SEND Educator Guide

Empowering children to become the Money Heroes of tomorrow!

A financial education programme for primary aged children

About Money Heroes

Money Heroes is a free programme from Young Money, supported by HSBC UK, which seeks to transform financial education for primary aged children.

Recognising that, as well as parents and teachers, practitioners are key influencers in a child’s development, the programme has been designed to enable a collaborative, child-centred approach to teaching financial education at home, in the classroom and now within wider settings.

About Young Money, part of Young Enterprise

Young Money is part of Young Enterprise - a national charity. Our vision is that every young person is provided with the opportunity to learn the vital skills needed to earn and look after their money, to develop an enterprising mindset and make a valuable contribution to their communities and wider society

Young Money (part of Young Enterprise) supports all educators in developing the financial capability of the young people they work with. We are a trusted and valued provider of knowledge, resources and training to anyone teaching children and young people how to manage money.

Money Heroes and BBC Children in Need

Money Heroes are proud to be working with BBC Children in Need to ensure that our resources are accessible for all. We recognise that teachers and parents are not always the key influencers in a child’s life, and so we have adapted our offer to increase accessibility for these children. By working with BBC Children in Need, we hope to reach children who may not otherwise receive financial education and make a difference to their futures.

The support that HSBC UK has given to Money Heroes will enable us to reach more young people than ever before, providing meaningful financial education and give extra help to the most disadvantaged communities across the UK.

Money Heroes Programme

Young Money, part of Young Enterprise

Email: moneyheroes@y-m.org.uk

@YoungMoneyEdu

www.moneyheroes.org.uk

Contents 04 Why financial education? 05 Financial Education Primary Planning Framework 07 Overview of resources 10 Activities for SEND Educators 11 Overview of activities 13 Bring learning to life with storybooks 18 Activities linked to the storybooks 19 Ed and Bunny Go Shopping, board game 20 Money Heroes digital game 21 Frequently Asked Questions – Talking about money 23 Frequently Asked Questions – Further support

We’re here to get you talking about money

Source: C&YP Financial Capability: 4 to 6 year olds Money and Pensions Service – Dec 2019 (Qualitative Research)

Research shows that those who developed financial capability in their childhood continue to have high levels as adults.

Why financial education?

Did You Know?

Children start to form their habits and attitudes around finance by the age of seven.1

That’s why it’s important to provide every child with financial education. Enabling understanding and providing opportunities around money from an early age, will allow them to make the right choices independently in the future. There is more to money management than understanding the value of coins and notes or counting change (though these themselves are important skills). Learning how to keep track of spending or whether an item offers value for money will help ensure children know how to make financial decisions for themselves when they grow up.

The role of the SEND Educator

The teaching of life skills is a huge part of the role of a SEND Educator and creating opportunities to help children in your setting to develop their financial capability will be invaluable.

As an educator, you can equip children with skills, knowledge and ideas to help them open up new ways of understanding money now and later on in life and support them to become as financially capable as possible.

For an educator of children who have special educational needs and disabilities, this educational journey will look different for every child. In the context of understanding and managing money, your role will be to support them to build on and develop skills for life.

1. Source: Money Advice Service (2013) Habit Formation and Learning in Young Children. Available at https://mascdn.azureedge.net/cms/the-money-advice-service-habit-formation-and-learning-in-young-children-may2013.pdf) 2. Source: Survey by Censuswide, 1001 Parents with children aged 5 – 20, 14.10.2020 - 19.10.2020

Being able to manage money well is what we call being financially capable.

Why financial education? 4

95% of 16 to 24 year olds believe that money management is something which can be learnt 2 .

Financial Education Primary Planning Framework

There are many money-related topics that children could learn about, and the Financial Education Primary Planning Framework has been created to help break down learning about money into chunks that are easy to handle.

Some schools may use the framework to help them plan financial education in their curriculum. You may find it useful to help plan your sessions, identify areas which the children you support may need to focus on most, and measure progress.

There are four key themes for all age groups to learn about:

1. How to manage money.

2. Becoming a critical consumer.

3. Managing risks and emotions associated with money.

4. Understanding the important role money plays in our lives.

The framework covers the most relevant topics and is split up into age groups. However, the age groups are just a guide and you will recognise the right level to teach the children you work with. You can pick elements out you think are best suited to them and it may even help to spark some new ideas for financial education projects or games within your setting.

Financial EducationPlanning Framework 3 -11 years

Spend it, save it, give it, get it? Whatever we do with money, we need to manage it well. A cross-curricular, planned programme of financial education can help give children and young people the confidence, skills and knowledge they need to manage their money, now and in the future. We have found that on average children begin to receive pocket money aged seven, own their first mobile phone at eight, and purchase items online at 10, with one in five having used their parents’ or older siblings’ credit or debit card to purchase these items. They can open a bank account and have a debit card at 11. At 18 they can apply for a credit card or loan, and before they leav school they have to make crucial decisions about jobs, student loans, and living independently. The need for young people to develop the skills to earn and look after their money has never been stronger. The 3-11 Planning Framework This framework aims to support the planning, teaching, and progression of financial education by setting out the key areas of financial knowledge, skills and attitudes, across four core themes: how to manage money; becoming a critical consumer; managing risks and emotions associated with money; understanding the important role money plays in our lives. The framework is designed to help you deliver financial education flexibly across your curriculum. It is not intended to be used rigidly. Placing the age ranges side by side shows progression from 3-11 years. However, you may need to draw on ideas from other ages depending on the needs of your pupils. There is also an 11-19 Planning Framework which has been designed in exactly the same way as this 3-11 framework, and is used in very similar ways with young people age 11 upwards. Our vision is to support schools with embedding high-quality financial education into their teaching and learning, thereby making a positive change to children and young people in a sustainable way. More information about how this framework can be used, and some of the services available to help you plan and deliver financial education in an effective and engaging way, can be found overleaf. You can download the Financial Education Planning Frameworks www.young-money.org.uk/ frameworks

3-11 years 5 Financial Education Primary Planning Framework

coins and notes I use and can put order of value.

VALUE OF COINS AND NOTES

I can recognise and choose the correct value of coins and notes to use and calculate change.

I can understand the importance of waiting for and checking change.

How to use the framework:

KEEPING TRACK OF MONEY

of keeping track of my money and keeping a spending diary.

PRACTITIONER RESOURCE

I can keep simple financial records e.g. recording the amount saved in a money box and how it has been used.

Our Money Heroes materials and resources all fall under these categories within the frameworks.

critical consumer

On each of the SEND Activity resources you will find a ‘Key Themes’ section. These key themes link to the learning objectives in the Primary Planning Framework, allowing you to map the content of the activity to the framework.

about saving and spending

I am beginning to understand I might run out of money unexpectedly if I don’t keep track of it.

DIFFICULTY LEVEL: INTERMEDIATE

CHOICES ABOUT SAVING AND SPENDING

I can make a simple plan for my saving and spending choices and stick to it.

Toy Time

You might choose to use the Primary Planning Framework to assess the current financial education knowledge and understanding of the children who attend your setting.

I am beginning to understand that people may make different choices about how to save and spend money.

NEEDS AND WANTS

What’s it about?

needs and wants may be different to I can explain the difference between something that I need and something I might want.

and emotions associated with money

money in different places, and that than others e.g. in a money box

Toy Time

I am beginning to understand that we might not always able to have the things we want.

The theme of ‘toys’ is a great way to teach financial education. the cost of buying toys and how long it would take to save up them to understand, in the wider sense, that they can make choices to spending and saving and that others may make different

LOOKING AFTER MY MONEY

Key Themes

I can choose a suitable place to keep my money safe, and explain my choice.

Being a critical consumer: Choices about saving and spending

I am beginning to understand the consequences of money or having it stolen, and how it might make me

• I know I have choices about saving and spending my money.

SAVING MONEY

• I am beginning to understand I might run out of money unexpectedly if I don’t keep track of it. Being a critical consumer: Wants and needs

money to use later instead of I can describe why I might want to save my money e.g. for something special or to buy a present for someone else, and where I might save it e.g. cash at home, in a savings account.

• I am beginning to understand that people may make different choices about how to save and spend money.

I am beginning to understand why saving money can important and how that makes me feel.

If you wish to further support children’s financial education, beyond what is outlined in this guide, then you can use this framework as a guide to teach children about money. Here is an example of how you might choose to do this…

How it works…

1. Show children the Toy Collection template, but hide the price tags. Ask the following:

the important role money plays in our lives

STEP 1 STEP 2

- Do they know how much it costs?

3. Ask children to share

- How many toys did Do they need all of

Choose an objective from the framework that you would like children to achieve.

- Do they think it is expensive or affordable?

I can describe where my money comes from.

WHERE MY MONEY COMES FROM comes to me in different ways e.g. borrowing, finding, being given.

Ask children to work together to order the toy pictures according to which they think would be the least to the most expensive. Reveal the cost of each toy and ask children if any of the prices were surprising.

HOW MONEY DEVELOPED

Example Objective: Needs and Wants

developed in many different forms barter, coins, notes, etc.

I can explain the difference between something that I need and something I might want.

Create an activity (or number of activities) which will help them to practise and achieve this outcome.

I understand that money will come to me in other ways the future e.g. being paid for working.

Example Activity:

I can describe the many forms that money comes in today, and the variety of ways in which it can be used to pay for things.

2. Using the pictures from the Toy Collection template, place children in pairs and give them a sum of money e.g., £10 (you can use real or plastic money or use the coins and notes template).

- If they spent all the why did they make Ask each pair to tell their reasons behind Explain that people about saving and spending choices affect people on their circumstances.

Bring in a range of items and ask children to group them according to whether they are needs or wants. Ask children to discuss their ideas and help them to think carefully about the difference between a need and a want.

I understand that money will continue to develop in variety of forms in the future.

Ask each pair to add up the money they have been given and then discuss which items they would choose to buy with that money. Once they’ve decided what they would buy, ask the

6 How to use the framework How to manage money VALUE OF COINS AND NOTES know the value of the coins and notes use and can put them in the correct order of value. I can recognise and choose the correct value of coins and notes to use and calculate change. can understand the importance of waiting for and checking change. KEEPING TRACK OF MONEY know there are ways of keeping track of my money and what spend e.g. keeping a spending diary. can keep simple financial records e.g. recording the amount saved in a money box and how it has been used. am beginning to understand I might run out of money unexpectedly if don’t keep track of it. Becoming a critical consumer CHOICES ABOUT SAVING AND SPENDING know have choices about saving and spending my money. can make a simple plan for my saving and spending choices and stick to am beginning to understand that people may make different choices about how to save and spend money. NEEDS AND WANTS know that my own needs and wants may be different to those of other people. can explain the difference between something that need and something might want. am beginning to understand that we might not always be able to have the things we want. Managing risks and emotions associated with money LOOKING AFTER MY MONEY know can keep money in different places, and that some places are safer than others e.g. in a money box or bank. can choose a suitable place to keep my money safe, and explain my choice. am beginning to understand the consequences of losing money or having it stolen, and how it might make me feel. SAVING MONEY know can save my money to use later instead of spending it all now. can describe why might want to save my money e.g. for something special or to buy a present for someone else, and where might save it e.g. cash at home, in a savings account. am beginning to understand why saving money can be important and how that makes me feel. Understanding the important role money plays in our lives WHERE MY MONEY COMES FROM know my money comes to me in different ways e.g. earning, winning, borrowing, finding, being given. can describe where my money comes from. understand that money will come to me in other ways in the future e.g. being paid for working. HOW MONEY DEVELOPED know that money has developed in many different forms throughout history e.g. barter, coins, notes, etc. I can describe the many forms that money comes in today, and the variety of ways in which it can be used to pay for things. understand that money will continue to develop in a variety of forms in the future. VOCABULARY: £ and p, cost, price, sell, total, choice, choose, customer, bank, value, need, want, earn, win, pocket money, chores, work, barter, change. 5-7 years to learning outcomes: Knowledge Skills Attitudes 5-7 years Financial Education Planning Framework 3-11 years PRACTITIONER RESOURCE Find out more at www.moneyheroes.org.uk

How it works… Toy collection template Template available ACTIVITY LENGTH: YOU WILL NEED... KEY VOCABULARY TIP! See our glossary online at www.moneyheroes.org.uk for a definition of words and phrases. 1. Show children the Toy Collection template but hide the price tags. Ask the following: - Do they know how much it costs? - Do they think it is expensive or affordable? Ask children to work together to order the toy pictures according to which they think would be the least to the most expensive. Reveal the cost of each toy and ask children if any of the prices were surprising. 2. Using the pictures from the Toy Collection template place children in pairs and give them a sum of money e.g., £10 (you can use real or plastic money or use the coins and notes template). Ask each pair to add up the money they have been given and then discuss which items they would choose to buy with that money. Once they’ve decided what

buy,

the children to count out the money

to pay

chosen toy. -

small toys? -

money? -

-

-

these choices. Explain that people make different choices about saving and spending and how these choices affect people differently depending on their circumstances. Pay Currency Spend Money Savings Coins Notes Barter Debit card Credit card Key Themes Being a critical consumer: Choices about saving and spending know have choices about saving and spending my money. • I am beginning to understand I might run out of money unexpectedly if I don’t keep track of it. Being a critical consumer: Wants and needs • I am beginning to understand that people may make different choices about how to save and spend money. What’s it about? The theme of ‘toys’ is a great way to teach financial education. Children can consider the cost of buying toys and how long it would take to save up for a toy. It will help them to understand, in the wider sense, that they can make choices when it comes to spending and saving and that others may make different choices 40 MINUTES DIFFICULTY LEVEL: INTERMEDIATE Show children the Toy template,Collection but hide the price tags. £15

they would

ask

they would need

for their

Would they buy one big toy or several

How much change would they get from the

If the toys costs more than they have been given, where could they get the money to buy the toy? 3. Ask children to share their choices:

How many toys did they choose? Do they need all of these toys?

If they spent all the money on one toy, why did they make this decision? Ask each pair to tell you their choices and their reasons behind

Show children the Toy Collection

Overview of Resources

Money Heroes has a range of free resources and support available to all educators and parents.

What’s

SEND Educator Guide

• Overview of financial education

• Reference guide for resources

• Overview of activities, books and games

• Answers to common questions (FAQs)

If you require accessible versions of any of our materials and resources, please contact the Money Heroes team.

Money Heroes Activities

Storybooks

Games

Financial Education Primary Planning Framework

Money Heroes Glossary

Parent Flyers

Money Heroes Activities

A number of free to download, high-quality activities have been created for use with children of varying abilities of special educational needs, covering a range of themes and topics.

• Pick and choose activities to suit your learners. You are not required to deliver all activities; they are designed to be used in a flexible way.

• Activities vary in difficulty; Beginner, Intermediate, Advanced or Expert.

• Each activity has a range of adaptation options, which will be described later in the guide.

• Take a look at the storybook follow on activities, so you can continue the learning after reading the book with your group.

For more information and details about how to use the activities see pages 10, 11 and 12 of this guide.

PRACTITIONER RESOURCE out at www.moneyheroes.org.uk Billy’s Payslip What’s it about? Billy’s monthly earnings are used to help children understand payslips including the deductions that might be taken from someone’s earnings and why. Children will begin to develop an understanding of tax and how this helps to provide things that we all need. Key Themes Understanding the important role money plays in our lives: Wider communities know that money is deducted from earnings to provide things we all need e.g., through taxes and National Insurance contributions am beginning to understand why and how some of the money we earn supports the wider community. How it works... 20 MINUTES Billy’s monthly payslip Template available HMRC’s Junior Tax Facts video (from 3:49min onwards) https://www.youtube.com/ watch?v=Un9W8U0VRpY ACTIVITY LENGTH: YOU NEED...WILL KEY VOCABULARY TIP! See our glossary online at www.moneyheroes.org.uk for a definition of words and phrases. 1. Explain to children that Billy has recently started a new job as a zookeeper. He’s really looking forward to earning money, but he can’t work out how much he will be paid. Give or show children a copy Billy’s Monthly Payslip template Point out the main features and explain the terms using the information on the template. Ask children to label the different parts using the numbering on the worksheet as you explain each one. Work through the calculations and ask children to complete the payslip with the correct figures. Explain that Billy can’t keep all the money he has earnt; some deductions made. 3. Have the children heard of income tax or National Insurance? Use Billy’s Monthly Payslip template to help explain these terms. Focus income tax. Ask children to tell you what they think the money taken from Billy’s payslip contributes towards. Show children the HMRC’s Junior Tax Facts video (from 3:49min to the end of the video). Ask children to create a poster which shows various ways income tax (tax from earnings) is used to help the community. Calculate Billy’s net pay. This is often called ‘take-home’ pay as it is the amount Billy will take home after the deductions have been made. Income Total Earn Work Wages Salary Job Pay Payslip Deductions Income tax Overtime Gross pay Net pay National Insurance DIFFICULTY LEVEL: EXPERT Show children the HMRC’s Junior Tax Facts video PRACTITIONER RESOURCE Find out at www.moneyheroes.org.uk TIP! See our glossary online at www.moneyheroes.org.uk for definition of words and phrases. A day out with Ed and Bunny How it works… KEY VOCABULARY Key Themes Managing risks and emotions associated with money: Saving money know can save my money to use later instead of spending it all now. Managing risks and emotions associated with money: Keeping money safe can choose a safe place to keep my money e.g., money box, purse. Being a critical consumer: Choices about saving and spending can make simple plan for my saving and spending choices and stick to it. What’s it about? This activity follows on from Ed and Bunny Earn Some Money and can be completed after reading the storybook, which is available as a hard copy as well as an eBook on the Money Heroes platform. However, the activity can also be used as a standalone resource without reading the book beforehand. These activities offer children opportunities to discuss where money comes from and help them begin to understand that money is a limited resource they will learn to manage Children help Ed and Bunny plan a day out using the money they have saved up, working out how much the trip will cost and what they could do on their budget DIFFICULTY LEVEL: INTERMEDIATE Afford Expenses Amount Money Budget Price Buy Purse Coins Save Cost Spend Starter Introduce the characters of Ed and Bunny and explain that Ed has bought Bunny a money tree (or money bank) to help keep money safe and to encourage Bunny to save some money. This activity will look at why it’s a good idea to save up for some things. Tell children that Bunny has been using the new money tree and managed to save some money. Ed and Bunny have decided to go on a day trip using the money they have saved. Can you help them decide where to go? Make two lists and ask the children to contribute their ideas... List 1: Different places to visit, e.g. a museum or art gallery, a trip to the beach, an exploration of local woodland or park. List Things Ed and Bunny would need money for on their trip, e.g., to buy souvenir or an ice-cream. Paper Coloured pencils or pens Coins and Notes template Template available Saving and Spending Record Template available Budget Tracker Template available ACTIVITY LENGTH: YOU WILL NEED... 30 MINUTES Ed and Bunny Earn Some Money published by Scholastic (2021) text and illustration Matt Carr.

available? 7 Overview of Resources

Overview of Resources

Storybooks

Money Heroes have 5 storybooks available in a number of formats:

Ed and Bunny Earn Some Money

Ed and Bunny Spend Some Money

• Ed and Bunny Raise Some Money

Picture books by author and illustrator Matt Carr.

Financial Education Primary Planning Framework

A handy tool to plan financial education in your setting. Find out more about the framework on page 5

Money Heroes Glossary

A useful tool to use to define financial terms and concepts when talking about money and working through the Money Heroes activities.

Games

• Super Stories for Money Heroes

Reader of three short stories, also available as an early-reader eBook.

• Super Stories for Climate Heroes

Reader of two short stories.

Chapter books written by E.L. Norry and illustrated by Iris Amaya.

Books and games can be requested free of charge at moneyheroes. org.uk

All books are also available in the following accessible formats:

• Audiobook

• Braille

• BSL signed stories

• Large print

• A3 size big books

Audiobooks and BSL signed stories are available on the Money Heroes platform. If you require copies of the braille, enlarged and large print versions, please get in touch with us at: moneyheroes@y-m.org.uk

For more information and details on how to use the storybooks see pages 13 - 16 of this guide.

Ed and Bunny Go Shopping Board Game

A fun lotto game that teaches early money-handling skills.

Money Heroes Digital Game

Players will be tasked with planning the end of year school disco! To play this, head to moneyheroes.org.uk/game

For more information and details on how to use the games see page 19 and 20 of this guide.

Also available...

Money Heroes SEND Teacher Training

A 2 hour online training session arranged at a time to suit your school. This will provide teaching staff with the confidence, knowledge and skills to deliver high-quality financial education and develop children’s habits and attitudes around money.

Up to 4 hours of bespoke mentoring support from our financial education experts. This can be split into multiple sessions and supports you as SEND Educators to deliver and embed financial education within your setting.

. Spend it, save it, give it, get it? Whatever we do with money, we need to manage it well. A cross-curricular, planned programme of financial education can help give children and young people the confidence, skills and knowledge they need to manage their money, now and in the future. We have found that on average children begin receive pocket money aged seven, own their first mobile phone eight, and purchase online at with one five having used their parents’ or older siblings’ or debit card to purchase these can open bank account and have debit card 11. At 18 can apply for credit card or loan, and before leav school they have make crucial decisions about jobs, student loans, living independently. The need for young people to develop the skills earn and after money has never been stronger. The 3-11 Planning Framework This framework aims support the planning, teaching, and progression of financial education setting the areas of financial knowledge, skills attitudes, across core how manage money; becoming critical consumer; ging and emotions associated with money; understanding the important role money plays our lives. The framework designed to help you deliver financial education flexibly across your curriculum. It is not intended be used rigidly. Placing age ranges side by shows progression from 3-11 years. However, may need draw on ideas other ages depending the needs of your pupils. There an 11-19 Planning Framework which has been designed in exactly same way this 3-11 framework, and used in similar with young people age 11 upwards. vision support schools with embedding high-quality financial education into their teaching and learning, thereby making a positive change to children and people sustainable way. More information about how framework be used, and of the services available to help you plan and deliver financial education in an effective and engaging way, can found overleaf. You can download Financial Education Planning Frameworks frameworkswww.young-money.org.uk/ Financial EducationPlanning Framework 3-11 years 3-11 years 8 Overview of Resources

•

•

Overview of Resources

Quick glance overview of available activities:

KEY THEME:

How to manage money

Covers topics including:

Recognising money in different forms

Cost of items/Value for money

Keeping track of money/Budgeting

KEY THEME:

Covers topics including:

Needs and wants

Managing money/Making choices and decisions

KEY THEME:

Activities to try:

• Coins, coins, coins (beginner)

• Let’s play shops (beginner)

• A day out with Ed and Bunny (intermediate –storybook activity)

• The super supper challenge (intermediate/advanced)

Activities to try:

• Help Bunny buy a gift (intermediate –storybook activity)

• Packing for Antarctica (intermediate)

• Toy time (intermediate)

• Ways to pay (intermediate)

• Going digital (intermediate/ advanced)

• Budget bonanza (advanced)

• A sporting chance (expert)

• Household budgeting (expert)

• To buy or not to buy (intermediate/advanced)

• Shopping sense (advanced)

• A sporting fan (advanced/expert)

• Become An Eco Hero! (advanced – storybook activity)

Activities to try:

• Save and share with Ed and Bunny (intermediate –storybook activity)

• How do we pay for things? (intermediate)

Covers topics including: Keeping money safe

Saving money

KEY THEME:

Covers topics including:

Where money comes from

Earning money/Tax

Activities to try:

• Money through the ages (intermediate)

• Why do people have jobs? (intermediate)

• Billy’s payslip (expert)

• World of work (expert)

• Keeping a record (intermediate)

• Become a Money Hero (advanced – storybook activity)

Managing risks and emotions associated with money

Becoming a critical consumer

Understanding the important role money plays in our lives

9 Overview of Resources

Activities for SEND Educators

Our Money Heroes SEND Activities have been designed for those delivering in a range of settings. We have included a number of sections which give ideas on how to adapt the activity to suit your setting and the children you work with.

Each activity contains the following sections:

Difficulty level

Each activity contains a difficulty level, based on children’s financial knowledge, skills and understanding. SEND Educators should choose activities based on the financial capability level of the children they are working with.

Beginner – This level suits children who have little financial education knowledge.

Intermediate – This level would suit children who have some financial education knowledge and are beginning to understand simple financial concepts such as spending and saving.

Advanced – This level would suit children who are ready to start building on their financial education knowledge and basic understanding with more challenging thinking and development of skills.

Expert – This level would suit children who are thinking more critically about and showing sound knowledge of financial concepts and are ready to explore more complicated topics such as tax and National Insurance.

What’s it about?

An introduction to the activity, including information about what financial themes it covers. Key financial education themes are highlighted in bold lettering.

Key themes

Activity learning objectives, taken from the Young Money Primary Planning Framework.

Materials needed

Materials required for the activity, including any links/references to specific resource templates.

Key vocabulary

The key vocabulary covered within the activity. See our Money Heroes Glossary for definitions of key financial terms.

Activity timings

Timings of either a whole activity, or in some cases, smaller sections of an activity. Most activities also contain a box on page 2 which states how SEND Educators could deliver the activity over separate sessions if their setting is short on time.

How it works

Instructions for the delivery of the activity. For some activities this section is split into smaller sub-sections.

Add a challenge

A way to extend the activity should SEND Educators want children to further explore some of the financial education themes outlined in the main activity.

Helping hand

Ideas for SEND Educators to deliver the activity, or some main concepts, in a simpler way.

Adaptations for this activity

Specific adaptations which might suit SEND Educators and children within various settings, such as the suggestion of how you might tackle a difficult concept with children.

How to deliver Money Heroes activities within your setting

As all settings and requirements are different and unique to you, there is no set requirement for the delivery of activities. However, you may choose to do one or more of the following:

• split your children into ability groupings and deliver the relevant activities within that ability level e.g., ‘advanced’ level.

• choose one theme at a time to focus on and deliver activities which fall within that theme e.g., budgeting.

• deliver sections of one activity, over a series of sessions.

• spend longer than the suggested timeframe on an activity.

• choose individual sections of an activity to deliver.

• deliver all activities, using the ‘add a challenge’ and ‘helping hand’ sections to cater for various ability levels.

• create opportunities within your setting to extend the learning of an activity e.g., by setting up a tuck shop after delivering the ‘Let’s Play Shops’ activity.

• deliver activities 1:1.

• adapt an existing activity to suit individual/ group needs e.g., instead of using paper resources provided, use practical resources.

PRACTITIONER RESOURCE Find out more www.moneyheroes.org.uk Going Digital How it works… KEY VOCABULARY TIP! See our glossary online at www.moneyheroes.org.uk for definition of words and phrases. Key Themes Managing risks and emotions associated with money: Using accounts to keep money safe and to save can keep my money in a standard and/or online bank account and what benefits this might have. How to manage money: How to pay know that cash is only one way to pay for goods and services. I can describe ways of paying that don’t involve cash e.g., debit cards, credit cards, online payments. What’s it about? As more people are using cashless payment methods in society today, it is important that we teach children how things are paid for without physically exchanging money. This activity supports children to understand the ways that people pay for things digitally by exploring various ways to pay through role play. DIFFICULTY LEVEL: INTERMEDIATE/ADVANCED Wallet Purse Money Cash Pay Debit card Credit card Gift card Online payment Bank transfer Owe Lend Money box Bank account Contactless Pupils will role-play various ways to pay for things and illustrate the process. Ask children to tell you all the forms of payment they are familiar with. Write them on piece of paper and add any of the following if they have been listed: Gift cards Bank transfer Debit Credit card • Cash Phone (contactless) 2. Once the forms of payment have been established, place children in groups of at least 3 and assign each group a type of payment (i.e., group 1 – gift cards). If you have a small group, you might want to complete this activity together. 3. Ask groups to discuss how their type of payment works and the pros and cons of using this payment method, as they will have to role-play the process and present it to the class. Role-play Role play receiving the request of transfer or money, gathering the correct amount, counting the money and telling the consumers that the money has been received and stored in the relevant place. Assign a child to play the role of a ‘consumer’. Assign a child to play the role of a ‘bank’. Assign the rest of the children to play the role of ‘money’. For the children playing ‘money’, you could give each child an amount to pretend to be e.g., ‘you are £20’. Please see ‘how to play each role’ and advise children of the instructions. 5. Once the groups have prepared their role play, ask them to present their type of payment to the whole group. 6. Iron out any misconceptions about how and why these kinds of transactions might happen and ensure children understand how each payment method works. You may want pupils to make labels to show their role-play ‘character’ Pen/markers Paper ACTIVITY LENGTH: YOU WILL NEED... 20 MINUTES per role play activity focus We recommend delivering this activity in conjunction with the Ways to Pay activity. Ways to Pay helps children familiarise themselves with different payment methods and work out which payment method would be the best for various spending dilemmas. You may wish to pause the Going Digital activity here and complete Part 1 of the Ways to Pay activity, to support children’s understanding of payment methods. 10 Activities for SEND Educators

Overview of Activities

Below you can find a summary of each of the SEND Activities

We’ve grouped them into some key themes, so you can easily find activities that look at the areas you want to focus on.

Recognising Money Keeping track of money and budgeting

Coins,coins,coins

Difficulty: Beginner

Children will learn to recognise coins and their value, through a series of short, fun activities and games. You could deliver this in preparation for the Let’s Play Shops activity.

Ways to Pay

Difficulty: Intermediate

Children will understand the similarities and difference between various ‘plastic’ cards that are used to pay for things in shops. They use a ‘decision tree’ to select methods of payment and to make spending choices. Children then explain their decisions by giving advice to a fictional character. You could deliver this activity in conjunction with Going Digital.

Going Digital

Difficulty: Intermediate/Advanced

This activity supports children to understand the ways that people pay for things digitally, by exploring various ways to pay through role play.

Cost and value for money

Let’s Play Shops

Difficulty: Beginner

For this activity, children will develop an awareness of how money is used and what it is worth by role-playing, buying various items from a ‘shop’. You might want to deliver the ‘Coins, coins, coins’ activity in preparation for this.

A Sporting Chance

Difficulty: Expert

This activity explores the cost of items and value for money through ticket sales to local sports games/matches. You might want to deliver ‘A Sporting Chance’ along with our ‘A Sporting Fan’ activity.

The Super Supper Challenge

Difficulty: Intermediate/Advanced

Children will choose meal or a snack that they could enjoy within your setting. Working within a given shopping budget they will plan for and potentially buy ingredients.

This challenge will help children to understand budgeting and making spending choices with money, based on needs, wants and priorities

Budget Bonanza

Difficulty: Advanced

Children will take control of the budget for a group trip. They will develop an understanding of how and why it is important to plan and track spending and take other people’s spending opinions into consideration.

Please note that this activity asks children to plan a real-life trip for your group or organisation and will require a budget of your choice to be spent. This may not be suitable for all settings.

Household Budgeting

Difficulty: Expert

Children will explore household budgeting through Billy and his family. They will find out the important role that money plays in our everyday lives, including the things people need to spend money on and will see how people plan and manage household budgets

You may choose to extend this activity by also delivering the Billy’s Payslip activity.

Beginner Intermediate Advanced Expert 11 Overview of Activities

Needs,wants and priorities

Packing for Antarctica

Difficulty: Intermediate

Children will understand needs and wants, by packing for a trip to Antarctica. They will begin to recognise that people might make different money choices to their own. We recommend delivering this lesson in conjunction with the ‘To Buy or Not to Buy’ activity.

To buy or not to buy

Difficulty: Intermediate/Advanced

Through the character of Sahana, children will learn about making money choices, based on priorities, needs and wants. We recommend completing this activity after delivering the Packing for Antarctica activity.

Managing money and making money choices and decisions

Toy Time

Difficulty: Intermediate

Children consider the cost of buying toys and how long it would take to save up for a toy. It helps them understand that they can make choices when it comes to spending and saving and that others may make different choices.

Shopping Sense

Difficulty: Advanced

Children explore the concept of ‘fairness’ and engage with real-life dilemmas about how to spend money ethically. They will develop an understanding of some of the ways supermarkets merchandise goods and can make informed spending decisions.

A Sporting Fan

Difficulty: Advanced/Expert

This activity explores how easy it can be to get ‘carried away’ spending money, using the example of being a fan of a sports team. Children will think carefully about what can influence their spending, how much money it would cost to ‘have everything’ and why we should think carefully about how we use money. This activity would follow on well from the ‘A Sporting Chance’ activity.

Keeping money

How do we pay for things?

Difficulty: Intermediate

Children learn step by step how we earn money through working, as well as how we access our money to pay for things, using either cash or a debit card, when wages are paid into a bank account.

Keeping a Record

Difficulty: Intermediate

In a simple, yet sensible way, this activity shows children how they can keep track of money, by creating and using records to track their money and keep it in a safe place.

Money through the ages

Difficulty: Intermediate

Through a timeline game, this activity teaches children how money has developed over time, as well as how money looks today and how we see money being used now.

Why do people have jobs?

Difficulty: Intermediate

Through learning about jobs people do, children will gain an understanding of where money comes from and that people are paid to work.

World of Work

Difficulty: Expert

How do people earn money? How does what people earn affect their spending and saving choices? Invite a volunteer or outside speaker into your setting and help this topic ‘come alive’ when they tackle concepts such as salaries and job satisfaction in a real-life context.

Billy’s Payslip

Difficulty: Expert

For this activity, children begin to develop an understanding of tax through Billy’s Payslip and will explore how this helps to provide things that we all need.

safe Saving money Where money comes from Earning money/Tax

12 Overview of Activities Beginner Intermediate Advanced Expert

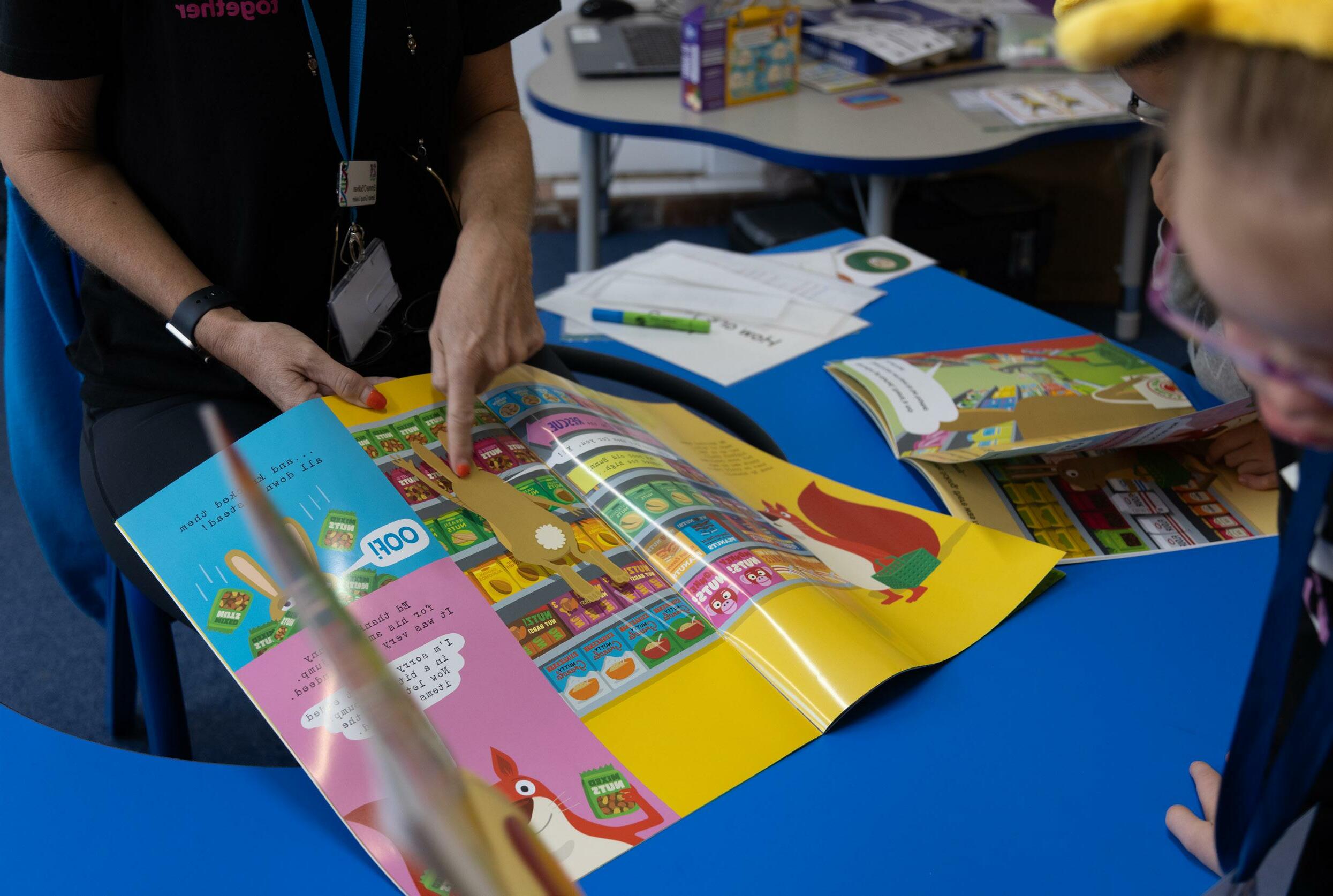

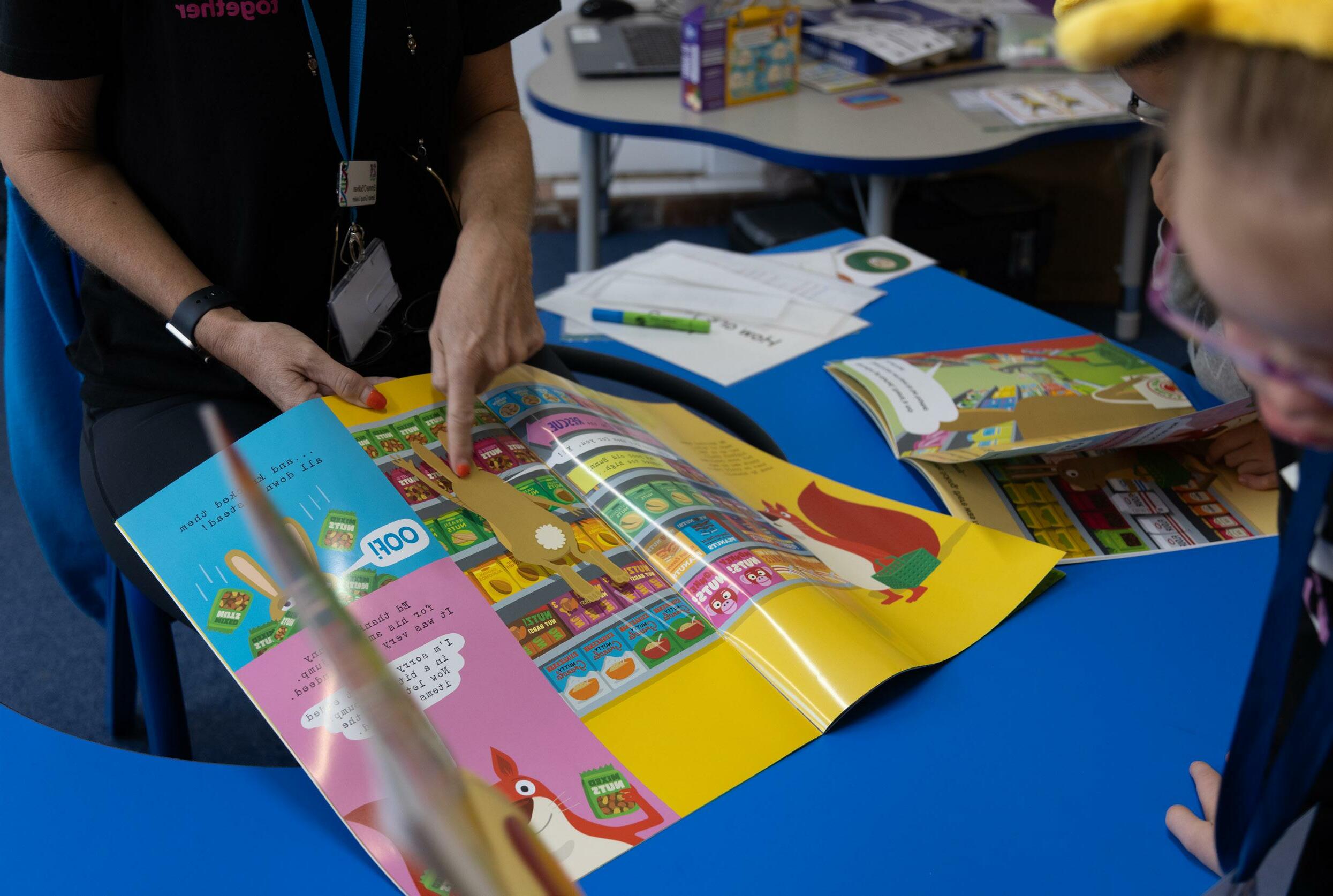

Bring learning to life with storybooks

Children learn best when they are engaged in activities they enjoy. That’s why we worked with leading global children’s publisher Scholastic, to bring learning to life and get children talking about money.

These books can be read with a child 1:1, or as part of a larger group. If you are delivering virtually or have access to an interactive whiteboard/large screen, you may choose to share these stories within your setting using the eBook versions, available on the Money Heroes platform

All books are also available in the following accessible formats:

• Audiobook

• Braille

• BSL signed stories

• Large print

• A3 size big books

Audiobooks and BSL signed stories are available on the Money Heroes platform. If you require copies of the braille and large-print versions, please get in touch with us at: moneyheroes@y-m.org.uk

Ed and Bunny Earn

Some Money

Children will join Ed and Bunny on an adventure to learn all about money in this storybook about making saving and spending choices and keeping money safe

This story will help children to learn about managing risks and emotions associated with money, as they read about the choices Ed and Bunny make about what they do with their earnings.

Our Ed and Bunny stories are aimed at children who are beginning to understand financial concepts, whilst the Super Stories series are aimed at children who are looking to build on existing financial knowledge.

All storybooks are available as eBooks or you can request your free copies through your dashboard on the Money Heroes platform.

Delivery ideas for SEND Educators:

Teach children financial capability skills by using the storybook to talk about using money in fun and interactive ways...

1. Decisions, decisions, decisions

After reading the story, ask children which character made the best saving choices and why.

2. Share it

Children love to share their new knowledge, so ask children to choose their favourite character and in small groups, act out how that character might feel about money in the story.

3. Drawing for fun

Ask children to tell a partner where they keep their money safe and why. Together, ask them to draw a poster, showing places where money can be kept safe.

Possible adaptations:

• Read and discuss the story in smaller, more manageable chunks, by splitting it into separate sessions.

• Encourage children to role-play characters and the story, to embed their learning.

Ed and Bunny Earn Some Money is published by Scholastic (2021) –text and illustration © Matt Carr.

13 Bring learning to life with storybooks

Ed and Bunny Spend Some Money

Children will join Ed and Bunny on an adventure to learn all about money in this storybook about keeping track of money and understanding needs and wants.

This story helps children to learn about how to manage money and to understand they might run out of money if they don’t keep track of it, as they read about the choices Ed and Bunny make on their trip to the shop.

Delivery ideas for SEND Educators:

Use the storybook to talk about spending choices and how to manage money in fun and interactive ways:

1. Who did it best?

After reading the story, ask children about which character made the better spending choices and why.

2. Gone shopping Talk to children about what questions they would ask one of the characters when they got back from the store.

3. Keep it safe

Ask children what advice they would give to someone on how to keep their money safe.

Possible adaptations:

• Read and discuss the story in smaller, more manageable chunks, by splitting it into separate sessions.

• Encourage children to role-play characters and the story, to embed their learning.

Ed and Bunny Raise Some Money

In this story, children will join Ed and Bunny on an adventure to learn all about money and sustainability.

They will learn that our needs and wants may be different to those of other people and will understand the important role money plays in our lives.

Delivery ideas for SEND Educators:

Use the storybook to talk about raising money in fun and interactive ways:

1. Raise for the roof

After reading the story, ask children why Ed and Bunny thought it was important for them to help raise money for their school.

2. I could help

Ask children to draw a picture of something they would sell, make or do at the fair to raise money for their school or setting. Encourage them to think about how much they would charge and how much money they think they could raise altogether.

Possible adaptations:

• Read and discuss the story in smaller, more manageable chunks, by splitting it into separate sessions.

• Encourage children to role-play characters and the story, to embed their learning.

Ed and Bunny Spend Some Money and Ed and Bunny Raise Some Money are published by Scholastic (2021) –text and illustration ©

Matt Carr.

14 Bring learning to life with storybooks

Super Stories for Money Heroes

By E.L. Norry

By E.L. Norry

Delivery ideas for SEND Educators:

1. Imagine it!

Ask children to imagine that they are a radio show or podcast host, offering advice to other children. What kind of advice would they give to one of the characters in the stories when they felt disappointed about not having enough money for the item they really wanted?

2. Act it out

Pretending that children will now interview one of the characters in the stories is a playful way to encourage them to ask questions such as, ‘Would you rather have a stylish pencil case for yourself or something that you can share with others?’ and ‘Would you rather run a shop that makes money quickly for one day or that lasts over time?’

This chapter book, aimed at more confident readers, includes a collection of short stories where children will join the characters on a journey to discover how money influences our everyday lives and how to overcome moneyrelated challenges.

These stories will help children to understand that sometimes money may need to be spent on essential items so there may not always be spare money available for other items they might want.

Each story will help children to develop valuable skills in financial capability and discover creative ways of saving money, making different choices about spending and understanding about needs and wants. Along the way, children will understand the important role money plays in our lives and why it is important to help others.

3. Time to design

Encourage children to think about some of the challenges that the characters overcame in the stories. For example, ask them to think about the skills they developed and the achievements or experiences they became better at coping with. Children can then create a certificate to award the character for developing those skills.

4. Get quizzy

Quizzing children about the needs and wants the characters had in the stories is a great way to help them to identify the differences between them.

Possible adaptations:

• Read to children, rather than them reading along with you.

• Split reading each story and talking about the content into separate sessions.

• Reinforce understanding, by reading some of the text and questioning children on what they know so far or what they think might happen next.

• Encourage role-play after reading each section of a story, to further embed learning.

Super Stories for Money Heroes is published

Scholastic

text

E.L. Norry and

An early reader edition of this book is also available as an eBook on the Money Heroes platform

by

(2021) –

©

illustrations by Iris Amaya © Scholastic.

15 Bring learning to life with storybooks

Super Stories for Climate Heroes

By E.L. Norry

By E.L. Norry

Delivery ideas for SEND Educators:

Use the storybook to talk about looking after the planet and money in fun and interactive ways:

1. Imagine it!

Ask your children to imagine that they have been asked to speak at a Climate Change Conference about how each person can make a difference to reduce waste and why this is so important for our planet. Ask them to consider why it might also help people to spend less money.

2. Act it out

This chapter book, aimed at more confident readers, includes two short stories where children will join the characters on a journey to learn how to look after the planet and their cash.

Each story will help children to develop valuable skills in financial capability.

They will discover how their spending decisions can help support others, as well as why it’s important to think carefully about how to use money and how it can impact the wider world, for example by having a positive impact on climate change.

Pretending that children will now interview one of the characters in the stories is a playful way to encourage them to ask questions such as, ‘Would you rather have a new t-shirt or do you think you would prefer to upcycle one?’ and ‘Would you rather throw something away which has passed its Best Before date, or eat it anyway?’

3. Time to design

Ask children to bring something in that they no longer need or want. As a group, swap items and ask individuals or groups to design and then upcycle items. Once completed give every child a ‘newly upcycled’ item to take home and wear/use.

Possible adaptations:

• Read to children, rather than them reading along with you.

• Split reading each story and talking about the content into separate sessions.

• Reinforce understanding by reading some of the text and questioning children on what they know so far or what they think might happen next.

• Encourage role-play after reading each section of a story to further embed learning.

Super Stories for Climate Heroes is published by Scholastic

text

(2021) –

© E.L. Norry and illustrations by Iris Amaya © Scholastic.

16 Bring learning to life with storybooks

Activities linked to the storybooks...

These activities continue exploring the learning themes from the storybooks, bringing learning to life with engaging activities and building on themes from the books. Continuing the learning and starting conversations with children can support in further developing their money management skills as they grow older and begin to handle money on their own.

Ed and Bunny

A day out with Ed and Bunny

Follows on from Ed and Bunny Earn Some Money

Children will have the opportunity to discuss where money comes from and begin to understand that money is a limited resource they will learn to manage. The activity asks children to help Ed and Bunny plan a day out using the money they have saved up, working out how much the trip will cost and what they could do on their budget.

Help Bunny buy a gift!

Follows on from Ed and Bunny Spend Some Money

Choosing how to spend money is tricky when you have a limited amount to spend. Children are given a budget to help choose a gift for Bunny to give to Ed. The activity explores the need to plan ahead and helps children understand that sometimes people do not always have the budget for things they want.

Save and Share with Ed and Bunny

Follows on from Ed and Bunny Raise Some Money

Children learn ways they can help their planet and how these things are closely linked to saving money in various settings. Giving children the chance to make choices about how savings might be used, e.g., through spending, saving or giving, allows them to practise making important money decisions.

We recommend delivering these activities after reading the relevant storybook with the children in your setting.

Super Stories

Become a Money Hero

Follows on from Super Stories for Money Heroes

Children become ‘Money Heroes’, taking on the role of advisor and using lessons learnt from the characters in the three stories to think about how people might use and manage money in the home.

Become an Eco Hero!

Follows on from Super Stories for Climate Heroes

Children become ‘Climate Heroes’ by learning how to correctly store food and work out when it is still okay to eat. Children will understand how to reduce wasted food and money. They will have a better concept of how much money is lost through waste.

18 Activities linked to the storybooks...

Ed and Bunny Go Shopping Board Game

Orchard Toys is a leading educational game producer, and their games are ideal for imaginative play, enabling the player to take on the role of customer and act out what they have seen in real life to gain a greater understanding of the world around them. (Orchard Toys, 2021)

That’s why we’ve teamed up to create a board game that allows children to mirror this behaviour to help them to understand some practices that develop financial capability when shopping.

Our Ed and Bunny Going Shopping board game is aimed at children who are beginning to understand financial concepts. The game is designed for all ages to enjoy and children with more advanced money skills may enjoy supporting other children in playing the game.

You may have children in your setting who perhaps either don’t experience going shopping or go shopping for their families. This game can support children to experience shopping through role-play, whilst helping others to improve their everyday life skills, such as recognising and choosing the correct value of coins.

Full instructions are included in the box which explain how to set up and play the game.

The aim of the game is to turn over a shopping item from the middle of the game and see whether it matches an item on your ‘shopping list’. If it matches, find the correct coins from your coin cards and pay Mrs Mole for the item, before putting it on your basket card. If it isn’t on your shopping list, turn it back over and wait until your next turn to have another go.

TOP TIPS:

• Each player has a set of coin cards and shopping list which have the same outline colour. It is important these are set out correctly to ensure the coin cards match the price of the supermarket items on that player’s list. For this reason, we do not recommend using real coins in this game.

• There are two difficulty levels to this game. The coin cards are two sided, with one side showing both the coins and the total sum, and the other showing just the coins. The advanced option requires the player to add up the coins to get the total sum, whereas the beginner option gives this information to the player.

There are no set timings for our Ed and Bunny Go Shopping board game; this will vary depending on factors such as the size of your group, attention and engagement, the difficulty level set on the game and children’s ability levels.

The game is suitable for 2-4 players, but children could work in pairs

19 Ed and Bunny Go Shopping Board Game

Why not signpost parents/carers to our Money Heroes platform, where they can sign up and request their own free copy of the boardgame.

Money Heroes Digital Game

This game is designed for children who will be building on existing financial knowledge. It can be played individually or in small groups. If children are playing the digital game together, they should discuss the options available and make decisions together. You could also show the game on a screen and discuss each decision as a group.

Delivery ideas for practitioners:

1. Change it up

Children have the chance to have a virtual experience of planning an end of school year disco as they carefully consider what will make their event a success.

Playing this game gives children the ability to develop financial capability skills by practising making decisions about cost-effective choices, keeping records, and getting value for money – all of which are packed into this game.

• The unique experience of being given a budget to manage will add to the excitement of the game. It will also build confidence in discovering the skills needed to develop the art of successful budgeting.

• One of the valuable lessons that children will learn is that people have choices when it comes to spending money. They will learn that careful planning will help them to get the results that best meet their preferred choices.

There are no set timings for our Money Heroes digital game; this will vary depending on factors such as; the size of your group, children’s ability levels, attention and engagement levels and any specific adaptations you may choose to make.

If playing the game repeatedly, you can skip the text on each page and head straight to the decision element by clicking the yellow skip button to the right of the subtitles.

Create a further challenge to this game by inviting children to make different choices the next time they play it, for example by spending less or more. They will enjoy sharing their learning about the difference these spending decisions made.

2. Track your spend

Encourage children to track their spending as they go along. This could be by drawing each choice and how much it costs. It might help them to visually see their decision-making journey and inform their next choice.

Accessibility:

The game has a number of accessibility features built in, including:

• Subtitles and voiceover.

• Ability to turn narrator, background music or all sound on or off.

Adaptations for your setting:

• Split the game into smaller, more manageable chunks. For example, by spending one session solely focusing on choosing the venue.

• Record work through drawing or writing, to help children remember the previous decisions made during the game.

• Provide a calculator to support children with larger money calculations.

This digital game is available on our Money Heroes platform at moneyheroes.org. uk/game

20 Money Heroes Digital Game

Frequently Asked Questions Talking about money

What questions do children often ask about money?

Sometimes, the questions children ask about money can be tricky ones to handle such as ‘Why is it that my friend can have an item or enjoy an activity and I can’t?’ Answers to this type of question could let them know families have different amounts of money which affects the kinds of decisions they make around their spending.

Questions such as ‘What will happen if my family runs out of money?’ might be an opportunity to find out if they have any money related worries and talk about them. In addition to this, if the children you work with are old enough to understand, it is a good chance to let them know that many people help to pay for services through taxes and the national insurance. The Billy’s Payslip activity could support them to understand this concept. It is also a good time to encourage children to think about needs and wants and the order of importance that might be given to spending choices in different situations.

A direct question such as ‘How much money do you earn?’ could be used to help a child understand that the value of a job is not always reflected through pay. People choose to do jobs for other reasons beyond money.

This may be a good time to let children know that asking how much a person earns is a personal question and a person may not want to share that information, so invite them to think of another question about work that might be suitable to ask. The World of Work activity could help open these conversations.

Can you suggest ways to talk to children about money?

Everyday experiences will involve an action that an adult has to take around money, without necessarily needing to be there for it to happen. It is good to let children learn about what items need to be paid for and how they are paid for. An example of this might include discussing things you have to pay for, either for your setting or at home.

Explain to children that cash is one way of paying for items, but, increasingly, people pay for items through contactless cards or devices. Helping them to

understand that contactless payments are linked to banks where money can be kept safe is an important idea to help children appreciate where money comes from. This includes explaining that the money that the bank keeps safe for people is what is used in cashless transactions, and if someone does not have enough then it could cost more money. Activities such as Budget Bonanza, Ways to Pay and Going Digital, can help children to understand these concepts.

How can I teach children about the value of money and consequences?

A starting point for learning about the value of money is understanding the value of coins and notes and that these reflect the worth of an item. Setting up opportunities in your setting to for children to pretend to look after money (e.g., by keeping it in a purse or money box), and for paying for items (e.g., by setting up a role-play shop), can help them gain an understanding of these financial concepts. Activities such as Keeping a Record and To Buy or Not To Buy cover themes such as keeping track of money and can help understanding that money has value and that is why it is important to keep it safe. You can also use the Ed and Bunny Go Shopping board game to show children examples of what you can get in the shop and how much for, to further explain that we need to keep our money safe to be able to buy these products.

How can I explain where money comes from?

Good starting points to help children understand where money comes from are letting them know that it shows up in different ways, such as earning it, being given it, finding it, winning it and borrowing it. From here it is worthwhile letting children know that lots of people have a job, so many people get money because they earn it; this might help you to talk more about the different kinds of jobs that people do.

It is good to help children understand that finding money, receiving money as a gift and winning it happen less often which is why a lot of people have jobs. Use the How do we pay for things? or What’s a job? activity to open conversation with children and allow them to ask any questions they may have.

21 Frequently Asked Questions - Talking about money

What happens if a child asks us a question about money, or money management, that we can’t answer?

There may be questions that you either don’t feel comfortable answering or are not able to. If you are still receiving mentoring support from your financial education expert, you could ask them for advice.

Depending on your relationship with the child’s parents/ carers, you might ask them to discuss this topic with the child. We would also recommend speaking to senior staff within your setting.

They may be able to suggest specific strategies to address sensitive questions from children about issues which may be affecting them. Alternatively, you could contact financial education experts at our Young Money Advisory Service for free advice and support.

Young Money Advisory Service

T: 020 4526 6389

E: advisory@y-e.org.uk

W: www.young-enterprise.org.uk/advisoryservice

How can we involve parents/carers in their child’s learning of financial education?

There are many ways to get parents/carers involved with their child’s learning:

• Signpost parents/carers to the materials and resources on the Money Heroes platform, by sharing the web address with them: moneyheroes.org.uk/parent-hub

• Advise them that they can request their own free printed copies of the books and games through the website once they have set up an account. If they require accessible versions, please ask them to contact us.

• Set up a Money Heroes parent/carer session, where they come into your setting and find out more about what their child is learning and try out some activities.

• Ask your mentor for advice on engaging parents/carers.

How do I deliver financial education to pupils with varying levels of understanding, needs and requirements?

As a SEND Educator you may be required to differentiate your teaching of financial education to suit individual needs. Whilst the Money Heroes resources offer a number of adaptation and differentiation options, there may be further steps required to ensure they are accessible to the young people you are working with. You may also have situations where you have young people working at different ability levels in the same session. Here are some suggestions of how you can adapt the materials and session to enable everyone to meet the learning objective.

• Adapt by outcome: Use the Financial Education Framework Planner to develop outcomes pitched at the right learning level for the young people in your group.

• Adapt by reducing expectations: For example, instead of learning about five key terms during a session, choose two to focus on for either the whole group or lower ability individuals.

• Adapt by reducing content: Complete part of a session or ask lower ability individuals to focus on a specific part of the task. A great way to reduce content is to take parts of the Money Heroes activities and use them as starter activities in sessions focused on other areas.

• Adapt by use of aids: Where calculations are required, supply a calculator, practical money, or visual aids such as a clock or calendar.

• Adapt by learning style: If the young people you work with prefer visual aids, use videos from the internet to help talk about jobs or shops. Use whiteboards to make sessions interactive, using technology that the young people are already familiar with.

22 Frequently Asked Questions - Talking about money

•

Frequently Asked Questions Further Support

Do you have any further financial education materials or resources?

Young Money have a range of materials and resources that can be used to further support children’s learning of financial education.

• Spending Sense

A resource for people working with secondary aged pupils with mild to moderate special educational needs. www.young-enterprise.org.uk/resources/spendingsense-special-needs-resource/

•

Developing Financial Futures

A resource for people working with vulnerable young people. These activities may be suitable if your setting also works with older children who are starting to manage their own money and making decisions about their future.

www.young-enterprise.org.uk/resources/ developing-financial-futures/

My Money Week Resource Hub

My Money Week is a national activity week, providing a fantastic opportunity to focus on money and financial education. Resources are provided which are flexible for use in a variety of settings. www.young-enterprise.org.uk/MMW/

•

Young Money Resources Hub

The Young Money Resources Hub contains tools and Quality Mark resources produced by Young Money and the organisations they support that can be used by educators in formal and non-formal settings, parents/ carers and children and young people themselves. www.young-enterprise.org.uk/teachers-hub/ financial-education/resources-hub/

23 Frequently Asked Questions - Further Support

24 Frequently Asked Questions - Further Support

We believe every child should have the opportunity to develop their money management skills for later life, and starting early is essential. Money Heroes helps those with the most influence in a child’s development create the heroes of tomorrow.

Stuart Haire, Head of Wealth & Personal Banking, HSBC UK.

Notes 25 Notes

Notes 26 Notes

Money Heroes provides a journey for children of different ages to travel on, increasing their confidence and ability to tackle higher levels of financial capability as they grow older.

The research we have referred to in this guide demonstrates positive results linked to children who are confident in managing money. Handling money, keeping track of it, being involved in money decisions and being able to answer questions about their choices were some of the benefits gained from this increased confidence.

Money Heroes wants to encourage this confidence and provide opportunities amongst children in a fun and engaging way. This is why we continue to develop resources to support children’s financial capability.

Keep the conversation going...

Tweet us @YoungMoneyEdu with pictures of your resources with the tags #MoneyHeroes @YoungMoneyEdu

Share Money Heroes with other parents and teachers.

If you would like to know more about Money Heroes scan the QR code opposite with your phone or contact us: Email: moneyheroes@y-m.org.uk Visit: www.moneyheroes.org.uk

Young Money is part of Young Enterprise, Registered Charity No:

313697 MH-SENGUIDE

By E.L. Norry

By E.L. Norry

By E.L. Norry

By E.L. Norry