3.7 MILLION SUBSCRIBERS

Xero's FY 2023 Financial Results

By Sukhinder Singh Cassidy, XeroTODAY WE ANNOUNCED XERO’S FULL YEAR FINANCIAL AND OPERATING RESULTS TO 31 MARCH 2023 (FY23).

Having started my journey as Xero’s CEO in February this year, I’m pleased to share our strong FY23 operating results, and I’m deeply excited about our opportunity to help power the global small business economy.

Our results demonstrate Xero’s resilience in a complex macroeconomic environment, our valuable customer proposition, our increasing efficiency, and commitment to even more disciplined, customer-focused growth.

We grew FY23 operating revenue by 28% (25% in constant currency (CC)) to $1.4 billion, which contributed to a 45% increase in adjusted EBITDA compared to FY22 to $301.7 million. This drove a significant increase in free cash flow to $102.3 million, reflecting a free cash flow margin of 7.3% compared to 0.2% in FY22.

We also incurred non-cash impairments and associated costs, and restructuring charges during the year. This led to EBITDA decreasing 26% compared to FY22 to $158.4 million. This included a $77.9 million impairment to Planday (mainly reflecting a reduction in market valuation multiples along with operational performance), $48.5 million of impairments

OVOLU LAUNCHES AT ACCOUNTEX

and other costs related to Waddle, $34.7 million in restructuring costs, and noncash accounting revaluation gains of $17.9 million.

Total lifetime value grew 23% (21% in CC) to $13.4 billion. This was driven by double digit subscriber growth across all regions – as average monthly churn (0.90%) remained low and ARPU improved 10% (8% in CC).

This underscores the trust customers place in Xero to help them manage their businesses.

Financial results

Performance highlights FY23 (All figures are in NZD and comparisons are made against FY22)

• Operating revenue increased 28% to $1,399.9 million

• Total subscribers increased by 470,000 to 3.74 million

• Annualised monthly recurring revenue (AMRR) grew 26% to $1,553.8 million

• Total subscriber lifetime value grew $2.5 billion to $13.4 billion

• Gross margin percentage remained flat at 87.3%

• Adjusted EBITDA increased $93.0 million to $301.7 million

• Operating income grew 61% to $57.3 million

• Net loss grew $104.4 million to $113.5 million

• Free cash flow was $102.3 million, up $100.2 million

Keep reading

The revolutionary digital business card solution took the event by storm.

1,000s went away with their FREE card.

ACCOUNTEX LONDON, THE LARGEST ACCOUNTING EXHIBITION IN THE UK, PROVIDED THE PERFECT PLATFORM FOR XU MAGAZINE TO INTRODUCE OVOLU TO THE WORLD.

This revolutionary digital business card solution took the event by storm, capturing the attention of thousands of attendees who eagerly embraced the concept and took a card away with them.

Ovolu offers a range of im-

pressive features designed to simplify business interactions and leave a lasting impression. With a sleek and user-friendly interface, Ovolu allows users to create their digital business card in minutes, complete with essential contact details, social media profiles, company information, and a personalised bio. Say goodbye to the hassle of carrying stacks of traditional business cards; Ovolu ensures that all vital information is conveniently stored in one place.

One of the standout fea-

tures of Ovolu is its use of near field communication (NFC) in the card. Users can tap their digital business card on any smartphone. This seamless tapping process instantly transfers the user's contact information to the recipient's smartphone, ensuring an efficient and accurate exchange of information. Gone are the days of manually entering contact details into your phone.

Ovolu is doing things a little differently however by offering its digital business cards for free! Speaking with

one of the co-founders they said “We’re so excited to see this initial uptake from the show but what we’re really excited about is what’s to come along the journey in terms of new value-added features for our users. Times are changing and so is how we connect with others. We believe that digital business cards are the first stage in this journey as business is, and will always be, built on connections.”

Sign-up for free

New Apps & Updates

Deputy

partners with EdApp to create industry-first data backed microlearning for shift workers and managers

SHIFT WORK MANAGEMENT PLATFORM

DEPUTY TODAY ANNOUNCED ITS PARTNERSHIP WITH MOBILE LEARNING MANAGEMENT SYSTEM (LMS) EDAPP, TO CREATE TWO NEW COURSES SPECIFICALLY DESIGNED FOR SHIFT WORKERS AND MANAGERS IN THE HOSPITALITY INDUSTRY.

Developed off the back of Deputy’s Big Shift Report: The Changing Landscape of Australian Hospitality, these courses were created as a

XU BIWEEKLY - No. 55

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell Director of Strategic

Partnerships: Alex Newson

Design & Communications

Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage.

The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

solution to one of the findings — 50% of global shift workers want their employer to place a greater focus on wellbeing. This re-confirms the need for the hospitality industry to support career development, build trust and improve the feedback loop between shift workers and managers.

Following these recent report findings, Deputy and EdApp joined forces to create a solution to this industry problem — mobile-first, micro-learning courses for frontline workers. This part-

nership produced two new courses: the Shift Workers Track and the Manager Track. With each micro-lesson taking between three to seven minutes to complete, teams are motivated to delve in at their own convenience, with little disruption to their workflow.

“To make training effective, businesses must meet their employees where they are. This means moving away from lengthy, hourslong, dull training sessions...

Find out more

Balancer has launched!

AFTER AN INCREDIBLY SUCCESSFUL BETA PERIOD, MAYDAY BALANCER IS NOW LIVE!

Balancer is the safety net that ensures your intercompany loan accounts will never again fall out of balance.

To see a demo of how Balancer transforms your intercompany loans so that you never have to worry about the accounts falling out of balance, watch our launch webinar.

in balance so that all of the entities are clear on what is owed and month/year-end consolidation can take place. Intercompany loan accounts between a business’s related entities easily fall out of balance because of:

1. posting asymmetry

2. FX adjustments can be missed or incorrectly calculated

3. Interest can be missed or incorrectly calculated

The result is that finance teams must then unravel these transactions to find the culprit and rebalance the accounts. The pain of rebalancing the accounts invariably comes at the worst time: at year end, or during a financing or acquisition.

How does it work?

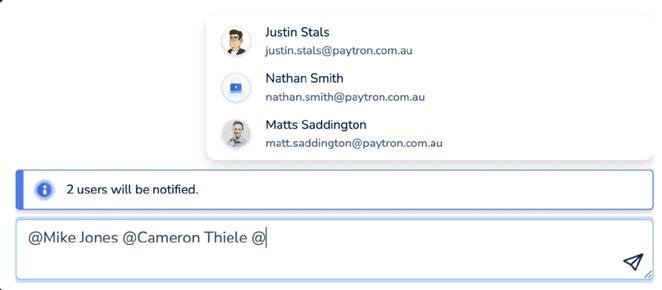

XERO TRACKING CATEGORIES ISSUE HAS BEEN FIXED: WE WERE AWARE OF ISSUES WHERE XERO TRACKING CATEGORIES THAT WERE FILLED IN PAYTRON WOULD APPEAR BLANK AFTER BEING PUSHED ACROSS TO XERO. WE'RE HAPPY TO SHARE THAT OUR TEAM HAVE RECTIFIED THE ISSUE SO ALL RELEVANT INFORMATION IS NOW CORRECTLY UPDATED IN THE TRACKING CATEGORY SECTION WITHIN XERO.

Tanda launches HR Legal Templates feature, simplifying compliance

TANDA USERS WILL NOW BE ABLE TO ACCESS TEMPLATE EMPLOYMENT CONTRACTS AND HR POLICIES, MAKING COMPLIANCE FAR SIMPLER FOR OUR CUSTOMERS, ALL ACCESSIBLE FROM THE TANDA APP.

Tanda HR Legal Documents are pre-written employment contract and policy documents made available for use in Tanda through our Contracts and Documents feature. The templates are written and maintained by qualified lawyers at national law firm Kingston Reid, and include a range of different employment types and conditions, designed to be flexible to meet your needs.

Tanda has a long-running commitment to making business more straightforward for...

Keep reading

Resend invite option now available: Previously sent an invitation request to a user but have yet to receive a response? You can now easily resend an invite or revoke an invite by heading to Teams > User > Click the 3 buttons next to their name.

You can now tag someone in a note: Need to notify a user? Just "@(name)" in a note and the person tagged will receive an email notification.

New condition available on Payment approval policies: You can now set a condition to filter by where the...

Keep reading

NEW XERO CONNECTED APPS!

Chaser wins Management Today Best use of innovation in business award

By Amaya WoodsDELIGHTED TO SHARE THAT CHASER HAS WON THE 'BEST USE OF INNOVATION IN BUSINESS AWARD' AT THE MANAGEMENT TODAY BUSINESS LEADERSHIP AWARDS 2023.

This award is for the SMS payment reminder feature in Chaser, and the results it's helped end-users to achieve.

Comments from the judges included:

“Simple innovation that has solved genuine business headaches - particularly beneficial in these challenging times.”

When would I need Balancer?

When a business has multiple related entities, the entities will almost always have intercompany loan accounts. These intercompany loan accounts need to stay

Balancer cross-checks your intercompany loan accounts and immediately flags any discrepancies between them.

You’ll be able to quickly...

Find out more

“I liked the entry, mainly because I haven't ever truly thought about innovation in this space. I also like the way the team has used something as simple and everyday as the SMS to dramatically improve sales collection.”

After being shortlisted for the award in March, the team were thrilled to hear that SMS payment reminders won and were recognised as the best use of innovation this year.

Winning one of these awards shows, not only, that you are a high-performing company, but that your performance is driven by the superior quality of your senior leaders...

Keep reading

AU - Free invoicing and cashflow management, from handling paymentes to negotiating supplier discounts, making paying bills faster, saving you hours every week. Plus, invoice on-the-go from your phone to get paid even quicker!

WISE FX BILLS ZETPY

AU, CA, IE, SG, UK & US - Connect with Wise, the fast and easy international business account, to automatically sync your activity with Xero for over 50 currencies. Effortlessly pay bills, vendors and employees in seconds and choose to reconcile manually or automatically.

ID, MY, PH & SG - Integrate eCommerce stores such as Shopee, Lazada, TikTok Shop, Shopify, WooCommerce, Zalora and Magento with Xero to have a centralized auto inventory across all of your platforms. Zetpy auto generates invoices for your online orders and updates payments.

BZTRACK HOMEBOZZ

GLOBAL - Easy management of your tenant invoices, automatically syncing all customer contacts in HomeBozz with Xero at the end of each day, simplifying your invoice generation and giving the ability to bulk transfer invoices all at once. Reduce manual data entry and get more accurate data.

Never Again will your intercompany loan accounts fall out of balance

EXPENSIFY EXPANDS EMPLOYEE REIMBURSEMENTS GLOBALLY

EXPENSIFY (NASDAQ: EXFY), A PAYMENTS SUPERAPP THAT HELPS INDIVIDUALS AND BUSINESSES AROUND THE WORLD SIMPLIFY THE WAY THEY MANAGE MONEY ACROSS EXPENSES, CORPORATE CARDS, AND BILLS, TODAY ANNOUNCED THE INTERNATIONAL EXPANSION OF THEIR EMPLOYEE REIMBURSEMENTS FUNCTIONALITY.

Businesses managing spend and expenses across borders can now reimburse employees almost anywhere in the world using Expensify.

“Employees can work from anywhere these days and expect to be reimbursed quickly for out-of-pocket expenses regardless of where they live”, said David Barrett, Founder and CEO of

Expensify. “We have listened to these customers and now include global reimbursements for free in all paid Expensify plans.”

Importantly, there are no pre-funding requirements to reimburse employees in other countries. Businesses simply link their local bank account and pay employees at any time. Expensify will handle the rest.

“Businesses can reimburse employees in over 154 different currencies across 200 plus countries”, explained Expensify COO, Anu Muralidharan. “Further, we’re adding the ability for businesses to link withdrawal bank accounts in the United Kingdom, Canada, Australia, and the entire European Union.”

Expensify customers or...

New partnership simplifies ‘Tipping Bill’ compliance

AWARD-WINNING CASHLESS TIPPING PLATFORM TIPJAR HAS JOINED FORCES WITH DEPUTY, THE LEADING WORKFORCE MANAGEMENT APP, TO ENABLE BUSINESS OWNERS AND MANAGERS TO AUTOMATICALLY DISTRIBUTE TIPS AND TRONC TRANSPARENTLY AND FAIRLY AMONGST THEIR TEAMS.

The announcement comes just as The Employment (Allocation of Tips) Act 2023 - or Tipping Bill - has been passed and will soon become law that staff must distribute 100% of tips and tronc directly to staff.

Honor Anstice, Head of Partnerships for EMEA at Deputy, said: “The timing of this partnership couldn’t be better. We’ve always strongly believed that businesses have a moral obligation to pass on tips to their staff.

The Tipping Bill legislation

will soon make it unlawful for employers to withhold tips from staff. When the legislation comes into force in 2024, two million workers will have the right to see an employer’s tipping record, so it makes sense for businesses to automate the process.”

Built by hospitality workers for hospitality workers, TiPJAR helps turn tips into an on-demand income stream for staff, empowering them to collect and share tips and tronc fairly and transparently. Deputy simplifies shift work and creates thriving workplaces by streamlining scheduling, timesheets, tasks, and communication and integrating with payroll for business owners and their workers.

Anita Bodis, Head of Partnerships at TiPJAR, said: “No matter where you are within the hospitality industry...

Keep reading

Streamline your firm’s valuations workflow with Figured’s new consolidated valuations

WE KNOW HOW IMPORTANT EFFICIENCY IS FOR OUR ACCOUNTANT PARTNERS, SO WE’RE THRILLED TO INTRODUCE CONSOLIDATED VALUATIONS IN FIGURED! CONSOLIDATED VALUATIONS ALLOW YOU TO COMPLETE YOUR VALUATIONS FOR ALL STOCK OF THE SAME TYPE IN ONE GO, RATHER THAN TRACKER BY TRACKER.

The ability to consolidate valuations means multi-farm users or those that use multiple trackers of the same stock type can now complete valuations

for all those trackers as a single valuation directly in Figured. This will substantially save you time and reduce the complexity of your valuations workflow, streamlining your firm’s compliance work and allowing you to more easily act on opportunities for advisory where clients require management valuations.

Learn how to consolidate valuations in 5 minutes!

Complete NSC calculations directly in Figured

Read more

Aotearoa New Zealand’s $7.8 billion digitalisation opportunity

TIME TRACKING JUST GOT EASIER WITH “ALEX” THE CHATBOT

Alex is like having your very own personal assistant! You can type into the chat or use voice dictation to ask Alex to make a time entry, clock in and out or take breaks (if you are using timecards) and Alex will do the heavy lifting and add your time. Currently only available on our desktop version.

How to Access the Chatbot Feature?

IN APRIL WE ROLLED OUT THE NEW-LOOK DIVERSITY REPORT TO OUR BETA USERS ON THE INVESTOR, EXPERT AND PROFESSIONAL PLANS. WE WILL INTRODUCE THIS RENEWED REPORT TO THE REST OF OUR INVESTOR AND EXPERT USERS IN THE COMING WEEKS.

As I touched on last month, apart from the refreshed look and feel of the diversity report, the real benefit of this re-architectured reporting function is that the report will no longer hit timeouts with larger portfolios. We intend to roll out this new approach to all fifteen of our reports, completely removing the

long-running issue of timeouts from our system.

New functionality / Enhancements

• We released our revamped diversity report.

• We introduced a new staff permission for our Professional users to allow for specific authorisation around the management of account level custom investments. We will continue to streamline our custom investment feature set as we expand beyond our core focus on share market investments into alternatives, property and the like.

Keep reading

WHEN IT COMES TO PRODUCTIVITY, IT’S NO SECRET AOTEAROA NEW ZEALAND LAGS HEAVILY BEHIND OUR OECD COUNTERPARTS. IN FACT, OUR RECENT RESEARCH SHOWS KIWIS WOULD NEED TO WORK 20 PERCENT MORE TO REACH THE AVERAGE OECD GDP OUTPUT.

For Kiwis working a 40hour work week, this is equivalent to working an extra day per week to make up the labour productivity gap – and that’s just to reach the average productivity mark.

These are impossible numbers. We can’t simply put our heads down and work our way to better productivity. We need to ensure every hour spent working is doing something only a human can do.

The opportunity for digitalisation

This week we released new insights developed by the New Zealand Institute of Economic Research (NZIER) revealing a 20% increase in... Find out more

Meet the new faces of Australia’s XPAC

How to Create an Expense Report in Dext

SPACE TO COLLATE AN INDIVIDUAL’S REIMBURSABLE PAYMENTS.

How to Create an Expense Report

Create an Expense Report from the Dext Costs Workspace:

1. Click on the Inbox

2. Select the item(s) you want to add to your new expense report using the checkboxes down the left-hand side of the page.

3. Click the Add to expense report button in the toolbar.

4. Specify your settings

5. The Account User who submitted these transaction(s)

6. End date

7. The name of the Expense Report

8. Click Add

The new report will be available to view, edit and publish from the ‘Expense Reports’ section of the account. Any items that have been added to an Expense Report will be available to view from inside the report, or from the Archive.

You can add additional transactions to an Expense Report by selecting the items, clicking ‘Add to Existing Report’ and choosing the report.

Who can create Expense Reports?

Only certain users can create expense reports. This is dependent on their level of User Privilege.

• Admin Users can create and edit anyone’s Expense Reports

• Expense Approvers can create Expense Reports for any user if they have the ‘Expense reports’ toggle turned to “ON”

• Basic Users can create Expense Reports for only themselves if they have the ‘Expense reports’ toggle turned to “ON”

Note: the Expense Approver role is... Find out more

The home of XU Magazine and XU Biweekly XU Hub is now on Apple News!

WhisperClaims Calls For Accountants to Keep Calm and Carry on Through The Reforms to R&D Tax

THE RECENT REFORM OF R&D TAX LEGISLATION HAS SPARKED A LOT OF DISCUSSION IN THE INDUSTRY, WITH SOME R&D TAX ADVISORS EXPRESSING CONCERNS ABOUT HMRC'S INCREASED SCRUTINY AND EFFORTS TO COMBAT FRAUD.

However, this new era of stricter enforcement could have positive outcomes for the market, including greater accountability and quality of R&D tax claims.As some advisors exit the market, there are opportunities for accountants to expand their services and provide more comprehensive client support. Mike Dean, Managing Director of WhisperClaims, shares his perspective on how accountants can remain focused on supporting their clients and providing valuable R&D tax advice.

Shaken not Stirred

It's important to note that the additional scrutiny from HMRC is necessary to eradicate the malpractice that has occurred in the R&D tax sector for years. While a few rogue advisors have pushed the boundaries of the scheme, failed to provide transparency, and given the market a bad name, most accountants recognise the importance of providing a genuine and compliant R&D tax service to eligible businesses. Rather than shying...

Find out more

WE’RE EXCITED TO ANNOUNCE THAT BRENDAN LUCAS, MANAGING DIRECTOR AND FOUNDER OF NEXT DIMENSION ACCOUNTING, AND CASSANDRA SCOTT, DIRECTOR OF LAURUS BOOKKEEPING ARE JOINING THE APPROVALMAX TEAM IN AUSTRALIA.

Both are experts in their respective fields and will be offering their expertise to help businesses tackle challenges related to end-to-end AP automation, financial controls, and digital adoption.

About Brendan Lucas

Brendan is a Chartered Accountant who brings a depth of accounting experience, having worked with hundreds of clients in the SME and NFP sectors to grow their businesses.

His expertise and understanding of ApprovalMax and how it brings immediate value, coupled with insightful advice that impacts people’s lives positively, makes Brendan an ideal candidate to talk about cost-effective technology that is truly efficient.

Brendan has a talent for teaching people how to use technology to make their accounting function more efficient and cost-effective. By doing so, he also helps business owners and decision-makers free up their time, while drastically improving the pace at which they do business.

“ApprovalMax is a prime example of productive technology. We know the right technology can transform the way a business works, and our hands-on experience of ApprovalMax has revealed the positive difference it makes to a range of SMEs and NFPs. By providing streamlined, secure and rapid...

Read more

XERO WOULDN’T BE WHERE IT IS TODAY WITHOUT THE SUPPORT OF OUR PARTNER COMMUNITY, AND THAT INCLUDES OUR XERO PARTNER ADVISORY COUNCIL (XPAC). THAT’S WHY WE’RE THRILLED TO ANNOUNCE OUR LATEST XPAC COHORT FOR AUSTRALIA.

The XPAC team is a group of experts connecting Xero to the community and industry alike. They both challenge and champion the needs of the accounting and bookkeeping sector by engaging in open discussion, sharing industry insights, and providing actionable feedback.

Made up of a diverse range of advisors from across the country, XPAC ultimately seeks to make a difference to the lives of Xero partners, small businesses and their communities.

Meet our newest XPAC members

Each cohort remains on the Australian XPAC for two years. After putting the call out to the industry, we’re very excited to welcome nine new XPAC members, starting this month:

• Aly Garrett – Founder, All in Advisory

• Melanie Gock – National Systems & Innovation Manager, Grant Thornton

• Michele Grisdale – Founder & Director, Rainforest Bookkeeping

• Zac Hayes – Managing Director, HA Accounting

• Amar Latif – Co-Founder, Mad Wealth

• Natalie Lennon – Founder & Director, Two Sides

• Jarrod Morris – Partner, Pitch Labs (Pitcher Partners)

• Grace Occleshaw – Client & Advisory Manager BYO Group

• Mei Yong Wu – Director & Partner, knp Solutions

They’re joining five of the current cohort who will remain on the XPAC in a mentoring capacity, while continuing to provide their invaluable feedback to Xero.

• Beau Gaudron – Tech Ninja, GrowthWise

• Sarah Lawrence – Founder, Hot Toast

• Sarah Pilling – Partner, Bramble and Briar

• Jason Robinson – Director, Future Advisory

• Cassandra Scott – Director, Laurus Bookkeeping

Working together for the wider Xero community

XU Magazine will be attending Seamless Middle East 2023

WE ARE THRILLED TO ANNOUNCE THAT XU MAGAZINE WILL BE ATTENDING SEAMLESS MIDDLE EAST 2023, THE LEADING EVENT FOR SMES, BANKS, FINTECH, AND PAYMENT PROVIDERS IN THE REGION. THE EVENT WILL TAKE PLACE ON MAY 23-24 AT THE DUBAI WORLD TRADE CENTRE, MAKE SURE YOU’RE THERE TO JOIN US.

The event will feature an

E-commerce University, Fintech Pavilion, Launch Pad, Seamless TV, Start-up Village & Pitch-off and much more! You can meet with over 15,000 buyers from the region who will be attending and browse over 500+ exhibitors on the expo floor.

Don't miss out on this unparalleled opportunity to stay ahead of the curve and drive innovation in your industry....

Find out more

ENTREPRENEURS ARE DRIVEN BY ‘THE ITCH’. IF YOU’VE FELT IT YOURSELF, YOU KNOW EXACTLY WHAT I MEAN. IT’S THAT INNATE GNAWING, DISCOMFORTING FEELING THAT COMES FROM A DEEP, AND OFTEN LIFELONG, CONVICTION THAT THERE HAS TO BE A BETTER WAY. THE ITCH IS NEVER FAR AWAY - IT LIVES IN YOUR HEAD, DISTRACTS YOUR THOUGHTS, NAGS AT YOU. I’M NO PSYCHOLOGIST, BUT TO ME THE ITCH IS AS DEEP AS DNA. IT’S NOT A LEARNED BEHAVIOUR, SO IT CAN’T BE ‘UNLEARNED’. THERE IS NO ESCAPE.

Entrepreneurs start businesses because the itch gets too much. They resist it, they damp it with logic, they try to ignore it, but it never goes away. As time goes on, it intensifies. Finally, they are compelled to do something about it.

The caricature view of the entrepreneur as a risk-taking, slick-talking hustler could not be further from the truth. The real entrepreneurs, the ones that you and I work with, are just people doing everything they can

to scratch their itch. And no matter where they are in the world, no matter what industry their business serves, no matter what age, sex, creed or colour, the itch, the belief, the drive to find a better way is exactly the same.

They can see the path ahead. They can see the forks in the road, the options, the decision points. And they need help to work out which way to go.

At Castaway, every day we talk to entrepreneurs and to the accountants who look after them. Our customer base is split evenly, so we get a healthy range of views from both perspectives.

The Entrepreneurs tell us they see the services their accountants provide on 3 levels:

• They appreciate the compliance work that keeps their business on the right side of the law

• They value the work that supports and sustains the business (bank loans, grants and the like)

• They love the work that helps unlock the possibilities of the business (scratching the itch)

It should be no surprise that their level of ‘excite-

ment’ about the fees they pay follows the same order.

The Accountants we talk to tend to fit into one of 3 categories:

• A few tell us “my clients just don’t need that sort of stuff”

• Some say they build budgets and forecasts when clients ask for them

• For others, forecasting is the backbone of their advisory practice. Clients love the work they do and happily pay their fees

To the first group… who knows, they may well be correct. But if there’s even one entrepreneur on the client list, I guarantee that firm is not asking the right questions.

When we dig deeper with the second group, their focus is generally the entrepreneur’s second level of satisfaction, the sustaining and supporting work like applying for bank loans and grants, churning out annual budgets and the like. Although the demand generation is reactive, this work is useful for clients and can be readily systemised and productised into a profitable service… definitely a winwin.

The third group are different. They work differently, they think differently, they talk differently. And they get different results for clients. By different, I mean better… much better. Of course, the question of “how” they are different has a hundred answers.

One thing stands out for me. The third group have gone beyond forecasting as a maths exercise focused on putting numbers on a page. They’ve evolved to embrace the idea of forecasting as a framework for exploring what is possible. This is a big step, in both mindset and methodology. They’ve found the holy grail - a way to help their entrepreneur clients scratch the itch, a way to help those entrepreneurs unlock the possibilities in their business.

It’s a simple idea, but it’s counter-intuitive, especially for firms with strong compliance-based business models, where efficiency and capacity utilisation are the traditional optimisation tools.

But it’s also entirely intuitive. Clients perceive the greatest value when you help solve their biggest, most annoying problems.

And for an entrepreneur, the ‘itch’ is the most significant long term problem there is. And forecasting, the process of looking ahead, considering scenarios, facing realities, game-planning responses, making decisions, is the best framework I know for unlocking possibilities, for finding solutions to the itch.

So how do the third group of accountants start the conversations with their clients? How do they build the interest? How do they get the clients to happily agree to engage them?

Well, the good news is we’ve seen lots of different approaches… and they all work very well. It’s a matter of finding something that works for you. If you’re looking for somewhere to start, here’s a simple 3-step approach that involves zero selling, but is highly effective at unlocking possibilities for both you and your client.

1. Find the itch

Here’s an idea. Find a client. Take them to coffee, or to lunch, or just have a call. With genuine interest, ask 3 questions:

1. Why did you start this

business?

2. What were your dreams for the business back then?

3. How have those dreams changed?

You’re looking for the itch. Given the chance, and an engaged audience, most entrepreneurs love talking about their business. Some will open up immediately, the ideas and stories will just start flowing. For others, the conversation might take some time to get rolling.

If you’ve been in business a while, the daily grind, decision fatigue, pandemics and other challenges can wear you down … its all too easy to forget (or suppress) the original dreams for the business. In this situation, be patient and nurture the conversation. The memories will start to come back, a trickle at first and then more. Keep at it and you’ll see the imagination spring to life and the ideas start to flow. That’s the itch firing up again … it never goes away.

2. Run a Possibilities session

Find out more

Singapore customers can now add money to Revolut via bank transfer

Once you link up, you won't be charged a penny for making a bank topup, no matter how many times you do it. And the best part? You never need to leave the app!

Set it up with a few taps

BANK OF CHINA.

Linking your account means you won't need to leave your app to top up via bank transfer. But, there’s more!

No more fees for SGD bank top-ups

Linking your account is super easy. Just follow the steps below.

1. Tap below to start the set-up

2. Choose one of the six banks from the list

3. You'll be automatically redirected to your...

Find out more

Airwallex and Expedia team up to help global business travelers travel easier

AGAINST A SURGE IN BOTH BUSINESS AND PERSONAL TRAVEL, GLOBAL FINTECH AIRWALLEX AND LEADING TRAVEL TECHNOLOGY COMPANY EXPEDIA GROUP ANNOUNCED TODAY A JOINT PROMOTION TO HELP CUSTOMERS SAVE WHEN BOOKING HOTEL STAYS.

Jessica Chiu, Head of North American Strategic

Partnerships at Airwallex said global business and personal travel was regaining momentum and the new partnership with the world’s leading traveler technology platform, Expedia Group, meant existing and new Airwallex customers could enjoy an exclusive 10 per cent discount off hotel stays when booking on the platform, starting from today.

Keep reading

Wise Platform: Mission Update Q1 2023

IN 2022, WISE PLATFORM LAUNCHED WITH 15 NEW PARTNERS IN 4 NEW MARKETS, MARKING OUR STRONGEST YEAR TO DATE. AND WE HAVEN’T SLOWED DOWN. WE ENTERED 2023 AT BREAKNECK SPEED, AND IN JUST 3 MONTHS WE HAVE ACHIEVED HALF AS MUCH AS WE DID IN THE PREVIOUS 12, EVEN AS WE GEARED UP TO REVEAL OUR BRANDNEW LOOK.

In Q1 2023, we went live with 6 new partnerships with some of the world’s largest banks and nonbanks, including Bank

Mandiri, Indonesia’s largest bank by assets. We shared our predictions for 2023 in The Banker and Busy Continent, mused about how the cloud helps companies achieve their ESG goals and explained why compliance will be make or break for bank-fintech partnerships. We also spoke about what the fintech rebundling trend means for the sector and shared more about what’s next for Wise in the US market.

Meet our new partners

This was our busiest...

Find out more

EARLIER THIS YEAR, I HAD SHARED OUR BROADER PLANS FOR 2023 AS WE CONTINUE TO SCALE AND REACH NEW HEIGHTS. AS A COMPANY, IMPROVING THE STATUS QUO REMAINS CORE TO OUR IDENTITY, AND ONE OF THE KEY PRIORITIES I SHARED WAS OUR FOCUS ON ENHANCING OUR INFRASTRUCTURE AND PLATFORM.

With that in mind, I want to update you on our progress in connecting you — the entrepreneurs, business builders, makers and creators — with economic

opportunities in every corner of the world. We have made significant progress in recent months as we look to constantly improve our capabilities that benefit businesses of all sizes, everywhere.

From increasing our global coverage across all services, to continuously improving the speed, security and reliability of our infrastructure while launching new products and features - we remain steadfast on delivering our mission and building the best solutions for our customers.

Read more

AVOID MONEY SPATS WITH THE NEW REVOLUT GROUP BILLS CHAT

ORGANISING A GROUP HOLIDAY WITH YOUR FRIENDS, OR A DINNER WITH YOUR FAMILY? OR DO YOU NEED AN EASY WAY TO SORT HOUSEHOLD EXPENSES WITH YOUR FLATMATES?

Group Bills is the ideal place to split and settle costs without hassle. Now we’ve added Group Chats to make it even easier! You can track, split, discuss, and settle your bills — all in one place.

Reach your squad in a heartbeat

Stay in touch with your group at all times. Did you pick up the tab on your friend’s birthday? Or did you book an awesome villa that you can all stay in on your holiday? Share the amount in the chat. If a few of you are pitching in, you can split the cost and settle up right there!

Track your shared...

Keep reading