Our exceptional line of stand-up bags make it more convenient to prepare desserts and beverages with premium Ghirardelli Chocolate.

CONVENIENT Smaller bags are easy to pour and store.

ACCESSIBLE Flexible offerings let you mix and match different chocolate varieties.

VERSATILE Couverture chocolate formats are perfect for flavoring, coating, melting, and glazing. Non-couverture chips hold up well when baked.

Explore the new line and request your samples today.*

3 Smart Strategies for Driving Incremental Sales with Co ee

Boost check averages without making operations more complex.

SPONSORED BY SEB PROFESSIONAL

57

Beat some of the most troublesome o -premises dining concerns. SPONSORED BY GENPAK

66

Why Houston’s Hot Chicken Does Things Differently A concept with a unique spin on hot chicken is on the franchising fast track. SPONSORED BY HOUSTON’S HOT CHICKEN

58

Abbott’s Frozen Custard

Is Heating Up The 120-year-old brand recently signed a franchise agreement for more than 100 new units. SPONSORED BY ABBOTT’S FROZEN CUSTARD

60

‘Live the Jump Life’ with Altitude Trampoline Park

Franchisees with restaurant industry experience could be the perfect fit for this growing franchise. SPONSORED BY ALTITUDE TRAMPOLINE PARK

62

EDITORIAL DIRECTOR, FOOD NEWS MEDIA: Danny Klein danny@qsrmagazine.com

MANAGING EDITOR, FOOD NEWS MEDIA: Nicole Duncan nicole@qsrmagazine.com

DIRECTOR OF CUSTOM CONTENT: Peggy Carouthers peggy@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Charlie Pogacar charlie@qsrmagazine.com

CUSTOM CONTENT ASSOCIATE EDITOR: Kara Phelps kara@qsrmagazine.com

CONTENT EDITOR: Ben Coley ben@qsrmagazine.com

ART & PRODUCTION

ART DIRECTOR: Tory Bartelt tory@qsrmagazine.com

ONLINE ART DIRECTOR: Kathryn “Rosie” Rosenbrock rosie@qsrmagazine.com

GRAPHIC DESIGNER: Erica Naftolowitz erica@qsrmagazine.com

PRODUCTION MANAGER: Mitch Avery mitch@qsrmagazine.com

ADVERTISING 800.662.4834

76 Slim Chickens Has Over 900 Units on the Way—and Counting QSR magazine’s Breakout Brand of 2021, the fan favorite is showing no signs of slowing down. SPONSORED BY SLIM CHICKENS

NATIONAL SALES DIRECTOR // EXTENSION 126 : Eugene Drezner eugene@foodnewsmedia.com

Ride the Bubbakoo’s Burritos

Wave This brand’s top-tier service, innovative customization options, and exceptionally fresh ingredients set it up for massive growth.

SPONSORED BY BUBBAKOO’S BURRITOS

64

Power in Numbers Focus Brands leverages its size to reap benefits for franchisees. SPONSORED BY FOCUS BRANDS

68

The Human Bean Is People First The coffee franchise is laser-focused on growing its values alongside its brand. SPONSORED BY THE HUMAN BEAN

70

Now Is the Perfect Time to Grow with Mici Award-winning Italian brand provides a unique offering in the $47 billion pizza segment.

SPONSORED BY MICI ITALIAN

72

Roy Rogers Restaurants Offers Timeless Value This chain is ready to share its one-of-a-kind broad appeal across multiple dayparts and generations. SPONSORED BY ROY ROGERS

74

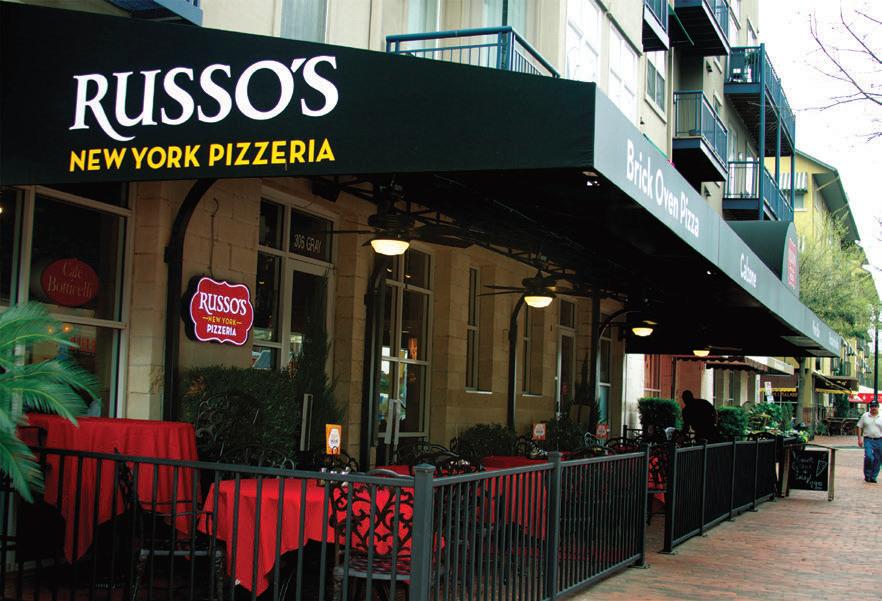

Russo’s New York Pizzeria Brings Back Old School with Flair This authentic, ingredient-driven Italian brand is poised for growth. SPONSORED BY RUSSO’S NEW YORK PIZZERIA

78

Achieve the American Dream with the Classic American Brand Steak ‘n Shake’s undeniable history and ongoing evolution bring a new modern twist to the brand customers know and love. SPONSORED BY STEAK ‘N SHAKE

80

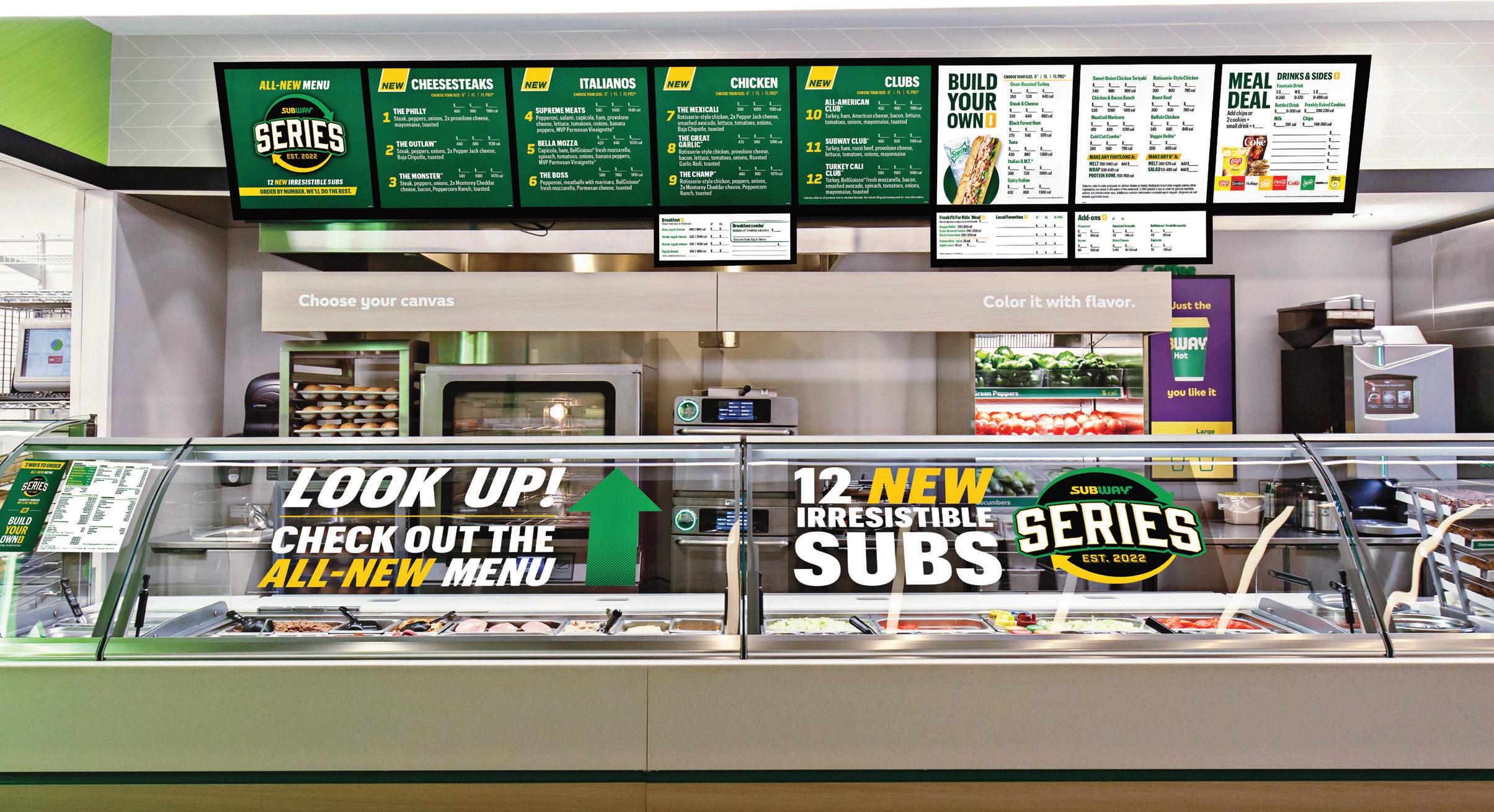

Subway Rolls Out Guest-Centric Restaurant Redesign Iconic brand offers franchisee remodel support. SPONSORED BY SUBWAY

84

The Toasted Yolk Offers Unique Blend of Profit, Work-Life Balance Nobody loves the brunch brand more than its franchisees SPONSORED BY THE TOASTED YOLK

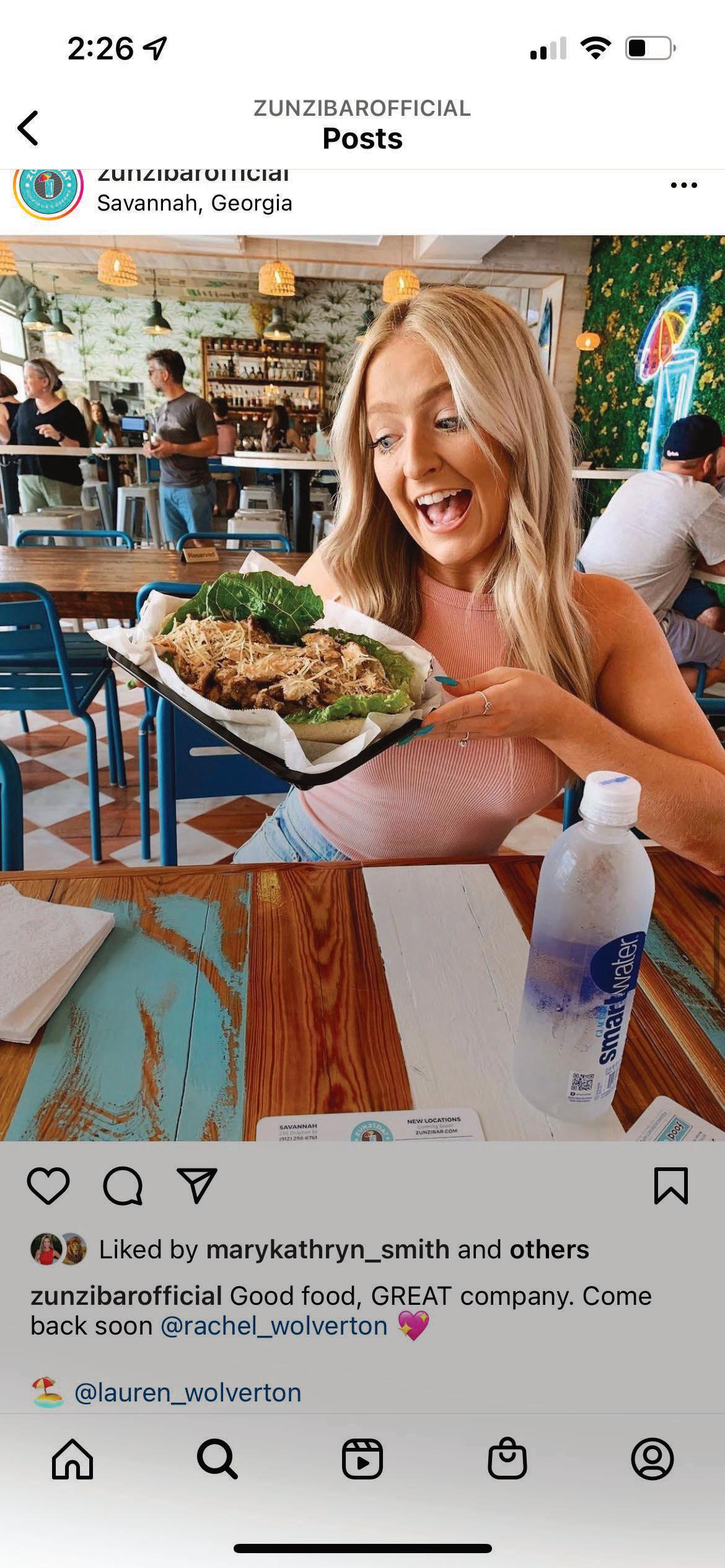

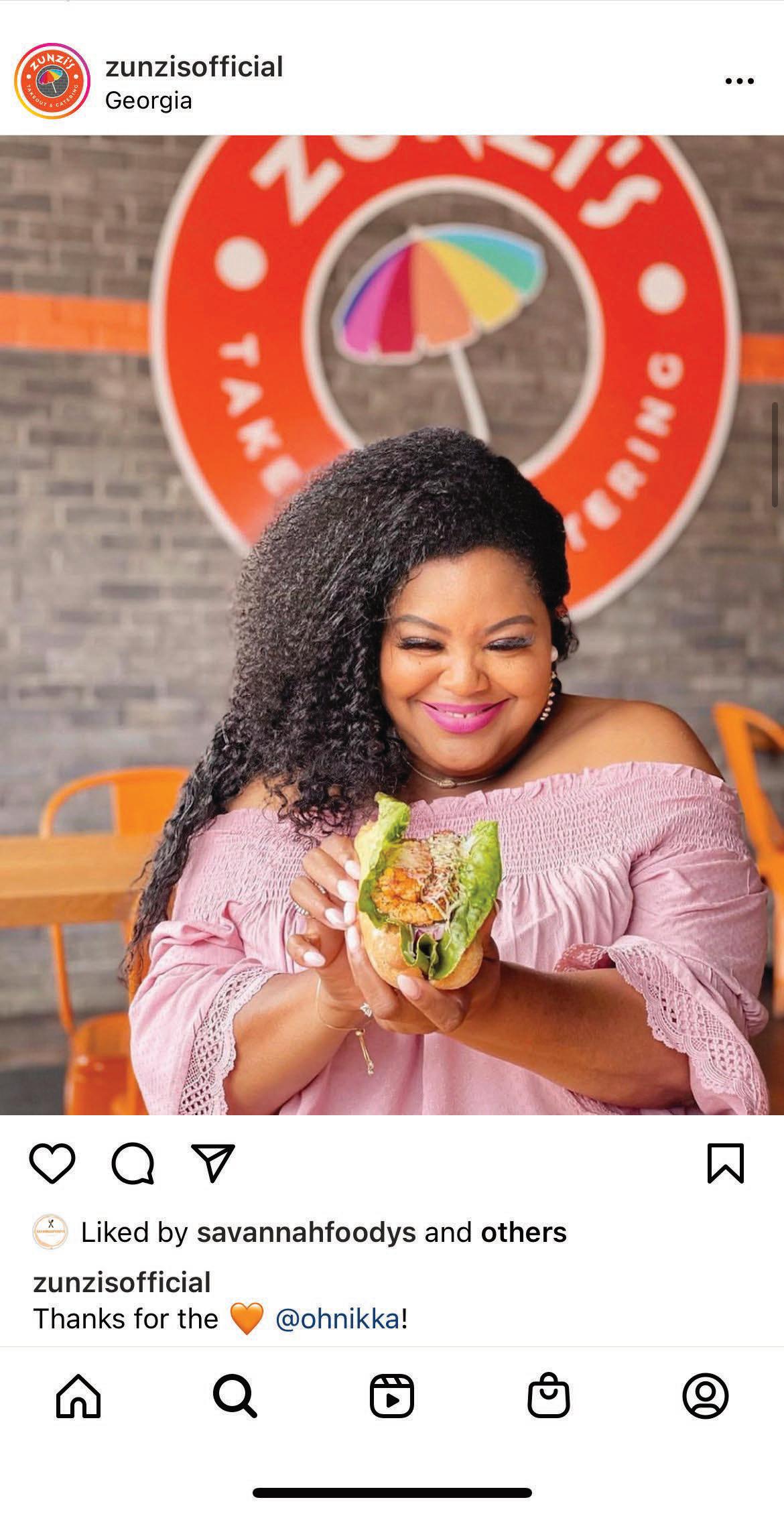

86 Zunzibar + Zunzi’s: The Brand with a Motto

SPONSORED BY

ZUNZIBAR + ZUNZI’S 58 Abbott’s Frozen Custard 60 Altitude Trampoline Park 62 Bubbakoo’s Burritos 64 Focus Brands 66 Houston’s Hot Chicken 70 Mici Italian 72 Roy Rogers 74 Russo’s New York Pizzeria 76 Slim Chickens 78 Steak ‘n Shake 80 Subway 86 Zunzibar Zunzi’s

NATIONAL SALES MANAGER // EXTENSION 149 : Edward Richards edward@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 141 : Amber Dobsovic amber@foodnewsmedia.com

NATIONAL SALES MANAGER // EXTENSION 148 : John Krueger john@foodnewsmedia.com

SALES SUPPORT // EXTENSION 124 : Tracy Doubts tracy@foodnewsmedia.com

CIRCULATION

WWW.QSRMAGAZINE.COM/SUBSCRIBE

CIRCULATION COORDINATOR: N. Weber circasst@qsrmagazine.com

ADMINISTRATION

GROUP PUBLISHER, FOOD NEWS MEDIA: Greg Sanders greg@foodnewsmedia.com

PRESIDENT: Webb C. Howell

MANAGER, IT SERVICES: Jason Purdy

ACCOUNTING ASSOCIATE: Carole Ogan

ADMINISTRATION

800.662.4834, www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher.

REPRINTS

THE YGS GROUP

TOLL FREE: 800.290.5460

FAX: 717.825.2150

E-MAIL: qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided by the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed. Direct to sponsoredcontent@foodnewsmedia.com

FOOD NEWS MEDIA PROPERTIES

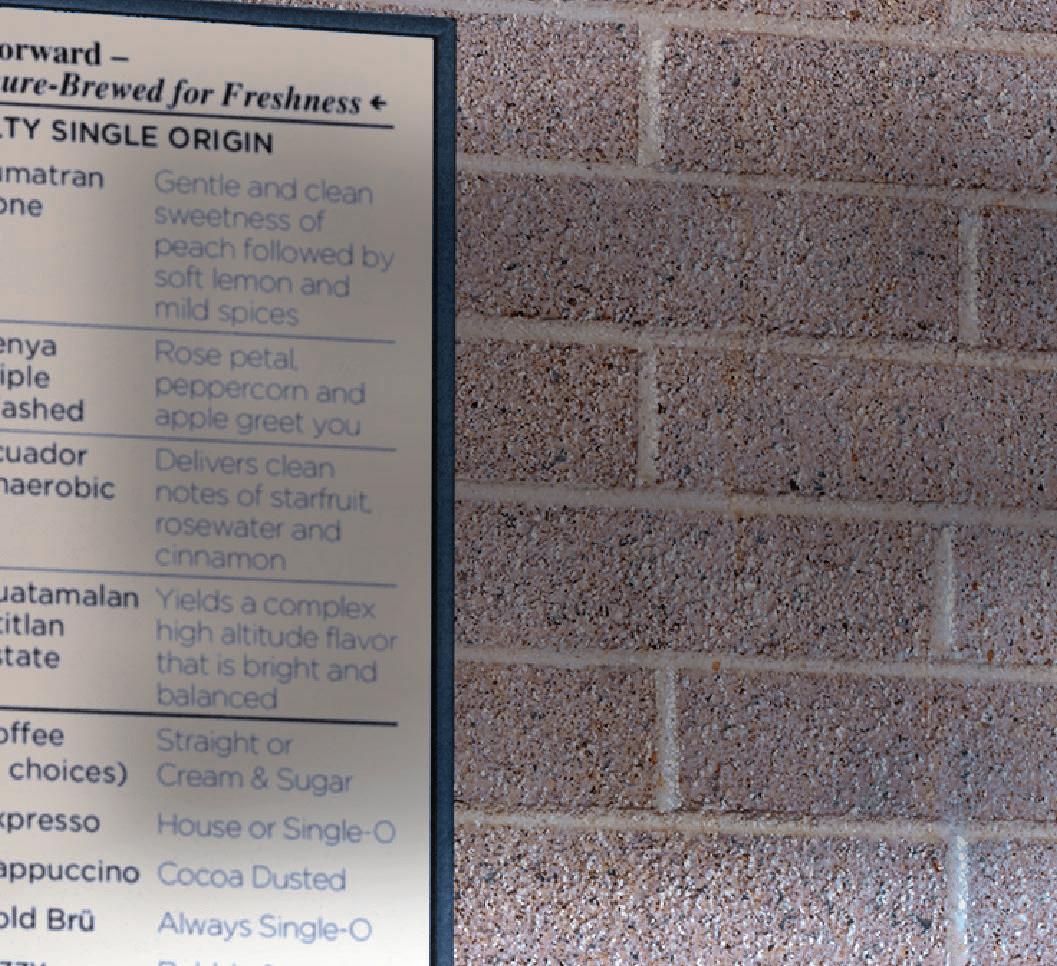

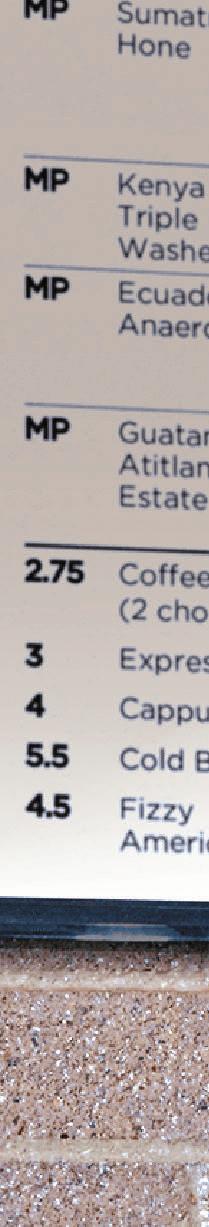

restaurant leaders can capitalize on co ee’s popularity to drive incremental sales.

First, Bowman says, operators should make their co ee programs stand out.

“Recently, the industry has seen subscription-based co ee programs take o ,” Bowman says. “This has been a big win for the chains that have adopted these programs. But for both these chains and smaller brands looking to compete with subscriptions, LTOs allow restaurants to create buzz around their co ee programs, while driving tra c from co ee drinkers who want to try something new. Often, LTOs also allow restaurants to charge a premium, meaning brands can drive even higher margins.”

Second, Amy Brown, marketing manager of commercial foodservice at SEB Professional, recommends restaurants o er cold co ee beverages. Mintel Foodservice’s 2021 Co ee and Tea report notes that Gen Z diners are core consumers of cold co ee, and nearly half of Gen Z consumers purchased iced coffee away from home.

“Cold co ee drinks were trending before COVID, but cold co ee drink sales will only grow as Gen Z diners gain more spending power and consumers shift from buying regular hot brewed co ee to beverages that are harder to create at home,” Brown says.

Bowman agrees and doesn’t see cold coffee sales slowing anytime soon. “Cold brew co ee and iced co ee continue to see doubledigit growth each year,” he says. “Cold co ees can also command a higher price point or an upcharge when paired with a combo meal that might typically include a hot co ee.”

hough restaurant tra c has improved since the onset of the COVID-19 pandemic, an NPD Group study reports restaurant tra c is still down 4 percent compared to 2019 levels. While that number is recovering, a decrease of even just a few percentage points can still create financial strain for restaurants. As a result, brands must focus on making each visit count by increasing check size and driving incremental sales. One of the simplest and most e ective ways for restaurants to do so is serving a strong beverage menu.

“Beverage programs have always helped restaurants drive incremental revenue,” says Chad Bowman, vice president of commercial foodservice sales at SEB Professional. “The

margins for beverages are good for operators, and adding a co ee or iced co ee to the menu can help restaurants realize large sales increases.”

Co ee is a particularly strong driver for restaurants. Not only is co ee one of the highest margin items on a restaurant menu, but it also has a strong built-in consumer base. In its 2022 report, “National Co ee Drinking Trends,” The National Co ee Association noted 66 percent of Americans drank co ee in the past day, and Americans choose co ee more often than other beverages, including tap water. By using a few smart strategies,

Of course, no co ee program is complete— nor can it compete with other restaurant’s offerings or co ees prepared at home—without a high-quality product.

“At SEB Professional, we’ve seen firsthand how implementing a full-scale co ee program can not only boost incremental sales, but an operator’s core foodservice o erings,” Brown says. “With all three of our brands—WMF, Schaerer, and Curtis—we have seen that operators o ering the freshest, high-quality co ees have the ability to quickly become a go-to beverage destination over their competitors. And with the right equipment from SEB Professional in place, operators can o er top-quality and consistency, no matter what their current labor situation looks like.” ◗

check averages without making operations more complex.

/BY PEGGY CAROUTHERS

In today's environment, foodservice operators are facing ongoing challenges like inflation, labor shortages, and supply chain issues - just to name a few. According to Cleveland Research Company in their recent “State of the Foodservice Industry" webinar, research shows that despite inflation, consumer demand for restaurants looks to remain strong and the outlook for dining out is optimistic. However, with growing competition to win consumer loyalty, how do you ensure you're standing out?

By providing a full-scale, top-quality coffee and tea program, you are laying the foundation to greatly enhance your food offerings! By upgrading your coffee and tea programs, your establishment can become a destination for hot and iced coffee and tea all day long!

I’m one of those millennials people call an “old soul.” Is that a badge to wear with honor? Or do I belong on one of those Progressive ads where I can’t pronounce quinoa and I’m more worried about the parking lot than the football game? But I will say this: In my time covering restaurants, early on, millennials were perhaps the A1 concern of every marketer in America. And it was a dicey slope. In hindsight, I think we can agree chasing “the next big thing” led to a lot of brand drift, especially in casual dining. We think of this today as the “all-things-to-all-people” trap. Or trying to be good at everything and ending up great at nothing. So many brands sought that golden egg only to end up at a place where core guests couldn’t recognize them anymore. And so began a multi-year stretch (again, this is particularly true of casual dining ) where brands recommitted to equities. Put differently, they remembered what got them to the dance in the first place.

Either way, we find ourselves today talking far less about millennials. COVID-19 is one reason why. The other is Gen Z. Generally speaking, this group includes anyone born after 1997. Yet, from the restaurant perspective, what’s critical to note is this is the first digitally native generation. Even myself, a grizzled millennial, didn’t discover Facebook until I was in college. Twitter wasn’t on my newspaper’s radar until about three years into my professional career. Gen Z consumers are often described as social and environmental idealists, with mobile phones as ubiquitous as water, and, notably, with estimated buying power of some $150 billion. Research company Knit, which empowers Gen Z to share

thoughts via video, recently released a restaurant and dining report to dive into preferences. Here were some key points:

Among the most influential decision criteria for Gen Z ( in order ) was: price, deliciousness of the food, convenience of location, quality and freshness of food, and cleanliness of the establishment. Of the surveyed Gen Z consumers, nearly 80 percent recognized price as an impactful criterion.

That instant gratification rumor you hear of Gen Z? Accurate. For the group of consumers who have become accustomed to getting almost anything at their fingertips with the click of a button, nearly 48 percent of respondents cited the speed of ordering and receiving their food as highly important, and another 24 percent marked ease of ordering via digital channels as an important consideration. Now, let’s look at their eating habits. Within the surveyed population of Gen Z consumers, 44 percent identified as healthy or “clean” eaters, while only 20 percent acknowledged they were overeaters. In addition, a sizable portion self-identified with one of the following restrictive dietary habits: low-carb (13.2 percent ), vegetarian (13.2 percent), vegan (5 percent ), and keto (4.3 percent )

The last point I’ll surface goes back. Gen Z demands stronger voices and social stances from restaurant companies. Roughly 15 percent noted the social impact and view of a company is something they factor into their decision when deciding where to eat out. The overall thread here is Gen Z is paying attention. It’s on us to prove we’re listening.

Danny Klein, Editorial Director

Gen Z guests aren’t millennials. But we can learn from past mistakes to meet them where they want to be.

Panera Bread found a creative way to highlight a new product line amid the summer rush.

The fast casual o ered guests a way to get through their summer slump.

—June 21—Panera launched “Charged Up Cups,” which gave customers a way to stay activated during the summer solstice. Also, the cups served as a branded vessel for Panera’s new Charged Lemonades, and, most notably, doubled as a portable phone charger.

The base of the 17-ounce bottle pops off to act as a charging base for somebody’s phone to rest and get some juice. No outlet needed.

Earlier this spring, Panera introduced Charged Lemonades with plant-based caffeine. Fueled by Clean caffeine from Guarana and green coffee extract, Charged Lemonades arrived in three flavor combinations: Strawberry Lemon Mint, Fuji Apple Cranberry, and Mango Yuzu Citrus. The drinks were part of Panera’s recently unveiled Unlimited Sip Club, the first nationwide unlimited beverage subscription for all self-serve beverages, available nationwide for $10.99 per month.

Yet like many arenas in the COVID-19 era, technology has reset the wheel. Namely, can technology bring the segments’ o erings closer together?

Customer arrival platform Bluedot released its first Convenience Experience Report, which explored consumer sentiment and the guest experience at gas stations and C-stores across America. It was based on survey data from more than 1,500 U.S. consumers.

• 61 percent of consumers in the report said they would visit a C-store more often if mobile ordering, drive-thru, and curbside pickup were available.

61%

• Nearly half would walk out of a C-store if one or two people were in line at the register (30 percent for two people and 16 percent if there’s one person in line)

• 54 percent said they’d turn away if they noticed three people waiting to check out.

• One in three would drive away if there was a single car ahead of them at the pump.

The kicker:

59 %

• 59 percent of respondents said they’d consider purchasing a meal from a C-store when stopping for fast food.

Can C-stores steal share?

27 %

25 % 21%

• One in four visit C-stores for lunch. Of that, 29 percent do so for fast food (brands inside the location or proprietary setups) at grab-and-go refrigerated items

made-to-order food.

hot food (like pizza or hot dogs, etc.)

• Also, 51 percent drop in for snacks, 20 percent for grocery items, and 16 percent for alcoholic beverages.

How do customers pick one C-store over another?

56 % 52% 37% 25 % 25 %

Some other points:

• Twenty-five percent of people said they were ordering C-store items from third-party apps If given the choice, however, two out of three preferred to use the C-store’s own app.

25 %

6 IN 10

• Six in 10 were more likely to visit a C-store if its mobile app automatically unlocked the pump and allowed in-app payments.

• Three in four consumers believed gas stations should start including charging stations for EVs, too.

3 IN 4

The market share jostle between quick-service restaurants and C-stores is nothing new.

Alot of quick-service restaurants have been “winging” it over the past couple years.

As the price of bone-in chicken wings soared in 2021, wing-centric eateries had to adjust quickly. And though bone-in wing costs have dropped this year to pre-pandemic levels, operators had to switch gears again, as the price for chicken breasts, which provide the meat for boneless wings and tenders, soared— as have the costs for many other commodities as well as labor.

The past two years “have been a constant juggling act” in terms of pricing, supply, staffing, menu development, and more, says Gus

Most wings restaurants took at least one price hike this year or in 2021, but stress on margins remain. In addition, rising gas prices and other inflationary pressures on consumers left little price elasticity. “Right now, there’s not a whole lot of room to move,” he says.

Dan Leyva, chief wing officer at Wings Over, sums up the supply price picture succinctly: “Everything that can go up at this point is going up.” Like many restaurants, “we’ve absorbed the majority of their costs,” he adds.

Malliaras, founder and owner of Detroit Wing Company, based in Eastpointe, Michigan.

Malliaras, founder and owner of Detroit Wing Company, based in Eastpointe, Michigan.

While some industry veterans have dealt with inflation in the past, it’s a new phenomenon to younger ones, who may have experienced price increases on only a couple of items at a time.

“I have franchisees who have never seen inflation,” says Sam Ballas, chief executive and managing director for East Coast Wings + Grill, based in Winston-Salem, North Carolina. “[At the company’s brand conference] I took 45 minutes telling them what it is and how we got here.”

Inflation is something brands are having to negotiate and continue battling, adds Michael Skipworth, chief executive of Addison, Texas-based Wingstop, the sector’s leader with some 1,858 units, including about 1,639 in the U.S. And with consumers facing higher food and gas prices, it is incumbent on restaurants to “provide value.”

Overall, however, experts believe the condition of the wings sector is strong.

“I would say wings are as popular as ever,” says Matt Ensero, chief executive of Wing It On!, a Raleigh, North Carolina-based brand. “If the past 12 months have taught us anything, wings are here to stay,” adding they have become a part of American food culture.

Operators adapted to the pandemic and its aftermath by relying on stable and sometimes additional suppliers, adding menu items, taking advantage of takeout and delivery options and enhancements, and offering profitable meal deals providing customer value.

Helping is the drop in bone-in wing prices, which stood at more than $3 a pound a year ago, compared to less than $1.75 a pound pre-pandemic, according to the U.S. Department of Agriculture. Prices have been declining this year to below $1.75 a pound by July.

Bone-in wing cost deflation is providing better margins— experts say for perhaps the first time—than for boneless wings and tenders, which have seen prices rise sharply over the past year in part due to higher demand for white-meat chicken.

“We can lean in and give some of that deflation back to maintaining the experience,” Skipworth says in the wake of the cost of boneless, skinless chicken breasts doubling during the first half of the 2022 and the cost of tenders jumping 28 percent.

Maintaining an adequate supply of wings and other items, from spices to carryout boxes, also became important in the wake of the pandemic’s chicken crunch and other supply chain issues. “I know more about logistics now than I ever did in my life,” Malliaras says.

In addition to using established suppliers, for instance, East Coast Wings “went to sources we never used before,” Ballas says, including buying 3,500 pounds of wings from a Chile supplier at a very good price. “You get a great win from that.”

Wingstop is contemplating going even further by potentially

investing in or even acquiring a poultry production plant, which could provide about 20 percent of its wings buy while also making costs more stable and predictable.

“It’s innovative and disruptive,” Skipworth says of the idea.

Some operators added wing-style thighs as a lower-cost option during the chicken crunch, and thighs have remained on some menus. Eateries also innovated around new sauces and items like chicken sandwiches and nuggets— all unique due to each chain’s many proprietary flavorings.

“The question is how do we make the pie bigger versus just raising prices,” Leyva says, noting Wings Over! added a price-sensitive tender sandwich, using only one new item, a split-top bun, with guests choosing one of the chain’s more than two-dozen flavors for the tender.

Although consumers have been fairly accepting of price hikes, it only goes so far, Ballas notes. One East Coast Wings location in the Southeast was allowed to take price increases equal to where they should have been, and “the store lost 35 percent of its sales in the four-week run.”

To battle some higher costs, several wing-centric operators are using meal deals and bundles to balance the higher cost of boneless wings or tenders with better margin side items. Others have eliminated non-essential items that didn’t sell well.

“We look at the menu every month,” Detroit Wings’ Malliaras states. That is likely to continue not only as inflation continues but as the specter of a recession looms on the horizon.

Restaurants have extended their menus by adding new sauce varieties to their already lengthy list—literally dozens—of sauce offerings. A few opted for a bit of out-of-the-box thinking.

Wing It On!, for instance, sought out a menu item not directly tied to protein. “We jumped into the test kitchen and considered factors like popularity, cost, and impact on operations,” Ensero says. The result: vegetable and chicken dumplings, sauced like a wing. “We think we hit a home run,” he says of the high-margin addition.

Alongside new ideas that revolve around the menu, many of the changes operators made during the pandemic, including customer dining habits, will go on into the future.

“We are optimizing our business model—how do we improve pickup and delivery to provide fresh food,” Leyva says. As a result, the company, with units across the Northeast and Midwest, switched to waffle fries that travel better and focuses on better packaging and improved delivery.

After all, he adds, “The guest behavior of ordering online and pickup is here to stay.” q

nearly as much as other businesses trying to find people to work our trucks and help our franchisees at events.”

Among frios’ roughly 50 units, there are still a few physical stores, but most of the franchisees who remain in storefronts have favorable deals with landlords in which the overhead makes sense. And many use the space as their commissary to store popsicles and keep their carts.

The current franchise opportunity doesn’t include retail locations. The primary focus is now mobile vans, or as frios fondly calls them, “Sweet Rides.” The vehicles are tie-dye and feature a slide-top storage freezer, internal and external remote-control LED neon lights, Bluetooth speakers, a built-in service window, power inverter, and a customizable menuboard.

Vans operate mostly around events, like an Employee Appreciation Day, or for schools, first responders, hospitals, festivals, fairs, farmers markets, and sporting events. On slower days, some franchisees drive through neighborhoods.

FOUNDERS: CEO Cliff Kennedy and president

Patti Rother

HEADQUARTERS: Mobile, Alabama

YEAR STARTED: 2015

ANNUAL SALES: N/A

TOTAL UNITS: 50

FRANCHISED UNITS: 50

AS A FRANCHISED BUSINESS, FRIOS GOURMET POPS had to get creative with its support once the initial wave of COVID-19 temporarily shut down storefronts nationwide.

CEO Cliff Kennedy felt it was time to go mobile, which wasn’t out of left field. Franchisees had already done iterations of this, with ice cream pushcarts and trailers.

About five operators participated in the first test, and it wasn’t too long afterward frios recognized how perfectly positioned its product is. The company sells prepackaged frozen popsicles in a variety of flavors, making it sanitary and safer to approach customers outside as opposed to them walking into a store.

The P&L potential is “drastically different,” as well, president Patti Rother says.

“The flexibility it gave in terms of labor was a game-changer,” she explains. “In a storefront, obviously you’re paying someone regardless if you’re selling popsicles. And then the food truck, if you’re at an event, you only just work the event and hand out popsicles and then you stop paying for labor as soon as the event is over. We’re a really labor light model. We haven’t struggled

As of July, frios vans stretch from the East Coast to Arizona, and by the end of 2022, the concept hopes to be closer to 100 units. The company established a predictable pipeline after being challenged by a shortage of Ford Transit vans. At the beginning of the year, frios held off on signing new operators to provide a more sophisticated system of support to existing partners, and because that’s now settled, franchise sales are ramping up.

The concept sells territories the same way it would actual stores. It targets areas of 200,000 people—although that figure is still a work in progress—and contiguous zip codes. In addition to vans, franchisees can use carts and join wholesale partnerships with local businesses, sports complexes, and schools and universities. Historically, frios has sold single units, but

started looking at managing prime costs versus just managing food costs and labor costs. That’s at the heart of the P&L. [And ] other lines in the P&L that you can manage and get one-tenth here, one-tenth there, and you try to survive.”

For Layne’s franchisees, the No. 1 priority is to have available product. The company sells one protein ( chicken tenders ), one side ( French fries ), and the packaging. With over 70 percent of the chain’s business being drive-thru, it is important essentials be available.

Even though we have emerged though the thick of the pandemic, life has not quite gotten back to “normal.” Given supply chain logjams, labor shortages, and the rising cost of fuel, which is affecting shipping costs for all goods, restaurant chains and independents alike are coping with price surges at the counter and worrying about passing along those costs to customers.

It is, as Garrett Reed, CEO of Layne’s Chicken Fingers, calls it: “A perfect storm of everything at once.”

Reed and Layne’s COO, Samir Wattar, recall this climate started brewing mid-2021 as many supplies lagged and demand was high, and it has not stopped since. “I wake up every week to letters from manufacturers—‘We’re taking an increase in 30 days or in 15 days, or your next deal is going to be increased by X,’” Wattir says. For example, the company used to pay $2 per pound for chicken tenders. That cost at the start of the summer was up to $3.70. Fries and soft drinks cost more, too.

“It’s been a struggle to manage,” Wattir adds. “We take price increases, but how much can we pass on to the consumer? When is the point that you’re going to price yourself out of the market? We

“We took a price increase earlier this year,” Wattir says, noting cross-country shipping costs have gone up as much as three or four times. “But we started managing more of prime costs, food and labor together, and implemented a labor management system based on productivity versus percentages. We’re able to control it that way, instead of saying, ‘I want X percent for food costs, and I want X percent for labor costs.’ Let’s combine them and manage them together. Then look at below the prime costs, see what’s on the P&L, and manage that— linen supplies, janitorial supplies, chemicals. Try to get some savings there so you don’t cheat your customer and you don’t overprice yourself out of the market.”

Layne’s took an approach where it will not reduce portion sizes (“shrinkflation” ) or make the customer feel cheated. It wants to stay fair to loyal users. Layne’s also notes it’s received little negative feedback from consumers, far less than normal even, which the brand sees as a sign people are adjusting to the overall price increases surfacing in post-lockdown life.

“It’s been refreshing because we’re fighting so many battles, and you really don’t want to fight the battle with your customer,” Reed says.

Another company working to sustain customer satisfaction amid the surge is Atomic Wings. During lockdown, some of the brand’s locations saw business double, CEO Zak Omar says. Then a shift came.

“I’m a Dunkin’ Donuts franchisee as well, and it seems like across [quick-service restaurants] transaction counts have [recently] gone down,” he says. “It’s a culmination of a couple things. Inflation, and a lot more people have less disposable income. Quick-serves also had to announce about a 20 to 30 percent

well. That’s all behind our engineering.” With a segmented base and lid, Genpak’s hinged ProView Close-Off containers provide complete meal component separation, preventing food migration by securing each compartment.

Genpak’s Clover line has a secure closure system that stacks well without blocking vents.

Genpak products solve presentation and safety needs across market segments with both its reliability and durability, which helps enhance off-premises customer experiences. Choosing the right product is a balance between form and function. “At the end of the day, it’s really based on functionality and what’s trending in the current market,” Bowser says. The same is true for choosing a container for its insulation properties while seeking recyclable or compostable properties across markets. “We receive feedback that the operator meals are arriving warm in our containers. Our goal is to hit those top performance values for the businesses.”

No one wants their specialty barbecue sauce to drip into their house-made pickles, or worse, hot and cold items to compromise each other—or the paying customer.

Food packaging manufacturer Genpak—headquartered in Charlotte, North Carolina with 17 facilities across North America—helps maintain consistent presentation and safety of takeout and delivery items to protect restaurants’ products and brand integrity.

A variety of to-go container shapes, sizes, and colors in sustainable, microwave-safe, hinged, two-piece, and vented options abound in their Harvest Fiber, Clover, ProView, and ProView Close-Off lines, for instance, to help alleviate the key problems including food presentation, safety, and food migration.

These containers allow restaurants to offer high-quality food to their customers the same way, every time. “Whether it’s a salad or a steak or chicken tenders, we really pride ourselves on the fact that the way the food leaves the kitchen is the way it’s received when the customer goes home,” says Monica Bowser, corporate marketing manager for Genpak. “Our containers are designed and tested to perform and travel

Genpak’s polypropylene containers, which Bowser reports are happily being repurposed by consumers, seem to hit that sweet spot. “They are curbside recyclable in some municipalities and can help merge that branding for business owners,” Bowser says. “What’s important is retaining presentation and keeping prepared meals at the optimal temperature.”

Containers designed with clear lids provide another presentation and safety benefit to help the back of the house visually double-check orders to ensure accuracy, which equates to safety, presentation, and customer satisfaction.

“The venting is a very small but powerful feature because it has humidity control that helps prevent moisture within the products,” Bowser says. “We’re trying to bridge being safe and secure while presenting the orders accurately.”

Evolving within the industry and forging long-term customer relationships is a Genpak priority.

“Overall, Genpak prides itself on having the right experts to continue that legacy, and provide great solutions for the market,” Bowser says. ◗

JOCELYN WINN

JOSÉ CIL’S GREAT AUNT WAS A SEAMSTRESS. One of her well-worn lines was, “measure twice so you only have to cut once.” The CEO of Restaurant Brands International shared this anecdote recently with franchisees. Calls had started to pour in to Cil and the company’s president of international, David Shear. Operators wanted a piece of Firehouse Subs.

In mid-November, the Burger King, Tim Hortons, and Popeyes owner announced it agreed to acquire the 1,200-unit sandwich chain for $1 billion in an all-cash deal. On its surface, the move, which closed December, added a jigsaw piece so often coveted by restaurant conglomerates. It gave RBI an emerging, growth-ready player in America’s $30 billion quick-service sandwich category to join chicken, burger, and beverage strongholds. For its part, Firehouse approached the M&A table having tripled its unit count since 2010. Founded by brothers and former firefighters Chris and Robin Sorensen, it was a privately held company since unit one in Jacksonville, Florida, to the moment it joined RBI.

The brand’s history wasn’t pitted by setbacks and leadership shakeups over the decades; it was merely ready for its next act. And RBI franchisees were eager to add a chain that’s domestic same-store sales rocketed 21 percent in 2021 and 20.6 percent across two years. Firehouse’s record-high $900,000 averageunit volumes drove systemwide sales north of $1.1 billion, which sailed 2020’s $872 million. Twenty-seven percent of the business flowed through digital channels. AUVs in Q1 2022 inched even higher to $920,000 on a trailing 12-month basis.

But Cil’s message was clear. While Firehouse’s runway is undeniable, there’s more opportunity than a first look-over might uncover.

“We’re spending time doing the measuring and making sure we have the right place so we only have to cut once,” Cil says.

The deal between RBI and Firehouse began on common ground. Firehouse CEO Don Fox spent 23 years at Burger King, from 1980–2003. Three of those—2000–2003—overlapped with Cil. Although they didn’t cross paths ( Fox was in field ops and Cil in legal) their shared history offered a starting point.

About six weeks before the deal was announced, Fox and Cil met. Fox says there was “instant chemistry and energy” that, frankly, wouldn’t have been possible with anybody else.

Cil, to that point, knew Firehouse best as a consumer. In the years he traveled Florida visiting Burger King pads, and the 10 months he worked as a regional general manager for Walmart, he often found himself eating at the inline locations that sparked Firehouse’s growth.

“And that’s how I got to know the brand and fall in love with

it,” Cil says, “because the product was great and the service was great, and it resonated with me.”

Cil and Fox simply had a lot to talk about.

One of RBI’s defining traits since forming in the wake of a 2014, $11 billion takeover of Tim Hortons, has been net-unit expansion. Burger King was growing by roughly 170 units per year when 3G Capital spent $1.56 billion and grabbed control 11 years ago. Ahead of COVID, Burger King pushed about 1,000 locations each calendar turn. Popeyes opened 216 restaurants the year before RBI jumped in and there were 2,725 stores on December 31, 2016. Today, there are about 3,851 globally and Popeyes, in 2021, experienced the highest number of openings since RBI bought it in 2017—unit growth of 7.4 percent, or a net of 254 stores. The chain, which RBI forked up $1.8 billion for, expects to eclipse the 200 figure again this year.

Firehouse presently operates in three countries and territories. Burger King is in more than 120, Tim Hortons over 10, and Popeyes clear of 30.

There are 47 Firehouse Subs in Canada—the first opened 2015 in Ontario—and AUVs, generally, perform above the company’s system average.

Just for context, Subway boasts close to 3,000 stores in that market. RBI? More than 4,500 across its three brands. Cil says 80 percent of Canadians visit Tim Hortons’ 3,900 or so venues every month.

RELIABILITY

Mechanical improvements to sensors, fans, controls, and other components to enhance performance and minimize downtime.

INTUITIVE CONTROLS

New next generation, capacitive touch controller with modern user interactions found on a smart device that takes the guesswork out of fryer operations.

SERVICEABILITY

Serviceable components accessible from front of fryer for easier and quicker removal making service calls more efficient and minimizing downtime.

INTERNET CONNECTION

No need to connect to Wi-Fi or an edge server for accessing Cloud capabilities such as remote configuration, data analysis, and diagnostics.

If you take a higher-level view, RBI’s footprint sits near 29,747 restaurants, and roughly 18,000 operate outside the U.S. As of November, it had more than 500 outposts in China (1,620), Brazil (928), Spain (897), Russia (792), Germany (744), and the U.K. (538); and more than 400 in Mexico (450), Australia (443), South Korea (425), and France (416).

Firehouse has zero restaurants in any of those spots. There are 52 international Firehouses, if you count Puerto Rico. And to toss an even more alluring point forward, outside of Spain, where there are only 50, a sandwich chain not named Firehouse touts at least 384 locations in every one. Australia (1,221), the U.K. (2,211), and Brazil (1,641) feature significant bases.

The U.S. picture isn’t one to gloss over, either. Subway has retracted by 3,651 stores since 2019. The broad, year-end 2021 domestic sandwich field: Subway, 21,147 locations; Arby’s, 3,409; Jimmy John’s, 2,657; Jersey Mike’s, 2,100; Panera, 2,080; Firehouse, 1,044; McAlister’s 505.

“You have this underlying mechanism and culture of growth that then will carry over into our brand,” Fox says. “If I’m a potential franchisee, I’m just thinking about the horsepower and the level of experience that’s behind that. … I’ve been in the industry for many years and I’m fairly well known, but if you think about the ownership of Firehouse, it’s not per se. So it really changes the dynamic quite a bit, I think, for any potential franchisee looking to invest.”

In February, Firehouse added a new member to its C-suite for the first time in 11 years (the position sat vacant since 2009 when Fox was promoted to CEO). Mike Hancock, a 6-foot-7 former defensive end who played in the CFL with the Toronto Argonauts, joined as chief operating officer. The nine-year RBI vet held the same post at Tim Hortons. Before, he clocked five years at Burger King directing operations across North America, Southern Europe, Turkey, and Africa.

The move wasn’t a cryptic one—it was a signal sender. “That just adds great firepower to an already great team,” Fox says.

“He’s been operating in an arena where we aspire to go,” he adds of Tim Hortons. “So that real-world experience is of incredible value. And again, I’ve been in the industry for 48 years, but I haven’t operated at a level with a 5,000-unit brand.”

Since close, Cil says RBI worked to integrate and elevate Firehouse. On the back-end, it’s connected the chain to RBI’s infrastructure—accounting, IT, and financial systems.

RBI has more than 200 engineers working through tech. The company created an in-house stack, including loyalty programs and a CRM engine. It’s also invested in white-label delivery alongside aggregator partnerships and continues to update menuboards to dynamic digital formats across the system, with an added focus on suggestive sell capabilities.

Firehouse already had a mobile app complete with order and pay and loyalty capabilities, as well as more than 3.5 million members. In 2021, 2 to 2.5X more dollars came via off-premises channels than pre-COVID-19. That October, 14 percent of sales owed to delivery alone. Rewards grew at a clip of 50,000

users per month and reached 10 percent of Firehouse’s total transactions.

“It’s so energizing when you know you’ve got these great, great assets that consumers love,” Fox says. “And know it’s more like fine tuning, with the technical side of the business to really unleash it.”

Cil says the more important integration piece, perhaps, is the “business standpoint mindset.”

With Fox now in the fold, RBI has a team of four presidents running each brand. They meet once a week and chat about performance and perspectives. Cil calls it a “sharing of best practices” that’s gone both ways since Firehouse arrived.

It extends from HQ analytics to site selection to format innovation and franchise recruitment. Yet it rests on economics, Cil says. “There’s no gaming that,” he notes. “You’ve got to have strong revenues, strong profitability, a good return on investment for a franchisee to invest and grow. And we think we have a great case here, and Mike and Don and the rest of the team will help accelerate that in years to come.”

One element Cil believes RBI can learn from Firehouse is its Public Safety Foundation. The program awarded $69 million over the years to “hometown heroes” and benefitted 5,700-plus organizations. Recently, RBI hosted its first Firehouse Public Safety Foundation event after it donated 17 automatic external defibrillators—good for $25,000—to the West Miami Police Department. The chief, major, and newly appointed mayor showed up. A speaker shared how a previously donated defibrillator saved a life in the last year.

“That’s pretty tangible,” Cil says. “And very direct and super powerful message for all of us. And for our team as well.”

At Tim Hortons, more than $27 million (cad) was raised in 2021 and early 2022 for the chain’s “Foundation Camps” and other initiatives. Burger King has provided nearly $55 million in scholarships to high school seniors and corporate and franchisee employees since 2002. The Popeyes foundation donated over $1.2 million to Support No Kid Hungry as of March.

So it’s yet another synergy RBI wants to build on, Cil says.

Cil adds RBI isn’t in a hurry to open Firehouse units just because it can. “What we’re doing now is taking time to do the research, to understand what consumers expect from the sandwich category in these markets that we think have the potential for growth,” Cil says. “We’re doing research on product; on taste; on naming conventions for products. We’re thinking about what types of formats; how does technology fit in; what’s the right price and menu architecture to consider; and format innovation.”

Just like its expansion prospects in general, Firehouse has ample room to maneuver here, too. Through the first four weeks of the pandemic, Firehouse’s sales plunged 45 percent, year-over-year. The Monday of COVID’s “official” landing ( March 16), it stopped collecting royalties. A day later, Firehouse did the same for ad fees. In fact, it would be months before the brand asked operators for either, and even then, it came as deferred payments.

›

›

›

›

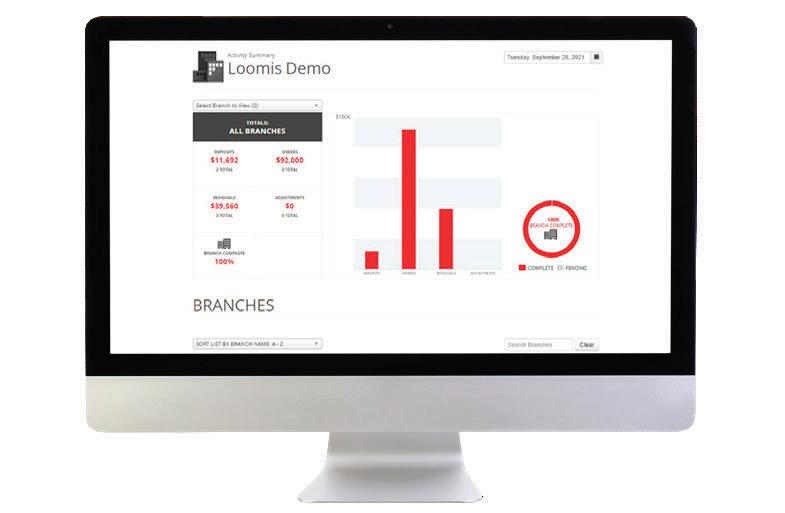

› Enterprise-wide reporting

› Receive daily provisional credit

› Eliminate bank trips

› Keep funds safe

The goal, Fox says, was to keep cash in the wallets of franchisees and provide them with ammo for whatever twist came next. However, what ended up happening was a return to prioryear levels after only 10 weeks. Come summer, Firehouse forgave deferred royalties and surged ahead.

“For us, what was very compelling was that the pandemic, and the initial stage of it, produced an environment where people in increasing numbers used us in a way that was perhaps different than they considered using us before,” Fox says.

But the positive spin was Firehouse had already begun to consider this. COVID didn’t invent off-premises realities as much as it provided kindling. The brand completed digital and packaging work pre-2020.

In 2012, Firehouse’s dine-in business accounted for 52.4 percent of sales (unusual for a sandwich shop, as most of its rivals were predominantly takeout, Fox notes) During succeeding years, the contribution from dine-in began to decline. In 2014, it dropped narrowly below 50 percent. Two years later, dine-in mixed just 46.5 percent. Fast forward to 2019 and it was down to 38 percent.

This was hardly a Firehouse-specific tale. From 2012–2019, fast casual showed a 5 percentage-point decline in dine-in. And more telling during the same span—a drop of 17 percentage points for a hefty collection of quick-service brands.

Close to 90 percent of Firehouse’s sales in 2012 came from a customer placing an order with a cashier at the point of sale. In 2019, the share of what the chain considered its “traditional chan-

nel of trade,” slid to 75.3 percent. Meanwhile, looking at 2012–2019, catering, online ordering, third-party delivery, drive-thru, and even phone orders, all grew.

Traditional ordering dropped below 40 percent of sales during COVID depths. It returned to 56 percent by year’s close.

The key here, Fox says, is Firehouse had assets in place. It only had to lay into advertising and promotion to jumpstart awareness. RBI can help with that.

“And that traffic that we’ve picked up has been lasting,” he says. “People are continuing to use us in that off-premises experience.”

Firehouse’s “Rapid Rescue,” or internal online ordering, plus third-party delivery, remains double what it was in 2019. “It has created a fundamental shift in how the consumer uses us,” Fox says. “I get so excited by the fact that RBI’s strategy was already in line with that in terms of the embracing of digital in particular. Being able to leverage those resources, it’ll be much more impactful than if I had been left to my own devices under private ownership for the foreseeable future.”

Fox says RBI’s tools will help the company anticipate further change as the sector’s recovery marches on. In particular, the deal instantly gave Firehouse a drive-thru playbook that stems from operating more than 12,000 across North America.

Firehouse has nearly 70 today and they’re overindexing sales in most cases, Fox says. The sandwich industry, in general, is not rife with windows like, say burgers are, which is one reason the category rebounded slower. “The vast majority of the system is in traditional in-line units, but in every instance where the business case is strong to look for drive-thru locations we’ve leaned into that,” Fox says.

As noted before, RBI spent the last 12–18 months modernizing its drive-thru fleet. Namely around digital menuboards. Those learnings are going to cascade to Firehouse.

“We think there’s an opportunity there to share best practices and you can basically cut to the chase versus iterate, which many of us have had to do over the past five, six years,” Cil says.

Adds Fox, who pushed “more Whoppers out windows than I can ever count,” in his 23 years with Burger King: “RBI can quickly make us better drive-thru operators. We are a great sandwich brand. We know how to make the best food. Do we have opportunity to learn how to serve it better?”

All told, Fox says, there are clear, myriad ways to grow Firehouse and generate more transactions. But it’s going to start with guest experience.

What he wants to bring to the portfolio from Firehouse “is that love of Firehouse.” RBI’s value core of “building the mostloved restaurant brands in the world,” is a vision Fox feels the chain fits right into.

“The thing is, we just have to make more customers aware of us so even more people can love us,” he says. q

Danny Klein is Food News Media’s editorial director. Contact him at danny@QSRmagazine.com

Danny Klein is Food News Media’s editorial director. Contact him at danny@QSRmagazine.com

oh, and streamline your operations too, with ( ) FIFO Bottle™

DISCOVER MORE!

DISPENSING, REINVENTED!

AAs the pandemic era nears its waning chapters, franchising has held steady. In fact, you could argue market conditions threw weight behind one of the sector’s historic growth vehicles. The franchising field expanded at a 3.2 percent compound annual growth rate from 2015–2021, according to financial services company Rabobank. The share of franchising as a portion of foodservice sales in the U.S. scaled about 4 percent, per year, through that window. The top 10 franchising restaurants’ market share lifted from 19 percent in 2012 to 28.4 percent by 2021. That compared to an 11 percent decline for non-franchised restaurants, based on Rabobank estimates. Per Euromonitor, as of 2021, franchises accounted for some 40 percent of domestic foodservice sales.

During the pandemic, franchises grew their market share nearly 10 percent, Rabobank data showed. And it’s just beginning. McDonald’s franchisees, for instance, which make up 95 percent of its U.S system, experienced average growth of $125,000 per restaurant last year. That put operators over $500,000, a 50 percent hike in the past three years.

Financial reporting from franchisees, industrywide, indicated stronger-than-normal cash operations, up 28 percent in 2021 versus the five-year average. Franchisees grew absolute sales from $213 billion in 2019 to $238 billion last year.

The why behind the sector’s resiliency traces back to decades of selling points. But it also owes to what’s changed.

“Great quick-service restaurant franchise deals stem from mutual trust, attraction to a dynamic and growing brand and above all, the fundamental financial metrics of the business,” says Robin Gagnon, CEO and cofounder of We Sell Restaurants. “Rapidly increasing costs to launch and operate require that franchisees join forces with those who offer the greatest opportunity to leverage their capital and grow their operation.”

“For those reasons, AUV has never been more critical since sales can play a key part in delivering on profitability,” she adds. “Low-volume operations that a few years ago may have been worth a second look will slide as occupancy, interest rates, and buildout costs spiral to new norms.”

This has been clear at the top. Yum! Brands and Restaurant Brands International turned in signficant growth in 2021. The Pizza Hut, KFC, Habit Burger, and Taco Bell owner debuted a net of 1,259 restaurants in Q4, pushing its year-end total to 3,057 net new openings—the most in its history, and, according to CEO David Gibbs, the most ever achieved by a restaurant group. Burger King, Popeyes, Firehouse Subs, and Tim Hortons’ parent achieved net growth of 4.5 percent, finishing the calendar with 29,456 restaurants compared to 27,025 in the yearago period.

Inspire Brands, which directs Dunkin’, Arby’s, Buffalo Wild Wings, Rusty Taco, Sonic Drive-In, Jimmy John’s, and Baskin-Robbins, opened more than 1,400 units in 2021, including over 500 U.S. franchise-led stores and 800 locations outside the country.

Alex Oswiecinski, cofounder and CEO of Prospect Direct, says you can’t get around hard numbers. Brands with a solid ROI are going to attract operators, especially amid rocky conditions. “In a time when other assets like stocks are very volatile, folks are looking at where they can put capital that has a reliable, proven track record of returning cashflow in the near- to-medium term,” he says. “I believe the trend will

Restaurant franchising did far more than weather the worst COVID-19 could muster. And now, it’s on the cusp of more growth, higher standards, and no shortage of possibilities.

continue where brands that have proof of existing franchisees making money by meeting the needs of today’s consumer will have a leg up over brands that are more aspirational, or oriented around hitting trends that are further out.”

According to the International Franchise Association’s 2022 outlook, franchise establishments in the quick-service industry increased by 2.6 percent last year. It expects the figure to clock in at 2.1 percent in 2022 for a total of 192,426 businesses. The important note was 2020 saw quick- and full-service franchise venues decline 6.7 and 6.5 percent, respectively. Both bounced back to the tune of 2.6 and 3.3 percent growth. Come 2023, they’ll nearly be on par with where the field stood pre-COVID.

Oswiecinski says his company has observed interest “about the same” for franchising as a whole pre- versus post-pandemic. “But it has polarized the winners and losers,” he says.

“The pandemic changed habits by teaching people that they could procure goods and services without leaving their homes,” Oswiecinski says. “Even after restrictions were lifted, these habits of expecting convenience remained. Brands that focused on technology or adapted to bring their service directly to the consumer, either physically or digitally, are winning.”

Gagnon agrees. “Franchisors that stand out are investing in technology on multiple fronts. This includes the customer service dimension where loyalty apps keep customers returning, measuring their distance to the door to prep food that’s hot when they arrive for pickup and allow for kiosk ordering, improved drive lanes, and more,” she says.

Franchise brands continue to leverage tech to reduce footprints (even to the point of cutting the dining room out altogether), while increasing speed of operations to reduce start-up costs, Gagnon notes. “They [also] are using tech to enhance marketing efforts, geo-targeting the consumer, even using artificial intelligence for order-taking to improve profitability as the labor model is re-evaluated within the category,” she says.

COVID solidified quick service as a category nimble enough to take the technological leap, while also delivering on a support model for franchisees. It’s a dynamic that helped build loyalty and goodwill from operators as investments paid off and they kept the doors open during one of the most chaotic periods on record. As noted, once the landscape shifted, hosts of quick-serves were able to retain sales or even gain market share.

It’s going to reshape the base. “Technology fees as part of the franchise agreement within the sector is a topic to be watching as we head into 2023,” Gagnon says. “Shockingly few brands collect these fees as part of their FDD, but this will be a must-have for the future. The evolution of technology is going to require constant

reinvestment to stay competitive in the marketplace. Companies that collect technology fees on an ongoing basis won’t need to put plans on hold to improve the customer experience while they search for funding to innovate.”

Stan Friedman, a 30-year franchise executive, veteran franchisor, and president of FRM Solutions, says leading bands are standing out due to adjustments and forward thinking just like what Gagnon mentioned. In other terms, whether brands met post-COVID requirements and cascaded those learnings down to operators, is a question prospective franchisees now seek out.

“More frictionless transactions and fewer touchpoints means online ordering and eliminating the need for someone to physically answer phones to take orders,” he says. “It’s a win for the operator in terms of labor, a win for the consumer—not needing to touch money, sign a credit card receipt, etc.”

Friedman believes the pandemic sped changes already coming. “And those who are really winning today,” he says, “are the brands that had the foresight to embrace these technological advances, prior to COVID, as opposed to making mad dashes toward less efficient solutions by virtue of necessity just to stay in the game.”

Graham Chapman, EVP of account services at 919 Marketing, refers to today’s leaders as franchise concepts “built for the modern-day customer.”

“These brands are usually led by forward thinking innovators who are ahead of the curve, especially from a marketing perspective,” he says, referencing product placements in popular Netflix shows and influencer campaigns.

“Of course, any brands that were early adopters of drive-thru models with a service-minded touch, i.e. Chick-fil-A’s new drive-thru model [express lanes], and have found creative ways to make Olo/delivery apps work without destroying margins are in a great spot,” Chapman adds. “However, an age-old principle is more relevant than ever today—a great franchise deal is awarded, not sold. Franchisors thrive only when they are growing sustainably and awarding locations and territories to qualified candidates who fit the brand and its culture.”

There should be plenty of movement as the market resets. Among the top 50 quick-serves in 2020, the total number of franchised units fell 2 percent. However, franchisors’ share of unit ownership lifted from 13 to 15 percent. Meaning, operators stepped in at times to take back sagging operations. Those units could be flipped. Yum! said it anticipates $100 million in refranchising proceeds this year alone. High multiples and eager buyers led to significant amounts of deal activity during COVID.

“A

is waiting.”

Private equity was aggressive. Wendy’s and Taco Bell franchisee Delight Restaurant Group reported a 92.2 percent growth in sales, primarily through acquisitions of units. Flynn Restaurant Group had $3.7 billion in revenue in 2021 after it completed a $552.6 million purchase of 937 Pizza Hut and 194 Wendy’s stores from bankrupt operator NPC International.

What’s next? Rabobank believes deals of this nature led to a shakeout of sorts for U.S. franchisees, “which is expected to result in greater consolidation of the landscape.” The company credited the uptick in deal activity to a confluence of challenges; higher returns, buyers’ cash levels, and recent growth trends.

Valuations in 2023/2024 are unlikely to be as attractive. Margins are tightening due to rising prices, instability in commodity complexes is increasing, and the cost of capital is climbing.

“I would say the economy is on everyone’s mind at the moment, specifically inflation and the government’s next moves,” Oswiecinski says. “This directly

while for others it will be an inflection point that prompts them to take the leap into something they’ve been wanting, but putting off, like franchise/business ownership,” Oswiecinski says.

Something else to consider is the landscape itself. In 2020, independent locations declined by 8 percent, according to The NPD Group (28,399 closures). But per NPD’s Fall 2021 ReCount restaurant census, which totals restaurants opened as of September 30, 2021, the independent field expanded by 1 percent, or 2,893 units, last year.

Independent locations grew in seven of the nine Census regions, NPD said, and large areas like Los Angeles, Dallas-Fort Worth, and Seattle-Tacoma.

Simply, independents are reemerging as a competitor, although they’re likely to trail for some time due to debt load and other realities difficult to address without collective scale.

“But even as dine-in returns, other channels aren’t going to vanish. While dining rooms are back, curbside and off-premises is not going anywhere,” Friedman says. “So brands that accommodate these incremental opportunities for transactions are win/win. Smaller footprints, fewer SKUs are also winning combinations, as supply chain and labor issues continue to linger.”

affects franchising with regarding to tightened lending, access to and cost of capital for prospective franchisees. This means brands that have the majority of their new franchisees using SBA loans may need to temper development expectations. Brands that have a product/ services tied to essential human needs will fare better.”

The same goes for brands that are more inflationresistant, or higher-margin business models with a smaller portion of the P&L tied up in labor and real estate expenses, he says—concepts differentiated enough in the market to have pricing power.

“Outside of labor challenges, the biggest topic to monitor has to be the economy in general,” Chapman reiterates. “Will the economy just endure a short dip or is a crash on the horizon? How do international conflicts/trade battles impact supply chain/distribution? If the economy does, indeed, crash will that actually be a good thing for quick-serves offering cheaper food, and often the comfort food options many folks turn to in an economic depression?”

As usual, setbacks will present opportunity for some and final straws for others, and that’s especially true of an entrepreneurial world like franchising. “Overall, though, as we saw in the last recession and during other periods of volatility, some people will use these external circumstances as an excuse to not make a change,

You can say the same about drive-thru, even if the angle has changed. “COVID made drive-thru an exponentially stronger competitive advantage,” Chapman says. “Drive-thru quick-serves could limit close proximity and face-to-face interaction, reduce/eliminate dining room service—therefore, limiting staffing needs—avoid complete reliance on delivery apps that can cripple margins, etc.”

“This created even more demand and interest in the quick-service category, especially for those with drivethru models as sales exploded,” he continues. “It will be interesting to see if drive-thru concepts maintain their momentum in a post-COVID world where more and more folks are working from home.”

Labor isn’t a topic losing ground, either. Quick-service franchises boasted a workforce of 3,880,612 in 2019. The 2022 projection was 3,810,044, according to IFA. Full-service: 1,116,894 in 2019 and 1,096,149 estimated for 2022. “Franchisors who are taking direct action and sharing the burden of raising wages and the ‘Great Resignation’ are the ones that stand out,” Chapman says. “Some brands have introduced robot servers and other new ideas to streamline service and cut labor costs. Others have doubled down on showing their people how much they care to improve hiring and retention, like offering entry-level employees actual career paths and possible future ownership opportunities and hosting systemwide surveys to reward devoted franchisees with great stories by paying for education/ certifications or subsidizing housing costs.”

“ FRANCHISORS WHO ARE TAKING DIRECT ACTION AND SHARING THE BURDEN OF RAISING WAGES AND THE ‘GREAT RESIGNATION’ ARE THE ONES THAT STAND OUT”

As consumers begin to dine at full-service brands again, Rabobank expects franchising valuations to suffer. In the U.S., unit economics will remain strong relative to competitors, the company noted, but perhaps not quite as robust as we’ve seen over the last five years. So 2022 could be a year for some franchisees to exit as well.

Meanwhile, Rabobank sees significant franchise whitespace overseas as restaurants seek joint development deals. Between 2016 and 2021, units in the rest of the world grew to twice the number of those in North America.

“For franchisors in the U.S., more focus will need to be put into maintaining share, margins, and smart growth than absolute growth,” Rabobank said. “This will be done through innovation, tech advancements, and optimizing existing tools to allow operators to be more effective and to keep up with the increasingly capricious consumer. This may include the deployment of ghost kitchens, host kitchens, and smart limited-timeoffering management.”

And just as COVID allowed franchisors to prove their mettle, the industry in 2023 and beyond will reflect the strength both ways. “Relationships are more important post-COVID than ever before,” Friedman says. “Relationships not just with consumers, but between franchisor and franchisees; franchisees and their teams, managers, and customers. And let’s not forget suppliers. Trust is not an entitlement and it takes intentionality to earn it and keep it.” »

QSR magazine’s Best Franchise Deals for 2022 were selected from a nomination process that ran from mid-May to mid-June. Finalists were reviewed by the Franchise Council, which selected their top choices from shared information and FDD data. Their top choices comprise the final list. Brands cannot appear on Best Franchise Deals for back-to-back years, but can return after a year off.

These brands are well-positioned to capitalize on a market rife with potential.

BY DANNY KLEIN

BY DANNY KLEIN

And now, on to this year’s Best Franchise Deals, the 12TH in QSR’s history. For 2022, we reconnected with our Franchise Council of industry experts to get their insight and picks.

Here are the 14 Best Franchise Deals (in no particular order).

THE FRANCHISE COUNCIL: GRAHAM CHAPMAN EVP of account services, STAN FRIEDMAN president, ALEX OSWIECINSKI co-founder and CEO, ROBIN GAGNON CEO and co-founder, We Sell RestaurantsNUMBER OF U.S. FRANCHISE UNITS: 765

NUMBER OF U.S. TOTAL UNITS: 911

TOTAL SYSTEMWIDE SALES: $2 billion

FRANCHISE AVERAGE-UNIT VOLUME: $2,544,354

FRANCHISE FEE: $35,000

ROYALTY: 6 percent of gross sales

RENEWAL FEE: 50 percent of the current franchise fee

MARKETING FEE: 4 percent of gross sales

TOTAL STARTUP COSTS: $501,700–$950,200

FRANCHISEE INCENTIVES: Veteran discount: 20 percent on initial franchise fee

“The numbers speak for themselves, franchise AUVs at $2.5 million, with start-up costs beginning at $502,000 make for a great ratio that puts them at the top of potential ROI opportunities in food. Strong year-over-year growth, a seasoned leadership team, and solid brand name recognition makes Zaxby’s a strong best franchise deal contender.”

“Strategic investment from Goldman Sachs is a game changer. Servant leadership mentality permeates all levels of the organization and offers franchisees a distinct/critical hiring and retention advantage—$2.5 million AUV and year-over-year growth numbers speak for themselves.”

“Zaxby’s AUV comes in at $2.5 million per store on a price tag to build of between $501,700 and $950,200. Assuming standard profitability, that is one of the best returns on capital invested among the contenders. With just 765 units nationwide, there is still room for development so the brand is ripe for continued growth without oversaturation.”

THE SKINNY:

Zaxby’s headed toward 2023 with fresh leadership and no shortage of runway, as the Council cited. Also, powerful backing after selling a “significant” stake to Goldman Sachs in fall 2020. Headed into the deal, Zaxby’s grew the franchise side of its business by 77 locations over a three-year stretch. And the company’s average licensee ran just three locations.

Today, the brand is helmed by Bernard Acoca, the former leader of El Pollo Loco. He became only the second CEO in Zaxby’s history when he stepped in for founder Zach McLeroy last year. McLeroy, who created the brand in 1990 with Tony Townley in Statesboro, Georgia, transitioned to chairman. In April, Zaxby’s added Sharlene Smith, who previously served as VP of operations for Papa Johns’ North America sector, as COO. A month later, 20-year Zaxby’s vet Michelle Morgan was elevated to the company’s first chief people officer. But this was hardly the last move. Mike Mettler arrived as chief development officer in May after a four-year run at Orangetheory Fitness (he previously worked for Dairy Queen and Domino’s) In the same announcement, former interim chief digital and technology officer Mike Nettles, who clocked time at Panera Bread and Papa Johns, moved into the position long term. Then, Patrick Schwing, formerly Arby’s CMO, came on as chief marketing and strategy officer in June.

To put it plainly, Zaxby’s is gearing up.

NUMBER OF U.S. FRANCHISE UNITS: 995

NUMBER OF U.S. TOTAL UNITS: 1,051

TOTAL SYSTEM-WIDE SALES: $602,044,735

FRANCHISE AVERAGE-UNIT VOLUME: $609,753

TOTAL AVERAGE-UNIT VOLUME: $608,723

FRANCHISE FEE: $30,000

ROYALTY: 6% of monthly gross sales

RENEWAL FEE: Currently, half of the current initial franchise fee; and $775 renewal upgrade design fee (non-refundable)

MARKETING FEE: National: Currently 3 percent of gross sales; with the right to increase the fee to 5 percent of gross sales upon 60 days’ notice

TOTAL START-UP COSTS: $320,301–$585,465

“Smoothie King opened more than 100 units in 2021 and turned in 25 percent growth in sales and 17 percent increases in AUV, with their store average-unit volume reaching $609,753. Perhaps more importantly, the nearly 50-year-old brand made real strides in technology. One of the few brands to charge a technology fee in their FDD, they have developed supply chain technology to fuel a fresh products brand, launched an innovated smoothie subscription service and are planning to implement artificial intelligence technology for their drive-through. They earned a space as one of the Best Franchise Deals for 2022 and their growth and technology adoption bears watching.”

After a year that included north of 100 openings, Smoothie King signed development agreements to debut nearly 100 more already this year. This includes growth markets in the Carolinas, Florida, New York, Ohio, Texas, and Wisconsin. Of late, the brand launched a healthy rewards loyalty program designed to reward customers for living a healthy and active lifestyle. Users have the ability to earn and redeem rewards and receive exclusive offers and online exclusives. Additionally, using a GPS platform, Smoothie King can reward loyalty members when they work out at the gym.

The brand’s menu innovation remains at the top of franchisees’ selling points. Menu categories are arranged by purpose, so guests select smoothies based on personal health and wellness goals. There’s a commitment to plant-based and vegan choices as well, with a sizable scope of ingredient add-ins for customization. This year, the company unveiled a new business model with its smoothie subscription program, “Nourish Daily,” which the company said this will provide incremental revenue to franchisees.

To the Council’s point, the numbers are difficult to ignore: AUVs lifted 17 percent to $609,753, with the top 25 percent of units reporting over $907,000.

“ THE NUMBERS SPEAK FOR THEMSELVES, FRANCHISE AUVS AT $2.5 MILLION, WITH START-UP COSTS BEGINNING AT $502,000 MAKE FOR A GREAT RATIO...”

NUMBER OF U.S. FRANCHISE UNITS: 32

NUMBER OF U.S. TOTAL UNITS: 36

TOTAL SYSTEM-WIDE SALES: $35,554,880

FRANCHISE AVERAGE-UNIT VOLUME: $1,099,722

TOTAL AVERAGE-UNIT VOLUME: $1,099,722

FRANCHISE FEE: 25,000

ROYALTY: 5 percent of gross sales

RENEWAL FEE: 50 percent of then-current initial franchise fee

MARKETING FEE: If established, the amount Rusty Taco specifies, subject to the Marketing Spending Requirement.

TOTAL START-UP COSTS: $531,900 to $897,450

FRANCHISEE INCENTIVES:

VETFRAN PROGRAM: The “VetFran Program” is designed to provide career opportunities for honorably discharged military veterans or wounded warriors. It applies if you are a veteran or returning service member (who has not previously signed, or had an affiliate that signed, a development agreement or franchise agreement with the brand) who qualifies. The discount is 50 percent off the initial franchise fee for each franchise agreement. Rusty Taco applies the prorated discount for each Franchise Agreement toward the development fee payable under your development agreement. Prospective franchisees may qualify for both the VetFran Program and the standard adopter incentive program.

STANDARD ADOPTER INCENTIVE PROGRAM: Notwithstanding the first sentence of Section 4.2 of the Franchise Agreement, if you open the restaurant in compliance with the terms of the franchise agreement (including, but not limited to, Section 3.1 (site selection and on-site evaluation) Section 3.2 ( franchise site application), Section 3.3 (Lease of Building), Section 3.4 (Restaurant Designed and BuildOut), Section 3.5 (Opening), Section 6.5 (Purchase Requirements), Section 6.6 (Purchases from Designated Sources), and Section 6.7 (Franchised Location; Vehicles), then the royalty fee will be amended as set forth below:

rant operates; and 5 percent of the restaurant’s gross sales accrued during the remainder of the initial term of the franchise agreement. If you fail to open the restaurant in compliance with the franchise agreement and/or development agreement (if applicable) on or before December 31, 2022, fail to submit the development costs to us within 120 days of opening the restaurant, or fail to build the restaurant in the design, to the specifications, and at the location approved, you will not qualify for the 2022 Pull Forward Incentive and your royalty fee with be 5 percent of gross sales for the term of the franchise agreement.

“Backed with more resources after being acquired by Inspire Brands, it’s hard to bet against this 36-unit brand becoming much bigger in coming years. With most markets open, and no end in sight to the taco-trend, franchisees have the opportunity to both pick prime territories and ride the rising tide of consumer preference and increased brand recognition.”

“I love this brand and its brand story. I also like the simplicity of the concept, ‘nothing fancy, just real flavor and cheap, too.’ While this brand hasn’t got the cache in its name that more mature brands enjoy, it does have the full strength of Inspire Brands behind it. That means the same economies of scale afforded to franchisees of brands such as Arby’s, Buffalo Wild Wings, Sonic, Jimmy John’s, Baskin-Robbins, and Dunkin’, will be found here. Also, Inspire offers some very powerful incentives to franchisees signing development agreements for store openings over the next 36 months.”

Founded in 2010 by Rusty Fenton and his wife, Denise, Rusty Taco merges the flavors and experience of a traditional taco stand with flexible prototype designs. The Inspire Brands-backed chain (Dunkin’, Sonic, Buffalo Wild Wings, Baskin-Robbins, Arby’s, and Jimmy John’s) has 36 locations across multiple states, with its newest store opening earlier this year in San Antonio.

“ I LOVE THIS BRAND AND ITS BRAND STORY. I ALSO LIKE THE SIMPLICITY OF THE CONCEPT, ‘NOTHING FANCY, JUST REAL FLAVOR AND CHEAP, TOO.’ ”

TIME PERIOD

First 12 months of operation

Months 13–24 of operation

Months 25–36 of operation

Remaining term of franchise agreement

Notwithstanding the foregoing, if you open the restaurant in compliance with the terms of the Franchise agreement at least three months before the opening date, then the royalty will be zero percent of gross sales accrued for the first six months that the restaurant is open for business, and the royalty rates described in the table above will apply beginning six months after the restaurant’s actual opening date.

2022 PULL FORWARD INCENTIVE: If Rusty Taco and you have already signed a pre-existing development agreement, or if the company and you sign a new development agreement, with a development schedule that requires you to open a restaurant in 2023 or later, and you sign a franchise agreement for and open that restaurant in compliance with the franchise agreement and development agreement on or before December 31, 2022, and you submit development costs to the company within 120 days of opening the restaurant and build the restaurant in the design, to the specifications, and at the location approved, then the royalty fee will be zero percent of gross sales accrued during the first year (12 months) that the restaurant operates; 2 percent of gross sales accrued during the second year (13–24 months) that the restaurant operates; 4 percent of gross sales accrued during the third year (25–36 months) that the restau-

Unlike some other taco chains, Rusty Taco appreciates three strong dayparts, with a high percentage of sales coming in the morning thanks to an array of breakfast tacos. All tacos can also be ordered as rice bowls or salads, which helps spread occasions. To capitalize on recent trends, it also unveiled an elevated prototype complete with an on-site bar. The layout provides further dining and seating options. Other adaptations include mobile ordering and pickup through its app, website, and third-party. As the Council mentioned, Rusty Taco is a rare up-and-comer with the support of one of the country’s largest conglomerates. The company notes franchisees can invest in a new, emerging chain with ample whitespace, yet do so with the “comfort and security” of Inspire Brands’ engine. That includes shared services like development, supply chain, and marketing support. Multiple franchise agreements were signed in 2021, which will lead to growth throughout Utah, Nevada, Virginia, and Texas. Several new operators are already a part of the Inspire family.

NUMBER OF U.S. FRANCHISE UNITS: 637

NUMBER OF U.S. TOTAL UNITS: 637

TOTAL SYSTEM-WIDE SALES: $687,500,000

FRANCHISE AVERAGE-UNIT VOLUME: $1,200,000

TOTAL AVERAGE-UNIT VOLUME: $1,200,000

FRANCHISE FEE: $50,000

ROYALTY: 6 percent of sales

RENEWAL FEE: $50,000

MARKETING FEE: 4 percent of sales

TOTAL START-UP COSTS: $246,500–$2,162,500

“Way ahead of the curve with a prime-time influencer/spokesperson relationship with Justin Bieber (will help the Canada to U.S. push in a big way). Third-largest coffee chain with serious name recognition. As other coffee chains battle territory restrictions (due to growth which highlights the ongoing upside of the coffee space), Tim Hortons is positioned well to capitalize.”