New Xero subscription plans are live in Australia:

New Xero subscription plans are live in Australia:

GGNITION, THE LEADING REVENUE GENERATION PLATFORM FOR PROFESSIONAL SERVICES, TODAY ANNOUNCES THAT NOMINATIONS ARE OPEN GLOBALLY FOR THE 2024 WOMEN IN ACCOUNTING AWARDS, WHICH WILL RECOGNIZE AND CELEBRATE THE TOP 50 INSPIRING CATALYSTS OF CHANGE IN THE ACCOUNTING AND BOOKKEEPING INDUSTRY.

Now in its seventh year, the awards are open to all women in the accounting industry across the globe, including public account-

ing, private industry, government, bookkeeping, and technology.

“The Women in Accounting Awards recognize exceptional women driving industry change and innovation,” says Ignition Founder and CEO, Guy Pearson. “These extraordinary women introduce new ideas, challenge the status quo, and highlight the need for transformation, inspiring others through their actions and words. Their enthusiasm and commitment encourage the entire community to engage in the change process. With the Women in Accounting

awards, we aspire to give these visionary and innovative leaders the recognition they deserve in 2024.”

Ignition, in an effort to empower women and inspire change, launched the Women in Accounting Awards in 2018.

The awards have since attracted over 2,600+ nominations worldwide, recognizing 248 winners from countries including Australia, Canada, New Zealand, South Africa, the United States, and the United Kingdom.

Find out more

Revolut’s revenues surpass $2.2bn, with record profits of $545m in 2023

TODAY, REVOLUT RELEASED ITS ANNUAL REPORT FOR THE YEAR ENDING 31 DECEMBER 2023.

Nik Storonsky, CEO of Revolut said: “This year, we took our biggest steps yet on our mission to deliver the best product and the best customer experience at great value to customers, everywhere. Our customer base is expanding at

impressive rates, and our diversified business model continues to fuel exceptional financial performance, delivering revenues of over $2.2bn in 2023 and a record profit before tax of $545m."

"With a net profit of $428m, 2023 was our third profitable year in a row. Every day, our products create value for new customer segments and new global markets. We remain committed to our

ongoing UK banking licence application in addition to bringing the Revolut app to new markets and customers around the world. Even as we reached 45 million global retail customers six months into 2024, Revolut remains poised for exponential growth in 2024 and beyond, continuing to redefine the financial services landscape as we’ve known it.”

Keep reading

Introducing global (Swift) account details - receive international business payments in 17 currencies

G-ACCON, A LEADING PROVIDER OF DATA INTEGRATION AND AUTOMATION TOOLS FOR GOOGLE SHEETS, IS EXCITED TO ANNOUNCE A NEW STRATEGIC PARTNERSHIP WITH JOURNEY, AN EXPERT IN GO-TO-MARKET STRATEGY AND EXECUTION FOR ACCOUNTING TECHNOLOGY.

This collaboration aims to enhance G-Accon’s market presence and expand its product marketing capabilities.

G-Accon offers powerful tools that connect Google Sheets with popular soft-

ware like Xero, QuickBooks, and FreshBooks. These integrations help businesses, accountants and bookkeepers automate data management, create custom reports, and gain real-time insights.

Journey, founded by Trent McLaren, is known for its guerilla marketing strategies that drive growth for tech companies in the accounting sector. By teaming up with Journey, G-Accon aims to leverage these strategies and grit to reach a wider audience and improve its market position.

Andrey Kustarnikov, CEO and Founder of G-Accon,

expressed his enthusiasm: "This partnership with Journey is a significant step for G-Accon."

"Their expertise in product marketing will help us reach a wider audience and better serve our customers."

Trent McLaren, Founder of Journey, added: "We look forward to working with G-Accon. We are eager to help them reach more accountants, bookkeepers and CFOs who need help with automating manual tasks and repetitive workflows in Google Sheets."

More news from XU

FOR US, 2024 IS ABOUT ENSURING THAT FINANCE TEAMS ARE LIBERATED FROM THE LABORIOUS ADMIN OF SPEND MANAGEMENT –FREEING THEM AND THEIR BUSINESS TO FOCUS ON STRATEGIC ACTIVITIES THAT DRIVE COMPETITIVENESS.

Our latest updates continue to listen to you and your needs – so we’ve gone back to basics to ensure more productivity and reduce inconveniences when managing your spend.

Keep reading

XU BIWEEKLY - No. 84

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

IT’S ALL SYSTEMS GO AT APRON HQ THIS MONTH, WITH LOADS OF FEEDBACK COMING THROUGH FROM ALL OF YOU IN THE ACCOUNTING AND BOOKKEEPING COMMUNITIES.

Here’s what’s new with Apron Pay and Apron Capture in June, and a look at what’s coming up in July, August and September.

New to Apron Pay in June

New ‘Paid’ tab for better clarity

This new tab shows a clear overview of batch payments that have been paid, including total amounts. You can search payments by keyword, and filter by both contacts and dates.

Fact: Our CEO, Bogdan, saved a good chunk of money using this feature recently!

Find out more

Worksheets:

NEW N81 HMRC Payroll Submissions

We are pleased to announce significant improvements in how we handle wages and pensions in our worksheets. A new worksheet now captures data lodged with HMRC, which is used to prefill the N80 Wages and PAYE and N75 Workplace Pension worksheets.

This new worksheet also allows for recording the number of employees and distinguishing between employee wages and director wages.

Keep reading

JOIIN, THE CONSOLIDATED FINANCIAL REPORTING PLATFORM, IS DELIGHTED TO LAUNCH ITS DIRECTORY OF APP VENDOR PARTNERS ON ITS WEBSITE.

About the new partners’ directory

The new app vendor partners’ directory will share information about similar companies with app platforms like Joiin; ones that also integrate with major cloud accounting software such as Xero, QuickBooks and Sage.

The common thread between Joiin and its partners is that each app integrates with cloud accounting software such as Xero, Quick-

Books, and Sage, while all partner apps also integrate seamlessly with the Joiin app to deliver even more powerful reporting. Joiin is then committed to collaborating with its partners to showcase how their apps work together to support multi-entity businesses already using Xero, QuickBooks or Sage.

The mutual aim is to support multi-entity businesses with common challenges, such as managing monthend reporting, establishing more robust processes, increasing business efficiency, and building an effective finance system for in-house accountants and business finance teams.

Keep reading

ANALYZE YOUR SUPPLY CHAIN, OBTAIN MORE PRECISE ACCOUNTING, AND GET MORE VISIBILITY INTO COSTING DATA TO BETTER PINPOINT EXTRA EXPENSES ON SALES OR PURCHASE ORDERS.

Two new features

With this update, everyone using Katana will have access to Shipping fees for sales orders (SO) and will also be able to add Additional costs to purchase orders (PO) and outsourced purchase orders (OPO).

Shipping fees

The Shipping fees feature enables you to track the exact price of a sales order by

Let’s make your day a little easier with Quotient’s ‘Waiting’ feature

EVER FELT LIKE YOU’RE JUGGLING A BIT TOO MUCH AT WORK? WE’VE GOT SOMETHING THAT MIGHT JUST MAKE YOUR DAY-TO-DAY A BIT SMOOTHER.

Our ‘Waiting’ feature in Quotient is here to help you keep things tidy and organized, no matter the project stage.

Here’s how it works:

• On your Dashboard, you’ll see two tabs: ‘Active’ and ‘Waiting.’

• Your quotes start out in ‘Active’ but when something doesn't need your immediate attention, you can move it to ‘Waiting.’

• This way, you can focus on what’s urgent without losing track of other important stuff.

Find out more

WELCOME BACK TO THE JUNE EDITION OF THE EMPLOYMENT HERO PRODUCT UPDATE.

It’s hard to believe that we’re more than halfway through the year (seriously, where did the time go…?), which means one thing –we’re rounding up the latest and greatest product updates over the past month. So, what’s new? We’ve introduced a new round of SmartMatch updates, internal job postings, a new shift bidding feature, a whole bunch of widgets to the dashboard, increased customisation in performance reviews and lots more. It’s all here and ready for you to use in-platform – let’s get to it!

Find out more

clearly showing the shipping costs separately.

The Shipping fee field itself can be found directly inside an SO card, where this data can be included in exported PDF invoices, .csv, and .xlsx files.

Shipping fees can be added to sales orders manually or pulled to Katana automatically from an integration with:

• Shopify

• BigCommerce

• WooCommerce

Note: You’ll need to reconfigure your existing e-com integration to enable this automation.

Find out more

Learn about recent product release challenges, wins, and Partner impact. Delivered straight from the source – Ash, Quoter’s Senior Product Manager. Includes teasers for next month’s releases! With its long nights and warm days, summer always reminds us to work smarter, not harder. We’re thrilled to share two significant releases on the Quoter platform that will help our Partners do just that.

Keep reading

WHAT A MONTH! WE’VE RELEASED MORE THAN 40 AMAZING UPDATES ACROSS XERO, MADE SOME PRETTY COOL PRODUCT ANNOUNCEMENTS AT XEROCON LONDON, AND GOT READY FOR THE NEW AUSTRALIAN TAX YEAR.

It’s been a busy month with lots of highlights, so read on to discover what’s new in Xero.

Global: Void or delete invoices on the mobile app [Product Idea]

Do you use the Xero Accounting app? Well, we have some great news for you!

Keep reading

STOCKTRIM, A LEADER IN INVENTORY FORECASTING SOFTWARE, IS EXCITED TO ANNOUNCE ITS LATEST INTEGRATION WITH SKUVAULT, A POWERFUL INVENTORY AND WAREHOUSE MANAGEMENT SOLUTION.

This partnership is set to revolutionize how small and medium-sized enterprises (SMEs) manage their inventory, combining the strengths of both platforms to deliver unparalleled efficiency and accuracy.

Enhancing Inventory Management with Cutting-Edge Integration

StockTrim is renowned for its ability to predict future

stock requirements, helping businesses optimize their inventory levels, reduce stockouts and overstocking, and save significant time on purchasing and administrative tasks.

The integration with SkuVault brings these capabilities to a new level by leveraging SkuVault’s comprehensive inventory management features.

What SkuVault Brings to the Table

SkuVault is a cloud-based inventory and warehouse management system designed for eCommerce and multi-channel merchants.

Keep reading

It's been a busy month for the team, I'll dig into the new features for July shortly. But first, we want to give a big shout-out to everyone we met at Xerocon London last month. Jack and I had an absolute blast connecting with so many awesome partners. Your feedback was gold –it's going to help us build the world's best accounts receivable tool for small to medium businesses.

We can't thank you enough for your insights!

to your account via email (and more) 4. Deliver actions (emails, late fees etc) during business

5. Tags and Filter Policies

Along with these new features, we're thrilled to introduce our new Expert Partner Directory. Find

are live in Australia: what this means for you

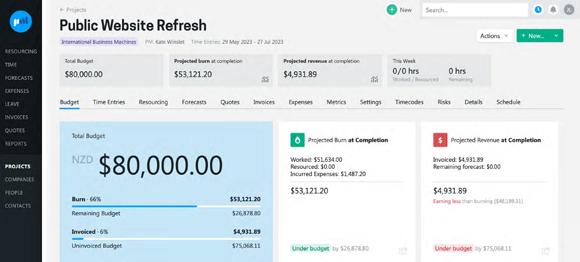

IN MAY, WE ANNOUNCED NEW SUBSCRIPTION PLANS FOR AUSTRALIAN CUSTOMERS AND PARTNERS AS PART OF OUR EFFORTS TO SIMPLIFY OUR PLAN OFFERING.

The new plan line-up bundles key features like Xero Expenses, Xero Projects and Xero Analytics Plus into some plans, making it easier to choose the right plan for your business or clients.

These plans are now live to coincide with the start of the financial year.

With our new plan line-up, our old plans – Payroll Only, Starter, Standard and Premium business plans, and GST Cashbook and Cashbook Payroll partner plans – are no longer available for purchase.

Find out more

BGL REGTECH 2024 is now a free event thanks to unprecedented support from our sensational sponsors!

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS THRILLED TO ANNOUNCE THAT BGL REGTECH 2024 IS NOW A FREE EVENT THANKS TO THE OVERWHELMING SUPPORT OF OUR SENSATIONAL SPONSORS.

This move reflects our collective goal of advancing the accounting sector by making this premier event available to BGL clients, partners and the broader accounting community in these challenging times.

“We are beyond grateful to our sponsors for their outstanding support, which has allowed us to extend an open invitation to all our clients and community to attend BGL REGTECH 2024 at no cost,” said BGL’s CEO, Daniel Tramontana.

Find out more

DEPUTY, THE GLOBAL PEOPLE PLATFORM FOR HOURLY WORK, IS THRILLED TO ANNOUNCE THE LAUNCH OF SHIFT PULSE+, A MAJOR UPGRADE TO ITS EXISTING SHIFT PULSE FEATURE.

This enhancement will be part of the comprehensive Deputy HR product suite, empowering businesses to Hire, Onboard, Document Manage, and Engage with their hourly workers more effectively.

Shift Pulse+ is the new premium version of the standard Shift Pulse feature integrated into Deputy's HR suite, offering a more robust and configurable user experience. This upgrade provides enhanced engagement capabilities and deeper insights into employee sentiment and well-being.

Key Features of Shift Pulse+:

Enhanced Configurability:

• Users can now customise Shift Pulse questions,

moving beyond the default "How did you feel during your shift today?" to tailor questions specific to their business needs.

• Flexibility in frequency settings allows Shift Pulse checks to be triggered daily, fortnightly, monthly, or at the end of every shift.

• Customisable pulse ratings enable users to select their preferred emojis and labels for a more personalised reporting experience.

• Role-specific and location-specific configurations ensure that Shift Pulse checks are targeted to the right employees and locations.

Advanced Reporting:

• Detailed reporting capabilities remain largely unchanged for HR subscribers, allowing access to historical data, comprehensive comments, and sentiment analysis over extended periods.

Keep reading

KOLLENO IS PLEASED TO ANNOUNCE A NEW PARTNERSHIP WITH WEBEXPENSES, ONE OF THE LEADING EXPENSE MANAGEMENT SOFTWARE COMPANIES. WEBEXPENSES ENABLES BUSINESSES TO OPTIMIZE THEIR EXPENSE TRACKING AND RECONCILIATION PROCESSES, STREAMLINING FINANCIAL OPERATIONS WITH EASE AND PRECISION.

Through this partnership, Kolleno and Webexpenses aim to enhance financial management for businesses globally. Kolleno’s expertise in automating accounts receivable processes and

Webexpenses’ innovative approach to expense management offer a powerful combination that addresses the key challenges faced by finance teams.

“We are excited to partner with Webexpenses to offer a comprehensive solution that addresses the critical financial management needs of businesses."

"Our combined expertise and innovative technologies will empower businesses to achieve greater financial control and efficiency” Irina Anichshuk, COO & Head of Partnerships, Kolleno

Find out more

AHUGE THANK YOU TO ALL THE XERO PARTNERS WHO PARTICIPATED IN THIS YEAR’S NOMINATION ROUND.

Accounting Partner of the Year finalists

The three awards, for small, medium, and large practices, recognise Xero ac-

UNLIKE US IN THE MARKETING TEAM, OUR DEVELOPERS ACTUALLY DO A LOT OF USEFUL THINGS HERE AT NEXTMINUTE.

They continuously work to improve the software for you and your crew, and have been flat out in the background preparing some epic new features.

Let’s dive in and see what’s coming up.

New Mobile App (coming soon)

What’s new?

• Fully redesigned mobile app for iOS and Android

- The new app is easier to navigate and use thanks to our awesome developer, Anton.

• Rebuilt from the ground

up - We’ve completely rebuilt the app on a much faster, more stable infrastructure.

• Dark mode - Back in black. Easier on the eyes, and your mates will think you’re pretty cool.

• It’ll keep getting betterWe’re committed to continuous development of our mobile app to make sure it’s your favourite tool on site.

Stay tuned for an official launch date.

Timesheet Break Enhancements

You asked, we listened. Very soon, timesheets will enable your crew to input the exact time of their break, and upload photos to jobs via the timesheet interface.

Find out more

DEPUTY, THE GLOBAL PEOPLE PLATFORM FOR HOURLY WORK, TODAY ANNOUNCED THE LAUNCH OF DEPUTY HR, DESIGNED TO STREAMLINE HIRING, ONBOARDING, DOCUMENT MANAGEMENT, AND EMPLOYEE ENGAGEMENT FOR HOURLY WORKERS AND THEIR EMPLOYERS ACROSS THE UNITED STATES.

The hourly work sector is poised for substantial growth, with projections indicating an increase of approximately 1,677,100 jobs by 2032, according to Deputy’s latest ‘The Big Shift’ report.

– Spring 2024: Rise of AI and

AMID SIGNIFICANT POLITICAL AND ECONOMIC SHIFTS, NAVIGATING THE NEW BUSINESS LANDSCAPE HAS BECOME EVER MORE IMPORTANT FOR FINANCE LEADERS WHO ARE BEING RECOGNISED AS AGENTS OF GROWTH.

Soldo’s Spend Index offers a clear, data-driven snapshot of current spending trends for over 18,000 companies using Soldo to help inform strategic decision-making in unpredictable times.

Harnessing artificial intelligence

Artificial intelligence continues to be a significant driver of innovation.

Keep reading

counting partners based in Asia who have shown commitment to leading the way with Xero and have achieved significant success.

Medium Accounting Partner of the Year

• Caltrix

• WLP Group

Keep reading

While knowledge workers benefit from cutting-edge technologies, hourly workers often lack similar advancements. Deputy HR addresses this gap with four integrated programs: Hire, Onboarding, Documents, and Engagement.

Simplifying the Hiring Process

Deputy’s hiring solution mitigates the challenge of finding suitable candidates for open roles. Tailored for HR professionals, this comprehensive toolset streamlines hiring.

Keep reading

-ACCON IS PROUD TO ANNOUNCE THAT IT HAS RECEIVED A RECORD-BREAKING 33 BADGES (THE MOST WE’VE EARNED SO FAR!) AND BEEN RECOGNISED IN 63 REPORTS IN THE G2 SUMMER REPORTS.

This achievement marks a significant milestone for G-Accon, highlighting its growth and excellence in the business software market.

G2, a leading peer-to-peer review platform for busi-

ness software, is an essential resource for software buyers and sellers in the B2B technology market. G2 aggregates authentic user reviews, providing unbiased insights and comprehensive comparative data, helping businesses make informed software purchasing decisions.

Key Highlights:

• Leader Status

• Global Impact

Find out more

ISS DATA SERVICES IS EXCITED TO ANNOUNCE AN IMPORTANT UPDATE TO THE ACSISS ADVISER PRODUCT. THIS UPDATE SIMPLIFIES THE SIGN-UP PROCESS FOR ACCOUNTANTS AND BOOKKEEPERS, BROADENING THE RANGE OF ACCEPTED VERIFICATION DETAILS.

Enhanced Verification Process

Previously, accountants signing up for ACSISS Adviser needed to provide their Tax Practitioners Board (TPB) details for verification.

Streamlined Sign-Up for Trusted Advisers

The latest update to ACSISS Adviser enables a wider range of trusted advisers to easily access ACSISS services. By allowing verification through CPA Australia, CAANZ, and IPA, ACSISS ensures that its platform remains secure while being more user-friendly. By allowing verification through CPA Australia, CAANZ, and IPA, ACSISS ensures that its platform remains secure while being more user-friendly. “Security and accuracy of our users’ data are our top priorities." said Grant Augustin, Managing Director at SISS Data Services.

Keep reading

Most consumers shocked by the scale of ‘unapproved debt’, agreeing it is a form of theft from small businesses

XERO, THE GLOBAL SMALL BUSINESS PLATFORM, TODAY ANNOUNCED THE FINDINGS OF ITS ‘SETTLE UP’ REPORT, WHICH FOUND 62% OF UK CONSUMERS SURVEYED EXPECT TACKLING LATE PAYMENTS TO BE A PRIORITY FOR GOVERNMENT.

For decades, policymakers pledged to address the power big businesses hold over small firms, which last year cost small businesses an estimated £1.6 billion.

Now, as the issue has become more entrenched, so has it entered public discourse; in fact, 80% of consumers surveyed now believe there is no excuse for large firms to pay their suppliers late.

The report also highlighted the shock amongst the public at the longevity of the issue.

More than half (56%) are surprised governments have not introduced policies to stop big businesses paying their small suppliers late, while 70% consider it a form of theft or bullying. 3 in 4

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION, AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THAT ITS AWARD-WINNING SMSF ADMINISTRATION SOFTWARE, SIMPLE FUND 360, NOW SUPPORTS OVER 8,200 CLIENTS MANAGING MORE THAN 300,000 FUNDS.

“This marks a significant milestone for BGL and the Simple Fund 360 team,” says BGL’s Founder/Director, Ron Lesh.

“I am incredibly proud of each and every member of the BGL team both past and present who have helped us get to this milestone. This accomplishment displays our Team's dedication to delivering an exceptional prod-

uct and outstanding service to our clients”.

Released in 2014, Simple Fund 360 is the complete SMSF administration software solution with AI-driven processing, industry-leading automation, analytical insights, accounting workpapers and much more. Innovative features like BGL SmartDocs, Smart Matching, Workflow and Smart Reports for financial analysis mean it stands alone as the market-leading SMSF administration solution.

Simple Fund 360’s impressive growth is set against the backdrop of the latest Australian Taxation Office (ATO) SMSF statistics. On 31 March 2024, Australia had 616,400 SMSFs managing $932.9 billion in assets.

Notably, BGL reached 250,000 funds in 2020, underscoring the remarkable progress we have made over the past few years.

Find out more

consumers (77%) believe it falls to the government to make businesses behave responsibly.

Bad payments are bad business

Late payments to small businesses provoke an emotional reaction in the general public.

More than six out of ten (61%) said they were shocked by the extent of the issue, and almost 4 in 5 (79%) stated they would not want small businesses in their area to be impacted.

Respondents also showed empathy for the struggles caused by late payments; 86% said not being paid what they’re owed would have a major impact on personal stress levels, 47% would be unable to pay household bills, and 41% would struggle to buy food for themselves and their family.

Furthermore, ethical buying trends means firms with poor payment practices could experience a reduction in sales.

Keep reading

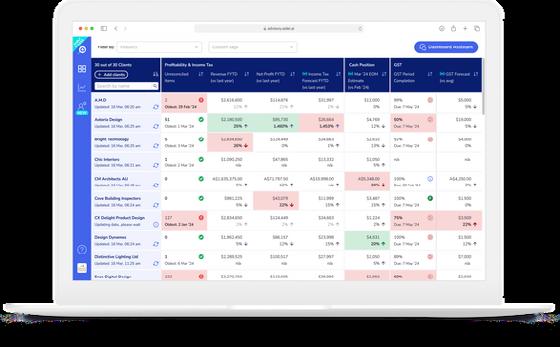

THE FACE OF FINANCE IS EVER-EVOLVING. FOR TOO LONG, FINANCE TEAMS HAVE WORKED IN THE BACKGROUND TO KEEP BUSINESSES TICKING OVER EVERY MONTH, WITH OTHERS THINKING THEY’RE JUST TINKERING WITH SPREADSHEETS AND NUMBERS.

But, finance leaders are fast becoming essential partners to the CEO, providing data and insights that form the basis of future business strategy. Now more than ever, finance teams everywhere are embracing technology to drive efficiency and reduce overall costs. With over 30,000 customers and 1,000 partners around Europe, we’re lucky enough to work alongside and support businesses of all shapes and sizes from varying industries.

That’s why we’re thrilled to announce the Beyond Finance Awards, celebrating these industry leaders.

CFO TECHSTACK, A LEADING COMMUNITY FOR FORWARD-THINKING INHOUSE FINANCE TEAMS, ANNOUNCED TODAY THAT GLOBAL SMALL BUSINESS PLATFORM XERO HAS SECURED THE HEADLINE SPONSORSHIP FOR ITS FLAGSHIP LONDON CONFERENCE, STACKED, TAKING PLACE ON 12TH SEPTEMBER 2024.

Stacked, London’s flagship conference for in-house finance teams

Stacked 2024 promises to be an inspirational event for finance professionals, offering a platform for knowledge sharing, networking, and professional development. The conference aims to help in-house finance leaders transform the finance function into a strategic powerhouse, especially those who leverage Xero and its ecosystem of integrations and Xero App Store apps.

David Tuck, CEO and Co-founder of Mayday and CFO Techstack, commented: “Xero’s sponsorship of Stacked 2024 underscores our shared commitment to empower finance teams with innovative tools and insights to maximise their impact."

"While Xero has a strategic vision to serve accountants and bookkeepers, we have witnessed firsthand how in-house finance teams can achieve remarkable growth using Xero and connected apps. We are excited to highlight the incredible potential of Xero and its ecosystem, and to encourage more companies to leverage this platform as they scale well into their growth phase.”

CFO Techstack is a community powered by Mayday, a software platform designed to help multi-entity businesses scale with Xero.

Keep reading

XWhat are the Beyond Finance Awards?

We’re proud to launch our very first Beyond Finance Awards, designed to showcase the leading businesses, bookkeepers, accountants, and consultants in the Pleo community across Europe.

We’ll be celebrating these awards at this year’s Beyond event happening in London in November.

What are the awards categories?

In total, we have 10 awards up for grabs. Each of these awards celebrate the best in finance, whether they’re well-seasoned in the industry or new to the game.

And we’re not just celebrating the individuals. More often than not, it takes a village to make the books add up, that’s why we have awards specially celebrating both teams and businesses.

ERO, THE GLOBAL SMALL BUSINESS PLATFORM, TODAY ANNOUNCED THE RETURN OF THE XERO BEAUTIFUL BUSINESS FUND FOR 2024 — AN INITIATIVE OFFERING MORE THAN NZ$750,000 IN FUNDING TO SUPPORT SMALL BUSINESSES AND NON PROFITS WITH THEIR GROWTH PLANS AND HELP DRIVE FUTURE SUCCESS.

Entries for the Xero Beautiful Business Fund are officially open to Xero small business customers in Australia, Canada (excluding Quebec), New Zealand, Singapore, South Africa, United Kingdom and the United States. The entry period will close on 27 August 2024 NZT.

Xero small business customers will need to complete an online form and record and submit a 90-second pitch video to the competition website for as many categories as they would like to enter:

• Innovating for environmental sustainability — For a small business or non profit who wants to take the next step in their environmental sustainability journey by: minimising

their own environmental impact; enhancing the sustainability of current products or services; or developing new environmentally friendly products or services.

• Trailblazing with technology — For a small business or non profit that has a ‘future focus’ mindset and is seeking to innovate. These organisations want to set the pace and lead the charge using new and emerging technologies.

• Strengthening community connection — For a small business or non profit that has a mission or purpose rooted in serving their communities and making a positive impact. It could be to make a difference in the community they serve, support underserved or marginalised groups or contribute to social good through innovative ideas or solutions.

• Upskilling for the future — For a small business or non profit that wants to overcome a skills gap, either through upskilling themselves or their employees.

Keep reading

UPCOMING EVENTS

UPCOMING WEBINARS

WEBINARS

WEBINARS

WEBINARS

IBy

N THE DYNAMIC LANDSCAPE OF HIGH-TECH INDUSTRIES, WHERE INTRICATE HIGH-MIX, LOW-VOLUME PRODUCTION INTERSECTS WITH COMPLEX PRODUCTS AND RAPID TECHNOLOGICAL ADVANCEMENTS, ACHIEVING PRECISION IN INVENTORY MANAGEMENT CAN POSE A FORMIDABLE CHALLENGE.

Recognizing the critical role of robust inventory management in overcoming these challenges, Raider Targetry, a pioneering force in military training solutions, proudly unveils a groundbreaking advancement in efficiency through the integration of Fishbowl Inventory, a market leading software solution for inventory management.

CEO & CTO Mick Fielding, alongside Executive Director Cody Webster, envisioned Raider Targetry’s global potential since its inception. Mr. Fielding emphasized the strategic importance of establishing a solid foundation for products and services to support the company’s growth trajectory, stating, “When we were looking at building the business, we knew that we needed an inventory management system that would support us today, but also into the growth that we would expect in the future.”

According to Simon Jupe, Fishbowl APAC Managing Director, “Accurate and efficient tracking of inventory movement from inception to its final consumption point is crucial for effective control

and decision-making processes within a business. Investing in a system that enables both signature tracking and inventory tracking facilitates swift resolution in cases where physical transactions diverge from the system records.”

Tim Kelly, Digital Systems Manager at Raider Targetry, expressed the transformative impact of Fishbowl, stating, “Fishbowl’s been game-changing for us in terms of having that single source of truth that everybody can refer to, to understand the status of any particular work order at any point in time.”

Further affirming his endorsement of the solution, Mr. Kelly emphasized, “Fishbowl’s also been fantastic in

terms of helping us to save costs, in particular the labour cost of trying to coordinate all of these different production and work orders. The main thing though, that Fishbowl’s really helped us with in terms of productivity is the ease of integration into the engineering software that we’re using. Implementing a new inventory management system is often a big commitment for any organisation. Thankfully, the Fishbowl support team is fantastic, and they’ve made it really, really easy for us to configure Fishbowl in a way that’s suitable for our organisation.” The software’s capabilities extend to meeting regulatory requirements and ensuring compliance by providing accurate records, traceability, and comprehensive reporting features. Mr.

Kelly highlighted Fishbowl’s prowess in digital track and trace, serialization, and managing complete bills of materials, ensuring the delivery of clean and clear, real-time information to the Defence Force. Looking ahead, Mr. Kelly emphasized forthcoming enhancements, stating:

“In the future, we’ve got an extensive amount of automated purchase order and production order planning coming into play. We’ve got additional integration through the full depth of our bills of materials, and we’re tracking a lot of custom fields like NATO stock numbers and those kinds of things too.”

Mr. Fielding reiterated the strategic alignment of Fishbowl with Raider Tar-

getry’s objectives, stating, “Fishbowl in particular has a number of features which support what we do. Fishbowl gives us a single source of truth for everything we do within the business, especially when it comes to production, but also supporting our R&D activities.”

Simon Jupe, Fishbowl APAC Managing Director, underscored the scalability of Fishbowl software emphasizing, “As high complexity, low volume businesses grow or evolve, Fishbowl software can scale to help our clients meet their changing needs. This flexibility can be essential, especially for companies dealing with diverse and evolving product lines.”

Keep reading

By Josh Skelding, Commercial Director, Paycada

IN TODAY’S FAST-PACED BUSINESS ENVIRONMENT, MANAGING ACCOUNTS RECEIVABLE EFFICIENTLY IS CRUCIAL FOR MAINTAINING HEALTHY CASH FLOW.

This is where Paycada steps in, offering a seamless solution that integrates with Xero to streamline your accounts receivable process.

The Ripple Effects of Late Payments

Late payments can cripple a business, leading to cash flow issues, a lack of working capital and wasted resources on chasing overdue invoices. Traditional methods of managing accounts receivable are often time-consuming and prone to errors, leaving businesses frustrated and financially strained.

The Role of Technology

Paycada offers a smart solution to these challenges. By integrating seamlessly with Xero, Paycada automates the accounts receivable process, ensuring timely payment reminders and real-time updates. This not only reduces manual processes but also improves cash flow management and working capital.

Key Features and Benefits:

• Automated Payment Reminders: your clients will

receive timely reminders, significantly reducing the occurrence of late payments.

• Real-Time Xero Data: Receive instant and accurate data from Xero, keeping your records up to date.

• Unlimited Invoices: Whether you’re managing a handful of invoices or thousands, Paycada handles it all with ease.

• Full Audit History: Maintain complete transparency and accuracy with a detailed audit trail for every transaction.

Enhanced Collection Service

For those persistent invoices that won't clear despite repeated reminders, Paycada offers an Enhanced Collection Service.

Powered by Bluestone Credit Management, a regulated FCA collections agency, this fully digital service takes debt recovery to the next level. You only pay for the results delivered based on a no-win, no-fee model. This service ensures that you can recover outstanding debts without incurring unnecessary costs.

Paycada Partner Programme

Expand your service offering and enhance client satis-

By Ryan Kagan, Head of Growth and Partnerships, WorkflowMax by BlueRock

AS HEAD OF GROWTH AND PARTNERSHIPS, I CAN CONFIDENTLY SAY THAT PARTNERSHIPS PLAY A PIVOTAL ROLE IN THE DEVELOPMENT AND SUCCESS OF NEW JOB MANAGEMENT SOFTWARE LIKE WORKFLOWMAX BY BLUEROCK.

By collaborating with a diverse range of technology and service providers, we've been able to create a robust ecosystem that enhances functionality and extends our capabilities.

These strategic alliances allow us to integrate complementary applications, such as accounting software, CRM systems, and various productivity tools, which streamline workflows and eliminate the need for multiple standalone solutions.

faction by joining the Paycada Partner Programme. As a technology partner, you can introduce Paycada's smart accounts receivable management to your clients, providing them with the tools they need to streamline their financial processes.

The Partner Programme offers a flexible commission structure, allowing your firm to benefit from an additional revenue stream. By partnering with Paycada, you not only help your clients manage their invoices more efficiently but you maximise your earning potential.

Incorporating Paycada into your accounts receivable management strategy can transform the way you handle payments, ensuring better cash flow and reducing administrative headaches.

Don’t let late payments hold your business back. Visit us on stand E2 at Xerocon or to get in touch with us, visit our website at www. paycada.com to discover how Paycada can help you streamline your accounts receivable process and enhance your financial stability.

By adopting Paycada, you’re not just improving your accounts receivable process—you’re investing in the future stability and growth of your business.

Keep reading

Such integrations not only save time and reduce errors but also significantly boost operational efficiency and overall profitability for our users.

Moreover, partnerships are essential in fostering innovation and ensuring our software remains at the cutting edge of technology.

They provide us with access to broader expertise and specialised knowledge, which is crucial in addressing complex user needs and adapting to changing market conditions. I’m thrilled to share more on our growing range of integrations that will really help small business customers.

Manage your customers and sales pipelines

HubSpot

Launching end of June.

Integrate HubSpot with WorkflowMax by BlueRock to seamlessly manage your customer relationships and sales pipelines. HubSpot's powerful CRM capabilities allow you to track every interaction, automate follow-ups, and gain valuable insights into your sales process. This integration ensures that your customer data is always up-to-date and easily accessible, enabling your sales team to focus on closing deals and building strong customer relationships.

Boost your ability to schedule and manage team capacity

PlanRight

Available now.

PlanRight enhances your scheduling capabilities by integrating with WorkflowMax by BlueRock to provide a visual overview of your team's availability and project timelines. Easily drag and drop tasks to reassign resources and adjust schedules as needed. This integration helps you maintain a balanced workload across your team, improving efficiency and ensuring that projects stay on track.

Runn.io

Launching in August.

With Runn.io integrated into WorkflowMax by BlueRock, you can effortlessly plan and manage your team's workload. Runn.io provides real-time visibility into your team's capacity, allowing you to allocate resources effectively and avoid overloading your staff. This integration helps you optimise project schedules, ensuring that deadlines are met and your team remains productive.

Automate payments and expense tracking

Xero

Live now.

Integrating Xero with WorkflowMax by BlueRock streamlines your financial management by automating invoicing, payments, and expense tracking. Sync your job management data with Xero to ensure that all financial transactions are accurately recorded and up to date. This integration reduces the time spent on manual data entry and helps you maintain accurate financial records.

EzzyBills Live now.

EzzyBills simplifies expense management by automating the capture and processing of receipts and invoices. Integrate EzzyBills with WorkflowMax by BlueRock to automatically extract data from receipts and sync it with your job man-

agement system. This integration helps you keep track of expenses in real-time, reducing administrative overhead and improving financial accuracy.

Power up your reporting insights

Dashboard Insights

Live now.

The Dashboard Insights integration provides WorkflowMax by BlueRock users with advanced reporting and analytics capabilities. Create custom dashboards and reports to gain deeper insights into your project performance, financial health, and team productivity. This integration helps you make data-driven decisions and identify areas for improvement.

SyncHub Live now.

SyncHub connects WorkflowMax by BlueRock with your preferred business intelligence tools, enabling you to consolidate data from multiple sources and generate comprehensive reports. Easily visualise your job management data alongside other business metrics, providing a holistic view of your operations. This integration enhances your reporting capabilities and supports strategic decision-making.

Rally

Launching end of June.

Rally’s integration with WorkflowMax by BlueRock enhances your project management by providing powerful reporting and analytics tools. Track project progress, measure team performance, and identify potential bottlenecks with ease. This integration helps you stay on top of your projects and ensures that you have the insights needed to deliver successful outcomes.

Etani

Launching end of June.

Etani enhances your administrative efficiency by integrating with WorkflowMax by BlueRock to automate data entry and reporting tasks.

Keep reading

DOING BUSINESS INTERNATIONALLY IS A COMPLEX CHALLENGE, OFTEN MADE MORE COMPLICATED WHEN CLIENTS WANT TO PAY YOU IN THEIR OWN CURRENCY WITHOUT BEING STUNG BY SKY-HIGH CONVERSION FEES.

That's why we're excited to announce we're introducing global (Swift) account details for receiving Swift payments in 17 currencies with Wise Business!

Whether you're an e-commerce company with customers in Poland or Singapore, or a consultant with clients in Hong Kong or Copenhagen, your customers can now use your new account details to send Swift payments directly to your account.

This means your business can now receive payments from more customers from bank accounts across the world. You can use your global (swift) account details to receive payments in the following currencies: AUD, NZD, SGD, SEK, NOK, DKK, PLN, HKD, CHF, CZK, JPY, HUF and BGN. You can also use your global (Swift) account details to receive Swift payments in GBP, USD,

EUR, and CAD, for a total of 17 currencies.

These new global (Swift) currencies are in addition to the 9+ currencies currently available with local account details including: GBP, EUR, USD, CAD, AUD, NZD, SGD, HUF, RON or TRY. Just so you know, unfortunately global account details are not available to customers in the US and Canada just yet.

You can always choose to convert these currencies in your Wise Business account with low fees and mid-market rate to pay suppliers or teams in different currencies. For some currencies including GBP, USD, EUR, CAD, SGD, AUD, NZD and HUF you can get both local and global (Swift) account details, read more about the difference below.

How does it work?

Global account details are also known as international or Swift details. These enable people to send you money in other currencies around the world via the global Swift payments network. Say for example, your UK-based business has expanded into the Swiss market and your clients and customers would like to pay you in CHF. With

your global account details, you can now receive Swiss Franc straight into your Wise Business account. From there, you can either send and spend from your CHF balance or you can opt to convert the balance into the 40+ currencies offered by Wise at the mid-market rate with low fees.

Global account details feesAt the moment, we don’t charge you to receive Swift payments except for those sent in CAD and USD.

Global (Swift) vs local account details

Wise offers businesses local account details in 9+ currencies including GBP, EUR, USD, CAD, AUD, NZD, SGD, HUF, RON or TRY. You can use these to receive money from customers and clients as if you were a locally-based business with IBANS, BICs or routing numbers specific to that currency.

For example, if you’d like to receive money in British pounds from your clients based in the UK, but you live in the US, we’ll provide GBP account details, so that your client can send GBP to you locally.

Find out more

THIS MONTH WE CONTINUED TO FOCUS ON OUR BROKER CONNECTIONS.

Seamless integrations are a key part of ensuring the Sharesight experience is as smooth as possible.

In addition to our expansion in broker support, we have also started to roll out small UX changes across the onboarding journey.

You’ll see an increase in these changes throughout the rest of the year.

Finally, we introduced the new holdings page to consolidated views, drawing to a

close one of our longer-running technology upgrades.

New functionality / enhancements

• We now offer payments via AMEX in Britain and the European Union

• We have switched our billing in European countries from USD to EUR, removing exchange rate conversion fees for our European customers

• Expanded support to another nine cryptocurrencies, including ONDO, PYTH, PRO, PEPE, SUI, ZRX, OXT, OMG and MEW

• Improved the functionality on our API transaction history logs, primarily to

GoCardless partners with ICE InsureTech to provide faster payments for insurance companies

GOCARDLESS, THE BANK PAYMENT COMPANY, HAS ANNOUNCED A STRATEGIC PARTNERSHIP WITH AWARD-WINNING INSURANCE SOFTWARE PLATFORM ICE INSURETECH, TO DELIVER FASTER AND SEAMLESS AUTOMATED PAYMENT COLLECTION FOR INSURANCE COMPANIES IN AUSTRALIA AND NEW ZEALAND.

ICE customers will be able to use GoCardless to address their pain points while delivering a high-quality customer experience. Automatic payment collection and reconciliation will offer them greater visibility, decrease manual admin and free up valuable time. In addition, switching from cards to bank payments will help to reduce involuntary churn and sidestep costly fees. At the same time, payers will benefit from peace of mind, knowing their payments will be taken on the day they're due, without having to take any extra steps.

Luke Fossett, General Manager ANZ at GoCardless, said: “This new partnership provides a strategic opportunity, giving us great exposure to insurance companies in most of the markets we operate in. We are excited to help them deliver better digital experiences through faster and more seamless payments, and look forward to growing our customer base together with ICE InsureTech.”

Keep reading

benefit our partners API developers

• Rolled out the new holdings page to consolidated views.

Broker import functionality

• Added support for Finclear trade file imports

• Added support for Openmarkets trade file imports

• Added support for trade confirmation imports via National Bank Direct Brokerage

• Added support for the seamless import of historical and ongoing E*TRADE trades using Snaptrade.

More news from XU

STRIPE, A FINANCIAL INFRASTRUCTURE PLATFORM FOR BUSINESSES, TODAY ANNOUNCED A RANGE OF PRODUCT AND PARTNERSHIP UPDATES FOR BUSINESSES OPERATING IN FRANCE.

This represents Stripe’s largest set of new products for the French market since launching in the country in 2016.

New advanced payments solutions for French businesses on Stripe

Starting this summer, Alma, the leading buy now, pay later (BNPL) provider in France with over 4 million active users, will be available as a payment method for all Stripe users. It can be turned on directly from the Stripe Dashboard with no code required. Alma is one of 100 payment methods available in Stripe’s Optimized Checkout Suite (OCS), including Apple Pay, PayPal, and Alipay. French retailer La Redoute has more than $1 billion in annual revenue, and immediately unlocked 2% of additional income, simply by switching to OCS.

New Stripe Terminal features to help French businesses unify online and offline commerce

Stripe is accelerating the deployment of Stripe Terminal’s unified commerce capabilities in France. Planity, Frichti, and Hertz already use Terminal to unify their online and offline revenue streams.

Find out more