How Banking Circle Group in the US is helping to solve the big dilemma at the heart of ‘rebundling’ Squar ıngthe Cırcle COVER FEATURE us.money2020.com | ffnews.com New rules of the game Currencycloud and Integrated Finance on APIs and partnerships INTEROPERABILITY Going with the flow Reimagining real time with The Clearing House INSTANT PAYMENTS The digital me Why UL Solutions believes wallets are the way forward IDENTITY & VERIFICATION

THE PAYMENTS BANK FOR THE NEW ECONOMY

Banking Circle’s proprietary technology enables Payments businesses and Banks of any scale to seize opportunities, compete and grow. From multi-currency accounts to real-time FX, international payments to local clearing, we’re quick, low-cost, and secure.

Bypass old, bureaucratic and expensive systems and enable global banking services for your clients.

bankingcircle.com

Welcome to

Beyond the bright lights and blackjack tables of the Las Vegas strip, fintech meets reality in the zip codes where kids go to school hungry.

Las Vegas isn’t among the poorest cities in the States but its poverty rate runs several points above average for the US. Charity workers see little evidence of the White House’s Build Back Better Act having an impact in some of these streets.

If fintech can live up to its promise of ‘financial inclusion’ – words we’re likely to hear used a lot at Money20/20 – it’s in downtown suburbs where it could be most keenly felt. Where earned wage access solutions could help a family avoid a crisis before the next paycheck drops; where a Latino business owner who, statistically, finds it twice as hard to secure lending as their fellow white entrepreneur, can be helped by radically different, data-rich decision-making; where BNPL could allow a mom to buy the basics her child needs to continue their education and graduate.

Money20/20 is a unique opportunity for the industry to come together on common ground, find consensus and strike up new working relationships – and, of course, to have fun. It’s one of the most convivial events on the circuit. But for the sake of those across the city, let‘s remember what it’s all for.

Squaring the Circle

The rebundling of financial services by tech-driven companies previously associated with just one vertical has highlighted infrastructure challenges as much as it has created market opportunities. Banking Circle Group’s entry into the US market seeks to resolve that dilemma

Touch & go!

We find out how Italy’s Credem bank worked with Temenos to get close to customers and give them ‘remote control’

Going with the flow

The Clearing House (TCH) sets out the case for transforming business payments at home and abroad

The digital me

UL Solutions is one of the gatekeepers to trust in, and global acceptance of, mobile identity, which could make all physical documents irrelevant

New rules of the game

Currencycloud and Integrated Finance consider the fundamental problem of interoperability that platformification represents

The rail thing

Payments provider ACI Worldwide joins Nationwide and Pay.UK to consider the opportunities presented by the biggest change to the country’s A2A payments system in more than a decade See it, touch it, smell it, hear it!

Cards are so much more than a payment utility – and they’re not going out of fashion any time soon, says Rüdiger Vogt at G+D

Who’s washing the dishes?

Curt Queyrouze, President of Seattle’s Coastal Bank and CCBX, its BaaS division, considers whether it’s time to rethink the organisational structure of a bank

Chequeing out?

The US is a long way behind much of the rest of world in weaning itself off paper transactions. Carl Slabicki and Isabel Schmidt from BNY Mellon explain what the bank is doing to accelerate it

us.money2020.com FintechFinancePresents 3

4 8 10 12 16 18 22 25 28 All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Sue Scott PRODUCTION Taylor Griffin HEAD OF CONTENT Douglas Mackenzie CONTENT TEAM Bobby Suman Aniqah Majid CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan “Dusty” Drew ONLINE EDITOR Lauren Towner ONLINE TEAM Lewis Johnson-Pitt FEATURE WRITERS David Firth Tracy Fletcher Martin Heminway Alex King Martin Morris Sue Scott Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP SALES TEAM Tom Dickinson Nicole Efthymiou Shaun Routledge VIDEO TEAM Lewis Averillo-Singh Max Burton IMAGES BY www.istock.com PRINTED BY LA Printers Ltd "PROUDLY NOT ABC AUDITED"

Squarıng the Cırcle

The rebundling of financial services by tech-driven companies previously associated with just one vertical has highlighted infrastructure challenges as much as it has created market opportunities. Banking Circle Group’s entry into the US market seeks to resolve that dilemma

A survey published this year by open banking platform Plaid found that more US consumers now use fintech services than they do video streaming and social media. Let’s take a moment to digest that fact.

In 2021, 88 per cent of American people accessed an app to manage their financial lives, up from 58 per cent in 2020. Fintech is now so much a part of US society that 71 per cent of consumers say that they talk about digital finance in their everyday conversations. Comparing features on Zelle or Venmo is as common as discussing last night’s Netflix mini-series or your favourite new meme.

That’s an extraordinary position of power, influence and responsibility for the industry to be in. How are providers responding? Many by mutualising and embedding services like never before; assembling a curated menu of options that are adjacent to their core offering and chosen to meet their users’ specific needs. That’s happening in the B2B environment as much as it is in B2C.

It’s a big swing of the pendulum, away from the ruthless ‘unbundling’ of financial services by a new wave of specialist digital providers who mined deep veins of financial exclusion and disillusion with banking services that followed the Great Financial Crash 15 years ago. Now they are busy ‘rebundling’ those services and adding more to offer a one-stop-shop, stocked with options that at least equal and often exceed those previously available through the mainstream banks, whether that’s payment services providers moving into lending or

investment platforms offering debit cards.

In the last few years we’ve seen plenty of examples of that in the US market, but these models differ from legacy institutions’ in many respects. While bundling is a tried and tested strategy for improving customer loyalty and increasing lifetime value, the customer experience these new players deliver is unrecognisable from what went before. As is the technical challenge in achieving it.

The integrations necessary for this ‘platformification’ of financial services, often embedded in another (not necessarily financial services) channel, have not kept pace with the aspiration at the slick front end, where much of the investment in startups focussed – rightly, in the first instance – on UX.

“Rebundling products is great for improving customer stickiness, as it allows businesses to offer a complete lifecycle of

Interoperability is increasingly an issue as the world becomes more globalised

Anders la Cour, Co-founder & CEO, Banking Circle Group

financial services to their customers,” says Anders la Cour, co-founder and CEO of Banking Circle Group. “But in the race to rebundle, the strongest multi-solution platforms will be those built on modern tech stacks.”

The key challenge is interoperability. “It’s increasingly an issue as the world becomes more globalised,” says la Cour.

“Many industries have been radically transformed at the front end, but often far less so when it comes to the back-end systems – it’s no different in payments.”

The trend hasn’t escaped the notice of investors. As seasoned fintech VC Mark Goldberg, a partner at Index Ventures, which has dual headquarters in San Francisco and London, commented recently: “The next wave of infrastructure will be towards one superstore that happens to sell 10 products, not 10 companies that sell one.”

With capital flowing most freely into later-stage fintechs over the past five years in the US, and mega raises in 2021 giving many a decent runway to aggregate services and grow into last year’s eye-watering valuations, the back-end infrastructure’s ability to support expansion is likely to come under increasing scrutiny. Banking Circle Group’s move into the US will help address those shortcomings, promises la Cour. He explains that, as companies accelerate the digitisation of their customer and supply-chain interactions, the Group acts as a bridge, creating the interoperability that is still lacking in banking and payments.

“We facilitate easy movement between financial systems and services, regardless of the markets that our clients and their own customers are in. As a back-end provider for other financial services businesses, our focus is on taking away the complexity and handling the infrastructure, leaving our clients to focus on what they do best.”

At the heart of the Group, is the Luxembourg-based Banking Circle bank,

: COVER FEATURE FintechFinancePresents ffnews.com4

headed by the Group's co-founder Laust Bertelsen, which has been providing banking, payments and embedded finance services across Europe since 2016, building a ‘super-correspondent banking network’ at the centre of which sits its own ‘bank for the digital economy’. Last year, it was granted a full banking licence in the state of Connecticut, in preparation for the Group’s move into the North American market.

The bank’s track record in Europe is impressive. At the time of writing, it had processed more than $250billion in transaction volumes since its launch on behalf of payment companies, other banks and marketplaces. And it processes six per cent of Europe’s B2C e-commerce flow. It’s built a client base of more than 250 financial institutions and larger marketplaces, including payments giant Stripe’s operation in Europe. It delivers access to 12 local clearing schemes through a combination of direct clearing and partner banks, enabling cross-border payments in 25 currencies.

The bank aims to become one of the few in the US that are able to deliver real-time payments at the lowest possible closing

cost between major clearings globally. It will do that by leveraging its already well-established network and direct access to US clearing.

That will be welcome news particularly for export-focussed businesses in the States, which may have been frustrated by the lack of fast, frictionless and transparent cross-border services that are only now being seriously explored by the two existing federal payments operators.

“Banking Circle’s goal is to reduce the cost of cross-border payments to just five cents and the time a transaction takes to under five minutes,” says Bertelsen.

While that might sound ambitious, similar targets at very high volumes have already been realised in Europe by moving fully to the Cloud in 2021.

“With an entirely Cloud-based infrastructure, we’re able to evolve architecture at rapid speed,” says Bertelsen. “The Cloud increases control, capacity and efficiency, and means our developer teams can take an agile approach to make specific upgrades in a decoupled way, which also

has a customer experience advantage, whereby systems can be improved without impacting other critical workloads.

“APIs also enhance the customer experience, facilitating effective integration between platform functionality and customer workflows. The advantage is clients have the ability to link payment services to their own infrastructure, which is unviable when using slower legacy systems. Banking Circle’s APIs enable clients to instantly access data to accelerate the process, in turn promoting a seamless user experience.”

The bank’s move into the US will not only open faster, cheaper export corridors to State-side businesses, but, of course, give US market access for European clients.

“We partner with banks, financial institutions and fintechs all across the globe, enabling them to gain geographical reach and access markets their customers want to trade in,” says Bertelsen. “US organisations are no different. For payments companies and fintechs looking to offer their customers payments services beyond North America, partnering with Banking Circle means they have the potential to handle transactions in up to 25 currencies without facing prohibitive costs, all with full regulatory compliance for each jurisdiction.

us.money2020.com FintechFinancePresents 5

Solving the rebundling puzzle: (clockwise from top) Anders la Cour, Laust Bertelsen and Mikkel Velin

“Working with US companies is important to our mission because we want all payments businesses to be able to unlock access to the global markets through fast, low-cost payments and multi-currency account solutions.”

Banking Circle recently announced the addition of USDC stablecoins to its payment rails for conversion from fiat currencies.

“This latest addition is an important step as we grow our super-correspondent banking network, giving banks and payments businesses the ability to step outside the traditional correspondent banking model and extend their offerings,” says Bertelsen. “Web 3.0 is already completely transforming the payments landscape and we encourage US banks and financial institutions to get onboard now.”

Banking Circle is taking on a job that very few other banks or fintechs want to tackle – investing in integrating a vast network of

YOU LEND

local clearing and payments schemes, which, points out Bertelsen, addresses another key issue.

“Many sellers and merchants still face financial exclusion as they are unable to access payment solutions that make it easy

and speed to the threat of de-risking. In creating this super-correspondent banking network, direct access to local payment rails cuts the cost and time of payments for specific currencies, opening up significant revenue opportunities in some geographies.”

Although it is expanding into the US, the bank won’t be going up against existing local banks, stresses la Cour. “Rather, through us, banks and financial institutions in the US can enable their own customers to operate in Europe and receive domestic payments from the region.”

for them to serve different geographies and accept different currencies. The root cause is that the financial institutions that underpin e-commerce businesses continue to struggle to tackle some of the inherent issues around international payments, from the cost

Cross-border payments are fundamental for businesses if they are to grow beyond their borders. And it’s likely to feature among additional services that, according to one survey last year, 53 per cent of US financial companies are looking to include for clients. The great rebundling is happening. It’s just a matter of making sure the payments infrastructure keeps up.

A GLOBAL OPPORTUNITY FOR SMEs

Embedded finance is said to have accounted for nearly five per cent of US financial transactions in 2021.

While that makes it the world’s largest market, there’s plenty of room for growth, says Mikkel Velin (left), CEO of YouLend, an embedded SME financing solution and part of the Banking Circle Group.

Already partnering with a number of enterprise platforms, such as eBay and Shopify, YouLend uses alternative data points to carry out credit risk assessments for small businesses, incorporating data points such as website analytics, social media trends and online reviews to predict the growth of a company and reduce reliance on outdated financial information to inform credit decisions.

Its launch in the US as part of the Group’s expansion into the region comes at a time of increased optimism among small business owners, despite the economic headwinds. The latest Small Business Recovery Report to be produced by Kabbage (part of American Express), revealed in September that many SMEs are looking to invest, particularly

in digitisation and making more of customer data. We asked Velin what YouLend could bring to that SME growth market.

FINTECH FINANCE: YouLend offers financing solutions to SMEs via payment service providers, banks, e-commerce platforms, marketplaces and techcos. Does that give you a particular perspective on the embedded economy?

MIKKEL VELIN: We think the embedded financing market in the US is still significantly underserved. Only a small proportion of enterprises are offering such products to their merchants and businesses and many of those are still working with clunky platforms or complicated and slow user experiences.

YouLend has already refined its offering across Europe, with one-click applications and instant offers. Being part of the Banking Circle Group gives us a significant advantage, too, in being able to quickly and cheaply implement a suite of complementary financing and payments products to enhance a merchant’s experience, so our partners can create an ideal roadmap for them.

FF: How do rebundled services and embedded solutions benefit businesses? There are clear signs in the payments space that finding opportunities for partnership between providers is delivering value to both those providers and their end customers. That applies to embedded financing as well. Enabling customers to quickly access multiple financial products is what most want – to build trust and familiarity with their main provider and go to one place to manage all their business activities, from making sales, to taking payments, to applying for funding for future growth.

FF: Can YouLend expose SMEs in the US to global lending opportunities, too?

MV: A key aspect of what we offer our partners is product parity, globally. We understand the challenges of running an enterprise platform across different geographies. So, we make it possible for these platforms to offer the same products everywhere, whenever they wish. We also offer clear improvements on key aspects of our partners’ growth – our solution spurs merchants’ growth by 15 to 35 per cent on average, for instance, and reduces their churn by half.

: COVER FEATURE FintechFinancePresents ffnews.com6

Clients have the ability to link payment services to their own infrastructure, which is unviable when using slower legacy systems

Laust Bertelsen, CEO, Banking Circle

about payments.

valantic FSA is at the heart of the evolving banking and payments landscape –delivering powerful applications through X-Gen, our low-code/no-code platform. To find out more about our low-code payments solution, visit www.valantic.com/fsa valantic FSA Passionate

Digitize. Augment. Evolve.

TOUCH & GO!

Florence was the birthplace of the Renaissance and Italy is where the ‘old’ modern bank began – the world’s longest-surviving bank, Banca Monte dei Paschi di Siena, can trace its roots to 1472.

Now, the country is very much part of the new banking renaissance with banks embracing digital to replace or at least compliment their bricks and mortar branches. Credem is one such incumbent that is undergoing a technological and cultural transformation, its recent journey shaped by the seismic event that dominated our lives for two years – COVID-19.

Lombardy was the first place outside China to be hit hard by coronavirus, leading to Italy imposing the world’s first national lockdown on March 9, 2020. It was at this moment that the bank’s teams began collaboration with Swiss software provider Temenos on the mobile app that is now the centrepiece of its omnichannel offer.

By January 2021 – nine months later – it was finished and ready to replace Credem’s existing app, which had proved difficult to update with new features. For the bank’s head of digital channels and business unit Fabio Caliceti, the new Touchpoint app became like the customer’s TV ‘remote control’, allowing them to tune into Credem’s accounts and services at the touch of a button.

“It’s an app that takes us towards a new service model, an evolving ecosystem service model that really

enables new ways of customer engagement,” he says. “At Credem, our business model continues to be based on strong human relationships, but the mix between digital and human is key. This app is now the remote control of our business."

Talking to Caliceti, alongside colleague Lorenzo Villa, Credem’s IT leader of digital channels, it’s obvious the bank has undergone a cultural transformation alongside the switch to digital technology. The customer-centric approach to modernisation is obvious. But so, too, is the realisation that it’s not just financial products that win customers for banks, but

Its IT team has faced the legacy issues common to all big banking incumbents and the partnership with Temenos was its solution to break free of them by deploying into the Cloud and fully embracing the possibilities presented by open banking.

Caliceti says: “If you look at banking business models today, often the products being offered are similar, or even the same. So, we need to ensure our digital channels are as effective and efficient as possible so customers engage with them.”

Villa, with his closer focus on IT delivery, points out that the bank’s new rivals, such as fintechs and spin-off speedboat banks, have posed the ‘biggest challenges due to their different nature and histories’.

also a slick front end that makes time spent on banking tasks satisfying – even enjoyable – for the user.

Credem was founded in 1910 in the city of Reggio Emilia where its HQ remains today, and as one of Italy’s 10 biggest banks, it offers a traditional comprehensive mix of retail, business and corporate banking, plus wealth management services.

He says: “We are a bank with more than 100 years of history and our competitors have changed in the last 10 years. A young company doesn’t have legacy systems so there’s usually less technology limitation, and there can be a difference in regulatory constraints, too, since some of these competitors are not financial institutions.

“It’s possible that they have less banking experience and competencies than incumbents, but, on the flip side, they typically have strength with regards to the digital experience. Another important aspect is these new

: OPEN BANKING FintechFinancePresents ffnews.com8

Digital creation: The Touchpoint app was Credem bank's renaissance moment

The mix between digital and human is key. This app is now the remote control of our business

Fabio Caliceti, Credem

Italy’s Credem bank worked with Temenos to get close to customers and give them 'remote control’. Fabio Caliceti, Lorenzo Villa and Adelina Rusu take up the story

competitors are typically leaner. That means they can be faster at making decisions, and faster at producing an outcome.”

Recognising that Credem’s technology systems needed to change, using an external digital platform provider was an efficient way to level the playing field with these new rivals.

Credem was impressed with the Temenos platform’s ‘low code’ nature which meant the bank’s teams could use the same JavaScript code for both iOS and Android versions of its app. Front-end features can be created relatively quickly, and since Temenos uses AWS Cloud infrastructure, the bank’s digital bandwidth can be scaled up and down as necessary.

“We had to improve technical capabilities to guarantee a higher speed in software development and deployment,” says Villa.

“We have to be conscious of the gaps that exist between the incumbents and new companies and fill those gaps. This means

We have to be conscious of the gaps that exist between the incumbents and new companies and fill those gaps. This means moving to Cloud and container technology as much as possible Lorenzo Villa, Credem

moving to Cloud and container technology because when it’s possible, it’s better. Infrastructure is crucial because we have to guarantee an elevated level of service – every day people use non-financial services that are always up and running. Sometimes I ask my colleagues to tell me the last time the Google home page wasn’t up, or had a problem, and no one is aware of such a day.”

Villa says one of the key goals when the new project began was the ability to integrate with third parties. Another was to retain control of the technology ‘so we understand exactly what has been developed in our app – we have to be able to manage directly the lines of code’.

The experience of COVID-19 lockdowns also underlined the need for increased delivery capacity, so services could be launched and evolved as necessary.

He adds: “Increasing capacity is crucial, it’s not just the ability to have more people using an application, but it also allows you to trial services with a subset of customers.”

Alongside the technical transformation Credem has undertaken, the bank has recognised that psychology is at play when winning hearts and minds. Adelina Rusu, Temenos head of solutions in marketing for digital banking, says harnessing customer data allows a bank to treat them as an individual. An example of it delivering on

or professional goal. Emotion plays a huge role in deciding where we bank and how we bank. If banks recognise this, and treat people as individuals, that will translate into the loyalty and trust that everyone craves.

“To achieve this, a bank first needs to meet customers where they are, and that’s why an omnichannel approach is crucial these days. Second, use analytics and artificial intelligence to make services personal and insightful. And third, look at adjacent services from third parties that can be offered on your platform.

“Data in particular is a way to strengthen customer relationships. There is a now a plethora of data available on the end user. But we must not stop at providing the bank with deeper insights. We should share insights with the customer to help them with their financial goals.”

Caliceti adds that people aren’t just seeking banking products, but a financial

that vision is a partnership with Italian insurtech Neosurance, announced in September. It uses analysis of purchasing data to identify pet owners among the banks’ customers and introduces them to Neosurance’s pet policies.

Rusu says: “Beyond the numbers, banking and financial decisions are eminently emotional decisions, and money is essentially a means to achieve a personal

partner, or ‘life coach’.

“That’s definitely a key driver when people are choosing a bank. So, offering a great customer experience is one of the most important goals, if you want to succeed in banking now. If we as a bank can follow a customer-centric culture and provide excellence in service, customers will become the first ambassadors of the brand.

“For a business, that is the most fantastic achievement, where your customers perform that role.”

us.money2020.com FintechFinancePresents 9

If banks treat people as individuals, that will translate into the loyalty and trust that everyone craves Adelina Rusu, Temenos

Going with the flow

Elena Whisler, SVP, Sales and Relationship Management at The Clearing House (TCH), describes how it’s hoping to transform business payments at home and abroad

TCH (The Clearing House) is one of the two principle automated clearing houses for payments in the US – the only private operator to run a country-wide infrastructure alongside the Federal Reserve Bank’s automated clearing house (ACH) for electronic funds transfers, processing financial transactions for consumers, businesses, as well as federal, state, and local governments.

Owned by the country’s major financial institutions, TCH’s Electronic Payments Network (EPN), handles batch-processed domestic electronic debits and credits (mainly comparatively low-value, high-volume bulk payments like payroll or recurring debits such as for utility bills), while CHIPS (The Clearing House Interbank Payments System) is an alternative to the Fed-operated FedWire for international transfers.

Neither EPN nor CHIPS was designed to be instant – payments typically take one to three days to complete – nor particularly transparent for the customer. But, in 2017, TCH rolled-out the RTP network, offering real-time gross settlement on a 24/7/365 basis for US domestic payments for the first time.

While the initial uptake by businesses might not have been as enthusiastic as anticipated, the pandemic in 2020 marked a major shift.

“Many B2B payments that moved to digital have stayed digital,“ says Elena Whisler, SVP, Sales and Relationship Management at TCH – and this despite a surprising resumption of cheque volume in 2022. “With B2B payments, what businesses want is the same thing individuals want, namely access to their cash. They [also] want predictability of their cash and real-time data/analytics of that information.”

Being responsible for roughly half of clearing volumes in the States gives TCH a huge amount of insight into payment

trends. And, what it’s seen is alternative payment providers are driving demand for faster, cheaper more transparent services from legacy institutions.

“We’re seeing more and more smaller shops/smaller businesses, such as landscapers or drycleaners, for example, starting to accept wallet transactions; which is interesting because those wallets are a closed-loop network, so you have to belong to that network and wallet, in order to move money," says Whisler. “That gets businesses involved in digital, which then allows them to ask their financial institution for more services.

“Our RTP network now has a good cross-section, between the largest financial institutions in the country, as well as the smallest, meeting the needs of all businesses and individuals here in the US.

“We’ve seen that grow not only in terms of the number of financial institutions using RTP, but also in terms of technology providers offering services to the financial institutions. Over the last five years, we’ve seen more than 250 financial institutions go live in our network, in

the standard two-week payroll cycle.

”For the Uber drivers who drive around all day, they may need to pull the wages they’ve earned [that day] and can do so through the RTP network, because of companies offering such services,” says Whistler. And that’s an example of the technology having a real-life impact.

As Whisler points out, having instant access to your cash, is empowering.

“Half of the US population work pay cheque to pay cheque. The RTP network is 24/7/365; so you don’t have to wait or plan in advance.”

In the B2B environment, meanwhile, escrow payments – commonly used in contract negotiations – offer volume growth potential, now that the RTP system can be used if the title company has access through its financial institution.

There’s still a way to go, though, in persuading businesses to see the benefit in using real-time rails. A recent Mastercard/ PYMNTS report, Accelerating The Time To Realized Revenue: The Real-Time Payments Edition, based on a survey of 400 businesses across three key industries in the US and Canada, found just 37 per cent are currently using them to settle or receive invoice payments, for example. Thirty per cent of Canadian respondents said they weren't interested in using them, either – citing fear of fraud as a major reason.

North America doesn't operate in payments isolation, of course, and neither does TCH.

addition to third-party service providers. We’ve pretty much achieved critical mass now.”

With the volume of transactions passing through the RTP network growing at more than 10 per cent each quarter, TCH has identified some interesting trends.

“We began to see people using it for things that they are not using other payment types for,” she says. A stand-out use case was paying workers outside of

Having beaten the Fed to introducing the country’s domestic real time rail, in April this year, it launched a pilot programme with SWIFT and pan-European payments infrastructure provider EBA Clearing to process immediate cross-border (IXB) payments, too.

With the support of various US, UK and Western European banks, the aim of the IXB initiative is to enable faster, smoother global money transfers by connecting directly into domestic payments networks. Initial proof of concept was completed in

: BUSINESS PAYMENTS FintechFinancePresents ffnews.com10

We basically looked at what would happen, and what would need to change, if we connected the RTP network here in the US to the RT1 in Europe

October 2021, and the expectations is for it go live by the end of 2022.

“We basically looked at what would happen, and what would need to change, if we connected the RTP network here in the US to the RT1 in Europe,“ explains Whisler.

“For example, a rule we have here with the RTP is that you have to post the transaction within five seconds. You go to Europe and they have a similar service level agreement related to payments. When we bring them together, we still want

our businesses and individuals to have the same experience, whether the payment is domestic, going state to state, whether it’s going US to Europe, or Europe to the US. “We believe we will change the cross-border payment landscape by linking these two networks together.”

The backdrop to the IBX pilot is an increasing focus by global organisations on cross-border payments, as Whisler explains: “Over the last few years, the G20, in particular, has a roadmap that is really looking to

global organisations, or systemically important organisations, here in the US and abroad, to see what we can do and, if we link our current domestic networks, and the networks in other countries, does that push people in organisations to maybe do something differently?”

She believes that it could certainly transform enterprises’ back office functions: “If businesses can send and receive money 24/7, 365, they don’t need to think of cashflow forecasting in some areas. They can send and receive their instructions, and the money related to that at the time they need to.

“The consequences for reconciliation and invoices are profound. Your accounts payable, your accounts receivable systems, today, they’re all after the fact. If you can shorten those cycles, and close that invoice in the moment that an invoice needs to get paid that solves a lot of problems that businesses.”

Combined with more data being transmitted along with the payment message than ever before, courtesy of ISO 20022 protocols, Whisler believes it can help eliminate many more headaches, too – particularly when things get messy.

“When you’re dealing with a whole payment, that’s pretty simple. That gets reconciled and moved. It’s with partial payments, when things don’t work that reconciliation becomes a nightmare.

“If you think of goods being shipped, and half of them being spoiled, or half of them falling off of a boat. If you have data along with that payment, you can clearly say, ‘well, the people that accepted it agreed to 50 per cent’, and so that 50 per cent is covered off, and they can create another process, in order to manage the remaining percentage that they weren’t able to receive.

“This requires a behaviour change in the businesses, related to accounts receivable, in that they will then be able to create a process for the exceptions in their business, and not the payment part.”

Payments journey:

An increasing number of small and large financial institutions are using the RTP network

She adds: ”At the end of the day businesses need choice, they need to know what the networks provide for them in terms of accountability, as well as confirmation of payment, transparency of payment and the foreign exchange related to that.“

us.money2020.com FintechFinancePresents 11

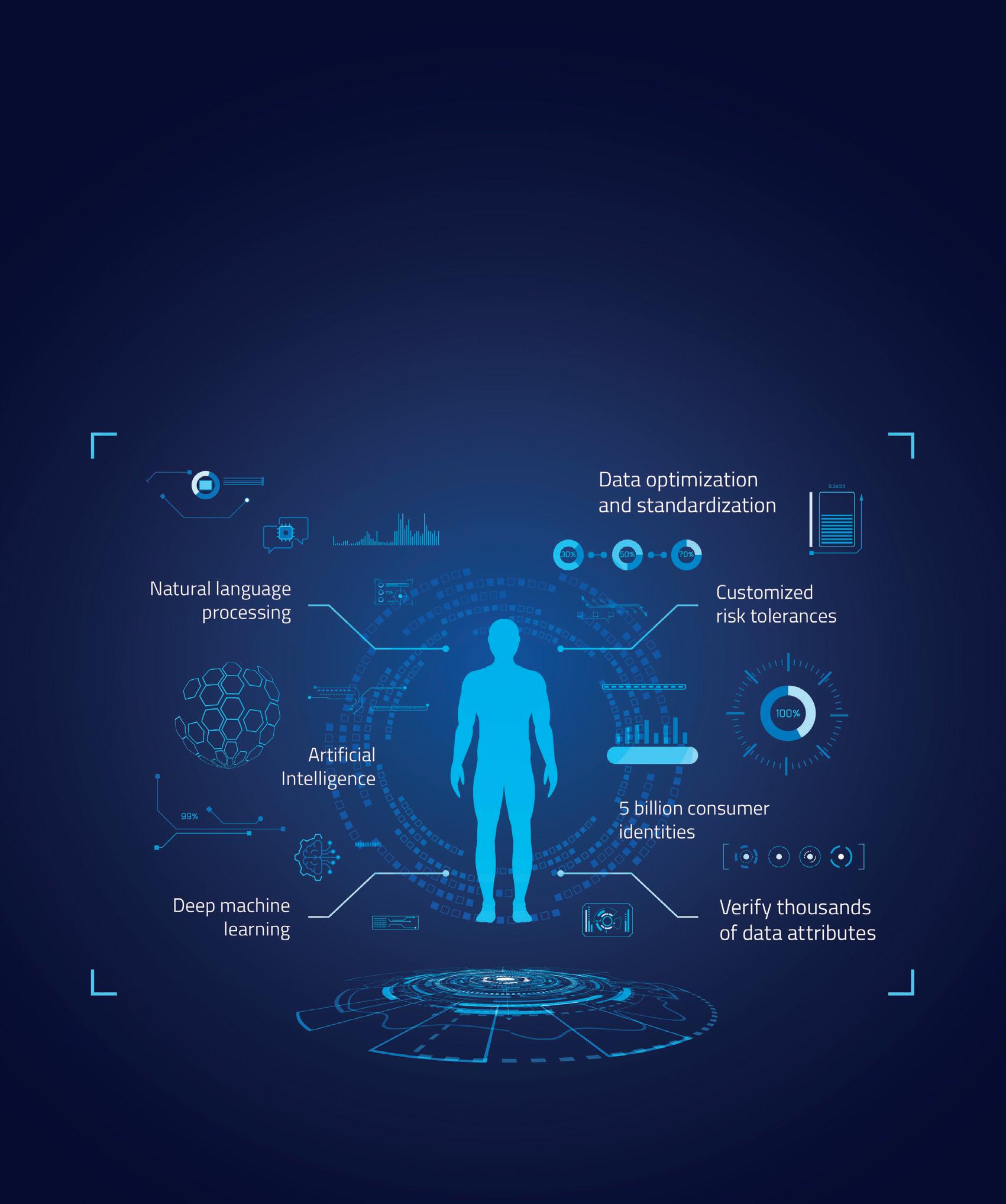

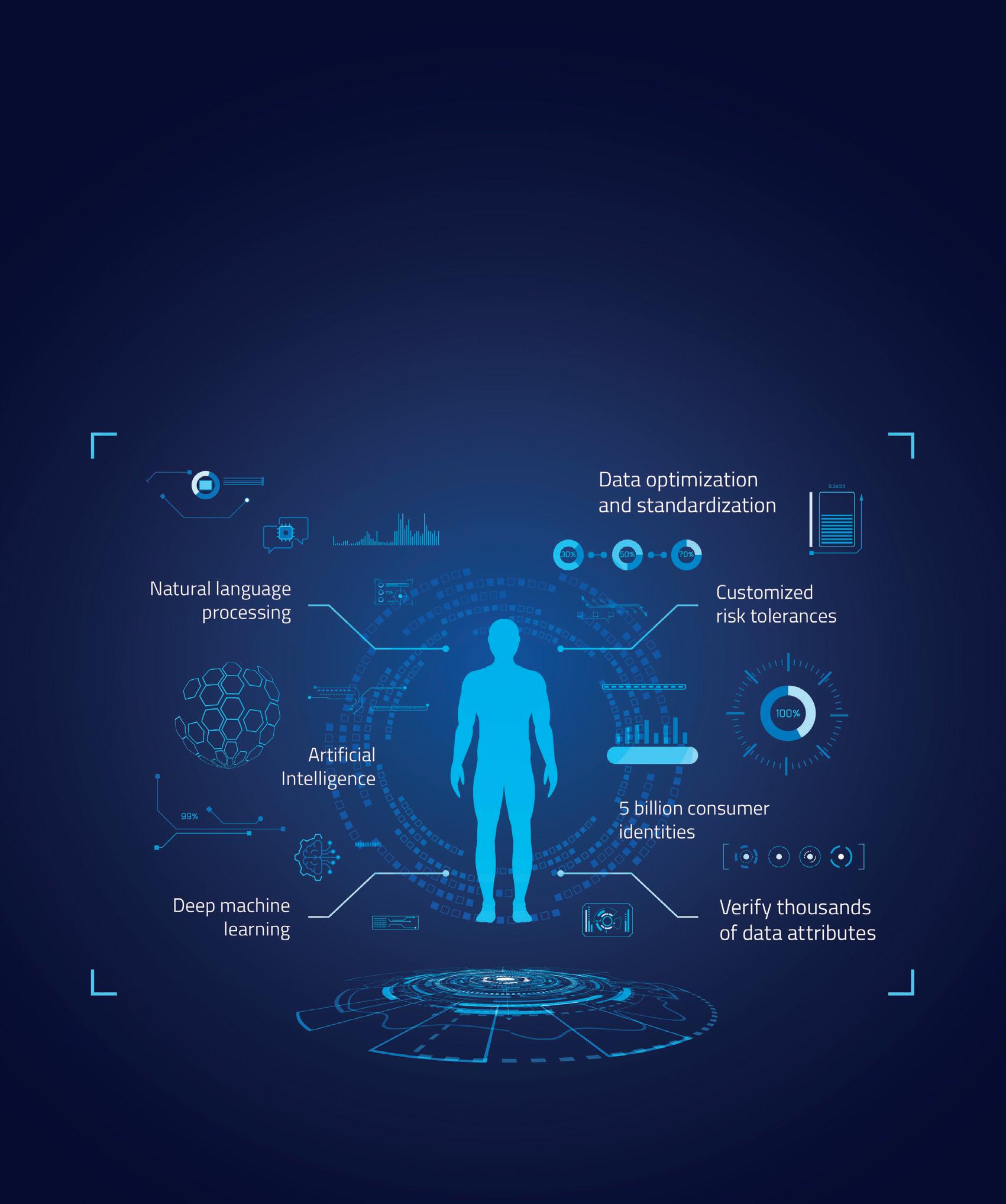

A new identity: It's not a case of ‘if ’ but ‘when’ we embrace digital IDs

The digital me

UL Solutions is one of the gatekeepers to trust in, and global acceptance of, mobile identity, which could make all physical documents irrelevant, says the company’s Sanne Ketelaar

When Sanne Ketelaar indulged her five-year-old son in a game of ‘grocery store’ – that age-old role-play where parents act as the bumbling customer and children play the earnest cashier – she didn’t expect it to be quite so relevant to her grown-up life.

“When I got to the payment, my son held up one of those big, base Lego bricks and said, ‘OK, you can now tap to pay’. I was completely flabbergasted!” she laughs.

But in this game of pretend, it was what happened next that spoke so directly to Ketelaar’s career.

“I’d bought a bottle of wine in his shop, so I said ‘hey, don’t you have to check mummy is old enough to buy this?’ That’s when I had to go and grab my physical wallet and show him my driver’s licence.”

A physical ID that unlocks a citizen’s rights – to consume alcohol, drive a car, draw down benefits or any number of other entitlements – might well be redundant by the time Ketelaar’s son reaches adulthood. And, in her role at the global safety certification company UL Solutions, she will be instrumental in driving that shift.

“Over the past decade, we’ve really seen a rise of convenient digital ways to pay. There’s mobile pay, peer-to-peer apps, and digital banks with no physical offices,” says Ketelaar. “But we still can’t leave our physical wallet at home. For most credentials, we still need to bring our ID card to identify who we are.”

Working in the US-based global testing and certification firm’s identity management and security division, Ketelaar helps oversee certification programmes that are key to the widespread adoption of mobile digital IDs. They promise to do away with those fumble-in-the-wallet moments for many of us, but there’s a much bigger vision driving their adoption. Mobile IDs could be instrumental in helping the United Nations hit its target of providing the entire world with a legal identity by 2030; in giving citizens access to the full

panoply of public and private services from their phone; and in liberating us from the username/password tyranny that is proving so vulnerable to cybercrime.

That’s not to say there are not deeply held concerns over how, and how safely, mobile digital IDs will be delivered, but, given that more than 80 per cent of the world’s population owns a smartphone and it’s the default for managing most of our daily lives, there’s little doubt that these forms of identity will play a big part in our future. Indeed, ABI Research forecasts that more than 850 million citizens will be equipped with a form of mobile identity by 2026, and the EU Commission is aiming for 80 per cent penetration across the EU for its cross-border digital ID scheme by 2030.

Among mobile digital IDs already available, some hold social security numbers and citizenship data; others contain biometric information or your COVID vaccination code. Few have developed beyond the national level, and most aren’t yet available in a mobile wallet – as with your flight or concert tickets, for instance.

In Estonia, citizens have been receiving a digital ID at birth for the past 20 years, and it’s being used as the bedrock of the

: DIGITAL ID FintechFinancePresents ffnews.com12

country’s drive towards full digital citizenship. In India, a staggering 99 per cent of adults (that’s 1.3 billion people) have now been issued with Aadhaar electronic IDs, used primarily to access benefits and other state services. In Germany, since 2020, people have been able to store the digital version of their national ID card on their phone.

New domestic projects seem to be emerging every week. But if digital IDs are to be as universally recognised and trusted as paper records, they need an agreed international approach, not least to make sure the technology is interoperable – and with robust testing and certification to ensure, for example, that there is no risk of a record of what you do in one area of your life being made visible to another organisation, or, indeed all of your activities revealed to one body, be it a big tech or a government.

The Verifiable Credential Data Model specification, published by the World Wide Web Consortium (W3C), already provides a standard way to express credentials on the web in a way that is ‘cryptographically secure, privacy-respecting, and machineverifiable’. But the International Standards Organisation (ISO)’s recent ISO/IEC 18013-5:2021 protocol specifically sets a standard for mobile driver’s licences (mDLs) where much of the current activity around mobile ID is focussed.

As one of the third parties used to certify that a vendor’s technology is compliant with ISO specifications, UL Solutions has already published its recommendations on how the two can be made to work together. But the standard around mDLs is important progress, believes Ketelaar, especially in the States.

“When you purchase an age-restricted item in a store, you hand over your entire driver’s licence – which, in the US, has lots of irrelevant information for a cashier to look at, like your height, your address, your weight, your eye colour, and whether you’re an organ donor.

“The ISO standard for mDLs stipulates a data collection limitation. Only your date of birth and a facial image will be requested and shared, and the app will ask you to provide approval to share that data. Plus, you can decide whether or not you let that information be stored – by a store, for instance, for future purchases there.”

As Ketelaar points out, in theory mDLs

would mean you share less data with fewer people. The ISO standard also specifies that, when using an mDL, phones should not have to be handed over – itself a privacy violation in today’s world. Instead, whoever needs to check ID, be they a cashier or a cop, has their own app to scan it with. A final useful specification is that mDLs should work when devices have no internet connection.

Google, which launched an API that supports mDLs in an identity wallet with Android 11 two years ago, has hinted that a mode could one day be built into phones that allows mDLs to be scanned, even when a phone is out of battery. Apple, meanwhile, has already integrated mDLs into its wallet app, which supports the ISO standard in multiple US states.

While, in the US, big techs have focussed on working with federal and the state governments to bring mobile drivers’ licences to market, in the UK, the government has just certified two providers to generate digital ID for use in two specific use cases – applying for a job and renting a house – but it verifies against either a driving licence or a passport.

We’ve seen a rise of mobile pay, peer-to-peer apps, and digital banks with no physical offices. But for most credentials, we still need to bring our ID card to identify who we are

As we’ve seen with past innovations, big tech integrations are crucial for building trust with consumers. For proof of that, you only need look at biometric technology – the subject of dystopian nightmares half a decade ago, but now a technology that the majority of people use to unlock their phones and approve payments. According to Dentsu Data Lab, 74 per cent of global consumers now have a positive view of the technology.

“I think biometrics will play a key role in future digital identity solutions, helping to combat money laundering and identity fraud,” says Ketelaar. “It’s already happening in US airports, where facial recognition becomes your entry ticket into an airplane. And we’re seeing some use in

financial services, with Mastercard’s new Biometric Checkout programme, for instance, where all you really need is yourself to check out.”

Mastercard has called its initiative ‘smile to pay’, which is redolent of Amazon’s ‘wave to pay’ authentication option, introduced in 2020. The Mastercard pilot scheme is currently taking place across five St Marche supermarkets in São Paulo, in partnership with the Brazilian biometric authentication firm Payface.

YOU ARE THE PAYMENT

With digital ID technology racing down the tracks towards us, the next obvious step is to combine those two separate tasks that Ketelaar experience in her son’s grocery store – ID verification and payment – into one.

In the analogue world, a handful of US city governments have already taken steps in that direction by offering prepaid debit cards as part of a municipal ID card (for people such as immigrants without citizenship who are unable to obtain a state driver's licence) or as part of a driver’s licence card.

Today, virtually every transaction can be handled by a smartphone. Tomorrow, it may just be our fingers and faces that we have to remember to take with us when we pop to the shops. Ketelaar reckons it’s only a matter of time before the technology, regulation and compliance barriers to that are overcome.

“[But] it is key these systems are tested by independent third parties – from a performance, functional, and security perspective – to really make sure they’re working as they should and there is no misuse of the systems or the data that has been collected,” she says.

“In the future, though, I really believe that we’ll be paying with our identity – because why would I need a separate bank account credential to do that?”

It’s a vision of a future that will please those with wallets bulging with plastic, as well as those accustomed to reordering their driver’s licence after a night out.

But it might just be the death of the grocery store game. Which toddler, after all, will derive enjoyment from watching their parents pick up a plastic banana, smile, and walk straight out of their store?

us.money2020.com FintechFinancePresents 13

New rules of the game

Financial services were unbundled by the first fintechs, now they’re reassembling them. Currencycloud and Integrated Finance consider the fundamental problem that presents

In the world’s most popular video game, League of Legends, there’s a strategy called one-tricking: you basically choose a single champion and learn to play that character really well. It’s a good strategy for newbies, as you find your way around, deepen your knowledge of that character’s strengths and weaknesses, and improve your skillset. But it’s debatable whether it’s the best strategy if you’re serious about competitive play, especially in the international leagues.

Most of the fintechs that emerged after the financial crisis 15 years ago, were one-trickers. They focussed on a single financial service and/or niche market – often one that had been badly underserved by banks – and mastered it. They had strength in depth. But, as the game got more competitive, they realised that being a one-trick pony was unlikely to serve them well into the future.

And so, they looked to add other services to their bow, often by integrating with third-party providers that were equally good at the single thing they did. As a result, they began to spend more and more time and effort on integration, which took focus away from their core purpose:

delivering superior experiences and products for their customers.

That was the problem that Integrated Finance was created to solve. The two-year-old startup says what it does on the tin: it works like a universal adapter plug for APIs, making sure the power flows from one platform to another without interruption and without either party having to worry about the ‘wiring’.

One of the integrations its regularly asked for is with Currencycloud, a global platform that enables banks and fintechs to provide innovative foreign exchange solutions for cross-border payments.

“On my VC deck, you’d see we are described as a ‘software-as-a-service, banking-as-a-service orchestration layer’, which doesn’t really mean anything to anyone outside of the ecosystem!” laughs co-founder Daniel Cronin.

“To boil it down, we give people access to the products and services they want, without having to technically integrate all of them. It’s a single interface, a single API, and it can consume the best features that you need of a provider like Currencycloud.

“Imagine you’re a young fintech entrepreneur. You want to do crossborder payments and you say ‘I’m going to use Currencycloud. It probably wants

to know that I’m checking who I’m giving these payment services to. So, I’d better find a digital onboarding solution. And that I’m monitoring the behaviour of users. So, I need transaction monitoring’.

“That’s three integrations right there, and you’re not going to have the bandwidth to do those in sync,” says Cronin. “They’re going to be consequential and sequential. Let’s say they take four months’ integration each. That’s 12 months before you’ve gone live and your burn rate is astronomical, because you’ve spent all that time on stuff that isn’t your core focus; but you need to get it done to satisfy quite an intense regulatory environment.

“Integrated Finance aggregates those vendors into a single API or interface for you, so that you can worry about going live with your actual product.”

There’s an incentive in using such an approach for vendors, too, given that none of them will probably see a return from your partnership until you start generating API calls. Telescoping the time to launch from years to weeks benefits all parties.

It’s a strategy that suits Currencycloud well. Launched in 2012 and fully Cloud-based on AWS, it has 85 different APIs across four modules – collect, convert, pay and manage – that cover

: PARTNERSHIPS FintechFinancePresents ffnews.com16

Up a League: Fintechs have moved on from being ‘one tricks’

the workflow in B2B payments. Regulated in Europe, Australlia, the US and Canada, it has processed more than $100billion to more than 180 countries and was among the first to identify the trend towards rebundling financial services, building its strategy around it and publishing its APIs publicly.

“Architecturally, we’re very open,” says Richard Stockley, who is responsible for commercial partnerships at Currencycloud. “Anyone can go in and have a play with our APIs to see what they do.

“Clients can consume our solutions directly, or work with our partners – such as Integrated Finance – to build a more complete solution, that has other parts that we don’t specialise in or provide.

“Being all things to all men is certainly a difficult ask,” he continues. “As different organisations that specialise in different areas realise that they are not the whole solution, collaboration with adjacent parts is absolutely essential.”

How partners go about things is as important as what they do, adds Stockley.

“I spend a lot of my time understanding what our clients’ needs are, and what the ecosystem adjacencies are that make the

where we can, with a very high degree of confidence, say, ‘dear client, you can rely on these partners; we’ve worked with them before, and this is the success rate’.”

Cronin agrees that how you go about identifying partners is important.

“There is an industry-agnostic graveyard of failed partnerships, where maybe the executive team got together and went, ‘this sounds like a good idea’, and just assumed it would happen because of that,” he says.

“What I’ve often found is that partnerships work best from the ground up, rather than top down, because it builds organic value that way. Let me give you an example. If a sales guy at Integrated Finance is contributing to a deal, and they know that there are other components that the entrepreneur or founder needs to deliver this, that person is incentivised to find those solutions for them – to find out who can help with this problem. That way, you build organic relationships.

“What I really value from Currencycloud is there’s a lot of active energy across that business, but especially, the sales guys don’t send stuff to us that they know we can’t help with. It’s going to make them look bad, it’s going to make us look bad, and it’s going to frustrate the mutual client. And vice versa. Whilst we’re not a regulated entity, our founders previously ran a regulated entity, and we know what to look for in another partner.

Currencycloud, which is a technical abstraction from Barclays, can remit those funds faster, possibly to some of Barclays’ own correspondents? The bank gets a huge advantage through having its customer base potentially aggregated, all of the technical headache aggregated, and still money is moved faster through a participant on its network than it could have done itself.

“So, it makes total sense to me that this starts happening at the BaaS level. But the thing that both Integrated Finance and Currencycloud needs to wrestle with, is that we’re disintermediating very successful protocols. Currencycloud, for example, is a participant of SWIFT gpi, but a lot of what it is doing is in parallel to SWIFT. So, I haven’t worked out yet whether fintech is going to embrace and empower SWIFT, or SWIFT will empower fintech, or whether

most sense for us and for them. One of the things you consider, obviously, is their capabilities. Do they fulfil a need that is adjacent to us, one where there’s not a great degree of overlap, and that, if we put the two together, creates something that’s incrementally valuable for our client?

“But second, is the cultural element,” says Stockley, “in terms of how can the working relationship between our two organisations provide an edge? That’s a softer, less measurable thing: it doesn’t come out in the specifications of what each player does, but that working relationship, and the pattern of working, is really important, in terms of getting stuff done.

“What we are building at Currencycloud is a whole series of partnerships, ones

“Once you’ve built up that rapport at the ground level, you generally see partnerships thrive much more from there on in. If I was a founder, I’d want to know that there was a rapport, too, between the partners, because that way I’m not going to get stonewalled, with people passing blame; everyone’s going to contribute, to try and deliver, to solve the problem I have when I’m launching my startup.”

Despite at least 10 years of digital transformation across the industry, Cronin still sees a lot of mismatched technology; developers tortured by complicated coding and working to different standards, which ultimately denies the customer what they really want. His ‘long-term future perfect’ would be for banks to smoothly co-operate with each other.

“The short and medium-term mechanisms for that to have happened is banking-as-a-service aggregation,” he says. “Barclays, for instance, has a fantastic correspondent network. So, how is it that

the emergent BaaS layers are going to create a sub-strata under SWIFT with its own messaging system.

“Currently, that messaging system is getting more and more disparate because, as more BaaS players, more fintechs emerge, they’re building the very best API they can, but they’re generally only considering one use case, their own customers.

“So, if you get 10 hyper-successful BaaS players, and a fintech that wants to use all of them, there needs to be some sort of protocol for that. That’s a non-subtle plan of what Integrated Finance is trying to build; we’re trying to build a protocol to make it easier to talk to all of these BaaS players.”

Stockley fully endorses that grand plan.

“Certainly, interoperability across different platforms is a key consideration for me, going forward, and one of the challenges in the coming years,” he says. “It’s the raison d'être of Integrated Finance, and one of the reasons we love working with them.”

us.money2020.com FintechFinancePresents 17

Interoperability across different platforms is a key consideration and I think one of the challenges in the coming years Richard Stockley, Currencycloud

There is an industry-agnostic graveyard of failed partnerships, where maybe the executive team got together and went, ‘this sounds like a good idea’ Daniel Cronin, Integrated Finance

The rail thıng

Mark Nalder from building society Nationwide, Pay.UK’s Shane Warman, and Andrew Moseley at payments provider ACI Worldwide consider the opportunities presented by the biggest change to the country’s A2A payments system in more than a decade

The UK is poised to introduce a New Payments Architecture (NPA) for its retail interbank payment systems, beginning with Faster Payments, the pioneering real-time rail that has powered account-to-account (A2A) transactions for the past 14 years.

An increasingly important part of the country’s payments landscape, they’ve been encouraged by open banking and saw a rapid increase in adoption by consumers and businesses alike after the pandemic. So much so, that some predict 40 per cent of e-commerce payments alone will be made that way by the end of this year. With 40 direct participants, including banks and other payments services providers (PSPs), along with many others who access the scheme indirectly, Faster Payments handled in excess of 3.4 billion single immediate payments, forward-dated payments, standing orders as well as direct corporate access payments in 2021.

Growth in A2A payments is not unique to the UK; it’s a global trend, so much so that all the major card schemes have launched initiatives to facilitate them. The NPA, which will eventually also extend to Bacs – direct credits, widely used to pay salaries, benefits, dividends and suppliers, and direct debits, which automate the collection of regular payments, such as domestic bills – is therefore seen as a way to future-proof a critical part of the country’s clearing and settlement system.

Indeed, it’s purposefully designed to stimulate innovation by simplifying integration for new market participants, such as challenger banks, fintechs and regtechs, and to support emerging payment types. Overlaid services should reduce the number of connections that payment providers are obliged to maintain, while richer payments messaging data, using ISO 20022, could be used to deliver more value-added benefits for both service providers and their customers, from smoother reconciliations to personalised journeys. Ultimately, it should result in a lot more payment choice for consumers and businesses at lower cost. At the same time, risk is reduced by using prefunded settlement capability.

Faster Payments participants have already had to demonstrate how they will comply with the NPA, and provide a timetabled plan for, and an impact assessment of, their required system changes. In April 2023, the NPA will begin certification testing with a view to the architecture going live in mid-2024.

Coming on top of other ongoing infrastructure changes to international and domestic payments systems, it’s a lot for financial institutions to juggle. Will the results be worth it? Unquestionably, says our panel…

FINTECH FINANCE: For any legacy provider, infrastructure changes have the potential to tie up a huge amount of

resource for years on end. On the other hand, digitally-led providers have been champing at the bit for an alternative A2A infrastructure. Is it possible to keep everybody happy?

MARK NALDER (NATIONWIDE):

One of the biggest challenges for the Pay.UK team has been getting a timeline to suit everyone. A top-tier bank is having to do a lot of things, while a fintech wants to go quicker because it’s got limited infrastructure in place, so it can. The industry doesn’t do scheme migrations very often, though, and you’ve got to get it right. We’ve seen major scheme outages in the cards rail in the last few years and we can’t have that happening. So, while it’s taken longer than I’d personally like, this is the foundation of the next 20, 30 years of payments. If we get it wrong, we lose consumer confidence straight away.

SHANE WARMAN (PAY.UK):

You’re right that we need to be cognisant of the amount of change that’s going on in the UK industry. RTGS CHAPS Renewal Programme (RTGS2), SWIFT, and NPA – there is a concern that we’re all fishing in the same pool for resources. So, in order to keep the pace of change and make sure that change is successful, as a core infrastructure provider, Pay.UK is trying to align the work that we’re doing with the work that’s happening at the Bank of England, and the work that’s happening at SWIFT.

ANDREW MOSELEY (ACI WORLDWIDE): We have two of

: INFRASTRUCTURE FintechFinancePresents ffnews.com18

Need for speed: But rapid payments must still be safe, secure and robust

the largest customers here in the UK for Faster Payments – the introduction of the NPA has a huge impact alongside what else is happening, so, working collaboratively across the industry will ensure that what we end up with is the right payments ecosystem; one that’s secure, resilient, robust, promotes competition and innovation, and is successful. It’s a mission-critical system, though, so we have to tread carefully.

FF: How important is ISO 20022 to domestic schemes like the NPA?

AM: As a global company, we believe that localised payments culture and preference is to be expected, and that will always be the case because, for a consumer, it’s all about the experience. But the key thing about the NPA is the harmonisation. Other markets have already moved to ISO 20022, some many years ago, while the US has its ongoing FedNow pilot, which we’re also involved in. What I’m saying is, rails aren’t the issue; what’s important is interoperability – the messaging standard being the same wherever you go, so the experience, while a little bit different,

The key thing about the NPA, is the harmonisation… rails aren’t the issue; what’s important is interoperability

Andrew Moseley, ACI Worldwide

depending on where you are, is still going to be supported.

It doesn’t matter if it’s a high-value payment, a low-value payment, a card payment, an A2A payment, whether it’s real time or near real time, eventually, I believe they will all come together, and having standards such as ISO 20022 will facilitate and accelerate that. Whether we ever reach the nirvana of a single rail for all payment types – it’ll probably be another 30 years before we get there.

With what’s happening in the next two or three years with the NPA, and what SWIFT’s doing in cross-border payments, it’s all coming together, though.

us.money2020.com FintechFinancePresents 19

.

MN: I agree that ISO is the key: a single message format for all types of payments. But will we get to a single rail? I don’t think we will. And I don’t think we need to. If you went down to a single rail, you’d limit competition and you’d get a concentration that I don’t think we want to see in the industry.

But a single message format gives you so much opportunity around interoperability. It drives resilience and it gives consumers confidence. So, yes, ISO is the key to taking us in the right direction.

FF: What benefits will consumers and business users see from the NPA?

MN: Honestly, the opportunities created by the enriched data that ISO 20022 brings could mean so much for the consumer. We can start to develop consumer profiles, understand how they spend, and identify where they could maybe save money, and customise offers

Most end users don’t care about the rails. In fact, they don’t even know about them. What they do expect, though, is that when they make a payment, it’s safe, it’s secure, and it’s robust Shane Warman, Pay.UK

for them. So, there is a real opportunity for the industry to understand consumers better. But it also creates an opportunity to improve security around fraud, giving consumers confidence that they can pay someone immediately because the extra data we have means we’ll be able to conduct additional fraud checks. It means we can change the prioritisation of payments, too – because we can build up a consumer profile of the types of payments he/she does and introduce additional levels of security for certain other types of transaction.

When it comes to the SME market, the NPA is all about improving the end-to-end customer journey. Invoicing is a great example of that. For instance, I get my windows cleaned and I receive an email or a text from the window cleaner with an invoice attached. I pay it and get a message

back, saying ‘here’s your next booking.’ Within that exchange, there’s a payment, but, for the consumer, it isn’t purely a financial transaction. The payment is an organic part of the conversation they’re having with that business.

Ultimately, NPA also creates potential competition in the future between payment types – could the NPA be a real competitive alternative to cards for consumers and merchants, for example?

SW: I agree that one of the strongest use cases is in the SME market, around providing an efficient way of sending people invoices and getting them paid. Here, as elsewhere, most of these kinds of opportunity will come from what sits on top of the rails. In Asia, for example, where you often pay by QR code, people see that as a different service, but it actually sits on top of – usually – a real-time payments rail. In fact, you could do all these things via either the real-time rails we have here, or via card rails, because the solutions are rail agnostic and developers will be looking for different things when they make that choice. Their decision could be based on cost, efficiency, security… so we have to connect to those people who are building the solutions that will sit on top of the NPA, the solutions that consumers use.

As for end users, though, most don’t care about the rails. In fact, they don’t even know about them. What they do expect is that when they make a payment, it’s safe, it’s secure, and it’s robust.

We need to make sure that we continue to maintain the robustness of the UK payment rails. Doing things in a safe and secure way, is the most important thing for us as a core infrastructure provider.

AM: Here in the UK, we’ve a fantastic

A2A scheme that’s been 14 years in production. The experience is good – but I think consumers will be blown away by the experience once the NPA ecosystem is in place – what participants to the scheme will be able to add on top of those rails by way of overlays and what they enable consumers to do.

FF: You’ve all referenced the need for trust in the system as being fundamental. How will a new payments infrastructure encourage that?

MN: Unfortunately, fraud is now moving into the Faster Payments space. Confirmation of payee has done

a great job reducing that fraud, but we are now seeing a lot of authorised push payment (APP) scams – romance scams being a typical example of that – instead.

I’m all for moving forward, and for payments being immediate, but if you take a step back and say for a very, very small percentage of transactions, we’re going to take a bit more time – if I’m buying something for £10 online, that’s low risk, but if I’m paying someone I’ve never paid before £20,000 that’s high risk – then, as a consumer, I’d be OK with that.

Innovation doesn’t mean everything has to be real time. There’s no harm in taking a risk-based approach around certain types of payments. For us at Nationwide, it’s just a matter of keeping our members informed about that. That said, it’s not always easy. We’ve had plenty of examples where a customer has come into the branch and

begged for a particular transaction to go through, and, despite us saying ‘no, we’re convinced this is fraud’, they’ve insisted. It’s gone through and, unfortunately, it did turn out to be fraud. So, you can only do so much, but I think the enriched data that ISO 20002 will bring, will absolutely help with that. Along with confirmation of payee, these things will add an extra level of security to a payment.

SW: Giving people confidence will absolutely allow us to innovate, depending on what the market needs. All around the world, the faster payments system is trying to solve different problems in different markets. In the UK, we don’t necessarily have the same numbers of people that are excluded from the financial system that they did in Asia, for example. When they rolled out real-time payments there, it really allowed people to begin to collect money and open bank accounts.

The biggest problem we’ve got at the moment in the UK is around fraud prevention. So, that’s the thing that we need to crack first.

: INFRASTRUCTURE FintechFinancePresents ffnews.com20

Innovation doesn’t mean everything has to be real time.

There’s no harm in taking a risk-based approach around certain types of payments

Mark Nalder, Nationwide

Ohio’s Economic Development Corporation

See it, touch it, smell it, hear it!

For banks that nailed their colours to the virtual mast early on, their obsession with one very tactile, 40-year-old payment method seems curious.

Are they acknowledging the immutable human attraction to things we can touch and hold in our hands? Or is it just an excuse for some shameless marketing? We’ve seen fluorescent, glow-in-the-dark, vertical designs, 24-carat gold-plated… business banking provider Anna even offers one that miaows like a cat (or, at least, the app notification does when users pay by contactless).

The physical payment card is clearly still seen very much as a brand ambassador but, more than that, it remains core to a bank’s interaction with its customers, according to Rüdiger Vogt from payments and identity provider G+D.

“We still see the payment card as an important physical connection between the bank or fintech and its clients, and I think this will continue for the foreseeable future,” says Vogt, who is in charge of fintechs, neobanks, and payment processors in the company’s global e-payments division.

Clients looking for the je ne sais quoi that elevates their card above every other on the market will find art nouveau and neo tech blended in G+D’s ‘Card Bodies’ catalogue. There is something highly sensual about the form factors displayed as part of its Convego services design suite, right down to the aroma-emitting cards infused with ‘the scent of a brand’.

“Over recent years, fintechs have differentiated with cards representing their unique offerings, be they comprehensive packages for exclusive travelling via metal

cards, green investment plans or cards manufactured from ocean-recovered plastic,” says Vogt. “And this is where we’re talking about going off limits, beyond anything we could’ve imagined, in terms of card material, packaging, unboxing experience – you name it. There’s still lots of potential in the physical card and we support our customers in creating innovative and exciting designs, like glow-in-the-dark, OLED (organic LED) display, 3D effects and using new materials such as metals, wood and ceramics.

“And let’s not forget alternative form factors: we’ve also ramped up our business enabling passive and active wearables, with fully tokenised, end-to-end solutions where we provide wearables manufacturers with the hardware, software and service back-up to add payment functionality to their devices, the most famous example being SwatchPAY.”

The investments G+D is making in new research and development (R&D) and production facilities just goes to underline its confidence in the durability of cards as a payment choice.

“We’re investing in physical card innovation and production, we’ve expanded our issuing services further globally and we’ve installed a lab for prototyping these new designs and materials, which keeps growing every year,” says Vogt.

As part of that expansion, the company recently also announced the acquisition of card manufacturer Valid USA, to expand its presence in the North American market.

Established 170 years ago, principally to printed bank notes, G+D has evolved to offer everything from physical card production via

: CARDS FintechFinancePresents ffnews.com22

A card in the hand… is worth a lot to the financial brand

Cards are so much more than a payment utility – and they’re not going out of fashion any time soon, says Rüdiger Vogt at G+D

numerous card personalisation centres around the world, to digital payment and security solutions. It’s also heavily invested in virtual card payment and security mechanisms around digital wallets, where the card crosses into the touchless, automated environment. G+D is seeing growing demand for virtual representations of cards, be they bank-branded or from the big tech XPays. As a crossover payment method, the card is a phygital blend of customer-centric services that ensure consumers feel loved and valued, says Vogt.

“So, we are not ignoring the trends towards, first, contactless payment, then digital payments and – the next stage – invisible or embedded payments. But I believe that a phygital approach to payments and banking will lead to more customer satisfaction and new growth in financial services,” he adds.

“This means focussing on immediacy, ensuring things happen at an exact moment in time; immersion, users becoming part of the experience, and interaction, to activate the physical and emotional part of the process, which is key in this phygital experience.

“The idea is to combine the best of both worlds, and to add value for our

SHUFFLING THE PACK

Be it Revolut supporting LGBTQ+ charities with its rainbow card, banking platform Curve’s entirely numberless card, or the transparent design from German neo N26, our ‘flexible friends’ have been transformed into fashion accessories, status symbols and, most recently, statements of social responsibility.

REVOLUT A GLOWING EXAMPLE

customers in banking and payments, looking at critical points in user journeys. Personalisation of services falls into this category. Card issuance is that first crucial moment after you’ve signed up with a new bank or fintech. It should be a really fun, easy experience and that’s what we’re enabling with our customers.”

G+D’s work with fintechs over recent years has had a formative influence on the company’s own business strategy.

Vogt adds: “Five years ago, we saw fintechs as an interesting development in

We learned not to underestimate the potential and power of the agile fintech approach

the market, but didn’t really know what to make of them. We were used to large and mid-sized traditional banks and, all of a sudden, along came these guys that said ‘today my strategy is this’, and then, three months later, after a new investment round, had changed it.

“But you learn to understand the different dynamics and stakeholders, and fintechs’ stronger focus on growth rather than short-term profitability.

limited edition with charitable support for independent boxing gyms affected by the pandemic, donating £1 for every card ordered, and stumping up £50,000 itself for the campaign.

RABOBANK AND BBVA KIND TO THE PLANET

Rabobank and BBVA’s recycled payment cards symbolise their commitment to environmentally-friendly practices. Both use G+D’s Convego® Recycled Cards made from 100 per cent recycled PVC layers and produced using renewable energy.

Rabobank also personalises its initial card mailings, using G+D’s Convego® Relate Print solution

“We learned not to underestimate the potential and power of the agile fintech approach of try, fail, improve, try again. Fintechs are an enormous enrichment for the banking sector, and for us as a paytech.”

In fact, its work with paytechs has inspired G+D’s ‘Payment 4.0’ innovation initiative.

“We started Payment 4.0 with the goal of developing a dedicated business relationship with key partners in the fintech market, to identify companies for cooperation and investment and drive payments innovation together,” explains Vogt, “because we realised there is plenty of growth in this segment compared to some of the traditional customers we work with. Over the last two-and-a-half years, we’ve really started to see the success of this learning experience.

“Last year, we grew by more than 100 per cent in the segment, revenue-wise, and we’re targeting 200 per cent growth this year. It is the fastest-growing segment of the financial industry. It’s giving major impetus to ideation and innovation.

“In general, we benefit a lot from each other – combining G+D’s experience and R&D power with the ideas and agile business development of the fintechs.”

to include targeted brand and marketing messages related to each individual customer, using sustainably produced stationery and reducing unnecessary logistics like stock transportation through on-demand printing.

AUMAX TESTING THE METAL Metal cards – are de rigueur these days for fintechs wanting to make premium customers feel extra special. G+D teamed up with French fintech Aumax to enable its metal card as an exclusive option for its most select ‘Aumax pour moi’ customers. A subsidiary of France’s Crédit Mutuel Arkéa, this card is linked to the neo’s premium service package, including fee-free withdrawals worldwide, refund guarantees, higher cashbacks, advantageous insurance benefits and concierge services.

us.money2020.com FintechFinancePresents 23

Who’s dishes?the washing

In the rush to digitise everything in financial services, have we forgotten infrastructure?

I don’t mean the tech infrastructure that is well-organised under a myriad of agile frameworks. I am talking about the more mundane parts of running a financial services company – making thousands of decisions per day, keeping the stability and reliability at the highest levels of trust.