Xero’s flagship partner event moves to a global format

THE NEXT XEROCON

EVENT

FOR AC-

COUNTANTS

AND BOOKKEEPERS WILL BE HELD IN SYDNEY, AUSTRALIA IN AUGUST 2023

Xero announced that from 2023, Xerocon, one of the world’s premier events for cloud accounting leaders, will be presented as a global event. The event will be held in different cities across Xero’s key regions, providing more opportunities for its growing communities to connect.

Following the success of Xerocon Sydney 2022, the next Xerocon will be back in Sydney, Australia from 23-24

August 2023 at the ICC Darling Harbour. Looking ahead to 2024, Xerocon will return to the United Kingdom and the United States, and in 2025, Xerocon will make its debut in Canada and then to Australia. The full schedule, including dates and venues over the next two years, will be released in early 2023.

Xerocon is one of the world’s most inspiring and innovative in-person events for cloud accounting leaders. Accountants, bookkeepers and app partners gather for an exciting blend of industry insights, inspiring speakers and networking with a community of forward-thinking peers. It’s also

an opportunity for attendees to gain expert insight into the newest Xero tools and features to help save time, grow their business and have a greater impact on their clients’ success.

Rachael Powell, Chief Customer Officer at Xero said: “After a fantastic year reconnecting with our communities at Xerocon in London, New Orleans and Sydney this year, we’re looking forward to bringing this vibrant event back to Sydney in 2023. As the event continues to evolve, we’re excited to be moving to the next phase for our highly anticipated Xerocons, now to be presented as global events.

“There’s something magical about connecting with our accounting and bookkeeping and app partners and experiencing the energy. Xerocon is also our chance to share how we’re delivering on our purpose to make life better for people in small business, their advisors and communities around the world.”

More details such as venues, dates and ticket sales information will be shared in early 2023. While the events are global, the content will be tailored to different experiences and regions.

Plooto Raises $20M USD in Series B Funding

By Hamed Abbasi

NEW FUNDING WILL BE USED TO CAPITALIZE ON PLOOTO’S GROWTH MOMENTUM AND CUSTOMER BASE BY SCALING THE TEAM AND EXPANDING PRODUCT CAPABILITIES.

Plooto, a leader in end-toend accounts payable and accounts receivable (AP/ AR) automation software for small to medium-sized businesses (SMBs), announced today the closing of $20M

USD ($27M CAD) in Series B funding. The all-equity round was led by Centana Growth Partners, a specialized growth equity firm that invests in the future of finance, with participation from existing investors FINTOP Capital and Luge Capital.

The funding will be used to drive customer expansion, introduce new product lines, ramp up hiring and help Plooto customize its offering for more businesses,

Accounting and Bookkeeping firms.

”Our vision, since inception, has been to enable the advancement of entrepreneurs to reach their full potential without being bogged down by cumbersome and inefficient financial processes,” said Hamed Abbasi, CEO and co-founder of Plooto. “By expanding our platform’s automation, workflows and payment capabilities, Plooto has become the mission control for

THE FINAL ISSUE OF 2022

Keep reading READ ALL ABOUT IT

managing cashflow end-toend.”

Small businesses in Canada employ 10.3 million people and contribute to 40% of the gross domestic product (GDP). In the United States, small businesses employ over 61 million people and contribute to 43.5% of the GDP. At the same time, poor cashflow management is the largest cause of failure for small businesses. Less than...

Find out more

Biweekly Saturday 17 December 2022 | No. 45

Saturday 17 December

P11 XU

The independent news source for Xero users, by Xero users

2022

P12

P12

FROM US

AT XU

HAPPY HOLIDAYS

ALL

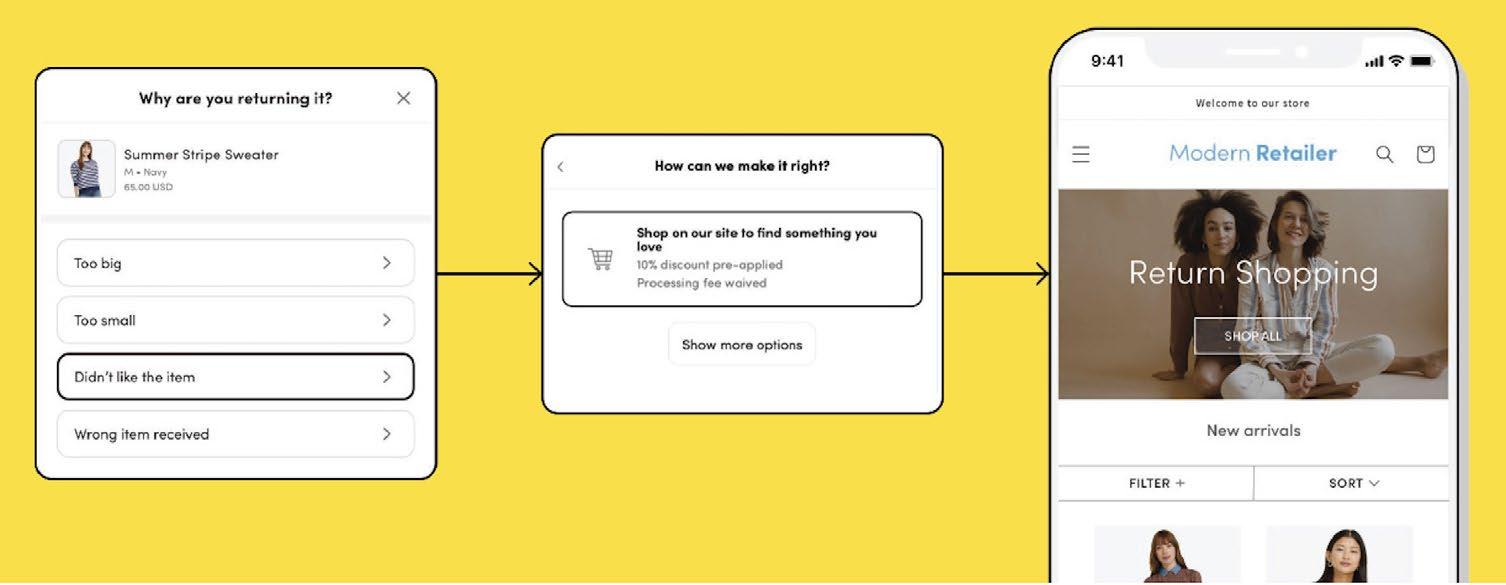

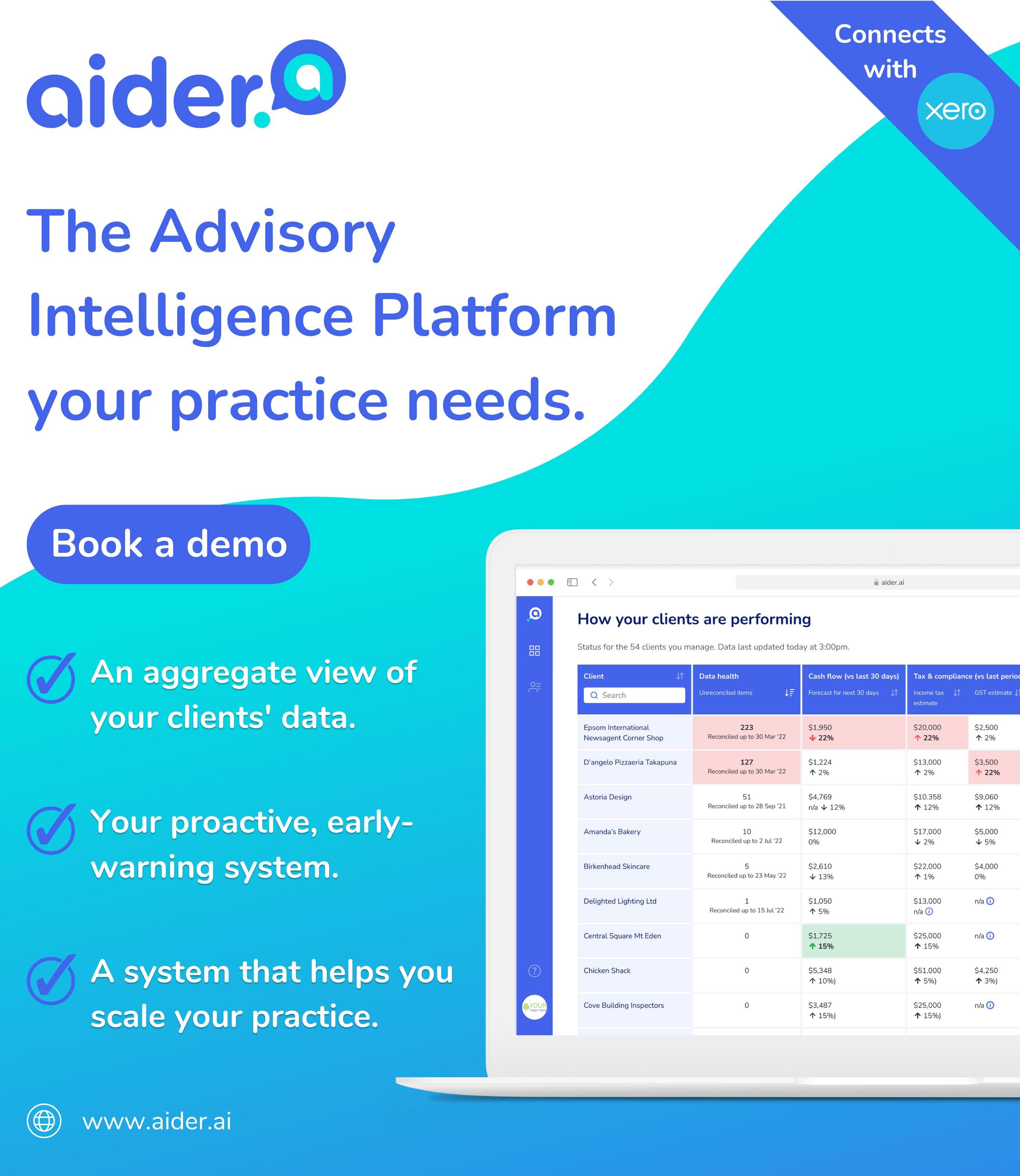

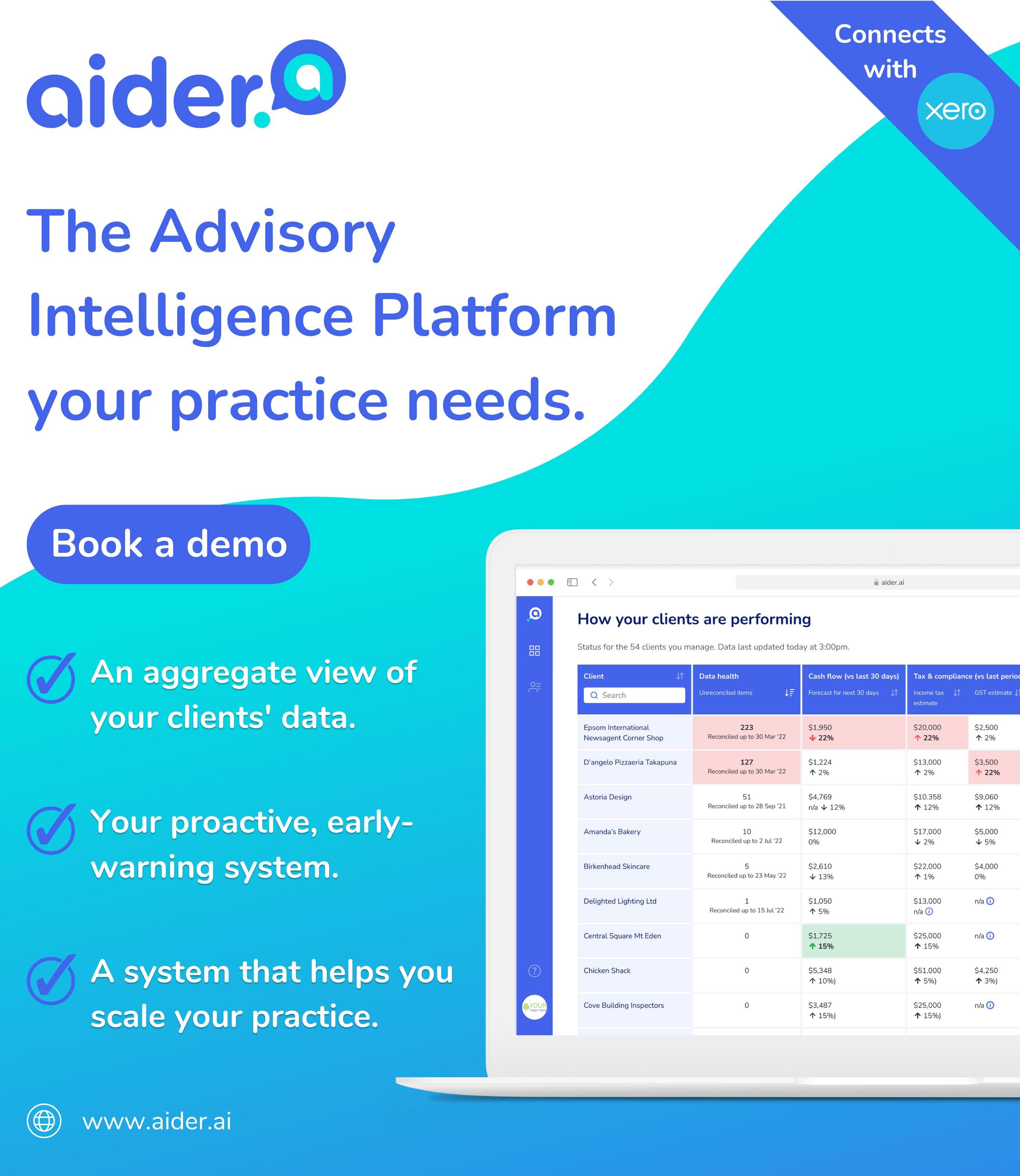

AIDER’S NEW DATA COMPLIANCE FEA-

We've made it easier to monitor more of the data checks you normally do to bring your clients' files to a more complete and accurate state, starting with a checklist for GST reporting. Now

XU BIWEEKLY - No.

& ACCURATE STATE

you can easily spot incomplete tasks and record-keeping anomalies that require your attention.

With this update, you can feel more in control, knowing that you don’t have to dig around Xero files for hours trying to identify issues across your entire client base. We're doing the legwork so that you can spend less time on admin, and more time focusing on correcting data issues and advising your clients.

Here’s how Aider’s “Data Compliance” feature has improved:

Via the new and improved “Data Compliance” tab in Aider, you can now monitor more data checks – including the following:

• Unreconciled items, Balance Sheet vs. GST returns, Bank Statement Balances vs. Balances in Xero, overdue invoices &...

Keep reading

Dext is releasing an endto-end MTD ITSA solution

ON DECEMBER 5 2022, THE FIRST RELEASE WILL BE AVAILABLE TO EXISTING DEXT PREPARE CUSTOMERS AS PART OF THE DEXT PREPARE PRODUCT. IN EARLY 2023, WE WILL MAKE THE MTD ITSA SOLUTION AVAILABLE TO THE WIDER MARKET. DEXT’S SOLUTION WILL INCLUDE THE OPTION TO SUBMIT DIRECTLY TO HMRC ON BEHALF OF SELF-EMPLOYED AND LANDLORD CLIENTS.

Dext has always strived to deliver a suite of bookkeeping efficiency tools that allows accountants and bookkeepers to manage the demands of modern-day accounting. Now, as we approach a landmark moment in HMRC legislation, Dext is determined to continue that promise by supporting firms (and their clients) with a best-in-class product for MTD ITSA.

PROUD TO ANNOUNCE THE RELEASE OF THE ELECTRONIC LODGMENT OF THE COMPANY TAX RETURN IN ITS INVESTMENT PORTFOLIO SOFTWARE SOLUTION, SIMPLE INVEST 360.

"This is a fantastic achievement and another industry first for the Simple Invest 360 product team, and I am incredibly proud of them," said Ron Lesh, BGL's Managing Director.

"With the ATO's approval, BGL clients can now prepare and electronically lodge the 2022 Company Tax Return in Simple Invest 360, streamlining their compliance workflow."

Hassall

Managing Editor: Wesley Cornell Director of Strategic Partnerships: Alex Newson Design & Communications Manager: Bethany Fulks Creative Assistant: Hebe Vermeulen

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2022. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

THIS NEW AUTOMATIONS FEATURE WILL ALLOW USERS TO CREATE WORKFLOWS IN THECRM, REMOVING THE NEED FOR DATA INPUT AND REPETITIVE TASKS, ALLOWING BUSINESSES TO STREAMLINE THEIR PROCESSES AND IMPROVE PRODUCTIVITY.

The no-code Automations use a simple graphical interface, rather than traditional computer coding, allowing users to create automated workflows for their business regardless of their technical ability.

Really Simple Systems’ founder and CEO, John Paterson, commented"I'm genuinely excited about the launch of our workflow automation software. It will open up a whole new level of functionality for our customers, and takes the Really Simple Systems features set up to a level that was previously only provided by competitors costing ten times as much."

Workflow automations can be used for a wide variety of processes in theCRM, saving time, minimising human error, reducing costs and increasing efficiency. Additionally,

users will also be able to automate their marketing activity with automated campaigns and lead scoring.

Helen Armour, Really Simple Systems’ General Manager, added “Customers who are new to workflow automations are in for a big surprise, it will literally change their life!

If you are looking to run campaigns using marketing automation, then our new workflow automation tools mean you can automate who receives which messages and score each new lead according to their activity. It really is a game changer!”

The feature is available to those on the Professional and EnterprisePlans, with the option to add this feature to other plans if required.

Really Simple Systems’ customer, Joanne Moss of Australian SweeperCompany, remarked “We’ve been one of the first companies to use the new automations feature in our CRM and already we are seeing the benefits. We keep thinking of more ways to use it which is making us increasingly efficient.”

Find out more

From 5 December, the Dext MTD ITSA solution will be available to all existing Dext Prepare customers in the Dext product. Those that aren’t a Dext...

Read more

By Alex Hoffman

KEEPING TRACK OF ALL OF YOUR CUSTOMERS AND PRODUCTS CAN BE TRICKY. PERHAPS IT WOULD MAKE MORE SENSE TO DIVIDE AND CONQUER AMONG DIFFERENT MEMBERS OF YOUR TEAM BY ASSIGNING ACCOUNT MANAGERS OR SPECIFIC LOCATIONS? OR MAYBE YOU'D LIKE TO HIGHLIGHT HIGH VALUE PRODUCTS SO THAT YOU ARE ALWAYS AWARE OF HOW THEIR SALES ARE GOING AND WHAT YOUR STOCK LEVELS ARE LOOKING LIKE? EITHER WAY, SYFT'S TAGS CAN HELP.

Our latest instalment of paperless file dividers, a.k.a tags, is here. The Customers and Products tables under Analyze now include tags to help you categorize your sales data in a way that makes sense to you.

Using tags for customers

You can now assign account managers, locations, or value labels to customer data with customer tags. How this works:

• Account manager: Assign account managers to each customer to track the sales performance per manager.

• Location: Use location tags to group your sales data by region - either globally (e.g. UK) or regionally (e.g. New York).

• Value: Tags such as "High value" or "VIP" help you keep track of the behavior of...

Keep reading

This latest release supports the 2022 Company Annual Tax Return and associated schedules. These are populated automatically by Simple Invest 360's CGT engine. The release also includes automatically generated reports such as a Declaration of Dividends, a Dividends Paid Minute, a Directors' Report and a Dividend Statement.

Previously, clients would have had to manually create all the supporting documentation in MS Word or Excel. Andrew Paszko, Simple Invest 360 Product Manager at BGL, said: "Simple Invest 360 is in a class of its own, offering investment reporting, CGT tracking, shareholder register, dividend payment, full set of financials, accounting workpapers and now electronic lodgment of the Company Tax Return all in one user-friendly software."

Simple Invest 360 is an end-to-end investment portfolio management solution for companies, individuals and trusts. It keeps track of investments, distributes profit, provides a complete set of financial reports...

GLOBAL - PIM's purchase invoice management system automates invoice approval to help cut costs and reduce the time you spend on mundane accounting tasks, freeing you up to focus on what really matters.

UK - Give your team the flexibility, tools and advice they need to improve financial health, including access to flexible pay, real-time visibility of earnings, supermarket discounts and expert financial coaching.

BGL CORPORATE SOLUTIONS, AUSTRALIA'S LEADING PROVIDER OF SMSF, INVESTMENT PORTFOLIO AND COMPANY COMPLIANCE MANAGEMENT SOFTWARE, IS

Find

out more

you

to

45 Newsdesk: If you have any news or updates that

would like us

consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com CEO: David

New

&

XU Biweekly | No. 45 2 Saturday 17 December 2022

NEW XERO

Apps

Updates

WAGESTREAM PIMS

CONNECTED APPS!

EFFICIENCY AND REDUCE COSTS TO BETTER SERVE YOUR

ENTS, WE’VE MADE SOME IMPROVEMENTS TO AIDER’S

TO HELP YOU IMPROVE

CLI-

“DATA COMPLIANCE” TAB (PREVIOUSLY NAMED “DATA HEALTH”).

TURE UPDATE:

BRING YOUR CLIENTS’

MAKING IT EASIER TO

XERO FILES TO A MORE COMPLETE

SPOTTED ON SOCIAL

Capitalise welcomes 100 new accounting partners in November

By Ollie Maitland, Capitalise

By Ollie Maitland, Capitalise

ABIG WELCOME TO OUR NEW ACCOUNTING PARTNERS WHO JOINED CAPITALISE IN NOVEMBER.

Financial health is top of mind for #smes and accountants (as always) are helping clients to keep powering on. 50,000 clients have their credit scores and metrics tracked on Monitor by our partners and this has really scaled up this year as creditworthiness has taken centre stage. Check out more about what we offer here: https://lnkd.in/ eBiEdKfW

I'm super proud of our team to help onboard these firms and from product we've got an exciting roadmap with new client tools to help with clients look for funding coming in January too.

#funding #newyear2023 Find out more

US bosses are more Santa than Scrooge this Christmas

DESPITE ECONOMIC DIFFICULTIES, A NEW SURVEY SHOWS THAT GENEROUS US BOSSES ARE STILL PLANNING TO GIVE THEIR STAFF CHRISTMAS PARTIES, PRESENTS, OR BONUSES.

In the survey* of 2,000 workers, undertaken by Moneypenny, the leading outsourced communications company, 70% of those surveyed said that their compa-

ny will be providing a staff Christmas party this year. This beats the UK, where a similar Moneypenny survey showed that only 50% of

workers said their bosses would be providing a Christmas party.

In addition, the US survey showed that 72% of workers are being given a Christmas bonus, while 67% are expecting a company Christmas present, with some generous bosses providing a combination of Xmas parties and presents or bonuses.

This year's survey... Keep reading

International Volunteer Day: Every effort can make a difference to our environment

By Tamara Somers, Xero

By Tamara Somers, Xero

TODAY, MONDAY 5 DECEMBER, IS INTERNATIONAL VOLUNTEER DAY – A GREAT OPPORTUNITY TO REFLECT ON HOW WE ARE MAKING A DIFFERENCE IN OUR COMMUNITIES.

The global theme for this year’s International

Volunteer Day is Solidarity through volunteering. For the future of our planet, we must act together and we must act now. This is not an era to stand alone but together, in solidarity with each other.

This theme really resonates with me, as someone who is passionate about volunteering and its positive impacts. Volun -

A

MONEYPENNY

Both Ela and Stephanie

have between them been at Moneypenny in their UK offices in Wrexham (UK) for 20 years and are very much looking forward to their new

teering can come in all different shapes and sizes across the social and...

Read more

roles in the Moneypenny Atlanta offices where they will be responsible for supporting the growth and development of the business.

Moneypenny in Atlanta is expanding rapidly and is also recruiting for a new head of marketing and many other roles. Recognizing the value and importance of connecting culture and many other roles.

Find out more

News XU Biweekly | No. 45 4 Saturday 17 December 2022

IS BRINGING A LITTLE BIT OF BRITAIN TO ATLANTA BY TRANSFERRING TWO OF ITS TEAM AND CREATING A MINIWREXHAM COMMUNITY WITH THE APPOINTMENT OF ELA BAYRAKTAR AS MARKETING MANAGER AND STEPHANIE VAUGHAN JONES AS HEAD OF BUSINESS DEVELOPMENT.

bridge across the Pond

As Rob McElhenney and Ryan Reynolds bought some American spirit to Wrexham, Moneypenny brings a touch of Britishness to Atlanta

By Bridget Snelling, Xero

into several more remote communities across the country.

We visited 28 locations across Aotearoa, travelled over 7000 kms, hosted 112 events, and served over 800 coffees from our tiny home.

It’s been a whirlwind few months, and we’re feeling grateful for the opportunity to get together with so many of our partners and customers.

Reconnecting with our communities

This year was all about reconnecting in person with our partners and small business customers in their local communities. Our Xero tiny home gave us the opportunity to visit some places we haven’t previously been able to go to with bigger events, so it was awesome to get out

Over the course of this year’s roadshow, we hosted 28 partner breakfasts and 28 small business evenings. These events gave us an opportunity to dive into the latest data from Xero Small Business Insights, explore recent Xero product updates and, most importantly, catch up with one another after a long two-and-a-half years of virtual events.

Supporting local small biz along the way

Another highlight of the roadshow this year was being able to support a number of local small businesses along the way. The Xero team hosted events at local cafes, restaurants, and other venues. In total, we hosted 112 events at 33 local small businesses.

Find out more

ACCOUNTEX CANADA LAUNCH ENDORSED BY CANADIAN ACCOUNTING & FINANCE COMMUNITY

FROM THE START OF MARTIN BISSETT’S KEYNOTE ADDRESS ON DAY ONE, YOU COULD FEEL THE ANTICIPATION OF ATTENDEES IN WHAT THIS CONFERENCE MIGHT OFFER, AND ACCOUNTEX CANADA DID NOT DISAPPOINT.

With over 600 registrations and 50-plus exhibitors who attended the Metro Toronto Convention Centre in Toronto on November 30 and December 1, it was clear Accountex Canada meant business.

A LinkedIn follower shared, “Based on the interactions and solutions at the Accountex conference, some predictions have already come to pass. The event lived up to its promise to connect finance and accounting professionals looking to expand their exposure and education in the digital revolution.“

Attendance at the 34 sessions confirms this summary, with standing room only at some and appreciation expressed for information

shared at the Flash Meetings.

“We could not be more pleased with the outcome of Accountex Canada,” says General Manager Steve Dempsey. “The positive feedback has been tremendous, and we’re looking forward to creating this same energy next year at Accountex 2023!”

The buzz on the display floor during the Network Reception demonstrated that attendees and exhibitors took full advantage of the opportunity to come together.

A LinkedIn participant described the atmosphere: “You could feel the palpable energy at the conference full of conversations as thousands of professionals connected with solution providers that are part of the finance transformation ecosystem.”

The Accountex Canada Conference 2022 has built a strong foundation and created much anticipation for what is in store for 2023.

Find out more

The home of XU Magazine and XU Biweekly XU Hub is now live on Apple News! News & Events XU Biweekly | No. 45 6 Saturday 17 December 2022 WATCH A FREE WEBINAR ON THE XU HUB! David Hassall, CEO of XU Magazine on LISTEN TO...

AS THE NEW ZEALAND ROADSHOW 2022 – TINY EDITION COMES TO A CLOSE, WE REFLECT ON AN INCREDIBLE SIX MONTHS ON THE ROAD.

WATCH A FREE WEBINAR ON-DEMAND NOW WATCH

Classifieds XU Biweekly | No. 45 Saturday 17 December 2022 7 Automate your workflow Optimise your time Find out more at Dext.com Goodbye manual data entry. Hello AutoEntry. Get 3 months free The #1 tool to get your financial documents approved on time www.approvalmax.com Accountant Tools Bills & Expenses Cloud Integrators Debtor Tracking Financial Services Inventory FOR BUILDERS JOB MANAGEMENT www.nextminute.com It’s a match made in heaven. Start your FREE trial: workflowmax.com/xero Invoices & Jobs Outsourcing Other Payments Account-to-account payments seamlessly connected with Xero crezco.com New Zealand Australia ipayroll.co.nz cloudpayroll.com.au If the only update your so tware gets each year is price, it could be time to switch wolterskluwer.co.uk/switch Year End magazine The independent magazine for Xero users, by Xero users ISSUE 33 Creating a long-term practice survival plan Scaling up, scaling back, specialising and more–how to jump off the treadmill and create an amazing future Xero PLUS MORELOADS FROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES COVER STORY OUT NOW: ISSUE 33 XU Subscribe to our mailing list and never miss an issue! Hub Subscribe 9 Daily The latest news from all your favourite Xero connected apps 9 Every fortnight XU Biweekly 9 Quarterly XU Magazine Payroll & HR BUSINESS FINANCE MADE EASY marketfinance.com Zahara is the All-In-One Automation Solution A Automation OCR Approvals zaharasoftware.com Zahara tidyinternational com Powerful Software Delightfully Simple Need brick-by-brick control of your building & construction projects? TidyBuild is designed specifically for the construction industry. CONSTRUCTION MANAGEMENT A smarter way to collect, convert and manage payments globally. Find out more at worldfirst.com Forecasting power in the cloud castawayforecasting.com/XU Powerful Integrated 3-way Modelling CRM GIFT AID DONOR MANAGEMENT www.infoodle.com Reporting

By Sean Woods

THE WORLD OF ACCOUNTING IS PIVOTING WITH INCREASING GOVERNMENT REQUIREMENTS AND EVOLVING CLIENT NEEDS.

IF YOU DON’T MANAGE CHANGE IN THE COMING YEARS, CHANGE COULD MANAGE YOU—LEADING TO A CAREER FOREVER ON THE TREADMILL. TAKE CONTROL NOW AND ENSURE THE COMING YEARS ARE EVERYTHING YOU WANT THEM TO BE.

The pandemic showed how accountants are the true superheroes of the business world.

Yes, there was significant extra work. But a door was opened. As accountants performed tasks like helping clients prepare reporting to access government assistance, clients were educated about a closer relationship with an advisor they could trust.

Similarly, Making Tax Digital in the UK has indicated that client relationships can evolve as accountants focus more on additional service offerings, such as periodic financial check-ups, and less on basic compliance now that the government de-

mands technology do much of that work.

All of this is becoming the norm, rather than the exception.

In the very near future, more and more taxes will be digitalised—everything from income tax to corporation tax. Simultaneously, governments worldwide are increasing business regulation.

that’s right for everybody. But it’s wise to jump off the treadmill for just a few minutes and plan your route. The focus should be less about the specific and unique challenges. Instead, look at the ways you can navigate through the challenges in a way that will create a future perfect for you.

Scaling up, scaling down, specialising or more rad-

Scaling up

As the philosopher Alan Watts said, the only way to make sense out of change is to plunge into it, move with it, and join the dance.

For accountants, this means scaling their practice to exploit challenges in the coming years.

But while basic growth is simple—do more of what

decade, resulting in an inevitable fight to the bottom when it comes to pricing and profit. Nowadays a high street accountant competes with online services.

Providing more of the same is unlikely to be effective. Instead, fresh service offerings and increasing your practice’s understanding of client needs must be central to any plans to scale.

clients being able to cope with the increased demands of at least quarterly reports for each trade and landlord income, plus discrete end of period statements (EOPS).

And that’s before we discuss the requirements for digital record keeping and digital linking.

Clients that scribble down income and expenses as they occur, then hand this over to their accountant each January along with a bag full of receipts, are in for a huge shock.

But some accountancy practices are seizing the chance to manage this change and in doing so, they illustrate perfectly the mindset needed for practices looking to scale.

Client accounting services

You need to choose how you and your practice will fit into this new world.

The issues are the same as they ever have been: ensuring you’re relevant to clients, pricing services optimally, remaining profitable, and so forth, all while being guided by your values.

There isn’t a single path

ical options—all must be explored, and a destination selected.

And that’s perhaps the most important point. All journeys start with a single step. But less often mentioned is that all successful journeys start by choosing the best destination for you.

you’re already doing—accountancy practices have opportunities to instead evolve what they do, driven by aforementioned increasing government requirements and changing client demands.

After all, basic accounting services have become commoditised over the last

For example, Making Tax Digital for Income Tax Self Assessment (MTD ITSA) arrives in the 2024/25 tax year, with the expectation that many businesses will signup to the pilot programme ahead of time as of the 2023/24 tax year.

There remains industry-wide incredulity about

MTD ITSA’s quarterly reporting requirement in particular means some business owners and managers will need to have much more contact with their accounting.

Because of the obvious reluctance of those clients to do so, some accountancy...

Find out more

Features XU Biweekly | No. 45 8 Saturday 17 December 2022

GAME-CHANGING ADD-ON FOR THOSE WHO MAKE THE WORLD A BETTER PLACE

Clay Sandoz, the founder and owner of Wellstead Solutions described his experience with G-Accon and proved that this add-on is a game-changing tool for any business.

By Andrey Kustarnikov, G-Accon

Our app excels in integrating Google Sheets with various cloud accounting platforms. With G-Accon, you can automatically export, import, email, and refresh your data and reports. You can pull data from apps like Xero, Quickbooks, and Freshbooks; make needed changes; and send the data back to your accounting software. You can also use a variety of pre-existing flexible templates to make 50+ reports including things like Account Transactions, Purchase Orders, Profit and Loss, Income Statement, Balance Sheet, and more.

From how we’ve described it, G-Accon might sound like the perfect glue that can hold your business’ data together. However, it can be more difficult to actually visualize how G-Accon would be used in your day-today operations. That is why we’ve started this new interview series!

We firmly believe that there is a whole story behind each individual client and business. In this series, we aim to explore these stories and show how G-Accon is used today by real, thriving companies. This will allow you to reflect on your own business and think about how you could use G-Accon to streamline your operations. For this

particular magazine issue, we had the distinct pleasure of talking to Clay Sandoz, the founder and owner of Wellstead Solutions.

Wellstead Solutions is the product of Clay looking at the market, seeing a gap, and filling it himself. Wellstead Solutions is essentially a consultant company for people who want to create their own non-profit foundations. Clay saw people and businesses in the market who wanted to make the world a better place but lacked the logistical support. This is where Clay stepped in with his skillset. Now, he helps these new nonprofits with logistics by creating structure and establishing processes so that the businesses can focus less on operations and more on doing good.

“G-Accon has been crucial in allowing me to reduce my time doing something a computer can do, greatly reducing error (no copy/paste or manual entry) - all of which has allowed me to scale my business”.

Behind the scenes, mid-sized nonprofits require full-service financial operations, including donation processing, bookkeeping, accounts payable, expense reimbursements, payroll, and more. One of the biggest factors that has to be handled is processing all things donation related. This means processing physical checks, overseeing online...

Help trade clients down tools and dig into data

5 reports for financial growth

By Alan Hyland, simPRO Software

UNDERSTANDING THE OVERALL HEALTH AND FINANCIAL STATUS OF ANY BUSINESS CAN BE DIFFICULT WITHOUT THE RIGHT INSIGHTS AND REPORTS. FOR YOUR TRADE CLIENTS, DAY-TODAY TASKS INVOLVED IN RUNNING SERVICE, PROJECT AND MAINTENANCE WORK OFTEN KEEP THEM BUSY, SO THEY RARELY HAVE TIME TO LOOK AT DATA. BUT BY NOT PAYING ATTENTION TO DATA WITHIN THEIR BUSINESS, THEY ARE MISSING AN OPPORTUNITY FOR GROWTH.

Consistently dedicating time to review and manage business data enables your trade clients to identify workflow blockages, eradicate outdated information, pinpoint discrepancies in revenue and much more. As their expert advisor you can be the driving force behind this change, encouraging them to run these reports as part of their regular data analysis processes.

Whether you have clients already using simPRO, or you’re new to the software, we’ve put together the top five reports that are available in simPRO to help your trade clients take their business to the next level.

1. Price Discrepancies Report

This report helps monitor materials and supplier costs, and helps identify when your clients may need to switch suppliers to get a better price for them and their customers.

Trades clients can review individual items on supplier invoices, such as price discrepancies, applied credits and updated pricing.

2. Stock Value Report

Stocktake is a time-consuming task for many businesses. Controlling the amount, location and type of inventory is a huge job in itself, then add to it the need to regularly account for the value of materials and you’ve got a big (and frequent!) headache for the business.

The Stock Value Report helps track the value of inventory throughout the year. It displays an overview of the value of stock across all of your storage devices - including separate warehouses, work vehicles, and site locations.

Trade clients can also use the extended Report View to see the quantity and value of stock items according to

part number.

3. Job WIP Report

Not every job progresses in a straight line from start to finish, especially right now, where there are frequent fluctuations in material costs. It’s important to be able to stay on top of job progress at every stage, as timeline disruptions cut into cash flow, especially if your trade clients don’t regularly invoice.

That is where the Job WIP Report can help. It shows trades clients which jobs are partially or not yet invoiced, which helps identify issues early on so they can manage cash flow and other jobs accordingly.

4. Profit / Loss Report

Profit and loss analysis helps trades businesses assess their performance by reviewing the profit/loss status of invoiced jobs.

By evaluating profit and loss per job, you can help your trades clients understand:

• Which jobs are most profitable

• What common factor causes a loss on similar...

WE HAVE BEEN

LY WITH THE CPD CERTIFICATION SERVICE TO HAVE OUR ARTICLES CPD CERTIFIED. As you read through our sister publication, XU Magazine, any article that shows the CPD Certified logo has been approved to count towards your CPD points. Claim your FREE CPD Points! XU MAGAZINE IS CPD CERTIFIED FOLLOW OUR SISTER PUBLICATION... @xumagazine @xumagazine @XU Magazine @xu_magazine

WORKING CLOSE-

Keep

reading

IF YOU ARE A BUSINESS OWNER, G-ACCON CAN IMPROVE THE WAY YOU MANAGE YOUR COMPANY.

Find out more

Features XU Biweekly | No. 45 10 Saturday 17 December 2022

A virtual card works just like a normal debit card for payments, but it’s linked to a Saving Space in the Starling app, instead of the main account balance. Like physical cards, virtual cards have a unique card number, expiry date and CVV.

Starling customers can have up to five virtual cards at any one time and can choose a different colour for each one, free of charge. To help customers with visual impairments differentiate the cards, each colour also has a unique shape, such as a circle or triangle, in the top-right corner of the card.

Virtual cards are being rolled out to customers from today.

Better budgeting

Each virtual card is assigned to a dedicated Space in the Starling app that can be personalised to give customers more control over their budget. Payments can be made directly from a Space, such as a daily bus fare from a ‘travel’ Space or food from a ‘groceries’ Space, rather than coming out from the customer’s primary account. When the budget is used up, the virtual card will decline instead of dipping into the customer’s main balance. Spaces can be topped up any time through one-off, weekly or monthly transfers. Keep reading

Airwallex aims to accelerate growth in APAC with new Chief Revenue Officer and APAC GM

LEADING GLOBAL FINTECH PLATFORM AIRWALLEX IS EXCITED TO ANNOUNCE THAT KAI WU HAS BEEN JOINTLY APPOINTED AS THE COMPANY’S CHIEF REVENUE OFFICER (CRO) AND ASIA-PACIFIC GENERAL MANAGER (APAC GM). KAI HAS HELD A NUMBER OF SENIOR POSITIONS AT AIRWALLEX FOR CLOSE TO FIVE YEARS, INCLUDING AS CHIEF FINANCIAL OFFICER AND GREATER CHINA CEO. THESE APPOINTMENTS COME AS AIRWALLEX AIMS TO RAPIDLY ACCELERATE ITS GROWTH GLOBALLY AND IN APAC IN 2023.

In the newly created CRO role, Kai is responsible for the company’s global revenue strategy, as well as closer alignment of all revenue-related functions globally, from marketing, sales, customer success to revenue operations. As Airwallex continues to grow and expand, Kai will play a pivotal role to increase revenue growth in a scalable and sustainable manner.

In addition to his responsibility of driving the global revenue strategy, Kai’s role as APAC GM reflects expanded responsibilities for oversight of Airwallex’s business operations across the Asia-Pacific region. Kai will spearhead the company’s growth plans in the region and drive greater efficiency across the markets where Airwallex operates.

Jack Zhang, Co-founder and CEO of Airwallex, said, “Our investment in building out a senior leadership team demonstrates our continued confidence and commitment to grow the business, in APAC and globally. Having Kai take on these new roles comes at a critical juncture as we take major steps to enable the world's most powerful global financial infrastructure and operating system for modern businesses. And as more and more businesses in the region strengthen their digital and tech transformation strategy, we want to ensure Airwallex is well...

Find out more

Seamlss Integrates with Stripe Identity

GLOBAL IDENTITY TOOL, STRIPE, HELPING SEAMLSS EXPEDITE THE TRANSITION FROM PHYSICAL TO DIGITAL

While the onboarding process primarily consists of submitting the required documentation and clients granting access to business financial data, the steps firms take to ease this process through automation,

technology, and solid communication, can form the foundation for strong commercial relationships.

Implementing a software platform that addresses the client onboarding process in one go can serve as an efficient remedy to this issue. Powered by Stripe’s identification tool, Seamlss helps firms keep critical data organised and protected, while also providing a convenient way for customers

to supply sensitive information.

Stripe Identity is a self-service tool that assists businesses to obtain reliable digital identities and fighting the ongoing identification and authentication challenge. Seamlss can begin securely verifying the identities of clients in a matter of minutes—not weeks or months—with Stripe... Keep reading

By Tilly Michell

IT’S ALMOST THE END OF THE YEAR, BUT WE’RE NOT SLOWING DOWN JUST YET.

This month, we’ve got a host of new features to help you maximise Q4 sales, save on fees and gear up for 2023. Scroll to see our latest releases.

New features

Sell more, save more with American Express and Airwallex

American Express card members spend 1.2x more per transaction and 3.9x more annually on average. So accepting American Express at your checkout is a no-brainer.

The good news? You can now accept American Express with Airwallex Online Payments.

Plug Airwallex into your eCommerce store and accept payment in multiple currencies whilst cutting out needless FX fees. Offer 60+ payment methods including

American Express, Visa, Mastercard and Apple Pay. Visit the Airwallex app and click Online Payments to learn more.

Refer a friend and earn rewards

Love Airwallex? Know someone that might love us too? Then we’d like to meet them!

Refer a friend and both of you will earn money...

Read more

H1 FY23 Trading Update

WELCOME TO OUR HALF YEAR RESULTS BLOG POST WHERE WE ARE EXCITED TO GO THROUGH OUR MISSION AND FINANCIAL HIGHLIGHTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2022.

Kristo Käärmann, our CEO and co-founder, said: “Our goal today remains the same as 11 years ago when we started to make moving and managing money faster, easier, cheaper and more transparent for people and busi-

nesses around the world.

In the first half of this financial year, we got faster, hitting a key milestone with 50 percent of all transfers now instant; completed within 20 seconds. During the period we had to raise prices on some routes but we were also able to decrease fees on others. As a result, our global average fee today is 0.64% and as such we consistently remain one of the cheapest and fastest options for moving money around the world.

Our customers agree:

5.5 million customers trusted us with their money in Q2 alone, up 40% from last year. In total, we have helped move £51.3 billion for people and businesses in the past six months, an increase of 49% year over year.

But we are still solving only a fraction of the problem, and the fight for transparency and fairness must continue. In the past months we also joined the European Commission in calling on all providers to commit to full...

Fintech News XU Biweekly | No. 45 Saturday 17 December 2022 11

Virtual cards and updated Spending Insights join Starling Bank’s enhanced suite of money management tools

STARLING BANK IS INTRODUCING VIRTUAL CARDS FOR PERSONAL CURRENT ACCOUNT CUSTOMERS AND UPDATED ITS SPENDING INSIGHTS. THESE NEW FEATURES ADD TO THE BANK’S MONEY MANAGEMENT TOOLS, DESIGNED TO HELP PEOPLE TRACK THEIR SPENDING

AND PROVIDE GREATER VISIBILITY OF THEIR BUDGETS.

Find out more

cash flow. The UNIPaaS solution enables platforms to provide new, innovative, and streamlined customer experiences while offering new value propositions to their customers, such as automating and digitizing manual processes, reducing admin and errors, and assisting businesses in improving their cash flow and growth.

Capium will be able to provide its customers with embedded finance solutions through its partnership with UNIPaaS, allowing them to add financial services alongside their core software products... Find out more

WE'RE THRILLED TO ANNOUNCE THAT, IN ADDITION TO GBP AND USD, OUR UK CUSTOMERS CAN NOW OPEN REVOLUT VAULTS IN EUR! EUR VAULTS ARE NOW LIVE IN-APP, AND YOU CAN ACCESS THE FEATURE TO EARN UP TO 1.15% ON THEIR EUR SAVINGS. WE HOPE THIS WILL HELP YOU REACH YOUR SAVINGS GOALS EVEN FASTER. KACHING!

Here’s how you can maximise your savings with EUR Vaults:

Standard plans can now earn 0.90% annual interest paid daily on your EUR funds

travelers

WITH THE SURGING DEMAND OF INTERNATIONAL BUSINESS TRAVEL, LEADING GLOBAL FINTECH PLATFORM AIRWALLEX IS PARTNERING WITH AGODA, A GLOBAL DIGITAL TRAVEL PLATFORM, TO MAKE TRAVEL PLANNING EASIER FOR HONG KONG SMES AND STARTUPS.

Starting today, Airwallex Hong Kong customers will be able to enjoy exclusive discounts on accommodation bookings using their Airwallex Borderless Cards.

By booking through Agoda’s platform, Hong Kong SMEs and startups with Airwallex Business Accounts can enjoy a 7% discount to book selected accommodations and Airwallex customers can enjoy 20% cashback on airfares and accommodation booking around the world, when they use Airwallex Borderless cards for their international travels during the promotion period.

Airwallex’s partnership with Agoda comes at a time when demand for travel has significantly increased over the past month, as quarantine measures and travel restrictions ease. In a recent Airwallex Hong Kong SME customer survey, 84% of respondents plan to take a business trip in the next 6 months. This figure rises to 93% when asked whether they intend to take a business trip in the...

Read more

EUR Vaults are available for all UK customers. You can also upgrade to our paid plans to access higher interest rates on EUR Vaults, including 0.95% with Plus, 1.0% with Premium, and 1.15% with Metal.

Fund it your way and withdraw instantly, any time

Stash cash without worrying about commitment or fees. Choose recurring transfers or round up spare change from purchases made with your Revolut cards, so you can save money without even noticing. Just earn interest daily and withdraw money whenever you need it.

Peace of mind as you save

Sit back and save, knowing your money’s secure. Vaults are deposited with our trusted partner bank, so your funds are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Stay tuned, We’ll be rolling out Vaults to other European countries soon!

SumUp on track to become the largest Point of Sale solution provider in Europe - launches POS Lite

LONDON: GLOBAL FINANCIAL TECHNOLOGY COMPANY SUMUP HAS TODAY UNVEILED A NEW SUITE OF POS SOLUTIONS - WITH THE LAUNCH OF POS LITE IN THE UK, IRELAND, FRANCE, GERMANY AND SPAIN, ALONGSIDE THE NEW AND IMPROVED POINT OF SALE SYSTEM POS PRO.

With POS Lite the company is creating an entry-level Point of Sale product that will serve the smallest businesses. With the improved POS Pro, SumUp is expanding the product suite for businesses of all sizes, whatever their needs, building on the success of the POS solution. By merchant count,

SumUp is already on course to become the leading POS solution in Europe by the end of the year, and these new products will accelerate that pace.

SumUp co-founder Marc-Alexander Christ comments: “SumUp has consistently delivered cutting edge technology, which supports and serves the global small and nano business community. By expanding our Point of Sale solutions, SumUp continues to provide merchants with the tools they need to make a success of their business. Innovation is at our core, and SumUp is very proud to support over 4 million merchants around the world.”

POS Lite is an out-of-the-

box Point of Sale solution that will empower nano to small merchants to perform smooth over-the-counter sales with a key set of features: from registering card and cash payments, to organising the merchant’s item catalogue, tracking earnings, and much more. Unlike what the market offers today, it's ready to use straight away, comes with free pre-installed SumUp Point of Sale software, and no subscription charges. It is built entirely in-house by SumUp, based on merchant feedback: merchants with a growing business are looking for easy tools to run their business but don’t need a...

Keep reading

Revolut acquires Nobly to expand services to the hospitality sector

REVOLUT TODAY ANNOUNCED THE ACQUISITION OF HIGHLY RATED EPOS SOFTWARE PROVIDER NOBLY POS (WWW.NOBLYPOS.COM) TO EXPAND ITS OFFERING TO SERVE THE RESTAURANT AND HOSPITALITY SECTORS.

Founded in 2013, Nobly has developed a comprehensive ePOS system for the restaurant and hospitality industry enabling hospitality businesses to manage their operations with its back office app, order and inventory management systems, kitchen displays, loyalty, and online ordering (click & collect) app. Nobly currently serves

merchants across the UK, USA and Australia.

Nobly’s product is currently being integrated with Revolut’s payment hardware and Revolut’s online and offline payment processing capabilities so that Revolut will offer a fully integrated solution to empower merchants to manage their businesses and accept payments easily.

This acquisition will enable Revolut Business hospitality customers to open a digital account, use FX, issue cards and seamlessly manage and sell their products and accept payments online and offline from the single Revolut Business environment saving time and reducing direct costs for its customers.

In the future, Revolut intends to launch it’s fully integrated solution across its international footprint and expand its product capabilities to serve its wider retail customers.

Nik Storonsky, CEO of Revolut said: “The Nobly team has built a great product and expertise which will further advance our mission to offer a one stop shop solution to enable merchants of every kind to manage their finances and run their businesses from a single platform.

“Nobly’s ePOS product will enhance our existing Revolut Business offering to make life easy for...

Find out more

• Make sure you’ve got the latest version of the app

• Head to Hub > Vaults

• Create a Vault or...

Keep reading

FinTech News XU Biweekly | No. 45 12 Saturday 17 December 2022

Airwallex partners with Agoda to support Hong Kong business

SIGN UP FOR FREE XU Don’t miss the next issue! Biweekly Capium Partners With UNIPaaS to make Embedded Finance More Accessible to Accountants

CAPIUM TODAY ANNOUNCES IT HAS SELECTED UNIPAAS AS ITS EMBEDDED FINANCE SOLUTIONS PROVIDER, TO BRING THE POWER OF EMBEDDED FINANCE TO ACCOUNTANTS. Through its partnership with UNIPaaS, Capium will be able to provide its customers with a more efficient and streamlined payments experience by truly embedding payments and open banking within its suite of products to improve SMEs

now

Revolut EUR Vaults

live for UK customers

Ready to start saving towards your financial goals?

By Ollie Maitland, Capitalise

By Ollie Maitland, Capitalise

By Tamara Somers, Xero

By Tamara Somers, Xero