The

BlueRock to acquire WorkflowMax brand

Xero to retire WorkflowMax product; BlueRock plans to offer new WorkflowMax solution

XERO, THE GLOBAL SMALL BUSINESS PLATFORM, HAS TODAY ANNOUNCED IT WILL RETIRE PROJECT MANAGEMENT SOFTWARE WORKFLOWMAX AND HAS SIGNED AN AGREEMENT WITH TECH-LED BUSINESS ADVISORY FIRM, BLUEROCK, TO ACQUIRE THE WORKFLOWMAX BRAND. BLUEROCK HAS COMMENCED PLANS TO OFFER A NEW WORKFLOWMAX PRODUCT, WORKFLOWMAX BY BLUEROCK, WITH SIMILAR FUNCTIONALITY.

Kirsty Godfrey-Billy, Chief Financial Officer, Xero said: “The decision to retire WorkflowMax allows us to continue to focus our efforts in key strategic areas that we believe will deliver the best value for all our stakeholders

in the short and long term.”

The WorkflowMax technology has also been used by Xero to build Xero Practice Manager which continues to be a focus and is an important part of its practice strategy specifically for accountants and bookkeepers.

Xero will retire the current WorkflowMax product in June 2024 and BlueRock plans to have WorkflowMax by BlueRock available to customers in early 2024 - which customers could choose to migrate to. Once released, WorkflowMax by BlueRock will be available directly from BlueRock or through the Xero App Store, where other alternate job and project management solutions are also available.

Keep reading

CITRUS HR JOINS THE ALCUMUS FAMILY

By Rachel Mudd

WE ARE DELIGHTED TO SHARE THE NEWS THAT ALCUMUS HAVE ACQUIRED CITRUS HR. ALCUMUS ARE A FAST GROWING, SUCCESSFUL COMPANY FOCUSSED ON CREATING SAFER AND MORE SUSTAINABLE WORKPLACES TO CREATE A BETTER WORKING WORLD.

Alcumus operate SafeContractor, the UK’s leading Supplier Certification business, as well as an ISO certification company and a Health & Safety and HR consultancy. Headquartered

in Cardiff, Alcumus employ over 600 people.

The acquisition is a strategic move, adding specialist HR expertise to Alcumus’ existing Health and Safety and HR Services, SafeWorkforce, and expanding the Alcumus portfolio further.

The citrus HR team, led by David Lester, will join Alcumus while continuing to operate independently with the support of the larger group.

David Lester, CEO and Founder of citrus HR: “Our 40 strong team are excited to be joining the Alcumus family and continuing our

successful journey. Our two companies’ vision, values and approach to helping customers are remarkably similar. With its established global brand and strong track record of supporting businesses to grow and develop, this is a great opportunity for us to work alongside an expert team and provide clients with wider compliance and risk management solutions.”

Alyn Franklin, CEO at Alcumus: “We’re delighted to welcome citrus HR to the Alcumus family, which fits perfectly into our well-established portfolio of solu-

tions. This acquisition will help further accelerate our growth ambitions and add value to our UK customer base where our expertise is highly relevant.”

At citrus HR our vision is to help small companies manage their people more easily. Joining the Alcumus family will help us to help more companies in even more ways, particularly Health & Safety.

We looking forward to starting to work with our new colleagues on more and better ways to help our...

Karbon and SuiteFiles: Software greats integrate to become greater

Professional services

By Tyler Cruse

By Tyler Cruse

KARBON AND SUITEFILES ARE STANDALONE B2B SAAS BUSINESSES THAT ARE COMING TOGETHER ON MARCH 22, 2023 VIA THEIR BRAND-NEW INTEGRATION, WHICH WILL BRING KARBON CONTACT AND ORGANISATION DATA INTO SUITEFILES.

“Firms today want a single interface that reduces clicks and does what they expect it to do,” said Jared

now experiencing Karbon data flowing into SuiteFiles

Baker, Managing Director APAC, Karbon. “This integration allows firms to use their contacts and organization data from a single source of truth, and auto-populate into SuiteFiles.”

SuiteFiles CEO Andrew Sims shares, “This integration is of immediate benefit to our customers and also holds future promise for our growth. We’re proud of our 99.6% customer renewal rate which we’ve achieved by combining our intuitive

platform with time-saving integrations. In particular, this integration enables existing shared customers of Karbon and SuiteFiles to be even more productive by combining their Karbon data with SuiteFiles’ features. It also appeals to future SuiteFiles customers who are looking to add additional document management capabilities to their existing Karbon subscription or enhance their tech stack by adding both Karbon and

SuiteFiles at once.”

As of March 22, 2023, the Karbon and SuiteFiles integration will bring firms’ Karbon contact and organization data into SuiteFiles. From there, they can use their Karbon data in SuiteFiles templates, client portal, and document signing. For example, when a firm onboards a new client, they will create that organization and the contacts under it in...

Keep reading

Biweekly Saturday 25th March 2023 | No. 51

Saturday 25th March 2023 XU P6 9 772054 723006 51 ISSN 2054-7234

independent user news source for accounting apps and their ecosystems

firms

out more P6

Find

WATCH A FREE WEBINAR ON THE XU HUB! P12

New Apps & Updates

SUITEFILES

RELEASE NOTES - MARCH 2023

THE SUITEFILES X KARBON INTEGRATION IS HERE!

The Karbon and SuiteFiles integration will bring your Karbon contact and organization data into SuiteFiles.

Karbon Integration Overview

With SuiteFiles and Karbon integrated, you can:

• Populate your client documents and emails in SuiteFiles with organization data from Karbon.

• Look up Karbon contacts in SuiteFiles and invite them to the SuiteFiles Connect portal

• Look up Karbon contacts in SuiteFiles to request their signature

• See if a SuiteFiles Client folder has found its Karbon match. A Karbon icon will appear in the Integrations column in the Clients folder.

Find out more

XU BIWEEKLY - No. 51

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell Director of Strategic

Partnerships: Alex Newson

Design & Communications

Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

ApprovalMax are proud to partner with Journey

APPROVALMAX HAS OFFICIALLY JOINED FORCES WITH JOURNEY, A LEADING MARKETING AND CONSULTING AGENCY IN AUSTRALIA.

Sydney-based consultancy, Journey, will be providing ApprovalMax with a range of services including market analysis, customer research, community initiatives, and strategic consulting to strengthen what is already a strong brand with growing customer advocacy in Australia.

“We are thrilled to be working with ApprovalMax and to be supporting their growth in the Australian market,” said Trent McLaren, Founder of Journey. “Our team of experts will use their extensive experience in marketing and data-driven approach to help ApprovalMax identify new exciting opportunities to get their product to in-front of...

Keep reading

Synergy March Update

Gain

HERE AT TOTAL SYNERGY, WE’RE ALWAYS WORKING HARD TO DELIVER THE TOOLS YOU NEED TO DRIVE YOUR COMPANY’S SUCCESS. THIS MONTH, WE’RE EXCITED TO BE INTRODUCING MORE TOOLS TO GIVE YOU GREATER CONTROL OVER BOTH YOUR PROJECT DATA AND YOUR FINANCIAL WORKFLOWS, WITH SYNERGY ANALYTICS PLUS AND INVOICE APPROVALS.

Invoice Approvals

IF YOUR

Modern sales professionals need to be both mobile and connected at all times. That’s where the Teamgate mobile CRM idea came to mind. Sales professionals need a fully mobile sales CRM to keep them in-touch and connected with their entire sales process. If something changes, anywhere in the sales pipeline, your sales team need to have access to that information, office-bound or not.

By bringing Teamgate CRM to mobile, your sales team will benefit from all of the features and tools that they need to take their sales office with them wherever they go.

Why a Mobile CRM?

Sales professionals can benefit greatly from having a mobile app for their Customer Relationship Management (CRM) system for several reasons: Accessibility: With a mobile app, sales... Find out more

Wolters Kluwer launches new analytical tool within MediRegs

OUTPATIENT PROSPECTIVE PAYMENT SYSTEMS (OPPS) BATCH GROUPER AND CALCULATOR SERVICE

EMPOWERS HEALTHCARE REVENUE CYCLE PROFESSIONALS TO BATCH CLAIM PAYMENT CALCULATIONS, SAVING VALUABLE TIME AND OPTIMIZING WORKFLOW.

Wolters Kluwer Legal and Regulatory U.S. has launched the Outpatient Prospective Payment System (OPPS) Batch Grouper and Calculator Service with-

in MediRegs, Wolters Kluwer’s healthcare coding, reimbursement, and compliance solution. With the launch of this tool, healthcare revenue cycle, reimbursement, and audit professionals can proactively analyze outpatient hospital reimbursement.

This provides instant insights, facilitates a smoother audit and appeals process, and enables more informed decisions.

Wolters Kluwer has introduced this analytical tool as its latest move in...

Keep reading

We’ve been listening to your feedback on our invoicing capabilities and are excited to introduce a new invoice approval workflow. This new feature will enable you to better collaborate with your team across the invoicing process, giving you greater oversight and a checking... Find

NEW GLIDE FEATURE: ONLY SEND EMAILS DURING WEEKDAY WORKING HOURS

WE’VE RECENTLY RELEASED A NEW FEATURE THAT ALLOWS YOU TO ORDER GLIDE TO ONLY SEND EMAILS GENERATED ON YOUR GLIDE SYSTEM DURING WEEKDAY WORKING HOURS.

This feature was requested by many people and allows you to bulk generate emails while working on a Saturday for example, and have those emails be sent at 9am on the following Monday morning.

This ensures your practice will maintain a professional image, without work emails being sent to clients at less than ideal times. Using this feature, any emails generated after 6pm will be sent at 9:01am the following day, emails generated after 6pm on Friday, will be sent at 9:01am on Monday. Bank holidays are not currently taken into account.

To enable this feature go to the “Advanced Config Settings” page under the “Config” menu. It is not enabled by default.

The queued message setting still works in the same way, if you have all messages set to queue before sending, then they will still queue in the same way and can be...

Keep reading

GREAT

AND COLLECT THEIR DETAILS QUICKLY AND ACCURATELY.

With the lead capture feature, firms can now create a custom link that they can share with potential clients. When someone clicks on the link, they’ll be directed to a form where they can enter their contact details and a brief message to the firm.

This new feature streamlines the client onboarding process and eliminates the need for manual data entry by the firm, making it faster and more accurate. The form includes a firm’s logo and colours, fields for names, email, and mobile phone number, and a free form space for clients to leave a message for the firm.

The benefits of the lead capture feature are clear. By simplifying the onboarding process, firms can attract more potential clients and improve their conversion rates. And by collecting accurate client details, firms can better manage their client relationships and provide more targeted services.

We believe that the new lead capture feature will be a game-changer for firms of all sizes. Whether you’re a solo practitioner or a large accounting firm, this feature can help you streamline your workflow, save time, and attract new clients by collecting the right information from the beginning of the relationship.

Find out more

NEW

XERO CONNECTED APPS!

SEAMLSS: LEAD CAPTURE LINK ASSIST

AU, MY, NZ, PH, SG, UK & US - Smart document management & information recognition for bookkeeping automation. Extract data from your invoices, receipts & other business records for quick automated entry into Xero.

PRACSUITE

CARBONINVOICE

AU,

XU Biweekly | No. 51 2 Saturday 25 March 2023

NZ & UK - Automatically analyses professional services firms accounting data to track & offset carbon emissions for every project they do. You can then share their efforts with your network.

AU & NZ - A practice management system for allied health professionals that offers deeper functionality, powerful workflows & genuine expert support. Sync your invoices & payments directly with Xero.

out more

SALES AREN’T MOBILE, THEY’RE STATIC

greater control over your project data and financial workflows, with Synergy Analytics Plus and new Invoice Approvals

NEW

BOOKKEEPING

NEWS! WE’RE EXCITED TO ANNOUNCE THE RELEASE OF OUR NEW LEAD CAPTURE FEATURE ON SEAMLESS. THIS

FEATURE MAKES IT EASIER THAN EVER FOR ACCOUNTING AND

FIRMS TO ONBOARD NEW CLIENTS

signing features coming your way

By Albert Patel-Cook

SUITEFILES HAD SOME RAVE REVIEWS COMING IN ABOUT OUR RECENTLY RELEASED SIGNING WIZARD AND WE HAVE EVEN MORE SIGNING RELATED UPDATES ON THEIR WAY VERY SOON! THE BELOW SIGNING FEATURES AREN’T YET RELEASED, BUT YOU CAN EXPECT TO SEE THEM IN THE VERY NEAR FUTURE.

Signing message templates

This has been a highly requested feature by our customers, so we’re very excited to get this out to all our Super Suite customers soon! The time-saving benefits of this feature are clear to everyone – so let’s jump in to how it’ll work.

In step 3 of the Signing Wizard, you’ll see the now familiar Subject and Message fields with new template buttons below. To use them, simply enter your unique subject line (this will be the email subject, and the template name) then fill out the message body as you see fit.

Once ready, hit the “Save as template” button, and the templates will be saved and available for all users with access to document signing on the SuiteFiles site.

Read more

Introducing new Batch Payment approval workflows for Xero to ApprovalMax

AT APPROVALMAX WE TAKE PRIDE IN BEING ABLE TO SAVE BUSINESSES TIME BY PROVIDING THEM WITH EASY-TO-USE APPROVAL SOFTWARE FOR THEIR BILLS, PURCHASE ORDERS, EXPENSES AND CREDIT NOTES.

We are very excited to announce that ApprovalMax now supports Batch Payment approval functionality. This allows businesses to create, authorise, and audit batch payments when using our tool with Xero. Batch payment approval workflows provide all the same benefits as regular approval automation in ApprovalMax, such as the ability to set up complex multi-role workflows, track changes with easy-to-refer-to audit logs, and one-tap approvals to your inbox when using a desktop, or via the ApprovalMax Mobile App.

Why use Batch Payments?

Batch payments allow businesses to send multiple payments to different recipients at...

Keep reading

Karbon Release Notes March 2023

XERO, THE GLOBAL SMALL BUSINESS PLATFORM, HAS PARTNERED WITH MULTINATIONAL ACCOUNTING ASSOCIATION, ALLINIAL GLOBAL, IN A THREE YEAR GLOBAL AGREEMENT TO BRING THE POWERFUL CAPABILITIES OF CLOUD ACCOUNTING TECHNOLOGY TO MORE OF ITS MEMBER FIRMS, ENABLING THEM TO ADD MORE VALUE TO THEIR CLIENTS.

Allinial Global is the second largest accounting association in the world. The Xero Global Partner status means Xero will become the preferred cloud accounting solution for Allinial Global member firms and their small to medium business clients. Partnering at a global level will support Allinial Global with its mission to bring international reach and capabilities to its independent member firms around the world.

Xero and Allinial Global have a joint desire to see business owners make better decisions as a result of access to accurate financial data from Xero and valuable insights from their advisor. Entering into a global partnership provides the opportunity for...

Find out more

RELEASE NOTES

FOR DETAILED INSTRUCTIONS ON HOW TO USE THE FEATURES OF WORKGURU, PLEASE SEE OUR LIST OF SUPPORT ARTICLES (HTTPS://SUPPORT.WORKGURU.IO/SUPPORT/SOLUTIONS). WE UPDATE THESE ARTICLES REGULARLY TO STAY UP TO DATE WITH THE FEATURES OF THE APPLICATION.

Features

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF) AND INVESTMENT PORTFOLIO MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE THE RELEASE OF EMAIL TO FUND - A UNIQUE NEW FEATURE OF ITS AI-POWERED DOCUMENT-TO-DATA SOLUTION, BGL SMARTDOCS.

BGL SmartDocs is fully integrated with BGL’s multi-award-winning SMSF administration and portfolio management solutions, Simple Fund 360 and Simple Invest 360.

"This release is a unique achievement by our Big Data and Simple Fund 360 Product Teams, who have dedicated more than 2 years to the project," said Ron Lesh, BGL's Managing Director.

Read more

IT’S ALL ABOUT NEW INTEGRATIONS. QUICKBOOKS ONLINE ACCOUNTANT AND SUITEFILES ARE MAKING CONTACT SYNCING EASIER THAN EVER BEFORE.

Two-way contact sync with QuickBooks Online Accountants

With a two-way contacts sync, you can quickly and easily keep your Karbon and QuickBooks Online Accountant data centralized and up-to-date. Once connected, when a change is made in Karbon or QuickBooks Online Accountant, it’s automatically sent to the other. You can run the data sync manually or automatically, and set it to create new contacts, update existing ones, or link contacts to existing or new companies.

This feature is available now in your...

Read more

Expensify forms Accountant Steering Committee to drive product development

TEN GLOBAL ACCOUNTING EXPERTS JOIN EXPENSIFY’S STEERING COMMITTEE TO ADVISE THE EXPENSE MANAGEMENT COMPANY ON PUSHING THE LIMITS OF THE ACCOUNTING INDUSTRY

Expensify, Inc. (Nasdaq: EXFY), a payments superapp that helps individuals and businesses around the world simplify the way they manage money across expenses, corporate cards, and bills, today announced a strategic partnership with accounting leaders to help shape the future of the industry for firms and clients alike.

The inaugural Expensify Steering Committee is comprised of:

• Colman Edwards, Sr Director of Technology at Countsy

• Deb Defer, Managing Director, Business Service Outsourcing at BDO

Keep reading

Timesheets

• Users now have ability to update billable length for weekly timesheets whilst editing. If the billable length fields are not visible when editing, timesheets will continue to work as usual.

Bug Fixes

Suppliers

• Fixed currencies not displaying when adding a new supplier

Invoices/ Xero

• Fixed issue with invoice credit allocations when getting payments from Xero

Custom Fields

• Fixed historically saved dropdown custom field values being cleared against documents when removed as an option

Keep reading

By Eleni Deacon

NEW YORK, NY — RELAY, THE ONLINE BUSINESS BANKING PLATFORM, AND PROFIT FIRST PROFESSIONALS, A MEMBER ORGANIZATION OF PROFITABILITY COACHES, HAVE ANNOUNCED THAT THEY ARE LAUNCHING A PARTNERSHIP.

As a result of this partnership, Relay becomes the official banking platform for Profit First. In addition, Relay is launching auto-transfer rules—a feature that allows businesses to automate the Profit First cash management system.

Profit First is a behavioral-based cash management system that enables you to run your business out of your bank and become permanently profitable. The system teaches entrepreneurs to allocate their income into different checking accounts, including Profit, Owner's Pay, Taxes and Operating Expenses, so they can better manage their cash flow and ensure long-term profitability.

"The day someone opens a Relay account and sets up Profit First is the day they become immediately profitable,” said Mike Michalowicz, Author of Profit First and...

Keep reading

News & Updates XU Biweekly | No. 51 4 Saturday 25 March 2023

Xero and Allinial Global partner to bring the power of cloud accounting to more member firms globally

RELAY BECOMES THE OFFICIAL BANKING PLATFORM FOR PROFIT FIRST

Emma Crawford-Falekaono steps down as Ignition Managing Director, EMEA

WILL DUTTON TO REMAIN INTERIM MANAGING DIRECTOR, EMEA FOLLOWING EMMA’S RESIGNATION

After more than three years as Ignition’s Managing Director for EMEA, Emma Crawford-Falekaono has resigned from the position for personal reasons to focus on her growing family.

Will Dutton has been acting Managing Director, EMEA since Emma went on maternity leave in September 2022 and will continue to oversee Ignition’s EMEA business in the interim. Emma’s final day at Ignition was Friday March 10 2023.

Since 2019, Emma has led Ignition through important stages of its international expansion to become a world leading client engagement and commerce platform for professional services. Emma has built a strong team to expand Ignition’s footprint in EMEA, growing the business by 125% in the...

Read more

New Deputy Report Highlights U.S. Retail Employment Changes in a Slowing Economy

Deputy CEO urges retail businesses to address employee vulnerabilities as job shortages remain high

DEPUTY, A GLOBAL LEADER IN SMART SCHEDULING AND WORKFORCE MANAGEMENT FOR SHIFT WORKERS AND BUSINESSES, TODAY RELEASED THE FINDINGS OF THE BIG SHIFT: U.S. RETAIL REPORT 2023, WHERE MORE THAN 13 MILLION HOURS WORKED BY OVER 24,000 SHIFT WORKERS WERE EVALUATED TO UNCOVER HOW THE RETAIL INDUSTRY IS FARING THREE YEARS SINCE THE PANDEMIC BEGAN.

In 2022, employment in the retail industry grew by 5% from its pre-pandemic employment levels in 2019.

“Half a billion shifts have been scheduled using Deputy – we really sit at the heart of the labor markets,” said Silvija Martincevic, CEO at Deputy. “The job market is tight, and competition for workers is stiff. Retail businesses that provide their employees with adequate support, including resources to enhance their performance, monitor their level of engagement, and prioritize their well-being, are more likely to retain a skilled workforce.”

Conducted in partnership with labor...

Keep reading

WOLTERS KLUWER RECOGNIZED AS #1 IN THE NETHERLANDS FOR GENDER DIVERSITY

The secret is out

ADVANCETRACK OUTSOURCING (E-ACCOUNTING SOLUTIONS LIMITED) ARE THE FIRST ORGANISATION CERTIFIED BY BSI IN THE UK FOR ISO27001:2022. THIS IS THE LATEST VERSION OF THE EPONYMOUS STANDARD.

AdvanceTrack Outsourcing are also one of the first ten to be globally certified by BSI. My thanks of course to my team, led by our Chief Technology Officer, Ian Gregory. My thanks also to our auditors, BSI, where the support from Simon Deam and David Lee was invaluable in attaining the standard. We'll be sharing more in the coming days and weeks.

Find out more

The home of XU Magazine and XU Biweekly

WOLTERS KLUWER IS THE TOP COMPANY FOR GENDER DIVERSITY IN THE NETHERLANDS, ACCORDING TO EQUILEAP, A LEADING PROVIDER OF DATA AND INSIGHTS ON GENDER EQUALITY.

This is the third consecutive year that Wolters Kluwer has won the honor. The company also ranked #6 out of only 18 companies globally to reach gender balance across all four levels (board of directors, executives, senior management and the workforce) measured by Equileap’s 2023 Gender Equality Global Report & Ranking.

The independent recognition comes as Wolters Kluwer prepares to celebrate International Women’s Day at Euronext Amsterdam on March 8 for the Ring the Bell for Gender Equality 2023 campaign. The event, a partnership between various high profile organizations including UN Women and the World Federation of Exchanges, will feature senior executives from the Company.

“At Wolters Kluwer we believe that diversity drives performance, and we are pleased to once again be recognized with the top ranking in the Netherlands for gender diversity,” says Carlos Rivero, Senior Vice President, Global Head of Talent Management at Wolters Kluwer. “Strong gender diversity representation is incredibly important to us and there is always more we can do. As a result, we will continue to take actions to further our commitment to diversity, equity, inclusion, and belonging across the entire organization.” As part of the Company’s commitment to taking further actions...

Keep reading

THE NATIONAL PRACTICE PREPARED FOR

Technology Officer

DEXT, THE LEADING CLOUD AUTOMATION PLATFORM FOR ACCOUNTING, HAS EXPANDED ITS LEADERSHIP TEAM WITH THE APPOINTMENT OF STEPHEN EDGINTON AS CHIEF PRODUCT AND TECHNOLOGY OFFICER.

Stephen was previously Chief Innovation Officer and SVP of Engineering at Epicor Software, a global ERP leader in highly-focused productivity solutions for manufacturing, distribution, retail and building supply industries. He was responsible for several key transformational initiatives from cloud migration, automation, integration, research and strategy.

At Dext, Stephen will help shape the company’s future product vision and roadmaps. He is responsible for interpreting customer needs, business needs, and shaping these requirements...

Read more

Richard Culberson appointed CEO of Moneypenny North America (Atlanta)

CALL AND LIVE CHAT COMPANY, MONEYPENNY, HAS BOLSTERED ITS GROWTH AMBITIONS IN THE US BY APPOINTING RICHARD CULBERSON AS CEO OF ITS NORTH AMERICA OPERATIONS. THIS NEW APPOINTMENT WILL STRENGTHEN MONEYPENNY’S RAPID GROWTH IN THE US AND BOOST ITS PLANS TO GROW THE NORTH AMERICAN BUSINESS BOTH ORGANICALLY AND THROUGH ACQUISITIONS.

Culberson was previously General Manager of GPS Apparel at Gap, Inc, and brings with him a wealth of experience in developing new business opportunities and helping companies scale by leveraging innovative technologies and launching differentiated products and services. His experience will be invaluable in leading the company to greater heights. He has also been lauded for his ability to manage complex organizations, and for his skills in developing strategies for growth.

Prior to his time at Gap Inc, Culberson launched and scaled the Homelife business unit and associated suite of connected home services at Cox Enterprises in Atlanta. He has a wide range of experience in media, technology, retail and communications industries, and is passionate about serving the unique needs of both small and large businesses and helping them deliver outstanding customer experiences.

Culberson, who will be based in the company’s Atlanta headquarters, commented: “I am looking forward to taking Moneypenny North America to the next level in terms of developing our Contact Center Teams provision and growing our bysiness. The...

Keep reading

ECONOMIC UNCERTAINTY

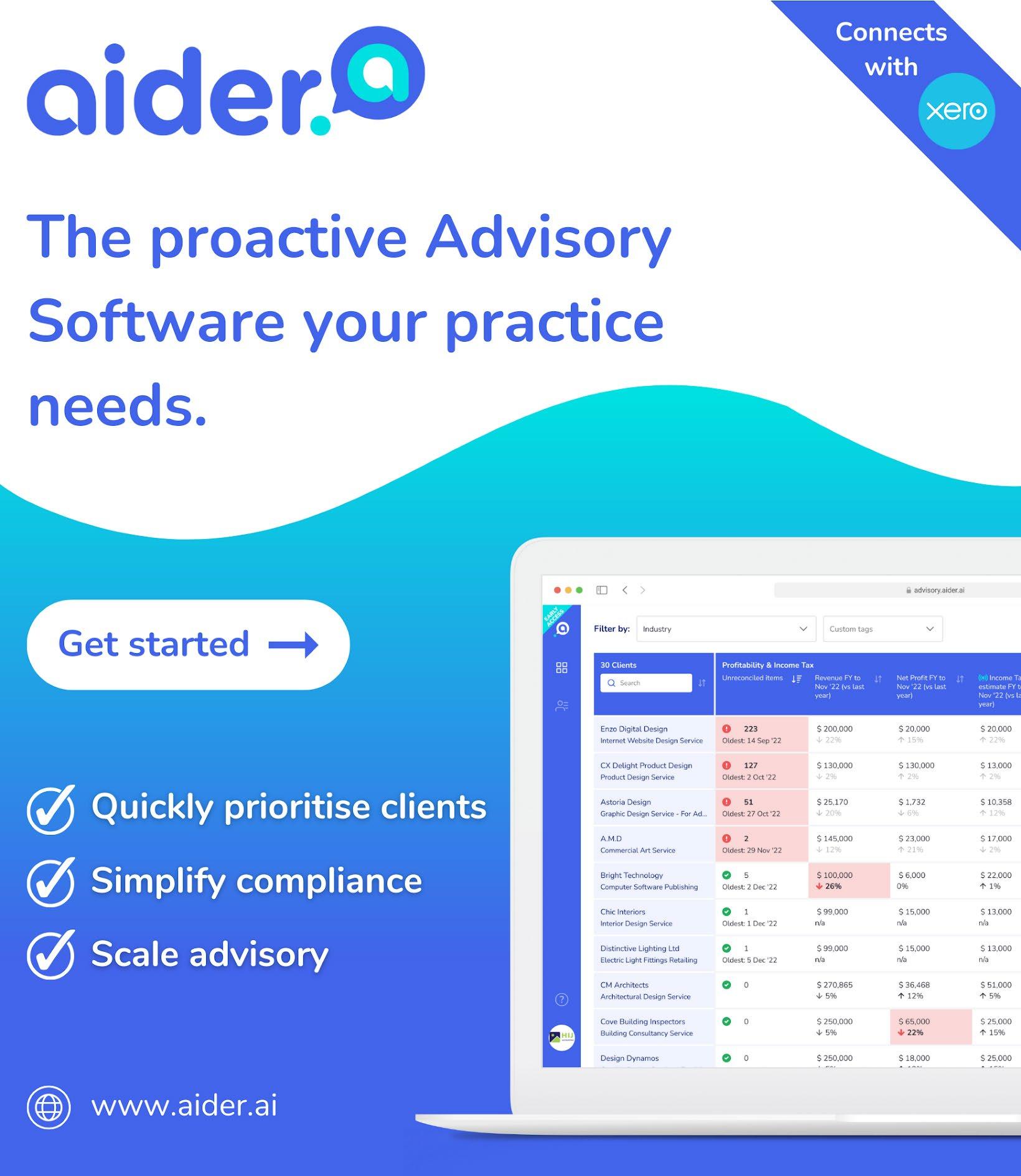

FOR DACE HARRIS, RSM AUSTRALIA’S NATIONAL HEAD OF BUSINESS ADVISORY, THE LOOMING THREAT OF RECESSION SEES HIM FOCUSED ON TWO THINGS – TRUSTED RELATIONSHIPS AND TIMELY DATA. WHY? TO PREPARE HIS CLIENTS FOR WHATEVER COMES NEXT.

When asked about his outlook on Australia’s economy, Dace Harris’ response is what you’d expect from a numbers man –level-headed and analytical. “No one has a crystal ball, but challenges are certainly on the horizon. Our job is to help clients make rational decisions when they’re in an emotional headspace. And we do this by turning to the data.” This is the cool, calm and practical attitude that advisory demands nowadays. But it’s not always easy to front.

Through recent years, Steven Cuffe – a business advisory manager and Dace’s right hand at RSM – was on the front line helping entrepreneurs protect their livelihoods. But despite his best efforts to leave emotion...

Keep reading

Chaser shortlisted for Management Today Best use of innovation award

By Amaya Woods

IAM THRILLED TO SHARE THAT CHASER HAS BEEN SHORTLISTED AT THE MANAGEMENT TODAY BUSINESS LEADERSHIP AWARDS 2023 FOR THE BEST USE OF INNOVATION IN BUSINESS AWARD. CHASER WAS SHORTLISTED FOR THIS INNOVATION AWARD FOR THE SMS PAYMENT REMINDER FEATURE RELEASED IN 2022.

The Management Today Business Leadership Awards acknowledge the vital role of leadership in enhancing business performance and highlight the significance of leadership as a collective effort. This is the only award ceremony that honours exceptional leadership skills in driving a company's success.

Being shortlisted for this award is a testament to Chaser's leadership and the continued focus on producing innovative solutions to help solve end-user needs:

Winning one of these awards shows, not only, that you are a high-performing company, but that your performance is driven by the superior quality of your senior leaders and managers. In short, you are a great place to work that also delivers for its customers, and for the bottom line.

Keep reading

News & Updates XU Biweekly | No. 51 6 Saturday 25 March 2022

Dext expands leadership team with the appointment of Stephen Edginton as Chief Product and

XU Hub

is now on Apple News!

Seamless, simple and accurate. AutoEntry’s automated

leaves time-consuming data entry behind. Start saving time and money today with our amazing deal*.

Automated data entry. No fuss. No fee. Just 3 months free. Get 3 months free

Save hours of admin time by accurately capturing all of your invoices, receipts, expenses, and statements into all major accounting software—including Xero.

bookkeeping

HEDGEFLOWS HAS BEEN ANNOUNCED AS WINNER OF THE 'BEST NEW BUSINESS' AND 'BEST INNOVATION' CATEGORIES AT THE 2023 BEST BUSINESS AWARDS.

It's not everyday you can say you are a winner, but today is one of those days for HedgeFlows!

We're so happy to announce that our platform and business have been awarded with the 'Best Innovation' and 'Best New Business' categories at the Best Business Awards 2023.

When we say we offer a fresh approach to risk management, FX and international payments, it's just our words. But when your platform wins not just one but two recognitions to back it up, then that's the plus to make it even more real.

'BEST INNOVATION' CATEGORY

HedgeFlows is an affordable SaaS alternative to expensive enterprise solutions that help streamline international payments, fraud prevention and currency management. We create impact by building sophisticated, yet easy-to-use technology that empowers SMEs to trade fairly and safely.

Our platform harness

data from the most popular accounting systems to sync past, current and upcoming currency cashflows. Finance teams can use this powerful integration to streamline invoicing and payment processes. In just three minutes from creating a HedgeFlows account and integrating it with your system, you can easily access risk management best practices and expertise previously available only to larger corporations. The platform automatically identifies and quantifies financial risks providing timely actionable data for Financial Directors and their teams to make informed decisions.

'BEST NEW BUSINESS' CATEGORY

After 20 years helping the world's largest banks and corporations reduce the risks and costs of trading in foreign markets, our founders saw an opportunity to level up the playing field for small companies. SMEs don't currently have access to the right tools or support to trade internationally in a safe and easy way as big companies do.

HedgeFlows was created to change that, and we couldn't be happier our efforts are now being...

Keep reading

Accountex Australia: Booking its way into the industry calendar

WITH A DIVERSE RANGE OF ATTENDEES REPRESENTING FIRMS OF ALL SIZES, OVER 130 SPEAKERS, AND MORE THAN 100 BRANDS IN ATTENDANCE, ACCOUNTEX’S FIRST-EVER EVENT IN THE SOUTHERN HEMISPHERE HAS OFFICIALLY WRAPPED UP.

Over two days, guests attended free and ticketed talks hosted by some of the industry’s most prominent thought leaders and disruptors who came together to discuss the future of accounting and bookkeeping. Attendees had a front-row seat to live recordings of some of the sectors’ leading podcasts and benefited from exclusive CPD-accredited workshops hosted by industry thought leaders.

Accountex Australia Product Manager, Sinead Kavanaugh thanked all those who attended Accountex.

“It’s been fantastic to see everyone gather and share knowledge and insights on some of the biggest trends affecting accounting and bookkeeping.”

“From adopting cutting edge technology that streamlines business operations and improves the client experience, to taking a holistic approach to employee wellbeing to combat burnout, the event shared a wealth of strategies relevant to firms of all sizes.”

“With the industry currently going through a period of widespread transformation, having the opportunity to network and hear from those who are leading the

charge is both inspiring and rewarding.”

The CA ANZ Pitch Night Live was a standout event, with attendees watching as six founders competed to be crowned the inaugural Accountex Australia Pitch Night winner and to take home a prize pack valued at over $12k.

With great pitches from finalists including Empiraa, bit.leave, Easy Business App, and Lumiant, the competition was fierce, but the event saw Content Snare crowned the winner for its innovative document collection portal and Brieff awarded the people’s choice award for its CFO in a box infrastructure.

Inbal Rodnay, Head of Innovation, Theory and Motion, a judge at the pitch night, noted the quality of each of the submissions and congratulated Content Snare on its win.

“Congratulations to all that took part in the pitch night. Content Snare and Brieff are both fantastic examples of how accountants and bookkeepers can utilise technology to provide an enhanced service and better support client’s needs.

“All of the finalists were strong, and should be proud of their efforts. I look forward to following their journeys as they innovate their platforms and products for the betterment of the industry.”

Accountex Australia concluded with a wrap party which saw attendees, exhibitors and speakers come together, network and...

Find out more

The home of XU Magazine and XU Biweekly XU Hub is now live on Apple News! Events XU Biweekly | No. 51 8 Saturday 25 March 2023 WATCH A FREE WEBINAR ON THE XU HUB! David Hassall, CEO of XU Magazine on LISTEN TO...

WATCH

WATCH A FREE WEBINAR WATCH

New Zealand Australia ipayroll.co.nz cloudpayroll.com.au Classifieds XU Biweekly | No. 51 Saturday 25 March 2023 9 Accountant Tools Bills & Expenses Cloud Integrators CRM Financial Services Payments Reporting Professional Services Invoicing & Jobs Outsourcing If the only update your so tware gets each year is price, it could be time to switch wolterskluwer.co.uk/switch Time Tracking Year End OUT NOW: ISSUE 34 Give your clients the tools to take control of their financial health Get started for free You could be this happy with your client collaboration Award-winning cloud software and knowledge solutions for your accounting practice. CCH iFirm CCH iKnow CCH Learning → Automate, 5-16 MARCH 2023 CC SYDNEY REGISTER NOW JOIN AUSTRALIA'S MOST EXCITING ACCOUNTING & FINANCE EVENT! 10 - 11 October 2023 Suntec Convent on Centre S ngapore REGISTER FREE FOR BUILDERS JOB MANAGEMENT www.nextminute.com It’s a match made in heaven. Start your FREE trial: workflowmax.com/xero Do more for your clients with SeedLegals Book a call New Zealand Australia ipayroll.co.nz cloudpayroll.com.au appogeehr Intelligent time tracking software www appogeehr com castawayforecasting.com/xu UNLOCK YOUR POSSIBILITIES Real Time Cash Flow Forecasting and Reports Find Out More Prepare R&D tax claims. Smarter. whisperclaims.co.uk tidyinternational com JOB MANAGEMENT Powerful Software Delightfully Simple Detailed reporting and tight project controls enable your business to maximise efficiency and profitability.

By Michael Ford

ENTREPRENEURS ARE DRIVEN BY ‘THE ITCH’. IF YOU’VE FELT IT YOURSELF, YOU KNOW EXACTLY WHAT I MEAN. IT’S THAT INNATE GNAWING, DISCOMFORTING FEELING THAT COMES FROM A DEEP, AND OFTEN LIFELONG, CONVICTION THAT THERE HAS TO BE A BETTER WAY. THE ITCH IS NEVER FAR AWAY - IT LIVES IN YOUR HEAD, DISTRACTS YOUR THOUGHTS, NAGS AT YOU. I’M NO PSYCHOLOGIST, BUT TO ME THE ITCH IS AS DEEP AS DNA. IT’S NOT A LEARNED BEHAVIOUR, SO IT CAN’T BE ‘UNLEARNED’. THERE IS NO ESCAPE.

Entrepreneurs start businesses because the itch gets too much. They resist it, they damp it with logic, they try to ignore it, but it never goes away. As time goes on, it intensifies. Finally, they are compelled to do something about it.

The caricature view of the entrepreneur as a risk-taking, slick-talking hustler could not be further from the truth. The real entrepreneurs, the ones that you and I work with, are just people doing everything they can

to scratch their itch. And no matter where they are in the world, no matter what industry their business serves, no matter what age, sex, creed or colour, the itch, the belief, the drive to find a better way is exactly the same. They can see the path ahead. They can see the forks in the road, the options, the decision points. And they need help to work out which way to go.

At Castaway, every day we talk to entrepreneurs and to the accountants who look after them. Our customer base is split evenly, so we get a healthy range of views from both perspectives.

The Entrepreneurs tell us they see the services their accountants provide on 3 levels:

• They appreciate the compliance work that keeps their business on the right side of the law

• They value the work that supports and sustains the business (bank loans, grants and the like)

• They love the work that helps unlock the possibilities of the business (scratching the itch)

It should be no surprise that their level of ‘excite-

ment’ about the fees they pay follows the same order.

The Accountants we talk to tend to fit into one of 3 categories:

• A few tell us “my clients just don’t need that sort of stuff”

• Some say they build budgets and forecasts when clients ask for them

• For others, forecasting is the backbone of their advisory practice. Clients love the work they do and happily pay their fees

To the first group… who knows, they may well be correct. But if there’s even one entrepreneur on the client list, I guarantee that firm is not asking the right questions.

When we dig deeper with the second group, their focus is generally the entrepreneur’s second level of satisfaction, the sustaining and supporting work like applying for bank loans and grants, churning out annual budgets and the like. Although the demand generation is reactive, this work is useful for clients and can be readily systemised and productised into a profitable service… definitely a winwin.

The third group are different. They work differently, they think differently, they talk differently. And they get different results for clients. By different, I mean better… much better. Of course, the question of “how” they are different has a hundred answers.

One thing stands out for me. The third group have gone beyond forecasting as a maths exercise focused on putting numbers on a page. They’ve evolved to embrace the idea of forecasting as a framework for exploring what is possible. This is a big step, in both mindset and methodology. They’ve found the holy grail - a way to help their entrepreneur clients scratch the itch, a way to help those entrepreneurs unlock the possibilities in their business.

It’s a simple idea, but it’s counter-intuitive, especially for firms with strong compliance-based business models, where efficiency and capacity utilisation are the traditional optimisation tools.

But it’s also entirely intuitive. Clients perceive the greatest value when you help solve their biggest, most annoying problems.

And for an entrepreneur, the ‘itch’ is the most significant long term problem there is. And forecasting, the process of looking ahead, considering scenarios, facing realities, game-planning responses, making decisions, is the best framework I know for unlocking possibilities, for finding solutions to the itch.

So how do the third group of accountants start the conversations with their clients? How do they build the interest? How do they get the clients to happily agree to engage them?

Well, the good news is we’ve seen lots of different approaches… and they all work very well. It’s a matter of finding something that works for you. If you’re looking for somewhere to start, here’s a simple 3-step approach that involves zero selling, but is highly effective at unlocking possibilities for both you and your client.

1. Find the itch

Here’s an idea. Find a client. Take them to coffee, or to lunch, or just have a call. With genuine interest, ask 3 questions:

1. Why did you start this

business?

2. What were your dreams for the business back then?

3. How have those dreams changed?

You’re looking for the itch. Given the chance, and an engaged audience, most entrepreneurs love talking about their business. Some will open up immediately, the ideas and stories will just start flowing. For others, the conversation might take some time to get rolling.

If you’ve been in business a while, the daily grind, decision fatigue, pandemics and other challenges can wear you down … its all too easy to forget (or suppress) the original dreams for the business. In this situation, be patient and nurture the conversation. The memories will start to come back, a trickle at first and then more. Keep at it and you’ll see the imagination spring to life and the ideas start to flow. That’s the itch firing up again … it never goes away.

2. Run a Possibilities session

Find out more

Features XU Biweekly | No. 51 10 Saturday 25 March 2023

By Emily Ossington, NextMinute

WE LIKE TO THINK WE KNOW OUR CLIENTS PRETTY WELL, BUT YOU KNOW WHAT ‘THEY’ SAY ABOUT ASSUMING…

As a company, we want to make sure that our customers succeed, and that our product plays an important role in helping our customers achieve their goals.

One of our team values at NextMinute is to sit alongside our customers and partners.

We also have the value proposition that we “make life easier by managing pricing, planning, people and profits.”

So, we recently put together a Customer Survey in order to get a better understanding of the needs and preferences of our customers, and to question are we delivering on what we promise?

‘They’ also say success is in the eye of the beholder, and our beholders are our customers - who are also your customers!

If you are a Trusted Advisor with clients in the Trade & Construction industry, here are some results from our Customer Survey that might help you understand the industry better.

Who are they?

Our average client is a 39 year old male builder, business owner, married with more than one child and has completed some form of tertiary education like trade school,

college or university.

What do they need?

We asked our clients, on a scale of 1 to 10 how important are the below items to their business (answers in order based on the av erage response.)

1. Profit

2. Managing their team

3. Save time

4. Consistent work

5. Scheduling work

6. More clients

This re-confirms for us that our value proposition of pricing, planning, people and profits aligns with what our customers con sider important in their businesses.

What do they want?

We asked them to rank the importance of family time on a scale of 1 - 10. It was num ber one.

Other questions around ‘hobbies and free time’ had a variety of answers, all of which included outdoor activities such as fishing, board sports, or playing sports with their family & friends.

These responses indicate that our clients value and want more time to spend...

Find out more

By Danny Bateman, SeedLegals

Want to make your accountancy practice more attractive to new and existing clients? Add more services and become a one-stop shop for startups and small businesses.

But how do you do that without hiring specialist staff? By partnering with SeedLegals, you’ll be able to offer a more comprehensive, integrated service for startups and SMEs. You do the accountancy tasks; your client uses SeedLegals for extras. You can choose to add SeedLegals as white label software to your existing digital services, or give your clients discounts for SeedLegals and claim a referral fee.

Established in 2016, SeedLegals is an online platform which combines automated legal documents with friendly, personalised help from a team of experts. Since 2020, the company has worked alongside accountants to provide clients with a seamless, affordable service.

Over 50,000 companies have used SeedLegals to grow and scale faster. As well as straightforward business legals such as employment contracts, company policies and board management, the legal-tech service helps founders and business owners with the pivotal moments that matter:

• Secure S/EIS Advance Assurance

Do S/EIS compliance

Two thirds of all SEIS and over half of all EIS Advance Assurance applications are

• Set up option schemes

Get an EMI valuation

One quarter of all UK EMI schemes are designed and managed on SeedLegals

• Do a funding round

Take an investment

SeedLegals is the UK’s number one closer of early-stage rounds in the UK with over £1 billion raised to date. The company pioneered ‘agile funding’ to help companies take one-off investments outside funding rounds.

Make clients happyand boost profits

By partnering with SeedLegals, you have the reassurance of offering extra services via a market leader. And with a more extensive set of

WE HAVE BEEN WORKING CLOSELY WITH THE CPD CERTIFICATION SERVICE TO HAVE OUR ARTICLES CPD CERTIFIED. As you read through our sister publication, XU Magazine, any article that shows the CPD Certified logo has been approved to count towards your CPD points. Claim your FREE CPD Points! XU MAGAZINE IS CPD CERTIFIED FOLLOW OUR SISTER PUBLICATION... @xumagazine @xumagazine @XU Magazine @xu_magazine Tired of saying, ‘We can’t

you

5 THINGS YOU

help

with that’?

SHOULD KNOW ABOUT YOUR RESIDENTIAL CONSTRUCTION CLIENTS

DANNY BATEMAN OF SEEDLEGALS EXPLAINS HOW ACCOUNTANTS CAN USE LEGAL-TECH SOFTWAREAS-A-SERVICE TO OFFER MORE VALUE TO CLIENTS.

Highlights XU Biweekly | No. 51 Saturday 25 March 2023 11 New user Search users… Hilda Henderson Benjamin Sanders Antonio Simpson

Becker

Lucinda

A RESPONSE TO THE SILICON VALLEY BANK CLOSURE FROM EKOS CEO

Earn extra rewards with Revolut Credit Cards

WE KNOW YOU’VE BEEN WAITING FOR REVOLUT CREDIT CARDS, WHICH IS WHY WE’RE WORKING HARD TO MAKE THEM AVAILABLE TO MORE AND MORE PEOPLE. NOW IT’S TIME TO DIAL UP THE EXCITEMENT EVEN FURTHER — WANT TO LEARN MORE ABOUT THE COOL STUFF THAT COMES WITH HAVING A REVOLUT CREDIT CARD? READ ON.

Who can apply for Credit Cards?

Credit Cards are currently available to existing Revolut customers in Poland, Lithuania, USA, and Ireland. We’ll soon be expanding to even more countries, so stay tuned on our social media channels or follow our blog to hear where Credit Cards

are headed next.

How can I apply for a Revolut Credit Card?

Head to Credit Cards in-app or tap here to start an application. Fill in the questionnaire and provide all the information requested, and you’ll receive a decision in minutes!

What can you get with a Revolut Credit Card?

Now the fun part. Our credit cards come with plenty of benefits and a customised limit to suit your spending needs.

Some highlights include:

• Cashback rewards for all of your purchases

• Additional cashback when you make your... Find out more

By Josh McKinney

IT’S BEEN A STRESSFUL COUPLE OF DAYS AS THE SILICON VALLEY BANK CRISIS HAS UNFOLDED. WHILE THE SVB NAME HAS BECOME SYNONYMOUS WITH TECH, IT HAS ALSO BEEN A MAJOR LENDER TO THE WINE INDUSTRY FOR DECADES. AS THE CEO OF A TECH COMPANY THAT SERVES THE WINE INDUSTRY, I’VE BEEN HIT WITH NEWS FROM EVERY ANGLE.

Our winery customers are wondering if their assets are safe, and now they face the challenge of securing new loans from banks without SVB’s deep industry knowledge. Industry partners like Rob McMillan are reeling from the sudden collapse of their company, and we all

face the potential loss of the gold-standard of industry benchmarking with the annual state of the industry report. And our software company peers are facing yet another blow to the already unstable tech industry.

In times of turmoil and uncertainty, my first instinct is to find a way to help. In the past few days, I’ve had conversations with industry peers about next steps for their company’s banking needs. Access to capital and making payroll are crucial in the near term. For the long term, it’s about finding the right financial partner that believes in your business and wants to grow alongside you — that is what so many had in SVB.

I’ve also been thinking specifically about what

Stripe announces new round of funding and plan to provide employee liquidity

Ekos can do to serve the wine industry during this time. From the beginning, the goal of Ekos has always been to help businesses run better. Especially in difficult times, we believe that having the right information at your fingertips can help you make data-driven decisions that mean the difference between failure and success. We saw this during the early months of the pandemic as our winery and brewery customers had to shift their operations due to government regulations and changing consumer habits. Those who were able to understand the state of their business and pivot were the ones who made it through.

Now, with more financial uncertainty than ever for SVB customers, we at Ekos

want to offer up help where we can. We’re offering support and financial relief to new and existing Ekos customers who are affected by the SVB shutdown. We’re contacting all of our customers today to let them know that we are here to help. While the ripple effects of the past couple of days will still take a while to reveal their full impact, we will do what we can to alleviate some immediate stress. Ekos is a proud member of the wine community, and we’re dedicated to supporting businesses navigating tumultuous times. We’re here for you.

Josh McKinney CEO, Ekos

Keep reading

By Linda Yang

GOCARDLESS, A GLOBAL LEADER IN BANK PAYMENT SOLUTIONS, HAS INTEGRATED WITH ZAPIER, THE LEADER IN NO-CODE AUTOMATION, TO HELP BUSINESSES SAVE TIME AND ENERGY WHEN MANAGING THEIR PAYMENTS.

Businesses can now build Zaps -- Zapier's automated workflows -- for GoCardless, eliminating manual labour for routine and repetitive tasks, such as creating a new payment mandate or tracking failed payments. Zapier’s platform includes over 5,000 apps, making it easy for businesses to connect GoCardless to the software they use every day.

Seb Hempstead, VP of

Partnerships at GoCardless, said: “Our mission is to take the pain out of getting paid. That’s why we’re excited to partner with Zapier, helping businesses tap into real-time information flows to turn manual admin into automated processes. This will give them more time to focus on their top priorities. And it’s simple to use – there’s no code involved.”

Businesses can find the new GoCardless integration on the Zapier App Directory page and learn more on the GoCardless landing page.

The announcement adds another leading name to GoCardless’ roster of more than 350 partners. These partnerships allow businesses...

Keep reading

STRIPE, WHICH BUILDS ECONOMIC INFRASTRUCTURE FOR THE INTERNET, HAS SIGNED AGREEMENTS FOR A SERIES I FUNDRAISE OF MORE THAN $6.5 BILLION (EUR6.15 BILLION) AT A $50B (EUR47B) VALUATION. PRIMARY INVESTORS INCLUDE EXISTING STRIPE SHAREHOLDERS— ANDREESSEN HOROWITZ, BAILLIE GIFFORD, FOUNDERS FUND, GENERAL CATALYST, MSD PARTNERS, AND THRIVE CAPITAL—AS WELL AS NEW INVESTORS INCLUDING GIC, GOLDMAN SACHS ASSET AND WEALTH MANAGEMENT, AND TEMASEK.

The funds raised will be used to provide liquidity to current and former employees and address employee withholding tax obligations related to equity awards, resulting in the retirement of Stripe shares that will offset the issuance of new shares to Series I investors. Stripe does not need this capital to run its business.

“Over the last 12 years, current and former Stripes have helped build foundational economic infrastructure for millions of businesses around the world, and this transaction gives them the opportunity to access the value they’ve helped create,” said John Collison, cofound-

er and president of Stripe.

“But the internet economy is still young, and the opportunities of the next 12 years will dwarf those of the recent past. There’s so much to discover and to create. For us, it’s now back to work.”

Benefiting from enterprise leadership and startup waves

As traditional businesses have continued to shift online, Stripe’s enterprise user base has compounded since 2019, and now includes some of the largest global enterprises like Amazon, Ford, Salesforce, BMW, and Maersk. At the same time, Stripe continues to see strong momentum with startups. Founders are starting companies at a historic rate, and Stripe Atlas saw a 155% increase in incorporations from 2019 to 2022.

Stripe benefits from the early role it plays in technology waves that reverberate across the industry, like mobile marketplaces, SaaS, and now AI, with users like OpenAI, Anthropic, Midjourney, Copy.ai, CoreWeave, and a long list of others.

“Stripe’s strategy is inherently indexed to secular trends that will only compound for decades to come: the growth of the internet...

Keep reading

Message from Veem CEO regarding recent banking disruptions

By Marwan Forzley

By Marwan Forzley

ON MARCH 10, 2023, CALIFORNIA FINANCIAL REGULATORS SHUT DOWN SILICON VALLEY BANK (SVB) AND APPOINTED THE FEDERAL DEPOSIT INSURANCE CORPORATION (FDIC) AS A RECEIVER TO PROTECT CUSTOMER FUNDS.

I want to assure you that Veem remains operational and is ready to serve your payment needs. Veem maintains multiple banking relationships to ensure we can service your payment needs both in the US and Canada, as well as

Cross Border Payments. We continue to rely on reputed banking partners across the globe to process payments including Citi and HSBC.

As always, we remain dedicated to processing your payments and supporting your needs. If you have additional questions, please reach out to us at clientservices@veem.com.

Thank you for your continued trust.

Marwan Forzley CEO, Veem...

Read more

PAYPAL: NEW EMPLOYEE INDUCEMENT GRANTS

FinTech News XU Biweekly | No. 51 12 Saturday 25 March 2023

GoCardless partners with Zapier to automate payment processes across 5,000+ apps

HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED IT HAS GRANTED EQUITY AWARDS ON MARCH 15, 2023, UNDER ITS 2022 INDUCEMENT EQUITY INCENTIVE PLAN (THE "PLAN") TO NEW EMPLOYEES WHO JOINED PAYPAL. The grants were previously approved by the Compensation Committee of the Board of Directors of PayPal Holdings, Inc. Keep reading

PAYPAL

CAR INSURANCE, COMING SOON IN IRELAND

Never overpay for currency exchanges with Revolut's Limit and Stop orders

By Richard Johnson

stung with transaction fees or overpay your future exchanges. Here’s how:

Use Limit and Stop Orders to name your price whenever you buy and sell. Automatically exchange your money and tokens, any time. At breakfast, in meetings… even in your sleep. And that means you can keep your eyes on your own finances and off the...

Find out more

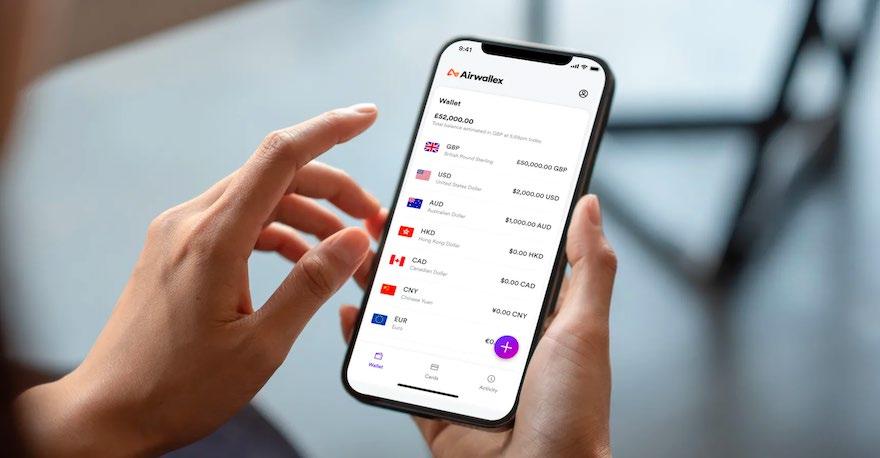

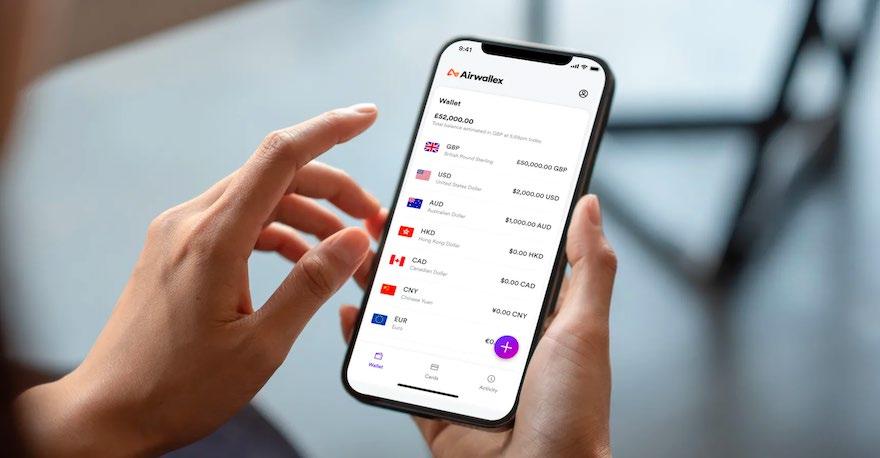

HOW AIRWALLEX BUSINESS ACCOUNTS WORK IN THE UK AND EUROPE, AND WHY YOUR FUNDS ARE ALWAYS SAFE

DRIVE SMART, SAVE SMARTER. THAT’S WHAT YOU’LL GET WITH REVOLUT CAR INSURANCE – NO FRILLS, NO FUSS. WE’RE LAUNCHING THIS SPRING, AND FROM 22 MARCH 2023, CUSTOMERS IN IRELAND WILL BE ABLE TO JOIN THE WAITLIST.

Plus, all Revolut customers that sign up to the waitlist by 13 April 2023 and buy a policy will get a chance to win EUR2,500! Terms and conditions apply.

Revolut will be the first to provide an app-based car insurance journey in Ireland. We’re revolutionising the insurance market, making insurance easy and more convenient for you. No need to leave the app

to fill out forms, or check out the terms and conditions. It’s all smoothly layed out in-app, you’ve never seen a car insurance so easy to get. Here's a rundown of what you can get with Revolut Car Insurance:

Save up to 30% on Car Insurance

Choose between Third-party, Fire and Theft, or Comprehensive cover, no hidden fees. Pay only for what you need with flexible coverage and excess options. Plus, you can choose between annual or monthly payments. Your car, your choice.

Get on the road in a few taps

Say goodbye to boring online forms, Revolut Car Insurance is here to save your day. Get a quote in-app in less than five minutes. No need to answer tons of questions, just a few easy ones to help you pick the right insurance coverage for you. All in a few taps, all in-app.

Drive smarter, save even more

If you appreciate safe

driving, this one’s for you. With our Smart Driving option, safe drivers can save up to 25% more while buying car insurance, and even more during their renewal. Keep your eyes peeled, we’ll let you in on all the details very soon!

Here’s how you can join the waitlist: Keep reading

IN THE WAKE OF THE COLLAPSE OF SILICON VALLEY BANK (SVB) IN THE US AND SIGNATURE BANK, WE’D LIKE TO TAKE A MOMENT TO CLARIFY HOW OUR CUSTOMERS’ FUNDS ARE KEPT SAFE IN THE UK AND EUROPE.

Airwallex is not a bank, we are licensed as an Electronic Money Institution (EMI) by the Financial Conduct Authority (FCA) in the United Kingdom and the Dutch

National Bank in the Netherlands. We partner with banks worldwide to offer multi-currency accounts, money transfers, foreign exchange, payment acceptance and more to global businesses. While we share many features with banks, there is a key difference in how we store our customers’ money.

How deposits work...

Keep reading

TO MARK THIS YEAR’S INTERNATIONAL WOMEN’S DAY THEME, #EMBRACEEQUITY, WE WANT TO SHARE WITH YOU THE LATEST FROM OUR WOMEN IN BUSINESS PROGRAMME.

And in light of this important celebration, we wanted to give our female members a voice. That’s why earlier in February, we surveyed* our mem-

bers from across the UK to understand both the challenges and the opportunities they face when starting up, and the support they’re looking for to help them grow. We received close to 2,000 responses, which gave us a wider perspective on how to continue to help more women start their business.

Empowering women is a topic that’s close to home for me: whether that’s the women on my team or the

women in business we serve at Tide. To this day, female entrepreneurs continue to be an under-represented group – that means championing each other is a priority, so our strengths are recognised.

We’ve fulfilled our commitment to helping 100,000+ female-led businesses

Back in 2019, we set a target to welcome 100,000 fe-

male-led businesses in the UK by the end of 20231 , to support them in starting and running their own business.

This initiative was in response to the Alison Rose Review of Female Entrepreneurship2, first published in March 2019, which found that only 32% of UK entrepreneurs are women. It revealed a huge untapped potential...

Read more

FinTech News XU Biweekly | No. 51 14 Saturday 25 March 2023

RELYING ON FOREIGN CURRENCIES TO FUEL YOUR BUSINESS MIGHT LEAVE YOU FEELING EXPOSED. BETWEEN SUPPLIERS, STOCK, AND WORKERS’ WAGES... YOU'RE ALL BUT GUARANTEED TO SEE CURRENCIES BOUNCE BEYOND YOUR COMFORT ZONE. AND YOUR CONTROL. You might not have a crystal ball. But you can make sure you won’t be

Tide has onboarded more than 100,000 female members. Here’s what they’ve told us about starting a business.

By Tyler Cruse

By Tyler Cruse

By Marwan Forzley

By Marwan Forzley