LEADING CLOUDFIRST ACCOUNTING AND COMPLIANCE SOLUTION SILVERFIN HAS TODAY ANNOUNCED A 10-YEAR EXCLUSIVE PARTNERSHIP WITH MYOB, A LEADING BUSINESS MANAGEMENT PLATFORM IN AUSTRALIA AND NEW ZEALAND.

Now with presence in 15 countries, this strategic collaboration marks a significant step in Silverfin’s commitment to global expansion, bringing cloud-first,

AI-powered post accounting solutions to new markets.

Silverfin will enhance MYOB’s cloud offering through the integration of its advanced financial reporting, work papers, and AI-driven advisory tools into MYOB’s platform where they will be tailored specifically to meet the compliance and regulatory needs of the Australian market.

This partnership highlights Silverfin’s commitment to revolutionising accounting compliance globally,

enabling more markets to benefit from access to its cutting-edge, cloud-first technology.

Silverfin CEO, Lisa MilesHeal, said: “Artificial Intelligence will transform client accounting compliance and advisory – from enhancing data accuracy, to providing forecasting analytics and actionable insights, automated file reviews and faster identification of errors and irregularities.

Find out more

ENFOLD (GETPENFOLD.COM), THE INNOVATIVE DIGITAL PENSIONS PROVIDER, IS EXCITED TO ANNOUNCE IT REACHED £500M AUA, DOUBLING ASSETS FROM £250M IN THE LAST 12 MONTHS AND ACHIEVING GROWTH OF 260% FROM £139M AT THE START OF 2023.

This robust growth trajectory has been driven by

the rapid expansion of its workplace pension offering, enabled by a proprietary technology platform that helps accountancy firms and payroll bureaus streamline their clients’ auto enrolment obligations.

This innovation has led to many small and medium-sized businesses being introduced to Penfold by their accountancy firm, alongside larger clients that

engage directly with Penfold to modernise their benefits package.

As a result, Penfold has more than doubled its customer base since the start of 2023, from33,000 to over 75,000, as the number of employers using Penfold for its workplace pension has increased from 300 to over 2,000.

Keep reading

AIRWALLEX, A LEADING GLOBAL PAYMENTS AND FINANCIAL PLATFORM FOR MODERN BUSINESSES, HAS SELECTED GOCARDLESS TO PROVIDE DIRECT DEBIT TO ITS CUSTOMERS ACROSS SEVERAL KEY MARKETS.

Through GoCardless Embed, a white-label integration, Airwallex now connects to the GoCardless’ global bank payment network, helping Airwallex customers to expand into new verticals and use cases where direct debit is preferred.

Airwallex has launched the service in the UK, with Europe expected to soon

follow. The announcement is the latest move from Airwallex as part of its commitment to supporting businesses of all sizes to achieve their global growth ambitions.

Justin Leung, Financial Partnerships Manager at Airwallex, said:

“Businesses of all sizes are looking at how they can adapt to evolving customer needs -- and payments are no exception. With direct debit continuing to be a trusted and popular way to pay, especially with the rise of the subscription economy, we felt it was the perfect time to strengthen our offering so that our customers

can better serve theirs. By working with GoCardless we were able to quickly provide this option through one simple integration."

Deepak Colluru, Director of Product Management for GoCardless Embed, said:

“We’re excited to work with Airwallex to bring the best of direct debit to its customers. With fewer intermediaries, they are cheaper than cards and in many cases more reliable too, without expiry dates or lost payment details.

“It’s a win-win for us to partner with Airwallex.” Find out more

WE'RE EXCITED TO INTRODUCE THE "RECORD SCREEN" OPTION IN BIGIN, WHICH ENABLES YOU TO REPORT ISSUES IN YOUR BIGIN ACCOUNT EASIER AND FASTER.

This new video-based issue reporting option enables you to record your screen and provide detailed descriptions of any problem, which makes it easier for our customer support team to track, identify, and resolve issues.

Previously, if you wanted to report a problem to Bigin's support team, you

XU BIWEEKLY - No. 86

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

had to write a description of the issue and send it via email, and the support team would then work on the ticket accordingly. Some problems need more detailed information for the support team to resolve effectively and necessitate screen sharing sessions, which creates too much back-and-forth correspondence between you and our support team. With this "Record Screen" option, you can now quickly record your screen to explain problems visually, cutting down on the need for lengthy meetings and screen-sharing sessions. Record your problem directly and send it to the support

team to generate a support ticket automatically. This significantly reduces the time taken for ticket resolution. What makes this even better is that the recording tool lets you mask sensitive customer data from your Bigin account before sharing, making it privacy-sensitive.

Access the "Record Screen" button in the "Need Help?" section or go to the user menu and navigate to the Need Help section. Upon clicking it, a consent screen will appear to obtain your approval.

Keep reading

WITH THE MUCH ANTICIPATED LAUNCH OF THEIR MULTI-DIMENSIONAL REPORTING FEATURE, YOU CAN NOW GET A MORE ROUNDED – 3D –VIEW OF YOUR FINANCIAL DATA WITHIN JOIIN, COMPARING BY PERIOD, COMPANY AND/OR CATEGORY SIMULTANEOUSLY.

Multi-dimensional reporting is here

We’re excited to announce that we’ve delivered one of our most popular feature requests: multi-dimensional reporting. Now, you can compare by period, company, or category, giving your reporting a 3D dimension.

The new feature is part of our continuous commitment to providing a rich variety of reporting.

It follows our latest global search and transaction drilldowns, and customisable dashboard features.

How does multi-dimensional reporting work?

Select the compare filter and check the options you wish to include in your reports.

This new feature works across all standard and custom financial reports, as well as Report Packs.

Find out more

Introducing Three-Way Match, New Filters, Tax Rounding Flag,

E WOULD LIKE TO INTRODUCE SEVERAL NEW FEATURES AND ENHANCEMENTS THIS QUARTER.

This update includes a three-way match feature for Ocerra's integration with MYOB Acumatica, new filters for quick searches, split line enhancement by quantity, and a solution to the common query about supplier tax rounding.

Three-way match for Ocerra and Acumatica

We are pleased to introduce an option to manual-

THE PUBLIC API HAS BEEN A POPULAR REQUEST FROM CLIENTS, AS IT ALLOWS YOU TO QUERY APPROVALMAX DATA IN REPORTING TOOLS AND INTEGRATES APPROVALMAX WITH 3RD PARTY SYSTEMS.

With it you can create personalised reports and connect ApprovalMax to other apps and services you use. This is well-suited for businesses, non-profit, and educational institutions

amongst others, that manage several entities that need to gather data from various sources.

Whether you’re a developer, data analyst or a manager you can use this to build new integrations to link ApprovalMax with various platforms and services.

Who can use the ApprovalMax public API?

Customers: Create custom reports, including those us-

ing data from different organisations within ApprovalMax.

This is particularly useful for companies with multiple entities or accounting firms needing an overview of all multiple clients’ activities.

Developers: The API opens a world of integration opportunities for other apps, allowing seamless connectivity with ApprovalMax.

Keep reading

AT RE-LEASED, WE ARE EXCITED TO INTRODUCE OUR NEW PROPERTY COMPLIANCE HUB.

Designed to simplify a complex and critical process, this hub ensures that compliance is managed effortlessly and accurately. Compliance errors can lead to significant financial and legal repercussions, and our goal is to make compliance management foolproof and effortless for our customers.

The Importance of Compliance Management

Property managers and landlords face numerous challenges, and ensuring

compliance should not be one of the factors keeping them up at night.

Compliance involves adhering to various regulations and safety standards. Any lapse can result in:

• Hefty fines

• Legal issues

• Damage to your reputation

Having reliable tools to prevent compliance errors is vital for property managers.

Key Features of the Property Compliance Hub

Comprehensive Reminder System: One of the stand-

out features of our Property Compliance Hub is its comprehensive reminder system.

Key benefits include:

• Automated reminders for critical compliance dates

• Filters and statuses to manage tasks effectively

• Significant reduction in the risk of non-compliance

This feature saves countless hours of manual tracking and reduces the risk of severe financial and legal consequences.

Seamless Delegation: Our platform allows for seamless delegation

ly select MYOB's purchase receipts in Ocerra. This enhancement complements our existing automatic receipt selection, providing flexibility for businesses with more complex needs.

Key Benefits:

Enhanced Flexibility For businesses requiring greater control, the new feature allows manual selection of receipts, ensuring accurate matching even in complex scenarios.

Improved Accuracy

Find

CIN7, AN INDUSTRY-LEADING CLOUD-BASED INVENTORY AND ORDER MANAGEMENT SOFTWARE PROVIDER, TODAY ANNOUNCED THE LAUNCH OF CIN7 CAPITAL, AN INTEGRATED LENDING PLATFORM TO HELP CUSTOMERS RUN AND EXPAND THEIR BUSINESSES FROM WITHIN CIN7 CORE AND SOON CIN7 OMNI.

First-to-market in the inventory management industry, Cin7 Capital’s financing options help product sellers and small to midsize busi-

nesses (SMBs) get the capital they need. In fact, more than 75% of small business owners report access to credit as a major concern. Cin7 Capital helps these companies – which may be stuck in traditional financing models – manage operations, receive financing, and view their financials all from one central platform by offering customized invoice financing solutions without ever leaving the Cin7 platform.

“Cin7 Capital is a new, high-impact way we are empowering our custom-

ers to not just survive but thrive in their inventory management,” said Ajoy Krishnamoorthy, CEO of Cin7. ”The product launch is a tremendous step towards unlocking unprecedented possibilities for SMBs to grow businesses in an unpredictable economy, where access to credit is a major challenge. Not to mention, it is a testament of our commitment to supporting our global customers as they navigate their financial challenges and drive growth for their business.”

Find out more

Choose to save your clients $1000 off their implementation costs for every client that you successfully refer to Fishbowl. Become a Referral Champion with over 5 successful referrals in a year, and get your clients a $2000 discount for each subsequent referral!

Opt to claim the rewards yourself as commissions. Earn $1000 for every successful referral and unlock a $2000 per referral once you’ve surpassed the 5-mark per annum.

Dext for Businesses: An Enhanced Experience with New Features

Accurate and current business data has always been essential. In today’s fastpaced world, businesses expect more from their tools and services. Compliance is also becoming increasingly digitised, which means your processes need to be connected more than ever and your data up to date and relevant.

To meet these evolving demands, we are pleased to have recently announced significant upgrades that integrate our core Dext Prepare product with fea-

tures from Dext Precision and Dext Commerce, creating one seamless platform. These updates, along with our recent and upcoming feature releases, are designed to make it even easier to manage your business bookkeeping and employee expenses in one place.

The updates will make it easier for you to capture data in real time, ensure accurate recording, and benefit from enhanced automation that saves time and reduces manual work. Above all, your data will be more actionable, supporting the health of your business.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE INTEGRATION OF ITS AI-POWERED DOCUMENT SOLUTION, BGL SMARTDOCS, INTO ITS COMPANY, TRUST AND ID VERIFICATION MANAGEMENT SOFTWARE, CAS 360.

The integration assigns each entity in CAS 360 a unique email address. When documents are sent to this address, they are automatically processed and at-

tached to the relevant document packs, ensuring a streamlined workflow and significantly reducing manual handling.

"This is another huge step for BGL and I am incredibly proud of our hard-working team who made this integration possible" said BGL's Chief Executive Officer, Daniel Tramontana.

"This new feature is set to enhance the user experience for our CAS 360 clients. I couldn't be more excited to deliver this cutting-edge solution to minimise manual processes for our users."

BGL SmartDocs saves time even when documents are not digitally signed.

Find out more

N JUNE, WE ANNOUNCED CHANGES TO XERO’S PLANS IN AOTEAROA NEW ZEALAND AS PART OF OUR EFFORTS TO SIMPLIFY OUR PLAN OFFERING.

The new plan line-up will launch on 12 September 2024 and bundles key features such as Xero Payroll, Xero Projects and Analytics Plus into some plans, making it easier to choose the best option for your business or clients.

We’re now able to share an update on our migration approach and the timing for moving customers to new subscription plans.

Key things to note:

• For the majority of customers whose new subscription plan will include the same or more features

BUSINESSES USING XERO AND QUICKBOOKS ONLINE (BETA) CAN ADD AN EXTRA LAYER OF OVERSIGHT IN APPROVALMAX WITH OUR NEW REVIEW STEP – A FEATURE THAT IS USED BEFORE THE APPROVAL PROCESS BEGINS TO CHECK THE ACCURACY OF EACH REQUEST TO ENSURE IT’S READY TO ENTER THE APPROVAL WORKFLOW.

The Review step is a dedicated stage that gives you the opportunity to review and validate requests for data consistency, and it helps to minimise the risk of errors and potential fraud. Additionally, approvers can return requests to the Review step from any approval stage without rejection, ensuring necessary revisions are made for a smooth and efficient workflow.

Why the Review step matters

Many organisations need a review phase where various stakeholders, such as finance teams or bookkeepers, can assess requests like

bills and purchase orders before final approval.

This step ensures accuracy and better financial control, reducing errors and making processes smoother. Additionally, if a request returns to the Review step, it will undergo all the approval steps again, providing continuous and thorough validation.

Key features of the Review step

Customised request routing: Direct each request to the right reviewer based on criteria like suppliers, accounts, items, or tax codes using the Review matrix.

Feedback and adjustments: Reviewers can adjust, give feedback, and match bills to purchase orders before submitting them for approval.

Return for revision: Approvers can return requests to the Review step for further revision without rejection, ensuring all requirements are met before final approval.

Find out more

for either the same or lower price*, we’ll move you in February 2025.

• For customers that will see a price increase* as a result of the new subscription plan that we’re migrating you to, we’ll delay moving you until September 2025.

We recognise for some customers this may be a significant price increase when moved by Xero to a new plan, and in some scenarios we’ll offer discounted pricing.

We’ll share more on this with eligible customers and partners in our October emails.

This means some customers will not be migrated by Xero by March 2025 as originally communicated.

Find

EVER FEEL LIKE TRACKING DEADLINES, TASK ASSIGNMENTS, AND PROGRESS UPDATES IS A NEVER-ENDING STRUGGLE? YOU'RE NOT ALONE. PROJECT MANAGERS EVERYWHERE FACE THESE COMMON HURDLES, OFTEN LEADING TO STRESS, DELAYS, AND INEFFICIENCIES.

Most project management teams juggle multiple projects, each with its own set of deadlines and priorities. The sheer volume of tasks and the need for constant updates makes it difficult to keep everything on track. While Zoho Projects can help significantly, it might feel like your project management team needs something more to keep the wheels turning.

If you feel the same way,

we have something exciting in store just for you. From the existing Zia Bot, which will help you monitor and update your projects on the go, to an AI assistant that interprets all the reports that you'll ever need—this new update has it all.

Enhanced efficiency and seamless task management with Zia Bot

Zia Bot is your intelligent project assistant, always ready to help you with your tasks, issues, and events in Zoho Projects.

Whether you need to know the status of a task, list upcoming events, assign users to tasks, or even create an entire project, Zia Bot's conversational interface makes it incredibly easy.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE INTEGRATION WITH SPECIALIST SMSF MORTGAGE LENDER OXYGEN TO STREAMLINE SMSF LOAN APPLICATIONS.

“We are excited to welcome Oxygen to the BGL Ecosystem” said BGL’s Chief Executive Officer, Daniel Tramontana.

“With easy access to Oxygen’s suite of tools and a seamless application process, Simple Fund 360 clients can now streamline SMSF loan applications for their clients.”

Sydney-based Oxygen is a specialist SMSF mortgage lender that provides high-quality advice, competitive loans and a hassle-free experience.

The integration connects Oxygen with BGL’s award-winning SMSF ad-

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE ITS REMARKABLE ACHIEVEMENTS DURING THE 2023-2024 FINANCIAL YEAR, SECURING 22 AWARDS AND SOLIDIFYING ITS POSITION AS AN INDUSTRY LEADER AND INNOVATOR.

BGL’s commitment to excellence and innovation has been recognised across the industry, earning the company many distinguished awards including:

ministration software, Simple Fund 360, via BGL’s free open API.

Ben Taylor, Managing Director at Oxygen Home Loans said:

“We are excited to have the opportunity to partner with BGL via digital integration into its world class technology platform. We look forward to collaborating with BGL clients to deliver better outcomes for SMSF members purchasing property to secure a comfortable retirement. Our goal is to deliver a digital solution to make the complex SMSF mortgage application easier and more streamlined for all concerned and this is a big step towards this goal”.

Jeevan Tokhi, General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs at BGL said:

“BGL clients can access the Oxygen integration via the property dashboard in both Simple Fund 360 and Simple Invest 360. Clients can automatically sign up to Oxygen's website using their BGL login credentials."

Find out more

• Financial Review Boss4th Most Innovative Tech-

nology Company 2023

• Australian Achievers Awards - National Winner for Remarkable Service 2024

• The Australian Business Awards - Business Innovation 2023

• Australian Enterprise Awards - Best Compliance Management Software 2024

• International Business Awards - Most Innovative Company of the Year 2023

• Great Place to Work - Australia’s Best Technology Workplaces 2024

• Great Place to Work - Australia’s Best Workplaces for Women 2023

• Global 100 Awards - Compliance Software Innovator of the Year 2024

• Global 100 Awards - Business Excellence in Information Technology & Services - 2024

Find out more

Airwallex partners with Float to deliver fast, cost-effective bill payments to Canadian businesses

AIRWALLEX, A LEADING GLOBAL PAYMENTS AND FINANCIAL PLATFORM FOR MODERN BUSINESSES, TODAY ANNOUNCED A PARTNERSHIP WITH FLOAT, ONE OF CANADA’S FASTEST-GROWING B2B FINTECHS, TO ENABLE FAST AND COST-EFFECTIVE BILL PAYMENTS FOR BOTH DOMESTIC AND OVERSEAS TRANSACTIONS.

Float’s Bill Pay product, powered by Airwallex, introduces payouts – including bank transfers, EFT, wire, and ACH – as part of Float’s unified business finance

THE ENTRIES ARE ROLLING IN FOR THE 2024 XERO BEAUTIFUL BUSINESS FUND AND WE’VE BEEN THRILLED BY THE RESPONSE. SUPPORTING AND CELEBRATING SMALL BUSINESSES IS AT THE CORE OF OUR PURPOSE AND WE LOOK FORWARD TO HELPING ANOTHER 28 ORGANISATIONS THIS YEAR AS THEY ACHIEVE THE NEXT LEVEL OF SUCCESS.

Today, we’re excited to reveal the country and global judging panels who will help select the winners of the 2024 Xero Beautiful Business Fund. Our judges are made up of leaders across accounting, small businesses, nonprofits and some of our amazing global and local partners.

The country judging panel will help us select four winners from each country. Each country winner will receive NZD $20,000 in funding (or local equivalent). Then four global winners will be selected from the pool of country winners. Learn about the judges along with some tips for getting started with your entry and how you can make it stand out.

Don’t miss the 27 August deadline

A big thank you to everyone who’s entered the Xero Beautiful Business Fund so far. You have a few more weeks to get your entry in before the deadline on 27 August 2024 at 5:00pm NZT.

• Theo Konstantas – Sales Director, Australia, Xero

• Kathy Wilson – Co-founder, Suitcase Records

• Natalie Lennon – Founder & Director, Two Sides Accounting

• Deep Banerji – Chief Product Officer, Deputy

• Syarna Gilmour – Senior Account Manager, Xero

platform for Canadian companies. Nearly 100,000 small and medium-sized Canadian businesses regularly conduct business outside the country and rely on efficient local and international payment processes to do so. The first-of-its-kind Bill Pay offering in Canada helps Float customers eliminate manual AP processes by increasing visibility and control over their company's largest expenses - invoices - with automated invoice collection, payment, and reconciliation, all while minimizing costly foreign exchange fees.

Find out more

• Bridget Snelling – Country Manager, New Zealand, Xero

• Madeleine Hakaraia de Young – Director, Maoriland Film Festival

• Jenny Rudd – Founder, Dispute Buddy

• Manoli Aerakis – Director, Malloch McClean

• Andrew Punnett – Senior Engineer, Xero

UPCOMING EVENTS

By David

JERSEY BASED SOFTWARE COMPANY CLIENTWINDOW, WHICH LAUNCHED IN 2023, MAY BE RELATIVELY NEW BUT IT IS MAKING SIGNIFICANT WAVES IN BOTH THE COMMUNICATIONS ARENA AND IN FINANCIAL SERVICES, WITH ACCOUNTANTS AND BOOKKEEPERS ESPECIALLY EXPERIENCING THE BENEFITS.

What’s more, it has just released a brand new feature which will have a significant impact on how teams communicate with their clients by linking WhatsApp to business email.

We caught up with founding partner David Moehle to find out more.

What exactly is ClientWindow and how does it work?

Talking about software can sound complicated but ClientWindow is genuinely easy to understand! ClientWindow is a messaging tool which sits on your computer and on your phone. It works by connecting the types of communications tools businesses

like to use most, their email, with their clients who like to use WhatsApp. It does this seamlessly in the background so no technical knowledge is required - and your client doesn’t experience any change to how they message you.

Why did you decide to develop the software?

Myself and my business partner, Tim Zeale, are both chartered accountants working in practice. More and more we were beginning to experience a very real dilemma with WhatsApp and similar messaging apps. Our clients wanted to talk to us on WhatsApp, it's so easy and efficient for them.

However, that cannot be said for their accountants. WhatsApp not only causes issues with compliance as it does not meet regulatory data retention obligations but it can also lead to all sorts of management issues as broader teams can’t easily read, or action these messages. We were seeing the same challenges reflected in many of our colleagues and peers. ClientWindow aims to solve these problems

Are the WhatsApp compliance issues a genuine risk?

Unfortunately, yes. According to the Financial Conduct Authority using messaging services, such as WhatsApp, on their own create significant compliance risks. Regulators have also acted against firms and individuals for misconduct involving the use of unmonitored or encrypted communication apps. However, evidence suggests that WhatsApp use is widespread, but the correct surveillance and retention of these messages is not. There are also insurance and GDPR risks in allowing off-channel communications – you wouldn’t allow staff to use their personal email for client communications and WhatsApp is no different. ClientWindow solves this problem by acting not only as a tool for excellent client communication but also as a compliance safeguard.

What makes your new feature special?

Our WhatsApp to email integration is a genuine game changer. There are

quite a few communications platforms out there which pull together lots of channels such as WhatsApp and social media. However, our WhatsApp to email integration is unique in its field. The feature allows clients to send and receive messages on their usual WhatsApp app on their smartphones whilst their accountant or the client services team they are communicating with send and receive messages on their normal work email. This allows for seamless communication between teams and clients, and the ability to integrate with email document filing, whilst also meeting regulatory and data retention requirements. It’s a one of a kind tool that you can use without any disruption to your client - so everyone gets what they want!

But is ClientWindow tailored for accountants and bookkeepers?

It definitely is! As accountants ourselves, ClientWindow was developed with accountants and bookkeepers at the forefront of our minds. Yes, it is such a useful tool that almost any professional services business could use

it, but we do have several features that are all about making the lives of accountants easier.

For example it can really help with capturing invoices and receipts. Clients can conveniently send their invoices and receipts to a firm via WhatsApp, and then ClientWindow automatically sends these onto your own system such as Dext, AutoEntry and Hubdoc.

Clients no longer need to install apps on their phones to manage the document capture process. Accountants and bookkeepers also have to request a lot of information from clients, which can be an arduous task at the best of times. ClientWindow can solve this with automated information requests and access to editable online questionnaires that clients can complete for all types of information gathering, including tax self-assessment, VAT returns and even due diligence information and customer surveys. ClientWindow can invite customers to complete questionnaires via both WhatsApp and email, making the process a lot quicker.

What is next for the industry - do you think we have evolved as far as we can?

The tech and digital landscapes are developing so quickly, especially with AI. I think that we haven’t even begun to see how useful they can be for accountants and the finance industry. FinTech and RegTech may seem like buzzwords but these companies are developing tools and software which can really help firms improve efficiency and make the most of their resources.

We have a vision that AI copilots will join WhatsApp chats between clients and accountants, being able to perform tasks on command such as extracting balance sheet reports directly from the clients’ ledgers or performing a cash flow analysis which can then be fed directly into the chat. For example, a command like “@AI give me a balance sheet at the end of last month” or “@ AI what is the current bank balance of the company”. This could make accountants’ daily lives much easier.

Keep reading

The Complete Company Secretarial, Trust and AML Management Software Solution

By BGL

BGL HAS LAUNCHED CAS 360, THE COMPLETE COMPANY SECRETARIAL, TRUST AND AML MANAGEMENT SOFTWARE IN THE UK.

As the accounting world converges at Xerocon London, BGL Corporate Solutions (BGL), the world's leading supplier of compliance management software solutions, is thrilled to announce the launch of CAS 360 in the UK.

This innovative software solution promises to transform the landscape for UK accountants, corporate service providers, and company administrators, heralding a new era of efficiency and innovation.

For 35 years, BGL has been at the forefront of developing cutting-edge compliance management solutions. With a global presence and trusted by more than 12,700 businesses, maintaining over 1.4 million entities worldwide, BGL’s multi-award-winning products provide cutting-edge innovation and are well-established in many markets.

CAS 360, now available in BETA in the UK, is the latest testament to this legacy. Designed to simplify and automate company compliance processes, CAS

360 integrates seamlessly with UK Companies House, providing automated alerts and workflows for managing companies (Annual Return confirmation statements, company registrations and common changes made by companies), trusts, AML compliance and much much more.

“We are thrilled to bring CAS 360 to the UK market,” said BGL’s Chief Executive Officer, Daniel Tramontana.

"It's been two decades since we first introduced our Corporate Affairs System (CAS) desktop software here. The launch of CAS 360 in BETA reflects our unwavering commitment to innovation and excellence. Our software will revolutionise how UK firms handle their compliance obligations and we couldn't be prouder of this achievement.”

The introduction of CAS 360 is more than just a software launch; it represents a strategic move to empower UK firms with the tools they need to stay ahead in an increasingly complex regulatory environment. With features like automated document management, Xero integration, digital signing and robust data protection (ISO 27001 certification), CAS 360 offers a complete,

By Oumesh Sauba, CEO, MYT

Key Trends and Developments in Accounting

• Shift Towards CloudBased Solutions: For example, software like MyT, QuickBooks Online and Xero allows accountants and their clients to access financial data from anywhere, facilitating real-time decision-making and collaboration.

• Increasing Importance of Real-Time Financial Data: Real-time data enables businesses to react quickly to market changes. An example is the use of dashboards that provide financial KPIs in real-time, helping businesses to pivot strategies swiftly.

• Future Technologies Shaping the Accounting Profession: IoT devices, for example, can track inventory in real-time, providing accurate data for financial reporting and analysis.

Regulatory Changes and Compliance

• Overview of Recent Regulatory Changes: Mention specific examples like the GDPR in Europe affecting data privacy practices or the Tax Cuts and Jobs Act in the U.S. altering corporate tax rates.

• Communication and Advisory Skills in a Digital Age: The ability to communicate complex financial information in an understandable way to non-financial stakeholders is crucial.

Embracing Change in the Accounting Profession

user-friendly solution designed to meet the unique needs of UK businesses.

Welcoming Ashley Barker: Driving Growth and Building Relationships

BGL is excited to welcome Ashley Barker as the UK Business Development Manager to coincide with the UK launch. Ashley’s role is pivotal; he will be the cornerstone of BGL’s efforts to build solid and lasting relationships with prospective clients and partners. His mission is to ensure a smooth transition to CAS 360 and ensure clients receive unparalleled support and remarkable experiences.

“Ashley’s appointment underscores our commitment to the UK market,” says Warren Renden, General Manager – CAS 360, Ecosystem and UK at BGL.

"His expertise and dedication will drive the growth of our cloud products, ensuring that our UK clients are well-supported and able to fully leverage CAS 360's transformative capabilities.”

Innovation Rooted in Experience

Since its inception in 1989, BGL has been synonymous with innovation and excellence.

Keep reading

• The Rise of Sustainable and Green Accounting Practices: This involves accounting practices that factor in environmental costs of business activities. For instance, calculating the carbon footprint of products and incorporating these considerations into financial planning and reporting.

• Integration of Blockchain Technology in Accounting Processes: Blockchain can be used for secure and transparent transaction recording, like using smart contracts for automatic invoicing and payments, reducing the need for manual reconciliation.

of Technology and Automation

• Automation of Routine Tasks: AI tools like receipt scanning and data entry software automate mundane tasks, freeing accountants to focus on analysis and advisory roles.

• The Role of Data Analytics in Decision-Making: Tools like Tableau or Microsoft Power BI enable accountants to analyse large datasets and provide actionable insights to their clients.

• Cybersecurity in the Accounting Sector: Implementing secure cloud storage solutions and educating clients on phishing scams are examples of how accountants can protect sensitive financial information.

• The Importance of Compliance in a Globalised Economy: Accountants must understand regulations not just in their own country but also in other jurisdictions where their clients operate, such as IFRS standards.

• Impact of International Accounting Standards on Business Practices: Adoption of IFRS by companies can lead to more transparent financial reporting and easier comparison across international boundaries.

• Preparing for Future Regulatory Challenges: Continuous professional education and leveraging regulatory technology (RegTech) solutions can help accountants stay ahead of changes.

Skills and Competencies for Future Accountants

• Critical Thinking and Analytical Skills: Accountants need to interpret complex data sets and provide strategic advice, moving beyond just number crunching.

• Technological Proficiency: Being proficient in advanced Excel, understanding cloud computing basics, and having a grasp of blockchain implications for accounting are becoming essential.

• Ethical Considerations and Professional Judgement: Accountants often face ethical dilemmas, such as client pressure to adjust numbers. Strong ethical principles guide them in making the right decisions.

• The Importance of Continuous Learning and Development: Encourage participation in webinars, online courses, and professional workshops to stay updated with the latest trends and technologies.

• Strategies for Accounting Firms to Adapt to Technological Advancements: Firms should invest in new technologies and foster a culture of innovation, encouraging staff to experiment with new tools and processes.

• The Role of Professional Accounting Bodies in Supporting Members: These bodies provide resources like training programs, networking opportunities, and up-to-date information on industry changes.

• Preparing for a Future Where Technology and Accounting Converge: Accountants should view technology as an enabler that enhances their role, rather than a threat to their existence.

Conclusion

In conclusion, the future of accounting is intricately tied to the ongoing evolution of technology, regulatory frameworks, and global economic landscapes. As these fields continue to develop, accounting professionals are poised to embrace significant changes that will redefine their roles and enhance their impact on business operations.

The transition towards cloud-based solutions, the integration of blockchain technology, and the adoption of sustainable accounting practices are just a few of the pivotal trends shaping the industry.

Keep reading

WELCOME TO THE JULY 2024 EDITION OF SHARESIGHT’S MONTHLY TRADING SNAPSHOT FOR GLOBAL INVESTORS, WHERE WE LOOK AT THE TOP 20 TRADES MADE BY SHARESIGHT USERS AROUND THE WORLD, EXCLUDING AUSTRALIA AND NEW ZEALAND (WHICH WE COVER SEPARATELY).

You may notice our trading snapshot looks different this month, as we have updated the design and are no longer highlighting the top 20 US trades. Instead, we are presenting the top trades by global investors, regardless of market or asset class.

Find out more

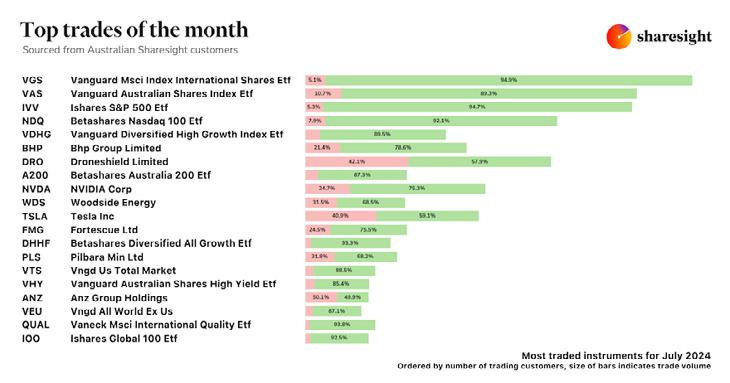

WELCOME TO THE JULY 2024 EDITION OF SHARESIGHT’S MONTHLY TRADING SNAPSHOT FOR AUSTRALIAN INVESTORS, WHERE WE LOOK AT THE TOP 20 TRADES MADE BY AUSTRALIAN SHARESIGHT USERS.

You may notice our trading snapshot looks different this month, as we have updated the design and are no longer highlighting the top 20 ASX trades.

Instead, we are presenting the top trades by Australian investors, regardless of market, because this is a better reflection of how Australians are actually investing.

You will also notice that we highlight the top 20 trades (across all asset classes), as well as the top 20 stocks, which allows us to observe the broader investment trends by Australian Sharesight users, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

Find out more

WELCOME TO THE JULY 2024 EDITION OF SHARESIGHT’S MONTHLY TRADING SNAPSHOT FOR NEW ZEALAND INVESTORS, WHERE WE LOOK AT THE TOP 20 TRADES MADE BY NEW ZEALAND SHARESIGHT USERS.

You may notice our trading snapshot looks different this month, as we have updated the design and are no longer highlighting the top 20 NZX trades.

Instead, we are presenting the top trades by New Zealand investors, regardless of market, because this is a better reflection of how Kiwis are actually investing.

Find out more

TODAY, FLYWIRE CORPORATION (FLYWIRE) (NASDAQ: FLYW) A GLOBAL PAYMENTS ENABLEMENT AND SOFTWARE COMPANY, ANNOUNCED THAT IT HAS ACQUIRED INVOICED, A SAAS PLATFORM THAT ENABLES B2B FINANCE TEAMS AND THE “OFFICE OF THE CFO” TO AUTOMATE THE CRITICAL ORDER-TOCASH PROCESS.

The acquisition is expected to build on Flywire’s existing B2B payments business by enhancing the software suite it provides to its global clients and target segments. Flywire plans to expand on Invoiced’s successful track record of providing invoicing software to a diversified client base across industries and geographies, and reinforces its commitment to powering software and payments to its target B2B segment, which Flywire estimates to be responsible for approximately $10 trillion in global payment volume.

Invoiced’s SaaS platform empowers B2B finance teams to automate A/R processes by managing invoices, communicating with payers, and reconciling payments to their Enterprise Resource Planning (ERP) systems. Invoiced does this through deep integrations with leading accounting systems and ERPs, including Oracle’s NetSuite, Sage Intacct, and Microsoft Business Dy-

namics. With a diversified global client base, Invoiced has a successful track record of delivering mission-critical software, having recently been named the #1 2024 A/R Automation Software by G2 Crowd.

The combination of Invoiced’s A/R automation software with Flywire’s proprietary global payment network - which supports diverse payment methods in more than 140 currencies across 240 countries and territories around the world - is expected to provide the B2B payments industry with a combined full-suite software and payments solution that streamlines workflows for finance departments.

“We seek M&A opportunities that will help us enhance our value proposition and strengthen our financial performance, while underscoring our core thesis that software drives value in payments,” said Mike Massaro, Flywire CEO.

“We believe Invoiced is an ideal software complement to our existing B2B payments business. Invoiced will help us significantly accelerate our product roadmap, and its Accounts Receivable product focus has strong alignment with Flywire’s global payment acceptance capabilities.”

Find out more

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED ITS SECOND QUARTER 2024 RESULTS FOR THE PERIOD ENDED JUNE 30, 2024.

The earnings release and related materials discussing these results can be found on PayPal's investor relations website at https://investor.pypl.com/financials/quarterly-results/default.aspx.

PayPal Holdings, Inc. will host a conference call to discuss these results at 5:00 a.m. Pacific time (8:00 a.m. Eastern time) today. A live webcast of the conference call will be available at https://investor.pypl.com. In addition, an archive of the webcast will be accessible for 90 days through the same link.

AYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED THAT FASTLANE BY PAYPAL IS NOW AVAILABLE FOR U.S. BUSINESSES OF ALL SIZES, HELPING TO INCREASE THEIR SALES AND DRIVE CUSTOMER LOYALTY IN TIME FOR THE UPCOMING HOLIDAY SHOPPING SEASON. ANNOUNCED EARLIER THIS YEAR, FASTLANE UTILIZES PAYPAL'S DECADES OF PAYMENT EXPERTISE TO INNOVATE AND ACCELERATE THE GUEST CHECKOUT EXPERIENCE – ALLOWING USERS TO COMPLETE THEIR PURCHASE IN AS LITTLE AS ONE CLICK.

"Fastlane by PayPal significantly reduces the time consumers spend using guest checkout – making for a more seamless checkout experience," said Alex Chriss, President and CEO, PayPal. "With Fastlane, we are bringing an accelerated guest checkout to businesses of all sizes helping them to drive more sales."

Merchants often lose sales due to lengthy guest checkout experiences. Despite the time-consuming process, guest checkout remains a preferred checkout method for many consumers. In fact, Capterra found that 43% of consumers said they prefer online guest checkout and 72% said they would still use guest checkout even if they have a store account.

Find out more