XU XU

The independent user news source for accounting apps and their ecosystems

BGL’s partnership with FuseSign reaches new heights!

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF), AND INVESTMENT MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE ITS PARTNERSHIP WITH FUSESIGN, A CUTTING-EDGE

DIGITAL SIGNING PROVIDER, HAS REACHED A SIGNIFICANT MILESTONE WITH OVER 100,000 DOCUMENTS NOW SIGNED WITH FUSESIGN IN BGL PRODUCTS DURING THE

2022/23 FINANCIAL YEAR.

This is a huge milestone for the BGL and FuseSign teams,” said Ron Lesh, BGL's Managing Director. "Our partnership continues to transform how accountants manage their clients' compliance and streamline document delivery and signing processes."

FuseSign has quickly risen to become the most widely used digital signing provider for BGL, a testament to its industry focus, efficiency and reliability. As a result, BGL has seen remarkable

growth, with over 100,000 documents signed with FuseSign in the 2022/23 financial year. This achievement translates to nearly 400 documents signed by clients on every business day, showcasing the platform's indispensable value.

"Our partnership with FuseSign aligns perfectly with our commitment to delivering exceptional solutions built for professionals," continued Lesh. "Together, we aim to revolutionise the way our clients manage compliance and enhance the client experience through

Zubair Mohammad helps Journey continue EMEA expansionPay to enhance client payments

ZUBAIR MOHAMMAD HAS JOINED THEIR RAPIDLY EXPANDING UK OPERATIONS AS EMEA MARKETING STRATEGIST.

seamless digital signing."

The synergy between BGL and FuseSign extends beyond their shared focus on the professional services industry. Both businesses are driven by a passion for innovation, client-centric values and a commitment to providing first-class services.

This collaboration will pave the way for further advancements and growth in the industry.

To celebrate this partnership and showcase the power of FuseSign in action...

Keep reading

THAT

Zubair, an industry stal-

wart with extensive experience at companies like Xero, Capitalise, and Market Finance, brings a robust portfolio in accounting tech to this strategic role.

"We're absolutely delighted to welcome Zubair to the Journey team," said Jordan Vickery, Global Director and Head of EMEA at Journey.

"Zubair's deep industry knowledge, strategic insights, and a proven track record of results make him a perfect fit as we continue to expand our presence in the EMEA market. We are confident that his leadership will accelerate growth for our clients.”

In his new role, Zubair will create marketing strategies for key projects and closely collaborate with high-profile clients, utilising his years of experience and innovative...

Find out more

CHASER, THE GLOBAL ACCOUNTS RECEIVABLES PLATFORM AND CREDIT CONTROL SERVICE PROVIDER, LAUNCHED RECOMMENDED CHASING TIMES. RECOMMENDED CHASING TIMES SHOW IN THE CHASER SOFTWARE WHEN BUSINESSES SET UP WORKFLOWS AND SCHEDULES TO CHASE CUSTOMER INVOICE PAYMENTS VIA EMAIL AND TEXT MESSAGES. RECOMMENDED CHASING TIMES PRESENT USERS WITH THE OPTIMAL TIME AND DAY TO CHASE CUSTOMERS, WHICH IS CALCULATED AND PREDICTED USING ARTIFICIAL INTELLIGENCE (AI).

By leveraging AI and machine learning, Chaser analyzes a wealth of data, including customer payment patterns and historical behaviors, to generate tailored

recommendations on the best times to chase customer payments. This strategic approach ensures that payment reminders are delivered when customers are most likely to engage with them, increasing the chances of prompt payment and reducing delays.

Key features of recommended chasing times:

• Payment reminder emails and SMS messages are sent at the best times and days, to ensure they have the maximum chance of getting noticed

• Businesses can reach customers precisely when they are most likely to pay their invoice, based on their previous payment behavior

• Ongoing analysis of customer behavior means recommended chasing times are continually updated based on new data and insights

• If calculations predict that a business would see improved results by sending out multiple sets of payment reminders per week, the Recommended chasing times feature will suggest multiple times and days to chase customers

"Recommended chasing times empower businesses to reclaim valuable time spent on manual follow-ups and to optimize their collections efforts," said Sonia Dorais, CEO of Chaser. "By automating the timing of payment reminders, SMEs can effectively reach customers when they are most likely to make payment, reducing the number of follow-ups needed, and increasing the likelihood that payment will be received on time.”

Key benefits of...

Keep reading

Saturday 12th August 2023

Biweekly Saturday 12th August 2023 | No. 61

FREE digital business cards for EVERYONE Get yours now

LAUNCH OF AI FEATURE LETTING BUSINESSES REACH CUSTOMERS PRECISELY WHEN THEY'RE MOST LIKELY TO PAY AN INVOICE

JOURNEY, A SOFTWARE-AS-A-SERVICE (SAAS) PERFORMANCE AGENCY MAKING WAVES IN THE TECH WORLD, IS EXCITED TO ANNOUNCE

New Apps & Updates

DIRECT DEBITS NOW AVAILABLE IN NEW ZEALAND

IN ONE OF OUR RECENT BLOGS WE WROTE ABOUT THE RANGE OF PAYMENT ARRANGEMENTS THAT CAN BE USED BY ACCOUNTING AND LEGAL FIRMS TO ENABLE THEIR CLIENTS TO PAY THEIR BILLS IN A TIMELY MANNER. ONE OF THE INCREASINGLY POPULAR METHODS INVOLVES RECURRING DIRECT DEBITS – FOR OUTSTANDING INVOICES, FIXED FEE ARRANGEMENTS AND MONTHLY SOFTWARE LICENCE SUBSCRIPTIONS (SUCH AS XERO).

Direct Debits are widely used within the Australian accounting industry however establishing such a facility in New Zealand has not been easy … until now!

XU BIWEEKLY - No. 61

Newsdesk:

If you have any news or updates that you would like us to consider for inclusion in the next edition of the XU Biweekly, please email us at: newsdesk@xumagazine.com

CEO: David Hassall

Managing Editor: Wesley Cornell Director of Strategic

Partnerships: Alex Newson

Design & Communications

Manager: Bethany Fulks

Creative Assistants: Hebe Vermeulen, Robyn Consterdine

Advertising: advertising@xumagazine.com www.xumagazine.com

‘Xero’ is a trademark of Xero Limited (New Zealand). XU Biweekly and XU Magazine is collaboratively produced by an independent group of Xero users and is not affiliated in any way with Xero. All other trademarks are the property of their respective owners.

© XU Magazine Ltd 2014-2023. All rights reserved. No part of this publication may be used or reproduced without the written permission of the publisher.

XU Biweekly is published by XU Magazine Ltd (08811842), registered in England and Wales. Registered office: Office 1, Brunswick House, Brunswick Way, Liverpool, L3 4BN, United Kingdom. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. XU Magazine Ltd cannot accept any responsibility for errors or inaccuracies in such information.

If you submit unsolicited material to us, you automatically grant XU Magazine Ltd a licence to publish your submission in whole or in part in all/any editions, including in any physical or digital format, throughout the world. Any material you submit is sent at your risk and, although every care is taken, neither XU Magazine Ltd nor its employees, agents or subcontractors shall be liable for loss or damage. The views expressed in this publication are not necessarily the views of XU Magazine Ltd, its editors or its contributors.

FeeSynergy has done all the hard work to enable its client firms to take full advantage of a properly integrated and bank compliant Direct Debit facility.

So how does the FeeSynergy Direct Debit facility work?

The FeeSynergy Direct Debit facility is an optional module of the FeeSynergy Collect debtor management platform (Collect). With this module, it is an easy 3 click process to set up a Direct Debit arrangement to automatically Direct Debit from the client’s nominated bank account or credit/debit card at the agreed interval – typically weekly or monthly.

The Direct Debit process in Collect enables the firm’s

clients to:

• View the Direct Debit Authority (DDA) form

• Digitally complete and sign the DDA forms – no more waiting around for client to print, sign manually and scan back to the firm the Authority

• Retain a PDF copy of the signed forms – they are automatically emailed a copy of the signed form

• Automatically have deductions made from their nominated bank Account

Use Cases

Fixed fee work – do you or have you ever wanted to charge your client for the years’ work and bill them a fixed amount each month...

Find out more

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF) AND INVESTMENT MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE THE LAUNCH OF ITS CLIENT IDENTITY VERIFICATION SOLUTION, BGLID.

BGLiD launched at BGL REGTECH, Sydney on 1 August 2023. BGL REGTECH is BGL's annual event that this year is focused on helping its clients Retain, Educate and Grow.

"This is another great achievement by the BGL team and I’m extremely proud of everyone involved," said Ron Lesh, BGL's Managing Director. "BGLiD will simplify the client identity verification process for CAS 360 clients, eliminating the need for manual ID verification."

BGLiD is a simple client identity verification solution seamlessly integrated...

Keep reading

Introducing Lightspeed Mobile Tap: Take Payments From Anywhere

IN THE LATEST UPDATE FROM BLUEHUB, THE SPOTLIGHT IS ON THE FRESH ADVANCEMENTS IN THE CIN7 CORE/DEAR SYSTEMS SOFTWARE RELEASED IN JUNE. WHILE WE’VE FACED A SLIGHT DELAY IN RELAYING THESE UPGRADES TO YOU, OUR ANTICIPATION IN DETAILING THESE NOVEL FEATURES AND IMPROVEMENTS HAS NOT WANED.

In recent months, Cin7 has clearly been channelling its efforts into refining the user experience and weaving in pivotal feedback from its client base. Let’s walk through the standout features of this release:

Password Reset Link:

Gone are the days when you’d need to ring up an administrator to help reset your password. You can promptly get a reset link directly from the WMS application.

Stock Lookup in MES:

The Manufacturing Execution System (MES) has taken a leap in utility. Users can now swiftly rummage for stock details within the application. This step undoubtedly...

Keep reading

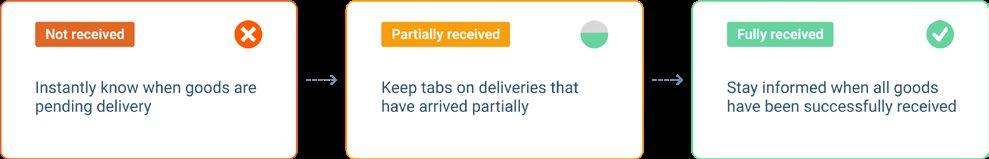

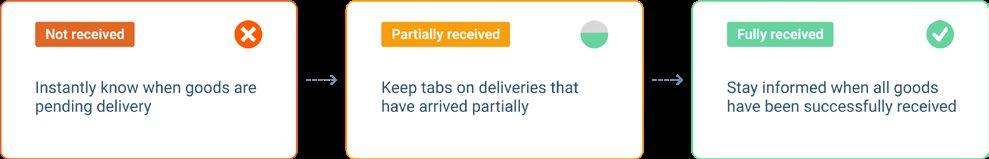

WE’RE EXCITED TO UNVEIL OUR LATEST FEATURE IN APPROVALMAX – THE GOODS RECEIVED NOTE (GRN)! DESIGNED WITH YOUR CONVENIENCE IN MIND, GRN ALLOWS YOU TO EFFORTLESSLY MANAGE AND TRACK THE STATUS OF YOUR DELIVERABLES ALONGSIDE RELEVANT PURCHASE ORDERS (POS) THROUGHOUT THE ENTIRE APPROVAL PROCESS.

Accounts Payable teams and individuals waiting to receive goods and services can say goodbye to manual tracking and the endless paperwork it creates. ApprovalMax’s GRN feature provides better visibility on received goods or services, ensuring you have the bigger

picture of where goods and services are from beginning to end. ApprovalMax users on Advanced and Premium Plans can take advantage of the GRN features and benefits in just a few clicks, under the workflow settings in the app.

Track delivery statuses during the approval process

Our new GRN feature has three statuses that provide teams with visibility where goods and services are.

GRN goes beyond status tracking. We’ve included a handy notes section for you to add any crucial details about the goods and services you’re waiting for. Being able to leave important...

Find out more

IT WASN’T SO LONG AGO THAT YOU COULD FIND YOURSELF HUNTING FOR AN ATM TO PAY YOUR RESTAURANT TAB, AND PAYING STEEP SERVICE FEES FOR THE PRIVILEGE. THEN ALONG CAME TECHNOLOGY—CUE HEAVENLY SOUND EFFECT!—AND FAST, CONVENIENT RESTAURANT PAYMENTS BECAME A REALITY. VERY SOON AFTER THAT IT BECAME AN EXPECTATION, THEN A REQUIREMENT.

Today, there’s a dizzying number of payment methods and restaurants need a way to accommodate guest expectations when the bill comes. That’s why we’re excited to announce the new Lightspeed Mobile Tap— now, Lightspeed Restaurant (K-Series) users in the U.S. can accept swipe, tap, chip and pin and contactless payments from anywhere in the restaurant.

What is Lightspeed Mobile Tap?

Lightspeed Mobile Tap is a powerful, portable payment device that allows restaurants to accept virtually all payment methods without spending a fortune on terminals.

Designed to look great on any counter...

Keep reading

NEW XERO CONNECTED APPS!

RUIAUTOMATION

GLOBAL - An advance cloud-based inventory management software designed to revolutionize the way businesses handle their inventory processes. RuiAutomation ensures businesses streamline their operations and achieve optimal inventory control.

PLUS91

AU & NZ - A cloud-based Job Management tool for Connect Outsourcing clients to effectively manage their workflow. Schedule work and extensive reporting on jobs to help Directors & Partners get a better understanding of where time is spent on each job in order to identify areas of improvement.

EXCONNECT

AU, CA, MY, NZ, PH, SG, SA, UK & USAutomatically synchronize all of your transactional data between Erply ERP and Xero with exConnects. Sync documents and reconciled payments between the two systems with a quick and easy setup.

XU Biweekly | No. 61 2 Saturday 12th August 2023

IT’S BEEN AN EXCITING MONTH FOR FIGURED AND OUR COMMUNITY AS WE’VE RELEASED SEVERAL HELPFUL UPDATES TO OUR PLANNING TOOLS! WITH EACH OF THESE UPDATES COMES BETTER EFFICIENCY, ACCURACY AND VALUE FOR YOUR FIRM, SO HAVE A READ BELOW TO ENSURE THAT YOU AND YOUR FIRM ARE ACROSS THE KEY UPDATES AND ARE SEEING THE FULL POTENTIAL OF YOUR PLANNING TOOLKIT ON FIGURED.

to automatically allocate transactions to a tracker using a formula based on a metric. The calculation will dynamically change throughout the season as the metrics changes.

• Manually: Allocate transactions by percentage split to your trackers.

RAVE’s New FMS Feature –On Charge Invoices

RAVE’S NEW FMS FEATURE – ON CHARGE INVOICES

For those with RAVE’s FMS module a new ”Add an Oncharge Invoice’ button has been added to the project’s ‘Invoices Out’ subtab. Clicking this opens the ‘Add an On Charge Invoice’ screen, where you have the option to choose any supplier or contractor to charge this invoice to.

There is also a ‘Visible to Client’ switch to make the invoice viewable to the client on their ‘Invoices Out’ subtab. If turned on, this will display an ‘eye’ icon, reaffirming that the client is able to see this invoice.

An ‘On Charge Invoice’ FAQ guide is available from the RAVE Help portal + an ‘On Charge Credit Note’ function will be available to...

Top-down planning:

Allocate forecast transactions in the planning grid

You now have the ability to allocate forecasted transactions to your trackers, which can be done in two ways:

• Dynamically: Create rules

The ability to allocate forecast transactions in the Figured planning grid gives you an added level of granularity as you forecast the profitability of your clients’ operations. Save time by letting Figured automatically update your budget based on predetermined metrics instead of manually updating your forecasts on new assumptions.

Notes in the planning grid

Keep reading

Keep reading SHARESIGHT

Employment Hero Product Update July 2023

BGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF) AND INVESTMENT MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE THE BETA RELEASE OF ITS AI POWERED PAPER-TO-DATA SOFTWARE SOLUTION, BGL SMARTDOCS 360.

"I'm thrilled to announce the BETA release of BGL SmartDocs 360,"

said Ron Lesh, BGL's Managing Director. "This sensational addition to the BGL cloud product suite is a testament to our product development teams' outstanding efforts and dedication. I couldn't be prouder of their hard work developing this innovative and unique paper-to-data solution."

BGL SmartDocs 360 is a multi-award winning, AI powered paper-to-data solution that helps businesses unlock their full...

Read more

OUR FOCUS THIS MONTH HAS BEEN ON AN ENTIRELY NEW REPORT, WHICH I WILL TALK MORE ABOUT IN THE NEXT MONTH OR SO. IN ADDITION TO THIS, WE CONTINUED TO EXPAND OUR MARKET SUPPORT AND IMPROVE OUR CUSTOM INVESTMENTS FEATURE SET IN PREPARATION FOR OUR EXPANSION INTO MULTI-ASSET CLASS SUPPORT.

New functionality / Enhancements

• Introduced support for the Philippine Stock Exchange (PHS)

• Introduced a new coupon rates screen to the custom investment feature set found under the accounts menu

• Added cryptocurrency Kusama (KSM)

• Introduced our revamped sold securities report which delivers a better mobile experience and no longer times out in large portfolios.

Broker import functionality

• Added Ausiex CSV support

Read more

WELCOME BACK TO ANOTHER EDITION OF THE EMPLOYMENT HERO PRODUCT UPDATE, WHERE WE SHARE ALL OF THE LATEST AND GREATEST UPDATES OVER THE PAST MONTH.

This month, we’ll be sharing changes to our Goals module, in-platform Reference Checks and more.

Let’s get to it.

In-platform reference checks

With so many stages involved in the hiring process, we’re making one very important step a whole lot easier for hiring managers. With our in-platform reference checks you’ll be able to complete an employment reference check for a candidate, at any given time during the hiring process.

With this new feature, you’d simply request referee details from the candidate and contact the listed referees for more information...

Keep reading

WWE HAVE LISTENED TO YOUR FEEDBACK (SOME OF YOU ARE NOT SHY!) AND IN THE NEXT COUPLE OF WEEKS WE WILL BRING YOU THE WORLD’S MOST FLEXIBLE BUDGET EDITOR (WE AREN’T SHY EITHER!) AND SIMPLER DASHBOARD EDITING. WE’LL MAKE IT EASIER TO ADD TILES TO YOUR DASHBOARDS BASED ON COMMON TEMPLATES SO THAT YOU CAN CREATE THE DASHBOARDS YOU NEED QUICKLY AND EASILY.

New in Calxa: Flexible Budget Layouts

With budgeting season well underway, the changes

to the layout of the budgeting grid will help many Calxa customers.

What do Traditional Budget Layouts look like?

We have all done budgets in spreadsheets at some point in our lives. For those of you who have been using Calxa for the past 13 years, it may be a distant memory but for some it’s much fresher. You have a column of accounts down the left side and months across the top. And probably a separate tab for each business unit or job or cost centre.

Often, especially when you are first creating a... Find out more

XU Biweekly | No. 61 4 Saturday 12th August 2023

News & Updates

UPDATED RaveBuild Site Manager & Site Staff user permissions

WE HAVE UPDATED VARIOUS PERMISSIONS MADE AVAILABLE TO THE SITE MANAGER AND SITE STAFF BRANCH USER GROUPS. WHILE THESE SITE MANAGER AND SITE STAFF USER GROUPS DO NOT HAVE ANY BRANCH-LEVEL ACCESS, THEY DO HAVE MORE PROJECT-LEVEL ACCESS AND FUNCTIONALITY (WITH EXTRA PERMISSIONS) THAN YOUR PROJECT’S CONTRACTORS AND SUPPLIERS – AS PER THE UPDATED PERMISSIONS TABLE BELOW.

NOTE: Project access is only available when the project is in an active or maintenance state, and schedule access is only available after the schedule has been activated.

Those with branch owner permissions can add Site Managers and/or Site Staff via the ‘Set Permission’ section of your user profile dropdown – selecting the ‘Site Staff/Managers’ tab.

Keep reading

TODAY, ANNATURE, AN AUSTRALIAN BASED TECHNOLOGY COMPANY RENOWNED FOR ITS ESIGNING AND CLIENT VERIFICATION SOLUTION, IS PROUD TO ANNOUNCE A NEW PARTNERSHIP WITH STACIE SHAW, ONE OF AUSTRALIA'S PRE-EMINENT ACCOUNTING THOUGHT LEADERS AND PARTNER OF AWARD-WINNING FIRM PKF NEW-

Appogee HR wins Best HR Software Provider 2023

CASTLE & SYDNEY.

Engaged as a brand ambassador for Annature, Stacie will also provide vital input to help tailor the company's offerings to best serve not just the accounting industry, but its clients – and therefore businesses across ALL industries. PKF Newcastle & Sydney are an Annature customer themselves; and...

Read more

WE ARE THRILLED TO SHARE THE EXCITING NEWS THAT WE HAVE BEEN CROWNED THE WINNER OF THE PRESTIGIOUS BEST HR SOFTWARE PROVIDER 2023 AWARD AT THE SME NEWS IT AWARDS 2023. WE TRIUMPHED OVER TOUGH COMPETITION FROM FIVE OTHER PROVIDERS TO CLAIM THIS ESTEEMED ACCOLADE. OUR GRATITUDE GOES TO SME NEWS FOR RECOGNISING OUR COMMITMENT TO PROVIDING INNOVATIVE AND FULLY CUSTOMISABLE HR SOLUTIONS TO SMALL BUSINESSES GLOBALLY.

Best HR software provider for Small businesses

This prestigious accolade is a true testament to the dedication and exceptional skills of our diverse and talented team, renowned for their hard work, creativity, and adaptability.

Despite being a smaller company, we have established ourselves as a formidable player in delivering exceptional HR solutions for small and medium-sized businesses. With a loyal customer base of over 700 companies spanning 50 countries, we have proven that success isn't determined by company size. By streamlining processes and...

Keep reading

Top 20 ASX trades by Sharesight users –July 2023

WELCOME TO THE JULY 2023 EDITION OF SHARESIGHT’S MONTHLY ASX TRADING SNAPSHOT, WHERE WE LOOK AT THE TOP 20 TRADES SHARESIGHT USERS MADE ON THE ASX DURING THE MONTH.

CAPE TODAY RELEASED THEIR CFO SPEND MANAGEMENT WHITEPAPER: STRENGTHEN CASH FLOW MANAGEMENT IN A TIME OF CRISIS.

With inflation running riot, the Reserve Bank of Australia has increased interest rates to a 11 year high of 4.1%. The knock on effects have led to the creation of a cost-ofliving crisis that began in March 2022. Seeing costs spiral on everything from housing, utilities, petrol, groceries, clothes and even the cost of holidays, for those who can afford them.

To better understand how businesses are adapting to this environment, Cape, a multi-user spend management account for Small and Medium Enterprises in Australia, carried out research with 160+ decision makers who were responsible for finance automation software solutions, or had the approval oversight of business spending.

The survey found that overspending and cash flow problems were the number one problem preventing employers from being willing to empower their employees with...

Keep reading

Andy Marks joins Moula as Head of Engineering and Innovation

ANDY MARKS HAS JOINED MOULA AS HEAD OF ENGINEERING AND INNOVATION, AFTER SPENDING OVER 20 YEARS IN SOFTWARE CONSULTING ROLES IN AUSTRALIA.

Andy brings almost 30 years’ experience to the role, as a teacher, practitioner and advisor of modern software engineering and architecture approaches.

“It is vital to me to nurture an environment where software engineers focus on quality and take pride in their work. It is good for their morale and development, but it also produces better solutions for all our customers,” he said.

Andy was attracted to the opportunity of evolving Moula’s products that are vital to the ongoing growth of small businesses in Australia.

He noted the difference in stepping out of the consulting world into directly leading a growing engineering team.

“From day 1, I was amazed at how wide the technical real estate was at Moula, and how well a small, highly skilled set of...

Keep reading

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS), followed by CSL (ASX: CSL), which has seen its share price plummet throughout July, hitting a new 52-week low. Over the same period, sell trades were led by Pilbara Minerals (ASX: PLS), which despite a brief dip due to plummeting lithium prices, has seen its share price remain relatively stable over the month. Overall, this month’s top trades were largely dominated by index-tracking ETFs as well as stocks in the banking, mining and minerals sectors.

Top 20 ASX trades July 2023

Let’s look at the news behind some of the key stocks in this month’s snapshot:

CSL (ASX: CSL)

• CSL share price hits new 52-week low

• Slow share price growth for CSL in FY23 but analysts are bullish for FY24

Find out more

BBGL CORPORATE SOLUTIONS (BGL), AUSTRALIA'S LEADING PROVIDER OF COMPANY COMPLIANCE, SELF-MANAGED SUPERANNUATION FUND (SMSF) AND INVESTMENT MANAGEMENT SOFTWARE, IS PROUD TO ANNOUNCE THE PROMOTION OF NADINE FREITAG TO HEAD OF PEOPLE AND CULTURE.

The announcement was made at BGL REGTECH, Sydney on 1 August 2023. BGL REGTECH is BGL's annual event that this year is focused on helping its clients Retain, Educate and Grow.

Recently, Freitag was appointed to the BGL Executive Team. "I am so proud of Nadine

and excited to see her take on this new role," said Daniel Tramontana, BGL's Chief Executive Officer. "Nadine's passion for fostering a supportive work environment and dedication to our team's well-being aligns perfectly with BGL's core values. I have no doubt Nadine will play a pivotal role in leading BGL into the future."

Since joining BGL in 2021 as People and Culture Manager, Freitag has been instrumental in implementing various initiatives to advance career development, mental health and well-being at BGL. "Nadine’s efforts over the past 2 years have significantly strengthened our exceptional workplace...

Read more

News & Updates XU Biweekly | No. 61 6 Saturday 12th August 2023

Crippling 'cost of living' crisis for employees further exasperated by employer cash flow management woes

Introducing our 2023 Xerocon Sydney event partners

UPCOMING EVENTS

DON'T MISS XU AT XEROCON SYDNEY!

XEROCON SYDNEY IS JUST WEEKS AWAY ON 23 AND 24 AUGUST, AND THE ICC EXHIBITOR FLOOR WILL BE FULL TO THE BRIM WITH SOME OF THE BEST AND MOST LOVED APPS, TOOLS AND SERVICES FOR ACCOUNTANTS, BOOKKEEPERS AND SMALL BUSINESSES.

This year, you can expect to see 80+ exhibitors at the event, including more than 70 leading Xero App Store app partners. Whether you’re looking for tools

to chase invoice payments, simplify tax compliance, or make job management easier, you’ll find plenty of solutions to help solve those key business challenges.

We’re excited to introduce to you our incredible Event Partners for this year’s event. Make sure to check them out, as well as our other exhibitors, as you explore Xerocon 2023.

Expensify

Expensify is a payments app that helps individuals

and businesses around the world simplify the way they manage money. More than

10 million people use Expensify’s free features, which include corporate cards, expense tracking, next-day reimbursement, invoicing, bill pay, and travel booking in one app. All free. Whether you own a small business, manage a team, or close the books for your clients, Expensify makes it easy so you have more time to focus on what really matters.

Read more

23-24 AUGUST 2023

Events & Webinars XU Biweekly | No. 61 8 Saturday 12th August 2023

Accountant Tools Time for Business Find out more at Dext.com Award-winning cloud software and knowledge solutions for your accounting practice. CCH iFirm CCH iKnow CCH Learning → Bills & Expenses The smarter way to handle bookkeeping. Start your free trial today! Cloud Integrators CRM eCommerce Powerful Software Delightfully Simple Integrates seamlessly with TidyStock and TidyEnterprise to provide a unified solution to your operations. POWERFUL ECOMMERCE 10 - 11 October 2023 Suntec Convent on Cen re S ngapore REGISTER FREE Inventory tidy nternational com STOCK MANAGEMENT Powerful Software Delightfully Simple Powerful software enables your business to grow through endto-end process control and reporting. Invoicing & Jobs Take control of your last mile deliveries www.vworkapp.com tidyinternational com Powerful Software Delightfully Simple Need brick-by-brick control of your building & construction projects? TidyBuild is designed specifically for the construction industry. CONSTRUCTION MANAGEMENT It’s a match made in heaven. Start your FREE trial: workflowmax.com/xero Manufacturing t dyinternat ona com Powerful Software Delightfully Simple PROJECT & INVENTORY MANAGEMENT Combines the most powerful aspects of both TidyStock and TidyWork. Outsourcing Payroll & HR New Zealand Australia ipayroll.co.nz cloudpayroll.com.au New Zealand Australia ipayroll.co.nz cloudpayroll.com.au Practice Management Professional Services Get Ready Prepare for the future at the Inspire Tour a seven-city hybrid event for bookkeepers www bookkeepers o g uk/even s Reporting castawayforecasting.com/xu UNLOCK YOUR POSSIBILITIES Deliver an R&D tax service that your clients can trust. whisperclaims.co.uk Time Tracking tidyinternational com JOB MANAGEMENT Powerful Software Delightfully Simple Detailed reporting and tight project controls enable your business to maximise efficiency and profitability. Year End Classifieds XU Biweekly | No. 61 Saturday 12th August 2023 9 Issue 35 1 Visit the XU Hub: Go to www.xumagazine.com Follow us on Twitter: @xumagazine magazine The independent news source for users of accounting apps & their ecosystems ISSUE 35 The next wave of global growth for ApprovalMax What can their evolution teach us about innovation? Xero PLUS MORELOADS FROM Connected Apps TUTORIALS CASE STUDIES INTERVIEWS NEW APPS NEW RELEASES 9 772054 722009 COVER STORY ISSUE 35 OUT NOW XU Subscribe to our mailing list and never miss an issue! Hub Subscribe 9 Daily The latest news from all your favourite Xero connected apps 9 Every fortnight XU Biweekly 9 Quarterly XU Magazine

LET YOUR CLIENTS DO THE TALKING: TIPS FOR MARKETING SUCCESS

By Karen Bennett, Chief Marketing Officer, Bright

mission to include them in a list of case studies on your website or social media.

2. Understand your clients

With so many firms falling into the small business category, you won’t be alone in having limited resources to invest in marketing. Activities like updating the website, posting on social media or running ads may fall on team members who have to fit them around their ‘day job’. An out-of-date website, no recent reviews and a poor social media presence are all an instant turn-off for many prospective clients today. While you might not have the budget for a dedicated marketing professional, there are simple and effective ways to market your firm.

1. Get the word out

If someone has a memorable meal in a restaurant, they tell their friends about it –and accountancy isn’t much different. Delighted clients tell positive stories about the brilliant service they’ve had. This often happens organically, but don’t be afraid to ask supportive clients to post a positive review on Google or Trustpilot. You can also ask a client’s per-

Understanding your clients allows you to tailor your service to meet their needs, while also informing your marketing strategies. Companies with more resources for marketing put a lot of effort into understanding their clients – their behaviours, values, life-stage and more. An alternative to this is to build deeper and more personal relationships with them. In a world of lowcost and often impersonal accountancy services, your reputation as a trusted advisor will help you stand out. It could be as simple as considering their age – the soon-to-retire owners of a tea shop will have a drastically different plan and outlook from an ambitious start-up firm hoping to disrupt their sector.

3. Go after small and digitally savvy businesses with digital marketing

Your established clients may still be using legacy systems and manual processes. However, with the average age of a business owner continuing to fall, the generation of digitally savvy business owners will have little time for outdated prac-

tices. Of course, you’ll be using the latest tools to provide clients services, so you should portray this through your marketing efforts. Furthermore, it would be best to utilise digital platforms to deliver this message to your target audience.

Social media isn’t just for pictures of your food anymore, it’s an essential platform of everyday life, and as such, is the perfect environment to capture the attention of your prospects.

4. Penny for your thoughts

One of the best ways to sell yourself to potential clients is to demonstrate exactly what you can do. Industry blogs, business and industry magazines, podcasts, webinars, and conference panel sessions all welcome experts to comment, discuss and pen thought leadership articles on a whole range of topics. That might be about new regulations, sector-specific issues your clients are facing, or even how you’ve made service a priority.

Whichever route you take, as in most areas of business or life, it’s all about preparation. If you want to stick to the more traditional clients and don’t have a burning desire to serve the digital native disruptors, that’s fine – ultimately, it’s about...

Find out more

Top 5 trends shaping accountancy in 2023

By Catherine Knowles, Freelance Writer, Spotlight Reporting

FROM AI TO ADVISORY SERVICES, SPOTLIGHT REPORTING UNCOVERS THE TOP TRENDS DEFINING A PIVOTAL PERIOD FOR THE FINANCIAL INDUSTRY.

As we move through 2023 and technology continues to advance, while businesses weather shifting economic tides, the world of accounting is undergoing transformation. Leaders in the industry are those that are leveraging the likes of cloud software, artificial intelligence (AI) and automation, data protection services, and visualisation technology, and also understand the growing need for advisory services.

Gartner finds that 20232025 will mark a pivotal time for the financial industry, with those that are able to marry traditional finance with rapidly evolving digital skills and tools the ones that will move from strength to strength. On top of this, accountants and business leaders that aren’t able to take up new capabilities

might not be able to keep up with the pace of change.

Leveraging advanced technologies, and being able to step into an advisor role, can help firms improve their level of service, insights and reporting in order to gain a competitive edge and help businesses achieve notable success.

1. AI and automation power and advance everyday tasks

With the rise of widely accessible tools that are powered by AI, this is the big topic on everyone’s minds. When it comes to accounting, AI tools that directly cater to the finance industry aren’t new, but their functionality is constantly evolving.

For instance, in 2023 AI can analyse financial data, generate reports, and even identify patterns and anomalies that suggest accounting fraud. In an industry underpinned by numbers and data, it’s also hugely powerful when it comes to automating repetitive tasks

so staff can focus more on strategy and reporting, while also saving potential human errors.

One of the most exciting areas of AI advancement that we’re seeing is around data insights and decision making. When powered by AI and automation, accounting data comes to life. It enables firms to far more easily perform cash flow forecasting, analyse salaries, analyse business performance, assess financial conditions, and predict drops or rises in the market.

International Data Corporation (IDC) finds that global spending on AI, including software, hardware and services, will surpass USD $300 billion in 2026, up from USD $118 billion in 2022. This represents a compound annual growth rate (CAGR) of 26.5% over the forecast period, which is four times greater than the CAGR of the same period for worldwide IT spending (6.3%).

Such figures reflect a growing investment and...

Keep Reading

Features XU Biweekly | No. 61 10 Saturday 12th August 2023 SIGN UP FOR FREE XU Don’t miss the next issue! Biweekly

WHEN YOU DELIVER A GOOD SERVICE, YOUR REPUTATION HELPS YOU ATTRACT NEW CLIENTS – ESSENTIAL IF EXISTING USERS ARE APPROACHING RETIREMENT OR WINDING DOWN THEIR BUSINESSES.

Q&A with Sabby Gill, CEO of Dext

Parlez-vous français?

XU: WE’RE JOINED AT DAY TWO OF ACCOUNTEX BY SABBY, THE CEO OF DEXT. HOW ARE YOU FINDING IT IN YOUR NEW ROLE?

SG: I’m absolutely loving it, I’ve been here just over seven months now. The great thing about working for an organisation like Dext is being back in the accounting and bookkeeping space. I’ve previously worked for Sage for a number of years, so it’s great being able to come back into it and have that passion back again, for something that I absolutely love. I just love the thrill of working with accountants and bookkeepers, they’re so integral to growth around GDP economies.

When we’ve got five and a half million small businesses in the UK, they don’t necessarily have everything that they need, such as the expertise and experience of how to run a business properly, especially from an accounting, legislation, regulatory and compliance perspective.

I’d like to think that Dext plays a major part in that, around the efficiency and effectiveness of their practice, giving them more time back, which is probably the number one thing I would say is the most critical thing that everybody craves for. Just the ability to get back time, whether that’s spending that time back in their own business or just taking time out

for them personally.

Being back in fintech has been a real eye-opener in relation to technology and emerging technology. A lot’s changed in the two years that I’ve been away, which you can tell by just looking at the number of organisations that are here at Accountex. We have more people attending as I’m sure after Covid there was that sort of yearn for having social engagement and interaction. We could never have done this over Zoom in the same way that we can do this sort of conversation face to face.

XU: Dext has been around for a while. I’d say it’s been one of the flagship companies for innovation within the fintech community. It was one of the main companies that was integrating with apps like Xero, Sage and QuickBooks and was really driving that change towards digitisation amongst the accountant and bookkeeping community, moving away from paper receipts and into a more digital world.

How do you see Dext’s journey over the next three to five years, in terms of continuing to drive that innovation and being one of the companies at the forefront of that continued change and evolvement?

SG: It’s a great point, we are probably the preeminent pre-accounting solution. We’re at the forefront

of any flow that you could possibly imagine. We’ve got some other inroads into receivables, mainly because of legislation changes in places like France and Australia. But for us, it’s really about continuing the journey we’re on. We will be the best at extraction, whether it is paper, whether it is digital. We have an e-commerce solution that works with people like Amazon, eBay, Etsy, Shopify, all of those organisations.

If you are a small business and you operate on any one of those platforms, you still want the ability to extract invoice information and load it up. Today, we are on a great journey. We do 330 million transactions on an annual basis. The data quality is sitting at 99% of the information that we extract, 75% plus of all of those are using the latest, greatest technology such as applied AI.

Really, it’s about making sure that we continue that journey because so many organisations are dependent on that type of efficiency and effectiveness. There’s other things that we’re also thinking about, you’ll hear more about it over the next few months, looking at how we can expand the value and the stickiness of our applications, and how much more we can do to make organisations more effective and efficient in the way they go about processing and...

Keep reading

CONFERENCE KICK-OFF

By Vipul Sheth ACA CTA, Founder and Managing Director, AdvanceTrack

AS THE 2023 CONFERENCE SEASON KICKS OFF IN EARNEST, VIPUL SHETH GAUGES THE DELEGATE (AND SOFTWARE COMPANY) TEMPERATURE AFTER THE COOLING OFF OF MTD.

It's that time of year: when we ponder whether we’ll get a ‘proper’ summer, and the major accounting conferences begin.

First-off, it was wonderful celebrating 20 years of AdvanceTrack. This year, the AdvanceTrack Conference was held in the magnificent British Museum (where we’ll be heading for in our 21 st year too).

“It was about the future of your firm, your people and your clients,” explains AdvanceTrack MD Vipul Sheth. That’s the message we wanted to get out there. “Working alongside you, we’ll help you navigate those three pillars. “The reason we do these events is around culture and people, all of those things – not six hours of technical updates,” explains Vipul.

“While our processes, technology and security are fundamental from an op-

erational point of view, the relationships we build with clients must be as good as the relationships our clients build with their clients. We are people-centric and well-organised, and that is mirrored in the practices we work with.

“People buy from people; and people keep coming back if you demonstrate that human piece. If you don’t, then they don’t come back.”

Xero’s Jamie Eddy spoke of a three-pronged set of challenges and opportunities that practices must understand and leverage, namely: your reputation; managing your talent; and, therefore, your capacity to undertake work.

Our newly-appointed sales director Dermot Hamblin covered a range of topics, from how to manage change in your practice, through to new developments in the world of business and accounting Technology.

Brian Coventry from Cloudcapcha spoke about the importance of differentiating your practice from others, and capturing data from your clients allows you to offer a unique service.

Accountex London

It was, by all accounts, a record-breaking show – certainly in terms of attendees. Of the show itself – the big players put in a lot of effort into their stands and presentations. In fact, there were presentations across 13 stands for the whole of the two days.

While there was an element of a post-MTD lull, in that there were few big product announcements, it was noticeable how busy the aforementioned stages were. People were hungry for information. And this information wasn’t specifically ‘post-MTD’; instead, there was a range of strategic and operationally-themed sessions.

I was delighted to serve as a panelist on the ‘Are outsourcing and offshoring the solutions to the recruitment crisis?’ session.

Ironically, some of the outsourcing session covered MTD’s impact on changing the way practices work with their clients, particularly around the increasing amount of bookkeeping...

Find out more

Features XU Biweekly | No. 61 Saturday 12th August 2023 11

THE BUSINESS SHOW: THE WORLD’S BIGGEST BUSINESS EVENT

Start Or Grow Your Dream Business At The Business Show

By Karina Kundzina, Social Media & Content Creator, Business Show Media

THE BUSINESS SHOW AIMS TO SUPPORT ASPIRING ENTREPRENEURS AND SME AND SMALL BUSINESS OWNERS BY HELPING THEM GROW A SUCCESSFUL BUSINESS.

Built from the ground up to equip, educate and encourage the small business owners and entrepreneurs of the world, The Business Show gathers and showcases the knowledge and services of hundreds of business experts and leaders. It’s jam-packed with everything you could possibly need to succeed in the world of business in 2023, with 750 incredible exhibitors, 200 inspiring seminars and unmissable masterclasses.

The Business Show is dedicated to helping you learn, grow, and succeed, so no matter the industry there will be something for you to uncover; this is the perfect place for business professionals. There are also a number of co-located shows to suit all your business needs and help you keep upto-date with industry trends and advancements.

When and where can you visit one of our shows?

• The Business Show Singa-

pore, 30th & 31st August 2023, Singapore Expo.

• The Business Show Los Angeles, 20th & 21st September 2023, Los Angeles Convention Center.

• The Business Show London, 22nd & 23rd November 2023, ExCeL London.

• The Business Show Miami, 6th & 7th March 2024, Miami Beach Convention Center.

More about The Business Show

The Business Show Singapore - The Business Show Singapore is the leading event for helping aspiring entrepreneurs and SME and startup owners to start, develop, and grow their dream business. The show gives you access to the products, services, & guidance you need to carve your path to success and propel your business to new and exciting heights. With 5,000 visitors in attendance, 300 incredible exhibitors, and over 350 unmissable seminars, this is the place to be in August.

The Business Show LA & Miami - The Business Show is expanding into the US this year as it lands at the LA Convention Center in September. It’s set to inspire 15,000 US entrepreneurs, business owners and pro-

fessionals. There are 300 industry-leading suppliers and 150 fascinating seminars and masterclasses. If you want the business of your dreams, come to the show and discover everything you need to make your company thrive.

The Business Show London - the show has been running in London for over 22 years and has been met with great success. The event focuses on connecting 30,000 entrepreneurs, SMEs and industry professionals under one roof. With 750 exhibitors showcasing their products and services, and 200 incredible seminars and masterclasses, you are sure to come away with more knowledge and an awareness of your next steps.

The B2B Marketing Expo California & Miami in conjunction with The Sales Innovation Expo - Business Show Media has recently acquired The B2B Marketing Expo. This is the leading event for marketing professionals in the US. The show offers advice and guidance on how marketers can advance their business and their personal careers. There will be over 5,000 in attendance exploring how they can market in new and innovative ways.

Find out more

The Dull, Dirty, and Dangerous: How Autoline is Revolutionising it all

By Doria Kao, Education Lead & Marketing Strategist, Tidy

FROM PAINTING AND PALLETISING TO WELDING AND ASSEMBLY, AUTOLINE HAVE TRANSFORMED INDUSTRIAL PROCESSES ACROSS A BROAD HOST OF INDUSTRIES.

With large projects under their belts like delivering a large-scale milk plant bottling line upgrade, Autoline estimate around 60% of New Zealand’s bottled milk passes over one of their conveyors at some point between the cow paddock and your fridge at home!

For companies around New Zealand, their robot and automation solutions are the secret to labour-saving, consistency, and high-quality production. Given their large-scale projects, it was vital for Autoline to find a project management system that could keep up. Enter TidyEnterprise; a project and stock management software with the depth and flexibility to serve Autoline’s needs.

Autoline’s Story

Autoline began as a family business over 30 years ago, selling press feeder and bowl feeding solutions to the manufacturing industry.

As the company grew, it introduced New Zealand to SlotPro (aluminium T-slot extrusion) and used the aluminium profile to build its

FREE digital business cards

first conveyor systems and guarding.

With a progressive development approach, Autoline continued to expand, diversifying into robotics with the acquisition of Carbines Engineering; New Zealand’s leading robotics integrator.

Today, Autoline is still 100% family-owned and have established themselves as New Zealand’s pre-eminent conveyor automation company. They continue to lead as the robotic, automation, and conveyor experts, bringing the latest technology and innovations to New Zealand.

The Three Ds

The rule of thumb to determine which tasks are best suited for robots is the Robotics Three Ds Principle: The Dirty, Dull, and Dangerous. For a long time now, robots have replaced or assisted work that is repetitive, unhygienic, or risky, in heavy industries.

What sets Autoline apart, is how they supply robotic welding cells to a range of industries for everything from heavy metal fabrication to aluminium gates, trailers, fireplaces, and more. The company also provides conveying solutions to many different industries in NZ, such as food and beverages, plastics, logistics, and many others.

Software Challenges

Prior to using TidyEnterprise as a project management software, Autoline faced several challenges. The company’s previous enterprise resource planning software was not very flexible, particularly given the range of products and services Autoline required.

“We were looking for software that could process smaller spare part sales while also managing larger-scale projects in tandem,” says Matthew Fisher, Managing Director of Autoline.

In addition, the company had limited support with its previous software, and any training or assistance was hard to come by. Autoline struggled to integrate projects and smaller spare part sales into one software solution.

The Solution

Autoline made the switch to TidyEnterprise just under 10 years ago and found the Kiwi company more approachable and flexible. TidyEnterprise software allows Autoline to process smaller spare part sales while managing larger-scale projects too.

Eight staff members across the sales, purchasing, and administration teams...

Keep Reading

Features XU Biweekly | No. 61 12 Saturday 12th August 2023

for EVERYONE Get yours now

DON’T MISS THE NORTH’S #1 EVENT FOR ACCOUNTANCY & FINANCE EXHIBITION | EDUCATION | NETWORKING GET 8 CPD HOURS BOOK YOUR FREE TICKET WWW.ACCOUNTEX.CO.UK/MANCHESTER PRIORITY CODE ASM201 19 SEPTEMBER | 2023

PAYPAL LAUNCHES U.S. DOLLAR STABLECOIN

PAYPAL USD (PYUSD) IS FULLY BACKED BY U.S. DOLLAR DEPOSITS, SHORT-TERM U.S. TREASURIES AND SIMILAR CASH EQUIVALENTS, AND CAN BE REDEEMED 1:1 FOR U.S. DOLLARS.

Fully-backed, regulated stablecoins have the potential to transform payments in web3 and digitally native environments. To address that emerging potential, PayPal (NASDAQ: PYPL) today announced the launch of a U.S. dollar-denominated stablecoin, PayPal USD (PYUSD). PayPal USD is designed to contribute to the opportunity stablecoins offer for payments and is 100% backed by U.S. dollar deposits, short-term U.S Treasuries and similar cash equivalents. PayPal USD is redeemable 1:1

for U.S. dollars and is issued by Paxos Trust Company.

Starting today and rolling out in the coming weeks1, eligible U.S. PayPal customers who purchase PayPal USD will be able to:

• Transfer PayPal USD between PayPal and compatible external wallets

• Send person-to-person payments using PYUSD

• Fund purchases with PayPal USD by selecting it at checkout2

• Convert any of PayPal's supported cryptocurrencies to and from PayPal

USD

"The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the U.S. dollar," said Dan...

Keep reading

GOCARDLESS, THE BANK PAYMENTS COMPANY, HAS TODAY ANNOUNCED A FOURYEAR DEAL TO BECOME THE OFFICIAL PAYMENTS PARTNER FOR SWIM ENGLAND, WITH PLANS TO EXTEND OFFERS AND BENEFITS TO AFFILIATED GROUPS AND INDIVIDUALS INCLUDING SWIMMING CLUBS, SWIM SCHOOLS, AND TRAINERS.

The agreement, effective 1 August, will also see GoCardless become the headline sponsor for all Swim England national events, covering activities across swimming, diving, artistic swimming and water polo.

Although this is the first sports sponsorship for the fintech, GoCardless has deep roots in the sport and health & wellness space...

Find out more

Accept contactless payments with only an iPhone

OK, WE’VE GOT SOME BIG NEWS: TAP TO PAY ON IPHONE IS NOW AVAILABLE VIA BOTH THE REVOLUT AND REVOLUT BUSINESS APPS.

If you’re a seller that accepts contactless payments in person, it means you can now do so straight from your phone. No strings attached, no POS, nothing – just an iPhone to process everything from physical cards to digital wallets such as Apple Pay and Google Pay.

Trust us: it’s as simple as it sounds. Here’s a rundown of how it works –and what it means for you, your business and your customers.

Starling Bank raises 1-Year Fixed Saver interest rate

STARLING BANK IS TODAY RAISING THE INTEREST RATE ON ITS 1-YEAR FIXED SAVER FROM 3.25% TO 5.25% AER/GROSS* IN RESPONSE TO CHANGES IN BANK OF ENGLAND INTEREST RATE RISES.

Effective from Thursday 3 August 2023, Starling Bank customers choosing the Fixed Saver will receive a return of 5.25% on balances of £2,000 - £1 million locked in for one year.

A Fixed Saver is managed from the Spaces section of both the Starling Bank app and online bank for maximum visibility and control. Funds can be transferred immediately from the main account balance to the Fixed Saver space, and customers will be able to see how much interest they will accrue on their savings over the full 12

months. They can also hold multiple Fixed Savers at any time.

Notes to Editors

• *5.25% AER/Gross p.a. fixed for 12 months. Minimum deposit of £2,000; maximum of £1 million. Interest calculated daily and paid after 12 months on maturity. Available for Starling Bank personal current account customers only. A 1-Year Fixed Saver can be opened immediately on setting up and funding an account.

• The fixed term starts on the day the money is deposited. Customers have the right to close the Fixed Saver within 14 days from the date of initial opening. Top-ups of individual Fixed Savers are...

Find out more

All you need is an iPhone

Accept in-person, contactless payments from customers using everything from physical cards to Apple Pay, and other digital wallets. No

extra hardware or terminals needed.

Security and privacy built in

Tap to Pay on iPhone uses the built-in features of iPhone to help keep your business and customer data private and secure.

Keep more of your money

No setup charge. No subscription. No hidden fees. Our pricing is transparent, so you can focus on your earnings, rather than your outgoings.

Settle up within 24 hours

Why wait for money that could be working hard for your business? Instead, access all your earnings within 24 hours of a sale. Simple and seamless.

Read more

PayPal Reports Second Quarter 2023 Results

PAYPAL HOLDINGS, INC. (NASDAQ: PYPL) TODAY ANNOUNCED ITS SECOND QUARTER 2023 RESULTS FOR THE PERIOD ENDED JUNE 30, 2023. THE EARNINGS RELEASE AND RELATED MATERIALS DISCUSSING THESE RESULTS CAN BE FOUND ON ITS INVESTOR RELATIONS WEBSITE AT HTTPS://INVESTOR.PYPL. COM/FINANCIALS/QUARTERLY-RESULTS/DEFAULT. ASPX.

PayPal Holdings, Inc. will host a conference call to discuss these results at 2:00 p.m. Pacific time (5:00 p.m. Eastern time) today. A live webcast of the conference call will be available at https://investor.pypl.com. In addition, an archive of the webcast will be accessible for 90 days through the same link.

Find out more

FinTech News XU Biweekly | No. 61 14 Saturday 12th August 2023

GoCardless becomes the official payments partner for Swim England, strengthening its ties to grassroots, membership and health & wellness organisations