean label products, which are created using a proprietary cooking method to produce Fresh-Dried™ potatoes. The cooking method “honors the integrity of the potato,” Hoelzel says, while adding a host of operational advantages. Included in those advantages is the fact that the products carry a 12-month shelf life and therefore reduce food waste.

Unlike potatoes that have undergone traditional dehydrated methodologies, Idahoan’s Fresh-Dried™ potatoes remain structurally sound. That’s why Honest Earth products are considered speed-scratch

ingredients—they perform and taste the way a potato should. Best of all, chefs get the credit for this while cutting back on labor otherwise spent prepping potatoes.

Hoelzel uses the Honest Earth Creamy Mashed Potatoes or the Honest Earth Rustic Mashed Potatoes in globally inspired bowls, like a Mashed Potato and Tofu Curry Bowl, or a Sweet Chili Pork Bowl with Creamy Mashed Potatoes. Honest Earth Hash Brown Shredded Potatoes open up a world of possibilities on every single menu—they can be made into Hash Brown Latkes or served as the base of a Cajun Crawfish Creole Bowl, for example.

Each Honest Earth product contains simple, familiar ingredients. The Honest Earth Creamy Mashed Potatoes and Honest Earth Rustic Mashed Potatoes contain Fresh-Dried™ potatoes, and a hint of sea salt and butter for flavor and texture. Honest Earth Shredded Potatoes contain Fresh-Dried™ potatoes, sea salt, and cracked black pepper. Chefs only need to add water, or some other liquid—Hoelzel even recommends coconut milk, or stock—to refresh the potatoes and enable a world of plant-based innovation.

“Nobody out there is doing potatoes the way we do them,” Hoelzel says. “These are clean-label potatoes that perform exactly the same as if you made them in-house. It’s truly a scratch-quality, foodservicefriendly, plant-based ingredient.” ◗

“Nobody out there is doing potatoes the way we do them.”

The versatile vegetable is opening up a world of flexitarian-friendly innovation.

CHARLIE POGACAR

“My favorite part is the bone”

According to Datassential, 29 percent of the American population limits meat consumption in some manner. Furthermore, 28 percent say they prefer plant-based over animal proteins. What does this add up to? A sizable opportunity for restaurants. Americans’ reasons for avoiding meat products vary. Some are taking a stance against the killing of animals and their byproducts; others are switching because rearing animals for meat takes a toll on the environment; others simply want to be healthier.

Steele Smiley falls into all of those categories, but especially the latter. He launched his fast casual, Stalk & Spade, last year and has three locations with 10 projected by the first quarter of 2023.

Stalk & Spade offers 100 percent plant-based food including burgers, chick’n sandwiches, and salads. It’s important to Smiley the meals taste like the meat dishes they mimic. “We won’t put some-

thing on the menu unless it tastes like the classic original,” he says.

But Smiley doesn’t work with external companies—all R&D is done in-house and the food is proprietary. “We’re the only fastfood chain that owns its own supply chain,” he says.

Matt de Gruyter launched Next Level Burger in 2014 with the goal of improving consumers’ health and being climate friendly.

There are now nine locations and de Gruyter, CEO and founder, opened a Denver flagship in August.

It’ll come as no surprise the nascent chain offers burgers and fries, but also brats, salads, chik’n burgers and meals, and shakes. Next Level’s signature patty is an organic quinoa and mushroom offering that’s made in-house. It also menus Beyond Meat burgers. Working with other companies just makes sense for them, de Gruyter says. “There are companies spend-

The beverage menu has long been a prime area to increase margins and ticket sizes.

Drinks can also be a great differentiator for brands looking to win brand loyalty at a time when that is increasingly pivotal—if diners are eating out less due to worsening economic conditions, then it is all the more critical to find ways to lure them out. And, just as food that is challenging to make at home will always be popular at restaurants, beverages that cannot easily be found on the shelf at the grocery store can lead to increased foot traffic.

So what type of drinks are consumers looking for? While soda consumption at restaurants has been declining for years, a renewed focus on innovative, functional beverages has taken center stage—for instance, energy drinks. According to Chicagobased Mintel, “the energy drink category is a strong performer within the wider non-alcoholic beverage industry, outpacing growth in other beverages.”

“Consumers, especially those aged 18 through 34, are always wanting to try new items,” says Emily Hirsch, vice president of beverages at Botrista Beverages. “The increasing demand for energy drinks is a good example of what those types of consumers are looking for.”

However, expanding the beverage menu to new categories is challenging for restaurant operators as they continue to face labor shortages. A recent report from the National Restaurant Association stated that nearly 80 percent of operators do not have enough employees to match demand. That can weigh heavily on a beverage program—when not executed well or consistently, drinks su er greatly.

“Developing great drinks to delight their customers—and drive revenue—is desirable, but not easy to execute,” says Jason Valentine, chief strategy o cer at Botrista Beverages. “Industry labor participation is not back up to pre-pandemic levels, so staing takes priority over investing in beverage innovation.”

Perhaps this is why, according to a recent Datassential survey, 63 percent of operators plan to keep their beverage menus the same, while only 8 percent saw the non-alcoholic beverage space as a place where they could innovate. This makes non-alcoholic beverages a clear place where brands could create di erentiation—if and when they have the solutions to do so.

In many ways, the solutions created by Botrista Beverages are primed to help operators meet the moment. CEO and co-founder Sean Hsu started Botrista Beverages with the goal of creating an automated way for operators to add a craft beverage menu that would enhance speed of service while not sacrificing on quality.

The concept was born when Hsu noticed this market ineciency while working at a cafe: While drinks were a key part of the restaurant experience, they often backed up the line to the point where guests would just settle for water. Hsu began to wonder what would be the best way to simplify the process of creating complex drinks and implementing them at any restaurant that could use it. Later on, using his background in robotics combined with experience creating automated liquid dispensing systems at Tesla, Hsu spent years researching a solution that would become the Botrista Beverages DrinkBot.

Using a bag-in-box (BiB) system, the DrinkBot can process syrups 1,000 times thicker than a traditional drink fountain to churn out a wide variety of high-quality beverages in under 20 seconds. The DrinkBot was built with the operator in mind and, for a number of reasons, is becoming increasingly popular with some of the most cutting-edge quick-service brands.

“The machine requires little-to-no training,” Hsu says. “It has a sleek touchscreen interface that requires the team member to simply follow on-screen prompts. You suddenly have automated, barista-quality drinks.”

The DrinkBot is the first automated energy drink dispenser and helps brands elevate their drink o erings. Botrista Beverages

has dozens of energy options that contain natural ingredients— co eeberry, ginseng, ashwagandha, guarana, and green co ee, to name a few. These are great examples of how the DrinkBot thrives in helping operators make the aforementioned pivot toward functional beverages. The DrinkBot goes beyond energy drinks, too, dispensing other functional beverages from categories that include iced tea, lemonade, agua fresca, mocktail, smoothie, and iced co ee.

Offer your guests freshly made on trend energy drinks with the touch of a button

Andrew Eck, vice president of marketing at The Halal Guys, says implementing the DrinkBot has increased both e ciency and profitability. The brand has been able to o er signature drinks and LTOs it may not have been able to execute previously.

“We o er flavored iced teas and lemonades, which our guests love,” Eck says. “This past spring, we o ered watermelon lemonade as an LTO, and it was a big hit. Our average check size has increased by 17 percent since implementing the new o erings.”

“Developing great drinks to delight their customers— and drive revenue— is desirable, but not easy to execute.”

“Consumers, especially those aged 18 through 34, are always wanting to try new items,” says Emily Hirsch, vice president of beverages at Botrista Beverages. “The increasing demand for energy drinks is a good example of what those types of consumers are looking for.”

However, expanding the beverage menu to new categories is challenging for restaurant operators as they continue to face labor shortages. A recent report from the National Restaurant Association stated that nearly 80 percent of operators do not have enough employees to match demand. That can weigh heavily on a beverage program—when not executed well or consistently, drinks su er greatly.

“Developing great drinks to delight their customers—and drive revenue—is desirable, but not easy to execute,” says Jason Valentine, chief strategy o cer at Botrista Beverages. “Industry labor participation is not back up to pre-pandemic levels, so staing takes priority over investing in beverage innovation.”

Perhaps this is why, according to a recent Datassential survey, 63 percent of operators plan to keep their beverage menus the same, while only 8 percent saw the non-alcoholic beverage space as a place where they could innovate. This makes non-alcoholic beverages a clear place where brands could create di erentiation—if and when they have the solutions to do so.

In many ways, the solutions created by Botrista Beverages are primed to help operators meet the moment. CEO and co-founder Sean Hsu started Botrista Beverages with the goal of creating an automated way for operators to add a craft beverage menu that would enhance speed of service while not sacrificing on quality.

The concept was born when Hsu noticed this market ineciency while working at a cafe: While drinks were a key part of the restaurant experience, they often backed up the line to the point where guests would just settle for water. Hsu began to wonder what would be the best way to simplify the process of creating complex drinks and implementing them at any restaurant that could use it. Later on, using his background in robotics combined with experience creating automated liquid dispensing systems at Tesla, Hsu spent years researching a solution that would become the Botrista Beverages DrinkBot.

Using a bag-in-box (BiB) system, the DrinkBot can process syrups 1,000 times thicker than a traditional drink fountain to churn out a wide variety of high-quality beverages in under 20 seconds. The DrinkBot was built with the operator in mind and, for a number of reasons, is becoming increasingly popular with some of the most cutting-edge quick-service brands.

“The machine requires little-to-no training,” Hsu says. “It has a sleek touchscreen interface that requires the team member to simply follow on-screen prompts. You suddenly have automated, barista-quality drinks.”

The DrinkBot is the first automated energy drink dispenser and helps brands elevate their drink o erings. Botrista Beverages

has dozens of energy options that contain natural ingredients— co eeberry, ginseng, ashwagandha, guarana, and green co ee, to name a few. These are great examples of how the DrinkBot thrives in helping operators make the aforementioned pivot toward functional beverages. The DrinkBot goes beyond energy drinks, too, dispensing other functional beverages from categories that include iced tea, lemonade, agua fresca, mocktail, smoothie, and iced co ee.

Andrew Eck, vice president of marketing at The Halal Guys, says implementing the DrinkBot has increased both e ciency and profitability. The brand has been able to o er signature drinks and LTOs it may not have been able to execute previously.

“We o er flavored iced teas and lemonades, which our guests love,” Eck says. “This past spring, we o ered watermelon lemonade as an LTO, and it was a big hit. Our average check size has increased by 17 percent since implementing the new o erings.”

BOTRISTA“Developing great drinks to delight their customers— and drive revenue— is desirable, but not easy to execute.”

Something else operators love about the DrinkBot is its size—the DrinkBot Pro takes up about the same amount of space as a beverage fountain and contains refrigerated space for up to 12 BiB containers of syrup. The DrinkBot Mini has a smaller footprint, but can still fit up to 8 BiBs.

Iva Chen, who runs a Goldilocks Filipino Cuisine location at SFO Airport, south of San Francisco, was immediately taken with the DrinkBot when she saw it at a trade show. The machine’s footprint, combined with its contributions to speed of service, made it a perfect fit for an airport location.

“As soon as I saw a demo of the DrinkBot at a food show, I knew we needed to have it at our quick-service restaurant,” Chen says. “It’s been a great addition to our menu—we are now able to o er customized craft beverages made in under 20 seconds for our customers, who are always in a rush.”

These operators are experiencing the solution to the issue Hsu set out to solve when he conceived of Botrista Beverages in the first place. That’s not lost on Hsu, who says his company is constantly innovating to help its customers meet shifting market demands.

“Our flexibility in drink formats and equipment is expanding to meet operators’ menu needs,” Hsu says. “We strive to continuously improve and meet our customers’ goals, so that they can meet their guests’ goals.” ◗

For more on adding craft beverages to the menu, visit botrista.co.

“The machine requires little-to-no training.”

ing hundreds of millions of dollars in developing the best plant-based food. We don’t have to figure out how to take it to the next level; instead we can be a gateway for people to eat the best of the best.”

Carin Stutz is the president and CEO of Native Foods, which offers a diverse menu featuring vegan comfort foods from burgers to entrees like cauliflower chickpea shawarma bowl, street tacos, and nachos.

Native Foods creates as many of its proteins in-house as it can, but like de Gruyter, Stutz is open to working with third parties. “If they can make something better than me and it’s good, clean ingredients, I’m interested,” she says.

Stalk & Spade is attracting a broad demographic. Younger generations, however, “are truly driving this trend,” Smiley says. “They are plant-positive and choosing to live that lifestyle. However, he adds, “people in their 50s and 60s are making the change because they want to be around as long as possible.”

De Gruyter’s goal with Next Level Burger was to appeal to a broad audience, too. “If you’re only attracting a slice of people, you’re limiting your income.” So, he aims to serve both the consumer who’s looking for a plant-based meal that closely resembles meat, and the vegan who doesn’t want to be reminded of animals.

And he has options for both on the menu.

Native Foods’ customers are also wide-ranging, and not just vegans, says Stutz, who notes today’s guest might tap plant-based foods just a few nights a week, while eating meat on other days.

Without appealing to all demographics, a restaurant chain won’t thrive, Stutz says. “Studies show that only 3 to 6 percent of people claim to be vegan, so plant-based restaurants that want to grow simply can’t survive on those numbers,” she says. “We therefore must make food that’s so delicious and approachable that everyone will want to try it. We must start by attracting the flexitarian.”

She also has items that resemble meat and some that don’t. “For the person who comes in for the first time we know certain items will be pretty close to what they’re familiar with,” she says. So staff are trained, Stutz adds, to steer the first-time guest toward more familiar items.

However, she points out, “the plant-based guest is the most adventuresome guest I’ve ever seen. Their willingness to try anything makes it really fun to put new items out there for them and they give you feedback.” Native Foods offers a monthly special, such as a fried green tomato BLT or a wasabi crabcake sandwich, as well as seven or eight dishes that change seasonally “so we can keep things fresh,” she says, adding “inspiration is everywhere, whether it comes from foreign cuisines or popular lifestyle foods.”

Stalk & Spade is largely focusing on urban areas for development, “because there’s more awareness there,” Smiley says. But he notes the suburban market “is where the real opportunity lies.” His first stores were in suburban areas, because “we always prove in a suburban market first. You don’t have a brand if it can’t be successful in the suburbs.”

He plans to grow via franchising, which will be about 90 percent of locations, and already has a large base of operators through his other concept, Crisp & Green. “They’re looking for more brands,” he says, “so we don’t need to go out and find new partners and it allows us to scale relatively quickly.”

Native Foods has 12 corporate locations and expects to open its 13th by the first quarter of next year. It may consider franchising down the road, Stutz says.

The chain has changed plans from urban to suburban. “The pandemic made us think about the diversity of our portfolio and we’re moving into the suburbs,” she says. “This is no longer a trend; plant-based dining is here to stay and there’s a lot of white space in the suburbs.”

Next Level Burger has nine restaurants, six of which are located within Whole Foods, but de Gruyter expects to grow mostly through standalone venues. He expects to quadruple his footprint from the beginning of this year when he had seven units, to 28 by the end of 2025, with an ultimate goal of 1,000.

“We’re looking to invest in a community that responds enthusiastically to our presence,” he says. “We’re not trying to be a commodity; we want to have relationships.” q

FOUNDERS: Antonio and Gelasia Cao

HEADQUARTERS: Miami

YEAR STARTED: 1972

ANNUAL SALES:

About $42 million systemwide

TOTAL UNITS: 20

is on top of the marketing department, and Fernando and Carmen run training and operations.

Santiago rose to CEO because of his military background, where he learned many of his management and discipline skills. And he knows his role. The restaurateur isn’t as talented at engineering cakes as his some of his family members, so he’s taken it upon himself to bring what Vicky Bakery has done for the past five decades and create a bridge to the next generation. And a big part of that is selecting the right franchisees to grow with.

“The American dream is that ability to start from nothing, pick yourself up by your bootstraps, and make something in your lifetime,” Santiago says. “And that’s what my in-laws did. It’s a sense of pride to be able to say that through franchising we are finding partners and investors that can go out there and take our concept because of the way it’s been set up. It’s become, in our limited experience, a very profitable business for those that decide to sign up with us.”

ALEX SANTIAGO WALKED INTO THE VICKY BAK ery business 30 years ago because he fell in love with his wife, Elizabeth, the youngest daughter of Cuban founders Antonio and Gelasia Cao.

Admittedly, he didn’t understand the company’s special nature at first, but he quickly came to realize just how much the neighborhood concept is part of South Flor-

ida’s culture. The learning process was as personal as it gets. Going back through baby pictures, he discovered the cake at his christening and baptism was from Vicky Bakery.

“I was born in 1975. This company’s been around since 1972, and it’s been doing amazing products ever since,” Santiago says. “Because I married the youngest daughter, I was the last one to come into the family. I’m still the rookie. I’ve only been here 28 years. I’m still in awe by all the knowledge and just the things that the family does.”

Vicky’s board of directors includes six members of the family: Santiago and Elizabeth; Pedro and Amy Cao; and Fernando and Carmen Oramas. Santiago serves as CEO while Elizabeth oversees human resources and account management. Pedro is in charge of business development, Amy

The growth will be meticulous. Vicky Bakery doesn’t want to open 100 stores, or even 50. It started 2022 with 17 locations and hopes to end next year with roughly 35. Currently, all of the concept’s locations are along Florida’s Southeast Coast, from Homestead to Boca Raton. More units are scheduled for Palm Beach, Orlando, and Southwest Florida. Santiago also mentioned that Vicky Bakery has been in talks with operators in Texas and Georgia.

The brand began with one store in 1972, which was actually Antonio and Gelasia’s third try, with the first two attempts burning down. The second outlet didn’t open until 1984 and the third came in the early 1990s as Santiago entered the business. Point being, Vicky Bakery thinks very deeply about growth before proceeding. The ongoing expansion phase,

The story of Atomic Wings is a remarkable one. The brand, created by Adam Lippin in 1989, is known as the first wing restaurant in New York City. It helped introduce authentic buffalo-style wings to the world.

Fast-forward to today. CEO Zak Omar and his brother, Ray, recently took over the brand with a franchisee-first mentality. As experienced franchisees, they have deep knowledge of the franchise model and what franchisees need in order to thrive.

“We really focus on franchisee success and satisfaction,” Omar says. “We stopped taking royalty payments during the earliest COVID-19 lockdowns. Those weren’t deferred payments—we stopped taking them altogether. During the national wing crisis, we also reduced royalties by half. We told our franchisees, ‘Hey, we’re in this together.’ We understand their cost burden, and we understand what it takes to run successful restaurants.”

With 16 current locations in the Northeast and over 90 more signed locations across the U.S., Atomic Wings is entering a phase of unprecedented growth. This growth has largely been spurred by the brand’s very selective Area Representative Program.

“2023 is going to be a year of aggressive expansion,” Omar says. “We’ve sold out several territories in the Midwest already. We’re looking for experienced operators all over the U.S.—people who know the restaurant industry and who know how to drive sales to their stores. We want to build this brand the right way from the ground up.”

That includes keeping construction costs to a minimum for franchisees. “We want to do everything we can to help our franchisees grow and get a return on their investment as soon as possible,” Omar says. “With our stores, we’re looking to create a friendly guest experience, and we’re hoping that translates across all of America.”

In many ways, it already has. In the last couple of years, Atomic

Wings has garnered attention from national media, from The Tonight Show with Jimmy Fallon to The Late Show with Stephen Colbert to Fox and Friends.

In addition to prioritizing franchisees, Omar attributes the brand’s success to its premium products. “To differentiate ourselves from other wing brands, our wings go through a series of steps before they ever hit the fryer,” Omar says. “Our product is always fresh, never frozen. We’ve also been able to reduce cook times from 12 minutes down to about four–six minutes due to our processes. It’s all about speed of service and convenience for our guests.”

The boneless wings and tenders are hand-breaded and hand-battered. (Grilled wings are also being rolled out in select locations.) The selection of sauces is huge, and Omar says about 95 percent of them are glutenfree. The brand recently introduced several new offerings, including a Nashville Hot line, a series of dry rubs, and aioli sauce for chicken tenders. Drive thrus—rare in the wing space—are also in the works.

“One of the things I love about this brand is that all the growth we’ve had has been organic,” Omar says. “We offer a superior product, and we treat our franchisees like a family.” ◗

Featured on national television multiple times, Atomic Wings is seeing explosive growth with a franchisee-first mentality.

and bowls, Moskow says, are mostly straightforward, “don’t require culinary prowess or training, and align with many people’s lifestyle choices.”

Take Rush Bowls, which is dedicated to healthy fruit and vegetable bowls. It launched in 2004 and started franchising in 2016. It has grown to 37 locations, with 35 franchised and two company owned, covering 21 states. In 2022, as of publication, the brand debuted five new outlets with 10 slated to open by year’s end, all franchised. And in 2023, it has ambitions to add 25–50 retail stores.

Andrew Pudalov, Rush Bowl’s CEO and founder, attributes its rapidly expanding franchising to the “rise in demand for healthy food within the [quick-service restaurant] space, as well as our smaller, more efficient store footprints.” His chain has capitalized on the delivery and takeout sector and technology, which now generates 30–60 percent of its revenue, depending on location.

During the height of the pandemic, sales at most established pizza franchises soared. Pizza was easy, and most of all, comforting, during a time of heightened stress.

But as conditions stabilize, health-oriented franchises are bouncing back and expanding. Pizza sales hiked during COVID because many people stayed home, didn’t want to dine indoors, and the product arrived via delivery “hot and ready to eat,” says Liz Moskow, principal at Bread & Circus, a food advisory company based in Denver.

An increasing number of customers worked from home and prepared their own lunches and dinners, which cut into the revenue at the healthier franchises, she says.

When safety fears subsided, though, many people had put on weight, wanted to lose it, and started returning to dining at more nutritious-based chains. “Taking time for a healthy bowl or salad at lunch fits into the ‘self-care’ trend that people are adopting into their everyday lifestyle,” Moskow says.

Moreover, franchisees left jobs that they felt trapped in, preferring to become entrepreneurs and run their own business. Smoothies

To become a franchisee at Rush Bowl “you don’t need to be a food connoisseur. We look for business experience and savvy,” says Pudalov, a former derivatives trader in New York City for 15 years. Its target audience is “young adults to people aged 50, who make Rush Bowls a part of their diet as opposed to the Subway sandwich model,” Pudalov adds. Its bowls are 16 ounces and about 500 calories, topped with granola or fruit. “Our busiest time is lunch,” he says.

Four of its latest locations include Birmingham, Alabama; Metairie, Lousiana; and Naples and Gainesville, Florida. “A lot of these communities are ill-served with health food, and there’s not a lot of competition. When a health food restaurant moves in, people gravitate there,” Pudalov says.

Rush Bowls specializes in bowls and smoothies, not salads or sandwiches, which differentiates it from competitors. Indeed, 80 percent of its business derives from bowls.

Despite plans to add 25 new stores or more in 2023, Pudalov says he can avoid the traps of growing too fast because the company is privately owned, carries no debt, has taken zero private equity money, and plans to scale at its own pace.

Locations are also rising at Vitality Bowls, which now has 130 outposts, seven corporate owned, and the rest

After a COVID rush to comfort food, health-driven brands are back on franchisees’ radars.

›

›

›

›

› Enterprise-wide reporting

› Receive daily provisional credit

› Eliminate bank trips

› Keep funds safe

As the cult-favorite sets off on a national growth push, there’s one secret-sauce element that won’t ever change.

/

/

BY DANNY KLEIN

BY DANNY KLEIN

We’re talking 900 percent growth over the next two-and-half decades for the classic chain, which began in 1964 when Dick Portillo took $1,100 for a first home and used it instead to purchase a 6-by-12-foot trailer.

Portillo’s, when it hit Wall Street, boasted 67 units in nine states (there are now 71) But it had shipped some 2.7 million sandwiches via its direct-to-consumer channel across all 50 states. The No. 1 landing spot? Texas. This offered Portillo’s ammo to circle the Lone Star state, as well as the Sun Belt in general, as a near-term target to bring its hot dogs, Italian beef, and sausages to the masses.

Yet there was an underlying current to all of Portillo’s plans

that stretched beyond alluring financials (think average-unit volumes of $7.9 million). Among the brand’s secret-sauce traits, so to speak, was its employee proposition and a culture built through decades of centralized growth. It takes an average of 87 people to run a single store, which is miles clear of industry averages—roughly 23 employees in quick service, per Black Box Intelligence.

And still, in Q1 2022, Portillo’s hourly turnover rate hovered around the low-100 percent range, or 20–30 percentage points better than sector norms. Over the last year, more than 80 percent of Portillo’s managers were internal promotions—an equation that once was flipped.

According to William Blair’s yearly longitudinal analysis of restaurant employee satisfaction, based on more than 350,000 Glassdoor reviews, only Shake Shack and Portillo’s reported sequentially improving scores from elevated 2021 levels when it

When Portillo’s went public last October, it laid a roadmap to 600 locations in front of investors.

came to the percentage of workers willing to recommend their job to a friend. Portillo’s surged 47 spots to No. 40 overall.

Like its food and unique service ticks—rhyming employees comes to mind—Portillo’s reputation as an employer of choice has deep, 58-yearold roots in Chicago. Just as people expect legendary chocolate cake that has no business being this good coming out of a fast-food joint, the same is true of workers who sign up. They know Portillo’s is different than the pack.

But now the task becomes spreading that message to fresh markets and new communities, says CEO Michael Osanloo, a former P.F. Chang’s executive who joined the company in August 2018.

Where to begin? “The first war you have to win as Portillo’s when you go to new states, is the war for talent,” he says.

Thanks to the cyclical nature of the restaurant business and its seasonal, part-time workforce, the labor dynamic has always been a convoluted puzzle. High turnover and shifting demographics pressed operators well before COVID-19. And it’s only become more fractured. The Leisure and Hospitality Sector filled 31,000 jobs in August, a slowdown from 95,000 hires in July and 202,000 in the year-ago period. Restaurants and bars filled 18,200 jobs, per the Bureau of Labor Statistics, meaning the industry was about 600,000 jobs shy of its pre-pandemic levels.

To put it simply, the industry staffed back up quickly over the past year or so but nobody is quite sure where the ceiling is. Will there ever be as many jobs as before?

And so, there’s a quandary, Osanloo says, every concept needs to address if they want to staff in the “new normal.”

“People need to understand why Portillo’s,” he says.

The brand’s marketing function spends roughly 30–40 percent of its time helping HR and recruiting. As Portillo’s prepared to open its first Texas location, at the Grandscape complex in The Colony, it sent its “Beef Bus” mobile unit to “prime the pump,” Osanloo says. This went beyond engaging customers and giving them a preview of what’s to come, however. There were also team members in the branded trailer recruiting.

Portillo’s wasn’t only asking potential workers to sign up for a paycheck, either. “This will sound funny,” Osanloo says, “but one of the most important things to me is I want them to eat our food. I want them, if they don’t know Portillo’s, I want them to fall in love with the food first.”

The chain spends a “considerable” pool of money, time, and

effort to introduce itself to the local workforce. When Portillo’s opened in St. Petersburg, Florida, despite having units in Tampa and Brandon, Osanloo recognized the need to drum up awareness. They drove the Beef Bus there as well. Portillo’s hired aggressively and in advance of need. “We trained the heck out of people, and we talked about culture; explained what it means to be a Portillo’s team member and why our values are so important to us.”

The goal was to hire 100–105 employees. Portillo’s ended up with 125.

One of Portillo’s A1 aims is to take wage and compensation off the table. Osanloo says if he can look employees in the eye and know Portillo’s is paying them above-average rates, the brand can get down to what matters.

Indeed, Glassdoor data puts Portillo’s average crew wages ( based on reviews ) at $12, tied with Raising Cane’s. Only nine fast casuals were higher and one fast-food chain ( In-N-Out). For GMs, Portillo’s purported average rate of $81,800 trailed only Shake Shack ($84,000) and Tender Greens ($92,900) on the fast-casual side and sailed every fast-food brand.

Jill Waite, Portillo’s chief human resources officer, doesn’t mention dollar figures until the third point of a three-pronged answer as to why Portillo’s is beating turnover rates during a stretch when some industry peers are approaching 200 percent. Instead, she starts with a metric that says as much by the fact it’s even being measured as to what it turns up. “One of the things that we’ve learned from our team members is that they like having a best friend at work and someone that they can count on,” Waite says. Seventy percent of employees highlight this, per internal surveys.

Notes Terry Kendrick, an assistant GM in training: “I started off as a knucklehead on the south side of Chicago. Here, I’ve had so many father figures that gave me a chance. They’ve built a bridge to a whole new lifestyle I never thought I could accomplish.”

Before getting into some of the high-level approaches, here’s a view into what Waite and the Portillo’s team have cultivated:

• Flexible scheduling

• Up to $10 in free meals during shifts.

• Paid vacation for full-time employees; a 401( k) plan option with a discretionary company match, and financial support for workers facing hardship through the company’s Heart of Portillo’s fund.

• Opportunities for career growth with personal and pro-

fessional training and development programs, including an accelerated leadership program for those eager to kickstart their restaurant career.

• Competitive pay at all levels (as mentioned), with a daily pay option, quarterly performance bonuses, annual PTLO stock grants for GMs and market managers, and extra pay for employees on major holidays—what Portillo’s calls “premium holiday pay.” This past holiday season, restaurant support center employees volunteered to help staff restaurants for two-day shifts.

• This is a perk rolled out during the COVID window where employees who work any of the calendar’s five key holidays earn $3 more per hour.

• Career interest days, individual development plans, and soon-tobe-introduced access to LinkedIn Learning.

• Paid parental leave, premier health insurance, flexible spending accounts, life insurance, vision and dental, and a monthly Gympass membership offering holistic wellness programs.

• Referral bonuses, which includes a combination of gift cards and Portillo’s swag. Last year, more than 30 percent of Portillo’s workers stemmed from employee referrals.

• The opportunity for hourly shift leaders to earn performance bonuses, like the rest of management.

• An annual GM summit where store-level leaders hear from corporate on the path forward as well as professional development times. GMs at Portillo’s can make well over $100,000 between base and bonus.

• Portillo’s Ignite Development Program provides all positions, lead-

ing up to market manager and general manager, a way to grow their career.

• The “Franks A Lot Fund” where each restaurant receives $250 per month to celebrate employees as they see fit, from meals to rewards as a means to recognition. This came from a survey where GMs suggested Portillo’s beef up its efforts. Some asked for $25 or $50 per month to honor hourly employees. The brand made it $150. They’ve come to life in everything from graduation parties to ice cream celebrations.

After speaking to culture and “bringing lifelong memories to life for both our team members and our guests,” No. 2 on Waite’s whiteboard is crystalizing the career ladder. A famed tactic of Portillo’s is its ability to cross-train. During the first 18 months of COVID, the brand didn’t lay off a single person, despite the fact its business disrupted dramatically, as it did industywide.

In the 12-month period that ended June 27, 2021, Portillo’s welcomed 825,000 guests. Drive-thru sales alone were $4.9 million per unit—more than double McDonald’s 2019 figures. Dine-in sales came in at $1.9 million and delivery $850,000. Before COVID, though, Portillo’s raked in $4.4 million within its four walls. “We trained them on how to do other things within the restaurants and that they could grow and that they could be more challenged,” Osanloo says. “But also, more valuable to the company.”

“Ignite,” he adds, speaking to Portillo’s development program, “is not here’s how you make a perfect hot dog, here’s how you make a perfect beef sandwich. It’s all about leadership skills. It’s how do

you coach in real time? When do you step in and when do you let somebody figure it out themselves? What’s the best way to staff around your team’s needs but also the business needs? What’s the best way to have a tough conversation with someone?”

These leadership traits, Osanloo says, are something employees keep asking for. “I’ve learned a lot about leadership and maturity,” echoes Zechariah Olson, a GM in training who’s first role was on the beef station six years ago. “I’ve also learned a lot about how to develop a team. When I was younger, I was very hot headed and immature, and I’ve learned a lot from the mentors I’ve had being here.” Employees realize the transferable benefit, regardless if they stick around at Portillo’s or decide to step-stone to another field. “Whatever you do in life, you’re learning leadership skills that will make you better,” Osanloo says. “And that’s because we’re investing in you. We want you to be the best version of yourself.”

This is far from lip service at Portillo’s. As noted, for senior hourly people and management, the brand offers an Ignite program to foster leadership. But the company also provided another set of wage increases at the beginning of July (the company spent $12 million to bump rates and add perks last year) And this latest round was predicated on people “stepping up.”

To explain, say there’s an employee who’s great at making beef sandwiches. After five years, they might see some slowing of wage growth. But if they learn how to make hot dogs, too, or “work the table,” as Portillo’s calls it, the brand will bump their salary because

they’ve added another skill set. If they learn how to do inside order taking, Portillo’s will do it again, and so forth.

“We’re tying wage increases to people who can become inherently more productive team members. And that matters because, we’re super busy most of the time,” Osanloo says. “But we still have some shoulder periods where if you’ve got somebody who is trained on both beef and table, you’ve got some staffing flexibility that you might not have had. And so, I love that because we’re paying people more, and we’re continuing to grow their wages, but they’re also learning more skills, learning different stations. Inevitably, and I’m sure you’ve seen this before, as people learn and grow, they enjoy their jobs more. They get more attached to the place.”

It’s a virtuous cycle Portillo’s continues to lean into.

“I’ve never worked for an establishment that’s such a family, such a core base, and there’s so much love and caring between employees, management, upper management, everyone,” says Cody Smith, an assistant GM in training.

Most people agree COVID, alongside everything else, did one sure thing for restaurants: it polarized winners and losers. That extends across the spectrum in terms of cleanliness, operations, and, without question, employee care. Waite says Portillo’s had a chance to stand behind company values and show its actions when the chips

All our architectural products serve a distinct, functional purpose. From louvers to wall coverings to every detail we perfect. But, at the same time, we never lose sight of the a ect a building has on people. The inspiration it provides. The satisfaction it brings to all who enter. For 70 years, we’ve based our success on the idea that putting people rst is the foundation for building better buildings. And, for 70 years, our partners have depended on us for architectural product solutions. Are you ready to think beyond the building with us? Visit c-sgroup.com.

were down. It provided paid leave, PPE, and created a “Wellness Team” to advise on and monitor the mental health of workers. Additionally, Portillo’s gave 100 percent meal discounts and gift cards throughout the crisis and funded bonuses to field managers. Portillo’s introduced a formal meal plan so employees could take food home to their families. If somebody wanted to step aside for personal reasons, Portillo’s allowed them to take leave, and still paid out benefits and offered gift cards for free meals. It then launched a foundation called “The Heart of Portillo’s Fund” to help workers with setbacks. Through this, the company raised more than $400,000 over 18 months and awarded about 40 grants for close to $100,000.

Coming out of 2020 depths and into the so-called “labor shortage,” is when Portillo’s conducted its “total rewards survey” referenced earlier. It was a straightforward ask: What do you want from the brand in an adjusted world?

The answer unfurled throughout the many benefits Portillo’s created, with a heavy focus on flexibility, development, and recognition. “It showed that we don’t just put our purpose and values on a wall, but we actually live them,” Waite says. “And an additional data point that showed that was we improved our engagement scores, year-over-year, which in a year that Gallup would say was a decline nationwide, worldwide, we actually saw an improvement.”

Why Portillo’s is opening its coffers for employees isn’t tied entirely to recruitment and retention. Waite says if the brand wants to deliver customer service in a way that separates it, especially amid inflation, employees need to like what they do and where they do it. It’s a challenging proposition to ask a stressed out and unhappy worker to be friendly to somebody walking in or pulling up to the drive-thru. That sounds simplistic in nature but the execution is far from it. Portillo’s has been working on ways to create efficiencies in-store so employees can shed menial tasks and concentrate on what makes the brand stand apart.

It gets as granular as catering boxes, which used to require employees to tape them up. A supplier and employee collaborated to develop a new “pop and lock” product where the box snaps in place. “It sounds crazy,” Osanloo says, “but it saves so many hours of labor.” Before, Portillo’s would have somebody spending three to four hours each morning putting them together.

Catering bread started to come in pre-cut, too. It used to be sliced in-house and packaged. Maxwell Street Polish Sausages— the brand’s offering born more than 75 years ago—also used to show up and get hand-trimmed by employees. Ends of the sausage were thrown away. Those arrive pre-cut and trimmed now as well. Portillo’s also moved to red onions machine cut by its supplier and vacuum sealed in bags.

Going back to the idea of fostering soft skills and setting employees up for future success, Portillo’s hosts “core interest” days where team members can raise their hands and ask about their futures. “What we’ve learned through our Ignite program is

as people are graduating and they’re promoting the energy in the restaurant, you can feel it,” Waite says. “From our recent engagement survey, it shows that our graduates from our Ignite program have a higher level of engagement that they then bring that back to the restaurant. What happens is when you visit a restaurant and say hey, tell me what’s going on, they’ll say Sarah is working on becoming the next assistant general manager. She’s in the next Ignite wave. It breeds a culture of continuous development and continuous improvement.” This creates a tribe-like culture that appeals to younger generations, Waite adds. The examples of success in-store are visible and apparent peer-to-peer. The notion of having a best friend at work, she says, has continuously shown up on surveys as a reason why people choose Portillo’s, and why they stay.

Osanloo says it’s no accident. Portillo’s recruits for “immutable characteristics.” Are they someone who aspires to being great? Do they treat people at work like extended family? Do they like being in front of other people and having fun?

Portillo’s trains GMs and assistant GMs on “what does a great Portillo’s team member look like,” Waite says. And what kind of behavioral questions can you ask to find that employee.

“We’re not really looking for what’s on the resume, but we’re looking for who that person is and what they will bring to our life our purpose and our values,” she says. “We ask questions through an interview guide and training of how do you create or how have you created lifelong memories for others? Tell us about how do you bring fun to work, or to your soccer team? We employ a lot of first-time jobs. Individuals who this is their firs- time job and they may not have a job experience. So tell us how you create fun on your soccer team. We’ll take them back on the line and see how they interact with our team members.”

“… I think that’s one of the key pieces that has allowed us to achieve the retention that we have,” Waite adds. “Because we’re not just looking for someone who can make a great beef sandwich.” The broad view is to hire a team with similar purpose. More than 56 percent of the company’s hourly employees are BIPOC, which is a reflection of something that’s going to factor in as the brand grows as well. Portillo’s hires individuals who reflect communities, so stores that open feel like a local brand customers and workers feel ownership of.

Osanloo says the company understands the challenge ahead, which is why Portillo’s has been unrelenting in its culturedriven approach. Consumers have become more demanding in COVID’s wake. And you could argue it’s tougher to work in a restaurant than ever given the myriad tasks and channels brands are operating through, from curbside to delivery. “There are just other career paths now where the work might be physically demanding but it’s emotionally easier,” he says. “You don’t deal with customers. And while it might be monotonous or boring, it’s easier in some ways. And we have lost people to that.”

“But I think, if there’s a secret sauce,” Osanloo continues, “it goes back to the culture that we’re trying to create and the values that we’re living.”

In today’s restaurant industry, how chains treat their employees is as vital as how they serve their guests. These are the brands setting the bar.

/ BY QSR STAFF

/ BY QSR STAFF

Hiring, retaining, and training workers has been central to the quick-service playbook for as long as restaurants have been in operation. Pre-COVID-19, it was arguably the lead concern. National unemployment was 3.6 percent in May 2019 and brands raced to amplify benefits, bolster recruitment, and invest in other people-centric initiatives designed to win a “war for talent” that was tightening by the day.

Since, however, terms like “The Great Resignation” and “Staffing Shortage” have become constants in the sector’s recovery. As of August, following a

month where restaurants added 74,100 jobs, the field remained more than 600,000 short of February 2020. In June, there were 1.304 million job openings in accommodation and food services and 1.004 million hires to go along with 918,000 separations. Wages, according to the Bureau of Labor Statistics, had climbed at a double-digit rate since April 2021 before retracting to 9 percent in June. Average hourly earnings fell in July for the first time since May 2020 (negative 0.16 percent), yet were still roughly 8 percent above year-over-year levels.

So the view looks something like this: Restaurants are paying more for labor, often have smaller staffs to operate with, and the nationwide unemployment rate, in July, was 3.5 percent.

What it adds up to is a higher stakes game than ever. The ability to identify talent, keep high-performing employees engaged, and create workplaces where people want to join and stick around, and, in turn deliver hospitality to guests, has become a differentiator that can’t be understated. To put it lightly.

In response to the continued importance of labor, QSR magazine, for the first time, put together its list of Best Brands to Work For. We polled restaurant brands and outside experts for submissions and then had a panel of industry pundits make their picks. The result: this group of 25 chains is QSR Best Brand to Work for Certified, and an example worth following for years to come. QSR will release this report annually. ➽

The pandemic hardly pushed labor to the forefront of operators’ minds.

LOCATIONS: 640

While every restaurant openly acknowledges it would be nothing without its employee base, Raising Cane’s takes that a step further with Cane’s Love—an entire department dedicated to showing appreciation to crewmembers.

As part of this initiative, leadership writes roughly 4,000 thank you cards per week to employees. Also, during the final systemwide call of 2021, Raising Cane’s surprised workers with more than $100,000 in giveaways. This included dozens of employees receiving $1,000 bonuses, five receiving $2,500 to help with tuition costs, and two receiving $5,000 to help pay bills.

“Cane’s Love brings to life something that has been a part of our business for the last 26 years—our culture that is rooted in appreciation,” co-CEO and COO AJ Kumaran says.

Cane’s Love was created with the idea that all Raising Cane’s employees are fry cooks and cashiers, no matter where they’re at on the organizational chart. The brand put that philosophy into action in 2021 when 50 percent of corporate employees—including the heads of finance, legal, and human resources—entered understaffed restaurants for a couple of weeks to pick up shifts and boost recruiting. The end goal was to go from 40,000 workers to 50,000 in 50 days, and at the 48-day mark, there were 53,000 employees.

Raising Cane’s also takes pride in its Restaurant Partner Program, which began at the start of 2020. It’s designed to give employees more than $1 million in net worth within 10 years. To qualify, one must be a general manager for at least one year and show strong results. Once selected, they go through a 12-month probationary period before graduating into the official program. As of late August, there were 150 Restaurant Partners, including 40 that joined this year.

At the time of publication, Raising Cane’s created 4,500 jobs in 2022. Those thousands of employees are entering a brand that’s increased crewmember wages by $200 million-plus in the

past two years. The company also promoted over 1,200 employees this year. More than 40 percent of corporate leaders began as workers inside a restaurant.

LOCATIONS: 31

Hawaiian Bros recognizes restaurants are known for burnout, low salaries, and long hours. The chain operates with a philosophy that it doesn’t own employees and that it should respect their time. Every role—from cashier to

executive—is designed to be a fun and positive experience. The No. 1 priority is to put team members in the best possible position to achieve a healthy work-life balance. Hawaiian Bros believes in separating itself from the crowd by not providing a definitive script on how to fulfill employees’ needs. The company understands that narratives differ and so should its response.

CFO Breck Templeton, who joined Hawaiian Bros this year, referred to the brand as having “limitless potential” because of leadership and its employees. The foundation is built by a combination of superior food, service, and operations.

The results of these efforts speak for themselves, such as the brand having an internal promotion rate of 27 percent. Also, Hawaiian Bros boasts an average-unit volume of $4 million, which is on par with the likes of McDonald’s and Shake Shack. The concept experienced 39 straight periods of same-store sales growth as of late August, and it’s seeing a return on invested capital of 60 percent. In 2021, the company earned $55 million in sales, an increase of 169 percent year-over-year.

■ NOODLES & COMPANY

RAISING CANE’S

■ NOODLES & COMPANY

RAISING CANE’S

LOCATIONS: 457

Noodles & Company carries itself through four key values—We Care, We Show Pride, We Are Passionate, and We Love Life. The fact that “We Care” comes first isn’t a coincidence. It reminds everyone that Noodles puts its people first. Depending on their role, every team member may be eligible for medical, dental, vision, life insurance, counseling services, disability, and the company’s 401k match. Other key perks include mental health support, immigration reimbursement, stock purchase plan, tuition reimbursement, InstaPay and automated savings, and more.

Eligible employees can receive up to 100 percent of their pay for part of their maternity or paternity leave. And in the late stages of pregnancy, schedules can be reduced while still receiving regular pay. Noodles also offers up to $10,000 for adoptions or surrogacy.

Additionally, Noodles supports career growth and has increased the tenure of its operations leaders for the past several years. For instance, in Q2 2018, the average general manager spent 4.4 years with the brand; that grew to 5.6 years by Q2 2022. For managers, average tenure was 5.6 years in Q2 2018; but by Q2 2022, it reached 8.1 years. This year, the fast casual launched its General Manager Equity Partner Plan, which rewards general managers for their positive impact on the company. Workers who meet certain metrics are automatically enrolled and remain so as long as they are employed by the brand.

The chain’s efforts toward diversity and inclusion have improved year-over-year, including 53.2 percent female representation at the management level in Q2 of this year.

LOCATIONS: 164

Team Schostak Family Restaurants, which operates Applebee’s, Olga’s Kitchen, Olga’s Fresh Grille, Wendy’s, MOD Pizza, and Del Taco, has a common saying—“We won’t be best on the block until we are best in the workplace.” A major part of that promise is TSFR University, a two-day training program in which managers from all brands meet with senior leadership and learn about the company’s vision. On one day, executive chairman Mark Schostak presents the company’s history while CEO Bill Angott talks about Team Schostak’s five core values— Our People, Delight our Guests, Community, Act with Integrity, and Achieve Results. On day two, managers learn how to communicate and supervise a team, including coaching, directing, praising, and on-the-spot corrective action.

from within—more than 75 percent of managers started at the company.

“Our approach is to provide a career path that takes an employee from an entry-level position to director of operations, during which time the employee gains the necessary skills and qualifications that is key to their professional development as a whole,” says Christian Camp, Team Schostak’s vice president of “awesome people.”

Each year, the company holds an annual leadership conference to recognize top achievers. On a more routine level, Team Schostak uses internal platform TSFR Connect to showcase everyday wins. These small triumphs create daily culture and reinforce purpose.

The company also values candid conversations and feedback, which is why it surveys workers twice per year to establish where it stands. The end goal is always to make the lives of employees better, like the TSFR Care Fund, which helps those in need regardless of whether they contribute.

LOCATIONS: 314

Blaze Pizza emphasizes a “Free to Be You” brand promise in which workers don’t have to shy away from being their authentic selves. For the fast casual, it’s not about making a polished impression; the true objective is having a genuinely good time while providing the best services to customers. Tattoos, piercings, colorful hairstyles, particular style of dressing—all are welcomed with open arms. To make restaurants an enjoyable place to work, the company partners with employees to generate a new musical playlist that includes 80 percent of their favorite songs. The company recognized that moments of joy for guests and employees could be accomplished at the same time.

There’s also the LEAD program—a series of three classes throughout the year for high potential managers. The agenda covers execution, planning and organizing, situational leadership, and the seven habits of highly successful managers. Team Schostak emphasizes building talent

“It’s the underpinning of an entirely new customer and team member centric brand platform,” CMO Vincent Szwajkowski says. In addition to highlighting self-expression and individuality, Blaze offers a plethora of benefits for corporate and field staff members, including full health benefits, accrued vacation, wellness program, tuition discounts, employee discounts on admission to theme parks and hotel stays, birthday PTO, 401k with an up to 3 percent match, and more. Also, corporate employees are given unlimited PTO days. To ensure worker success, the chain provides development and coaching through its Blaze training program. And to recognize unforeseen life events, the company offers schedule flexibility. Upward mobility is encouraged, from working ovens to supervisor, manager, and even becoming a franchise owner.

LOCATIONS: 36

Regardless of an employee’s future, Hopoddy’s intention it to help motivated team members achieve their dreams. That could mean the fast casual is a steppingstone toward another career. It could also lead to Hopdoddy becoming a career choice. The chain has a team member to general manager program that develops knowledge, skills, and abilities. Sixty-four of Hopdoody’s general managers started as hourly workers.

One example is Chris Hill, who began as a bartender in Houston and is now the general manager of the brand’s certified training restaurant. Hill exemplifies a level of loyalty that Hopdoddy encourages and rewards. The company developed a 512 Program that offers five-year general managers a year’s salary bonus and 28-day sabbatical. So far, three workers have achieved this goal. To ensure its mission is being carried out appropriately, Hopdoddy holds an annual town hall at every location to interact face-to-face with employees and managers.

All full-time workers, whether at the support center or in Hopdoddy restaurants, receive health, vision, and dental insurance policies for under $2 a day. The chain also offers earned paid time off and paternal and maternal leave for birth or adoption after one year. Additionally, employees enjoy a 50 percent discount when they dine at any store outside of work hours.

LOCATIONS: 51

To prove how much it values all corporate employees, Dog Haus doesn’t keep a defined hierarchy structure or titles. The brand considers itself a horizontal organization in which employees work alongside partners and executives. At the corporate office, Dog Haus keeps a casual dress code and encourages wellness, like its “calm mat” for workers to meditate, take breaks, and stretch. The chain also pays for employees to participate in 5K/10K races.

The brand maintains an open-door policy so workers consistently feel heard and valued. In turn, partners welcome feedback and constantly check in with their employees for comments. This gives workers freedom to expand their role to as big as they aspire. For some, this could mean becoming a franchisee owner down the line. Dog Haus was founded by a small group of family and friends, and the fast casual intends to keep that feeling around its office space.

No corporate employees were furloughed during the height of the pandemic, and no one’s salary was reduced. Fewer than five corporate employees have left the company since it began more than 10 years ago, and there’s been a 15 percent-plus average pay raise for those who’ve earned it. Workers are covered by medical, dental, vision, and life insurance, and they also receive annual bonuses and presents. To

avoid burnout, Dog Haus offers floating holidays, generous PTO, summer Friday hours, an annual retreat, and free parking at Old Pasadena, a shopping center in Southern California. A kitchenette is stocked with snacks and coffee, with beer and wine on tap. For a mental break, there’s ping pong tables, happy hour, and holiday and birthday parties.

LOCATIONS: 150

When Flame Broiler asked one employee about their experience, they responded with “Flame Broiler has values, a mission, and a purpose that the whole team lives by. One of the values being ‘Exemplify with love.’ The company cares about their employees and gives everyone who is hungry to learn, the opportunity to grow and have a career with Flame Broiler.” In that statement, the operative word is opportunity. When the fast casual brings a worker on board, there’s an immediate focus on possible career path development. The team believes a solid cultural fit from its internal team member bench is the best way to approach filling leadership roles.

In fact, Flame Broiler has an internal promotion rate of 72 percent in 2022. Total headcount has increased 22 percent year-overyear, and 25 percent have been with the brand for at least 23 months. Diversity is a crucial part of this, too—70 percent of in-store leadership are women.