The modern workplace pension with fully automated pension contribution processing

PENFOLD, THE MODERN DIGITAL PENSION PROVIDER, IS THRILLED TO ANNOUNCE ITS NEW PULL INTEGRATION WITH XERO – AUTOMATING PENSION CONTRIBUTION PROCESSING ENTIRELY.

It eliminates the need for manual uploads or button presses, enabling employers and accountants to set and forget their pension processing.

Penfold’s the first pension scheme to offer this kind of powerful integration to a mainstream payroll software. And soon to be the first pension in the Xero App Store!

For businesses connected to Xero and Penfold, their contributions are processed automatically every time payroll is run or re-run in Xero. There’s no need for users to do anything – they can just use Xero as usual

and Penfold takes care of the rest.

This integration significantly reduces the administrative burden on accountants, payroll professionals and employers – allowing businesses to save valuable time and resources. And it’s included with Penfold’s modern workplace pension that’s free for payroll professionals, accountants and employers.

Keep reading

Journey has entered a multi-year partnership with ACCA UK. This collaboration will focus on two key initiatives aimed at enhancing professional growth.

JOURNEY, THE LEADING GTM AGENCY FOR ACCOUNTING-TECH, IS PROUD TO ANNOUNCE A STRATEGIC PARTNERSHIP WITH LEADING GLOBAL ACCOUNTANCY BODY ACCA (THE ASSOCIATION OF CHARTERED CERTIFIED ACCOUNTANTS.

This multi-year partnership will see Journey be-

come an events partner for ACCA UK, organising national roadshows and providing exclusive member benefits through access to innovative software solutions.

Journey, renowned for its expertise in go-to-market strategies for accounting technology, has entered a multi-year partnership with

ACCA UK. This collaboration will focus on two key initiatives aimed at enhancing the professional growth and technological advancement of ACCA UK members.

The first initiative involves Journey taking on the role of an events partner for ACCA.

Find out more

Find out how Joiin swapped exorbitant international transfers for streamlined, cost-effective and faster global money movement processes.

Introducing Joiin

Inter-company finances are complex, especially when entities are spread across multiple regions. As a result, group reporting can be a huge burden on finance teams’ time. Using Excel or other make-shift solutions for group reporting or complex consolidations is typically problematic, prone to errors, highly time-consuming and non-repeatable. As a result, group reporting can be a huge burden on finance teams’ time.

That’s where Joiin comes in. Joiin’s consolidated finance reporting software saves multi-entity companies 8 hours of work a month, reducing management reporting to a 30 minute task.

This B2B, cloud-based solution simplifies complex consolidations for VCs, and makes group reporting a breeze for CFOs and wider finance teams.

With Join’ s highly flexible features, users can quickly produce beautiful reports and presentations.

Joiin is trusted by over 40,000 companies across 120 countries worldwide.

After launching in 2018, Joiin quickly gained widespread attention among the finance community. Before long, Joiin organically grew a global customer base, serving customers in the US, Australia, New Zealand, UK, Ireland and South Africa.

To meet this global demand, Joiin extended its pricing to include USD, AUD, NZD and EUR. As a result, Joiin’s currency handling needs suddenly surged and costs escalated rapidly.

“We were receiving funds from multiple currencies into our GBP account,” explains Lucien, Co-Founder of Joiin. “We were charged fees to receive funds and charged again to convert them into GBP.”

Handling US dollars was particularly costly. Joiin was paying 2.5% on transactions to receive USD into its UK bank account, plus a conversion fee on top of that which amounted to 5% overall.

Payouts were costly too. Joiin remits tens of thousands in US dollars each month to suppliers. “When we needed to make payouts in USD, we had to pay FX

fees again to convert funds from GBP into USD, and a transaction fee as well,” says Lucien.

Joiin was losing money in multiple ways, as Lucien explains; “Firstly we lost money by using Stripe to convert all the different currencies - including USD - back into our home currency of GBP, and then again when we paid suppliers in USD! It was a double whammy.”

Caught in the conversion trap, Joiin searched for a more cost-effective global treasury solution and discovered Airwallex.

Lucien Wynn: Co-founder of Joiin

“Before Airwallex, we were paying £150 in handling fees to send a single transaction. It was ludicrous.”

The Solution

Joiin chose Airwallex to reduce its FX bill, but realised a whole host of added benefits along the way.

Optimising global treasury: “First and foremost we wanted to receive funds in USD,” explains Lucien.

Keep reading

SUMMER BREAK? NEVER HEARD OF IT. INSTEAD, WE’VE BEEN HARD AT WORK IMPROVING SOME OF APRON’S BEST BITS, AND ADDING SOME NEW STUFF TO HELP YOU 10X YOUR PAYMENT WORKFLOW.

Here’s what’s new this month.

Two-Factor Authentication and Passwords

Two-factor authentication, or 2FA as it’s called in the business, adds an extra layer of security to your account.

You can now enable 2FA on your Apron account by

XU BIWEEKLY - No. 88

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell

Chief Revenue Officer: Alex Newson

Account & Partnership Assistant: Robyn Consterdine

Creative Assistant: Aidan McGrath

Advertising: advertising@xumagazine.com

www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2024. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

going to Personal settings > Login and security.

With 2FA enabled, you’ll be asked to verify your login attempt once a month using your Authenticator app. It’s quick, easy, and should give you added peace of mind that your account is ultra-safe.

Prefer to log in using a password? You can now do that, too. Set it up by going to Personal settings > Login and security.

Also coming soon: The option to make 2FA mandatory for your entire team via a simple toggle. Perfect for ensuring greater security

across your whole practice. Stay tuned.

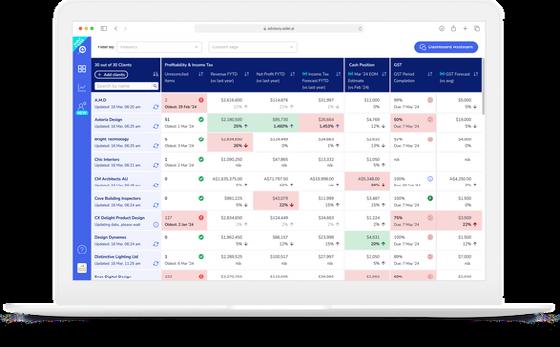

All new Practice Hub interface

We’ve given the Hub a refresh, making it even easier to see all of your clients at a glance in a single, streamlined interface. The redesign makes it easier for Admins to see which team members are assigned to which clients, helping you to optimise how you spend your resources. We’ve also introduced two new predefined roles, which determine what a user can see when they visit the Hub.

Keep reading

It’s vibrant, accessible, and it’s got lots of personality! Today we’re excited to introduce the new modern look of Arlo.

BRINGING FRESH ENERGY INTO THE PLATFORM WITH STYLISH COLORS, FONTS AND A HOST OF SLICK NEW ACCESSIBILITY IMPROVEMENTS, IT’S TIME TO ROLL OUT A SLEEK NEW EXPERIENCE. OUR NEW DESIGN ENSURES MORE PEOPLE CAN USE THE PLATFORM SEAMLESSLY, REFLECTING OUR CORE BELIEF OF EMPOWERING THE DELIVERY OF GREAT TRAINING FOR EVERYONE.

Big, bold and modern

Welcome to the bright new look and feel of Arlo! You’re in the platform throughout the day, so it was only logical for us to improve the experience and make it a more joyful place to be.

Now, the font and design is bigger, bolder, and stylish. Every element has been modernized and makes it more enjoyable to use. Plus, it’s so much easier to read –especially on smaller laptop screens and devices.

MANAGING SCENARIOS HAS ALWAYS BEEN PART OF CALXA BUT NOW WE’RE TAKING THINGS UP TO A NEW LEVEL WITH OUR NEXT RELEASE IN OCTOBER. RATHER THAN USING SEPARATE BUDGETS, YOU’LL BE ABLE TO LAYER YOUR SCENARIOS, COMBINING 1, 2 OR MORE WITH A BUDGET TO SEE WHAT THE RESULTING FORECAST LOOKS LIKE.

How Do the New Budget Scenarios Work in Calxa?

For those of you impatient to get to the core of the changes:

• Scenarios now contain just the changes you want to include

• Under Budget Tools, there’s a new Scenario Manager where you create new scenarios.

• Next to Budgets & Actuals, you’ll see the Scenarios builder where you edit and manage the detail of your

scenarios

• Add the changes you plan to implement

• Switch to Preview Mode to combine with a base budget

• On any report, select the base budget and one or more scenarios

That’s the quick summary.

As Chaser continues to innovate and expand its offerings, businesses worldwide can access a comprehensive tool to help them forecast, protect, and collect their revenue automatically.

What Is the New Scenario Manager?

This is the place to go to:

• Create new scenarios. Like budgets, they contain all business units and all years

• Group and sort your scenarios. We’ve added this functionality to the Budget Manager too

• Archive or Merge scenarios

This is the spot where you will start and finish with a scenario. Create it here and then return when it’s time to either merge into your main budget or archive because you don’t need it any more.

How Does the Scenario Builder Work?

You can edit scenarios in exactly the same way as you have previously edited budgets. The key thing to remember is that you only want to include what will change in your new scenario.

If your scenario is “Hire a new sales team”, include just the additional salary and wages costs, not those already budgeted. Include the extra revenue they will generate, not the income you have already budgeted.

• You can still budget by business unit and you get the same layout options of editing a business unit, an account or a metric

Find out more

WE’RE COMMITTED TO CONTINUOUSLY IMPROVING YOUR INVOICING EXPERIENCE IN XERO. AND AS WE TRANSITION TO THE NEW VERSION OF INVOICING, WE’RE ROLLING OUT MORE FEATURES AND ENHANCEMENTS DESIGNED TO STREAMLINE YOUR WORKFLOW AND BOOST PRODUCTIVITY.

New icons make navigation a breeze

Bolder, sleeker and more recognizable – our icons have had an overhaul.

Welcome improved navigation throughout the entire app, and we know you’ll agree they look so much better.

Revamped status indicators

We’ve also enhanced success, warning, and alert colors, and improved the contrast and accessibility.

Whether a task is due, payment is late, your course is fully booked – you’ll see the status at a glance, and know straight away when to take action.

As you move your mouse over different elements, we’ve added a new shade that clearly indicates to you what action or item you’re about to click.

Find out more

As a reminder, there are some important changes happening in Xero invoicing:

• Beginning the week of 2 September 2024 at 9am NZT, we will be defaulting users to the new version of invoicing experience

on a rolling basis. From the time you are defaulted, you will see the new invoicing experience each time you log in to Xero.

• We’ve extended the availability of classic invoicing, so users can choose to temporarily switch back to it until 20 November at 9am NZT, when classic invoicing will be retired.

What’s coming before classic invoicing retirement

We have been making many improvements to new invoicing based on your feedback to better accommodate a wider range of invoicing needs and com-

plexities. For example, many of the ideas shared with us related to ways we could improve the experience when creating a regular high number of invoices. By making improvements for these complex scenarios, customers with more basic needs also benefit. If you haven’t tried new invoicing recently, we encourage you to jump in and have a look at the latest enhancements. And there are still many more product updates coming before retiring classic invoicing. If you are worried about a feature that is missing, be sure you first check out the list below to see if it’s still on the way.

Keep reading

THIS MONTH, WE HAD THE OPPORTUNITY TO CONNECT WITH MENDY GREEN FROM MSPGEEK, WHO WALKED THROUGH SOME OF THE NUANCES OF IMPROVING OUR QUOTER + HALOPSA INTEGRATION WITH US.

We appreciate everyone in the Channel who brings us feedback; you’re not only driving your own business but also taking the time to work with us to improve Quoter so that everyone in the community can benefit. Bravo!

So, here’s a big shout-out to Mendy and thanks to all of those MSPs who provided feedback through this

iterative process of making Quoter work really well with HaloPSA.

Looking ahead, we’ve got big projects in the works for our development team this fall, ranging from integrating Quoter into the ScalePad ecosystem, improving our Reporting interface and profitability reporting features, and expanding filter and view options for our new Quotes List.

Now, on to this month’s releases!

Format the content sections of your quotes, friction-free

Since moving away from

CKEditor to Froala as the base of our WYSIWYG editor, we’ve been working to ensure our Quoter Partners love how easy it is to create beautiful, informative, and professional quotes and proposals in Quoter.

While you can still manage your content using CKEditor, we encourage you to take advantage of what this modern editor has to offer!

Our knowledge base articles can walk you through the configuration settings to try it out, and our Partner Success team is always here if you need an extra hand.

Find out more

WE’VE RELEASED NEW TECHNICAL BEST PRACTICE DOCUMENTATION TO HELP YOU BUILD GREAT INTEGRATIONS WITH XERO. WE CREATED THESE BEST PRACTICES AFTER RECEIVING FEEDBACK FROM APPS AND DEVELOPERS WHO WANTED MORE SPECIFIC INFORMATION ON BUILDING HIGH QUALITY INTEGRATIONS WITH THE XERO PLATFORM.

These best practices can be used by anyone building to Xero, and includes relevant information for certification too.

One of the great things about our platform is the community of apps and developers. Thank you to all of the apps who have given us permission to share screenshots of how they’ve implemented various features so you can learn from them. What’s in the best practice documentation?

The new documentation contains answers to questions such as “What’s the

best way to handle multiple tenants?” or “How do I test App Store Subscriptions?”

The place to start is the best practices overview. This page breaks down in alphabetical order all of the features which we’ve created best practices for. You can find this by:

1. Going to the Xero Developer documentation page

2. Clicking on ‘Best Practices’ in the side-menu

Each of the topics in the overview page has been grouped into the following sections, summed up they cover:

• Managing connections includes essential requirements around handling connections with tenants and how best to handle multi-tenancy.

• Branding and naming covers how best to use Xero branding eg Xero’s logo, buttons and considerations with naming your app.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE RELEASE OF THE HIGHLY ANTICIPATED ASIC INVOICE DATA EXTRACTION FEATURE IN ITS MARKET LEADING COMPANY, TRUST AND ID VERIFICATION MANAGEMENT SOFTWARE, CAS 360.

This cutting-edge technology, unveiled at BGL REGTECH 2024, uses the power of BGL SmartDocs to extract debt due dates from ASIC invoices and use these to generate reminders in CAS 360. This data is not available in the invoice data provided by ASIC.

"We are incredibly excited to bring this new feature to our clients," said BGL's CEO, Daniel Tramontana. "The ability to manage ASIC debt due dates in CAS 360 is a game-changer."

Find out more

YOU MAY REMEMBER OUR ACCOUNT OF THE RECENT CRISIS AT TRAVEL RECTANGLE AND THE ENSUING LITIGATION THAT THEY'RE STUCK WITH. NOW WE'RE READY TO TELL YOU ALL ABOUT HOW ZOHO COULD HELP!

Zoho's brand-new product could've prevented not only the spoofed email from entering users' mailboxes but also assisted in locating the email in question for the legal proceedings.

We proudly present to you Zoho eProtect, an email security and archiving solution that processes emails for possible cyber threats and safely archives them to enable simple eDiscovery search for legal and compliance reasons.

The eProtect story

For over 15 years, Zoho has been making its mark in the world of email. Zoho Mail has been adopted by different types of industries of all sizes. Over time, this has helped us understand the unique needs of businesses.

THE BUSINESS SHOW IS THE WORLD’S LEADING EVENT FOR ENTREPRENEURS, BUSINESS OWNERS AND START-UPS.

Running for 25 years, The Business Show takes place in locations across the globe including London, Los Angeles, Miami, and Singapore, and the team behind the event have plans to continually expand to reach more countries and markets.

The Business Show aims to support entrepreneurs and start-ups by offering them the services and products they need to run a successful business.

Bringing together the inspirational entrepreneurial and business community from across Asia, The Business Show is the leading platform to provide you with the insights you need to kickstart your business venture or take your organisation to new heights. Running for its third year, the show welcomes over 250 exhibitors, 150 speakers and 8,000 entrepreneurs, business owners and startups from across the country.

This year, some of Asia’s most influential business professionals and entrepreneurs from the likes of Google, Forbes, and PayPal will be taking to the stage and delivering keynote seminars to inspire and educate our audience. Alongside this are esteemed businesses, joining the event centre stage to share their products, resources, setbacks, and successes.

Keep reading

One common requirement posed by most enterprises is the need for amplified security for their emails. In addition to examining the emails entering the organization for possible threats, it's also important to archive emails securely and make sure they can be retrieved whenever required.

Zoho Mail has been perfecting its email security, archiving, and eDiscovery capabilities to address this need, and the result?

The spam processing and archiving capabilities that have powered Zoho Mail for the past 15 years is now available as Zoho eProtect.

This adds a remarkable accolade to Zoho's security lineup, once again making Zoho a desired choice for enterprises. eProtect can be implemented for additional security and archiving with your email provider. If you are a Zoho Mail user, you do not have to sign up for eProtect because these features are already built into Zoho Mail.

Keep reading

WE ARE THRILLED TO SHARE SOME GREAT NEWS WITH YOU — AND IT’S NOT ABOUT APRON CAPTURE FOR ONCE.

Apron Payments Ltd is now directly authorised by the Financial Conduct Authority (FCA).

This milestone is a significant vote of confidence in our product, business, and growth, and it brings with it some exciting benefits for you, our valued community of accountants, bookkeepers and business owners.

What does this mean for Apron?

Being directly authorised as an Authorised Electronic Money Institution by the FCA allows us to issue electronic money (e-money) and provide payment services independently (i.e. not relying on third-party providers).

A resounding success uniting the accounting community

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, WOULD LIKE TO THANK THE ATTENDEES, SPONSORS AND SPEAKERS FOR THE OVERWHELMING SUCCESS OF BGL REGTECH 2024, ITS ANNUAL ACCOUNTING TECHNOLOGY ROADSHOW.

Since its debut in 2017, BGL REGTECH has grown to become a hallmark event in the accounting technology industry. BGL REGTECH 2024 attracted over 1,800 registrations with events in Adelaide, Brisbane, Hobart, Melbourne, Perth and Sydney and a live stream drawing attendees from New Zealand, Singapore, Hong Kong and the United Kingdom.

“BGL REGTECH 2024 has been a remarkable success and I am so proud of everyone involved,” said BGL’s CEO, Daniel Tramontana.

“Seeing so many clients, prospects and sponsors come together to celebrate our incredible industry is amazing. Never would I have imagined so many people coming together under the BGL banner.”

Tramontana continued, “What I love most about BGL REGTECH is the opportunity to showcase the incredible work of the BGL team." Find out

This means fewer intermediaries, meaning enhanced security, smoother, more efficient payments, and the opportunity to build truly bespoke products for all of you.

What does this mean for you?

For Apron customers, it’s business as usual — nothing changes in how you use our services. We will update our bank details in the next few months, which will require action from you later, but we will send a separate communication about that nearer the time. This authorisation positions us to expand our offerings in the future.

We’re working on new products that will make local and global payments even easier, faster, and more affordable for finance professionals and business owners.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE IT HAS BEEN RECOGNISED BY GREAT PLACE TO WORK® AS ONE OF THE BEST WORKPLACES IN AUSTRALIA™ 2024.

“This recognition is a testament to our unwavering commitment to nurturing a positive and inclusive work environment” said BGL’s Chief Executive Officer, Daniel Tramontana. “Our people are our greatest asset and this award highlights their dedication and passion. We’re proud to be acknowledged as one of Australia’s best workplaces and will continue to prioritise the wellbeing and support of our Team.” Ron Lesh, Founder and Director of BGL, added, “Creating a workplace where our people feel respected, appreciated and empowered has always been at the heart of BGL’s values."

Keep reading

LESSN, A PLATFORM MAKING BUSINESS PAYMENTS SIMPLER FOR SMALL TO MEDIUM-SIZED ENTERPRISES (SMES), HAS SECURED NEARLY A $1 MILLION INVESTMENT FROM MOROKU, A COMPANY WITH STRONG CONNECTIONS TO AFTERPAY, CUSCAL, AND VOLT BANK. THIS INVESTMENT MARKS A KEY STEP IN LESSN'S PLANS TO EXPAND ITS PLATFORM INTERNATIONALLY.

Lessn, founded by David Grossman, is already making a name for itself in the payments industry. Recently, the company partnered with April, a payments firm acquired by ASX-listed Spenda, to enter the Singapore market. Now, with backing from Moroku, Lessn is better positioned to grow and reach new markets.

"This investment shows confidence in what we’re building and gives us the tools to take Lessn to a global audience," said Grossman.

The $1 million from Moroku will help Lessn enhance its technology and expand beyond Australia. With a valuation of $30 million, the company is focused on using this momentum to achieve its global goals.

Find out more

Re-Leased raises US$12.5m to expand the use of its AIpowered commercial real estate software

NEW ZEALAND-FOUNDED PROPERTY SOFTWARE COMPANY RELEASED HAS ANNOUNCED AN OVERSUBSCRIBED US$12.5M RAISE LED BY MOVAC, WITH PARTICIPATION FROM ICEHOUSE VENTURES AND EXISTING INVESTORS. THE RAISE WILL ENABLE RELEASED TO BOOST THE USE OF AI WITHIN ITS SOFTWARE (WHICH IT HAS BUILT OUT WITH THE LAUNCH OF ITS AI-TOOL CREDIA) AND GIVE EARLY INVESTORS LIQUIDITY. THE CAPITAL WILL ALSO ASSIST IN FUNDING ITS CONTINUED EXPANSION IN THE UK AND US.

Re-Leased repositioned during the Covid pandemic to achieve ‘break even’ by focusing on capital efficiency, and has since maintained strong growth rates and unit economics which has attracted high investor interest in a challenging global investment market.

“Our vision is to help our customers run a better real estate business. The global real estate industry is facing significant headwinds and a cyclical downturn, and in this challenging environment we’re seeing more property professionals recognise that automation and AI gives them a distinct advantage in the market,” explains Tom Wallace, Founder of Re-Leased.

Keep reading

THE ACCOUNTING INDUSTRY IS AT A CROSSROADS. WITH A SIGNIFICANT PORTION OF THE PROFESSION NEARING RETIREMENT AGE, THE CHALLENGE OF FINDING VIABLE EXIT STRATEGIES HAS NEVER BEEN MORE PRESSING.

Many firm owners are looking for ways to step back from their businesses, but the avenues to do so are limited. At the same time, a talent shortage is creating a bottleneck for ambitious and thriving firms to grow.

So, as a logical remedy to both of these problems, it’s no surprise that mergers and acquisitions (M&A) are on the rise.

But connecting buyers and sellers effectively remains a daunting task. Firms are either hesitant to put themselves out there or find it challenging to identify the right match.

But today, we’re excited to share a solution: Practice Marketplace by Karbon.

What is Practice Marketplace by Karbon?

Practice Marketplace by Karbon is a platform specifically tailored for accounting firms to connect, negotiate, and complete transactions in a secure, streamlined environment.

Think of it as the ‘Zillow for the accounting profession.' Firms can list their businesses for sale, and potential buyers can browse, filter, and connect based on various criteria.

Keep reading

Tackling the talent issue: Xero report examines accounting and bookkeeping industry’s ‘image problem’

Xero launches mentoring initiative, aiming to shift perceptions from within

NEW RESEARCH FROM GLOBAL SMALL BUSINESS PLATFORM XERO REVEALS ALMOST ONE IN TWO ACCOUNTANTS AND BOOKKEEPERS (45%) BELIEVE THEIR INDUSTRY HAS AN ‘IMAGE PROBLEM’ [1]. IN RESPONSE, XERO HAS ANNOUNCED THE LAUNCH OF XERO MENTOR MATCH, A PEER-TO-PEER MENTORING PROGRAM FOR ITS AUSTRALIAN ACCOUNTING AND BOOKKEEPING PARTNERS.

The report, Reshaping accounting and bookkeeping: Image, talent and the way forward, is based on a survey of almost 400 accountants and bookkeepers in Australia and New Zealand and examines how the professions are generally perceived, and the impact this is having on the industry-wide talent problem.

In a second survey of 155 university students from Australia and New Zealand studying a Bachelor degree (or above) in accounting [2], 41% agreed the industry has an image problem.

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), INVESTMENT MANAGEMENT, IDENTITY VERIFICATION AND AI-POWERED PAPER-TO-DATA SOFTWARE SOLUTIONS, IS PROUD TO ANNOUNCE THE LAUNCH OF ITS OPEN BANKING INTEGRATION WITH SKRIPT.

This integration, unveiled on 22 August 2024 at BGL’s annual accounting technology roadshow BGL REGTECH 2024, marks a significant leap forward in how BGL handles bank data feeds.

“This is an exciting time for our partnership with Skript,” said BGL’s Chief Executive Officer, Daniel Tramontana. “This integration connects Simple Fund 360 and Simple Invest 360 clients to the world of Open Banking, providing a secure and seamless way for clients to access bank data. It enhances efficiency and accuracy and will revolutionise how BGL clients manage financial data going forward.”

Skript is an Australian-owned business with extensive experience in banking, data and payment services.

Find out more

TAX TORCH, A NEW CLOUD-BASED PERSONAL TAX PLANNING SOFTWARE, IS SET TO ENHANCE THE WAY UK ACCOUNTING FIRMS MANAGE THEIR CLIENTS' TAX PLANNING NEEDS. FOUNDED BY ACCOUNTANTS ROBERT DAVIDSON, NICOLE CHRISTIE, AND STEVEN BARR, TAX TORCH AIMS TO SIMPLIFY AND IMPROVE THE BESPOKE TAX PLANNING PROCESS FOR ACCOUNTING FIRMS AND THEIR CLIENTS.

Tax Torch addresses a critical need in the accounting industry by providing an automated solution to the manual, time-consuming, and often incomplete process of personal tax planning.

Traditionally, accountants have relied on complex spreadsheets or avoided offering bespoke tax planning services. Tax Torch changes this by centralising clients' personal, financial, and business goals in one place, allowing accountants to quickly and accurately build personalised tax scenarios.

Tax Torch eliminates the need to sift through emails and client records and chase other team members for information, ensuring all relevant data is readily accessible.

Keep reading

IT’S NO SECRET THE ACCOUNTING AND BOOKKEEPING INDUSTRY HAS BEEN BATTLING A CRITICAL TALENT SHORTAGE FOR SOME TIME. IN FACT, WE’VE CONDUCTED NEW RESEARCH THAT REVEALS ALMOST TWO-THIRDS OF EMPLOYING PRACTICES (65%) HAVE EXPERIENCED CHALLENGES WITH FINDING AND KEEPING THE RIGHT STAFF IN RECENT YEARS.

Our report, Reshaping accounting and bookkeeping: Image, talent and the way forward, suggests this talent problem is, in part, due to an image problem, with most accountants and bookkeepers (81%) agreeing their industry needs to do a better job of conveying the full scope and impact of what they do. While these issues can’t be solved in isolation, there are things we can do to help resolve them.

Find out more

THE ANTICIPATION IS BUILDING AS WE COUNT DOWN TO THE XERO ASIA ROADSHOW IN KUALA LUMPUR. WE’VE GOT AN EXCITING PROGRAMME FOR YOU AND WE CAN’T WAIT TO SHARE IT!

Winning on purpose

This year, we’re all about helping you win on purpose.

We all have a purpose that drives us, whether that be supporting our customers and clients with world-class experiences, growing our businesses, or nurturing our staff.

At this year’s Xero Roadshow, we’ll share how technology, trends and changes will help us all deliver on this goal.

Keep reading

through technology

ERO, THE GLOBAL SMALL BUSINESS PLATFORM, HAS SIGNED A STRATEGIC PARTNERSHIP AGREEMENT WITH XEINADIN TO BRING THE POWER OF CLOUD ACCOUNTING TO MORE XEINADIN ADVISORS AND THEIR CLIENTS.

Xeinadin is a business advisory and accountancy firm with more than 135 offices and 2,000 employees, and is one of the top 20 largest accountancy firms in the UK and Ireland.

As part of the strategic partnership, Xero will help Xeinadin to create a more digitally-enabled advisor and client base, through technology and training.

Xero’s platform and insights will enable Xeinadin advisors to deliver data-driven business advisory to their clients.

Find out more

UPCOMING EVENTS US EVENTS

UPCOMING WEBINARS UK EVENTS

UK WEBINARS AU WEBINARS

If inefficient processes are holding your firm back from maximising revenue and profitability, it’s time to consider a smarter way to run your business.

By Matt Kanas, Managing Director, Americas, Ignition

HERE ARE SEVEN PROVEN STEPS FOR FAST-TRACKING YOUR REVENUE, CASH FLOW, AND EFFICIENCY.

1. Clearly define your services, pricing, and packaging

Many firms are using outdated ways to price and package services. Yet strategic pricing and packaging can significantly enhance your firm’s profitability and operational efficiency. Effective pricing strategies start by clearly defining and breaking down your services into detailed components. Once you’ve identified the services you’re offering, only then can you determine the value and put a price on each of those services.

This is where a three-option pricing system comes in, enabling your business to offer predefined service packages to clients. Clients understand exactly what they’re getting, when, and for how much, which improves communication and sets clear expectations.

Using a platform such as Ignition allows you to easily build your service library and create predefined service packages using proposal options.

2. Re-evaluate your billing model

Holding on to traditional billing models is another common culprit that can hinder efficiency and profitability for service-based businesses. Billing by the hour, manually tracking billable hours, billing after you’ve completed the work, chasing clients for payments – these are all entrenched habits that drain your resources and your profits.

Updating old billing models is key to managing your firm’s revenue. This includes rethinking how you bill and get paid – for example, shifting from billing upon completion to billing upfront or taking a deposit before the work begins.

When re-evaluating your billing practices, it’s important to have a billing and payments solution that can

help you successfully navigate this transition. Ignition’s flexible billing options mean you can bill hourly or use fixed fees, apply one-off or recurring fees, take upfront payments or deposits, and more.

3. Shift to upfront client payments

It’s no surprise that many firms suffer from cash flow issues if they’re stuck using outdated billing practices.

Even if your business isn’t ready to make the leap from hourly to fixed-fee billing, you can still implement billing processes that will guarantee you’ll get paid.

Just like when signing up for a gym membership, firms can collect payment details upfront when clients sign a proposal using a tool such as Ignition. This puts you, rather than your clients, in control of the payment process and allows you to collect the payment automatically when the invoice is due. You can then transition to upfront payments, before the work even begins.

4. Transition to recurring revenue

If your business is stuck on a roller-coaster revenue recycle, it may be time to transition to recurring revenue or diversify your revenue streams to protect your cash flow year-round. For Marcus Dillon, CPA and President of Dillon Business Advisors (DBA), transitioning from a traditional accounting practice to offering more comprehensive client advisory services (CAS) has led to increased revenue. DBA now offers Essential, Premier, and Elite core packages for CAS.

5. Engage clients with a clear scope of work

One of the fastest ways for firms to lose out on revenue and profits is by not having a clearly defined scope of work when engaging clients. You’re not only missing out on an opportunity to communicate your firm’s true value, but also introducing ambiguity to the client relationship. Clients don’t know exactly what they’re paying for, and your staff members are unclear on the services

they should be delivering –exposing your business to scope creep.

When sending clients your proposal or engagement letter, it’s vital to include the scope, frequency, and pricing for the services you’re offering, alongside your payment terms, so everyone is on the same page.

Luckily, Ignition enables you to templatise proposals and engagement letters, meaning it takes only minutes to create proposals that provide clients with complete clarity on the scope of services.

6. Get paid when the scope changes

The solution? Refer back to your original signed agreement to remind clients what is or isn’t in scope, and charge them for additional services appropriately.

Thankfully, Ignition makes it easy to bill for any ad hoc or out-of-scope work using the instant bill feature.

7. Automate time-consuming processes

Once your firm has redefined its approach to pricing and packaging, engaging clients, billing, and payment collection, it’s time to tackle the biggest challenge holding many firms back – administrative burden. Automating manual client engagement, billing, and payment processes is the key to scaling your business, and your revenue, more efficiently. Taking stock of your current processes is the first step to helping you identify the biggest efficiency gains for your business.

Even if your business is diligent in engaging clients with a clear scope of work, chances are that you’re not charging them for all the ad hoc services you’re providing. It’s all too easy to assist clients with a ‘quick favour’ or spend time on the phone giving advice you probably should be charging for. Ultimately, it all adds up and means you and your staff are working, at least in part, for free.

Keep reading

Outdated pension providers have had their day. Discover Penfold’s innovative Xero integration.

By Chris Eastwood, CEO & Co-Founder, Penfold

PENFOLD’S MISSION IS TO HELP EVERYONE SAVE ENOUGH FOR A COMFORTABLE RETIREMENT, SIMPLIFYING PENSIONS FOR PAYROLL PROFESSIONALS, EMPLOYERS AND SAVERS.

For one of the UK’s most lucrative tax-relief schemes, pensions have a pretty bad rap. And it’s easy to see why.

Many workplace providers have complicated offerings with no saver app, long-winded integrations, poor customer service and excessive fees. It’s no wonder people are put off from saving.

Since the introduction of auto enrolment in 2012, payroll professionals have only been involved in pensions because they’ve had to be. It’s the same for employers. And savers often don’t engage with their pension or choose to opt out altogether – meaning it’s unlikely they’ll have the funds they need for a comfortable life after work.

But pensions don’t have to be complex and boring. Outdated providers have had their day.

In 2018, I co-founded Penfold to create an easy, simple and accessible way to help people save for the future. We built a modern, digital pension from scratch and an innovative mobile app.

With our app, savers can track down and combine pensions from their previous jobs, and forecast how much they’ll need to save with realistic yearly targets. Savers can change their investment strategy at any time, choosing a plan that suits their risk appetite and values. Plus, they can adjust their contributions whenever they like, easily topping up or skipping a month.

Almost five years later, we have over 70,000 savers and half a billion pounds in assets under administration. We’re helping individuals find £26.6 billion worth of lost pensions, supporting payroll professionals streamline pension management and strength-

en client relationships, and ensuring employers get the most out of their most expensive benefit. And we’re not stopping there.

Penfold’s automated Xero integration

With our new 100% automated Xero integration, you can manage contributions without the press of a button, never uploading or processing a pension contribution file again.

We’re the first pension scheme to offer this kind of powerful integration to a mainstream payroll software. And soon to be the first pension in the Xero App Store!

But how can you process contributions without doing… anything? Well, for each of your clients that are connected to Xero and Penfold, we automatically process contributions every time you run or re-run payroll.

So, once you’re set up, there’s no need to spend any time sorting contributions, no need to log into Penfold to upload files after a pay run. Just use Xero as you usually would.

When we're done processing your client’s contributions, you receive an email to confirm the amount of pension contributions for the pay period.

It’s as simple as that. An innovative, automated integration for workplace pensions. When Nikki Shefferd, Director of N S Accounts and Xero Gold approved provider, connected her client, Automotive, to Penfold and Xero she said: "I did get excited when I saw Automotive was automatically done. Love it so far."

You’re probably thinking there’s a huge markup for this kind of effortless technology. But no! Penfold's free for payroll professionals, accountants, advisers and their clients. And the cost isn’t passed on to employees as a monthly charge either. They pay just one transparent saver fee based on the value of their pension pot.

By Luke Yamnitz, Avalara

WWith Penfold, you’re also guaranteed first-class service from your own dedicated account manager. So, if you need help switching providers, ever encounter any contribution mishaps, or simply have a question, you can contact your named account manager directly.

And with industry-leading funds managed by BlackRock and HSBC, a 5-star Defaqto rating, 4.4 Trustpilot score, and 5-star rated savers app, Penfold is trusted by payroll professionals, employers and their employees to help save for their futures.

The modern pension that’s better for everyone

For one of the UK’s most lucrative tax-relief schemes, outdated providers give pensions a pretty bad rap. But we’re here to change things.

By empowering accountants to simplify their pension management, we’re helping strengthen client relationships with a simple and accessible solution. Not to mention we’re helping employees engage in saving for retirement in an easy and meaningful way – and make the most of free money in the form of government tax relief.

But don’t just take our word for it. Before switching to Penfold in 2022, Cone Accounting was frustrated by unhelpful and confusing traditional providers.

Cone’s clients often struggled to access and navigate their pension accounts, resulting in minimal engagement and little added value.

Ben Nacca, Founder of Cone Accounting, wanted to bring its pension offering into the 21st century.

“As a digital practice, we’re always trying to make sure that we have the right app stack. Xero for our accounting, Dext for our receipt management. We see Penfold as our pension option in that space,” explained Ben.

Keep reading

ITH THE OECD’S BUSINESS CONFIDENCE INDEX (BCI) DROPPING TO BELOW PRE-COVID LEVELS BEFORE THE START OF THIS YEAR, THE OUTLOOK FOR BUSINESSES ACROSS VARIOUS INDUSTRIES HAS BEEN DRIVEN BY THE POSSIBILITY OF RECESSION, RISING INFLATION, AND VOLATILE CONSUMER CONFIDENCE, AMONG OTHER ECONOMIC FACTORS.

As a result, businesses across the globe have shifted their focus to meeting efficiency goals, rather than putting a bullseye on unrestrained growth.

A goal around efficiency includes many of the same practices businesses have been leveraging for years, now coupled with the benefits of digital modernization. To meet new goals around efficiency, businesses are leveraging technology that automates operations and processes; many on the backend. To cut down on added costs, time, and resources spent on low value business requirements, businesses have turned to areas like tax compliance as a part of their operations where they could be more efficient.

Tax compliance is an area especially ripe for automation within global businesses because easy-to-use automation solutions drive both time and cost reduction, protects businesses from

harsh fines and penalties from audits, and creates a better overall customer experience. This is especially true for small and midsize businesses, which have fewer resources at their disposal.

According to research from Avalara, small and midsize businesses spend a combined 163 hours and more than $17,000 per month on manual sales tax management. That’s 163 hours that tax professionals could spend on numerous other and more important tasks to support their business’s bottom line. After all, an hour spent on tax management is an hour lost on other parts of the business, which can lead to growth.

The cost of manual tax compliance goes beyond time and money. Like many human-centric tasks, manual tax management is an error-prone process. Using outdated methods, like spreadsheets, makes it increasingly difficult for tax professionals to keep up with constantly changing tax rates and rules.

The uncertainty surrounding manually managed tax rates and rules that are used to make tax determinations for a business creates unnecessary risk.

Tax can also serve as a barrier to business growth and expansion. Entering new markets and adding sales channels, employees, prod-

ucts, and/or services can trigger new tax obligations to register and file in more locations.

When businesses are looking for areas to cut costs and resources, and drive overall efficiency, tax compliance can quickly become the poster child for automation because of the low value that managing it provides to a business. Adding in the risk of getting tax wrong and the impact it can have on a business, the decision to automate makes even greater sense.

Automation not only allows businesses to reduce the time and money currently spent on manually managing processes that can be handled more quickly and accurately with technology, but it also reduces barriers to growth and enhances the value of existing technology and systems.

Automation decreases the tax complexity that often comes with business growth. The effort required to remain compliant in a few states is vastly different when you do business in most of the USA. Selling into more countries adds a whole new level of complexity. With automation, it’s easier to scale.

The rise in the adoption of automation signals that more businesses are realizing that tax is simply too complex to manage on their own.

Keep reading

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED AN EXPANSION OF ITS GLOBAL STRATEGIC PARTNERSHIP WITH FISERV, INC.. (NYSE: FI) WHICH WILL STREAMLINE HOW MERCHANT CLIENTS OF FISERV ENABLE PAYPAL EXPERIENCES FOR THEIR CUSTOMERS. BUILDING ON A LONGSTANDING PARTNERSHIP BETWEEN THE TWO COMPANIES COVERING SEVERAL PRODUCTS AND SERVICES AND MILLIONS OF BUSINESSES, THE EXPANDED RELATIONSHIP SIMPLIFIES HOW FISERV CLIENTS ENABLE PAYPAL, VENMO AND RELATED SERVICES, AND PROVIDES THESE BUSINESSES WITH A SIMPLE CONNECTION POINT TO FASTLANE BY PAYPAL TO ACCELERATE GUEST CHECKOUT FLOWS IN THE U.S.

"We're excited to deepen our collaboration with Fiserv and extend our innovative products and solutions to a broader audience," said Frank Keller, Executive Vice President and General Manager Large Enterprise and Merchant Platform Group, PayPal. "This partnership reinforces our commitment to driving excellence in checkout convenience by partnering with leading payment service providers and e-commerce platforms."

Fiserv and PayPal have partnered for over a decade on a variety of best-in-

class merchant and payment functions spanning payment processing, payouts and network services and other ecommerce capabilities across millions of merchants globally. Fiserv is a core strategic partner, delivering technology and capabilities that fuel PayPal's customer-centric innovation across multiple domains and product lines.

"Fiserv is committed to simplifying the complexities of commerce, creating value for our clients by making it simple for businesses to enable new, engaging experiences for their customer base," said Jennifer LaClair, Head of Merchant Solutions, Fiserv.

"Our expanded partnership with PayPal supports our mission to enhance client value by providing simple, cutting-edge solutions to our clients that elevate and accelerate the commerce experience."

Fastlane utilizes PayPal's decades of payment expertise to innovate and accelerate the guest checkout experience – allowing users to complete their purchase in as little as one click. Guest shoppers using Fastlane convert more than 80% of the time, achieve up to 50% higher conversion rates compared to non-Fastlane users, and reduce checkout time by 32%*.

Keep reading

UME, A PAYMENT NETWORK AND MERCHANT SERVICES PLATFORM FOR SMALLAND MID-SIZED BUSINESSES (SMBS) ON PIX, TODAY ANNOUNCED IT HAS RAISED $ 15 MILLION IN SERIES A EQUITY FUNDING.

The round was led by PayPal Ventures, with participation from NFX, Globo Ventures, Clocktower Ventures, Big Bets, FJ Labs, Endeavor and Norte Ventures. Ume has also raised a USD $20 million FIDC debt facility from Verde, Wersten Asset, Itaú, Credit Saison and Milenio. The equity funding and debt facility will be used primarily for sales, marketing, and technology to accelerate Ume’s expansion into new regions and enhance its Pix capacities.

Buy now, pay later (BNPL) has become one of Brazil’s

most popular financial services, with nearly 71% of Brazilian consumers regularly making installment purchases according to the Brazilian credit bureau Serasa Experian. Ume offers its consumer financing product through its robust, established network of 6,000 merchants in Brazil, reaching more than 220,000 consumers. By enabling consumers to use Ume’s BNPL product across all of its partner merchants, Ume has driven strong repeat usage behavior, with 85% of purchases coming from repeat customers.

Now, Ume is leveraging Pix to scale and grow its business by building a Pixfirst payment network and merchant services platform that enables SMBs on Pix to offer greater flexibility in payment options for their customers. Pix has dramatically transformed the

Salesforce customers can now benefit from global account-to-account payments integration

BANK PAYMENT COMPANY GOCARDLESS HAS LAUNCHED GOCARDLESS FOR SALESFORCE ON SALESFORCE APPEXCHANGE, A LEADING ENTERPRISE MARKETPLACE FOR PARTNER APPS AND EXPERTS, EMPOWERING CUSTOMERS TO ACCESS THE GOCARDLESS PAYMENTS PLATFORM DIRECTLY WITHIN SALESFORCE.

Customers can tap into GoCardless’ full product suite including Instant Bank Pay, its open banking-powered payment feature and Direct Debit, automating the collection of one-off and recurring payments in over 30 countries.

GoCardless for Salesforce

Switching to account-to-account payments with GoCardless means Salesforce customers will save time and money by automating their payment processes.

Because GoCardless bank payments pull money directly from customers’ bank accounts, payers can also say goodbye to the inconveniences, payment failures and unwanted service disruptions associated with expired, lost or stolen card details.

Keep reading

financial landscape in Brazil by allowing faster, more accessible mobile payment transactions, and has quickly become the main payment method in the country with more than 100 million monthly users. Since incorporating the Pix rail into its network in early 2023, Ume has grown its merchant base 5x faster, seen consumer repeat rates that are 3x higher and default rates diminish by 33%.

“Our vision is to build a next generation payment network and merchant services platform on Pix rails that provides Brazilians with more accessible and flexible payment methods and enables thousands of Brazilian SMBs to grow their businesses,” said Berthier Ribeiro, co-founder and CEO of Ume. “By creating infrastructure on the Pix rails, we are able to provide SMBs with

an array of financial products that they can quickly, easily and conveniently offer to their customers – fueling their growth and improving how Brazilians shop and pay.

”By building its infrastructure on the public Pix rails, Ume is able to quickly scale up by instantly onboarding new merchants and consumers, as well as through expanded product offerings such as enabling certain consumers to purchase from merchants outside the Ume network, allowing them to buy both online and offline.

"Today, 80% of purchases using Ume happen offline, while 20% are online. “Ume has capitalized on the ubiquity of Pix in Brazil and has gained impressive traction,” said Ian Cox, Investment Partner at PayPal Ventures.

Keep reading

WELCOME TO THE AUGUST 2024 EDITION OF

SHARESIGHT’S MONTHLY TRADING SNAPSHOT FOR GLOBAL INVESTORS, WHERE WE LOOK AT THE TOP 20 TRADES MADE BY SHARESIGHT USERS AROUND THE WORLD, EXCLUDING AUSTRALIA AND NEW ZEALAND (WHICH WE COVER SEPARATELY). BELOW WE WILL REVEAL THE TOP TRADES BY OUR GLOBAL USERBASE, HIGHLIGHTING SOME OF THE MOST POPULAR STOCKS AND THE MARKET-MOVING NEWS BEHIND THEM.

Top trades in August 2024

This month’s top trades were led primarily by buy trades in NVIDIA (NASDAQ: NVDA), with opportunistic investors taking advantage of declining share prices in

the wake of the company’s quarterly earnings report.

The top trades were followed by Apple (NASDAQ: AAPL), which has seen its share price rise steadily throughout August.

It was a strong month for tech stocks in general, with 14 of the top 20 trades consisting of stocks belonging to the tech, EV, semiconductor and e-commerce sectors.

Let’s look at the market-moving news behind some of this month’s top stocks:

NVIDIA (NASDAQ: NVDA)

• NVIDIA share price drops despite record sales; investors concerned about slowing rate of growth

Keep reading