113 minute read

Machinery Repairs

KOTC’s Al Funtas is one of four KOTC VLCCs to be retrofitted with the Wärtsilä Fuel Efficiency Boost

Wärtsilä wins KOTC contract

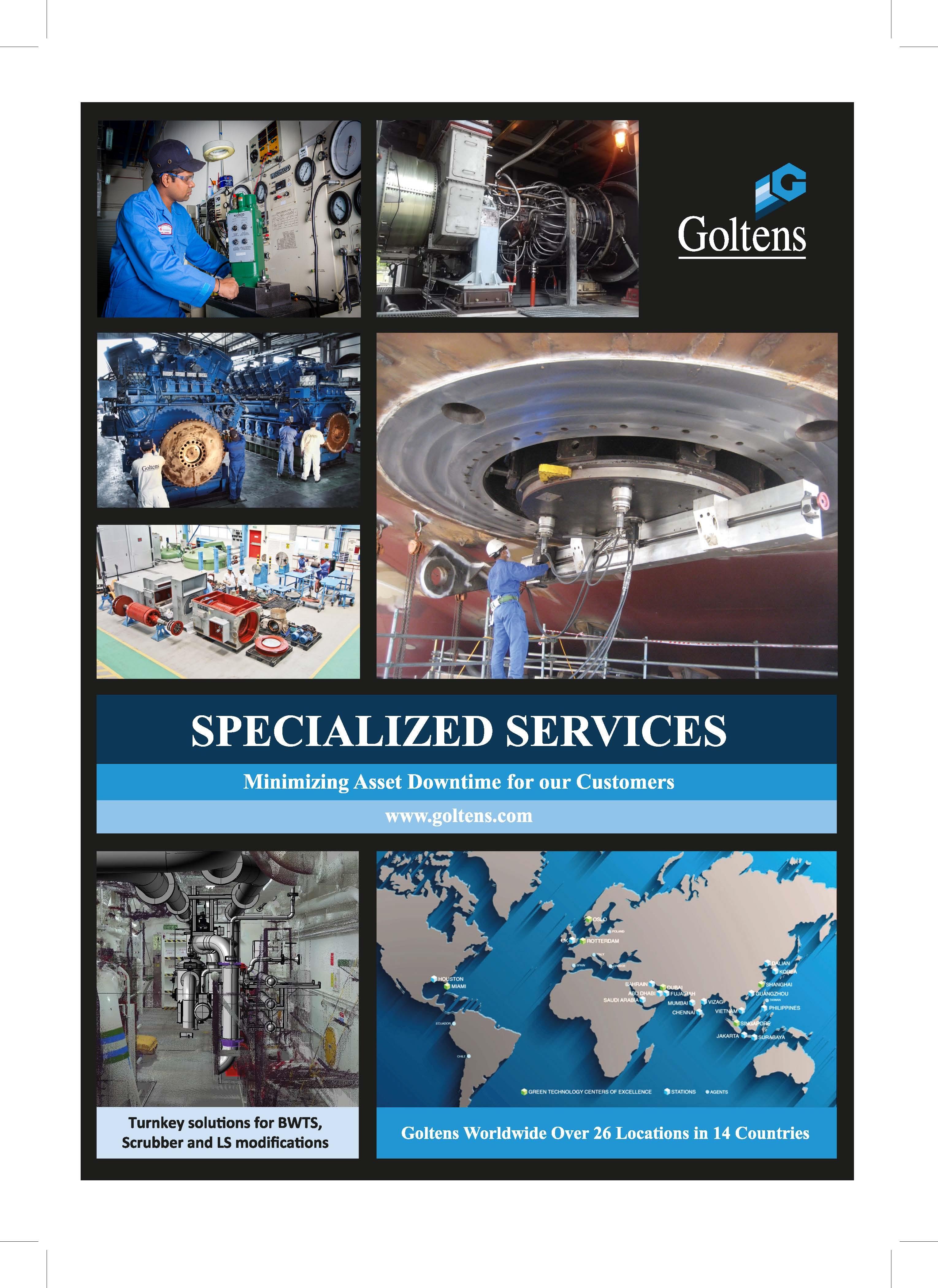

Advertisement

Finland’s Wärtsilä has been contracted to upgrade the performance of four vessels owned by Kuwait Oil Tanker Company (KOTC) by retrofitting the Wärtsilä Fuel Efficiency Boost solution to the ships’ main engines. The modification, which will be carried out ‘in service’, will reduce fuel consumption, and correspondingly lessen the environmental impact by lowering greenhouse gas emission levels. KOTC and other major ship owners who have taken a proactive approach towards environmental protection have been actively looking for ways to reduce their fuel consumption and carbon footprint, thus paving the way for them to reduce greenhouse gas emissions. As a result, the Wärtsilä Fuel Efficiency Boost initiative has attracted considerable interest, and similar orders from other large shipping companies have been placed in recent months. The Wärtsilä solution is based on two-stroke engine optimisation technology for selected Wärtsilä RT-flex and earlier deliveries of X-type two-stroke engines. The four KOTC very large crude carriers (VLCCs) to be retrofitted operate with seven-cylinder Wärtsilä RT-flex82T twostroke main engines. The retrofitting of the vessels with the Wärtsilä Fuel Efficiency Boost will take place over the coming six months. “Our smart marine approach is dedicated towards raising efficiencies and improving the environmental sustainability of marine operations. The Wärtsilä Fuel Efficiency Boost is completely aligned with this philosophy, while at the same time lowering operating costs,” says Riad Belaid, Area Sales GM, Middle East & Asia, two-stroke & Specialised Services, Wärtsilä Marine Business. “By modifying the main engines of these tankers, we are assured of operating with the latest technology and having the best operational efficiency. We know and trust Wärtsilä’s high quality products and systems, and we appreciate the excellent support they offer,” says KOTC’s Acting CEO, Ali Shehab. The Wärtsilä Fuel Efficiency Boost is a well-balanced combination of an increased compression ratio and modified injector nozzles. Together with optimised engine tuning parameters, it allows fuel savings of up to 4%. The pilot installation showed around 10~12 tons per day lower fuel consumption than a sister vessel operating the same route, and resulted in 1,195 tons of fuel savings over the nine months pilot period. In 2019, Wärtsilä successfully installed the company’s Intelligent Combustion Control and Fuel Activated Sacless Technology (FAST) upgrades on these same four vessels. Meanwhile, Wärtsilä, Stena, and Methanex Corporation have marked five years of successful operation of the methanol-fuelled ro/pax ferry Stena Germanica. This is the first ship in the world to run on methanol as a marine fuel, signifying a major milestone in the continued shift towards a more sustainable future for commercial shipping in line with the industry’s decarbonisation efforts. The Stena Germanica was converted to be capable of running on methanol fuel in early 2015 at Remontowa Shipyard in Poland. The 240 m long ferry, with a capacity for 1,500 passengers and 300 cars, was retrofitted with a first-of-its-kind fuel-flexible Wärtsilä 4-stroke engine that can run on methanol or traditional marine fuels. The ferry began the world’s first methanol-powered sailings between Gothenburg, Sweden and Kiel, Germany in late-March 2015. Stena Germanica’s conversion was a cooperation between Methanex Corporation, Stena Line, Wärtsilä, the Port of Gothenburg, and the Port of Kiel. The project was cofinanced by the European Union, and the classification of the conversion to methanol was conducted by Lloyd’s Register. In the five years since the Stena Germanica’s launch, the market for methanol-powered vessels has seen continued growth. Methanex Corporation, through a wholly-owned subsidiary, Waterfront Shipping, operates the world’s largest methanol ocean tanker fleet with 11 vessels. Stena Bulk recently announced a jointventure with Proman Shipping to build two methanol-powered vessels with delivery scheduled for the beginning of 2022.

Euronav signs up for LR’s MPMS CM

UK’s Lloyd’s Register (LR) has signed an agreement with Belgium’s Euronav to approve its Machinery Planned Maintenance and Condition Monitoring Scheme (MPMS CM) for 25 LR-classed vessels. This will be performed in accordance with LR’s recently updated ShipRight procedures for MOMS (CM), helping Euronav optimise maintenance schemes and embrace available technology. To approve Euronav’s MPMS (CM), LR will conduct a remote audit of the planned maintenance scheme, which involves the review and approval of selected machinery on the basis of satisfactory Condition Monitoring data, and an implementation audit performed during the first annual survey. During September 2019, MPMS (CM) and the corresponding Rules, which enables operators to apply the most appropriate planned, condition-based, risk-based or predictive maintenance methodologies to each of their machinery items, in order to suit their specific needs. Euronav’s Fleet Technical Manager Theodore Mavraidis said, “Over the past five years, we have extensively applied conditionbased maintenance techniques throughout our fleet, supplementing the traditional ‘preventive maintenance’ and ‘condition monitoring’ routines. Within our organisation, we have built a strong technical knowledge base and valuable expertise enabling the next step. This next step encompasses as its main objectives - the use of our resources, people and equipment, even more effectively,

improved efficiency of equipment/machinery performance, which provides savings in operations and energy consumption and proactive condition-based maintenance that will imply more control over resources, as well as reduce business and safety risk. “In this journey, we feel fortunate having LR by our side, supporting us with their established tools and approval framework of the updated ShipRight procedures. Just as technology has been developing rapidly in fields like telecoms, data analytics, smart devices and infrastructure, the same can be said of asset condition monitoring and we recognise in LR a reliable partner who can significantly contribute to our organisation’s progress in digital transformation,” Mr Mavraidis added. LR’s Theodosis Stamatellos added, “Providing approval for MPMS(CM) is a key step in supporting Euronav’s move towards optimised maintenance, paving the way for risk-based maintenance and predictive techniques. LR updated its ShipRight procedures for Machinery Planned Maintenance and Condition Monitoring to reflect technological development and owner operational needs, helping our clients create suitable maintenance schedules which fit their needs and take advantage of available technologies.

Wärtsilä announces launch of Smart Service Centre

Finland’s Wärtsilä has announced the launch of its global Smart Support Centre service. This service is aimed at improving asset uptime via remote access for customers of Wärtsilä’s Voyage business, thereby substantially reducing the need for physical service attendance. Operational support is delivered via virtual service engineers. Smart Support is designed to maintain all Wärtsilä Voyage equipment, including ship handling solutions, such as ECDIS and charts, simulation & training systems, and ship traffic control solutions. The service is a notable extension to the company’s already extensive remote monitoring and support capabilities covering other areas of Wärtsilä’s total offering. The Wärtsilä Smart Support Centre remotely manages the health of systems, proactively warns if anything is deteriorating, makes Remote monitoring of equipment and systems with Wärtsilä’s Smart Support Centre reduces the user’s involvement in maintenance issues

software updates, and assists system users in all operative questions with fast response times. The service has been extensively tested in a pilot programme together with Danish shipping company J. Lauritzen AS. Hans Elker Hansen, Marine QA, Vetting & Nautical Manager at Lauritzen, commented as follows: “Firstly, the crew is aware that 95% of all errors can be rectified remotely, and they don’t need to arrange for a service engineer in the next port to solve the issue. This means that we have the equipment up and running at all times. Secondly, the use of e-mails to solve a technical or user-related problem is almost entirely eliminated, which avoids excessive communication.” “The Wärtsilä Smart Support Centre connects our equipment and systems, for example ECDIS, simulators and our Vessel Traffic System, allowing significant enhancement to our remote service capabilities. It gives an opportunity to really establish the status of the systems, to carry out remote software updating, and to enable the customer and Wärtsilä to work closely together on the systems,” says Torsten Büssow, Managing Director, Wärtsilä Voyage. The Wärtsilä Smart Support Centre delivers outstanding service levels backed by an experienced team of engineers and subject matter experts who are available 24/7. In addition, it provides access to the company’s knowledge base and responds to the most frequently asked questions.

DNV GL research reveals trends on tubes and piping failures

New DNV GL research based on more than 1,000 failure cases has revealed that tubes and piping are the most failure-prone components in the oil and gas and maritime industries. Fatigue and corrosion are the most common failure types. The research is based on cases from DNV GL’s global network of five laboratories in the United States, Europe and Asia, which specialise in failure investigation. The laboratories identified that, of the components they examined, some 27% of failures occur in tubes and piping, and 20% in rotating machinery. Fasteners and mooring and lifting components also appear in the top five components most prone to failure. Fatigue (30%) and corrosion (19%) make up nearly half of the primary failure types occurring in the cases DNV GL analysed. Brittle fracture, overload and wear are also in the top five. “The cost of prevention, monitoring, repair or replacement as a result of these forms of component degradation can run into billions of dollars. Potentially, financial penalties can occur if major incidents and loss of life result from such a failure. Our experts can provide in-depth technical advice to prevent future failure on similar components that keep operations running and importantly keep the workforce safe,” said Koheila Molazemi, Technology and Innovation Director, DNV GL - Oil & Gas. To obtain the data for its research, DNV GL’s laboratory experts applied several methods to analyse data and documentation to assess failure trends and predict what components are most likely to fail. This included innovative approaches applying advanced search engine technologies combined with technical subject matter expertise. DNV GL continues to enhance this approach with its customers. This systematic analytical approach means high volumes of data can be examined far more rapidly than using traditional databases and spreadsheets. The accumulation of more and better data and learnings from failures can be applied in the front-end engineering design

Koheila Molazemi

phase of development projects to engineer more robust assets. During operations, learnings can enhance optimisation of inspection, repair and maintenance for more efficient and safer use of capital and people.

Royston completes research vessel overhaul

UK’s Royston Marine has completed the overhaul of two turbocharger units as part of service work on a marine diesel engine on-board Gardline’s 1,967 gt research vessel, Ocean Endeavour. The project saw the removal of the heavy-duty ABB VTR 200 turbochargers from the vessel’s Mirrlees Blackstone ES6 engines and transportation from Hull docks to Royston’s test and repair centre on the banks of the River Tyne in the North East of England. There, the units were dismantled and inspected by engineers for signs of wear or damage before being cleaned, serviced and reassembled with new bearings, seals and joints. The rotor shaft was also blasted and balanced while filter panels were re-packed with copper mesh. After being repainted, the unit was returned to the Ocean Endeavour where it was reconnected to the engine and tested to ensure oil and charge air pressures were in line with appropriate tolerances. Royston’s specialist turbocharger test and repair facility in Newcastle upon Tyne features a Schenk H3BU horizontal balance machine alongside an IRD B5OU-290 instrument, as part of a precision instrumentation capability to carry out balance testing. This allows skilled engineers to undertake specialist work, which can involve the removal and replacement of turbochargers and components as well as the re-routing of associated pipework. Shaun Cairns, Royston’s operations manager, said, “Our experience with the engine and vessel type ensured the work was carried out efficiently and effectively, enabling the Ocean Endeavour to return to important sea-going operations as quickly as possible. Vessel operators can achieve considerable cost savings when using service providers like Royston without compromising the quality and standard of engineering work provided.” The Ocean Endeavour is part of a fleet of dredgers, offshore support vessels and pontoons and barges owned and operated by Gardline which currently includes Ocean Reliance, Ocean Researcher, Ocean Observer, Kommandor, Ocean Vantage, Ivero and Vigilant.

The Ocean Endeavour

Dave Newcombe, marine workshop supervisor at Gardline, said, “As a global operator, we not only require efficiency gains, but also rapid and effective service solutions. Royston’s experience, expertise and streamlined operation are a huge advantage for any customer like us looking for beneficial gains.”

Marinfloc announces new equipment

Sweden’s Marinfloc has announced its combined Exhaust Gas Recirculation Bleed Off water treatment system and Bilge water separator. The innovative solution is approved by both DNV GL and MAN Energy Solutions and fulfils the requirements of MEPC 107(49) and MEPC 307(73). The approval means that only one separator is required instead of two. Reducing the amount of equipment needed on a vessel will provide shipyards, engine makers and ship owners with a significant cost saving solution. Exhaust Gas Recirculation (EGR) is used to reduce NOx as per the Tier III requirements when used with compliant fuel. The EGR process will generate a portion of bleed off water that must be treated to < 15 ppm which is also the requirement for bilge water. By combining the two treatment systems, the CAPEX will be significantly reduced without any negative impact on performance. Additionally, there will also be a welcomed reduction in Operating Expenditures as maintenance, spare parts and training are needed only for one unit. The system is based on Marinfloc’s flocculation technology with thousands of references world-wide. The Whitebox is included as standard to segregate the waste streams, to eliminate cross contamination and record all activities. Moreover, the Whitebox fulfils the EXXON requirements and is Marinfloc’s recommendation on all vessels calling in the US. “Both treatment units are mandatory, so why not combine them. It would be foolish to have a separate treatment unit that might not even be in use for the majority of the year. This way neither crew nor owners will lose any sleep going into NECAs as they are already operating the unit on a daily basis,” says Martin Gombrii MD at Marinfloc S&P.

A MAN-ES two stroke engine with EGR

The development of this solution started back in 2016 at MAN Energy Solutions facilities in Copenhagen and concluded when DNV GL approved the system design in early 2020. “Sometimes new products are done overnight, sometimes they take five years. Looking at the result I’m glad that we didn’t rush anything. We have developed a truly unique product and are proud to be a MAN Energy Solutions approved supplier,” says Benny Carlson, Chairman of Marinfloc.

SCHOTTEL retrofit for Norwegian ferry

The successful SCHOTTEL Rudder EcoPeller is set to be installed in a retrofit project for the first time. Two four-bladed SCHOTTEL EcoPellers type SRE 340 L CP with an input power of 750 kW each will be featured in a double-ended ferry from Norway’s Torghatten Trafikkselskap. Gunnar Heringbotn, Technical Manager at Torghatten Trafikkselskap said, “We have already equipped several of our ferries with SCHOTTEL propellers. For the electrification of the Torghatten, we have opted for the SRE, as it optimally meets our requirements and supports us on our way to an eco-friendly future. Thanks to the tailor-made modernisation concept, downtimes can be kept as short as possible.” Since it is possible to integrate the SCHOTTEL solution into the existing steel structure of the former propulsion system, no hull changes or major steel work will be necessary. Beyond this, the work can be carried out by a local shipyard – thus reducing installation efforts and shortening downtime tremendously. The EcoPellers will be driven by electric motors. In operating mode, the required power The Torghatten will be supplied by battery packs installed onboard. These will be recharged from the land grid during the stays on the quay. To be environmentally compliant, the propulsion system of the Norwegian ferry will be equipped with the patented and DNV-GL type-approved SCHOTTEL LEACON sealing system. Through the use of separate seals on the seawater side and on the gearbox side, the sealing system ensures that, in case of leakage, seawater entering the system or gear oil escaping from the system is collected in an intermediate chamber. This prevents water from entering the gearbox and, of even greater importance, oil from escaping into the seawater. Higher efficiency, lower operating costs Covering the range from 500 to 5,000 kW, SCHOTTEL EcoPellers ensure high efficiency and improve course keeping stability many times over. The ecologically clean propulsion system has been primarily developed for open seas and coastal operating conditions. By combining proven SCHOTTEL quality with latest technologies, the azimuth thruster contributes to the ship’s low fuel consumption, resulting in low operating costs and low emissions.

Alewijnse wins Jumbo contract

Dutch heavy-lift specialist, Jumbo, has awarded Holland’s Alewijnse Marine, Rotterdam, a contract to fabricate and install two switchboard panels for its 15,022 gt heavy-lift crane vessel Jumbo Javelin. Alewijnse Marine will engineer, supervise,

test and commission the cabling and electrical The Jumbo Javelin

installation activities during the conversion. The switchboards will manage the additional power provided by six containerised temporary generator sets, which Jumbo has installed to increase the vessel’s capacity for an upcoming contract. The Jumbo Javelin is a dynamic positioned heavy-lift crane vessel operated by heavy-lift shipping and offshore installation contractor Jumbo. The 144 m long vessel is typically mobilised for offshore installation contracts, providing DP heavy-lift services with its two 900 tonne capacity mast cranes. Fully redundant power preparing for an upcoming contract that will require increased power requirements, Jumbo has equipped the Jumbo Javelin with six additional containerised generator sets. These will supply power to her bow thrusters and offshore equipment during DP operations. The Alewijnse Marine switchboards will manage this increased power supply. Jumbo will remove the six generators at the end of the project. “Our switchboards will make it possible for the Jumbo Javelin to have a fully separated power supply for the two bow thrusters,” says Pieter Vosselman, Account Manager Alewijnse Marine. “In the existing setup, there will not be enough power available for the temporary set up. This upgraded configuration will give Jumbo the extra capacity and reliability to take on this project.” Future flexibility Alewijnse Marine will ensure the complete integration of the new switchboards into the Jumbo Javelin’s existing systems. The company will install the switchboards in such a way to allow the ship’s electrical systems to return to their previous settings after the removal of the company generators. This will be achieved through modifications to the PMS and PLC control systems. The switchboards will remain in position, giving Jumbo the option to increase the vessel’s power capacity again in the future. “We worked on Jumbo Javelin when she was being built,” continues Pieter Vosselman. “It is nice to be back on-board with this project giving this great vessel the flexibility to take on similar jobs in the future.SORJ

Optimarin offers flexible installation options for BWM systems By Paul Bartlett

Logistics challenges, survey extensions and reduced shipyard productivity as a result of COVID-19 are likely to lead to a spike in demand for repair capacity sometime fairly soon, though nobody knows when. For owners and operators with BWM system installations pending or overdue, this could be challenging, particularly if repair costs rise on the back of surging demand. Some operators thought that de-linking renewal of the International Oil Pollution Prevention Certificate and the next scheduled docking of their vessel would buy more time. However, many of these could now face the prospect of installing a ballast water system perhaps a year or two before necessary, or the unthinkable prospect of paying for two dockings. Not necessary, says Leiv Kallestad, Chief Executive Officer of Norway’s privately-owned Optimarin who joined the company from TTS Group ASA where he was Chief Financial Officer. There are other options, at least for many ship types. And the company has already demonstrated how, with careful planning, design and engineering at an advance docking or even alongside, it is possible for systems to be installed at sea. It was quite a move that Kallestad made – from a large public limited company to a small privately owned one – but he admits candidly that he liked what he saw. Not only was Optimarin the first system maker to complete a shipboard installation in 2006 and the first to receive USCG approval in 2016, but it had a chunky orderbook and the 2019 financials were looking good. Meanwhile the company had clearly been managed well – with the first-ever system guarantees, providers of key components duplicated for security of supply, and a sophisticated logistics set-up run out of Luxembourg. In March this year, a tie-up with China’s Sunrui, a maker of treatment systems based on electro-chlorination for larger vessels, enables both companies to offer a choice of technologies potentially suitable for a broad range of ship sizes. Sunrui has a similar pricing strategy, aiming for high quality, not low price, explains Tore Andersen, who handed over to Kallestad as CEO in May last year and is now the company’s Executive Vice President, Sales & Marketing. “You get what you pay for in this business,” he says, while Kallestad points out that the company could not offer equipment guarantees if components were unreliable. The two companies will now co-operate in the global market, tailoring customised services for different shipowners and vessel types, and going forward consider the possibility of future supply chain and after sales service cooperation. The General Manager of SunRui, Fu Hongtian has emphasised that SunRui’s marketing philosophy is always customercentric. He states SunRui realised that when analysing the competition in the crowded BWM system maker market, with shipowners often forced to go through complicated assessment

We’re here to help

Don’t drown under the pressure of ballast water treatment compliance. Optimarin is on hand to help.

Proven technology, easy installations, retrofit expertise, and simple operations and maintenance – we have the systems, experience and segment understanding you need for complete BWT compliance.

In these challenging times we’re also offering the market’s first leasing agreements, easing financial pressure so you can concentrate on your core business.

Breathe easy with Optimarin. Your partner for simple, flexible and reliable BWT compliance.

www.optimarin.com

Optimarin engineers install a BWM system at sea

processes of different technologies to figure out potential risks. The collaboration of the two partners will now allow shipowners to simplify the process, reaching an optimal solution of both technology and maker, while benefiting from value-added services. He adds, “This partnership is first and foremost beneficial to our clients. We believe this co-operation removes a major hurdle for many in the industry that are now racing to comply, but are finding it difficult to make a selection amongst the crowded field of suppliers. This is an exciting development – for us as suppliers and, more importantly, for our customers across the world.” Andersen reveals that the company turned profitable in 2019 and has now notched close to 1,000 orders, of which 650 have been installed, mostly retrofits. He also describes the installations at sea, which require a combination of meticulous strategic planning, smart logistics and careful dock and alongside preparations. Often, this work is undertaken with the assistance of specialist marine engineering firms such as Goltens, Hauschildt

Leiv Kallestad, Chief Executive Officer of Optimarin Marine in Denmark and Aries in Dubai. UK short-sea shipowner, Carisbrooke, has recently had BWM systems successfully installed at sea and Optimarin is currently using a specialist subcontracted riding gang to complete installations across a fleet of similar vessels for an unnamed owner whose ships trade world-wide. The specially-trained team moves from ship to ship, completing similar installations carefully planned in advance. The capacity of systems can be a constraint, Kallestad concedes. Handling heavy components in a rolling sea is clearly not possible. But he explains that the company simplifies installation by diligent preparation. Installing heavy system plant and a new overboard line in advance – in dock or alongside – whilst leaving piping and cabling to be configured at sea, saves time and makes installation at sea possible. This approach demonstrates Optimarin’s drive to meet the demands of customers who realise that “minimum compliance” is not a prudent strategy. Just having a type-approved system on-board, Andersen points out, does not mean plain sailing. If it doesn’t work properly or components fail, a ship can be delayed, detained or even diverted. If faults occur repeatedly, an operator risks reputational damage. For some owners, this approach has already proved expensive. No names are given but both men confirm that Optimarin systems have been installed a number of times as replacements for faulty systems. Treatment systems are the company’s main activity and after-sales service is therefore a top priority. Both agree that the installation curve is likely to be flatter and longer than some experts predicted earlier, but there will come a time when installations will be confined to newbuildings - the rest will be service. But Kallestad and Andersen already have their eyes on the next phase of corporate development. Applications for UV-related technologies are expanding all the time and Norway offers plenty of possibilities, with aquaculture and algaculture high on the list.

Alfa Laval’s activities in China

Alfa Laval’s PureBallast 3 has become one of the first non-Chinese BWM solutions to be type approved by the China Classification Society. With the Chinese type approval in hand, PureBallast 3 systems can now be installed on vessels that carry the Chinese flag. The type approval certificate for PureBallast 3 was issued by the China Classification Society on January 17 th this year. For Chinese customers, it provides access to one of the global market’s most respected and successful BWM solutions. “Alfa Laval has long had a strong position in the Chinese newbuilding market and has grown considerably in the retrofit market during the last 12 months,” says Peter Sahlén, Head of Alfa Laval PureBallast. “Now that PureBallast 3 has Chinese type approval, we can support all shipowners who build or sail under the Chinese flag. There are many who see the benefits of a strong international partner in BWM – one with proven UV technology that can handle large ballast water flows, but also one with global service and support.” Despite the COVID-19 delays impacting many of China’s repair shipyards, Italy’s SeaQuest Shipmanagement has ensured that the 34,053 dwt handysize bulk carrier San Felice completed her second special survey, drydock and BWM system retrofit two days ahead of schedule and 7% below budget. The completed her retrofit on March 5 th that COSCO Nantong under the supervision of a SeaQuest team. The work list included routine drydocking work, hull blasting and painting, cargo holds blasting and painting, maintenance of the hatch cover hydraulic system, other minor deck and engine works, and the installation of an Alfa Laval PureBallast BWM system, including ballast lines’ modification, new electric cabling and remote control system. The duration of the repairs was estimated at 28 days. The project had originally been scheduled for early December 2019, but was postponed for commercial reasons, before COVID-19 struck, to January 28 th 2020, just ahead

The San Felice in drydock

of Chinese New Year. During the last week of January 2020 China was severely hit by COVID-19 and COSCO Nantong, as well as all its subcontractors, was forced to stop all activities until February 8 th 2020. “We are proud of our achievement,” said Massimo de Vincenzo, director of SeaQuest’s service centre in Genoa. “It clearly shows how expertise, continuous co-ordination

between owners and managers, a strong local presence and selection of reliable partners enable demanding projects can overcome any hurdle. We are particularly grateful to the master of the San Felice and his crew for their high professionalism and commitment during such a critical situation, and to COSCO’s management and staff for the great assistance granted throughout the whole repair period”. The next vessel under SeaQuest management due for drydock, repairs and BWM system retrofit at COSCO was scheduled for March 17 th 2020.

USCG approval for Bawat system

Denmark’s Bawat has been awarded Type Approval from USCG for its BWM system and sets an industry benchmark utilising waste-heat for treatment rather than chemicals, filters and UV lamps - and all done in a truly one-pass process. The system is the only BWM system available to shipowners that relies on heat pasteurisation to kill off potentially dangerous aquatic organisms in ballast water instead of expensive and hard to maintain filters, ultraviolet lights, electrolysis systems or active chemicals. “We are extremely pleased to have been awarded Type Approval by the USCG, which has one of the toughest approval processes,” says Marcus Hummer, chief executive, Bawat,

TOTAL SOLUTIONS PROVIDER

PRODUCT ENGINEERING MANPOWER

A /SSERVICE

PRODUCTIVITY

We are BWMS total solutions provider. Having played a leading role in BWMS industry since the world's first IMO basic approval in 2006, Techcross continue to pioneer the industry standards suggesting the way forward. Based on the technologies and experiences accumulated for the past 10 years, Techcross have been set to provide total solution with safer, simpler and more varied & economical options to address the diverse needs from customers and lead them to the best service they have never experienced before.

TECHCROSS

ECS

adding that this is proof that this unique system using waste heat really works. “Most shipowners seek cost effective systems that have both IMO’s Type Approval and the more stringent USCG Type Approval to gain the reassurance that the technology works and their vessels can remain compliant of both international as well as local rules.” The Bawat system was awarded Type Approval according the updated standards set by IMO in late 2019. The Bawat technology is also unique in that there are no filters which need cleaning when clogged, there are no UV bulbs, which can break and often perform badly if the water is turbid and there are no active substances or other chemicals which need to be continually purchased, stored and handled on-board. It is also the only treatment technology that works with only a single straight-forward pass of the ballast water through the system. For vessels on time sensitive operational profiles this is a winning factor as it gives ship operators flexibility to treat the ballast water when it suits during the vessel’s voyage. Other systems on the market require the ballast water to be treated either during loading or discharge, or both, potentially influencing port stay times. Hummer also points out that the technology is highly cost-effective in that it is designed to use a ship’s own waste heat to pasteurise the ballast water rather than rely on vast amounts of electricity to be generated on-board. A final winning factor for Bawat customers is the ease of installation. As shipowners rush to find solutions, competent engineers and even drydock space, a simple to install, compliant, type-approved system with tried and tested components will make this a go-to-choice for many owners and operators.

Two PSV contracts for Evac

Evac Evolution BWM systems are to be installed on two PSVs operated by Harvey Gulf International, the US-based offshore company that specialises in providing OSVs and PSVs for deepwater operations in the US Gulf of Mexico. The 3,672 dwt Harvey Spirit and 4,000 dwt Harvey Supplier will each be fitted with Evac Evolution BWM systems with the capacity to treat ballast water at the rate of 250 m 3 /hr. “We have seen a steady rise in orders and The Harvey Spirit

enquiries since achieving USCG Type Approval last year and there is every sign that this will continue as more operators approach their compliance deadlines”, said Adam Rogers, Evac’s Head of Global Sales for BWM Systems. Based on a combination of filtration and UV technology, the Evac Evolution system has a ‘feedback loop’ which uses UV transmission as the parameter for precisely determining UV dosage. This ensures effectiveness in challenging water conditions, but saves on power during normal running. Effective in fresh, brackish and seawater, the system that has been developed over a 10 year period by the UK marine equipment manufacturer enabling vessels to operate without restriction. The system is available with capacities from 34 m 3 /hr to 1,500 m 3 /hr in a single unit. It can be supplied in modular form for retrofits or skid mounted for newbuilding applications. During 2016, Cathelco installed a BWM system on the 1,589 dwt Harvey Stone, a multi-purpose field support vessel owned by Harvey Gulf, the vessel having operated successfully over the past four years. Its record of reliability was an important factor in winning the contracts for the two latest vessels. The Evac Evolution system has now been installed on a wide variety of vessels including cruise ships, container vessels, cargo ships, trawlers and polar research vessels. Its spacesaving features have also made it the choice for a number of superyachts

BIO-UV gains IMO and USCG approval

France’s BIO-UV Group has received IMO and USCG type approval for its next generation low flow rate BWM system range. The BIO-SEA L Easy-to-Fit system had to undergo new type approval testing as it incorporates a completely new UV-reactor, designed specifically to meet market demand from the luxury yacht, expedition cruise and offshore vessel segments, where ballast water pump flow rate capacities are often under 100 m 3 /hr. A key change is the UV lamp and casing materials used in the new system. One 6 kW

BIO-SEA L Easy-to-Fit is specifically designed and adapted for ships with small flow rate

lamp can treat ballast water flows of up to 30 m 3 . A further one or two lamps can be added to the BWM system’s skid for flow rates of 60 m 3 and 90 m 3 , respectively. Based on the experience gained from BIO-SEA B range (50 to 2,000 m 3 /hr) which received USCG type approval in 2017, the system designer and manufacturer says the development provides ship operators with more competitive BWM with low CAPEX and low OPEX. With a footprint starting at 1.36 m 2 , the BIOSEA L skid is not only the most compact system on the market, it can also be split into two parts simplifying on-board delivery, installation and integration, and making it suitable for retrofit projects. With quick response times and flexibility, BIO-UV Group can deliver its modular BIO-SEA system in eight weeks – a highly competitive lead time. “So far, the new corona virus has not presented any significant risk to our activities,” said Gillmann. “As to manufacturing supplies, we currently have an inventory level sufficient to maintain production rates. The bulk of our UV systems are assembled mainly in France and Asian operations are restarting.”

Largest contract for Techcross

South Korea’s Techcross began 2020 by entering into its largest ECS installation contract to date. This contract designates Techcross ECS as the BWM system that will be installed on South Korea’s largest semi-submersible heavy transport vessel owned by local owner Megaline. The ship’s size is at 41,000 dwt, with a ballast pump capacity involving eight sets of 3,000 tonnes. Here, six sets of Techcross’ ECS 3000 model will be installed to simultaneously conduct ballasting and de-ballasting. This is the largest capacity of all BWM systems installed in South Korea. The deciding factor in this contract was the company’s extensive experience installing BWM systems in large ships, starting with the world’s first installation of BWM systems on-board several VLCCs. In addition to this contract, Techcross won contracts for approximately 50 vessels as of February, with many contracts signed for existing foreign ships as well. Techcross is set The Techcross BWM system

to install BWM systems on-board 10 ships on a rolling basis this year. Techcross also won a contract from another UK-based shipping company for seven large vessels, with capacities ranging from 900 tonnes to 3,000 tonnes, with more contracts expected to follow. Meanwhile, Techcross is processing contracts of various sizes including advance payment contracts for 16 ships owned by a Greek shipper and for 20 LNG ships owned by a Russian owner. Meanwhile, Japan’s shipbuilders Mitsubishi and Hitachi, have transferred the patent for the BWM system installation solution allowing South Korea’s Techcross to provide reliable service to clients. Under these arrangements, Techcross entered into a patent transfer agreement with Mitsubishi and Hitachi to receive the patent for a BWM system installation solution. The transfer of rights will be completed by the beginning of June at least as each country finished administrative procedures. The patent is recognised in four major shipbuilding countries including Korea, China, Indonesia and Philippines. As of 2020, Techcross holds 115 patents and utility models regarding BWM systems, related technologies, and installation solutions. The company continues to develop technology through sustained research projects, purchasing patents if needed to secure the source technology. In doing so, Techcross provides customers with reliable services under various circumstances. The key objective of this patent transfer is to ensure that all Techcross customers are supplied legal product solutions reliably within the scope of the international law, as well as to eliminate potential risks such as legal disputes. The competition in the ship ballast equipment industry will elevate for the next four to five years, which is expected to cause much fatigue for suppliers and consumers alike. The acquisition of new patents by Techcross will not only lift the risk of undesired incidents that are unrelated to individual intentions but also help clients grow their businesses. Techcross’ Singapore Office has moved to a larger office on April 1 st . In order to establish a regional base to respond to increasing orders, Techcross dispatched two employees from headquarters in May 2018 to the export incubator office operated by KOTRA (Korea Trade-Investment Promotion Agency) and the Korea SMEs (Small and Medium Enterprises) and Startups Agency, and it is now making its second leap even before two years have passed since opening the branch in Singapore. With the mandatory installation of BWM systems for the BWMC, Techcross Singapore Office has moved its offices to the nearby Jurong East area to reinforce manpower and services to respond to the explosive growth in service requests and meetings with customers since last year. The new office is over 230 m 2 in size and capable of accommodating up to 15 people, and is also equipped with a warehouse able to store more than 50 sets of materials including rectifier parts and reagents that are frequently requested for urgent dispatch, bringing added speed to the supply and provision of materials. The new office will house ten employees, including five engineers, and plans to seek further stabilisation through recruiting of more local employees. Techcross has also established a local partnership system based on material warehouses and three engineers at local service partner Dintec Singapore and a stable chemical supply from Eureka Control System, with an ultimate goal of growing into a hub for Southeast Asia service centres, including Singapore, nearby Malaysia, Indonesia, and Vietnam. SORJ

Sembcorp Marine’s AY has always had a fine reputation in the cruiseship repair and refit markets Holdings and Galp Sinopec Brazil Services.Measuring 316m in length

Cruiseship repair continue at Sembcorp Marine

Sembcorp Marine’s Admiralty Yard (AY) is the eastern hemisphere’s leading yard fort cruiseship refits and refurbishments. The yard has held this to spot for many many years and this past winter season has been no exception. Earlier this year, Carnival Cruise Line’s 113,323 gt 2008-built Carnival Splendourentered Sembcorp Marine Admiralty Yard (AY) for an US$60m upgrade to ready the 2,974 passenger capacity vessel for yearround cruises out of Australian ports. The vessel will receive Carnival’s Fun Ship 2.0 upgrades, including new bars and dining options. The Japanese cruise ship Asuka II, owned by NYK Line, drydocked at AY during January 15th to begin a US$50m upgrade completed on February 28 th . UK cruise line Cruise & Maritime Voyages (CMV) has bought two cruise ships from P&O Cruises (Australia) – the 1994-built 55,820 gtPacific Aria and the 1991-built 70,285 gt Pacific Dawn, which will be taken over in the AY facility in during 2020. They will both undergo The yard also recently drydocked P&O Cruises (Australia)’s 77,411 gt 1997-built cruise vessel Pacific Explorer ex Dawn Princess. Another cruise vessel recently in the yard was Princess Cruises’ 115,875 gt 2004-built Sapphire Princess, which is redeploying to Australia six months earlier than scheduled. Seabourn Cruises’ 41,865 gt 2018-built Seabourn Ovationwas also recently in the shipyard as wasCrystal Cruises’ 51,044 gt 1995-built Crystal Symphony Sembcorp Marine’s wholly-owned and operated subsidiary EstaleiroJurongAracruz (EJA) in Brazil has crossed a significant operational milestone with the completion of its first FPSO project.P-68, a newbuild FPSO vessel, left the shipyard recently for deployment on the ultra-deepwaterBerbigão and Sururu fields in Brazil’sSantos Basin. The vessel is constructed for Tupi BV, a consortium comprising Petrobras Netherlands,Total Brazil Services, BG Gas Netherlands

drydocking in Singapore, before being renamed and heading to the UK. and 54m in width, P-68 will produce up to 150,000 bbls of oil/day and has a 1.6m bbls storage capacity. EJA’s P-68 workscope included fabricating six modules, pipe-racks and a flare, and integrating them on the vessel along with other freeissue items. It also executed carry-over works on the FPSO’s hull, which was built by a Chinese shipyard. The 82.5ha shipyard has been operating in the Espirito Santo municipality of Aracruz since 2014 and employs up to 4,400 workers at peakperiods.Following the P-68 project, EJA will complete the P-71 FPSO modules fabrication and integration project, also for Tupi B.V.

Conversion work continues at Keppel

Singapore’s Keppel Shipyard, part of Keppel Offshore & Marine, currently has a number of large contracts underway – three FPSO conversions, an offshore turret newbuilding, and a FLNG project. The yard has also recently completed the FPSO Abigail-Joseph conversion project. The three FPSO conversions contracts are the FPSO Liza Unity and the FPSO BW Opportunity, which includes a new aft section hull, both these projects being carried out in the Tuas and Pioneer Shipyards, and theIngenium II FPSO, being carried out in the Gul Shipyard. The turret newbuilding is for the Coral South project offshore Mozambique. The long-term FLNG conversion project is Golar’sGimi FLNG, which is

Keppel celebrates the delivery of the FPSO Abigail-Joseph

being carried out in the Benoi Shipyard. Another FPSO project recently completed was the 274,333 dwt 1976-built Berge Helene, which underwent condition assessment and upgrades to enable her to operate in the Maromba field offshore Brazil. The BW Opportunity project involves the former Petrobras FPSO Cidade de Sao Mateus, which suffered extensive explosion damage during 2015. The 250,000 dwt hull of FPSO Liza Unity has drydocked at Keppel Tuas Shipyard for topsides installation and final commissioning work. Owned by Holland’s SBM Offshore, the hull of the FPSO was ordered on speculation in 2017 as the first of five hulls being built for SBM’s Fast4Ward standardised FPSO hull programme. Liza Unity has been chartered to Exxon-Mobil and will operate offshore Guyana. The hull of the FPSO was built in China by Shanghai’s SWS shipyard and arrived in Singapore in February. When operational in 2022 Liza Unity will be able to produce 220,000 bbls/day. Keppel Shipyardrecently delivered the world’s fastest brownfield FPSO modification and upgrading project,Abigail-Joseph,safely and on time, to YinsonNepeta Production, a wholly-owned subsidiary of Yinson Holdings Berhad. Chris Ong, CEO of Keppel O&M said, “This is our 134 th floating production vessel, and we are pleased to be able to fast-track the project and upgrade it in less than seven months. This achievement reflects Keppel’s track record of reliability and quality, anchored in our strong engineering and project management capabilities, which enable us to offer value adding solutions for customers.” Keppel’s scope in this project includes refurbishment and life extension work, engineering and procurement, fabrication and installation of new structures including the helideck and riser balcony, as well as the installation, integration and completion of topside modules. Lim Chern Yuan, Group CEO of Yinson Holdings, added, “This is our third FPSO conversion project with Keppel since 2012, and our close partnership has grown from strength to strength. Leveraging our FPSO expertise and Keppel’s experience in vessel conversions, we are able to achieve this significant industry milestone and bring FPSO Abigail-Joseph to market quickly, maximising its operational uptime.” Chartered by First Exploration and Petroleum Development Company on a firm seven-year contract with options to extend, FPSO AbigailJoseph will be deployed in Block OML 83/85 in the Anyala-Madu field, Niger State, Nigeria. She has a processing capacity of 50,000 bbls of oil/day and 60,000 bbls of liquid/day. It also has a gas compression capacity of 34m standard cubic feet/day (mmscfd) and a storage capacity of not less than 550,000 bbls of oil. It is designed for 15 years of operations without dry docking. Keppel has clinched 104 scrubber and BWM systems retrofit orders worth a combined value of about S$160mduring 2019. This brought the total number of retrofit projects secured to date to 108 scrubber and 97 BWM projects. Keppel has recently completed the five-year special survey and the scrubber retrofit on-board Dorian LPG-owned 84,000 m 3 LPG tankerCratis in just 30 days.The 2015-built Cratis was retrofitted with a Clean Marine 140K hybrid scrubber system. This is the sixth Dorian LPG tanker to be fitted with an exhaust gas scrubber system by Keppel. As of the first quarter of 2020, 69 BWM systems installations have been completed inclusive of eightsystems completed during the first three months of 2020. Also during the first three months of this year, Keppel has completed the repairs to a total of 16 LNG tankers. Keppel’s Offshore & Marine (O&M) Division registered a net profit of S$3m for the first quarter of 2020, compared to a net profit of S$6mthe previous year - due mainly to the share of losses from associated companies which had offset the Division’s stronger operating results. Keppel’s efforts to right size its operations and diversify from oilrelated projects over the past few years is helping it to remain resilient amid challenging conditions posed by the COVID-19 pandemic and the collapse in oil prices. Notably, renewables and gas-related solutions make up over 70% of the Division’s net orderbook of S$4.0bn as at endMarch 2020.

ST Marine delivers converted OSV

The Mariska G is an offshore supply vessel (OSV) belonging to Norway’s Rederij Groen,a shipping company specialising in guard and seismic support vessel operations. The customer’s brief was to convert this newly acquired OSV into a robust platform that could support their seismic activities. Class approval for the engineering concept was still pending when the vessel sailed into Tuas Yard during early January this year. Nevertheless, having worked with the Marine team in ST Engineering on ship maintenance and repairs over the last two years, the customer had full confidence in the yard’s experience and capabilities. The Marine team swung into action the moment Class approval was obtained by mid-January. The schedule was two months to complete the massive mission, which included the installation of a new fuel oil (FO) tank and bunkering system, as well as the streamer and hose reels required for the seismic support function. According to Dirk Klok the vessel manager in ST Engineering Marine, who was responsible for Mariska G’s redelivery, meticulous planning was the secret to the team’s success. “The removal of existing cement tanks, fabrication and conversion of various tanks into FO tanks, as well as integration of the FO system interface with the ship system were among the complex engineering works involved in this contract. To achieve the modification works within the tight timeline, we anticipated the challenges, had the right resources on standby and were well prepared.” SORJ

Meyer Werft’s Bernard Meyer

The global travel industry has been devastated by COVID-19 and, for many companies, it is not a question of when the recovery may come, but whether they will still be around to see it. Cruise lines are amongst those to have been hit hardest. A steady rise in passenger numbers and new markets in Asia had been underpinning aboom in the business. At the end of 2019, the orderbook stood at 105 ships with an estimated value of around US$63bn and specialist cruise ship builders had record orderbooks. What a difference a month makes! By the end of January, the sector was in crisis. Infected ships could not find a port to dock and evacuate sick passengers, multiple sailings were cancelled, builders rescheduled construction timetables and laid off workers and cruise lines’ finances went into free-fall. The world’s largest cruise group, Carnival, with 105 vessels, told US Securities and Exchange Commission in a recent filing that it is spending $1bn a month on fleet upkeep while revenues have dried up. Meanwhile, Royal Caribbean Cruises, the second largest cruise group, announced early in May that it was burning cash at a rate of $250-275m a month. The company, with 62 ships lying idle, has already assigned some vessels to cold lay-up for an as-yet indeterminate period. “We are in a great crisis,” declared Bernard Meyer, CEO of the privately owned Meyer Group, a shipbuilding group established 225 years ago and now a specialist cruiseship builder. Meyer, who has been in the business for 47 years, said he had never seen anything like the impact of COVID-19. Speaking in a video released by the shipyard in the middle of April, Meyer said that the sector would sustain huge losses this year and would take years to recover. Meyer Werft would be rescheduling its construction timetable, introducing short-time working, and discussing with customers delivery delays and other measures. One customer had even told the shipyard that he no longer wanted the ships he had ordered there, Meyer said. Now, cruise lines and builders – still reeling from the speed at which their fortunes were dashed – are holding frantic talks to assess possible strategies. Some ships have been delivered recently but all have had their early itineraries cancelled or postponed. Meanwhile, schedules for existing ships have been cancelled or postponed and new vessel

deliveries over the balance of this year delayed into 2021. More than 400 cruise vessels are now in some form of lay-up, ranging from ‘hot’ right through to full ‘cold’ decommissioning. Meanwhile, ship launches that have been postponed include Princess Cruises’ 3,560-passenger Enchanted Princess which was due to have a naming ceremony in Southampton on June 30th, and P&O Cruises’ 5,200-passenger Iona where final outfitting work at Meyer Werft has been delayed and a delivery date reflecting this had not been released at the time of writing. The cruise orderbook extends until 2027 although many of the specialist yards have building slots available before then. Now, though, new ship deliveries in the peak years of 2021, 2022 and 2023 are likely to be pushed back under mutual agreements made in the interests of both cruise lines and builders. Meanwhile, postvirus health-and-safety work requirements and necessary workforce adjustments resulting from the crisis will inevitably have a long-term impact on ship construction schedules, shipyard capacity, and delivery dates. Two new cruise lines were due to launch their first vessels this year.

Richard Branson’s Virgin Voyages took delivery of the 2,800 passenger Scarlet Lady from Fincantieri on February 17 th . With a new business model aimed at attracting young adults and no children, the company scheduled overnight stops at Dover and Liverpool in the UK before the ship’s transatlantic voyage for New York. Now, she is one of about 50 cruise vessels off the US coast near Fort Lauderdale. Another new line – The Ritz-Carlton Yacht Collection, a company within the upmarket Ritz-Carlton Hotel group –was due to introduce the 298-passenger Evrima in June this year, but this has been postponed until April 2021.

Short- and long-term opportunities for yards

Some repair yards have already benefited from the rescheduling of planned maintenance by cruise lines. Hapag-Lloyd brought forward maintenance on two expedition vessels – Hanseatic Inspiration and Hanseatic Nature – at Blohm+Voss. Meanwhile, Germany’s Phoenix Reisen opted to refit the 1973-built Albatros and the 1988-built Amera at Germany’s Emden Dockyard, which has aimed to attract cruise business for some time. The Phoenix Reisen-owned, 1991-built Amadea has also completed an overhaul at Germany’s Lloyd Werft. Tallink Group brought forward scheduled maintenance on the cruise ferry, Silja Symphony, at Finland’s Turku Repair Yard. Outside Europe, Sembcorp Marine Admiralty Yard, widely considered Asia’s leading cruise repair facility, has undertaken repairs and upgrades to Princess Cruises’ 2004-built Sapphire Princess and Crystal Cruises’ Crystal Symphony, built in 1995. Other repair yards in China and the Middle East are also believed to be eyeing up current opportunities. However, with virtually the entire cruise fleet idle or laid up, repair yards specialising in cruise are likely to have a tough time for months to come. Thereafter, however, they may well be able to play catch-up as out-ofservice vessels undergo the overhauls, upgrades, repairs and surveys necessary before they are recommissioned. Much of their potential success, however, will depend on cruise lines’ lay-up strategies and their choice of location. Most operators were caught on the back foot as the speed and scale of the crisis overwhelmed them but the type of lay-up – particularly for medium- to long-term arrangements – is important both for running expenses and recommissioning costs. In a recent filing to the US Securities and Exchange Commission, Carnival Corporation said, “During the pause in our global fleet cruise operations, certain of our ships will be in warm lay-up where the ship will be manned by a full crew, and certain of our ships will be in a prolonged ship lay-up where the ship will be manned by a limited crew. We currently estimate the substantial majority of our fleet will be in prolonged ship lay-up.” Sector experts expect that most cruise lines will follow a similar strategy. Even if the virus is brought under control more quickly than expected, demand for cruises is likely to remain low for the moment. So cruise executives and their marine superintendents have been weighing up the pros and cons both of strategies and possible lay-up locations. Whatever the strategy, however, keeping a ship idle is not cheap: experts suggest a range of $1m a month for a large cruise vessel in cold lay-up to double or treble this for hot lay-up, meaning that the ship is fully crewed and ready to sail within a few hours. In long-term cold lay-up, ship systems are shut down, electronic installations removed where possible, with both structure and fittings protected as much as possible from extremes of temperature and humidity. Even if lay-ups extend to more than a year which, some experts say, may well be possible for at least some of the fleet, a docking is likely, a refit possible and a major engineering overhaul essential. Hull coatings will require close attention, if not renewal. For repair yards, cruise lines’ decisions at this stage are likely to signal possible future business. Classification society Lloyd’s Register, which has the largest share of cruise vessels in its portfolio, gave indications recently of recommissioning times. At one end of the scale, ships in hot lay-up should be ready to sail within 24 hours and are unlikely to require external support from a repair yard. In warm lay-up lasting between one and twelve months, recommissioning could take up to one week and involve repair yard services. In cold lay-up of 12 to 60 months, a spell in dock and a threeweek recommissioning process provides an indication while ships in longterm lay-up of more than five years could spend up to three months in preparation to sail again. Cruise ship executives and marine superintendents have inevitably been weighing up the pros and cons of various lay-up locations. For those with long memories, Norwegian fjords were viewed favourably by large tanker owners in the depression of the 1980s. Temperature, humidity and fouling risk were all low; waters were mostly sheltered, and a comprehensive service network was close at hand. Yards in Europe which could offer repair services for large cruise vessels in future include Denmark’s Fayard, which has the large Odense Dock (415 m by 90 m), Blohm+Voss and Lloyd Werft in Germany, Navantia’s Cadiz shipyard and Chantiers Naval de Marseille in France. Meanwhile, Grand Bahama Shipyard (GBS) – owned by Carnival, Royal Caribbean and Grand Bahama Port Authority, will be well-placed. Not only will it have guaranteed business from its shareholders who have laid up vessels nearby, some adjacent to cruise company-owned private island resorts such as Cococay, but the yard will also be well-placed for business from other cruise ship owners with vessels in the vicinity. There were 50 cruise vessels off the coast near Fort Lauderdale early in May. Owing to shortage of space, other vessels are idle near Gulfport, Jacksonville and Mississippi. The questions at that point could be: is there sufficient repair capacity to service the fleet and how long will it take? SORJ

Cruiseships in Fort Lauderdale

Tanker earnings are likely to remain solid for some time

Tanker owners cash in on extraordinary market dynamics

There are many shipowners whose operations are being ravaged by the spread of COVID-19, with lockdowns across the world preventing normal industrial activity and crushing demand. The virus is likely to have dealt a lethal dose to many companies whose business models now lie in bits. Luckily for tanker owners, they are not amongst them. Quite the reverse, in fact. Tanker owners have benefited from extraordinary and unprecedented market dynamics that pushed some VLCC rates briefly to more than US$400,000 a day in April. They then eased back to the $200,000s for a spell, before falling back further during the last week of April. Even these lower rate levels, however, are highly profitable. And with no dramatic fleet growth on the cards, tanker earnings are likely to remain solid for some time, analysts predict. As is often the case in the factors that determine the fortunes of tanker owners, it is economics and geopolitics that have set the scene. A failure by OPEC+ to agree on production cuts in March sent the Saudis on a mission to win market share, upping output by thousands of barrels a day. The Russians also boosted production. Trouble was – nobody wanted the extra oil. The virus had wiped about 30% off daily demand as people stayed home, flights were grounded and heavy industries closed the gates. It is too early to assess the impact of a new round of production cutbacks but experts believe the latest moves have come too late. The world is already awash with unwanted oil and producers are still turning out far more crude and products than are needed.

Negative territory

When the oil surplus began to accumulate, oil prices crashed, with US benchmark West Texas Intermediate plunging into negative territory (lower than minus $40 for a brief spell on April 20 th ) for the first time ever. At the beginning of May, Brent crude was priced at $26.60 and WTI at $19.70. Analysts predicted little change to the underlying fundamentals – demand for crude oil was not getting a boost any time soon and even though more supply cuts had been agreed by OPEC+ members and other producers including Norway, they appeared not to have an impact on the market sufficient to offset the collapse in demand. In more normal times, weak demand for crude oil and products would spell bad news for tanker owners. But this market is far from normal. Hoping to avoid production shut-ins and refinery closures, producers and refiners were still selling into markets awash with crude and products. Shore-based storage facilities were filling up quickly and charterers turned to floating storage on tankers ranging from the largest VLCCs right through the range to MR product tankers.

Contango market

In this so-called ‘contango market’, the forward curve for crude oil and product prices makes it worthwhile to buy cheap oil now, store it at sea, and sell it in the future at a higher price. Contango conditions are not uncommon, particularly in the tanker market, but the sheer scale of this one has been unprecedented. The outcome for tanker owners was fantastic – in a market that should have meant ships lying idle at anchorages or heading for lay-up, they’d been fixed instead on lucrative storage contracts. It is telling that bullish tanker earnings expectations are not only being talked about by owners. The fact that big ships are being fixed at robust rates on six-month to year-long deals indicates that charterers are expecting the firm market to last for some time. Meanwhile, owners are in the unusual and lucky position of being able to choose between fixing a long-term storage contract at a lower but still solid rate and continuing with spot business where earnings have a shorter window but offer a better return.

Across the board

Unusually, the drive for floating storage has spread across the tanker board. At the end of April, more than 100 VLCCs were engaged on storage contracts. Suezmax and Aframax units were also storing oil. According to Clarkson figures, 60m dwt of dirty tanker capacity had been fixed for storage by the end of April, an increase of more than 150% from the beginning of March. However, it is not only the owners of crude tankers that are benefiting. Again unusually, collapsed demand for aviation and land transport fuel and a decline in demand for oil products used in industrial processes has meant that many product tankers have also been fixed on storage contracts. Clarkson estimates that the capacity of products tankers fixed on such deals rose almost ten-fold between the beginning of March and the end of April, reaching about 10.5m dwt by then.

Star performers

The impact on publicly quoted tanker companies’ share prices was dramatic. Euronav is the world’s largest VLCC and Suezmax owner - DHT Holdings also owns VLCCs, Scorpio Tankers is the largest operator of product tankers, with a fleet of 137 vessels. All three companies were due to report first quarter earnings early in May and analysts were expecting some phenomenal numbers, both in terms of first quarter earnings and projections for the future. Late in April, investors had piled into tanker stocks, with more than $1bn ploughed in on a single record day. Their expectations were understandably sky high. Whatever lay down the road for tanker owners in 2021 and beyond, this year would see huge dividend pay-outs, debt write-downs and a transformation of balance sheets. Despite the euphoria, however, some analysts agree that whilst tanker stocks are a good risk in

the short term, what goes up must come down. They warn that at some stage, the huge number of tankers engaged in storage deals will have to be absorbed again into the trading fleet.

Post-viral demand

At such time, they point out, global oil production may have fallen significantly as producers adjust to lower post-viral demand. There could be fewer cargoes, no need for storage and, potentially, a significant number of tankersseeking cargoes in the crude and product markets. Concordia Maritime Chief Executive, Kim Ullman, detailed some of these issues in a late-April conference call with analysts. He said that the relatively small product tanker orderbook would bereassuring for owners when the storage boom is over. He pointed out, however, that declining oil production coinciding with a potential increase in consumer demand would mean that consumption exceeds production and oil in storage would be released back in the system. Such an inventory drawdown, Ullman noted, would not be good for tanker owners because consumers can access products that do not require long-haul shipments - supplies of product could well be stored locally on land requiring no shipping capacity at all. However, he conceded that the volume of tankers now engaged on relatively long-term floating storage contracts would mean that tanker supply would remain constrained for a significant period.

Tanker boom – implications for repairers

The unexpected tanker boom has certainly encouraged many owners to look again at their fleet planning strategies, particularly in relation to older tankers that were due to be phased out soon. Options for such vessels are limited at present – the global recycling market is effectively closed for business and no-one would want to leave an elderly tanker, provided it was seaworthy, lying idle or at an anchorage in Fujairah or Singapore in this buoyant market. So, the obvious option could be to undertake life extension with perhaps an unexpected intermediate or special survey, an unforeseen ballast water treatment system installation, and even a scrubber retrofit if another five years of trading looked possible. On the other hand, in the short run, storage options lookattractive, particularly over a period of six Concordia Maritime Chief Executive, Kim Ullman

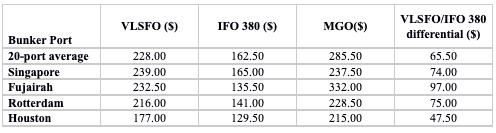

to 12 months. Such a contract would mean that there is no downside on a thirsty old engine, no question of scrubbers and, possibly, a way round a ballast water installation. Sources contacted by SORJ on this last point, however, were not able to provide a definitive answer by press-time. They were able to agree, however, that this market potentially offers a new lease of life to elderly vessels that were destined for the recycling yards of the Indian subcontinent sometime soon. And this development opens up a whole range of opportunities for tanker repair yards. Clarkson figures reveal that there are about 190 VLCCs already 15 years old or more - 40 of them are over 20 years. Another 380 crude tankers in other size categories are more than 15 years old. The total number of crude and product tankers 15 years old or more is almost 1,340. For tanker owners considering the possibility of further trading for older vessels, the question of scrubber installation is no longer so tricky. At the price differentials between heavy fuel oil and very low sulphur fuel oil prevailing at the beginning of the year, a scrubber investment looked attractive, given sufficient time for amortisation. For timecharter deals, scrubber-fitted tankers are clearly much more attractive to charterers who pay for bunkers. Now, though, as bunker prices have fallen, the differential has narrowed significantly, extending the possible payback period for a scrubber investment. Across an average of 20 bunker ports tracked by Ship and Bunker, the differential at the beginning of May was $65.50 (see Table). Many owners are known to have assessed potential returns

We supply products & solutions for all your tank management requirements.

Tank Cleaning Equipment Tank Level Gauging Gas Freeing Fan P/V Valves Electropneumatic Gauging

www.scanjet.se

This market potentially offers a new lease of life to elderly vessels

on scrubber investments at a far higher price differential than this.

Table: Bunker prices at key hubs – May 1 s Source: Ship and Bunker

Meanwhile, following lengthy contracts storing oil at sea, tankers are likely to require significant recommissioning maintenance. Components that have not been monitored remotely will require inspection and possibly overhaul, class extensions will require attention, hulls and propellers will need cleaning and polishing and other essential maintenance that is not possible with minimum save manning requirements may also be necessary. Dockings may not be required but alongside or afloat operationsmay offer the next best option. Is there another opportunity here for mobile repair squads made available by repair yards.

Stopford’s analysis

Dr Martin Stopford, President of Clarkson Research Services, has suggested that COVID-19 could be the catalyst required to accelerate the global shipping industry’s digital adoption and emissions reduction endeavours. Together with other industry experts, he is concerned that the IMO’s decarbonisation targets are based on a relatively short timeframe and, despite the opportunities made possible by Industry 4.0, many shipowners and operators continue to operate as though business can

continue as usual. In a recent White Paper, he assesses three possible Scenarios resulting from virus opportunities which present threats but opportunities too. Stopford believes that a catalyst is required to propel global ship design and technology to a position where meeting IMO 2030 and 2050 decarbonisation ambitions may become possible. The inference is that ‘business as usual’ is simply not enough. A major sea change is required, he believes, as shipping embraces new digital technologies which are still an anathema to many companies. All three of his Scenarios are bad news for newbuilding yards because the global economy is inevitably suffering from the impact of the virus and shipping demand will therefore suffer. Even in the most favourable one, new contracting will fall away in the near term. Thereafter, expansion in the world’s sea trade will revert to its historical average of an annual 3.2% although average ship speeds are likely to stabilise at around 12 knots – roughly the same as today – despite the fact that the average design speed of ships in operation today is 14 knots. In his second Scenario, the virus proves harder to shake off and it is not until 2023 that the G7 economies are back to a new normal, with virus testing, immunity identification and inoculation. Sea trade recovers in 2024 but grows at a slower rate – 2.2% a year between then and 2050 – owing to the impact of higher low-carbon transport costs, a reduction in the transport of fossil fuels - and some reduction in demand from shipping’s heavy industrial consumers. His worst case, the third Scenario, is a serious worry. Lockdown measures don’t work fast enough to prevent high or recurrent infection levels, governments face funding problems or businesses struggling to re-establish themselves. Global oil trade falls steadily and by 2024, the world’s total trade by sea has dropped by 15%. For shipping, Stopford says, this recession is similar to the 1980s cycle, but not as bad as the 1930s. The result is that sea trade grows at just 0.5% a year from the trough until 2050, reaching 11.9bn tonnes by the middle of the century – slightly less than today’s seaborne trade volume of a about 12.5bn tonnes. SORJ

No fuel like an old fuel

If I was thinking about renewing my fleet (instead of sitting “locked down” in my garden idly wondering whether to buy a few cheap enormous cruiseships, or a couple of hardly used Airbus A380s), how on earth am I going to propel any vessel I might get around to ordering? Assuming a shipyard can be found that can build me some tankers or bulk carriers in the next year Michael Grey or two, these ships are going to be around for the next quarter century, and this question really needs to be answered before we sign the contract. There are a growing number of people, not all of them the noseringed middle-class ‘activists’ – I nearly wrote ‘terrorists’- of Extinction Rebellion, who suggest that hydrocarbon fuel is really operating on borrowed time. If I opt for conventionally fuelled big diesels which operate to the economic criteria and horsepower that is needed for large, ocean going ships, are they going to retain any value, 10 years into their lives? All ships represent deteriorating assets, but might such an investment today amount to a reckless waste of my shareholders’ cash. And with the banks increasingly seized with a sort of green ‘wokeness’ where they are more interested in your environmental credentials, than the returns you need to pay the blighters back, it could be increasingly hard to finance conventionally powered tonnage.

Dockgate

There is no shortage of advice about the ‘fuel of the future’, although with the exception of LNG, which is allegedly only a ‘bridging solution’ to the sulphur problem and really leaves the carbon conundrum un-addressed, most remain very much in in the realms of the future, rather than the present. There are experiments being undertaken with ammonia, on a small scale, although these look promising. There are various small craft operating with hydrogen fuel cells - the same fuel is being used in some buses in London and other progressive cities. Just a matter of scaling up, you might ask? Except that another desktop study concluded that if you wanted to power a big bulk carrier with this splendidly clean fuel, on a 10,000 mile voyage, the payload would be so small that you could load it in wheelbarrows. Waste vegetable oil is regarded by some as a useful fuel that will answer the dual problems of harmful emissions and what you do with the inedible products of several million deep fat fryers. There are a few brave suppliers already offering various blends of bio-fuels that are said to have excellent calorific value and don’t smell like burned cod. But could you eat enough fried food to fuel the big diesels of whole fleets of ocean-going ships? These are, once again, early days and small scale business that only a brave owner would put his shirt on to fuel a future fleet. Maybe somebody will achieve a spectacular breakthrough, although one wouldn’t suggest that it would be soon, and the years are ticking away to the zero-carbon deadline. It is suggested that both the industry and government will need to put their collective shoulders to the research wheel, but we are still just talking about these matters. On the subject of waste, it was not many years ago that I corresponded with an Italian engineer who had devised a design to burn solid waste in a large containership, once again answering the problem of ‘fuel poverty’ with the need to dispose of waste that might otherwise end up in a landfill. This was no eccentric inventor, but a bone fide professional mechanical engineer who made his living

One of Nauticor’s LNG bunker vessels supplying DEME’s new offshore wind installation vessel Orion in northern Germany

The bulk carrier Tomini Destiny