The independent magazine for Xero users, by Xero users

ISSUE

10

magazine

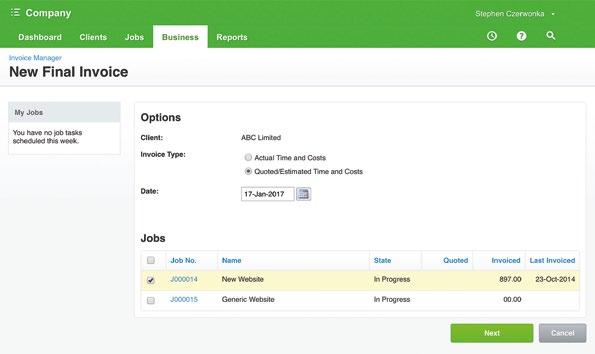

ON DEMAND

BUSINESS

FINANCE Satago (Latin): to satisfy/pay a creditor

ISSN 2054-7226

10

9 772054 722009

Have you subscribed? Go to subscriptions.xumagazine.com

COVER STORY Satago’s Steven Renwick explains how the Financial Web is transforming the traditional lending landscape Follow us on Twitter: @xumagazine

Issue 10 / 1

Have you subscribed for FREE? Go to subscriptions.xumagazine.com