Duke

Business & lifestyle

01

9 euros

9 789995 974558

An independent Luxembourg firm committed to personalised legal service in a global setting. PRACTICE AREAS BONN & SCHMITT is a full service commercial law firm that practices all aspects of business

law, with special expertise in: Corporate

Corporate Law Mergers & Acquisitions Insolvency and Restructuring

Tax

Corporate and International Tax Advisory Indirect Taxes and VAT Tax Litigation

Banking, Finance

Banking and Finance

and Regulation

Structured Finance and Securitisation Capital Markets, Securities Law Insurance

Investment Management

Asset Management and Services Investment Funds

Litigation and

Commercial Litigation

Dispute Resolution

Finance and Securities Litigation Employment and Benefits IP and IT

BONN & SCHMITT

22-24, Rives de Clausen L-2165 Luxembourg B.P. 522 L-2015 Luxembourg Tel: Fax: E-mail:

+352 27 855 +352 27 855 855 mail@bonnschmitt.net

Visit us at: www.bonnschmitt.net

T

H

E

A

R

T

O

F

F

U

S

I

O

N

Big Bang Ferrari Magic Gold. Mouvement UNICO chronographe roue à colonnes, 72 heures de réserve de marche. Entièrement manufacturé par Hublot. Réalisé dans un tout nouvel alliage d’or inrayable et inoxydable inventé et développé par Hublot : Le Magic Gold. Bracelet interchangeable. Série limitée à 500 exemplaires. 4a, Rue du Marché aux Herbes • L-1728 Luxembourg Tel: (+352) 22 44 90

www.hublot.com •

twitter.com/hublot •

facebook.com/hublot

Contents

8

Duke 01

Success

9

James Dyson: Serial innovator

10

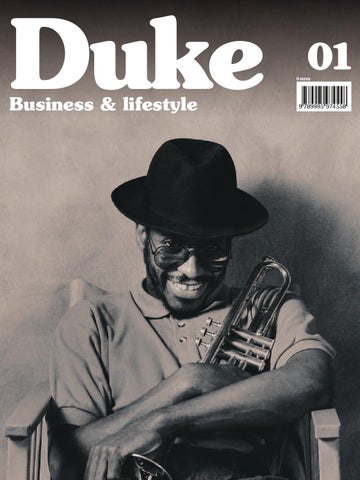

Duke Ellington: The King of Swing

14

Grand Duke Henri: There’s more to Grand Duke Henri than just being the sovereign…

16

Etienne Schneider: Interview

18

History

GRAND DUKE Minister FUNDS

Financial Sector Supervisory Commission (CSSF): Interview with Simone Delcourt 20 Elvinger, Hoss & Prussen opens in Hong Kong: What is changing ? 22 RBS & Luxembourg: Partners of choice 24 SGG acquires ANT: Luxembourg the Conqueror 26 MDO Services: Independent Oversight of a Fund Structure 28 Arendt: The big picture 30

FINANCE

KPMG: From finance in general to Luxembourg in particular 32

Private Banking

Why Duke? There is only one “Duke Ellington” and there is only one “Grand-Duke” in the world today: Grand-Duke Henri of Luxembourg. This magazine has been created to promote the Grand-Duchy of Luxembourg abroad, by presenting a selection of Luxembourg based companies, remarkable places and other featured articles. We hope that you will enjoy reading the magazine and will feel inspired to explore business opportunities in the heart of Europe. Kindly contact us to be introduced to the business leaders. The editorial team

Banque Privée Edmond de Rothschild: Luxembourg as “Architect and Integrator” Banque de Luxembourg: Private Banking Expert

34 36

Jean-Noël Lequeue: Compliance & trends

38

SES ASTRA: A superpower manager Telindus Telecom: ICT & Telecommunications Solutions Anytime, Anywhere & Anyhow Kabam: Paving the way for a digital future

40

Brasserie Simon: Brewer from father to daughter Robert Dennewald: Passing on the Flame

46 48

Ernster: The spirit of books

50

Office Freylinger: An Intellectual Property all-rounder

52

Lord Foster: The invisible wall

54

MUDAM: The contemporary citadel

59

2 rue de la loge: A bistro – a private club Um Plateau: A place with soul

60 61

Ceos’ favourite addresses

62

Networking in Luxembourg

65

Compliance ICT

INDUSTRY Retail

INTELLECTUAL PROPERTY Architecture CULTURE

RESTAURANTS GUIDE

SOCIAL CLUBS

Duke 01

42 44

Editor in Chief: Jérôme Bloch (jbloch@360crossmedia.com) – Conception & coordination: 360Crossmedia – Production: Julie Kaes (julie@360crossmedia.com) – Sales: Anna Maria Goryczka (anna@360crossmedia.com) – Artistic Director: Franck Widling – Cover Photo: Getty images – Printed in Luxembourg/Print run: 5000 copies www.duke.lu – Phone: (+352) 35 68 77 – contact@360crossmedia.com

10

Duke 01

11

SUCCESS

>> Dyson

James

Serial innovator www.myofficialstory.com/dyson www.dyson.com

“The more original your idea, the more resistance you will meet.” James Dyson

12

Duke 01

13

SUCCESS

>>

The bagless vacuum cleaner that bears his name brought him fame and made him a billionaire, but this was neither James Dyson’s first attempt nor his final invention.

A brilliant idea There is a myth about inventors. They simply need to have a good idea to make their fortune. In reality, these ideas don’t exist.” We could feel rather sceptical about such a statement if it wasn’t for the fact that it was made by James Dyson, one of the most successful inventors in the world. His fortune is estimated at more than one billion pounds sterling. According to him, it all starts with a problem that needs to be resolved: “You start to build prototypes. Hundreds of them. Sometimes even thousands. Most of the time, the final solution no longer bears any relation to the original problem”. In this process, failure is the starting point for innovation. “When something doesn’t work, you can understand why and overcome this difficulty”. The moral of the story? “Keep failing! It’s the most effective method”. First invention Trained at the Byam Shaw art school in London, Dyson didn’t just want to paint, he wanted to invent. He went on to study architecture at the Royal College of Art, but instead of designing houses he thought up a new type of boat. One of his first innovations, “the Ballbarrow”, was a wheelbarrow with a wheel in the shape of a ball to prevent it from getting stuck in earth or mud. James Dyson decided to sell the operation of his patent to a company. The growing sales volumes required a capital increase which the inventor could not supply. His partners

provided a cash injection in return for shares. Now a minority shareholder, James Dyson took part, against his will, in the sale of his invention. There was nothing he could do, except learn the painful lesson. One good idea led to the next. In 1978, Dyson noticed that the air filter in the Ballbarrow painting workshop was constantly being blocked by powder particles. He decided to design an industrial cyclone tower to remove the powder particles from the air by exerting a centrifugal force 100,000 times greater than that of gravity. Could the same principle apply to a vacuum cleaner? Dyson set to work: 5 years and 5,127 prototypes later, the first bagless vacuum cleaner appeared. The $2,000 vacuum cleaner The multinationals weren’t interested in this new product. Their sales of vacuum bags amounted to hundreds of millions of euros every year. It was in Japan, the birthplace of high-tech products, that James managed to have his invention accepted. Known as the “G-Force”, in 1991 this vacuum cleaner took first prize at the International Design Fair in Japan. The Japanese decided to make it a luxury product, selling at a unit price of $2000. In 1993, James used the income from the licence to open his own research and production complex in Wiltshire, not far from his home: the result was the DC01, which became the biggest selling vacuum cleaner in the United Kingdom in just 22 months. Its successor, the DC02 took the

design of this household item to a new level, playing with the effects of transparency and colours. An approach shared with another success story: Apple. The patent nightmare Unlike a singer who owns the songs he writes, an inventor must pay large sums of money to renew his patents every year. Entrepreneurs know that the best form of protection is success, which sometimes leads to the temptation to miss out on solid and costly protection. James Dyson had no income during the development years. He almost went bankrupt, but his experience with “the Ballbarrow” saved the day: he filed a patent and when Hoover tried to copy his invention in 1999, it took the inventor 18 months to record a victory against the multinational for infringement. To be continued… Backed by his research centre and 350 engineers, Dyson is launching new innovations on the market: an airblade to dry your hands using clean, non-heated air, emitted at 640 km/h. Its faster action also consumes less energy than its predecessors. Not forgetting the bladeless fan that propels air through the narrow gap of a striking coloured metal circle. In addition to the various prizes he has won, James Dyson is proud of his greatest achievement: having one of his vacuums displayed in the Museum of Modern Art in San Francisco, the Victoria and Albert Museum in London and the Georges Pompidou Centre in Paris.

14

15

Duke 01

History

Duke Ellington: The King of Swing www.myofficialstory.com/dukeellington

Cotton Club Edward Kennedy Ellington was born into Washington DC’s “black petty bourgeoisie” in 1899. As a child, he was attracted as much by baseball as he was by drawing and music. At the age of seven, he started to play ragtime. After studying decorative arts, the man who was later to be called Duke for his elegant attire, turned his sights to music. He was soon hired by several orchestras before setting up his own band in 1923 in New York. Dubbed “The Washingtonians” in honour of his hometown, his big band was to revolutionise the world of jazz for half a century. In 1927 he became the resident band leader of Harlem’s “Cotton Club” and was to play in this legendary venue for several years, as well as at the Paramount and Fulton

with Maurice Chevalier. By this time, his fame had spread far beyond New York. Touring success In 1933, he earned rave reviews during a tour in Europe. From then on and for decades to follow, Duke Ellington was to travel the world to tell the story of his people with recurring musical references to the African-American culture. He enjoyed the same success with his band, comprised of only the best musicians. From the 1960s onwards, he took his swing to the four corners of the globe. Duke Ellington did not only perform in the most exclusive clubs but also in dark bars, concert halls, popular dances and festivals, playing for audiences of all backgrounds and social classes.

One of the greatest jazz musicians If he is regarded as one of the greatest jazz musicians of all time, along with Louis Armstrong, and one of the most popular with the general public, it is thanks to his musical compositions, but also to his popular rhythms that strike a chord in everyone. His orchestra was considered one of the best in the world and his creative work compared to that of classical composers. Duke Ellington received the Presidential Medal of Freedom on his seventieth birthday in 1969 at the White House. He is the only jazz musician to be awarded an honorary doctorate from the University of Columbia, in 1973. The following year he left us to go and swing and sing the blues in heaven.

© GettyImages

A brilliant composer and arranger, Duke Ellington managed to combine his sense of swing with grandiose orchestrations that convey the spirit of the blues and the history of his people.

16

Duke 01

17

GRAND DUKE Grand Duke Henri: There’s more to Grand Duke Henri than just being the sovereign… www.myofficialstory.com/grandduchenri

When he succeeded his father, Grand Duke Jean, on 7 October 2000, Grand Duke Henri promised to use his dynamism and learning to serve the Grand Duchy.

© DR

Globetrotter Grand Duke Henri is as dynamic as his country. As well as Luxembourgish, he is also fluent in French, German, English and Spanish. He acquired this multilingualism at an early age due to the fact that he attended secondary school in Luxembourg and France before going on to the University of Geneva, where he gained a degree in political science in 1980. His Royal Highness studied abroad on many occasions, both in Europe and overseas. Between 1978 and 1980, he trained in various companies in the United States. In his role as Honorary Chairman of the Board of Economic Development, which was founded in 1977, he carried out numerous exploratory trips around the world promoting the Grand Duchy of Luxembourg as a place for investment (1978-2000). He still attaches a lot of importance

to education, and has honorary doctorates from several universities around the globe. Man of action Keen on literature and classical music, Grand Duke Henri is also a great lover of sport. Sailing, tennis and hunting are among his favourite pastimes, and he loves to practise them. He is patron of many sporting, cultural, scientific and economic associations today. Notably, he is a member of the International Olympic Committee and is involved in the Charles Darwin Foundation for the Galapagos Islands. A man of action, the Grand Duke is also known for his military commitment. After enrolling at the Royal Military Academy Sandhurst, he became an officer and subsequently an honorary major in the British Parachute Regiment. As the Commander of the Luxembourg

Army, he is ranked as a General. Devoted father It was while he was studying in Geneva that Prince Henri met Miss Maria Teresa Mestre. They were married on 14 February 1981 at Luxembourg Cathedral. The prince and new princess of Luxembourg went on to have four sons [and one daughter]: Guillaume (heir to the throne since 2000), Félix, Louis, Alexandra and Sébastien. Acceding to the throne on 7 October 2000 following the abdication of his father Jean, Grand Duke Henri is Head of State, an association patron and a father all at the same time. The Grand Duke plays a vital and essential role today. He is considered to be the keystone of the institutional system. However, he strictly abides by the maxim that “the sovereign reigns but does not govern”, which is undoubtedly the secret of his success.

18

19

Duke 01

Minister Etienne Schneider Interview www.myofficialstory.com/etienneschneider

Interview with Etienne Schneider, Luxembourg’s Minister for the Economy.

What are the arguments you would put forward to convince an investor or an entrepreneur to opt for Luxembourg? The answer to that depends on the sector of activity in which the company operates. It is probably interesting to

note that the qualitative elements are often those that prevail. To go by the companies present in Luxembourg, the added values are considered to be the social security system, its central geographical position in Europe and the direct vicinity of the German, French and Belgian markets, political stability, great quality of life, multilingualism, the regulatory and legal framework, as well as easy access to the political decision-makers. At present, what are the priority sectors of development for the Minister of the Economy and Foreign Trade? Before talking of sectors as such, I think that we should turn our sights to infrastructures. We need to guarantee the security of Luxembourg’s energy supply, in particular by setting up new storage depots for oil products. This question is as important for private households as it is for companies. The construction of a direct electricity line with France and of a second with Belgium would be an important step in the development of a European electricity network. I also plan to set up a gas pipeline with France in order to diversify the supply from Germany. As for the sectors to be developed, I believe in the future

of eco-technologies, as I consider them to be essential for the creation of a sustainable economy. Secondly, the “life sciences” sector. After the investments in research made by the government, we can soon expect to see concrete economic returns in this niche market. Thirdly, the government intends to further develop ICT in order to put Luxembourg on the European map in this field. Last but not least, logistics. This sector is important in that it will create highly qualified jobs as well as less qualified jobs. If you had a magic wand, what are the 3 first things that you would transform to improve Luxembourg’s competitiveness? It is difficult to limit a term such as competitiveness to only three “things”. There is no magic formula that can be applied. The complexity of the term becomes only more evident when you analyse the annual balance sheet of the Competitiveness Observatory that covers more than 10 categories and presents around 80 indicators. The main pillars of competitiveness are the economy, the environment and social cohesion and the Ministry for the Economy and Foreign Trade will continue to pursue this line of development. Etienne Schneider

© DR

How would you describe your country to someone who has never been there? Luxembourg is known as the green heart of Europe. It is a founding Member State of the European Union and has Germany, Belgium and France as its neighbours. It is also a great place to live. Luxembourg City has a great deal to offer, in terms of culture, gastronomy or leisure. And yet in no time at all you can enjoy the peace and quiet of the surrounding forest. Luxembourg is unmistakeably multicultural, boasts a cosmopolitan population and an international environment. It also benefits from a high degree of political stability, excellent industrial relations, as well as a safe living environment in general. Furthermore, I would underline that Luxembourg’s economy does only hinge around its reputation as a financial centre but also encompasses heavy industry, innovative services and attractive trading opportunities.

20

Duke 01

21

FUNDS Financial Sector Supervisory Commission (CSSF) Interview with Simone Delcourt www.myofficialstory.com/simonedelcourt www.cssf.lu

Simone Delcourt, Director of the CSSF since 2005, answers our questions about the recent regulatory changes.

Š CSSF

What is the CSSF’s view about the regulatory changes Luxembourg has seen over the past few years? There have been massive changes in the regulations governing the financial sector in recent years in response to the global economic crisis and the crisis in customer confidence in financial players and products. The crisis brought to light the fact that international integration of financial institutions was closer than international cooperation between supervisory authorities. Precisely in order to overcome these variations, a new European financial supervision system was set up in January 2011, comprising a European Banking Authority (EBA), a European Securities and Markets Authority (ESMA) and a European Insurance and Occupational Pensions Authority (EIOPA). Their aim is to restore confidence, help develop a single set of rules, resolve the problems linked to cross-border Simone Delcourt

companies and avoid a build-up of risks liable to threaten the stability of the global financial system. It is clear that the establishment of this system means that Member States’ room for manoeuvre is destined to disappear in favour of greater harmonisation, both in terms of the transposition of the regulations and in terms of applying and overseeing them. What is the outlook like for the country? Luxembourg will increasingly find itself on an equal footing with the other Member States when it comes to the application of the regulations in the financial sector. The financial centre should take advantage of the opportunity to take a long, hard look at itself and engage in more innovation and internationalisation. In recent decades, Luxembourg has acquired undisputed expertise in the field of finance, and this process must continue in order to improve the products and

services offered further still. Certain projects underway, such as the transposition of the AIFM Directive, are liable to offer new prospects for the country, and several offshore funds have already indicated an interest in moving their registered offices to Luxembourg. What are the main challenges ahead? Luxembourg must acquire the means to deal not just with European competition but with global competition. The financial centre has good advantages. For example, it enjoys an undisputed international reputation for trustworthiness and has a respected supervisory authority. It must continue along these lines, at the same time as investing in product and service innovation and in training the various stakeholders with the emphasis on financial consumer protection, so as to restore customer confidence.

22

Duke 01

23

FUNDS Elvinger, Hoss & Prussen opens in Hong Kong What is changing ? www.myofficialstory.com/ehp www.ehp.lu

With the recent developments of the economic environment and the rapid growth of the Asian markets, it has been a natural move for the Luxembourg law firm Elvinger, Hoss & Prussen to open its first overseas office in Hong Kong.

© Chungking-Fotolia

A partner in residence The local team will be headed by Katia Panichi, a partner who has relocated to Hong Kong: an unusual move for Luxembourg professionals. Katia’s experience in regulated funds and unregulated investment structures made her the ideal candidate to open the office. She will be seconded by senior associate Emmanuel Gutton from the firm’s investment funds’ department and supported by a dedicated team in Luxembourg lead by partner Gaston Juncker. The office will have local Chinese staff. Senior partners Jacques Elvinger and Pit Reckinger are co-responsible for the Hong Kong office and will regularly travel to the region. Added value for existing clients Existing Asian clients will be able to receive Luxembourg legal advice in

key areas of practice of the firm during their business hours. Being closer to the firm’s clients will allow the team to even better understand their needs and to assist them rapidly in facing the challenges arising from ongoing changes in the legal and regulatory environment and turning these into opportunities for their businesses. The Hong Kong team will thus allow the firm to tighten its relationships with local actors and continue the uncompromising and continuous focus on excellence of its services both in terms of quality and timing. New opportunities The Hong Kong presence will allow professionals in the Asian markets as well as their advisers interested in Luxembourg structures to have an immediate and facilitated access to partner expertise and explore

possibilities to set up business in the Grand-Duchy. The country is a truly competitive and financially stable jurisdiction in the heart of the European Union and the firm will be able to promote Luxembourg and the advantages it has to offer in terms of investment fund and asset management, private equity and real estate acquisition finance, corporate finance and capital market as well as tax law. The Hong Kong team will be able to intensify working relationships with distinguished firms in Asia allowing it to handle today’s increasingly complex crossborder transactions to the advantage of common clients. As part of its services in Hong Kong, the team will offer “made to measure” seminars and training on various topics of Luxembourg law or on specific transactions.

24

Duke 01

25

FUNDS RBS & Luxembourg: Partners of choice www.myofficialstory.com/antoniothomas www.rbs.lu

Interview with Antonio Thomas, Managing Director of RBS (Luxembourg) S.A.

© DR

How does Luxembourg fit into RBS group’s global strategy? Being 100% owned by the RBS Group, the Luxembourg Management Company subsidiary benefits from the vast resources and strength of one of the world’s leading financial services companies. RBS (Luxembourg) S.A. was launched in 2004, in response to the the substance requirements of UCITS III and this experience enables us to provide fully-compliant UCITS IV management-company and unbundled substance-services such as Investment Restriction Monitoring or Risk Management services to third-party Fund Promoters. We are the eyes and ears on the ground for clients sitting several thousand miles away from Luxembourg. This makes us a partner of choice that they can trust, with direct contact with the Luxembourg Regulator and marketplace. Thanks to the cross-border nature of UCITS IV, we have set the standard in providing independent governance and substance services to both UCITS and Antonio Thomas

non-UCITS funds within Europe. You could say that Luxembourg excellence in this domain is now being exported to other jurisdictions. What part do UCITS funds play in your local activities? UCITS funds represent 85% of the 18 billion euro of assets for which we act as management company. All of the assets are held within Luxembourgdomiciled products, via 46 investment fund vehicles. We also support an additional 51 billion euro worth of third party assets from a regulatory compliance perspective, all in UCITS funds domiciled in Luxembourg and investment funds domiciled in the UK, Ireland and Switzerland. A similar cross-border servicing model applies to the risk monitoring services that we provide to third party assets of ca. 72 billion euro, of which 80% are in UCITS funds. How do you see the future of RBS Luxembourg? We have seen growing demand

since 2011 for both full management company and unbundled services to support non-UCITS and alternative strategies, such as hedge funds, using the SIF structure. In a crisis-hit environment, fund managers do not want too many providers and turn to players they can truly rely on. They also want a harmonised approach, which avoids additional investment in systems and people. So, they are coming to RBS (Luxembourg) S.A., because they are familiar with RBS’s expertise and trust the excellence of Luxembourg-based professionals. I expect increased growth in the unbundled side of the business. This will be supporting existing management companies in Luxembourg, but also other EUbased management companies and vehicles which require harmonised reporting or substance. The new wave of clients is coming from Hong Kong, Singapore, China… They are launching here and some are distributing to their own domestic markets.

26

Duke 01

27

FUNDS

SGG acquires ANT: Luxembourg the Conqueror www.myofficialstory.com/sgg www.sgg.lu

© © MyOfficialStory/J.theis

The Grand Duchy may well be accustomed to seeing its flagship companies being taken over by foreign multinationals, but SGG has turned the tables. SGG: all about trust With its landmark tower in the Cloche d’Or district, SGG is a company that boasts a history dating back to 1953, when a large local bank created a registered office and fund administration division. In 1998, SGG became a subsidiary of one of the world’s leading audit companies. The Oppenheim family bought the company in 2005, heralding five years of strong growth, leading to a management buyout in early April 2010. Three types of clients use SGG: institutional clients seeking accounting, consolidation and reporting, legal secretariat, registered office and fund administration services, multinational corporations that entrust the company with their establishment in Luxembourg but also Serge Krancenblum

high net worth families, as part of the Family Office services business. The acquisition of ANT As the 4th largest player on the Dutch financial and administrative services market, ANT offers its services to international corporations and wealthy families, but is also a leading player in the administration of private equity funds and real estate, and a specialist in administrative services for listed companies. By acquiring 100% of the ANT shares, SGG SA Holdings now employs over 500 professionals, generating a turnover in excess of EUR 80 million. Note that this friendly takeover was the subject of a plebiscite by ANT’s 190 shareholders - some representing the fourth generation - since the firm was

first established back in 1896. The future The ANT management team remains strongly committed to the new structure. SGG is strengthening its ability to offer global solutions and more value-added services in 14 countries. The ANT and SGG clients can now take advantage of two operational platforms, Luxembourg and the Netherlands. This alliance allows the SGG group to move closer towards its goal of becoming a world leader in fund administration and corporate services. Together, ANT and SGG are boosting their capacity to serve their clients in their international development and contributing to greater interconnection between open economies.

28

Duke 01

29

FUNDS MDO Services: Independent Oversight of a Fund Structure www.myofficialstory.com/martinvogel www.mdo-services.com

© MyOfficialStory/S.Eastwood

Martin Vogel, the CEO of MDO, speaks about the advantages of having an impartial oversight body within your organisation. In house solutions versus an independent oversight for Luxembourg Investment Funds In general, investment funds are increasingly turning into more complex investment vehicles, mainly because potential investment regions and the choice of available securities are becoming larger making investment strategies more complex as a consequence. Fund governing rules applicable to custodians, distributors and management are also changing and increasing in complexity. The changing landscape requires a qualified body to oversee the fund on a daily basis in order to implement the necessary checks and controls, and to ensure proper knowledge of what is taking place in the fund structure. “It is my belief,” says Martin Vogel, “having an independent entity that is autonomous and independent from other service providers within the fund complex is better suited to carry out fund activities and objectives.” If, within the fund structure, the entity entrusted to such oversight is part of a group that carries other functions, there is the potential risk of having a conflict of interest that may later Martin Vogel

become the cause of discussions in case of problems. Benefit of such a structure for fund investors An independent service provider gains experience from working with a variety of different businesses and clients. “The skills gained from monitoring different businesses can be transferred to a larger client base. Also, knowledge acquired from a single client’s activity can benefit multiple clients. Having only one client limits the opportunity of exposure to multiple scenarios and the benefits that come from a vast learning experience,” Martin Vogel states. Independent oversight body or entities should ensure that potential problems or issues leading to financial losses are detected earlier in the cycle and are dealt with immediately. With respect to potential corrective actions, a fund investor can be sure that there is a proper entity taking care of the fund structure and, as far as possible, protecting the fund and reducing the risk of being caught in an in house conflict that may lead to a loss that would be otherwise avoidable. What’s more, the investor is ensured that he

has invested in a fund structure that is state of the art and independent from the performance of the fund when it was set-up. Daily operational issues are also correctly addressed and executed. Market Trends There are 3 aspects to consider. While still being discussed within the EU and internationally, regulators are deciding on how to ensure the independence of management companies in order to enhance their effectiveness through additional concrete measures. It is also apparent that large financial institutions refrain from offering in-house solutions when executing functions involved in other activities within the same fund structure. Lastly, it is apparent that many fund promoters are actually looking to have independent directors as part of fund boards and are appointing independent fund management companies to benefit from the value added. Internal market regulation is functioning well and is a positive sign of how the business may regulate itself without being forced to do so by legislators or similar bodies.

30

Duke 01

31

FUNDS

Arendt: The big picture www.myofficialstory.com/gillesdusemon www.arendt.com

Look at the big picture and everything becomes clearer, including context, strengths and opportunities.

© MyOfficialStory

European harmonisation European harmonisation in the financial sector has intensified significantly. Take the AIFM Directive, which will regulate alternative investment fund managers in Europe and beyond. While the regulatory effort cannot be halted, legislators and stakeholders may adopt one of two attitudes: delay the unstoppable or transform it into an opportunity. In both cases, this will not be without challenges and consequences to those involved. However, while some continue to resist change, Luxembourg is getting ready to be a first mover yet again. The new set of rules will push European integration further than ever before. The early approval may yet ahgain allow another head start for the asset management servicing industry established in Luxembourg. Global reputation The design of the new rules impacting alternative investment funds and Gilles Dusemon

their managers is leaning on the well-established European legal and regulatory framework applying to retail (i.e., UCITS) funds. This being the case, Luxembourg as Europe’s leading UCITS centre has the infrastructure and experience needed to take full advantage thereof. Thus while some countries are recognised for their engineering, design or lifestyle prowess, Luxembourg is world renowned for its investment funds servicing industry. The “Made in Luxembourg” label is the result of a long tradition of excellence in the field of collective investment management and servicing. That same label may now be relied upon by the alternative investment management industry. Universal capital The country owes its dynamism to its constituent parts. The success of Luxembourg as the future European capital of alternative investment funds will thus to a large extent depend

on the country’s ability to attract managers of alternative asset classes from around the world. It is therefore of utmost importance that all initiatives aiming at bolstering the Luxembourg asset management value chain and at attracting further talent be encouraged. The end of the beginning… While the EU is only at the beginning of the process, Luxembourg has already been testing and trying regulated alternative investment funds for over two decades. Consider the demand for Undertakings for Collective Investment (UCI), the interest in the Investment Company in Risk Capital (SICAR) and the overwhelming success of Specialized Investment Funds (SIF); add hereto the formidable infrastructure built up by the international fund servicing industry: what you get is one of the most attractive domiciles for alternative investment managers from around the world. The scene being set, you may spread the message!

32

33

Duke 01

FINANCE KPMG: From finance in general to Luxembourg in particular www.myofficialstory.com/alainpicquet www.kpmg.lu

Interview with Alain Picquet, a partner at KPMG Luxembourg in charge of Advisory and Markets. product per capita to see the unique position we enjoy in the world. To preserve it, I would start by working on our image: Luxembourg is and must be considered one of the most reputable countries in terms of transparency. In the same vein, I think every effort should be made to keep the triple AAA rating. We need to reform pensions and wage indexation. This is a sensitive issue that politicians are reluctant to face, but it is crucial because it has a direct impact on competitiveness and sustainability of the Luxembourg model. Finally I would do more to foster training: why not reinvest the savings from reforms in education credits to maintain the excellence of employees in the Grand Duchy?

If you had an influence on Luxembourg’s economic policy, what would you do? Just compare the gross national

Which companies are most resistant to the crisis? Those that have a clear and positive long-term vision, but that can

adapt quickly. They share a great intransigence when it comes to quality, liquidity and fundamentals. But the hardest part is convincing shareholders to accept variable returns from one year to another: companies are leaving the stock market to free themselves of this dictatorship. A word about the new KPMG Luxembourg building? We were talking about positive state of mind: for the first time, the KPMG partners will be the owners of their workplace. Valentini has designed us a wonderful building in the Kirchberg. The first stone has just been laid. It is a symbol of our confidence in the future!

“A clear and positive vision” Alain Picquet

© MyOfficialStory/O.Minaire

Is the current crisis having a different impact on the various branches of the financial world? My personal feeling is that the crisis is being felt throughout the banking industry. We will return to a better balance between the world of business and that of finance. The least indebted countries like Canada are doing better, the U.S. benefit from their excellent positioning in emerging markets, but Europe is suffering a double crisis: global and European. Consequently, banks are impacted globally: they are reducing the size of their balance sheet, are more selective and are forced to improve their solvency ratio. In short, they are seeking to restore their credibility.

34

Duke 01

35

Private Banking Banque Privée Edmond de Rothschild: Luxembourg as “Architect and Integrator” www.myofficialstory.com/marcambroisien www.edmond-de-rothschild.eu

© MyOfficialStory/A.Kirsch

Interview with Marc Ambroisien, Vice-Chairman of the Executive Committee of the Banque Privée Edmond de Rothschild Europe. How do you see the Private Bank’s future in Luxembourg? In the past, Luxembourg relied mainly on selling financial and tax products. Today, banks based in Luxembourg are leading the way in solutions and services. This transformation is driven, on the one hand, by changes in the European legal framework, and on the other hand by the sophistication of high level clients. These clients want multidisciplinary senior contacts and tools to control and consolidate their investments. Furthermore, mistrust of traditional financial investments means that private equity-type and real estatetype (SIF, SICAR, etc.) investment solutions need to be created. This being the case, experience in the investment fund business area is essential in order to be able to offer this client segment all the expertise of the institutional world. In my opinion, Luxembourg’s future lies in increasing the links between the “Private Banking” and “Investment Fund” business areas. It is possible to create dedicated funds for our clients, go down a board route by sitting down with them and their board advisers, use all the control and reporting tools from the CIU world, and bring in several internal or external managers. The general approach is to devise the global investment plan in Luxembourg, then co-ordinate its implementation Marc Ambroisien

by seeking out the best specialists from all over the world. Luxembourg can become a centre of excellence for financial architects and integrators! What changes need to be made in order for this development to happen? There are three priority fields, starting with training. There are a number of initiatives along these lines. Luxembourg has to attract and retain its talents, but also train them. Next, it is important to provide a regulatory framework tailored to the business areas of the future. The “Family Office” FSP is the finest example of this. Although the future lies in being able to control a toolbox of “worldwide” solutions and no longer solutions focused just on “Luxembourg”, we need to continue strengthening the arsenal of Luxembourg solutions. The upcoming arrival of a trust tailored to Luxembourg would be a perfect illustration of Luxembourg’s long tradition of legislative pragmatism. I might perhaps add a fourth area, which is communication. Professionals and the financial centre itself should be better known. The know-how is here, we just need to get the message out. How is the Private Bank Edmond de Rothschild

Europe adapting to these developments? Our bank’s services are divided into three main activities, namely the private bank, funds and asset management. In terms of the private bank, we started the change in direction to onshoring some years ago, and have a firm strategy of services to high level sophisticated clients. Wealth planning features strongly in the establishment of dedicated solutions. In the field of funds, we lead the way when it comes to high added value sectors such as private equity and alternative funds. Clearly, this cornerstone business area is a key link in the bank’s “Private Global Offer” via dedicated funds. Finally, our asset management expertise is available to large institutions, but is primarily aimed at private bank clients. The needs of HNWI and UHNWI clients mean that this business area is positioned as an essential and dedicated adviser close to its clients. Our bank was named “Best Private Bank in Luxembourg” in the “Euromoney Awards” for our services to the HNW and UHNW client segments, as well as our family office services. This was only made possible because of the synergies between our business areas both within the Bank and the group Edmond de Rothschild.

36

Duke 01

37

Private Banking Banque de Luxembourg: Private Banking Expert www.myofficialstory.com/lucrodesch www.banquedeluxembourg.com

The expertise of Luc Rodesch, responsible for the group of private banks within Luxembourg’s ABBL bankers’ association, takes us on an exploration of private banking “made in Luxembourg”.

© ONT

Confident about confidences With a master’s degree in applied economics, Luc Rodesch has carved out a brilliant path at the BGL, specialising in private banking and taking charge of this area. In 2005, he joined the Banque de Luxembourg as head of private banking and became a member of the Management Committee. In 2010, he took over as head of the ABBL’s Private Banking Group Luxembourg (PBGL), bringing together almost all of the private banks within the Grand Duchy. Although they are basically competitors, all members work together within this group to define a joint strategy. Its collaborative operation results in various synergies, made possible by the pooling of resources. One of the PBGL’s main tasks is identifying training needs in partnership with the Luxembourg School of Finance and the IFBL (Luxembourg banking

training institute). It also carries out studies on aspects such as the living environment, education and taxation, all areas of interest to foreign experts. Luxembourg, an excellent financial market Always synonymous with stability, Luxembourg is the leading private banking centre in the euro zone. However, to retain this status, it must meet certain obligations: on the one hand, it must ensure the necessary economic, political, social, regulatory and legal stability to reassure investors. On the other hand, competent local advisors play an important role in providing effective responses to clients’ expectations. Finally, confidentiality is another key consideration for customers. All this in an increasingly restrictive context in which total fiscal transparency is advocated, reflected in the drive by

many European countries to promote automatic exchanges of banking information. Excellent skills Despite the economic situation, private banking in Luxembourg employs 7,200 people directly, still generates significant revenue and holds a growing number of assets. The sector is constantly developing in response to its clients’ changing needs. Younger generations view their assets as an accessible resource, taking a more consumerist approach than their elders. Private banking is therefore adapting to these new and more sophisticated needs. From new products, new expertise and asset engineering to solutions to optimise the holding and transmission of assets. Luxembourg is asserting itself by promoting its specialist tools in all these areas.

38

Duke 01

Compliance

39

Jean-Noël Lequeue: Compliance & trends www.myofficialstory.com/jeannoellequeue www.icesa.lu

Interview with Jean-Noël Lequeue, Chairman of the ALCO, the Luxembourg Association of Compliance Officers. The day to day life of a compliance officer Members of ALCO are clearly torn between the successive waves of new regulations and the expectations of their colleagues who are demanding faster action to preserve the competitiveness of their business. They often have their “nose to the grindstone”. But the noble side of this job is to follow the rules to the letter, but with a talent that allows a rollout which has minimal adverse effects on business or that even works in its favour. For example, if a regulation reduces the risk for customers, it can be marketed as an added value. In the case of registered addresses, for example, many lawyers and accountants are in competition. Those who opt for a PSF status, synonymous with control by the CSSF, do not

hesitate to advertise the fact: it is a guarantee of transparency, thus making it a real selling point. Compliance and trends As the current overregulation is increasing obligations in companies of all sizes, there is a strong trend towards outsourcing all or part of compliance. Companies need to keep their finger on the pulse of the new rules in real time, but also need to orchestrate the successive rollouts at a very fast pace. As the CSSF has accepted the total or partial subcontracting of the compliance function, this solution makes it possible to share the costs and hand things over to the specialists whose core business is to deal with such matters.

Jean-Noël Lequeue

© MyOfficialStory/J.mura

Influences Luxembourg is not entirely free to set its compliance policy. For 10 years, the European Union has been laying down the guidelines via a range of initiatives, the last of which, the AIFM Directive, aims to standardise and protect investors at European level. This makes sense because with the European passport, a fund is distributable across Europe once it is validated in its home country. On the other hand, the IMF and FATF are closely monitoring the activities of the Grand Duchy: the CSSF is stricter, is quicker to sanction any delays or defaults, hunts down the rogue traders, but Luxembourg is still demonstrating a high reactivity in implementing the laws, which allows companies on the market to position themselves quicker against foreign competitors.

40

Duke 01

41

ICT

SES ASTRA: A superpower manager www.myofficialstory.com/astra www.ses.com

© MyOfficialStory

A former high-ranking civil servant – having worked as secretary general at the Ministry of Finance in a past life – Romain Bausch was appointed to the head of SES in 1995. A change of career and a new challenge for which he has signed up for the duration. A change of direction A former President of the SNCI (Société Nationale de Crédit et d’Investissement) and of the Economic and Social Council, Commissioner appointed by the State to the CLT (Compagnie Luxembourgeoise de Télédiffusion) Romain Bausch took over at the helm of SES when it was at a turning point in its existence. The company was poised to resolutely embrace the digital age, and the time was ripe to pave the way for the strategic development of SES, a very profitable regional company, while safeguarding its independence. Under the management of Romain Bausch, SES was floated on the stock market - a way for the company to fund its future expansion. Romain Bausch

Success The blueprint was drawn up for its strategic development. From a European operator focusing on the broadcasting of television programmes, SES was gradually transformed through an acquisition and a geographical expansion policy into a group with a global reach, offering a full range of satellite communication services. In terms of turnover, by 2010, SES had become the world’s second-ranking operator. “In space terms, Luxembourg is now a superpower,” says Romain Bausch. Challenges While reaping in successes left, right and centre, the company nevertheless has to contend with a string of

challenges. Two examples illustrate the task ahead: “Over the next ten years, there will be a real shift in the weighting of the SES activities towards emerging countries,” says Romain Bausch. It will be necessary to seize this opportunity for growth for satellite services. It will also be necessary to secure the competitiveness of the satellite technology solution, thanks to hybrid technologies, combining satellite and terrestrial technologies, but also by exploring new options beyond geostationary orbits.

42

Duke 01

43

ICT Telindus Telecom: ICT & Telecommunications Solutions Anytime, Anywhere & Anyhow www.myofficialstory.com/telindus www.telindus.lu

© MyOfficialStory/V.Flamion

Reporting a turnover of over 70 million in 2011, Telindus Telecom is one of the region’s top Information and Communications Technology (ICT) providers as well as market leader in data storage. End-to-End ICT and Telecommunications Solutions Telindus Telecom offers a unique and highly customisable range of ICT and telecommunications services to a growing number of national and international corporations in the financial services, manufacturing, construction and e-commerce sectors. A unique one-stop shop, Telindus Telecom merges a large range of cutting-edge telecommunications and ICT packages including fixed and mobile telephony, Internet, networking, Cloud Computing and data storage solutions. Honed to each customer’s individual needs, Telindus Telecom is committed to providing them with the high quality, flexible and cost-effective services they need to thrive in today’s competitive business environment. “Our clients can rest safe in the knowledge that our world class 24 hour 365 day support systems are always at hand should they need them”, says Gérard Hoffmann, Chairman & Managing Director of Telindus Luxembourg. Gérard Hoffmann

Growth Based on Expertise & Employee Ingenuity Despite the economic downturn Telindus Telecom continues to weather the storm, relying on solid relationships and efficiencies developed in recent years. Tens of millions worth of investment in employee training, technology and innovation have proven successful, with a 2011 record increase in revenue of 13%. “Employee expertise and ingenuity are at the cornerstone of the company’s success story, and with financial results well ahead of our five-year business plan, we are confident that we have the necessary people, skill sets, capital and strategic vision to solidify our leading position in the ICT and telecommunications arenas,” Mr. Hoffmann adds. Eyes Set On International Customers With a reputation for intuition and made to measure end-to-end ICT solutions, Telindus Telecom has

supported a growing list of high profile national and international corporations. Closely working together with the Luxembourgian government under the Luxconnect partnership and with the support of the Belgacom group to which it belongs, the company continues to foster new strategic relationships with multi-national organisations as it offers its connectivity and datacentre services throughout Europe and beyond. “Offering our services to international clients is an integral part of Telindus Telecom’s five year business plan. With our leadership position in the market, the quality of our products and word of mouth publicity, we are confident to reach a global market share of 15 to 20% over the next couple of years. The ICT and Telecommunications sector is a fast-paced industry. At Telindus Telecom we are well prepared to stay ahead of the curve to meet each new challenge with confidence and determination,” Mr. Hoffmann says.

44

Duke 01

45

ICT Kabam: Paving the way for a digital future www.myofficialstory.com/kabam

© MyOfficialStory

Arguably one of the most lucrative industries in entertainment, the games industry is a tough nut to crack. Kabam now have an HQ in Luxembourg, and are poised to climb to the very summit of this digital domain. How? By cornering the social network’s games market. Digital means for communication methods Kabam, founded in 2006 developed social network applications, and spotting a gap in the market, shifted direction, becoming one of the first developers on Facebook, creating sports and entertainment communities. The results saw app installations top 60 million. What better in-built audience is there than those already logged onto social networking platforms? Kabam aim to maximize Massively Multiplayer Online (MMO) games and create a unique experience for ‘hardcore’ gamers - those who know what they want and how they want it. Tailoring challenges for this niche group is no mean feat and adaptation is key to survival. Kabam has offices

in San Francisco and Redwood City, California, Beijing, China, and now Luxembourg. With seven games on the market, and a growing team (400 and counting), the only way is up. Gaining the access to maximize the RAM Kabam’s soundbite is ‘We play, for real’. The double meaning speaks volumes for both the ability to identify and target the required audience but also to indicate their passion for providing the ultimate free-to-play gaming experience. Kabam have launched extensive research into the whos and whys of social networks, highlighting the outmoded stereotype of the social platform game player and focused on the rise of a rapidly growing segment –

the hardcore social gamer. Social networks key to global presence It’s an industry wide fact that gamers are migrating their playing time, and the currency they spend, to social games at the expense of traditional gaming platforms. Today, as a leading developer of free-to-play online games that combine deep, immersive gameplay with the connectivity and interaction benefits of social networks, Kabam is leading the charge of a new wave of games. With this in mind, Kabam are serious when they say they are offering a very real challenge to the Xbox 360® system, PlayStation® 3 and Nintendo Wii™. First Europe, then the world!

46

47

Duke 01

INDUSTRY

Brasserie Simon: Brewer from father to daughter www.myofficialstory.com/bettyfontaine

A break with tradition The Brewery was created in 1824 by Charles Mathieu, whose wife was a member of the Simon family. It was sold 15 years later and returned to the hands of the family in 1890 when it was bought at auction by Jules Simon, Betty’s great-great-grandfather. Jules’ son, Joseph, was to take over the business, followed by his daughter, Jacqueline, Deputy Mayor of Wiltz, who married Charles Fontaine. Their son, Jacques took over the reins in turn in 1975. Betty’s arrival in the brewery in 2003 marked a break with tradition: she is the first person in the family since 1890 to join the brewery without a first name that starts with a “J”! The “Betty” touch She was not destined to take over the brewery and, indeed, the subject was taboo at home. Her mother thought she would become a housewife.

Finally, her big brother chose to go into computing and Betty completed a course in electro-mechanical engineering. She had intended to specialise in aeronautics, but graduated in mechanical engineering, which had a less theoretical bent. She still regards the 27th of June 2003, the last day of her studies, as a milestone even though she went back to study for an MBA at night school later on. Her mission began at the brewery with a first year of observation, and then she moved from theory to practice. At the time, the brewery only had one brand and a production of 18,000 hectolitres. In 2006, the Brasserie Simon bought Ourdaller microbrewery, based in Heinerscheid, which produced a special beer from buckwheat. The following year, the Okult brewery was taken over: an organic beer flavoured with coriander and orange peel.

The Malt War The results of this strategy bore fruit in 2009. This meant that the company could invest in the modernisation of its production tool and innovate: for example, Okult launched a ‘stout’ similar to the famous Guinness and the Simon Pils was marketed in a beautiful aluminium bottle, 100% recyclable. This niche strategy allowed Betty to strengthen her position on the Luxembourg market while avoiding confrontation with the two giants on the market, Bofferding-Mattin and Mousel-Diekirch, which boast incomparable production volumes and marketing budgets. “You can’t go and pee with the big dogs if you can’t lift your leg as high as them” she likes to joke. Future growth may be driven by exports, but in the meantime the lorries of the Brasserie Simon criss cross the country with their deliveries, even calling in on private customers. Betty Fontaine

© MyOfficialStory

At the head of the Brasserie Simon since 2003, Betty Fontaine is developing her business in a delicious niche market: specialty beers.

48

49

Duke 01

INDUSTRY

Robert Dennewald: Passing on the Flame www.myofficialstory.com/robertdennewald

Eurobéton owner and president of the FEDIL (Luxembourg’s Business Federation), a light comes on in Robert Dennewald’s eyes at the mere mention of the word “Entrepreneurship”.

MBO His own career has benefited from

decisive strokes of luck: he graduated from the University of Liege as a Civil Engineer in 1978 and immediately began working for the Highways Department of the Ministry of Public Works in Luxembourg. His career path seemed all mapped out. Four months later, he joined ARBED “through the back door”, which actually opened up a life-changing opportunity. The success of the laminated beams in Differdange - those used today to rebuild Ground Zero buildings - allowed him to work for 3 years in New York, from where he returned in 1986 with 250 contracts signed. He then worked for the directorate of TradeARBED, then as director of Europrofil, which took him to China and Japan. He joined the Ciments Luxembourg group in 1993 and was appointed CEO of Eurobéton SA in 1996, which he took over 10 years

later via an MBO before taking control of the group in 2010. The spark When his last two children embarked on their own careers, the President of the Fedil advised them to go off and learn about the world of business, but not in his company as that would be too easy. He thus participated in the creation of the competition 123go and the emergence of Jonk Entrepreneuren. Both programmes are devised to stimulate an entrepreneurial spirit in young people from an early age. For Robert Dennewald, the best way of finding one’s way in the world is to notch up as much experience as possible, whether through a project with fellow students or an internship in a company.

Robert Dennewald

© MyOfficialStory

Transmission Robert Dennewald firmly believes that entrepreneurs have a responsibility: to pass on the flame to the next generation in the spirit of the craftsmen of old, who instilled their art in their companions. He obviously regrets the lack of entrepreneurial culture in the Grand Duchy, and believes that to change this situation, you have to give children a sense, very early on, that they are not doomed to become civil servants. Not that there is anything wrong with being a civil servant, but he would like to see a career choice being made with all the facts at hand. Of course, being an entrepreneur is risky, but the freedom and control it offers over one’s own time and destiny make it all worthwhile.

50

Duke 01

51

Retail

Ernster: The spirit of books www.myofficialstory.com/ernster www.ernster.com

One family, one profession, one location. This is the story of the Ernster family, four generations of booksellers in Luxembourg.

© DR

Once upon a time 1889. A male teacher and editor/ publisher of school books had the idea, due to the proximity of a local secondary school, of making a few alterations to the ground floor of the family home in order to set up a bookshop and stationers. Back then, the pages were delivered loose and the family members would sew the exercise books by hand. When the wars came, the grandmother and her son were deported. A loyal employee stood in at a moment’s notice and stayed for 48 years. The shop survived. The arrival of teaching material in the 1960s led to a boom in business. The next twist in the tale came in 1969, when the entire district was demolished! The temporary relocation meant a loss in turnover. After the district was rebuilt, the shop rose from the ashes in September 1971. A new page was turned. Fernand Ernster

The next chapter Bigger and better. The world of the bookshop changed, and there was a boom in Luxembourg culture. Fernand Ernster, the grandson, entered centre stage in 1984. New companies were created, new outlets opened and shares were bought out within the family. The sites focused on shopping centres (Belle Etoile in 1988, Center City Concorde in 1999), attracting a wider clientèle, then on town centres (Erny in 2008 and Esch in 2009). Each location specialised in a different kind of literature, be it German language, French language, fun, creative or aimed at women. Fernand was the first bookseller to have a website, and appointed a salesperson to distribute educational material to nurseries and schools. Today, he and his wife Annick are the sole shareholders, and the couple make all the strategic decisions. Cautious expansion is the watchword, and tradition is cultivated

by welcoming progress. An endless story Ernster employs 60 staff today, some of whom have been with the company for 30 years, and all of whom are equally passionate. This is fundamental, even when the book world changes with every passing generation. The firm is renowned for its know-how and has won many different awards. Notably, the bookshop was awarded the “Women in Business” prize in 2007 by the Ministry of Equal Opportunities to recognise its involvement in the positive action programme. Gender equality, consideration for working time and difficulty, and internal audits contribute to a genuine social policy. The desire to continue the adventure lies at the heart of the company, and the history of this family will be written in many more pages to come, perpetuating the spirit of books.

52

53

Duke 01

INTELLECTUAL PROPERTY Office Freylinger: An Intellectual Property all-rounder www.myofficialstory.com/officefreylinger

The experts at the Office Freylinger accompany innovations from the glint in their inventor’s eye to their sale. An insight into a highly varied and exciting profession.

Entrepreneurs By dint of being around entrepreneurs, the specialists at the Office Freylinger have developed a keen sense of innovation that they apply to their own field. They were the first to create

an i-Phone application to perform free searches on trademarks and to allow trademark registrations online. They design tools that make offers and procedures legible, such as “all inclusive” packages for example. They have also broken new ground by offering their customers “Intellectual Property” insurance (in cooperation with an insurance broker) that gives financial clarity to entrepreneurs and inventors in the event of conflict with a competitor. While some Intellectual Property firms are relocating to India, the Office Freylinger is based solely in the Grand Duchy. The Office Freylinger works in French, German and English with its neighbouring countries, a guarantee of efficiency and cost control. For the rest of the world, they use their network of colleagues. The growth process: the three ages of I.P. Intellectual property has become a living matter that needs to be nurtured to help it grow. Companies and their trademarks, patents, designs or models have long been protected by borders, but this is no longer the case: potential

competitors are everywhere on the planet. It all starts when designing new products or services, where an appropriate protection strategy makes it possible to safeguard the interests of the company and the profitability of these developments. This is the critical phase because any error will mean the end of the road for the innovation: you cannot reregister the same invention if it fails the first attempt. If a competitor has registered an identical or similar trademark, the conflict will be fatal to the product or service carrying the same name. The second phase is the implementation: registration in the country that is of interest to the company, followed by the procedure to obtain the trademark until the right is finally issued. Then comes the age of maturity via licensing agreements and conflict management, particularly when a third party counterfeits a product or if you are accused of counterfeit. A trademark, patent or design may also be sold and the amounts originally invested for registration - a few hundred dollars for a brand and a few thousand for a patent - can generate excellent returns on investments. Pierre Kihn

© DR

Established in 1966 Employed at the International Patent Institute in The Hague (now part of the European Patent Organisation) as an examiner, Ernest Freylinger returned to the Grand Duchy in 1966 and created the Office that bears his name. In the early days, the firm was primarily concerned with the protection of steel industry innovations (patents, licensing agreements, etc.) before spreading its wings to cover all technical fields. Ernest Freylinger also earned a reputation as an expert in procurement and litigation relating to trademarks, designs and models. Besides the protection of inventions in the traditional industrial fields, the advice of the Office Freylinger has also helped protect a golf club, a female condom, websites, a tsunami warning system, a cigarette without smoke or tobacco, etc.

54

Duke 01

55

Architecture

Lord

Foster

The invisible wall www.myofficialstory.com/lordfoster www.fosterandpartners.com

>>

56

Duke 01 -

SUMMER 2012

57

Architecture

>>

Lord Norman of Thames Bank gives a very simple definition of Beijing airport, which he built just before the 2008 Olympic Games: “It’s so big that, in certain light conditions, you can’t see the far wall of the building.” The dragon-shaped roof is over 3 km long and 785 meters wide. It is estimated that, by 2020, annual traffic will reach 55 million passengers. To cope with such projects, the offices of Foster + Partners employ over 900 people spread between London and the rest of the world. Together, they embark on the quest for the holy grail of any architect: reconciling with one stroke of a pencil the inspiration of the master and the technical constraints... pushing back these barriers with new flashes of innovation, if necessary.

The perfect curve Born in Manchester in 1935, Lord Norman Foster first graduated from the University of his hometown. He went on to win a scholarship that enabled him to complete his training at Yale, where he earned a Masters Degree in Architecture. He initially entered into a partnership with Richard Rogers, then created Foster + Partners in 1967. While the Millau Viaduct may be the most emblematic project for the French, his signature appears on hundreds of structures of all kind, which touch the daily lives of millions of people. He transformed the London landscape with his domed tower and the Millennium Bridge, that of Frankfurt with the Commerzbank Tower and the Berlin skyline with the transparent dome of the Reichstag. He was also behind the facelift given to Barcelona stadium and the brains behind the plans for a complete university campus in Malaysia, and the Virgin Galactic Spaceport in New Mexico ... to name but a few. Lord Norman Foster is also a prestige brand that many companies have tapped into: Deutsche Bank, Allen & Overy, McLaren, IBM or Astana in Kazakhstan. Calling on this particular architect has become a “status symbol” and he has designed countless cultural centres, bridges, industries or urban projects. His list of prizes and awards is also endless: winner of the Royal Gold Medal of Architecture in 1983, he was ennobled by the Queen in 1999.

The Pritzker prize That same year he joined the elite club of winners of the Pritzker Prize, considered as the Nobel Prize for architects, joining illustrious predecessors such as IM Pei, Richard Meier, Frank Gehry and Fumihiko Maki. His old friend Richard Rogers was to join them in 2007 for his work on the Pompidou Centre in Paris or Heathrow Terminal 5. Along with Rogers and Fumihiko, he made up the illustrious trio selected by the unfortunate owner of the twin towers, Larry Silverstein, to come up with the design of three new towers. The construction of the first has already begun. The first containers of steel from Luxembourg have already been dispatched to Ground Zero. Alliances Steel and glass. When admiring the works of a hi-tech architect like Norman Foster, it is this alliance that is most striking. HSBC bank in Hong Kong is a fascinating example of this successful combination. At the heart of the building, a complex structure ensures the vital functions, while the shell endows the building with light, beauty and functionality. A third element also comes to complete the whole: air! It rushes in through the vast gaping spaces of the ground floor to allow the structure to breath. Respect for the environment is a recurring theme of the architect. In 1974, he introduced an innovative approach to transparency and ingenuity with the

Sainsbury Centre for Visual Arts. When discussing the importance of local culture on the work of the architect, Lord Norman Foster’s response is uncompromising: “We take the lead with design”. That being said, a touch of local colour can come through in the design, though sometimes in an unexpected form. Beijing airport, for example, benefited from the Chinese expertise in shipbuilding to model subtle curves into huge steel elements. Derived products The architect has channelled his imagination into everyday objects, just like Philippe Starck: chairs, kitchens, lighting, sofas, yachts, wind turbines, and even petrol stations! However, we would probably be right in saying that these are only exercises of style, because when asked about the major impact that his work will leave, Lord Norman Foster thinks for a moment before calmly pronouncing: “At first, we wanted to reinvent the office by breaking down the boundaries between the culture of the white collar and blue collar workers. But over time, we have worked mainly to connect architecture and infrastructure.” What does the architect feel when he admires the Millau Viaduct or the panorama of a city on which he has left his stamp? Many millionaires are obsessed with the idea of leaving a mark after their deaths. Architectural genius seems the best means of achieving this aim.

Duke 01

Business focused.

59

CULTURE

DELAGARDELLE LAW FIRM

MUDAM: The contemporary citadel

www.delagardelle-law.com

www.myofficialstory.com/mudam

Luxembourg has made a name for itself in the world of contemporary art. Since 2006, the MUDAM, the Grand Duke Jean Museum of Modern Art has been a unique hub of activity.

Structuring Investment Funds / Vehicles UCITS & UCI’s Law of 17 December 2010 concerning undertakings for collective investment, as amended form time to time. SIF’s Law of 13 February 2007 relating to specialised investment funds, as amended for time to time. SICAR’s Law of 15 June 2004 relating to the investment company in risk capital, as amended from time to time. 3, rue Thomas Edison L-1445 Grand Duchy of Luxembourg Direct Dial: + (352) 27 44 09 – 09 Switchboard: + (352) 27 44 09 – 01 info@delagardelle-law.com www.delagardelle-law.com

Results driven.

From Vauban to Ieoh Ming Pei Created by the Grand Duchy to pay tribute to Great Duke Jean on the 25th anniversary of his reign and built on the old Vauban citadel, the MUDAM stands between the Old City and Kirchberg. Though embroiled in controversy for a while – as is often the case with projects of this magnitude – the Great Duke Jean MUDAM is today a universal favourite. Designed by Ieoh Ming Pei, to whom we owe the pyramid of the Louvre in Paris, the building follows the contours of the Thüngen fort on the site on which it is built. But unlike the original building, the MUDAM is not an impenetrable fortress! To the contrary, it is designed as a meeting place for modern art and a mosaic of visitors, from the children participating in the “MUDAMINI” programme, the adolescents heading for Art Freak Sessions ‘and adults attending the Mudamis events. Modernity and nothing but modernity Everything in the MUDAM breathes modernity. Its collections, its architecture but also its furniture and café, where visitors can take a break between exhibitions. Far from being regarded as the temple of elitism,

within its walls the museum also hosts works by designers from the worlds of fashion, graphic design or decoration. Just hang around the entrance for a few minutes to get an idea of the range of motivations that attract visitors to the Museum: curiosity, thirst for culture, introduction to contemporary art by a friend, a quest for inspiration … Diehard fans cannot help but come back every week to get their emotional fix. The Pompidou effect With the recent opening of the Pompidou Centre in Metz, some questions have been raised about the impact this will have on the success of the MUDAM. Time has shown that the two sites are complementary rather than competitors. They manage, in their different ways, to attract a public that is not necessarily familiar with modern art, while at the same time saving art enthusiasts a long trip. The Philharmonie managed the same feat in the world of music. The draw of the Pompidou museum in Metz can only have positive repercussions for MUDAM and Luxembourg, which is constantly developing its tourist attractions to cater for an increasing number of visitors.

60

Duke 01

Duke 01

RESTAURANTS 2 rue de la loge: A bistro – a private club

Um Plateau: A place with soul

www.myofficialstory.com/2ruedelaloge

www.myofficialstory.com/umplateau

In a house typical of the city centre, Clothilde Ludorf has created a unique meeting place. A guided tour.

Clothilde Ludorf

A club When she arrived in Luxembourg in 2003, the new owner was primarily an expert in payments by smart card. A technology that she immediately put to good use by taking advantage of a peculiarity of the place: the private entrance that provides access to the second floor by the side of the building. This space is

When she took over the restaurant “Um Plateau” in 2008, the biggest challenge facing Stéphanie Jauquet was to live up to the reputation forged by Roland Sunnen, the charismatic founder of this institution, sixteen years earlier.

reserved at all times, and can be accessed at will, as the door can be opened with their membership card. Coffees, soft drinks, internet, concierge and chauffeur are provided for all so that they can relax or work undisturbed. And if they want to order a cocktail or a meal, the bar staff can be reached via an intercom. Best of all, no membership is required: just pre-load the card to get a long list of privileges. A bistro The bistro is open to all visitors, all day. They can be seated on the terrace of the ground floor, the room near the bar or on the beautiful terrace of the first floor. A chef is now ‘based’ in a kitchen under the roof. He serves traditional French and Luxembourg dishes: steak, beef tartare, vol-au-vents … There’s something for everyone. Events are organised to spice up the week: cigar evenings, theme nights, private parties. And with its three floors, it is always possible to privatise a part of the establishment. Luck or opportunity? As Clothilde says: “Time will tell!”.

The genesis Roland Sunnen studied economics in Paris. He returned to Luxembourg and created the Bar-Restaurant “Humpfrey” where he launched the fashion for gratins and salads. Regulars queued up and sat around large tables in a friendly atmosphere. It was an immediate hit. In 1992, Roland set his sights higher. He found a private house in an ideal location. His sister, who was to stay by his side throughout the adventure, was not immediately convinced, but was won over by her brother’s enthusiastic vision. They called their restaurant simply “Um Plateau”, in reference to its location.

© MyOfficialStory

A place Guides stop at “2 rue de la loge” to show their groups the oldest pub in Luxembourg. At the time, it was called “Onnert de Steiler” (Under the arcades). When Clothilde saw the “to rent” sign, she has been working for three years at the Abbaye de Neumünster, and was looking for a cosy place to smoke her cigars in peace and quiet, among aficionados She fell in love at first sight, with the house in general and with its beautiful terrace on the first floor in particular. She was handed the keys in October 2011 and came up with a unique concept to facilitate meetings between cigar aficionados, enthusiasts of all kinds and foodies.

© MyOfficialStory/S.Eastwood

61

Stéphanie Jauquet

“Chez Roland” At the time, nobody called the restaurant by its real name. Everyone went to eat “Chez Roland.” The establishment was still full to bursting, to the extent that queuing quickly became part of the experience. Taking a drink at the bar, watching the ballet of the service and having a chat with the owner meant that time went by very quickly. Most regulars didn’t

just go there to eat: they spent the evening there and rarely returned home before 2 a.m. The place was in constant evolution. Roland would jet off to Munich or Paris, spend time in restaurants and bring back ideas for his decoration or dishes. Once a year, he would paint the entire restaurant in one weekend. It went from salmon to sky blue and finally to red, an idea inspired by an evening at Costes in Paris. The renewal After Roland’s death in 2003, his sister wanted to hand over the restaurant. She was persuaded to sell by Parisians met via Costes, but the good intentions did not translate well in practice. In 2008, Stéphanie Jauquet took over the business. She brought in Moreno for the renovation work and opened in November of that year. Already honoured with a string of awards, the address has returned to Roland’s values: a good menu, good wines and above all a warm atmosphere capable of transforming a good dinner into a memorable evening.

62

Duke 01

Duke 01

GUIDE

63

Ceos’ favourite addresses

Clairefontaine.

Eating UPSCALE