MarketFinance is now Kriya!

hman Brothers - collapsed, leaving me out of a job, and fuelling my desire to find new and innovative ways to help firms with their working capital needs.

The seeds that led me to co-found this company 12 years ago were planted a couple of years before, in the crash of 2008. Traditional financial institutions stopped almost all lending to small businesses, starving firms of the funding they needed to survive and grow. The bank I worked for at the time - Le-

Fast forward to today, I’m proud to lead a company that has helped businesses collect more than £20 billion in B2B payments, and advanced over £3 billion worth of credit through working capital and business loans to thousands of firms.

During this time, the market and our customers have evolved, and so has our product offering. We extended beyond offering invoice finance to providing

business loans during Covid, a time when businesses were forced to embrace digital ways of working – especially eCommerce – just to stay afloat.

With this new way of working, we see a market that’s ripe for Embedded Finance. Businesses need fast and straightforward access to credit, and Embedded Finance allows them to use these products at the point of need online.

Embedded Finance involves a complex set of interlinked steps. Suppliers can use it to authenticate...

Keep reading

THE BOARD AT LIGHTYEAR GROUP LTD IS PLEASED TO ANNOUNCE THE APPOINTMENT OF MR MICHAEL JEFFRIESS TO THE ROLE OF CHIEF EXECUTIVE OFFICER. MR JEFFRIESS IS CURRENTLY A NON-EXECUTIVE DIRECTOR AND COMPANY SECRETARY OF LIGHTYEAR GROUP.

Chairman, Director and Founder, Grant Abbott said “Michael Jeffriess brings a

wealth of experience in both the accounting and advisory industry and in c-suite roles covering off leading teams, mergers and acquisitions, and governance. Importantly Michael has vast experience in both capital raising and ASX listing”.

With Mr Jeffriess appointment the leadership structure has been updated and will see Grant Abbott, Ashleigh Jaremyn and Ben Gill report through to the CEO under their respective exec-

utive roles. Grant Abbott has been appointed to of Head of Legal, Ashleigh Jaremyn to Head of Operations, Product & development, and Ben Gill to Head of Sales and Marketing. Separate to this all four will maintain their director roles on the Board for which Mr Jeffriess will report to from an executive function.

LightYear Group has recently completed a...

BGL CORPORATE SOLUTIONS,AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF) AND INVESTMENT PORTFOLIO MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE THE PROMOTION OF DANIEL TRAMONTANA TO CHIEF EXECUTIVE OFFICER (CEO). RON LESH WILL CONTINUE IN HIS ROLE AS MANAGING DIRECTOR.

"This is a momentous moment for BGL, the team, our

clients and our community," said Ron Lesh, BGL'sManaging Director. "I am incredibly proud and excited to see Daniel step in to the CEO role on 1 January 2023."

"Daniel's contribution over his almost 26-year tenure at BGL has been incredible," continued Lesh."Starting in software support to helping BGL grow from 10 to over 200 people, Daniel has had his hand in every pie. BGL would not be where it is today without him."

"I am privileged to have worked with someone of his calibre for such a long time. I have no doubt Daniel is the

person to lead BGL into the future," said Lesh.

Daniel Tramontana joined BGL in1997 as a member of the Support Team. With a Bachelor of Computer Science &Accounting, Daniel added a new area of competency to BGL's Support and TrainingTeams. Through his time at BGL, Daniel obtained a Master's in BusinessAdministration and a Six Sigma Black Belt while performing in roles includingGeneral Manager and, most recently, Chief Operating Officer (COO).

Find out more

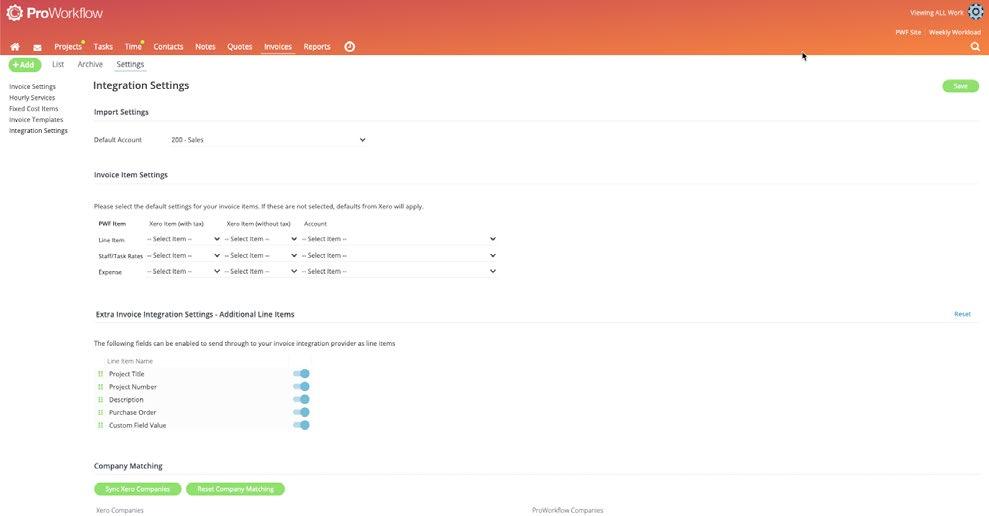

RECENTLY WE MADE A POLL OVER OUR APP AND ASKED OUR CLIENTS SOME IMPROVEMENTS THEY MIGHT LIKE TO SEE IN THE TOOL. ONE OF THE REQUESTS THAT CAME OUT OF THAT WAS AN EXPANSION OF WHAT OUR EXISTING ACCOUNTING INTEGRATIONS COULD DO. IN LINE WITH THIS REQUEST, WE HAVE EXPANDED WHAT DATA TWO OF OUR MAJOR PARTNERED ACCOUNTING PLATFORMS WILL RECEIVE.

Prior to this update, only the core information of the

XU BIWEEKLY - No. 46

Newsdesk: If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell Director of Strategic Partnerships: Alex Newson Design & Communications Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

HELLO AND HAPPY NEW YEAR! AT RECURLY, WE’VE HIT THE GROUND RUNNING AND ARE ALREADY WORKING ON NEW PRODUCT INNOVATIONS TO HELP YOU KEEP A GOOD THING GROWING IN 2023.

Before we say a final farewell to 2022, though, I wanted to take the oppor-

tunity to recap last year’s launches to make sure you didn’t miss out on any of them. With that in mind, here’s a recap of Recurly Launch releases in 2022, specifically designed to help you:

• Acquire more new customers

• Retain and grow your...

Read more

By Alex HoffmanFRAUD CAN TAKE ON MANY SHAPES - FROM MAKING FALSE INSURANCE CLAIMS AND COOKING THE BOOKS TO PUMP AND DUMP SCHEMES AND UNAUTHORIZED PURCHASES MADE AS A RESULT OF IDENTITY THEFT. OFTEN, BUSINESSES WILL APPOINT AUDITORS TO INVESTIGATE THEIR FINANCES FOR ANY POTENTIAL CASES OF FRAUD. HOWEVER, IF YOU RUN A SMALLER BUSINESS, YOU MAY NOT HAVE THE CAPACITY TO BRING IN EXTERNAL AUDITORS.

With our new Anti-Fraud tools, you can conduct your own audit to see if there's any fraudulent activity taking place in your organization. Read on to find out how.

Keep reading

CA & US - Effortlessly receive, approve, post and pay invoices with the accounts payable automation platform built for property management companies. Save time and money, whilst building better relationships.

UK - Manage and track all of your companies outgoings in one place, whether that's company cards, invoices, or employee expenses. Get rich insights on your companies spend based on real-time data.

GLOBAL - A powerful data management and visualisation tool that connects Xero with PowerBi and Excel. Build reports that sync in real-time with your accounting system and other data sources.

CA, UK & US - Financial planning and analysis platform for Excel users, that automates data consolidation, reoprting and planning. Enable your finance teams to unlock strategic value for your business.

GLOBAL - Quickly and easily create professional-looking invoices, estimates, purchase orders and more, wherever you are, with Billdu's professional invoice maker for small businesses.

AU - A hospitality e-invoicing platform that allows venues to recieve, manage, pay and reconcile invoices received from suppliers. Manage your entire accounts payable process with HospoPay's digital wallet.

GLOBAL - One app to run your bookkeeping business. Keep is a ledger integrated workflow that allows you to run your month-end close in one tab. Communicate with clients, catch coding errors, track KPIs and more.

OLTERS KLUWER LEGAL & REGULATORY TODAY ANNOUNCED IT HAS ACQUIRED

AI LTD., A PROVIDER OF

INTELLIGENCE (AI) TECHNOLOGY BASED ON ADVANCED NATURAL LANGUAGE PROCESSING (NLP). THIS TECHNOLOGY ALLOWS LEGAL PROFESSIONALS TO REVIEW CONTRACTS IN MULTIPLE LANGUAGES BY SIMPLY ASKING QUESTIONS.

Della AI will become part of the Legal Software unit of Wolters Kluwer Legal & Regulatory, which offers market-leading LegalTech solutions such as Legisway, allin-one software for corporate legal departments, and Kleos, cloud-based legal practice management software for law firms.

GiuliettaLemmi, CEO of Wolters Kluwer

Legal & Regulatory Legal Software, commented: “By integrating the expertise and know-how of Della AI into Wolters Kluwer Legal & Regulatory, we are further enhancing the value we deliver to our customers, by investing in the continuous development of this key technology and the people behind it. Today, our customers already acknowledge the value of Legisway in all their legal activities. Together with Della AI, we will further enhance our customers’ experience and secure a leading position for Wolters Kluwer in the corporate legal market.”

Christophe Frèrebeau, Della AI’s founder and CEO, adds: “We are extremely proud to be joining the Wolters Kluwer family. Wolters Kluwer recognized Della AI's potential for...

FINANCE TEAMS SHOULDN'T HAVE TO TOIL FOR DAYS AT MONTH-END PROCESSING MANUAL ACCOUNTING ADJUSTMENTS. AT MAYDAY, OUR MISSION IS TO DELIVER REAL-TIME ACCOUNTING. WE ARE EVISCERATING THE MANUAL WORK BETWEEN ACCURATE BOOKKEEPING AND ACCURATE ACCOUNTING. WE ARE MENDING MONTH END.

We are incredibly excited about the product vision we have to bring about real-time accounting.

We want you to help us carve out this path, to make real-time accounting real. Want the chance to win up to £100*? Read on and answer our two-minute survey to enter!

This is our product vision. In the coming

months, we will publish a more detailed product roadmap of which features we plan to build, and when. We're so excited to get your input on exactly what they should look like. But for now, this is an overview of where we're headed.

We can’t wait to hear what you think.

Here you have it: the vision for our end product.

Let’s dive into the individual areas, the pains they address, and what the Mayday-enhanced future looks like.

Find out more

2022 WAS THE YEAR TO DETERMINE WHAT OUR NEW NORMAL WOULD BE, AFTER THE LOCKDOWNS OVER THE LAST 2 YEARS IT WAS TIME TO GET BACK OUT THERE AND FIGURE OUT HOW TO MOVE ON, REBUILD AND, OF COURSE, LIVE WITH COVID-19.

The new normal has pre-

sented its own challenges across the globe for businesses, families, and institutions, but there is a real sense of hope heading into 2023 as we take our learnings and refocus on a new and better way to move forward together.

Accountants have continued to deal with an array of challenges that “the new normal” presents, continu-

ing to go to extra-ordinary lengths to support their clients (and each other) through changing circumstances. It is a community we’re truly humbled to serve and be a part of, and we continue to be driven by your dedication to develop ground-breaking tools to give you the gift of time...

THE 2022 LATE PAYMENTS REPORT PRODUCED BY CHASER, THE GLOBAL ACCOUNTS RECEIVABLES SOFTWARE PROVIDER, FOUND THAT 87% OF BUSINESSES ARE TYPICALLY PAID LATE.

The 2022 late payments report gathered insights from over 400 businesses around the world on the severity of late payments and the methods businesses have used to reduce them. Key findings from the report

include:

• Almost 9 in every 10 businesses are typically paid late.

• 50% of businesses spend more than four hours per week on accounts receivables tasks

• Over a quarter of businesses admit to struggling to keep on top of their accounts receivables tasks every month.

Findings also show characteristics that can make a business prone to later pay-

ments, such as:

• Businesses in the marketing, advertising, and construction industries reported that 100% of their invoices are paid late.

• Larger businesses generally wait for the longest for payment from customers

• Information technology businesses wait the longest for invoice payments from their customers (typically paid 30 or more...

Keep reading

As another year draws to a close, let’s look back and reflect on the remarkable achievements of our customers throughout 2022.

Ignition customers got paid almost 2 million times to improve cash flow Business has boomed this year for Ignition customers!

In 2022, customers got paid over and over again. More than 1.8 million payment transactions were processed via Ignition, this year alone.

Getting paid for all your great work, maintaining regular cash flow and eliminating...

Read more

NEW KRIYA RESEARCH FINDS THAT UK B2B FIRMS WITH E-COMMERCE OPERATIONS DO NOT PLAN TO OFFER ‘BUY NOW, PAY LATER’ TERMS TO THEIR CUSTOMERS FOR ANOTHER 3 YEARS, DESPITE 92% KNOWING WHAT EMBEDDED FINANCE IS, AND HOW IT HELPS ACCELERATE THEIR REVENUES WITH MORE SALES AND 5X HIGHER ORDER VALUES.

UK B2B SMEs missing out on opportunity to use Embedded Finance to grow sales volume and order value more than 5x, despite

high levels of awareness

• New Kriya research finds that UK B2B firms with e-commerce operations do not plan to offer ‘buy now, pay later’ terms to their customers for another 3 years, despite 92% knowing what Embedded

Finance is, and how it helps accelerate their revenues

• With Kriya able to deploy its Payments solution in just 4 weeks, this delay leaves B2B firms at risk...

Find out more

BGL CORPORATE SOLUTIONS, AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF) AND INVESTMENT PORTFOLIO MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE

IT HAS ACHIEVED GREAT PLACE TO WORK RECERTIFICATION FOR THE 2022-2023 YEAR.

"This is a great accomplishment by the BGL Team and especially our People and Culture Team" said Ron Lesh, BGL's Managing Director. "This certification means a lot to BGL

and recognises the constant and consistent effort of our People and Culture Team to provide BGL's 200+ employees with a safe, inclusive, and friendly work environment. I'm extremely proud of them."

Great Place To Work Certification recognises employers who create an outstanding employee experience. Certification is a two-step process that requires the submission of a comprehensive culture brief, capturing the people practices that make a company brilliant and unique. Plus, an employee experience survey, with...

Find out more

EUROPE’S TOP ACCOUNTING AND FINANCE EVENT IS HEADING DOWN UNDER TO BRING THE ACCOUNTEX EXPERIENCE TO AUSTRALIA ON 15-16 MARCH 2023 AT SYDNEY’S ICC.

Commercial Director, Alex Haughton of Diversified Communications, said there has been a significant push from the Australian industry to get an Accountex event for the local market.

“Accountex will be an invaluable opportunity for these firms to scope the latest innovations and gain the practical and positive tools they need to help Australia’s

businesses continue to be the strong backbone of Australia’s economy,” she said.

The event has garnered many high-profile supporters including its exhibiting Founding Partners BGL, DEXT, Fathom, Ignition, Intuit QuickBooks, MYOB, TOA Global and Xero, as well as Associate Partners Australian Bookkeepers Network, Chartered Accountants Australia and New Zealand, Council of Small Business Organisations Australia, CPA Australia, Institute of Certified Bookkeepers, Institute of Public Accountants and Pure Bookkeeping.

•

•

These

pre-

• Professional Services Automation

• Project Management

• Resource Management

• Time Tracking

• Workforce Management

The G2 accolades are awarded based on an analysis of more than 3 million reviews on thousands of software products published by users.

Due to our ongoing commitment to providing high-quality software and a user-focused experience, we are honoured to receive these awards based on customer reviews.

THE WORLD OF ACCOUNTING IS PIVOTING WITH INCREASING GOVERNMENT REQUIREMENTS AND EVOLVING CLIENT NEEDS.

IF YOU DON’T MANAGE CHANGE IN THE COMING YEARS, CHANGE COULD MANAGE YOU—LEADING TO A CAREER FOREVER ON THE TREADMILL. TAKE CONTROL NOW AND ENSURE THE COMING YEARS ARE EVERYTHING YOU WANT THEM TO BE.

The pandemic showed how accountants are the true superheroes of the business world.

Yes, there was significant extra work. But a door was opened. As accountants performed tasks like helping clients prepare reporting to access government assistance, clients were educated about a closer relationship with an advisor they could trust.

Similarly, Making Tax Digital in the UK has indicated that client relationships can evolve as accountants focus more on additional service offerings, such as periodic financial check-ups, and less on basic compliance now that the government de-

mands technology do much of that work.

All of this is becoming the norm, rather than the exception.

In the very near future, more and more taxes will be digitalised—everything from income tax to corporation tax. Simultaneously, governments worldwide are increasing business regulation.

that’s right for everybody. But it’s wise to jump off the treadmill for just a few minutes and plan your route. The focus should be less about the specific and unique challenges. Instead, look at the ways you can navigate through the challenges in a way that will create a future perfect for you.

Scaling up, scaling down, specialising or more rad-

As the philosopher Alan Watts said, the only way to make sense out of change is to plunge into it, move with it, and join the dance.

For accountants, this means scaling their practice to exploit challenges in the coming years.

But while basic growth is simple—do more of what

decade, resulting in an inevitable fight to the bottom when it comes to pricing and profit. Nowadays a high street accountant competes with online services.

Providing more of the same is unlikely to be effective. Instead, fresh service offerings and increasing your practice’s understanding of client needs must be central to any plans to scale.

clients being able to cope with the increased demands of at least quarterly reports for each trade and landlord income, plus discrete end of period statements (EOPS).

And that’s before we discuss the requirements for digital record keeping and digital linking.

Clients that scribble down income and expenses as they occur, then hand this over to their accountant each January along with a bag full of receipts, are in for a huge shock.

But some accountancy practices are seizing the chance to manage this change and in doing so, they illustrate perfectly the mindset needed for practices looking to scale.

You need to choose how you and your practice will fit into this new world.

The issues are the same as they ever have been: ensuring you’re relevant to clients, pricing services optimally, remaining profitable, and so forth, all while being guided by your values.

There isn’t a single path

ical options—all must be explored, and a destination selected.

And that’s perhaps the most important point. All journeys start with a single step. But less often mentioned is that all successful journeys start by choosing the best destination for you.

you’re already doing—accountancy practices have opportunities to instead evolve what they do, driven by aforementioned increasing government requirements and changing client demands.

After all, basic accounting services have become commoditised over the last

For example, Making Tax Digital for Income Tax Self Assessment (MTD ITSA) arrives in the 2024/25 tax year, with the expectation that many businesses will signup to the pilot programme ahead of time as of the 2023/24 tax year.

There remains industry-wide incredulity about

MTD ITSA’s quarterly reporting requirement in particular means some business owners and managers will need to have much more contact with their accounting.

Because of the obvious reluctance of those clients to do so, some accountancy...

ANNNNND JUST LIKE THAT, ANOTHER YEAR IS OVER. BUT WITHOUT GETTING TOO EXISTENTIAL ABOUT IT, THERE’S A LOT TO CELEBRATE FROM LAST YEAR, DESPITE SOME OF THE CHALLENGES 2022 BROUGHT.

We wanted to reflect on what last year brought for us at Pleo, so here are 15 of our achievements to round off 2022 (and learn from this year!)

Last year, we said Bonjour! to France, Hei! To Finland, and Hallo! To the Netherlands. Since the beginning of the year, we launched Pleo in 10 countries - and there’s still more to come.

Launching in market after market isn’t a one-size-fits-all process (or an easy one at that), and it’s something that we’re constantly learning about and rethinking.

Fancy reading more about perfecting the process of launching Pleo into new markets? You're in luck...

Find out more

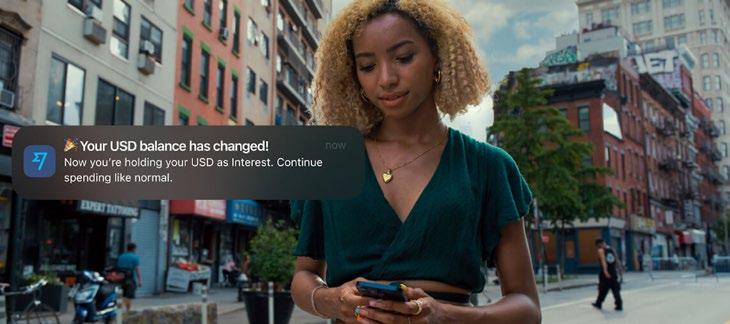

AS MORE OF YOU HOLD MONEY IN WISE, WE’RE BRINGING YOU THE BENEFIT OF INTEREST RATES, SO YOU GET MORE OUT OF YOUR MONEY.

Following the launch of stocks last year, we’ve added interest-earning assets for customers in the UK. Now you’re able to grow your GBP, EUR, and USD balances with Interest.

As of 14th December 2022 this is the variable annual yield after all fees have been deducted. Variable annual yield is a projected return based on the past 30 day performance of this asset.

For the latest fees and interest rates please check your account.

Offered through Wise Assets. Growth not guaranteed. Capital at risk

You have some money on your Wise account. You may be using it for everyday shopping or keeping it there for your next transfer. When you switch your balance to Interest, your money will be moved to a fund that holds government guaranteed assets such as bonds. You can continue to spend & send as before, yet you’ll be earning interest and enjoying the 100% government...

Read more

SOLDO HAS BEEN NAMED THE FINTECH OF THE FUTURE IN THE PAYMENTS CATEGORY AT THE BANKING TECH AWARDS. THE AWARDS, NOW IN THEIR 23RD YEAR, RECOGNISE EXCELLENCE AND INNOVATION IN THE USE OF IT IN FINANCIAL SERVICES WORLDWIDE.

The gala evening featured some of the world’s most influential financial institutions, including Lloyd’s, Morgan Stanley, JP Morgan and BNP Paribas.

For banks and financial in-

stitutions, winning a Banking Tech Award recognises “the value of their technology investments and showcases their skills, commitment, creativity and execution”.

When Soldo started in 2015, we were just six people in a Marylebone basement. Fast forward to now, the company has raised almost $250m in funding, employs around 350 people and is trusted by over 30,000...

Keep reading

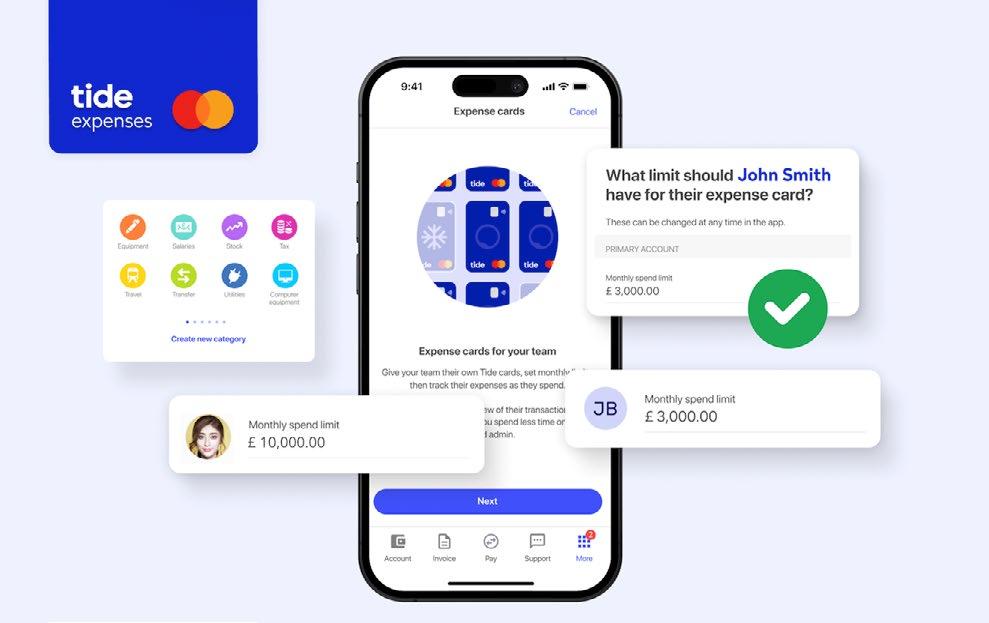

RUNNING YOUR OWN BUSINESS INVOLVES KEEPING YOUR EYES ON MANY DIFFERENT AREAS, INCLUDING SALES, TURNOVER, AND BUSINESS PURCHASES, TO NAME BUT A FEW.

Whether you’re working on your own as a sole trader, or you employ a small team, it can be very easy for business expense management to spiral out of control.

Costs such as fuel, stationery, and travel may all seem relatively insignificant, but if you don’t keep a close rein

on your expenses, they can soon start to spiral and begin to erode your profits.

Tide already offers Expense Cards, which, give

your team flexibility to buy what they need for their job, and also provide a great...

TO PUT YOUR REVOLUT YEAR INTO PERSPECTIVE, WE’VE GOT SOMETHING SPECIAL PLANNED. AND IT DOESN’T INVOLVE RIBBONS.

From top merchants to spending habits, we have a full deck of customised insights to share (we’re like Mystic Meg, just with better data).

You’ve had a busy 2022, and we’ve got the cards

to prove it. With each flip, you’ll discover how your year was spent. Spoiler alert — there’s more than a few surprises in store.

And while you’re revelling in revelations, why not share some of them on social media, so your friends and family can enjoy some of the magic too?

The gifts just kept coming, didn’t they? We’ve worked hard to introduce as many features as possible, and don’t plan on...

MONZO IS REALLY EXCITED TO ANNOUNCE THAT JOINT ACCOUNTS FOR US CUSTOMERS ARE COMING SOON! THIS WAS HIGHLY-REQUESTED BY MANY OF YOU IN OUR COMMUNITY AND WAS ONE OF THE TOP-VOTED FEATURES ON OUR PUBLIC ROADMAP.

We believe in building the Monzo product along-

side our customers, so we’re looking for beta testers to help us test joint accounts. You’ll get early access to joint accounts and help us spot bugs, identify improvements, and give your feedback directly to the Monzo product team. All you need is someone you know and trust to share a joint account with. Sign up below to help us test this new feature!

A joint account is a separate account that you share with someone you know. We’ll send you both a joint Monzo account debit card so you and your partner can spend from your combined joint account (separate from your personal account). Your joint account also has its own routing and account numbers, making it easy to pay bills or save for shared goals, all with no monthly...