By Will Buckley,

IF THE LAST FEW YEARS HAVE PROVEN ANY THING, IT’S THAT THE TE NACITY AND RESILIENCE OF AUSTRALIA’S BUSINESS COMMUNITY IS NOTHING SHORT OF AWE-INSPIR ING. THIS IS WHY WE’RE HONOURED TO ONCE AGAIN RECOGNISE AND CELEBRATE THE ACHIEVE MENTS OF OUR SMALL BUSINESS COMMUNITY IN THE FY23 XERO AWARDS. BELOW, YOU’LL FIND THIS YEAR’S FINALISTS.

But first of all, a huge thank you to everyone who submitted their nomina tions. The calibre of entries was exceptional, and it was no mean feat for our judges to narrow them down to just a handful of contenders.

Without further ado, con gratulations to the FY23 Xero Australia Awards final ists:

Partner AccountingCategoryPartner of the Year

• Yield Advisory

• Air Accounting

• Elevate Tax & Accounting

Bookkeeping Partner of the Year

• Diverse

• Cloud9 Strategic

• Heart Bookkeeping

Cloud Champion of the Year

• Elevate Tax & Accounting

• Heart Accounting

• Clarico

When Spenmo started, there was no way we could have ever predicted how far

we'd come or even imagined the milestones and success stories we had trailing be hindFastus. forward to three years later, and in the spirit of everything new (includ ing a new office space!) – we decided it was time for a change.Assuch, we're excited to announce that we have a

Community Partner of the Year

• Allan Hall Business Advi sors

• Trinity Advisory

• Together Business Aus tralia Pty Ltd

Innovative Partner of the Year

• Smart Business Solutions Group

• BDO Australia

• Allan Hall Business Advi sors

Enterprise Partner of the Year

• RSM Australia Pty Ltd

• BDO Australia

• Aero Accounting Group

App Partner Category

Emerging App of the

Year

• Marmalade

• Paytron

• Amaka

Financial Services App of the Year

• Fathom

• Airwallex

• Parakeet

Small Business App of the Year

• Finlert

• ServiceM8

• Weel formerly Divipay

Practice App of the Year

• Ignition

• Syft Analytics

• ApprovalMax

Read more

DIRECT BANK PAYMENTS ARE HIGHLY BENEFICIAL FOR INSURERS AND CUSTOMERS ALIKE. FOR IN SURERS, THEY CAN REDUCE COSTS, IMPROVE THE NUMBER OF PAYMENTS YOU COLLECT, AND INCREASE CASH FLOW. FOR POLICYHOLDERS, IT MAKES THE WHOLE PROCESS SIMPLER AND CHEAPER.

Benefits for Insurers

Firstly, direct bank payments enable insurers to reduce costs on transaction fees, as their fees are typically lower than credit card processing fees. Direct bank payment fees are approximately 1-2%, compared to 2-3% when using cred it cards to process payments. With direct bank payments, insurers have stronger control of their payment cycles and a healthier cash flow, as there are fewer risks of failed pay ments.Credit card transactions fail 8% of the time, as credit cards can expire or be blocked due to fraud or unpaid credit limits, or cardholders may have insufficient funds due to maxed... reading

new logo and brand identity for Spenmo, which we hope will better encapsulate our grounding values and direc tions for the future.

Why the Rebrand?

Previous brand story might be unclear

Our CEO and Founder,

Mohandass Kalaichelvan, felt that rebranding was a natu ral step for our customers to form a more profound and in-depth understanding of what Spenmo is.

When Spenmo initially launched in 2019, our sole mission was to be the lead ing provider of corporate...

Find out more Awards Australia Finalists

WE’VE REBRAND ED. HERE’S WHAT'S HAP PENING WITH SPENMO’S LATEST BRAND REVAMP, INCLUDING A NEW LOGO AND MANY EXCITING THINGS AHEAD!

Biweekly Saturday 24 September 2022 | No. 39 The independent news source for Xero users, by Xero users Saturday 24 September 2022 P8 XU Xero

FY23

AnnouncedPAGE2P4ImprovingDirectBankPaymentswithImburseandGoCardless

Keep

Xero SPENMO HAS REBRANDED! 9 772054 723006 39 ISSN 2054-7234

By Nerissa Goedhart

PAYHAWK WAY.STRAIGHTFORWARDASPENDLOOKCOMPANIESENABLESTOAFTERTHEIRMANAGEMENTINTRANSPARENTAND

From company cards to expense management software, our tools let businesses digitise their corporate expenses, set spend controls, and man age bulk updates in an easy-to-use single plat form.Moreover, our expense

XU BIWEEKLY - No. 39

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

DavidCEO: advertising@xumagazine.comAdvertising:

‘Xero’www.xumagazine.comisatrademarkof Xero

Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2022. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher. XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

New Apps & Updates

CGT FROM

WE

accounting systems in real time in order to get good spend visibility and avoid month-end stresses and delays. That’s why our solution integrates with multiple accounting sys tems and ERPs.

RELEASED IMPORTANT UP DATES FOR CGT WORKSHEETS.

Cost base

Work out a cost base of an asset by split ting its costs into 5 elements. Please note that since now Capital proceeds is the amount of money received as a result of a CGT event.

Main residence exemption

Exact is a global provid er of cloud software that focuses on supporting fi nancial processes for small and medium-sized...

You can apply full or partial main residence exemption. In order to apply the exemption use the Less main residence exemption field.

Please note, you have to calculate the ex emption amount manually.

By Laura Tien

Find out more Planning allow seamless data trans fer from Payhawk to your preferred accounting sys tem.At Payhawk, we go to great lengths to ensure that accounting funda mentals are adhered to in every integration. We understand that custom ers need to manage and automate the data be tween Payhawk and their

Easier than

Exemption or rollover code

Read more

Now you can select multiple exemption or rollover codes directly on a worksheet.

Help Clients

AND SQUARE HAVE EX TENDED THEIR PARTNERSHIP TO LAUNCH THE SQUARE POINT OF SALE INTEGRATION WITH SAGE AC COUNTING.

ARE YOU LOOKING FORWARD TO THE NEW FISCAL YEAR? THE GLOOM OF COVID HAS PASSED, AND IT'S A FAVOURABLE TIME FOR BUSINESS DEVELOPMENT. adjust quan tities or modify pricing.

This follows the successful rollout of a range of Square accounting said Pedram sales and settlements tions reconciliation multiple payment types to of and easily allocate sync your books in histor ical by back syncing in just a few

Set a customer-facing...

HattyCreativeBethanyCommunicationsPartnerships:DirectorWesleyManagingHassallEditor:CornellofStrategicAlexNewsonManager:FulksAssistant:Morton

XU Biweekly | No. 392 Saturday 24 September 2022

management tool inte grates with your account ing system or Enterprise Resource

(ERP). And these integrations

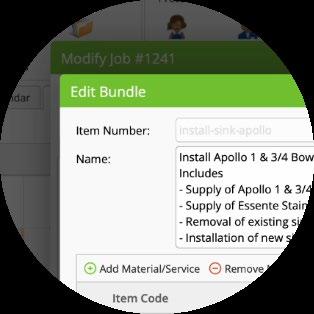

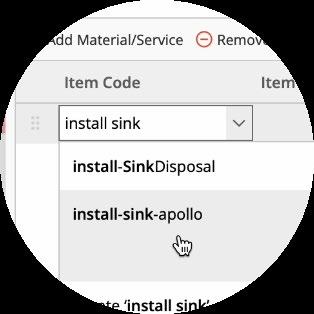

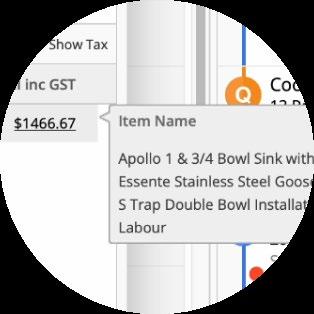

WE UN DERSTAND YOU WANT TO MAINTAIN CONTROL OVER YOUR COMPANY'S PROFITABILITY, WHICH IS WHY OUR MAY RELEASE INCLUDES SIGNIFICANT IMPROVEMENTS TO INVOICE CREA TION AND BUDGETS GROUPED INTO DIFFERENTSubcontractorCATEGORIES.managementintroducedtobudgets We understand you need to handle different subcontractors in your daily projects, so we made significant chang es to the budget planning. The budget line under work breakdown is grouped into Externals, Internals and Expenses categories that allow you to keep track of individual areas as well as your gross •budget:Internals – are your internal team costs • Externals – are sub-contractor costs • Expenses – are any budgeted expens es you predict on the project such as equipment purchases Find out more NAGGING CONNECTEDNEWINTERVALPANDAXEROAPPS! ZA - Turbocharge invoice payment reminder funcrtionality with Nagging Panda's essential business tool for higher quote acceptance rates and faster payments, allowing you to see who pays on time and who doesn't. CA & US - A better way for finan cial and advisory-focused institutions to help their business owners to make better, more informed financial deci sions by leveraging real-time valuation data. BUNDLES: A NEW WAY TO STREAMLINE AND SYSTEMISE YOUR PRICING, QUOTING & IN VOICING. YOU CAN NOW ROLL SEVERAL ITEMS OF LABOUR, MATERIALS OR SERVICES INTO A PRESET ‘BUNDLE’, WITH A SINGLE DESCRIPTION FOR CLI ENTS TO SEE ON YOUR QUOTES & INVOICES. Bundles makes it easier to accurately charge for your services and systemise your pricing, while guiding your clients to focus on the value and outcomes they’re pay ing for. Save Time Systemise& Build fixed-price bundles to streamline quoting & in voicing, and systemise pric ing of your popular service components & options. Search & Add Bundles You can easily search a Bundle by number or key word (just like normal), to add them to jobs. ViewContentsBundle Hover over a Bundle to quick-view its contents, and click to open it up. Optimise per Job Make one-off changes to a Bundle to suit the job — add or delete items,

See Value

Read more

WORKSHEET UPDATES

LODGEIT

Ever Synergy Product Update – May 2022 Budgets, invoicing, SynergyCRM, document management and resource scheduling

AMAKA

automation solutions available globally. “We’re proud to be working with the team at Square as an integration partner once more,”

Afshar, CEO at Amaka. “This launch will allow even more.. Read more Square strengthens partnership with Amaka to launch Sage Accounting integration Payhawk introduces new Exact Online integration Payhawk now has a direct Exact Online integration via API. Data is automatically transferred error-free from Payhawk to Exact Online. ServiceM8 11 is all about making it easier than ever to manage your jobs, staff & customers. To help you succeed. CONNECT EBAY AND MYOB ACCOUN TRIGHT AND ESSENTIALS TO AUTO MATICALLY KEEP YOUR SALES IN SYNC AND GET PERFECTLY BALANCED BOOKS. SUPPORTS CUSTOMERS IN AUS TRALIA.Connect eBay + MYOB Connect eBay and MYOB Account Right Live or Essentials and sync sales records in minutes without having to write a single line of code. Summarised

Automatically sync your sales transac

and managing your settlements into one invoice. Easy

Sync

accounts

your choice

deposits to these accounts during reconciliation. Historical

Keep

check with our

export

your data

clicks. Find out more eBay + MYOB Integration

DON’T MISS THE NORTH’S #1 EVENT FOR ACCOUNTANCY & FINANCE EXHIBITION | EDUCATION | NETWORKING BOOK YOUR FREE TICKET WWW.ACCOUNTEX.CO.UK/MANCHESTERPRIORITYCODE A SM126 GET 8 HOURSCPD

Rebranded.Payhawk,

Launching the Open Finance Association - OFA

By Natalie Reiss

WHY

REBRAND, WHY NOW?

Payhawk launched in 2018, in Sofia, Bulgaria with two people and a laser-focussed vision: to become the world’s biggest bank without holding a single cent. Four years on, seven offices and 250 Payhawkers later, and our prod uct powers the fastest growing, multina tional companies, and we employ the top 1% of tech talent. As the first Bulgarian unicorn, it was time for our brand to level up and reflect our global reality and di rection.

“Our ambition was to bring our strong enterprise-product DNA into the pay ments world. We saw an opportunity to converge multiple market categories into a single experience for finance teams. And as we have been building and grow ing our vision, we see that the multina tional companies with a growth mentality have been the best customers for us.” — Hristo Borisov, CEO of Payhawk

Mission: Building the technology around business payments to navigate change,

Vision:together.Toprovide the world’s first seamless payment experience trusted by businesses.Purpose: Helping businesses achieve their full potential in a constantly chang ing environment.

A brand is not a logo

A brand is not a logo. I repeat this as often as I can before people’s eyes start to close and here’s why. Branding is about your intentions, your purpose, and the ex perience you provide. Yes, there are tech purists who will argue that objective val ue supersedes subjective value, but we need only to look at Steve Jobs’ legacy to see that tech is not that black and white.

It can be challenging to develop an emotionally-resonant brand for a prod uct-led company, but ultimately, your ex perience of the product matters, and that experience doesn’t start when you use...

Keep reading

How it started vs how it's going?!

By Trent McLaren

PROGRESS

PICTURE FROM WEEL'S LAST XEROCON TO NOW!

Back in 2019, Weel (Pre viously DiviPay) was award emerging app partner of the year.In 2022, we were listed as a Xerocon event partner

and some would say their fa vourite new app of the year!

We absolutely CRUSHED IT THIS WEEK!

It was great to meet part ners in the flesh again, amaz ing to unveil the new brand, and so so good to show off the product in all it's sleek glory!

We had a lot of "Wows!" and alot of "How have I not heard about this before?"

We easily spoke to nearly 600 accountants and book keepers over the last 2 days. I'm sore, very tired and cannot wait to have a...

Read more

CREZCO

IS EXCITED TO ANNOUNCE OUR MEMBERSHIP IN THE NEWLY LAUNCHED OPEN FINANCE ASSOCI ATION - OFA.

OFA is dedicated to furthering open fi nance in the UK and EU, empowering con sumers and businesses to make better use of their financial data and payments. We believe secure, open APIs (application programming interfaces) are key to compe tition and innovation in this space.

What is open finance?

Open finance is the next step in the evo lution of open banking. By bringing the ben efits of open banking to a broader array of financial products, open finance will give consumers and businesses greater control and visibility of their economic lives.

Why launch OFA now?

Policy discussions about open finance are well underway...

Read more

MAKE BUILDING YOUR

PLAN A BREEZE WITH DYNAMIC PLANNING

Warren Renden, Head of CAS 360 at BGL, said: “We developed CAS 360 to be the complete tool for managing company compliance requirements. This new train ing course will give participants an over view of company secretary duties, so they may better grasp their roles and respon sibilities.”

BGL’s Company Secretary 101: A Begin ner’s Guide live online training course is ideal for new ASIC registered agents...

Find out more

FIGURED

IS DELIGHTED TO INTRO DUCE THEIR NEWEST FEATURE, DY NAMIC PLANNING, USING THE AUTO CALCULATION TOOL IN THE PLANNING

GRID!What is dynamic planning?

Dynamic planning is a new way to enter transactions in your Planning grid by allow ing you to use existing on-farm metrics in Figured to automatically calculate your plan for the year - instead of manually inputting values

Withcell-by-cell.dynamicplanning, you’ll now have the ability to forecast dollar values in your Planning grid as a percentage of other ac count codes and even on a per hectare, per KgMS, per stock unit or per head basis, mak ing building your plan a breeze!

This also means that as your on-farm metrics change throughout the season, your forecast will dynamically change each month along with them.

How do I get started?

Dynamic planning is live on Figured now and ready to use. If you’d like to read a stepby-step guide on how to use dynamic plan ning, check out our handy help article.

Find out more to a company secretary role find their feet in a complex and ever-changing compliance landscape,” said Ron Lesh, BGL’s Manag ing Director. “BGL has over 30 years of experience in the corporate compliance space and has developed this course to share its knowledge and expertise with the community and help pave the way for the next generation of company secretaries and administrators”.

MANY TIMES A DAY DO YOU OPEN UP YOUR WHATSAPP OR FACEBOOK MESSENGER TO SEND A QUICK MESSAGE? IF YOU ARE LIKE THE AVERAGE ACCOUNTANT, IT IS PROBABLY A LOT! HOWEVER, YOU PROBABLY AREN’T USING THESE CASUAL CHAT APPS TO DIS CUSS SENSITIVE FINANCIAL MATTERS.

THOW

Chat apps have become the preferred means of communication to cut through email clutter and to get quicker responses from clients but they bring huge risks. Pri marily they aren’t GDPR compliant or audit trail secure. Yet, because these regulations are so complex, many accountants aren’t aware that they are exposing both them selves and their firms to liability by using common chat apps (and other software).

Seeing this as a critical industry problem, Timworks has broken down the often...

Keep reading

Payhawk launched in in Bulgaria with two people and a laser-focussed vision. Now it’s time for our Brand to level up and reflect our global reality.

News & UpdatesXU Biweekly | No. 394 Saturday 24 September 2022

BGL offers FREE corporate compliance training XBGL CORPORATE SOLUTIONS, AUSTRALIA'S LEADING PROVID ER OF SMSF, INVESTMENT PORT FOLIO AND COMPANY COMPLIANCE MANAGEMENT SOFTWARE, IS PROUD TO OFFER FREE CORPORATE COMPLI ANCE TRAINING FOR ASIC REGISTERED AGENTS, ACCOUNTANTS AND ADMINIS TRATORS. “We’re excited to offer this free live training course to help those new

2018,

Accountants using WhatsApp - Yikes!

Register

Register

Now

SPOTTEDLINKEDINON

Prioritising the mental health and well-being of credit controllers and debt collectors

By Sonia Dorais

By Sonia Dorais

Payhawk opens New York office and launches US credit card

CONTROLLERS AND DEBT COLLECTORS ARE OFTEN THE UNSUNG HEROES OF THE BUSI NESS WORLD. THEY WORK HARD TO ENSURE THAT BUSINESSES GET PAID ON TIME, AND THEY PLAY A VITAL ROLE IN ENSURING THAT COMPANIES STAY AFLOAT.

CREDIT

However, their jobs can be extremely stressful, and it is important to make sure that their mental health and well-being are taken into account.

In this blog post, we'll look at how cur rent economic conditions are affecting credit controllers and debt collectors, and how businesses can help to support their employees.

The impact of current economic instability

In the wake of the COVID-19 pandem ic, many businesses have been forced to close their doors, and this has had a knock-on effect on the economy as a whole. This has left many people out of work, and it has put a strain on the financ es of those who are still employed.

This economic instability has had a sig nificant impact on credit controllers and debt collectors. With more people strug gling to make ends meet, there has been an increase in the number of people and businesses defaulting on their debts. This means that credit controllers and debt collectors are often working with custom ers who are experiencing financial difficul ties.This can be a difficult and stressful job, as they may be dealing with customers who are angry or upset about their sit uation. They may also have to deal with threats or abuse from debtors who are struggling to pay their debts. It is impor tant that businesses recognise the chal lenges that their employees are facing, and provide support where possible.

Read more

By Trish Toovey

EUROPEAN-BORN

• In response to market demands, and with more than 10% of its customer base al ready subscribed to a waiting list, the company launches its first credit card product in the US

• The US credit cards will run alongside its existing cards in the UK and Europe to support global scaleups in 32 countries

• The entry into the US market comes off the back of a record year of growth for Payhawk, in which revenue has grown by over 520%, and employee headcount by over Payhawk,250%the

spend management solution with a presence across the UK and Europe, officially launches in the US today. The uni corn has opened an office in New York and is introducing a US credit card to support companies with multiple offices across the UK, Europe, and the US. The US launch is a key part of Payhawk’s expansion strategy, following a record year of growth that has seen its revenue grow 524%, and its employ ee headcount grow 250%, year to date.

The transatlantic expansion means that not only is Payhawk’s spend management solution now available to US customers, but by offering a mix of credit cards and debit cards, it becomes the first and only business in the space to offer the most prominent card types in each market. This enables fi nance teams to use a single spend manage ment solution across different continents. With more than 2.6m businesses with over 100 employees across the UK, Europe, and...

Find out more

Mark Holton Joins Jazoodle As Board Advisor

By Andrew Paton Smith

Mark Holton Joins Jazoodle As Board Advisor

By Andrew Paton Smith

JAZOODLE

IS DELIGHTED TO AN NOUNCE THE APPOINTMENT OF MARK HOLTON AS BOARD AD VISOR TO JAZOODLE’S EXISTING EX ECUTIVE TEAM AND BOARD. MARK IS A COMPANY DIRECTOR, CHAIRMAN, AND CO FOUNDER OF SMITHINK, A SPECIALIST ACCOUNTING PRACTICE BUSINESS ADVISOR. MARK BRINGS 35 YEARS SUCCESSFUL BUSINESS EXPE RIENCE TO JAZOODLE.

“We are absolutely thrilled to have Mark on board with us, and advise on our growth plans as we expand our platform to the accounting and advisory industry.”

Commented Andrew Paton-Smith, co founder and CEO of Jazoodle.

“Mark’s insights within the industry, along with his critical thinking, experi ence, and the collaboration opportuni ties we have is almost unparalleled. He is a huge advocate of the currently evolv ing accountancy business model, and the opportunities this will bring with the utilisation of modern, scalable, and high ly efficient technology. ”

For Jazoodle, the appointment is key in preparation for its scaling plans with a great strategic fit all round.

Mark Holton is a highly respected fig ure within the accounting and practice advisory industry and is delighted with this latest collaboration.

"Jazoodle is an exciting platform, de livering economic and scalable client performance insights to accountants and business advisors. For me, this is a...

Keep reading

FINTECH PAYHAWK INTRODUCES ITS LEADING SPEND MANAGEMENT SOLUTION TO THE US MARKET TO SUPPORT GLOBAL SCALEUPS AND ENTERPRISES WITH OFFICES IN MUL TIPLE COUNTRIES

European-born fintech Payhawk launches US office and credit card to a leading global spend management solution for growing businesses and Enterprises.

COMING UP SOON

News & UpdatesXU Biweekly | No. 396 Saturday 24 September 2022

ClassifiedsXU Biweekly | No. 39 Saturday 24 September 2022 7 Try for FREE! Automated Data Entry. SmarterEasierBooks.Lives. The #1 tool to get your financial documents approved on time www.approvalmax.com Accountant Tools Bills & Expenses Cloud FinancialDebtorIntegratorsTrackingServicesInventory FOR BUILDERS JOB MANAGEMENT www.nextminute.com www.qicworks.comERPSolutionforEngineering,Construction&SiteInstallers It’s a match made in heaven. Start your FREE workflowmax.com/xerotrial: Invoices & OutsourcingJobs Payments We pay so the planet won’t. CarbonPay.io New cloudpayroll.com.auipayroll.co.nzAustraliaZealand Never quest on where your team s aga n w th LeaveCal Xero s top rated leave & hybrid work ca endar S g p t d y @ f t INVOICE AUTOMATION Join the Line-Item Revolution! burdi.com.au If the only update your so tware gets each year is price, it could be time to wolterskluwer.co.uk/switchswitch Year End magazine The independent magazine for Xero users, by Xero users ISSUE32 COVER STORY Isn’t life strange? Not a pilot, dancer, or a #IWantToBeAnAccountantfootballer...An Accountant! Xero PLUS MORELOADSFROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES AnAccountant#IWantToBe OUTISSUENOW:32 XU Subscribe to our mailing list and never miss an issue! Hub Subscribe 9 Daily The latest news from all connectedfavouriteyourXeroapps 9 Every fortnight XU Biweekly 9 Quarterly XU Magazine Payroll & HR BUSINESS FINANCE MADE EASY marketfinance.com You could be this happy with us on your side su tef les com All-in-one invoice processing www.zaharasoftware.com A smarter way to collect, convert and manage payments globally. Find out more at worldfirst.com Forecasting power in the cloud castawayforecasting.com/XU Powerful Integrated 3-way Modelling Reporting

IT’S

Joe: “Throughout Xerocon, we spoke about purpose, partnership and continuing to drive innovation. But what really stood out to me within these conversations is the importance of community. It’s clear that together, we’re committed to collaborating in order to keep improving –which is pretty special.”

Bridget: “I thought about our purpose – to make life better for small businesses, their advisors, and commu nities around the world – and asked myself, what does this actually mean? What brought it home were the re al-life stories I heard at Xerocon. For instance, we have a customer in the trucking industry who has digitised their logbooks so their drivers can spend less time on manual, written entries and get home to have dinner with their families. This is just one (of many) examples that shows us what an amazing opportunity we have to guide small businesses into a more digital, efficient and productive future – all so they focus on what’s most important in life.”.

Why is Xerocon such a special event, and what does it mean to our community?

Will: “I’ve been with Xero for seven years now and have been lucky enough to spend a lot of that time in Canada and the US. But there’s nothing like coming home to fa miliar faces. So what’s been most special about Xerocon for me is seeing people smiling from ear to ear. I walked the expo floor and witnessed how everyone interacted, sharing stories and learnings. And it reignited a desire for us, at Xero, to do more of that. Moving forward, I’m excited to be more outward facing – working alongside our partners to help their clients get the most out of being a connected business and enjoying the experience along the way.”

What gives you a sense of hope and opti mism from Xerocon?

Koren: “There are so many reasons to be optimistic about what lies ahead, and Xerocon was a real testa ment to this. What stood out to me is that everybody – especially our partners from Asia, who contended with complex travel requirements from visas and in some cases, quarantine to get to Sydney – made a huge effort to show up. It speaks volumes about their commitment to our partnership. This camaraderie between Xero and our community fuels a sense of hope that we can make a real difference – not just in Asia and APAC, but across the globe.”

Find out more

By Amaya Woods

XEROCON

SYDNEY IS THE ANNUAL GLOB AL CONFERENCE HELD BY THE LEADING GLOBAL CLOUD ACCOUNT ING PLATFORM, XERO. IT'S THE LARGEST EVENT OF ITS KIND FOR ACCOUNT ANTS AND BOOKKEEPERS ACROSS AUSTRALIA, NEW ZEALAND, AND ASIA.

Xerocon provides an op portunity for accountants and bookkeepers to see the latest and greatest in Xero technology, apps and attend inspiring talks from industry experts.Coined the 'Coachella for accountants', Xerocon Syd ney certainly lived up to its reputation this year. See highlights from the event for leading accountants and bookkeepers.Afterexhibiting at Xero con London in July and then Xerocon New Orleans in August - our next stop was

Sydney! Chaser has inte grated with the Xero cloud accounting platform since we launched in 2014 - so the Xero community is close to ourOverhearts.3,000 attendees were registered for this year's Sydney event- one of the largest to date. The twoday event provided keynote speakers across multiple stages, updates on the latest industry trends, and talks from Xero's CEO Steve Va mos. See highlights from the two-day event below.

Highlights from Xero con Sydney 2022: Day one

Chaser team members Krissie and Amaya set up at stand E14 ready to discuss all things accounts receiva bles with Xerocon Sydney...

Find out more

BEEN EXACTLY TWO WEEKS TODAY SINCE XEROCON SYDNEY KICKED OFF, AND IT’S SAFE TO SAY WE’RE STILL BUZZING FROM THE EXPERIENCE. IN CASE YOU MISSED IT, WE WRAPPED THE EVENT WITH A SPECIAL SIGN-OFF FROM OUR APAC LEAD ERSHIP TEAM. JOSEPH LYONS, MANAGING DIRECTOR FOR APAC, TOOK TO THE MAIN STAGE WITH WILL BUCKLEY, KOREN WINES AND BRIDGET SNELLING – OUR COUNTRY MANAGERS FOR AUSTRALIA, ASIA AND NEW ZEALAND, RESPECTIVELY. THEY SHARED THEIR HIGHLIGHTS, REFLECTIONS AND ALL-AROUND GRATITUDE TO OUR COMMUNITY FOR MAKING XERO CON 2022 ONE TO REMEMBER. READ ON TO HEAR WHAT THEY HAD TO SAY.

Tell us, what are your biggest takeaways from Xerocon Sydney?

David CEO of

EventsXU Biweekly | No. 398 Saturday 24 September 2022

THE XU TEAM HIT UP THE ACCOUNTING & FINANCE SHOW SINGAPORE WATCH A WEBINARFREEONTHEXUHUB!

Hassall,

XU MagazineLISTENon TO...

Xerocon Sydney: Reflections from our APAC leadership team

needs to be translated into a language your clients can understand.

Nikki Adams, joint MD, Ad Valore

As a child, what did you want to be when you grew up?

I had no idea what I wanted to be, and if you’d have told me when I was at school what I’m doing now I wouldn’t believe you. I was very shy but heavily influ enced by my father, who was a business and systems analyst, and my first ‘boss’ who was a very charismat ic accountancy recruitment entrepreneur.

Where had that got to during your later studies (or not, as the case may be)?

I learnt on the job, leav ing school after A-Levels and going straight into the workplace. Since then, I’ve been very keen to learn con tinuously. I read avidly and have mentors both inside and outside the accountan cy profession.

When did you move into accountancy; why, and how?

I started in an accountan cy recruitment company at the age of 19, being given responsibility (directorship) very early running a finance team for a fast-growing company, and learning firsthand how hard it is to get a company from start-up to £6m and then being part of an MBO. After a career in London, I then had a fam ily and joined my husband in building an accountancy firm of our own.

How important is ac counting in your role – and how has being an account ant helped you develop in your career and as a per son?

Accounting has been the core of everything for me for most of my working life either directly in my role or now it is the industry our company is centred around. Working in another industry and in general practice, has given me incredible insight into what a business own er needs to know to build a successful business.

Business strategy, risk management, credit/cash management, pricing, peo ple management, economic factors, geo-politics, busi ness analytics, technology integration, requirements for R&D/innovation grant fund ing, change management, marketing strategy, net working skills, presentation skills, public speaking... the list is almost endless of what I’ve learnt along the way!

The driver for me is work ing with micro and small...

Find out more

Cover Story This article is #IWantToBeAnAccountant storyShareyourwithus SHARESTORY!YOUR What did you want to be when you grew up? #IWantToBeAnAccountant Share your photos with us When Igrow up...#IWantToBeAnAccountant ISN’T LIFE STRANGE? NOT A PILOT, DANCER OR A FOOTBALLER... AN ACCOUNTANT!

WE

How to future-proof your accounts payable process for a looming recession

By Drew Murrary

WHAT ARE SMES DOING TO SE CURE THEIR FI NANCES?

The daunting topic of in flation and a potential re cession is starting to make SMEs consider how they can secure their financial opera tions for the future.

Xero offers its clients accounting and pay roll solutions however it may not meet all businesses payroll requirements. It is criti cal to understand what add-on options you have with Xero when your clients come to you as their trusted advisor for advice on a payroll solution to best suit their business needs.CloudPayroll is assisting current Xero pay roll clients when they require more detailed tracking of costs over multiple tracking cat egories. As well as better reporting capabili

ties, an ability to restrict user access, and im mediate phone support. Or their employee head count reaches 200, meaning Xero can no longer support their payroll so they must find another solution and often quickly.

If your clients are maintaining various ex cel spreadsheets or manually entering hours into Xero these are two good indicators that there may be a better, more time effective payroll solution for them to consider.

It is imperative that businesses can elec tronically store and quickly access employee records. With CloudPayroll your clients can upload documents within their payroll or alternatively integrate with an existing HR solution making it easier to find documents at anytime from anywhere.

CloudPayroll has seamless integration with Xero, various HR, rostering and time...

Keep reading

Various factors such as Brexit and the cost of living crisis are impacting daily operations and supply chain management. SMEs are find ing it more challenging to control their costs and plan ahead for business growth. Businesses using Xero are already off to a great start, as they’re able to manage finances in real time using a cloud-based accounting software suited to the mod ern

However,business. for times like these, businesses are look ing to make the most out of their finance systems by choosing accounts payable automation software that helps them to take control onHerecosts.are a few features of AP automation that Za hara recommends for fu ture-proofing your process es:

Spend control using purchaseapprovalsorder

For SMEs, every penny counts when it comes to budgeting, and spending can quite quickly get out of hand if there aren’t pro cesses in place to control it. Zahara controls spending by giving finance managers the power to predetermine budgets for each depart ment and project and even makes these budgets ad aptable throughout the year, accounting for your typical busy periods. It’s up to you whether these budgets en force a hard stop on raising new orders, or simply offer a subtle indication as to how you’re doing against your

targeted project spend.

The importance of securing your accounts payable process in today’s economy with ZaharaBUILD YOUR PAYROLL ECO-SYSTEM

Many of the finance man agers I speak with will have a simple form of PO approv al in place, often involving a physical Purchase Order being rushed across the of fice & waiting for an illegible scrawl when your director is finally off their call. Whilst this method can work, it ob viously has its limitations. We believe our highly versa tile approval workflows are the perfect solution for this as approvers can review the order by app or email & give the green light in seconds...

Find out more

PAYROLL IS VERY IMPORTANT; IT CAN BE ONE OF THE LARGEST EXPENSE ITEMS ON THE PROFIT AND LOSS WITHIN A BUSINESS. YOUR CLIENTS’ EM PLOYEES EXPECT TO BE PAID ON TIME AND CORRECTLY EVERY TIME. SELECTING THE CORRECT PAYROLL SYSTEM IS ES SENTIAL.

By Joanna Cruickshank, Cloud Payroll

FeaturesXU Biweekly | No. 39 Saturday 24 September 2022 11

HAVE BEEN WORKING CLOSE LY WITH THE CPD CERTIFICA TION SERVICE TO HAVE OUR ARTICLES CPD CERTIFIED. As you read through our sister publication, XU Magazine, any article that shows the CPD Certified logo has been approved to count towards your CPD points. Claim your FREE CPD Points! XU MAGAZINE IS CPD CERTIFIED FOLLOW OUR PUBLICATION...SISTER@xumagazine@xumagazine@XUMagazine@xu_magazine

Introducing

By Katharine Yacovone

IT’S

OFFICIAL. YOU CAN NOW INVEST IN CRYPTO THROUGH YOUR REVO LUT BUSINESS ACCOUNT.

We’re not really about doing things the traditional way – and the same goes for your business assets. Now our border less financial super app is the first plat form allowing companies to buy and sell crypto in the same account where they manage their business. We think that’s prettyInterestedcool. in trying out our new cryp to offering? Read on to learn a bit more about it.

What is Crypto for Business? You’re in the know, always... more

Let’s redefine affordable. Meet Pay Later.

By Kirsty Daniel

Lifeline for Buy Now, Pay Later Service Providers

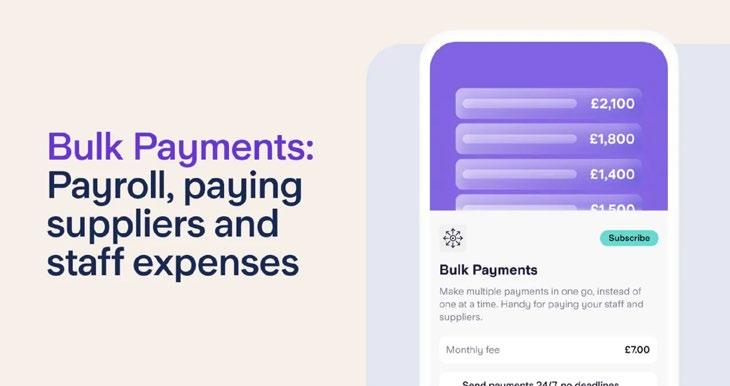

IFYOU’RE RUNNING A BUSINESS AND NEED TO MAKE SEVERAL PAYMENTS IN ONE GO, OUR BULK PAYMENTS FEATURE IS FOR YOU. IT CAN BE USED FOR PAY ROLL, REIMBURSING STAFF FOR EXPENS ES OR PAYING SUPPLIERS - PAY MULTIPLE PEOPLE THROUGH ONE SIMPLE SYSTEM.

The new Bulk Payments feature is avail able to limited companies with a Starling business account and can be accessed through our Online Banking web browser. For a limited time only, new subscribers can use Bulk Payments for free during their first month. After that, the feature costs £7 per month (VAT exempt) per business account. Bulk Payments is an optional add on, there are no monthly fees for Starling’s standard business accounts.

How bulk payments can help

The Starling Bulk Payments feature is de signed to save Starling business customers time and effort when making payments to multiple recipients.

The feature enables you to enter different amounts for each recipient and you don’t need to set them up as a payee before in cluding them in a bulk payment. Simply (but carefully!) enter payee details and the amount you want to pay them (maximum £250,000) into our .csv template. Then up load, review and confirm.

“It’s time saving and has a lower risk of er ror than entering the payment details...

Keep reading

VERIFIED

MANDATES WILL HELP MERCHANTS REDUCE FRAUD, PRO TECT REVENUE AND PROVIDE A BETTER CUSTOMER EXPERIENCE

GoCardless, a leader in direct bank pay ment solutions, has launched Verified Man dates in France. Part of the GoCardless glob al ‘bank payment’ platform, Verified...

Keep reading

WE

KNOW NOW MORE THAN EVER, IT'S IMPORTANT TO BE SMART WITH YOUR SPEND ING. SO MEET OUR LATEST WAY TO GET FINANCIAL FREEDOM, COMPLETE CONTROL AND MORE FLEXIBILITY THAN AN OLYMPIC GYMNAST. HELLO, PAY LATER.

Make a purchase, anywhere with your Revolut card, and pay in instalments. So, keep reading to find a new way to pay...

Read more

By Danny Savic

CUSTOMERS

LOVE BUY-NOW-PAYLATER (BNPL) SERVICES.

38% of 1,746 Australians surveyed by RFI Global for the Australian Finance Industry Association reported using BNPL services in the last financial year, yet the sector lost over $1 billion in 2021. Why?

High processing values carry fraud and...

Keep reading

SUMUP LAUNCHES DIGITAL WALLET WITH INTEGRATED LOYALTY SCHEME TO BOOST PORT FOR LOCAL BUSINESSES

SumUp

HSBC Ventures invests $35m in Monese

FOR

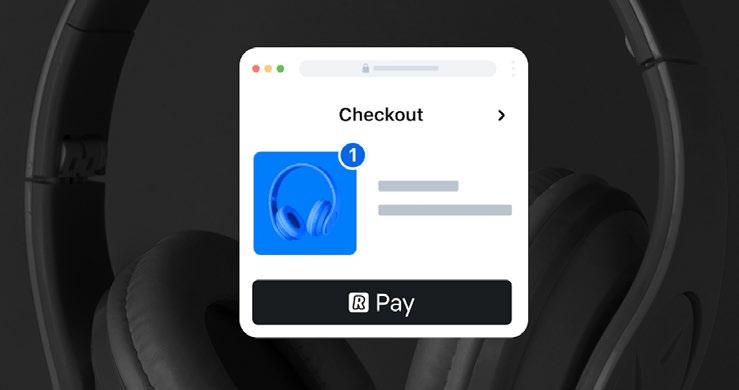

BUSINESSES THAT SELL ONLINE, CHECKOUT IS KINDA FUNCTIONAL. WE GET IT. BUT IF YOU’VE GOT BIG AMBITIONS, YOUR CHECKOUT COULD BE AN UNTAPPED RESOURCE – ESPECIALLY WHEN IT MAKES YOUR CUSTOMERS SMILE AND SAVES YOU MONEY AT THE SAME TIME.

So let’s talk about Revolut Pay…

It’s a fast, frictionless and flexible way to pay

Revolut Pay streamlines the payment pro cess for everyone. Your customers can check out in a single step, meaning they’ll want...

Find out more

MADRID

BIZUM ARRIVES AT N26.

THE ONLINE BANK HAS AN NOUNCED TODAY THAT ALL CUS TOMERS WITH A SPANISH IBAN (1) CAN NOW SEND, RECEIVE AND REQUEST MON EY THROUGH THE POPULAR MOBILE PAY MENTS SOLUTION.

In addition, the online bank's app will in corporate the Bizum functionality to pay at partner merchants in early October. Thus, N26 becomes the first neobank to integrate Bizum into its payment methods and con tinues to expand its range of services and functionalities to offer the best banking ex perience.Withthe arrival of Bizum, N26 has reached a new milestone in its unstoppable expan sion in the Spanish market. In less than five years, the neobank, the first in our country...

Find out more

SUMUP

THE FINANCIAL PARTNER FOR OVER 4 MILLION SMALL BUSINESS ES WORLDWIDE, HAS TODAY AN NOUNCED THE LAUNCH OF SUMUP PAY, THE FIRST DIGITAL WALLET THAT MAKES SHOPPING LOCALLY EASIER AND MORE REWARDING.

As the first ever direct-to-consumer of fering launched by SumUp, the SumUp Pay app offers a secure payment mechanism for consumers across Europe, and is equipped with several features designed to enhance the user experience and make everyday pur chases as seamless and convenient as possi ble. These include:

• A SumUp Pay virtual Mastercard - which can be topped up using a saved card or via bank transfer - allowing users to make remote or in-person purchases enabled...

Find out more

HOW WE’RE SHAPING THE COMMUNITY TO DELIVER WOW

ANNOUNCES A $35 MIL LION INVESTMENT BY HSBC. THE INVESTMENT BRINGS THE TOTAL RAISED BY MONESE TO $208 MILLION.

MONESE

Benefits for Insurers

Monese and HSBC are closely aligned in their commitment to opening up the full extent of digital banking possibilities. The investment is part of a broader, strategic partnership that will focus on Monese’s in dustry-leading, cloud-based Platform as a Service business.

The new funding will support the contin ued growth of Monese’s platform.

Taylan Turan, Group Head of Retail Bank ing and Strategy, Wealth and Personal Bank ing at HSBC, said: “HSBC is continually pio neering new wealth and banking innovations for our digitally-savvy customers - we want to help clients make smarter decisions so they can meet their financial goals with in novative digital tools. This new partnership is a key step towards helping us deliver dig ital wealth and banking tools at pace and scale, combining Monese’s fintech creden tials with our own global wealth and banking capabilities.”CatherineZhou, Global Head of Ventures, Digital Partnerships and Innovation at HSBC Ventures, said “HSBC is excited to invest in Monese as one of the leading fintech players in the market. Our investment will provide stronger strategic alignment and enable us to build on our strengths as partners.”

Norris Koppel, Founder and CEO of Monese, said: “Securing the support of a tier one global bank demonstrates the strength of our platform and the continued appetite from investors in the platform. I am delight ed to have such a distinguished partner and investor in HSBC, who brings a great deal of experience in delivering exceptional bank ing services. We look forward to taking this partnership forward.”

In September 2021, Monese announced...

Keep reading

GoCardless launches its first open banking-powered feature in France, built to tackle fraud

HERE AT REVOLUT, WE NEVER SET TLE, SO WE’RE ALWAYS LOOKING FOR WAYS TO IMPROVE OUR CUS TOMERS' EXPERIENCE, BE IT THROUGH OUR APP, BLOG, OR COMMUNITY. THIS YEAR, WE’VE DECIDED TO TAKE ON AN EXTRA GOAL: OFFERING YOU THE BEST COMMUNITY OUT THERE. are redesigning, and restructuring our forum environment, so you can easily share feedback, get help, and get to know new features on Revolut. You’ll be able to engage with us more effectively, and help to create

HSBC makes investment as part of strategic partnership

FinTech NewsXU Biweekly | No. 3912 Saturday 24 September 2022 Revolut Pay: checkout for businesses with big ambitions N26 becomes the first neobank to join Bizum

SUP-

expands its service offering into the B2C payments space with ‘SumUp Pay’

Crypto for Business

Read

We

products...customer-centrictruly Find out more